NorthOne is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A., Member FDIC.

How to Find Your EIN Verification Letter From The IRS

Table of Contents

One of the many steps involved in starting a business is obtaining an employer identification number (EIN), which is also known as a federal tax identification number. This unique nine-digit number is used for all sorts of things required to run a legitimate business. After applying for your EIN, you’ll receive an EIN verification letter from the IRS.

You should hold onto this letter for as long as you own your business. But thankfully, if you lose it, you’re not totally out of luck. This article will cover everything you need to know about EINs and what to do if you lose your EIN confirmation letter from the IRS.

The basics of employer identification numbers

You can think of an EIN as being the equivalent of a Social Security number for your business. It allows your business to pay state and federal taxes—which is why the IRS sends verification letters—along with other essential aspects of your daily business.

In addition to paying taxes, you need an EIN to hire employees, open a bank account, and to apply for a business license. Of course, not all businesses need employees, but a business owner can get in a ton of trouble for operating without a license or not paying taxes. Additionally, having a business bank account is a smart way to help ensure you run a successful organization.

How to apply for an EIN

The IRS has taken a number of steps to make EIN applications easy for business owners. These are the options you have when applying for your EIN:

- Apply online: Filling out the online application is the easiest way to get an EIN. The information is validated upon completion of the application, so you receive your EIN immediately. However, keep in mind that you won’t get the confirmation letter until it arrives in the mail. This application process is available for entities with principal locations in the U.S. or U.S. Territories.

- Apply by fax: If you’re a taxpayer with access to a fax machine, you can fill out Form SS-4 and fax it back to the IRS. You’ll just want to ensure that all of the information is correct, as this option doesn’t have instantaneous confirmation like the online application. If your application is approved and you provide your fax number, the IRS will fax you back within four business days with your confirmation.

- Apply by mail: You can also submit Form SS-4 through the mail. However, the mail can be a bit slow at times, so this method of EIN processing takes around four weeks to complete. Again, you’ll want to double-check that every field is filled out correctly on your SS-4 form.

- Apply by telephone: International applicants can also apply by telephone Monday through Friday from 6:00 a.m. to 11:00 p.m. Eastern Time. This method simply involves telling an IRS agent all of your answers to the questions on Form SS-4. Applicants calling in must be authorized to receive EINs (which we’ll cover in the next section).

What is an EIN confirmation letter from the IRS?

The EIN verification letter from the IRS is a document that’s sent to business owners upon receiving their EIN. If you know your EIN off the top of your head, this letter will likely only be needed one time. You’ll just need to present a physical copy to open your business bank account.

However, that nine-digit number isn’t always easy to remember, so it’s not a bad idea to keep the verification letter in a safe place. Plus, you’ll need it if you need to open up a new business bank account.

How do I get my EIN confirmation letter?

Keeping your EIN verification letter from the IRS in a secure location (like a safe deposit box) is the best way to ensure you never lose it. But with so many documents to keep track of, it’s not out of the ordinary for these confirmation letters to go missing.

Although you don’t want to find yourself in bad standing with the IRS, the agency is fairly understanding when it comes to needing a new copy of your EIN confirmation letter, so they make it easy to get a new copy. Here are the steps to take if you misplace your IRS EIN confirmation letter:

- Call the IRS: If you need to contact the IRS, it’ll have to be over the phone. To get a copy of your verification letter, you can call them toll-free at 1-800-829-4933. This is the “business and specialty tax line.”

- Speak to an agent: Once you’re on the phone with an IRS agent, tell them you need a 147c letter—the document number for a new copy of your EIN verification letter from the IRS—and give them your EIN.

- Confirm your identity: Only authorized individuals can request a 147c letter. Even if you know your EIN, the agent will need to ask some questions to verify your identity. Examples of people who can request a 147c letter are business owners, partners in an LLC, corporate officers or anyone who has power of attorney over a company. In addition to providing your EIN, you’ll need to tell the agent your name, business address and the type of tax return you file.

- Choose how you’d like to receive your letter: Even though it’s the fastest way to receive documents, the IRS will never email you any sensitive information, so your only two options for receiving your 147c letter are through the mail or via fax. It’s not uncommon for mail from the IRS to take several weeks to arrive, so we recommend choosing the fax option if you need your 147c letter sooner rather than later.

What if my address has changed?

Getting a 147c letter is a bit more complicated if either your business address or personal address has changed since you started your company. If your business address changed, you’ll need to file Form 8822-B. And if your personal address changed, you’ll need to file Form 8822. You can download both of these forms online, but you’ll need to print them and mail them back to the IRS.

Can I get a copy of my EIN letter from the bank?

We get it—calling the IRS or waiting by the mailbox for your EIN verification letter from the IRS can be tedious. Thankfully, your bank can help you out! Although they can only provide you with a scan of your letter, this may be enough to accomplish whatever task you initially needed the document for.

Of course, you’ll want to verify that a scanned copy of the letter will suffice, but only waiting for a few minutes to get the document compared to several weeks is obviously preferable.

Get the small business banking help you need

The options are nearly limitless when you need to open up a small business bank account , but for a seamless banking experience, be sure to choose NorthOne. We’re committed to helping small businesses succeed and making life easier for business owners. Apply for an account today to start taking advantage of our innovative financial and organizational tools. Just be sure to submit your EIN verification letter from the IRS when you apply!

Eytan Bensoussan

Related posts, how to start a thriving ecommerce business in 2024, what is an s corporation and how to open one in 5 steps, 18 telling gig economy stats in 2024, 4 ways to test your small business idea in 2024, how to start a bookkeeping business in 8 steps, s corp vs. c corp: which one is the best structure for your business.

Username or Email Address

Remember Me

Registration is closed.

- Open an Account

147C Letter – IRS EIN Verification

Searching for your misplaced EIN verification letter, also known as the IRS 147c letter? You’re not alone. Many business owners and tax professionals need to request a replacement EIN confirmation document. Thankfully, retrieving your 147c letter from the IRS is a straightforward process.

This comprehensive guide will simplify everything you need to rapidly get a replacement 147c letter. We’ll explain what the EIN verification letter contains, why you may need it, who can request it, and detail the fastest options to obtain your personalized 147c letter from the IRS.

So if you’ve lost your original Employee Identification Number (EIN) confirmation notice from the IRS and need another copy, you’re in the right place. Let’s dive in and demystify the entire 147c letter request process.

What is a 147c Letter?

An IRS 147c letter, also referred to as an EIN verification letter, is an official document sent from the Internal Revenue Service. It displays your business’s assigned nine-digit federal Employer Identification Number (EIN).

This EIN confirmation notice also includes your business entity’s complete registered legal name and address listed in the IRS database.

Essentially, whenever you successfully receive a federal EIN for tax and identification purposes, the IRS automatically mails your business this 147c verification letter. It serves as formal proof and acknowledgment from the IRS that your corporation, LLC, partnership or other business structure secured an official EIN.

Why do you need an IRS 147c Letter?

There are several important reasons you may need to acquire an EIN verification letter (147c) for your business:

- Opening a Business Bank Account – Most financial institutions require IRS confirmation of your EIN before opening a business bank or credit account under your company’s name and tax ID number. The 147c letter satisfies this prerequisite.

- Applying for Business Licenses – Local, state and federal licensing bureaus commonly mandate verified EIN documentation when processing applications for company licenses, permits or registrations.

- Proof of EIN for Tax Filings – Both the IRS and state taxing agencies can request your 147c letter to validate the legal business name and EIN matching their records when processing company tax documents.

- Legal Verification of Business Entity – Courts, government institutions and third parties frequently require formal IRS verification when confirming the legitimate existence of an organization’s tax identification.

