About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Get Involved

- Reading Materials

- Teaching & Curriculum

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

ESG Investing: What Shareholders Do Fund Managers Represent?

In this Closer Look, we examine individual investor perception of ESG to gauge their concern for environmental and social issues, their view of whether fund managers should use their voting power to influence ESG practices, and their willingness to sacrifice return in the advancement of ESG objectives. We find that investors are not homogenous in their viewpoints and demonstrate significant divergence based on age and wealth, with the most vulnerable investors—those who are older and those with low levels of savings—largely opposed to ESG and unwilling to risk their assets to advance these objectives, in contrast to younger, wealthy investors who are much more supportive and willing to forfeit returns. Significant differences in perception of ESG also exist within and across fund companies. The results suggest that fund managers should consider the various viewpoints of their investor base and potentially split their votes on controversial ESG-related proxy proposals to reflect the divergent interests of beneficial owners.

How do fund managers determine how to vote shares regarding ESG-related proxy proposals?

How rigorous is the analysis they perform regarding the economic impact of these proposals?

How do fund managers balance the interests of their investor base when these interests diverge?

Would split voting improve mutual fund governance by protecting the interest of minority voters—whether that minority is in favor of or opposed to ESG?

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

Morningstar Investment Research

Morningstar’s independent research is only biased in favor of investors. Dig into expert analysis from 100+ global researchers on securities, funds, markets, and portfolios. With transparent insights, investors can make more confident investment decisions.

Trending Investment Research

2024 us financial health report, q2 2024 markets observer, q1 2024 apparel industry pulse, morningstar's guide to us active etfs, global equity fund flows, climate action 100+ departures put proxy voting in the spotlight, active etfs in europe: small, shy, and on the rise, u.s. drug distribution landscape, h1 2024 u.s. housing outlook, biopharma landscape, q2 2024 stock market outlook, target-date funds and annuities, 2024 target-date strategy landscape, 2024 diversification landscape, financial services observer, mining industry landscape, u.s. renewable energy pulse, u.s. active/passive barometer, q1 2024 oil and gas industry pulse, small-cap equities and funds, q1 2024 u.s. economic outlook, motors and markets 2024, u.s. e&ps landscape, 2023 model portfolio landscape, software landscape report, mutual fund manager stock hit rates, 2024 utilities outlook, what motivates clients to stay with their financial advisors, dividend funds landscape report, q4 2023 digital & analog semiconductors pulse, 2023 retirement withdrawal strategies report, luxury goods landscape report, cybersecurity landscape report, a global guide to strategic-beta exchange-traded products, compare robo-advisor performance & assess the best options, a simple framework for structured products, fund managers switching firms - should investors tag along, can asset managers take direct indexing to the masses, why money is important to investors, large growth stocks: hurdles and risks for fund managers, intended and unintended crypto exposures, beware of overconfidence in “outlook season”, 2022 health savings account landscape, morningstar's cryptocurrency landscape, morningstar’s global automotive observer:, 2022 u.s. interest rate & inflation forecast, morningstar's guide to tax managed investing, thematic fund handbook, sustainable investing, global sustainable fund flows report, us annual sustainable funds landscape, sfdr article 8 and article 9 funds, investing in times of climate change, esg proxy-voting insights: blackrock, vanguard, state street, us sustainable fund flows, esg landscape on commercial air travel, proxy-voting insights: voting on politics, morningstar sustainability atlas, esg landscape on biopharma, esg commitment level landscape, 2022 carbon credits landscape, esg landscape on oil and gas, proxy-voting insights: 2022 in review, water, water everywhere. how are asset managers responding, esg landscape on consumer packaged goods, net zero asset managers initiative, cop15: a turning point for investor approaches to biodiversity, esg landscape on telecommunication services, the hidden esg risks of feel-good companies, how to talk to investors about sustainable investing, esg landscape on autos, investment strategies, liquid alternatives observer, momentum inflection factor, morningstar’s primer on defined outcome etfs, global thematic funds landscape, morningstar prospects, the reasons behind fund closures, financial well-being, 2024 target-date funds and cits landscape, q1 2024 u.s. asset manager pulse, morningstar's annual 529 college-savings plan landscape, us asset manager landscape report, mind the gap: a report on investor returns in the u.s., morningstar's robo-advisor landscape, morningstar's u.s. fund fee study, global investor experience: fees and expenses report.

Career Concerns of Mutual Fund Managers

This paper examines the labor market for mutual fund managers and managers' responses to the implicit incentives created by their career concerns. We find that managerial turnover is sensitie to a fund's recent performance. Consistent with the hypothesis that fund companies are learning about managers' abilities, managerial turnover is more performance-sensitive for younger fund managers. Interpreting the separation-performance relationship as an incentive scheme, several of our results suggest that a desire to avoid separation may induce managers at different stages of their careers to behave differently. Younger fund managers appear to be given less discretion in the management of their funds; i.e. they are more likely to lose their jobs if their fund's beta or unsystematic risk level deviates from the mean for their fund's objective group. We also show that the shape of the job separation-performance relationship may provide an incentive for young mutual fund managers to be risk averse in selecting their fund's portfolio. Consistent with these implicit labor market incentives, younger fund managers do take on lower unsystematic risk and deviate less from typical behavior than their older counterparts. Finally, additional results on the flow of investments into mutual funds suggest that rather than just being due to a screening process, firing decisions may also be influenced by a desire to stimulate inflows of investment into the fund.

- Acknowledgements and Disclosures

MARC RIS BibTeΧ

Download Citation Data

Published Versions

More from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

Puzzle solved? A comprehensive analysis of hedge fund-like mutual funds according to the value-added paradigm

- Original Article

- Published: 11 March 2022

- Volume 23 , pages 256–275, ( 2022 )

Cite this article

- Nathaniel Light 1 &

- Ivan Stetsyuk ORCID: orcid.org/0000-0003-0767-3745 2

101 Accesses

Explore all metrics

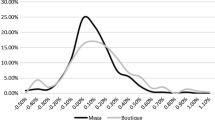

Mutual funds that claim hedge fund strategies (HMFs) have experienced large increases in assets under management, yet academic studies are nearly unanimous in their negative appraisal of HMF performance. This paper examines whether this inconsistency can be resolved through the ‘value added’ paradigm. We demonstrate instead that pockets of value production and skill coexist alongside a largely wasteful HMF space as a whole. We document a highly fractured market structure in which the top 10 firms control 48% assets, the bottom half only 4%, and nearly 40% of firms disappear within a brief window. We explore the implications for tests of performance under such conditions.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Is there a boutique asset management premium? Evidence from the European fund management industry

Do sophisticated investors follow fundamental analysis strategies? Evidence from hedge funds and mutual funds

The Exclusive Role of Centralized Fund Family Management

https://www.marketwatch.com/story/here-come-hedged-mutual-funds-2010-11-10?fbclid=IwAR3_py3OP-P81mjNYv198Xdn290uNoWdWegZ46dmrxuhxuS5ezaR20No5PU .

https://www.etfstrategy.com/the-future-of-liquid-alts-goldmans-answer-replication-10338/ .

