- Share full article

Advertisement

Supported by

High & Low Finance

Deep Roots of Fraud at Olympus

By Floyd Norris

- Dec. 8, 2011

Blame it on James A. Baker III. The “Plaza Accord” that halted the appreciation of the United States dollar in 1985 was largely his doing, as Ronald Reagan’s Treasury secretary. It set in motion a series of events that led to a huge fraud at the Olympus Corporation, the Japanese maker of cameras and medical imaging equipment, that lasted more than two decades.

It turns out that it was an effort to make the company’s books accurate — at least in terms of its balance sheet — that led to the suspicious transactions noticed by Michael C. Woodford, at the time the newly appointed president and chief executive. He thought they showed theft from the company by its chairman, and he confronted him.

It now appears the chairman reacted with righteous indignation. He had not stolen; he had only tried to clean up a mess without damaging the reputation of generations of Olympus executives.

From his point of view, I infer from a new report by an investigating committee , there had been no need to tell Mr. Woodford about what had happened because the fraud was finally behind the company when Mr. Woodford took the job.

The report, released by Olympus this week, shows that two changes in accounting rules, one caused by the Enron scandal, eventually led to the collapse of the scheme.

It shows that KPMG AZSA, the Japanese affiliate of the international accounting group, failed to notice what was going on for years but balked at the somewhat clumsy transactions intended to finally, if misleadingly, put the losses on Olympus’s books. Ernst & Young Sjin Nihon, a Japanese affiliate of that network, was brought in and did sign off.

The scandal also highlights the need for mark-to-market accounting. Until accounting rule makers finally started to require it for some financial instruments in 1997 — seven years after the fraud began — covering up the losses was easy. A decade later, efforts to force companies to stop hiding things in off-balance-sheet entities led to the transactions that ended up exposing the fraud. The collapse of Lehman Brothers in 2008 also played a role.

To understand this scandal fully, remember what life was like for a Japanese company before the Plaza Accord. The dollar had been rising at a good clip and by the end of 1984 was worth more than 250 yen. That was heavenly for Japanese exporters, who could reap large profits exporting to the United States, and it led to a gaping Japanese trade surplus with the United States.

The Plaza Accord was reached by what was then the Group of Five — Japan, the United States, West Germany, France and Britain — at the Plaza Hotel in New York. They agreed on concerted action to bring down the value of the dollar, and to the surprise of many it worked. By the end of the year, the rate was down to 200 yen, and by the end of 1987 it was only 121 yen. It was no longer as much fun to be a Japanese exporter.

But the Japanese bubble was still expanding. In the final four years of the decade, stock prices tripled. In 1985, Olympus — not alone among Japanese companies — introduced zaiteku, or speculative investment, as a major business strategy.

The strategy worked until the Japanese bubble burst in 1990. That year, the company chose to hide losses of nearly 100 billion yen, or about $730 million at the exchange rate at the time. The report does not detail exactly how those losses came, only saying that they involved financial instruments.

How could such a loss be hidden? At the time, accounting rules in Japan, as well as in other countries, allowed investments to be carried at cost. Theoretically, there should eventually have been a write-down, but there never was.

There seems to have been some hope that with additional risky investments, the losses could somehow be made up. They were not. Over time, the company tried securities speculation and private equity, investing in what it thought were promising start-up companies. None of it worked. Eventually, the losses evidently grew to more than $1 billion.

Olympus seems to have been content to sit on the losses until 1997, when accounting rules changed and some investments had to be marked to market. To do so would reveal the entire sordid tale.

So a plan was developed to “sell” the losing investments, at original cost, to shell companies set up by Olympus for that purpose. The sales were financed with loans from banks, which received cash from Olympus to secure the loans. Under lenient accounting rules, those shell companies would not have to be consolidated with Olympus, so the losses could remain hidden.

The plan was to get out of the losses eventually, either by more investments or through overpriced acquisitions, with the extra cost of the acquisitions going to the off-balance-sheet subsidiaries to make them whole. That was done through a variety of means, one of which was retaining the phony companies as high-priced investment advisers. That “cost” would be put on the company’s balance sheet as good will, and eventually written off. When that was done, the balance sheet would show an accurate value for Olympus.

From 1999 to 2003, Olympus managed to get out of some losses, or at least to convert them to good will. No one outside the company was the wiser. KPMG, the auditor, did not notice, the report says, in part because some of the information it received was false.

Perhaps the company could have gradually accomplished the goal, had it not been for Enron.

But in 2001, Enron went broke. One of the ways it had concocted phony profits was to “sell” assets to off-balance-sheet entities it controlled, and to book profits on those sales.

Accounting rule makers do not move rapidly, so it took years to do anything about that in the United States, and even longer in Japan. But in 2007, the Japanese rules were changed. Those shell companies would have to be consolidated. Olympus had until March 31, 2008, the end of its fiscal year, to clean up its books. Some deals were quickly closed in March.

One complicated transaction in 2008 fell apart almost immediately. A company that had accepted some securities from Olympus in September, with the promise they would be exchanged for cash in two years, suddenly demanded immediate payment. That company, the report states, “seemed to be in need of cash due to the impact of Lehman,” which failed in mid-September.

That transaction could not be completed immediately, however, because KPMG was reluctant to sign off on the accounting. It went through only after Ernst & Young became the auditors.

All this might have gone unnoticed but for a Japanese magazine, which reported in July that the company had overpaid spectacularly for the acquisitions that Olympus made to avoid the Enron-related accounting deadline. Olympus denied the allegations.

Mr. Woodford, a British citizen who had run the company’s European operations, became president in April and chief executive in September. He was told to not worry about such history when the magazine article appeared. But he did. With the assistance of PricewaterhouseCoopers, he unraveled the transactions but not their purpose, and concluded that company money was being stolen. He confronted the chairman and was fired. He forced an investigation, which resulted in this week’s report.

The investigating committee reported that it had been assisted by two affiliates of Deloitte Touche Tohmatsu. That makes all members of the Big Four involved in some way.

The committee says the top officers of Olympus knew what was going on throughout and that new presidents always accepted the decisions made by their predecessors. It does not say why Mr. Woodford evidently was not told, but it seems reasonable to think that it was some combination of not trusting a foreigner who had not worked in Japan and a belief that, with the balance sheet now reflecting reality, there was no need to involve him.

Now Olympus is experiencing a mass departure of tainted executives and directors. It is not clear whether a new board will bring Mr. Woodford back.

More than 20 years after the scandal began, the valuation of financial assets for which there is no ready market remains a subject of controversy. This week, the Public Company Accounting Oversight Board, which regulates audit firms in the United States, issued an “audit practice alert” that made clear it was concerned that American auditors were now — like Japanese auditors in the past — too willing to believe whatever management said.

“Auditors are reminded,” the board said, “that audit evidence consists of both information that supports and corroborates management’s assertions and information that contradicts such assertions, including assertions regarding fair values, estimates and related disclosures.”

There is a certain symmetry here. The Olympus scandal might never have been uncovered if reforms had not been forced by the Enron debacle. The accounting oversight board owes its very existence to outrage over Enron, which led Congress to establish the agency in 2002.

Floyd Norris comments on finance and the economy at nytimes.com/economix.

- Accounts and outsourcing

- Audit and assurance

- Business advisory

- Corporate finance

- Financial planning

- Forensic accounting and valuations

- Legal services

- Online accounting

- Restructuring and transformation

- Wealth management

Achieving B Corp™ certification

In line with our values, we take great pride in being a B Corp™ certified accountancy firm.

Resource hub

Shaping your future

This hub of resources aims to help you and your business plan for and reach a brighter future.

- Academies and education

- Agriculture

- Charities and not for profit

- City of London Livery Companies

- Financial services

- Life sciences

- Manufacturing

- Pension schemes

- Professional practices

- Real estate

Kreston Charities Report 2024

The latest Kreston Charities Report explores and explains how charities are planning to deal with relevant issues such as financial challenges, diversity and digitisation. The full report is available for download now.

