Sign up for Newsletter

Signup for our newsletter to get notified about sales and new products. Add any text here or remove it.

- Business Cards

- Leaflets and Flyers

- Booklet & Brochures

- Letterheads

- Compliment Slips

- Presentation Folders

- Folded Flyers

- Restaurant Menus

- Small Posters

- Notepads and Deskpads

- Duplicate & Triplicate Books

- Shelf Wobblers

- Invitations

- Large Posters

- PVC Banners

- Rigid Media

- Canvas Printing

- Self Adhesive Vinyl

- Magnetic Signage

- Forecourt Overbags

- Waterproof Posters

- Backlit Lightbox Posters

- One Way Vision

- Fabric Posters

- Presentation Cheques

- Selfie Frames

- Roller Banners

- Roll Up Banners

- Fabric Media Wall

- Feather Flags

- Counter Displays

- Plotted Sticker Printing

- Shaped Labels on Sheets

- Sticker Printing – Indoor

- Wall Calendars

- Year Planners

- Tent Calendars

- Flip Tent Calendars

- Christmas Cards

- Gift Vouchers

- Invitations and Tickets

- Graphic Design

- Health & Safety Printing – Social Distancing

Kaizen Print Inspire & Support Blog

Reusable presentation cheques and their advantages.

Presentation cheques are a fantastic way to spread the word about a positive news story you have been involved in. They are also a great way to reward others. If you are unsure of what a presentation cheque is, they are usually seen during charity events, such as at marathons or on comic relief. The novelty size makes them ideal for presentations and photo opportunities. Reusable presentation cheques are therefore of course presentation cheques that you can use repeatedly over and over. Here’s why, if you’re thinking about investing in a presentation cheque, you might want to consider a reusable one.

They’re ideal if you hold multiple events

For those who regularly hand out presentation cheques, it makes sense to invest in a reusable presentation cheque. Typically the type of organisations who may require repeated use of presentation cheques include;

- Council bodies

- Awards bodies

- Institutions, i.e. universities

- And more….

Organisations such as these regularly exchange sums of money to good causes. And these good causes are ones that for PR reasons they would like the world to know about. For this reason having a reusable presentation cheque to rely on is a fantastic solution.

Ad hoc celebrations or awards

On the other hand you may not work for an organisation that makes regular use of presentation cheques. This doesn’t necessarily mean you shouldn’t take advantage of them however. In business we don’t always have time to wait, nor do we always plan ahead (as much as we know we should). You may have an awards ceremony coming up, or you might want to quickly recognise a member of staff. Waiting for print and delivery of a presentation cheque can hold up delivery times. Having a presentation cheque ready as a fail-safe option can help when it comes to scenarios such as this.

Good for exposure

If you’re looking to get your brand out there then reusable presentation cheques is a great way to achieve this. Fully customisable, presentation cheques can be branded. By branding your presentation cheques you can ensure that every time it is seen in a newspaper or online your brand is front and centre for all to see. The more you make use of presentation cheques the more exposure you will get. By investing in a reusable cheque that’s one less barrier to making them a regular part of your PR and marketing plan.

It’s a great cost-effective option

One of the biggest advantages of making use of reusable presentation cheques is of course that it makes good sense financially. Rather than paying out for every time you require a presentation cheque you can simply reuse one that you have already prepared and waiting to go. So not only do you save on the hassle of having to design and print a new presentation cheque every time, you also save time and money in the process too.

Restore to as good as new

It is important when using a presentation cheque that the product is of a high quality. A low quality presentation cheque can present a bad impression. Not what you want for that all-important photo opportunity! It is also important therefore that every time you reuse a presentation cheque it retains this same high quality finish. The great thing about our reusable presentation cheques at Kaizen Print is that they are;

- High quality – printed on 3mm foamex matt or laminated vinyl

- Durable – high quality printing materials ensure a superior finish

- Washable – all trace of previous text can be washed off

This means that with the correct care there your presentation cheque should look as good at the tenth time of use as the first. By opting for quality fully reusable presentation cheques you can ensure that no remnants of previous text or marks on your cheque will show through.

Kaizen Print

To find out more about how we can help you with your presentation cheque requirements you can visit our large presentation cheque page or get in touch via our contact form or by calling 028 9002 2474.

kaizeninspire

519-787-1162

- Same day printing*

- Make it right guarantee*

- We ship across Canada

Large Presentation Cheques

Do you need a Big Cheque to help generate publicity and to make your event memorable?

Alpha Graphics and Signs specialize in creating and delivering high-quality Large, Giant, aka Big Presentations cheques.

Get Your Big Cheque Done Right.

Inexpensive. We Ship Across Canada.

Big Cheques

Your new Large Presentation Cheque can be printed fully filled out with names, dates, and an amount, or can be laminated with a dry-erase material so you can use and reuse it many times.

We also print on a flexible banner material (not dry-erase though) in case you travel often and need to carry your Big Cheque with you.

You don’t want just another Big Cheque! You want a Big Cheque with your organization clearly identified, so don’t settle for anything plain. Let us help you create a Big Cheque you will be proud to display.

A few examples.

Big Cheques We've Created

Have any questions about Big Presentation Cheques for your special event?

Why Alpha Graphics & Signs?

We know how overwhelming it can be to create the big graphics and signs you need to make money and grow.

That’s why we’ve spent 20+ years guiding and serving local businesses in Elora and Fergus, Ontario.

Order your giant big cheque today.

No-stress print jobs.

We make things easier by guiding you through all of the critical decisions you need to make.

Fast turnaround.

We get it done fast. Some Vehicle Wrap projects can be ready in as little as a week.

Sharp quality.

You get the finest quality lasting product. We use the latest equipment, the best materials, and brand-name inks for results.

- Street Party

- Event Tools

- Pens & Stationery

- Pads & Notebooks

- Giveaway & Gift Items

- Clothing & Apparel

- Food & Drink

- Tech & Gadgets

Large Cheques

Branded charity cheque.

Our large Printed Cheques are highly popular for creating awareness of donations.

Available in 3 different sizes, our charity fundraising presentation cheques are perfect if you are staging a charity or fundraising event.

Sturdy and durable, these cheques can be designed to contain your own logos and artwork to promote your contribution!

Large Printed Cheques

Branded Cheque Printing

Similar Products...

Specialist Finishing Options

Branded Charity Cheque Product Details

Standard product.

Standard Cheque is 1000mm x 500mm Printed Full Colour

Branding Area

Artwork Dimensions 500mm x 250mm 1000mm x 500mm 2000mm x 1000mm

Small 50cm x 25cm The smallest of the cheques, these are slightly bigger than an A3 in width.

Standard 100cm x 50cm Our most popular printed option is just the right size to hold, but big enough to be seen from a distance.

Large 200cm x 100cm Perfect for large outdoor display surrounded by staff and colleagues, these are giant!

Standard Turnaround 2-3 Working Days

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

- Additional Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

This website uses the following additional cookies:

(List the cookies that you are using on the website here.)

- Cambridge Dictionary +Plus

Meaning of cheque in English

Your browser doesn't support HTML5 audio

- anti-kickback

- automatic withdrawal

- meal ticket

- microtransaction

- monetization

- ready money

- wave and pay

cheque | Intermediate English

Cheque | business english, examples of cheque, translations of cheque.

Get a quick, free translation!

Word of the Day

on top of the world

extremely happy

Keeping up appearances (Talking about how things seem)

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- English Noun

- Intermediate Noun

- a cheque bounces/is bounced

- cash a cheque

- a cheque clears/is cleared

- Translations

- All translations

To add cheque to a word list please sign up or log in.

Add cheque to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

Check Endorsement

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 08, 2023

Get Any Financial Question Answered

Table of contents, what is check endorsement.

