Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 11 September 2023

Research on the influence of digital finance on the economic efficiency of energy industry in the background of artificial intelligence

- Qiao He 1 &

- Ying Xue 2

Scientific Reports volume 13 , Article number: 14984 ( 2023 ) Cite this article

2144 Accesses

1 Citations

Metrics details

- Environmental sciences

- Environmental social sciences

- Solid Earth sciences

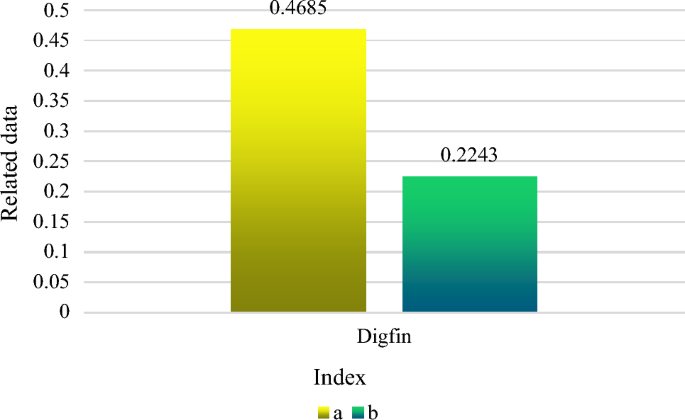

China's economic growth has reached a new plateau. It is no longer appropriate to use the old economic growth model, which relied on labor, land resources, mineral resources, and other economic considerations. Under the background of artificial intelligence, high-quality economic development is an inevitable trend. A new financial paradigm called "digital finance" integrates financial services with information technologies. Digital financial technology is thought to be a crucial foundation for fostering high-quality and sustainable economic and social development since it may offer more economic entities reduced cost of capital and more realistic financial service skills than in traditional financial models. In the era of artificial intelligence, how to reasonably release the momentum of digital finance for China's sustained economic growth has become a hot topic of discussion at this stage. This paper studies the impact of digital finance on the economic efficiency of the energy industry in the context of artificial intelligence. Relevant metrics were also calculated. The findings revealed that: The benchmark regression result of digital finance on the efficiency of the green economy was 0.4685 before adding the main restrictions; the benchmark regression result of digital finance on the efficiency of the green economy was 0.2243 after adding the main constraints. As a result, data finance had a favorable impact on the effectiveness of the green economy.

Similar content being viewed by others

The impact of artificial intelligence on employment: the role of virtual agglomeration

Yang Shen & Xiuwu Zhang

Digital Regenerative Agriculture

Tom O’Donoghue, Budiman Minasny & Alex McBratney

The role of artificial intelligence in achieving the Sustainable Development Goals

Ricardo Vinuesa, Hossein Azizpour, … Francesco Fuso Nerini

Introduction

The coordinated growth of the real economy and the digital economy takes the conventional "reverse integration" path, with the financial sector serving as the first example of its transformation and development characteristics in the tertiary sector. Digital finance generally refers to the use of electronic information technology by traditional financial institutions and online businesses to carry out new financial services like payment, project investment, and equity financing. The limitations on time and space between product transactions and financial services have been eliminated by the quick development of digital finance. In the era of artificial intelligence, what is the role of the rise and application of digital finance in the critical period of innovation in promoting strategic planning. Whether it can fill the shortcomings of the traditional financial system and improve the efficiency of urban green economic development and the financial market department's strong support and promotion of innovation and manufacturing, and better support the economy of the energy industry, requires further review and debate. Digital financial technology can provide more accurate Market trend forecast and energy price forecast by processing large-scale data and applying advanced data analysis technology. This will help energy companies make more intelligent decisions, optimize resource allocation, reduce production and operating costs, and thus improve Economic efficiency. The application of digital financial technology can improve the Economic efficiency of the energy industry, improve the efficiency of resource utilization, reduce waste and promote the sustainable development of the energy industry.

Literature review

Numerous professionals and academics have always focused their research on strategies to increase the effectiveness of the urban green economy. In order to create a model that could be used for urban green economy planning, Liu T enhanced the conventional algorithm and merged the principle of machine learning algorithm. Efficiency indicators for the green economy were evaluated in terms of input, anticipated output, and unexpected production. Comparison and analysis were done on the green efficiency determined using the relaxation value calculation model. The study's findings demonstrated that the model could be used in the design phase of urban green planning and that it had specific effects 1 . China's green economic efficiency and green total factor productivity were assessed and examined by Gao X. Furthermore, the shortcomings of conventional clustering techniques in high-dimensional data clustering were highlighted by outlining the properties of high-dimensional data. A sampling and residual squared-based density peak clustering technique was put forth. The experimental comparison on the data set revealed that in terms of time complexity and clustering outcomes, the modified algorithm outperformed the delayed procedure call approach 2 . Sarcheshmeh M examined the performance of urban green space in terms of social and economic indices in the Mashhad metropolitan region. 15 social questions and 5 economic questions from the research questionnaire were tested and examined using the SPSS22 program. The findings demonstrated that there was no appreciable impact on the management effectiveness of the urban green space sector in the city of Mashhad. From the perspectives of citizens and managers, several features of the social index were rated as desirable 3 . In order to examine the dynamic changes in the economic effectiveness of urban land use in South Korea at the regional level and to determine whether it would be feasible to implement the green belt policy, Yongrok C used the ecological efficiency measurement model. In order to increase the economic benefits of urban land use and execute sustainable green space management, more performance-oriented policy solutions were advocated 4 . These studies do have some impact on increasing the effectiveness of urban green economy and urban planning, but digital finance has received far too little attention. The market for digital finance is quickly taking over with the pace of the new economic system. The city's long-term development would have an effect on how effective the urban green economy is.

There are more research on the direct or indirect effects of digital finance on economic growth than there are on the effect of digital finance on the effectiveness of urban green economies. Based on the database for the growth of digital financial inclusion and the China Family Panel Studies, Xie W investigated the relationship between coastal rural residents' entrepreneurship and the development of China Family Panel Studies (CFPS). The empirical findings indicated that a crucial factor in encouraging rural entrepreneurship was the thorough development of digital financial inclusion. The monetary capital index and the payment index both significantly boosted rural inhabitants' entrepreneurial activity. The study also discovered that the effects of digital financial inclusion on rural residents' entrepreneurship exhibited signs of geographical variation 5 . In the context of economic digitization and the development direction of contemporary financial technology legal supervision, Barykin S determined the function of digital finance in the financial system. By adding new features of digital assets, the digital financial cube might be expanded to match the level of openness of industrial firms in the future Industry 4.0 technological framework 6 . The long-term causal impacts of digital financial inclusion on economic growth in sub-Saharan Africa were investigated by Thaddeus K J. The study made use of quarterly data from 2011 to 2017 and a sample of 22 sub-Saharan African nations. The findings indicated a long-term causal link between digital financial inclusion and economic growth in sub-Saharan Africa, with the causal relationship running one way from economic growth to inclusion in the latter 7 . Rastogi S set out to investigate how unified payment interface affects financial inclusion, economic development, and financial literacy of the underprivileged in India. He discovered that financial literacy was being impacted. Financial stability and trust both served as partial moderators of the significant associations between digital financial inclusion and economic development as well as the significant link between financial literacy and financial inclusion. This fostered financial inclusion and economic growth for the underprivileged in addition to supporting financial literacy 8 . Lin Boqiang uses the non radial direction distance function to build green Economic efficiency indicators that can evaluate cities at prefecture level and above in China under the super efficiency framework, and further empirically studies the impact of economic agglomeration on green Economic efficiency. To solve the endogenous problem caused by reverse causality between economic agglomeration and green Economic efficiency 9 .

The perfect combination of digital technology and financial services has created a new financial service model. With the help of intelligent digital technology, digital finance can provide lower capital cost and faster service mode for the real economy, provide financial services with "high efficiency, convenience and sustainable commercial services" for the energy industry, and complete the unification of objectivity and precision of financial services. This paper discusses the influence of digital finance on the economic efficiency of the energy industry under the background of artificial intelligence, and aims to provide theoretical guidance for the improvement of the green economic efficiency in the energy industry.

The influence mechanism of digital finance on the economic efficiency of the energy industry

New energy technologies include solar power generation, water energy, wind energy, tidal energy, sea surface temperature difference energy, wave energy, firewood, peat soil, biochemical material energy conversion, geothermal energy, tar sand, etc. At this stage, it is generally recognized that new energy and renewable resources are based on the development trend of new technology application, and gradually change the development and utilization of renewable resources. The traditional fossil energy resources with environmental pollution problems and limited total amount should be replaced by new energy sources that will not be limited by the total amount and the utilization of the recycling system. The key development areas include solar power generation, tidal energy, hydrogen energy and wind energy.

The new energy industry is the exploration, development and utilization of new energy. It uses social methods to achieve effective utilization and popularization, including the whole process of scientific research, industrial utilization, production, manufacturing and operation. It is a high-tech that commercializes solar power generation, wind energy, bioenergy, etc. From the perspective of the characteristics of the industrial chain, the new energy industry is to replace the new industries with strategic status represented by fossil energy, and has extremely important obligations in replacing fossil energy, promoting economic growth, protecting the environment, and building a harmonious society; From the perspective of the whole industry chain, the new energy industry can be divided into energy supply, product research and development, investment and manufacturing, transportation and trading.

The Corona Virus Disease 2019 pandemic has had a major impact on the traditional financial services provided by financial institutions, but it has also accelerated the digital transformation of these services. According to the statistics and analysis of the China Asset Appraisal Association, during the epidemic period, the average service item replacement rate of online banking reached 96%. Despite the epidemic's considerable effects on small and micro businesses and traditional financial "long-tail clients", However, under the background of the intelligent era, the development speed of digital banking is enough to solve the problems of these groups. Through "zero contact" to provide them with low-cost, convenient and fast service projects, especially the contact-free loan has become an important means to help the sustainable development of the energy industry 10 .

