Digital Innovation and Transformation

Mba student perspectives.

- Assignments

- Assignment: Data and Analytics as…

ZARA: Achieving the “Fast” in Fast Fashion through Analytics

How does fast fashion make any business sense? Zara uses intensive data and analytics to manage a tight supply chain and give customers exactly what they want.

Introduction

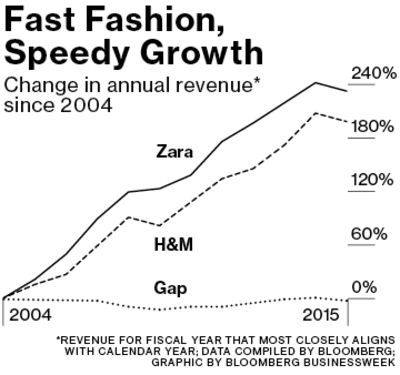

Zara’s parent company Inditex has managed to thrive in the last decade while several other fashion retailers have faced declining sales or stagnant growth. Inditex has grown over 220% in annual revenue since 2004, more than its key competitors like H&M, Gap, or Banana Republic (1).

The value of a fast fashion brand is to bring the latest designs and “trendiest trends” into the market as quickly as possible, preferably as soon as they became hot on the catwalk, and to provide these at a reasonable price. The traditional fashion industry is not well equipped to provide such value as it operates on a bi-annual or seasonal basis, with long production lead times due to outsourced manufacturing to low cost-centers. Zara has turned the industry on its head by using data and analytics to track demand on a real-time, localized basis and push new inventory in response to customer pull. This enables them to manage one of the most efficient supply chains in the fashion industry, and to create the fast fashion category as a market leader.

Pathways to a Just Digital Future

How Zara Uses Data

Inditex is a mammoth retailer, producing over 840 million garments in a year, the majority of which are sold by Zara (2). Every item of clothing is tagged with an RFID microchip before it leaves a centralized warehouse, which enables them to track that piece of inventory until it is sold to a customer (3). The data about the sale of each SKU, inventory levels in each store, and the speed at which a particular SKU moves from the shelf to the POS is sent on a real time basis to Inditex’s central data processing center (see picture below). This center is open 24 hours a day and collects information from all 6000+ Inditex stores across 80+ countries and is used by teams for inventory management, distribution, design and customer service improvements (4).

Zara’s Data Processing Center receives real-time data from around the world (4).

When the apparel arrives in store, RFID enables the stockist to determine which items need replenishing and where they are located, which has made their inventory and stock takes 80% faster than before (3). If a customer needs a particular SKU, salespeople are able to serve them better by locating it immediately in store or at a nearby location. Moreover, every Zara location receives inventory replenishments twice a week, which is tailored to that stores real-time updates on SKU-level inventory data.

The sales tracking data is critical in enabling Zara to serve its customers with trends that they actually want, and eliminate designs that don’t have customer pull. Zara’s design team is an egalitarian team of over 350 designers that use inspiration from the catwalk to design apparel on daily basis. Every morning, they dive through the sales data from stores across the world to determine what items are selling and accordingly tailor their designs that day. They also receive qualitative feedback from empowered sales employees that send in feedback and customer sentiment on a daily basis to the central HQ e.g., “customers don’t like the zipper” or “she wishes it was longer” (1).

At the start of the planning process, Zara orders very small batches of any given design from their manufacturers (even just 4-6 of a shirt per store). The majority of Zara’s factories are located proximally in Europe and North Africa, enabling them to manufacture new designs close to home and ship them to their stores within 2-3 weeks. They then test these designs in store, and if the data suggests the designs take off, Zara can quickly order more inventory in the right sizes, in the locations that demanded it. Such store-level data allows Zara to be hyper-local in serving their customer’s needs – as tastes can vary on a neighborhood level. As Inditex’s communication director told the New York Times,

“ Neighborhoods share trends more than countries do. For example, the store on Fifth Avenue in Midtown New York is more similar to the store in Ginza, Tokyo, which is an elegant area that’s also touristic. And SoHo is closer to Shibuya, which is very trendy and young.” (5)

Unlike other retailers that may order inventory based on their hypotheses about tastes at a regional level, Zara is tailors its collections based on the exact zip code and demographic that a given location serves (5).

Zara’s Results vs. Competitors

Zara sells over 11,000 distinct items per year versus its competitors that carry 2,000 to 4,000. However Zara also boasts the lowest year-end inventory levels in the fashion industry. This lean working capital management offsets their higher production costs and enables them to boast rapid sales turnover rates.

At Zara, only 15% to 25% of a line is designed ahead of the season, and over 50% of items are designed and manufactured in the middle of a season based on what becomes popular (2). This is in direct contrast to a close competitor like H&M where 80% of designs are made ahead of the season, and 20% is done in real-time during the season (6). Most other retailers commit 100% of their designs ahead of a season, and are often left with excess inventory that they then have to discount heavily at season-end. Instead, Zara’s quick replenishment cycles create a sense of scarcity which might actually generate more demand:

“With Zara, you know that if you don’t buy it, right then and there, within 11 days the entire stock will change. You buy it now or never.” (5)

- https://www.bloomberg.com/news/articles/2016-11-23/zara-s-recipe-for-success-more-data-fewer-bosses

- http://www.digitalistmag.com/digital-supply-networks/2016/03/30/zaras-agile-supply-chain-is-source-of-competitive-advantage-04083335

- http://static.inditex.com/annual_report_2015/en/our-priorities/innovation-in-customer-services.php

- http://www.refinery29.com/2016/02/102423/zara-facts?utm_campaign=160322-zara-secrets&utm_content=everywhere&utm_medium=editorial&utm_source=email#slide-11

- http://www.nytimes.com/2012/11/11/magazine/how-zara-grew-into-the-worlds-largest-fashion-retailer.html?pagewanted=all

- https://erply.com/in-the-success-stories-of-hm-zara-ikea-and-walmart-luck-is-not-a-key-factor/

Student comments on ZARA: Achieving the “Fast” in Fast Fashion through Analytics

Great post Ravneet – I had never read about Zara’s extremely quick supply chain or hyper-local testing. I have a question for you about fast fashion in general, but especially for Zara since it produces and sells more distinct items than its competitors: it seems that many designers are not fond of the “runway-inspired” fashions sold at these stores and some have even sued stores for copying their designs. Do you think Zara and other brands like it are doing anything wrong, and if not, what recourse do designers have for “imitations” of their work?

