How to Write a Business Plan for a Small Business

Noah Parsons

24 min. read

Updated September 2, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of writing a business plan

If you’re reading this guide, then you already know why you need a business plan .

You understand that writing a business plan helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your business plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After writing your business plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

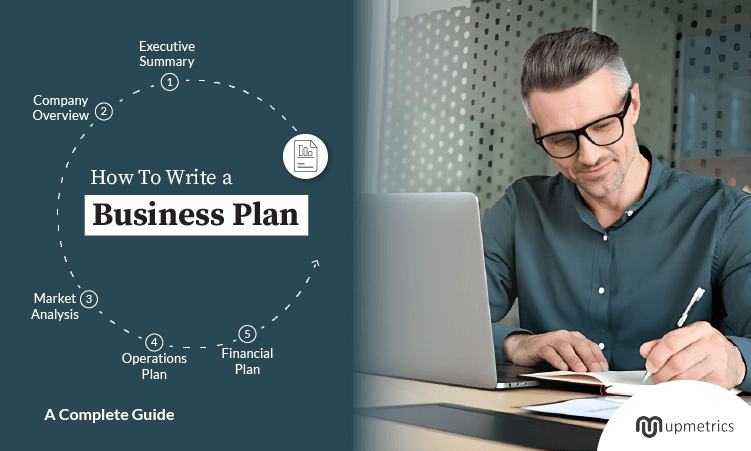

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

When writing a business plan, the produces and services section is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

When writing a business plan, the operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