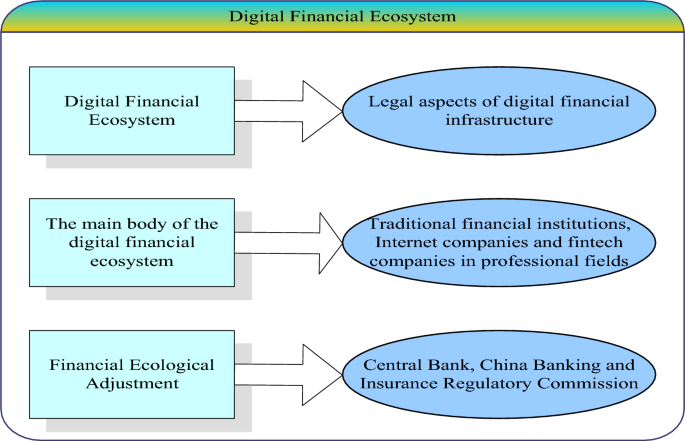

The development of digital finance requires a complete institutional system, and the institutional system of digital finance is the financial ecosystem, which is composed of the main body of the ecosystem and the financial ecological environment. The close combination of the two can produce a regular financial ecosystem with internal logic and self-improvement. Judging from the current overall situation of China's financial institution management system, it has basically formed a large digital financial service ecological chain dominated by banking, Internet banking, non-bank finance, and large and medium-sized financial high-tech companies with electronic payment system, integrity management system, legal norms as infrastructure and institutional guarantee, which is dominated by the "one committee, one bank, two committees and one bureau" supervisory agency 11 , 12 . A schematic representation of the structure of the digital financial ecosystem is given in Fig. 1 .

Digital financial ecosystem.

At this point, a significant trend is the close integration of digital technology with finance. In the era of artificial intelligence, digital technology is playing a unique and important role in modern finance. The following points mostly highlight the benefits of digital finance: Firstly, by increasing financing channels, the threshold for financial services has been lowered; secondly, by greatly reducing service prices, comprehensive financial services have achieved sustainable development; thirdly, the personalized financial services can better meet the various requirements of different users; the fourth is to help reduce information asymmetry and provide new risk management methods 13 .

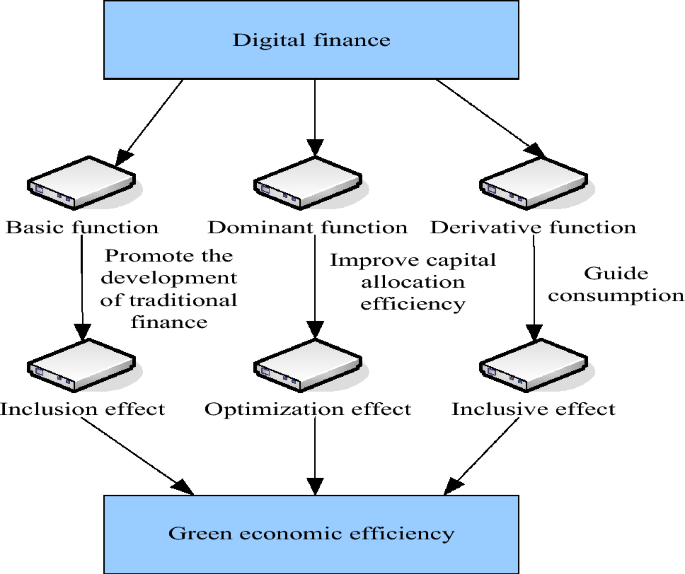

According to different levels of financial functions, digital finance can be divided into three categories: basic functions, leading functions and derivative functions. Figure 2 shows the mechanism of digital finance on the efficiency of urban green development. There are three behavioral paths for the above three functions. The first is digital finance → intermediary services → inclusive utility. Digital finance uses digital information technology to manufacture and expand the role of finance. The network effect of digital technology expands the boundaries of traditional financial services and reduces the service cost of traditional finance. The scale and economic characteristics of digital finance reduce the entry threshold and related costs for innovative enterprises. At the same time, by relying on digital technology, the ability to obtain data and analyze information has been greatly improved and the information asymmetry and the cost of credit intermediary companies have been reduced, and the credit environment has been optimized. After building a three-dimensional credit image based on enterprise big data and cloud technology, sporadic enterprises and start-up companies that are difficult to obtain the support of traditional credit services would obtain a high probability of credit. In order to increase the effectiveness of the urban green economy, the development of digital finance would also help traditional finance change and grow. It would also make full use of the complementary roles that traditional finance and digital finance play in advancing economic growth. Therefore, digital finance will promote the development of traditional finance, and will promote the economic development of the energy industry, and achieve the effect of improving the economic efficiency of the energy industry 14 , 15 .

The impact of digital finance on how well urban green development is carried out.

The second is digital finance → resource allocation service → upgrade utility. Resource allocation service is the core role of finance and an excellent way to correctly guide use value. On the one hand, the birth of digital finance has promoted competition among financial formats and enhanced the charm of folk capital and the financial system, and improved the efficiency and capability of capital allocation. The use of artificial intelligence and electronic information technology can better match the investment needs and financing needs, reduce the financing pressure of the energy industry, and make the capital used more efficiently and quickly for innovation. On the other hand, the circulation of capital factor commodities has been improved. For a long time, in the factor market, the government department has the dominance and dominance of the vast majority of manufacturing factors, and there may be behaviors such as abuse of power. In addition, the popularity of local protectionism and the emergence of administrative systems have resulted in serious market segmentation. The inconsistency and segmentation of the elements of the sales market make some enterprises, especially state-owned enterprises, lose the driving force of "self-innovation". This harms the development of the urban green economy's efficiency. To provide enough financial factors for the supply-side structure's green development, Digital finance enables the energy industry to overcome regional barriers and enhance the environment for the free flow of capital. Therefore, by enhancing and upgrading the efficiency of regional capital element allocation, data finance can achieve the effect of boosting the efficiency of urban green economy 16 .

The third is digital finance → redistribution of finance → inclusive utility. The rapid development of inclusive finance, on the one hand, helps low-income people get rid of poverty and become rich, which improves the level of per capita consumption and promotes economic transformation and upgrading; on the other hand, with the expansion of the number of netizens and network coverage and the rapid rise of e-commerce and Internet consumer finance, the consumption structure of urban residents has also gradually changed. The demand-side consumption capacity and consumption structure have been upgraded, and the energy industry has increased its demand for high-quality products. This has prompted the energy industry to expand the scope of its technology investment and product development efforts, and to encourage the growth of a local green economy. Therefore, digital financing encourages the energy industry to expand technology investment and product research and development, which has the effect of improving the efficiency of urban green economy 17 .

The energy industry is an indispensable part of economic development. Digital finance provides loans to small and medium-sized energy enterprises to meet the financing needs of small and medium-sized energy enterprises, thus stimulating regional economic growth. However, these small and medium-sized energy enterprises are struggling with financial problems and high financing costs. Only a small number of enterprises can apply for loans from financial institutions through official channels, and other enterprises are under pressure of capital loans. The growth of financial inclusion through digital means has reduced borrowing costs and simplified processes. By providing special loans to such enterprises to help them improve their financing and risk management capabilities, it will help improve their profitability and ultimately improve China's economic growth rate 18 , 19 .

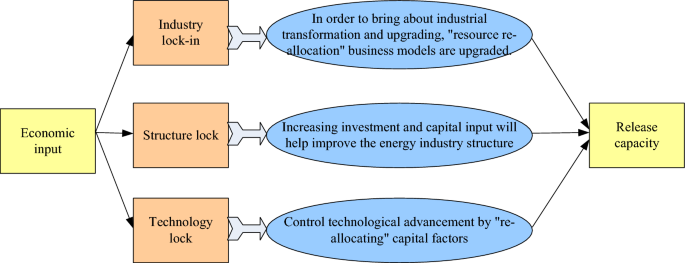

If the capital supply cannot keep up, there will be a lock-in effect, and it is imperative to get rid of this inefficient equilibrium state. The basic strategy is to provide specific capital elements for the energy industry, so the assistance of participating banks is essential, and micro loans for small and medium-sized energy industries can help them achieve higher output. Continuous investment in capital and technology will reduce marginal costs, which will have an impact on increasing output and income 20 , 21 . As shown in Fig. 3 , the structure of micro credit's anti lock support effect.

Anti-lock-in support effect structure diagram of microfinance.

This paper discusses the impact of digital finance on the economic efficiency of the energy industry in the context of artificial intelligence. The calculation formula of some indicators related to the measurement of the economic efficiency of the energy industry is as follows:

\(T\) -set of control variables; \({GTFP}_{au}\) -Green economic efficiency of energy industry; \({df}_{au}\) -digital finance; \({df2}_{au}\) -square term of digital finance; \({\omega }_{au}\) -disturbance term; \({\theta }_{a}\) -time fixed effect

\({m}_{au}{^\prime}\) -a collection of independent variables; \({\mathrm{g}}_{\mathrm{au}}\) -threshold variables

\(distrk\) -degree of capital misallocation

\({\mathrm{lngdp}}_{\mathrm{au}}\) -degree of capital distortion

\({MP}_{au}\) -margin of capital

\(\mathrm{d}\) - \(\mathrm{d}\) kinds of inputs; L-L kinds of expected outputs; J-J kinds of undesired outputs; \(\upgamma \) -green total factor productivity efficiency value.

Restrictions:

Let the formulas be:

\({\mathrm{cap}}_{\mathrm{au}}\) -fixed capital stock of the whole society; \({\propto }_{\mathrm{a}}\) -capital depreciation rate

\({\mathrm{cap}}_{\mathrm{a},0}\) -cap initial capital stock; \({\mathrm{o}}_{\mathrm{a}}\) -cap average annual growth rate.

