The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Rigorous portfolio review reveals a better opportunity for PwC’s Public Sector business

Proactive portfolio management helps PwC grow responsibly

- April 02, 2024

Conventional business wisdom tends to prize growth above all: Bigger is better, yet divestitures often play a key part in a successful business strategy. PwC understands that a more thoughtful approach to portfolio management can better serve both a company and its employees. Through its own portfolio review process, PwC realized its Public Sector business would have more opportunity to thrive under a different owner. The firm successfully navigated the divestiture process with vigorous preparation, creating a positive outcome for the business and the future prosperity and well-being of its partners, principals and employees.

CLIENT

Professional services

Divestiture strategy Portfolio management

value reinvested in other priority areas of PwC’s business as a result of the divestiture

employees retained under new ownership during the divestiture, from announcement through closing

Prioritizing the well-being of employees while building trust in the divestiture process

Cultivating a responsible growth mindset

Managing a business portfolio is like tending a garden. Without active, intentional cultivation, growth might happen, but not to its overall potential. As PwC considered its own business portfolio, it realized that achieving its long-term growth objectives required an active hand. PwC knew from experience advising clients that a proactive review process to help identify incompatible business units could double the chances of delivering a positive return to shareholders. With the CFO and Head of Portfolio Strategy in the lead, the organization applied a formal process for portfolio review and analysis to help inform better strategic decision-making.

For decades, the company’s approach had been to build or acquire businesses and hold them. But as PwC reevaluated its portfolio with a critical eye, it decided that increasing shareholder return meant wielding the options at its disposal — including divestitures. PwC reframed its thinking around the concept of divestitures: a proactive choice to sell an attractive asset to a buyer who could grow it, while freeing time and capital to invest in other priority areas of its business. Good business and good stewardship.

It’s about potential

During its regular, rigorous portfolio review, PwC concluded that its Public Sector division might be a candidate for a divestiture. PwC asked itself, is our firm the right owner for this business? Perhaps not: PwC’s position in the market and obligation to adhere to certain regulatory requirements were likely holding back its Public Sector business. But under a different owner, one who could invest more into the business and whose capabilities aligned more closely with its needs, the business would have a greater chance of achieving its overall potential. With those goals in mind, PwC set about finding a qualified buyer.

Though PwC considers a divestiture an option in portfolio management, it’s not the only one. The goal of the portfolio review process is to better understand the performance of each business unit and how to shepherd it to success. PwC’s process categorized its portfolio holdings and set thresholds for action, including when to invest for growth, maintain the same level of investment, restructure, wind down or divest. Based on these guidelines, the company committed to divesting only if the deal was favorable for all parties, especially the employees retained in the sale.

Get more on this topic

Explore our divestiture solution

C-suite executive insights and strategies

Preparing for success

As in other divestitures, a key to executing the divestiture with positive outcomes for all was preparation. To do right by its partners, principals and employees, PwC took care to factor emotional and cultural impact into its plans alongside logistical considerations. A small executive team, including the CFO and the head of the departing Public Sector business, began consulting investment bankers about the possibility of selling. The head of the Public Sector group compiled a plan to showcase the value of the business to potential investors. At the same time, the leadership team invested heavily in resources to prepare for the sale. In addition to facilitating the divestiture itself by confirming financial readiness, completing the requisite sell-side due diligence and meticulously carving out the business from the rest of its holdings, PwC also took the time to form a plan for clearly communicating its intention to the board and its employees.

Time was of the essence. PwC needed to maintain confidentiality to make sure that employees did not hear of the divestiture prematurely from an outside party, which could severely damage internal trust. That meant the leadership team had to balance speed and quality, moving as swiftly as possible to secure a suitable buyer. PwC carefully laid the groundwork to carve out its Public Sector business before approaching its employees. Months of diligent work on a communication plan were not in vain. PwC quickly and clearly explained the opportunity to its partners, principals and employees — demonstrating how a divestiture would benefit all shareholders.

Managing change with integrity

Navigating the transition with sensitivity was crucial to maintaining the trust of employees. Once its plan was solidified and communicated, PwC addressed concerns with care. It assured its Public Sector employees that the goal was to find them a better opportunity; short of that, there would be no deal. As part of that promise, PwC dedicated itself to fostering an environment where employees felt not only secure in their jobs, but eager for the future. It committed to finding a buyer who could better invest in the future of the acquired business and offer employees a greater chance of growth.

With the employees’ buy-in and the board’s go-ahead, PwC was ready to divest. In the end, the company identified Veritas Capital as the right-fit buyer, a private equity firm with a resume of relevant experience in the public sector and a strategic vision to move the business forward. Just three months later, the deal was complete.

Success in a large-scale business transformation relies on speed and certainty. Moving quickly reduces the amount of time required to keep confidentiality — essential for maintaining trust and reducing disruption — and builds momentum toward the deal. Competitive tension drives investors to come to the table with a final bid, making sure that the deal closes without the risk of value leakage. Both speed and certainty are the result of careful preparation. The tighter the deal, the shorter the time between signing and closing, and the greater the deal’s value and shareholder return.

Read our full report: The power of portfolio renewal and the value in divestitures

Reinvesting for future growth

Divesting its Public Sector business provided PwC with an influx of capital to distribute among its shareholders and reinvest in other priority services and solutions. Over $200 million of the proceeds went toward incremental capital for growing the company’s Cloud and Digital and Cyber, Risk and Regulatory businesses. What is PwC most proud of? Doing right by its employees. PwC would only move forward with a deal if the outcome was fair to its partners, principals and employees. The business retained nearly all 1,500 employees in the transition, thanks to PwC’s commitment to making a mutually beneficial deal and helping people see its value.

A playbook for proper portfolio divestiture

One of the most valuable outcomes of divesting is experience. In the process of divesting its Public Sector business, PwC applied years of experience and a well-honed set of leading practices. These included the directive to continuously evaluate its portfolio, prepare resources ahead of a deal, communicate clearly with employees and shareholders, and move quickly to maintain confidentiality. From initial analysis to final closing, the company navigated the process with care and consideration for its partners, principals and employees. Executing its own divestiture left PwC with an even more refined playbook to help advise its clients and partners through the same process.

By applying its proven process for rigorous portfolio management, PwC was able to make proactive, strategic decisions toward its long-term goals, fast. Regular, detailed analysis gave the company insight into how to move forward, and a cultural mindset shift opened new possibilities for responsible growth. Thanks to agile, data-driven decision making, PwC emerged ready to grow — not necessarily bigger, but better.

Sign up here to receive our monthly newsletter; a one-stop-shop for new thought leadership

“Divestitures are not about cutting losses. They are about identifying whether a better owner exists who could prioritize and focus investments and see opportunities for synergies to increase value.” Martyn Curragh CFO & Head of Portfolio Strategy, PwC US

“A successful divestiture takes careful preparation. In divesting our own Public Sector business, we knew how to manage the process properly.” Marina Shvartsman Head of FP&A & Corporate Development, PwC US

EXPLORE PwC’s DEALS INSIGHTS LIBRARY

Check out the latest thought leadership and upcoming events from our Deals specialists. Learn more

EXPLORE PwC’s CASE STUDY LIBRARY

See how we're helping clients build trust and become outcomes obsessed in our case study library. Learn more

Michael Niland

US Divestitures Services Leader, PwC US

Elizabeth Crego

Deals Clients & Markets Leader, PwC US

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

- Leadership Team

- Our Approach

- PMO Services

- Program & Project Managers

- PM Training & Development

- Case Studies

- Our Culture

- Employee Benefits

- Job Opportunities

- Benefits Realization Management Diagnostic

- Project Management Maturity Guide

- Guide to Agile Project Management

- PM Maturity Assessment

- Project Management as a Service (PMaaS) and Why It’s the Future

About PM Solutions

PM Solutions is a project management consulting firm that helps PMO, project, and business leaders apply project and portfolio management practices that drive performance and operational efficiency.

- Co-Founder & Co-CEO J. Kent Crawford

- Co-Founder & Co-CEO Deborah Bigelow Crawford

- President, PM Solutions & PM College Bruce Miller

- Vice President, Client Success, Eric Foss

- Managing Director, HR & Administration, Karen Alfonsi

- Director, Marketing and Communications, Carrie Capili

With our approach , companies can expect high-value, high-impact solutions, and measurable, sustainable results.