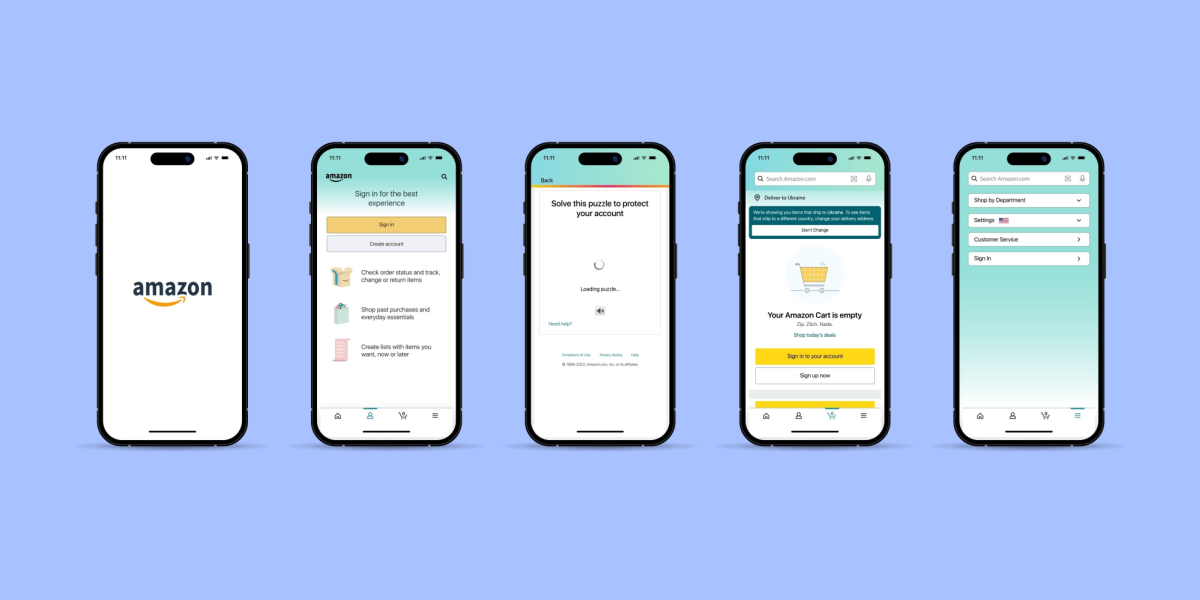

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

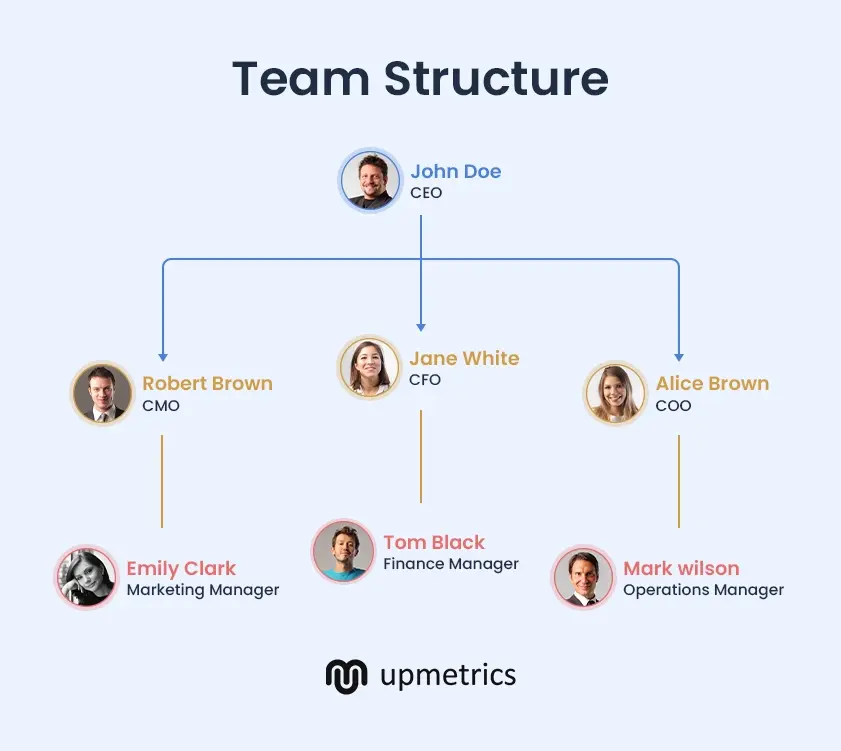

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

The last section of your business plan is your financial plan and forecasts.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI to write a business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of writing a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Writing a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of writing a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

7 Min. Read

How to Write a Bakery Business Plan + Sample

1 Min. Read

How to Calculate Return on Investment (ROI)

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Tailor Brands

$0 + state fee + up to $50 Amazon gift card

On Tailor Brands' Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

- How To Write An Effective Business Proposal

Best Pennsylvania LLC Services In 2024

Best Florida LLC Services In 2024

Best Maryland LLC Services In 2024

Best Texas LLC Services In 2024

Best Arizona LLC Services In 2024

Best California LLC Services In 2024

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

Updated: July 01, 2024

Published: November 08, 2018

I believe that reading sample business plans is essential when writing your own.

hbspt.cta._relativeUrls=true;hbspt.cta.load(53, 'e9d2eacb-6b01-423a-bf7a-19d42ba77eaa', {"useNewLoader":"true","region":"na1"});

As you explore business plan examples from real companies and brands, it’s easier for you to learn how to write a good one.

So what does a good business plan look like? And how do you write one that’s both viable and convincing? I’ll walk you through the ideal business plan format along with some examples to help you get started.

Table of Contents

Business Plan Types

Business plan format, sample business plan: section by section, sample business plan templates, top business plan examples.

Ultimately, the format of your business plan will vary based on your goals for that plan. I’ve added this quick review of different business plan types that achieve differing goals.

For a more detailed exploration of business plan types, you can check out this post .

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

1. Startups

Startup business plans are for proposing new business ideas. If you’re planning to start a small business, preparing a business plan is crucial. The plan should include all the major factors of your business.

You can check out this guide for more detailed business plan inspiration .

2. Feasibility Studies

Feasibility business plans focus on that business's product or service. Feasibility plans are sometimes added to startup business plans. They can also be a new business plan for an already thriving organization.

3. Internal Use

You can use internal business plans to share goals, strategies, or performance updates with stakeholders. In my opinion, internal business plans are useful for alignment and building support for ambitious goals.

4. Strategic Initiatives

A strategic business plan is another business plan that's often shared internally. This plan covers long-term business objectives that might not have been included in the startup business plan.

5. Business Acquisition or Repositioning

When a business is moving forward with an acquisition or repositioning, it may need extra structure and support. These types of business plans expand on a company's acquisition or repositioning strategy.

Growth sometimes just happens as a business continues operations. But more often, a business needs to create a structure with specific targets to meet set goals for expansion. This business plan type can help a business focus on short-term growth goals and align resources with those goals.

I’m going to focus on a startup business plan that needs to be detailed and research-backed as well as compelling enough to convince investors to offer funding. In my experience, the most comprehensive and convincing business plans contain the following sections.

Executive Summary

This all-important introduction to your business plan sets the tone and includes the company description as well as what you will be exchanging for money — whether that’s product lines, services, or product-service hybrids.

Market Opportunity

Information about gaps in your industry’s market and how you plan to fill them, focused on demand and potential for growth.

Competitive Landscape Analysis

An overview of your competitors that includes consideration of their strengths and how you’ll manage them, their weaknesses and how you’ll capitalize on them, and how you can differentiate your offerings in the industry.

Target Audience

Descriptions of your ideal customers, their various problems that you can solve, and your customer acquisition strategy.

Marketing Strategy

This section details how you will market your brand to achieve specific goals, the channels and tactics you’ll utilize to reach those goals, and the metrics you’ll be using to measure your progress.

Key Features and Benefits

This is where you’ll use plain language to emphasize the value of your product/service, how it solves the problems of your target audiences, and how you’ll scale up over time.

Pricing and Revenue

This section describes your pricing strategy and plans for building revenue streams that fit your audiences while achieving your business goals.

This is the final section, communicating with investors that your business idea is worth investing in via profit/loss statements, cash flow statements, and balance sheets to prove viability.

Okay, so now that we have a format established, I’ll give you more specific details about each section along with examples. Truthfully, I wish I’d had this resource to help me flesh out those first business plans long ago.

1. Executive Summary

I’d say the executive summary is the most important section of the entire business plan. It is essentially an overview of and introduction to your entire project.

Write this in such a way that it grabs your readers' attention and guides them through the rest of the business plan. This is important because a business plan can be dozens or hundreds of pages long.

There are two main elements I’d recommend including in your executive summary: your company description and your products and services.