In other words, despite having an EIN, many agencies and businesses will not formally recognize the legal status of your corporation or LLC without IRS-stamped validation. Whether opening a bank account, registering your company vehicle or simply proving your business life, expect to routinely provide a copy your 147c letter.

Who can request a 147c Letter?

Only authorized owners or representatives can retrieve a replacement EIN verification notice from the IRS. Typically, this means:

- A principal owning at least 20% equity share in the business

- An officer, member or partner listed in the company’s formal registration

- A designated Power of Attorney (POA) or Third Party Designee officially affiliated with the business

Minority shareholders, unofficial LLC members, employees, contractors or associates generally cannot request EIN confirmation directly from the IRS. However, with proper permissions, these informal affiliations can still obtain the 147c letter through an authorized representative listed above.

If no principal owner or officer remains active in the company, registered POAs may still qualify to receive a 147c notice on its behalf. Either way, the IRS will only issue replacement EIN letters to verified identities authorized under the business’s official registration.

How to get IRS 147c Letter (3 fast options)

Now that you understand what the form contains and why you need it, let’s explore the fastest ways to get your hands on an EIN verification letter (147c) from the IRS.

The IRS provides three reliable methods to quickly obtain your replacement 147c notice: call them directly, utilize a POA, or request through a professional tax service provider.

Option 1: Call the IRS directly

Calling the IRS Business and Specialty Tax line is the simplest way owners and principal officers can directly request a new 147c letter:

- Verify your government ID and personal details are available (SSN, ITIN, EIN, address etc.)

- Prepare answers to all potential IRS identity confirmation questions

- Call 800-829-4933, then press 1 for English or 2 for Spanish, followed by pressing 3 for all other questions

- Clarify the reason for your call is to request an updated 147c EIN verification letter

- Provide your fax number or verify mailing address for fastest IRS letter delivery

As long as you pass the standard security checks, the agent can instantly fax your new 147c letter or place a mail request to your registered business address. Just inform them of your preferred method to receive the refreshed EIN confirmation notice.

Expect a faxed 147c letter within minutes or mailed verification within 5-7 business days. Remember, only owners or partners can directly call the IRS through this process.

Option 2: Utilize an IRS Power of Attorney

If you cannot or prefer not to call the IRS directly, authorizing a Power of Attorney (POA) provides another path to securing your necessary 147c letter. Here are the step-by-step instructions when using an IRS-approved POA representative:

- Identify an appropriate POA for your business (tax preparer, lawyer, trusted affiliate etc.)

- Fully complete IRS Form 2848 Power of Attorney with your POA

- Write “147c letter” next to Tax Form Number on section 3 of your 2848 POA form

- Provide your POA with access to all required identity verification details

- Call the IRS together at 1-800-829-4933, select language option, then press 3

- Your POA informs the agent they will speak on your behalf with POA form ready

- Fax your Form 2848 during the call when requested

- Answer all IRS security checks through your representative POA

- Request your updated 147c EIN verification letter delivery method

- Receive your refreshed letter instantly via fax or in 5-7 days by mail

This approach allows someone to securely obtain your 147c confirmation on your behalf. Make sure to fully prepare your chosen POA representative in advance.

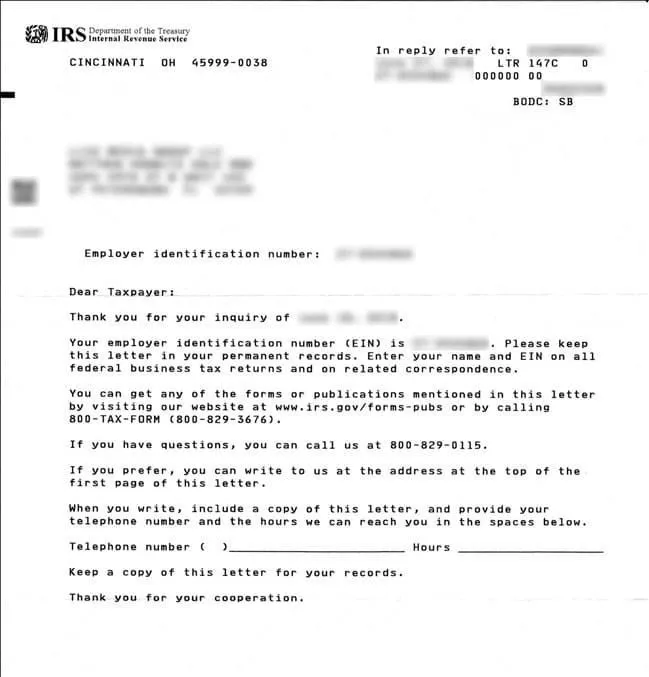

IRS 147c letter sample

Option 3: Retain Professional Tax Services

Finally, specialized tax preparation firms frequently provide 147c letter retrieval services for businesses nationwide. Their IRS connections and specialized staff simplify the entire EIN verification process.

Although paid services can seem inconvenient, this hands-off approach requires no effort from you. Reputable providers like H&S Accounting & Tax Services can swiftly procure your refreshed IRS notice containing up-to-date legal business details.

Professional tax services also help correctly update any changed information with the IRS, guaranteeing your new 147c letter contains current company data. Their expertise ensures you receive a valid 147c suitable for all legal and institutional purposes.

In certain cases, tax experts may directly expedite letter requests through dedicated IRS processing channels not available elsewhere. This yields the fastest and most reliable 147c letter turnaround.

While costs vary between providers, paying reliable tax professionals removes all hassle getting your urgently needed EIN verification letter reissued correctly.

147c Letter request turnaround times

Outside of professional services, how long does it take to receive your EIN confirmation after placing a 147c letter request?

The good news is the IRS can instantly fax your refreshed letter minutes after approving an owner’s call or POA request. This electronic copy usually satisfies most needs requiring the EIN notice.

For a physical mailed copy, expect your official 147c envelope from the IRS within 5-7 business days after successful telephone or POA requests.

So if you need fast verification, request fax delivery and receive IRS confirmation of your EIN almost instantly. Otherwise, standard mail provides you an official document for more stringent bureaucratic demands.

Bottom Line: Verifying your business EIN is simple

Obtaining a replacement copy of your critical IRS 147c EIN verification letter is a quick and easy process. Now that you understand what this notice contains, why you need it, and how to request it, you can confidently prove and validate your registered business identification at any time.

Whether you handle the straightforward phone call directly or use a specialized service for convenience, the IRS makes retrieving your 147c confirmation simple and fast. With this guide’s help getting a refreshed letter, you can keep your company compliance and financial operations running smoothly.

- Meet the Team

- Event Speaking

- Testimonials

- Bookkeeping

- S-Corp Formation

- Virtual CFO

How can I get a copy of my EIN Verification Letter (147C) from the IRS?

If you have lost your federal employer identification number , you can contact the IRS to request a copy of the EIN confirmation letter.

To request a copy of the EIN Verification Letter (147C), complete the following steps:

- Call the IRS Business & Specialty Tax Line toll-free at 1-800-829-4933 between the hours of 7 am and 7 pm in your local time zone.

- When the call is answered, press 1 for English

- Next, you will be asked to press 1 for information related to your FEIN or EIN

- Next, select option 3 – You have a FEIN or EIN but need a confirmation number

- You will need to have the FEIN or EIN number, name, and address you have been using on your 941 forms, W‐2 forms, and or 1099 forms.

- Once your information has been verified, the IRS agent will offer to fax the letter to you immediately or snail mail you a copy of the letter.

Only an owner or a Power of Attorney (POA) can request a 147C Letter. If you would like a POA to request your EIN Verification Letter (147C), both you and your POA will need to complete the IRS Form 2848 and have it ready to send to the IRS via fax during the phone call with the IRS.