Check endorsement refers to the act of signing the back of a check for the purpose of transferring it to another entity, whether that be a person or a bank.

It's a crucial step in the process of cashing or depositing a check , serving as a legal verification of the transfer of ownership of the check from one party to another.

The purpose of endorsing a check is to validate its authenticity and approve its payment to the designated payee . Endorsements essentially serve as an insurance mechanism for banks , mitigating the risk of fraud or bounced checks .

This endorsement doesn't merely involve a simple signature; it also necessitates understanding the various types of endorsements, as well as their implications.

Misunderstanding or misuse can lead to a variety of complications, from check fraud to legal repercussions.

How Check Endorsement Works

The endorser simply signs their name on the back of the check in the designated area. However, this step should ideally be performed in the bank or right before depositing or cashing the check to prevent any misuse if the check is lost or stolen.

Different types of endorsements serve different purposes and entail varying levels of risk. The endorser must understand the implications of each type to select the most appropriate one based on the situation.

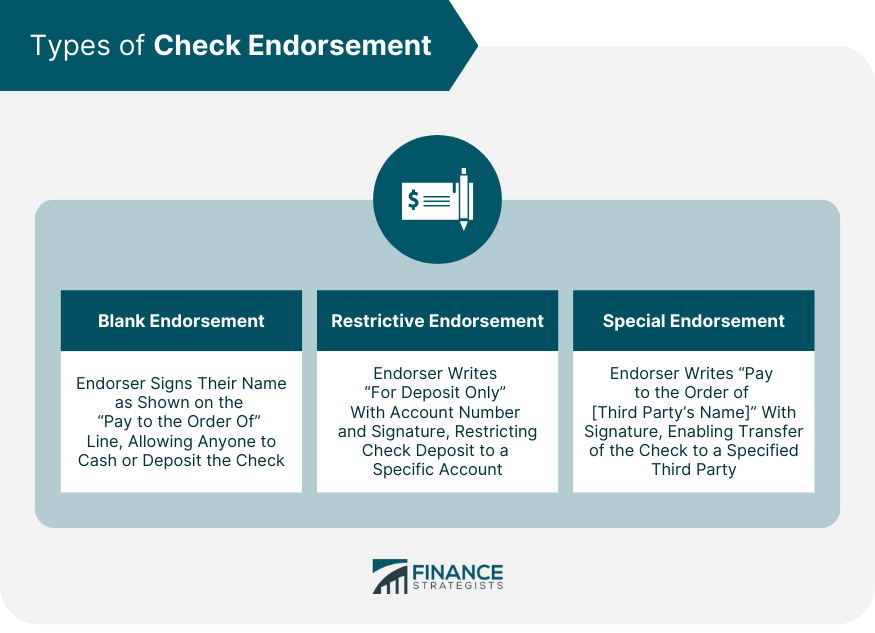

Different Types of Check Endorsement

Blank endorsement.

A blank endorsement happens when the endorser signs their name exactly as it appears on the "Pay to the Order of" line on the front of the check.

It is the simplest form of endorsement but also the riskiest, as anyone who possesses the check can cash or deposit it.

Restrictive Endorsement

A restrictive endorsement limits the actions that can be taken with the check. The most common form involves writing "For Deposit Only" followed by the endorser's account number and signature.

This endorsement adds a layer of security, specifying the check can only be deposited into a specific account.

Special Endorsement

A special endorsement, also known as an endorsement in full, allows the endorser to specify a third party to whom the check can be transferred.

This endorsement is made by writing "Pay to the order of [third party's name]" followed by the endorser's signature. Special endorsements are often used when checks are transferred from one person to another.

Rules and Legal Implications

Rules governing check endorsements are established by the Uniform Commercial Code (UCC), which most states have adopted in some form. These rules ensure the validity of the check and protect the parties involved.

For instance, a bank is not required to honor a check if the endorsement is missing or if it suspects fraud.

The legal implications of check endorsements are significant. An incorrect or fraudulent endorsement can lead to serious repercussions, such as legal disputes, financial loss, and in some cases, criminal charges.

Understanding the proper way to endorse a check can mitigate these risks.

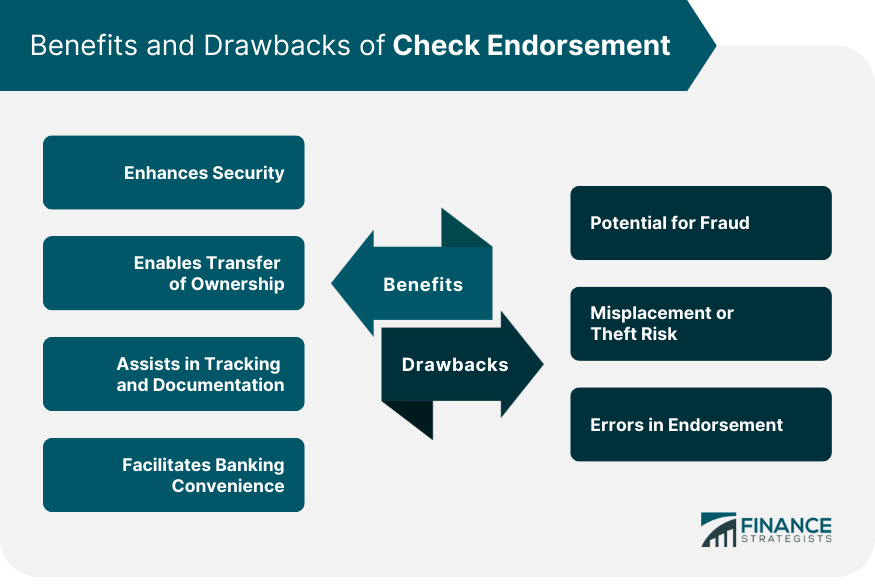

Benefits of Check Endorsement

Enhances security in check processing.

Check endorsement adds a layer of security to the check processing procedure. By requiring a physical signature and providing various endorsement options, banks can validate the authenticity of the transaction and minimize the chances of fraud.

In particular, restrictive endorsements can offer additional protection by designating a specific course of action with the check, such as depositing it directly into a specified account. This can protect the payee if the check is lost or stolen.

Enables Transfer of Ownership

Check endorsement enables the legal transfer of a check's ownership from the payee to another party or a financial institution . By signing a check, the original payee provides their consent for this transfer, ensuring the check’s negotiability.

Without this key step, banks would not have the necessary authorization to process the check, making endorsements integral to the check-cashing or depositing process.

Assists in Tracking and Documentation

Endorsements assist in the tracking and documentation of financial transactions.

Each endorsed check leaves a paper trail that can be traced back if questions or disputes arise. This makes check endorsement a valuable tool for both personal and business accounting.

Moreover, with the increasing use of digital imaging in banks, endorsed checks can be stored and retrieved digitally. This aids in record-keeping and provides easy access to transaction history.

Facilitates Banking Convenience

Check endorsements also contribute to banking convenience. By endorsing checks, customers can deposit them via ATMs or mobile apps, thus reducing the need to visit a bank branch.

This convenience, combined with the security measures associated with endorsements, makes checks a practical option for various transactions, despite the prevalence of electronic payments.

Drawbacks of Check Endorsement

Potential for fraud.

If a check is endorsed but then lost or stolen, it can be cashed or deposited by unauthorized individuals. This risk is especially high with blank endorsements, which don't limit who can cash or deposit the check.

While restrictive and special endorsements provide additional security measures, they are not foolproof. Banks often process checks automatically, and discrepancies in endorsements may not be caught, resulting in fraudulent transactions.

Misplacement or Theft Risk

Once a check is endorsed, it is effectively "live" money, and if it falls into the wrong hands, it can lead to financial loss for the endorser.