- PMO Deployment, Operation, and Enhancement

- Project Management as a Service (PMaaS)

- Project Review & Recovery

- Project Portfolio Management (PPM)

- Project Management Maturity Advancement

- Organizational Change Management

- Project Management Methodology Implementation

- Demand Management

- Project Management Mentors

- Resource Management

- Vendor Management

Project & Program Managers

We can provide you with highly experienced program and project managers ; experts to help guide, lead, and support high-visibility initiatives.

PM Training & Development

PM College® provides corporate project management training and competency programs for clients around the world.

By Project Initiatives

- Cost Reduction Initiatives (1)

- Data Center Consolidation (1)

- High-risk Capital Initiatives (1)

- Infrastructure Program Management (0)

- Manufacturing Facility Operations (1)

- Mentoring (11)

- Methodology (4)

- New Product Development (1)

- Organizational Change (6)

- PMO Assessment (4)

- PMO Deployment (4)

- Process Improvement (7)

- Program & Portfolio Management (10)

- Project Audits (1)

- Project Management Training (7)

- Regulatory Compliance (1)

- Resource Management (1)

- Strategy Execution (1)

- Systems Integration Deployment (0)

- Troubled Project Recovery (3)

- Vendor Management (2)

By Industry

- Automotive (1)

- Energy & Utilities (7)

- Financial Services (2)

- Human Resources (1)

- Information Technology (5)

- Insurance (5)

- Manufacturing (6)

- Pharma/Biotech (2)

- Professional Services (2)

- Research and Development (1)

- Retail & Merchandise (1)

- Security (1)

- Benefits Realization (4)

- Change Management (6)

- IT Project Management (4)

- Outsourcing Project Management (4)

- Performance & Value Measurement (12)

- Project Management Maturity (23)

- Project Management Methodology (12)

- Project Management Office (58)

- Project Management Training (31)

- Project Management Trends (50)

- Project Manager Competency (18)

- Project Portfolio Management (11)

- Project Recovery (9)

- Resource Management (5)

- Strategy & Governance (14)

- Articles (46)

- Brochures (3)

- eNewsletters (19)

- Research (46)

- Webinars (24)

- White Papers (36)

- contact us get in touch call: 800.983.0388

Home » Case Studies » Program & Portfolio Management

More program & portfolio management case studies, ontario power generation achieves project excellence through the establishment of an enterprise project management office.

"We have really changed public perception, and as a result, increased our credibility in OPG’s ability to execute projects. “- Mike Martelli, Chief Projects Officer, OPG Read More »

- Energy & Utilities

- PMO Assessment

- Process Improvement

- Program & Portfolio Management

‘Never Waste a Good Crisis’: Kettering Health Network Doubles Down on Project Management Improvement

Agile transformation of the PMO and transforming how Agile Scrum was used helped the PMO complete 103 projects, including a new hospital and a new cancer treatment center. It grew to a Level 3 PMO from a 1.8 PMO within a 12-month period. As the PMO transitions to an EPMO, this mission-critical function will have a broader strategic footprint, doubling its influence and impact across the network’s portfolio of projects over the next couple of years. Read More »

- Pharma/Biotech

- Organizational Change

Transformative Leadership Sets Financial Services Enterprise PMO on Fast Track to Strategic Value

For this privately held financial services company, a compelling journey of business transformation started with a good read. Read More »

- Financial Services

- PMO Deployment

- Project Management Training

- Strategy Execution

Accident Fund’s Award-Winning PMO Puts Processes Before Tools in Implementing Project Portfolio Management

PM Solutions used its PPM Maturity and Project Management Maturity Models to develop an improvement roadmap that included a number of specific recommendations from a project management governance perspective. Established PPM processes that helped eliminate approximately 100 non-value-adding projects, led to the successful implementation of a PPM tool, and won the company national acclaim – all in under three years. Read More »

Claims Management Company Successfully Completes Massive M&A Initiative Using Best-Practice Project and Program Management

The company grew dramatically by successfully integrating more than 10,000 new customers, opening two additional call centers, and doubling the number of claims serviced — while meeting program deadlines, contractual obligations, and increasing revenues by over 30%. Read More »

- Information Technology

- Methodology

- Troubled Project Recovery

Fast-Track PMO Implementation Rescues Troubled Projects and Improves Customer Satisfaction

For one of the largest privately-held staffing companies in the United States: PM Solutions implemented a fully-functional PMO including Project Portfolio Management tools after an unsuccessful first attempt at implementing a PMO on behalf of the Company. Value Delivered: The resulting visibility into projects allowed the client to recover 100% of the troubled projects in a portfolio valued at approximately $13M, while significantly improving project manager morale as well as project performance and customer satisfaction. Read More »

- Professional Services

Improvements in Project and Portfolio Management Yield Immediate Returns

Dramatic increases in project execution capabilities and productivity resulted in $900,000 of operational cost avoidance during the current budget year. Read More »

- Project Audits

Project Management Maturity Practices Yield Improved Operational Efficiencies

For a multi-billion dollar strategy and technology consulting firm: PM Solutions performed a project management maturity assessment, delivered an implementation plan to improve maturity, provided portfolio management consulting and project management training, and performed a re-assessment to gauge improvement over a three-year period. Value Delivered: Overall process maturity improved by 40%. Read More »

New Manufacturing Facility Goes Online in Record Time

PM Solutions is providing project and program management to bring a state-of-the-art, $60 million dollar manufacturing facility online and fully operational in record time. Value Delivered: The facility was operational in just 12 months, allowing the client to realize 33% of their project return seven months ahead of schedule. Read More »

- Manufacturing

- Manufacturing Facility Operations

Program Meets Regulatory Requirements Ahead of Schedule and Under Budget

PM Solutions provided program management of a product reformulation initiative that affected $260 million (Net Sales Value) worth of products driven by regulatory compliance. Value Delivered: The program was completed six months ahead of schedule and $2 million under budget. Read More »

- Regulatory Compliance

- eNewsletters

- White Papers

- PMO of the Year Award

Connect with Us

The project management experts®.

PM Solutions is a project management services firm helping organizations apply project management and PMO practices to improve business performance.

Toll-free (US): 800.983.0388 International: +1.484.450.0100 [email protected]

285 Wilmington-West Chester Pike Chadds Ford, PA 19317 USA

© 2012-2024 Project Management Solutions, Inc. All Rights Reserved. Privacy & Terms

Case Studies

Strategic Porfolio Management Tools Create Value for Leading Pharmaceutical Company

Innovation Portfolio Management: Balancing Value and Risk (abbreviated) Frost & Sullivan case study of SmartOrg and “Beta Inc.”

Co-Innovation Supports “Big Wins” – An HP-Shell Case Study Frost & Sullivan case study of SmartOrg’s work with HP supporting Shell

Catalent Pharma Solutions Prioritizing the Portfolio

Verathon, Inc. Creating focus across the organization

Major Oil Company Improves Results by 100% Aligning with business value

Hewlett-Packard (HP) Turbo-charging new business creation

Strategic and Economic Value Analysis of New Business Ideas Frost & Sullivan case study of HP, featuring tools provided by SmartOrg

Creating Profitable Opportunities in a Commodity Business Should their main emphasis be on reducing costs or growing through innovation?

Focus on Value Improves Returns by 100% Case study of a major technology-based packaging company

Thanks for your interest in scheduling an interactive demo of Portfolio Navigator. Fill out your contact information below, and we’ll get back to you in one business day. For any questions, please fill out the Message area.

Best Way to Reach Me

No Preference Email Phone

I understand and consent to the Privacy Policy (required).

Coming Soon!

The iNav sandbox isn’t available yet. Please fill out the form below, and we’ll notify you when it’s ready.

Schedule an information session

Fill out your contact information and we’ll be in touch soon!

Driving breakthrough growth starts with a simple conversation. Send us your contact information, and we’ll be in touch within one business day to set up a time to connect.

Small steps can lead to big opportunities. Connect with us today to get the ball rolling and see if we have what you’re looking for. Fill out your contact information and we’ll be in touch within one business day!

