Business Strategies that set FMCG giant “Unilever” a class apart

The first name that comes to mind as soon as somebody talks about the FMCG industry is Unilever. A century ago no one would have predicted that a company founded by a margarine owner and a soapmaker would years later become one of the most established and famous companies and one of the most desirable employers in the world .

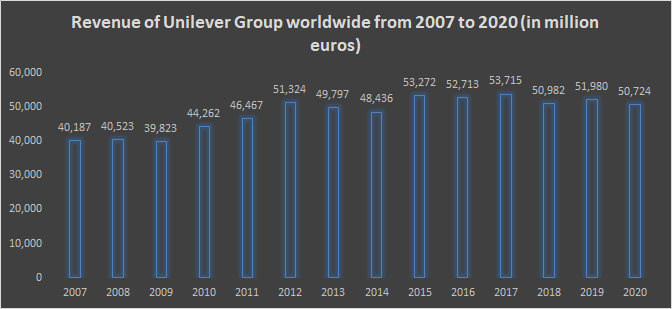

As of 2020, it has a turnover of around €50.724 billion and has approximately 155,000 employees worldwide. Apart from financially doing well, it has also progressed towards achieving sustainable development goals. Unilever is one of the few companies which have achieved gender equality in the workplace (as of 2020).

Transformation of a merged operation to a renowned brand

Unilever was established in September 1929 by merger of Dutch-based company Margarine Unie and British soapmaker Lever Brothers. The name Unilever came up by blending the names of both the companies. It has emerged as one of the largest consumer brands owning around 400 brands. It is primarily known for its diversification and has three main divisions.

1) Food and Refreshments

2) Home Care

3) Beauty and Personal Care

It was only in the late 20th century; the organization increasingly diversified from making oils and fats products to expanding its operations worldwide. It has made numerous corporate acquisitions with brands like Dove, Omo, Knorr, Lipton, Lux, Magnum, Rexona/Degree, Sunsilk, etc.

We're proud to say our brands are known for being widely used around the world. Check out some of our leading products: https://t.co/xRZwMakuFM pic.twitter.com/d91MmjipCw — Unilever Global Careers (@CareersUnilever) January 5, 2018

Unilever is famously known for its U-Shaped logo. It was only in 2004 that the current logo was established, which was designed by Wolff Olins. The current logo is made up of 25 icons which represents an aspect of the company.

View this post on Instagram A post shared by Unilever Global #StaySafe (@unilever)

Unilever’s Marketing Strategy: A brand with a purpose

One of the best business strategies used by Unilever is that it integrates its global strategies with the local community to attract consumers who are attracted to the products that are famous worldwide; however, it can hold on to its local essence.

For example, Hindustan Unilever, a subsidiary of Unilever in India, has established itself as one of the most loved brands by the Indian audience. For decades it has been one of the top five most valuable companies in India . The reason for the success of HUL in the Indian market is its association with middle-class values and old-fashioned essence. Although it has been changing with time simultaneously, HUL’s philosophy has remained rooted in the purpose and values of the consumers.

While promoting these brands, Unilever also focuses on achieving the upper hand in communication to the audience without compromising these brands’ delivery.

For instance, the Surf Excel tagline has been ‘dirt is good and has portrayed it in various forms. At the same time, the case of Brooke Bond Red Label depicted how a social conversation over a cup of tea (or perhaps just a sip) could bring a change in the social views of the tea lover. Therefore, due to such creative methods, Unilever’s brands, despite being one of the oldests, have continued to gain consumers’ confidence.

Unilever: A company that keeps sustainability at the heart of its business strategy

As of 2020, Unilever celebrated 10 years of the Sustainable Living Plan . The company had committed to providing sustainable living for 8 billion people worldwide and decided to address social inequality and climate changes. The company did not neglect these goals despite the occurrence of COVID-19.

Unilever worked on the longer-term implications of global trends for its business. Thus, the adoption of the Sustainable Living Plan has been a game-changer. It understood the importance of Sustainability and accepted it as a cultural transformation journey by integrating the USLP targets into its core working practices and procedures.

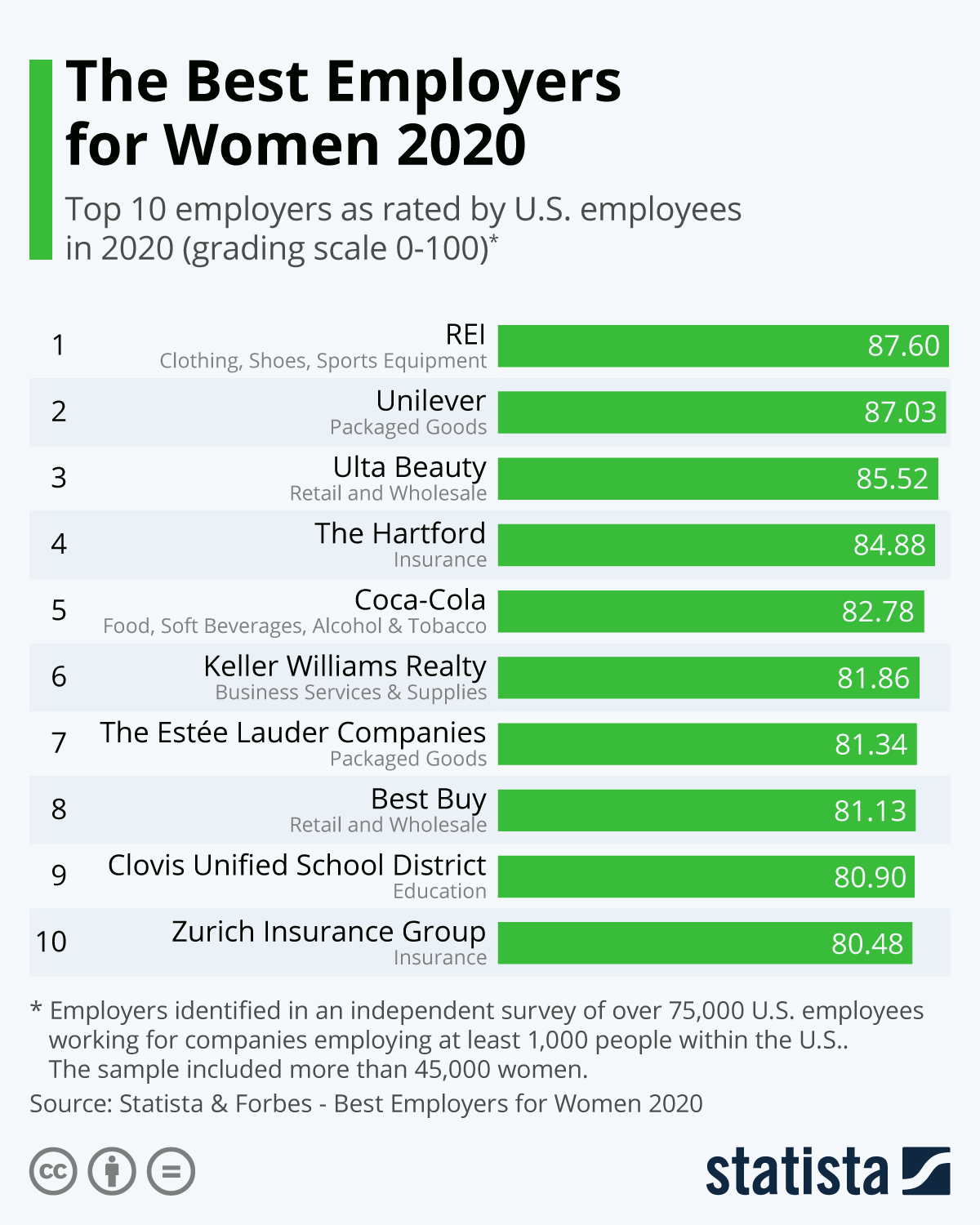

At the corporate level, Unilever has been committed to gender equality for a long time. As of 2020, 50% of managerial positions are held by women as compared 2010 to 38%. The organization had set a goal in 2010 to have a 50/50 split in the employment and added a women-leadership program . It collected, reviewed, and analyzed the data for the past 10-years and used it to battle gender stereotypes every month.