Agarwal, V., N.M. Boyson, and N.Y. Naik. 2009. Hedge funds for retail investors? An examination of hedged mutual funds. Journal of Financial and Quantitative Analysis 44 (2): 273–305.

Article Google Scholar

Amihud, Y., and R. Goyenko. 2013. Mutual fund’s \(r^2\) as predictor of performance. The Review of Financial Studies 26 (3): 667–694.

Badrinath, S., and S. Gubellini. 2011. On the characteristics and performance of long-short, market-neutral and bear mutual funds. Journal of Banking & Finance 35 (7): 1762–1776.

Barras, L., O. Scaillet, and R. Wermers. 2010. False discoveries in mutual fund performance: Measuring luck in estimated alphas. Journal of Finance 65 (1): 179–216.

Berk, J.B., and R.C. Green. 2004. Mutual fund flows and performance in rational markets. Journal of Political Economy 112 (6): 1269–1295.

Berk, J.B., and J.H. van Binsbergen. 2015. Measuring skill in the mutual fund industry. Journal of Financial Economics 118 (1): 1–20.

Berk, J.B., J.H. Van Binsbergen, and B. Liu. 2017. Matching capital and labor. The Journal of Finance 72 (6): 2467–2504.

Bollen, N.P., J. Joenväärä, and M. Kauppila. 2021. Hedge fund performance: End of an era? Financial Analysts Journal 77: 109–132.

Carhart, M.M. 1997. On persistence in mutual fund performance. Journal of Finance 52 (1): 57–82.

Chen, J., H. Hong, M. Huang, and J.D. Kubik. 2004. Does fund size erode mutual fund performance? the role of liquidity and organization. American Economic Review 94 (5): 1276–1302.

Clifford, C., B. Jordan, and T.B. Riley. 2013. Do absolute-return mutual funds have absolute returns? The Journal of Investing 22 (4): 23–40.

Cooper, M.J., H. Gulen, and P.R. Rau. 2005. Changing names with style: Mutual fund name changes and their effects on fund flows. Journal of Finance 60 (6): 2825–2858.

Cremers, K.M., and A. Petajisto. 2009. How active is your fund manager? A new measure that predicts performance. The Review of Financial Studies 22 (9): 3329–3365.

Elton, E.J., M.J. Gruber, S. Das, and M. Hlavka. 1993. Efficiency with costly information: A reinterpretation of evidence from managed portfolios. The Review of Financial Studies 6 (1): 1–22.

Fama, E.F., and K.R. French. 1995. Size and book-to-market factors in earnings and returns. Journal of Finance 50 (1): 131–155.

Fama, E.F., and K.R. French. 2010. Luck versus skill in the cross-section of mutual fund returns. Journal of Finance 65 (5): 1915–1947.

Ferreira, M.A., A. Keswani, A.F. Miguel, and S.B. Ramos. 2013. The determinants of mutual fund performance: A cross-country study. Review of Finance 17 (2): 483–525.

Fung, W., and D.A. Hsieh. 2005. Extracting portable alphas from equity long/short hedge funds. In The world of hedge funds: Characteristics and analysis , 161–180. Singapore: World Scientific.

Chapter Google Scholar

Harvey, C.R., and Y. Liu. 2021. Decreasing returns to scale, fund flows, and performance. Duke I&E Research Paper , (2017-13).

Huang, J.-Z., and Y. Wang. 2013. Should investors invest in hedge fund-like mutual funds? Evidence from the 2007 financial crisis. Journal of Financial Intermediation 22 (3): 482–512.

Jensen, M.C. 1968. The performance of mutual funds in the period 1945–1964. Journal of Finance 23 (2): 389–416.

Jiang, G.J., and H.Z. Yüksel. 2019. Sentimental mutual fund flows. Financial Review 54 (4): 709–738.

Jones, C.S., and H. Mo. 2021. Out-of-sample performance of mutual fund predictors. The Review of Financial Studies 34 (1): 149–193.

Kacperczyk, M., C. Sialm, and L. Zheng. 2008. Unobserved actions of mutual funds. The Review of Financial Studies 21 (6): 2379–2416.

Kanuri, S. 2016. Hedged ETFs: Do they add value? Financial Services Review 25 (2): 181–198.

Google Scholar

Kanuri, S., and R.W. McLeod. 2014. Performance of alternative mutual funds: The average investor’s hedge fund. Financial Services Review . https://doi.org/10.2139/ssrn.2445279 .

Kooli, M., and I. Stetsyuk. 2020. Are hedge fund managers skilled? Global Finance Journal. Advance online publication . https://doi.org/10.1016/j.gfj.2020.100574 .

Kosowski, R., A. Timmermann, R. Wermers, and H. White. 2006. Can mutual fund “stars’’ really pick stocks? New evidence from a bootstrap analysis. Journal of Finance 61 (6): 2551–2595.

Linnainmaa, J.T. 2013. Reverse survivorship bias. Journal of Finance 68 (3): 789–813.

Lo, A.W., and P.N. Patel. 2008. 130/30: The new long-only. The Journal of Portfolio Management 34 (2): 12–38.

McCarthy, D. 2013. Hedge funds versus hedged mutual funds: An examination of equity long/short funds. The Journal of Alternative Investments 16 (3): 6–24.

Pástor, L., and R.F. Stambaugh. 2012. On the size of the active management industry. Journal of Political Economy 120 (4): 740–781.

Sherrill, D.E., S.E. Shirley, and J.R. Stark. 2017. Actively managed mutual funds holding passive investments: What do ETF positions tell us about mutual fund ability? Journal of Banking & Finance 76: 48–64.

Yan, X.S. 2008. Liquidity, investment style, and the relation between fund size and fund performance. Journal of Financial and Quantitative Analysis 43 (3): 741–767.

Download references

Acknowledgements

We thank Jonathan Berk, Alexandre F. Roch, Oleg Rytchkov and participants of the 2019 Financial Management Association Annual Meeting and 2019 Annual International Conference on Accounting & Finance for valuable comments. All remaining errors are ours.

Author information

Authors and affiliations.