- Discover our global expertise Project services PMO & Project Delivery Project Dashboards Project Management as a Service (PMaaS) Project Portfolio Execution Strategy execution & Business Improvements Project Management Improvement Agility at scale Change Management Lean Innovation Project Portfolio Management & Optimisation Digital Solutions Digital PMO Deployment of PM Solutions Intelligent Project Prediction (IPP) Clayverest: the PMO's Copilot Case studies Discover how our expertise supports our clients

- Join our team Our company culture Empower your project experience Empower your professional experience Empower your CSR experience Empower your social experience Our job families Project Management Consultant Delivery Manager Business Manager Your profile Early Professional Experienced Professional Our job offers Discover our local and international opportunities

- The Project Management Blog PM Guides Agile Change Management Cost Management Crisis Management Digital PMO Industry Insights Lean Innovation PMaaS PMO Portfolio Management Project Management Delivery Project Managements Roles Risk Management Schedule Management Latest articles Newsroom Case studies Discover how our expertise supports our clients

- Europe France Germany Italy Portugal Romania Spain Switzerland United Kingdom North America Canada Mexico United States Asia South East Asia Oceania Australia Contact Us

Case Study: Project Portfolio Management Solution

- 10 November 2020

- Automotive & Transportation , PPM Solutions & Services

The Challenge

Our client, a leading UK car insurance firm, engaged MIGSO-PCUBED to deploy a cost-effective Project Portfolio Management (PPM) solution. The client wished to manage their portfolio of IT and Strategic projects through a single online tool.

Moreover, the client wanted to establish an overall Project Portfolio Management solution that would enable them to centralise their portfolio data at both the leadership and implementation level. This would provide leadership with visibility on ongoing project work needed to manage projects. Enhancements included detailing why those projects exist, what benefit they bring, and what they cost. This would allow the client to better prioritise their portfolio, focusing on those projects that give the biggest benefit to the business.

Provide clarity over all change delivery work being undertaken to enable us to execute our most important changes more quickly.

The client’s changing environment presented an additional challenge. They had recently started their journey to deliver more change via a Tribe based model. The Tribe model was made famous as a method of scaling agile by Spotify and is based on autonomous teams. As such, it would ultimately alter the mix of delivery methods within the portfolio of projects. The Portfolio Office would need to be able to support a hybrid delivery model.

Read also: The 4 Trends Shaking Up Project Portfolio Management

The Solution

Understanding that the client’s portfolio was in a state of flux, we adopted an adaptive delivery approach. This allowed the team to iteratively deliver value over two accelerated phases of work. The approach also ensured that the overall solution could be refined in line with regular feedback and could incorporate any changing requirements.

In the spirit of enhancing collaboration, we formed an integrated project team with our client. We adopted a sprint process and agile principles to promote engagement and transparency. Finally, implementing regular review retrospectives of our delivery approach supported embedding a culture of continuous improvement within the client organization.

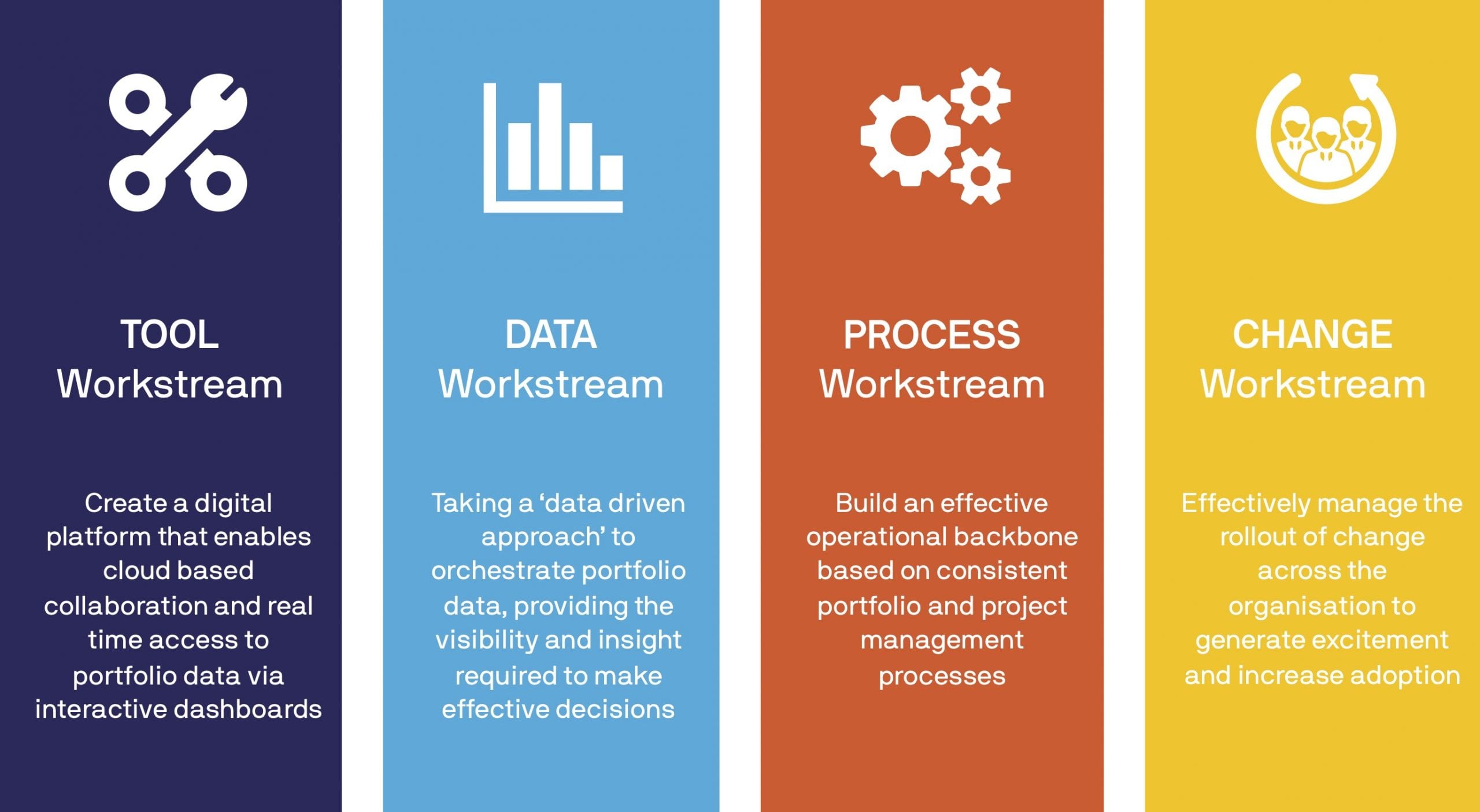

The project was structured around the four dimensions of transformation: Tool, Data, Process, and Change. Operating within these four integrated workstreams, we were able to ensure that each key dimension was adequately considered when developing any new capability.