Empirical study on the impact of digital finance on economic efficiency of energy industry

In order to explore the impact of digital finance on the economic efficiency of the energy industry in the context of artificial intelligence, we calculated some indicators of the economic efficiency development level of the energy industry 22 , 23 . Kao (1999) Panel data cointegration test uses the correlation information between individuals to decompose Panel data into inter individual mean and intra individual changes. If the inter individual mean is non-stationary and the residual term is stationary, then the existence of cointegration can be verified. The results are as follows:

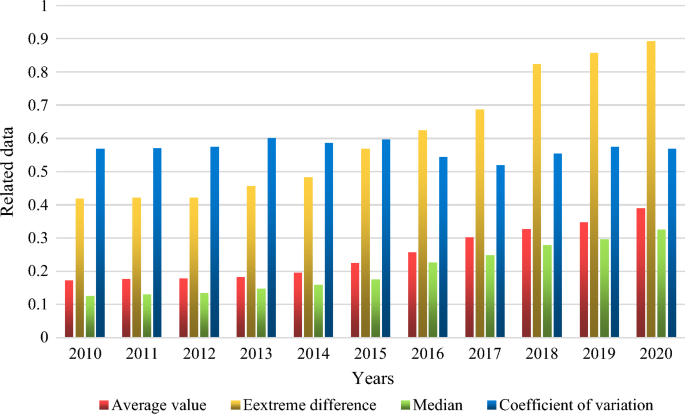

As shown in Fig. 4 , the change index of green economic efficiency development of energy industry in some cities of China from 2010 to 2020. We selected 20 cities in China for data analysis. The standard deviation is used to measure the Statistical dispersion of a group of data. The larger the standard deviation, the higher the volatility of the data. The average is the average of the green Economic efficiency development index. From the average and median, the average development level of green economic efficiency of these energy industries has increased from 0.1782 in 2012 to 0.3891 in 2020, and the median has also increased from 0.1342 in 2012 to 0.3247 in 2020. Both are rising year by year. From these two indicators, the green economic efficiency level of the energy industry shows a trend of doubling, this also means that the green economy development level of the energy industry has made a qualitative leap. The coefficient of variation did not change significantly from 2010 to 2020, with a value of 0.5687 in 2010 and 0.5682 in 2020. From the perspective of range and coefficient of variation, the range describes the difference between the highest level and the lowest level. In 2012, the range value of green economic efficiency of the energy industry was 0.4213, while in 2020, the range value of green economic efficiency of the energy industry was 0.8925, which also shows an increasing trend year by year. This means that the gap between the development levels of green economy of the energy industry is increasing year by year, while the difference between the extreme values from 2018 to 2020 shows a trend of slowing growth, this also shows that we are also increasing the level of green economy development in economically backward energy industries. It can be seen from the figure that the coefficient of variation of the green economic efficiency of the energy industry fluctuates, but it does not change much, and even shows a downward trend, which also shows that the green development level of the energy industry does not show a development trend of two-level differentiation.

Change index of green economic efficiency development of energy industry in some cities.

Regression analysis is conducted with or without control variables to examine the robustness of digital finance on the effectiveness of green economy in the energy industry 24 . The regression results of the efficiency standards of green economy and digital finance in the energy industry are shown in Fig. 5 . Where, A represents the result of basic regression without major control factors, and B represents the result of benchmark regression including major control components. It can be seen that before adding the main restrictions, the benchmark regression result of digital finance on the effectiveness of green economy is 0.4685. After the main limiting factors are included, the benchmark regression result of the effectiveness of digital finance on the green economy is 0.2243. Therefore, data finance has a beneficial impact on the effectiveness of the green economy. The green development level of the energy industry does not show a trend of two-stage differentiation, and the benchmark regression results slightly decrease after adding limiting factors. Digital finance will affect the green development level of the energy industry.

Digital finance and green economy efficiency benchmark regression results.

The benchmark regression coefficient results of the influence of pertinent variables on green economic efficiency are shown in Table 1 . It is clear that the benchmark regression coefficients for improving industrial structure, economic development level, and income from both the public sector and higher education are all positive and pass the 5% significance level test. This demonstrates how investing in financial education, upgrading the industrial structure, and the degree of economic development all help the green economy grow and become more efficient. Despite being positive, the benchmark regression coefficient of environmental legislation on green economic efficiency fails the test of significance. The expense of reducing environmental pollution has perhaps increased, which forces businesses to implement relevant technology advancements. The benchmark regression coefficient for openness to the effectiveness of the green economy is negative, and thus failed the significance threshold test. This may be because the entry of foreign high-tech has raised pressure on environmental governance by bringing about not only economic development but also an industrial chain that produces a lot of pollution and uses a lot of energy.

Choosing cross-sectional analysis with fixed effects rather than random effects means that there are fixed differences between individuals, and the impact of these differences on variables is constant. This fixed effects model assumes that individual specific factors have a significant impact on the observed variables, and these factors are fixed during the observation period.

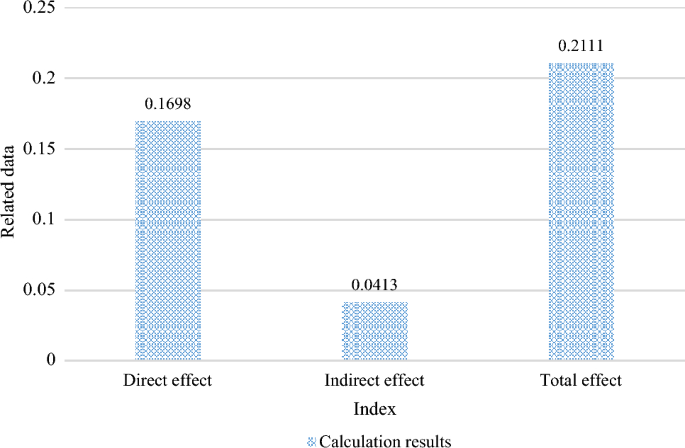

The computation of the conduction effect is shown in Fig. 6 . They are digital finance-green economy development efficiency, digital finance-scientific and technical innovation-green economy efficiency, and digital finance-green economy efficiency as a whole. The conduction line of direct effect is digital finance-green economy efficiency. It can be seen that the computed value of the direct relationship between digital finance and green economic efficiency is 0.1698, indicating that the growth of urban green economic efficiency would be directly impacted by the development of digital finance. The calculated indirect effect value is 0.0413, which suggests that digital finance can boost technological innovation to make cities more environmentally friendly by saving energy and lowering consumption and pollution. The level of green economic growth can be raised while industrial upgrading is encouraged. The total effect of digital finance on the effectiveness of green economy in the energy industry is the sum of its direct effect and indirect effect, of which the intermediary effect accounts for 19.56% of the total effect.

Conduction effect calculation results.

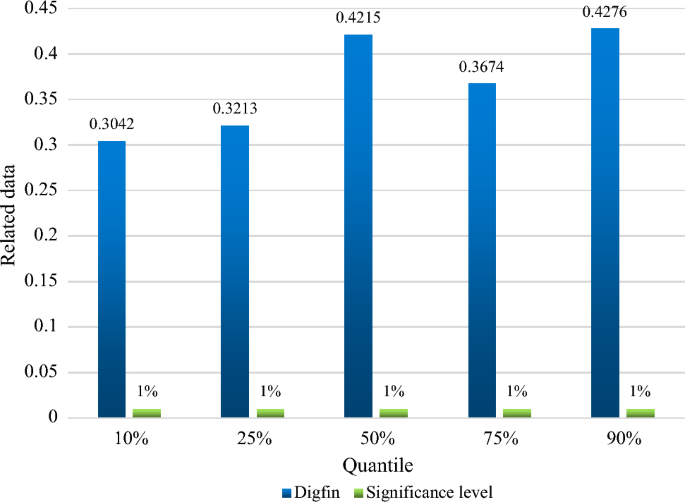

The panel quantile estimation can assess the effect of digital finance on it under each quantile based on the distribution of green economy efficiency levels. The efficiency of the green economy and digital finance are shown in Fig. 7 as the panel quantile regression findings. It is can be seen that for the five quantiles, the estimated coefficient of digital finance climbs as the quantile increases from 0.3042 for the 10% quantile to 0.4276 for the 90% quantile. The increase in the favorable effect is 0.1234, and the significance threshold is 1%. In other words, digital finance has a good effect on the effectiveness of the green economy, and the promotion effect would get stronger as the quantile value rises. This does not help digital finance increase the efficiency of the green economy. However, as the green economy expands and digital infrastructure continues to advance, the beneficial role that digital finance plays in fostering the growth of the green economy would only grow.

Panel quantile regression results of digital finance and green economy efficiency.

In the panel Quantile regression analysis data of digital finance and green Economic efficiency, the estimation coefficient of digital finance is constantly improving, and the significance threshold has always been 1%, so the rise of quantile value will make the promotion of green Economic efficiency stronger.

Conclusions

This paper analyzes the impact of digital finance on the green economic efficiency of energy industry in the context of artificial intelligence, and evaluates the green economic performance of energy industry in some cities from 2010 to 2020. The empirical research results show that the rapid development of digital finance will significantly improve the efficiency of green economy in the energy industry, and show diversity with the change of city size and industrial development level. Digital finance has the synergistic effect of independent innovation and ecological compensation. Through independent innovation and environmental security management, we can jointly improve the efficiency of green economy. Based on this paper, the following suggestions are put forward: encourage financial institutions, insurance and other traditional finance to transform to digital, use data technology to safeguard the traditional financial system, and accelerate the construction of intelligent facilities in various regions; Give full play to the coordinating role of the financial technology service management system in the introduction of innovation policies, patent applications and other aspects. Accelerate the cooperation between the government and the digital financial platform, and give full play to the aggregation effect of financial markets and policies on independent innovation. Make full use of the ecological compensation effect of digital finance on production units, promote financial innovation through joint development of digital finance, and promote the growth of small and medium-sized enterprises in the upstream and downstream of the green industrial chain and supply chain. The government can formulate policies to encourage energy companies to adopt digital financial technologies, such as blockchain, Big data analysis and artificial intelligence, to improve efficiency and reduce costs. For example, the government can provide tax or subsidy incentives to encourage enterprises to invest in the research and application of digital technology. At the same time, it is necessary to prevent losses caused by excessive economic leverage, so that data finance can better provide energy for the urban real economy.

Data availability

Datasets generated and/or analyzed during the current study are available from the corresponding author on request.

Liu, T., Xin, B. & Wu, F. Urban green economic planning based on improved genetic algorithm and machine learning. J. Intell. Fuzzy Syst. 40 (4), 7309–7322 (2021).

Article Google Scholar

Gao, X. Urban green economic development indicators based on spatial clustering algorithm and blockchain. J. Intell. Fuzzy Syst. 40 (3), 1–12 (2020).

Google Scholar

Sarcheshmeh, M., Khakpoor, B. A. & Shokuhi, M. A. Analysis of economic and social indicators in optimizing the performance of urban green space management (a study of Mashhad metropolis). Geoj. Tour. Geosites 32 (4), 1370–1375 (2020).

Yongrok, C. & Na, W. The economic efficiency of urban land use with a sequential slack-based model in Korea. Sustainability 9 (1), 79–79 (2017).

Xie, W., Wang, T. & Zhao, X. Does digital inclusive finance promote coastal rural entrepreneurship?. J. Coastal Res. 103 (sp1), 240–240 (2020).