St. John Fisher College, 235 Salerno Hall, 3690 East Avenue, Rochester, NY, 14618, USA

Nathaniel Light

École des sciences de la gestion, Université du Québec á Montréal, 315, rue Sainte-Catherine Est, Montréal, Québec, H2X 3X2, Canada

Ivan Stetsyuk

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Ivan Stetsyuk .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Light, N., Stetsyuk, I. Puzzle solved? A comprehensive analysis of hedge fund-like mutual funds according to the value-added paradigm. J Asset Manag 23 , 256–275 (2022). https://doi.org/10.1057/s41260-022-00261-5

Download citation

Revised : 22 December 2021

Accepted : 23 January 2022

Published : 11 March 2022

Issue Date : May 2022

DOI : https://doi.org/10.1057/s41260-022-00261-5

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Hedged mutual funds

- Manager skills

- Value added

JEL classification

- Find a journal

- Publish with us

- Track your research

McKinsey Global Private Markets Review 2024: Private markets in a slower era

At a glance, macroeconomic challenges continued.

McKinsey Global Private Markets Review 2024: Private markets: A slower era

If 2022 was a tale of two halves, with robust fundraising and deal activity in the first six months followed by a slowdown in the second half, then 2023 might be considered a tale of one whole. Macroeconomic headwinds persisted throughout the year, with rising financing costs, and an uncertain growth outlook taking a toll on private markets. Full-year fundraising continued to decline from 2021’s lofty peak, weighed down by the “denominator effect” that persisted in part due to a less active deal market. Managers largely held onto assets to avoid selling in a lower-multiple environment, fueling an activity-dampening cycle in which distribution-starved limited partners (LPs) reined in new commitments.

About the authors

This article is a summary of a larger report, available as a PDF, that is a collaborative effort by Fredrik Dahlqvist , Alastair Green , Paul Maia, Alexandra Nee , David Quigley , Aditya Sanghvi , Connor Mangan, John Spivey, Rahel Schneider, and Brian Vickery , representing views from McKinsey’s Private Equity & Principal Investors Practice.

Performance in most private asset classes remained below historical averages for a second consecutive year. Decade-long tailwinds from low and falling interest rates and consistently expanding multiples seem to be things of the past. As private market managers look to boost performance in this new era of investing, a deeper focus on revenue growth and margin expansion will be needed now more than ever.

Perspectives on a slower era in private markets

Global fundraising contracted.

Fundraising fell 22 percent across private market asset classes globally to just over $1 trillion, as of year-end reported data—the lowest total since 2017. Fundraising in North America, a rare bright spot in 2022, declined in line with global totals, while in Europe, fundraising proved most resilient, falling just 3 percent. In Asia, fundraising fell precipitously and now sits 72 percent below the region’s 2018 peak.

Despite difficult fundraising conditions, headwinds did not affect all strategies or managers equally. Private equity (PE) buyout strategies posted their best fundraising year ever, and larger managers and vehicles also fared well, continuing the prior year’s trend toward greater fundraising concentration.

The numerator effect persisted

Despite a marked recovery in the denominator—the 1,000 largest US retirement funds grew 7 percent in the year ending September 2023, after falling 14 percent the prior year, for example 1 “U.S. retirement plans recover half of 2022 losses amid no-show recession,” Pensions and Investments , February 12, 2024. —many LPs remain overexposed to private markets relative to their target allocations. LPs started 2023 overweight: according to analysis from CEM Benchmarking, average allocations across PE, infrastructure, and real estate were at or above target allocations as of the beginning of the year. And the numerator grew throughout the year, as a lack of exits and rebounding valuations drove net asset values (NAVs) higher. While not all LPs strictly follow asset allocation targets, our analysis in partnership with global private markets firm StepStone Group suggests that an overallocation of just one percentage point can reduce planned commitments by as much as 10 to 12 percent per year for five years or more.

Despite these headwinds, recent surveys indicate that LPs remain broadly committed to private markets. In fact, the majority plan to maintain or increase allocations over the medium to long term.

Investors fled to known names and larger funds

Fundraising concentration reached its highest level in over a decade, as investors continued to shift new commitments in favor of the largest fund managers. The 25 most successful fundraisers collected 41 percent of aggregate commitments to closed-end funds (with the top five managers accounting for nearly half that total). Closed-end fundraising totals may understate the extent of concentration in the industry overall, as the largest managers also tend to be more successful in raising non-institutional capital.

While the largest funds grew even larger—the largest vehicles on record were raised in buyout, real estate, infrastructure, and private debt in 2023—smaller and newer funds struggled. Fewer than 1,700 funds of less than $1 billion were closed during the year, half as many as closed in 2022 and the fewest of any year since 2012. New manager formation also fell to the lowest level since 2012, with just 651 new firms launched in 2023.

Whether recent fundraising concentration and a spate of M&A activity signals the beginning of oft-rumored consolidation in the private markets remains uncertain, as a similar pattern developed in each of the last two fundraising downturns before giving way to renewed entrepreneurialism among general partners (GPs) and commitment diversification among LPs. Compared with how things played out in the last two downturns, perhaps this movie really is different, or perhaps we’re watching a trilogy reusing a familiar plotline.

Dry powder inventory spiked (again)

Private markets assets under management totaled $13.1 trillion as of June 30, 2023, and have grown nearly 20 percent per annum since 2018. Dry powder reserves—the amount of capital committed but not yet deployed—increased to $3.7 trillion, marking the ninth consecutive year of growth. Dry powder inventory—the amount of capital available to GPs expressed as a multiple of annual deployment—increased for the second consecutive year in PE, as new commitments continued to outpace deal activity. Inventory sat at 1.6 years in 2023, up markedly from the 0.9 years recorded at the end of 2021 but still within the historical range. NAV grew as well, largely driven by the reluctance of managers to exit positions and crystallize returns in a depressed multiple environment.

Private equity strategies diverged

Buyout and venture capital, the two largest PE sub-asset classes, charted wildly different courses over the past 18 months. Buyout notched its highest fundraising year ever in 2023, and its performance improved, with funds posting a (still paltry) 5 percent net internal rate of return through September 30. And although buyout deal volumes declined by 19 percent, 2023 was still the third-most-active year on record. In contrast, venture capital (VC) fundraising declined by nearly 60 percent, equaling its lowest total since 2015, and deal volume fell by 36 percent to the lowest level since 2019. VC funds returned –3 percent through September, posting negative returns for seven consecutive quarters. VC was the fastest-growing—as well as the highest-performing—PE strategy by a significant margin from 2010 to 2022, but investors appear to be reevaluating their approach in the current environment.