News and insights

Case studies

We’re proud of our clients’ achievements and growth stories. Find out more about our clients and how we’ve supported them on their journeys in our case study section.

- Publications

- Environmental, social and governance

Working here

Careers at Kreston Reeves

It’s often said that it’s the people you work with that make a job special. We really believe that’s true.

Guiding you to a brighter future

Explore our purpose, values and vision that define who we are, what we stand for, and how we behave.

- Annual accounts preparation

- Company secretarial services

- Management accounting and virtual finance team

- Debt funding

Outsource your payroll

It's important that your employees are paid correctly and on time. Our specialist payroll team are on hand.

- ATOL assurance services

- ICAEW assurance services

- Internal audit

- Company credit checking

- Grants and funding

- Growth advisory

I'm looking to...

Accelerate my business growth

Being an entrepreneur can be one of the greatest experiences of a lifetime, but it can also be a period of uncertainty.

- Buying a business

- Capital markets

- Due diligence

- MBO/MBI financing

- Raising finance

- Reporting accountant

- Selling your business

- Attract business investors

- Explore some of the deals recently completed by Kreston Reeves

- Introducing and managing employee benefits

- Leaving a legacy

- Planning for later life

- Protecting you and your family

- Retirement planning and pensions

- Manage and protect wealth

Estate planning organises finances to take care of your own needs and pass on wealth.

- Business and intangible asset valuations

- Commercial disputes and loss of profits / earnings

- Fraud investigations, crime and confiscation

- Deeds of variation

- Estates and inheritance tax planning

- Executor, trustee and attorney services

- Lasting Powers of Attorney

- Banking reviews

- Business turnaround services

- Restructuring insolvent businesses

- Solvent liquidations and dissolutions

- Working with other accountants

- Corporate tax

- International tax

- Making tax digital

- Personal tax

- Tax disputes

- Tax investigation service

- Trusts and estates

- VAT and duty

- Buy or sell land

- Exit a business

Suggested: Result one Result 2 Result 3

Sorry, there are no results for this search.

Person Name

Norris Holdings

Published by Darren Hurdle on 1 October 2021

Share this article

- Share on Facebook

- Share on LinkedIn

- Share on Twitter

- Send by email

We recently advised Norris Holdings Limited on its disposal of subsidiary Flotronic Pumps Limited.

Originally established in 1981, Flotronic Pumps has been designing bespoke pumping solutions for a wide variety of customers, and manufactures air operated double diaphragm pumps to order. Each pump has a unique “ONE NUT” design enabling rapid disassembly cleaning and maintenance. These are used for a wide range of applications including food, adhesives, pharma, petrochemicals and hazardous materials, with Flotronic also providing excellent support and after sales service.

Its reputation has been built upon quality and understanding customer requirements, innovation on its core product and technical leadership. It is the last remaining British manufacturer of air driven double diaphragm pumps.

The Business is based in Bolney in Sussex and has been in the Norris family since its inception. Customers and users are to be found across the world, and with its excellent reputation most are longstanding.

The shareholders of Norris Holdings wanted to realise their investment in the Business and sought a new owner that would be able to protect the heritage and take the business forward.

Legal advisor

- Doug Stewart of Adams and Remers

Client comments:

"I was really impressed with the quality and insight; it made a positive impact on making sure the transaction progressed, ensuring the deal got over the line."

Rod Partlett, Director of Norris Holdings Limited

Darren Hurdle

- Corporate Finance Director - Lead Advisory

- +44 (0)330 124 1399

- Email Darren [email protected]

View team Subscribe

Email Darren

Full name required

Email address required

Phone number required

Your message

yes I have read the privacy notice and am happy for Kreston Reeves to use my information

Please leave this field empty.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related news and insights

26th April 2024 We advise A4P Consulting on sale to LabConnect

21st March 2024 We advise global infrastructure services provider on £5m funding facility

9th January 2024 We advise Kondor AI on Aquis Stock Exchange listing

View latest news and insights

Subscribe to our newsletters

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

Please send me updates and event invitations for the following required Business, finance and tax issues Personal finance, tax, legal and wealth management issues International business issues Charity and not-for-profit issues

Sectors of interest: Academies and education Agriculture Financial services Life sciences Manufacturing Professional practices Property and construction Technology

First name required

Last name required

Phone number

yes I agree I have read and accept the privacy policy and am happy for Kreston Reeves email communications I have selected above

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

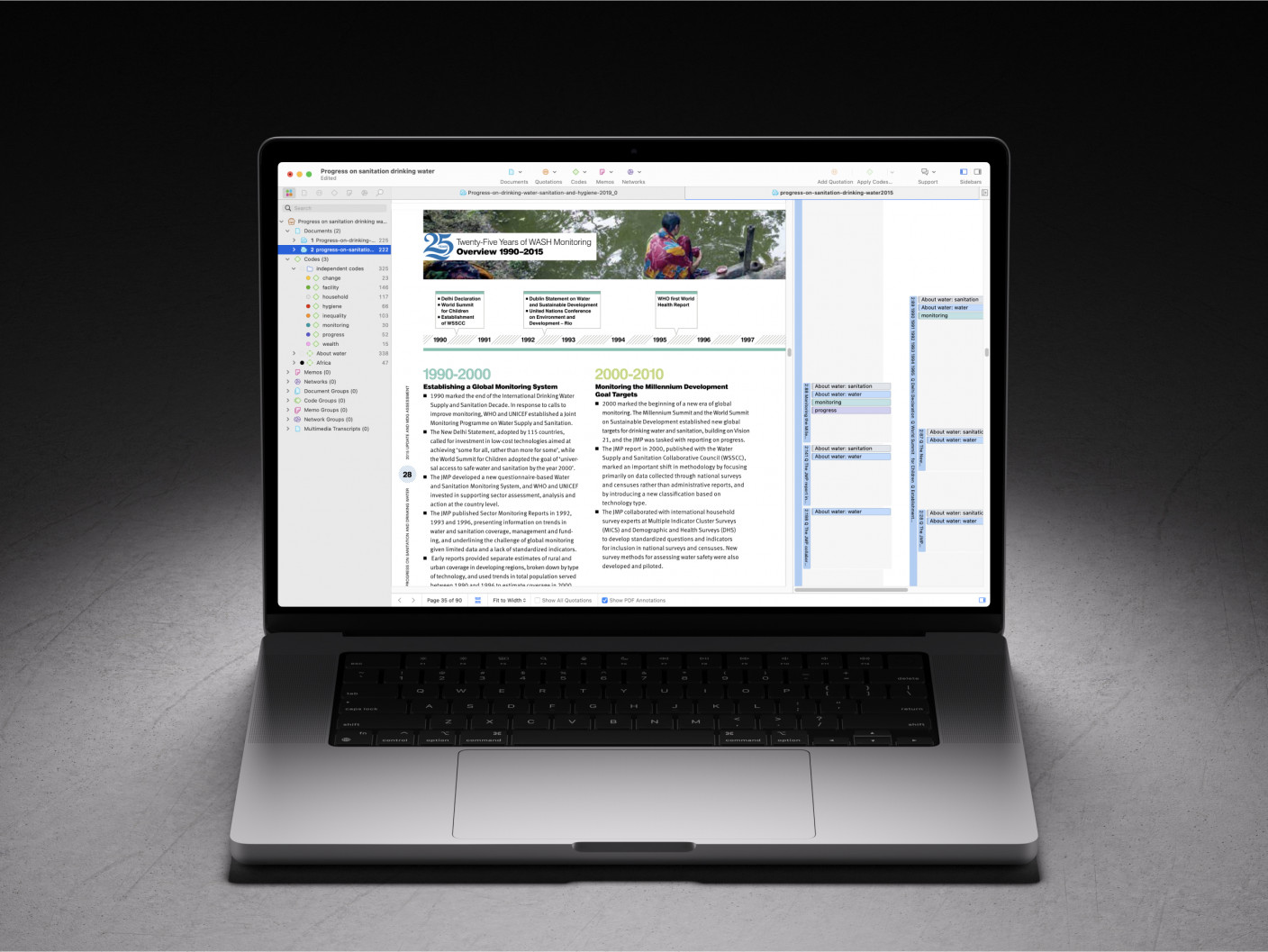

The Ultimate Guide to Qualitative Research - Part 1: The Basics

- Introduction and overview

- What is qualitative research?