Company Description

This is the perfect space to highlight your company’s mission statement and goals, a brief overview of your history and leadership, and your top accomplishments as a business.

Tell potential investors who you are and why what you do matters. Naturally, they’re going to want to know who they’re getting into business with up front. This is a great opportunity to showcase your impact.

Need some extra help firming up your business goals? I’d recommend HubSpot Academy’s free course to help you set meaningful goals that matter most for your business.

Products and Services

Here, you will incorporate an overview of your offerings. This doesn’t have to be extensive, as it is just a chance to introduce your industry and overall purpose as a business. I recommend including snippets of information about your financial projections and competitive advantage here as well.

Keep in mind that you'll cover many of these topics in more detail later on in the business plan. The executive summary should be clear and brief, only including the most important takeaways.

Executive Summary Business Plan Examples

This example was created with HubSpot’s business plan template . What makes this executive summary good is that it tells potential investors a short story while still covering all of the most important details.

Our Mission

Maria’s Gluten Free Bagels offers gluten-free bagels, along with various toppings, other gluten-free breakfast sandwich items, and coffee. The facility is entirely gluten free. Our team expects to catch the interest of gluten-free, celiac, or health-conscious community members who are seeking an enjoyable cafe to socialize. Due to a lack of gluten-free bagel products in the food industry currently, we expect mild competition and are confident we will be able to build a strong market position.

The Company and Management

Maria’s Gluten Free Bagels was founded in 2010 by Maria Jones, who first began selling her gluten-free bagels online from her home, using social media to spread the word. In 2012 she bought a retail location in Hamilton, MA, which now employs four full-time employees and six part-time employees. Prior to her bagel shop, Maria was a chef in New York and has extensive experience in the food industry.

Along with Maria Jones, Gluten Free Bagel Shop has a board of advisors. The advisors are:

- Jeni King, partner at Winding Communications, Ltd.

- Henry Wilson, president of Blue Robin, LLP.

Our Product

We offer gluten-free products ranging from bagels and cream cheese to blueberry muffins, coffee, and pastries. Our customers are health-conscious, community-oriented people who enjoy gluten-free products. We will create a welcoming, warm environment with opportunities for open mic nights, poetry readings, and other community functions. We will focus on creating an environment in which someone feels comfortable meeting a friend for lunch, or working remotely.

Our Competitive Advantages

While there are other coffee shops and cafes in the North Shore region, there are none that offer purely gluten-free options. This restricts those suffering from gluten-free illnesses or simply those with a gluten-free preference. This will be our primary selling point. Additionally, our market research [see Section 3] has shown a demand for a community-oriented coffee and bagel shop in the town of Hamilton, MA.

Financial Considerations

Our sales projections for the first year are $400,000. We project a 15% growth rate over the next two years. By year three, we project 61% gross margins.

We will have four full-time employees. The salary for each employee will be $50,000.

Start-up Financing Requirements

We are seeking to raise $125,000 in startup to finance year one. The owner has invested $50,000 to meet working capital requirements, and will use a loan of $100,000 to supplement the rest.

Example 2 :

Marianne and Keith Bean have been involved with the food industry for several years. They opened their first restaurant in Antlers, Oklahoma in 1981, and their second in Hugo in 1988. Although praised for the quality of many of the items on their menu, they have attained a special notoriety for their desserts. After years of requests for their flavored whipped cream toppings, they have decided to pursue marketing these products separately from the restaurants.

Marianne and Keith Bean have developed several recipes for flavored whipped cream topping. They include chocolate, raspberry, cinnamon almond, and strawberry. These flavored dessert toppings have been used in the setting of their two restaurants over the past 18 years, and have been produced in large quantities. The estimated shelf life of the product is 21 days at refrigeration temperatures and up to six months when frozen. The Beans intend to market this product in its frozen state in 8 and 12-ounce plastic tubs. They also intend to have the products available in six ounce pressurized cans. Special attention has been given to developing an attractive label that will stress the gourmet/specialty nature of the products.

Distribution of Fancy's Foods Whipped Dream product will begin in the local southeastern Oklahoma area. The Beans have an established name and reputation in this area, and product introduction should encounter little resistance.

Financial analyses show that the company will have both a positive cash flow and profit in the first year. The expected return on equity in the first year is 10.88%

Tips for Writing Your Executive Summary

- Start with a strong introduction of your company that showcases your mission and impact, then outline the products and services you provide.

- Clearly define a problem, explain how your product solves that problem, and show why the market needs your business.

- Be sure to highlight your value proposition, market opportunity, and growth potential.

- Keep it concise and support ideas with data.

- Customize your summary to your audience. For example, you might emphasize finances and return on investment for venture capitalists, whereas you might emphasize community benefits and minimal environmental impact for progressive nonprofits.

For more guidance, check out our tips for writing an effective executive summary .

2. Market Opportunity

This is where you'll detail the opportunity in the market. Ask and answer: Where is the gap in the current industry, and how will my product fill that gap?

To get a thorough understanding of the market opportunity, you'll want to conduct a TAM, SAM, SOM analysis , a SWOT analysis , and perform market research on your industry to get some insights for this section. More specifically, here’s what I’d include.