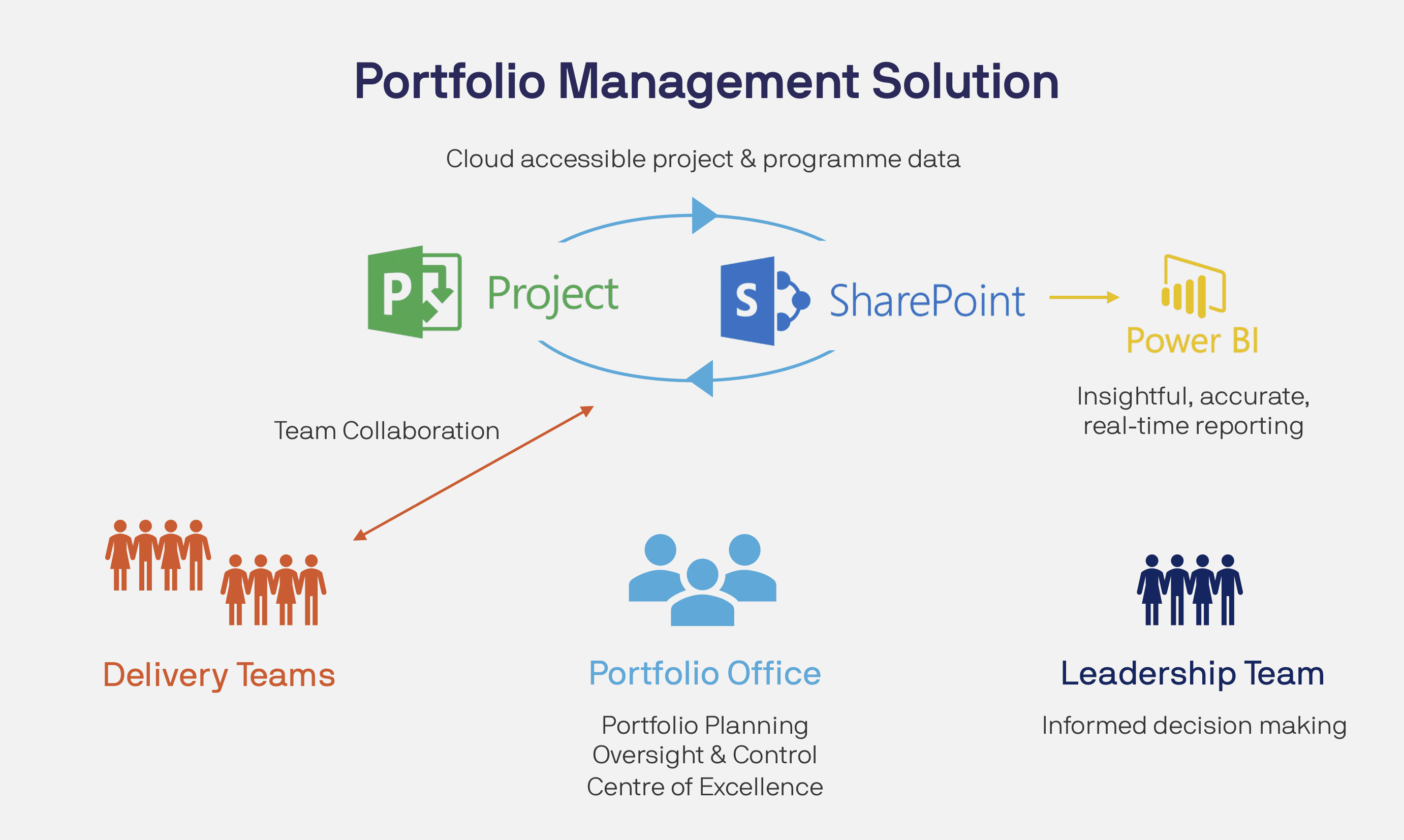

During the first phase, MIGSO-PCUBED focussed on deploying an MVP configuration with Microsoft Project Online tool. We engaged with a core stakeholder group of users to refine the solution to meet their needs. This enabled us to quickly stand up a PPM platform for the client’s IT and strategic projects, centralising their data, and driving early efficiencies through team collaboration.

During the second phase, we continued to enhance the functionality of the project portfolio management software tool. We focused on enhancing the ability to manage resources and financials across all change delivery – including both Tribe and Project data.

Additionally, we helped the client to establish its digital reporting capability developing Power BI reports based around key leading indicators. This enabled us to provide automated, real-time access to portfolio data across multiple data sources.

Once we had successfully migrated project data into the platform, we used MIGSO-PCUBED’s lean innovation techniques to run Rapid Improvement Events. These events were focussed around continuously improving data quality and completeness. The team established data KPIs providing the team with the ability to first identify poor performing areas and then to innovate around improvement initiatives. We would then implement and measure their effectiveness on an iterative basis.

In parallel with the development of the digital platform, we defined consistent project and programme management processes in the form of Working Practice Guides. These guides detailed the key process steps across various disciplines and how they could be executed effectively within the tool.

For the second phase, the core focus of the process workstream was to help define and establish a Portfolio Office (PfO) function. We ran several interactive workshops with the client to ideate the scope, mission, and objectives of the PfO. We then defined the services it would provide in order to drive value across the portfolio and its stakeholders. By establishing a Development Roadmap, we were then able to successfully roll out the first stage (of three) of its capability.

Encapsulating all the other workstreams was our change workstream. We applied MIGSO-PCUBED’s change management principles , tools, and techniques to ensure that any changes we deployed were successfully adopted. Consequently, we were able to identify key stakeholders and engage with them regularly to generate excitement. We also provided them with the relevant training and development needed to effectively sustain those changes from day one.

The Benefits

After the two accelerated phases of work, the joint MIGSO-PCUBED / client team had successfully deployed an effective Project Portfolio Management solution.

Improved Team Collaboration

Improved project team collaboration “in excess of 150 active users” through a digital accessible platform that facilitates remote working.

More Accurate Portfolio Data

“Increased data completeness from 42% to 67%” and improved the quality of data held within the digital platform. This enabled the PfO to ensure more accurate and reliable data is made available for consumption by the leadership team.

Increased Visibility Through More Efficient Reporting

Established a suite of “ 7 Power BI reports across project, programme and portfolio data” providing automated, real-time access to portfolio data. This improved visibility and insight whilst reducing manual reporting effort and lead times.

Established a Portfolio Office function

Provisioned a central PfO function that proactively supports portfolio planning and provides oversight and control over portfolio delivery. The PfO “defined and rolled out 27 PfO service elements” . It also operates as a centre of excellence to drive continuous improvement and learning.

Improved PPM Maturity

Drove the consistent application of PPM processes through training/development and sharing of working practice guides across the PPM community. This resulted in a “15% increase in PPM Maturity” .

Interested in our Portfolio Management services?

You might also like:.

Managing Resistance When Switching to Agile

Revolutionising breast screening with AI Integration

Mondelēz’s Digital Transformation Journey

Loved what you just read? Let's stay in touch.

No spam, only great things to read in our newsletter.

We combine our expertise with a fine knowledge of the industry to deliver high-value project management services.

MIGSO-PCUBED is part of the ALTEN group.

Find us around the world

Australia – Canada – France – Germany – Italy – Mexico – Portugal – Romania – South East Asia – Spain – Switzerland – United Kingdom – United States

Follow us here

© 2024 MIGSO-PCUBED. All rights reserved | Legal information | Privacy Policy | Cookie Settings | Intranet

Perfect jobs also result from great environments : the team, its culture and energy. So tell us more about you : who you are, your project, your ambitions, and let’s find your next step together.

- Netherlands

South East Asia

Switzerland

United Kingdom

United States

In accordance with the General Data Protection Regulations (GDPR), the data entered is processed for the management of recruitment and its improvement. To find out more, visit our privacy policy .

Dear candidates, please note that you will only be contacted via email from the following domain: migso-pcubed.com . Please remain vigilant and ensure that you interact exclusively with our official websites. The MIGSO-PCUBED Team

Discover our global expertise →

Project Services →

Strategy Execution & Business Improvements →

Digital Solutions →

Our case studies →

Join our team →

Company Culture →

Job Families →

Choose your language

Subscribe to our Newsletter

A monthly digest of our best articles on all things Project Management.

Subscribe to our newsletter!

Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content. Please come back on a more recent browser to have the best experience possible

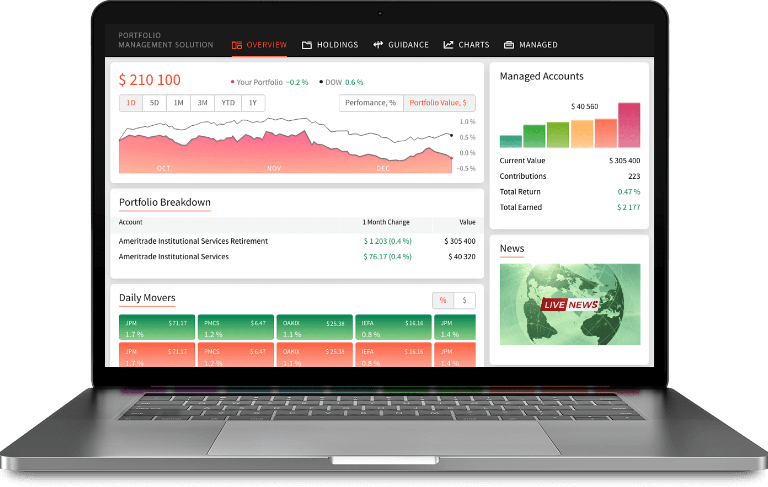

Portfolio Solution for a Digital Transformation of an Asset Management Firm

About the client.

The Client is a private investment firm based in the US. They have been in business since the ‘90s, working with high net worth individuals, investment firms, pension, and profit-sharing plans, charitable organizations, and corporations.

The Client employs financial advisors that provide expensive specialty services through a turn-key asset management platform (TAMP). With almost $30 billion in assets, the advisor-strategists build customers’ financial portfolios based on their risk tolerance and personal preference. They also assist in managing funds and investments.

Business Challenge

The Client used to provide advisors with a third-party off-the-shelf solution for portfolio management. This meant recurring licensing fees and incapability to enhance the software with the Client’s tailored features to fine-tune custom portfolios. The Client also required to reconceptualize the user experience. It implied the digital transformation of business processes, which was impossible with the off-the-shelf product.