- What is qualitative data?

- Examples of qualitative data

- Qualitative vs. quantitative research

- Mixed methods

- Qualitative research preparation

- Theoretical perspective

- Theoretical framework

- Literature reviews

Research question

- Conceptual framework

- Conceptual vs. theoretical framework

Data collection

- Qualitative research methods

- Focus groups

- Observational research

What is a case study?

Applications for case study research, what is a good case study, process of case study design, benefits and limitations of case studies.

- Ethnographical research

- Ethical considerations

- Confidentiality and privacy

- Power dynamics

- Reflexivity

Case studies

Case studies are essential to qualitative research , offering a lens through which researchers can investigate complex phenomena within their real-life contexts. This chapter explores the concept, purpose, applications, examples, and types of case studies and provides guidance on how to conduct case study research effectively.

Whereas quantitative methods look at phenomena at scale, case study research looks at a concept or phenomenon in considerable detail. While analyzing a single case can help understand one perspective regarding the object of research inquiry, analyzing multiple cases can help obtain a more holistic sense of the topic or issue. Let's provide a basic definition of a case study, then explore its characteristics and role in the qualitative research process.

Definition of a case study

A case study in qualitative research is a strategy of inquiry that involves an in-depth investigation of a phenomenon within its real-world context. It provides researchers with the opportunity to acquire an in-depth understanding of intricate details that might not be as apparent or accessible through other methods of research. The specific case or cases being studied can be a single person, group, or organization – demarcating what constitutes a relevant case worth studying depends on the researcher and their research question .

Among qualitative research methods , a case study relies on multiple sources of evidence, such as documents, artifacts, interviews , or observations , to present a complete and nuanced understanding of the phenomenon under investigation. The objective is to illuminate the readers' understanding of the phenomenon beyond its abstract statistical or theoretical explanations.

Characteristics of case studies

Case studies typically possess a number of distinct characteristics that set them apart from other research methods. These characteristics include a focus on holistic description and explanation, flexibility in the design and data collection methods, reliance on multiple sources of evidence, and emphasis on the context in which the phenomenon occurs.

Furthermore, case studies can often involve a longitudinal examination of the case, meaning they study the case over a period of time. These characteristics allow case studies to yield comprehensive, in-depth, and richly contextualized insights about the phenomenon of interest.

The role of case studies in research

Case studies hold a unique position in the broader landscape of research methods aimed at theory development. They are instrumental when the primary research interest is to gain an intensive, detailed understanding of a phenomenon in its real-life context.

In addition, case studies can serve different purposes within research - they can be used for exploratory, descriptive, or explanatory purposes, depending on the research question and objectives. This flexibility and depth make case studies a valuable tool in the toolkit of qualitative researchers.

Remember, a well-conducted case study can offer a rich, insightful contribution to both academic and practical knowledge through theory development or theory verification, thus enhancing our understanding of complex phenomena in their real-world contexts.

What is the purpose of a case study?

Case study research aims for a more comprehensive understanding of phenomena, requiring various research methods to gather information for qualitative analysis . Ultimately, a case study can allow the researcher to gain insight into a particular object of inquiry and develop a theoretical framework relevant to the research inquiry.

Why use case studies in qualitative research?

Using case studies as a research strategy depends mainly on the nature of the research question and the researcher's access to the data.

Conducting case study research provides a level of detail and contextual richness that other research methods might not offer. They are beneficial when there's a need to understand complex social phenomena within their natural contexts.

The explanatory, exploratory, and descriptive roles of case studies

Case studies can take on various roles depending on the research objectives. They can be exploratory when the research aims to discover new phenomena or define new research questions; they are descriptive when the objective is to depict a phenomenon within its context in a detailed manner; and they can be explanatory if the goal is to understand specific relationships within the studied context. Thus, the versatility of case studies allows researchers to approach their topic from different angles, offering multiple ways to uncover and interpret the data .

The impact of case studies on knowledge development

Case studies play a significant role in knowledge development across various disciplines. Analysis of cases provides an avenue for researchers to explore phenomena within their context based on the collected data.

This can result in the production of rich, practical insights that can be instrumental in both theory-building and practice. Case studies allow researchers to delve into the intricacies and complexities of real-life situations, uncovering insights that might otherwise remain hidden.

Types of case studies

In qualitative research , a case study is not a one-size-fits-all approach. Depending on the nature of the research question and the specific objectives of the study, researchers might choose to use different types of case studies. These types differ in their focus, methodology, and the level of detail they provide about the phenomenon under investigation.

Understanding these types is crucial for selecting the most appropriate approach for your research project and effectively achieving your research goals. Let's briefly look at the main types of case studies.

Exploratory case studies

Exploratory case studies are typically conducted to develop a theory or framework around an understudied phenomenon. They can also serve as a precursor to a larger-scale research project. Exploratory case studies are useful when a researcher wants to identify the key issues or questions which can spur more extensive study or be used to develop propositions for further research. These case studies are characterized by flexibility, allowing researchers to explore various aspects of a phenomenon as they emerge, which can also form the foundation for subsequent studies.

Descriptive case studies

Descriptive case studies aim to provide a complete and accurate representation of a phenomenon or event within its context. These case studies are often based on an established theoretical framework, which guides how data is collected and analyzed. The researcher is concerned with describing the phenomenon in detail, as it occurs naturally, without trying to influence or manipulate it.

Explanatory case studies

Explanatory case studies are focused on explanation - they seek to clarify how or why certain phenomena occur. Often used in complex, real-life situations, they can be particularly valuable in clarifying causal relationships among concepts and understanding the interplay between different factors within a specific context.

Intrinsic, instrumental, and collective case studies

These three categories of case studies focus on the nature and purpose of the study. An intrinsic case study is conducted when a researcher has an inherent interest in the case itself. Instrumental case studies are employed when the case is used to provide insight into a particular issue or phenomenon. A collective case study, on the other hand, involves studying multiple cases simultaneously to investigate some general phenomena.

Each type of case study serves a different purpose and has its own strengths and challenges. The selection of the type should be guided by the research question and objectives, as well as the context and constraints of the research.

The flexibility, depth, and contextual richness offered by case studies make this approach an excellent research method for various fields of study. They enable researchers to investigate real-world phenomena within their specific contexts, capturing nuances that other research methods might miss. Across numerous fields, case studies provide valuable insights into complex issues.

Critical information systems research

Case studies provide a detailed understanding of the role and impact of information systems in different contexts. They offer a platform to explore how information systems are designed, implemented, and used and how they interact with various social, economic, and political factors. Case studies in this field often focus on examining the intricate relationship between technology, organizational processes, and user behavior, helping to uncover insights that can inform better system design and implementation.

Health research

Health research is another field where case studies are highly valuable. They offer a way to explore patient experiences, healthcare delivery processes, and the impact of various interventions in a real-world context.

Case studies can provide a deep understanding of a patient's journey, giving insights into the intricacies of disease progression, treatment effects, and the psychosocial aspects of health and illness.

Asthma research studies

Specifically within medical research, studies on asthma often employ case studies to explore the individual and environmental factors that influence asthma development, management, and outcomes. A case study can provide rich, detailed data about individual patients' experiences, from the triggers and symptoms they experience to the effectiveness of various management strategies. This can be crucial for developing patient-centered asthma care approaches.

Other fields

Apart from the fields mentioned, case studies are also extensively used in business and management research, education research, and political sciences, among many others. They provide an opportunity to delve into the intricacies of real-world situations, allowing for a comprehensive understanding of various phenomena.

Case studies, with their depth and contextual focus, offer unique insights across these varied fields. They allow researchers to illuminate the complexities of real-life situations, contributing to both theory and practice.