- The size of the market

- Current or potential market share

- Trends in the industry and consumer behavior

- Where the gap is

- What caused the gap

- How you intend to fill it

Market Opportunity Business Plan Example

I like this example because it uses critical data to underline the size of the potential market and what part of that market this service hopes to capture.

Example: The market for Doggie Pause is all of the dog owners in the metropolitan area and surrounding areas of the city. We believe that this is going to be 2/3 of the population, and we have a goal of gaining a 50% market share. We have a target of a 20% yearly profit increase as the business continues.

Tips for Writing Your Market Opportunity Section

- Focus on demand and potential for growth.

- Use market research, surveys, and industry trend data to support your market forecast and projections.

- Add a review of regulation shifts, tech advances, and consumer behavior changes.

- Refer to reliable sources.

- Showcase how your business can make the most of this opportunity.

3. Competitive Landscape Analysis

Since we’re already speaking of market share, you‘ll also need to create a section that shares details on who the top competitors are. After all, your customers likely have more than one brand to choose from, and you’ll want to understand exactly why they might choose one over another.

My favorite part of performing a competitive analysis is that it can help you uncover the following:

- Industry trends that other brands may not be utilizing.

- Strengths in your competition that may be obstacles to handle.

- Weaknesses in your competition that may help you develop selling points.

- The unique proposition you bring to the market that may resonate with customers.

Competitive Landscape Business Plan Example

I like how the competitive landscape section of this business plan shows a clear outline of who the top competitors are. It also highlights specific industry knowledge and the importance of location. This demonstrates useful experience in the industry, helping to build trust in your ability to execute your business plan.

Competitive Environment

Currently, there are four primary competitors in the Greater Omaha Area: Pinot’s Palette Lakeside (franchise partner), Village Canvas and Cabernet, The Corky Canvas, and Twisted Vine Collective. The first three competitors are in Omaha and the fourth is located in Papillion.

Despite the competition, all locations have both public and private events. Each location has a few sold-out painting events each month. The Omaha locations are in new, popular retail locations, while the existing Papillion location is in a downtown business district.

There is an opportunity to take advantage of the environment and open a studio in a well-traveled or growing area. Pinot’s Palette La Vista will differentiate itself from its competitors by offering a premium experience in a high-growth, influential location.

Tips for Writing Your Competitive Landscape

- Complete in-depth research, then emphasize your most important findings.

- Compare your unique selling proposition (USP) to your direct and indirect competitors.

- Show a clear and realistic plan for product and brand differentiation.

- Look for specific advantages and barriers in the competitive landscape. Then, highlight how that information could impact your business.

- Outline growth opportunities from a competitive perspective.

- Add customer feedback and insights to support your competitive analysis.

4. Target Audience

Use this section to describe who your customer segments are in detail. What is the demographic and psychographic information of your audience? I’d recommend building a buyer persona to get in the mindset of your ideal customers and be clear about why you're targeting them. Here are some questions I’d ask myself:

- What demographics will most likely need/buy your product or service?

- What are the psychographics of this audience? (Desires, triggering events, etc.)

- Why are your offerings valuable to them?

Target Audience Business Plan Example

I like the example below because it uses in-depth research to draw conclusions about audience priorities. It also analyzes how to create the right content for this audience.

The Audience

Recognize that audiences are often already aware of important issues. Outreach materials should:

- Emphasize a pollution-prevention practice

- Tell audience a little about how to prevent pollution

- Tell audience where they can obtain information about prevention.

Message Content

- Focus the content for outreach materials on cost savings, such as when and where pollution prevention is as cheap as or cheaper than traditional techniques. Include facts and figures.

- Emphasize how easy it is to do the right thing and the impacts of not engaging in pollution prevention.

- Stress benefits such as efficiency or better relations with government, for businesses not primarily concerned with public image.

Tips for Writing Your Target Audience Section

- Include details on the size and growth potential of your target audience.

- Figure out and refine the pain points for your target audience , then show why your product is a useful solution.

- Describe your targeted customer acquisition strategy in detail.

- Share anticipated challenges your business may face in acquiring customers and how you plan to address them.

- Add case studies, testimonials, and other data to support your target audience ideas.

- Remember to consider niche audiences and segments of your target audience in your business plan.

5. Marketing Strategy

Here, you‘ll discuss how you’ll acquire new customers with your marketing strategy. I think it’s helpful to have a marketing plan built out in advance to make this part of your business plan easier. I’d suggest including these details:

- Your brand positioning vision and how you'll cultivate it.

- The goal targets you aim to achieve.

- The metrics you'll use to measure success.

- The channels and distribution tactics you'll use.

