English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- TESLA, INC.

- AMD (ADVANCED MICRO DEVICES)

- MICROSOFT CORPORATION

- NIPPON ACTIVE VALUE FUND PLC

- WALMART INC.

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Growth stocks at reasonable prices

- Momentum stocks

- Trend-Following Stocks

- Quality stocks

- Dividend Kings

- In Vino Veritas

- Warren Buffett

- Serial buyers

- The Internet of Things

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Pricing Power

- Semiconductors

- The Vegan Market

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Grab Holdings Limited

Kyg4124c1096.

- Grab : Investor Day 2022 Presentation

Q&A Session

Cautionary Statement

FORWARD-LOOKING STATEMENTS. This presentation and the related webcast (together, this "Presentation") contain "forward-looking statements" within the meaning of the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Presentation, including but not limited to, statements about Grab's goals, targets, projections, outlooks, roadmaps, estimations, steady-state information, beliefs and expectations, business strategy and plans, objectives of management for future operations of Grab, market sizes, and growth opportunities, are forward-looking statements. Similarly, ESG roadmaps are dependent on future factors, such as continued technological progress and policy support, and also represent forward-looking statements. Some of the forward-looking statements can be identified by the use of forward-looking words, including "anticipate," "expect," "suggest," "plan," "believe," "intend," "estimate," "target," "project," "should," "could," "would," "may," "will," "forecast," "annualized," "illustrative" or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab's ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19 and currency exchange fluctuations; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described in the "Risk Factors" section of Grab's registration statement on Form F-1 and the prospectus therein, and other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the "SEC"). Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law. "Grab" refers to, unless the context otherwise requires, Grab Holdings Limited and its subsidiaries and consolidated affiliated entities.

NON-IFRS FINANCIAL MEASURES. This Presentation includes references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin and financial information on a constant currency basis. However, the presentation of these non-IFRS financial measures is not intended to be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab's management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab's management uses: Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab's business segments, as it does not include regional corporate costs. There are a number of limitations related to the use of non-IFRS financial measures. In light of these limitations, Grab provides specific information regarding the IFRS amounts excluded from these non-IFRS financial measures and evaluate these non-IFRS financial measures together with their relevant financial measures in accordance with IFRS. With regard to forward-lookingnon-IFRS guidance and targets provided in this Presentation, Grab is unable to provide a reconciliation of these forward-lookingnon-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict. See the Supplemental Information from page 105 to 107 of this Presentation for additional important information regarding the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures.

SUPPLEMENTAL INFORMATION. See the Supplemental Information from page 105 to 107 of this Presentation for additional important information regarding unaudited financial information, industry and market data, definitions of operating metrics, trademarks and tradenames, and rounded numbers contained in this Presentation.

Anthony Tan

CEO & Co-founder

Southeast Asia's leading superapp

Country Countries

City Cities

This is an excerpt of the original content. To continue reading it, access the original document here .

Attachments

- Original Link

- Original Document

Grab Holdings Ltd. published this content on 28 September 2022 and is solely responsible for the information contained therein. Distributed by Public , unedited and unaltered, on 28 September 2022 00:15:04 UTC .

Latest news about Grab Holdings Limited

Chart grab holdings limited.

Company Profile

Income statement evolution, ratings for grab holdings limited, analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector application software.

- Stock Market

- News Grab Holdings Limited

Press Centre

We blog about driver events, product updates, driving tips, driver stories and more.

- PRODUCT UPDATES

- DRIVER STORIES

Grab Reports Third Quarter 2022 Results

Excerpt here. allow the user to have fully control on excerpt.

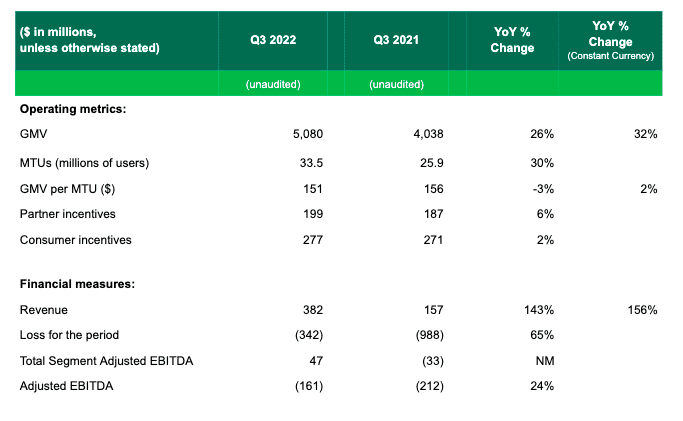

Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the quarter ended September 30, 2022.

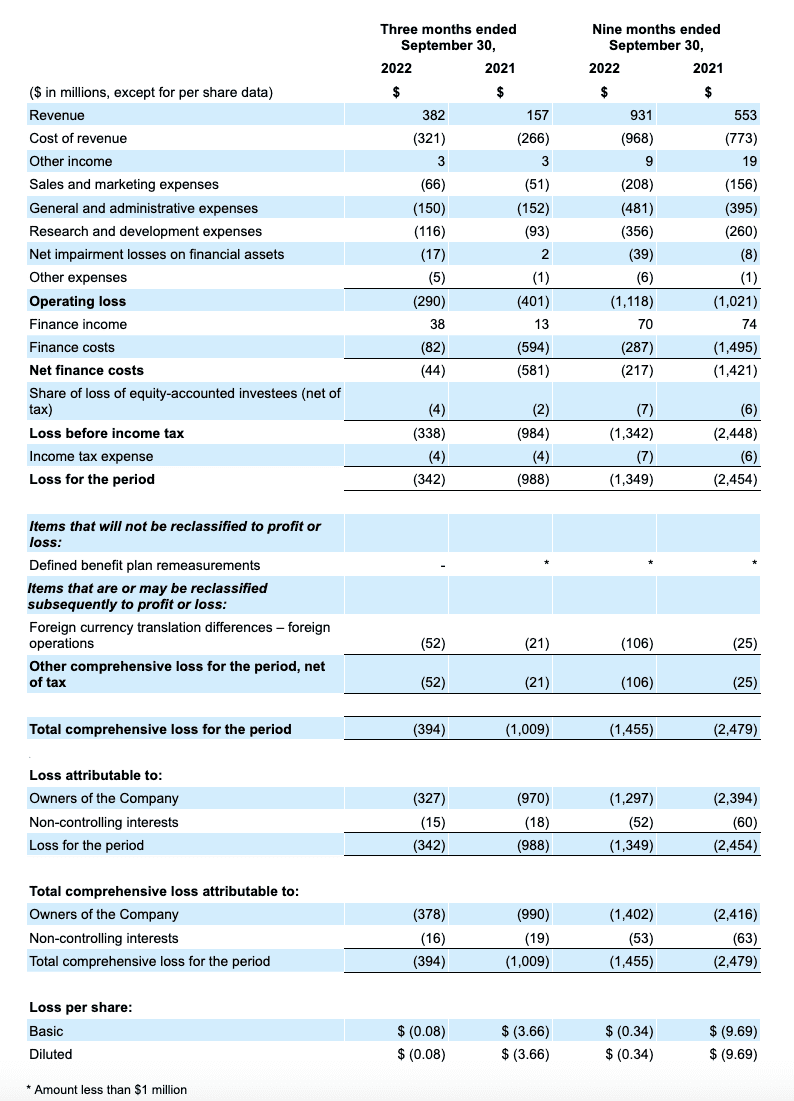

- Q3 record Revenue of $382 million, up 143% year-over-year

- Q3 GMV of $5.1 billion, up 26% year-over-year

- Q3 Loss of $342 million, a 65% improvement year-over-year

- Achieved segment adjusted EBITDA breakeven for overall Deliveries and Core Food Deliveries

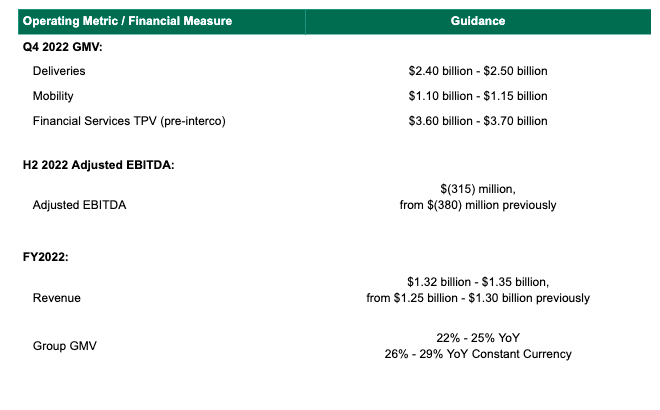

- Revised FY2022 revenue guidance to $1.32 billion – $1.35 billion, up from $1.25 billion – $1.30 billion

- Revised H2 2022 Adjusted EBITDA guidance to negative $315 million, $65 million improvement from negative $380 million and a 40% half-on-half improvement

SINGAPORE, November 16, 2022 – Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the quarter ended September 30, 2022.

