The Role of Management Representation Letters in Audits

Explore the significance of management representation letters in audits, their preparation process, and common misunderstandings in this insightful overview.

Audits are a critical component of financial transparency and corporate governance. Within this process, management representation letters play an essential role that often goes unnoticed by those outside the accounting profession.

These documents serve as a written assertion from company management regarding the accuracy and completeness of information provided to auditors. Their importance cannot be overstated, as they underpin the trust and integrity of the entire audit process.

Purpose of Management Representation Letters

Management representation letters serve as a formal attestation from a company’s executives to the auditors, confirming the veracity of the financial statements and disclosures. These letters are a professional necessity, providing auditors with assurances that all relevant information has been disclosed. They are a testament to the management’s confidence in their financial reporting and their commitment to transparency.

The letters also support the auditor’s assessment of the risk of material misstatement in the financial statements. By obtaining written confirmations, auditors can reduce the extent of substantive testing required, which can streamline the audit process. This efficiency is beneficial for both the auditors and the company being audited, as it can lead to a more focused and timely audit.

Moreover, these letters can be a safeguard against potential disputes or legal issues that may arise post-audit. In instances where inaccuracies are discovered after the audit has been completed, the letter serves as a record that management had affirmed the completeness and accuracy of the information at the time of the audit. This can be particularly important in cases where financial statements are later found to be fraudulent or misleading.

Preparing a Management Representation Letter

The preparation of a management representation letter is a meticulous process that requires careful attention to detail and a comprehensive understanding of the company’s financial affairs. It is a collaborative effort between management and auditors to ensure that all significant information is accurately reflected.

Necessary Statements Identification

Identifying the necessary statements to be included in the management representation letter is a foundational step. These statements typically cover a range of areas such as the acknowledgment of responsibility for the fair presentation of financial statements in conformity with the applicable financial reporting framework, confirmation of the completeness of the information provided, and the disclosure of any subsequent events that may affect the financial statements. Management must also confirm that they have made the auditors aware of all known instances of fraud or suspected fraud affecting the company. The identification process is guided by professional auditing standards, such as those issued by the American Institute of Certified Public Accountants (AICPA) or the International Auditing and Assurance Standards Board (IAASB).

Information Completeness

Ensuring the completeness of information in the management representation letter is paramount. This involves a thorough review of the company’s financial records and disclosures to verify that all relevant information has been included. Management must confirm that all transactions have been recorded and are reflected in the financial statements. They must also attest to the appropriateness of the accounting policies applied and whether any unrecorded liabilities exist. This step is critical as it directly impacts the credibility of the financial statements and the audit’s outcome. The completeness of information also extends to the disclosure of any related party transactions and the effects of any uncorrected misstatements identified during the audit.

Review and Approval

The final step in preparing a management representation letter is the review and approval by the company’s top executives, typically the CEO and CFO. This review process is not merely a formality; it is an active examination to ensure that the letter accurately reflects the company’s financial position and that all statements can be substantiated. The approval signifies that management has taken ownership of the representations made within the letter. It is also an opportunity for management to discuss any concerns or clarifications with the auditors before the letter is finalized. The signed letter is then dated as of the last day of fieldwork, signifying that the representations are relevant and up-to-date with the findings of the audit.

Misconceptions About Representation Letters

A common misunderstanding about management representation letters is that they are a mere formality, a routine sign-off without substantial impact on the audit’s outcome. This view underestimates the letter’s function as a document that auditors rely upon for assurance beyond the financial data and records they examine. It is not simply a procedural step, but a declaration that can have legal implications for the signatories, particularly if it is later found that the information provided was knowingly false or misleading.

Another misconception is that the letter is solely for the benefit of the auditors. While it is true that auditors use these letters to corroborate information and reduce audit risk, the benefits extend to the management and the company as well. The process of preparing the letter encourages a comprehensive review of the company’s financial disclosures, which can lead to the identification and rectification of errors before the audit is finalized. This proactive approach can enhance the quality of financial reporting and potentially prevent future financial discrepancies.

There is also a belief that once the letter is signed and the audit is complete, the responsibilities of management in relation to the representations made are concluded. However, the representations have a lasting effect, as they are a testament to the financial condition of the company at the point of the audit. Should any issues arise from the period covered by the audit, the representations made can be scrutinized for their accuracy and completeness.

How External Users Leverage Accounting Information

Strengthening your control environment for financial integrity, you may also be interested in..., audit work papers: ensuring integrity in financial reporting, how accountant awards shape finance careers, sec and pcaob: pillars of financial regulation, the role of accounting worksheets in financial analysis and auditing.

What is a Management Representation Letter?

Getting through financial audits can be frustrating for companies, especially when asked to provide management representation letters.

This article will clarify exactly what a management representation letter is, why auditors request them, what should be included, and provide examples to make the process smooth and compliant.

You'll learn the purpose of these letters, see template examples, understand international audit standards, and gain key takeaways to improve financial reporting at your organization.

Introduction to Management Representation Letters

A management representation letter is a formal document signed by a company's senior management that is provided to external auditors. It contains certain written representations that auditors require in order to complete an audit and form an opinion on the company's financial statements.

Defining the Management Representation Letter in Audit Context

The management representation letter serves an important role within the financial statement audit process. Auditors use it as audit evidence to support their assessment of whether the financial statements are free of material misstatement. Specifically, auditors request written confirmation from management regarding the accuracy and completeness of information provided during the audit. This includes representations related to:

- The financial statements and adequacy of disclosures

- Proper recording of transactions and account balances

- Internal controls over financial reporting

- Compliance with laws and regulations

By obtaining these written representations from management, auditors gain additional audit evidence to complete their testing and analysis. The management representation letter also outlines management's responsibilities under the audit engagement.

Essential Components of a Management Representation Letter

A standard management representation letter contains certain key statements that auditors rely upon. These include:

- Financial statement disclosures : Confirmation that management has provided the auditors with all relevant information and access needed to perform the audit.

- Recognition, measurement and disclosure : Assertion that the financial statements comply with the applicable financial reporting framework and standards.

- Non-compliance : Disclosure of any non-compliance with laws and regulations.

- Litigation and claims : Details of any actual, pending or threatened litigation and claims that could impact the financial statements.

The letter will also typically list areas of significant estimates and judgments made by management in preparing the financial statements. For example, allowances for doubtful accounts, asset impairment assessments, and assumptions used in valuation models.

By obtaining written representation on these matters, auditors gain evidence to issue their audit opinion. The management representation letter should be signed by the CEO and CFO or equivalent members of senior management.

Legal and Ethical Implications of Management Representations

Signing a management representation letter has legal and ethical implications. Management must ensure representations made to the auditors are accurate and made in good faith. Intentionally misrepresenting information or omitting relevant details could constitute fraud and result in legal liability.

Auditors also have a duty to assess the reasonableness of management representations and corroborate them with other audit evidence. Relying solely on management representations without further verification could call into question the quality of the audit.

Overall, the management representation letter facilitates open and transparent communication between management and auditors. It serves as a legally binding confirmation of management's fulfillment of its financial reporting responsibilities.

What is the main purpose of a management representation letter?