Barykin, S. & Shamina, L. The logistics approach to perspectives for the digital technologies in Russia. IOP Conf. Ser. Mater. Sci. Eng. 918 (1), 012187–012196 (2020).

Thaddeus, K. J., Chi, A. N. & Manasseh, C. O. Digital financial inclusion and economic growth: Evidence from Sub-Saharan Africa (2011–2017). Int. J. Bus. Manag. 8 (4), 212–226 (2020).

Rastogi, S., Panse, C. & Sharma, A. Unified Payment Interface (UPI): A digital innovation and its impact on financial inclusion and economic development. Univ. J. Account. Financ. 9 (3), 518–530 (2021).

Boqiang, L. & Ruipeng, T. China’s economic agglomeration and green Economic efficiency. Econ. Res. 54 (2), 119–132 (2019).

Monteiro, L., Cristina, R. & Sciubba, E. Water and energy efficiency assessment in urban green spaces. Energies 14 (17), 5490–5490 (2021).

Gwak, J. H., Bo, K. L. & Lee, W. K. Optimal location selection for the installation of urban green roofs considering honeybee habitats along with socio-economic and environmental effects. J. Environ. Manag. 189 (15), 125–133 (2017).

Zhou, L., Zhou, C. & Che, L. Spatio-temporal evolution and influencing factors of urban green development efficiency in China. J. Geog. Sci. 30 (5), 724–742 (2020).

Fu, J., Xiao, G. & Wu, C. Urban green transformation in Northeast China: A comparative study with Jiangsu, Zhejiang and Guangdong provinces. J. Clean. Prod. 273 (3), 122551–122551 (2020).

Vargas-Hernandez, J. G. & Pallagst, K. Urban green innovation: Public interest, territory democratization and institutional design. Int. J. Green Comput. 11 (1), 57–73 (2020).

Zanizdra, M. Y., Harkushenko, O. M. & Vishnevsky, V. Digital and green economy: Common grounds and contradictions. Sci. Innov. 17 (3), 14–27 (2021).

Delcart, L., Neacsu, N. & Oncioiu, I. Regions and cities as stimulators towards green and digital economy. Int. J. Innov. Digit. Econ. 9 (4), 1–10 (2018).

Bongomin, G., Yourougou, P. & Munene, J. C. Digital financial innovations in the twenty-first century: Do transaction tax exemptions promote mobile money services for financial inclusion in developing countries?. J. Econ. Admin. Sci. 36 (3), 185–203 (2019).

Wang, Z., Jin, W. & Dong, Y. Hierarchical life-cycle design of reinforced concrete structures incorporating durability, economic efficiency and green objectives. Eng. Struct. 157 (15), 119–131 (2018).

Sha, R., Li, J. & Ge, T. How do price distortions of fossil energy sources affect China’s green economic efficiency?. Energy 2021 (1), 121017–121017 (2021).

Ren, Y., Wang, C. & Xu, L. Spatial spillover effect of producer services agglomeration on green economic efficiency: Empirical research based on spatial econometric model. J. Intell. Fuzzy Syst. 37 (5), 6389–6402 (2019).

Li, Q. Regional technological innovation and green economic efficiency based on DEA model and fuzzy evaluation. J. Intell. Fuzzy Syst. 37 (3), 1–11 (2019).

Zhang, D., Chen, L. & Yang, Y. Assessing the green economic efficiency of municipalities and provinces in China with a Meta-US-SBM model. Paper Asia 2 (2), 159–162 (2019).

Batrancea, L. M., Pop, M. C., Rathnaswamy, M. M., Batrancea, I. & Rus, M.-I. An empirical investigation on the transition process toward a green economy. Sustainability 13 (23), 13151 (2021).

Aivaz, K. A., Munteanu, I. F., Stan, M. I., Stan, M.-I. & Chiriac, A. A multivariate analysis of the links between transport noncompliance and financial uncertainty in times of COVID-19 pandemics and war. Sustainability 14 (16), 10040 (2022).

Download references

Research on identification and regulation of performance window dressing of China Securities Investment Funds (2023-JC-YB-618), Shaanxi 2023 Natural Science Foundation research project. Research on the motivation, risk and effect of hedging based on empirical data of Chinese listed companies (105–45119026).

Author information

Authors and affiliations.

School of Economics and Management, Xi’an University of Technology, Xi’an, 710000, Shaanxi, China

School of Finance, Shanghai Lixin University of Accounting and Finance, Shanghai, 201209, China

You can also search for this author in PubMed Google Scholar

Contributions

Q.H., Y.X. wrote the main manuscript text.

Corresponding author

Correspondence to Ying Xue .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

He, Q., Xue, Y. Research on the influence of digital finance on the economic efficiency of energy industry in the background of artificial intelligence. Sci Rep 13 , 14984 (2023). https://doi.org/10.1038/s41598-023-42309-5

Download citation

Received : 28 February 2023

Accepted : 08 September 2023

Published : 11 September 2023

DOI : https://doi.org/10.1038/s41598-023-42309-5

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

This article is cited by

Research on the coupling mechanism and influencing factors of digital economy and green technology innovation in chinese urban agglomerations.

- Xuesi Zhong

Scientific Reports (2024)

By submitting a comment you agree to abide by our Terms and Community Guidelines . If you find something abusive or that does not comply with our terms or guidelines please flag it as inappropriate.

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

- Reference Manager

- Simple TEXT file

People also looked at

Original research article, a bibliometric analysis of fintech trends and digital finance.

- Department of Administrative Sciences, Applied College, University of Bisha, Bisha, Saudi Arabia

Digital finance has piqued the curiosity of academics, students, and institutions all around the globe for more than a decade. Innovative financial services companies are offering a wide range of new financial products and new ways of interacting with customers via digital finance (Fintech). Research on finance and information systems has thus examined these shifts as well as the implications of technological advancements on the financial industry. Through presenting a bibliometric analysis, the article summarizes how scientific research has developed on the connections between financial technology developments and digital finance during the previous years. According to the ScienceDirect database, we base this literature review on journals and articles that have been published. We conducted a content analysis of 343 articles based on the discovered clusters, finding research gaps and suggesting actionable areas for further study. The results offer a solid path for future research in this area. We discuss the significance of the aforementioned publications and articles as well as potential areas of future study. The next step is to analyze the citation linkages between the most important articles to identify how they are related to one another. For financial technology research, the study looks at the way they are organized. The research is concerned with the roles of Fintech and the limits of research in digital financing. We point out potential routes for researchers to take to expand on current knowledge while also seeking possibilities for new, interesting, and creative research that adds to the expansion of the topic of research.

Introduction

The financial industry has witnessed continuous development in providing services due to digitization ( Brandl and Hornuf, 2020 ; Kanungo and Gupta, 2021 ). This improvement is distinguished by increased communication and better information processing in the client interface and back-office processes. Recently, the emphasis on digitization has shifted from enhancing the performance of conventional tasks to mainly creating employment possibilities and new business models for financial services firms ( Gomber et al., 2017 ; Legner et al., 2017 ). Digital finance includes many new financial products, financial companies, related financial programs, and new forms of customer interaction ( Anjum et al., 2017 ; Azizi et al., 2021 ) and interaction offered by financial technology companies and innovative financial services providers, for e.g., Barras (1990) , Gomber et al. (2017) , and Ozili (2018) . In light of this, research on finance and information systems has started to examine these shifts as well as the financial sector’s influence on digital development. Financial technology appears in a short time and attracts much attention from practitioners. Why ?

The answer is the ability to switch supply chain networks in almost all business sectors. New business models and technology concepts provide the foundation for innovative financing solutions, knowledge sharing within a firm, and organizational innovation ( Abbas et al., 2019a ) and knowledge management and sustainable organizational innovation ( Abbas et al., 2020 ), including intelligent, easy-to-use, time and time financial services, and lower costs ( Teece, 2010 ; Gomber et al., 2017 ; Varga, 2017 ). Some studies identified a link between the conflicting and creative characteristics of social media and the paths for future research by providing a better understanding of how social networks on the Internet are used ( Abbas et al., 2019b ; Abbas et al., 2019c ; Lebni et al., 2020 ; Liu et al., 2021 ). Also, results indicated that corporate social responsibility presented a positive impact on firms’ sustainable performance. Also, therefore, there is a definite necessity to employ media or communication resources to achieve timely progress ( Su et al., 2021a ; Su et al., 2021b ).

Current financial service providers, such as banks and insurance companies, are being challenged by digital finance. Because of the growing competition from FinTech companies, the latter provides unique prospects for employers to contact their younger and more innovative technological clientele ( Arner et al., 2015 ; Joshi, 2020 ; Wang et al., 2021 ). Against this background, there is an ongoing discussion on traditional financial intermediaries about handling FinTechs and whether competitive approaches acquisitions and alternatively engaging those firms as service providers that are compatible with their business models, for e.g., Lai (2020) ; Suprun et al. (2020) ; Vučinić, 2020 . The new opportunities presented by technology allow them to maintain their competitiveness and provide new and attractive services to their clients.

The study of Abbas et al., 2019d proved that highly innovative firms exhibited a propensity for building a business network to achieve sustainable performance. Furthermore, the findings indicated that firms achieving sustained performance did so by applying effective business networks and flexible capacities. The study’s results suggest that it presented a holistic and systematic approach for achieving sustainable performance through the dynamic capacities of businesses.

This study thus contributes to the actual literature by studying the linkage between digital finance and fintech. The bibliometric study data are represented in the overall research work on Digital Finance and FinTech in the ScienceDirect database. These data covered the period from 2006 to 2020, where the focus was on data of recent studies completed, especially in the last 3 years (2018, 2019, and 2020). The following parts of this article are structured as follows: Section Research Method and Questions discusses the research method and research questions. Section Methods and Materials deals with the methods and materials. Section Results and Discussion lays out our results and discussion. Section Conclusion and Limitation presents the conclusion and suggestions.

Research Method and Questions

Research method.

The bibliometric analysis takes all kinds of illumination as a research goal and uses mathematical and statistical methods to study science and technology’s technological trends and development ( Moed, 2006 ; Zhang et al., 2021 ). Reference measurements have been used extensively to reveal research status and development trends in a field. They have an essential role for researchers to understand a particular research field in depth ( van Oorschot et al., 2018 ; Vatananan-Thesenvitz et al., 2019 ). Additionally, scientists also use bibliometric methods to systematically study in ScienceDirect database publications to uncover their past, present, and future, especially in recent years, there have been many valuable research findings of this kind. A bibliographic measurement approach was used to analyze all publications in the database.