“Our third-quarter results demonstrate our ability to drive growth and profitability in tandem. We achieved core food deliveries and overall Deliveries segment-adjusted EBITDA breakeven ahead of guidance while narrowing our overall loss for the period significantly. We accomplished this by staying laser-focused on our cost structure and incentives, while innovating on services that increase synergies within our superapp ecosystem to promote transaction frequency, user retention and engagement. We are confident that we have a strong foundation to continue to scale our business sustainably,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab .

“We are pleased to report a strong third quarter that reflects our accelerated path to profitability. Despite foreign currency translation headwinds and normalizing food delivery demand, our revenue increased 143% year-over-year (“YoY”), with incentive spend as a percentage of GMV reduced substantively to 9.4%, down from 11.4% for the same period last year. In the quarters ahead, we will continue to focus on cash preservation and cost optimization as we execute on our plans to grow sustainably and drive towards our expectations of 45% – 55% YoY revenue growth in 2023 on a constant currency basis,” said Peter Oey, Chief Financial Officer of Grab .

Group Key Operational and Financial Highlights

- Revenue rose 143% YoY to $382 million in the third quarter of 2022, or 156% on a constant currency basis [1] , primarily driven by strong growth in Mobility and Deliveries revenue, representing 101% and 250% YoY growth, respectively.

- Total GMV grew 26% YoY or 32% YoY on a constant currency basis, primarily due to a strong recovery in our mobility segment and continued growth in Deliveries.

- During the quarter, our performance was impacted by foreign exchange currency translations. Quarter-over-quarter (“QoQ”) revenue grew 19% and GMV was flat, respectively, while they grew by 23% and 4% QoQ, respectively, on a constant currency basis.

- During the quarter, incentives came down to 9.4% as a percentage of GMV, compared to 11.4% for the same period last year and 10.4% for the previous quarter, demonstrating our commitment to growing profitably and sustainably.

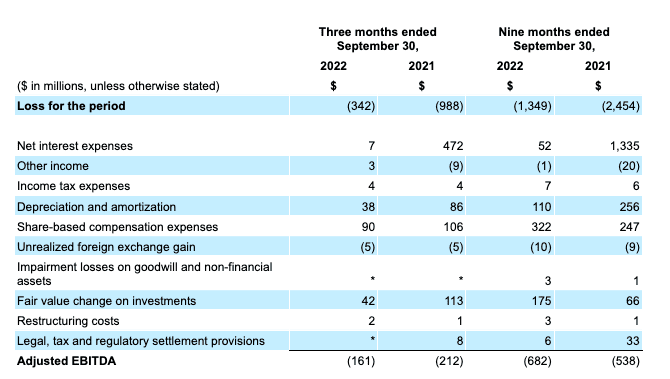

- Loss for the quarter was $342 million, a 65% improvement YoY, primarily due to the elimination of the non-cash interest expense of Grab’s convertible redeemable preference shares that converted to ordinary shares in December 2021. Our loss for the quarter included a $42 million non-cash expense from fair value changes on investments, and $90 million in non-cash stock-based compensation expense.

- Adjusted EBITDA was negative $161 million, an improvement of 24%, compared to negative $212 million for the same period last year as we continued to grow GMV and optimize incentive spend as a percentage of GMV across our business.

- Adjusted EBITDA margin was (3.2)%, an improvement of 209 basis points YoY and 145 basis points compared to the second quarter of 2022. For the first time, Deliveries segment adjusted EBITDA margins turned positive at 0.4%, compared to (0.9)% for the same period last year and (1.4)% for the second quarter of 2022. Our Core Food Deliveries business also recorded positive adjusted EBITDA for the third quarter of 2022.

- Regional corporate costs [2] as a percentage of GMV was 4.1%, an improvement from 4.4% of GMV for the third quarter of 2021 and 4.2% for the previous quarter. As part of our efforts to continue to optimize our cost structure, we have slowed our pace of hiring, streamlined some functions, and reduced other overhead expenditure.

- Cash liquidity totaled $7.4 billion at the end of the third quarter, while our net cash liquidity was $5.3 billion.

- MTUs grew 30% YoY, accelerating from 12% YoY in the second quarter of 2022 and 10% YoY in the first quarter 2022, primarily driven by the strong recovery in Mobility as countries reopened and international and domestic travel resumed. GMV per MTU declined by 3% compared to the same period of last year, but grew 2% on a constant currency basis

- Cross-vertical penetration rates continued to improve, with 62% of MTUs using two or more offerings on Grab platform, up from 56% compared to the same period last year.

- 72% of our two-wheel drivers [3] performed both food delivery and mobility jobs on Grab, up from 65% in the third quarter of 2021 and 69% in the second quarter of 2022. GrabFin continues to drive and enhance the power of our ecosystem, offering customized lending solutions to empower our driver-partners, which in turn, drives higher satisfaction and productivity on the platform when compared to driver-partners without loans. In the quarter, the number of active driver-partners with a loan from Grab has more than doubled YoY and outstanding balance from driver-partner loans has grown by nearly 3 times YoY.

The guidance represents our expectations as of the date of this press release, and may be subject to change.

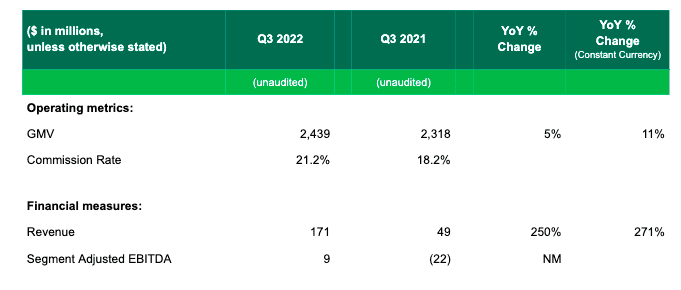

Third Quarter Segment Financial and Operational Highlights

- Revenue for deliveries recorded strong growth, up 250% YoY, or 271% on a constant currency basis, primarily driven by our disciplined approach to reducing incentives as a percentage of GMV as we focus on driving higher quality GMV transactions, and contributions from Jaya Grocer. Commission rate [4] rose to 21.2%, up from 18.2% for the same period last year.

- GMV for Deliveries was up 5% YoY, or 11% YoY on a constant currency basis, supported by a YoY increase in MTUs. GMV declined by 1% QoQ but grew by 2% QoQ on a constant currency basis. Both Food Deliveries and Non-Food Deliveries category GMV continued to grow resiliently YoY.

- Deliveries segment adjusted EBITDA turned positive for the first time, three quarters ahead of our previous guidance primarily due to optimization of our incentive spend, and contributions from Jaya Grocer. Food Delivery also turned adjusted EBITDA positive in the third quarter of 2022, two quarters ahead of our previous guidance.