Unilever focuses on eliminating inequality at the global level by removing stereotypes in its advertising and showing how fathers or husbands could contribute to society

Even during COVID-19 for 3-months, it did not stop working on its sustainable development plan and gender equality. It stated that organizations measuring inequality now would be better positioned to improve business and equality post-Covid. It made progress slowly over the years and was one of the few companies to achieve a balance. In 2020 Unilever won the ‘Catalyst Award’ for achieving gender equality

As of 2021…..Unilever is using sustainability as an opportunity…

Unilever has been honored as being the most environmentally responsible companies and topped the list back in 2017.

In its latest goals, Unilever further added that it would reduce food waste from the factory to the shelf by half by 2025, which is five years earlier than what the organization has committed as part of the 10x20x30 (i.e 200 companies pledge to reduce wastage by 2030) initiative. It further added to increase the plant-based sales to around 1 billion euros ($1.2 billion) by the next 5-7years to reduce greenhouse gas emissions from traditional animal-based agriculture.

Unilever : Building a customer-centric business strategy

The organization has a competitive advantage due to its continuously enhancing values amongst consumers globally. Furthermore, it possesses a diversified portfolio of the top brands, thus achieving a unique position and innovating with the consumers’ preferences globally.

It has also taken up initiatives in its Research and Development, which are heavily funded to align with changing consumer needs. It has its R&D operations in China, India, UK, the US, and the Netherlands. Due to its manufacturing facilities in around 270 locations globally, Unilever has been able to cut costs and achieve expertise in its distribution channels.

Unilever has been able to establish itself as the most significant FMCG due to its direct-to-consumer business model, i.e. by extensively understanding the needs of the consumers. Unilever also started its marketing campaign by forming a relationship between the consumer and the brand.

The most crucial element in the business strategy of Unilever is the R&D in its product development, while being on par with its marketing activities. Unilever understood changing needs of the consumers and implemented them in their development. In 2017 alone, Unilever invested more than 900 million euros in its R&D.

It’s not easy to be a market leader for a century and that too by winning the hearts of its consumers. With its dedicated sustainable yet customer-centric business strategy, Unilever would continue to do so.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

Kashish M is an Undergraduate student from the Middle East. Apart from listening songs and learning new languages and exploring different culture over time she developed interests in writing and gained interest in exploring different parts of the accounting/finance world.

Related Posts

AI is Shattering the Chains of Traditional Procurement

Revolutionizing Supply Chain Planning with AI: The Future Unleashed

Is AI the death knell for traditional supply chain management?

Merchant-focused Business & Growth Strategy of Shopify

Business, Growth & Acquisition Strategy of Salesforce

Hybrid Business Strategy of IBM

Strategy Ingredients that make Natural Ice Cream a King

Investing in Consumer Staples: Profiting from Caution

Storytelling: The best strategy for brands

How Acquisitions Drive the Business Strategy of New York Times

Rely on Annual Planning at Your Peril

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

The Leading Source of Insights On Business Model Strategy & Tech Business Models

Unilever Direct-To-Consumers Business Model

Unilever is the world’s leading consumer goods company, making and selling around 400 brands in more than 190 countries in 2022 – based on a direct-to-consumer business model . With over 60 billion euros in revenues that span personal care, home care, foods, and refreshment, Unilever is the second largest advertiser in the world. Unilever can reach millions of consumers across the world thanks to its marketing campaigns.

Table of Contents

Unilever Purpose

Unilever stated purpose is “to make a sustainable living to a commonplace. We believe this is the best way to deliver long-term sustainable growth .”

Unilever Operating segments

In 2022, Unilever operated across five categories.

Personal care is the largest segment in terms of revenues and also the most profitable regarding operating margins. It comprises brands like Axe, Dove, and Sunsilk.

Unilever Direct-To-Consumer Business Model Based On A Global Value Chain

Source : Unilever annual report for 2017

Unilever has been able to create a global value chain. This value chain is based on a direct-to-consumer business model , which requires a deep understanding of consumers and what brands they want to relate to. Therefore, Unilever leverages on massive marketing campaigns that aim at establishing a connection between consumers and those brands.

Besides its claimed value chain, for sure the strength of Unilever is based on its ability to quickly adapt to economic scenarios, to purchase or push brands that can sell well during those periods.

The critical ingredient is to structure the R&D for its product development, in a way that is coordinated with marketing activities. While the company gathers insights about consumers, used for product development. Indeed, Unilever spent over nine hundred million euros in R&D in 2017 alone.

Unilever Massive Distribution Strategy

In addition, the company can provide a proper distribution to its brands by working with thousands of suppliers across the world, with a massive supply chain that purchased over thirteen billion in ingredients and raw materials for its products and brands.

Those materials are turned into finished products, based on consumer insights, and manufactured in more than three hundred factories in sixty-nine countries. The distribution and direct access to consumers via a network of more than four hundred warehouses and twenty-five million retail stores.

Among direct-to-consumer channels , Unilever brands and products are served in:

- hypermarkets

- wholesalers and cash and carry

- small convenience stores

- other fast-growing channels such as e-commerce

- out-of-home and direct-to-consumer

All those channels are critical to Unilever brands to make them properly available and displayed. A significant part of this distribution is also accompanied by massive spending in marketing campaigns, that in 2017 alone saw over seven billion euros in spending.

The company also uses digital channels to create a target and more personalized campaigns based on consumer insights. And in doing so, our value chain cycle repeats itself.

To notice how among the most significant piece of the pie regarding spending the company leverages on distribution costs, brand , and marketing investments. That’s how the value chain is created.

Summary and conclusions

Unilever leverages on a direct-to-consumer business model that in 2017 made over fifty billion in revenues. The key ingredients of this value chains are consumer insights that are used in their R&D strategy , that goes back to product development. Also, the company leverages on massive branding campaigns to make those brands on top of minds of its consumers.

Key Highlights

Leading Consumer Goods Company : Unilever is a global consumer goods company that operates in over 190 countries, selling around 400 brands in categories such as personal care, home care, foods, and refreshments.

Direct-to-Consumer Model : Unilever operates on a direct-to-consumer business model , focusing on creating a strong connection between consumers and its brands through extensive marketing campaigns.

Purpose : Unilever’s stated purpose is to “make a sustainable living commonplace,” aiming for long-term sustainable growth .

Operating Segments : Unilever operates across five main categories, with personal care being the largest segment in terms of revenue and profitability. Notable brands include Axe, Dove, and Sunsilk.

Global Value Chain : Unilever’s success is attributed to its global value chain that incorporates consumer insights into product development, effectively integrating R&D and marketing activities.

Distribution Strategy : Unilever has a massive distribution strategy involving thousands of suppliers, over 300 factories, 400 warehouses, and 25 million retail stores. It utilizes various distribution channels including hypermarkets, convenience stores, e-commerce, and more.

Marketing Campaigns : The company invests heavily in marketing campaigns to establish its brands in the minds of consumers, spending over seven billion euros on marketing in a single year.

Digital Channels : Unilever uses digital channels to create targeted and personalized campaigns based on consumer insights.

Revenue and Profits : Unilever experienced significant revenue growth , with total revenue reaching 60.07 billion euros in 2022. Net profit also grew to 8.27 billion euros in the same year.

Ownership : Unilever is primarily owned by Unilever and its associates, followed by foreign portfolio investors, individuals, and others.