Marketing Strategy Business Plan Example

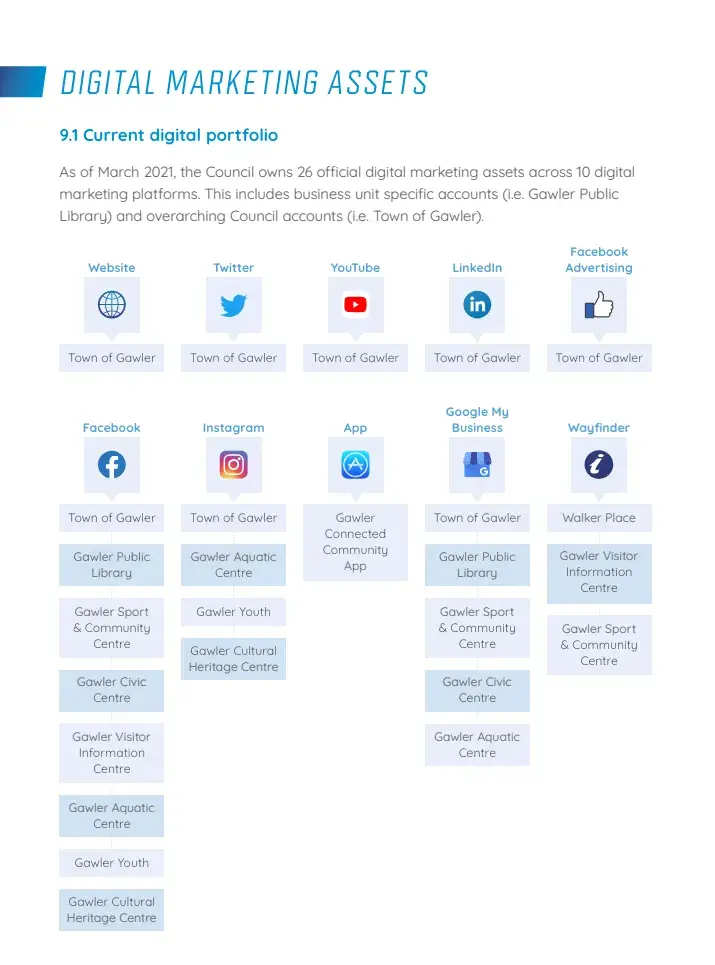

This business plan example includes the marketing strategy for the town of Gawler. In my opinion, it works because it offers a comprehensive picture of how they plan to use digital marketing to promote the community.

You’ll also learn the financial benefits investors can reap from putting money into your venture rather than trying to sell them on how great your product or service is.

This business plan guide focuses less on the individual parts of a business plan, and more on the overarching goal of writing one. For that reason, it’s one of my favorites to supplement any template you choose to use. Harvard Business Review’s guide is instrumental for both new and seasoned business owners.

7. HubSpot’s Complete Guide to Starting a Business

The Best AI Tools for Ecommerce & How They'll Boost Your Business

23 of My Favorite Free Marketing Newsletters

![business plan for introduction The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

What is a Business Plan? Definition, Tips, and Templates

![business plan for introduction 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![business plan for introduction How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

21 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How To Write A Business Plan: A Comprehensive Guide

The Startups Team

How To Write A Business Plan: A Comprehensive Guide

A comprehensive, step-by-step guide - complete with real examples - on writing business plans with just the right amount of panache to catch an investor's attention and serve as a guiding star for your business.

Introduction to Business Plans

So you've got a killer startup idea. Now you need to write a business plan that is equally killer.

You fire up your computer, open a Google doc, and stare at the blank page for several minutes before it suddenly dawns on you that, Hm…maybe I have no idea how to write a business plan from scratch after all.

Don't let it get you down. After all, why would you know anything about business planning? For that very reason we have 4 amazing business plan samples to share with you as inspiration.

For most founders, writing a business plan feels like the startup equivalent of homework. It's the thing you know you have to do, but nobody actually wants to do.

Here's the good news: writing a business plan doesn't have to be this daunting, cumbersome chore.

Once you understand the fundamental questions that your business plan should answer for your readers and how to position everything in a way that compels your them to take action, writing a business plan becomes way more approachable.

Before you set fingers to the keyboard to turn your business idea into written documentation of your organizational structure and business goals, we're going to walk you through the most important things to keep in mind (like company description, financials, and market analysis, etc.) and to help you tackle the writing process confidently — with plenty of real life business plan examples along the way to get you writing a business plan to be proud of!

Keep It Short and Simple.

There's this old-school idea that business plans need to be ultra-dense, complex documents the size of a doorstop because that's how you convey how serious you are about your company.

Not so much.

Complexity and length for complexity and length's sake is almost never a good idea, especially when it comes to writing a business plan. There are a couple of reasons for this.

1. Investors Are Short On Time

If your chief goal is using your business plan to secure funding, then it means you intend on getting it in front of an investor. And if there's one thing investors are, it's busy. So keep this in mind throughout writing a business plan.

Investors wade through hundreds of business plans a year. There's no version of you presenting an 80-page business plan to an investor and they enthusiastically dive in and take hours out of their day to pour over the thing front to back.

Instead, they're looking for you to get your point across as quickly and clearly as possible so they can skim your business plan and get to the most salient parts to determine whether or not they think your opportunity is worth pursuing (or at the very least initiating further discussions).

You should be able to refine all of the key value points that investors look for to 15-20 pages (not including appendices where you will detail your financials). If you find yourself writing beyond that, then it's probably a case of either over explaining, repeating information, or including irrelevant details in your business plan (you don't need to devote 10 pages to how you're going to set up your website, for example).

Bottom line: always be on the lookout for opportunities to “trim the fat" while writing a business plan (and pay special attention to the executive summary section below), and you'll be more likely to secure funding.

2. Know Your Audience

If you fill your business plan with buzzwords, industry-specific jargon or acronyms, and long complicated sentences, it might make sense to a handful of people familiar with your niche and those with superhuman attention spans (not many), but it alienates the vast majority of readers who aren't experts in your particular industry. And if no one can understand so much as your company overview, they won't make it through the rest of your business plan.

Your best bet here is to use simple, straightforward language that's easily understood by anyone — from the most savvy of investor to your Great Aunt Bertha who still uses a landline.

How To Format Your Business Plan

You might be a prodigy in quantum mechanics, but if you show up to your interview rocking cargo shorts and lime green Crocs, you can probably guess what the hiring manager is going to notice first.

In the same way, how you present your business plan to your readers equally as important as what you present to them. So don't go over the top with an extensive executive summary, or get lazy with endless bullet points on your marketing strategy.

If your business plan is laden with inconsistent margins, multiple font types and sizes, missing headings and page numbers, and lacks a table of contents, it's going to create a far less digestible reading experience (and totally take away from your amazing idea and hours of work writing a business plan!)

While there's no one right way to format your business plan, the idea here is to ensure that it presents professionally. Here's some easy formatting tips to help you do just that.

If your margins are too narrow, it makes the page look super cluttered and more difficult to read.

A good rule of thumb is sticking to standard one-inch margins all around.

Your business plan is made up of several key sections, like chapters in a book.

Whenever you begin a section (“Traction” for example) you'll want to signify it using a header so that your reader immediately knows what to expect from the content that follows.

This also helps break up your content and keep everything nice and organized in your business plan.

Subheadings

Subheadings are mini versions of headings meant to break up content within each individual section and capture the attention of your readers to keep them moving down the page.

In fact, we're using sub-headers right now in this section for that very purpose!

Limit your business plan to two typefaces (one for headings and one for body copy and subheadings, for example) that you can find in a standard text editor like Microsoft Word or Google Docs.

Only pick fonts that are easy to read and contain both capital and lowercase letters.

Avoid script-style or jarring fonts that distract from the actual content. Modern, sans-serif fonts like Helvetica, Arial, and Proxima Nova are a good way to go.

Keep your body copy between 11 and 12-point font size to ensure readability (some fonts are more squint-inducing than others).

You can offset your headings from your body copy by simply upping the font size and by bolding your subheadings.

Sometimes it's better to show instead of just tell.

Assume that your readers are going to skim your plan rather than read it word-for-word and treat it as an opportunity to grab their attention with color graphics, tables, and charts (especially with financial forecasts), as well as product images, if applicable.

This will also help your reader better visualize what your business model is all about.

Need some help with this?

Our business planning wizard comes pre-loaded with a modular business plan template that you can complete in any order and makes it ridiculously easy to generate everything you need from your value proposition, mission statement, financial projections, competitive advantage, sales strategy, market research, target market, financial statements, marketing strategy, in a way that clearly communicates your business idea.

Refine Your Business Plans. Then Refine Them Some More.

Your business isn't static, so why should your business plan be?

Your business strategy is always evolving, and so are good business plans. This means that the early versions of your business plans probably won't (and shouldn't be) your last. The details of even even the best business plans are only as good as their last update.

As your business progresses and your ideas about it shift, it's important revisit your business plan from time to time to make sure it reflects those changes, keeping everything as accurate and up-to-date as possible. What good is market analysis if the market has shifted and you have an entirely different set of potential customers? And what good would the business model be if you've recently pivoted? A revised business plan is a solid business plan. It doesn't ensure business success, but it certainly helps to support it.

This rule especially holds true when you go about your market research and learn something that goes against your initial assumptions, impacting everything from your sales strategy to your financial projections.

At the same time, before you begin shopping your business plan around to potential investors or bankers, it's imperative to get a second pair of eyes on it after you've put the final period on your first draft.

After you run your spell check, have someone with strong “English teacher skills” run a fine-tooth comb over your plan for any spelling, punctuation, and grammatical errors you may have glossed over. An updated, detailed business plan (without errors!) should be constantly in your business goals.

More than that, your trusty business plan critic can also give you valuable feedback on how it reads from a stylistic perspective. While different investors prefer different styles, the key here is to remain consistent with your audience and business.

Writing Your Business Plan: A Section-By-Section Breakdown

We devoted an entire article carefully breaking down the key components of a business plan which takes a comprehensive look of what each section entails and why.

If you haven't already, you should check that out, as it will act as the perfect companion piece to what we're about to dive into in a moment.

For our purposes here, we're going to look at a few real world business plan examples (as well as one of our own self-penned “dummy” plans) to give you an inside look at how to position key information on a section-by-section basis.

1. Executive Summary

Quick overview.

After your Title Page — which includes your company name, slogan (if applicable), and contact information — and your Table of Contents, the Executive Summary will be the first section of actual content about your business.

The primary goal of your Executive Summary is to provide your readers with a high level overview of your business plan as a whole by summarizing the most important aspects in a few short sentences. Think of your Executive Summary as a kind of “teaser” for your business concept and the information to follow — information which you will explain in greater detail throughout your plan. This isn't the place for your a deep dive on your competitive advantages, or cash flow statement. It is an appropriate place to share your mission statement and value proposition.