The main purpose of a management representation letter is to obtain written confirmation from management that they have fulfilled their responsibility for the fair presentation of the financial statements. This letter documents that management has provided the auditors with all relevant information and access needed to conduct the audit.

Some key purposes of the management representation letter include:

Confirming management's responsibility for the preparation and fair presentation of the financial statements in accordance with the applicable financial reporting framework (e.g. GAAP or IFRS).

Affirming that management has provided the auditors with all relevant information and access to records, documentation and personnel that is necessary for the audit.

Disclosing any instances of fraud involving management, employees with significant internal control roles, or those that cause a material misstatement of the financial statements.

Presenting details on matters that impact the financial statements - such as plans or intentions that may affect asset/liability carrying values, information about related parties, contingencies, subsequent events, etc.

Stating that all transactions have been recorded and are reflected in the financial statements. This helps confirm completeness and cut-off assertions.

So in summary, the management representation letter serves as important audit evidence that validates information provided by management to the auditors. It also formally documents management's responsibilities and representations concerning the financial statements.

What is the meaning of management representation?

Management representation refers to written confirmation provided by management of an entity to the auditors regarding the accuracy and completeness of financial statements and adequacy of internal controls.

The management representation letter is a key audit evidence prepared at the completion of the audit process. It contains management's assertions regarding:

- Fair presentation of financial statements

- Completeness of information provided to auditors

- Proper accounting policies used

- Reasonableness of significant estimates made

Essentially, through this letter, management takes responsibility for the fair presentation of the financial statements. They confirm to the auditors that they have fulfilled their financial reporting responsibilities.

The management representation letter covers all periods encompassed by the audit report and is dated the same date as the completion of audit fieldwork. It is addressed to the engagement partner and signed by those with appropriate responsibilities for the financial statements, usually the Chief Executive Officer and Chief Financial Officer.

By obtaining written representations from management, the auditors demonstrate they have obtained sufficient appropriate audit evidence to support their audit opinion. The representations serve as necessary supplementary corroboration of management's oral assertions made during the audit.

In summary, the management representation letter is a written statement from management provided to the auditors as part of the audit evidence. It confirms management's compliance with financial reporting responsibilities to enable auditors to form their audit opinion.

What is an example of a management representation letter?

We are providing this letter in connection with your audit of the cost representation statement of USAID resources managed by (Client Name) under Contract No. XXX “Project Name” for the period MM/DD/YY to MM/DD/YY.

We confirm, to the best of our knowledge and belief, the following representations made to you during your audit:

- We have made available to you all financial records and related data, including service auditor reports.

- There have been no communications from regulatory agencies concerning noncompliance with or deficiencies on financial reporting practices.

- We have no knowledge of any known or suspected fraudulent financial reporting or misappropriation of assets involving management or employees with significant roles in internal control.

- We have disclosed to you the results of our assessment of risk that the cost representation statement may be materially misstated as a result of fraud.

- There are no material transactions that have not been properly recorded in the accounting records.

- We believe the effects of any uncorrected financial statement misstatements aggregated by you are immaterial.

- We have disclosed all liabilities, both actual and contingent.

- There are no violations or possible violations of laws or regulations whose effects should be considered.

We confirm that the representations we have made to you during your audit are complete, truthful, and accurate.

Sincerely, [Signature] [Client Representative Name and Title]

What is the difference between management letter and management representation letter?

The key differences between a management letter and a management representation letter in an audit are:

Focus : The management letter focuses on identifying weaknesses and areas of improvement in the company's financial reporting process and internal controls. Management representation, on the other hand, focuses on providing evidence of management's understanding and support of the audit process.

Purpose : The purpose of a management letter is to communicate deficiencies in internal control and make suggestions for improvements. The purpose of a management representation letter is to confirm certain information that the auditors have requested from management.

Content : A management letter contains comments and recommendations from the auditor about issues encountered during the audit. A management representation letter contains specific statements by management regarding matters such as the fairness of financial statements.

Timing : A management letter is typically issued after the audit report while a management representation letter is obtained during the audit.

In summary, while both letters relate to the audit process, the management letter aims to provide suggestions for improvement while the management representation letter serves as audit evidence regarding management's assertions. The management representation letter supports the audit by confirming the accuracy of the financial statements.

sbb-itb-beb59a9

The purpose and importance of management representation letters.

Management representation letters serve several key purposes in the audit process. Most importantly, they provide additional audit evidence to support the auditor's opinion on the financial statements.

Reinforcing the Auditor's Collection of Audit Evidences

Management representation letters reinforce the audit evidence the auditor has already obtained throughout the audit. As outlined in ISA 500 Audit Evidence, auditors must obtain sufficient appropriate evidence to support their opinion. The letter serves as written representation from management on important assertions related to the financial statements. This includes the completeness and accuracy of information provided to the auditor.

Management's Accountability for Financial Reporting

Additionally, the letter highlights management's responsibilities over financial reporting. Management, not the auditor, is responsible for the preparation and fair presentation of the financial statements. The representation letter formally documents that management has fulfilled these duties, a key assertion needed to issue an audit opinion.

Assurance on Contingent and Off-Balance-Sheet Liabilities

Auditors also rely on management's representations on significant estimates and disclosures. This includes assurance from management that the financial statements appropriately reflect contingent liabilities and off-balance-sheet liabilities in accordance with the applicable financial reporting framework.

In summary, representation letters serve as a final confirmation from management that they have fulfilled their financial reporting responsibilities. The letters provide key audit evidence and accountability to support the auditor's work in accordance with auditing standards.

Drafting a Management Representation Letter: Best Practices

A management representation letter is an important part of the audit process. It documents certain written representations made by management to the auditors regarding the company's financial statements.

Drafting an effective management representation letter requires following several best practices:

Management Representation Letter Template: A Starting Point

When creating a management representation letter, it's best to start with a template. This ensures all relevant topics are covered such as:

- Management's responsibility for the preparation and fair presentation of the financial statements

- Availability of all financial records and related data

- Completeness of information provided regarding transactions and events

- Disclosure of all liabilities, both actual and contingent

- Non-existence of any fraud or illegal acts

Tailor the template to the specific circumstances and transactions of the business. But the template establishes a solid foundation.

Who Should Sign the Management Representation Letter

Typically the management representation letter should be signed by:

- The CEO or Managing Director

- The CFO or Financial Controller

This demonstrates the company's overall governance has reviewed the representations and attests to their validity and completeness.

In some cases, representation from heads of divisions or departments may also be necessary regarding transactions or activities under their specific purview.

Customizing Representations to Reflect Unique Organizational Circumstances

While a template is useful, each management representation letter must be customized to reflect the distinct transactions and activities of the organization. Specifically call out areas the auditors have highlighted as potential risks or requiring further representations.

For example, if the company underwent a major acquisition, restructuring, or system implementation, representations would be needed to address the associated impacts and risks regarding financial reporting.

The management representation letter is not a mere formality. It serves as an indispensable record of the critical dialogue between management and auditors. Following these best practices helps craft letters that clearly communicate important representations.

Management Representation Letter Samples and Examples

Management representation letters are important documents in the financial audit process. They contain written confirmation from management about the accuracy and completeness of financial statements and disclosures. Reviewing examples can help companies understand what to include in their own letters.