Business Model Recap

Related stories.

Unilever Revenue

Unilever Profits

Who Owns Unilever?

More Resources

About The Author

Gennaro Cuofano

Leave a reply cancel reply, discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- 70+ Business Models

- Airbnb Business Model

- Amazon Business Model

- Apple Business Model

- Google Business Model

- Facebook [Meta] Business Model

- Microsoft Business Model

- Netflix Business Model

- Uber Business Model

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Share Podcast

How Unilever Is Preparing for the Future of Work

How should the consumer goods company upscale its global workforce for the future?

- Apple Podcasts

Launched in 2016, Unilever’s Future of Work initiative aimed to accelerate the speed of change throughout the organization and prepare its workforce for a digitalized and highly automated era. But despite its success over the last three years, the program still faces significant challenges in its implementation. How should Unilever, one of the world’s largest consumer goods companies, best prepare and upscale its workforce for the future? How should Unilever adapt and accelerate the speed of change throughout the organization? Is it even possible to lead a systematic, agile workforce transformation across several geographies while accounting for local context?

Harvard Business School professor and faculty co-chair of the Managing the Future of Work Project William Kerr and Patrick Hull , Unilever’s vice president of global learning and future of work, discuss how rapid advances in artificial intelligence, machine learning, and automation are changing the nature of work in the case, “ Unilever’s Response to the Future of Work .”

BRIAN KENNY: On November 30, 2022, OpenAI launched the latest version of ChatGPT, the largest and most powerful AI chatbot to date. Within a few days, more than a million people tested its ability to do the mundane things we really don’t like to do, such as writing emails, coding software, and scheduling meetings. Others upped the intelligence challenge by asking for sonnets and song lyrics, and even instructions on how to remove a peanut butter sandwich from a VCR in the style of King James. But once the novelty wore off, the reality set in. ChatGPT is a game changer, and yet another example of the potential for AI to change the way we live and work. And while we often view AI as improving how we live, we tend to think of it as destroying how we work, fears that are fueled by dire predictions of job eliminations in the tens of millions and the eradication of entire industries. And while it’s true that AI will continue to evolve and improve, eventually taking over many jobs that are currently performed by people, it will also create many work opportunities that don’t yet exist. Today on Cold Call , we welcome Professor William Kerr, joined by Patrick Hull of Unilever, to discuss the case, “Unilever’s Response to the Future of Work.” I’m your host, Brian Kenny, and you’re listening to Cold Call on the HBR Podcast Network. Professor Bill Kerr is the co-director of Harvard Business School’s Managing the Future of Work initiative. His research centers on how companies and economies explore new opportunities and generate growth, and he is a fellow podcaster. He hosts a show called Managing the Future of Work . Bill, thanks for being here.

Bill Kerr: Thanks for having us.

BRIAN KENNY: And Patrick Hull is Unilever’s VP of Global Learning and Future of Work. He goes by Paddy. Paddy, thanks for joining us.

PATRICK HULL: Thank you very much for having me.

BRIAN KENNY: It’s great to have you both here today. I think people will really be interested in hearing this case and how Unilever is thinking about the future of work. So why don’t we just dive right in. And, Bill, I’m going to ask you to start by telling us what the central issue is in the case, and what your cold call is to start the discussion in class.

Bill Kerr: Well, Brian, I think your introduction clearly outlined the central issue, which is technology is really transforming the world of work. And that means, companies must learn how to do things different than what they’ve done over 50 or a hundred year history. And it also means they must transform the skill base in how they’re approaching employees and talent. I think we can simply say: that ain’t easy, and it’s also going to introduce significant challenges and tensions for organizations. A big company like Unilever is going to really want to appeal to employees, put the purpose of the company in front of employees, embrace that, but it’s also going to have to make challenging decisions regarding employees and their transition of skills and what’s the future workforce going to look like. So the most common cold call is a really simple question, which is: has Unilever, through its Future of Work Program, resolved the paradox of profit and purpose? And pretty quickly, the answer to that is, “no.” It hasn’t fully resolved that. I will occasionally get maybe one person that goes all the way there. So then we’ve got to start unpacking, okay, how close is it to resolving that? And are we very near the end point or are we farther away?

BRIAN KENNY: Yeah. Simple question to you maybe, but probably not to others who are listening. That sounds like a pretty complex question. I mentioned your involvement with the Managing the Future of Work initiative here. So I know you think a lot about this. This is on your mind all the time. How did you hear about what Unilever was doing, and why was it important to you to write this case?

Bill Kerr: Well, it’s interesting. The history of the connection came through another case that we wrote. Very early in our project on Managing the Future of Work , we’re always very deliberate about putting the “managing” in front of the future of work, and that we want to think about how leading companies are reacting to the forces that are shaping the future, like digitization and demographic changes and so forth. So, we’ve written a case about Vodafone, which we did a Cold Call a while back. With Vittorio Colao. And Vittorio was on Unilever’s board and said, “You have got to go and meet this organization and see what they’re doing,” because they have one of the most comprehensive, well thought out programs for the future of work that he had come across. And in fact, that was the connection that then followed on. And yes, for a sector that Unilever’s working in that has end-to-end change going on from the manufacturers, all the way down through the consumers or the products, to be able to have an organization that’s thought very deeply about what pillars do we need to put into place to make the change occur is great. The other thing that was delightful about Unilever and writing this case study is that, a lot of times, companies want to talk about their programs, only after they know that it was a success. They would prefer to wait until they’ve… They’re like, wait another two years and then we’ll write the case study about this transformation. But Unilever’s been very upfront in saying, “The future of work’s a big challenge. We have to get in front of that. Here’s what we’re doing. We haven’t necessarily figured it all out yet, and some of this will prove wildly successful. Others may be challenging, but this is where we’re going.” And that’s been a great thing to really spark a lot of executives and students a conversation about, what will the future of work require, and how can we get there?

BRIAN KENNY: Yeah. So, Patty, I have to ask, I have to start by asking you, what’s your job? Because your title’s very lofty. It basically calls you a visionary. You are the VP of Global Learning and Future of Work. So what do you do?

PATRICK HULL: I’ve got a funny answer to that question. Since the pandemic, and obviously, been working a lot from home, and I work in a slightly open area, so my wife gets to hear a little bit of what I’m talking about. She seems to think that what I do is laugh a lot and chat a lot to people. So that’s what-

BRIAN KENNY: Kind of like we’re doing today. So, she’s listening in…

PATRICK HULL: She says, “When do you do some real work?” But yes, I guess what I do is work with a really passionate, dedicated team of people who are looking at how are we preparing our organization, and our people in particular, for a future that is very different to what we’ve been experiencing in our traditional work models up to this point. You mentioned ChatGPT as well. I mean, that really is the talk of the town at the moment. And I guess we’ve been thinking for a bit of time, as Bill mentioned, about the impact of things like that on our business, and trying to get on the forefront of what’s our response to that. So I wouldn’t quite say visionary. I think, at this stage in business and what’s going on, it’s quite hard to be truly visionary, but trying to stay one or two steps slightly ahead of what’s going on in the world of work, that’s, I guess, what my job’s all about.

BRIAN KENNY: Yeah. That’s great. For our listeners who… I think most people have heard of Unilever, but for people who aren’t really aware of the scope and scale of Unilever, can you describe the business for us a little bit?

PATRICK HULL: Yes. So we’re a fast moving consumer goods business. So most of you will probably interact with one of our brands or products every day. In fact, we say that we serve 3.4 billion people every day. That’s how often someone buys one of our products or uses one of our products. We’ve got about 400 brands in 190 countries across the world, ranging from global brands like Dove, Sunsilk, Hellmann’s, Rexona, all the way through to what we call local jewels like Marmite in the UK, which is one of those brands that you either love it or hate it.