The main goal of a bibliometric analysis was to collect and evaluate the available research relevant to the area of interest and to produce objective results that can be audited and reproduced over and over again. When it comes to research results, a bibliometric analysis is a rigorous methodological assessment with the goal of grouping existing works on the subject and assisting in the development of evidence-based guidelines for professionals working in the study field ( Kitchenham, 2004 ; Prinsen et al., 2018 ). A bibliometric analysis should also identify the state of the art about the research subject ( Levy and Ellis, 2006 ).

Financial technology and the newer “Fintech” topics are gaining further focus as the effect of digitalization on the financial services sector rises ( Nicoletti et al., 2017 ; Leong and Sung, 2018 ). When it comes to financial services, one of these is why there is a lot of dependence on information, and the other is that most procedures, such as trading on an online platform ( Karagiannaki et al., 2017 ). With new financing models made available, broad and significant digitization of the financial service providers and customers’ needs to occur to facilitate the value chain transformation that is taking place. The word “Fintech” is a contraction of “financial technology,” and Citicorp chairman John Reed most likely coined it in the early 1990s in the light of a newly formed “Smart Card Forum” ( Puschmann, 2017 ). In a digital age, fintech applications redefined today’s product-centered thinking to include emerging ecosystems. Individual channels can become redundant when financial service designers focus on hybrid and incompatible modes of interaction-based consumer operations ( Gill et al., 2015 ).

Research Questions

The actual study compares bibliometric analysis to other methodologies (meta-analysis and systematic review), specifically in digital finance and fintech research. The study’s purpose is tied to its motivation. We will identify its scope and research trends, which will help readers learn more about digital finance and fintech in the scientific community, and the justification and significance of this study’s analysis are obtained from two research topics: the future trends and issues in the literature review on digital finance and fintech.

The following two suggested research questions will help the study accomplish its goals, which are to offer academics and practitioners a systematic, categorized perspective of what has been generated in the literature on digital finance and fintech. According to the main problem, the first question is focused on providing an overall quantitative and longitudinal perspective of the works on this topic, and it is worded as follows:

RQ1. What changes have occurred in the literature on digital finance and fintech?

The following sub-questions were generated from the main question:

RQ1.1. What has been the most influential research, such as those published in ScienceDirect?

RQ1.2. Which important references had the most impact on the studies that were identified?

RQ1.3. Which journals are the most widely read on this topic, and how has the number of publications changed over time?

To find the existing literature to build and develop new studies, a categorization of the key topics and research questions was used to classify the digital finance and fintech activities identified in published materials from the sample into several categories. As a result, the following is the formulation of the second question of this work:

RQ2. What are the most important topics and problems discussed in the scholarly literature on digital finance and fintech?

This section explains the procedure that was followed to complete this bibliometric literature evaluation using a technique that was previously established and verified. Furthermore, bibliometric analysis methods were used to determine the scenario state of the scientific literature on digital finance and fintech ( Ikpaahindi, 1985 ).

Methods and Materials

Bibliometric data.

The quantitative method “bibliometrics” ( Fairthorne, 1969 ; Pritchard, 1969 ) is one of the most quantitative measures used in evaluating literature. Bibliometric forms have been prevalent in digital finance, but few studies have considered them—nonetheless, citations connected to the concept of payments, protection, deposit, and retail provisioning. Fintech trends have been overlooked in publications. Looking at fintech-related metadata and the publications they connected to, the metadata gives us various viewpoints on each publication series.

The bibliometric study data are represented in the overall research work (in title, abstract, and author keywords for the article) on Digital Finance and FinTech in the ScienceDirect database. These data covered the period from 2006 to 2020, where the focus was on data of recent studies completed, especially in the last 3 years (2018, 2019, and 2020).

Study Methods and Tools

Many researchers ( Hood and Wilson, 2001 ; Osareh, 1996a ; Osareh, 1996b ; Tsay, 2005 ) have identified three key bibliometric rules. The first and earliest of these, according to Hood and Wilson (2001) , is Lotka’s law ( Lotka, 1926) which provides a relationship between authors and articles. Bradford’s law ( Bradford, 1934) deals with scattering articles on a scientific subject through scientific journals. Zipf’s law ( Zipf, 1949) is interested in the concept of frequency or occurrences.

The bibliometric study data represent the overall research on “Digital Finance and FinTech” in the ScienceDirect database. These data covered the period from 2006–2020. In which, we expected the use of Digital Finance and FinTech because of the closure and quarantine procedures during the epidemic. Therefore, articles from the ScienceDirect database that included fintech keywords in the title, abstract, and author keywords were reviewed and analyzed. Through review articles that were published starting in 2006 and also the literature from 2006 to 2020, the articles were reviewed and analyzed.

According to the processes and approaches used in bibliometric analysis, citation, co-citation, bib. coupling, co-author were analyzed for keywords, for e.g., Zupic and Čater, 2015 . The study relied on the citation indicator to find out the main keywords that studies focused on and prominent authors in Digital Finance and FinTech. To determine the network of research relationships between them, the practical stages of preparing the bibliometric study was carried out (study design, data collection, analysis, presentation, and guide); see Lobato et al. (2021 ).

Following the methodology of preparing the bibliometric study in management and organization, which is explained by Zupic and Čater (2015 ), the bibliometric analysis was carried out by completing the following steps: research design, study questions, and analysis approach selection (co-occurrence, publication, citation, and co-authorship), bibliometric data compilation, selection, and filtration, analysis (choose the appropriate bibliometric software, clean the data, and generate networks), visualization, and interpretation.

Results and Discussion

Descriptive of bibliometric data.

Analysts must provide complete knowledge regarding ongoing investigations in their respective fields and scholars that contribute to the analysis. These data change with time. Every day, fresh pieces of knowledge are introduced to the systems due to the advancement of new technology and new research. The usage of mathematical techniques to analyze articles, books, magazines, and other publications is bibliometric analysis. Geographic research, top writers, affiliations, colleges, documents, year-by-year articles, and citation analysis are all included in this report. The literature in this article was collected using the ScienceDirect database. Several networks have created keyword-based and titles in Digital Finance and FinTech science, sources, and authors.

To select the articles for final review, we used a three-step process. First, we collected and stored research articles (research articles, review articles, book chapters, and others) for the specified search keywords in the ScienceDirect databases, with an open beginning period to include as many publications as practical up to December 31, 2020. A total of 343 titles were retrieved during the first search. The article title, authors’ names and affiliations, abstract, keywords, and references were all included in the search results, which were downloaded in a CSV format.

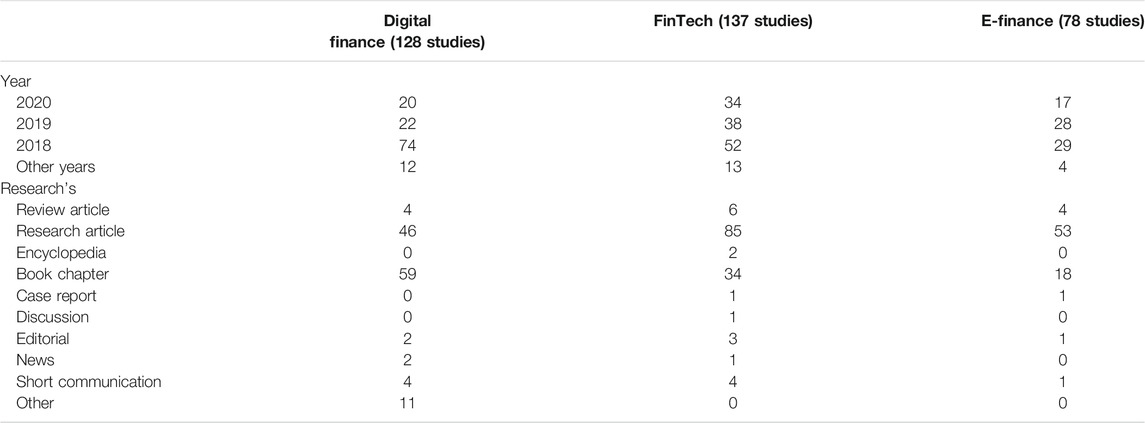

We retrieved published research via a topic search of Digital Finance and FinTech of the ScienceDirect database on January 01, 2020. The following search terms were used: topic = (“Digital Finance” or “e-Finance” or “FinTech” Or “Fintech”), in title-abs-key from 2006 to 2020, and we got 343 studies (184 research articles and 14 review articles; 111 book chapters, 02 encyclopedias, 02 case reports, and 32 others) distributed over 15 years, as shown in Table 1 . The database used in bibliometric analysis or previous studies in a topic of digital finance and FinTech is described here, using numerical expressions (descriptive statistics).

TABLE 1 . Statistics of previous studies.

Identifying various contributing publications may enable the identification of the most relevant journal outlets in each area. The various publishing ports are shown in Table 1 . According to the number of published articles, research articles contribute the most, while book chapters rank second. Table 1 shows that the topics of digital finance, FinTech, and e-finance constitute a modern knowledge field, especially since most studies have been completed in the last 3 years (2018, 2019, and 2020). Moreover, most of these studies are research articles or book chapters; this explains the abundance of production in this type of research, which can be clearly shown in the following figure.

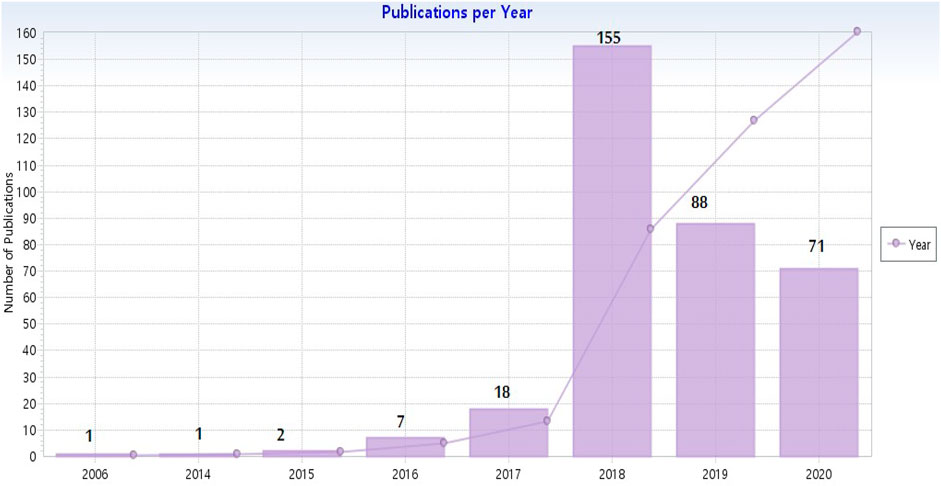

Figure 1 shows that most of the research has been performed in recent years: 155 in 2018, 88 in 2019, and 71 in 2020. Why is the curve appearing to rise, indicating the novelty of digital finance and financial technology as an area of knowledge in the financial management discipline?