Private equity entry multiples contracted

PE buyout entry multiples declined by roughly one turn from 11.9 to 11.0 times EBITDA, slightly outpacing the decline in public market multiples (down from 12.1 to 11.3 times EBITDA), through the first nine months of 2023. For nearly a decade leading up to 2022, managers consistently sold assets into a higher-multiple environment than that in which they had bought those assets, providing a substantial performance tailwind for the industry. Nowhere has this been truer than in technology. After experiencing more than eight turns of multiple expansion from 2009 to 2021 (the most of any sector), technology multiples have declined by nearly three turns in the past two years, 50 percent more than in any other sector. Overall, roughly two-thirds of the total return for buyout deals that were entered in 2010 or later and exited in 2021 or before can be attributed to market multiple expansion and leverage. Now, with falling multiples and higher financing costs, revenue growth and margin expansion are taking center stage for GPs.

Real estate receded

Demand uncertainty, slowing rent growth, and elevated financing costs drove cap rates higher and made price discovery challenging, all of which weighed on deal volume, fundraising, and investment performance. Global closed-end fundraising declined 34 percent year over year, and funds returned −4 percent in the first nine months of the year, losing money for the first time since the 2007–08 global financial crisis. Capital shifted away from core and core-plus strategies as investors sought liquidity via redemptions in open-end vehicles, from which net outflows reached their highest level in at least two decades. Opportunistic strategies benefited from this shift, with investors focusing on capital appreciation over income generation in a market where alternative sources of yield have grown more attractive. Rising interest rates widened bid–ask spreads and impaired deal volume across food groups, including in what were formerly hot sectors: multifamily and industrial.

Private debt pays dividends

Debt again proved to be the most resilient private asset class against a turbulent market backdrop. Fundraising declined just 13 percent, largely driven by lower commitments to direct lending strategies, for which a slower PE deal environment has made capital deployment challenging. The asset class also posted the highest returns among all private asset classes through September 30. Many private debt securities are tied to floating rates, which enhance returns in a rising-rate environment. Thus far, managers appear to have successfully navigated the rising incidence of default and distress exhibited across the broader leveraged-lending market. Although direct lending deal volume declined from 2022, private lenders financed an all-time high 59 percent of leveraged buyout transactions last year and are now expanding into additional strategies to drive the next era of growth.

Infrastructure took a detour

After several years of robust growth and strong performance, infrastructure and natural resources fundraising declined by 53 percent to the lowest total since 2013. Supply-side timing is partially to blame: five of the seven largest infrastructure managers closed a flagship vehicle in 2021 or 2022, and none of those five held a final close last year. As in real estate, investors shied away from core and core-plus investments in a higher-yield environment. Yet there are reasons to believe infrastructure’s growth will bounce back. Limited partners (LPs) surveyed by McKinsey remain bullish on their deployment to the asset class, and at least a dozen vehicles targeting more than $10 billion were actively fundraising as of the end of 2023. Multiple recent acquisitions of large infrastructure GPs by global multi-asset-class managers also indicate marketwide conviction in the asset class’s potential.

Private markets still have work to do on diversity

Private markets firms are slowly improving their representation of females (up two percentage points over the prior year) and ethnic and racial minorities (up one percentage point). On some diversity metrics, including entry-level representation of women, private markets now compare favorably with corporate America. Yet broad-based parity remains elusive and too slow in the making. Ethnic, racial, and gender imbalances are particularly stark across more influential investing roles and senior positions. In fact, McKinsey’s research reveals that at the current pace, it would take several decades for private markets firms to reach gender parity at senior levels. Increasing representation across all levels will require managers to take fresh approaches to hiring, retention, and promotion.

Artificial intelligence generating excitement

The transformative potential of generative AI was perhaps 2023’s hottest topic (beyond Taylor Swift). Private markets players are excited about the potential for the technology to optimize their approach to thesis generation, deal sourcing, investment due diligence, and portfolio performance, among other areas. While the technology is still nascent and few GPs can boast scaled implementations, pilot programs are already in flight across the industry, particularly within portfolio companies. Adoption seems nearly certain to accelerate throughout 2024.

Private markets in a slower era

If private markets investors entered 2023 hoping for a return to the heady days of 2021, they likely left the year disappointed. Many of the headwinds that emerged in the latter half of 2022 persisted throughout the year, pressuring fundraising, dealmaking, and performance. Inflation moderated somewhat over the course of the year but remained stubbornly elevated by recent historical standards. Interest rates started high and rose higher, increasing the cost of financing. A reinvigorated public equity market recovered most of 2022’s losses but did little to resolve the valuation uncertainty private market investors have faced for the past 18 months.

Within private markets, the denominator effect remained in play, despite the public market recovery, as the numerator continued to expand. An activity-dampening cycle emerged: higher cost of capital and lower multiples limited the ability or willingness of general partners (GPs) to exit positions; fewer exits, coupled with continuing capital calls, pushed LP allocations higher, thereby limiting their ability or willingness to make new commitments. These conditions weighed on managers’ ability to fundraise. Based on data reported as of year-end 2023, private markets fundraising fell 22 percent from the prior year to just over $1 trillion, the largest such drop since 2009 (Exhibit 1).

The impact of the fundraising environment was not felt equally among GPs. Continuing a trend that emerged in 2022, and consistent with prior downturns in fundraising, LPs favored larger vehicles and the scaled GPs that typically manage them. Smaller and newer managers struggled, and the number of sub–$1 billion vehicles and new firm launches each declined to its lowest level in more than a decade.

Despite the decline in fundraising, private markets assets under management (AUM) continued to grow, increasing 12 percent to $13.1 trillion as of June 30, 2023. 2023 fundraising was still the sixth-highest annual haul on record, pushing dry powder higher, while the slowdown in deal making limited distributions.

Investment performance across private market asset classes fell short of historical averages. Private equity (PE) got back in the black but generated the lowest annual performance in the past 15 years, excluding 2022. Closed-end real estate produced negative returns for the first time since 2009, as capitalization (cap) rates expanded across sectors and rent growth dissipated in formerly hot sectors, including multifamily and industrial. The performance of infrastructure funds was less than half of its long-term average and even further below the double-digit returns generated in 2021 and 2022. Private debt was the standout performer (if there was one), outperforming all other private asset classes and illustrating the asset class’s countercyclical appeal.

