The Student’s Guide to Budgeting in College

BestColleges.com is committed to delivering content that is objective and actionable. To that end, we have built a network of industry professionals across higher education to review our content and ensure we are providing the most helpful information to our readers.

Drawing on their firsthand industry expertise, our Integrity Network members serve as an additional step in our editing process, helping us confirm our content is accurate and up to date. These contributors:

- Suggest changes to inaccurate or misleading information.

- Provide specific, corrective feedback.

- Identify critical information that writers may have missed.

Integrity Network members typically work full time in their industry profession and review content for BestColleges.com as a side project. All Integrity Network members are paid members of the Red Ventures Education Integrity Network.

Explore our full list of Integrity Network members.

Your spending habits — what you buy and how you choose to pay for those things — impact not only your current financial situation but also your future finances. This includes what types of loans you may qualify for and your ability to meet emergency expenses.

By becoming financially literate, you can create and sustain a college budget that helps you accomplish key goals.

This in-depth guide offers essential tips for putting together a college student budget. It covers money-saving strategies and provides a college budget example.

Why Is a College Student Budget Important?

Even if you’re attending an affordable college, tuition and fees can still be expensive . According to the College Board , the average debt level of four-year college graduates in 2020-21 who took out student loans was $29,400. Additionally, in a 2024 Sallie Mae report , the average amount of money students borrowed through credit cards was $2,268.

Altogether, students who borrow money to help pay for bachelor’s degrees owe around $31,000. Combined with the fact we’re in a high-interest environment, this amount of debt can take years to pay off. It can also hinder personal growth and limit your professional opportunities.

Fortunately, students can greatly reduce this potential financial strain by learning to budget with careful regard to their needs, limitations, and goals.

How to Budget in College: 4-Step Guide

Follow the steps below to learn how to budget as a college student and save money .

Step 1: Break Down Your Total Income

The first step to making an effective college student budget is breaking down your income. Your income each term may be influenced by the following factors, according to the Federal Student Aid Office :

- Financial contributions from family members put toward your educational expenses

- Financial aid that you can apply toward tuition and fees, such as scholarships, grants , and student loans

- Refunds you receive from your financial aid office

- Recurring funds that you earn each month, such as pay from a part-time job or federal work-study job or funding from other sources

- The number of hours you work per week

If you accepted more loans, grants, or college scholarships than you needed to cover tuition, room and board, and facilities fees, your school’s financial aid office should give you a refund for the excess amount, usually in the form of direct deposit or a check.

You can save refunds in your bank account or apply them toward textbooks and other education-related expenses. Check your student bill to make sure everything has been paid for before you spend any refund money.

Step 2: Assess and Categorize Your Expenses

To assess your financial situation, log in to your bank or credit union’s website. Here, you can review your spending and earnings over the past month.

Referring to this statement, you can then make a list of all the things you spend money on in a typical month and the average cost of each item. Fixed expenses are necessities with the same prices every month. Variable expenses are necessities or wants with prices that vary month to month. Make sure you categorize these expenses, tagging everything as either a “necessity” or a “want.”

For example, a daily cup of coffee from Starbucks would be considered a want, whereas a 30-day supply of a prescription medicine you take would be considered a need.

Step 3: Crunch the Numbers

Now that you’ve organized your expenses, it’s time to crunch the numbers. Start by adding all your expenses together. Then, subtract that number from your monthly income.

If the final number you get is negative, that means that you’re spending more money than you make each month. If the number is positive, you have extra money to spend or put toward your savings. Building an emergency fund — a stash of money put aside to cover unexpected or emergency situations, such as medical bills — is especially important if you can. Many students keep emergency funds in their savings accounts.

Step 4: Create a College Student Budget

Now that you’ve calculated all the numbers, look through your expenses to see what items you can adjust or cut from your list.

For instance, if you’re spending $50 a month at the movie theater and you’re spending far more than you earn, consider cutting back on this “want” to balance your budget. Many people use the 50/30/20 rule, which calls for putting 50% of your total after-tax income toward needs, 30% toward wants, and 20% toward savings and other financial goals.

This step takes the longest, but getting your finances under control with a college student budget is worth the effort.

College Budget Example

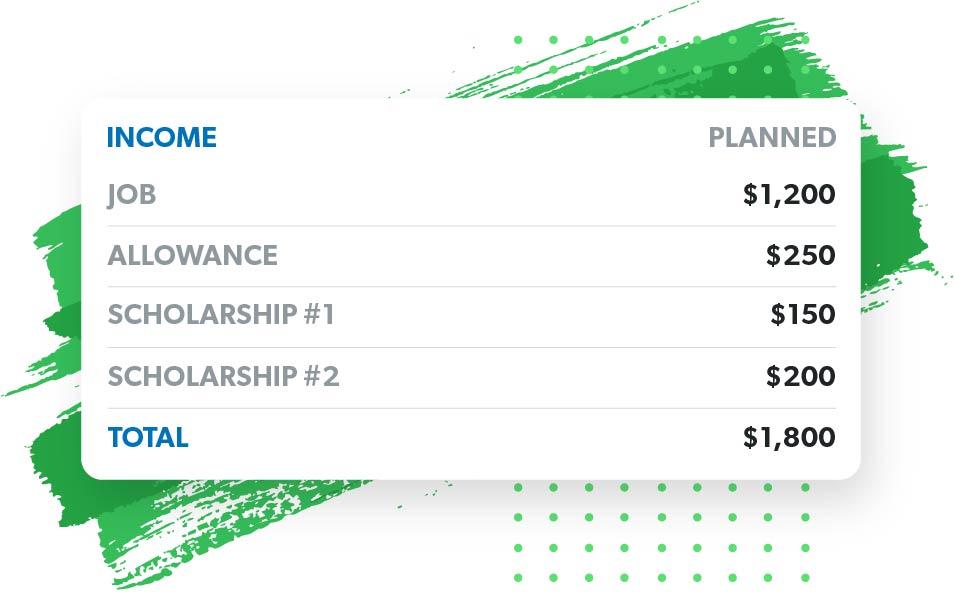

In this section, we provide a college budget example for a student attending an in-state, four-year university in Georgia. You can use our budgeting worksheet for college students to create your own budget.

The following student’s parents cover their cell phone bill, medical expenses, and health insurance (except prescriptions). They also provide a semester allowance. This student doesn’t have a savings account or a credit card, shares the expenses of a three-bedroom house near campus, and works part time as a server at a local restaurant.

What Tools Can You Use to Create a College Student Budget?

Tracking and managing your expenses through an app, a computer program, or a bank service can simplify the budgeting process and reduce the likelihood of mistakes in calculations.

Microsoft Excel is arguably one of the best tools students can use to learn how to stick to a college student budget. This software program offers budgeting templates, including a template specifically for college students. All are free to use and can be saved directly on your computer.

Alternatively, you may prefer Google Sheets , a free web-based spreadsheet application similar to Excel.

Another option is to rely on a money-saving app. Some of the best budgeting apps for college students include Mint , You Need a Budget , and EveryDollar .

Many financial institutions also provide account-holders with budgeting tools that are automatically populated with your balance and spending habits. These tools are usually free to use and integrated with an institution’s website or online portal.

Regardless of your preference, you should use some sort of tool to help organize your college budget, especially if you’re new to budgeting. Staying organized is key to maintaining a balanced budget.

6 Tips for Saving Money and Budgeting in College

It’s never too early to start saving. Here are some tips to help you develop savvy saving habits outside of attending an affordable college.