FIGURE 1 . Publications per year.

For this research, the ScienceDirect database with all types of already published and unpublished publications is considered. There are many types of publications such as articles, journals, conference papers, and book chapters in a database. When researching for FinTech regulations, publication types that formed the majority were articles and conference papers and very few research studies were published in notes, conference reviews, and letters. When the results from the query were analyzed, all kinds of publications were articles, magazines, conference reviews, book chapters, etc. From 2006–2020, the trend has been increasing since 2006 and is being researched and explored more and more. Below line graph shows this trend:

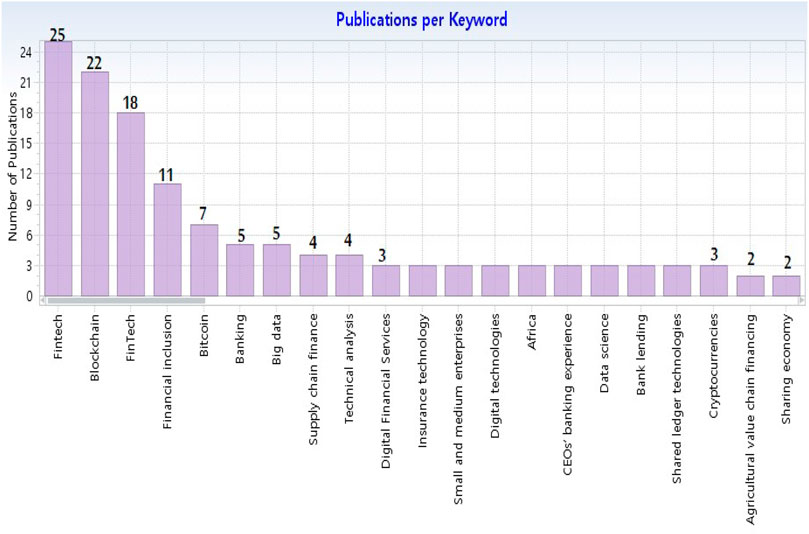

Figure 2 shows that most studies used the following keywords: Fintech, blockchain, financial inclusion, bitcoin, banking, big data, etc.; this indicates that the previous studies used focus on the topic of digital finance and fintech.

FIGURE 2 . Publications per keyword.

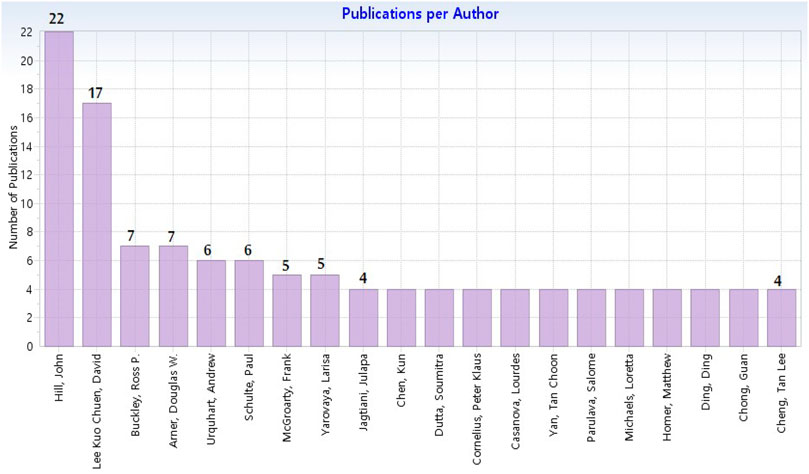

In the last 3 years, it appears that the most prominent researchers in the area of digital finance and fintech are John Hill and David Lee Kuo Chuen; any researcher should refer to these in this specialty Figure 3.

FIGURE 3 . Publications per author.

Bibliometric Analysis and Networks

Items: 42 / Clusters: 8 / Links: 194 / Total link strength: 636.

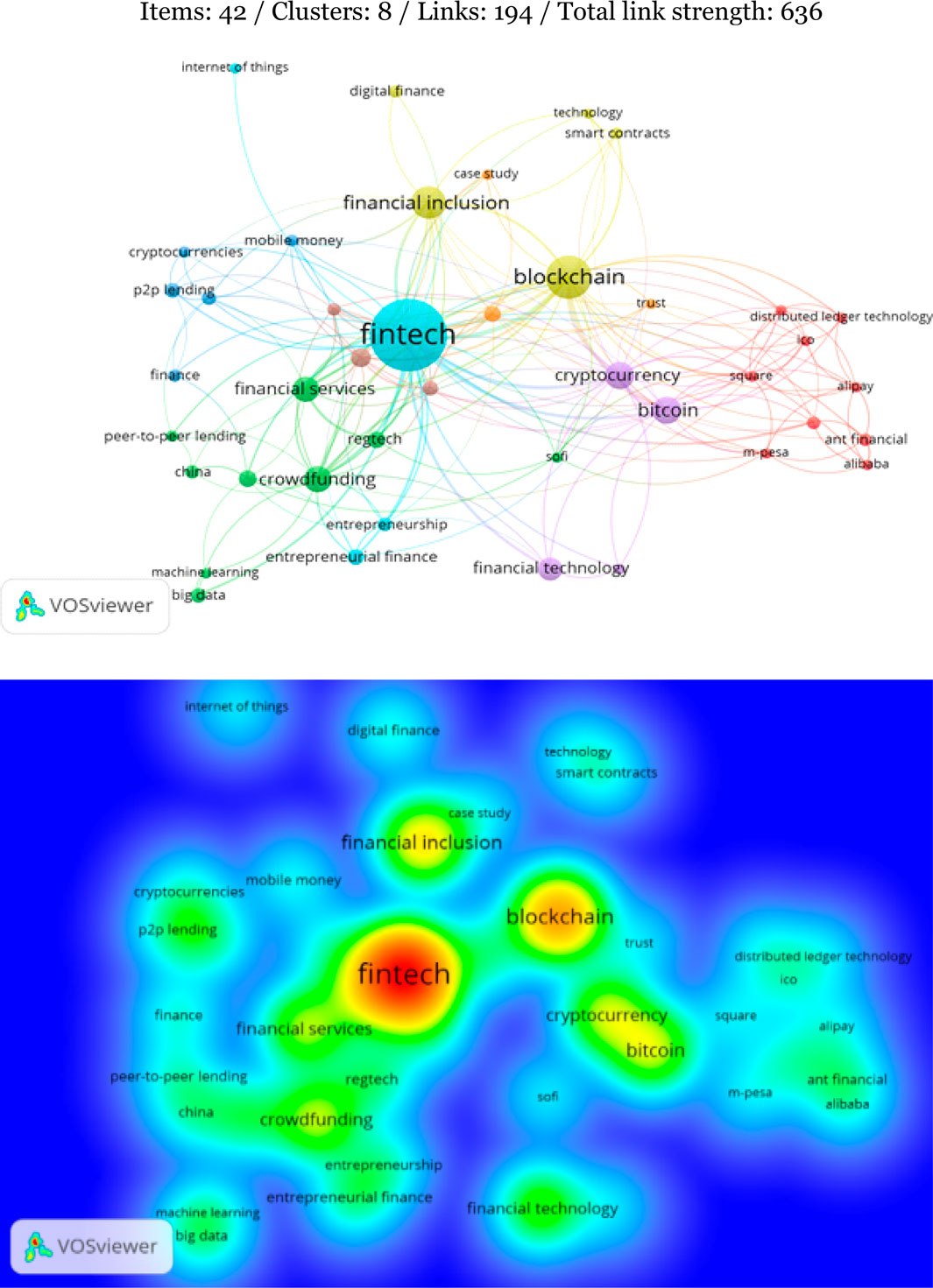

It is noted from the Figure 4A,B that there are 8 clusters in the network that the researcher can take in the field of digital finance and FinTech as research thematic namely Fintech and its related clusters, financial inclusion and blockchain, cryptocurrency and bitcoin, financial services, entrepreneurial finance, P2P lending, distributed ledger technology, and trust.

The researcher should delve deeper into fintech, blockchain, financial inclusion, cryptocurrency, and bitcoin, as shown in the density and the following table in all these areas.

FIGURE 4 . (A) Network of keywords. (B) Density of keywords.

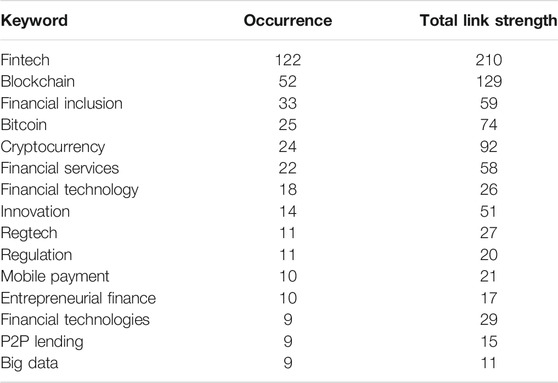

The most common terms used in previous studies were fintech, blockchain, financial inclusion, cryptocurrencies, financial services, and bitcoin. These should be concerned with the research and analysis of researchers in digital finance and FinTech. Now, we come to examine the most visible researchers in this field Table 2 .

TABLE 2 . Occurrence of keywords in the network.