Analyzing a Management Representation Letter Sample

Here is an excerpt from a sample management representation letter:

We acknowledge our responsibility for the fair presentation in the financial statements of financial position, results of operations, and cash flows in conformity with U.S. generally accepted accounting principles (GAAP). We have provided you with unrestricted access to persons within the Company...

This excerpt demonstrates several key elements:

- Acknowledgment of management's responsibility for financial statements conforming to GAAP

- Confirmation that auditors had full access to people and information

Other standard inclusions are statements around contingent liabilities, litigation matters, plans or intentions that may affect assets or liabilities, and confirmation that appropriate disclosures have been made.

Analyzing examples helps identify customary terms to include.

Management Representation Letter PDF: Accessibility and Format

Management representation letters are often provided to auditors as PDF files. This locked, uneditable format:

- Facilitates easy sharing of the definitive final version

- Allows clear version control with digital signatures

- Enables reliable long-term archival storage

PDF format removes ambiguity around which representation letter version was relied upon.

Real-World Examples: Complex Issues

Consider these excerpts from real-world representation letters:

"The restructuring provision of $20 million represents our best estimate of costs to complete the plant closure based on current plans..."

"We confirm that we have properly recorded and disclosed the acquisition of Company XYZ in the financial statements..."

These excerpts demonstrate how companies transparently address complex real situations like restructurings or major transactions in the representation letter.

Real examples provide assurance that the company has appropriately considered complex accounting matters.

Comparing Management Letters and Management Representation Letters

Management letters and management representation letters serve important but distinct purposes in the audit process.

Management Letter vs Management Representation Letter: Clarifying the Distinction

A management letter communicates deficiencies or recommendations for improvement identified by the auditor during the audit. These may relate to internal controls, processes, or compliance issues that could be made more effective.

In contrast, a management representation letter obtained near the end of an audit contains specific written representations from management about the accuracy and completeness of the financial statements and disclosures. Common representations confirm that:

- Financial statements are fairly presented

- Significant assumptions used by management are reasonable

- All relevant information has been provided to the auditor

- There are no undisclosed side agreements or contingencies

While management letters offer suggestions, representation letters confirm critical facts underlying the audit.

The Role of the Auditor in Relation to Management Representations

Auditors use both tools to fulfill their responsibilities:

Management letters reflect the auditor's duty to communicate control deficiencies to those charged with governance. This allows the entity to take timely remedial action.

Representation letters provide audit evidence as part of the auditor's risk assessment procedures under auditing standards. They represent a form of documentary evidence about management's intents, knowledge and accuracy of the financial statements.

If management were unwilling to sign the representation letter, the auditor would need to reconsider their audit opinion.

Impact on Audit Opinions and Auditor's Reports

The management letter has no direct bearing on the auditor's opinion, unless the issues it raises cast doubt on the fairness of the financial statements.

However, matters raised in the representation letter directly relate to the audit evidence obtained. If management refuses to sign the letter, the auditor would likely issue a qualified opinion or disclaimer of opinion on the financial statements due to the limitation on audit scope and evidence.

In summary, while management letters offer helpful recommendations, representation letters provide the auditor written confirmation of critical information pertinent to the audit itself. Both play key roles in the audit process.

International Standards on Auditing: ISA 580 Management Representations

The International Standards on Auditing (ISA) provide a framework for conducting high quality external audits. ISA 580 specifically focuses on obtaining appropriate written representations from management to support the audit evidence gathered.

Understanding ISA 580 and Its Relevance to Management Representation Letters

ISA 580 outlines the auditor's responsibilities for obtaining written representations from management to confirm certain matters or to support other audit evidence. Some key points:

- Requires auditors to obtain written representations from management that they have fulfilled their financial reporting responsibilities

- Covers areas like recognition, measurement, presentation, and disclosure of information as per the financial reporting framework

- Helps auditors obtain confirmation on matters material to the financial statements, like the completeness of information provided

- Allows for detection of material misstatements due to fraud

By adhering to ISA 580, auditors can ensure management representation letters align with the necessary audit evidence requirements.

Compliance with International Standards on Auditing

It is critical that management representation letters comply with ISA guidelines, including:

- Obtaining representations from appropriate individuals : Those with overall responsibility for financial reporting, such as the CEO and CFO

- Written format : Printed on the organization's letterhead and signed by hand

- Date : No earlier than the date of the audit report

- Wording : Clear acknowledgement of responsibilities, accuracy of information provided, etc.

Strict compliance ensures the representations constitute valid and appropriate audit evidence as per ISA 500.

Case Studies: Adherence to ISA 580 in Practice

Company A - Drafted a management representation letter that was vague, unsigned, and outdated. By not adhering to ISA 580, they had to invest additional time and resources to obtain proper representations.

Company B - Carefully followed ISA 580 requirements. The CFO and CEO signed off on a letter confirming completeness of information and awareness of responsibilities. This aligned smoothly with the audit process.

As exemplified, non-compliance ultimately wastes time and resources. Whereas alignment with ISA 580 standards helps streamline external audits.

Conclusion and Key Takeaways

Management representation letters are important, standard audit evidence that reduce risk. They signify management's representations concerning the financial statements and accountability for internal controls, fraud, and information provided to auditors.

Summarizing the Role of Management Representation Letters in Audits

Management representation letters summarize key information and representations from management to auditors. They serve several key functions:

- Confirm management's responsibility for the preparation and fair presentation of the financial statements

- Disclose any issues or deficiencies in internal controls

- Affirm that all relevant information has been provided to auditors

- Highlight any fraud, illegal acts, or noncompliance with laws and regulations

By obtaining these written representations, auditors reduce engagement risk and confirm their understanding of management's views and positions.

Final Thoughts on Best Practices and Compliance

It is critical that management representation letters adhere to regulations and professional standards. Key best practices include:

- Ensuring the letter is dated as of the date of the auditor's report

- Having the letter signed by those with appropriate responsibilities and authority

- Disclosing all relevant issues completely and accurately

- Following the guidelines and requirements outlined in ISA 580 and other applicable standards

Diligent compliance promotes accuracy, transparency, and accountability.

Encouraging Diligence and Transparency in Financial Reporting

At their core, management representation letters aim to foster diligent, truthful, and transparent financial reporting. By eliciting key written representations from management, auditors promote an environment of responsibility, compliance, and ethical practice. This ultimately supports the accuracy and reliability of financial statements for all stakeholders.

Related posts

- What is Transfer Pricing?

- Related Party Disclosures in Financial Statements

- Statutory Audit vs Internal Audit

- Financial Statement Presentation: Structure and Requirements

Promoting a Culture of Compliance and Accountability: The Significance of Termination Letters

How to Use Xero for E-commerce: Streamlining Online Sales

The Full Overview of Offshore Accountants: Top Countries for Outsourcing

We've received your job requirements, and our team is working hard to find the perfect candidate for you. If you have more job openings available, feel free to submit another job description, and we'll be happy to assist you.

- Submit a New Job Description

Unlock the Talent Your Business Deserves

Hire Accounting and Finance Professionals from South America.