Avoid Paying Full Price for Textbooks

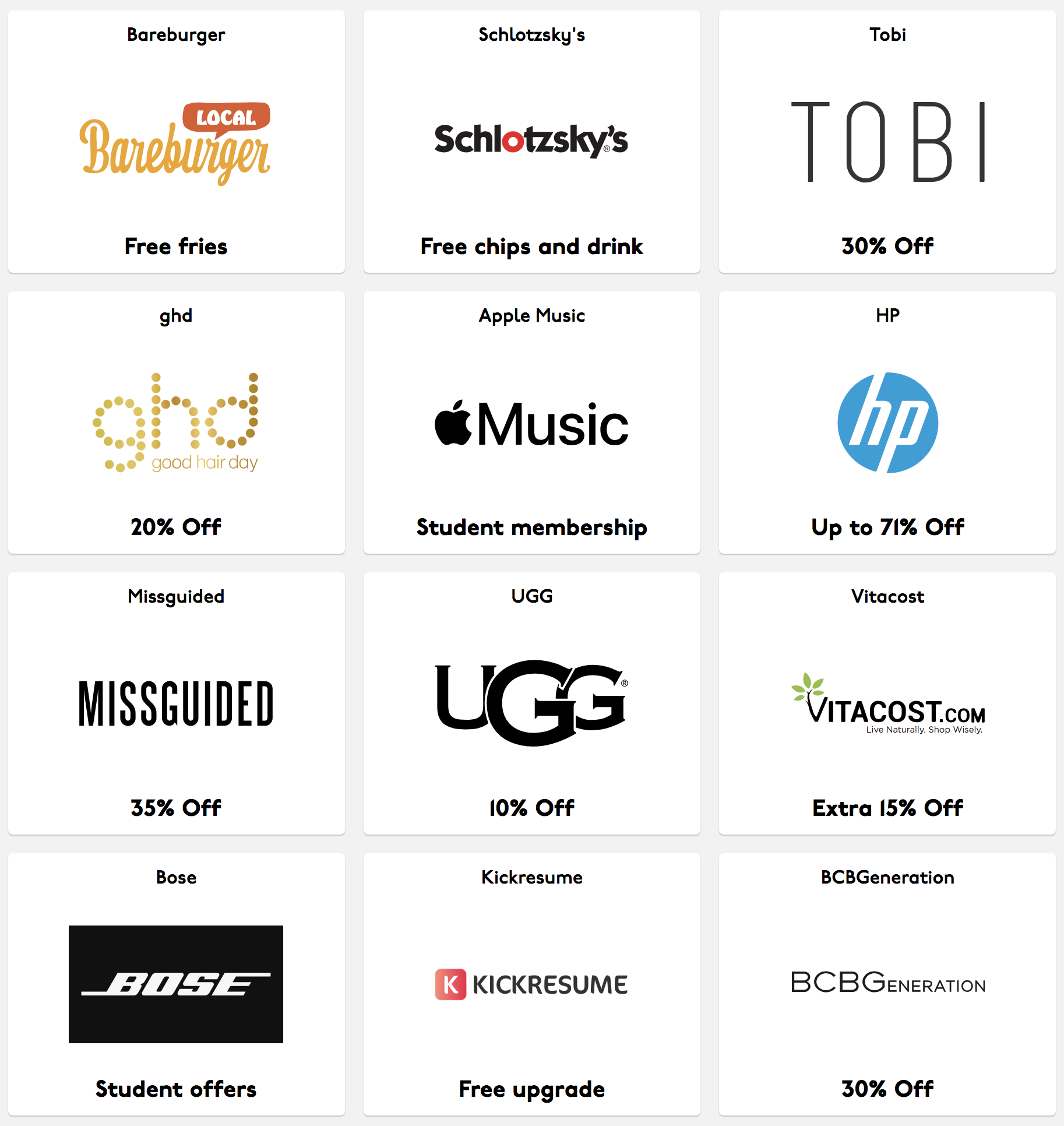

Cook for yourself, embrace communal living, shop at thrift stores, use student discounts, take advantage of campus resources and events, frequently asked questions about budgeting in college, what is a good college student budget for the academic year.

College Board data shows that students who spend moderately should prepare a 12-month budget of approximately $35,190. An acceptable lower budget would be around $23,580 per year. This number can act as a guideline, but remember that your budget must ultimately reflect your location, your personal lifestyle, and your individual financial needs.

Students living in high-cost of living areas like San Francisco, San Diego, and Honolulu will generally need higher annual budgets for living expenses.

What is a good monthly budget for college students?

According to the College Board , the average college student spends approximately $2,930 per month on living expenses. The amount of money you need each month depends on several factors, such as your location, your rent, whether you’re splitting the cost with roommates, and so on. Other factors include how much you spend on things like entertainment and going out to eat.

What is a good grocery budget for college students?

How much money you spend on groceries per month will vary depending on where you live and the type of diet you follow.

According to the USDA , a thrifty meal plan for college students between the ages 18 and 50 would be anywhere from $242-$311 per month. How much you spend will vary slightly depending on your sex and age, with male students and younger students typically requiring more food.

How much money should a college student have in emergency funds?

According to a 2024 Bankrate poll , almost 60% of U.S. adults are uncomfortable with their emergency savings. In general, you should save up enough emergency funds to cover at least one month of expenses. This money can also come in handy after graduation as you search for work or if you decide to relocate.

DISCLAIMER: The information provided on this website does not, and is not intended to, constitute professional financial advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact a professional advisor before making decisions about financial issues.

Explore More College Resources

How to Make Money in College

Even with financial aid, many college students are strapped for cash. Learn how to make money in college and why working now can help you earn more later on.

by Staff Writers

Updated September 28, 2021

Should You Get a Student Credit Card?

Many students start to build credit in college. Learn the pros and cons of getting a student credit card and how to build credit wisely.

by Lindsay VanSomeren

Updated February 11, 2022

8 Scams Targeting College Students and How to Protect Yourself

Read about scams targeting college students, including financial aid, scholarship, and credit card scams. Learn how to avoid becoming a victim of common scams.

- Debt Consolidation

- Debt Management

- Debt Settlement

- Credit Card Debt Forgiveness

- Debt Consolidation Programs

- Military & Veteran Debt Relief

- Credit Counseling

- Online Bankruptcy Classes

- Housing Counseling

- Foreclosure Prevention Counseling

- Eviction Prevention Help

- Credit Card Debt

- Student Loan Debt Relief

- Family Finances

- Credit Scores & Credit Reports

- Getting Out of Debt with Bad Credit

- Financial Literacy

- Financial Help

- Tools & Resources

- Budgeting Tips

- Military Money

- Your Dream Team

- Hours of Operation

- Client Success Stories

- Partner With Us

- Free Financial Literacy Resources for College Students

Home » Financial Literacy » Resources for Teachers » Free Financial Literacy Resources for College Students

College presents a unique time in a young person’s life where financial literacy education is particularly important. Our resources for college students cover a number of important topics faced by young people who may be living on their own for the first time. These personal finance resources also lay the groundwork for major decisions that happen shortly after college graduation – like buying a home, a car and managing credit and debt.

Practical Money Skill Curriculum

Below is a library of workbooks, teacher’s guides and presentation materials from the Practical Money Skills Library.

Lesson One: The Art of Budgeting

A personal budget is a financial plan that allocates future income toward expenses, savings, and debt repayment. “Where does the money go?” is a common dilemma faced by many individuals and households when it comes to budgeting and money management. Effective money management starts with a goal and a step-by-step plan for saving and spending. Financial goals should be realistic, be specific, have a timeframe, and imply an action to be taken. This lesson will encourage students to take the time and effort to develop their own personal financial goals and budget.

- Teacher’s Guide – Lesson One: The Art Of Budgeting

- Student Guide – Lesson One: The Art Of Budgeting

- Teacher’s Slide Presentation Lesson One: The Art Of Budgeting

- Teachers Power Point Presentation Lesson One: The Art Of Budgeting

Lesson Two: Living on Your Own

As young people grow up, a common goal is to live on their own. However, the challenges of independent living are often quite different from their expectations. This lesson provides a reality check for students as they investigate the costs associated with moving, obtaining furniture and appliances, and renting an apartment.

- Teachers Guide – Lesson Two: Living On Your Own

- Student Guide – Lesson Two: Living On Your Own

- Teachers Slide Presentation – Lesson Two: Living On Your Own

- Teacher’s Power Point Presentation – Lesson Two: Living On Your Own

Lesson Three: Buying a Home

For many, buying a home is the single most important financial decision they will make in their lifetime. However, the process of becoming a first-time homebuyer can be overwhelming, and requires a foundation for basic home-buying knowledge. This lesson will provide students with information on buying a home and where and how to begin the process. After comparing the differences between renting and buying, students will be introduced to a five-step process for home buying. This framework provides an overview for the activities involved with selecting and purchasing a home.

- Teacher’s Guide – Lesson Three: Buying A Home

- Student Guide – Lesson Three: Buying A Home

- Teacher’s Slide Presentation – Lesson Three: Buying A Home

- Teacher’s Power Point Presentation – Lesson Three: Buying A Home

Lesson Four: Credit

In today’s world, credit is integrated into everyday life. From renting a car to reserving an airline ticket or hotel room, credit cards have become a necessary convenience. However, using credit wisely is critical to building a solid credit history and maintaining fiscal fitness. While most students have a general idea about the advantages and disadvantages of credit, this lesson provides an opportunity to discuss these issues in more detail.

- Teacher’s Guide – Lesson Four: Credit

- Student Guide – Lesson Four: Credit

- Teacher’s Slide Presentation – Lesson Four: Credit

- Teacher’s Power Point Presentation – Lesson Four: Credit

Lesson Five: Credit Cards

What is APR? What is a grace period? What are transaction fees? These and other questions will be answered in this lesson as students learn about credit cards, and the different types of cards available and features of each, such as bank cards, store cards, and travel and entertainment cards. As students start to shop for their first (or next) credit card, this lesson will make them aware of various costs and features. Included in this section is a discussion of the methods for calculating finance charges.

- Teacher’s Guide – Lesson Five: Credit Cards

- Student Guide – Lesson Five: Credit Cards

- Teacher’s Slide Presentation – Lesson Five: Credit Cards

- Teacher’s Power Point Presentation Lesson Five: Credit Cards

Lesson Six: Cars and Loans

“Should I buy a new car or a used car?” “Where is the best place to finance my automobile purchase?” “Is it better to take the rebate or the low-rate financing plan?” These are typical questions asked by people buying vehicles. In this lesson, students are asked to identify costs associated with owning and operating a motor vehicle. Since these costs are commonly underestimated, guidelines are provided on how much to spend when buying vehicles.

Teacher’s Guide – Lesson Six: Cars And Loans

Student Guide – Lesson Six: Cars And Loans

Teacher’s Slide Presentation – Lesson Six: Cars And Loans

Teacher’s Power Point Presentation – Lesson Six: Cars And Loans

Lesson Seven: Consumer Awareness

Decisions, decisions. With so many choices available to us, how can we be sure we’re making the right decision? Wise consumer buying starts with a plan. Using a systematic purchasing strategy will provide students with an ability to make more effective purchases. Comparative shopping techniques will be discussed to encourage students to carefully consider price, product attributes, warranties, and store policies. Next, this lesson covers a variety of buying methods, such as buying clubs, shopping by phone, catalogs, online, and door-to-door selling.

- Teacher’s Guide – Lesson Seven: Consumer Awareness

- Student Guide – Lesson Seven: Consumer Awareness

- Teacher’s Slide Presentation – Lesson Seven: Consumer Awareness

- Teacher’s Power Point Presentation – Lesson Seven: Consumer Awareness

Lesson Eight: Saving and Investing

Saving just 35 cents a day will result in more than $125 in a year. Small amounts saved and invested can easily grow into larger sums. However, a person must start to save. This lesson provides students with a basic knowledge of saving and investing. The process starts with setting financial goals. Next, a commitment to saving is discussed.

- Teacher’s Guide – Lesson Eight: Saving And Investing

- Student Guide – Lesson Eight: Saving And Investing

- Teacher’s Slide Presentation – Lesson Eight: Saving And Investing

- Teacher’s Power Point Presentation – Lesson Eight: Saving And Investing

Lesson Nine: Trouble

The material in this lesson will help students become aware of the warning signs of financial difficulties.

- Teacher’s Guide – Lesson Nine: In Trouble

- Student Guide – Lesson Nine: In Trouble

- Teacher’s Slide Presentation – Lesson Nine: In Trouble

- Teacher’s Power Point Presentation – Lesson Nine: In Trouble

Lesson Ten: Consumer Privacy

In today’s information age, keeping your personal financial information private can be challenging. What you put on an application for a loan, your payment history, where you make purchases, and your account balances are but a few of the financial records that can be sold to third parties and other organizations. This lesson will discuss how public and private records are accessed and used by various organizations, as well as review privacy laws to protect your information.

- Teacher’s Guide – Lesson Ten: Consumer Privacy

- Student Guide – Lesson Ten: Consumer Privacy

- Teacher’s Slide Presentation – Lesson Ten: In Trouble

- Teacher’s Power Point Presentation – Lesson Ten: In Trouble

You will need Adobe Reader to view the PDF Download Adobe Reader

If you are working with adults who are not in college, consider using our free financial literacy curriculum , developed for Habitat for Humanity’s home recipients. This curriculum provides similar information but is designed for a lower-literacy student.

6 MINUTE READ

Financial Literacy Menu

- Financial Literacy Workshops & Webinars

- Financial Data

- Resources for Teachers

- Using Comic Books To Teach Financial Literacy

- How to Calculate Debt-To-Income Ratio

- Free Financial Literacy Workshops For Habitat For Humanity Homebuyers

- Free Personal Finance Workshops At Goodwill

- Financial Literacy Education Statistics from FINRA’s NFCS

- Financial Literacy for Kids

- Free Financial Literacy Program For Teachers: Teach Money

- How Much Are Americans Saving for College, Retirement and Emergencies?

- Financial Literacy for High School Students

- What Do Social Security Taxes Pay For?

- Life Insurance for Seniors

- Is Life Insurance Worth It?

- When Should I Get Life Insurance?

- Retirement Checklist

- High-Risk Loans

- What Is Check Cashing?

- Title Loans

- Should We Deduct Our Daughter’s Loan From Her Inheritance?

- Bonds 101: Bond Investment Basics

Ascent Private Student Loan Review

CU Student Choice Private Student Loan Review

Abe Private Student Loan Review

Get expert insights delivered straight to your inbox.

Tips for a Successful College Budget

9 Min Read | Feb 23, 2023

If you're in college, you're probably focused on so many things. You're trying to get good grades, set yourself up for career success, and win your intramural disc golf championship (hey, that's a big deal too). As you keep up with all of those important things, there’s another one I don’t want you to forget about: making good financial decisions.

Believe me, I get it—college isn’t easy. But being smart with money while you’re in school is just as important to your future success as your degree. And it all starts with a good college budget.

Why Do I Need a College Budget?

To put it simply: When you don’t have a budget, you’re not in control of your money. A budget is like a game plan, and when you don’t have a game plan, you’re more likely to lose the game. I want you to win with money.

You may not be completely on your own yet, but there are still several expenses you need to be prepared for as a college student. That’s where the budget comes into play.

Common Monthly Expenses for College Students

Here are some common monthly expenses that apply to most college students.

- Food: Whether you have a campus meal plan or you buy your own groceries , you’ll have to pay for your food.

- Textbooks: When most students see how much college textbooks can cost, their jaws almost hit the floor. But you can save money on textbooks if you know the right resources (and we’ll go over them later on).

- Transportation: Whether you have a car, ride the bus, or rent a campus scooter, you’ll be paying for transportation . (This can include routine maintenance, like oil changes and car insurance , in addition to gas.)

- Housing: Whether you live in a dorm or apartment, you’ll be paying rent.

- Entertainment: You want to have at least a little bit of fun in college, right? Entertainment expenses include everything from going to the movies with friends to taking flugelhorn lessons (if that happens to be the sort of thing you’re into).

It’s also important to think about saving money (a $500 emergency fund is a good place to start) and building the habit of generosity. Just because you don’t have a lot of money doesn’t mean you can’t think about helping others (I recommend giving 10% of your income).

And don’t forget about tuition. You might not be getting a monthly bill for it (most students pay their tuition before the semester begins), but that doesn’t mean you don’t need to think about it. You’ll want to save money for tuition every month—that’s one of the keys to avoiding student loans .

How to Make a College Budget

Now that you know why you need a college student budget, let’s talk about how to make one. If you’ve never made a budget, don’t worry. You can do this! And once we break it down, it won’t seem so overwhelming. Here are the steps to making your college budget:

1. Write down your income.

A budget is simply a plan for your money where you decide— before each month begins—how much you’re going to give, save and spend. So, the first step to making a budget is figuring out how much money you have to start with.

Add up how much money you’ll have coming in during the upcoming month from all sources—including the money you’ll make from jobs or side hustles , any scholarships that are paid to you directly, and any money you’ll receive from your parents (if they help you out in that way).

Start budgeting with EveryDollar today!

If your income varies and you can’t write down exact numbers, that’s okay—just get as close as possible. Once you’ve got all the numbers, write them down on your budget. Here’s what that could look like:

By the way, my favorite way to keep track of my budget is with the free EveryDollar app . It makes setting up your budget super easy—especially if it’s your first time. The best part? It does all the math for you. And did I mention it’s free to use?

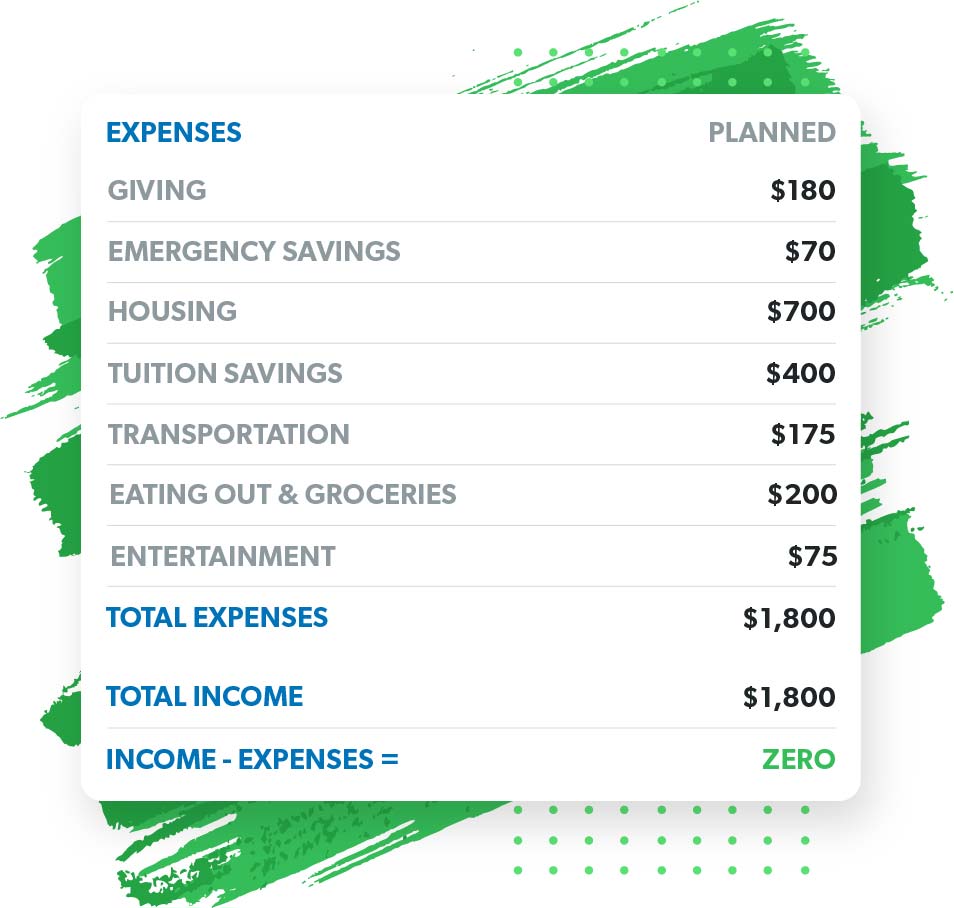

2. List your expenses.

Next, you’ll want to write down everything you spend money on. The list I mentioned earlier is a great starting point, but you may have some other expenses that aren’t on the list. Look back at your bank statements or receipts and think about everything you spend money on—then write those things down in categories, like food, rent, bills, transportation and so on.

Once you’ve organized your spending into categories, plan how much you’ll spend on each of them. I like to start my budget with the right perspective by putting giving and saving at the top of my list. (Plus, this helps me make sure I don’t run out of money before I give and save.) Then I move on to the other categories.

Some expenses, like rent and subscription payments, are the same cost each month. For others, like food and transportation, you have more control over how much money you’ll spend. To make this easier, look at what you spent last month in each category.

3. Subtract your expenses from your income.

Once you’ve assigned a dollar amount to every category, it’s time for the fun part: getting out the calculator. Okay, maybe this isn’t super exciting (unless you’re a math major), but it’s also not that difficult.

Add up all the expenses you just listed, including what you plan to give, save and spend. Then, subtract that total from your income. The goal is for that to equal zero. Why? Because a zero-based budget , where your income minus your expenses equals zero, is the best type of budget. This means every single dollar you earn has a job. If you do the math and your difference is zero, you can go ahead and move on to the next step. If not, you’ll need to make some adjustments to get there.

So, if the total of your expenses is less than your income, give that leftover money something to do—maybe you add it to savings or give it to a cause you care about. And if the total is more than your income, you have two great options: increasing your income (trust me, there are plenty of ways to make extra money in college) or cutting back on your expenses. We’ll go over some tips on how to do that a little bit later.

Here’s what your budget might look like with the example income we used in the first step:

4. Track your spending.

Congratulations! You’ve made your first official college student budget. But you’re not quite done. Because you can’t just make a budget. You have to stick to it .

The biggest key to sticking to your budget is tracking your spending . If you’re looking for a simple way to track your spending without constantly combing through your bank account, EveryDollar is perfect for that. It’s free to make a budget on EveryDollar, but the premium version lets you connect your bank account so all of your transactions will automatically show up in the app. Super easy.

How to Cut Back on College Expenses

If you need some more room in your budget, cutting back on spending is an easy way to free up some cash. Here are some of my favorite tips for saving money in college and how students can spend less on monthly expenses.

How to Save Money on Tuition

There’s one tried and true way to cut back on tuition costs that every student should take full advantage of: scholarships . I talk to students about scholarships a lot, and I’ve found that many of them think you can’t get scholarships once you’ve started college. But that’s not true at all. There are plenty of scholarships for students already enrolled in college. My advice is to start researching scholarships you qualify for and apply to as many as you can.

How to Save Money on Food

A lot of colleges require meal plans, especially if you live on campus. If that’s your situation, try to get as much bang for your buck as you can. I know college food isn’t the best, and eating in the cafeteria isn’t as fun as making a run to Taco Bell or Chick-fil-A. But try to eat in the cafeteria as much as possible—you’re already paying for it, so you might as well get your money’s worth.

If you don’t have a meal plan, try buying groceries and eating at home more often instead of eating out. That’ll save you a ton of money in the long run.

How to Save Money on College Books

Shopping at your school’s online bookstore may be the easiest and most convenient way to buy books, but it’s rarely the cheapest. In fact, you can get used books for a lot less on sites like Chegg, eBay or Amazon. (Just make sure you purchase the correct version.) You can also save some money by renting books instead of buying them.

How to Save Money on Entertainment

There’s a good chance your college offers a lot of options for free entertainment. Try talking to older students and asking about some ways to have fun on campus without reaching into your wallet. Another great way to cut back on your entertainment budget is to limit the number of music and TV streaming services you pay for. There are several great free streaming services you can use. And be honest: Do you really need Netflix, Hulu, HBO Max and Disney+?

How to Save Money on Housing

Deciding on the best plan for college housing can be tricky. In some cases, taking advantage of on-campus housing is the most affordable option. Other times, finding a roommate and renting an apartment off campus is your best bet. Make sure you do your research and figure out which choice is the best for your situation.

By the way, if you do live on campus, becoming a resident assistant is a great way to save money on housing. RAs monitor the dorms and help with student activities, and in exchange, they typically get discounted housing and a cash stipend on top of that.

The Best Tool for Making Your Budget

Budgeting may not be the easiest thing in the world but, as you can see, you can do it. Plus, there are lots of great tools out there to make the process even more simple.

As I mentioned earlier, my favorite tool is EveryDollar. It was made by our awesome team at Ramsey, and it will let you set up your college budget in less than 10 minutes so you can get back to studying and playing guitar in the quad.

Download EveryDollar for free today.

Did you find this article helpful? Share it!

About the author

Kristina Ellis

Kristina Ellis is a bestselling author who believes no student should be burdened by loans. Drawing from her experience of earning over $500K in college scholarships, Kristina helps thousands of students graduate debt-free through her syndicated columns, podcast appearances, online courses and books. She’s a co-host of The Ramsey Show, the second-largest talk show in America, which reaches 18 million weekly listeners, and she appeared in the award-winning documentary Borrowed Future. Kristina has appeared on NBC News, Business Insider, Fox & Friends, USA Today and Yahoo!, where she’s shared practical, real-world strategies for going to college without debt. Learn More.

How to Create a Family Budget

You can create a family budget that works, no matter your time, income or fear of talking about the dreaded M-word (you know, money). These tips and tricks will help you do it.

What Is a Budget?

What is a budget? A plan for your money. Plain and simple. Now let's break down types of budgets, how to get started budgeting, and some common budgeting myths.

To give you the best online experience, Ramsey Solutions uses cookies and other tracking technologies to collect information about you and your website experience, and shares it with our analytics and advertising partners as described in our Privacy Policy. By continuing to browse or by closing out of this message, you indicate your agreement.

- High School

- College Search

- College Admissions

- Financial Aid

- College Life

Why and How To Budget as a College Student

When you think of the word “budgeting,” what is the first thing that pops into your head? Money hardships? Excessive saving?

Mastering budgeting is a skill every college student needs. If you are on your own for college expenses, whether it be through scholarships , financial aid , or working to afford your education, budgeting skills are crucial.

Even if you are receiving help from family or friends (like me), you should also budget and use the extra help to your advantage by learning good budgeting skills. That way, you can work towards being on your own in the future.

First step to independence

The first reason to budget is because you are entering the real world, and being independent is a lot pricier than you think.

For most incoming freshmen, college is the start to being on your own. Many students will no longer live at home where parents take care of most, if not all, of your living expenses.

All of a sudden, you’ll have to think about paying for groceries, gas, and other expenses. Many students take out loans for their tuition.

This great responsibility can be overwhelming. Don’t get caught without a plan or you may find yourself in a financial hole you unwillingly dug yourself!

Limited funds to spend

The second reason to budget is because your funds are now limited and restricted. If you will be a full time student, you will not have the time for a full-time job, meaning the money you make may barely be enough to cover your full-time expenses.

However, even students who work part-time will find cash not coming in as quickly as it goes out to pay your expenses. It is all too common to find college freshmen who have zeroed out their checking account before the end of the first semester (personally guilty).

Increased responsibilities

With financial demands increasing by the day, the third reason to budget is because financial demands increase, and it is your responsibility to keep up with the tide.

Not only is your income coming in at a slow or non-existent rate, but the financial demands of living independently are always increasing.

For me, I’ve been trying to keep up with gas prices constantly increasing, and my electric bill is particularly high in the summer due to my air conditioning units.

Even students who have their financial aid in order will find themselves spending money. Takeout after late nights of studying, mall trips with your new college friends, and activities such as cool campus restaurants and movies quickly add up.

Grocery runs and the need for toiletries take a toll, not to mention the added expense of school supplies (textbooks, calculators, etc.) needed.

Add in a few fun weekend getaways to neighboring landmark cities, and the $500 you had saved up for an entire year can be blown though in as quick as the first month you’re in college!

Distraction from your studies

College is a crucial part of your development, and if you are like me, you put significant importance on your GPA. Distractions are detrimental, which is reason number four why you should budget.

Being short on cash distracts me from my studies. I always seem to worry more and study less at the end of the month right before tuition payments are due.

With all the demands of college, budgeting may be last on the list of importance. However, as the old saying goes, those who fail to plan, plan to fail.

Studying for a good GPA, creating new relationships, and having a social life can be difficult to prioritize since these things are so important in forming your college experience.

However, be wary of deciding not to plan and simply going with the flow. To you, many choices seem more important than spending the time and energy to budget because the immediate satisfaction is greater.

All the activities college offers can serve as distractions to making wise financial decisions. If you decide to save and invest in your financial life, you will save the need to worry and invest in a richer college experience in the long run!

Your future!

The last reason to budget today is to start setting yourself up for the future. Budgeting is as important for health as getting sleep and eating well because it brings peace of mind.

Falling into debt traps at the beginning of life can have serious consequences. That college experience is great, but you won’t enjoy life afterwards if you’re drowning in student loans and credit card debt.

You will also regret not investing early if you have long term goals, such as buying a house or car or going back to school. Plan for these goals with budgeting in the present to ensure you have an enjoyable future.

So how exactly does one budget? In order to effectively budget as a college student, you must first recognize your financial goals!

While most college students can pinpoint tuition payments as their main financial strife, financial goals go beyond simply spending money to pay for things you need and/or want.

To determine your financial goals, you must think of your strategy. How do you define what you invest into the future? Are you happy with your day-to-day spending habits?

Let’s think of your financial life in the same way we see a business. You have expenses, income to pay them with, and goals you have for the near and far future. Let’s break apart our management strategy into three simple subcategories: strategic, tactical, and operations management.

Strategic Financial Management

Strategic financial management is a company finance term, but managing our financial life is like managing a business! Strategic financial management means not only managing your finances but also managing them with the intention to succeed.

To do this, you must define your main goals and objectives for yourself. Where are you right now? Where do you want to go? What do you want to do?

Now, this may sound like regular financial management, but the key differentiator is the word strategic. While regular financial management is in charge of keeping up with your short term goals, such as paying rent on time, paying off that car lease, or finding the best ways to efficiently buy groceries, strategic financial management is also continuously evaluating, planning, and adjusting to keep you focused and on track toward long-term goals you may have.

Have you ever thought about paying your first mortgage? What if you have goals for grad school? You can even think about investing into a retirement fund to retire early if you wanted.

In conclusion, strategic financial management is defined by your financial goals, your current situation, and your overall money philosophy.

Tactical Financial Management

Tactical Asset Allocation (or for our purposes, tactical financial management) plays off of strategic management. According to Thane Yost, “The will to win is useless if you do not have the will to prepare.”

Tactical financial management deals with the systems you set up to deal with regular money flow and your individual financial decisions. Your way of management in the tactical field will also help to mold and readjust any goals you have in your strategic financial management.

Let’s say one of your long term financial goals includes retiring by the age of 50. Your strategic financial management is what defines that goal while tactical financial management creates your plan to get there.

Perhaps that means investing in a stock fund you only pitch into when it’s time to retire. Or you may put aside a certain amount each month to ensure a secure fund by the time you’re 50.

Planning out your financial goals is crucial in actually achieving them, so tactical financial management is a step you do not want to ignore!

Operations Financial Management

Operations financial management is the last but most important part of your management strategy. Operations management plays into your day-to-day money details, mostly around your spending habits.

When you get that paycheck, it’s wise to track how much you spend daily. That daily takeout, coffee, and Uber ride can really add up in the end!

Make sure you are not spending unnecessarily, and put that money forward to save for more important things, such as loans, investments and recurring expenses.

To understand how much you earn and spend, you need to organize your income, spending, and savings into a visual you can comprehend, update, and track accordingly.

Taking the time to write down your expenses and earnings will give you a clearer picture of how much you have, and how much you can spend. It can also help you track growth as a budgeter.

Unfortunately, there’s no one-size-fits-all approach to organizing your budgeting, particularly because everyone’s budgeting is different and unique to their own situations. However, it’s important to choose the budgeting tool that works best for you.

Spreadsheets, software, and apps offer different approaches to tracking your money, which includes how much time you will have to invest in keeping up with it. As a college student, you do not have the time to play around with elaborate and expensive budgeting software. Here are four personal yet free and low maintenance organizing tools you can use for your budgeting.

Google Sheets

My personal favorite! Google Sheets allows you to organize your finances in spreadsheet form. While you have to manually input their expenses, there are some budgeting templates that offer preset categories.

Third-party add-on software is available on certain templates to import your banking transaction data. Don’t worry! Google Sheets is very secure.

Unless you have shared your Google Sheet with someone, nobody can access your files without your Gmail account username and password. Google also offers two-factor authentication to protect your finance information.

Although Google Sheets requires users to manually input transactions and other data, unless you use a third-party add-on, there are many upsides to it being so hands-on. Google Sheets is free to use with your Gmail account, making it a cost-efficient way to track your finances.

Google Sheets can be accessed from anywhere via the mobile app on any device, so its hands-on approach forces users to think about each transaction they make.

Mint: The Smartphone App

Mint is a popular budgeting app that is all the craze with college students. Mint tracks your income, expenses, savings goals, credit score, investments, and even your own net worth!

Mint is offered in both the App Store (for iOS) and on Google Play (for Android), making it accessible for most college students with phones. While Mint categorizes your expenses automatically, users can modify it to fit their own comfortability.

Mint allows you to link your bank account and credit card information, and with Mint offering Verisign scanning, multi-factor authentication, and Touch ID mobile access, you can be assured that all financial information is secured.

Users can create savings goals and track investments through Mint’s simple organization designs. Mint also customizes personal alerts when you go over budget, when you make large transactions, when there are ATM fees, etc.

It also gives you bill payment reminders and has a credit score monitoring service. For the beginner budgeter, Mint offers blog and education tools, such as a loan repayment calculator. Best of all: Mint is FREE to use!

Goodbudget: The Smartphone App

Ever heard of the “envelope method” where you put a certain amount of cash in specifically labeled envelopes that are dedicated to certain expenses (ex: “Rent” envelope, “Rainy Day Fund” envelope, etc)?

Goodbudget took this method to the next level. Now, instead of keeping your envelopes in that old shoebox, you can have access to your organized envelopes in the palm of your hand.

Goodbudget allows users to plan their household’s spending through the envelope method and tells users they are only supposed to spend what’s in their envelopes. If they go beyond their budget, the envelope will show red to indicate that they overspent.

Goodbudget has a web-based version and is also offered in both the App Store (for iOS) and on Google Play (for Android). While you need to upgrade to Goodbudget Plus, which is $7 per month or $60 per year, for the full experience, you can get 20 envelopes for FREE and use them unlimitedly. However, the subscription to visualize your spending and prioritize meeting different goals in an unlimited amount of envelopes just might be worth it.

Users can customize the envelope categories according to their needs, such as saving for an emergency fund or a vacation. By requiring manual entry of your data, this helps to analyze spending habits versus it being automated (users can also download their recent activity from their bank’s website and import that into Goodbudget).

The Goodbudget app provides real-time updates of how your transactions impact your budget and personalized reports. It also offers educational resources like a blog, podcast, and online courses you can take to further help you become a better budgeter.

The app plans to launch a pandemic-inspired feature, allowing people to prioritize “envelopes” based on their most urgent expenses, such as housing, utility bills, etc.

Lastly, Goodbudget is extremely safe to use. Its security features, which includes 256-bit bank grade encryption in a secure data center, ensure that all of your finances are secure.

Personal Capital

Do you have more experience with budgeting and are now looking for more support in investing? Personal Capital is for you! Personal Capital is a budgeting app and investment tool that tracks both your spending and wealth.

While this isn’t your typical budgeting app, it is perfect for those with more experience saving and more desire to invest. Personal Capital is free to use, but users have the option to add investment management services for 0.89% of their money (for accounts under $1 million).

Personal Capital includes a money-tracking dashboard, a net-worth tracker, and a breakdown of your investment portfolio. This is beneficial if you are interested in tracking your greater financial growth.

While it doesn’t have as many tools as other budgeting apps, Personal Capital still offers free investing tools, such as a retirement planner, education planner, and fee analyzer to check portfolio fees. It also offers a daily Capital blog for financial planning tips.

This app syncs to your bank accounts and credit cards as well as other financial accounts and securely holds your information. Features include data encryption, fraud protection, and strong user authentication.

As you can see, there are many resources you can use to make sure you get the most out of organizing your budget.

Remember the most important thing: your budget is unique to YOU! Don’t let other influences make you uncomfortable with the way you budget.

More Articles By Niche

Having spent nearly three semesters there already, I’ve had my fair share of conversations with non-Princetonians about my experiences there, and I have to say, being such a famous university, there are a lot of outside perspectives on Princeton that aren’t quite reflective of how Princeton truly is.

If you have ever wanted to become an RA and are looking for some tips on how to excel in the process, you have come to the right place.

Here are 10 key statements that could change your sorority recruitment process that no one tells you.

Budget Breakdown: How College Students Spend Their Money

College students are finding ways to manage their money, even with limited funds.

How College Students Spend Their Money

Getty Images

Learning how to manage a budget is a life skill that goes beyond the classroom.

Money concerns are a major stressor for many college students. A 2024 study by Ellucian, an higher education technology solutions provider, found that nearly 80% of undergrads report that financial stress is negatively impacting their mental health and 57% are choosing between college expenses and basic needs.

However, paring down costs and increasing income is allowing many college students to make it to their educational finish line.

To understand how some are handling the financial pressure, we spoke with college students from across the country to find how much they’re spending on a weekly basis and to learn how they’re making it all work.

Prioritizing Expenses at Providence College

Serena Daaboul is a neuroscience major starting her sophomore year at Providence College in Rhode Island. She spends between $80 and $140 per week.

Daaboul says that may not seem like much, but navigating the financial challenges of college life is a constant exercise in prioritization, especially while honoring her Lebanese heritage. Generosity and maintaining a well-dressed appearance are important, but she’s found balance. Daaboul feels fortunate to have received a scholarship at Providence College, where tuition is $63,550, because she didn’t want to put her parents in debt.

“I’ve learned how to budget my money wisely, allowing me to feel and look my best while still being able to spoil my friends without breaking the bank,” she says. “Some weeks are simpler when there are fewer unforeseen costs, but others require meticulous preparation and adjustments to stay within my budget.”

The juggling act has made her more resourceful and adaptable, skills Daaboul believes will serve her well in her academic and future professional life. Still, she does feel anxious about money .

“I try to be optimistic, but I’m a realist,” she says. “I’m still a kid. My future into adulthood is coming shortly and I hear about so many people living at home, struggling and in debt. If I play my cards right and work hard at school, I think things will go my way.”

Hustling at University of California, Berkeley

Benjamin Njila Fields is a Ph.D. student in the sociology department of University of California, Berkeley. His weekly spend is around $210. “I keep a rolling average of $30 a day,” Fields says. “I eat a lot of noodles and Chipotle.”

Because life in the Bay Area is notoriously expensive, Fields is maximizing money-making opportunities so he can complete his doctorate and travel in his downtime.

“I’m a real hustler,” Fields says. He earns money with teaching assistantships, a stipend and summer research grants, which cover his costs.

"I’m always willing to work extra,” he says. Among his jobs: internships, his own perfume business, gig work on platforms like Fiverr and selling copies of his book, "Understanding Credit and Finances: How to Improve Your Credit Score."

Fields grew up in Oklahoma with a single mom, food stamps and very little money to go around. As a teenager he worked at a Subway franchise and thought owning a store epitomized success. His outlook changed when he went to Cornell University, double majoring in public health and sociology, taking on eight minors and studying abroad.

“College is 100% worth it,” Fields says. “When I look back, the life I live now is lavish,” he says. “I just keep comparing myself to it. I’m happy with the grind. I enjoy it. Now, being a millionaire isn’t a goal, it’s a given.”

Setting and Following Personal Rules at Arkansas State University

International business and marketing major Lauren Maness, is a junior at Arkansas State University. She’s been tracking her monthly expenses with her credit card statements. In August she spent $391.97 which makes her weekly spend $97.99.

“Luckily, my college tuition and housing were paid for by scholarships, so all of my ‘fun’ and grocery money comes from my job with the Kays Foundation Scarlet to Black Program for Financial Independence," she says.

Maness is acutely aware of her cash flow . For example, in August, she noticed that the majority of her funds went to fast food, totaling $142.50. She also bought a $112.50 new pair of shoes, purchased $106.02 worth of gifts for family and friends, and $31.66 went to other expenses like a date night and a trip to Walmart.

“I have been raised to be very mindful of my spending habits,” Maness says, explaining that she sets rules for herself, including getting the best deals.

"I was actually eyeing that pair of shoes for a few months and determined where they were the best priced. I ended up finding a place that had them at the cheapest price, offered a student discount and I bought them over tax-free weekend,” she says.

She also makes her money work for her by opening a high-yield savings account and using her Discover it credit card for all of her purchases so she can earn cash back.

“I used to be terrified of credit cards , but I realized that all of my money would be coming out of my personal checking account either way so I might as well make 1% cash back on all purchases or 5% back on the purchases that qualify for the special categories that change each quarter,” Maness says. She always deletes the balance by the due date to avoid interest fees and build her credit score.

“My plans for the future are to really dive down on my expenses and budget better as well as save more,” Maness says.

Saving for Future Goals at University of Massachusetts Amherst

Cameron Chabot, a film studies major, is entering his junior year at University of Massachusetts Amherst. Currently his weekly spend is averaging between $270 and $300. “It covers gas, food, insurance, stuff like that,” he says.

Chabot is a restaurant server who works every night to save for his upcoming move to Los Angeles, where he plans to finish his degree.

“I budget based on how much I make in a month and charge everything to my credit card,” Chabot says. “But I have a personal limit, and if I surpass that I don’t charge anything else. When I go out I’m usually the designated driver, so that’s the least of my expenses.”

He also decided to go to a well-priced institution. Although his first choice was Emerson College, the yearly tuition is a steep $55,392 . So he decided on UMass, which is a bargain at just $17,357 . Because he also was awarded a scholarship, Chabot is paying only about $12,000 a year for his education.

“I’m very strict with myself,” Chabot says. “Because my mom helps and I work a lot, I can graduate and not be in debt.”

Still, there have been plenty of unplanned expenses, like an $80 math program that he was required to download in his freshman year.

“College life is not what I expected,” Chabot says. “Since I was younger I always wanted to work in the film industry. I had an emotionally hard time paying for something I didn’t like so I had to break the barrier and alter my path. Los Angeles is a tiny bit cheaper than where I am in Massachusetts.”

Chabot worries that he may never feel financially ready. “It all starts to feel overwhelming,” he says. “The pressure gets more intense. I can’t miss a day of work.”

College Students May Struggle, But Many Find a Way to Make It Through

Despite challenges, these students are succeeding and looking forward to what's ahead, but none said it was easy. Overall, meeting their weekly costs is doable but stressful. To make it though, students are budgeting, tracking expenses, working hard, using credit cards wisely and making tough financial choices.

In the end, though, they’ll be able to look back with pride. And maybe they’ll tell their own college-bound children about how they lived on Ramen noodles, checked their balance before making even the smallest purchase and hustled their way to the next stage of their lives.

Colleges Address Housing Insecurity

Sarah Wood April 6, 2022

Tags: money , personal finance , paying for college

Popular Stories

Saving and Budgeting

Family Finance

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Your Money Decisions

Advice on credit, loans, budgeting, taxes, retirement and other money matters.

You May Also Like

8 best expense tracker apps.

Maryalene LaPonsie Oct. 24, 2024

The Last Decade's Best Finance Movies

Jessica Walrack and Andrea Woroch Oct. 23, 2024

DIY Estate-Planning Ideas

Aja McClanahan Oct. 22, 2024

Budgeting Calendar Benefits

Jessica Walrack Oct. 21, 2024

What Is Dynamic Pricing?

Erica Sandberg Oct. 18, 2024

Documents to Prepare Now for Your Heirs

Maryalene LaPonsie Oct. 17, 2024

Cheap Fall Activities

Erica Sandberg Oct. 16, 2024

11 Steps to Writing a Will

Maryalene LaPonsie Oct. 15, 2024

Overspending and How to Stop

Jessica Walrack Oct. 14, 2024

What is the Pink Tax?

Maryalene LaPonsie Oct. 11, 2024

Key Insights for Interest Rate Dips

Aja McClanahan Oct. 10, 2024

How to Save for Your Child's College

Geoff Williams Oct. 10, 2024

Save Money When Grocery Shopping

Maryalene LaPonsie Oct. 9, 2024

Checking the CPI and Interest Rate Drops

Aja McClanahan Oct. 9, 2024

5 Ways to Save for Vacation

Geoff Williams Oct. 8, 2024

How Much Should I Spend on Groceries?

Geoff Williams Oct. 7, 2024

Spend a Windfall Wisely

Erica Sandberg Oct. 4, 2024

How to Save Money: 10 Expert-Backed Ways

Geoff Williams Oct. 3, 2024

Tax Extension Deadline 2024

Jessica Walrack Oct. 2, 2024

Best Apps for Selling Used Stuff

Emily Sherman Oct. 1, 2024

The Importance Of Budgeting During College

College is an incredible experience — even if it does have a “double-edged sword” vibe. Learning something you’re passionate about, completing a degree, and beginning your career in the best position possible are all well worth a good old four-year collegiate effort. However, those aforementioned pros come with some cons as well.

For instance, college is known for hefty workloads, late nights spent studying, and unstable finances. Between the overwhelming costs of tuition and the lack of sustainable income, college can be a financial nightmare.

While it’s difficult to find a way to completely eliminate the financial concerns of attending college, keeping a strict budget while on campus can go a long way towards ameliorating financial strain throughout your academic journey.

Why Budgeting in College is Important

Collective student loans have risen 116% over the last decade , reaching a staggering $1.5 trillion dollars in recent years. With so much money being borrowed, it’s absolutely essential that students invest in the benefits that budgeting can offer, including:

Avoiding Unnecessary Expenses

Budgeting helps you separate wants from needs. This allows you to identify expenses that absolutely must be paid — things like tuition, housing, and food — and are thus worthy of taking out a student loan.

At the same time, it helps you identify unnecessary expenses — like eating out, going to the movies, or other recreational spending — that can be avoided if you don’t have the cash.

Helping You Stay Healthy

There’s no doubt that school is stressful, and the crushing weight of tens of thousands of dollars of debt only adds to that burden. Studies show that 68% of students literally lose sleep over school-associated stress. Many of them turning to things like substance abuse to help them cope with insomnia.

Keeping a budget can help to reduce stress by providing a sense of organization, understanding, and consistency within your finances.

Teaching You Valuable Life Skills

Budgeting isn’t a skill that will ever become dated. After college, as you start your career, buy a house, have a family, prepare for retirement, and so on, the ability to maintain a budget will ensure that your expenses are properly covered at all times.

Taking the time while you’re in college to learn how to properly budget and handle your money can help you hone your financial skills — skills that will serve you far into the future.

Fostering a Healthy Financial Future

Finally, budgeting in college can put you in the best position possible post-school.

Rather than racking up debt and wasting money in the present — all of which will have to be paid back with interest in the future — a college budget helps you control your spending and create the healthiest financial situation possible when you start your career.

With less debt, you’ll be able to do things like save for a downpayment on a house, maintain a better credit score, and create an emergency fund without juggling excessive debt-related payments in the process.

How to Set Up a College Budget

If you’re nodding your head in approval but you aren’t sure exactly where to start, here are a few tips to set up your first budget while in college:

Start With the Basics

Before you get too far into the weeds, start by creating a simple budget. This can be done with two basic steps:

- Track all of your income: Add up every source of income you have available so that you know exactly how much money you’re working with on a weekly or monthly basis. This can be tricky, especially if you’re dividing a college loan over the course of your school year or career, or you’re working with part-time or seasonal income, but it’s an important starting point in the process.

- Calculate your expenses: Next, figure out each and every major expense that you have. Again, this can be tricky if you’re considering tuition or other costs that come in lump sums, but do your best to break down roughly what you need to spend on a weekly or monthly basis over the course of each year. It can be helpful to group smaller-yet-significant expenses, such as eating out or other discretionary spending, into single, estimated categories — $100 a month for entertainment, for instance.

Once you have these two foundational elements, you can see estimations of how much money you have and how much you spend. At this point, you’ve created the foundation for your budget.

Refine Your Budget

With your basic budget laid out, look for ways that you can sharpen and improve it. For instance, while you may understand what your actual income is at the moment, it may be worth looking into financial aid options , especially if you’re a first-generation college student who may have more opportunities, or picking up a side gig in order to increase your overall cash flow.

It’s also important to identify the wants versus the needs within your expenses. What items are absolutely essential and what can be eliminated if necessary? For example, lodging is an essential expense. However, a discretionary fund created to cover drinking costs is something that can be cut out entirely if you’re in a financial pinch. It can even help you avoid some of the risks inherent in drinking on campus.

Another option would be to comb over your essential expenses and see where you can cut things down. For instance, if you live in a dorm, you may be able to trim your lodging costs by moving off-campus. Even off-campus there may be ways that you can invest in a more energy-efficient house — think LED light bulbs, sealing cracks, or using cold water to wash your clothes — that can reduce your living expenses.

Budgeting While Going to College

From learning life skills to securing your financial future, budgeting is an essential activity while attending college. It’s understandable if the severe lack of income and excessive debt makes you want to throw your hands up and give up on the entire budgeting process from the get-go.

Nevertheless, the truth is, college is one of the most important times to track your expenses, limit your debt, and set yourself up for as promising a financial future as possible. So put in the effort now to establish good habits. You won’t regret it down the road.

View the discussion thread.

Related Stories

Grief won't help

She sleeps...

Surviving in a World Where Money is Required to Live

C 2019 Voices of Youth. All Rights Reserved.

EXPLORE our brands

Best Credit Cards

Best Personal Loans

Home Equity

Student Loans

Student Loan Refinance

Certificate of Deposits

Explore Options

Best Insurance Companies

Best Investments

Getting Started

Filing Taxes

Women's Clothing

Men's Clothing

Women's Shoes

Men's Shoes

Accessories

Living Room Accessories

Heaters, fans, and air purifiers

Kitchen products

Product reviews

Office Accessories

Home Office

Guides and How-To's

Home and garden

Pet Accessories

Prime Big Deals Days

Memorial Day

Black Friday

Home Audio Gear

Headphones & Earbuds

Laptops & Laptop Accessories

Tablets & Tablet Accessories

Wifi & Computer Accessories

Glasses & Headsets

Smart Watches

Electric Bikes & Scooters

Smart Devices

Travel Gear

Gift guides

For loved ones

Special occassions

Coffee Makers & Espresso Machines

Online Coffee Shops & Subscriptions

Coffee Accessories & How Tos

Wine & Champagne Glasses

Wine Accessories

Gifts for Wine Lovers

Non-fiction

Board Games

Buy Side from WSJ is a reviews and recommendations team, independent of The Wall Street Journal newsroom. We might earn a commission from links in this content. Learn more .

How to Budget as a College Student

Follow these four steps to manage your money and build strong habits for the future

Contributor, Buy Side from WSJ

Michelle Lambright Black is a contributor to Buy Side from WSJ.