The risk is particularly high for businesses that deal with a large volume of checks. They must have robust systems in place for check storage and processing to prevent theft or misplacement.

Errors in Endorsement

Misspelled names or missing information in a restrictive or special endorsement can lead to delays in check processing. In some cases, banks might refuse to accept checks with incorrect endorsements.

Endorsers must ensure the correct spelling of names and accurate account information, particularly for restrictive or special endorsements. Mistakes not only cause inconvenience but can also lead to disputes or legal issues.

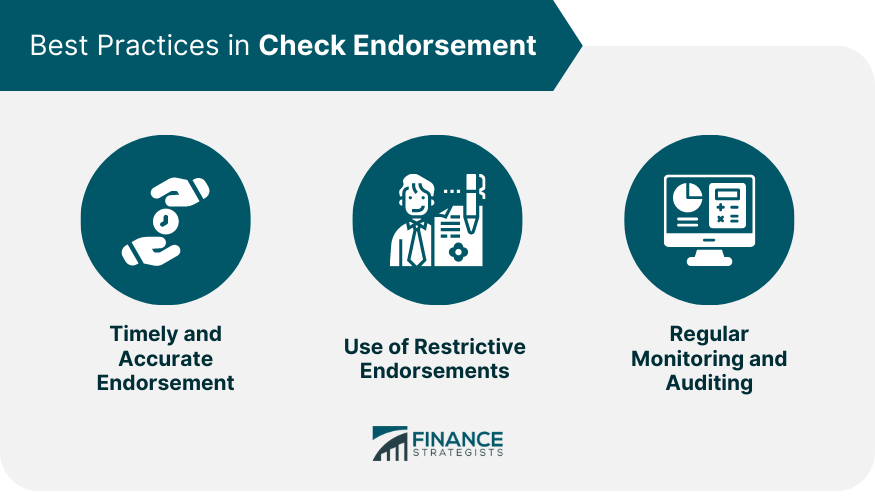

Best Practices in Check Endorsement

Timely and accurate endorsement.

One of the best practices in check endorsement involves endorsing the check accurately and in a timely manner. This means signing the check immediately before presenting it for cashing or depositing, not in advance.

Endorsing a check right before its negotiation minimizes the risk of unauthorized access in case the check is lost or stolen. Accuracy in endorsement, particularly in restrictive or special endorsements, ensures the check is processed without issues.

Use of Restrictive Endorsements for Security

Given the security risks associated with blank endorsements, it is often advisable to use restrictive endorsements, especially for checks of large amounts.

Writing "For Deposit Only," followed by the account number, can provide added security and direct the funds to the correct account.

While it might take a little more time than a simple signature, a restrictive endorsement can save a lot of potential trouble down the line by minimizing the risk of unauthorized transactions.

Regular Monitoring and Auditing

Regular monitoring of financial transactions is crucial to ensuring their integrity. This practice involves regularly reviewing bank statements to detect any fraudulent activities or irregularities.

Regular audits, either done internally or by a third-party auditor, can also be highly beneficial. They help in identifying procedural issues or potential vulnerabilities that could lead to fraud or loss.

A check endorsement is a crucial step in the process of cashing or depositing a check, serving as a legal verification of the transfer of ownership from one party to another.

It facilitates banking convenience, allowing customers to deposit checks via ATMs or mobile apps.

However, check endorsement also presents challenges and risks. There is potential for fraud, especially with blank endorsements.

Misplacement or theft of endorsed checks can lead to financial loss. Errors in endorsement can cause delays or disputes in check processing.

To mitigate these risks, best practices include timely and accurate endorsement, the use of restrictive endorsements for added security, and regular monitoring and auditing of financial transactions.

By following these practices, individuals and businesses can ensure the integrity of their check endorsements and safeguard against potential issues.

Check Endorsement FAQs

What is check endorsement.

Check endorsement refers to signing the back of a check to transfer its ownership to another entity, serving as a legal verification for cashing or depositing the check.

Why is check endorsement important?

Check endorsement is important because it validates the authenticity of the check and approves its payment to the designated payee, mitigating the risk of fraud or bounced checks for banks and ensuring smooth financial transactions.

What are the different types of check endorsement?

The different types of check endorsement include blank endorsement, where the endorser signs their name; restrictive endorsement, which limits check actions; and special endorsement, where the endorser specifies a third party to whom the check can be transferred.

Are there any legal implications of check endorsement?

Yes, there are legal implications. An incorrect or fraudulent endorsement can lead to serious repercussions, including legal disputes, financial loss, and, in some cases, criminal charges. Understanding the proper way to endorse a check is crucial to mitigate these risks.

How can I ensure the security of check endorsement?

To ensure the security of check endorsement, it is advisable to use restrictive endorsements, accurately endorse checks in a timely manner, regularly monitor financial transactions, and conduct audits to detect any irregularities or potential vulnerabilities that could lead to fraud or loss.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Bad Credit Score

- Benefits of a Small Business Loan From a Credit Union

- BlueOr Bank Review

- Business vs Personal Bank Account

- Can a Debt Collector Withdraw Money From Your Bank Account?

- Credit Union Loan for Bad Credit

- Credit Union Marketing Strategies to Improve Engagement

- Credit Union Mobile Deposit Funds Availability

- Credit Union Routing Number

- Does Closing a Credit Card Hurt Your Credit Score?

- Does Credit Score Affect Car Insurance Rates?

- FICO Score vs Credit Score

- Frozen Bank Account

- Good Credit Score

- History of Credit Scores

- How Does Debt Consolidation Affect Your Credit Score?

- How a Missed Payment Affects Your Credit Score

- How to Deposit at Any Credit Union

- How to Finance Your Car With No or Low Credit

- How to Join a Credit Union

- How to Join a Credit Union Online

- How to Open a Credit Union Account

- How to Open a Credit Union Business Account

- How to Switch From Personal to Business Bank Account

- Ideal Credit Score to Buy a Car

- Ideal Credit Score to Buy a House

- Importance of a Credit Score

- Largest Credit Unions in the USA

- Opening a Bank Account Without a Job

- What Affects a Credit Score?

Ask a Financial Professional Any Question

Find bank branches and atms near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

Cheque Truncation

- What is Cheque Truncation?

Truncation is the method of stopping the flow of the physical check issued at some point by a drawer with the presenting bank on its way to the branch of the drawee bank. In its place, the clearinghouse transmits an electronic picture of the cheque to the drawee branch along with relevant information, such as MICR band details, date of presentation, bank presentation, etc.

Cheque truncation, thus, obviates the need to transfer the physical instruments through branches, rather than for clearing purposes in exceptional circumstances. The electronic transfer of information eliminates the cost associated with the transfer of the physical cheques, reduces the time required for their collection, and speeds up the entire activity of cheque processing.

- How Cheque Truncation Works in India?

Cheque truncation speeds up the process of collecting checks resulting in improved service to customers, decreases the risk for clearing-related frauds or loss of instruments in transit, lowers the cost of collecting cheques, and avoids issues related to reconciliation and logistics, thereby helping the system as a whole.

With the other major products being RTGS and NEFT, the Reserve Bank has developed the ability to allow interbank and customer payments electronically and in almost real-time.

Since cheques are still the country's prominent mode of payment, the Reserve Bank of India has decided to concentrate on improving the efficiency of the cheque clearing cycle, providing an alternative to the Cheque Truncation System (CTS). As pointed out earlier, CTS is a more secure method vis-à-vis physical document exchange.

In addition to the operational efficiency, CTS offers banks and customers many advantages, including rationalization of human resources, cost-effectiveness, re-engineering of business processes, improved service, implementation of the new technology, etc. CTS has, thus, emerged as a significant efficiency improvement initiative undertaken by RBI in the field of payment systems.