- Start Interviewing For Free

- Popular Courses

- Drafting of Appeal

- More classes

- GST Audit Course

- More Courses

Note on Management Representation Letter (MRL)

Management Representation Letter is issued by the client (Auditee) to the auditor in writing as a part of Audit Evidence. This document during the audit clarifies the separation of responsibilities of the auditor and auditee (management).

ISA 580 (SA580) covers written representations should read in conjunction with ISA (SA) 200, “Overall objective of the Independent Auditor and the conduct of audit in accordance with International Standards of accounting.

As such, The MRL is a part of Audit Evidence and hence should be taken (applicable) for all type of audits like Statutory, Internal, Transfer pricing, tax audit, management audit and so on.

The purpose of MRL is

- To focus the management attention on those matters so that, the management can address matters and issues mentioned in detail with specific attention giving the due weightage about specific management functions, internal controls etc.

- Confirmation from the management about the correctness, fairness of the various financial statements as the management has the primary responsibility for their accuracy.

- Management representations and attestations in the letter provide some assurance that information during examination is reliable in use of audit procedure and to base for any report.

- The MRL is also require as it gives reasonable assurance and details of all the events occur after the last date on which the financial statements are prepared, if any may, and/or may not happen after the date of the financial statement and have a material impact on the financial statements consider for the purpose of audit. Such events are listed in the MRL for more clarity to the reader of the financial statement.

- The MRL is assurance that, the management is upholding & stand by the verbal, written representations made during audit on the matters covers the audit scope.

- Auditing standards require auditor to communicate the management about the material weakness and/or significant deficiencies in internal control during audit, the MRL will help in such communication from both the sides auditor as well as auditee. Significant matters (SA 230).

The Content

The contents of the MRL are enumerated as follows:

- Type of audit and period of audit to be covered. Date of the financial statements.

- Management responsibilities w.r.t. financial statements. Preparation, maintenance of the accounting records, internal financial systems, controls, and these controls are effective as to the financial statements are free from material deficiencies, omissions, miss statements. If any list of uncorrected misstatements, if any. (SA450)

- Accounting policies to be adopted. Accounting standards applicable. (SA540)

- Information and documents, representations provided and their authenticity.

- Conflicts of Interest, related party transactions. if any, (SA550)

- Details of Frauds, Misstatements, misappropriations if any. (SA240)

- Assets Title of the fixed assets, records of the fixed assets, record of additions, deletion, depreciation on the fixed assets. Physical verification and reconciliation if any.

- Investments. Investment policy, Investments made during the year. As per the policy document of the auditee. Deviation from the policy if any. And the terms of the investment are beneficial to the auditee.

- Cash Balances, its verification, Balance certificate, whether as per the norms of the company.

- Bank balances, Balance confirmations, Reconciliation, Comments on the items of reconciliation if any.

- Other Current assets and its releasable value, determination of the value as stated in the financial statements.

- Liabilities their adequacy, confirmation, reconciliation of the balances.

- Contingent liabilities, their nature, their impact on the financial statements.

- Capital Commitments if any. Differed commitments, if any.

- Expenses, nature of expenses to the auditee business, their adequacy, and provisions.

- Provision for claims and losses if any, provision for ascertained, known losses, and claims to be occurred after the date of the financial statements.

- The coverage of the main audit report, and the details, statistical data, its correctness, accuracy, analysis if any given in the report for which this representation is given.

- Disclosure in Revenue and Expenditure account, ascertainment, policy adopted for revenue recognition.

- General commitments. About compliance of the various acts, statutory dues, taxation, and provisions for the same, pending assessments, and disputes, litigation, and its position as on the date. (SA250)

- Details of subsequent events affecting the financial statements. (SA560)

- Specific representations applicable to the business of the auditee and covering the scope of audit /assignment.

Signature on the MRL

The MRL should be signed by,

- Those who govern and manage the affairs of the company, branch, profit center,

- The persons responsible for and decision-making authority for the financial statements.

- Head, or in charge of the respective Branch, or office as Regional, zonal Office etc.

Date of MRL

The date of MRL should be before the date of the Audit report when the audit is near completion.

Refusal to Sign the MRL

(SA 705) If management refuses to sign the representation letter, it means that they are not willing to standby their verbal representations when asked to do so in writing. Management refusal to sign the management representation letter is considered a scope limitation which results in disclaimer report. The auditor is required to consider the effect of non-compliance in accordance with SA 705.

MRL being the important part of audit evidence there should be a constructive discussion between auditor and auditee on the MRL. Nevertheless, being part of audit evidence the same must be obtained in all type of audit as per my view.

Published by

CA Satish Badve (Professional Practice) Category Audit Report

Related Articles

Popular articles.

- GST Payable on Sale of Capital Goods under CGST Act: Section 18(6) viz-a-viz Rule 40(2) and Rule 44(6)

- How to Save Tax if Salary is Above 5 Lakhs for FY 23-24?

- Why Many Salaried Employees Received Notices for AY 2023-24?

- TDS: A Bird's-Eye Summary

- CBDT releases guidelines for compulsory selection of ITR for mandatory scrutiny during FY 2024-25

- Statutory Tax Compliance Tracker: May 2024

- How B2C suppliers can claim credit note amount when issued by the registered person

- Delay in complying with timelines relating to Cost Audit 2023-24 to be informed to MCA by Cost Auditors

Trending Online Classes

Certification Course on Practical Filing of Income Tax Returns

5th Live Batch for Basic and Advanced MS Excel

Live Course on Drafting of appeal and reply of penalty notice, Rectification and stay of demand (with recording)

CCI Articles

You can also submit your article by sending to [email protected]

Browse by Category

- Corporate Law

- Info Technology

- Shares & Stock

- Professional Resource

- Union Budget

- Miscellaneous

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

2022 Baker McKenzie Joint Special Report: The Global Landscape of Transfer Pricing Controversy: Trends You Can't Afford to Ignore

Transfer pricing audits are increasing in number, complexity, and expense, all around the world.

As taxing authorities look for additional revenue after the Covid-19 pandemic, countries like the United States have provided them additional funding to bolster compliance by multinational enterprises, targeting investments in data analysis and artificial intelligence to increase transparency.

This Special Report — created with Baker McKenzie — shares best practices to help businesses navigate the complex and costly transfer pricing audit.

Topics include:

- Pre-audit prevention

- International Compliance Assurance Program

- Settlement options

- Three forms of APAs

- Trends and benefits

- Is an APA right for you

- Best practices and jurisdiction-specific insights

- MAP and arbitration overview

- Procedure break down

- Articulation with domestic litigation

- Peer review

- Coca Cola – U.S. controversy

- Scope of transfer pricing litigation

- Recharacterization of transactions

- Selecting the best transfer pricing method

- Intangibles, business restructuring, management fees

Download this complimentary report for insights to help strengthen your transfer pricing policy and mitigate risk.

By clicking download report, I agree to the privacy policy and to learn more about products and services from Bloomberg Industry Group.

By clicking submit, I agree to the privacy policy .

Home » Blog » Illustrative Management Representation Letter (MRL) for Tax Audit

Illustrative Management Representation Letter (MRL) for Tax Audit

- Blog | Account & Audit |

- Last Updated on 20 September, 2023

Recent Posts

Blog, News, Insolvency and Bankruptcy Code

IBBI Proposes the Requirement for the Debtors to Upload Proof to the Information Utility to Deter Frivolous Disputes

News, Blog, Company Law

SEBI Amends Stock Exchanges & Clearing Corporations Norms | Reduces Timeline for Payment of Regulatory Fee to 15 Days

Latest from taxmann.