Updated September 13, 2024, 5:10 PM EDT

Budgeting is hardly the most fun or most romantic part of going to college. But learning to do it can be as important as what you learn in class.

Expected student living expenses can range from around $18,000 to over $41,000 a year depending on location, time on campus and financial capacity, according to the College Board. Moreover, living on your own, juggling classes and new friends, it’s easy to overspend.

Learning to budget as a college student can help manage financial stress now and help you avoid problems when you are older, such as graduating with unmanageable credit card debt . By creating good financial habits, you’ll benefit for years to come.

“Having a budget before you leave for college can be empowering,” says Winnie Sun, managing partner of Sun Group Wealth Partners in Irvine, Calif. “By knowing how much you have to spend, you’re establishing boundaries, but you’re also practicing critical life skills.”

Below are four steps you can use to budget money as a college student.

1. Calculate your income

The first step to budgeting as a college student is to figure out how you’re going to pay for everything. In other words, you need to write out potential sources of income and determine how much cash each source will contribute to your overall budget.

Student loans and grants are two of the most common income sources for first-time undergraduate students. Nearly 90% of full-time students relied on some kind of financial aid between 2020 and 2021 according to the National Center for Education Statistics. And nearly a third of undergraduates accept federal student loans each year according to the Education Data Initiative, or EDI.

Yet it’s also important to point out that it could be risky to live off student loans alone. Even if you can cover your tuition and living expenses with financial aid, you might want to consider getting a job to give yourself wiggle room.

“There’s a common misconception that students shouldn’t be bothered with working and earning money while in college,” says Sun. “Yet often, when you learn to better manage your time and money, you’ll find that work can equal early opportunities to build your network and earn valuable work and life experience.”

Most students rely on various income sources to pay for college. During the 2022-2023 school year, the typical college student covered school expenses using the following funding strategies according to a Sallie Mae study:

- Parent contributions (income and savings): 40% of costs

- Grants and scholarships: 29%

- Student financing (student loans, credit cards, etc.): 11%

- Student contributions (income and savings): 10%

- Parent financing (Parent Plus loans, private loans, etc.): 8%

- Contributions from relatives and friends: 2%

Scholarships are the second most common sources of student income, but many families overlook the possibility of these resources. Sixty percent of students used scholarships in 2021-2022 with the money covering an average of $6,300 in expenses. Yet among students who didn’t receive scholarships, two-thirds didn’t apply for them.

2. Anticipate expenses

Next, think about common expenses you might face each month as a college student. This exercise can make it easier to divide up your available cash.

Student expenses can vary based on whether you’re living on or off campus, if you have a car to maintain and more. The cost of living can also depend on the part of the country where you attend school.

Below are the average annual costs of common college expenses for the 2022-2023 school year, according to the Education Data Initiative.

- Tuition: $9,700 for a four-year, public institution (in-state tuition) to $38,786 for a private, four-year institution

- Textbooks and supplies: $900 to $1,400

- Room and board: $9,000 to $13,000

In addition to these standard expenses above, the EDI also states that the average student attending a four-year college pays between $3,00 and $5,000 a year in additional living expenses. So, you’ll want to leave space in your budget for costs such as food, transportation, insurance (health, auto, etc.), streaming subscriptions, your mobile phone bill and more.

When it comes to everyday spending, such as entertainment and eating out, those expenses can be harder to track. But you can set a limit for how much you can afford to spend in those categories and aim to avoid going over that amount.

Remember that your budget shouldn’t just be about doing without things. Instead, it’s there to set you up for success and to make sure you have enough money for what matters most to you.

“A budget is not restrictive,” says Sharita M. Humphrey, a business and financial coach in Houston, Texas. “It’s a road map that will change over time and help you to better manage your money.”

3. Create a savings plan

Not only is it important to include expenses in your budget, you also need to save money. Having savings, even a small amount, can help you avoid debt and improve your financial security both as a college student and later in life.

It’s wise to add the money you plan to save into your budget, just as you would any other recurring expense. You may want to consider automating your savings goals too—a feature that many banks offer in their mobile apps or online accounts to make saving easier.

“The best way to save toward a future goal, like a spring break trip or upgrading a laptop, is to save without thinking about it,” says Matt Gromada, head of family banking at Chase Bank. “Just set it and forget it.”

When it comes to saving, a solid emergency fund is also essential. The classic guideline is saving enough to cover three to six months of expenses. Yet that amount could be a tall order for many college students. If your tuition, room and board are already covered, it may be fine to think outside of the box where your emergency fund is concerned.

“Anything is better than nothing,” says Dan Rooker, a Chicago, Ill.-based consultant for Student Loan Planner. “Start with something and work up to a cash cushion that equals the number of months in expenses that it would take you to find a new job if you lost your job.”

Storing your cash in a high-yield savings account can also help your money grow faster. Plus when you keep your emergency savings separate from your regular checking account it could reduce the temptation to spend that money on something else.

If you think college is too soon to start thinking about future retirement plans, you might want to consider adjusting your mindset. There can be tremendous benefits to saving money earlier in life if you can afford to do so.

“If you talk to anyone over the age of 30, the one thing that you will consistently hear them say is that they wish they started investing for retirement earlier,” says Chris Browning, host of the Popcorn Finance podcast in Los Angeles. “That’s because your best tool when it comes to reaching your retirement goal is time.”

Imagine you want $1 million in your retirement account when you turn 65. If you wait until your senior year of college (commonly 22 years old) to start investing, you’d need to invest around $220 a month (assuming an 8% annual return), according to Investor.gov’s retirement calculator . But if you start investing as a college freshman at age 18, you only need to invest $160 a month to reach that same $1 million goal. You’re eligible to contribute to an individual retirement account, or IRA , as long as you have earned income.

4. Make adjustments

Once you write out your income, expenses, and savings goals, you might find that you need to make some adjustments where your college budget is concerned. That’s a normal part of the process.

Over half of families (54%) say they took at least one action to reduce the overall cost of college according to Sallie Mae. Meanwhile, the most (76%) also worked to increase their income to help pay for college expenses.

“Budgets are fluid and will change and it takes time to master them,” says Humphrey. “Don’t get discouraged if you don’t get it right the first time. The great thing about a budget is that you’re in control and can make adjustments along the way.”

There are many ways to make college more affordable if you need to balance your budget. Some students apply for more scholarships or cut spending. Others participate in work-study programs, work part-time jobs or freelance for extra income. Still others take foundational courses at community college to reduce tuition costs before transferring to a university.

“College has gotten ridiculously expensive, even in the decade plus since I’ve graduated. So, it’s understandable that college students are having to make some difficult financial decisions,” says Browning. “If you’ve already cut your spending down as much as you can, working a few side gigs throughout the semester could help give you the breathing room you need.”

Once you have a financial plan you believe will work for you, you can use a budgeting app to simplify the money management process. (Buy Side particularly likes PocketGuard for first time budgeters and the basic version is free.) Setting up alerts on your checking account or student credit card (if you use one) may also help you avoid overspending , late payments and other financial mistakes.

“We typically don’t notice that we are overspending until we take a look at our bank account or credit card balance, which probably doesn’t happen often enough,” says Browning. “So one thing that you can do to stay on top of your money is to spend more time watching your spending.”

Above all, remember to give yourself grace when you create your first budget as a college student. No one is perfect at managing money the first time they try.

Frequently asked questions about budgeting for college

How much should a college student spend a month.

For the 2024-2025 academic year, a college student with a moderate budget should anticipate spending $26,400 to cover nine months of living expenses while attending school, or about $2,900 a month, according to the College Board . If your funds don’t stretch that far, the College Board projects low-budget students will still need $17,700 for nine months, or about $2,000 a month.

The amount you’ll end up spending could vary widely from those average projections, however, depending on your school’s location, your housing situation, and your extracurricular activities. You can find area-specific budget estimates on the College Board’s website .

How much do college students spend on groceries?

The amount you’ll shell out on food depends on whether you join a meal plan, how often you’ll dine out, and your dietary needs. According to the U.S. Department of Agriculture , the lowest amount a thrifty individual, between the ages of 20 and 50, cooking a “nutritious, practical, cost-effective diet prepared at home,” typically spends on groceries each month is $240 to $300.

If you opt for a college meal plan, it will likely cost you around $450 a month, according to the Education Data Initiative.

How much do college textbooks cost?

While the exact amount you’ll spend on course materials will vary depending on your major, access to used or e-textbooks and ability to rent rather than buy, the average four-year university student spent $1,230 a year on textbooks in 2020-2021, according to the National Center for Educational Data Statistics.

How much student aid will I get for college expenses?