The Client decided to get a proprietary custom financial software capable of providing advisors with the best customer engagement experience. Advisors demanded a business tool for a full cycle of operation with portfolios and a customizable interface layout. Through a proprietary solution, the Client also wanted to eliminate the license expenses and increase their business capitalization with a new valuable intangible asset.

The Client chose Devexperts due to their experience in the development of tailored wealth management solutions and a previous record of successfully delivered FinTech projects.

Devexperts developed both the front- and back-end of a new portfolio management solution, which incorporated the following features required by advisors:

- Compilation and on-the-fly adjustment of custom portfolios

- Comparison of solution’s portfolios with external accounts (held at any financial institution)

- Configuration of UI layout for the variability of portfolio visuals – intelligent customer engagement through the capability to shift and change portfolio information based on advisor’s demands

On top of these features, the new proprietary portfolio management solution provides:

- Elaborate information with the risk-return ratio for portfolio returns evaluation based not solely on investment returns

- The fulfillment of customer demands according to short- and long-term investments – demonstration how different investment decisions and market conditions impact customers’ goals

Additionally, the new software provides advisers with instruments that optimize their day-to-day business activities. They comprise of initial customer conversation, ongoing financial planning discussions, performance, compliance and tax reporting, and billing.

New Client’s portfolio management solution consists of modeling, comparison, and analysis tools. The robust proprietary solution allowed the Client to accomplish the purposes of:

- Cutting costs on the key software for their business by eliminating license fees

- Implementing a portfolio management solution customizable for business requirements

- Providing the best service to advisors, the key customers of the Client

Through the implementation of the new proprietary solution, the Client was also able to accomplish outstanding financial results. According to the Client’s financial reports, a year after the solution’s introduction, the business reached a CAGR of 17%, and net flow grew by 245%. The new portfolio management solution had a direct impact on bringing more assets to the platform and thus in successful valuation for the Client’s IPO launch.

- Performance & Yields

- Ultra-Short

- Short Duration

- Empower Share Class

- Academy Securities

- Cash Segmentation

- Separately Managed Accounts

- Managed Reserves Strategy

- Capitalizing on Prime Money Market Funds

Liquidity Insights

- Liquidity Insights Overview

- Audio Commentaries

- Case Studies

- Leveraging the Power of Cash Segmentation

- Cash Investment Policy Statement

- China Money Market Resource Centre

Market Insights

- Market Insights Overview

- Eye on the Market

- Guide to the Markets

- Market Updates

Portfolio Insights

- Portfolio Insights Overview

- Fixed Income

- Long-Term Capital Market Assumptions

- Sustainable investing

- Strategic Investment Advisory Group

MORGAN MONEY

- Global Liquidity Investment Academy

- Account Management & Trading

- Announcements

- Navigating market volatility

- 2024 US Money Market Fund Reform

- Diversity, Equity & Inclusion

- How we invest

- Sustainable and social investing

- Our Leadership Team

- LinkedIn Twitter Facebook

Case studies

Working with clients to solve short-term fixed income needs

FEATURED CASE STUDIES

Guazi: Driving home a treasury framework fit for purpose

Meituan-Dianping: A unicorn’s path to achieve world-class treasury

All case studies, vertex pharmaceuticals.

Vertex Pharmaceuticals transforms its investment processes with Morgan Money.

Kulicke & Soffa

Kulicke & Soffa meets strong risk management standard with MORGAN MONEY’s cash optimizer.

Nigeria LNG

Harnessing the Power of Technology. Nigeria LNG transforms Money Market Fund investments with MORGAN MONEY.

Micro Focus

Short-term AAA-rated money market funds provide short-term investment opportunities for divestment proceeds.

Liquidity and security over yield deliver investment benefits to NIO

Active Super (previously known as Local Government Super)

Prioritizing cash management at scale, Active Super (previously known as Local Government Super), an Australian superannuation fund, found “operational alpha”.

Guazi’s rapid expansion created a cash placement challenge for the treasury function. Its operating cash was unpredictable, whilst its liquidity needs were extremely high.

Meituan-Dianping

Meituan-Dianping, a growing unicorn, had a major challenge to accurately forecast its cash flow beyond three months.

Alkane Resources

Like many others in the sector, Australian mining company Alkane Resources has to set aside a portion of surplus cash to cover any unexpected costs or delays.

NTUC Income

Singapore-based insurance provider NTUC Income had always handled its investments entirely through its internal portfolio management team.

J.P. Morgan liquidity solutions help solve SEEK employment marketplace build up of surplus cash.

The challenge: a solution that delivers increased returns for onshore and offshore cash holdings.

AstraZeneca

J.P. Morgan Global Liquidity provided a successful short-term investment solution to AstraZeneca, a global science-led biopharmaceutical company.

Recruit Holdings

As the business has grown globally, liquidity and cash positions outside of Japan have expanded, creating foreign exchange (FX) exposure.

The challenge: to assess the optimal level of liquidity required to ensure John Lewis Partnership has continued financial sustainability.

Explore more

Cash investment policy statement

How to write an investment policy statement for your organization.

Leveraging the power of cash segmentation

The most effective strategy incorporates a clear investment policy, well-defined goals and parameters for liquidity, quality and return.

Invest with ease, operational efficiency and effective controls via our state-of-the-art trading and analytics platform.

- Predictive Analytics Workshops

- Corporate Strategy Workshops

- Advanced Excel for MBA

- Powerpoint Workshops

- Digital Transformation

- Competing on Business Analytics

- Aligning Analytics with Strategy

- Building & Sustaining Competitive Advantages

- Corporate Strategy

- Aligning Strategy & Sales

- Digital Marketing

- Hypothesis Testing

- Time Series Analysis

- Regression Analysis

- Machine Learning

- Marketing Strategy

- Branding & Advertising

- Risk Management

- Hedging Strategies

- Network Plotting

- Bar Charts & Time Series

- Technical Analysis of Stocks MACD

- NPV Worksheet

- ABC Analysis Worksheet

- WACC Worksheet

- Porter 5 Forces

- Porter Value Chain

- Amazing Charts

- Garnett Chart

- HBR Case Solution

- 4P Analysis

- 5C Analysis

- NPV Analysis

- SWOT Analysis

- PESTEL Analysis

- Cost Optimization

Vertex Pharmaceuticals: R&D Portfolio Management (A)

- Technology & Operations / MBA EMBA Resources

Next Case Study Solutions

- Nucleon, Inc. Case Study Solution

- Central Parking Case Study Solution

- Creating Auctionwire Case Study Solution

- National Logistics Management Case Study Solution

- Jamcracker: Pivot Path Case Study Solution

Previous Case Solutions

- Chiron Corp. Case Study Solution

- Online Reverse Auctions: Common Myths versus Evolving Reality Case Study Solution

- Taking on the Challenge of IT Management in a Global Business Context: The Alcan Case - Part A Case Study Solution

- Dayton Electric Corp. Case Study Solution

- Taking on the Challenge of IT Management in a Global Business Context: The Alcan Case - Part B Case Study Solution

Predictive Analytics

May 22, 2024

Popular Tags

Case study solutions.

Case Study Solution | Assignment Help | Case Help

Vertex pharmaceuticals: r&d portfolio management (a) description.

Vertex Pharmaceuticals, Inc., a drug discovery company that recently decided to pursue a vertically integrated business model, chose to build up its clinical development and commercial capabilities and infrastructure. For the first time in its history, Vertex will select two drug candidates from its internal research portfolio of four projects to develop on its own, without the help of strategic partners. CEO Joshua Boger and President Vicki Sato are grappling with which two projects to select. Focuses on how to select projects and how to manage the process of portfolio selection.

Case Description Vertex Pharmaceuticals: R&D Portfolio Management (A)

Strategic managment tools used in case study analysis of vertex pharmaceuticals: r&d portfolio management (a), step 1. problem identification in vertex pharmaceuticals: r&d portfolio management (a) case study, step 2. external environment analysis - pestel / pest / step analysis of vertex pharmaceuticals: r&d portfolio management (a) case study, step 3. industry specific / porter five forces analysis of vertex pharmaceuticals: r&d portfolio management (a) case study, step 4. evaluating alternatives / swot analysis of vertex pharmaceuticals: r&d portfolio management (a) case study, step 5. porter value chain analysis / vrio / vrin analysis vertex pharmaceuticals: r&d portfolio management (a) case study, step 6. recommendations vertex pharmaceuticals: r&d portfolio management (a) case study, step 7. basis of recommendations for vertex pharmaceuticals: r&d portfolio management (a) case study, quality & on time delivery.