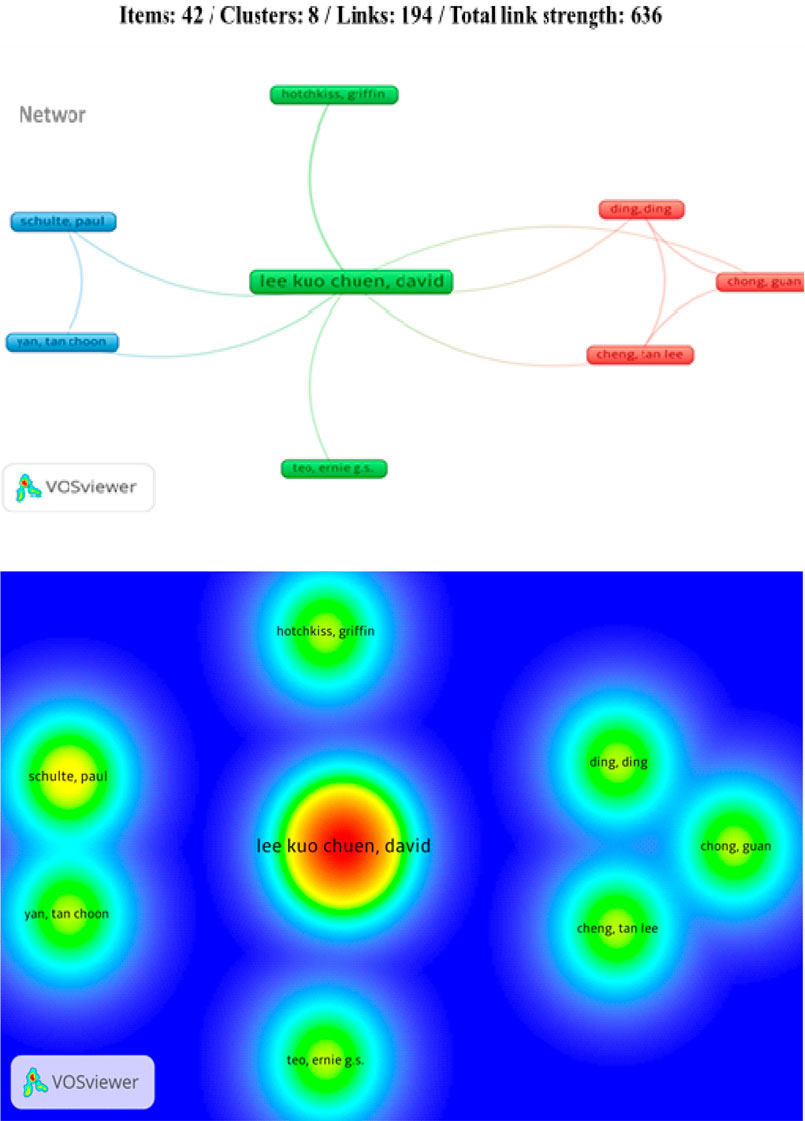

It appears in the Figures 5A,B that the primary researcher in the area of digital finance and FinTech to which all other researchers are related is David Lee Kuo Chuen, and this should return all researchers to his research because of its importance in the field which was similar to the following study: Chuen (2015) , Chuen and Deng (2017) , Nian and Chuen (2015) , and Chuen et al. (2017) .

FIGURE 5 . (A) Network of authors. (B) Density of authors.

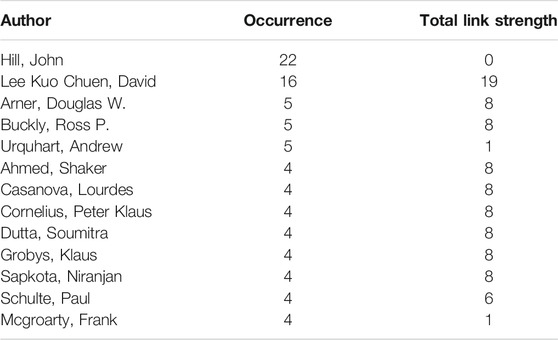

There too, John Hill’s research has not been widely used by other researchers, so we find that his name did not appear on the network and the density. The results of the following table show this.

The Table 3 results show that the most visible researcher in digital finance and FinTech is John Hill, especially his research ( Hill, 2018 ). Still, his research is not used by other researchers who are more visible in this field. On this basis, we can say that the study of David Lee Kuo Chuen is more influential than the research of John Hill in this field; this does not negate the return to his research but must refer to it because of its great importance in this field.

TABLE 3 . Occurrence of authors in the network.

Conclusion and Limitation

This article aims to explain digital finance and financial technology (Fintech), two distinct trends imposed in these areas. The second part of this article uses bolometric analysis with the ScienceDirect database to determine research progress in the field. This reveals that these superpowers are also driving research on the topic, with the most significant digital finance and financial technology publications, and FinTech is emerging on the market ( Omarova, 2021 ). We highlighted specific aspects that need further discussion based on the bibliometric analyses of the research focused on implementing FinTech and digital finance and its application disciplines. The methodologies and new main study topics are all discussed in the published studies.

Bibliometric analyses are a well-established method of meta-analytical investigation ( Paul and Criado, 2020 ) or so-called “meta-reviewed” of the literary world. Bibliometric analyses reveal key articles and explain critically if and within articles relate to any study subject or analyze how many other articles have been cited by one another. Finally, these analyses will assess the success of individual writers and their publications and their effect. The bibliometric citation analysis thus enables the meta-analytical evaluation of the history of a particular area or discipline and the identification of main strands and theoretical frameworks.

The analysis suggests a fundamental unit of study. It, therefore, goes farther than a single count of publications to cover impact centers and maps of relations between articles in a particular field of science ( Kim and McMillan, 2008 ; McKiernan et al., 2019 ). The meta-analysis of quotations thus represents the utility of the literature in other similar researchers ( Timulak, 2009 ). The bibliometric cycle review approach is an appropriate meta-analytic instrument for improving the three research objectives described previously. It provides insights into the research area of digital finance and the pattern of correlations in the Fintech industry.

This research will assist scholars and financial policymakers who are interested in digital finance in understanding the current state of Fintech needs and identifying trends in the corporate boardroom. It also supports the emerging acknowledgment that Fintech will play a critical element in the world endeavor to achieve digital financial trends, which is outlined in this research. Furthermore, digital finance and Fintech publications develop with the regularity, the multidisciplinary nature of digital finance, and the high-disciplinary individual’s inclusions. The high- or low-quality literature around digital finance is getting better, and individuals are involved.

The findings of this study can help the digital finance and Fintech industries develop policies and processes to enhance the emerging digital finance trends in the future. Financial and non-financial institutions can directly assess the financing process as strategic dimensions and policy makers’ vision.

Limitations of Research

This study has some methodological limitations, which may be addressed in future research. First, this research analyzed one database, ScienceDirect, which limited research in articles; other databases, such as Web of Science or Scopus, may be suggested in future bibliometric analyses. Second, it may envision future research from the source or topic of the publications, which may help develop a more comprehensive perspective on financial technology and digital finance.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author Contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The author extends his appreciation to the Deputyship for Research & Innovation, Ministry of Education in Saudi Arabia, to fund this research work through the project number UB-56-1442.

Abbas, J., Aman, J., Nurunnabi, M., and Bano, S. (2019b). The Impact of Social Media on Learning Behavior for Sustainable Education: Evidence of Students from Selected Universities in Pakistan. Sustainability 11 (6), 1683. doi:10.3390/su11061683

CrossRef Full Text | Google Scholar

Abbas, J., Hussain, I., Hussain, S., Akram, S., Shaheen, I., and Niu, B. (2019a). The Impact of Knowledge Sharing and Innovation upon Sustainable Performance in Islamic Banks: A Mediation Analysis through an SEM Approach. Sustainability 11 (15), 4049. doi:10.3390/su11154049

Abbas, J., Mahmood, S., Ali, H., Raza, M., Ali, G., Aman, J., et al. (2019c). The Effects of Corporate Social Responsibility Practices and Environmental Factors through a Moderating Role of Social Media Marketing on Sustainable Performance of Firms' Operating in Multan, Pakistan. Sustainability 11 (12), 3434. doi:10.3390/su11123434

Abbas, J., Raza, S., Nurunnabi, M., Minai, M. S., and Bano, S. (2019d). The Impact of Entrepreneurial Business Networks on Firms' Performance through a Mediating Role of Dynamic Capabilities. Sustainability 11 (11), 3006. doi:10.3390/su11113006

Abbas, J., Zhang, Q., Hussain, I., Akram, S., Afaq, A., and Shad, M. A. (2020). Sustainable Innovation in Small Medium Enterprises: the Impact of Knowledge Management on Organizational Innovation through a Mediation Analysis by Using SEM Approach. Sustainability 12 (6), 2407. doi:10.3390/su12062407

Anjum, M. N., Xiuchun, B., Abbas, J., Shuguang, Z., and McMillan, D. (2017). Analyzing Predictors of Customer Satisfaction and Assessment of Retail Banking Problems in Pakistan. Cogent Business Manag. 4 (1), 1338842. doi:10.1080/23311975.2017.1338842

Arner, D. W., Barberis, J., and Buckley, R. P. (2015). The Evolution of Fintech: A New post-crisis Paradigm. Geo. J. Int'l L. 47, 1271. doi:10.2139/ssrn.2676553

Azizi, M. R., Atlasi, R., Ziapour, A., Abbas, J., and Naemi, R. (2021). Innovative Human Resource Management Strategies during the COVID-19 Pandemic: A Systematic Narrative Review Approach. Heliyon 7, e07233. doi:10.1016/j.heliyon.2021.e07233

Barras, R. (1990). Interactive Innovation in Financial and Business Services: The Vanguard of the Service Revolution. Res. Pol. 19 (3), 215–237. doi:10.1016/0048-7333(90)90037-7

Bradford, S. C. (1934). Sources of Information on Specific Subjects. Engineering 137, 85–86.

Google Scholar

Brandl, B., and Hornuf, L. (2020). Where Did FinTechs Come from, and where Do They Go? the Transformation of the Financial Industry in Germany after Digitalization. Front. Artif. Intell. 3, 8. doi:10.3389/frai.2020.00008

Chuen, D. L. K., and Deng, R. H. (2017). Handbook of Blockchain, Digital Finance, and Inclusion: Cryptocurrency, Fintech, Insurtech, Regulation, Chinatech, mobile Security, and Distributed Ledger . London, UK: Elsevier .

Chuen, D. L. K. (2015). Handbook of Digital Currency: Bitcoin, Innovation, Financial Instruments, and Big Data London, UK: Academic Press .