Thanks for the post Ravneet. Zara and H&M are beacons of hope for a mostly distressed industry. Do you think Zara’s advantage could be sustained in the event of a full-on assault by the Amazons of the world?

Leave a comment Cancel reply

You must be logged in to post a comment.

Nirmalya Kumar

Professor, Author, Art Lover

Zara: Fast Fashion and RFID

Last month I had the opportunity to visit Zara headquarters in La Coruna, Spain for a second time. A decade since my last visit, this company has continued to blaze a trail in the apparel industry, inventing what is now dubbed as “fast fashion.” Sales in 2017 for Inditex, the holding company (Zara accounts for more than 70% of revenues), exceeded 25 billion Euros. On one particular day of 2017, Forbes dubbed the owner, Amancio Ortega, as the richest man in the world!

The supply chain and operations of Zara are world class and innovative, which is why it has been a staple in my teaching repertoire for many years. On this trip, keen to learn what is new at Zara, I encountered their efforts with RFID.

For those who are unaware, RFID (Radio-Frequency Identification) uses electromagnetic fields to automatically identify and track tags attached to objects. These are now frequently used to track packages and products. Given the challenge of managing inventories, logistics, and shrinkage (employees and customers stealing merchandise) in the retail industry, retailers have been seeking to tag their merchandise with RFID. Unfortunately, the cost of an RFID tag alone has been in excess of 10 cents, making it economically unviable for the cheap and low margin merchandise that is ubiquitous at retailers.

Zara made a big push for RFID starting in 2009, when the CEO gave a mandate that the Zara RFID model must be reusable and recyclable. It took five years of research, working with Tyco, before realizing that the RFID tag could be embedded within the security device that is on each product. This allows the RFID to be recycled along with the security device when the latter is removed at the checkout counter on purchase of an item by the customer. In early 2018, the RFID costs less than 8 cents. With each RFID being recycled at least 10 times, Zara has found a cost-effective solution.

As an item is sold, the store management immediately knows it via the RFID, and as a result, someone is immediately despatched to the store stockroom to replace it. Zara’s display strategy is for each item to have four sizes on display – small, medium, large, and extra-large. RFID also helps know the rate of sales of different items at the store level and with online sales fulfilment.

A pistol-like gadget running across the display can tell how much inventory there is, and how that portion of store is selling compared to other areas as well as to the previous years. RFID has also enabled taking month end inventory to become a small two-person job, instead of having all the staff working intensively on this task.

Today, each and every item at Zara is tagged with RFID and this will be rolled out to the other Inditex brands (e.g., Bershka, Massimo Dutti, Pull&Bear) in the coming years.

Previously, people had to choose between the expensive fashion house merchandise and the mass market garments available in cheaper outlets. Zara essentially democratized fashion for the world by offering fashion similar to the brand name designers at reasonable prices. Their RFID strategy fits consistently with this vision and business model.

Latest Book : http://bit.ly/ThinkingSmart

Magic Dust: Mumbai Mirror – Small Talk: Fired, and Proud of it

I invite you to follow me on Twitter @ProfKumar and LinkedIn .

Share this post:

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to print (Opens in new window)

Leave a reply Cancel reply

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

- Oct 19, 2022

Inventory Visibility and Accuracy: A Case Study of How ZARA Using Technology and Speed to Become the

ZARA, a wholly owned subsidiary of Inditex group, was launched in 1975, in Galicia, Spain. ZARA is one of the largest international fashion stores with over 2000 physical stores in 96 countries.

ZARA specializes in fast fashion and launches over twenty new product lines per year, with brands covering clothing, accessories, shoes, perfumes, and beauty products. In 2010, ZARA launched its first online store in Jordan and expanded to other countries quickly.

On product strategy, ZARA adopted the principle of quick response, small quantity, and great variety of style. To cope with this strategy, ZARA has invested a lot on implementing just-in-time approach, RFID technology, and Cloud-based inventory management system, in order to manage the complex supply chain.

Just-In-Time (JIT)

Changes and updates offer more reasons for customers to visit the stores and keep their shopping experience fresh.

ZARA changes its apparel design every 2 weeks on average, while the competitors change theirs every 2 or 3 months. To be the lead of the market and compete on its speed to market, ZARA implemented just-in-time (JIT) and production in-house.

Just-in-time (JIT) is a strategy that encourage the company to generate the order of material and intermediate products only when required. This method helps the company to effectively reduce the production wastage, and the cost of storing and maintenance of inventory, which is especially suitable for ZARA – a fast changing fashion company.

ZARA started implementing RFID technology in its stores and warehouses in 2014. The RFID tag is buried inside the plastic security tag of each product, and this allows ZARA to track the item throughout the whole process from production until it's sold.

Before RFID system was implemented, ZARA’s staff had to scan one barcode at a time, so lots of staff and time have to be involved in each inventory-taking task, and hence, they would carry out the inventory count once every six months only.

The RFID system allows the warehouse to take inventory counting quickly, and now, they can carry out the inventory count every 6 weeks, and this helps ZARA to get a clearer picture on what products are popular and what are growing weak, and results in a better demand forecast.

Cloud-based Inventory Management

ZARA is now using a cloud-based inventory management system , and its integrated solutions allow ZARA to fulfill online orders from physical stores or warehouse, and this enables ZARA to allocate their stock more effectively and shorten the order waiting time.

Since ZARA will change their apparel design every 2 weeks, supply chain visibility and inventory accuracy become more important to them. The cloud-based platform allows everyone on ZARA’s team to check inventory levels, review orders and be productive from anywhere and anytime.

To execute the just-in-time approach, ZARA will need a high inventory visibility to monitor the demand, to allow them to plan their replenishment accurately to meet customer expectations, seasonal or even unexpected demand changes.

The Importance of Technology

To maintain the market leading position, ZARA keeps improving their business process to keep their service standard and set the bar even higher.

By developing and implementing cutting-edge technologies, such as RFID and cloud-based inventory management system, ZARA is able to make big savings in inventory, which is a major expense for many fashion companies, and hence, increase the profit.

Are you ready to grow by adopting new technologies? Want to explore more about how technology can help your business?

Contact us today and we will provide you with professional consulting and technical assistance.

NetSuite Solutions: https://www.linkage-retail.com/netsuite-cloud-erp

You can reach us by:

Webpage: https://www.linkage-retail.com/

WhatsApp: +852 3157 1384

Email: [email protected]

Recent Posts

F&B Industry Solutions: Frozen Food Shop

Food & Beverage Technology Trends - Cloud Kitchen

How Does Technology Improve Efficiency In The Restaurant?