Whatever field you're in, ATLAS.ti puts your data to work for you

Download a free trial of ATLAS.ti to turn your data into insights.

Understanding the key elements of case study design is crucial for conducting rigorous and impactful case study research. A well-structured design guides the researcher through the process, ensuring that the study is methodologically sound and its findings are reliable and valid. The main elements of case study design include the research question , propositions, units of analysis, and the logic linking the data to the propositions.

The research question is the foundation of any research study. A good research question guides the direction of the study and informs the selection of the case, the methods of collecting data, and the analysis techniques. A well-formulated research question in case study research is typically clear, focused, and complex enough to merit further detailed examination of the relevant case(s).

Propositions

Propositions, though not necessary in every case study, provide a direction by stating what we might expect to find in the data collected. They guide how data is collected and analyzed by helping researchers focus on specific aspects of the case. They are particularly important in explanatory case studies, which seek to understand the relationships among concepts within the studied phenomenon.

Units of analysis

The unit of analysis refers to the case, or the main entity or entities that are being analyzed in the study. In case study research, the unit of analysis can be an individual, a group, an organization, a decision, an event, or even a time period. It's crucial to clearly define the unit of analysis, as it shapes the qualitative data analysis process by allowing the researcher to analyze a particular case and synthesize analysis across multiple case studies to draw conclusions.

Argumentation

This refers to the inferential model that allows researchers to draw conclusions from the data. The researcher needs to ensure that there is a clear link between the data, the propositions (if any), and the conclusions drawn. This argumentation is what enables the researcher to make valid and credible inferences about the phenomenon under study.

Understanding and carefully considering these elements in the design phase of a case study can significantly enhance the quality of the research. It can help ensure that the study is methodologically sound and its findings contribute meaningful insights about the case.

Ready to jumpstart your research with ATLAS.ti?

Conceptualize your research project with our intuitive data analysis interface. Download a free trial today.

Conducting a case study involves several steps, from defining the research question and selecting the case to collecting and analyzing data . This section outlines these key stages, providing a practical guide on how to conduct case study research.

Defining the research question

The first step in case study research is defining a clear, focused research question. This question should guide the entire research process, from case selection to analysis. It's crucial to ensure that the research question is suitable for a case study approach. Typically, such questions are exploratory or descriptive in nature and focus on understanding a phenomenon within its real-life context.

Selecting and defining the case

The selection of the case should be based on the research question and the objectives of the study. It involves choosing a unique example or a set of examples that provide rich, in-depth data about the phenomenon under investigation. After selecting the case, it's crucial to define it clearly, setting the boundaries of the case, including the time period and the specific context.

Previous research can help guide the case study design. When considering a case study, an example of a case could be taken from previous case study research and used to define cases in a new research inquiry. Considering recently published examples can help understand how to select and define cases effectively.

Developing a detailed case study protocol

A case study protocol outlines the procedures and general rules to be followed during the case study. This includes the data collection methods to be used, the sources of data, and the procedures for analysis. Having a detailed case study protocol ensures consistency and reliability in the study.

The protocol should also consider how to work with the people involved in the research context to grant the research team access to collecting data. As mentioned in previous sections of this guide, establishing rapport is an essential component of qualitative research as it shapes the overall potential for collecting and analyzing data.

Collecting data

Gathering data in case study research often involves multiple sources of evidence, including documents, archival records, interviews, observations, and physical artifacts. This allows for a comprehensive understanding of the case. The process for gathering data should be systematic and carefully documented to ensure the reliability and validity of the study.

Analyzing and interpreting data

The next step is analyzing the data. This involves organizing the data , categorizing it into themes or patterns , and interpreting these patterns to answer the research question. The analysis might also involve comparing the findings with prior research or theoretical propositions.

Writing the case study report

The final step is writing the case study report . This should provide a detailed description of the case, the data, the analysis process, and the findings. The report should be clear, organized, and carefully written to ensure that the reader can understand the case and the conclusions drawn from it.

Each of these steps is crucial in ensuring that the case study research is rigorous, reliable, and provides valuable insights about the case.

The type, depth, and quality of data in your study can significantly influence the validity and utility of the study. In case study research, data is usually collected from multiple sources to provide a comprehensive and nuanced understanding of the case. This section will outline the various methods of collecting data used in case study research and discuss considerations for ensuring the quality of the data.

Interviews are a common method of gathering data in case study research. They can provide rich, in-depth data about the perspectives, experiences, and interpretations of the individuals involved in the case. Interviews can be structured , semi-structured , or unstructured , depending on the research question and the degree of flexibility needed.

Observations

Observations involve the researcher observing the case in its natural setting, providing first-hand information about the case and its context. Observations can provide data that might not be revealed in interviews or documents, such as non-verbal cues or contextual information.

Documents and artifacts

Documents and archival records provide a valuable source of data in case study research. They can include reports, letters, memos, meeting minutes, email correspondence, and various public and private documents related to the case.

These records can provide historical context, corroborate evidence from other sources, and offer insights into the case that might not be apparent from interviews or observations.

Physical artifacts refer to any physical evidence related to the case, such as tools, products, or physical environments. These artifacts can provide tangible insights into the case, complementing the data gathered from other sources.

Ensuring the quality of data collection

Determining the quality of data in case study research requires careful planning and execution. It's crucial to ensure that the data is reliable, accurate, and relevant to the research question. This involves selecting appropriate methods of collecting data, properly training interviewers or observers, and systematically recording and storing the data. It also includes considering ethical issues related to collecting and handling data, such as obtaining informed consent and ensuring the privacy and confidentiality of the participants.

Data analysis

Analyzing case study research involves making sense of the rich, detailed data to answer the research question. This process can be challenging due to the volume and complexity of case study data. However, a systematic and rigorous approach to analysis can ensure that the findings are credible and meaningful. This section outlines the main steps and considerations in analyzing data in case study research.

Organizing the data

The first step in the analysis is organizing the data. This involves sorting the data into manageable sections, often according to the data source or the theme. This step can also involve transcribing interviews, digitizing physical artifacts, or organizing observational data.

Categorizing and coding the data

Once the data is organized, the next step is to categorize or code the data. This involves identifying common themes, patterns, or concepts in the data and assigning codes to relevant data segments. Coding can be done manually or with the help of software tools, and in either case, qualitative analysis software can greatly facilitate the entire coding process. Coding helps to reduce the data to a set of themes or categories that can be more easily analyzed.

Identifying patterns and themes

After coding the data, the researcher looks for patterns or themes in the coded data. This involves comparing and contrasting the codes and looking for relationships or patterns among them. The identified patterns and themes should help answer the research question.

Interpreting the data

Once patterns and themes have been identified, the next step is to interpret these findings. This involves explaining what the patterns or themes mean in the context of the research question and the case. This interpretation should be grounded in the data, but it can also involve drawing on theoretical concepts or prior research.

Verification of the data

The last step in the analysis is verification. This involves checking the accuracy and consistency of the analysis process and confirming that the findings are supported by the data. This can involve re-checking the original data, checking the consistency of codes, or seeking feedback from research participants or peers.

Like any research method , case study research has its strengths and limitations. Researchers must be aware of these, as they can influence the design, conduct, and interpretation of the study.

Understanding the strengths and limitations of case study research can also guide researchers in deciding whether this approach is suitable for their research question . This section outlines some of the key strengths and limitations of case study research.

Benefits include the following:

- Rich, detailed data: One of the main strengths of case study research is that it can generate rich, detailed data about the case. This can provide a deep understanding of the case and its context, which can be valuable in exploring complex phenomena.

- Flexibility: Case study research is flexible in terms of design , data collection , and analysis . A sufficient degree of flexibility allows the researcher to adapt the study according to the case and the emerging findings.

- Real-world context: Case study research involves studying the case in its real-world context, which can provide valuable insights into the interplay between the case and its context.

- Multiple sources of evidence: Case study research often involves collecting data from multiple sources , which can enhance the robustness and validity of the findings.