Popular Topics

Latest articles.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- Trending Blogs

- Geeksforgeeks NEWS

- Geeksforgeeks Blogs

- Tips & Tricks

- Website & Apps

- ChatGPT Blogs

- ChatGPT News

- ChatGPT Tutorial

- Commercial Law

I. Law of Contract

1. nature and kinds of contracts.

- Agreement under Contract Law: Meaning, Essentials, Types and FAQs

- Contract : Meaning, Elements, Types and Purpose

- Types of Contract | Based on Validity, Formation and Performance

- Law of Contracts : Elements, Purpose and FAQs

- Doctrine of Privity of Contract: Meaning, Exceptions and FAQs

- Doctrine of Restitution: Meaning, Exceptions and FAQs

- Difference between Agreement and Contract

- Franchising Agreements: Meaning, Components, and Types

- Master Service Agreement (MSA): Significance, Merits, Clauses and FAQs

- Pre-Incorporation Contracts: Meaning, Legality and FAQs

- Balfour Vs. Balfour: Case Analysis

- How to Read a Contract in 7 Easy Steps?

- Rental Agreements: Important Clauses and Format

- Rental Agreements : Meaning, Importance, Procedure and Documents

- Types of Legal Agreement

- Difference between Under Contract and Pending Contract

- Essentials of a Strong Contract : A Checklist

- All about Termination of Employment Contracts in India

2. Offer and Acceptance

- Proposal or Offer: Meaning, Legal Rules and Revocation

- Acceptance: Meaning, Legal Rules and FAQs

- Communication of Offer, Acceptance and Revocation

3. Consideration

- Consideration: Meaning, Essentials and FAQs

- No Consideration, No Contract : Exceptions and FAQs

4. Capacity of Parties

- Capacity of Parties : Capacity to Contracts and Legal Requirements

- Minor: Meaning, Minor's Agreements and Exception

- Person of Unsound Mind: Meaning, Cases and Effects

- Disqualified Persons under Law: Meaning and Disqualifications

5. Free Consent

- Free Consent : Meaning, Elements and FAQs

- Coercion under Indian Contract Act : Case Laws and Effects

- Undue Influence : Meaning, Presumption and Effects

- Difference between Coercion and Undue Influence

- Misrepresentation : Meaning, Cases & Effects (Indian Contract Act)

- Fraud: Meaning, Cases and Effects

- Difference between Fraud and Misrepresentation

- Mistake under Indian Contract Act, 1872

6. Legality of Object and Consideration

- Consideration: Meaning and Unlawful Considerations

- Unlawful Consideration in Part & Illegal Agreements (Indian Contract Act)

7. Void Agreements

- Void Agreements : Meaning and Expressly Declared Void Agreements

- Difference between Void and Voidable Contract

- Difference between Void and Illegal Agreement

8. Contingent Contract

- Contingent Contract: Meaning, Elements and Enforcement

9. Performance of Contracts

- Performance of Contract under Indian Contract Act

- Doctrine of Frustration : Meaning, Applicability, Conditions, and Effects

10. Discharge of Contract

- Discharge of Contract : Meaning, Modes and Exceptional Cases

11. Quasi-Contracts

- Quasi Contracts: Meaning, Features and Types

12. Remedies for Breach of Contract

- Remedies for Breach of Contract: Meaning, Legal Remedies and FAQs

- Consequences of Breach of Confidentiality

13. Indemnity and Guarantee

- Contract of Indemnity: Meaning & Features (Indian Contract Act)

- Contract of Guarantee: Meaning & Features (Indian Contract Act)

- Difference between Contract of Indemnity and Guarantee

- Difference between Guarantee and Warranty

14. Bailment and Pledge

- Contract of Bailment : Meaning, Features, Duties and Rights

- Contract of Pledge : Meaning, Features, Duties and Rights

- Contract of Pledge: Meaning and Important Cases

- Difference between Contract of Bailment and Contract of Pledge

- Agent: Definition, Meaning, Rules and Kinds

- Contract of Agency : Meaning, Characteristics, Methods and Types

- Extent of Agent's Authority: Indian Contract Act

- Duties & Rights of Agent: Indian Contract Act 1872

- Rights, Duties & Liabilities of Principal: Indian Contract Act 1872

- Termination of Agency : Indian Contract Act, 1872

- Difference between Agent and Servant

II. Law of Sale of Goods

16. contract of sale of goods.

- Contract of Sale of Goods: Meaning, Definition and Essentials

- Difference between Sale and Agreement to Sell

- Kinds of Goods under the Sale of Goods Act, 1930

17. Conditions and Warranties

- Conditions under Sale of Goods Act, 1930

- Warranty: Meaning, Elements and Types

- Difference between Condition and Warranty

18. Transfer of Property

- Transfer of Property under Sale of Goods Act 1930

- Transfer of Title by Non-Owners: Meaning and Rules

19. Performance of Contract of Sale

- Delivery : Meaning, Modes & Rules (Sale of Goods Act)

20. Rights of Unpaid Seller

- Rights of Unpaid Seller : Sale of Goods Act 1930

- Buyer's Rights Against Seller and Auction Sale

III. Law of Partnership

21. definition and nature of partnership.

- Indian Partnership Act, 1932: Meaning, Essential Requirements and Kinds

- Partnership | Meaning and Features of Partnership

22. Formation of Partnership

- Partnership Deed : Aspects and Registration

- Types of Partnership

- Non- Registration of Partnership Firm: Effects and Exceptions

23. Rights, Duties and Liabilities of Partners

- Rights & Duties of Partners (Law of Partnership)

- Relations of Partners to Third Parties (Law of Partnership)

24. Dissolution of Partnership Firm

- Dissolution of a Partnership Firm: Meaning, Modes of Dissolution, Modes of Settlement of accounts (Section 48)

IV. Law of Negotiable Instruments

25. negotiable instruments.

- Negotiable Instruments Act 1881 : Definition, Kinds & Features

- Promissory Note: Features and Parties

- Bills of Exchange: Meaning, Features, Parties, and Advantages

- Difference between Bills of Exchange and Promissory Note

- Types of Bills of Exchange

What is a Cheque – Types, Features, Chequebook, Advantages

- Dishonour of Cheque : Meaning, Essentials, and Legal Implications

- Types of Instruments under Negotiable Instruments Act

- Maturity of Negotiable Instruments : Meaning, Rules, and Payment

26. Parties to Negotiable Instruments

- Holder and Holder in Due Course: Meaning, Conditions and Privileges

- Capacity of Parties under Negotiable Instruments Act

- Liability of Parties to Negotiable Instruments: Negotiable Instruments Act, 1881

27. Presentment of Negotiable Instruments

- Presentment For Acceptance: Negotiable Instruments Act

- Presentment for Sight & Payment: Negotiable Instruments Act

28. Negotiation of Negotiable Instruments

- Negotiation of Negotiable Instruments: Definition, Meaning and Modes

- Negotiation by Unauthorised Parties: Negotiable Instrument Act, 1881

29. Dishonour and Discharge of Negotiable Instruments

- Dishonour of Negotiable Instruments: Types, Effects & Notice

- Discharge of Negotiable Instruments : Meaning, Types and Concepts

- Difference between Dishonour and Discharge of Negotiable Instrument

30. Crossing and Bouncing of Cheques

- Crossing of Cheques (Negotiable Instruments Act)

- Bouncing of Cheques: Meaning, Remedies, Offences and Case Laws

V. Law of Information Technology

31. information technology act, 2000.