Executive Summary Example

Here's an example of an Executive Summary taken from a sample business plan written by the Startups.com team for a fictional company called Culina. Here, we'll see how the Executive Summary offers brief overviews of the Product , Market Opportunity , Traction , and Next Steps .

Culina Tech specializes in home automation and IoT technology products designed to create the ultimate smart kitchen for modern homeowners.

Our flagship product, the Culina Smart Plug, enables users to make any kitchen appliance or cooking device intelligent. Compatible with all existing brands that plug into standard two or three-prong wall outlets, Culina creates an entire network of Wi-Fi-connected kitchen devices that can be controlled and monitored remotely right from your smartphone.

The majority of US households now spend roughly 35% of their energy consumption on appliances, electronics, and lighting. With the ability to set energy usage caps on a daily, weekly or monthly basis, Culina helps homeowners stay within their monthly utility budget through more efficient use of the dishwasher, refrigerator, freezer, stove, and other common kitchen appliances.

Additionally, 50.8% of house fires are caused in the kitchen — more than any other room in the home — translating to over $5 billion in property damage costs per year. Culina provides the preventative intelligence necessary to dramatically reduce kitchen-related disasters and their associated costs and risk of personal harm.

Our team has already completed the product development and design phase, and we are now ready to begin mass manufacturing. We've also gained a major foothold among consumers and investors alike, with 10,000 pre-ordered units sold and $5 million in investment capital secured to date.

We're currently seeking a $15M Series B capital investment that will give us the financial flexibility to ramp up hardware manufacturing, improve software UX and UI, expand our sales and marketing efforts, and fulfill pre-orders in time for the 2018 holiday season.

2. Company Synopsis

Your Company Synopsis section answers two critically important questions for your readers: What painful PROBLEM are you solving for your customers? And what is your elegant SOLUTION to that problem? The combination of these two components form your value proposition.

Company Synopsis Example

Let's look at a real-life company description example from HolliBlu * — a mobile app that connects healthcare facilities with local skilled nurses — to see how they successfully address both of these key aspects. *Note: Full disclosure; Our team worked directly with this company on their business plan via Fundable.

Notice how we get a crystal clear understanding of why the company exists to begin with when they set up the problem — that traditional nurse recruitment methods are costly, inconvenient, and time-consuming, creating significant barriers to providing quality nursing to patients in need.

Once we understand the painful problem that HolliBlu's customers face, we're then directly told how their solution links back directly to that problem — by creating an entire community of qualified nurses and directly connecting them with local employers more cost-effectively and more efficiently than traditional methods.

3. Market Overview

Your Market Overview provides color around the industry that you will be competing in as it relates to your product/service.

This will include statistics about industry size, [growth](https://www.startups.com/library/expert-advice/the-case-for-growing-slowly) rate, trends, and overall outlook. If this part of your business plan can be summed up in one word, it's research .

The idea is to gather as much raw data as you can to make the case for your readers that:

This is a market big enough to get excited about.

You can capture a big enough share of this market to get excited about.

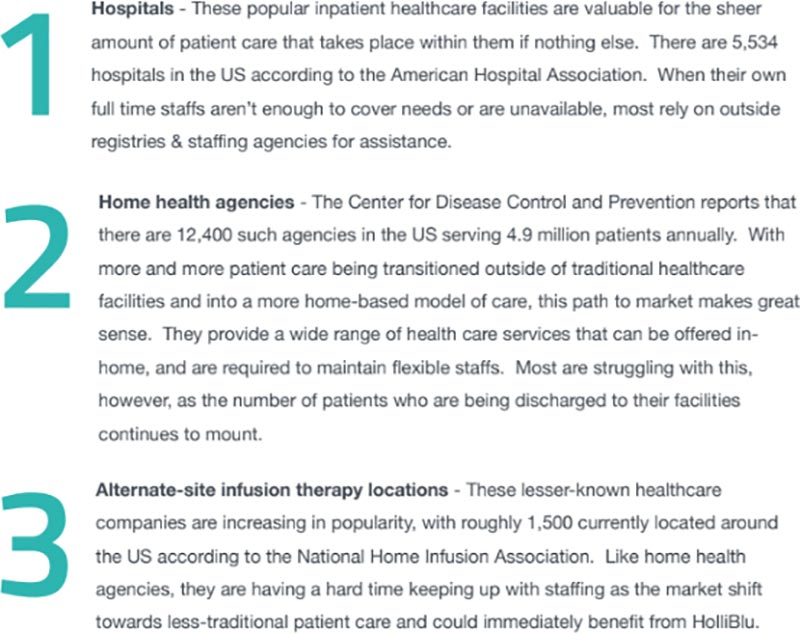

Target Market Overview Example

Here's an example from HolliBlu's business plan:

HolliBlu's Market Overview hits all of the marks — clearly laying out the industry size ($74.8 billion), the Total Addressable Market or TAM (3 million registered nurses), industry growth rate (581,500 new RN jobs through 2018; $355 billion by 2020), and industry trends (movement toward federally-mandated compliance with nurse/patient ratios, companies offering sign-on bonuses to secure qualified nurses, increasing popularity of home-based healthcare).