_____________________

Chartered Accountants

Address: ____________

(Date: ______________)

Sub: Representation from Management for the purpose of Tax Audit under section 44AB of the Income Tax Act, 1961 (The “Act”) for the year ended on 31st March, 20XX.

Respected Sir/ Madam,

This representation letter is provided in connection with the tax audit u/s 44AB of the Income Tax Act of _______________ for the year ended 31st March, 20XX for the purpose of expressing an opinion as to whether the Form 3CD along with the annexure thereto gives a true and correct view of the facts mentioned therein. We acknowledge our responsibility to keep and maintain such books of account and other documents as may enable tax auditor to complete tax audit u/s 44AB, in accordance with the provisions of the Income Tax Act, 1961

We confirm the following representations to the best of our knowledge and belief:

1. The name of the assessee as per PAN card is __________. A copy of PAN Card has been attached herewith.

2. The assessee has no other business address than communicated to the Income-tax Department for assessment purposes.

3. The Assessee has employed the cash/mercantile system of accounting during the year.

4. There has been a change in the method of accounting employed in the previous year as compared to that employed in the immediately preceding financial year i.e. F.Y. 20XX-XX. The effect of the same on profit is as follows:

The assessee is liable/not liable to pay indirect taxes & if yes, for that registration number is as follows:

(a) Service Tax: _________________

(b) VAT: _________________

(c) Excise: _________________

(d) Import Export Code: _________________

(e) GST: _________________

Copy of the Registration Certificates (RCs) has been attached herewith.

5. The Assessee has not opted to be assessed under any of the 115BA/115BAA/115BAB/115BAC/115BAD.

6. We confirm that the profit and loss account does not include any profits and gains assessable on a presumptive basis under relevant sections 44AD, 44AE, 44AF, 44B, 44BB, 44BBA, 44BBB or any other relevant section

7. The Assessee is engaged in the business as reported in clause 10(a) of Form 3CD.

8. The Assessee has disclosed the nature of every business carried on by it and there is no change in the nature of business carried in the previous year from the earlier years.

9. The Assessee has maintained books of accounts in the “ERP” based computer system in accordance with the generally accepted accounting principle and the following books are generated by the computer systems:-

(a) Cash Book

(b) Bank Book

(d) Journal

10. The above books and accounts have been maintained and kept as per the addresses mentioned in clause 11(b) of Form 3CD.

11. The following are the members/partners of the firm & their profit-sharing ratio is as follow:

12. There are no items of the following nature which are not credited to the profit and loss account where applicable:

(a) items falling under the scope of Section 28 of the Act;

(b) the performa credits, drawbacks, refund of duty or customs or excise or service-tax or refund due by the authorities concerned;

(c) escalation claims accepted during the previous year;

(d) any other item of income; and

(e) capital receipts.

13. During the Previous Year, the assessee has not transferred any land or building for a consideration less than the value adopted or assessed or assessable by any authority of a State Government referred to in section 43CA or 50C.

14. The Assessee has disclosed ICDS as required by the disclosure norms mentioned as per section 145(2) of the Income Tax Act, along with any adjustment in clause 13(e) of Form 3CD.

15. Adjustments is required to be made to the profits or loss to comply with the provisions of ICDS. The effects of such adjustments are as follow:

16. The Closing stock in respect of Raw Material, Work In Progress, and Finished Goods are valued at cost or Net Realizable Value (NRV) whichever is less. The assessee has changed/not changed its accounting policy regarding the valuation of inventories during the previous year. The change of accounting policy has resulted in an increase/decrease in profit by Rs. ____________ in the previous year 20XX-XX.

17. The particulars disclosed in respect of depreciation allowable as per the Income Tax Act, 1961 in respect of each asset or block of assets, as the case may be as required under clause 18 of Form No. 3CD are correct.

18. There are no amounts admissible under sections 32AC, 32AD, 33AB, 33ABA, 33AC (wherever applicable), 35(1), 35(2AB), 35ABB, 35AC, 35CCA, 35CCB, 35CCC, 35CCD, 35D, 35DD and 35E which are debited/not debited to the profit and loss account.

19. The Assessee has not paid any sum to an employee as bonus or commission for services rendered, where such sum was otherwise payable to him as profits or dividend.

20. The sums received from employees towards contributions to any provident fund or superannuation fund or any other fund mentioned u/s 2(24) (x) and the due date of payments and the actual date of payments to the concerned authorities u/s 36(1) (va) as disclosed against clause 20(b) of form 3CD are correct.

21. The assessee has not debited any expense being in the nature of Capital Expenditure to Profit and Loss Account.

22. We certify that there are no capital assets which are converted into stock in trade

23. The assessee has not debited any expense being in the nature of Personal Expenditure to Profit and Loss Account.

24. The Assessee had not released any advertisement in any souvenir, brochure, tract, pamphlet or the like, published by any political party.

25. The Assessee had not made any payments to club as entrance fees, subscriptions and for club services and facilities used.

26. The Assessee had not incurred any expenditure by way of penalty or fine for violation of any law and no expenditure was incurred for any purpose which is an offence or which is prohibited by law except a sum of Rs. ________ as interest on late deposit of TDS under section 201(1A) and Interest on Income Tax under section 206C(7) which is duly reported in clause 34(c) of Form 3CD.

27. The Assessee had not incurred any expenditure by way of any other penalty or fine.

28. There are no amounts inadmissible u/s 40(a) of the Act except Rs. __________ being the amount paid to a resident on which tax is not deducted. Refer clause 21(b)(ii)(A) of Form 3CD.

29. As certified, in relation to any expenditure covered u/s 40A (3), all payments were made by an account payee Cheque drawn on a bank or account payee bank draft. That all payments exceeding Rs. 10,000 have been made either by an account payee Cheque drawn on a bank or account payee bank draft or by electronic clearing system.

30. The Assessee has paid no sums, which are disallowed u/s 40A (9).

31. The Assessee has not debited any item of a contingent nature to the profit and loss account.

32. The deduction u/s 14A amounting to Rs. ___________ in respect of expenditure incurred in relation to income which does not form part of the total income is correct.

33. The Assessee does not have any amount of interest paid that is inadmissible under the provision to section 36 (1) (iii) of the Act.

34. Particulars of payments made to persons specified under section 40A(2)(b) as mentioned in clause 23 of Form 3CD are correct.

35. There is no amount of profit chargeable to tax u/s 41 of the Act.

36. That during the previous year the assessee has not received any property, being share of a company not being a company in which the public are substantially interested, without consideration or for inadequate consideration as referred to in section 56(2)(viia) except reported under clause 28 of Form 3CD.

37. There are no other income during the previous year that the assessee received by way of consideration for issue of shares which exceeds the fair market value of the shares as referred to in section 56(2)(viib)/(ix)/(x) except for clause 29 of Form 3CD.