For more information on how to retrieve your EIN Verification Letter, visit this IRS resource .

- What Is a Sales Tax Number?

- What Is IRS Code 409A?

Amy Northard, CPA

Founder of The Accountant for Creatives® + taxes + bookkeeping + consulting + Hang out with me over on Instagram !

Comments are closed.

We’re not your parent’s accountant. When you hire us, you will be treated with care during every step of the process.

- Find out more about us.

- Invite us to speak at your event.

- Sign up for free tax tips and advice.

News & Tax Tips

- Tax Rules for Giving Money to Family

- IRS Code 414: Retirement Plans and Your Taxes

- IRS Code 162: What Is an Ordinary and Necessary Business Expense?

- Know Your Worth® Course

- S-Corp Reasonable Compensation

© 2024 The Accountants for Creatives®. Privacy and Terms .

- Corporations

- Definitions

EIN Letter (What It Is And How To Get A Copy: Explained)

What is EIN Letter ?

What is an example of an EIN verification letter?

How do you get a new one?

In this article, I will break down the EIN Letter so you know all there is to know about it!

Keep reading as I have gathered exactly the information that you need!

Let me explain to you what is an EIN letter from IRS and why it’s important!

Are you ready?

Let’s get started!

Table of Contents

What Is An EIN Letter

An EIN letter can either refer to the Form CP 575 which is a letter sent by the IRS shortly after having assigned an EIN number to your or your business or it can refer to an EIN Verification Letter which is a letter sent by the IRS when Form CP 575 is misplaced.

Companies and some individuals get an EIN number (Employment Identification Number) representing a nine-digit number assigned to them by the IRS.

The EIN number is used to identify your company or sole proprietorship with the tax authorities, government agencies, banks, and other stakeholders.

The EIN letter (whether we are referring to CP 575 or the EIN Verification Letter) is a document that officially confirms your company’s EIN number.

At some point in time in your business, you may need to present this official EIN letter to banks, financial institutions, investors, suppliers, vendors, or others.

How EIN Letters Work

Now that we know what is an EIN letter, let’s see how it works.

Original EIN Letter

When you first apply for an Employer Identification Number, the IRS will send you an official confirmation of the EIN letter assigned to your company in a document called CP 575.

The CP 575 document is sent to you within 8 to 10 weeks following the approval of your EIN application.

It’s crucial to keep the CP 575 document in a safe place as the IRS will only mail this to you once.

If you lose or misplace your CP 575 , you will need to ask for a replacement EIN letter but this letter will no longer be a CP 575 but an EIN Verification Letter.

Replacement EIN Letter

No matter how careful we are, it’s possible that we lose paperwork from time to time.

The same is true for your EIN letter.

If you happen to lose your original EIN letter, you’ll need to ask the IRS for a replacement copy.

However, the IRS will not replace your original EIN letter by issuing once more the same CP 575 Form.

Instead, the IRS will issue an EIN Verification Letter in the form of a 147C Letter .

This letter is essentially the official substitute of the CP 575 form allowing you to officially confirm your company’s EIN letter should banks and lenders ask.

Why Is An EIN Letter Important

An EIN letter is an important document that is issued to your company by the IRS.

When the IRS assigns a tax identification number to your company (an EIN), it will officially confirm that assignment by sending a letter (an EIN letter).

The confirmation of your company’s EIN in a letter is like getting the confirmation of Social Security Number for individuals.

In the same way that an SSN is a crucial number for individuals, EIN is a crucial number for companies.

When you get your IRS EIN letter, it’s important that you keep this document in a safe place as you may be asked to show the original of this document in the normal course of business.

For example, financial institutions may ask you for your original Employer Identification Letter, lenders may ask for it, you may need it to open a business bank account, get a business license or permit, and many other things.

If you are asked for an original EIN confirmation letter and you do not have one, you will need to go through the process of contacting the IRS to get a replacement copy sent to you.

So be sure to always have your original Employer Identification Number confirmation letter handy.

How To Get EIN Letter From IRS

You are asking: how do I get a copy of my EIN letter from the IRS?

To get your original EIN letter, you’ll need to apply for an Employer Identification Number.

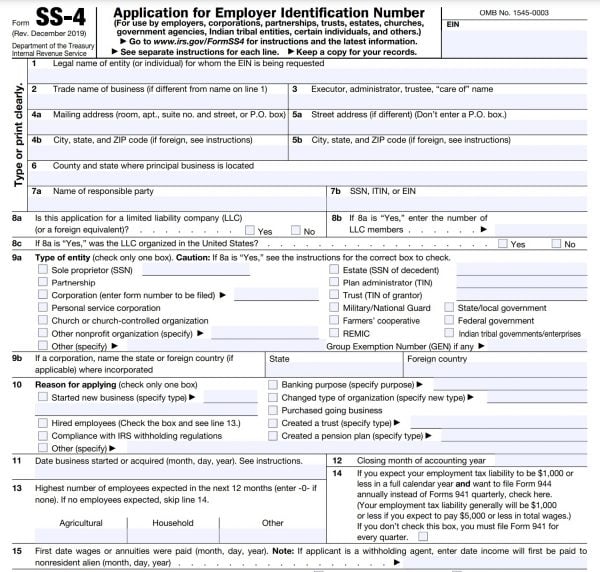

You do that by completing the SS-4 Form called Application for Employer Identification Number.

Once the IRS approves your EIN application, you will get your EIN Letter (CP 575) in the mail.

If you have lost your CP 575 and need to get a copy of the EIN letter, the best way is to call the IRS.

Here is how to get EIN letter from IRS:

- Call the IRS customer service line at 1-800-829-4933

- When the IRS answers, identify your business and answer any IRS questions to locate your company file

- Request EIN letter

- If your contact information has not changed, the IRS will send a replacement EIN letter to your company’s address on file

If your company’s address has changed or contact information needs to be updated, you must submit Form 8822 to the IRS before getting an IRS EIN letter replacement.

EIN Letter Sample

What does the IRS EIN letter look like?

If you are wondering what an EIN letter looks like, here is a sample copy of the original EIN letter sent to you by the IRS.

As you can see from this letter, the IRS indicates that they have assigned an Employer Identification Number to the company or business.

The EIN number will be used to identify the business, business accounts, tax returns , and documents.

The IRS invites you to permanently keep your EIN letter.

IRS EIN Letter Takeaways

So there you have it folks!

What does an EIN letter mean?

How to get EIN letter from IRS if you lost or misplaced your EIN ?

In essence, an EIN letter is the official confirmation of your company’s tax ID number (essentially the Employer Identification Number).

The first official letter confirming your company’s EIN is in the 575 Form.

However, if you lose or misplace your first official EIN letter, you can ask the IRS for a copy.

The IRS will then send you another EIN confirmation letter this time called the 147C letter (as the 575 Form is only issued once).

You may need your EIN letter in some cases to open a bank account, apply for licenses or business permits, get loans, or for other reasons.

Make sure that you keep your EIN letter in a safe place so you don’t lose it.

If you do lose your original letter, don’t worry, you can contact the IRS to get copy of EIN letter .

Now that you know what is an EIN letter, why it’s important, and how to get a copy of EIN letter, good luck with your business!

My Investing, Business, and Law Blog

By the way, on this blog, I focus on topics related to starting a business, business contracts, and investing, making money geared to beginners, entrepreneurs, business owners, or anyone eager to learn.

I started this blog out of my passion to share my knowledge with you in the areas of finance, investing, business, and law, topics that I truly love and have spent decades perfecting.

You may find useful nuggets of wisdom to help you in your entrepreneurship journey and as an investor.