BRIAN KENNY: How big is the workforce at Unilever?

PATRICK HULL: The workforce is about 149,000 people who are directly employed by us. But we always often speak about how we have an extended workforce of around 3 to 5 million people, who if you ask them who they work for, they would say Unilever, even though they’re actually employed by someone else.

BRIAN KENNY: Yeah. So we know Unilever well at Harvard Business School. We’ve had lots of cases written on over the years by our faculty, and we’ve actually talked about it on Cold Call before, particularly, the focus on sustainability. Unilever really stands out in this regard. And I wonder if you could talk a little bit about how important this is to the culture at Unilever.

PATRICK HULL: It is. I can’t tell you how important it is. In fact, when Paul Polman, previous CEO, came into the organization in 2009, he launched the Unilever Sustainable Living Plan in 2010. And he did this beautiful job when he launched it of reminding us that sustainability has been part of Unilever since day one. When Lord Leverhulme started selling Sunlight soap, his mission was to make cleanliness commonplace. That was back in the late 1800s. And what Paul did beautifully is he then simply shifted that a little bit and said, “We are now here to make sustainable living commonplace, because now we impact so many more people and so many more homes. If we can help every consumer out there make more sustainable choices with how they eat, how they clean, how they use plastic, how they use water, then we can have a massive impact, positive impact, on the planet and society, and that’s good for business.” That was the business model that we’ve ascribed to. So we hire on it. We are tracked on it. We develop on it. It’s definitely part of the way things get done here.

BRIAN KENNY: Bill, let me turn back to you for a second. The FMCG sector is fast moving, as it indicates. What are some of the forces that are putting pressure on that particular sector these days?

Bill Kerr: Yeah. The case outlines three forces, and let me walk through those and also say a little bit of, before I do that, why we think this sector’s amazing to watch. If you want to have a kind of front row seat as to how the future of work may play out in other sectors, I often direct them towards the fast moving consumer good sector because the technology forces, the demographic forces, the gig workplace force that we’ll talk about are all happening already. They’re deep into this sector, so we can learn a lot from it. So, the first one is clearly technology that links through all the way to our opening conversation. There’s many ways in which the touch points between consumers and the outlets and last mile delivery and drones possibly dropping off future packages reverberates all the way up through the supply chain to Unilever and its suppliers above. A simple kind of easy metric is, think about the speed that we now demand or expect of our package delivery. It’s no longer that we’re going to go to the store and pick this up and the store can replenish itself over a week-long horizon. It’s going to be, I just pressed the button in the app and I’m expecting it in the next five minutes to be handed to me. That puts a lot of demands on how an organization needs to function, and also increase the expectation about the customization and the personalized products that consumers will require. So, the technology requires Unilever to think differently. The second is a broader force, but equally as impactful, and even more predictable for the future, which is the role of aging populations and demographic change in the workplace that is quite different than the workplace of the 20th century, where many of the large companies today kind of got their grounding. One of the early kind of points that it makes is that, in the UK, about a third of the workforce currently is over the age of 50, and that’s true in most every advanced economy, as well as also, increasingly across East Asia and elsewhere, that we have older populations. We have workforces that are going to span many more generations in the workplace. And then the third one, which in our project, Managing the Future of Work , we think of as kind of an outcome of tech and demographics coming together is the gig workplace. Paddy talked about the extended workforce beyond Unilever, and the case tries to unpack some of the ways they’re approaching bringing people to work that aren’t the traditional full-time jobs that most companies got built up around. And the gig workplace is activated by that technology that lets us schedule and involve people in gig works. And also, as we think about low unemployment rates and older populations and tacked out and so forth, the degree that we can, as a company, attract in people that are currently not working or at the edge of working and tempt them to come work for us on projects is a very valuable labor supply to these organizations.

BRIAN KENNY: Paddy, you’re in it, literally. So what are you seeing as some of the things that have shifted over time?

PATRICK HULL: So, when I started, I’m going to give my age away here a little bit, but back in the 1990s, I remember us talking a lot about, how could we get direct to the consumer? Back in those days, we sold everything through big box retail, and it was all about maintaining those relationships, making sure you had great store shelf positioning and great relationships with those buyers. One of the most massive shifts is that direct to consumer is the channel now. Bill spoke about how we all just order stuff off Amazon directly. We don’t have any advantage anymore in terms of getting to consumers. You and I, any little startup, can throw some ads on Instagram, speak to a few influencers and start sending their products out. So the whole game has changed in terms of how are we reaching people.

BRIAN KENNY: And I can already imagine, just based on the examples you’ve both given, I’m already seeing areas where there would be churn in the workforce around some of these developments. So let’s talk a little bit about Unilever’s Future of Work plans. And there’s a framework that goes along with it. I wonder if you could describe that and talk about the three pillars that support that framework.

PATRICK HULL: Yes, our three pillars are: change the way we change, ignite lifelong learning, and redefining the Unilever system of work. And I’ll explain a little bit about each of those. So changing the way we change. The first one is, what we’ve realized is that change is continuous. Disruption is continuous in our organization. It’s not about standalone moments where we see that, oh, we need to shut down a factory or change something because of a dramatic shift. Change is happening all the time. All of our factories are rapidly automating all of our office processes, so we can’t stick to the old traditional model of change, which was a very slow moving consultative approach, and also, where management held its cards close to its chest until sort of the last moment and then announced, “This is happening.” We’ve realized that, really, to be true to our purpose around making sustainable living commonplace, we need to enter into a far more open, early, proactive dialogue with our people around the change that’s affecting our organization, and how to help start preparing them well in advance of any actual impact on them in terms of how they can prepare for that change. So that’s the first one, changing the way we change. The second one around igniting lifelong learning is about engaging with our people to make sure that they’re all equipped to thrive, both now and into the future, and that we are showing them a bit of what that future looks like and where they need to be focusing their attention. And then the third, redefining the whole system of work is a bit of what Bill was mentioning earlier. Here, we really want to embrace this notion of accessing talent rather than owning talent. We’ve felt that if we just keep on trying to hold onto all our FTEs and compete against everyone else with talent, we are never going to have the people and the skills in our organization that we need to take us forward into the future. So we really want to redefine new models of working, so it’s not just you’re either fixed or you’re a gig worker, but how can we find some flex in the middle that helps people transition out of this traditional life cycle of work, the kind of 40-hour, 40-week, 40-year traditional employment pattern, and help get them future fit for a hundred year life, where they may want to slowly move into retirement, where they may want to spend some time looking after their kids, where they may want to set up their side hustle. How do we create that sort of flexibility?

BRIAN KENNY: There’s definitely, and understandably, a lot of emotion involved with some of these things. And I’m wondering if maybe you could give our listeners a sense, based on all the research you’ve done in the initiative, about what kinds of jobs are going to go away, and what kinds of skills you think are going to be most important for people to think about in the future?

Bill Kerr: Well, Brian, I come back with, that we don’t think of jobs really going away. And I think it’s important to instead think of jobs as a collection of tasks. And certain tasks will be taken over by the machine and require less human input, as the technology gets more advanced. And that could be in a very manual kind of sense. It could also be with ChatGPT in a more cognitive relationship. And perhaps, the thing that we’re experiencing right now that’s very front and center in the world of work is, lots of ways that technology is coming in towards more cognitive tasks that are complex, they’re non-routine. They were not able to be done by the computer before, but artificial intelligence machine learning and so forth are able to take those off. So if you think about how supply chain forecasting will happen at Unilever, that’s going to be done in a fundamentally different way than it would’ve been even 10 years ago.

BRIAN KENNY: Sure.