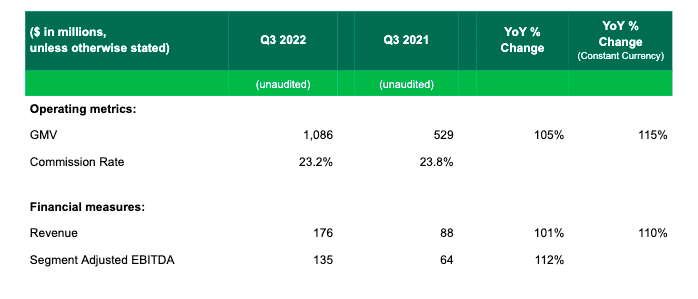

- Revenue for Mobility recorded strong growth, up 101% YoY, or 110% on a constant currency basis, primarily driven by the strong demand recovery following the easing of COVID-19 restrictions and our efforts to improve active driver supply across the region.

- Mobility GMV was up 105% YoY, or 115% YoY on a constant currency basis, as demand remained strong. GMV from airport rides as a percentage of total Mobility GMV also continued to increase.

- Mobility segment adjusted EBITDA as a percentage of GMV improved by 41 basis points to 12.5% of GMV, compared to 12.0% in the same period last year.

- During the quarter, we continued to streamline and expedite the onboarding process across countries to enable drivers access to more leasing vehicles. Grab’s monthly average active driver-partners in the third quarter of 2022 was 80% of pre-COVID levels in the fourth quarter of 2019.

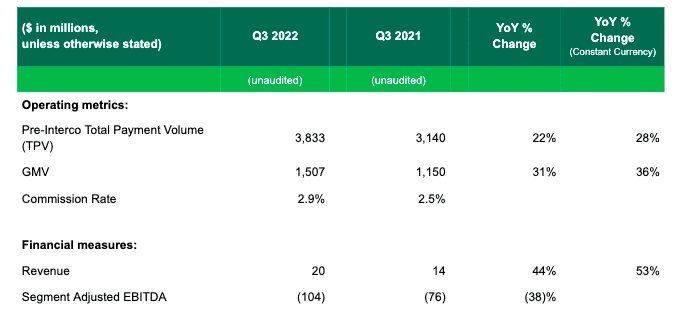

Financial Services

- Revenue for Financial Services recorded strong growth, up 44% YoY, or 53% YoY on a constant currency basis, primarily driven by higher GMV, and higher contributions from our lending business. Commission rates increased to 2.9% in the third quarter of 2022 from 2.5% in the same period last year.

- GMV for Financial Services was up 31% YoY in the quarter, or 36% YoY on a constant currency basis, as we continued to benefit from the reopening post-COVID.

- Segment adjusted EBITDA for the quarter declined 38% YoY, due to higher expenses in our Digibank operations. As a result of our strategic initiatives to focus on ecosystem transactions and streamline our GrabFin cost base, segment adjusted EBITDA for the quarter improved 9% QoQ.

- Loan disbursements for the quarter rose 121% YoY and were up 7% QoQ. In the quarter, the number of active driver-partners with a loan from Grab has more than doubled YoY while maintaining low single digits nonperforming loans.

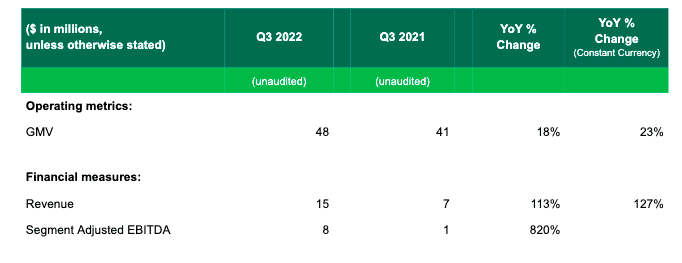

Enterprise and New Initiatives

- Revenue and GMV from Enterprise and New Initiatives rose 113% and 18% YoY, respectively, or 127% and 23%, respectively, on a constant currency basis, driven by growing contributions from our Advertising services.

- Segment adjusted EBITDA rose 9 times in the quarter compared to the same period last year, primarily driven by lowered incentives as a percentage of GMV.

Other Events Consistent with our disciplined capital allocation approach to preserve cash and chart a clear path to profitability while maintaining a strong balance sheet, Grab’s Board of Directors has approved the repurchase of up to $750 million of our outstanding Term Loan B. This loan facility was issued in January 2021, with a five-year tenor and a principal amount of $2 billion. The repurchase is expected to create significant interest expense savings. With $5.3 billion of net cash liquidity as of September 30, 2022, we expect to have ample net cash buffer upon reaching our expected Group Adjusted EBITDA breakeven in the second half of 2024.

About Grab Grab is Southeast Asia’s leading superapp based on GMV in 2021 in each of food deliveries, mobility and the e-wallets segment of financial services, according to Euromonitor. Grab operates across the deliveries, mobility and digital financial services sectors in over 480 cities in eight countries in the Southeast Asia region – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Grab enables millions of people each day to access its driver- and merchant-partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance, wealth management and telemedicine, all through a single “everyday everything” app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone, and since then, the Grab app has been downloaded onto millions of mobile devices. Grab strives to serve a triple bottom line: to simultaneously deliver financial performance for its shareholders and have a positive social and environmental impact in Southeast Asia.

Forward-Looking Statements This document and the announced investor webcast contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s goals, targets, projections, outlooks, beliefs, expectations, strategy, plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab’s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19 and currency exchange fluctuations; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described in the “Risk Factors” section of Grab’s registration statement on Form F-1 and the prospectus therein, and other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information Grab ’ s unaudited selected financial data for the three months and nine months ended September 30, 2022 and 2021 included in this document and the investor webcast is based on financial data derived from the Grab ’ s management accounts that have not been reviewed or audited.

Non-IFRS Financial Measures This document and the investor webcast include references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Total Segment Adjusted EBITDA and Adjusted EBITDA margin. Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab ’ s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab ’ s management uses: Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab ’ s business segments, as it does not include regional corporate costs. However, there are a number of limitations related to the use of non-IFRS financial measures, and as such, the presentation of these non-IFRS financial measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. See below for additional explanations about the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures. With regard to forward-looking non-IFRS guidance and targets provided in this document and the investor webcast, Grab is unable to provide a reconciliation of these forward-looking non-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict.

Explanation of non-IFRS financial measures:

- Adjusted EBITDA is a non-IFRS financial measure calculated as net loss adjusted to exclude: (i) interest income (expenses), (ii) other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses.

- Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

- Total Segment Adjusted EBITDA is a non-IFRS financial measure, representing the sum of Adjusted EBITDA of our four business segments.

- Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value.

This document and the investor webcast also includes “ Pre-InterCo” data that does not reflect elimination of intragroup transactions, which means such data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions.

We compare the percent change in our current period results from the corresponding prior period using constant currency. We present constant currency growth rate information to provide a framework for assessing how our underlying GMV and revenue performed excluding the effect of foreign currency rate fluctuations. We calculate constant currency by translating our current period financial results using the corresponding prior period ’ s monthly exchange rates for our transacted currencies other than the U.S. dollar.

Operating Metrics Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab ’ s services, including any applicable taxes, tips, tolls and fees, over the period of measurement. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab ’ s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of a consumer ’ s spend that is being directed through Grab ’ s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare, Grab ’ s aggregate operating results, which captures significant trends in its business over time.

Total Payments Volume (TPV) means total payments volume received from consumers, which is an operating metric defined as the value of payments, net of payment reversals, successfully completed through our platform.

Monthly Transacting User (MTUs) is defined as the monthly transacting users, which is an operating metric defined as the monthly number of unique users who transact via Grab ’ s products, where transact means to have successfully paid for any of Grab ’ s products. MTUs is a metric by which Grab understands, evaluates and manages its business, and Grab ’ s management believes is necessary for investors to understand and evaluate its business.

Commission rate represents the total dollar value paid to Grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of GMV, over the period of measurement.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by Grab from those driver- and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by Grab from those driver- and merchant-partners.

Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Industry and Market Data This document also contains information, estimates and other statistical data derived from third party sources (including Euromonitor), including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations and due to the nature of the techniques and methodologies used in market research, and as such neither Grab nor the third-party sources (including Euromonitor) can guarantee the accuracy of such information. You are cautioned not to give undue weight on such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

Unaudited Summary of Financial Results

Condensed consolidated statement of profit or loss and other comprehensive income

Condensed consolidated statement of financial position

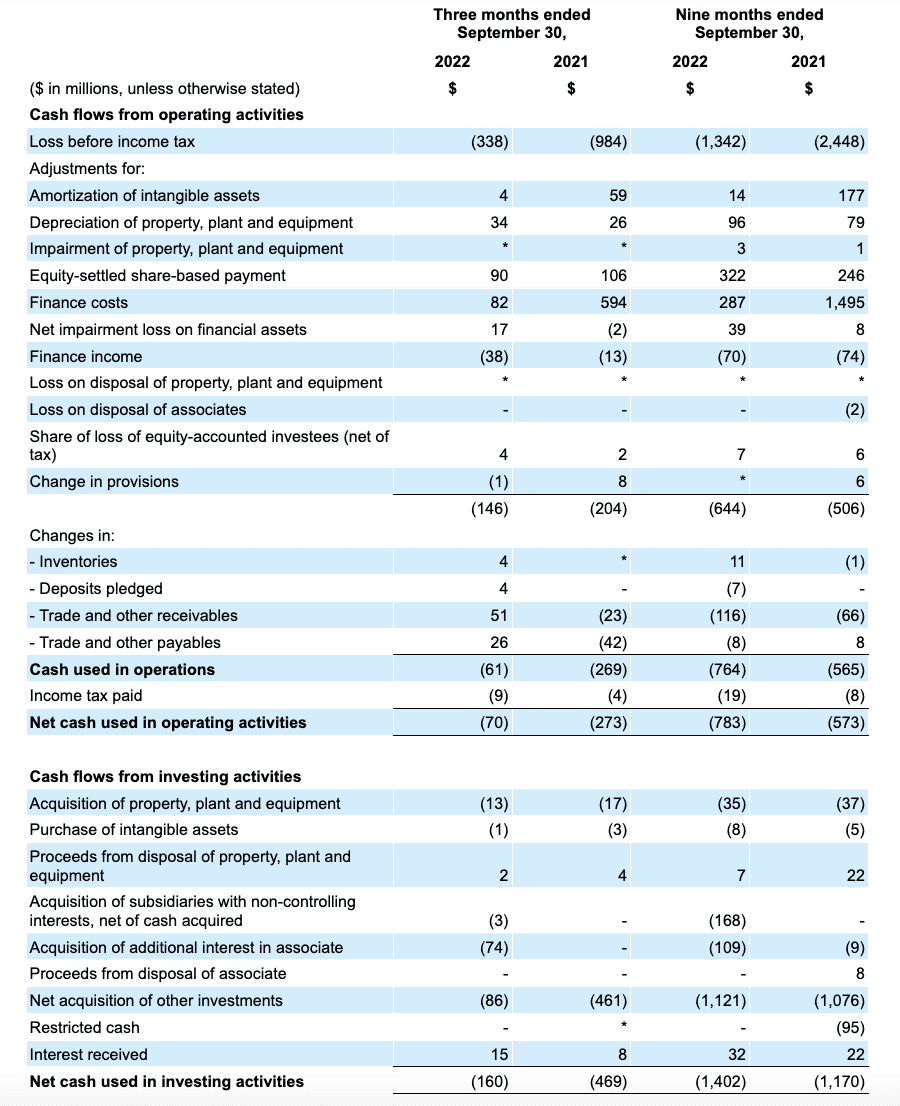

Condensed consolidated statement of cash flow.

[1] We calculate constant currency by translating our current period financial results using the corresponding prior period ’ s monthly exchange rates for our transacted currencies other than the U.S. dollar.

[2] Regional corporate costs are costs that are not attributed to any of the business segments, including certain regional research and development expenses, general and administrative expenses and marketing expenses. These regional research and development expenses also include mapping and payment technologies and support and development of the internal technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude share-based compensation expenses

[3] Based on Indonesia, Vietnam and Thailand driver base

[4] commission rate is an operating metric, representing the total dollar value paid to grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of gmv, over the period of measurement., visit our country press centres.

- Philippines

Media Library

Media inquiries, follow us on grab social channels.

- Inside Grab

Engineering Stories

Contact the grab media team.

Please complete the fields below and a member of the Grab media team will respond to your inquiry regarding news stories. For customer support inquiries, do use the contact details found at the bottom of the webpage.

Press Contact

- Your Name *

- Email Address *

- Your Country Your Country Singapore Malaysia Indonesia Thailand Philippines Vietnam Afghanistan Albania Algeria American Samoa Andorra Angola Antigua and Barbuda Argentina Armenia Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia and Herzegovina Botswana Brazil Brunei Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile China Colombia Comoros Congo, Democratic Republic of the Congo, Republic of the Costa Rica Côte d'Ivoire Croatia Cuba Curaçao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Faroe Islands Fiji Finland France French Polynesia Gabon Gambia Georgia Germany Ghana Greece Greenland Grenada Guam Guatemala Guinea Guinea-Bissau Guyana Haiti Honduras Hong Kong Hungary Iceland India Iran Iraq Ireland Israel Italy Jamaica Japan Jordan Kazakhstan Kenya Kiribati North Korea South Korea Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Maldives Mali Malta Marshall Islands Mauritania Mauritius Mexico Micronesia Moldova Monaco Mongolia Montenegro Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands New Zealand Nicaragua Niger Nigeria Northern Mariana Islands Norway Oman Pakistan Palau Palestine, State of Panama Papua New Guinea Paraguay Peru Poland Portugal Puerto Rico Qatar Romania Russia Rwanda Saint Kitts and Nevis Saint Lucia Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Sint Maarten Slovakia Slovenia Solomon Islands Somalia South Africa Spain Sri Lanka Sudan Sudan, South Suriname Swaziland Sweden Switzerland Syria Taiwan Tajikistan Tanzania Togo Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vanuatu Vatican City Venezuela Virgin Islands, British Virgin Islands, U.S. Yemen Zambia Zimbabwe

- Media Title *

For members of the media who have inquiries about Grab for your reporting, kindly fill in the form below and our Grab Communications team will reach out to assist you.

We will only be able to reply to media inquiries. For all other questions, please visit our Help Center.

Forward Together

3 Media Close, Singapore 138498

Follow us and keep updated!

- Investor Relations

- Sustainability

- Grab Financial Group

- GrabForGood Fund

- Airport Guides

- GrabExpress

- GrabRewards

- Financial services

- Family Account BETA

- Help Centre

- Drive with us

- Deliver with us

- Driver Centre

- GrabAcademy

- Partner with us

- Financial resources

- Grab for Business

- GrabFinance

- GrabDefence

- Business Delivery Service

Quick Links

- Developer Portal

Komsan Chiyadis

GrabFood delivery-partner, Thailand

COVID-19 has dealt an unprecedented blow to the tourism industry, affecting the livelihoods of millions of workers. One of them was Komsan, an assistant chef in a luxury hotel based in the Srinakarin area.

As the number of tourists at the hotel plunged, he decided to sign up as a GrabFood delivery-partner to earn an alternative income. Soon after, the hotel ceased operations.

Komsan has viewed this change through an optimistic lens, calling it the perfect opportunity for him to embark on a fresh journey after his previous job. Aside from GrabFood deliveries, he now also picks up GrabExpress jobs. It can get tiring, having to shuttle between different locations, but Komsan finds it exciting. And mostly, he’s glad to get his income back on track.

Grab Holdings Limited (NASDAQ:GRAB) Q1 2024 Earnings Call Transcript

Grab Holdings Limited (NASDAQ: GRAB ) Q1 2024 Earnings Call Transcript May 15, 2024

Operator: Ladies and gentlemen, thank you for joining us today. My name is Faith, and I will be your conference operator for this session. Welcome to Grab’s First Quarter 2024 Earnings Results Call. After the speaker’s remarks, there will be questions-and-answers session. I will now turn it over to Douglas Eu to start the call.