- InternetRetailing

- Retail Media

- Sustainability

- Merchandise

- Performance

- RetailCraft Podcast

- Subscription Podcast

- DeliveryX: Beyond the Buy Button Podcast

- Video Channel

- Browse All Reports

- Sector Reports

- Country Reports

- Ranking Reports

- Marketplace Reports

- Whitepapers

Featured Reports

- Top500 2024

- Growth 1000 2023

- Global Elite 1000 2023

- RetailX Brand Index 2023

- RetailX Europe Growth 3000 2024

- RetailX Europe Ecommerce Region 2023

Buy Data pack

- RetailX European TOP1000 Data Pack 2023

- RetailX Top500 2024 Data Pack

- Download Free Sample Data Pack

- RetailX Events

- RetailX Events Spring Festival

- SubscriptionX

- SustainabilityX

- Ecommerce World Review

- Upcoming Webinars

- Upcoming Events

- Past Events

- ChannelX World

- Editorial Calendar

- Join our Press List

- Work with us

- Research Partners

- Terms and Conditions

- Privacy Policy

You are in: Home » Research Articles » Research Articles » Case Study: Zara: testing, testing, one-two-three

Case Study: Zara: testing, testing, one-two-three

By jonathan wright.

Zara: seeing online and in-store sales grow

Zara, the Spain-headquartered fast-fashion retailer, has long innovated with its merchandising and promotion tactics and, in the past year, that push has continued. Perhaps the most striking work it does is in using test facilities, pop-ups and prototypes to explore and refine its approach to selling.

In April of 2018, it launched an augmented reality (AR) add-on to its app that allows shoppers to see the clothes they are examining ‘come to life’. The embedded tool works by allowing shoppers in-store and online to hold the app over certain signs and see models wearing the clothes move about on the screen. These models can (and do) even talk about the clothes. Plus, naturally, all of the outfits can be purchased via a single tap of the app.

Another merchandising move by Zara that’s notable is its opening of a store at Westfield Stratford City in London dedicated to click-and-collect orders. The store opened in January 2018 for a four-month run while the refurbishment and extension of the company’s existing flagship store at the centre continued.

Staff at the store were equipped with mobile devices to assist customers, who received orders on the same day if ordering before 2pm. The store also embedded technology to help recommend items to customers, with information screens embedded into mirrors triggered by RFID.

As it enters new markets in Africa in particular, Zara is also trying out several new approaches. It is curating collections of its merchandise, as well as developing visual tours it labels ‘stories’. Turnover of stock will also drive its approach, with a roll-out of new offerings in its collections for men, women and children happening twice each week.

Zara’s embrace of testing is also in evidence in the ‘secret’ pilot stores it runs at its Spanish HQ. It uses the stores to mock up and try out future store designs, employing a full-time team of architects and visual merchandising experts to curate and work on the stores, from decor to lighting choices to music to the positioning and display of the clothes.

There is a pilot store for each of the retailer’s core categories: women’s, men’s, home and the trendy TRF range aimed at younger customers.

Zara’s emphasis on merchandising is in part a reflection of its decision not to run conventional advertising. It means the stores and its websites effectively serve as the public face of the brand – and have to deliver personality as well as individual sales.

Register for Newsletter

Receive 3 newsletters per week

Gain access to all Top500 research

Personalise your experience on IR.net

Privacy Overview

- Manage Account

site categories

Self-service second thoughts, material world, byte-sized ai, zara increases rfid implementation for faster fast fashion.

By Tara Donaldson

Tara Donaldson

pmc-editorial-manager

- Share this article on Linkedin

- Share this article on Facebook

- Share this article on Flipboard

- Print this article

- Share this article on Pinit

- Share this article on Reddit

- Share this article on Twitter

- Share this article on Tumblr

- Share this article on Whatsapp

- Share this article on Email

- Share this article on Comment

If Zara ’s speed to market was not yet speedy enough, its parent company Inditex recently announced it would add radio frequency identification ( RFID ) tagging to its supply chain processes in a much bigger way.

The technology will allow for garment tracking from logistics platforms through to ultimate sale.

Inditex chairman and CEO Pablo Isla announced the move at its annual shareholders meeting Tuesday and said the innovative technology will make distribution more efficient, in-store garment management more accurate, and improve customer service standards.

“Implementation of this next-generation technology is one of the most significant changes in how the Group’s stores operate,” Isla said. RFID technology is already present in more than 700 Zara stores, and is currently being rolled out further. All of the retailer’s logistics centers already use RFID, and Inditex expects to have the tracking technology installed in all of its Zara stores by 2016. Following the full implementation at Zara, Inditex expressed plans for a gradual rollout across the rest of its brands, including Massimo Dutti and Bershka, at a rate of roughly 500 additional stores each year.

Zara has been known for its keen ability to get fashion from runway to sales floor, often before the customer even realizes which trend they’re after. This speedy turnaround is owed in part to Inditex’s centralized distribution system in which product goes from suppliers to distribution centers in its Spanish home base before being forwarded on to stores.

With the RFID technology, each garment is coded in the logistics centers, so that when Zara gets its twice-weekly store shipments, the system immediately pinpoints which sizes and models need replenishing, making the retailers whole product to market process that much faster. Using RFID will also allow Zara to maximize its omnichannel offering– key to targeting today’s ever connected consumer –by being able to immediately identify for a shopper whether a size is available in-store, in another store nearby, or online.

SJ Newsletters

Receive Our Daily Newsletter & Special Offers

SJ Recommends

Selfridges set for job cuts, citing freeze on tax-free shopping, zulily parent beyond’s bringing back apparel & footwear to overstock, after backlash, target will only sell pride merchandise in select stores this year, frasers, boohoo and shein have more in common than you think.

Copyright © 2024 Penske Business Media, LLC. All Rights reserved.

Topics Expand topics menu

- Consumer Insights

- Fashion Trends

- Lifestyle Monitor

- Raw Materials

- Thought Leadership

- Trade Shows

Market Data Expand market-data menu

- Market News

- Import/Export

- Other Raw Materials

Denim Expand denim menu

- Influencers

- Innovations

Footwear Expand footwear menu

- Supply Chain

Home Expand home menu

- Furnishings

Sustainability Expand sustainability menu

Webinars expand webinars menu, reports expand reports menu, video expand video menu, events expand events menu, sj studio expand sj-studio menu.