Private equity down but not out

Higher financing costs, lower multiples, and an uncertain macroeconomic environment created a challenging backdrop for private equity managers in 2023. Fundraising declined for the second year in a row, falling 15 percent to $649 billion, as LPs grappled with the denominator effect and a slowdown in distributions. Managers were on the fundraising trail longer to raise this capital: funds that closed in 2023 were open for a record-high average of 20.1 months, notably longer than 18.7 months in 2022 and 14.1 months in 2018. VC and growth equity strategies led the decline, dropping to their lowest level of cumulative capital raised since 2015. Fundraising in Asia fell for the fourth year of the last five, with the greatest decline in China.

Despite the difficult fundraising context, a subset of strategies and managers prevailed. Buyout managers collectively had their best fundraising year on record, raising more than $400 billion. Fundraising in Europe surged by more than 50 percent, resulting in the region’s biggest haul ever. The largest managers raised an outsized share of the total for a second consecutive year, making 2023 the most concentrated fundraising year of the last decade (Exhibit 2).

Despite the drop in aggregate fundraising, PE assets under management increased 8 percent to $8.2 trillion. Only a small part of this growth was performance driven: PE funds produced a net IRR of just 2.5 percent through September 30, 2023. Buyouts and growth equity generated positive returns, while VC lost money. PE performance, dating back to the beginning of 2022, remains negative, highlighting the difficulty of generating attractive investment returns in a higher interest rate and lower multiple environment. As PE managers devise value creation strategies to improve performance, their focus includes ensuring operating efficiency and profitability of their portfolio companies.

Deal activity volume and count fell sharply, by 21 percent and 24 percent, respectively, which continued the slower pace set in the second half of 2022. Sponsors largely opted to hold assets longer rather than lock in underwhelming returns. While higher financing costs and valuation mismatches weighed on overall deal activity, certain types of M&A gained share. Add-on deals, for example, accounted for a record 46 percent of total buyout deal volume last year.

Real estate recedes

For real estate, 2023 was a year of transition, characterized by a litany of new and familiar challenges. Pandemic-driven demand issues continued, while elevated financing costs, expanding cap rates, and valuation uncertainty weighed on commercial real estate deal volumes, fundraising, and investment performance.

Managers faced one of the toughest fundraising environments in many years. Global closed-end fundraising declined 34 percent to $125 billion. While fundraising challenges were widespread, they were not ubiquitous across strategies. Dollars continued to shift to large, multi-asset class platforms, with the top five managers accounting for 37 percent of aggregate closed-end real estate fundraising. In April, the largest real estate fund ever raised closed on a record $30 billion.

Capital shifted away from core and core-plus strategies as investors sought liquidity through redemptions in open-end vehicles and reduced gross contributions to the lowest level since 2009. Opportunistic strategies benefited from this shift, as investors turned their attention toward capital appreciation over income generation in a market where alternative sources of yield have grown more attractive.

In the United States, for instance, open-end funds, as represented by the National Council of Real Estate Investment Fiduciaries Fund Index—Open-End Equity (NFI-OE), recorded $13 billion in net outflows in 2023, reversing the trend of positive net inflows throughout the 2010s. The negative flows mainly reflected $9 billion in core outflows, with core-plus funds accounting for the remaining outflows, which reversed a 20-year run of net inflows.

As a result, the NAV in US open-end funds fell roughly 16 percent year over year. Meanwhile, global assets under management in closed-end funds reached a new peak of $1.7 trillion as of June 2023, growing 14 percent between June 2022 and June 2023.

Real estate underperformed historical averages in 2023, as previously high-performing multifamily and industrial sectors joined office in producing negative returns caused by slowing demand growth and cap rate expansion. Closed-end funds generated a pooled net IRR of −3.5 percent in the first nine months of 2023, losing money for the first time since the global financial crisis. The lone bright spot among major sectors was hospitality, which—thanks to a rush of postpandemic travel—returned 10.3 percent in 2023. 2 Based on NCREIFs NPI index. Hotels represent 1 percent of total properties in the index. As a whole, the average pooled lifetime net IRRs for closed-end real estate funds from 2011–20 vintages remained around historical levels (9.8 percent).

Global deal volume declined 47 percent in 2023 to reach a ten-year low of $650 billion, driven by widening bid–ask spreads amid valuation uncertainty and higher costs of financing (Exhibit 3). 3 CBRE, Real Capital Analytics Deal flow in the office sector remained depressed, partly as a result of continued uncertainty in the demand for space in a hybrid working world.

During a turbulent year for private markets, private debt was a relative bright spot, topping private markets asset classes in terms of fundraising growth, AUM growth, and performance.

Fundraising for private debt declined just 13 percent year over year, nearly ten percentage points less than the private markets overall. Despite the decline in fundraising, AUM surged 27 percent to $1.7 trillion. And private debt posted the highest investment returns of any private asset class through the first three quarters of 2023.

Private debt’s risk/return characteristics are well suited to the current environment. With interest rates at their highest in more than a decade, current yields in the asset class have grown more attractive on both an absolute and relative basis, particularly if higher rates sustain and put downward pressure on equity returns (Exhibit 4). The built-in security derived from debt’s privileged position in the capital structure, moreover, appeals to investors that are wary of market volatility and valuation uncertainty.

Direct lending continued to be the largest strategy in 2023, with fundraising for the mostly-senior-debt strategy accounting for almost half of the asset class’s total haul (despite declining from the previous year). Separately, mezzanine debt fundraising hit a new high, thanks to the closings of three of the largest funds ever raised in the strategy.

Over the longer term, growth in private debt has largely been driven by institutional investors rotating out of traditional fixed income in favor of private alternatives. Despite this growth in commitments, LPs remain underweight in this asset class relative to their targets. In fact, the allocation gap has only grown wider in recent years, a sharp contrast to other private asset classes, for which LPs’ current allocations exceed their targets on average. According to data from CEM Benchmarking, the private debt allocation gap now stands at 1.4 percent, which means that, in aggregate, investors must commit hundreds of billions in net new capital to the asset class just to reach current targets.

Private debt was not completely immune to the macroeconomic conditions last year, however. Fundraising declined for the second consecutive year and now sits 23 percent below 2021’s peak. Furthermore, though private lenders took share in 2023 from other capital sources, overall deal volumes also declined for the second year in a row. The drop was largely driven by a less active PE deal environment: private debt is predominantly used to finance PE-backed companies, though managers are increasingly diversifying their origination capabilities to include a broad new range of companies and asset types.

Infrastructure and natural resources take a detour

For infrastructure and natural resources fundraising, 2023 was an exceptionally challenging year. Aggregate capital raised declined 53 percent year over year to $82 billion, the lowest annual total since 2013. The size of the drop is particularly surprising in light of infrastructure’s recent momentum. The asset class had set fundraising records in four of the previous five years, and infrastructure is often considered an attractive investment in uncertain markets.