Looking For Real Actionable Tips To Reach Your Financial And Business Goals?

If you’re interested in my actionable tips, guides, and knowledge on how to achieve your financial and business goals, subscribe to my blog and I’ll share with you my premium and exclusive content that will blow you away!

I’d love to share the insider knowledge that I’ve acquired over the years helping you achieve your business and financial goals.

Now, let’s look at a summary of our findings.

Understanding EIN Letter

If you enjoyed this article on EIN Letter , I recommend you look into the following terms and concepts. Enjoy!

You May Also Like Related to Employer Identification Number Letter

147C Letter By Name Title Business license Capital accounts Capital expenditures Cash distribution CP 575 Deductible expenses Federal payroll taxes How to start a business Its signature Managing partner Non-recourse debt Partnership basis calculation Partnership vs corporation Self-employment taxes Sole proprietorship Tax A reorganization Tax ID Number Tax-exempt income Tax-free reorganization Wholesale license Author

Related to Business

Business credit card Business lawyer Business taxes Commercial bank account Contract to hire EIN lookup Employee ID E-signature Find my EIN number Form 1120 Form 11-C Form 637 Form 720 Form 8822 Form 940 Form 941 Form 944 Form 990-T Responsible party SS4 form Types of businesses W2 contract What is EIN What is an INC What is an LLC What is SSN Author

RELATED ARTICLES

What is contract manufacturing (all you need to know), types of business strategy (all you need to know), is it cc’d or cc’ed (explained: all you need to know), most popular, what is a special purpose entity (all you need to know), what is corporate raiding (explained: all you need to know), what are golden shares (explained: all you need to know), what is a targeted repurchase (explained: all you need to know), what is a friendly takeover (explained: all you need to know), editor's picks, cobid (what it is and how it works: all you need to know), what is as of date (in business: meaning and common mistakes), anonymous llc (what it is and how it works: overview), utah business entity search (guide: all you need to know).

- Privacy Policy

- Terms of Use

Customer login

Tax Pro login

Business tips

Obtaining Your EIN Verification Letter (Form 147C) from the IRS

8 minute read

Copy Article URL

Obtaining Your EIN Verification Letter From the IRS Form 147C: Request an EIN, Copy of EIN By Using IRS Letter 147C

Kristal Sepulveda, CPA

November 14, 2023

An Employer Identification Number (EIN) Verification Letter or EIN confirmation letter, also known as Form 147C, is a document issued by the Internal Revenue Service (IRS) to confirm the validity of your EIN. It is essential proof of your business's identity to conduct various financial and tax-related activities. This article will guide you through obtaining your EIN Verification Letter and help you understand its significance.

What is an EIN Verification IRS Letter 147C?

An EIN Verification Letter is an official document provided by the IRS that serves as confirmation of your business's EIN - a unique nine-digit number assigned to business entities for tax filing and reporting purposes. The letter includes important details such as the legal name of the business and its EIN, which are crucial for interacting with the IRS and other entities.

Understanding the purpose of an EIN Number Verification Letter

An EIN Verification Letter's primary purpose is to authenticate a business entity's existence and legitimacy. It provides third parties, such as financial institutions, vendors, and government agencies, with assurance regarding the accuracy of the EIN and the associated business entity.

Why do you need an EIN Verification Letter?

Businesses often require an EIN Verification Letter when opening bank accounts, applying for business loans, obtaining permits and licenses, or engaging in certain types of financial transactions. It is a vital piece of documentation that ensures smooth business operations and compliance with legal and regulatory requirements.

How does the IRS use the EIN Verification Letter?

From the IRS's perspective, the EIN Verification Letter is a means of validating the accuracy of the information provided by business entities . It helps the IRS confirm the identity of businesses and ensures that they are fulfilling their tax obligations in a lawful manner.

Want To Organize Your Business's Finances? Download A Free Balance Sheet Excel Template Here

How to request an ein verification letter.

If you need to request an EIN Verification Letter, the process involves contacting the IRS and submitting the necessary documentation to obtain the letter. Here are the steps for requesting an EIN Verification Letter:

Steps for requesting an EIN Verification Letter

To request your EIN Verification Letter, you'll need to complete Form SS-4, Application for Employer Identification Number, which is available on the IRS website or through their office. Once completed, you can submit the form to the IRS either online, by mail, fax, or in person.

Where to submit the request for an EIN Verification Letter?

The submission of Form SS-4 and the request for an EIN Verification Letter should be directed to the IRS Business and Specialty Tax Line or the appropriate IRS office, based on your business's location and the method of submission chosen.

Timeframe for receiving the EIN Verification Letter

Once the IRS processes your request, you can expect to receive your EIN Verification Letter within a reasonable timeframe. It's important to plan ahead and consider the time required for the IRS to review and respond to your request.

Want To Stay On Top Of Your Business's Accounts? Download A Free Chart Of Accounts Excel Template Here

When do you need to request a 147c letter need a 147c letter.

There are specific situations and events that may necessitate the need for a 147C Letter from the IRS. Understanding when you require this document is crucial to ensuring your business operations remain compliant and unhindered.

Events that require a 147C Letter from the IRS

Several circumstances, such as changes in business structure, tax audits, opening new business accounts, or interactions with government agencies, may require a 147C Letter from the IRS as part of the verification process.

How to identify if you need a 147C letter?

If you are unsure whether a particular situation or transaction requires a 147C Letter, it is advisable to consult with tax professionals, legal advisors, or directly with the IRS to determine the appropriate course of action. Proactively understanding the circumstances that warrant a 147C Letter can prevent potential disruptions in business activities .

Consequences of not having a 147C Letter when required

Failing to obtain a 147C Letter when needed can lead to delays in crucial business processes, denials of important applications, or even legal and financial repercussions. It is essential to be aware of the instances where a 147C Letter is mandatory and ensure timely compliance.

How to Contact the IRS for EIN Verification Letter?

When reaching out to the IRS to request an EIN Verification Letter or address related issues, it is important to understand the available options for communication and the information required for effective correspondence.

Options for contacting the IRS

You can contact the IRS through various channels, including phone, mail, online inquiries, or in-person visits to IRS offices. Each communication method has its own procedures and requirements, so selecting the most suitable option based on your specific needs is essential. The most common method is applying online via irs.gov.

Information required when calling the IRS for EIN Verification Letter

When contacting the IRS, you'll need to provide specific details such as your EIN, business name, contact information, and the purpose of your request. This information helps IRS agents process your request efficiently and accurately.

Resolving issues related to the EIN Verification Letter

In the event of errors, delays, or discrepancies related to your EIN Verification Letter, it's important to engage with the IRS promptly to address and resolve the issues. Working closely with IRS agents can help expedite the resolution process and prevent potential complications.

Common Errors and Issues when Requesting an EIN Verification Letter

While requesting an EIN Verification Letter, it's essential to be mindful of common errors and issues that may arise during the process. Being aware of these potential pitfalls can help you navigate the process more effectively.

Typical mistakes made when requesting an EIN Verification Letter

Errors such as incorrect information on the Form SS-4, incomplete documentation, or inaccuracies in the application details can lead to delays or rejections in issuing the EIN Verification Letter. Reviewing your submission thoroughly can help mitigate these issues.

Dealing with errors on the EIN Verification Letter

If you encounter errors or discrepancies on the EIN Verification Letter you receive, it's crucial to address them promptly by contacting the IRS. Providing clear explanations and supporting documentation can aid in rectifying any inaccuracies present in the letter.

Appealing a decision regarding the EIN Verification Letter

In situations where you disagree with the IRS's decision regarding your EIN Verification Letter, you have the right to appeal the decision through established procedures. Seeking professional guidance and understanding the appeals process can help effectively present your case.