How Zara’s strategy made her the queen of fast fashion

Table of contents, here’s what you’ll learn from zara's strategy study:.

- How to come up with disruptive ideas for your industry.

- How finding the right people is more important than developing the best strategy.

- How best to address the sustainability question.

Zara is a privately held multinational clothing retail chain with a focus on fast fashion. It was founded by Amancio Ortega in 1975 and it’s the largest company of the Inditex group.

Amancio Ortega was Inditex’s Chairman until 2011 and Zara’s CEO until 2005. The current CEO of Zara is Óscar García Maceiras and Marta Ortega Pérez, daughter of the founder, is the current Chairwoman of Inditex.

Zara's market share and key statistics:

- Brand value of $25,4 billion in 2022

- Net sales of $19,6 billion in 2021

- 1,939 stores worldwide in 2021

- Over 4 billion annual visits to its website

- Inditex employee count of 165,042 in 2021

{{cta('ba277e9c-bdee-47b7-859b-a090f03f4b33')}}

Humble beginnings: How did Zara start?

Most people date Zara’s birth to 1975, when Amancio Ortega and Rosalia Mera, his then-wife, opened the first shop. But, it’s impossible to study the company’s first steps, its initial competitive advantage, and strategic approach by starting at that point in time.

When the first Zara shop opened, Amancio Ortega already had 22 years of industry experience, ten years as a clever and hard-working employee, and 12 years as a business owner. Rosalia Mera also had 20 years of industry experience.

As an employee , Ortega worked in the clothing industry, first as a gofer and then as a delivery boy. He quickly demonstrated great talent for recognizing fabrics, understanding and serving customers, and making sound business suggestions. Soon, he decided to use his insights to develop his own business instead of his boss’s.

As a business owner , he started GOA Confecciones in 1963, along with his siblings, his wife, and a close friend. They started with a humble workshop making women’s quilted dressing gowns, following a trend at the time Amancio had noticed. Within ten years, that workshop had grown to support a workforce of 500 people.

And then, the couple opened the first Zara shop.

Zara’s competitive positioning strategy in its first year

The opening of the first Zara shop in 1975 wasn’t just a new store to sell clothes. It was the final big move of a carefully planned vertical integration strategy.

To understand how the strategy was formulated , we need to understand Amancio’s first steps. His first business, GOA Confecciones, was a manufacturing business. He was supplying small stores and businesses with his products, and he wasn’t in contact with the end customer.

That brought two challenges:

- A lack of insight into market trends and no direct consumer feedback about preferences.

- Very low-profit margins compared to the 70-80% profit margin of retailers.

Amancio developed several ideas to improve distribution and get a direct relationship with the final purchaser. And he was always updating his factories with the latest technological advancements to offer the highest quality of products at the lowest possible price. But he was missing one essential part to reap the benefits of his distribution practices: a store .

So, in 1972 he opened one under the brand name Sprint . An experiment that quickly proved unsuccessful and, seven years later, was shut down. Although it’s unknown the extent to which Amancio put his ideas to the test, Sprint was a private masterclass in the retail world that gave Amancio insights that would later turn Zara into a global success.

Despite Sprint’s failure, Amancio didn’t abandon the idea of opening his own store mainly because he believed that his advanced production model was vulnerable and the rise of a competitor who could replicate and improve his system was imminent.

Adding a store to his vertical integration strategy would have a twofold effect:

- The store would operate as a direct feedback source. The company would be able to test design ideas before going into mass production while simultaneously getting an accurate pulse of the needs, tastes, and fancies of the customers. The store would simultaneously reduce risk and increase opportunity spotting.

- The company would have reduced operating costs as a retailer. Since the group would control all aspects of the process (from manufacturing to distribution to selling), it would solve key retail challenges with stocking. The savings would then be passed on to the customer. The store would have an operational competitive advantage and become a potential cash cow for the company.

The idea was to claim his spot in prime commercial areas (a core and persistent strategic move for Zara) and target the rising middle class. The market conditions were tough, though, with many family-owned businesses losing their customer base, giant players owning a huge market share, and Benetton’s franchising shops stealing great shop locations and competent potential managers.

So the first Zara store had these defining characteristics that made it the successful final piece of Amancio’s strategy:

- It was located near the factory = delivery of products was optimized

- It was in the city’s commercial heart = more expensive, but with access to affluence

- It was located in the city where Ortegas had the most customer experience = knowing thy customer

- It was visibly attractive = expensive, but a great marketing trick

Amancio’s team lacked experience and expertise in one key factor: display window designing . The display window was a massive differentiator and had to be bold and attractive. So, Amancio hired Jordi Bernadó, a designer with innovative ideas whose work transformed display windows and the sales process.

The Zara shop was a success, laying the foundations for the international expansion of the Inditex group.

Key Takeaway #1: Challenge your industry’s conventional wisdom to create a disruptive strategy

Disrupting an industry isn’t an easy task nor a frequent occurrence.

To do it successfully, you need to:

- Understand the prominent business mode of your industry and the forces that contributed to its development.

- Challenge the assumptions behind it and design a radically different business model.

- Develop ample space for experimentation and failures.

The odds of instantly conquering the industry might be low (otherwise, someone would have already done it), but you’ll end up with out-of-the-box ideas and a higher sensitivity to potential disruptors in your competitive arena.

Recommended reading: How To Write A Strategic Plan + Example

How Zara’s supply chain strategy is at the core of its business strategy

According to many analysts, the Zara supply chain strategy is its most important innovative component.

Amancio Ortega and other senior members of the group disagree. Nevertheless, the Inditex logistics strategy is extraordinarily efficient and plays a crucial role in sustaining its competitive advantage. Most companies in the clothing retail industry take an average of 4-8 weeks between inception and putting the product on the shelf. The group achieves the same in an average of two weeks. That’s nothing short of extraordinary.

Let’s see how Zara developed its logistics and business strategy.

Innovative logistics: how Zara’s supply chain evolved

The logistics methods developed by companies are highly dependent on external factors.

Take, for example, infrastructure. In the early days of Zara, when it was expanding through Spain, the company considered using trains as a transportation system. However, the schedule couldn’t keep up with Zara’s needs, which had the goal of distributing products twice a week to its shops. So transportation by road was the only way.

However, when efficiency is a high priority, it shapes logistics processes more than anything else.

And for Zara, efficient logistics was – and still is – of the highest priority.