While there is little doubt that the broader fundraising headwinds discussed elsewhere in this report affected infrastructure and natural resources fundraising last year, dynamics specific to the asset class were at play as well. One issue was supply-side timing: nine of the ten largest infrastructure GPs did not close a flagship fund in 2023. Second was the migration of investor dollars away from core and core-plus investments, which have historically accounted for the bulk of infrastructure fundraising, in a higher rate environment.

The asset class had some notable bright spots last year. Fundraising for higher-returning opportunistic strategies more than doubled the prior year’s total (Exhibit 5). AUM grew 18 percent, reaching a new high of $1.5 trillion. Infrastructure funds returned a net IRR of 3.4 percent in 2023; this was below historical averages but still the second-best return among private asset classes. And as was the case in other asset classes, investors concentrated commitments in larger funds and managers in 2023, including in the largest infrastructure fund ever raised.

The outlook for the asset class, moreover, remains positive. Funds targeting a record amount of capital were in the market at year-end, providing a robust foundation for fundraising in 2024 and 2025. A recent spate of infrastructure GP acquisitions signal multi-asset managers’ long-term conviction in the asset class, despite short-term headwinds. Global megatrends like decarbonization and digitization, as well as revolutions in energy and mobility, have spurred new infrastructure investment opportunities around the world, particularly for value-oriented investors that are willing to take on more risk.

Private markets make measured progress in DEI

Diversity, equity, and inclusion (DEI) has become an important part of the fundraising, talent, and investing landscape for private market participants. Encouragingly, incremental progress has been made in recent years, including more diverse talent being brought to entry-level positions, investing roles, and investment committees. The scope of DEI metrics provided to institutional investors during fundraising has also increased in recent years: more than half of PE firms now provide data across investing teams, portfolio company boards, and portfolio company management (versus investment team data only). 4 “ The state of diversity in global private markets: 2023 ,” McKinsey, August 22, 2023.

In 2023, McKinsey surveyed 66 global private markets firms that collectively employ more than 60,000 people for the second annual State of diversity in global private markets report. 5 “ The state of diversity in global private markets: 2023 ,” McKinsey, August 22, 2023. The research offers insight into the representation of women and ethnic and racial minorities in private investing as of year-end 2022. In this chapter, we discuss where the numbers stand and how firms can bring a more diverse set of perspectives to the table.

The statistics indicate signs of modest advancement. Overall representation of women in private markets increased two percentage points to 35 percent, and ethnic and racial minorities increased one percentage point to 30 percent (Exhibit 6). Entry-level positions have nearly reached gender parity, with female representation at 48 percent. The share of women holding C-suite roles globally increased 3 percentage points, while the share of people from ethnic and racial minorities in investment committees increased 9 percentage points. There is growing evidence that external hiring is gradually helping close the diversity gap, especially at senior levels. For example, 33 percent of external hires at the managing director level were ethnic or racial minorities, higher than their existing representation level (19 percent).

Yet, the scope of the challenge remains substantial. Women and minorities continue to be underrepresented in senior positions and investing roles. They also experience uneven rates of progress due to lower promotion and higher attrition rates, particularly at smaller firms. Firms are also navigating an increasingly polarized workplace today, with additional scrutiny and a growing number of lawsuits against corporate diversity and inclusion programs, particularly in the US, which threatens to impact the industry’s pace of progress.

Fredrik Dahlqvist is a senior partner in McKinsey’s Stockholm office; Alastair Green is a senior partner in the Washington, DC, office, where Paul Maia and Alexandra Nee are partners; David Quigley is a senior partner in the New York office, where Connor Mangan is an associate partner and Aditya Sanghvi is a senior partner; Rahel Schneider is an associate partner in the Bay Area office; John Spivey is a partner in the Charlotte office; and Brian Vickery is a partner in the Boston office.

The authors wish to thank Jonathan Christy, Louis Dufau, Vaibhav Gujral, Graham Healy-Day, Laura Johnson, Ryan Luby, Tripp Norton, Alastair Rami, Henri Torbey, and Alex Wolkomir for their contributions

The authors would also like to thank CEM Benchmarking and the StepStone Group for their partnership in this year's report.

This article was edited by Arshiya Khullar, an editor in the Gurugram office.

Explore a career with us

Related articles.

CEO alpha: A new approach to generating private equity outperformance

Private equity turns to resiliency strategies for software investments

The state of diversity in global private markets: 2022

- MyU : For Students, Faculty, and Staff

News Roundup Spring 2024

CEGE Spring Graduation Celebration and Order of the Engineer

Forty-seven graduates of the undergraduate and grad student programs (pictured above) in the Department of Civil, Environmental, and Geo- Engineering took part in the Order of the Engineer on graduation day. Distinguished Speakers at this departmental event included Katrina Kessler (MS EnvE 2021), Commissioner of the Minnesota Pollution Control Agency, and student Brian Balquist. Following this event, students participated in the college-wide Commencement Ceremony at 3M Arena at Mariucci.

UNIVERSITY & DEPARTMENT

The University of Minnesota’s Crookston, Duluth, and Rochester campuses have been awarded the Carnegie Elective Classification for Community Engagement, joining the Twin Cities (2006, 2015) and Morris campuses (2015), and making the U of M the country’s first and only university system at which every individual campus has received this selective designation. Only 368 from nearly 4,000 qualifying U.S. universities and colleges have been granted this designation.

CEGE contributed strongly to the College of Science and Engineering’s efforts toward sustainability research. CEGE researchers are bringing in over $35 million in funded research to study carbon mineralization, nature and urban areas, circularity of water resources, and global snowfall patterns. This news was highlighted in the Fall 2023 issue of Inventing Tomorrow (pages 10-11). https://issuu.com/inventingtomorrow/docs/fall_2023_inventing_tomorrow-web

CEGE’s new program for a one-year master’s degree in structural engineering is now accepting applicants for Fall 2024. We owe a big thanks to DAN MURPHY and LAURA AMUNDSON for their volunteer work to help curate the program with Professor JIA-LIANG LE and EBRAHIM SHEMSHADIAN, the program director. Potential students and companies interested in hosting a summer intern can contact Ebrahim Shemshadian ( [email protected] ).