38. There are no sums referred to under clauses (a), (b), (c), (d), or (e) of section 43B, the liability for which pre-existed on the first day of the previous year but was not allowed in the assessment of any preceding previous year except those disclosed against clause 26(A) of form 3CD. The amount of expenditure incurred during the previous year, paid on or before filing of return u/s 139(1) is duly reported in clause 26(B)(a) and not paid on or before the aforesaid date under clause 26(B)(b) of Form 3 CD.

39. The amount of Central Value Added Tax Credits/Input Tax Credit (ITC) availed of or utilised during the previous year and its treatment in profit and loss account and treatment of outstanding Central Value Added Tax Credits/Input Tax Credit(ITC) in accounts as per relevant law is duly reported in Form 3CD vide clause No. 27 (a).

40. There is no income or expenditure or prior period credited to the profit and loss account except those shown against clause 27 (b) of 3CD.

41. As certified, it is the practice of the Assessee to accept any loan or deposit or any sum and to make any repayment of loan or deposit or any sum in excess of Rs. 20,000 by account payee cheque or account payee bank draft or by electronic clearing system only.

42. There are no amounts/deductions admissible under Chapter VI-A or Chapter III (section 10A, section 10AA) under Clause 33 of Form No. 3CD except disclosed in Form 3CD.

43. That the assessee has complied with all the provisions of Chapter XVII-B or Chapter XVII-BB of the Act and deduction or collection of tax at source has been made at the applicable rates under the relevant provisions of the Act. There have been no cases of tax-deductible where tax has not been deducted at all, or shortfalls on account of lesser deduction than required to be deducted or tax deducted or tax deducted late or tax deducted but not paid to the credit of the Central Government in accordance with the provisions of Chapter XVII-B or Chapter XVII-BB of the Act, except as disclosed in clause 34(a) of Form 3CD.

44. The Assessee has furnished the statement of tax deducted and collected within the prescribed time except as disclosed in clause 34(b) of Form 3CD.

45. The interest under section 201(1A) or section 206C (7) disclosed under clause 34(c) of Form 3CD is correct.

46. There are no other quantitative details of any other item that an entity principally traded or manufactured other than disclosed under clause 35.

47. That assessee has not received any amount in the nature of dividend as referred to in sub-clause (e) of clause (22) of section 2 except as disclosed under clause 36A of Form 3CD.

48. During the previous year there was no audit conducted under the Central Excise Act 1944 and under section 72A of the Finance Act, 1994.

49. There was no adverse comment raised and reported by the cost auditor of the assessee during the previous year.

50. There is no demand raised or refund issued during the previous year under any tax laws other than the Income Tax Act,1961 and Wealth Tax Act, 1957 except as disclosed in clause 41 of Form 3CD.

51. The detail regarding turnover, gross profit etc. for the previous year and preceding previous year are correctly calculated and disclosed in clause 40 of Form 3CD.

52. The Assessee has complied the requirement of furnishing the statements in Form 61 or Form No. 61A or Form No. 61B

53. The Assessee has complied the requirement to furnish statement as prescribed under sub-section (2) of section 286.

54. There is no other expenditure of entities registered or not registered under the GST as disclosed in clause 44 of Form 3CD.

For and on behalf of

(Director Finance)

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

- Tax Liability Insurance: Overview & 2024 Market Update

It is well known that two things in life are certain—death and taxes—and the world of Mergers & Acquisitions (M&A) is no exception. Navigating various tax systems is challenging, even with the best advisors because there are differences between tax jurisdictions on the domestic and global front. These differences are why tax liability policies are invaluable.

What Is Tax Liability Insurance?

Representations & Warranties Insurance (RWI) will cover breaches of tax covenants that were unknown and occurred prior to the acquisition. But what about known tax exposures? Compromising tax positions can lead to stalled or hostile M&A negotiations, even causing parties to walk away from a deal.

Tax liability insurance addresses these known tax exposures, thereby eliminating the buyer’s need to self-insure the risk or negotiate an indemnity escrow. The purpose of Tax Liability Insurance is to protect the insured if a taxing authority (local, state, federal, or foreign) prevails in challenging the insured’s tax position. Subject to certain terms and conditions, Tax Liability policies provide coverage for taxes owed, as well as any associated interest, fines, penalties, and costs of defending your tax position. 1 In addition, coverage may include a “gross-up” to reimburse the buyer for any income taxes assessed after a covered insurance claim has been paid out.

What’s Covered and What's Excluded?

There is no standard form for Tax Liability policies, as each policy is tailored to the individual tax position. The different types of taxes covered include Sales Tax, Corporate Income Tax, Property Tax, and Capital Gains Tax. A few specific examples of insured risks include:

- Tax-free Reorganizations

- Debt Equity

- Capital gains vs. Ordinary income treatment

- Tax positions under audit or challenged by a tax authority

- Net Operating Losses/Section 382 change of control

- Transfer Pricing (positions on cross border transactions)

- S-corporations

- REIT Status

- Renewable Energy (Investment Tax Credits and Production Tax Credits)

Standard exclusions an insured can expect in addition to any deal specific exclusions are:

- Changes in Law (typically limited to changes in Treasury regulations and Internal Revenue Code)

- Inconsistent Tax Filings (where insured files a tax return with a position that differs from the position covered under the policy)

- Material Misrepresentations in the Representation Letter

Nearly all carriers will list the above exclusions; however, some may also exclude Fraud and Settlement without Consent from coverage.

As with RWI, Tax Liability Policies are non-renewable. They have a one-time premium payment, an aggregate self-insured retention—the amount of which is determined on a case-by-case basis—and a typical cover period of seven years. The period can be extended to up to 10 years for an additional premium.

Read more about tax liability insurance, policy elements, coverage triggers and more in our blog, “ Tax Lia bility Insurance: The Basics " .

What Are Current Trends In Tax Liability?

Carriers across the tax liability space report that tax submissions are on the uptick in general, with a particular spike in tax credit policies. Many carriers note that renewable energy policies concerning ITCs (Investment Tax Credits) and PTCs (Production Tax Credits) make up half to two-thirds of their business as of 2023 some already seeing placement double between Q3 2023 and Q1 2024. Therefore, carriers assume this trend will continue throughout 2024 and beyond.

Green Energy: The Driving Force

Much of the increased activity in the renewable energy space can be attributed to the passage of the Inflation Reduction Act (IRA) of 2022. The IRA incentivizes private sector investment in clean energy and manufacturing - including solar, hydropower, pumped storage hydropower, and marine energy projects via its creation or enhancement of more than 70 different tax incentives. 2

PTCs and ITCs

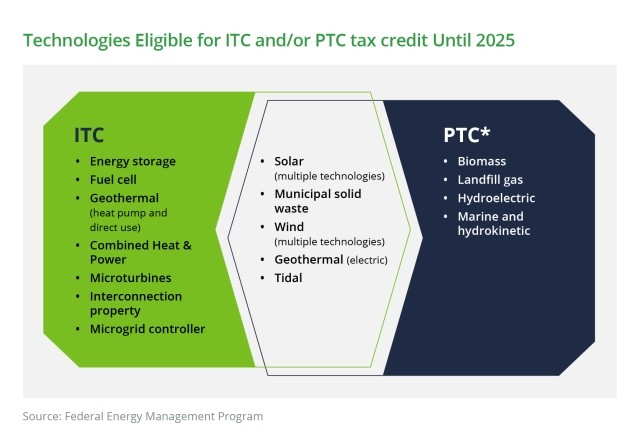

Production tax credits (PTCs) reduce a taxpayer’s liability based on the amount of electricity it generates, whereas investment tax credits (ITCs) reduce its liability based on a percentage of eligible investment costs. The diagram below from the Federal Management Program details technologies eligible for the ITC and/or the PTC tax credit until 2025.