- Information Technology Act, 2000: Elements, Applicability and Amendments

- Difference between Electronic Signature and Digital Signature

- Electronic Governance : Information Technology Act, 2000

- Electronic Contracts: Meaning, Legal Validity and Kinds

- Electronic Payment System: Types, Advantages, Disadvantages and Regulatory Bodies

- Legal Issues and Consideration in E-commerce

- Digital Signature, Electronic Signature & Authentication of Electronic Records

VI. Law of Consumer Protection

32. consumer protection act, 1986.

- Consumer Protection Act 2019 : Features, Significance, Rights and Provision

VII. Law of Insurance

Viii. law of insolvency, 37. objects and scope of the insolvency law.

- SARFAESI Act: Introduction, Procedure, Penalties and FAQs

38. Procedure of Insolvency

- Adjudication - Meaning, Definition, Process and Examples

IX. Law of Arbitration and Conciliation

41. general provisions regarding arbitration.

- Alternative Dispute Resolution (ADR): Meaning, Types and FAQs

42. Arbitral Tribunal

- Arbitral Tribunal: Appointment, Composition, Jurisdiction and FAQs

- List of 7 Famous Arbitrators Who Made an Impact

44. Conciliation

- Difference between Mediation and Conciliation

Other Topics

- Payment of Bonus Act, 1965 : Applicability, Calculation, Offences and Penalties

- Banking Regulation Act, 1949: Features, Objectives and Provisions

- Factories Act, 1948: Provisions, Advantages, Disadvantages and FAQs

- Employees' Compensation Act, 1923: Rights, Liability, and Compensation

- Maternity Benefit Act, 1961: Objectives, Provisions, Impact and Challenges

- The Apprentices Act 1961: Meaning, Obligations, Legal Status and FAQs

- Payment of Gratuity Act, 1972: Features, Advantages, Disadvantages and FAQs

- Industrial Disputes Act, 1947 : Objectives, Amendments, Provisions & FAQs

- Provident Fund: Types, Applicability, Eligibility and FAQs

- Child Labour Legislation in India: Features, Evolution, Amendments, and Ongoing Challenges

- Difference between Payment of Wages Act, 1936 and Minimum Wages Act, 1948

- Difference between Strict Liability and Absolute Liability

- 10 Common Signs of Child Abuse : What to Look For

- Internet Safety for Kids: 10 Legal Tips for Parents

- 10 Steps to file an FIR

- 10 Steps to Apply for Mutual Consent Divorce

- 10 Top Law Colleges in India in 2024

- Legal Aspects of Buying a Home : 10 Step-by-Step Guide

- 10 Factors Property Owners Must Consider

- 10 Must Have Skills to get a Good Legal Job in India

- 10 Best Certificate Courses for Law Students in India

- 7 Child Custody Tips for Parents Going Through Divorce

- Top 7 Career Options in Law in India in 2024

- 5 Steps to Take if You Are a Victim of Domestic Violence

- Juvenile Delinquency | Meaning, Causes, Types and FAQs

- Professional Ethics in Law: Legal Framework and Advantages

- Nidhi Companies: Meaning, Benefits, Rules & Registration

- Medical Malpractice: Signs, Prevention & Legal Recourse

- How to Send a Legal Notice?

- How to Start Studying Law : Step-by-Step Guide for Indian Students

- Role of Cryptocurrencies in Money Laundering : Myth vs Reality

- How can you become Advocate on Record (AOR) in Supreme Court of India?

Cheques, cheques, what’s the big deal, right? They’re those little pieces of paper people deposit, and transactions happen. Simple, right? Well, cheques are more than just a mundane financial instrument; they’re a testament to the evolution of humanity itself. You see, my curious friend, the history of cheques dates back to the 13th century, and it’s a story that has shaped your very existence.

So, picture this: someone randomly asks you, “What is a cheque?”. But you don’t know the answer. So, you find yourself stammering and lost for words. It’s not just your reputation at stake; it’s the struggles of all humankind! But worry not. We’re here to rescue you from the embarrassment. Stay tuned till the end to know all about cheques.

What is a Cheque?

Cheque is a written instrument that serves as a substitute for cash. It is a negotiable instrument, instructing the bank to pay a specific amount from the drawer’s account to a designated payee.

Cheques provide a convenient and secure way to:

- Transfer funds.

- Make payments.

- Settle debts between individuals and businesses.

Types of Cheque

Knowing what a cheque is is not enough. You must know about its various types to fully understand the dynamics of cheques. Here are some of the types of cheques which you should be aware of:

1. Bearer Cheque

The bearer cheque is payable to the person who holds or “bears” the cheque. It is a form of open instrument, and whoever possesses it can encash it.

2. Order Cheque

An order cheque is payable only to a specific person or organization mentioned on the cheque as the payee. It requires endorsement by the payee to be encashed.

3. Crossed Cheque

Crossed cheque has two parallel lines across its face. These lines are drawn to indicate that the cheque must be deposited directly into the payee’s bank account. It also disables the check to be encashed over the counter.

Sorry, folks, no loopholes here!

4. Open Cheque

An open cheque is not crossed or specified as a bearer or order cheque. It is payable to the person presenting it and can be encashed over the counter.

5. Post-Dated Cheque

Post-dated cheques carry an upcoming date as the payment date. It becomes valid for encashment only on or after that date.

6. Stale Cheque

Just like that forgotten sandwich in the back of your fridge, cheques have an expiration date.

An expired cheque is called a stale cheque. So, remember, presenting stale cheques after their due date will leave you with nothing but disappointment.

7. Traveler’s Cheque

When Adventure calls, this cheque answers.

A traveler’s cheque is a pre-printed fixed-amount cheque. It is designed to be used while traveling. It also serves as a safer and more convenient alternative to carrying cash.

8. Self Cheque

A self cheque is a type of cheque written by the account holder and payable to themselves. It allows you to withdraw cash from your account.

It’s like a gift from you to yourself.

Features of Cheque

Here are certain features of a cheque:

1. Issued by Individuals

A bank cheque can be issued by individuals who hold a savings or current account. It provides them with a convenient payment method.

2. Fixed Amount

The amount written on the cheque cannot be changed later on. It provides a secure means of transferring a specific sum of money to the payee.

3. Formal Order of Payment

A cheque is an unconditional order and not a request to the bank. It represents a legally binding instruction to the bank to make the specified payment.

4. Validity and Authorization

The cheque is valid only when signed and dated. Unsigned cheques are considered invalid and cannot be honored by the bank.

5. MICR Code

Magnetic Ink Character Recognition (MICR) code is present at the bottom of the cheque. It facilitates automated processing by banks.

How to Write a Cheque?

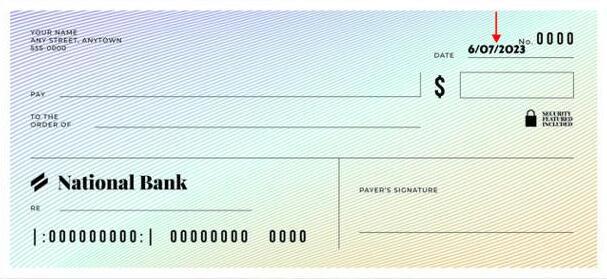

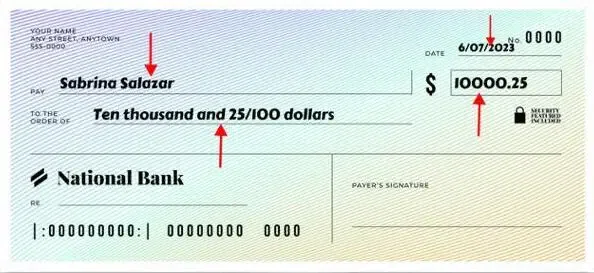

Writing a cheque involves several steps to ensure accuracy and legitimacy. Don’t panic! Let’s take baby steps:

But before that, here’s some advice for you,

Always keep your chequebook with you (it will come in handy in such cases.)