Douglas Eu: Good day, everyone, and welcome to Grab’s first quarter 2024 earnings call. I’m Douglas Eu, Director of Investor Relations and Strategic Finance [ph] at Grab. And joining me today are Anthony Tan, Chief Executive Officer; Alex Hungate, Chief Operating Officer; and Peter Oey, Chief Financial Officer. During the call today, Anthony will discuss our key strategic and business achievements, followed by Alex, who will provide operational highlights, and Peter will share details of our first quarter 2024 result -- financial results. Following the prepared remarks, we will open the call to questions. During this call, we will be making forward-looking statements about future events, including our future business and financial performance.

These statements are based on our current beliefs and expectations. Actual results could differ materially due to a number of risks and uncertainties as described on these earnings call, in the earnings release and in our Form 20-F and other filings with the SEC. We do not undertake any duty to update any forward-looking statements. We will also be discussing non-IFRS financial measures on this call. These measures supplement but do not replace IFRS financial measures. Please refer to the earnings materials for reconciliation of non-IFRS to IFRS financial measures. For more information, please refer to our earnings press release and supplemental presentation available on our website. And with that, I will turn the call over to Anthony to deliver his remarks.

Anthony Tan: Thanks, Doug. Thank you for joining us today. First quarter 2024 was a standout quarter for us, as we drove both topline growth, as well as bottomline adjusted EBITDA profitability, recording our ninth consecutive quarter of adjusted EBITDA improvement. Consumer activity was strong across Southeast Asia, in spite of seasonality arising from Chinese New Year festivities in January and the Ramadan fasting month, which commenced in March. As such, we continued to achieve multiple milestones in the quarter, such as expanding the number of users on our platform to a record high of 38 million monthly transacting users, while at the same time, order frequency for On-Demand also continued to track up healthily as we improved the affordability and reliability of our services.

As a result, we have continued to bolster our competitive position and triple bottomline in Southeast Asia, enabling us to further improve usage frequency and engagement and increasing earnings for our drivers and merchant partners. At the same time, we are also driving joint initiatives with the governments and regulators in the region. We have been partnering with the Tourism Authority of Thailand to promote Thai Tourism among local and foreign tourists, and boosting economy through engagement activities and elevating travel experiences with Grab’s Mobility services. And in Indonesia, through Grab’s Kota Masa Depan program, we work closely with local governments and several ministries to offer training and support to MSME business owners in second and third tier cities in the country, which enables them to effectively manage their business and to make the most of the opportunities on the Grab platform.

The program was born in 2021 during the COVID pandemic and since then has already benefited 26,000 MSMEs in nine cities nationwide. As highlighted in our fourth quarter 2023 results, this is the year where we will build up on our foundations and execute on driving engagement and expanding the top of our funnel by leveraging bold product innovation and generative AI capabilities. We’re making strong progress as On-Demand GMV expanded to a new record of $4.2 billion in a quarter, increasing by 21% year-on-year in constant currency terms. As Alex will share later, there are numerous new strategic initiatives that we are incubating which are already beginning to drive LTV uplifts. Products such as our small-language model translation feature for Tourists, Saver and Party Deliveries and our FlexiLoan product from GXS Bank have sharpened our competitive edge and led to the strong outperformance in the quarter.

Finally, on creating incremental shareholder value, we initiated our $500 million share buyback program during the quarter and repurchased approximately 97 million of Class A ordinary shares. We are focused on taking the necessary steps to address our shareholder overhang and proactively engage with these shareholders, as well as welcoming new institutional investors to bolster our shareholder base. In closing, our first quarter results demonstrate our relentless focus on driving profitable growth while staying true to our mission of empowering everyday entrepreneurs. In the upcoming weeks, we will be releasing our 2023 ESG Report where we share more about the progress we have made on our mission, where over 1 million new driver partners and over 500,000 new MSME merchant partners registered on the Grab platform last year.

And at scale, we continue to execute on our triple bottomline with 99.99% of all rides occurring without any safety incidents, while we reduce our carbon intensity per kilometer in Deliveries and Mobility in 2023. We are incredibly excited about what lies ahead in the years to come and remain deeply committed to driving greater improvements in our core businesses to generate sustainable EBITDA and free cash flow. With that, I’ll hand over to Alex who will cover our first quarter operational highlights in more detail.

Alex Hungate: Thank you, Anthony. Our first quarter performance was robust in spite of seasonal festivities demonstrated by On-Demand GMV recording sequential growth even as we improve bottomline. And year-on-year against our major regional competitors, we continue to improve on our category leadership across countries for both Food Delivery and Mobility. Over the next few minutes, I will share our operational highlights and the underlying drivers of these results starting with Deliveries. In Deliveries, demand was resilient despite seasonal impacts from the Chinese New Year festivities and the Ramadan fasting period in the first quarter. Deliveries MTUs recorded growth on both a sequential and a year-on-year basis and we continue to increase total transactions.

This came as a direct result of the initiatives that we have shared over the past few quarters to improve the affordability and reliability of our services to drive stronger engagement through our loyalty program Grab Unlimited and roll new use cases out to widen the top of the funnel. We will continue to leverage our category leadership, network advantages and tech capabilities to create differentiated services that maximize choice, convenience and reliability for our users. In the past year, we’ve been focused on affordability and have built strong traction with products like Saver. Saver Deliveries now account for slightly over a quarter of Deliveries transactions and continue to drive frequency uplifts amongst users. Users who opted for Saver have an average order frequency that was 1.8 times higher than non-Saver users.

And average delivery fees for Saver Delivery have also reduced to 25% year-on-year as we translate efficiency gains into greater cost savings for our users. It has also been effective in widening the top of funnel with over a quarter of new monthly transacting users joining the platform through Saver Delivery despite the seasonal softness. At the same time, although it’s still early days, we continue to grow adoption of priority Deliveries with transactions growing 213% year-on-year and 12% quarter-on-quarter to reach 7% of Deliveries transactions. And priority Deliveries continue to yield higher EBITDA margins relative to standard deliverers. Our Grocers and Mart business is also growing from strength-to-strength with GMV growing at a faster rate relative to our core Food business and is also profitable.

We are fortunate to have a wide range of MSMEs on the platform along with some of the leading supermarket chains in the region such as Transmart in Indonesia, Central Group in Thailand, SM Group and Robinsons in Philippines, and of course, our very own Jaya Grocer in Malaysia. Jaya Grocer in particular has been performing well. In the first quarter, Jaya recorded same-store sales growth up by 12% year-on-year and is now the largest merchant on GrabMart Malaysia, with its sales on Mart increasing over 100% year-on-year. We will continue to innovate on our Grocery offering, looking to offer the best-in-class fulfillment while also improving on our selection and speed to deliver across our various markets. For our merchants, we have been able to create even more value for them with the trust that we have established, coupled with our growing scale and network advantages.

We have enhanced our Advertising platform by simplifying the process for merchants to run and manage a business using our self-serve Advertising tools. As a result, on a year-on-year basis, we continue to drive strong growth in ads. Total active advertisers on our platform grew 46% year-on-year to 119,000, while the average spend of these advertisers increased 1.5 times. Looking ahead to the rest of the year, we will continue to build on our position as the leading On-Demand platform in the region, powered by innovative technologies and we are well-placed to continue creating value for our users and partners. As an update with April GMV growing month-on-month, we anticipate sequential growth in Deliveries GMV in the second quarter, underpinned by a rebound in demand, as well as our continued focus on the affordability and reliability of our services.

Now, moving on to Mobility, our Mobility business continued to record strong year-on-year and quarter-on-quarter GMV growth. Our efforts to capitalize on growing inbound tourism through strategic initiatives of the past few quarters have paid off, such as partnerships with Ctrip, AliPay, WeChat and Booking.com to target the traveller segment and improving brand visibility at major international airports across the region. With inbound tourism volumes in the region still below pre-COVID levels, we have been able to grow traveller MTUs on our platform to above pre-COVID levels. Year-on-year, Mobility traveller MTUs and spend grew 69% and 80%, respectively, during the quarter, as we saw strong inbound tourism tailwinds from events held in Singapore, as well as the rollout of visa-free entry for Chinese tourists across several of our markets.

We will continue to leverage key technology and product initiatives to improve the quality of our services to tourists. In February, we rolled out our small-language model translation feature in Thailand, with this feature now available in all six of our core markets. This has resulted in significant cost savings from no longer having to outsource translation service to external vendors. And by leveraging these in-house models, we reduced translation processing times from 100 days with a vendor to just five days for onboarding any new language regionally. This allows us to expand language support and meet the needs of diverse travelers as the segment continues to grow. In tandem with enhancing our products and services for users, we also improved the productivity and earnings of our drivers on our platform, while reducing our cost to serve to improve the affordability of our services.

Average driver earnings per transit hour improved 9% year-on-year. In addition, our efforts to optimize driver supply and enhance driver efficiencies to meet growing user demand continue to gain traction. During the quarter, monthly active driver supply grew 11% year-on-year, with total online hours growing 13% year-on-year, resulting in the proportion of search Mobility rides further reducing by 622 basis points year-on-year. Correspondingly, average frequency per Mobility user grew 10% year-on-year. We are also focused on harnessing our tech stack to enhance the productivity of our driver partners. An example of this is Grab Navigation, our in-house map navigation tool. By integrating GrabNav [ph] into our operations, we’ve been able to significantly streamline our processes, resulting in improved trips per transit hour and fulfillment rates.

GrabNav has proven to be popular with our driver partners, exemplified by its high adoption rate. 86%, close to 90% of our drivers now utilize GrabNav to optimize their routes and deliver a more seamless service to our customers. To conclude, for the Mobility segment, we remain confident on the long-term trajectory of the business and see headroom for volume and user penetration to continue to grow. Our strategic initiatives to drive affordability and improve reliability positions us well for longer term growth. Lastly, on Financial Services, on year on basis -- year-on-year basis, revenues grew 53%, while adjusted EBITDA losses narrowed 34% on the back of higher contributions from our ecosystem payments and lending businesses. In both GrabFin and our digital bank in Singapore, our lending business continues to gain traction.

Total loans dispersed in the first quarter grew 64% year-on-year to reach $483 million and we ended the quarter with a loan portfolio of $363 million, underpinned by the expansion of ecosystem lending in GrabFin and growing FlexiLoan volumes from GXS Bank in Singapore. And while we grew our loan portfolio, we continued to maintain a prudent stance on credit risk, with 90 days non-performing loans at around 2%. Customer deposits across our Digibanks grew to $479 million in the first quarter, from $374 million in the prior quarter, driven by an increased number of deposit customers for GXBank, our Digibank in Malaysia, which grew to 262,000 customers as of March, from 131,000 customers at the end of 2023. For GXBank in Singapore, the deposit cap was raised earlier this month, which will enable us to further grow our deposit base in the country.

Our Digibank’s ability to the Grab ecosystem continues to provide tailwinds to their growth. Notably, around 80% of users with a loan from GXBank and over 90% of depositors in GXBank are Grab customers, underscoring the cross-platform synergies and lower acquisition costs associated with our bank launches. As we continue to improve our topline, we also saw improvements in profitability. Quarter-on-quarter, adjusted EBITDA improved by 42%. This was supported by lower than expected credit losses in GrabFin, even as we continue to scale our lending revenues, along with greater cost optimizations and monetization of our payment services. Net cost of funds, a variable cost that supports our payments platform and offset by fees earned from payment services remain stable year-on-year and quarter-on-quarter at 0.7% of total payments volume.

Last quarter, we also mentioned that we expected Digibank expenses to come down following peak losses associated with the launch of our Malaysian Digibank at the end of last year. We delivered on that commitment and saw sequential reduction in overall Digibank expenses. Going forward, we see significant headroom to further scale our lending business and optimize expenses within our Digibanks as they begin to gain traction. In closing, we remain laser-focused on scaling our platform and growing our topline, while leveraging our tech-led initiatives to improve operational efficiencies across our organization and drive profitable growth. We are committed to leveraging our scale advantage and market leadership positions in both Mobility and Food Deliveries to deliver value to all of our stakeholders, especially the 38 million users on our platform today.

With that, let me turn the call over to Peter.

Peter Oey: Thanks, Alex. Before going over our first quarter results, I will first provide an update on our segment reporting changes that we highlighted in our prior earnings call. In Q1, we made several reporting changes to align with how we manage and evaluate our business performance, and to facilitate better comparison with our industry peers. The reporting changes are as follows. From the first quarter, we will report our segment results as Deliveries, Mobility, Financial Services and Others. Revenues from Others is a combination of multiple operating businesses that are not individually material. Advertising contributions previously reported within the Enterprise and New Initiative segment are now reported in the respective Mobility, Deliveries and Financial Services segments.

This aligns with our view of Advertising’s growing significance in driving both top and bottomline growth for our On-Demand and Financial Services segments. As a result, the majority of Advertising revenues is also now reported within our Deliveries segment. Second, a portion of payment transaction revenues and other relevant support costs previously reported in our Financial Services segment that facilitate Mobility and Deliveries transactions are now allocated to the respective On-Demand segments. Third, a portion of our Regional Corporate costs that support our Mobility, Deliveries, and Financial Services segments have now been allocated to these respective segments. And lastly, we discontinued the reporting of Financial Services GMV consistent with our strategic focus on ecosystem transactions and lending.

As such, we will aim to continue improving on the disclosures of our Financial Services segment particularly on the performance of our lending and bank businesses. In our supplemental presentation, we provided certain unaudited historical financial data that is on a comparative basis consistent with our revised segment structure. Do note that these updates only affect segment allocation of our financial results and do not revise or restate our previous reported consolidated financial statements. Turning over now to our first quarter results starting with revenues. First quarter revenues grew 24% year-on-year and 29% on a constant currency basis to reach $653 million. The strong revenue growth was driven by all segments of our business. On a year-on-year basis, Mobility revenue was up 27% and 30% on a constant currency basis as we continue to see strong demand from local commutes and international travelers across the region bolstered by events held across various countries.

Deliveries revenue grew 19% and 24% on a constant currency basis continuing to grow GMV despite a reduction in incentive spend. We also saw higher contributions from Jaya Grocer and Advertising. Financial Services revenue was up 53% and 56% on a constant currency basis as lending contributions across GrabFin and GXS Bank continue to grow while we improve the monetization of our payment services within GrabFin. Moving on to On-Demand GMV. First quarter On-Demand GMV grew 18% year-on-year and 21% on a constant currency basis to $4.2 billion. On a segment level, Mobility GMV grew strongly by 27% year-on-year and 30% year-on-year on a constant currency basis to $1.5 billion. Deliveries GMV grew 13% year-on-year and 16% year-on-year on a constant currency basis to $2.7 billion.

On segment adjusted EBITDA, total segment adjusted EBITDA expanded over 4 times year-on-year to $153 million attributed to all segments of the business. Deliveries segment adjusted EBITDA grew to $42 million in the first quarter while Deliveries segment adjusted EBITDA margins expanded by 235 basis points year-on-year to 1.6%. Assuming the segment reporting changes had not occurred, segment adjusted EBITDA margin for Deliveries improved 77 basis points year-on-year to 3.3%. Mobility segment adjusted EBITDA grew 41% year-on-year to $138 million with margin expanding by 91 basis points to 80 -- to 8.9% in the first quarter. Assuming the segment reporting changes had not occurred, segment adjusted EBITDA margin remained stable at 12.4% for Mobility in the first quarter of 2023 and 2024.

Financial Services segment adjusted EBITDA losses narrowed 34% year-on-year to negative $28 million. The reduction in losses was driven primarily by two main factors. First, higher revenues, mainly from lending activities in our GrabFin business and GXS Bank. Secondly, lower operating costs recorded in GrabFin underpinned by lower staff costs, cost of funds and expected credit losses as a percentage of revenues. Assuming the segment reporting changes had not occurred, Financial Services segment adjusted EBITDA would have improved quarter-on-quarter and year-on-year to negative $58 million. On Regional Corporate costs, we saw improvements of 11% year-on-year and 10% quarter-on-quarter to $91 million. Assuming the segment reporting changes had not occurred, Regional Corporate costs improved 14% year-on-year and 3% quarter-on-quarter.

These improvements in Regional Corporate costs were driven by reductions across both variable and fixed costs. Year-on-year, we continued to drive greater cost efficiencies across the organization. Total headcount costs declined 20% as we continued to streamline our workforce, while variable costs, such as cloud infrastructure, declined 15%, even as total transaction volumes continued to grow. And as a result of our commitment towards driving both top and bottomline improvements, as Anthony mentioned, we delivered our ninth quarter of sequential group adjusted EBITDA growth. Group adjusted EBITDA stood at $62 million for the quarter, an improvement of $129 million from the same period last year and a quarter-on-quarter improvement of $26 million.

On operating cash flows, we recorded negative $11 million for the quarter, an improvement of $147 million year-on-year. This was primarily driven by a reduction in loss before income tax and an increase in deposits from customers in our banks, as our Malaysia Bank’s GXB was launched in the fourth quarter last year. We also reported adjusted free cash flow of negative $98 million in the first quarter. On a year-on-year basis, this represents an improvement of $115 million, following increased profitability. And on a quarter-on-quarter basis, adjusted free cash flow reduced by $99 million, primarily due to seasonality of cash payments, which includes prepayments and annual bonus payments. Moving on to our operating loss and our IFRS net losses for the period.

On a year-on-year basis, operating loss in the first quarter improved by $129 million to negative $75 million, attributable mainly to improvements in revenue. IFRS net loss for the quarter improved by $134 million to negative $115 million, largely driven by improvements in group profitability, reduced shared base compensation costs and lower net interest expenses. The IFRS loss of $115 million also includes $118 million of non-cash expenses below the adjusted EBITDA line. Of this, $94 million was from shared base compensation expenses and $40 million was from depreciation and amortization expenses. Turning now to our balance sheet and liquidity position, we continue to maintain a strong liquidity position, ending the quarter with $5.3 billion of gross cash liquidity, which reduced from $6 billion in the prior quarter.

The decline in gross cash liquidity was mainly attributable to the repayment of the remainder of our Term Loan B facility of $497 million and a $97 million repurchase of Class A ordinary shares in March. Net cash liquidity was $5 billion at the end of the first quarter, compared to $5.2 billion at the end of the prior quarter. As we look to the rest of 2024, we remain committed to growing our business sustainably, anchored on generating profitable growth and free cash flow. In the second quarter and the second half of 2024, we expect to drive sequential GMV and EBITDA growth as we continue to drive product innovation and expand use cases on our platform, while improving frequency and retention amongst our existing users. With a strong first quarter under our belt and our outlook for the rest of the year, we are raising our full year 2024 adjusted EBITDA guidance from $180 million to $200 million to now $250 million to $270 million, while maintaining our current revenue guidance of $2.7 billion to $2.75 billion, which represents a year-on-year growth of 14% to 17%.

Now, this is primarily driven by several factors. First, stronger than expected Mobility demand from increases in local commutes and tourism throughout the region. Second, further optimization in net cost of funds and expected credit losses as a proportion of our Financial Services revenues. And third, greater discipline on operating expenses in our Regional Corporate costs as we continue to leverage tech and generative AI to improve operating efficiency and better serve our partners and customers. From a segment margin perspective for the rest of this year, we expect Mobility and Deliveries segments such as EBITDA margins to remain stable as we continue to incubate new product and tech-led initiatives to improve affordability and reliability of our services.

We expect losses in Financial Services for the full year to improve year-on-year, driven by continued cost optimization and increased contributions from our lending and bank businesses. On overhead costs, we will continue to exercise stringent discipline as we drive greater operating leverage in the business. We expect Regional Corporate costs to be relatively stable year-on-year as compared to our prior expectations of a slight increase in line with inflation. Quarterly stock-based compensation is also expected to track lower over the course of the year. More importantly, total stock dilution was around 2% in 2023 and we expect dilution in 2024 to be around or below these levels, depending on the timing of additional stock repurchases. As for the full year adjusted free cash flow, we remain committed to driving substantial improvement year-on-year as we generate increased operating cash flows.

On long-term margin expectations for our On-Demand business, we expect long-term Mobility margins to be around 9% plus, which is slightly above the first quarter of 8.9%. This long-term margin is comparable with our previously communicated margin guidance of 12%, plus under our prior reporting structure. For Deliveries, we expect long-term Deliveries margin to improve to 4% plus, representing over 300 basis points improvement from 2023 margins of 0.8% and over 240 basis points improvement on the first quarter margins of 1.6%. This long-term margin is comparable to 6% plus under our prior reporting structure. The additional long-term Deliveries margin upside is primarily driven by expansion of 100 basis points by higher expected Advertising revenue contributions in the mid-term.

Expansion of 100 basis points to 200 basis points consistent is what we guided towards during our fourth quarter of 2023 earnings call from improving marketplace efficiencies and achieving greater operating leverage as the business continues to scale. And finally, for our Financial Services segment, we expect to achieve breakeven no later in the second half of 2026 on a segment adjusted EBITDA basis. We will continue to scale up our lending services across GrabFin and the banks in a prudent manner in managing credit risk while continuing to drive operating leverage across the segment. In closing, our performance in the first quarter gives us confidence in our ability to continue to grow both our top and bottomlines for the rest of 2024 and in the longer term.

Anthony, Alex, and I would like to express our deep appreciation to our fellow Grabbers, to our customers and to all our partners for their contributions and support. Thank you very much for listening and we’ll now open up the call to questions. Operator?

Operator: Thank you. [Operator Instructions] Your first question comes from the line of Alicia Yap from Citigroup. Alicia, your line is open.

To continue reading the Q&A session, please click here .

- Grab Holdings-stock

- News for Grab Holdings

Grab Reports First Quarter 2024 Results

- Revenue grew 24% year-over-year, or 29% on a constant currency basis to $653 million

- On-Demand GMV grew 18% year-over-year, or 21% on a constant currency basis to $4.2 billion

- Operating Loss improved by $129 million year-over-year to $(75) million

- Adjusted EBITDA improved by $129 million year-over-year to an all-time high of $62 million

- 2024 Adjusted EBITDA guidance raised to $250 – $270 million from $180 – $200 million previously

SINGAPORE, May 16, 2024 (GLOBE NEWSWIRE) -- Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the first quarter ended March 31, 2024.

“Our focus on product-led growth is bearing fruit, with On-Demand GMV scaling to new highs in spite of the seasonal impact we usually see in the first quarter of the year. Our push on affordability and reliability is pulling more people onto our platform and driving up order frequency. We also continue to see our partner earnings trending up,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab . “We continue to strengthen our category position and we will leverage this scale and our technological edge to serve our users and partners better.”

“We continued to drive profitable growth in the first quarter, as we achieved another record Adjusted EBITDA,” said Peter Oey, Chief Financial Officer of Grab . “As we drive growth across our business, we remain focused on continued improvements in profitability as demonstrated by our ninth consecutive quarter of Group Adjusted EBITDA expansion while improving shareholder returns and managing our balance sheet. Pursuant to our $500 million share repurchase program, we have repurchased approximately $97 million worth of Class A ordinary shares in March, and also paid down the remaining $497 million balance of our Term Loan B.”

Changes to Segment Reporting

As announced in the prior quarter, beginning with this first quarter 2024, Grab made a number of reporting changes to align with changes in how we are managing and evaluating the performance of our business and to facilitate comparison with our industry peers.

As part of the segment reporting changes, we have discontinued the reporting of GMV for our Financial Services segment, consistent with our strategic focus on ecosystem transactions and lending for GrabFin and our digital banks, and we limit our GMV reporting to our On-Demand businesses. Additionally, Advertising contributions previously reported within the Enterprise and New Initiatives segment are now reported in the respective Mobility, Deliveries and Financial Services segments in accordance with the relevant Advertising products. Other reporting changes made include a portion of payment transaction revenues and transaction costs (which we refer to as the net cost of funds) and other relevant support costs previously reported in our Financial Services segment that relate to Mobility and Deliveries transactions now being allocated to the respective Mobility and Deliveries segments. Selected regional corporate costs that support our Mobility, Deliveries and Financial Services segments are now also allocated to these respective segments. After the aforementioned reporting updates are made, Grab’s four reporting segments include: Deliveries, Mobility, Financial Services, and Others.

We have provided certain unaudited historical financial data that is on a basis consistent with our revised segment structure in the section headed “Segment Reporting Changes” below. These reporting changes only affect segment allocation of our financial results and do not revise or restate our previously reported consolidated financial statements.

Group First Quarter 2024 Key Operational and Financial Highlights 1

- Revenue grew 24% year-over-year (“YoY”) to $653 million in the first quarter of 2024, or 29% on a constant currency basis 4 , driven by revenue growth across all segments amid a reduction in On-Demand incentives as a percentage of On-Demand GMV.

- On-Demand GMV grew 18% YoY, or 21% YoY on a constant currency basis, supported by strong underlying demand growth across Deliveries and Mobility, with On-Demand MTUs growing by 19% YoY, despite seasonal headwinds as a result of the Chinese New Year festivities and the Ramadan fasting period in the first quarter.

- Total incentives were $416 million in the first quarter of 2024, with incentives primarily attributable to the On-Demand segments. On-Demand incentives as a proportion of On-Demand GMV reduced to 9.7% in the first quarter, compared to 10.7% in the same period in 2023, reflecting our focus on reducing our cost to serve while improving the health of our marketplace.

- Operating loss in the first quarter was $75 million, an improvement of $129 million YoY, attributable mainly to improvements in revenue and lower general and administrative expenses.

- Loss for the quarter was $115 million, an improvement of $134 million YoY, primarily due to improvements in Group Adjusted EBITDA, and reductions in net interest expenses and share-based compensation expenses. Our loss for the quarter included a $31 million foreign exchange loss, and $94 million in non-cash share-based compensation expenses.

- Group Adjusted EBITDA was $62 million for the quarter, an improvement of $129 million YoY compared to negative $67 million for the same period in 2023, as we continued to grow On-Demand GMV and revenue, while improving profitability on a Segment Adjusted EBITDA basis and lowering Regional corporate costs 5 . We also recorded sequential improvements in Group Adjusted EBITDA on a quarter-over-quarter (“QoQ”) basis for nine consecutive quarters.

- Regional corporate costs 5 for the quarter were $91 million, compared to $102 million in the same period in 2023 and $100 million in the prior quarter. We focused on driving cost efficiencies across our organization, with staff costs within regional corporate costs declining 20% YoY, and cloud costs declining 15% YoY.

- Cash liquidity 6 totaled $5.3 billion at the end of the first quarter, compared to $6.0 billion at the end of the prior quarter, with a substantial part of the cash outflow attributed to the full repayment of the outstanding principal and accrued interest of our Term Loan B of $497 million, and the repurchase of 30 million shares in the aggregate principal amount of $96.6 million pursuant to our share repurchase program. Our net cash liquidity 7 was $5.0 billion at the end of the first quarter, compared to $5.2 billion at the end of the prior quarter.

- Net cash used in operating activities was negative $11 million in the first quarter of 2024, an improvement of $147 million YoY, driven by a reduction in loss before income tax. Correspondingly, Adjusted Free Cash Flow was negative $98 million in the first quarter of 2024, driven by the seasonality of payments made during the first quarter, and improved by $115 million YoY on improving profitability.

Business Outlook

The guidance represents our expectations as of the date of this press release, and may be subject to change.

Segment Financial and Operational Highlights

- Deliveries revenue grew 19% YoY, or 24% YoY on a constant currency basis, to $350 million in the first quarter from $294 million in the same period in 2023. The strong growth was primarily attributed to robust GMV growth from our Food Deliveries business, as well as growing contributions from Jaya and Advertising businesses.

- Deliveries GMV grew 13% YoY, or 16% YoY on a constant currency basis, to $2,695 million in the first quarter of 2024, underpinned by an increase in transactions, as well as growth in Deliveries MTUs.

- Deliveries segment adjusted EBITDA as a percentage of GMV stood at 1.6% in the first quarter of 2024, compared to negative 0.8% in the first quarter of 2023, amid greater optimization of our incentive spend as a percentage of Deliveries GMV, lowered overhead expenses and increasing contributions from Advertising.

- During the first quarter, the total number of monthly active advertisers who joined our self-serve platform increased 46% YoY to 119,000 while average spend by monthly active advertisers on our self-serve platform increased 54% YoY, as we continued to deepen Advertising penetration among our merchant-partners.

- Adoption of Saver and Priority Deliveries continues to grow. Saver deliveries, which offers users a lower delivery charge in exchange for a longer delivery time and improved batch rates, has seen adoption growing to 26% of Deliveries transactions 8 in the first quarter of 2024, from 23% in the prior quarter.

- Mobility revenues continued to grow strongly, rising 27% YoY, or 30% YoY on a constant currency basis, in the first quarter 2024. Growth was broad-based, with positive revenue growth across all of our core markets being driven by continued growth in domestic demand, as well as further growth in inbound international tourist demand.

- Mobility GMV increased 27% YoY, or 30% YoY on a constant currency basis to $1,547 million during the quarter, driven mainly by a 27% YoY growth in Mobility MTUs.

- Mobility segment adjusted EBITDA as a percentage of Mobility GMV was 8.9% in the first quarter of 2024, increasing from 8.0% in the same period last year, attributable to an increase in revenues and optimization of our overhead expenses.

- During the quarter, we continued to increase active driver supply while optimizing our existing driver supply to meet the strong demand growth. In the first quarter of 2024, monthly active driver supply increased by 11% YoY and 2% QoQ, while quarterly active driver retention rates remained healthy at 90%, and average driver earnings per transit hour 9 increased by 9% YoY and 4% QoQ.

- Our efforts to improve driver supply resulted in 622 basis points reduction in the proportion of surged Mobility rides 10 YoY. Underpinned by strong demand levels, Mobility fulfillment rates also improved YoY.

Financial Services

- Revenue for Financial Services grew 53% YoY, or 56% YoY on a constant currency basis, to $55 million in the first quarter of 2024. The YoY growth was driven by increased contributions mainly from lending across GrabFin and Digibank, and improved monetization of GrabFin’s payment services.

- Segment adjusted EBITDA for the quarter improved by 34% YoY to negative $28 million, attributable to the increase in revenues amid growing contributions from higher margin lending activities, coupled with a further reduction in overhead expenses. We continued to streamline our cost base across GrabFin’s businesses, with total operating expenses improving by 15% YoY and 14% QoQ, with the YoY improvement driven by lower staff costs, and further optimization of cost of funds and credit and compliance costs as a percentage of revenues. Total operating expenses for Digibank reduced 23% QoQ, as expenses lowered following the launch of GXBank, our Digibank in Malaysia, in November 2023, but also recorded a 48% YoY increase in total operating expenses due to the launch of GXBank.

- We continued to focus on lending to our ecosystem partners across GrabFin and Digibank, with total loan disbursements during the quarter growing by 64% YoY and 9% QoQ, and loan portfolio ending the quarter at $363 million from $196 million in the same period last year. As of March 31, 2024, around 80% of GXS Bank’s FlexiLoan customers were also Grab users. We remained prudent in our management of credit risk in our loan portfolio, with non-performing loans (more than 90 days past due) at 2% of our loan portfolio.

- Deposits from customers in our Digibank business were $479 million at the end of the first quarter 2024, growing from $36 million in the same period last year and $374 million in the prior quarter. QoQ growth was mainly driven by an increased number of deposit customers for GXBank, our Digibank in Malaysia, which doubled to 262,000 customers as of March, from 131,000 customers at the end of 2023. Notably, over 90% of deposit customers of GXBank are also Grab users.

- Net Cost of Funds, a variable cost that supports the payment platform across our On-Demand and Financial Services segments, and offset by fees earned from payment services, was stable YoY and QoQ at 0.7% of total payments volume 11 in the first quarter of 2024.

* Amount less than $1 million

- Revenue for Others grew 53% YoY, to $1 million in the first quarter of 2024, with segment adjusted EBITDA at $1 million in the same period.