Initially, leadership tried outsourcing logistics, but the experiment failed and the company assigned a member of the house with a thorough knowledge of the company's operating philosophy to take charge of the project. The tactic of entrusting important big projects to employees imbued with the company’s philosophy became a defining characteristic.

So, one of Zara’s early strategic decisions was that each shop would make orders twice a week. Since the first store was opened, the company has had the shortest stock rotation times in the industry. That’s what drove the development of its logistics methods. The whole strategy behind Zara relied on quick production and distribution. And the proximity of manufacturing and distribution was essential for the model to work. So Zara had these two centers in the same place.

Even when the brand was expanding around the world, its logistics center remained in Arteixo, Spain, despite being a less-than-ideal location for international distribution. At some point, the growth of the brand, and Inditex as a whole, outpaced Arteixo’s capacity, and the decentralization question came up.

The debate was tough among leadership, but the arguments were strong. Decentralization was necessary because of:

- Safety and security. If there was a fire or any other crippling disaster there (especially on a distribution day), then the company would face serious troubles on multiple fronts.

- Arteixo’s limitations. The company’s center in Arteixo was reaching its capacity limits.

So the company decided to decentralize the manufacturing and distribution of its brands.

Initially, the group made the decision to place differentiated logistics centers where the management of its chain of stores was based, i.e. Bershka would have a different logistics center than Pull&Bear, although they were both part of the Inditex Group. That idea emerged after Massimo Dutti and Stradivarius became part of Inditex. Those brands already had that geographical structure, and since the group integrated them successfully into its strategy and logistics model, it made sense to follow the same pattern with its other brands.

Besides, the proximity of the distribution centers to the headquarters of each brand allowed them to consolidate them based on the growth strategy and purpose of each brand (more on this later).

But just a few years after that, the group decided to build another production center for Zara that forced specialization between the two Zara centers. The specialization was based on location, i.e. each center would manufacture products that would stock the shelves of stores in specific locations.

Zara’s supply chain strategy is so successful because it’s constantly evolving as the group adapts to external circumstances and its internal needs. And just like its iconic fashion, the company always stays ahead of the logistics curve.

Zara’s business strategy transcends its logistics innovations

Zara’s business strategy relies on four key pillars:

- Flexibility of supply

- Instant absorption of market demand

- Response speed

- Technological innovation

Zara is the only brand in the Inditex group that is concerned with manufacturing. It’s the first brand in the clothing sector with a complete vertical organization. And the production model requires the adoption or development of the latest technological innovations.

This requirement is counterintuitive in the clothing sector.

Most people believe that making big investments in a market as mature as clothing is a bad idea. But the Zara production model is very capital and labor intensive. The technological edge derived from that investment gave the company, in the early days, the capability to manufacture over 50% of its own products while maintaining an extremely high stock rotation frequency.

Zara might be one of the best logistics companies in the world, but that particular excellence is a supporting factor, or at least a highly contributing factor, to its successful business strategy.

Zara’s business strategy is so much more than its supply chain strategy.

The company created the “fast fashion” term and industry. When other companies were manufacturing their collections once per season, Zara was adapting its collection to suit what people asked for on a weekly basis. The idea was to offer fashionable items at a fair price and faster than everybody else.

Part of its cost-cutting strategic priority was its marketing strategy. Zara didn’t – and still doesn’t – advertise like the rest of the clothing industry. Its marketing strategy starts with choosing the location of the stores and ends with advertising that the sales period has started. In the early years of the brand’s expansion, Amancio would visit potential store locations himself and choose the site to build the Zara shop.

The price was never an issue. If the location was in a commercial center, Zara would build its store there no matter how high the cost was because the company expected to recoup it quickly with increased sales.

Zara’s marketing is its own stores.

The strategy of Zara and her Inditex sisters

Despite Zara’s success (or because of it), Amancio Ortega created – or bought – multiple other brands that he included in the Inditex group, each one with a specific purpose.

- Zara was targeting middle-class women.

- Pull&Bear was targeting young people under twenty-five years old with casual clothing.

- Bershka was targeting rebel teens, especially girls, with hip-hop-style clothing.

- Massimo Dutti was targeting both sexes with more affluence.

- Stradivarius was competing with Bershka, giving Inditex two major brands in the teenage market.

- Oysho was concentrating on women's lingerie.

- Zara Home manufactures home textiles and decor.

Pull&Bear was initially targeting young males between the ages of 14 and 28. Later it extended to young females of the same age and focused on selling leisure and sports clothing. It has the slowest stock turnaround time in the group.

Bershka’s target group was girls between 13 and 23 years of age with highly individualized tastes. Prices were low, but the quality average. Almost a fiasco in the beginning, it underwent a successful strategic turnaround becoming today one of the biggest growth opportunities for the group. And out of all the Inditex chains, Bershka has the most creative designs.

Massimo Dutti was the first retail brand Amancio bought and didn’t create himself. Its strategy is very different from Zara, producing high-quality products and selling them at a high price. It’s an extension of the group’s offer to the higher end of the price spectrum in the fashion industry. It’s also the only Inditex chain brand that advertises regularly.

Stradivarius was the second acquired brand, with the purchase being a defensive move. The chain shares the same target group with Bershka, making it, to this day, a direct competitor.

Oysho started as an underwear and lingerie company. Its product lines evolved to include comfortable night and homewear along with swimwear and a very young children’s line. The brand’s strategy was aggressive from its conception, opening 286 stores in its first six years of existence.

Zara Home is the youngest brand in the Group and the only one outside the clothing sector, though still in the fashion industry. It was launched with the least confidence and with immense prior research. An experiment to extend the Zara brand beyond clothing, it was based on the conservative view that Zara could extend its product categories only to textile items for the home. But it turned out that customers were more accepting of Zara Home selling a wide variety of domestic items. So the brand made a successful strategic pivot.

Key Takeaway #2: The right people are more important than the best strategy

It might not be obvious in the story, but a key reason for Zara's and Inditex’s success has been the people behind them.

For example, a vast number of people in various positions from inside the group claim that Inditex cannot be understood without Amancio Ortega. Additionally, major projects like the development of Zara’s logistics systems and the group's international expansion had such a success precisely because of the people in charge of them.

Zara’s radically different model was a breakthrough because:

- Its leadership had a clear vision and a real strategy to execute it.

- People with a deep understanding of the company’s philosophy led Its largest projects.