On the other hand, researchers should consider the following limitations:

- Generalizability: A common criticism of case study research is that its findings might not be generalizable to other cases due to the specificity and uniqueness of each case.

- Time and resource intensive: Case study research can be time and resource intensive due to the depth of the investigation and the amount of collected data.

- Complexity of analysis: The rich, detailed data generated in case study research can make analyzing the data challenging.

- Subjectivity: Given the nature of case study research, there may be a higher degree of subjectivity in interpreting the data , so researchers need to reflect on this and transparently convey to audiences how the research was conducted.

Being aware of these strengths and limitations can help researchers design and conduct case study research effectively and interpret and report the findings appropriately.

Ready to analyze your data with ATLAS.ti?

See how our intuitive software can draw key insights from your data with a free trial today.

- Harvard Business School →

- Faculty & Research →

- HBS Case Collection

Barbara Norris: Leading Change in the General Surgery Unit

- Format: Print

About The Authors

Boris Groysberg

Nitin Nohria

Related work.

- Faculty Research

Barbara Norris: Leading Change in the General Surgery Unit (TN)

- Barbara Norris: Leading Change in the General Surgery Unit (TN) By: Boris Groysberg, Nitin Nohria and Deborah Bell

Chapter 14: Case Study

Chapter learning objectives

The audit & assurance paper tests a range of practical andapplication skills. This case study helps to underpin core knowledge andto allow application of knowledge via a series of short exercises.

1 Background

The date is 15 November 20X7 and your audit firm (KPAD Co) has beenapproached by Bling Bling Co, a national chain of jewellers, to tenderfor their statutory audit for the year ending 31 December 20X7.

You are an audit manager working at KPAD and will be managing theaudit of Bling Bling if KPAD is appointed. KPAD is a large audit firmwith branches around the country and in Europe. The firm has over 500clients in many different industries.

You have a meeting scheduled with the Chief Executive Officer (CEO)and Finance Director (FD) of Bling Bling next week to discuss thecontract in more detail.

You have carried out some research on Bling Bling by reviewingtheir website, brochures and also by reading articles from the nationalpress, and have identified the following key points:

- Bling Bling was established 10 years ago and is owned and run by two entrepreneurs who have extensive experience in the jewellery industry.

- Bling Bling is a jewellers with 66 high street stores throughout England.

- They buy high value jewellery from Italy (mainly gold and silver) and sell it in their high street shops, on-line or to other jewellery retailers on a wholesale basis.

- The on-line business is relatively new and has been operating for just over one year.

- An article in the national newspaper in September 20X7 indicated that the price of gold was likely to fall dramatically during the following months due to an upturn in the world economy with major investors moving their funds out of gold and into other investment areas.

Points from meeting with the FD

- The FD informs you that Bling Bling has had another successful year and have opened another three stores at the start of 20X7.

- The directors have asked your firm to commence the audit immediately because audited accounts are needed by the bank by 5th February 20X8.

- Bling Bling would also like your firm to prepare their tax computations for the year in addition to the audit work.

- When asked why the previous auditors left, the CEO indicated that there had been a disagreement with the previous auditors about certain disclosures in the financial statements in the previous year.

Points from meeting with the KPAD audit partner

- Tom Parrott (partner of KPAD) would like to know more about the disagreement from the previous auditors .

- You conclude that the audit firm will have the skills to carry out the audit as it already audits another high street chain of jewellers. In addition, Tom's brother in law is a director at Bling Bling and should be able to assist with any difficulties the auditors have.

- Tom raises his concerns over staffing as it is a busy time of year for the audit firm.

Engagement acceptance

Describe the matters to consider and the procedures that must beundertaken before accepting the appointment as auditor to Bling Bling.

2 Draft Financial Statements for the year ended 31 December 20X7

Bling Bling Co Draft Statement of Financial Position as at 31 December 20X7

Bling Bling Co Draft Income Statement for the year ended 31 December 20X7

Risk assessment

As part of your risk assessment procedures for Bling Bling, identify and explain possible audit risks using:

(a) your knowledge of the business; and

(b) analytical procedures.

Non-current assets: property, plant and equipment note

Non-current assets substantive testing

You are in charge of auditing Bling Bling's non-current assets.

(a) What initial procedures would you perform on the non-current asset note?

(b) Which of the financial statement assertions are most relevant to the testing of motor vehicles?

(c) How would you test each of the assertions you have identified in (b)?

Bank and cash substantive testing

The draft financial statements as at 31 December 20X7 show apositive cash balance of $48,000 and a bank overdraft of $680,000. Thereis also a long term loan of $3,300,000.

(a) What 3 documents would you obtain to prove,with reasonable certainty, that Bling Bling had a bank overdraft of$680,000 at 31 December 20X7?

(b) Rank these three documents in order of reliability.

(c) What would you do with these three documentsto prove, with reasonable certainty that Bling Bling had a bankoverdraft of $680,000 at 31 December 20X7?

(d) How could you prove the amount of cash (notes & coins) that Bling Bling held in its tills and safes at 31 December 20X7?

Aged receivables analysis at 31 December 20X7 ($000)

Trade receivables substantive testing

(a) State and briefly explain three assertions associated with the audit of trade receivables.

(b) Select four balances that should be includedin your trade receivables direct confirmation audit testing. Explainwhy you have included each of the balances.

(c) Apart from direct confirmation, state andexplain six substantive procedures the auditor should perform on theyear-end trade receivables of Bling Bling.

Inventory substantive testing

You attended the physical inventory count at Bling Bling's year endof 31 December 20X7. The company does not maintain book inventoryrecords, and previous years' audits have revealed problems withpurchases cut-off.

Your audit tests on purchases cut-off, which started from the goods received note (GRN), have revealed the following results:

Assume that goods received before the year end are in inventory atthe year end, and goods received after the year end are not in inventoryat the year end.

From the results of your purchases cut-off test described in the question:

(a) Identify the cut-off errors and produce aschedule of the adjustments which should be made to the reportedpurchases and payables in the draft financial statements to correct theerrors.

(b) Comment on the results of your test, and state what further action you would take.

Payables substantive testing

You are now auditing the company's trade payable balance of £400kat 31 December 20X7. The total balance has already been agreed to thepurchase ledger which shows that trade payables consists of 5 suppliers.

A junior member of the audit team has been checking these 5balances by reconciling suppliers' statements to the balances on thepurchase ledger. He is unable to reconcile a material balance, relatingto Geminite, who supply gold jewellery to Bling Bling. He has asked foryour assistance, and your suggestions on the audit work which should becarried out on the differences.

The balance of Geminite on Bling Bling's purchase ledger is shown below:

Purchase ledger Supplier: Geminite Co

Geminite Co have sent the following supplier statement:

Geminite's terms of trade with Bling Bling allow a 2% cash discounton invoices where Geminite receives a cheque from the customer by theend of the month following the date of the invoice (i.e. a 2% discountwill be given on November invoices paid and received by 31 December).

On Bling Bling's purchase ledger, under 'Status' the cash anddiscount marked 'Alloc 1' pay invoices marked 'Paid 1' (similarly for'Alloc 2' and 'Paid 2').

Bling Bling's goods received department checks the goods when theyarrive and issues a goods received note (GRN). A copy of the GRN and thesupplier's advice note is sent to the purchases accounting department.

(a) Prepare a statement reconciling the balance on Bling Bling's purchase ledger to the balance on Geminite's supplier's statement.

(b) Describe the audit work you will carry outon each of the reconciling items you have determined in your answer topart (a) above, in order to determine the balance which should beincluded in the financial statements.

Test your understanding answers

The firm needs to consider a variety of commercial issues and ethical matters (under ACCA's Rules of Professional Conduct).

Matters to consider. Before accepting appointment the firm should ensure that:

- It has the necessary staff with appropriate competencies to complete the audit (this seems likely given that the firm has another client in the jewellery industry).

- The staff are available at what is a busy time of year for the firm (it may be possible that all of the staff with the necessary competencies are otherwise occupied).