Bill Kerr: But we always think about new tasks emerging, and it’s hard to predict exactly what those tasks will involve. When you think about the skills, we know that having digital fluency and also social skills are the two biggest things that you can put money on, bank on, those being important enough for the future. But there’s also going to be judgment, and there’s going to need to be innovativeness. So even if the computer starts to do a really good job at predicting about how salespeople should arrange the shelves or how they should approach consumers, you still have to think about, as an organization, what data are we feeding into the system? And where could Unilever develop a proprietary data advantage? And how would we collect those data streams and put them into it? So the technology will be there, it’s going to take over evermore parts of work as it has been for 150 years at this point, but there’ll also be places where humans will be complementing and helping to achieve the goals of the company.

BRIAN KENNY: So that’s an optimistic viewpoint, Paddy. And I’m wondering what the response is from people when you start to talk about these ideas with them. And how do you move them beyond just their own insecurity and concern for themselves, to really embrace learning new skills and thinking about a different way of working in the future?

PATRICK HULL: This is a fundamental dilemma facing us, Brian. I’m so glad you asked me that question. And whilst I don’t know if we’ve cracked it, I think we’ve got a really good hypothesis around what helps this. One of the things we know is, the way not to motivate people to learn new skills is to tell them, “You better re-skill or the robots are going to take your job away.” So we’ve taken the view that if we can help people to discover their purpose, what makes them unique, how do they approach work in their own way, and then start from that point and say, “Okay, when you are at your best, you are doing these things. How do we make sure that you are developing the skills in line with that, that are going to keep you future fit in an environment that is changing around you in terms of the nature of your job and how you work?” And we’ve found that when people come from that place of purpose, they do feel far more agency over it. They are far more motivated to learn new skills, to continue to be relevant, but it’s coming from a much more positive place. It’s not coming from that fight or flight or freeze sort of mode. It’s coming from a place of agency. And in fact, we partnered with some academic institutions to measure the impact of starting people thinking about purpose and then creating future fit plans from there. And we’ve found that it does lead to people being 25% more engaged in thinking about the future, in going the extra mile, in having this intrinsic motivation to take it on. And they’re 22% more productive, which is another great benefit to us.

BRIAN KENNY: Yeah. So, Bill, we’ve been through situations like this before. If you look back over the long arc of history, we’ve had movement from an agrarian society to an industrial society. We’ve had manufacturing sector turned on its head when a lot of manufacturing jobs have gone overseas. And I think each time we’ve done that, there’s been a portion of the workforce that’s just not been able to make the leap to the new mode of doing things. Unilever is talking about ensuring that 80% to 100% of their workforce can be transitioned in the right way. Is that too big of a promise to make?

Well, to their credit, I believe they stayed at the pretty top end of that range so far. And I think the workshops and so forth that Paddy just outlined are best in class for trying to stay up there. I do think, Brian, you see organizations, and I’m spanning out from Unilever at this point, that are trying to set a new contract with workers, both explicitly and implicitly, that says, “Our part of the bargain is, we’re going to give you great clarity as to what roles we see the company needing in the future, and help you kind of think about where you are today and what you would need to acquire skill-wise to get to that future point. And we’re going to give you the platform to acquire those skills. But your part of the bargain has to be to put the time and the investment in to be having those skills when that time comes.” And so I think we’re seeing a shift in a bit of the, we want to be a great place for you to have worked and developed your career, but we’re not going to be guaranteeing a lifelong employment. We’re going to focus on the skills that are needed and help you make the investments and choices that should be made.

BRIAN KENNY: Yeah. And what does that start to look like at Unilever, Paddy? What are some of the ways that you’re sort of redefining the systems of work there?

PATRICK HULL: So, one of the big initiatives that we’ve undertaken was this whole idea of, how do we help people create more flexibility in their roles, so that they can discover new ways of working, discover new skills, grow in new and different ways? And I mentioned to you earlier that we thought there’s this sort of gridlock that, on the one hand, you’ve got full-time employees, you’ve got lots of security, but no flexibility in terms of how and where they work. And on the other hand, you’ve got gig workers, freelancers, lots of flexibility, but not much security in terms of guaranteed income. And we’ve set ourselves a challenge of, how do we create this responsible alternative to the gig economy? And our idea was something called U-Work. U-Workers no longer have a job title. They work on gigs and projects in Unilever, but they are still 100% Unilever employees. They are not gig workers, so they’re not contractors or anything. In fact, they’re an internal pool of contractors, if you like, but they remain Unilever employees. They get a guaranteed retainer. They get a package of social care, pension benefits, healthcare benefits. And they get a learning stipend. But in return for that, they then only need to work on projects. They can set up their own business on the side. They can look after their kids or aging parents, or they can gradually move into retirement. And I think it’s this kind of thing that we need to continue to explore, as we see in the impact of automation and digitization, and also this trend or this desire for people to have more flexibility to choose how and when they work.

BRIAN KENNY: Yeah. It actually sounds kind of appealing. So you also get variety that goes along with that. You get to move from one project to another, and you’re not sort of locked in on the same kinds of things, all the time.

PATRICK HULL: And, Brian, the one thing, just to emphasize on that, people get very locked into the thing of, ah, does someone have the skill I need for the job? In fact, what we found is, one of the most important skills is knowing the organization. So U-Work is great because they are Unilever employees. They know the organization. They know how to get things done in Unilever. And we must never underestimate the power of that skill

BRIAN KENNY: Bill, it seems like anytime that we enter into one of these huge labor market transitions, manufacturing jobs, take it on the nose. And so I’m wondering, as you think about the implications for jobs in the future, what are the implications for manufacturing specifically?

Bill Kerr: Well, I think, Brian, we’re already been seeing that in motion for a while. Manufacturing has been at the forefront of technology adoption for decades. I think time will tell how it will continue to evolve. I would anticipate more skilled, more advanced, more technology enabled, but there could also be some interesting twists. It’s not the current case study that we’re talking about, but there’s another case study at Harvard Business School, done by Raj Choudhury, our colleague, with Unilever that’s about remote manufacturing. So how can the remote workforce be connected into the manufacturing sector? So we’ll see a lot of innovation towards the future.

BRIAN KENNY: And how is Unilever thinking about that, Paddy?

PATRICK HULL: So actually, the whole genesis of this future of work framework was done together, well, co-created together with our European Works Council actually, so our manufacturing representatives coming together with management to think about, how is the future of work impacting the manufacturing environment? So actually, our whole framework came from them. So, we very much see this as a critical way of addressing the impact of digitization and automation in the manufacturing environment. We’ve found some fantastic examples where we’ve started people thinking about their roles in future. And what we’ve found is, there’s quite a strong correlation between some of the skills our manufacturing workers have and lab assistants in our R&D labs. And funnily enough, we tend to have quite big R&D centers right next to our factories. So we’ve seen quite a bit of movement of people being able to re-skill from manufacturing environment into R&D labs in a way, a more sustainable future environment, all because they’ve identified, what’s the work that they really enjoy doing, what are they really good at, and then what are the skills required to go into the future?

BRIAN KENNY: Yeah. That’s a huge win-win, right? For the worker and for the firm.

PATRICK HULL: Correct.

BRIAN KENNY: This has been a great conversation. I’ve really enjoyed it. I’m wondering if… I’ve got time for one question for each of you left here. So, I’m going to start with you, Paddy. How is Unilever going to know if they’re succeeding in this? Is there a sort of an end game in mind here?

PATRICK HULL: The big goal is obviously that we are proving that our sustainable business model is more effective than others in terms of driving superior performance. So the big number is still, how are we doing as an organization? I would say the key input metrics are things like, how well are we able to re-skill our people for the future? We really believe that re-skilling is the way forward. We know it’s cheaper than recruiting from outside. It’s better for our people. It’s a way of getting people who know our business to continue to do good things. So we do measure that. How many people are we helping to transition? And then it’s about, how attractive do we continue to be as an employer for new recruits and for the people within our organization? So we’ll track the traditional input metrics like engagement, attrition, our employer brand, how well people are collaborating going forward.