Sustainability: Zara’s strategy to make fast fashion sustainable

Building a sustainable business in the fast fashion industry is a tough nut to crack.

To achieve it, Inditex has made sustainability a cornerstone of its business model. Its strategy revolves around the values of collaboration , transparency, and innovation . The group’s ambition is to make a positive impact with a vision of prosperity for the planet and its people by transforming its value chain and industry.

Inditex’s sustainability commitments and strategy to achieve them

Inditex has developed a sustainability roadmap that extends up to 2040 with ambitious goals. Specifically, it has committed to

- 100% consumption of renewable energy in all of its facilities by 2022 (report pending).

- 100% of its cotton to originate from more sustainable sources by 2023.

- 100% of its man-made cellulosic fibers to originate from more sustainable sources by 2023.

- Zero waste from its facilities by 2023.

- 100% elimination of single-use plastic for customers by 2023.

- 100% collection of packaging material for recycling or reuse by 2023.

- 100% of its polyester to originate from more sustainable sources by 2025.

- 100% of its linen to originate from sustainable sources by 2025.

- 25% reduction of water consumption in its supply chain by 2025.

- Net zero emissions by 2040.

The group’s commitments extend beyond environmental issues to how its manufacturing and supplying partners conduct their business . To bring its strategy to fruition, it has set up a new governance and management structure.

The Board of Directors is responsible for approving Inditex’s sustainability strategy. The Sustainability Committee oversees and controls all the proposals around the social, environmental, health, and safety impact of the group’s products, while the Ethics Committee makes sure operations are compliant with the rules of conduct. There is also a Social Advisory Board that includes external independent experts that advises Inditex on sustainability issues.

Finally, Javier Losada, previously the group’s Chief Sustainability Officer and now promoted to Chief Operations Officer, will be leading the sustainability transformation of the group. Javier Losada first joined Inditex back in 1993 and ascended its rank to reach the C-suite.

Inditex is dedicated to its commitment to reducing its environmental impact and seems to be headed in the right direction. The only question is whether it’s fast enough.

Key Takeaway #3: Integrating sustainability with business strategy is a present-day necessity

Governments and international bodies around the world are implementing more stringent environmental regulations, forcing companies to commit to ambitious goals and developing a realistic strategy to achieve them.

The companies that are impacted the least are those that always had sustainability as a high priority .

From the companies that require significant changes in their operations to comply with the new regulations, only those who integrate sustainability into their business strategy and model will succeed.

Why is Zara so successful?

Zara is the biggest Spanish clothing retailer in the world based on sales value. Its success is due to its fast fashion strategy that is based on a strong supply chain and quick market feedback loops.

Zara's customer-centric approach places a strong emphasis on understanding and responding to customer needs and preferences. This is reflected in the company's product design, marketing, and customer service strategies.

Zara made fashionable clothes accessible to the middle class.

Zara’s vision guides its future

Zara's vision, as part of the Inditex Group, is to create a sustainable fashion industry by promoting responsible consumption and production, respecting the environment and people, and contributing to the communities in which it operates.

The company aims to offer the latest fashion trends to its customers at accessible prices while continuously innovating and improving its operations and processes.

Growth by numbers (Inditex)

BUS303: Strategic Information Technology

Zara: Fast Fashion from Savvy Systems

Both Zara and The Gap are retail online clothing giants in the fashion s industry. Zara, now worldwide, was founded in Spain. The Gap, also now worldwide, is a US Corporation. Both companies made a critical strategic decision on the future growth of their companies, with Zara taking the lead to move their significant marketing online. Gap later followed. Both still make retail sales but are positioned on the Internet. Zara currently has over 1M hits on its website each month. Read this chapter to understand how early the use of IT, particularly data collection and analysis, helps gain a competitive advantage. How did Zara use data to make early decisions about its business operations? How did Zara's use of data compare to Gap's?

Introduction

Learning objective.

After studying this section you should be able to do the following:

- Understand how Zara's parent company Inditex leveraged a technology-enabled strategy to become the world's largest fashion retailer.

The poor, ship-building town of La Coruña in northern Spain seems an unlikely home to a tech-charged innovator in the decidedly ungeeky fashion industry, but that's where you'll find "The Cube," the gleaming, futuristic central command of the Inditex Corporation (Industrias de Diseño Textil), parent of game-changing clothes giant, Zara. The blend of technology-enabled strategy that Zara has unleashed seems to break all of the rules in the fashion industry. The firm shuns advertising and rarely runs sales. Also, in an industry where nearly every major player outsources manufacturing to low-cost countries, Zara is highly vertically integrated, keeping huge swaths of its production process in-house. These counterintuitive moves are part of a recipe for success that's beating the pants off the competition, and it has turned the founder of Inditex, Amancio Ortega, into Spain's wealthiest man and the world's richest fashion executive.

Zara's operations are concentrated in Spain, but they have stores around the world like these in Manhattan and Shanghai.

The firm tripled in size between 1996 and 2000, then its earnings skyrocketed from $2.43 billion in 2001 to $13.6 billion in 2007. By August 2008, sales edged ahead of Gap, making Inditex the world's largest fashion retailer. Table 1.1 "Gap versus Inditex at a Glance" compares the two fashion retailers. While the firm supports eight brands, Zara is unquestionably the firm's crown jewel and growth engine, accounting for roughly two-thirds of sales.

Table 1.1 Gap versus Inditex at a Glance

The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

News & Analysis

- Professional Exclusives

- The News in Brief

- Sustainability

- Direct-to-Consumer

- Global Markets

- Fashion Week

- Workplace & Talent

- Entrepreneurship

- Financial Markets

- Newsletters

- Case Studies

- Masterclasses

- Special Editions

- The State of Fashion

- Read Careers Advice

- BoF Professional

- BoF Careers

- BoF Insights

- Our Journalism

- Work With Us

- Read daily fashion news

- Download special reports

- Sign up for essential email briefings

- Follow topics of interest

- Receive event invitations

- Create job alerts

Fashion’s Stalled Self-Checkout Revolution

- Cathaleen Chen

Key insights

- Self-checkout is slowly gaining traction in fashion as retailers like Zara and Uniqlo have installed an improved version of the technology powered by RFID.

- Champions of self-checkout say it can make stores operate more efficiently, while sceptics see the feature as a enabler of theft.

- For now, a dual approach that combines the speediness of self-service with traditional human-operated registers may be the best option, analysts say.