4. Product (How it Works)

Where your Company Synopsis is meant to shed light on why the company exists by demonstrating the problem you're setting out to solve and then bolstering that with an impactful solution, your Product or How it Works section allows you to get into the nitty gritty of how it actually delivers that value, and any competitive advantage it provides you.

Product (How it Works) Example

In the below example from our team's Culina sample plan, we've divided the section up using subheadings to call attention to product's key features and how it actually works from a user perspective.

This approach is particularly effective if your product or service has several unique features that you want to highlight.

5. Revenue Model

Quite simply, your Revenue Model gives your readers a framework for how you plan on making money. It identifies which revenue channels you're leveraging, how you're pricing your product or service, and why.

Revenue Model Example

Let's take a look at another real world business plan example with brewpub startup Magic Waters Brewpub .*

It can be easy to get hung up on the financial aspect here, especially if you haven't fully developed your product yet. And that's okay. *Note: Full disclosure; Our team worked directly with this company on their business plan via Fundable.

The thing to remember is that investors will want to see that you've at least made some basic assumptions about your monetization strategy.

6. Operating Model

Your Operating Model quite simply refers to how your company actually runs itself. It's the detailed breakdown of the processes, technologies, and physical requirements (assets) that allow you to deliver the value to your customers that your product or service promises.

Operating Model Example

Let's say you were opening up a local coffee shop, for example. Your Operating Model might detail the following:

Information about your facility (location, indoor and outdoor space features, lease amount, utility costs, etc.)

The equipment you need to purchase (coffee and espresso machines, appliances, shelving and storage, etc.) and their respective costs.

The inventory you plan to order regularly (product, supplies, etc.), how you plan to order it (an online supplier) and how often it gets delivered (Mon-Fri).

Your staffing requirements (including how many part or full time employees you'll need, at what wages, their job descriptions, etc.)

In addition, you can also use your Operating Model to lay out the ways you intend to manage the costs and efficiencies associated with your business, including:

The Critical Costs that make or break your business. In the case of our coffee shop example, you might say something like,

“We're estimating the marketing cost to acquire a customer is going to be $25. Our average sale is $45. So long as we can keep our customer acquisition costs below $25 we will have enough margin to grow with.”

Cost Maturation & Milestones that show how your Critical Costs might fluctuate over time.

“If we sell 50 coffees a day, our average unit cost will be $8 on a sale of $10. At that point we're barely breaking even. However as we scale up to 200 coffees a day, our unit costs drop significantly to $4, creating a 100% increase in net income.”

Investment Costs that highlight strategic uses of capital that will have a big Return on Investment (ROI) later.

“We're investing $100,000 into a revolutionary new coffee brewing system that will allow us to brew twice the amount our current output with the same amount of space and staff.”

Operating Efficiencies explaining your capability of delivering your product or service in the most cost effective manner possible while maintaining the highest standards of quality.

“By using energy efficient Ecoboilers, we're able to keep our water hot while minimizing the amount of energy required. Our machines also feature an energy saving mode. Both of these allow us to dramatically cut energy costs.”

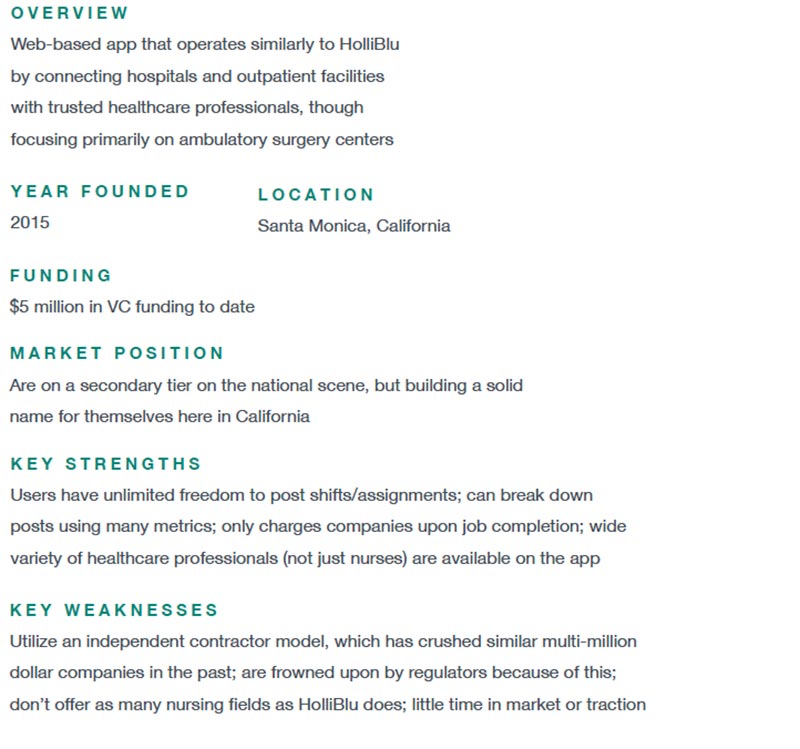

7. Competitive Analysis

Like the Market Overview section, you want to show your readers that you've done your homework and have a crazy high level of awareness about your current competitors or any potential competitors that may crop up down the line for your given business model.

When writing your Competitive Analysis, your overview should cover who your closest competitors are, the chief strengths they bring to the table, and their biggest weaknesses .