BRIAN KENNY: Yeah. It sounds like you’re off to a fantastic start. Bill, I’ll give you the last words, since you wrote the case. If there’s one thing you’d like people to remember about this case, what is it?

Bill Kerr: Well, let me go back. We started with the cold call, so let me tell you how I end the class. There’s a video of one of Paddy’s colleagues, Nick Dalton, who is quoting President Kennedy, who was in turn quoting an Irish writer named Frank O’Connor. And Kennedy was speaking about the space mission, and Frank O’Connor was describing, as a kid, when they would come to this orchard wall that was too high for them to climb over. They had no idea how they were going to do it. They would take their hats and they would throw them over the orchard wall, so that they just committed themselves to figuring it out. And Nick basically thought of the Unilever program as a bit of, “We’re throwing our hat over the wall. We don’t know exactly how we’re going to climb over this future of work wall, but we know we must do it. And this is our public commitment to making that happen.” And the thing I’d come back to listeners around this is, the future of work is scary. And we talked about job transitions and how quickly the new technologies are coming. This time last year, we had no thought of ChatGPT as being part of this Cold Call podcast, but now, it’s what we lead with. And so, hopefully, people can unfreeze a little bit and can start thinking about, regardless of what the twists and turns may lie ahead, they need to begin a journey with their employees. And Unilever is showing, here’s how we’re approaching that. Now, let’s all work on it together.

BRIAN KENNY: Yeah. Well, I suspect I’m not alone when I say we’re rooting for you. We hope that you get this right. There’s a lot at stake.

PATRICK HULL: Thanks, Brian.

BRIAN KENNY: Thank you both for joining me.

Bill Kerr: Thanks.

BRIAN KENNY: If you enjoy Cold Call , you might like our other podcasts, After Hours , Climate Rising , Deep Purpose, IdeaCast , Managing the Future of Work , Sk ydeck , and Women at Work . Find them on Apple, Spotify, or wherever you listen, and if you could take a minute to rate and review us, we’d be grateful. If you have any suggestions or just want to say hello, we want to hear from you. Email us at [email protected] . Thanks again for joining us. I’m your host, Brian Kenny, and you’ve been listening to Cold Call , an official podcast of Harvard Business School and part of the HBR Podcast Network.

- Subscribe On:

Latest in this series

This article is about change management.

- Organizational change

- Mission statements

- Human resource services

- Retail and consumer goods

Partner Center

How Unilever Went From Soap Manufacturer To Multinational Giant

Table of contents, here’s what you’ll learn from unilever’s strategy study:.

- How to make the most out of the opportunities you meet.

- How to be proactive with market changes and thrive by adapting quickly.

- How product innovation becomes the source of competitive advantage.

- How strengths like in-depth knowledge of specific markets become powerful expanding factors.

- How to grow by taking advantage of unparalleled localization.

- How growth opportunities are revealed by empowering your management.

- How sustainability can be used as a brand lever.

With over 2.5 billion people consuming its products on any given day, it’s difficult to find any corner of the world where Unilever has not reached.

What started as one soap brand has now become one of the world’s largest consumer brand conglomerates, spreading into beauty and personal care, home care, and food and refreshments.

Unilever's market share and key statistics:

- Staggering turnover of €52.4 billion in 2021

- Portfolio of 400+ brands, 13 of which feature in Kantar Worldpanel Global Top 50

- 14 brands with a $1 billion turnover

- Over 53,000 supplier partners

- Number of employees worldwide: 148,000

- Owning 280 factories, 270 offices and 450 logistics warehouses globally

- A reach spanning over 190 countries

From innovative strategies and impeccable management to effective marketing and commitment to sustainability, there are several reasons behind the success of this multi-industry giant.

In this study, we analyze them closely to highlight how Unilever has been able to continuously expand its horizons over the years and across countries as well as continents, gaining a competitive edge while growing exponentially.

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

Humble beginnings: How did Unilever start?

Although it wasn't until 1929 that the company we now instantly recognize as Unilever was formed, its story goes way back to the late 19th Century.

In fact, it is set in two different countries simultaneously, with two major companies operating in seemingly different industries coming together and setting the foundation of Unilever.

In many ways, it can be said that it set the tone for what sort of brand Unilever was going to be in the coming years.

More than just soap

_(14779880014)%20(1).jpg)

William Hesketh Lever began his career in the 1880s as a salesman in his family's grocery business. At the time, The Long Depression was still affecting the global economy, and many companies were struggling to survive.

Amidst the chaos, Lever saw an opportunity to step into the manufacturing of soap, which he believed had great potential for growth.

Thus, in the 1890s, as the founder of Lever Brothers, William Lever penned his ideas for Sunlight Soap: "to make cleanliness commonplace; to lessen work for women; to foster health and contribute to personal attractiveness, that life may be more enjoyable and rewarding for the people who use our products."

Mission and vision statements were hardly a thing during the Victorian era. Yet, Lever was well ahead of his time. They envisioned changing attitudes towards hygiene and personal care in the UK and solve customers’ problems simultaneously.

Soon, the company was not only making waves in the British Isles, but also began expanding its reach in many parts of Europe, North America, Australia, and South Africa.

The first bar of Sunlight Soap was in 1884

Diversifying operations

In the early 1900s, much of Britain's consumption of butter and margarine was sourced from Dutch and Danish companies. However, with the threat of WWI and trade coming to a standstill, the British government asked Lever to produce margarine as well.

Recognizing that the required raw materials, including oils and fats, were quite similar for soaps and margarine, William Lever welcomed the opportunity with open hands.

From there on, Lever became more than a soap company as it took its first step towards forming a multi-brand legacy that would inspire and lead the world of consumer brands for the next century and probably, beyond.

A manufacturing company through and through

Not only did Lever plan to manufacture its products, but it also extended its operations to produce its raw materials itself.

From mills to crush seeds for vegetable oil to whole transportation and packaging operations, Lever became a well-established vertically integrated company, taking giant strides to redefine the consumer goods industry.

The Dutch side of things

Before Lever Brothers had set foot in the margarine industry, there was already intense competition in the Dutch market.

To see off new entrants exporting their products at lower prices and to make the most of the global economic situation, two Dutch giants Jurgens and Van den Bergh joined hands in 1908.

A few years later, in 1920, these two companies combined with Schitt and established their operations in the Netherlands as Margarine Unie NV and in England as Margarine Union Limited.

This put them in direct competition with the Lever Brothers and what ensued was a tussle of giants for most of the following decade.

Putting Uni and Lever together

Both the Dutch and English companies knew they would benefit from synergies if they came together rather than going head-to-head in the soap and margarine industries.

Thus, after two years of discussions, they merged in 1929 to form Unilever, which was owned by two holding companies, Unilever Limited and Unilever NV, with setups in both countries.

The structures for the holding companies were identical, and the profit-sharing was on an equal basis.

This merger allowed the company to foray into multiple industries and establish dominance with its hold on manufacturing operations.

Key takeaway 1: cash In on opportunities

With the amalgamation of two companies – Lever Brothers and Margarine Unie – Unilever was formed.

From Lever entering an utterly new soap manufacturing business to competitors Jurgens and Van den Bergh combining, there are countless examples of the founders of Unilever realizing an opportunity and being quick to grab it.

Navigating The Great Depression – Initial Challenges

Unilever was still in its early years when the Great Depression struck, and the company was riddled with challenges on all fronts.

Its products’ prices plummeted 30% to 40% within the first year while at the same time butter came forward as an even cheaper alternative, further lowering the demand for margarine. The company’s agricultural products, such as cattle cake, also took a major hit and its retail grocery and fish shops saw a major decline in revenues.