Key Takeaways: Understanding Your Employer Identification Number Verification Letter

- CP 575 and 147C Letter : The CP 575 is the initial notice you receive from the IRS when you are assigned an EIN. If you need a copy, you can request a 147C letter, also known as an EIN Verification Letter.

- Getting a Copy of Your EIN : If you already have an EIN but require proof of your EIN, you can contact the IRS Business and Specialty Tax Line to request a copy of your EIN, specifically the CP 575 or 147C letter.

- EIN Verification Letter 147C : The IRS 147C letter is a document that serves as official proof of your EIN. If you need your 147C letter, you can request one from the IRS.

- Applying for an EIN : The way to get an EIN is through the IRS, and you can apply for an EIN if you don't remember your EIN or need a new one.

- Requesting EIN Confirmation Letter : If you need to provide your EIN to a third party or for official purposes, request an EIN confirmation letter, which the IRS will mail to you.

- Contact the IRS for EIN Issues : To receive your 147C letter or any documentation of your EIN, contact the IRS to request it. The IRS support team can guide you through the process.

- Form 2848 and EIN Representation : To allow someone else to request a copy of your EIN, you can use IRS Form 2848, which grants power of attorney.

- Understanding Your IRS Correspondence : The IRS send EIN Verification Letter as a way to provide official proof of your EIN. Remember, the IRS will never email 147C letters for security reasons.

- EIN Verification for Business Needs : If you need to prove your EIN for tax forms with the IRS or for business verification, the 147C letter or a copy of your CP 575 notice serves as a replacement for the original EIN notice.

- Receiving and Using Your EIN Documentation : Once you receive your verification letter, it's crucial to keep it for records as it is essential for maintaining good standing with the IRS and for various business needs.

- IRS Agent Communication : When you contact the IRS to request a copy or clarification, the IRS agent will ask for specific information to verify your identity and business details.

- Ensuring Compliance and Proof of Identity : It's important to recall your EIN or have a copy from the IRS for various transactions and interactions, as most financial institutions in the US accept 147C letters as well as other forms like Form 8821 or Form 2848.

How can Taxfyle help?

Finding an accountant to file your taxes is a big decision . Luckily, you don't have to handle the search on your own.

At Taxfyle , we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you.

Get started with Taxfyle today , and see how filing taxes can be simplified.

Legal Disclaimer

Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

Was this post helpful?

Did you know business owners can spend over 100 hours filing taxes, it’s time to focus on what matters..

With Taxfyle, the work is done for you. You can connect with a licensed CPA or EA who can file your business tax returns. Get $30 off off today.

Want to put your taxes in an expert’s hands?

Taxes are best done by an expert. Here’s a $30 coupon to access to a licensed CPA or EA who can do all the work for you.

Is this article answering your questions?

Thanks for letting us know.

Whatever your questions are, Taxfyle’s got you covered. If you have any further questions, why not talk to a Pro? Get $30 off today.

Our apologies.

Taxes are incredibly complex, so we may not have been able to answer your question in the article. Fortunately, the Pros do have answers. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

Do you do your own bookkeeping?

There’s an easier way to do bookkeeping..

Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. Get $30 off today.

Why not upgrade to a licensed, vetted Professional?

When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle. Get $30 off today.

Are you filing your own taxes?

Do you know if you’re missing out on ways to reduce your tax liability.

Knowing the right forms and documents to claim each credit and deduction is daunting. Luckily, you can get $30 off your tax job.

Get $30 off your tax filing job today and access an affordable, licensed Tax Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle.

How is your work-life balance?

Why not spend some of that free time with taxfyle.

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility.

Why not try something new?

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

Is your firm falling behind during the busy season?

Need an extra hand.

With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients.

Perhaps it’s time to scale up.

We love to hear from firms that have made the busy season work for them–why not use this opportunity to scale up your business and take on more returns using Taxfyle’s network?

by this author

Share this article

Subscribe to taxfyle.

Sign up to hear Taxfye's latest tips.

By clicking subscribe, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

Get our FREE Tax Guide for Individuals

Looking for something else? Check out our other guides here .

By clicking download, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

File simpler.

File smarter., file with taxfyle..

2899 Grand Avenue, Coconut Grove, FL 33133

Copyright © 2024 Tickmark, Inc.

What is the Care-of name? Back to top The Care-of name is a specific person or department within your organization to which the mail should be directed.

How to Obtain a Confirmation Letter for an Assigned EIN Number

by Mariel Loveland

Published on 21 Nov 2018

When you sign up for a federal Employer Identification Number (EIN), also known as a federal tax ID number, the government makes a real point to remind you to never misplace your number. Let's be totally real, though. Some of us are pretty forgetful regardless of how successful our budding businesses may be. Losing your EIN number and the IRS confirmation happens. Don't worry – it's not gone forever.

Why Do I Need An EIN?

An Employer Identification Number is like a Social Security number for a business. You'll need your EIN to file taxes, apply for business licenses, open business bank accounts, obtain loans and new lines of credit and fill out various forms such as 1099-MISCs for contracting work. If you're working as a sole proprietor, you may wish to register for a federal tax ID number to avoid using your Social Security number for business purposes.

Sometimes, a bank or vendor may require a confirmation of your EIN from the IRS. Before you get nervous and start tearing apart your office looking for that pesky letter, don't worry. You can easily request a new confirmation letter instead.

Call The IRS And Request A Replacement Confirmation Letter

Getting a replacement confirmation letter for your Tax ID Number is as simple as calling up the IRS. Dial (800) 829-4933 if you're in the U.S. and (267) 941-1099 if you're abroad. Ask the IRS for a replacement 147C letter – that's what the letter is called. If you remember your EIN number, you can have the form faxed directly to you. If you don't remember your number, you'll have to wait for the letter to be sent by mail because the IRS will not give you the number over the phone.

Be Prepared To Answer Questions About Your Business

The IRS can't just give out EIN information to anyone. They can only send a 147C letter to an authorized individual like a corporate officer or partner. In order to confirm that you're authorized to get the form, you're going to need to answer some questions including telling the IRS your title in the business.

What Happens If I Lost My EIN Number?

If you don't need your confirmation letter and simply lost your EIN number, you can avoid calling the IRS by digging a bit into your company's records. Your EIN can be found on an old tax return. If you've set up a business account with a bank or applied for a license, you can call the bank or agency to get your EIN. If all else fails, call the IRS.

Still need to file? An expert can help or do taxes for you with 100% accuracy. Get started

3 Ways to Look Up Your EIN Number

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to print (Opens in new window)

Written by TurboTaxBlogTeam

- Published May 14, 2024

The IRS identifies taxpayers by their Social Security numbers, but what about businesses? From small businesses to corporations, every business has an Employer Identification Number — or EIN.

When tax season arrives, you need your EIN number to file your business taxes. There are a few easy ways to figure out your EIN so you can file taxes on time.

Table of Contents

Do you need an ein number.

Generally speaking, every business should have an EIN that serves as a unique identifier for that business. If you answer yes to any of these questions, you may need an EIN for your business:

- Do you have employees?

- Is your business a corporation or partnership?

- Do you file employment, excise, or alcohol, tobacco, and firearm taxes?

- Do you withhold income taxes paid to a non-resident alien?

- Do you have a Keogh plan?

- Are you involved with a trust, estate, real estate mortgage investment conduit, non-profit organization, farmers’ cooperative, or plan administrator?

If you answered yes to any of the questions above, you probably need to a pply for an EIN .

If your business is a sole proprietorship, you would file your business taxes as part of your individual tax return, which allows you to use your Social Security number.