100% money back guarantee if the quality doesn't match the promise

100% Plagiarism Free

If the work we produce contain plagiarism then we payback 1000 USD

Paypal Secure

All your payments are secure with Paypal security.

300 Words per Page

We provide 300 words per page unlike competitors' 250 or 275

Free Title Page, Citation Page, References, Exhibits, Revision, Charts

Case study solutions are career defining. Order your custom solution now.

Case Analysis of Vertex Pharmaceuticals: R&D Portfolio Management (A)

Vertex Pharmaceuticals: R&D Portfolio Management (A) is a Harvard Business (HBR) Case Study on Technology & Operations , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights. Vertex Pharmaceuticals: R&D Portfolio Management (A) is designed and drafted in a manner to allow the HBR case study reader to analyze a real-world problem by putting reader into the position of the decision maker. Vertex Pharmaceuticals: R&D Portfolio Management (A) case study will help professionals, MBA, EMBA, and leaders to develop a broad and clear understanding of casecategory challenges. Vertex Pharmaceuticals: R&D Portfolio Management (A) will also provide insight into areas such as – wordlist , strategy, leadership, sales and marketing, and negotiations.

Case Study Solutions Background Work

Vertex Pharmaceuticals: R&D Portfolio Management (A) case study solution is focused on solving the strategic and operational challenges the protagonist of the case is facing. The challenges involve – evaluation of strategic options, key role of Technology & Operations, leadership qualities of the protagonist, and dynamics of the external environment. The challenge in front of the protagonist, of Vertex Pharmaceuticals: R&D Portfolio Management (A), is to not only build a competitive position of the organization but also to sustain it over a period of time.

Strategic Management Tools Used in Case Study Solution

The Vertex Pharmaceuticals: R&D Portfolio Management (A) case study solution requires the MBA, EMBA, executive, professional to have a deep understanding of various strategic management tools such as SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis.

Texas Business School Approach to Technology & Operations Solutions

In the Texas Business School, Vertex Pharmaceuticals: R&D Portfolio Management (A) case study solution – following strategic tools are used - SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis. We have additionally used the concept of supply chain management and leadership framework to build a comprehensive case study solution for the case – Vertex Pharmaceuticals: R&D Portfolio Management (A)

Step 1 – Problem Identification of Vertex Pharmaceuticals: R&D Portfolio Management (A) - Harvard Business School Case Study

The first step to solve HBR Vertex Pharmaceuticals: R&D Portfolio Management (A) case study solution is to identify the problem present in the case. The problem statement of the case is provided in the beginning of the case where the protagonist is contemplating various options in the face of numerous challenges that Vertex Select is facing right now. Even though the problem statement is essentially – “Technology & Operations” challenge but it has impacted by others factors such as communication in the organization, uncertainty in the external environment, leadership in Vertex Select, style of leadership and organization structure, marketing and sales, organizational behavior, strategy, internal politics, stakeholders priorities and more.

Step 2 – External Environment Analysis

Texas Business School approach of case study analysis – Conclusion, Reasons, Evidences - provides a framework to analyze every HBR case study. It requires conducting robust external environmental analysis to decipher evidences for the reasons presented in the Vertex Pharmaceuticals: R&D Portfolio Management (A). The external environment analysis of Vertex Pharmaceuticals: R&D Portfolio Management (A) will ensure that we are keeping a tab on the macro-environment factors that are directly and indirectly impacting the business of the firm.

What is PESTEL Analysis? Briefly Explained

PESTEL stands for political, economic, social, technological, environmental and legal factors that impact the external environment of firm in Vertex Pharmaceuticals: R&D Portfolio Management (A) case study. PESTEL analysis of " Vertex Pharmaceuticals: R&D Portfolio Management (A)" can help us understand why the organization is performing badly, what are the factors in the external environment that are impacting the performance of the organization, and how the organization can either manage or mitigate the impact of these external factors.

How to do PESTEL / PEST / STEP Analysis? What are the components of PESTEL Analysis?

As mentioned above PESTEL Analysis has six elements – political, economic, social, technological, environmental, and legal. All the six elements are explained in context with Vertex Pharmaceuticals: R&D Portfolio Management (A) macro-environment and how it impacts the businesses of the firm.

How to do PESTEL Analysis for Vertex Pharmaceuticals: R&D Portfolio Management (A)

To do comprehensive PESTEL analysis of case study – Vertex Pharmaceuticals: R&D Portfolio Management (A) , we have researched numerous components under the six factors of PESTEL analysis.

Political Factors that Impact Vertex Pharmaceuticals: R&D Portfolio Management (A)

Political factors impact seven key decision making areas – economic environment, socio-cultural environment, rate of innovation & investment in research & development, environmental laws, legal requirements, and acceptance of new technologies.

Government policies have significant impact on the business environment of any country. The firm in “ Vertex Pharmaceuticals: R&D Portfolio Management (A) ” needs to navigate these policy decisions to create either an edge for itself or reduce the negative impact of the policy as far as possible.

Data safety laws – The countries in which Vertex Select is operating, firms are required to store customer data within the premises of the country. Vertex Select needs to restructure its IT policies to accommodate these changes. In the EU countries, firms are required to make special provision for privacy issues and other laws.

Competition Regulations – Numerous countries have strong competition laws both regarding the monopoly conditions and day to day fair business practices. Vertex Pharmaceuticals: R&D Portfolio Management (A) has numerous instances where the competition regulations aspects can be scrutinized.

Import restrictions on products – Before entering the new market, Vertex Select in case study Vertex Pharmaceuticals: R&D Portfolio Management (A)" should look into the import restrictions that may be present in the prospective market.

Export restrictions on products – Apart from direct product export restrictions in field of technology and agriculture, a number of countries also have capital controls. Vertex Select in case study “ Vertex Pharmaceuticals: R&D Portfolio Management (A) ” should look into these export restrictions policies.

Foreign Direct Investment Policies – Government policies favors local companies over international policies, Vertex Select in case study “ Vertex Pharmaceuticals: R&D Portfolio Management (A) ” should understand in minute details regarding the Foreign Direct Investment policies of the prospective market.

Corporate Taxes – The rate of taxes is often used by governments to lure foreign direct investments or increase domestic investment in a certain sector. Corporate taxation can be divided into two categories – taxes on profits and taxes on operations. Taxes on profits number is important for companies that already have a sustainable business model, while taxes on operations is far more significant for companies that are looking to set up new plants or operations.

Tariffs – Chekout how much tariffs the firm needs to pay in the “ Vertex Pharmaceuticals: R&D Portfolio Management (A) ” case study. The level of tariffs will determine the viability of the business model that the firm is contemplating. If the tariffs are high then it will be extremely difficult to compete with the local competitors. But if the tariffs are between 5-10% then Vertex Select can compete against other competitors.

Research and Development Subsidies and Policies – Governments often provide tax breaks and other incentives for companies to innovate in various sectors of priority. Managers at Vertex Pharmaceuticals: R&D Portfolio Management (A) case study have to assess whether their business can benefit from such government assistance and subsidies.

Consumer protection – Different countries have different consumer protection laws. Managers need to clarify not only the consumer protection laws in advance but also legal implications if the firm fails to meet any of them.

Political System and Its Implications – Different political systems have different approach to free market and entrepreneurship. Managers need to assess these factors even before entering the market.

Freedom of Press is critical for fair trade and transparency. Countries where freedom of press is not prevalent there are high chances of both political and commercial corruption.

Corruption level – Vertex Select needs to assess the level of corruptions both at the official level and at the market level, even before entering a new market. To tackle the menace of corruption – a firm should have a clear SOP that provides managers at each level what to do when they encounter instances of either systematic corruption or bureaucrats looking to take bribes from the firm.

Independence of judiciary – It is critical for fair business practices. If a country doesn’t have independent judiciary then there is no point entry into such a country for business.

Government attitude towards trade unions – Different political systems and government have different attitude towards trade unions and collective bargaining. The firm needs to assess – its comfort dealing with the unions and regulations regarding unions in a given market or industry. If both are on the same page then it makes sense to enter, otherwise it doesn’t.

Economic Factors that Impact Vertex Pharmaceuticals: R&D Portfolio Management (A)

Social factors that impact vertex pharmaceuticals: r&d portfolio management (a), technological factors that impact vertex pharmaceuticals: r&d portfolio management (a), environmental factors that impact vertex pharmaceuticals: r&d portfolio management (a), legal factors that impact vertex pharmaceuticals: r&d portfolio management (a), step 3 – industry specific analysis, what is porter five forces analysis, step 4 – swot analysis / internal environment analysis, step 5 – porter value chain / vrio / vrin analysis, step 6 – evaluating alternatives & recommendations, step 7 – basis for recommendations, references :: vertex pharmaceuticals: r&d portfolio management (a) case study solution.

- sales & marketing ,

- leadership ,

- corporate governance ,

- Advertising & Branding ,

- Corporate Social Responsibility (CSR) ,

Amanda Watson

Leave your thought here

© 2019 Texas Business School. All Rights Reserved

USEFUL LINKS

Follow us on.

Subscribe to our newsletter to receive news on update.

Dark Brown Leather Watch

$200.00 $180.00

Dining Chair

$300.00 $220.00

Creative Wooden Stand

$100.00 $80.00

2 x $180.00

2 x $220.00

Subtotal: $200.00

Free Shipping on All Orders Over $100!

Wooden round table

$360.00 $300.00

Hurley Dry-Fit Chino Short. Men's chino short. Outseam Length: 19 Dri-FIT Technology helps keep you dry and comfortable. Made with sweat-wicking fabric. Fitted waist with belt loops. Button waist with zip fly provides a classic look and feel .

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

A CASE STUDY ON PORT FOLIO MANAGEMENT

Related Papers

John Kevin Pogoy

21 varargin is variable length input argument list. The varargin statement is used only inside a function M-file to contain optional input arguments passed to the function. The varargin argument must be declared as the last input argument to a function, collecting all the inputs from that point onwards. In the declaration, varargin must be lowercase.

SSRN Electronic Journal

Dr. S. Senthilnathan

Fairuz Chowdhury

In investment, particularly in the portfolio management, the risk and returns are two crucial measures in making investment decisions. This paper attempts to provide a brief theoretical explanation with illustrations on determining the returns and associated risk of shares, and of the portfolio of the shares. The illustrations of tables and figures can significantly contribute to the understanding of a reader in relation to portfolio management of risk and returns. The illustrative table and figures are the significance of this paper and it is believed that the reader of this paper would gain reasonable knowledge in portfolio management.

Kamal Eldik

European Journal of Applied Economics

Tijana Šoja

Gold is a unique asset, highly liquid, but scarce and limited. It is a luxury good and can be considered an investment opportunity. Gold is an asset which does not carry counterparty risk-there is no associated credit risk. Due to these characteristics, gold represents a significant asset, and has a fundamental role in investment portfolios. These circumstances increase the interests of investors to include gold in investment portfolios , especially during times of financial crisis. If an investor decides to include gold in investment portfolio, it is necessary to evaluate the portion of gold in the portfolio considering risk aspect, return and diversification. In this research, a hypothesis was tested and confirmed that gold offers good diversification for the investment portfolio, which implies that gold is a desirable asset in the investment portfolio. This research is focused on developing an optimal portfolio that combines the Eurozone bond index with the investment grade rating from 1 to 10 years (EG05), the stock index Euro Stoxx50 and gold using the Markowitz methodology. The result showed that optimal portfolio should include gold with a share between 1% to 9%, depending on the risk that the investor is willing to accept.

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Order Status

- Testimonials

- What Makes Us Different

Portfolio Management Harvard Case Solution & Analysis

Home >> Harvard Case Study Analysis Solutions >> Portfolio Management

Portfolio Management Case Solution

Portfolio Management analysis

The term portfolio means to analyse, identify and manage the associate projects, which are subjected to risk and return. In order to handle the portfolio of different companies, fund managers involve in a critical evaluation of managing the stocks of different portfolio companies and conclude the annual results to the investors regarding decisions about the current investment within the selected companies.

In the case, various stock markets are selected to assess the portfolio under the trading of New York stock exchange. Therefore, four stocks under the market are selected to build the portfolio in order to make high returns for the potential investors.

Business Development Corporation

This sector is the most popular in the recent history due to increase in the average market share of the emerging venture capital investment companies. Therefore, the selected companies in this sector have been included in order to assess the expected returns and risks of the portfolio. McKesson Corporation and Terex Corporation are considered the main sectors for the selected portfolio of Business Development Corporation. Following are the factors, which are used to analyse the expected risk and return for the particular analysis.

McKesson Corporation

McKesson Corporation is the most successful company in the field of pharmaceutical and health care operations. It was involved in various merger and acquisition of different small firms in order to increase the market shares through expanding the internal operational activities for higher profits.

Factors under Portfolio analysis

The first factor to consider under the portfolio is the expected return generated from the historical data of one year. It is the main tool to assess the expected performance of the portfolio for the selected years. On the other side, the standard deviation is high and thus illustrates that the investment will be quite risky because of the fluctuation in shares price.

The prices would go down due to the developing phase of the company, and would allow investors to make certain decisions regarding the interest to hold the share for high profit margins. Therefore, this portfolio is quite better for the investment due to the high expected annual return.

Terex Corporation

Terex Corporation is one of the leading companies in the field of construction and mining. It was involved in various acquisitions of different small firms in order to boost its operational activities and to increase the market share price by increasing the company’s performance. According to the current portfolio, various factors have been analysed to assess the performance of the company for the coming period

Expected return

From the following analysis, it is identified that the summary of the monthly returns shows positive results in the market due to the increasing level of small firms under the acquisition of the major venture capitalist. Therefore, the expected return would tend to increase in the same margin over the number of selected years.

It is determined from the historical price data of the past year that the price would be less than the last price because of the lower ranges in the initial stage of the sector. This means that various companies were not subjected to the merger and acquisition in the early years of stock. That is why the average prices are low as compared to the last price . However, the expected price mean would tend to increase in the coming period.

Standard Deviation

From the following results, it is identified that the average standard deviation shows less volatility due to the less fluctuated results of the stock prices. Therefore, there is less risk to this portfolio and this allows the investors to make decisions about their investments......................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Harvard Case Study Analysis Solutions

- The Flexibility Stigma: Work Devotion vs. Family Devotion

- Gobi Partners and DMG

- Protecting the WTO Ministerial Conference of 1999, Epilogue

- Aman Resorts (B)

- JCU Spring Concert

- Dylan Pierce at Hanguk Industries

- Caesars Entertainment: CodeGreen

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

Index | Index / ETFs

Climate transition indices launched with willis towers watson.

The STOXX Willis Towers Watson Climate Transition indices were developed in close collaboration with Willis Towers Watson (WTW) incorporating their proprietary Climate Transition Value at Risk (CTVaR) data.

Customized sustainable climate indices created for Northern Trust’s FlexShares

We designed four indices that integrate FlexShares’ proprietary ESG and factor scores. The indices aim to capture the excess returns associated to factors such as quality, low volatility and dividend yield while adjusting for sector, region, country and security-level biases.

Developing an ESG enhanced version of DAX for BlackRock

The DAX ESG Target index was developed in collaboration with BlackRock, the world’s largest asset management firm. The index combines a tracking error target relative to the parent DAX index with ESG filters and carbon reduction targets. ESG data is provided by Sustainalytics.

“Layered” Approach to ESG Results in Innovative Responsible Indices for APG

We devised a series of co-branded indices that offer investors a spectrum of strategy tools and specific optionality, and gave our client flexibility, full support in index management, and the objectivity of a third-party index provider

Flexiblity for Asset Owner Portfolios: iSTOXX MUTB Index Series

Index | Benchmarks

Manage and hedge portfolio with listed derivatives on esg benchmark indices.

When a large Scandinavian asset manager extended its responsible principles to all investment instruments, it left its trading arm with no listed derivatives to manage flows and risk in equity portfolios

Stay in touch

Sign up to receive STOXX’s news, research, and event invitations directly to your inbox.

Connect with us on LinkedIn for the latest news and exciting announcements.

- Skip to content

- Skip to search

- Skip to footer

Support & Downloads

- Worldwide - English

- Arabic - عربي

- Brazil - Português

- Canada - Français

- China - 简体中文

- China - 繁體中文 (臺灣)

- Germany - Deutsch

- Italy - Italiano

- Japan - 日本語

- Korea - 한국어

- Latin America - Español

- Netherlands - Nederlands">Netherlands - Nederlands

- Helpful Links

- Licensing Support

- Technology Support

- Support for Cisco Acquisitions

- Support Tools

- Cisco Community

To open or view a case, you need a service contract

Get instant updates on your TAC Case and more

Contact TAC by Phone

800-553-2447 US/Canada

866-606-1866 US/Canada

- Returns Portal

Products by Category

- Unified Communications

- Networking Software (IOS & NX-OS)

- Collaboration Endpoints and Phones

Status Tools

The Cisco Security portal provides actionable intelligence for security threats and vulnerabilities in Cisco products and services and third-party products.

Get to know any significant issues, other than security vulnerability-related issues, that directly involve Cisco products and typically require an upgrade, workaround, or other customer action.

Check the current status of services and components for Cisco's cloud-based Webex, Security and IoT offerings.

The Cisco Support Assistant (formerly TAC Connect Bot) provides a self-service experience for common case inquiries and basic transactions without waiting in a queue.

Suite of tools to assist you in the day to day operations of your Collaboration infrastructure.

The Cisco CLI Analyzer (formerly ASA CLI Analyzer) is a smart SSH client with internal TAC tools and knowledge integrated. It is designed to help troubleshoot and check the overall health of your Cisco supported software.

My Notifications allows an user to subscribe and receive notifications for Cisco Security Advisories, End of Life Announcements, Field Notices, and Software & Bug updates for specific Cisco products and technologies.

More Support

- Partner Support

- Small Business Product Support

- Business Critical Services

- Customer Experience

- DevNet Developer Support

- Cisco Trust Portal

Cisco Communities

Generate and manage PAK-based and other device licenses, including demo licenses.

Track and manage Smart Software Licenses.

Generate and manage licenses from Enterprise Agreements.

Solve common licensing issues on your own.

Software and Downloads

Find software bugs based on product, release and keyword.

View Cisco suggestions for supported products.

Use the Cisco Software Checker to search for Cisco Security Advisories that apply to specific Cisco IOS, IOS XE, NX-OS and NX-OS in ACI Mode software releases.

Get the latest updates, patches and releases of Cisco Software.

IMAGES

VIDEO

COMMENTS

Product Portfolio Management Case Study Overview: Conagra Brands. Industry: Consumer packaged goods and food processing. The consumer packaged goods industry has exploded in size over the last few years, and the sudden competition put Conagra Brands in a challenging spot. Confronted by trends in digital transformation, they needed to remain ...

Though PwC considers a divestiture an option in portfolio management, it's not the only one. The goal of the portfolio review process is to better understand the performance of each business unit and how to shepherd it to success. PwC's process categorized its portfolio holdings and set thresholds for action, including when to invest for ...

proprietary portfolio management application to make second-to-second investment decisions in one centralized location. ... CASE STUDY: INVESTMENT MANAGEMENT FIRM TRANSFORMS PORTFOLIO MANAGEMENT TO MAKE TRADING DECISIONS IN REAL TIME 2. 3 SOLUTION Employing their Rapid Alignment, Design and Development (RADD) methodology, Janeiro Digital ...

The Solution. This paper focuses on recent events within CH2M, and what the Transportation business did as a result of new leadership being put in place, the transition for which started in 2011. CH2M took the following steps to strengthen its portfolio: Diversification strategy: The 2008 global economic recession led the company to a ...

PM Solutions is providing project and program management to bring a state-of-the-art, $60 million dollar manufacturing facility online and fully operational in record time. Value Delivered: The facility was operational in just 12 months, allowing the client to realize 33% of their project return seven months ahead of schedule. Read More ».

The QU endowment case study covers important aspects of institutional portfolio management involving the illiquidity premium capture, liquidity management, asset allocation, and the use of derivatives versus the cash market for tactical asset allocation and portfolio rebalancing. In addition, the case examines potential ethical violations in ...

Summary. Most organizations respond well to big changes, but small, frequent changes truly test them. Program and portfolio management leaders can look to how ElevenShift* addressed change while still driving strategy with a mindset shift to flexible funding and off-cycle reprioritization.

appropriate solutions. The first case study considers issues associated with the development of a strategic asset allocation (SAA) for a long- horizon institutional investor—a university endow- ... Reading 28 Case Study in Portfolio Management: Institutional by Gabriel Petre, CFA Reading 29 Case Study in Risk Management: Private Wealth

Strategic Porfolio Management Tools Create Value for Leading Pharmaceutical Company. Download. Innovation Portfolio Management: Balancing Value and Risk (abbreviated) Frost & Sullivan case study of SmartOrg and "Beta Inc.". Download. Innovation Portfolio Management: Balancing Value and Risk for Beta Corporation.

The Challenge. Our client, a leading UK car insurance firm, engaged MIGSO-PCUBED to deploy a cost-effective Project Portfolio Management (PPM) solution. The client wished to manage their portfolio of IT and Strategic projects through a single online tool. Moreover, the client wanted to establish an overall Project Portfolio Management solution ...

In this study, research method was case study carried out in business organizations. The study showed interconnection between company strategy, project portfolio and projects in process and ...

That's why most portfolio managers would rather settle for a "satisficing" solution (Simon, 1969) that is "good enough" for all stakeholders. Wicked problems are indeterminate and essentially unique, where endless solutions cannot be fully tested. Portfolio management behaves in a similar fashion.

Rockefeller Asset Management's legacy challenge: "multiple points of failure" Seeking operational enhancement, seamlessness, and efficiency, Rockefeller Asset Management made the decision to move to a front-to-back whole-of-stack solution with an alternate provider (not Bloomberg). The stack was full of promise, but it didn't go as planned.

• 68.4% of the respondents disagreed that the portfolio management solution and IT support are adequate to support portfolio management. Only 10.5% of the respondents agreed, and 21.1% were unsure. ... that a case study as a research strategy comprises an all-encompassing method - covering the logic of design, data collection techniques, and ...

Case Study: Portfolio Solution for a Digital Transformation of an Asset Management Firm. RESULTS New Client's portfolio management solution сonsists of modeling, comparison, and analysis tools. ... • Implementing a portfolio management solution customizable for business requirements • Providing the best service to advisors, the key ...

New Client's portfolio management solution consists of modeling, comparison, and analysis tools. The robust proprietary solution allowed the Client to accomplish the purposes of: Cutting costs on the key software for their business by eliminating license fees. Implementing a portfolio management solution customizable for business requirements.

It relates to decisions that define expectations, grant power, or verify performance. It consists of either a separate process or part of management or leadership processes. These processes and systems are typically administered by a government. Final Degree Project, Rasiha Delilbasic Project Portfolio Management.

Case studies. Working with clients to solve short-term fixed income needs. FEATURED CASE STUDIES. AuthorName ... Singapore-based insurance provider NTUC Income had always handled its investments entirely through its internal portfolio management team. Read more ... a solution that delivers increased returns for onshore and offshore cash holdings.

Vertex Pharmaceuticals: R&D Portfolio Management (A) is a Harvard Business (HBR) Case Study on Technology & Operations , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights.

PORT FOLIO MANAGEMENT MEANING: A portfolio is a collection of assets. The assets may be physical or financial like Shares, Bonds, Debentures, Preference Shares, etc. The individual investor or a fund manager would not like to put all his money in the sares of one company, that would amount to great risk.

Portfolio Management Case Solution. Portfolio Management analysis. The term portfolio means to analyse, identify and manage the associate projects, which are subjected to risk and return.

Summary. This research provides strategy leaders with solutions to common challenges across four phases of portfolio management: balancing initiatives, screening new initiatives, tracking initiatives' performance and killing initiatives.

Flexiblity for Asset Owner Portfolios: iSTOXX MUTB Index Series. We devised a series of co-branded indices that offer investors a spectrum of strategy tools and specific optionality, and gave our client flexibility, full support in index management, and the objectivity of a third-party index provider. Case Studies.

1. Introduction: This case study explores the challenges faced by Smart Innovations Global LCC in managing its portfolio of projects and the role of a Portfolio Management Professional (PfMP) in enhancing PPM maturity. 2. Executive Summary: The organisation is facing challenges in effectively managing its portfolio of projects due to the lack ...

Complete the form below, and one of our sales specialists will call you within 15 minutes or on a date and time you request. Specialists are available Monday through Friday, 8 a.m. to 5 p.m. Eastern Time.We are currently experiencing delays in response times. If you require an immediate sales response - please call us 1 800-553-6387.

Check the current status of services and components for Cisco's cloud-based Webex, Security and IoT offerings. Cisco Support Assistant. The Cisco Support Assistant (formerly TAC Connect Bot) provides a self-service experience for common case inquiries and basic transactions without waiting in a queue.