Things did not look too bright for the company that had already shown so much promise and growth. However, just as William Lever had come out of the Long Depression as a successful business, Unilever responded proactively to this crisis too.

Responding to the challenge

The 1930s saw fresh faces managing the operations at Unilever with Francis D'Arcy Cooper at the helm of affairs.

This new management’s initial response to the Great Depression was to form a special committee that would oversee the firm’s operations in both Netherlands and UK. It also supervised two further committees; one that would handle the company’s business in Europe and one for other regions.

These actions helped the company mitigate the immediate effects of the recession and lay the groundwork for further changes.

Restructuring & redistributing assets

Initially, the Dutch group contributed two-thirds of Unilever's total profits while the British side accounted for the remaining. However, owing to trade conflicts in Europe, similar to those preceding WW1, the equation was reversed, and the British group's contribution increased.

Therefore, in 1937, Cooper convinced the company’s boards that it was time for restructuring, and Unilever needed to align itself with its original goal of equal profit sharing. As part of this dynamic shift, one significant action was selling the Lever Brothers Company in the United States and other Lever Brothers' assets outside Britain to Unilever's Dutch group.

This allowed the two factions to operate with nearly equal profit volumes and assets and overcome the trade challenges.

Key takeaway 2: proactively adapt to the situation

Had Unilever not set up the special committee and undergone the changes it did in the 1930s, it is possible it would not have survived the Great Depression. But with pro-activeness and resilience, it was able to tackle the challenges successfully and come out on the other side stronger than before.

Growth Through Localization & Innovation

Following the years of the Great Depression and WWII, the world’s economic landscape completely transformed. At that point in time, Unilever was establishing itself in various countries and needed a strategy to localize its products, marketing efforts, and management.

It realized that growth in new markets now was not limited to or even dependent on increasing production capacities or lining up products. It needed to have a strong footing in research and development to keep up with changing consumer preferences and increasing competition.

This meant that the company had to make some much-needed changes in its approach and it did just that.

Heading into new markets

Unilever was growing and expanding its operations into many new countries and diverse communities. This meant more local challenges wherever it set up operations. However, much of the management was still under the control of Dutch and English representatives of the parent companies.

Undoubtedly, the people from the parent head offices were capable managers and had contributed to the company's growth, but the challenge here was different. Markets such as India, Brazil, or even the USA did not function in the same way as European Markets.

Customers had different preferences, supply chains were unique, and external influencing factors, such as laws and regulations, were also always specific to the respective regions. Therefore, Unilever's management needed local players who could understand what was required in their region and develop effective strategies to achieve it.

Hence, in the 1940s, Unilever started a localization policy referred to as 'ization.’ The Dutch and English representatives were recalled, and local positions were handed over to local executives.

It began to be implemented as early on as 1942, with the company’s Indian subsidiary going through the process of Indianization. Australianization, Brazilianization, and more followed it. These centers had greater autonomy in decision-making and marketing, which enabled the company to penetrate further into these new markets and localize its products.

Unilever continued with this localized, decentralized management system throughout WWII and several years following. However, they did encourage Unileverization, sharing a common mission across their various subsidiaries during this time, and took it up more rigorously later on.

Embracing research & innovation

The embracing of research did not occur before facing a few setbacks. For instance, the market for soap, Unilever’s main product, revolved around color, scent, and application on fabrics. This changed when in the 1950s, their competitor in the US Market, Proctor & Gamble, introduced Tide. This nonsoap synthetic detergent powder was far superior and solved many plumbing problems caused by insoluble soaps.

For some years, Unilever remained behind its competitors until it found a way to solve the shortcomings of new detergent.

Tide was formed from petrochemicals, and its residues in sewerage systems and rivers were causing major problems. Now, Unilever had the chance to explore chemical technology and retain its position in the market. By 1965, they had launched their very own biodegradable version of the product.

It wasn’t just soap where Unilever invested in research. The company also established 11 research centers, including laboratories, all around the world to come up with innovative solutions for food preservation, health, and animal care. That was going to define the company as one that looked ahead into the future and relied on improving itself to remain at the top.

Another significant example of Unilever's constant innovation can be seen in its margarine. When butter was short in supply, margarine became a convenient alternative – one of the reasons why the Lever Brothers started manufacturing it in the first place. However, butter soon became available widely again, and that too at lower prices. Now, there was not much that made margarine an enticing option to customers.

Unilever's laboratory in Vlaardingen was tasked to find a way to improve the quality of margarine and make it stand out, whether through better nutrition, flavor, or convenience. The solution came in the form of enhanced refining of soybean oil, a key raw material in margarine production.

Benefiting from tariff lift

A major boost to Unilever's operations was the formation of the European Economic Community and its efforts to make Europe a common market in the 1950s and 1960s.

Previously, Unilever has based its factories and production in various European countries to avoid tariff restrictions. It was, however, an inconvenient solution. Not only did they have to bear additional costs of production in expensive locations, but such a spread-out production system posed the challenges of supply, logistics, capacity, and more.

Through the common market, there was no need to restrict themselves anymore. Unilever now took its production to wherever costs could be minimized, and operations could be consolidated. Thus, they were able to produce in greater quantities and accelerate their processes.

Key takeaway 3: innovate & solve

Unilever's growth in 1940 to 1960s had a lot to do with improving their products and their management system to cater to modern problems. This helped them stay ahead of the competition and keep their production up-to-date and cost-effective all the while delighting customers.

Expansion & Acquisitions Till The 1990s

As a well-known multi-industry firm, Unilever was no stranger to acquisitions and takeovers. They expanded in the US Market in 1937 by adding the tea manufacturer Thomas J. Lipton Company to their portfolio. Later on, in 1944, they also entered the toothpaste industry by acquiring Pepsodent.

In the post-WWII era, they continued to take over larger firms like Birds Eye, a UK frozen foods company, in 1957. By 1961, they had also taken control of US ice cream producer, Good Humor.

Unilever acquires Birds Eye parent company T. J. Lipton in 1943

However, these were only gradual acquisitions that allowed them to explore new product lines. From the 1980s, Unilever's approach took an aggressive turn, and they set their eyes on bringing many more brands under their banner.

The shopping spree of the 80s

Unilever’s targets changed in the 1980s. They wanted to expand but with a plan to strengthen their hold in industries in which they had resources and expertise and the market had a lucrative potential for growth. This meant they were sticking to foods, detergents, toiletries, etc. but were ready to eliminate the competition.

Thus, they began by selling off their ancillary business and services, such as transporting, packaging, and initiating their acquisitions. In 1984, Unilever oversaw a hostile takeover of the British tea company Brooke Bond for £376 million. The company complemented Unilever’s Lipton in the USA, and now, the road was clear for further growth.

One of Unilever’s biggest acquisitions was of Chesebrough-Pond in 1986. The company owned some very high-potential and popular products in the USA like Vaseline Intensive Care and Pond's Cold Cream. Moreover, with over $3 billion in annual sales, it was the perfect chance to cement itself in the personal product business internationally.

Another major market that the company dominated with its acquisitions in the late 1980s was the perfume and cosmetic industry. It simultaneously became the owner of Shering-Plough's perfume business in Europe, Calvin Klein in the US, and Fabergé Inc. The latter was bought for $1.55 billion and handed Chloe, Lagerfeld, and Fendi perfumes to Unilever.

Now, the company was a force to reckon with, if not the leader in its primary industries and in the markets it predicted would generate the most gains.

The global giant

Unilever clearly showed its aggressive intent in the 1980s, and they were not going to stop in the 1990s.