Fairthorne, R. A. (1969). Empirical Hyperbolic Distributions (Bradford‐Zipf‐Mandelbrot) for Bibliometric Description and Prediction. J. documentation 25 (4), 319–343. doi:10.1108/eb026481

Gill, A., Bunker, D., and Seltsikas, P. (2015). Moving Forward: Emerging Themes in Financial Services Technologies’ Adoption. Commun. Assoc. Inf. Syst. 36 (1), 12. doi:10.17705/1cais.03612

Gomber, P., Koch, J.-A., and Siering, M. (2017). Digital Finance and FinTech: Current Research and Future Research Directions. J. Bus Econ. 87 (5), 537–580. doi:10.1007/s11573-017-0852-x

Hill, J. (2018). Fintech and the Remaking of Financial Institutions . UK: Elsevier .

Hood, W. W., and Wilson, C. S. (2001). The Literature of Bibliometrics, Scientometrics, and Informetrics. Scientometrics 52 (2), 291–314. doi:10.1023/a:1017919924342

Ikpaahindi, L. (1985). An Overview of Bibliometrics: its Measurements, Laws and Their Applications. Libri 35, 163.

Joshi, V. C. (2020). Digital Finance, Bits and Bytes . Singapore: Springer .

Kanungo, R. P., and Gupta, S. (2021). Financial Inclusion through Digitalisation of Services for Well-Being. Technol. Forecast. Soc. Change 167, 120721. doi:10.1016/j.techfore.2021.120721

Karagiannaki, A., Vergados, G., and Fouskas, K. (2017). “The Impact of Digital Transformation in the Financial Services Industry: Insights From an Open Innovation Initiative in Fintech in Greece.,” in Mediterranean Conference on Information Proceedings 2. (MICS) , Genoa, Italy . Available at: http://aisel.aisnet.org/mcis2017/2

Kim, J., and McMillan, S. J. (2008). Evaluation of Internet Advertising Research: A Bibliometric Analysis of Citations from Key Sources. J. Advertising 37 (1), 99–112. doi:10.2753/joa0091-3367370108

Kitchenham, B. (2004). Procedures for Performing Systematic Reviews . Keele, UK: Keele University .

Kuo Chuen, D. L., Guo, L., and Wang, Y. (2017). Cryptocurrency: A New Investment Opportunity? Jai 20 (3), 16–40. doi:10.3905/jai.2018.20.3.016

Lai, K. P. (2020). “FinTech: The Dis/Re-Intermediation of Finance?,” in The Routledge Handbook of Financial Geography . London, UK: Routledge , 440–457. doi:10.4324/9781351119061-24

Lebni, J. Y., Toghroli, R., Abbas, J., NeJhaddadgar, N., Salahshoor, M. R., Mansourian, M., et al. (2020). January 1, 2020). A Study of Internet Addiction and its Effects on Mental Health: A Study Based on Iranian University Students [Original Article]. J. Educ. Health Promot. 9 (1), 205. doi:10.4103/jehp.jehp_148_20

Legner, C., Eymann, T., Hess, T., Matt, C., Böhmann, T., Drews, P., et al. (2017). Digitalization: Opportunity and challenge for the Business and Information Systems Engineering Community. Business Inf. Syst. Eng. 59 (4), 301–308. doi:10.1007/s12599-017-0484-2

Leong, K., and Sung, A. (2018). FinTech (Financial Technology): what Is it and How to Use Technologies to Create Business Value in Fintech Way? Int. J. Innovation, Manag. Techn. 9 (2), 74–78. doi:10.18178/ijimt.2018.9.2.791

Levy, Y., and Ellis, T. J. (2006). A Systems Approach to Conduct an Effective Literature Review in Support of Information Systems Research. Informing Science 9. doi:10.28945/479

Liu, F., Wang, D., Duan, K., and Mubeen, R. (2021). Social media Efficacy in Crisis Management: Effectiveness of Non-pharmaceutical Interventions to Manage the COVID-19 Challenges [Original Research]. Front. Psychiatry 12 (1099), 626134. doi:10.3389/fpsyt.2021.626134

Lobato, C. G., Cristino, T. M., Faria Neto, A., and Costa, A. F. B. (2021). Lean System: Analysis of Scientific Literature and Identification of Barriers for Implementation from a Bibliometric Study. Gestão & Produção 28 (1), 1–26. doi:10.1590/1806-9649.2020v28e4769

Lotka, A. J. (1926). The Frequency Distribution of Scientific Productivity. J. Wash. Acad. Sci. 16 (12), 317–323.

McKiernan, E. C., Schimanski, L. A., Nieves, C. M., Matthias, L., Niles, M. T., and Alperin, J. P. (2019). Meta-research: Use of the Journal Impact Factor in Academic Review, Promotion, and Tenure Evaluations. Elife 8, e47338. doi:10.7554/eLife.47338

Moed, H. F. (2006). Citation Analysis in Research Evaluation . Netherlands: Springer Science & Business Media .

Nian, L. P., and Chuen, D. L. K. (2015). “Introduction to Bitcoin,” in Handbook of Digital Currency (London, UK: Academic Press ), 5–30. doi:10.1016/b978-0-12-802117-0.00001-1

Nicoletti, B., Nicoletti, W., and Weis, (2017). Future of FinTech . Basingstoke, UK: Palgrave Macmillan .

Omarova, S. T. (2021). “Fintech and the Limits of Financial Regulation: A systemic perspective,” in Routledge Handbook of Financial Technology and Law . London, UK: Routledge 44–61.

Osareh, F. (1996a). Bibliometrics, Citation Analysis and Co-Citation Analysis: A Review of Literature I. Libri 46 (3), 149–158. doi:10.1515/libr.1996.46.3.149

Osareh, F. (1996). Bibliometrics, Citation Anatysis and Co-Citation Analysis: A Review of Literature II. Ann. Phys. 46 (4), 217–225. doi:10.1515/libr.1996.46.4.217

Ozili, P. K. (2018). Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanbul Rev. 18 (4), 329–340. doi:10.1016/j.bir.2017.12.003

Paul, J., and Criado, A. R. (2020). The Art of Writing Literature Review: What Do We Know and what Do We Need to Know? Int. Business Rev. 29 (4), 101717. doi:10.1016/j.ibusrev.2020.101717

Prinsen, C. A., Mokkink, L. B., Bouter, L. M., Alonso, J., Patrick, D. L., De Vet, H. C., et al. (2018). COSMIN Guideline for Systematic Reviews of Patient-Reported Outcome Measures. Qual. Life Res. 27 (5), 1147–1157. doi:10.1007/s11136-018-1798-3

Pritchard, A. (1969). Statistical Bibliography or Bibliometrics. J. documentation 25 (4), 348–349.

Puschmann, T. (2017). Fintech. Business Inf. Syst. Eng. 59 (1), 69–76. doi:10.1007/s12599-017-0464-6

Su, Z., McDonnell, D., Cheshmehzangi, A., Li, X., and Cai, Y. (2021a). The Promise and Perils of Unit 731 Data to advance COVID-19 Research. BMJ Glob. Health 6 (5), e004772. doi:10.1136/bmjgh-2020-004772

Su, Z., McDonnell, D., Wen, J., Kozak, M., Šegalo, S., Xiang, L., et al. (2021b). Mental Health Consequences of COVID-19 media Coverage: the Need for Effective Crisis Communication Practices. Globalization and Health 17 (1), 4. doi:10.1186/s12992-020-00654-4

Suprun, A., Petrishina, T., and Vasylchuk, I. (2020). “Competition and Cooperation between Fintech Companies and Traditional Financial Institutions,” in E3S Web of Conferences , Ukraine , April 22, 2000 . Available at: https://doi.org/10.1051/e3sconf/202016613028 . doi:10.1051/e3sconf/202016613028

Teece, D. J. (2010). Business Models, Business Strategy and Innovation. Long range Plann. 43 (2-3), 172–194. doi:10.1016/j.lrp.2009.07.003

Timulak, L. (2009). Meta-analysis of Qualitative Studies: A Tool for Reviewing Qualitative Research Findings in Psychotherapy. Psychotherapy Res. 19 (4-5), 591–600. doi:10.1080/10503300802477989

PubMed Abstract | CrossRef Full Text | Google Scholar

Tsay, R. S. (2005). Analysis of Financial Time Series . Hoboken, NJ: John wiley and sons .

van Oorschot, J. A., Hofman, E., and Halman, J. I. (2018). A Bibliometric Review of the Innovation Adoption Literature. Technol. Forecast. Soc. Change 134, 1–21. doi:10.1016/j.techfore.2018.04.032

Varga, D. (2017). Fintech, the new era of Financial Services. Vezetéstudomįny-Budapest Manag. Rev. 48 (11), 22–32. doi:10.14267/veztud.2017.11.03

Vatananan-Thesenvitz, R., Schaller, A. A., and Shannon, R. (2019). A Bibliometric Review of the Knowledge Base for Innovation in Sustainable Development. Sustainability 11 (20), 5783. doi:10.3390/su11205783

Vučinić, M. (2020). Fintech and Financial Stability Potential Influence of FinTech on Financial Stability, Risks and Benefits. J. Cent. Banking Theor. Pract. 9 (2), 43–66. doi:10.2478/jcbtp-2020-0013

Wang, C., Wang, D., Abbas, J., Duan, K., and Mubeen, R. (2021). 2021-September-03)Global Financial Crisis, Smart Lockdown Strategies, and the COVID-19 Spillover Impacts: A Global Perspective Implications from Southeast Asia [Original Research]. Front. Psychiatry 12 (1099), 643783. doi:10.3389/fpsyt.2021.643783

Zhang, J., Jiang, L., Liu, Z., Li, Y., Liu, K., Fang, R., et al. (2021). A Bibliometric and Visual Analysis of Indoor Occupation Environmental Health Risks: Development, Hotspots and Trend Directions. J. Clean. Prod. 300, 126824. doi:10.1016/j.jclepro.2021.126824

Zipf, G. K. (1949). Human Behavior and the Principle of Least Effort: An Introd. To Human Ecology .

Zupic, I., and Čater, T. (2015). Bibliometric Methods in Management and Organisation. Organizational Res. Methods 18 (3), 429–472. doi:10.1177/1094428114562629

Keywords: digital finance, fintech, bibliometric analysis, ScienceDirect database, e-finance

Citation: Brika SKM (2022) A Bibliometric Analysis of Fintech Trends and Digital Finance. Front. Environ. Sci. 9:796495. doi: 10.3389/fenvs.2021.796495

Received: 16 October 2021; Accepted: 14 December 2021; Published: 10 January 2022.

Reviewed by: