How To Present Your Market Research Results And Reports In An Efficient Way

Table of Contents

1) What Is A Market Research Report?

2) Market Research Reports Examples

3) Why Do You Need Market Research Reports

4) How To Make A Market Research Report?

5) Types Of Market Research Reports

6) Challenges & Mistakes Market Research Reports

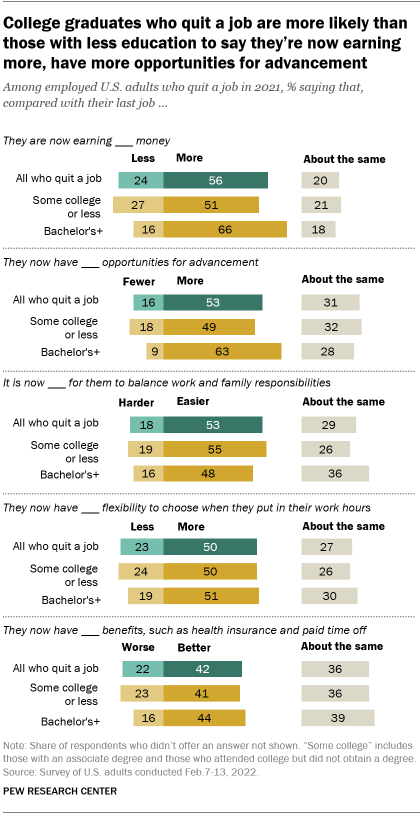

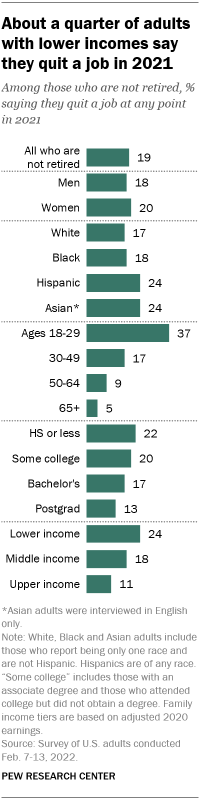

Market research analyses are the go-to solution for many professionals, and for good reason: they save time, offer fresh insights, and provide clarity on your business. In turn, market research reports will help you to refine and polish your strategy. Plus, a well-crafted report will give your work more credibility while adding weight to any marketing recommendations you offer a client or executive.

But, while this is the case, today’s business world still lacks a way to present market-based research results efficiently. The static, antiquated nature of PowerPoint makes it a bad choice for presenting research discoveries, yet it is still widely used to present results.

Fortunately, things are moving in the right direction. There are online data visualization tools that make it easy and fast to build powerful market research dashboards. They come in handy to manage the outcomes, but also the most important aspect of any analysis: the presentation of said outcomes, without which it becomes hard to make accurate, sound decisions.

Here, we consider the benefits of conducting research analyses while looking at how to write and present market research reports, exploring their value, and, ultimately, getting the very most from your research results by using professional market research software .

Let’s get started.

What Is a Market Research Report?

A market research report is an online reporting tool used to analyze the public perception or viability of a company, product, or service. These reports contain valuable and digestible information like customer survey responses and social, economic, and geographical insights.

On a typical market research results example, you can interact with valuable trends and gain insight into consumer behavior and visualizations that will empower you to conduct effective competitor analysis. Rather than adding streams of tenuous data to a static spreadsheet, a full market research report template brings the outcomes of market-driven research to life, giving users a data analysis tool to create actionable strategies from a range of consumer-driven insights.

With digital market analysis reports, you can make your business more intelligent more efficient, and, ultimately, meet the needs of your target audience head-on. This, in turn, will accelerate your commercial success significantly.

Your Chance: Want to test a market research reporting software? Explore our 14-day free trial & benefit from interactive research reports!

How To Present Your Results: 4 Essential Market Research Report Templates

When it comes to sharing rafts of invaluable information, research dashboards are invaluable.

Any market analysis report example worth its salt will allow everyone to get a firm grip on their results and discoveries on a single page with ease. These dynamic online dashboards also boast interactive features that empower the user to drill down deep into specific pockets of information while changing demographic parameters, including gender, age, and region, filtering the results swiftly to focus on the most relevant insights for the task at hand.

These four market research report examples are different but equally essential and cover key elements required for market survey report success. You can also modify each and use it as a client dashboard .

While there are numerous types of dashboards that you can choose from to adjust and optimize your results, we have selected the top 3 that will tell you more about the story behind them. Let’s take a closer look.

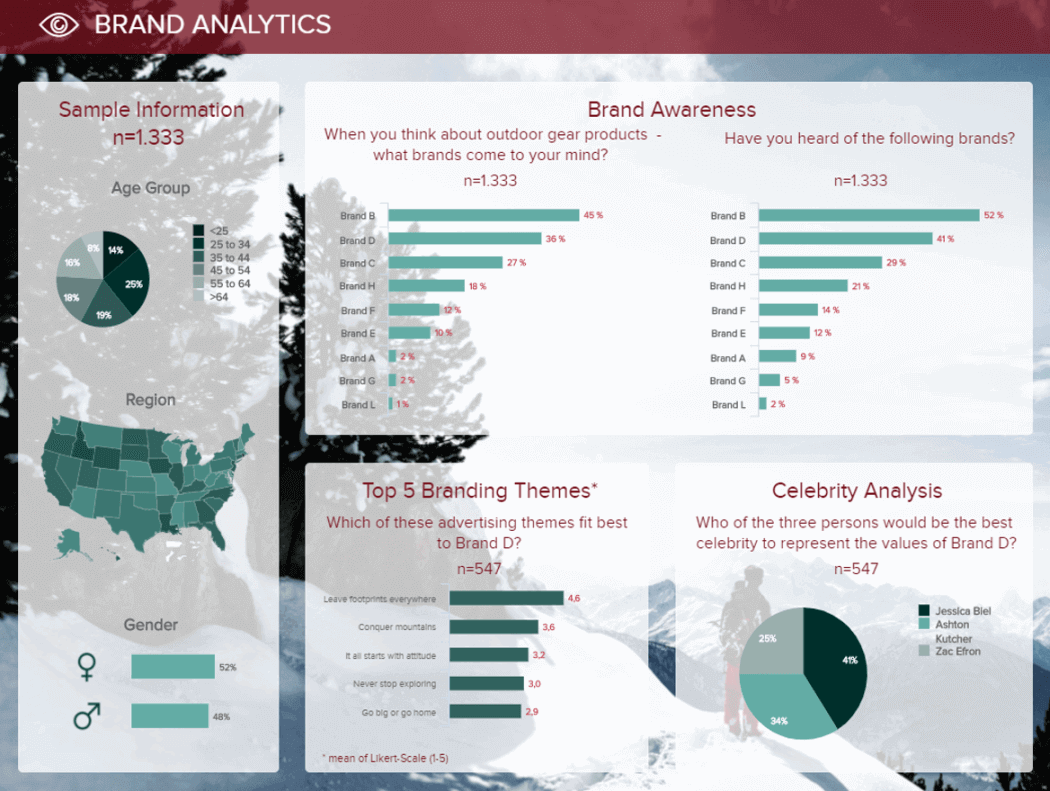

1. Market Research Report: Brand Analysis

Our first example shares the results of a brand study. To do so, a survey has been performed on a sample of 1333 people, information that we can see in detail on the left side of the board, summarizing the gender, age groups, and geolocation.

**click to enlarge**

At the dashboard's center, we can see the market-driven research discoveries concerning first brand awareness with and without help, as well as themes and celebrity suggestions, to know which image the audience associates with the brand.

Such dashboards are extremely convenient to share the most important information in a snapshot. Besides being interactive (but it cannot be seen on an image), it is even easier to filter the results according to certain criteria without producing dozens of PowerPoint slides. For instance, I could easily filter the report by choosing only the female answers, only the people aged between 25 and 34, or only the 25-34 males if that is my target audience.

Primary KPIs:

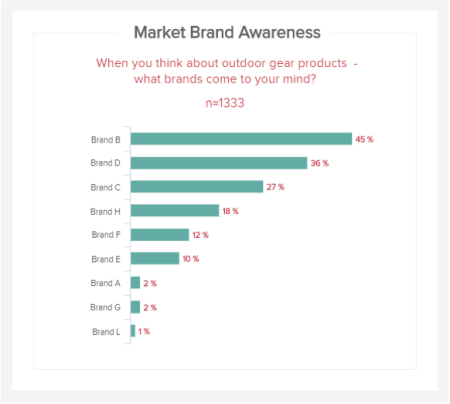

a) Unaided Brand Awareness

The first market research KPI in this most powerful report example comes in the form of unaided brand awareness. Presented in a logical line-style chart, this particular market study report sample KPI is invaluable, as it will give you a clear-cut insight into how people affiliate your brand within their niche.

As you can see from our example, based on a specific survey question, you can see how your brand stacks up against your competitors regarding awareness. Based on these outcomes, you can formulate strategies to help you stand out more in your sector and, ultimately, expand your audience.

b) Aided Brand Awareness

This market survey report sample KPI focuses on aided brand awareness. A visualization that offers a great deal of insight into which brands come to mind in certain niches or categories, here, you will find out which campaigns and messaging your target consumers are paying attention to and engaging with.

By gaining access to this level of insight, you can conduct effective competitor research and gain valuable inspiration for your products, promotional campaigns, and marketing messages.

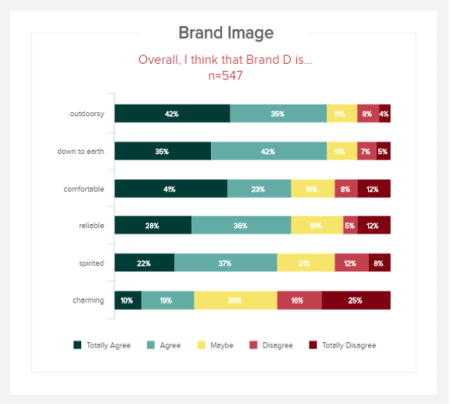

c) Brand image

When it comes to research reporting, understanding how others perceive your brand is one of the most golden pieces of information you could acquire. If you know how people feel about your brand image, you can take informed and very specific actions that will enhance the way people view and interact with your business.

By asking a focused question, this visual of KPIs will give you a definitive idea of whether respondents agree, disagree, or are undecided on particular descriptions or perceptions related to your brand image. If you’re looking to present yourself and your message in a certain way (reliable, charming, spirited, etc.), you can see how you stack up against the competition and find out if you need to tweak your imagery or tone of voice - invaluable information for any modern business.

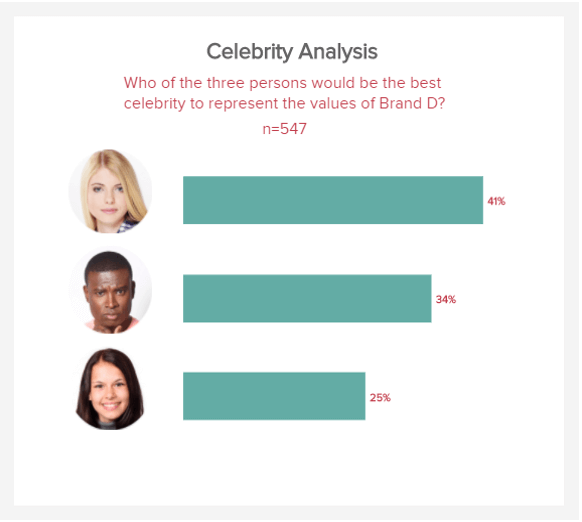

d) Celebrity analysis

This indicator is a powerful part of our research KPI dashboard on top, as it will give you a direct insight into the celebrities, influencers, or public figures that your most valued consumers consider when thinking about (or interacting with) your brand.

Displayed in a digestible bar chart-style format, this useful metric will not only give you a solid idea of how your brand messaging is perceived by consumers (depending on the type of celebrity they associate with your brand) but also guide you on which celebrities or influencers you should contact.

By working with the right influencers in your niche, you will boost the impact and reach of your marketing campaigns significantly, improving your commercial awareness in the process. And this is the KPI that will make it happen.

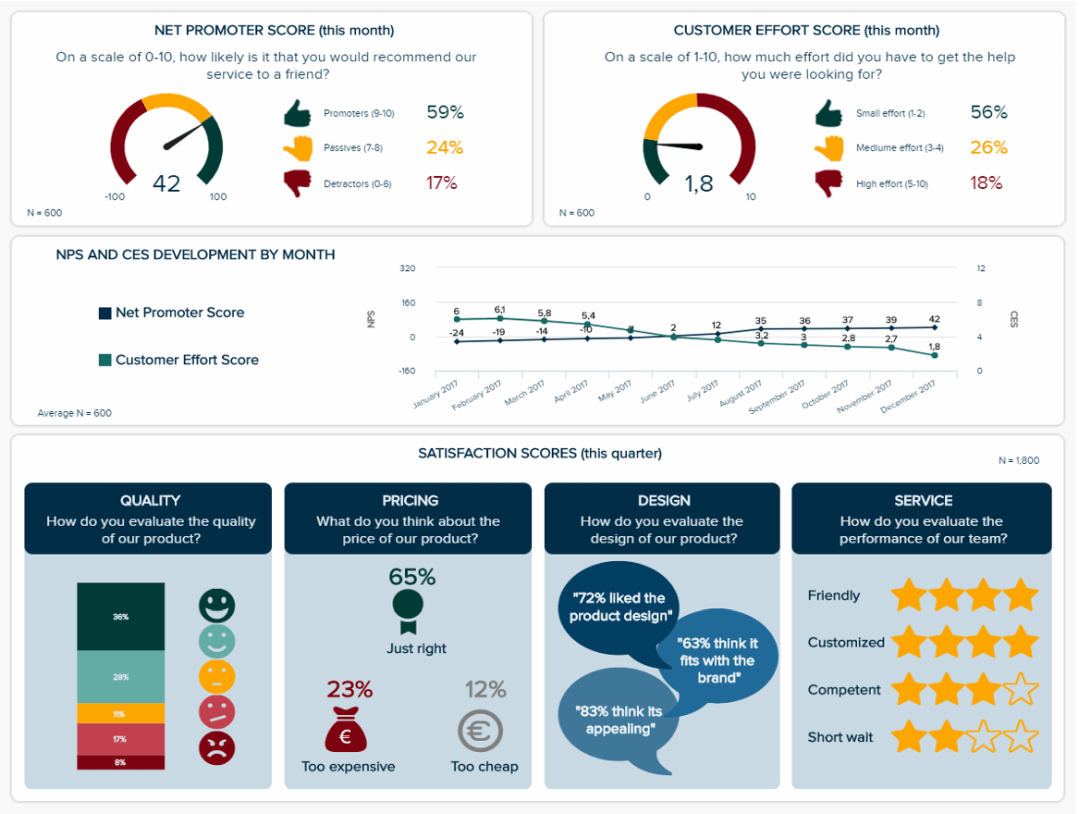

2. Market Research Results On Customer Satisfaction

Here, we have some of the most important data a company should care about: their already-existing customers and their perception of their relationship with the brand. It is crucial when we know that it is five times more expensive to acquire a new consumer than to retain one.

This is why tracking metrics like the customer effort score or the net promoter score (how likely consumers are to recommend your products and services) is essential, especially over time. You need to improve these scores to have happy customers who will always have a much bigger impact on their friends and relatives than any of your amazing ad campaigns. Looking at other satisfaction indicators like the quality, pricing, and design, or the service they received is also a best practice: you want a global view of your performance regarding customer satisfaction metrics .

Such research results reports are a great tool for managers who do not have much time and hence need to use them effectively. Thanks to these dashboards, they can control data for long-running projects anytime.

Primary KPIs :

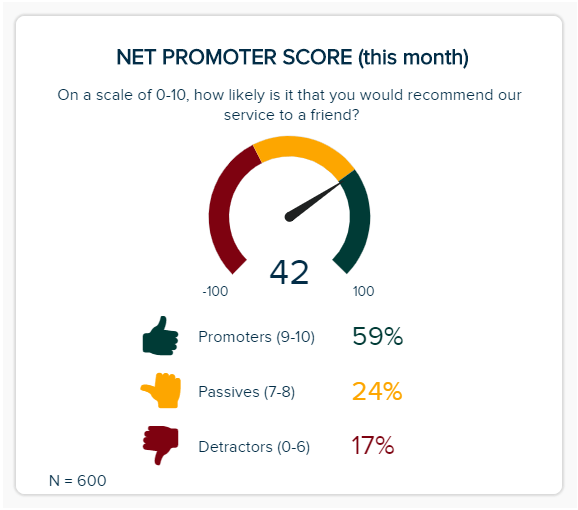

a) Net Promoter Score (NPS)

Another pivotal part of any informative research presentation is your NPS score, which will tell you how likely a customer is to recommend your brand to their peers.

Centered on overall customer satisfaction, your NPS Score can cover the functions and output of many departments, including marketing, sales, and customer service, but also serve as a building block for a call center dashboard . When you’re considering how to present your research effectively, this balanced KPI offers a masterclass. It’s logical, it has a cohesive color scheme, and it offers access to vital information at a swift glance. With an NPS Score, customers are split into three categories: promoters (those scoring your service 9 or 10), passives (those scoring your service 7 or 8), and detractors (those scoring your service 0 to 6). The aim of the game is to gain more promoters. By gaining an accurate snapshot of your NPS Score, you can create intelligent strategies that will boost your results over time.

b) Customer Satisfaction Score (CSAT)

The next in our examples of market research reports KPIs comes in the form of the CSAT. The vast majority of consumers that have a bad experience will not return. Honing in on your CSAT is essential if you want to keep your audience happy and encourage long-term consumer loyalty.

This magnificent, full report KPI will show how satisfied customers are with specific elements of your products or services. Getting to grips with these scores will allow you to pinpoint very specific issues while capitalizing on your existing strengths. As a result, you can take measures to improve your CSAT score while sharing positive testimonials on your social media platforms and website to build trust.

c) Customer Effort Score (CES)

When it comes to presenting research findings, keeping track of your CES Score is essential. The CES Score KPI will give you instant access to information on how easy or difficult your audience can interact with or discover your company based on a simple scale of one to ten.

By getting a clear-cut gauge of how your customers find engagement with your brand, you can iron out any weaknesses in your user experience (UX) offerings while spotting any friction, bottlenecks, or misleading messaging. In doing so, you can boost your CES score, satisfy your audience, and boost your bottom line.

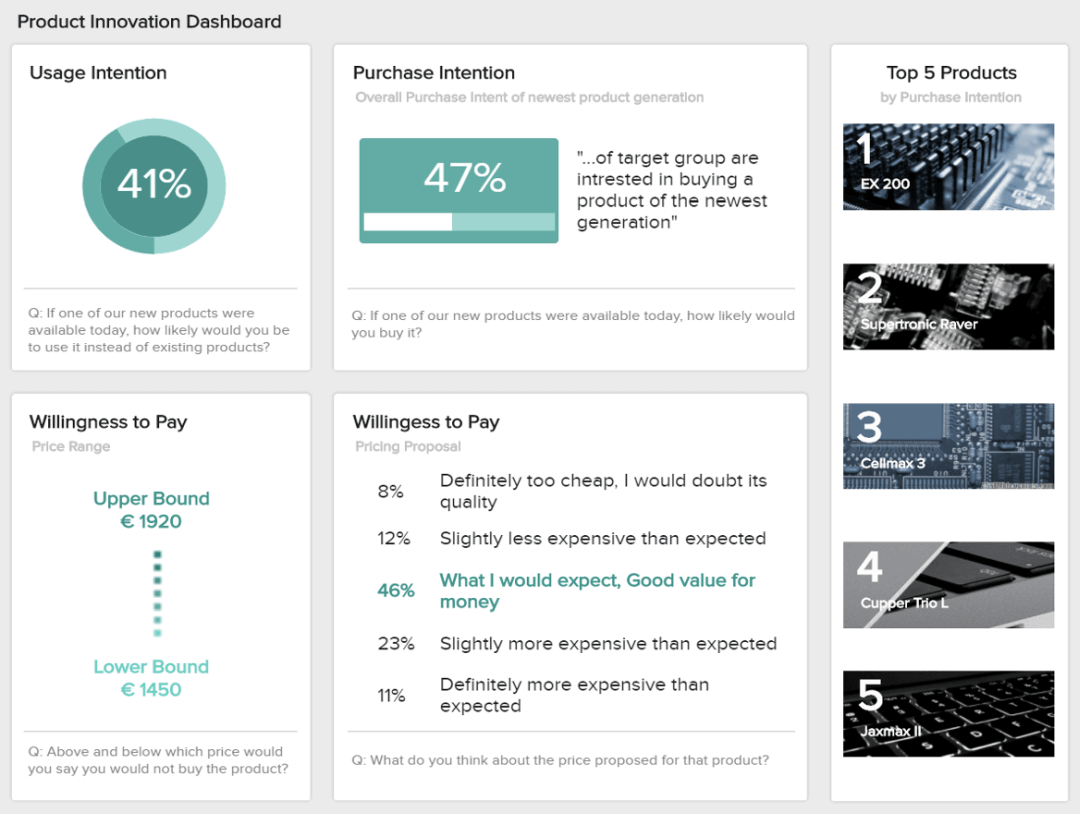

3. Market Research Results On Product Innovation

This final market-driven research example report focuses on the product itself and its innovation. It is a useful report for future product development and market potential, as well as pricing decisions.

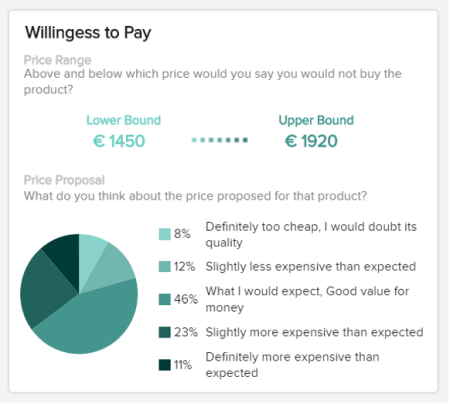

Using the same sample of surveyed people as for the first market-focused analytical report , they answer questions about their potential usage and purchase of the said product. It is good primary feedback on how the market would receive the new product you would launch. Then comes the willingness to pay, which helps set a price range that will not be too cheap to be trusted nor too expensive for what it is. That will be the main information for your pricing strategy.

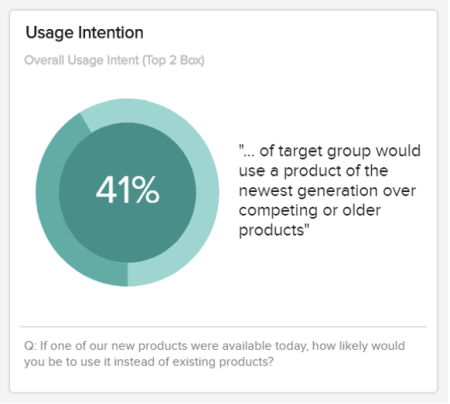

a) Usage Intention

The first of our product innovation KPI-based examples comes in the form of usage intention. When you’re considering how to write a market research report, including metrics centered on consumer intent is critical.

This simple yet effective visualization will allow you to understand not only how users see your product but also whether they prefer previous models or competitor versions . While you shouldn’t base all of your product-based research on this KPI, it is very valuable, and you should use it to your advantage frequently.

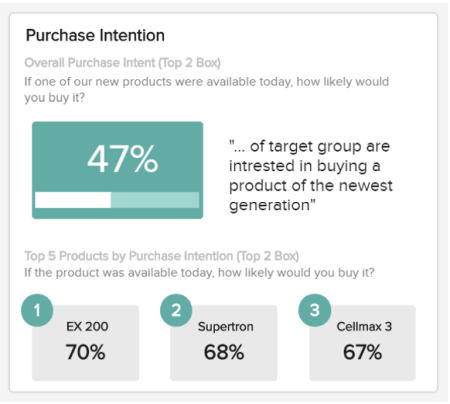

b) Purchase Intention

Another aspect to consider when looking at how to present market research data is your audience’s willingness or motivation to purchase your product. Offering percentage-based information, this effective KPI provides a wealth of at-a-glance information to help you make accurate forecasts centered on your product and service offerings.

Analyzing this information regularly will give you the confidence and direction to develop strategies that will steer you to a more prosperous future, meeting the ever-changing needs of your audience on an ongoing basis.

c) Willingness To Pay (WPS)

Our final market research example KPI is based on how willing customers are to pay for a particular service or product based on a specific set of parameters. This dynamic visualization, represented in an easy-to-follow pie chart, will allow you to realign the value of your product (USPs, functions, etc.) while setting price points that are most likely to result in conversions. This is a market research presentation template that every modern organization should use to its advantage.

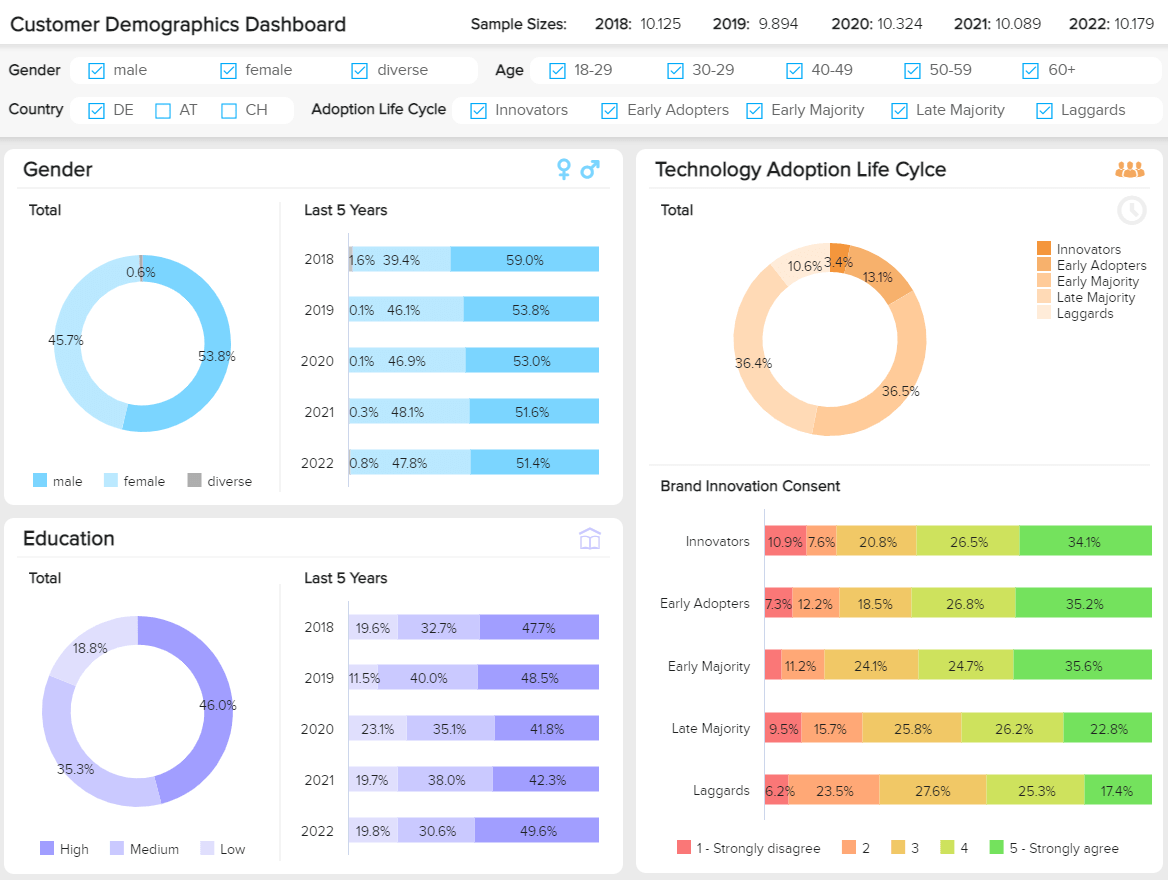

4. Market Research Report On Customer Demographics

This particular example of market research report, generated with a modern dashboard creator , is a powerful tool, as it displays a cohesive mix of key demographic information in one intuitive space.

By breaking down these deep pockets of consumer-centric information, you can gain the power to develop more impactful customer communications while personalizing every aspect of your target audience’s journey across every channel or touchpoint. As a result, you can transform theoretical insights into actionable strategies that will result in significant commercial growth.

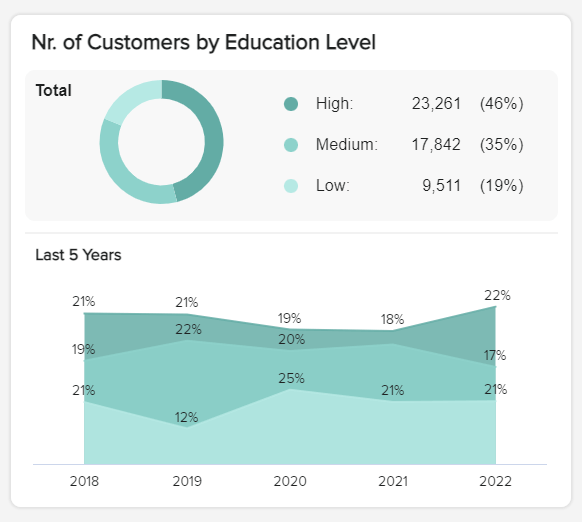

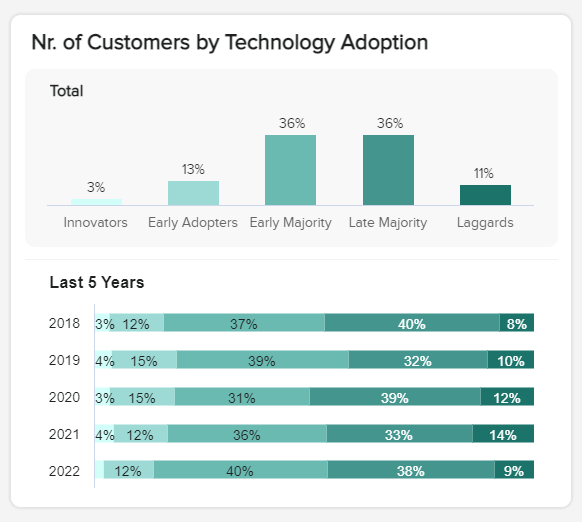

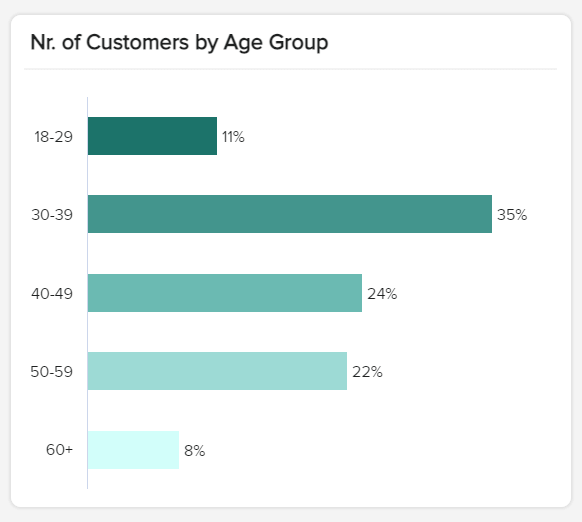

Every section of this responsive marketing research report works in unison to build a profile of your core audience in a way that will guide your company’s consumer-facing strategies with confidence. With in-depth visuals based on gender, education level, and tech adoption, you have everything you need to speak directly to your audience at your fingertips.

Let’s look at the key performance indicators (KPIs) of this invaluable market research report example in more detail.

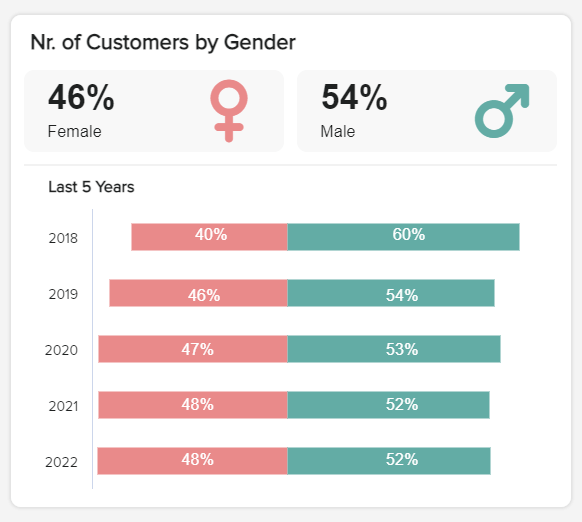

a) Customer By Gender

This KPI is highly visual and offers a clear-cut representation of your company’s gender share over time. By gaining access to this vital information, you can deliver a more personalized experience to specific audience segments while ensuring your messaging is fair, engaging, and inclusive.

b) Customers by education level

The next market analysis report template is a KPI that provides a logical breakdown of your customers’ level of education. By using this as a demographic marker, you can refine your products to suit the needs of your audience while crafting your content in a way that truly resonates with different customer groups.

c) Customers by technology adoption

Particularly valuable if you’re a company that sells tech goods or services, this linear KPI will show you where your customers are in terms of technological know-how or usage. By getting to grips with this information over time, you can develop your products or services in a way that offers direct value to your consumers while making your launches or promotions as successful as possible.

d) Customer age groups

By understanding your customers’ age distribution in detail, you can gain a deep understanding of their preferences. And that’s exactly what this market research report sample KPI does. Presented in a bar chart format, this KPI will give you a full breakdown of your customers’ age ranges, allowing you to build detailed buyer personas and segment your audience effectively.

Why Do You Need Market Research Reports?

As the adage goes, “Look before you leap“ – which is exactly what a research report is here for. As the headlights of a car, they will show you the pitfalls and fast lanes on your road to success: likes and dislikes of a specific market segment in a certain geographical area, their expectations, and readiness. Among other things, a research report will let you:

- Get a holistic view of the market : learn more about the target market and understand the various factors involved in the buying decisions. A broader view of the market lets you benchmark other companies you do not focus on. This, in turn, will empower you to gather the industry data that counts most. This brings us to our next point.

- Curate industry information with momentum: Whether you’re looking to rebrand, improve on an existing service, or launch a new product, time is of the essence. By working with the best market research reports created with modern BI reporting tools , you can visualize your discoveries and data, formatting them in a way that not only unearths hidden insights but also tells a story - a narrative that will gain a deeper level of understanding into your niche or industry. The features and functionality of a market analysis report will help you grasp the information that is most valuable to your organization, pushing you ahead of the pack in the process.

- Validate internal research: Doing the internal analysis is one thing, but double-checking with a third party also greatly helps avoid getting blinded by your own data.

- Use actionable data and make informed decisions: Once you understand consumer behavior as well as the market, your competitors, and the issues that will affect the industry in the future, you are better armed to position your brand. Combining all of it with the quantitative data collected will allow you to more successful product development. To learn more about different methods, we suggest you read our guide on data analysis techniques .

- Strategic planning: When you want to map out big-picture organizational goals, launch a new product development, plan a geographic market expansion, or even a merger and acquisition – all of this strategic thinking needs solid foundations to fulfill the variety of challenges that come along.

- Consistency across the board: Collecting, presenting, and analyzing your results in a way that’s smarter, more interactive, and more cohesive will ensure your customer communications, marketing campaigns, user journey, and offerings meet your audience’s needs consistently across the board. The result? Faster growth, increased customer loyalty, and more profit.

- Better communication: The right market research analysis template (or templates) will empower everyone in the company with access to valuable information - the kind that is relevant and comprehensible. When everyone is moving to the beat of the same drum, they will collaborate more effectively and, ultimately, push the venture forward thanks to powerful online data analysis techniques.

- Centralization: Building on the last point, using a powerful market research report template in the form of a business intelligence dashboard will make presenting your findings to external stakeholders and clients far more effective, as you can showcase a wealth of metrics, information, insights, and invaluable feedback from one centralized, highly visual interactive screen.

- Brand reputation: In the digital age, brand reputation is everything. By making vital improvements in all of the key areas above, you will meet your customers’ needs head-on with consistency while finding innovative ways to stand out from your competitors. These are the key ingredients of long-term success.

How To Present Market Research Analysis Results?

Here we look at how you should present your research reports, considering the steps it takes to connect with the outcomes you need to succeed:

- Collect your data

As with any reporting process, you first and foremost need to collect the data you’ll use to conduct your studies. Businesses conduct research studies to analyze their brand awareness, identity, and influence in the market. For product development and pricing decisions, among many others. That said, there are many ways to collect information for a market research report. Among some of the most popular ones, we find:

- Surveys: Probably the most common way to collect research data, surveys can come in the form of open or closed questions that can be answered anonymously. They are the cheapest and fastest way to collect insights about your customers and business.

- Interviews : These are face-to-face discussions that allow the researcher to analyze responses as well as the body language of the interviewees. This method is often used to define buyer personas by analyzing the subject's budget, job title, lifestyle, wants, and needs, among other things.

- Focus groups : This method involves a group of people discussing a topic with a mediator. It is often used to evaluate a new product or new feature or to answer a specific question that the researcher might have.

- Observation-based research : In this type of research, the researcher or business sits back and watches customers interact with the product without any instructions or help. It allows us to identify pain points as well as strong features.

- Market segmentation : This study allows you to identify and analyze potential market segments to target. Businesses use it to expand into new markets and audiences.

These are just a few of the many ways in which you can gather your information. The important point is to keep the research objective as straightforward as possible. Supporting yourself with professional BI solutions to clean, manage, and present your insights is probably the smartest choice.

2. Hone in on your research:

When looking at how to source consumer research in a presentation, you should focus on two areas: primary and secondary research. Primary research comes from your internal data, monitoring existing organizational practices, the effectiveness of sales, and the tools used for communication, for instance. Primary research also assesses market competition by evaluating the company plans of the competitors. Secondary research focuses on existing data collected by a third party, information used to perform benchmarking and market analysis. Such metrics help in deciding which market segments are the ones the company should focus its efforts on or where the brand is standing in the minds of consumers. Before you start the reporting process, you should set your goals, segmenting your research into primary and secondary segments to get to grips with the kind of information you need to work with to achieve effective results.

3. Segment your customers:

To give your market research efforts more context, you should segment your customers into different groups according to the preferences outlined in the survey or feedback results or by examining behavioral or demographic data.

If you segment your customers, you can tailor your market research and analysis reports to display only the information, charts, or graphics that will provide actionable insights into their wants, needs, or industry-based pain points.

- Identify your stakeholders:

Once you’ve drilled down into your results and segmented your consumer groups, it’s important to consider the key stakeholders within the organization that will benefit from your information the most.

By looking at both internal and external stakeholders, you will give your results a path to effective presentation, gaining the tools to understand which areas of feedback or data are most valuable, as well as most redundant. As a consequence, you will ensure your results are concise and meet the exact information needs of every stakeholder involved in the process.

- Set your KPIs:

First, remember that your reports should be concise and accurate - straight to the point without omitting any essential information. Work to ensure your insights are clean and organized, with participants grouped into relevant categories (demographics, profession, industry, education, etc.). Once you’ve organized your research, set your goals, and cleaned your data, you should set your KPIs to ensure your report is populated with the right visualizations to get the job done. Explore our full library of interactive KPI examples for inspiration.

- Include competitor’s analysis

Whether you are doing product innovation research, customer demographics, pricing, or any other, including some level of insights about competitors in your reports is always recommended as it can help your business or client better understand where they stand in the market. That being said, competitor analysis is not as easy as picking a list of companies in the same industry and listing them. Your main competitor can be just a company's division in an entirely different industry. For example, Apple Music competes with Spotify even though Apple is a technology company. Therefore, it is important to carefully analyze competitors from a general but detailed level.

Providing this kind of information in your reports can also help you find areas that competitors are not exploiting or that are weaker and use them to your advantage to become a market leader.

- Produce your summary:

To complement your previous efforts, writing an executive summary of one or two pages that will explain the general idea of the report is advisable. Then come the usual body parts:

- An introduction providing background information, target audience, and objectives;

- The qualitative research describes the participants in the research and why they are relevant to the business;

- The survey research outlines the questions asked and answered;

- A summary of the insights and metrics used to draw the conclusions, the research methods chosen, and why;

- A presentation of the findings based on your research and an in-depth explanation of these conclusions.

- Use a mix of visualizations:

When presenting your results and discoveries, you should aim to use a balanced mix of text, graphs, charts, and interactive visualizations.

Using your summary as a guide, you should decide which type of visualization will present each specific piece of market research data most effectively (often, the easier to understand and more accessible, the better).

Doing so will allow you to create a story that will put your research information into a living, breathing context, providing a level of insight you need to transform industry, competitor, or consumer info or feedback into actionable strategies and initiatives.

- Be careful not to mislead

Expanding on the point above, using a mix of visuals can prove highly valuable in presenting your results in an engaging and understandable way. That being said, when not used correctly, graphs and charts can also become misleading. This is a popular practice in the media, news, and politics, where designers tweak the visuals to manipulate the masses into believing a certain conclusion. This is a very unethical practice that can also happen by mistake when you don’t pick the right chart or are not using it in the correct way. Therefore, it is important to outline the message you are trying to convey and pick the chart type that will best suit those needs.

Additionally, you should also be careful with the data you choose to display, as it can also become misleading. This can happen if you, for example, cherry-pick data, which means only showing insights that prove a conclusion instead of the bigger picture. Or confusing correlation with causation, which means assuming that because two events happened simultaneously, one caused the other.

Being aware of these practices is of utmost importance as objectivity is crucial when it comes to dealing with data analytics, especially if you are presenting results to clients. Our guides on misleading statistics and misleading data visualizations can help you learn more about this important topic.

- Use professional dashboards:

To optimize your market research discoveries, you must work with a dynamic business dashboard . Not only are modern dashboards presentable and customizable, but they will offer you past, predictive, and real-time insights that are accurate, interactive, and yield long-lasting results.

All market research reports companies or businesses gathering industry or consumer-based information will benefit from professional dashboards, as they offer a highly powerful means of presenting your data in a way everyone can understand. And when that happens, everyone wins.

Did you know? The interactive nature of modern dashboards like datapine also offers the ability to quickly filter specific pockets of information with ease, offering swift access to invaluable insights.

- Prioritize interactivity

The times when reports were static are long gone. Today, to extract the maximum value out of your research data, you need to be able to explore the information and answer any critical questions that arise during the presentation of results. To do so, modern reporting tools provide multiple interactivity features to help you bring your research results to life.

For instance, a drill-down filter lets you go into lower levels of hierarchical data without generating another graph. For example, imagine you surveyed customers from 10 different countries. In your report, you have a chart displaying the number of customers by country, but you want to analyze a specific country in detail. A drill down filter would enable you to click on a specific country and display data by city on that same chart. Even better, a global filter would allow you to filter the entire report to show only results for that specific country.

Through the use of interactive filters, such as the one we just mentioned, you’ll not only make the presentation of results more efficient and profound, but you’ll also avoid generating pages-long reports to display static results. All your information will be displayed in a single interactive page that can be filtered and explored upon need.

- Customize the reports

This is a tip that is valuable for any kind of research report, especially when it comes to agencies that are reporting to external clients. Customizing the report to match your client’s colors, logo, font, and overall branding will help them grasp the data better, thanks to a familiar environment. This is an invaluable tip as often your audience will not feel comfortable dealing with data and might find it hard to understand or intimidating. Therefore, providing a familiar look that is also interactive and easier to understand will keep them engaged and collaborative throughout the process.

Plus, customizing the overall appearance of the report will also make your agency look more professional, adding extra value to your service.

- Know your design essentials

When you’re presenting your market research reports sample to internal or external stakeholders, having a firm grasp on fundamental design principles will make your metrics and insights far more persuasive and compelling.

By arranging your metrics in a balanced and logical format, you can guide users toward key pockets of information exactly when needed. In turn, this will improve decision-making and navigation, making your reports as impactful as possible.

For essential tips, read our 23 dashboard design principles & best practices to enhance your analytics process.

- Think of security and privacy

Cyberattacks are increasing at a concerning pace, making security a huge priority for organizations of all sizes today. The costs of having your sensitive information leaked are not only financial but also reputational, as customers might not trust you again if their data ends up in the wrong hands. Given that market research analysis is often performed by agencies that handle data from clients, security and privacy should be a top priority.

To ensure the required security and privacy, it is necessary to invest in the right tools to present your research results. For instance, tools such as datapine offer enterprise-level security protocols that ensure your information is encrypted and protected at all times. Plus, the tool also offers additional security features, such as being able to share your reports through a password-protected URL or to set viewer rights to ensure only the right people can access and manipulate the data.

- Keep on improving & evolving

Each time you gather or gain new marketing research reports or market research analysis report intel, you should aim to refine your existing dashboards to reflect the ever-changing landscape around you.

If you update your reports and dashboards according to the new research you conduct and new insights you connect with, you will squeeze maximum value from your metrics, enjoying consistent development in the process.

Types of Market Research Reports: Primary & Secondary Research

With so many market research examples and such little time, knowing how to best present your insights under pressure can prove tricky.

To squeeze every last drop of value from your market research efforts and empower everyone with access to the right information, you should arrange your information into two main groups: primary research and secondary research.

A. Primary research

Primary research is based on acquiring direct or first-hand information related to your industry or sector and the customers linked to it.

Exploratory primary research is an initial form of information collection where your team might set out to identify potential issues, opportunities, and pain points related to your business or industry. This type of research is usually carried out in the form of general surveys or open-ended consumer Q&As, which nowadays are often performed online rather than offline .

Specific primary research is definitive, with information gathered based on the issues, information, opportunities, or pain points your business has already uncovered. When doing this kind of research, you can drill down into a specific segment of your customers and seek answers to the opportunities, issues, or pain points in question.

When you’re conducting primary research to feed into your market research reporting efforts, it’s important to find reliable information sources. The most effective primary research sources include:

- Consumer-based statistical data

- Social media content

- Polls and Q&A

- Trend-based insights

- Competitor research

- First-hand interviews

B. Secondary research

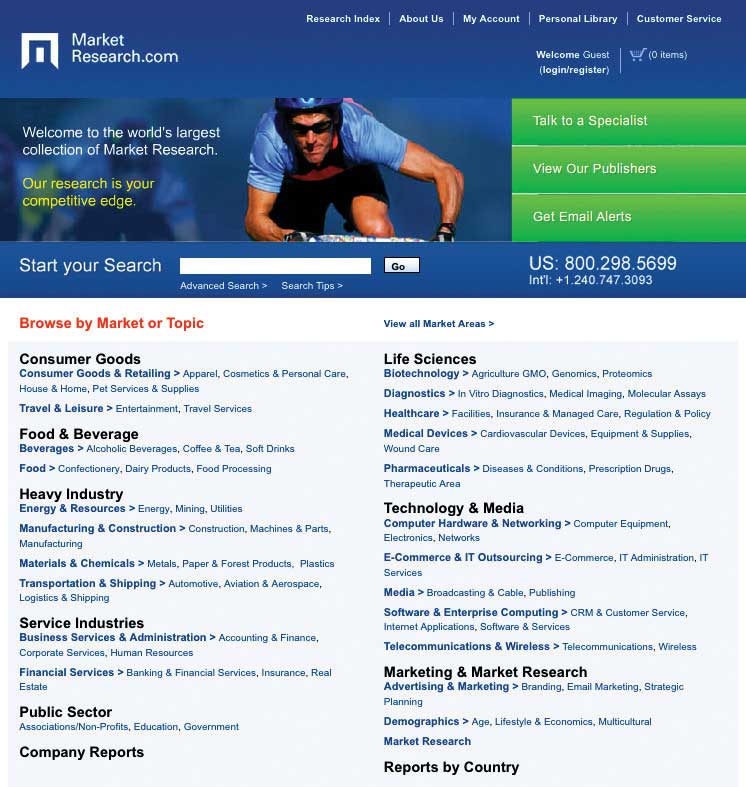

Secondary research refers to every strand of relevant data or public records you have to gain a deeper insight into your market and target consumers. These sources include trend reports, market stats, industry-centric content, and sales insights you have at your disposal. Secondary research is an effective way of gathering valuable intelligence about your competitors.

You can gather very precise, insightful secondary market research insights from:

- Public records and resources like Census data, governmental reports, or labor stats

- Commercial resources like Gartner, Statista, or Forrester

- Articles, documentaries, and interview transcripts

Another essential branch of both primary and secondary research is internal intelligence. When it comes to efficient market research reporting examples that will benefit your organization, looking inward is a powerful move.

Existing sales, demographic, or marketing performance insights will lead you to valuable conclusions. Curating internal information will ensure your market research discoveries are well-rounded while helping you connect with the information that will ultimately give you a panoramic view of your target market.

By understanding both types of research and how they can offer value to your business, you can carefully choose the right informational sources, gather a wide range of intelligence related to your specific niche, and, ultimately, choose the right market research report sample for your specific needs.

If you tailor your market research report format to the type of research you conduct, you will present your visualizations in a way that provides the right people with the right insights, rather than throwing bundles of facts and figures on the wall, hoping that some of them stick.

Taking ample time to explore a range of primary and secondary sources will give your discoveries genuine context. By doing so, you will have a wealth of actionable consumer and competitor insights at your disposal at every stage of your organization’s development (a priceless weapon in an increasingly competitive digital age).

Dynamic market research is the cornerstone of business development, and a dashboard builder is the vessel that brings these all-important insights to life. Once you get into that mindset, you will ensure that your research results always deliver maximum value.

Common Challenges & Mistakes Of Market Research Reporting & Analysis

We’ve explored different types of market research analysis examples and considered how to conduct effective research. Now, it’s time to look at the key mistakes of market research reporting. Let’s start with the mistakes.

The mistakes

One of the biggest mistakes that stunt the success of a company’s market research efforts is strategy. Without taking the time to gather an adequate mix of insights from various sources and define your key aims or goals, your processes will become disjointed. You will also suffer from a severe lack of organizational vision.

For your market research-centric strategy to work, everyone within the company must be on the same page. Your core aims and objectives must align throughout the business, and everyone must be clear on their specific role. If you try to craft a collaborative strategy and decide on your informational sources from the very start of your journey, your strategy will deliver true growth and intelligence.

- Measurement

Another classic market research mistake is measurement – or, more accurately, a lack of precise measurement. When embarking on market intelligence gathering processes, many companies fail to select the right KPIs and set the correct benchmarks for the task at hand. Without clearly defined goals, many organizations end up with a market analysis report format that offers little or no value in terms of decision-making or market insights.

To drive growth with your market research efforts, you must set clearly defined KPIs that align with your specific goals, aims, and desired outcomes.

- Competition

A common mistake among many new or scaling companies is failing to explore and examine the competition. This will leave you with gaping informational blindspots. To truly benefit from market research, you must gather valuable nuggets of information from every key source available. Rather than solely looking at your consumers and the wider market (which is incredibly important), you should take the time to see what approach your direct competitors have adopted while getting to grips with the content and communications.

One of the most effective ways of doing so (and avoiding such a monumental market research mistake) is by signing up for your competitors’ mailing lists, downloading their apps, and examining their social media content. This will give you inspiration for your own efforts while allowing you to exploit any gaps in the market that your competitors are failing to fill.

The challenges

- Informational quality

We may have an almost infinite wealth of informational insights at our fingertips, but when it comes to market research, knowing which information to trust can prove an uphill struggle.

When working with metrics, many companies risk connecting with inaccurate insights or leading to a fruitless informational rabbit hole, wasting valuable time and resources in the process. To avoid such a mishap, working with a trusted modern market research and analysis sample is the only way forward.

- Senior buy-in

Another pressing market research challenge that stunts organizational growth is the simple case of senior buy-in. While almost every senior decision-maker knows that market research is an essential component of a successful commercial strategy, many are reluctant to invest an ample amount of time or money in the pursuit.

The best way to overcome such a challenge is by building a case that defines exactly how your market research strategies will offer a healthy ROI to every key aspect of the organization, from marketing and sales to customer experience (CX) and beyond.

- Response rates

Low interview, focus group, or poll response rates can have a serious impact on the success and value of your market research strategy. Even with adequate senior buy-in, you can’t always guarantee that you will get enough responses from early-round interviews or poll requests. If you don’t, your market research discoveries run the risk of being shallow or offering little in the way of actionable insight.

To overcome this common challenge, you can improve the incentive you offer your market research prospects while networking across various platforms to discover new contact opportunities. Changing the tone of voice of your ads or emails will also help boost your consumer or client response rates.

Bringing Your Reports a Step Further

Even if it is still widespread for market-style research results presentation, using PowerPoint at this stage is a hassle and presents many downsides and complications. When busy managers or short-on-time top executives grab a report, they want a quick overview that gives them an idea of the results and the big picture that addresses the objectives: they need a dashboard. This can be applied to all areas of a business that need fast and interactive data visualizations to support their decision-making.

We all know that a picture conveys more information than simple text or figures, so managing to bring it all together on an actionable dashboard will convey your message more efficiently. Besides, market research dashboards have the incredible advantage of always being up-to-date since they work with real-time insights: the synchronization/updating nightmare of dozens of PowerPoint slides doesn’t exist for you anymore. This is particularly helpful for tracking studies performed over time that recurrently need their data to be updated with more recent ones.

In today’s fast-paced business environment, companies must identify and grab new opportunities as they arise while staying away from threats and adapting quickly. In order to always be a step further and make the right decisions, it is critical to perform market research studies to get the information needed and make important decisions with confidence.

We’ve asked the question, “What is a market research report?”, and examined the dynamics of a modern market research report example, and one thing’s for sure: a visual market research report is the best way to understand your customer and thus increase their satisfaction by meeting their expectations head-on.

From looking at a sample of a market research report, it’s also clear that modern dashboards help you see what is influencing your business with clarity, understand where your brand is situated in the market, and gauge the temperature of your niche or industry before a product or service launch. Once all the studies are done, you must present them efficiently to ensure everyone in the business can make the right decisions that result in real progress. Market research reports are your key allies in the matter.

To start presenting your results with efficient, interactive, dynamic research reports and win on tomorrow’s commercial battlefield, try our dashboard reporting software and test every feature with our 14-day free trial !

Get science-backed answers as you write with Paperpal's Research feature

How to Write a Conclusion for Research Papers (with Examples)

The conclusion of a research paper is a crucial section that plays a significant role in the overall impact and effectiveness of your research paper. However, this is also the section that typically receives less attention compared to the introduction and the body of the paper. The conclusion serves to provide a concise summary of the key findings, their significance, their implications, and a sense of closure to the study. Discussing how can the findings be applied in real-world scenarios or inform policy, practice, or decision-making is especially valuable to practitioners and policymakers. The research paper conclusion also provides researchers with clear insights and valuable information for their own work, which they can then build on and contribute to the advancement of knowledge in the field.

The research paper conclusion should explain the significance of your findings within the broader context of your field. It restates how your results contribute to the existing body of knowledge and whether they confirm or challenge existing theories or hypotheses. Also, by identifying unanswered questions or areas requiring further investigation, your awareness of the broader research landscape can be demonstrated.

Remember to tailor the research paper conclusion to the specific needs and interests of your intended audience, which may include researchers, practitioners, policymakers, or a combination of these.

Table of Contents

What is a conclusion in a research paper, summarizing conclusion, editorial conclusion, externalizing conclusion, importance of a good research paper conclusion, how to write a conclusion for your research paper, research paper conclusion examples.

- How to write a research paper conclusion with Paperpal?

Frequently Asked Questions

A conclusion in a research paper is the final section where you summarize and wrap up your research, presenting the key findings and insights derived from your study. The research paper conclusion is not the place to introduce new information or data that was not discussed in the main body of the paper. When working on how to conclude a research paper, remember to stick to summarizing and interpreting existing content. The research paper conclusion serves the following purposes: 1

- Warn readers of the possible consequences of not attending to the problem.

- Recommend specific course(s) of action.

- Restate key ideas to drive home the ultimate point of your research paper.

- Provide a “take-home” message that you want the readers to remember about your study.

Types of conclusions for research papers

In research papers, the conclusion provides closure to the reader. The type of research paper conclusion you choose depends on the nature of your study, your goals, and your target audience. I provide you with three common types of conclusions:

A summarizing conclusion is the most common type of conclusion in research papers. It involves summarizing the main points, reiterating the research question, and restating the significance of the findings. This common type of research paper conclusion is used across different disciplines.

An editorial conclusion is less common but can be used in research papers that are focused on proposing or advocating for a particular viewpoint or policy. It involves presenting a strong editorial or opinion based on the research findings and offering recommendations or calls to action.

An externalizing conclusion is a type of conclusion that extends the research beyond the scope of the paper by suggesting potential future research directions or discussing the broader implications of the findings. This type of conclusion is often used in more theoretical or exploratory research papers.

Align your conclusion’s tone with the rest of your research paper. Start Writing with Paperpal Now!

The conclusion in a research paper serves several important purposes:

- Offers Implications and Recommendations : Your research paper conclusion is an excellent place to discuss the broader implications of your research and suggest potential areas for further study. It’s also an opportunity to offer practical recommendations based on your findings.

- Provides Closure : A good research paper conclusion provides a sense of closure to your paper. It should leave the reader with a feeling that they have reached the end of a well-structured and thought-provoking research project.

- Leaves a Lasting Impression : Writing a well-crafted research paper conclusion leaves a lasting impression on your readers. It’s your final opportunity to leave them with a new idea, a call to action, or a memorable quote.

Writing a strong conclusion for your research paper is essential to leave a lasting impression on your readers. Here’s a step-by-step process to help you create and know what to put in the conclusion of a research paper: 2

- Research Statement : Begin your research paper conclusion by restating your research statement. This reminds the reader of the main point you’ve been trying to prove throughout your paper. Keep it concise and clear.

- Key Points : Summarize the main arguments and key points you’ve made in your paper. Avoid introducing new information in the research paper conclusion. Instead, provide a concise overview of what you’ve discussed in the body of your paper.

- Address the Research Questions : If your research paper is based on specific research questions or hypotheses, briefly address whether you’ve answered them or achieved your research goals. Discuss the significance of your findings in this context.

- Significance : Highlight the importance of your research and its relevance in the broader context. Explain why your findings matter and how they contribute to the existing knowledge in your field.

- Implications : Explore the practical or theoretical implications of your research. How might your findings impact future research, policy, or real-world applications? Consider the “so what?” question.

- Future Research : Offer suggestions for future research in your area. What questions or aspects remain unanswered or warrant further investigation? This shows that your work opens the door for future exploration.

- Closing Thought : Conclude your research paper conclusion with a thought-provoking or memorable statement. This can leave a lasting impression on your readers and wrap up your paper effectively. Avoid introducing new information or arguments here.

- Proofread and Revise : Carefully proofread your conclusion for grammar, spelling, and clarity. Ensure that your ideas flow smoothly and that your conclusion is coherent and well-structured.

Write your research paper conclusion 2x faster with Paperpal. Try it now!

Remember that a well-crafted research paper conclusion is a reflection of the strength of your research and your ability to communicate its significance effectively. It should leave a lasting impression on your readers and tie together all the threads of your paper. Now you know how to start the conclusion of a research paper and what elements to include to make it impactful, let’s look at a research paper conclusion sample.

How to write a research paper conclusion with Paperpal?

A research paper conclusion is not just a summary of your study, but a synthesis of the key findings that ties the research together and places it in a broader context. A research paper conclusion should be concise, typically around one paragraph in length. However, some complex topics may require a longer conclusion to ensure the reader is left with a clear understanding of the study’s significance. Paperpal, an AI writing assistant trusted by over 800,000 academics globally, can help you write a well-structured conclusion for your research paper.

- Sign Up or Log In: Create a new Paperpal account or login with your details.

- Navigate to Features : Once logged in, head over to the features’ side navigation pane. Click on Templates and you’ll find a suite of generative AI features to help you write better, faster.

- Generate an outline: Under Templates, select ‘Outlines’. Choose ‘Research article’ as your document type.

- Select your section: Since you’re focusing on the conclusion, select this section when prompted.

- Choose your field of study: Identifying your field of study allows Paperpal to provide more targeted suggestions, ensuring the relevance of your conclusion to your specific area of research.

- Provide a brief description of your study: Enter details about your research topic and findings. This information helps Paperpal generate a tailored outline that aligns with your paper’s content.

- Generate the conclusion outline: After entering all necessary details, click on ‘generate’. Paperpal will then create a structured outline for your conclusion, to help you start writing and build upon the outline.