By 1992, the conglomerate consisted of over 500 businesses in 75 countries. In the mid-1990s, they went on to acquire over 100 more companies. From buying personal care giant Helene Curtis for $770 million to sweeping the US ice cream market by buying Philip Morris's Kraft General Foods’ division for $215 million, there was no shortage of the treasure chest Unilever had.

By 1999, they had grown from 500 businesses to 1600 brands. But this brought them back to where they started the extensive series of acquisitions, with many companies that didn't have the potential to grow or simply didn't fall in with Unilever's strengths.

It was time for a major strategy shift and to go back to the basics. Out of 1600 brands, 400 were generating 90% of the revenue. Unilever decided to let go of the remaining 1200 and put all its efforts into strengthening its already powerful brands.

This has been their path ever since and one that has enabled them to maintain their position as one of the top consumer products companies in the world.

Toppling competitors

Along with buying their competitors, Unilever did not stop introducing new products into the market. In 1984, their product Whisk overtook P & G’s Cheer in the US laundry detergent market.

Two years later, Whisk was introduced in Britain, along with Breeze, a soap powder the company had only seen of in Surf. Unsurprisingly, Unilever recorded a 50% growth in operating profits for detergent products while it also experienced increasing returns in the food industry.

This multi-pronged strategy of introducing new products and acquiring ones with potential did not allow Unilever to capitalize fully on the market's potential for growth and left little room for competitors to adjust.

Standing out from the competition

From Lever Brothers and Margarine Unie taking on their rivals head-on to Unilever PLC establishing its unique identity despite battling against giants P&G and Nestle, the company has always embraced healthy competition.

One of the main reasons Unilever has been so successful in standing out is its expansion in over 190 countries through products they specialize in and dominate in. Moreover, it hands significant decision-making power to local managers to strengthen their position in diverse markets. Both P&G and Nestle have not been able to grow as much in terms of reach.

Another, key aspect that differentiates Unilever is its emphasis on and funding towards Research & Development. They continue to improve their products and adapt to changing consumer needs by providing enhanced solutions.

Last but not least, Unilever’s sustainable plans set them apart from major competitors, whereby they show their commitment to the collective betterment of people and societies.

Key takeaway 4: stick to your strengths

Unilever’s origins lay in soap and margarine – industries they knew very well and had the potential to grow in. They expanded their portfolio but stuck to their strengths and, as a result, grew exponentially.

Changing Product Groups With Evolving Markets

Throughout the nearly 100 years of Unilever, they have acquired and sold brands and expanded their reach into many territories. Naturally, they experiment with product groups and divisions to decide which suits their goals best and when.

At times, their product groups have had a significant influence on their strategies, whereas at other times, they were merely playing advisory roles. But whatever the situation, Unilever has kept an eye on how operations and revenues were affected and carefully reorganized their groups accordingly.

Understanding complex markets

There is no one fixed way to distribute product groups. Sometimes, they require to focus on research and distribution while emphasizing localization from time to time. For instance, the food industry, from which many of Unilever's top brands belong, undergoes changes every few years. It can be categorized into three regional groups.

Firstly, the global fast-food category. Fried chicken, burgers, soft drinks, etc., are famous worldwide, from Asia to Europe and beyond. The core products remain the same, and the tastes do not differ greatly.

The next category is international foods. These are products that belong to one country but are also popular in other countries as well—for example, Chinese, Indian, and Italian foods.

Hence, the third category leads to national foods – those that represent and are popular in their country of origin. For Unilever's base region, the UK, pies, puddings, steaks, etc., are considered national foods.

Now, that is only one way to look at food markets. Another method or problem, as you may call it, is that a product may not even be defined or preferred the same way in different regions.

For example, take something as simple as tea - a globally consumed product. The British like their tea hot and with milk; Americans prefer it iced; Middle Easterners drop the milk and add sugar.

Therefore, Unilever cannot keep its product groups fixed or stringent and must recognize where it can churn out the most profits.

Giving more autonomy to product groups

Until the 1960s, Unilever's localization policy played a major role in its decisions and actions. Product groups served advisory or assisting roles with little power. That was how to company was progressing, and there was no need for change.

Carrying on the example of food products, during and post-WWII, raw material sourcing was a crucial factor in the production of Unilever foods. But then, when the 60s came, and firms, along with Unilever, started to invest in research, the dynamic shifted towards preservation technology and logistics.

Gradually, the power of determining revenues was handed to product groups, and local managers took a backseat. A pivotal change made in the new structure was introducing three separate food units: edible fats, frozen foods and ice cream, and a general food and drinks group.

These groups proved fruitful and helped the company expand in the European and North American markets.

Rising consumer awareness

The 1970s was the time the marketing arena transformed. With every brand wanting to stand out, they popularized concepts, such as healthy eating and natural ingredients.

The surge in demand for low-calorie foods was also a result of effective marketing. The challenge for Unilever was that all three of its food groups contained low-calorie products. It came in the way of their progress and dented their profits.

But how could they form a system that resolved this problem and kept local managers and product groups intact?

Unilever formed a committee called “Food Executive” consisting of three directors. Its role was to control all food products instead of leaving it to specific groups or managers.

Now, there are 5 product groups: edible fats, meals and meal components, beverages, ice cream, and professional markets. They play an essential role as advisors (more valued than in the 1960s) but are not responsible for profits.

Simultaneously, local managers are allowed to oversee the regional needs and preferences of consumers.

Key takeaway 5: balancing decentralization and product groups

Managers and product groups are both vital components of a multinational firm. To ensure their products satisfy consumers’ wants, Unilever continues to come up with ways to combine the two productively.

Unilever Strategy - Management Dynamics Over The Years

One of the key factors that have fueled Unilever's growth ever since 1929 is its evolving management dynamics that have allowed the company to stay true to its roots while adapting to the local areas it operates in.

Think globally. Act locally!

Think globally and act locally has been at the heart of Unilever's operations and enabled it to make a mark in even the most far-flung areas successfully. As a result of trial and error, Unilever's management dynamics over the years showcase the company's drive to excel, innovate, learn, and get the job done.

Let's delve deep into the management dynamics to better understand the growth of the company.

Given that both the parent companies of Unilever had a tradition of scaling their business through export as well as local production that British and Dutch expatriates mostly ran, it comes as no surprise that Unilever, too, had the same management style initially. British and Dutch executives ran the show, at least for the first decade. However, in the early 1940s, Unilever began changing things by hiring local managers to lead the operations in respective parts of the world, as already highlighted in Chapter 3.

The localization and decentralization began with the subsidiary in India in 1942. Key roles were given to Indian managers, who were also provided with the freedom and flexibility to run operations on their own with little involvement from the head office on a day-to-day basis.

This process of localization of management, in addition to the growing competition as well as the alienation of the subsidiaries during World War 2, led to decentralization, with each subsidiary becoming a self-reliant and self-sufficient unit.

This is where the senior management decided that while decentralization has indeed paid off, it would be in the company's best interest to guard against too much of it. Hence, to ensure that the Unilever culture, vision, and mission were shared among all subsidiaries, Unileverization was promoted.

It has now become a long-standing practice at Unilever to regularly train managers from around the world, be it at a Unilever Four Acres facility or hired facilities in local areas, to ensure that Unilever's values are ingrained and followed everywhere.

The Unilever management matrix, which mainly consists of local talent and initiative with centralized control, is empowered to think transnationally. From nurturing local talent to cross-posting managers worldwide so that they can gain diverse experiences, better understand the Unilever culture, and establish unity, an array of practices are followed.

Break communication barriers

Given the sheer size and scale of Unilever around the globe, effective communication across borders is an essential need for it. It doesn’t come as a surprise that the most relevant and used language for all forms of communication is English.

Hence, Unilever actively looks for employees with fluency in the English language when hiring and regularly invests to develop the English language as well as communication skills in general for its employees through various training programs.

Pick the cream of the crop