- The firm is independent of Bling Bling. Tom Parrott will not be able to partner the audit due to the family relationship he has with one of the directors. KPAD will need to ensure there are no shareholdings or other relationships that may comprise independence.

- There are no conflicts of interest that cannot be properly managed. This is a potential issue as KPAD already audit another high street jewellers. However, as the firm is large with many different branches across the country it should be possible to put in place appropriate safeguards.

Procedures. The firm should:

- Seek the directors' permission to communicate with the company accountant about the nature of the 'disagreement' and the directors should authorise the accountant to co-operate with the firm.

- Seek the directors' permission to communicate with the outgoing auditors. If permission is refused, the appointment should not be accepted.

- Ask the client to write to the outgoing auditors notifying them of the change and giving them permission to communicate with the firm (if Bling Bling refuses to give permission to the outgoing auditors the appointment should not be accepted).

- Communicate with the outgoing auditors (preferably in writing) requesting all the information which ought to be made available to enable the firm to decide whether or not to accept the appointment (if there are no such matters, the outgoing auditors should inform the firm of this).

- Indicate a likely fee (or the basis on which fees are calculated) to Bling Bling, ensure that this is acceptable and that the client is able to pay (by some form of credit check).

- Ensure that the outgoing auditor has properly resigned, been dismissed or has not sought re-appointment in accordance with legal requirements.

(a) Audit risks found using knowledge of the business:

(b) Audit risks found using analytical procedures:

(a) Initial procedures

- Agree opening cost, depreciation and NBV to last years audited closing balances to ensure they have been brought forward accurately. As PKAD were not the auditors in the previous year they may need to consider if any of their own audit work should be conducted on these opening balances.

- Cast (add up) the note to ensure there are no arithmetical errors.

- Agree the total on the note to the trial balance and the financial statements to ensure that it is accurate and complete.

- Compare the disclosure of the note in accordance with the requirements of the International accounting standards to ensure it is adequate.

(b) Assertions

Completeness – have all the vehicles that should have been recorded been recorded?

Accuracy – have amounts been recorded and disclosed appropriately?

Existence – do the vehicles actually exist?

Rights and obligations – does the entity hold or control the rights to the vehicles?

Valuation and allocation – are vehicles valued appropriately in the financial statements?

(c) Audit tests

Completeness

- During the physical inspection for existence, record details of some vehicles and ensure those vehicles are recorded in the non-current asset register.

- Identify the supplier of the vehicles from a purchase invoice. Obtain all invoices from this supplier and confirm completeness of recording in the non-current asset register.

- For a sample of vehicles from the ledger, confirm existence by physically seeing the vehicle.

Rights and obligations

- Examine a sample of purchase invoices to confirm ownership of the vehicles.

Valuation and allocation

- Review company policy for depreciation. Confirm with amount charged in similar companies that the depreciation percentage appears to be correct.

- Agree depreciation charged in the non-current asset note to the amount on the profit and loss account.

- Check a sample of depreciation calculations to ensure that they are accurate and that they conform to company policy.

(a) Three documents to assist an auditor wouldbe the clients bank reconciliation, the bank statements and also a bankconfirmation letter. The bank confirmation letter is a reply directly tothe auditor from the bank that details the accounts and balances thatare held at a bank by a particular client. It will also detail any longterm loans that are owed together with any other relevant informationsuch as any security held by the bank over outstanding loans.

(b) In order of reliability the bankconfirmation letter is the most reliable evidence, the bank statementsnext and finally the bank reconciliation is the least reliable source ofevidence.

The bank confirmation letter is the most reliable as it a thirdparty document that has been generated at the request of the auditor andsent directly to the auditor without the client being involved, apartfrom providing authorisation to the bank to disclose such information tothe auditor.

The bank statements are next in order of reliability as althoughthey are third party documents they are usually provided to the auditorby the client – i.e. the bank sends the statements to the client(Bling Bling) who pass them on to the auditor to review during theaudit. Any documents that pass through the hands of the client will beless reliable as there is the risk, however small, that the client willalter the documents to fulfil their own objectives.

Finally the bank reconciliation is the least reliable as it is aclient generated document. As such this source document cannot be fullyrelied upon and further audit evidence will be sought to confirm itsaccuracy.

(c) Audit procedures:

- Cast the bank reconciliation to confirm arithmetical accuracy.

- Trace and agree the bank statement balance on the bank reconciliation to an original bank statement and also to the bank confirmation letter.

- Trace and agree all unpresented cheques and outstanding lodgements on the bank reconciliation to post year end bank statements to ensure that they have cleared in a reasonable timeframe.

- Trace and agree the cash book balance on the bank reconciliation to Bling Bling's actual computer accounting records.

- Scrutinise the bank confirmation letter to ensure that no other bank accounts exist.

(d) The auditor should plan to attend all/someof Bling Bling's shop's on the last day of year to observe counting ofall cash on the premises. This can then be verified to a list ofyear-end cash balances during the final audit.

(a) Assertions

NB: Only four assertions are given, for example purposes.

- Existence – does the receivable and the amounts listed as outstanding actually exist

- Rights & obligations – does Bling Bling have the right to receive the outstanding amounts from each customer to settle legitimate outstanding invoices

- Accuracy – does the trade receivable listing add up and are individual ledger balances arithmetically accurate

- Valuation – are the trade receivable balances stated at the appropriate carrying value, net of any bad debt write offs or provisions.

(b) Balances selected for testing

- JPM Pickles – The outstanding balance is over 30% of the total receivables outstanding at the year end and is therefore material. Errors in this account may result in a material error in the account balance as a whole.

- The Prawnbrokers – The large and old credit balance on the listing suggests an error has been made in this account. A payment from another customer may have been misallocated to this account or a the client may have over or double paid an invoice.

- Goldensmiths – This large and old balance may require write off or a specific provision to be made if the recoverability of the amount is in doubt.

- Watches of Sunderland – Although the outstanding amount is small the credit balance appears to be due to a difference between a recent large payment and the outstanding balance. The error may indicate other potential errors that have taken place in this account.

There are several other balances that could be identified andjustified in your answer for similar reasons to the above answers. Theseinclude Beautiful things, Ernst Bones and Jewels R us.

- For a sample of outstanding balances at the year end trace and agree receipts from the customer shown in the receivables ledger after the year end to the cash book and bank statements.

- For any amounts over 90 days old at the year end that have not subsequently been received discuss with the client the need for write offs or the provision for irrecoverable receivables.

- For a sample of invoices raised just before and just after the year end trace to the relevant goods dispatch note and confirm that the sale has been recorded in the correct period to ensure the cut-off has been applied correctly.

- Cast and agree the arithmetical accuracy of the receivables ledger and a sample of individual accounts.

- Trace and agree the balance on the receivable listing to the draft financial statements.

- Verify the opening balance on the receivables ledger matches the closing balance on the prior year ledger and the prior year financial statements.

- Discuss with management the assumptions underlying any general provisions to ensure reasonable and appropriate.

- Recalculate the general provision based on management's assumptions and agree the figure to the draft financial statements.

(a) In the list of items given in the question,purchases cut-off is correct for items 1, 2, 7 and 8. So the adjustmentsto profit are:

(b) The test has highlighted four errors in asample of 8 items, an error rate of 50%, which is very high. With thehigh error rate, there is evidence of serious purchases cut-off errors,and to quantify the potential error, a larger sample of items should beselected, covering a longer period. It is suggested the period shouldcover two weeks before the year end to two weeks after the year end, anda greater proportion of GRN's should be selected.

If there are cut-off errors at the end of these periods (i.e. twoweeks before the year end and two weeks after the year end), the periodfor checking cut-off should be extended. In addition, the company'smanagement should be notified of the problem. They could help bychecking cut-off and giving me a schedule of the items they have checkedand the errors they have found.

As further checks of purchases cut-off, I would check purchaseaccruals at the year end. They should be for goods received before theyear end which have not been included on the purchase ledger before theyear end. A purchase accrual should not be included where:

- goods are received before the year end and the purchase invoice has been posted to the purchase ledger before the year end; or

- goods are received after the year end.