Taxpayers who aren’t eligible for a Social Security number need to apply for an Individual Tax Identification number (ITIN) . This may include nonresident aliens and dependents or spouses of nonresident alien visa holders.

How to look up your EIN

When you start your business , you need to file Form SS-4 to receive your EIN. If you’ve already been assigned one but you can’t remember it, there are a few ways to look up an EIN number. Some methods might not work for you, so we’ll provide several options.

- Your EIN Confirmation Letter

After you apply for an EIN, you’ll receive an EIN confirmation letter from the IRS. This letter lets you know that your application was approved and includes your EIN. If you still have your EIN confirmation letter, you can look on the letter to find your EIN.

If you’re just applying for an EIN, make sure you keep your EIN confirmation letter somewhere safe. You should keep copies of all your small business tax forms for at least 3 years after you file, but you might want to keep them on hand for the long term, that way you can reference them if you need to.

- Business Documents

Your EIN is a unique identifying number for your business, which means you have to use your EIN when you’re filing a tax return or opening a bank account for your business. If you had to provide your EIN on an application or business document, try looking for it there.

When you submit an application or receive a business-related document in the mail, keep a copy of it on hand so you can always find your EIN and other basic information about your business. It’s easy to scan, upload, and store these documents digitally. You can even create a folder on your computer to keep all of these documents in one place so the information is easier to locate.

Keep in mind that some business documents may not include your EIN, and some may only show part of your EIN. If you have any documents that show your full EIN number, store them somewhere safe for the future.

If you don’t have any previous tax returns, bank account statements, or your EIN confirmation letter, you can contact the IRS to find your EIN. Call the Business & Specialty Tax Line at (800) 829-4933 from 7 a.m. – 7 p.m. Monday through Friday.

When you call for an IRS EIN number lookup, make sure you’re ready to provide identifying information. If you’re authorized to receive your EIN, the IRS will provide it over the phone. Some examples of an authorized person include:

- A sole proprietor

- A partner in a partnership

- A corporate officer

- A trustee of a trust

- An executor of an estate

If you’re not authorized or can’t provide the identifying information the IRS requests, you won’t be able to receive your EIN over the phone.

What if you need to look up another business’s EIN?

Every commercial organization that does business in the US needs to have an EIN, so you may want to look up another business’s EIN to verify that it’s a legitimate business.

While you can technically look up the EIN of another business, it depends on the type of business you’re dealing with. Finding the EIN of a public business is easy, but private businesses may be more difficult.

Ways to look up a business’s EIN

If you’re planning on hiring or working with a business and you want to make sure everything is accurate, you have a few options for finding another business’s EIN.

- From the business

The easiest way to figure out the EIN of another business is to contact the business owner directly. As long as you have a good reason for requesting an EIN, many business owners will be happy to provide one to verify their business.

Call the business you’re inquiring about and try to get an executive or owner on the phone. As long as you clearly explain why you’re asking for their EIN, many business owners will be happy to help.

Keep in mind that business owners don’t have to provide their EIN at your request. Most legitimate businesses will provide an EIN if you’re a reputable business owner or contractor, but they don’t have to.

While the IRS can’t provide the EIN of another business to a non-authorized person, you can contact a business owner or authorized person to have them retrieve their EIN on your behalf. They can call the Business & Specialty Tax Line to find out their EIN.

An EIN is essentially an SSN for a business, it can be used for identity theft. Therefore, the IRS limits who can obtain the information to authorized persons to limit this from happening. If you reach out to a business owner and they don’t know their EIN, have them call the IRS at (800) 829-4933 to find their EIN.

What if you need a new EIN?

When the ownership or structure of a business changes, you may need to register for a new EIN. You can apply for an EIN online to receive a new EIN for your business, but you should make sure you need a new EIN before applying for one.

Visit the Do you need a new EIN? page on the IRS website to determine whether you need a new EIN for your business. The rules change based on your business structure, so make sure you’re looking at the right type of business.

You don’t need an EIN if you change the name of your business. That being said, there are other steps you have to take after changing your business name. You can visit the IRS website to learn more about what to do after changing your business name .

What if you need to cancel an EIN?

You need an EIN if you’re doing taxes as a business , but what if you decide to close your business? While you can’t cancel your EIN through the IRS, you can contact the IRS to close your business account.

If you decide to close your business account , you need to write to the IRS with:

- Full legal name of your entity

- Business address

- Reason for closing the account

The IRS will use this information to close your account.

If you have a copy of your EIN Assignment Notice, you should attach a copy of that to the letter you send to the IRS. Send your letter and additional support as needed to the following address :

Internal Revenue Service Cincinnati, OH 45999

Keep in mind that you may be required to pay outstanding business taxes, pay any remaining employment taxes, as well as file the final tax returns before you can close your business.

No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.

Previous Post

How to Know if You Should Invest in Business Insurance

What Is Form 2553 & Which Businesses Use It?

More from TurboTaxBlogTeam

Leave a Reply Cancel reply

Browse related articles.

- Tax Planning

What Is A Form SS-4 & Why Do I Need One?

- Small Business

Guide to Small Business Tax Forms, Schedules, and Resou…

- Business Income

7 Tips When Starting a Side Business

- TurboTax News

TurboTax and Sprintax Now Make Filing Easier for Non-Re…

What is a Qualified Joint Venture?

How to File Small Business Taxes

What Tax Forms to File as a First-Time Business Owner

Use Form 8832 to Choose Your Business’s Tax Status

- Income and Investments

Schedule (K-1) Instructions: How to File in 11 Steps

Understanding The 147c Letter: A Guide

The 147c letter is a crucial document sent by the IRS to businesses. This guide aims to provide a comprehensive understanding of the 147c letter, its significance, who can request it, how to obtain it, and key takeaways for businesses.

What is the 147c Letter?

The 147c Letter is sent by the IRS to businesses that have misplaced or lost their EIN , and have therefore requested the letter in order to confirm their EIN. Business owners receive this letter to verify their EIN and ensure compliance with IRS regulations.

The 147c letter, also known as an EIN confirmation letter, is a document from the IRS that verifies a company’s Employer Identification Number (EIN). When businesses receive this letter, it means they have inquired with the IRS business specialty tax line to have the letter sent in order to confirm their company’s EIN. The information in the 147c letter has the sole objective of confirming a business’s EIN.

To obtain this letter, businesses need to contact the IRS directly by phone and follow the procedures outlined by the IRS.

Why is a 147c Letter Important?

The 147c letter from the IRS holds significant importance for businesses due to several key reasons:

- Verification of EIN: The 147c letter serves as a document that verifies a company’s Employer Identification Number (EIN), ensuring that the EIN is accurate and legitimate.

- Correction of Errors: Business owners can use the 147c letter to rectify any errors or mismatches between the company’s business name and its corresponding EIN.

- Confirmation for Third Parties: The 147c letter acts as proof of the business entity’s EIN, assuring third parties such as financial institutions or government agencies when required.

Overall, the 147c letter plays a vital role in ensuring the accuracy of a company’s EIN, facilitating compliance with IRS regulations, and providing verification for various financial and tax-related activities.

Why You Need a 147c Letter

Businesses require the 147c letter for various purposes such as filing tax forms accurately, opening bank accounts, obtaining permits, and ensuring compliance with IRS regulations.

The primary purpose of a 147c letter from the IRS is to authenticate the existence and legitimacy of a business entity. This letter serves as an EIN verification document, confirming the accuracy and validity of a company’s Employer Identification Number (EIN). It is also known as an “EIN confirmation letter” and is essential for providing third parties, such as financial institutions or government agencies, with proof of the business entity’s EIN.

Who Can Request a 147c Letter?