NEW YORK — On a recent Thursday afternoon at Zara’s SoHo store, dozens of tourists and urban professionals shuffled along a checkout line that snaked halfway across the sales floor.

Upstairs, there was no line. Here, just two customers navigated a self-checkout station at a sleek, L-shaped white bar. Built into the bar are crates that automatically scanned their purchases and rang up the total on a screen above in a matter of seconds.

It wasn’t completely seamless. There were hiccups involving hangers and security tags. There were no instructions.

Even so, when asked if they’d use the self-checkout system again, the answer from both customers was a resounding yes. A little confusion about the security tag removal device, which only worked after the products were paid for, was a small price to pay for skipping the queue. “It was easy enough,” said one woman.

ADVERTISEMENT

Self checkout has an image problem. Many consumers still associate the technology with clunky self-scanning kiosks at the grocery store. Walmart and Dollar General have scaled back their use of the technology in recent months, citing operational efficiency and theft prevention, respectively. Target is limiting its self-checkout lanes to 10 items or fewer. After a 2018 trial, Spanish fast-fashion retailer Mango decided against offering self-checkout.

The technology is slowly gaining traction in fashion. Fashion retailers like Zara and Uniqlo typically install sleek stations that allow shoppers to place items in a bin to be priced using radio frequency identification , sidestepping the dreaded barcode scanner. At Uniqlo’s SoHo flagship, self-checkout bins have completely replaced cashier-operated registers. The bins will eventually be installed in all of the retailer’s roughly 2,400 stores globally.

Champions of the technology say self-checkout can make stores operate more efficiently — where Uniqlo has installed them, machines have cut transaction times by half, according to Takahiro Tambara, chief information officer at Uniqlo-parent Fast Retailing. The machines also have the potential to reduce labour costs by eliminating the need for cashiers and even drive sales in high-traffic locations where long lines can deter purchases.

But rollout has been slow and retailers are being cautious about fully embracing the technology, which has also been associated with an increase in theft. Self-checkout equipment is also expensive to implement; the scan-less checkout systems that Uniqlo and Zara deploy require their entire supply chains to be RFID-tagged, an intensive process that takes upwards of six months.

While acceptance is growing, particularly among young consumers, many shoppers prefer interacting with human employees. A study from Drexel University published earlier this year in the Journal of Business Research found that traditional, cashier-operated checkout services make customers more loyal to the store.

And the concept may never be a good fit for many brands. High-end stores see relatively few transitions on any given day, making streamlined checkout a less-pressing issue. Many brands — and not just in the luxury space — also make high-touch, or human, service part of the value proposition.

“When you think of someone buying a $150 bag, it almost feels like self-checkout would cheapen the service,” said Matt Moorut, marketing analyst at Gartner. “Fashion has been one of the slowest areas to make changes in checkout.”

For now, Uniqlo’s all-in approach to self-checkout is an outlier. Zara’s dual-service approach is more likely to be widely adopted: self-checkout for customers in a rush, and traditional checkout for sceptics and shoppers craving a personal touch.

“We are far from a seamless and pure value-add level of self-checkout,” said Simeon Siegel, analyst at BMO Capital Markets. “Trial is key … It needs to add more value than discomfort.”

A Trial-and-Error Approach

For self-checkout to work, retailers have to experiment with what configuration best fits their needs. Uniqlo began piloting its RFID self-checkout solution more than a decade ago, and the most recent iteration of the concept launched in 2019.

“We continuously made tweaks based on our learnings, to evolve to where it is today,” said Tambara. “Our first design included a lid that had to be closed to accurately scan the RFID tags, but having to shut and open a lid was an inconvenience to customers, so we found a solution to eliminate it.”

Even today, Uniqlo’s self-checkout offering isn’t perfect; at the kiosks in its SoHo store, all the shopping bags are placed toward the end of the checkout section rather than in individual stations, causing some shoppers to walk over to the bags and then return to their station again to complete their transactions.

Every retailer has its own needs when it comes to self-checkout, said Moorut of Gartner, pointing to UK retailer Marks & Spencer, which in addition to self-checkout, offers self-service for in-store online returns and pickup.

Preventing ‘Shrink’

According to a 2023 survey conducted by LendingTree, an online loans marketplace, one in five respondents said they’ve accidentally taken items during self-checkout. One in seven admitted to stealing.

While RFID technology eliminates the tedium of scanning — and the opportunity for error or intentional skips — it hardly mitigates theft, analysts say. Zara’s RFID self-checkout stations equipped with security tag removal devices in fact might pose a heightened risk for shoplifting, said Siegel.

“It’s somewhat ironic the tag designed to specifically prevent theft can be removed by the potential thief,” he said. A number of retailers, including Uniqlo, don’t use security tags at all. Instead, a number of store associates are placed at the checkout stations for customer assistance, while other store personnel are dedicated to loss prevention, the company said.

But RFID could soon serve an anti-theft function, according to Spencer Hewett, founder and chief executive of Radar, a technology company that works with American Eagle and other major apparel retailers that already deploy RFID technology for real-time inventory visibility.

Radar’s RFID scanning sensors can detect when customers interact with and carry items throughout the store. When combined with cameras, this feature would be able to detect the exact number of products customers bring to the station so that if that doesn’t match the number of pieces rung up in the point-of-sales system, there will be a notification on the screen and store personnel would be alerted.

Radar is planning to launch its checkout function within the year.

For now, “self-checkout in fashion is still at a fairly immature stage,” said Moorut. “There are a lot of opportunities but also a lot of figuring out on the part of retailers before we get to a point where it’s driving massive benefits.”

RFID’s ‘Quiet Revolution’ in Retail

Zara, Uniqlo and American Eagle are among those leaning on the technology for abilities like self-checkout and better inventory tracking, while more companies join the ‘cult of RFID’ each year.

Battling the Retail Apocalypse: What Worked and What Didn't

The last decade was the most transformative for retail since the rise of big-box stores in the 1980s. To drive traffic and better engage consumers, companies have tried out a number of different tactics. What were gimmicks and what stuck?

The Organised Retail Crime Phenomenon, Explained

Reports of large-scale theft rings are driving US lawmakers to explore tough-on-crime policies. Data on whether there is a crime wave paints a more ambiguous picture. BoF unpacks the murky situation.

Cathaleen Chen is Retail Correspondent at The Business of Fashion. She is based in New York and drives BoF’s coverage of the retail and direct-to-consumer sectors.