In addition I would check the reconciliation of suppliers'statements to the balances on the purchase ledger, and investigate anydifferences. For instance, if there are invoices on the supplier'sstatement which are not on the client's purchase ledger, I will checkthe goods were received after the year end (if they were received beforethe year end, and were not included in purchase accruals, there wouldbe a purchases cut-off error). This work should quantify the totalpurchases cut-off error, which should be included in the summary ofunadjusted errors in my audit working papers.

(a) Reconciliation of purchase ledger balance to balance on supplier's statement:

(b) Looking at each of the items above:

(i) The date of the cash payment forthe October invoices suggests that Geminite will not have received thecheque for £61,630 until after the 30 November and so Bling Bling maynot be entitled to the 2% cash discount. The date the cheque was bankedby Geminite can be found by looking at Bling Bling's bank statement andchecking the date it was cleared by the bank. The entry in Bling Bling'sledger suggest the cheque was posted on 30 November however this is notconclusive evidence that the cheque was actually sent to Geminite onthis date. Neither is the date of clearance at the bank conclusive proofof when the cheque was actually received by Geminite. To establish thevalidity of the discount I will ask Bling Bling's purchase ledgercontroller about this item, and inspect correspondence with Geminite. IfBling Bling usually pays this disallowed discount to Geminite, thisdisallowed discount should be added to the purchase ledger balance. IfGeminite eventually allows the discount, there is no need to add thediscount to the balance.

(ii) The apparent transposition erroron invoice 6080 would be checked by inspecting the invoice. If theinvoice shows $37,520, then an additional payable of $1,800 should beadded at the year end to correct this error. No adjustment will benecessary if Bling Bling's figure is correct.

(iii) It appears that invoice 6210 for£47,350 has not been included on Bling Bling's purchase ledger. As thisinvoice is dated some time before the year end, the first question toask is whether the goods have been received. I will check whether thegoods have been received by looking for the appropriate goods receivednote (I may have to ask Geminite for details of this item, if no invoicecan be found at Bling Bling). If the goods have been received, I willcheck if there is a purchase invoice. If there is a purchase invoice, Iwill ask the purchases department why the invoice has not been posted tothe purchase ledger. This may be because of a dispute, possibly eitheran incorrect price, the wrong quantity or some faults with the goods. Ifthe goods relating to this invoice are in inventory (or have been sold)a purchase accrual should be made for this item. If there has been ashort delivery, the purchase accrual would be for the actual goodsreceived, rather than for those on the invoice. I will inspectcorrespondence relating to this invoice with Geminite to assess whatwill be finally agreed. If there is no evidence of the goods beingreceived by Bling Bling, I will ask Geminite for details confirming thatBling Bling has received the goods. If there is no evidence that BlingBling has received the goods, then no purchase accrual for this invoiceis necessary.

(iv) For invoice 6355, the key questionis likely to be whether Bling Bling received the goods before the yearend. I will check if Bling Bling received the goods before the year endby looking at the date on the goods received note. If the date is beforethe year end, then Bling Bling should include a purchase accrual at theyear end for this invoice.

(v) The cheque on 31 December appearsto be cash in transit. I will check the date the cheque is cleared bythe bank after the year end. If this is within a week, and most othercheques are cleared within a week, then this is validly cash in transit.If most cheques issued immediately before the year end take more than aweek to clear, it indicates they were sent to suppliers after the yearend, in which case they should be deducted from payments before the yearend and added to payables (as these were payments made after the yearend).

(vi) If, as appears likely, the chequefor £60,050 is not received by Geminite until some time after the yearend, then the discount of $1,230 may be disallowed by Geminite. If thisdiscount is disallowed, it should be added to payables at the year end.Checks on this item are similar to those for item (i) above.

- Useful Information

- Give Us Your Feedback

- Privacy and Cookie Information

- Cookie Preferences

- Terms & Conditions

- Related Free Resources

- Kaplan Blog

- Kaplan Business in the UK

- Kaplan Financial

- Kaplan Publishing

This Product includes content from the International Auditing and Assurance Standards Board (IAASB) and the International Ethics Standards Board for

Accountants (IESBA), published by the International Federation of Accountants (IFAC) in December 2012 and is used with permission of IFAC.

- Open Research Repository

Beyond commercial in confidence: accounting for power privatisation in Victoria

Journal title, journal issn, volume title, description, collections, entity type, access statement, license rights, restricted until.

DSpace software copyright © 2002-2024 LYRASIS

- Cookie settings

- Privacy policy

- End User Agreement

Case Study Instructions

Before attempting the Case Study and Case Study Exam , you should first read and be familiar with the Unit Content and the Case Study Avatar .

After you have read the Unit Content and the Case Study Avatar , you should then read the Case Study .

Following your review of the Case Study , you must answer all of the questions in the Case Study Exam in order to complete the Case Study for Unit 1.

- Click the Case Study Avatar button to learn about the Dealing Representative in the Case Study

- Click the Case Study (Online) button and/or the Case Study (PDF) button to read the Case Study

- Click the Case Study Exam button to launch the online Case Study Exam

Note: On tablets or phones, please view this course in landscape orientation.

Case Studies in Financial Services: Success and Failures

- First Online: 01 January 2020

Cite this chapter

- Brian Scott-Quinn 2

440 Accesses

Keeping investment banks alive in difficult times is challenging. Many have failed to survive. Bear Stearns and Lehman are only the latest in a long line of investment banks which have failed over the past decades. Royal Bank of Scotland and Citigroup are examples of those which survive, but in a much weakened state and only through temporary state ownership. Indeed the failure rate of investment banks over decades has made some rating agencies view them as not being eligible for ‘investment grade status’ in their company ratings. JP Morgan Chase is one which came through the financial crisis strengthened relative to its competitors. Even harder is the creation of a new ‘bulge bracket’ investment bank able to challenge the other major houses. I will now off er a contrast between a successful challenger and an unsuccessful one, before looking at some of the walking wounded from the war of att rition of 2007–12.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Unable to display preview. Download preview PDF.

Author information

Authors and affiliations.

ICMA Centre for Financial Markets, Henley Business School, University of Reading, UK

Brian Scott-Quinn

You can also search for this author in PubMed Google Scholar

Copyright information

© 2012 Palgrave Macmillan, a division of Macmillan Publishers Limited

About this chapter

Scott-Quinn, B. (2012). Case Studies in Financial Services: Success and Failures. In: Commercial and Investment Banking and the International Credit and Capital Markets. Palgrave Macmillan, London. https://doi.org/10.1007/978-0-230-37048-7_27

Download citation

DOI : https://doi.org/10.1007/978-0-230-37048-7_27

Published : 02 March 2020

Publisher Name : Palgrave Macmillan, London

Print ISBN : 978-0-230-37047-0

Online ISBN : 978-0-230-37048-7

eBook Packages : Business and Economics Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Creative Accounting Practices at Satyam Computers Limited: A Case Study of India’s Enron

- Madan Lal Bhasin Professor in Accounting KIMEP University Almaty

Satyam Computers were once the crown jewel of Indian IT industry, however, the debacle of Satyam raised a debate about the role of CEO in driving a company to the heights of success and its relation with the board members and core committees. The scam brought to the light the role of corporate governance (CG) in shaping the protocols related to the working of audit committees and duties of board members. The Satyam scam was a jolt to the market, especially to Satyam stockholders. This paper attempts an in-depth analysis of India’s Enron, Satyam Computer’s “creative-accounting” scandal. In public companies, this type of ‘creative’ accounting leading to fraud and investigations are, therefore, launched by the various governmental oversight agencies. The accounting fraud committed by the founders of Satyam in 2009 is a testament to the fact that “the science of conduct is swayed in large by human greed, ambition, and hunger for power, money, fame and glory.” Scandals have proved that “there is an urgent need for good conduct based on strong corporate governance, ethics and accounting & auditing standards.” The Satyam scandal highlights the importance of securities laws and CG in emerging markets. Indeed, Satyam fraud “spurred the government of India to tighten the CG norms to prevent recurrence of similar frauds in future.” Thus, major financial reporting frauds need to be studied for ‘lessons-learned’ and ‘strategies-to-follow’ to reduce the incidents of such frauds in the future. The increasing rate of white-collar crimes “demands stiff penalties, exemplary punishments, and effective enforcement of law with the right spirit.”