The letter is typically sent to entities that need to verify or update their EIN information with the IRS. The request for a 147c letter from the IRS can only be made by the company’s authorized agents, which typically includes the business owner or individuals authorized to act on behalf of the business.

How Do You Request a 147c Letter?

To obtain a 147c letter from the IRS, businesses can follow specific procedures outlined by the IRS. The best way to get hold of a 147c letter is to request it by phoning the IRS. You can place this request by calling the speciality business tax line. The operator will confirm your business information so that they can source the correct EIN assigned to your business.

Once they have correctly identified your business’ EIN, they will send you the 147c letter via mail. For this reason, it is essential that you provide them with the correct return address information. The mailing process can take between 4 and 6 weeks before you receive the 147c letter.

Correcting Mistakes On a 147c Letter

To correct errors in a 147c letter, business owners can follow a specific process outlined by the IRS. Here is the general process for correcting errors on a 147c letter:

- Contact the IRS: The only way to request a 147c letter or correct errors on it is by contacting the IRS directly. Business owners can call the IRS Business and Specialty Tax line at 1-800-829-4933.

- Provide Necessary Information: When contacting the IRS, be prepared to provide all relevant information about the errors or mismatches between the company’s business name and its corresponding EIN that need correction.

- Follow IRS Instructions: The IRS representative will guide you on the specific steps to take to correct the errors on the 147c letter. It is essential to follow their instructions carefully to ensure accurate and timely resolution.

By following these steps and reaching out to the IRS directly, business owners can correct any errors or discrepancies in their 147c letter efficiently and effectively. The time it takes to correct errors on a 147c letter can vary depending on the method of delivery you choose.

Key Takeaways

The 147c Letter is a document sent by the IRS to businesses to verify their EIN. Responding promptly to the 147c letter is crucial to avoid penalties and maintain compliance.

For further information on EINs and related services, businesses can access resources like EINsearch’s databases and validation services that offer efficient ways to manage EIN-related processes.

Wants to stay in the know for all things EIN Search & TIN Matching

Related posts, do i need to cancel my ein if i close my business, can i use the same ein for two businesses, can i use my previous ein for a new business.

Privacy Policy | Terms of Use

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

IRS Form SS-4 Instructions: What It Is and How to Find Yours

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is IRS Form SS-4?

IRS Form SS-4, Application for Employer Identification Number, is an IRS form businesses use to apply for an employer identification number (EIN). Business lenders may require an IRS Form SS-4 notice to verify a business’s EIN when evaluating a loan application.

Applying for a small business loan can be overwhelming, but there are a few things you can do in advance to make applying for a business loan go smoothly. Along with filing your most recent year’s business income tax return (and any past due tax returns , too), you’ll also want to locate and make copies of the documents your lender is likely to request. Among these documents is your IRS Form SS-4. Lenders often ask for the IRS Form SS-4 notice you receive after filing the form, not the form itself.

Here’s everything you need to know about IRS Form SS-4, why it’s important to your lenders, and how to obtain yours.

IRS Form SS-4, “Application for Employer Identification Number,” is the form businesses use to apply for an employer identification number (EIN). A business's EIN is its business tax ID number for use when filing small business taxes.

What is an EIN and why apply for it?

An employer identification number, aka an EIN, is a unique, nine-digit number that many types of businesses need for tax purposes.

If a business has employees, it needs an EIN to pay and file payroll taxes. And certain types of business entities need an EIN to file a business income tax return.

Sole proprietorships and single-person LLCs with no employees are the only types of business entities that are exempt from this requirement.

All U.S.-based businesses have the option of getting an EIN.

There are lots of benefits to having an EIN. For example, with an EIN, you can streamline your bookkeeping processes by separating your personal and business finances, open a business bank account, establish business credit, and even speed up your business loan application.

How to use IRS Form SS-4

You can get the IRS Form SS-4 on the IRS website. The form is only one page long.

Expect to provide information like:

Your business’s legal name and address

Name of applicant and their SSN, ITIN , or EIN

Type of entity

Reason for applying for an EIN

Date your business started

Highest number of expected employees in the next year

Principal business activity

Principal type of products or services sold or rendered

Also, note that business owners themselves don’t need to apply for their business’s EIN—you can delegate that task to any responsible party, which the IRS defines as the individual or entity that “controls, manages, or directs the applicant entity and the disposition of its funds and assets.” [0] IRS.gov . . Accessed May 10, 2022. View all sources You can apply via mail, fax, or phone (phone for international applicants only).

Why lenders ask for a copy of the IRS Form SS-4

Lenders need to verify EINs, which is why they often request a business’s IRS Form SS-4. However, when a lender asks for your IRS Form SS-4, it's not asking for a copy of your EIN application; it wants the notice the IRS sends out once it assigns your EIN. (Because IRS Form SS-4 is referenced on this notice, the notice itself is often referred to as Form SS-4.)

Why you need IRS Form SS-4 to verify your EIN

Lenders can't just use a tax return to verify an EIN. Clerical errors and typos happen. It’s possible that your tax preparer entered your EIN incorrectly, and the IRS hasn’t notified you of the error yet. This is a common error for returns filed on paper rather than electronically. It can take the IRS months—sometimes even longer—to identify the error and notify you of it.

The SS-4 allows lenders to go straight to the source of the information, which can speed up the underwriting process.

What if you don’t have an SS-4 notice?

If you’re a sole proprietor or an LLC with no employees, you might not have an EIN (these are the only two types of business entities that aren’t required to get an EIN for tax purposes). In that case, the loan will be in your name, and your lender will use your social security number in lieu of an EIN.

But for all other kinds of business entities, the business is a separate and distinct legal entity from the individual. Even if you provide a personal guarantee for a loan, you’ll still need to complete the loan application in the corporation's name, using the corporation’s EIN instead of your Social Security number. That requires an SS-4.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How to get an IRS Form SS-4 notice: Instructions

Look on your hard drive or cloud-based filing system. If you applied for your EIN online, you received an IRS Form SS-4 notice — along with your EIN — immediately as a PDF.

U.S.-based banks require a copy of the IRS Form SS-4 notice in order to open a business bank account. Your banker may be able to get you a copy.

Your accountant might have completed your EIN application form for you and may have a copy.

Call the IRS Business and Specialty Tax Line at (800) 829-4933. After providing your EIN and identifying information about your business, the IRS sends a copy of your EIN assignment letter by mail or by fax. For security purposes, the letter will be sent to the address or fax number the IRS has on file for your business.

» MORE: See our list of IRS phone numbers

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

On a similar note...

What Is the EIN Confirmation Letter: Everything You Need to Know

You receive an EIN Confirmation Letter once you have completed the Employer Identification Number (EIN) application on the IRS website. 3 min read updated on February 01, 2023

You receive an EIN Confirmation Letter once you have completed the Employer Identification Number (EIN) application on the IRS website. Upon completion, you will have the options for downloading and saving the Tax ID certificate. The confirmation letter, along with saved copies of your Federal Tax ID Number should be kept alongside all your other Limited Liability Company documents.

For every EIN application processed by the IRS, the agency sends out a confirmation letter called CP 575. The EIN confirmation letter is sent to the address provided on the SS-4 form, eight to ten weeks following the issuance of the Federal Tax ID Number. However, if you choose to apply online, a copy of the letter is viewable, printable, and ready for download directly from the IRS website as soon as the process is complete. Aside from serving as a documented proof of your LLC 's EIN assignment, a bank or a vendor may request to see a copy of the letter.

What Happens If You Lose Your Federal Tax ID Certificate?

If for whatever reason you need a replacement for a lost or never-received EIN confirmation letter, you can call the Internal Revenue Service, and they will send the verification letter to you. The copy is sent to the contact information you provided at the time you filed to have the application processed initially. If there has been a change of mailing address or fax number since that time, file Form 882 2 to update the IRS so that they can send the letter to the appropriate destination.

The Business & Specialty Tax Line is available Monday through Friday from 7 a.m. to 7 p.m. local time and handles all requests for a replacement of lost or misplaced EIN confirmation letters. The number to call is (800) 829-4933. If you want to contact the IRS directly, you can do so by calling (267) 941-1099 and ask for a 147C letter.

For security, you will need to verify your identity when contacting the IRS. Some of the security questions you may be required to answer include, but are not limited to, the following:

- Your name and position with the company

- The kind of income tax form you file for the business

- Name and address of the LLC

After adequately identifying yourself, the phone representative you have connected with will look up the number and send the confirmation letter replacement right away. There is no cost for receiving a copy.

If your need for the copy confirmation is dire, another option is to contact your bank or accountant. Either of the two may have kept a copy of your original Tax ID certificate, and you can merely get what you need from either of those sources.

Even if you applied online, for protection against fraudulent conduct, the Internal Revenue Service does not offer online verification. Alternatively, if you initially completed your EIN application online , your email's inbox or archive folder would be a superb place to check for the confirmation email the IRS would have sent to you when your Employer Identification Number was first issued.

A Few More Things To Know About the EIN

You cannot apply for an EIN until after your LLC has state approval. An important thing to remember is that although you must obtain a Tax ID if you have hired employees, your LLC does not need to have employees to be assigned an Employer Identification Number.

The EIN is nine digits long, just like a person's Social Security Number. To distinguish the two, the EIN is written starting with two numbers, then a hyphen, followed by the remaining seven digits. So here's an example of the EIN format: 12-3456789.

Although the IRS does not require businesses to pay a fee for to receive an EIN, there are quite a few websites that will complete the application for you at costs ranging from $50 to $100.

If you already have an EIN from a former taxation identity, it is likely due to a connection with a Sole Proprietorship . You want to close that Tax ID number out. After you have received state approval for your LLC, obtain a new number, which will be a completely different EIN for your Limited Liability Company .

If you need help with EIN Confirmation Letter, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Copy of EIN Letter From IRS

- Where Do I Find My LLC Number? Everything You Need to Know

- Applying For Ein For LLC

- Application for Tax ID

- Get Federal Tax ID for LLC

- How to Get an EIN

- EIN Number Florida

- Application for Tax ID Number

- EIN Number Lookup NY

- Apply for EIN for LLC

- Ethics & Leadership

- Fact-Checking

- Media Literacy

- The Craig Newmark Center

- Reporting & Editing

- Ethics & Trust

- Tech & Tools

- Business & Work

- Educators & Students

- Training Catalog

- Custom Teaching

- For ACES Members

- All Categories

- Broadcast & Visual Journalism

- Fact-Checking & Media Literacy

- In-newsroom

- Memphis, Tenn.

- Minneapolis, Minn.

- St. Petersburg, Fla.

- Washington, D.C.

- Poynter ACES Introductory Certificate in Editing

- Poynter ACES Intermediate Certificate in Editing

- Ethics & Trust Articles

- Get Ethics Advice

- Fact-Checking Articles

- International Fact-Checking Day

- Teen Fact-Checking Network

- International

- Media Literacy Training

- MediaWise Resources

- Ambassadors

- MediaWise in the News

Support responsible news and fact-based information today!

- Newsletters

Opinion | Wall Street Journal marks one year of reporter’s detainment in Russian jail

Evan gershkovich was arrested a year ago today in russia while on a reporting assignment for the journal.

Good morning. First, an update on the newsletter . There will be no Poynter Report on Monday. My colleagues will handle the newsletter next Tuesday, and I will return to see you all again on Wednesday.

And now onto today’s Poynter Report, with an opening item written by my colleague, Angela Fu.

Today, images of Wall Street Journal reporter Evan Gershkovich will run in several prominent news outlets. Emblazoned across some, a promise: “We’ll Keep Telling Evan’s Story. Until He Can Tell His Own.”

It’s the culmination of a weeklong effort by The Wall Street Journal to mark the one-year anniversary of Gershkovich’s detainment in Russia. On March 29, 2023, Russian officials arrested Gershkovich, 32, while he was on a reporting assignment and charged him with espionage. Gershkovich, The Wall Street Journal and the United States government have all denied the charges, but he continues to be held in a Moscow prison, uncertain of when he will face trial.

“This is a full-frontal assault on the free press,” said Wall Street Journal assistant editor Paul Beckett. “The charge he faces is totally bogus. We haven’t seen any evidence or been presented with a shred of anything that would explain what they thought he was doing that leads to the false charges they filed against him.”

On the night of Gershkovich’s arrest, Beckett, the Journal’s Washington, D.C., bureau chief at the time, contacted the State Department, National Security Council, Pentagon and other institutions to report Gershkovich missing. By October, Beckett had transitioned to a new role to work on Gershkovich’s case full time. His work involves multiple fronts: supporting Gershkovich and his family, keeping Wall Street Journal employees updated on Gershkovich’s situation, talking to people in Washington about strategies to bring Gershkovich home, and creating awareness campaigns.

Lawyers for The Wall Street Journal and parent company Dow Jones are working most directly to negotiate Gershkovich’s release, Beckett said. “But we believe that keeping Evan front-of-mind will help those negotiations and hopefully help them end faster.”

The latest awareness campaign started last weekend with “Swim for Evan” events at 10 beaches named Brighton across the world. (Gershkovich used to regularly visit the Brighton beaches in New York and England.) On Wednesday, more than 200 people attempted to symbolically cover the 4,707 miles that separate Moscow from Gershkovich’s hometown of Princeton, New Jersey, in a dozen different “Run for Evan” events. And throughout the week, major publications in the U.S. and the U.K. ran editorials and feature stories about Gershkovich’s detainment .

The front page of The Wall Street Journal for Friday, March 29, features a large blank space to honor the work of Evan Gershkovich, who has been detained in Russia for a year. (Courtesy: Wall Street Journal)

Reporters across major outlets also came together Wednesday for a 24-hour “Read-A-Thon” of Gershkovich’s work. Along with Gershokivch’s friends and colleagues, prominent journalists including CNN anchor Kaitlan Collins, ABC News anchor David Muir, Fox News anchor Brett Baier, Washington Post executive editor Sally Buzbee, Atlantic editor-in-chief Jeffrey Goldberg, New Yorker editor David Remnick and New York Times reporter Jodi Kantor read Gershkovich’s reporting aloud.

“I think it’s easy for it to be lost on people what the impact for democracy and journalism is for Evan to be detained,” said Wall Street Journal reporter Caitlin Ostroff, who helped organize the event. “When I was printing out Evan’s stories for the Read-A-Thon and putting together the massive binders that we have of them, I was completely awestruck by how much he has done — how many different types of topics, people, regions he has covered.”

Gershkovich, the son of Soviet Union immigrants, started his journalism career at The New York Times before working for The Moscow Times and Agence France-Presse. He joined The Wall Street Journal in January 2022 and helped cover the Russia-Ukraine war. Gershkovich was working in Yekaterinburg with press credentials from Russia’s foreign ministry when he was arrested.

“He had just a great interest in Russian culture, people and society, in addition to all the usual things a foreign correspondent covers in terms of the government and economy. He really took to Russia and loves the country, loves covering the Russian people. That’s the kind of reporter he was,” said Beckett, who worked with Gershkovich when he was D.C. bureau chief. “Some foreign correspondents will go and just hobnob with expats and embassy people. He went and dived right in.”