BERNIE BULLERT , CEGE benefactor and MN Water Research Fund founder, was profiled on the website of the University of Minnesota Foundation (UMF). There you can read more about his mission to share clean water technologies with smaller communities in Minnesota. Many have joined Bullert in this mission. MWRF Recognizes their Generous 2024 Partners. Gold Partners: Bernie Bullert, Hawkins, Inc., Minnesota Department of Health, Minnesota Pollution Control Agency, and SL-serco. Silver Partners: ISG, Karl and Pam Streed, Kasco, Kelly Lange-Haider and Mark Haider, ME Simpson, Naeem Qureshi, Dr. Paul H. Boening, TKDA, and Waterous. Bronze Partners: Bruce R. Bullert; Brenda Lenz, Ph.D., APRN FNP-C, CNE; CDM Smith; Central States Water Environment Association (CSWEA MN); Heidi and Steve Hamilton; Jim “Bulldog” Sadler; Lisa and Del Cerney; Magney Construction; Sambatek; Shannon and John Wolkerstorfer; Stantec; and Tenon Systems.

After retiring from Baker-Tilly, NICK DRAGISICH (BCE 1977) has taken on a new role: City Council member in Lake Elmo, Minnesota. After earning his BCE from the University of Minnesota, Dragisich earned a master’s degree in business administration from the University of St. Thomas. Dragisich retired in May from his position as managing director at Baker Tilly, where he had previously served as firm director. Prior to that, he served as assistant city manager in Spokane, Washington, was the city administrator and city engineer in Virginia, Minnesota, and was mayor of Chisholm, Minnesota—all adding up to more than 40 years of experience in local government. Dragisich was selected by a unanimous vote. His current term expires in December 2024.

PAUL F. GNIRK (Ph.D. 1966) passed away January 29, 2024, at the age of 86. A memorial service was held Saturday, February 24, at the South Dakota School of Mines and Technology (SDSM&T), where he started and ended his teaching career, though he had many other positions, professional and voluntary. In 2018 Paul was inducted into the SDSM&T Hardrocker Hall of Fame, and in 2022, he was inducted into the South Dakota Hall of Fame, joining his mother Adeline S. Gnirk, who had been inducted in 1987 for her work authoring nine books on the history of south central South Dakota.

ROGER M. HILL (BCE 1957) passed away on January 13, 2024, at the age of 90. His daughter, Kelly Robinson, wrote to CEGE that Roger was “a dedicated Gopher fan until the end, and we enjoyed many football games together in recent years. Thank you for everything.”

KAUSER JAHAN (Ph.D. 1993, advised by Walter Maier), PE, is now a civil and environmental engineering professor and department head at Henry M. Rowan College of Engineering. Jahan was awarded a 3-year (2022- 2025), $500,000 grant from the U.S. Department of Environmental Protection Agency (USEPA). The grant supports her project, “WaterWorks: Developing the New Generation of Workforce for Water/Wastewater Utilities,” for the development of educational tools that will expose and prepare today’s students for careers in water and wastewater utilities.

SAURA JOST (BCE 2010, advised by Timothy LaPara) was elected to the St. Paul City Council for Ward 3. She is part of the historic group of women that make up the nation’s first all-female city council in a large city.

The 2024 ASCE Western Great Lakes Student Symposium combines several competitions for students involved in ASCE. CEGE sent a large contingent of competitors to Chicago. Each of the competition groups won awards: Ethics Paper 1st place Hans Lagerquist; Sustainable Solutions team 1st place overall in (qualifying them for the National competition in Utah in June); GeoWall 2nd place overall; Men’s Sprint for Concrete Canoe with rowers Sakthi Sundaram Saravanan and Owen McDonald 2nd place; Product Prototype for Concrete Canoe 2nd place; Steel Bridge (200 lb bridge weight) 2nd place in lightness; Scavenger Hunt 3rd place; and Aesthetics and Structural Efficiency for Steel Bridge 4th place.

Students competing on the Minnesota Environmental Engineers, Scientists, and Enthusiasts (MEESE) team earned second place in the Conference on the Environment undergraduate student design competition in November 2023. Erin Surdo is the MEESE Faculty Adviser. Pictured are NIKO DESHPANDE, ANNA RETTLER, and SYDNEY OLSON.

The CEGE CLASS OF 2023 raised money to help reduce the financial barrier for fellow students taking the Fundamentals of Engineering exam, a cost of $175 per test taker. As a result of this gift, they were able to make the exam more affordable for 15 current CEGE seniors. CEGE students who take the FE exam pass the first time at a rate well above national averages, demonstrating that CEGE does a great job of teaching engineering fundamentals. In 2023, 46 of 50 students passed the challenging exam on the first try.

This winter break, four CEGE students joined 10 other students from the College of Science and Engineering for the global seminar, Design for Life: Water in Tanzania. The students visited numerous sites in Tanzania, collected water source samples, designed rural water systems, and went on safari. Read the trip blog: http://globalblogs.cse.umn.edu/search/label/Tanzania%202024

Undergraduate Honor Student MALIK KHADAR (advised by Dr. Paul Capel) received honorable mention for the Computing Research Association (CRA) Outstanding Undergraduate Research Award for undergraduate students who show outstanding research potential in an area of computing research.

GRADUATE STUDENTS

AKASH BHAT (advised by William Arnold) presented his Ph.D. defense on Friday, October 27, 2023. Bhat’s thesis is “Photolysis of fluorochemicals: Tracking fluorine, use of UV-LEDs, and computational insights.” Bhat’s work investigating the degradation of fluorinated compounds will assist in the future design of fluorinated chemicals such that persistent and/or toxic byproducts are not formed in the environment.

ETHAN BOTMEN (advised by Bill Arnold) completed his Master of Science Final Exam February 28, 2024. His research topic was Degradation of Fluorinated Compounds by Nucleophilic Attack of Organo-fluorine Functional Groups.

XIATING CHEN , Ph.D. Candidate in Water Resources Engineering at the Saint Anthony Falls Laboratory is the recipient of the 2023 Nels Nelson Memorial Fellowship Award. Chen (advised by Xue Feng) is researching eco-hydrological functions of urban trees and other green infrastructure at both the local and watershed scale, through combined field observations and modeling approaches.

ALICE PRATES BISSO DAMBROZ has been a Visiting Student Researcher at the University of Minnesota since last August, on a Doctoral Dissertation Research Award from Fulbright. Her CEGE advisor is Dr. Paul Capel. Dambroz is a fourth year Ph.D. student in Soil Science at Universidade Federal de Santa Maria in Brazil, where she studies with her adviser Jean Minella. Her research focuses on the hydrological monitoring of a small agricultural watershed in Southern Brazil, which is located on a transition area between volcanic and sedimentary rocks. Its topography, shallow soils, and land use make it prone to runoff and erosion processes.

Yielding to people in crosswalks should be a very pedestrian topic. Yet graduate student researchers TIANYI LI, JOSHUA KLAVINS, TE XU, NIAZ MAHMUD ZAFRI (Dept.of Urban and Regional Planning at Bangladesh University of Engineering and Technology), and Professor Raphael Stern found that drivers often do not yield to pedestrians, but they are influenced by the markings around a crosswalk. Their work was picked up by the Minnesota Reformer.

TIANYI LI (Ph.D. student advised by Raphael Stern) also won the Dwight David Eisenhower Transportation (DDET) Fellowship for the third time! Li (center) and Stern (right) are pictured at the Federal Highway Administration with Latoya Jones, the program manager for the DDET Fellowship.

The Three Minute Thesis Contest and the Minnesota Nice trophy has become an annual tradition in CEGE. 2023’s winner was EHSANUR RAHMAN , a Ph.D. student advised by Boya Xiong.

GUANJU (WILLIAM) WEI , a Ph.D. student advised by Judy Yang, is the recipient of the 2023 Heinz G. Stefan Fellowship. He presented his research entitled Microfluidic Investigation of the Biofilm Growth under Dynamic Fluid Environments and received his award at the St. Anthony Falls Research Laboratory April 9. The results of Wei's research can be used in industrial, medical, and scientific fields to control biofilm growth.

BILL ARNOLD stars in an award-winning video about prairie potholes. The Prairie Potholes Project film was made with the University of Delaware and highlights Arnold’s NSF research. The official winners of the 2024 Environmental Communications Awards Competition Grand Prize are Jon Cox and Ben Hemmings who produced and directed the film. Graduate student Marcia Pacheco (CFANS/LAAS) and Bill Arnold are the on-screen stars.

Four faculty from CEGE join the Center for Transportation Studies Faculty and Research Scholars for FY24–25: SEONGJIN CHOI, KETSON ROBERTO MAXIMIANO DOS SANTOS, PEDRAM MORTAZAVI, and BENJAMIN WORSFOLD . CTS Scholars are drawn from diverse fields including engineering, planning, computer science, environmental studies, and public policy.

XUE FENG is coauthor on an article in Nature Reviews Earth and Environment . The authors evaluate global plant responses to changing rainfall regimes that are now characterized by fewer and larger rainfall events. A news release written at Univ. of Maryland can be found here: https://webhost.essic. umd.edu/april-showers-bring-mayflowers- but-with-drizzles-or-downpours/ A long-running series of U of M research projects aimed at improving stormwater quality are beginning to see practical application by stormwater specialists from the Twin Cities metro area and beyond. JOHN GULLIVER has been studying best practices for stormwater management for about 16 years. Lately, he has focused specifically on mitigating phosphorous contamination. His research was highlighted by the Center for Transportation Studies.

JIAQI LI, BILL ARNOLD, and RAYMOND HOZALSKI published a paper on N-nitrosodimethylamine (NDMA) precursors in Minnesota rivers. “Animal Feedlots and Domestic Wastewater Discharges are Likely Sources of N-Nitrosodimethylamine (NDMA) Precursors in Midwestern Watersheds,” Environmental Science and Technology (January 2024) doi: 10.1021/acs. est.3c09251

ALIREZA KHANI contributed to MnDOT research on Optimizing Charging Infrastructure for Electric Trucks. Electric options for medium- and heavy-duty electric trucks (e-trucks) are still largely in development. These trucks account for a substantial percentage of transportation greenhouse gas emissions. They have greater power needs and different charging needs than personal EVs. Proactively planning for e-truck charging stations will support MnDOT in helping to achieve the state’s greenhouse gas reduction goals. This research was featured in the webinar “Electrification of the Freight System in Minnesota,” hosted by the University of Minnesota’s Center for Transportation Studies. A recording of the event is now available online.

MICHAEL LEVIN has developed a unique course for CEGE students on Air Transportation Systems. It is the only class at UMN studying air transportation systems from an infrastructure design and management perspective. Spring 2024 saw the third offering of this course, which is offered for juniors, seniors, and graduate students.

Research Professor SOFIA (SONIA) MOGILEVSKAYA has been developing international connections. She visited the University of Seville, Spain, November 13–26, 2023, where she taught a short course titled “Fundamentals of Homogenization in Composites.” She also met with the graduate students to discuss collaborative research with Prof. Vladislav Mantic, from the Group of Continuum Mechanics and Structural Analysis at the University of Seville. Her visit was a part of planned activities within the DIAGONAL Consortium funded by the European Commission. CEGE UMN is a partner organization within DIAGONAL, represented by CEGE professors Mogilevskaya and Joseph Labuz. Mantic will visit CEGE summer 2024 to follow up on research developments and discuss plans for future collaboration and organization of short-term exchange visits for the graduate students from each institution.

DAVID NEWCOMB passed away in March. He was a professor in CEGE from 1989–99 in the area of pavement engineering. Newcomb led the research program on asphalt materials characterization. He was the technical director of Mn/ROAD pavement research facility, and he started an enduring collaboration with MnDOT that continues today. In 2000, he moved from Minnesota to become vice-president for Research and Technology at the National Asphalt Pavement Association. Later he moved to his native Texas, where he was appointed to the division head of Materials and Pavement at the Texas A&M Transportation Institute, a position from which he recently retired. He will be greatly missed.

PAIGE NOVAK won Minnesota ASCE’s 2023 Distinguished Engineer of the Year Award for her contributions to society through her engineering achievements and professional experiences.

The National Science Foundation (NSF) announced ten inaugural (NSF) Regional Innovation Engines awards, with a potential $1.6 billion investment nationally over the next decade. Great Lakes ReNEW is led by the Chicago-based water innovation hub, Current, and includes a team from the University of Minnesota, including PAIGE NOVAK. Current will receive $15 mil for the first two years, and up to $160 million over ten years to develop and grow a water-focused innovation engine in the Great Lakes region. The project’s ambitious plan is to create a decarbonized circular “blue economy” to leverage the region’s extraordinary water resources to transform the upper Midwest—Illinois, Indiana, Michigan, Minnesota, Ohio, and Wisconsin. Brewing one pint of beer generates seven pints of wastewater, on average. So what can you do with that wastewater? PAIGE NOVAK and her team are exploring the possibilities of capturing pollutants in wastewater and using bacteria to transform them into energy.

BOYA XIONG has been selected as a recipient of the 2024 40 Under 40 Recognition Program by the American Academy of Environmental Engineers and Scientists. The award was presented at the 2024 AAEES Awards Ceremony, April 11, 2024, at the historic Howard University in Washington, D.C.

JUDY Q. YANG received a McKnight Land-Grant Professorship Award. This two-year award recognizes promising assistant professors and is intended to advance the careers of individuals who have the potential to make significant contributions to their departments and their scholarly fields.