ACFE (2010), “Report to the Nation on Occupational fraud and abuse,” The Association of Certified Fraud Examiners, available at

American Institute of Certified Public Accountants (2002), “SAP-99: Consideration of Fraud in a Financial Statement Audit,” Auditing Standard Board, AICPA, available at http://www.aicpa.org/info/sarbanes_oxley_summary.html .

Agrawal, S. and Sharma, R. (2009), “Beat this: Satyam won awards for corporate governance, internal audit.” VCCircle. Available at www.vccircle.com/news.

Ahmad, T., Malawat, T., Kochar, Y. and Roy, A. (2010), “Satyam Scam in the Contemporary corporate world: A case study in Indian Perspective,” IUP Journal. Available at SSRN,1-48.

Behan, B. (2009), “Governance lessons from India’s Satyam,” Business Week, 16 January.

Basilico, E., Grove, H, and Patelli, L. (2012), “Asia’s Enron: Satyam (Sanskrit word for truth),” Journal of Forensic & Investigative Accounting, 4(2), 142-160.

Beirstaker, J.L., Brody, R.G. and Pacini, C. (2005) “Accountants’ perceptions regarding fraud detection and prevention methods”, Managerial Auditing Journal, 21(5), 520-535.

Bhasin, M.L. (2008), “Corporate Governance and Role of the Forensic Accountant, The Chartered Secretary Journal, Vol. 38(10), October, 1361-1368.

Bhasin, M.L. (2011),Corporate Governance Disclosure Practices: The Portrait of a Developing Country, International Review of Business Research Papers, 7(1), January, 393-419.

Bhasin, M.L. (2013), Corporate Accounting Scandal at Satyam: A Case Study of India’s Enron, European Journal of Business and Social Sciences, 1(12), March, 25-47.

Bhasin, M.L. (2013a), Corporate Accounting Fraud: A Case Study of Satyam Computer Limited, Open Journal of Accounting, April, 2(2), 26-38.

Bhasin, M.L. (2013b), Corporate Governance and Role of the Forensic Accountants: An Exploratory Study of an Asian Country, International Journal of Contemporary Business Studies, 4(7), July, 38-59.

Bhasin, M.L. (2015), Menace of Frauds in Banking Industry: Experience of a Developing Country, Australian Journal of Business and Management Research, 4(12), April, 21-33.

Bhasin, M.L. (2015a), Creative Accounting Practices in the Indian Corporate Sector: An Empirical Study, International Journal of Management Science and Business Research, Volume 4, Issue 10, October 2015, E-ISSN 2226-8235 published by QS publishers, USA, pp. 35-52 (USA).

Bhasin, M.L. (2016), Contribution of Forensic Accounting to Corporate Governance: An Exploratory Study of an Asian Country, International Business Management Journal, 10(4), 479-492.

Bhasin, M.L. (2016a), Survey of Creative Accounting Practices: An Empirical Study, Wulfenia Journal KLAGENFURT, 23(1), January, 143-162,

Bologna, G.J. and Lindquist (1996), “Fraud Auditing and Forensic Accounting: New Tools and Techniques,” Wiley & Sons, New Jersey.

Bowen, R.M., Call, A.C and Rajgopal, S. (2010), “Whistle-blowing: target firm characteristics and economic consequences,” The Accounting Review, 85(4)1239-1271.

Blakely, R. (2009). “Investors raise questions over PWC Satyam audit,” Times Online.

Calderon, T. G., and B. P. Green. (1994). “Signaling Fraud by Using Analytical Procedures,” Ohio CPA Journal, April, 27-38.

Cecchini, M., Aytug, H., Koehler, G.J. and Pathak, P. (2010), “Detecting management fraud in public companies,” Management Science, 56(7) July, 1146-1160.

Crutchley, C.E., Jensen, M.R.H., and Marshall (2007), “Climate for scandal: corporate environments that contribute to accounting fraud,” The Financial Review, 42, The Eastern Finance Association, pp.53-73.

Chen, S. (2010) “The role of ethical leadership versus institutional constraints: a simulation study of financial misreporting by CEOs,” Journal of Business Ethics, Springer, 93(2), 33-52.

Cheng, S.S., Padgett, D.R. and Parekh, V. (2013), Crisis Response across borders: a comparative study of two companies’ image repair discourse, International Journal of Business and Social Science, 4(5), May 124-140.

Chakrabarti, R., Megginson, W., Yadav & Pradeep K. (2008). Corporate Governance in India. Journal of Applied Corporate Finance, 20(1), 59.

Chopra, A. (2011), “Satyam fraud, not an accounting failure,” Business Standard, 25 January. Available at http://www.business-standard.com .

Choo, F. and Tan, K. (2007) ‘An “American Dream” Theory of Corporate Executive Fraud’, Accounting Forum, Issue 31: 203-215.

COSO (2010), “Fraudulent financial reporting: 1987-2007,” Committee of Sponsoring Organizations of the Treadway Commission, available at http://www.coso.org .

D’Monte, L. (2008). Satyam: just what went wrong? Rediff India Abroad.

Dagar, S.S. (2009). How Satyam was sold The untold story: How the IT services major was rescued against all odds.Business Today, July.

Damodaran, M. (2009), “Listed firms to get new conduct code,” Financial Chronicle, available at http://wrd.mydigitalfc.com .

Deloitte Forensic Center (2011), “Fraud, Bribery and Corruption Practices Survey,” available at http://www.deloitte.com .

Dixit, N. (2009), What Happened at Satyam? March 1, available at [email protected]

Fernando, A.C. (2010), Satyam: Anything but Satyam, Loyala Institute of Business Administration. Available at www.publishingindia.com.

Haugen, S. and Selin, J.R. (1999) “Identifying and controlling computer crime and employee fraud”, Industrial Management & Data Systems, 99(8),340-344.

Hindustan Times (2015), “Satyam Scam: All you need to know about India’s biggest accounting fraud,” April 9.

Hogan, C.E., Razaee, Z, Riley, R.A. and Velury, U.K. (2008), “Financial statement fraud: insights from the academic literature,” Auditing: A Journal of Practice & Theory, 27(2), November, 231-252.

ICAI (2009). ICIA finds ex Satyam CFO, Price Waterhouse auditors guilty. Outlook India.com.

Ingam, K. (2015), India’s Satyam Scandal: A Blessing in Disguise? 20 Dec. Recorder Press.

Jeffords, R. (1999), “How useful are the Treadway risk factors?”, Internal Auditor, 49(2) June.

Kahn, J. (2009). The Crisis exposes all the flaws. Newsweek.

Kaul, V. (2015), Satyam scam: Ramalinga Raju, the man who knew too much, gets 7 years in jail, April 10.

Khedekar, D. (2010), Corporate Crime: a comparison of culture at Enron and Satyam, Economics & Business Journal: Inquiries and Perspectives, 3(1) Oct. 156-175.

Kripalani, M. (2009). India’s Madoff Satyam scandal rocks outsourcing industry. Business Week.

KPMG Fraud Survey 2009, 2003, 1998, 1994. Available at www.kpmginstiutes.com.

Krishnan, A. (2014), Finally, the truth about Satyam, The Hindu Business Line, July 18.

Manoharan, T.N. (2011), “Financial Statement Fraud and Corporate Governance,” 11 November. Available at www.slideserve.com.

Miller, G.S. (2006), “The press as a watchdog for accounting fraud,” Journal of Accounting Research, 44(5), December, 1001- 1033.

Norris, F. (2011), “Indian Accounting Firm is Fined $7.5 million over fraud at Satyam,” The New York Times, April 5, 2011.