Step 1. Write the Date on the Cheque Write the date on the line provided in the upper-right corner of the bank cheque . You must fill in the date in the standard format, like “DD/MM/YYYY.”

Step 2. Fill in the Payee’s Name Can you see the line that says “Pay”? Write the full name of the organization or person to whom the payment is directed.

Step 3. Write the Amount in Numbers Now, write the payment amount in numbers against the line with the dollar symbol ($). If applicable, you must also include cents in decimals.

Step 4. Write the Amount in Words In the line below the payee’s name, write the amount in words. You must start with the dollar amount and then mention the cents as a fraction over 100.

Step 5. Add a Memo If you want, you may add a brief memo or note in the designated section of the cheque. A memo is generally added to indicate the purpose of the payment or provide additional information.

Step 6. Sign the Cheque At the lower-right corner of the cheque, sign your name using your signature. Remember to use the one registered for your bank account. Signing validates the cheque and confirms its authenticity.

And, Voila! Your masterpiece is complete.

Parties to Cheque

There are three main parties involved in a bank cheque transaction:

The drawer is the person who writes and signs the cheque, issuing the payment instruction. The drawer is typically the account holder who authorizes the payment from their bank account.

The payee is the person or organization named on the cheque to receive the payment. The payee is the intended recipient of the funds specified by the drawer.

The drawee is the bank or financial institution on which the bank cheque is drawn. The drawee is responsible for paying the payee as instructed by the drawer.

These parties collectively form the foundation of a cheque transaction. The drawer initiates the payment, the drawee holds the funds, and the payee receives the payment.

Advantages and Disadvantages of Writing a Cheque

Like a coin, a cheque also has two faces. It has both advantages and disadvantages. So let’s have a look at the table below:

The Key Takeaway

While digital payment methods dominate today’s financial landscape, cheques remain a valuable tool for certain transactions. Thus, properly understanding cheques equips you with the necessary skills to navigate the financial world effectively. So, we hope that you understand the value of these little pieces of paper by now.

And now, it’s time for us to part ways!

Now, you did not think we would go without giving you a gift, did you?

No matter what you have to do with a cheque, always handle it with care. !

FAQs on What is a Cheque

Q1: are cheques still widely used today.

Many businesses and individuals continue to use cheques for specific transactions due to the wide acceptability and lack of understanding of the latest technology.

Q2: Can I Write a Post-Dated Cheque?

Yes, you can write a post-dated cheque by specifying a future date as the payment date.

Q3: How to Correct a Mistake While Writing a Cheque?

If you make a mistake while writing a cheque, do not use correction fluids or overwrite. Instead, mark the cheque as void, tear it up, and start fresh with a new cheque.

Q4: Can Anyone Encash a Bearer Cheque?

Yes, bearer cheques are payable to the person who holds or “bears” the cheque. They can be encashed by anyone in possession of the cheque, so it is essential to keep them secure.

Please Login to comment...

Similar reads.

- Money & Banking

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

- Toll Free 1800 309 8859 / +91 80 25638240

Home Accounting Post-dated Cheque – Definition, Validity and How to Write it

Post-dated Cheque – Definition, Validity and How to Write it

Yarab A | Updated on: December 29, 2021

--> published date: | updated on: --> <--, what is a cheque, what is a post-dated cheque, how to write a post-dated cheque, why do we issue a post-dated cheque.

- Post-dated cheque situations

Post-dated cheque validity

Why is it not advisable to issue a post-dated cheque, what are the alternatives for post-dated cheque, managing post-dated cheque.

Before we understand the definition of post-dated cheque and why it is issued, let’s understand little more about the cheque.

A cheque is a bill of exchange drawn on a specified banker and to be payable on demand. It includes the printed form and a cheque in the electronic form.

In simple words, a cheque is a form of a bill of exchange which orders the bank to pay an amount of money from a person’s account to another individual’s or company’s account in whose name the cheque has been issued.

Now we know the definition of cheque, let’s understand post-dated cheque.

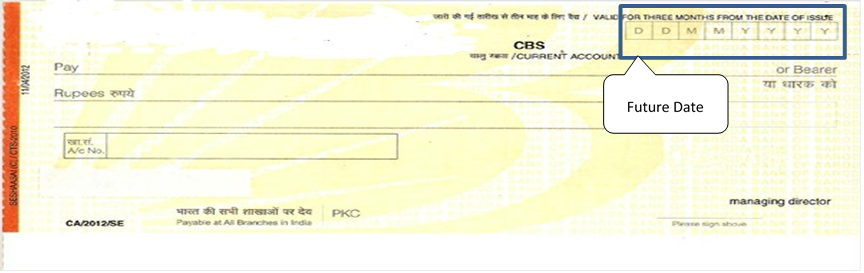

To define post-dated cheque, it is a form of a cheque drawn with a future date written on it. To simply put, post-dated cheque is one which is drawn with a date which is after the date on which cheque was written.

Let’s understand with an example.

Assume that today is 27 th Jan and you are writing a cheque. Generally, if you write a cheque, you will write the current date of the cheque i.e., 27 th Jan. But when you write a date which is later than the current date, say you write a date of a cheque as 3 rd Feb, this is when it becomes post-dated cheque.

This arrangement of issuing a post-dated cheque to the recipient (the person or business receiving the payment, also known as the payee) is only made when the drawer wants the recipient to wait before depositing the cheque.

Here, it is important to note that cheque will be presented to the bank either on the date written on cheque and after the date.

Post-dated cheque image

Writing the post-dated cheque is no different from writing a regular or normal cheque. In writing a post-dated cheque, the only difference is that you will write a future date instead of the current date. The rest remains the same.

If you are a drawer of the cheque and if you have issued a post-dated cheque to the recipient, it implies that a written communication from your end to the recipient asking him to wait for the time, from the date the cheque is physically issued till the date mentioned in the face of the cheque.

In the above example, if you are a recipient of the cheque, you can deposit the cheque on 3 rd Feb or after that though the cheque was physically written and received to you on 27 th Jan. The gap between 27 th Jan and 3 rd Feb is the wait time here.

Post date cheque situations

While we know why businesses issue a post-dated cheque, it is also important to know the possible situations under which the post-dated cheque is issued.

- Insufficient funds : You do not have sufficient funds available on the date of writing the cheque, but you are sure funds will be available on the future date or the date mentioned on the cheque.

- Writing a cheque in advance : A cheque is written for paying something ahead of time i.e. before the payment is due or the service has been completed.

In India, the validity of a post-dated cheque is 3 months from the date mentioned on the cheque. Similarly, each country has specific rules related to the issue and validity of the post-dated cheque

So, the story of the post-dated cheque is that you don’t have sufficient balance on the date the drawee demands the sum from you and you issue him a post-dated cheque with a future date. This is kind of giving assurance to the recipient or the drawee that on this future date, the payment will be honoured.

But in reality, it is not always advisable to issue a post-dated cheque. This is because there could be possibilities that you may not be able to honour the cheque on the given future date. The possible reason could be expected funds have not come into the bank.

On the other side, the recipient may not be aware of this and he may deposit the cheque into bank resulting in a cheque bounce. This will not cost you in terms of additional charges that a bank may charge you but a loss of credibility and relationship that has been built so far.

Today, most of the banking process has been automated and banks rarely look at the date mentioned on the cheque. Sometimes, this may also possibly lead to cheque bounce.

Issuing a post-dated cheque also involves a process of informing the bank with the written instructions which are cumbersome. To add to it, each bank has different policies monitoring and preventing premature payment.

Do we have any other alternatives? Take a look at the next section.

If you have an option to exercise, then it is best to avoid writing a postdated cheque. Even if your payee (the recipient) is honest, they may make the honest mistake of forgetting and leaving you with bad cheque fee.

Usually, a postdated cheque is used when you are short on money and that’s exactly when you can’t afford extra fees. In those circumstances, instead of writing a postdated cheque, you can try the following:

- If you’re postdating a check for timing or convenience reasons, say you will be out of town and will unable to pay when you usually do, schedule the payment through your bank’s online bill payment service such as Net banking, mobile banking etc.,

- Sign up for automatic electronic payments - only if you trust the payee. Dishonest or disorganized businesses may make withdrawals from your account before you’re ready.

Sometimes, the alternative doesn’t work, and you choose to issue post-dated cheque(s) assuming the funds will be available on the future date. To make the situation little more interesting, you may have received the post-dated cheques promising to honour the payment on a given date. You might have considered this as well in issuing a post-dated cheque.

Now, you are in a situation where you have one or more post-dated cheques received as well as issued? This requires you to track and manage the post-dated cheques. Also, you need to have a special accounting treatment so that the transaction will automatically affect the accounting books on the date of the post-dated cheque.

TallyPrime, comprehensive business management software facilitates the smooth management of post-dated cheques. The post-dated cheque management feature supports the following:

- You can mark an entry as post-dated and specify the date on which the cheque was received/issued

- The transaction will automatically affect the accounting books on the date of the post-dated cheque

- You can obtain a comprehensive summary of all transactions involving post-dated cheques, using the post-dated summary report

- You can include post-dated transactions in other accounting reports like bills outstanding’s reports and accordingly make the decisions

Take a look at complete features of TallyPrime .

Yarab A | Apr-17-2020

- Business Guides

- ERP Software

Latest Blogs

GST E-invoice Mandate: Including 6-Digit HSN for Wholesale Tax

TallyPrime on AWS – The Best Cloud Accounting Software

Top Causes of GST Notices Demystified

E-invoicing and Cash Flow Management Strategies to Optimize Financial Processes

6 Tasks to Complete Before You Start Your E-Invoicing Journey

How to Easily Shift/Migrate Your Data to TallyPrime

Accelerate your profitability & business growth with TallyPrime!

Thanks for Applying

We will be in touch with you shortly.

'Thank God it stopped': N.S. bus driver recognized for averting potential tragedy

Terrie brown says he's no hero and was just doing his job.

Bus driver recounts moments leading up to overpass crash near Bedford

Social sharing.

Terrie Brown had just entered Highway 102 near Bedford, N.S., last week and was getting close to the speed limit when he noticed a tractor-trailer crash through the guardrail above on Highway 101.

Brown, who has been a bus driver for nine years, had just left Rocky Lake Junior High with 23 students. He managed to stop the bus in time, dodging what could have been a tragedy.

"I was hard on the brakes trying to get the bus stopped and thank God it stopped," Brown told reporters on Friday.

"I mean, I didn't have any alternatives. It was either go to the concrete median and try to stop the bus that way or to the ditch. I chose to stay on a straight line with the brakes hard."

On Friday, Brown was recognized for that quick action. He was presented with a cheque for $500 and a community hero award by Southland, the school bus company and his employer.

"With your quick reaction time, you were able to get safely home to Joanne [Brown's wife], and those 23 students were able to get safely home to their parents and their guardians," Coady MacNeil, operations manager of Southland, said during the presentation.

"When you saw what was happening in front of you, you made several split-second decisions and were able to go from 100 km/h to zero in six seconds over a distance of 100 metres in a 14-ton school bus, and also had the wherewithal to keep the wheels straight [so the bus wouldn't tip]."

Recalling the crash, Brown said the first thing he did was ask if everyone on the bus was OK. Police told CBC News last week that no one was injured on the bus or truck.

Brown said the students all started looking out the front window once the bus came to a stop.

"They were in shock," he said. "They didn't know what was going on.... By that time, the truck was probably still bouncing around a little bit and the motor, that was still steaming and all that. So they knew right away what happened, that a truck had come down in front of me and I had to stop, and stop immediately."

He said he felt anxious the first day back on the job. He said he enjoys his job and never expected to be recognized for what he did.

He said it will take time to feel back to normal again because "it was quite an ordeal."

"Everybody's calling me a hero," he said. "I don't feel like a hero. I just feel like I've done my job the best I could do it."

David Reed, the principal of Rocky Lake Junior High, said Brown has made the community proud.

"I would say this is the most extraordinary thing I've seen a bus driver do and we're very fortunate that Mr. Brown acted so quickly and in such a heroic manner," Reed said. "It would have been a very tragic event that would have had a huge impact on Rocky Lake and the school community."

Reed said the incident is a reminder to students to be respectful to bus drivers.

"We need to get home safely and if the bus drivers are focused on the road, then they can make the necessary actions and the necessary stops to keep them safe. And from what I hear, since then, it's been exceptional on the way home."

- Halifax clinic renamed to honour hockey player who died of inherited heart disease

- Have you ever seen a yellow lobster?

- Pilot project monitors patients while they wait in Dartmouth ER

- Volunteers help Louisbourg legion feed those in need

- How one N.S. town is working with people with disabilities toward a barrier-free community

ABOUT THE AUTHOR

Anjuli Patil is a reporter and occasional video journalist with CBC Nova Scotia's digital team.

With files from Gareth Hampshire

Related Stories

- Tillsonburg teenager charged for following school bus too closely

- Saint John recommends purchase of 6 electric buses, currently being leased

- Boy, 11, killed in collision with school bus in Rockland

What you need to know about education for sustainable development

What is education for sustainable development .

Education for sustainable development (ESD) gives learners of all ages the knowledge, skills, values and agency to address interconnected global challenges including climate change, loss of biodiversity, unsustainable use of resources, and inequality. It empowers learners of all ages to make informed decisions and take individual and collective action to change society and care for the planet. ESD is a lifelong learning process and an integral part of quality education. It enhances the cognitive, socio-emotional and behavioural dimensions of learning and encompasses learning content and outcomes, pedagogy and the learning environment itself.

How does UNESCO work on this theme?

UNESCO is the United Nations leading agency for ESD and is responsible for the implementation of ESD for 2030 , the current global framework for ESD which takes up and continues the work of the United Nations Decade of Education for Sustainable Development (2005-2014) and the Global Action Programme (GAP) on ESD (2015-2019).

UNESCO’s work on ESD focuses on five main areas:

- Advancing policy

- Transforming learning environments

- Building capacities of educators

- Empowering and mobilizing youth

- Accelerating local level action

UNESCO supports countries to develop and expand educational activities that focus on sustainability issues such as climate change, biodiversity, disaster risk reduction, water, the oceans, sustainable urbanisation and sustainable lifestyles through ESD. UNESCO leads and advocates globally on ESD and provides guidance and standards. It also provides data on the status of ESD and monitors progress on SDG Indicator 4.7.1, on the extent to which global citizenship education and ESD are mainstreamed in national education policies, curricula, teacher education and student assessment.

How does UNESCO mobilize education to address climate change?

Climate change education is the main thematic focus of ESD as it helps people understand and address the impacts of the climate crisis, empowering them with the knowledge, skills, values and attitudes needed to act as agents of change. The importance of education and training to address climate change is recognized in the UN Framework Convention on Climate Change , the Paris Agreement and the associated Action for Climate Empowerment agenda which all call on governments to educate, empower and engage all stakeholders and major groups on policies and actions relating to climate change. Through its ESD programme, UNESCO works to make education a more central and visible part of the international response to climate change. It produces and shares knowledge, provides policy guidance and technical support to countries, and implements projects on the ground.

UNESCO encourages Member States to develop and implement their country initiative to mainstream education for sustainable development.

What is the Greening Education Partnership?

To coordinate actions and efforts in the field of climate change education the Greening Education Partnership was launched in 2022 during the UN Secretary General's Summit on Transforming Education. This partnership, coordinated by a UNESCO Secretariat, is driving a global movement to get every learner climate-ready. The Partnership addresses four key areas of transformative education: greening schools, curricula, teachers training and education system's capacities, and communities.

How can I get involved?

Every single person can take action in many different ways every day to protect the planet. To complement the ESD for 2030 roadmap , UNESCO has developed the ESD for 2030 toolbox to provide an evolving set of selected resources to support Member States, regional and global stakeholders to develop activities in the five priority action areas and activities in support of the six key areas of implementation.

UNESCO also launched the Trash Hack campaign in response to the 2 billion tons of waste that the world produces every year, waste which clog up the oceans, fill the streets and litter huge areas. Trash Hacks are small changes everyone can make every day to reduce waste in their lives, their communities and the world.

Related items

- Education for sustainable development

- Environmental education

What is Memorial Day? The true meaning of why we celebrate the federal holiday

For many Americans, Memorial Day is more than a long weekend and an unofficial start to the summer season. The real meaning of the holiday is meant to honor all U.S. soldiers who have died serving their country.

Originally called Decoration Day, Memorial Day's history goes back to the Civil War. It was was declared a national holiday by Congress in 1971, according to the U.S. Department of Veterans' Affairs.

Although Veterans Day in November also honors military service members, Memorial Day differs by honoring all military members who have died while serving in U.S. forces in any current or previous wars.

The late-May holiday has also evolved into an opportunity for Americans to head to the beach or lake , travel to see friends and family , or even catch a Memorial Day parade .

Here's what to know about the history and the reason behind why we observe Memorial Day.

Memorial Day weather: Severe storms could hamper your travel, outdoor plans for Memorial Day weekend

When is Memorial Day?

One of 11 federal holidays recognized in the U.S., Memorial Day is always observed on the last Monday of May. This year, the holiday falls on Monday, May 27.

Why do we celebrate Memorial Day?

The origins of the holiday can be traced back to local observances for soldiers with neglected gravesites during the Civil War.

The first observance of what would become Memorial Day, some historians think, took place in Charleston, South Carolina at the site of a horse racing track that Confederates had turned into a prison holding Union prisoners. Blacks in the city organized a burial of deceased Union prisoners and built a fence around the site, Yale historian David Blight wrote in The New York Times in 2011.

Then on May 1, 1865, they held an event there including a parade – Blacks who fought in the Civil War participated – spiritual readings and songs, and picnicking. A commemorative marker was erected there in 2010.

One of the first Decoration Days was held in Columbus, Mississippi, on April 25, 1866 by women who decorated graves of Confederate soldiers who perished in the battle at Shiloh with flowers. On May 5, 1868, three years after the end of the Civil War, the tradition of placing flowers on veterans’ graves was continued by the establishment of Decoration Day by an organization of Union veterans, the Grand Army of the Republic.

General Ulysses S. Grant presided over the first large observance, a crowd of about 5,000 people, at Arlington National Cemetery in Virginia on May 30, 1873.

This tradition continues to thrive in cemeteries of all sizes across the country.

Until World War I, Civil War soldiers were solely honored on this holiday. Now, all Americans who’ve served are observed.

At least 25 places in the North and the South claim to be the birthplace of Memorial Day. Some states that claim ownership of the origins include Illinois, Georgia, Virginia, and Pennsylvania, according to Veterans Affairs.

Despite conflicting claims, the U.S. Congress and President Lyndon Johnson declared Waterloo, New York, as the “birthplace” of Memorial Day on May 30, 1966, after Governor Nelson Rockefeller's declaration that same year. The New York community formally honored local veterans May 5, 1866 by closing businesses and lowering flags at half-staff.

Why is Memorial Day in May?

The day that we celebrate Memorial Day is believed to be influenced by Illinois U.S. Representative John A. Logan, who was elected to the U.S. House of Representatives as a Democrat in November 1858, and served as an officer during the Mexican War.

It is said that Logan, a staunch defender of the Union, believed Memorial Day should occur when flowers are in full bloom across the country, according to the National Museum of the U.S. Army.

Congress passed an act making May 30 a holiday in the District of Columbia in 1888, according to the U.S. Congressional Research Service.

In 2000, the National Moment of Remembrance Act – which created the White House Commission on the National Moment of Remembrance and encourages all to pause at 3 p.m. local time on Memorial Day for a minute of silence – was signed into law by Congress and the President.

What is the difference between Memorial Day and Veterans Day?

Memorial Day and Veterans Day both honor the sacrifices made by U.S. veterans, but the holidays serve different purposes.

Veterans Day, originally called “Armistice Day,” is a younger holiday established in 1926 as a way to commemorate all those who had served in the U.S. armed forces during World War I.

Memorial Day honors all those who have died.

Releasing Windows 11, version 24H2 to the Release Preview Channel

- Windows Insider Program Team

UPDATE 5/29: We’re aware that some Windows Insiders in Release Preview are not seeing Windows 11, version 24H2 offered yet. We’ve just begun the rollout and will gradually increase the rollout over time so not everyone will see it right away. If you are not seeing it yet and want to update to Windows 11, version 24H2 right away, you can do so by using the ISO which are available for download here . The ISO is Build 26100.560 but once you update using the ISO and join Release Preview, you’ll get Build 26100.712.

Hello Windows Insiders!

Today, we are making this year’s annual feature update Windows 11, version 24H2 (Build 26100.712) available in the Release Preview Channel for customers to preview ahead of general availability later this calendar year.

Windows 11, version 24H2* includes a range of new features such as the HDR background support, energy saver, Sudo for Windows , Rust in the Windows kernel, support for Wi-Fi 7, voice clarity and more. It also includes many improvements across Windows. For example, we are introducing a scrollable view of the quick settings flyout from the taskbar, the ability to create 7-zip and TAR archives in File Explorer (in addition to ZIP), and improvements for connecting Bluetooth® Low Energy Audio devices. We will be sharing more details in the coming months on many of the new features and improvements included as part of Windows 11, version 24H2 leading up to general availability. Please note that the new AI features such as Recall announced earlier this week will not be available on your PC after installing this update today as they require a Copilot+ PC. For more information on those new AI features and Copilot+ PCs, see this blog post here .

As part of this update, we’re also evolving the Copilot** experience on Windows as an app that will be pinned to the taskbar. This enables users to get the benefits of a traditional app experience, including the ability to resize, move, and snap the window – feedback we’ve heard from users throughout the preview of Copilot in Windows. This model also allows Microsoft to more agilely develop and optimize the experience based on user feedback. This change will be making is way to Insiders in the Canary, Dev, and Beta Channels shortly.

[ADDED 5/30] As part of the Copilot experience’s evolution on Windows to become an app that is pinned to the taskbar, we are retiring the WIN + C keyboard shortcut. For new devices that ship with a Copilot key , this key will open Copilot. For existing devices without that key, using the WIN + (number position for Copilot pinned to your taskbar) is a great way to open Copilot.

Windows Insiders in the Release Preview Channel can install Windows 11, version 24H2 via our “seeker” experience in Windows Update. This means if you are an Insider currently in the Release Preview Channel on a PC that meets the Windows 11 hardware requirements , you can go to Settings and Windows Update and choose to download and install Windows 11, version 24H2 if you want. Once you update your PC to Windows 11, version 24H2, you will continue to automatically receive new servicing updates through Windows Update (the typical monthly update process). For instructions on how to join the Windows Insider Program and join your PC to the Release Preview Channel, click here .