Most businesses who claim an ITC also seek to combine this benefit with bonus depreciation deduction. As depreciation is considered an expense, a larger rate of depreciation during a tax year corresponds to a smaller tax liability. The Tax Cuts and Jobs Act of 2017 (TCJA) allowed qualified property placed in service between Sep.28, 2017 – Dec. 31, 2026, to depreciate at an increased rate, which was 100% up until 2022. 3

*Per FEMP, PTC value is reduced by half for facilities using municipal solid waste or biomass.

Tax Credits & Bonus Depreciation

To take full advantage of available tax credits and bonus depreciation, developers sometimes partner with tax equity investors. Partnership flips and sale leasebacks are the two most common ways to do so.

- Partnership Flips: in this scenario, the investor contributes capital to the project and is the beneficiary of the returns, which later “flip” from the investor to the developer after the investor achieves target yields.

- Sale leasebacks: the facility is sold to the investor, rapidly increasing depreciation, and the investor then provides a long-term lease to the developer; allowing developer to utilize the tax benefits and reduce overall costs over time.

The bonus depreciation benefit, however, phases out, so there is limited time for investors to take advantage of it. The current rate of depreciation is 60%, and it will reduce by 20% each year until it reaches 0% in 2027.

Likewise, 2032 is set to be the trigger year of a four-year phase-out process of various ITC and PTC tax credits more broadly. Therefore, time is of the essence for maximum return for investors.

Transferring Tax Credits

Before the IRA, partnership flips were typically the best avenue for developers of large-scale renewable energy projects as they often did not have adequate short-term tax liability to utilize the federal credits. However, since the IRA went into effect, taxable entities can transfer qualifying renewable energy credits if the following conditions are met: 4

- Credits are exchanged for cash with an otherwise unrelated 3rd party.

- Credits are subject to a one-time transfer, i.e. they may not be re-sold.

- Cash paid by the buyer is non-deductible, and cash received by seller is considered tax exempt income.

- Likewise, it is not possible to sell only a part of a credit. For example, a bonus credit cannot be transferred separately from a base credit. These rules were recently affirmed in final form with IRS regulations released on April 30, 2024. Credit transfers create a market-like system where buyers can purchase renewable energy credits at a discount. However, those savings are meritless if the credits purchased do not ultimately equate to their advertised value. For example, they fail to meet certain requirements and become subject to recapture or disallowance. To address this risk, Buyers have increasingly turned to tax liability insurance to both protect their investment and streamline the purchasing process.

Now Is the Right Time for Tax Liability

Insurance Carriers are preparing for M&A activity to increase and green energy efforts to continue. More markets are entering the space and expanding their capacity, offering higher limits with lower pricing than in previous years. While the particulars of each transaction need to be considered, average pricing ranges from 2%-5% ROL (rate on line) and is frequently less expensive for tax credit policies, which hover at 2%-3% ROL. The enthusiasm of the markets combined with the expanding breadth of options make now a great time to purchase tax liability insurance.

1 Euclid https://euclidtransactional.com/tax-liability/#:~:text=Subject%20to%20certain%20terms%20and,related%20to%20defending%20the%20position .

2 https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses#:~:text=The%20investment%20tax%20credit%20(ITC,installed%20during%20the%20tax%20year .

3 https://www.plantemoran.com/explore-our-thinking/insight/2022/08/the-tcja-100-percent-bonus-depreciation-starts-to-phase-out-after-2022

4 https://www.bdo.com/insights/tax/renewable-energy-tax-credit-transfers-doing-well-by-doing-good

SHARE LinkedIn X

Latest Posts

- IRS Releases 2025 HSA Contribution Limits and HDHP Deductible and Out-of-Pocket Limits

- Managing Workers' Comp Costs with a Nurse Triage Program

- Harness the Potential of GenAI and Mitigate the Potential Legal Risk, Part 1: A Risk-Aware Approach

- You Got Stuck with Oversight of Your Company’s Insurance Program, What Now?

See more »

Refine your interests »

Written by:

Published In:

Woodruff sawyer on:.

"My best business intelligence, in one easy email…"

- Submit Post

- Union Budget 2024

Responsibilities of Accountants under Transfer Pricing Regulations

The term ‘accountant’ has been defined in clause (i) of section 92F as under:

‘accountant’ shall have the same meaning as in the Explanation below subsection (2) of section 288 .

The above-mentioned Explanation reads as under:

“accountant” means a chartered accountant as defined in clause (b) of subsection (1) of section 2 of the Chartered Accountants Act, 1949 (38 of 1949) who holds a valid certificate of practice under sub-section (1) of section 6 of that Act, but does not include [except for the purposes of representing the

Assessee under sub-section (1)]

Therefore, the meaning of “accountant” now applies for the definition of an “Authorized Representative” under section 288(2). As a result, in order to be appointed as an Authorized Representative for an Assessee for any proceedings under the Act, a Chartered Accountant must have a certificate of practice. However, a Chartered Accountant having any other qualification specified in section 288 may be appointed as an Authorized Representative.

Therefore, after this amendment, a Chartered Accountant who does not satisfy both the following conditions cannot be appointed as an Authorized Representative for an Assessee:

- He/she does not have a certificate of practice; and

- He/she does not have any other specified qualification.

Section 92E does not stipulate that only the statutory auditor appointed under the Companies Act or other similar statute should perform the examination. The examination can, therefore, be conducted either by the statutory auditor or by any other chartered accountant in practice having certificate of practice.

The accountant should obtain from the Assessee a letter of appointment for conducting the examination as mentioned in section 92E. It is advisable that such an appointment letter should be signed by the person competent to sign/verify the return of income in terms of the provisions of section 140 or by any person who has been authorized by the company to make such an appointment. The accountant should get the statement of particulars, as required in the annexure to the report, authenticated by the Assessee before he proceeds to verify the same. The accountant is required to submit his report to the person appointing him viz. the Assessee.

The Act prohibits a relative or an employee of the Assessee being appointed as an accountant under section 92E. Also, as per a decision of the Council (reported in the Code of Ethics under clause (4) of Part I of Second Schedule), a chartered accountant who is in employment of a concern or in any other concern under the same management cannot be appointed as an auditor of that concern. Therefore, an employee of an Assessee or an employee of a concern under the same management cannot examine the accounts and records of an Assessee under section 92E.

An accountant responsible for writing or the maintenance of the books of account of the Assessee should not examine such accounts. This principle will apply to the partner of such an accountant as well as to the firm in which he is a partner. In view of this, an accountant who is responsible for writing or the maintenance of the books of account, his partner or the firm in which he is a partner should not accept the examination assignment under section 92E in the case of such an Assessee.