- Simeon Siegel

© 2024 The Business of Fashion. All rights reserved. For more information read our Terms & Conditions

Shein Steps Up London IPO Preparations Amid US Hurdles to Listing

The online fashion retailer plans to update China’s securities regulator on the change of the initial public offering venue and file with the London Stock Exchange as soon as this month, a person with knowledge of the matter said.

Op-Ed | How Macy’s Can Repel the Barbarians at Its Gate

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

Adidas Prepares for Samba Slump

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

Op-Ed | The Rise of the Unwasteful Brand

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

Subscribe to the BoF Daily Digest

The essential daily round-up of fashion news, analysis, and breaking news alerts.

Our newsletters may include 3rd-party advertising, by subscribing you agree to the Terms and Conditions & Privacy Policy .

Our Products

- BoF Insights Opens in new window

IMAGES

VIDEO

COMMENTS

Fashion Industry: A Case Study of Zara . Ruojia Li 1,*, Wenxin L iu 2, and Sunwen Zhou 3. ... Zara implemented RFID technology in . all of its offline stores as early as 201 6 to more .

Published Mar 14, 2022. Zara, said to be the world's largest fashion retailer with over 2000 stores worldwide and a huge offering through their online store started an RFID project back in 2009 ...

Many retailers have stumbled implementing RFID tags for inventory control, but the Zara chain is working the system. The scale and speed of its rollout is drawing notice in the industry.

In the longer term, Zara is becoming increasingly focused on digitalization every aspect of a consumer's shopping experience. This can be seen in its implementation of online "click and collect" in its key flagship locations, 6 which allows customers to order items online and pick them up in-store, providing a win-win for the customer and ...

The security tag's plastic case would protect the chip, allowing for reuse, and it would be removed at checkout. One benefit was on display on a recent morning, when store manager Graciela Martín supervised inventory-taking at one of Zara's biggest outlets in Madrid. The task previously tied up a team of 40 employees for five hours, she said.

This paper presents a case study of Zara's RFID deployment, one of the largest-scale implementations in the industry, based on secondary data. It explores how Zara's RFID adoption aligns with its ...

Zara uses intensive data and analytics to manage a tight supply chain and give customers exactly what they want. Introduction. Zara's parent company Inditex has managed to thrive in the last decade while several other fashion retailers have faced declining sales or stagnant growth. Inditex has grown over 220% in annual revenue since 2004 ...

Zara made a big push for RFID starting in 2009, when the CEO gave a mandate that the Zara RFID model must be reusable and recyclable. It took five years of research, working with Tyco, before realizing that the RFID tag could be embedded within the security device that is on each product. This allows the RFID to be recycled along with the ...

This paper presents a case study of Zara's RFID deployment, one of the largest-scale implementations in the industry, based on secondary data. It explores how Zara's RFID adoption aligns with its existing supply chain structure, business model and IT infrastructure. By drawing on the IT value hierarchy model (Urwiler and Frolick, 2008) in ...

ZARA, a wholly owned subsidiary of Inditex group, was launched in 1975, in Galicia, Spain. ZARA is one of the largest international fashion stores with over 2000 physical stores in 96 countries.ZARA specializes in fast fashion and launches over twenty new product lines per year, with brands covering clothing, accessories, shoes, perfumes, and beauty products. In 2010, ZARA launched its first ...

RBC Capital analyst Richard Chamberlain wrote in an April research note that Inditex's use of RFID at Zara "freed up staff hours, made in-store replenishment easier and optimised full price sales.". This March, Inditex announced it would go a step further by eliminating its hard security tags and sewing RFID directly into garments.

Zara: seeing online and in-store sales grow. Zara, the Spain-headquartered fast-fashion retailer, has long innovated with its merchandising and promotion tactics and, in the past year, that push has continued. Perhaps the most striking work it does is in using test facilities, pop-ups and prototypes to explore and refine its approach to selling.

July 16, 2014 6:09pm. If Zara 's speed to market was not yet speedy enough, its parent company Inditex recently announced it would add radio frequency identification ( RFID) tagging to its supply chain processes in a much bigger way. The technology will allow for garment tracking from logistics platforms through to ultimate sale.

Zara is a privately held multinational clothing retail chain with a focus on fast fashion. It was founded by Amancio Ortega in 1975 and it's the largest company of the Inditex group. Amancio Ortega was Inditex's Chairman until 2011 and Zara's CEO until 2005. The current CEO of Zara is Óscar García Maceiras and Marta Ortega Pérez ...

What are Zara's critical big data approaches? Data is captured from POS terminals, e-commerce sales, customer surveys, PDA devices and RFID tags on the clothing. Store personnel are trained to ...

Thanks to its increased focus on technology, Zara has certainly made steps to improve and enhance the customer experience in stores, with initiatives helping to counteract some of its previous problems. Self-checkouts help to ease congestion and make buying items less frustrating, while fitting room technology makes the experience of trying on ...

Zara's operations are concentrated in Spain, but they have stores around the world like these in Manhattan and Shanghai. The firm tripled in size between 1996 and 2000, then its earnings skyrocketed from $2.43 billion in 2001 to $13.6 billion in 2007. By August 2008, sales edged ahead of Gap, making Inditex the world's largest fashion retailer.

Learn how Zara, the fast fashion pioneer, achieved success with its unique strategy and supply chain management. Read the case study on ResearchGate.

Oct 25, 2017. 47. By Adam Nathan — July 11, 2017. Zara is the envy of its competitors. The company spends virtually nothing on advertising. Their products rarely go on sale, and their typical ...

Zara began a Radio Frequency Identification (RFID) project in 2005, which became full-blown in 2015 with a 17% sales boost in the first half. This project involves placing an RFID chip within each ...

Picture 3: Frequency of visits to the store. Picture 4: Money spent by consumers per store visit. Picture 5: Type of clothes consumers are looking for at Zara stores. Picture 6: Evolution of brand image: Zara and General Stores. Picture 7: Reasons driving consumers to the stores: Zara and General Stores.

Request PDF | On Jan 1, 2016, Amy C.Y. Yip and others published Strategic values of technology-driven innovation in inventory management: a case study of Zara's RFID implementation | Find, read ...

NEW YORK — On a recent Thursday afternoon at Zara's SoHo store, dozens of tourists and urban professionals shuffled along a checkout line that snaked halfway across the sales floor.. Upstairs, there was no line. Here, just two customers navigated a self-checkout station at a sleek, L-shaped white bar. Built into the bar are crates that automatically scanned their purchases and rang up the ...