Similarly, an internal auditor of the Assessee cannot conduct the examination if he is an employee of the Assessee. However, an accountant or a firm of accountants appointed as tax consultants of the Assessee can conduct the examination under section 92E.

In the case of an examination, the accountant is required to express his opinion as to whether the Assessee has maintained the proper information and documents, as prescribed, in respect of the international transactions entered into by him. As regards the statement of particulars to be annexed to the report, he is required to give his opinion as to whether the particulars are true and correct. In giving his report the accountant will have to use his professional skill and expertise and apply such tests as the circumstances of the case may require, considering the contents of the report.

The report by the accountant given under section 92E sets forth such particulars as have been prescribed in Form 3CEB. In order that the accountant may be in a position to explain any question which may arise later on, it is necessary that he should keep detailed notes about the evidence on which he has relied upon while conducting the examination and also maintain all his working papers. Such working papers should include his notes on the following, amongst other matters:

- work done while conducting the examination and by whom;

- explanations and information given to him during the course of the examination and by whom;

- decision on the various points taken;

- the judicial pronouncements relied upon by him while making the report;

- certificates issued by the client

- representation letter issued by the management of the Assessee; and

- annexure to Form No.3CEB duly filled in and authenticated by the client.

The extent of check undertaken would have to be indicated by the accountant in his working papers. The accountant is advised to design his examination programme in such a manner, which will reveal the extent of checking undertaken by the accountant and ensures that adequate documentation in maintained in support of the information being certified by him.

The accountant must ensure that he receives a standard Management Representation Letter in respect of all oral representations explicitly or implicitly given to him. The letter should indicate and document the continuing appropriateness of the representations made to him and reduce the possibility of any misunderstanding concerning the matters which are the subject of the representations. Further, in relation to certain transactions, such as deemed international transactions, free of cost services/ goods, etc. the extent of reliance placed by the Accountant on the Assessee is higher as compared to transactions such as sales/ purchase of goods, provision of services, etc. In these cases, while the Accountant should exercise due professional judgement and care, the onus to identify and disclose such transactions (i.e., deemed international transactions, free of cost services/ goods, etc.) is with the Assessee. Therefore, in such scenario Accountant is entitled to place reliance on management representation letter issued by the Assessee. However, it may be noted that in respect of matters that may be directly verified by the accountant, mere obtaining of a management representation letter will not be sufficient compliance with the Generally Accepted Auditing Standards.

Where Accountant’s Report is issued to non-resident Assessee and such non-resident is not statutorily required to maintain books of accounts in India under any law, the Accountant should place reliance on Form 26AS, invoices, agreements etc. The Accountant may also place reliance on documents, information and accounts maintained by the Indian Assessee with whom the non-resident Assessee has entered into international transaction(s).

Paragraph 3 of Form No. 3CEB requires the accountant to state whether the prescribed particulars are furnished in the annexure to the report and whether in his opinion and to the best of his information and according to the explanations given to him, they are true and correct. The accountant may have a difference of opinion with regard to the particulars furnished by the Assessee and he has to bring these differences under various clauses in Form No.3CEB. The accountant should make a specific reference to those clauses in Form No. 3CEB in which he has expressed his reservations, difference of opinion, disclaimer etc. in this paragraph.

In case the prescribed particulars are given in part or piecemeal to the accountant or the relevant form is incomplete and the Assessee does not give the information against all or any of the clauses, the accountant should not withhold the entire report. In such a case, he can qualify his report on matters in respect of which information is not furnished to him. In the absence of relevant information, the accountant would have no option but to state in his report that the relevant information has not been furnished by the Assessee. As a good practice, the Accountant should provide a note detailing the rationale of Accountant. Such note should be provided along with the Accountant’s Report.

Accountant should communicate basis for each position taken to the Enterprise in writing.

- Transfer Pricing

- « Previous Article

- Next Article »

Name: Suraj R. Agrawal

Qualification: ca in practice, company: transprice tax advisors llp, location: pune, maharashtra, india, member since: 11 feb 2019 | total posts: 56, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Channel

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Subscribe to Our Daily Newsletter

Latest posts.

Section 119(2)(b) Order passed without any reasoning remanded back to PCIT

Material gathered in search with no correlation to assessee cannot be said to pertain to assessee

Private Company Director’s Liability: Companies Act, Income Tax & GST

Counterfeit Currency Case: HC Grants Bail Due to Lack of 41A CrPC Notice

Mock Test Papers Series-II & Counselling Sessions for CA Exam

Weekly newsletter from Chairman, CBIC dated 13/05/2024

CGST Rule 86(A) not allows insertion of negative balances in Electronic Credit ledger: Telangana HC

Classification of Whole/Split/Cut Roasted Areca Nut: CAAR Delhi Ruling

A Bench of co-equal strength must follow decision of another Bench of co-equal strength

Deposits cannot be treated as Bogus merely because of common Directors

Featured posts.

Unlisted Shares: Capital Gain Tax and Its Reporting in ITR 2

Arrest cannot be Routine on mere CGST Act Violation Allegations: Bombay HC

Real-Time Feedback Monitoring in Annual Information Statement introduced

Live webinar: Block Credit in GST under Section 17(5)

Non-filing of e-Form CHG-4 for satisfaction of Charges: MCA imposes ₹19.50 Lakh Penalty

Applicability & Non-Compliance in Cost Records/Audit: MCA Notices & ICMAI Advisory

Live Course on How to Reply to GST Notices & SCN & to Fake ITC Notices? – Last day to Register

Non-filing of e-Form DIR-12 for Additional Director regularisation: MCA Imposes ₹6 Lakh Penalty

Non-Appointment of CS: MCA imposes a whopping ₹21.73 Lakh Penalty

Non-filing of E-Form CHG-1 for secured charge creation: MCA imposes ₹3.75 Lakh Penalty

Popular posts.

Due Date Compliance Calendar May 2024

Corporate Compliance Calendar for May, 2024

GST Implications on Hotels & Restaurant Industry

May, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines

Empanelment with Punjab & Sind Bank for Concurrent Audit: Last Date 08/06/2024

GST compliance calendar for May 2024

Time Limits in GSTR 3B for Late Input Tax Credit Claims

Importance of a Well-Crafted Signature for Chartered Accountants (CA)

CBDT Circular No. 6/2024: Relief for TDS Deductors on PAN-Aadhar Linkage

SC explains Principals of Condonation of delay

IMAGES

VIDEO

COMMENTS

Reliance on Management Representations.02 During an audit, management makes many representations to the au-ditor, both oral and written, in response to specific inquiries or through the fi-nancial statements. Such representations from management are part of the audit evidence the independent auditor obtains, but they are not a substitute

Management representation letters serve as a formal attestation from a company's executives to the auditors, confirming the veracity of the financial statements and disclosures. These letters are a professional necessity, providing auditors with assurances that all relevant information has been disclosed.

Written Representations as Audit Evidence ... .A22 Management's representations may be limited to matters that are considered either individually or collectively material to the financial state- ... ever,possession of the signed management representation letter prior to re-

The management representation letter is a key audit evidence prepared at the completion of the audit process. It contains management's assertions regarding: Fair presentation of financial statements. Completeness of information provided to auditors. Proper accounting policies used.