- Write your conclusion: Use the generated outline to build your conclusion. The outline serves as a guide, ensuring you cover all critical aspects of a strong conclusion, from summarizing key findings to highlighting the research’s implications.

- Refine and enhance: Paperpal’s ‘Make Academic’ feature can be particularly useful in the final stages. Select any paragraph of your conclusion and use this feature to elevate the academic tone, ensuring your writing is aligned to the academic journal standards.

By following these steps, Paperpal not only simplifies the process of writing a research paper conclusion but also ensures it is impactful, concise, and aligned with academic standards. Sign up with Paperpal today and write your research paper conclusion 2x faster .

The research paper conclusion is a crucial part of your paper as it provides the final opportunity to leave a strong impression on your readers. In the research paper conclusion, summarize the main points of your research paper by restating your research statement, highlighting the most important findings, addressing the research questions or objectives, explaining the broader context of the study, discussing the significance of your findings, providing recommendations if applicable, and emphasizing the takeaway message. The main purpose of the conclusion is to remind the reader of the main point or argument of your paper and to provide a clear and concise summary of the key findings and their implications. All these elements should feature on your list of what to put in the conclusion of a research paper to create a strong final statement for your work.

A strong conclusion is a critical component of a research paper, as it provides an opportunity to wrap up your arguments, reiterate your main points, and leave a lasting impression on your readers. Here are the key elements of a strong research paper conclusion: 1. Conciseness : A research paper conclusion should be concise and to the point. It should not introduce new information or ideas that were not discussed in the body of the paper. 2. Summarization : The research paper conclusion should be comprehensive enough to give the reader a clear understanding of the research’s main contributions. 3 . Relevance : Ensure that the information included in the research paper conclusion is directly relevant to the research paper’s main topic and objectives; avoid unnecessary details. 4 . Connection to the Introduction : A well-structured research paper conclusion often revisits the key points made in the introduction and shows how the research has addressed the initial questions or objectives. 5. Emphasis : Highlight the significance and implications of your research. Why is your study important? What are the broader implications or applications of your findings? 6 . Call to Action : Include a call to action or a recommendation for future research or action based on your findings.

The length of a research paper conclusion can vary depending on several factors, including the overall length of the paper, the complexity of the research, and the specific journal requirements. While there is no strict rule for the length of a conclusion, but it’s generally advisable to keep it relatively short. A typical research paper conclusion might be around 5-10% of the paper’s total length. For example, if your paper is 10 pages long, the conclusion might be roughly half a page to one page in length.

In general, you do not need to include citations in the research paper conclusion. Citations are typically reserved for the body of the paper to support your arguments and provide evidence for your claims. However, there may be some exceptions to this rule: 1. If you are drawing a direct quote or paraphrasing a specific source in your research paper conclusion, you should include a citation to give proper credit to the original author. 2. If your conclusion refers to or discusses specific research, data, or sources that are crucial to the overall argument, citations can be included to reinforce your conclusion’s validity.

The conclusion of a research paper serves several important purposes: 1. Summarize the Key Points 2. Reinforce the Main Argument 3. Provide Closure 4. Offer Insights or Implications 5. Engage the Reader. 6. Reflect on Limitations

Remember that the primary purpose of the research paper conclusion is to leave a lasting impression on the reader, reinforcing the key points and providing closure to your research. It’s often the last part of the paper that the reader will see, so it should be strong and well-crafted.

- Makar, G., Foltz, C., Lendner, M., & Vaccaro, A. R. (2018). How to write effective discussion and conclusion sections. Clinical spine surgery, 31(8), 345-346.

- Bunton, D. (2005). The structure of PhD conclusion chapters. Journal of English for academic purposes , 4 (3), 207-224.

Paperpal is a comprehensive AI writing toolkit that helps students and researchers achieve 2x the writing in half the time. It leverages 21+ years of STM experience and insights from millions of research articles to provide in-depth academic writing, language editing, and submission readiness support to help you write better, faster.

Get accurate academic translations, rewriting support, grammar checks, vocabulary suggestions, and generative AI assistance that delivers human precision at machine speed. Try for free or upgrade to Paperpal Prime starting at US$19 a month to access premium features, including consistency, plagiarism, and 30+ submission readiness checks to help you succeed.

Experience the future of academic writing – Sign up to Paperpal and start writing for free!

Related Reads:

- 5 Reasons for Rejection After Peer Review

- Ethical Research Practices For Research with Human Subjects

7 Ways to Improve Your Academic Writing Process

- Paraphrasing in Academic Writing: Answering Top Author Queries

Preflight For Editorial Desk: The Perfect Hybrid (AI + Human) Assistance Against Compromised Manuscripts

You may also like, phd qualifying exam: tips for success , ai in education: it’s time to change the..., is it ethical to use ai-generated abstracts without..., what are journal guidelines on using generative ai..., quillbot review: features, pricing, and free alternatives, what is an academic paper types and elements , should you use ai tools like chatgpt for..., 9 steps to publish a research paper, what are the different types of research papers, how to make translating academic papers less challenging.

- Privacy Policy

Buy Me a Coffee

Home » Research Paper Conclusion – Writing Guide and Examples

Research Paper Conclusion – Writing Guide and Examples

Table of Contents

Research Paper Conclusion

Definition:

A research paper conclusion is the final section of a research paper that summarizes the key findings, significance, and implications of the research. It is the writer’s opportunity to synthesize the information presented in the paper, draw conclusions, and make recommendations for future research or actions.

The conclusion should provide a clear and concise summary of the research paper, reiterating the research question or problem, the main results, and the significance of the findings. It should also discuss the limitations of the study and suggest areas for further research.

Parts of Research Paper Conclusion

The parts of a research paper conclusion typically include:

Restatement of the Thesis

The conclusion should begin by restating the thesis statement from the introduction in a different way. This helps to remind the reader of the main argument or purpose of the research.

Summary of Key Findings

The conclusion should summarize the main findings of the research, highlighting the most important results and conclusions. This section should be brief and to the point.

Implications and Significance

In this section, the researcher should explain the implications and significance of the research findings. This may include discussing the potential impact on the field or industry, highlighting new insights or knowledge gained, or pointing out areas for future research.

Limitations and Recommendations

It is important to acknowledge any limitations or weaknesses of the research and to make recommendations for how these could be addressed in future studies. This shows that the researcher is aware of the potential limitations of their work and is committed to improving the quality of research in their field.

Concluding Statement

The conclusion should end with a strong concluding statement that leaves a lasting impression on the reader. This could be a call to action, a recommendation for further research, or a final thought on the topic.

How to Write Research Paper Conclusion

Here are some steps you can follow to write an effective research paper conclusion:

- Restate the research problem or question: Begin by restating the research problem or question that you aimed to answer in your research. This will remind the reader of the purpose of your study.

- Summarize the main points: Summarize the key findings and results of your research. This can be done by highlighting the most important aspects of your research and the evidence that supports them.

- Discuss the implications: Discuss the implications of your findings for the research area and any potential applications of your research. You should also mention any limitations of your research that may affect the interpretation of your findings.

- Provide a conclusion : Provide a concise conclusion that summarizes the main points of your paper and emphasizes the significance of your research. This should be a strong and clear statement that leaves a lasting impression on the reader.

- Offer suggestions for future research: Lastly, offer suggestions for future research that could build on your findings and contribute to further advancements in the field.

Remember that the conclusion should be brief and to the point, while still effectively summarizing the key findings and implications of your research.

Example of Research Paper Conclusion

Here’s an example of a research paper conclusion:

Conclusion :

In conclusion, our study aimed to investigate the relationship between social media use and mental health among college students. Our findings suggest that there is a significant association between social media use and increased levels of anxiety and depression among college students. This highlights the need for increased awareness and education about the potential negative effects of social media use on mental health, particularly among college students.

Despite the limitations of our study, such as the small sample size and self-reported data, our findings have important implications for future research and practice. Future studies should aim to replicate our findings in larger, more diverse samples, and investigate the potential mechanisms underlying the association between social media use and mental health. In addition, interventions should be developed to promote healthy social media use among college students, such as mindfulness-based approaches and social media detox programs.

Overall, our study contributes to the growing body of research on the impact of social media on mental health, and highlights the importance of addressing this issue in the context of higher education. By raising awareness and promoting healthy social media use among college students, we can help to reduce the negative impact of social media on mental health and improve the well-being of young adults.

Purpose of Research Paper Conclusion

The purpose of a research paper conclusion is to provide a summary and synthesis of the key findings, significance, and implications of the research presented in the paper. The conclusion serves as the final opportunity for the writer to convey their message and leave a lasting impression on the reader.

The conclusion should restate the research problem or question, summarize the main results of the research, and explain their significance. It should also acknowledge the limitations of the study and suggest areas for future research or action.

Overall, the purpose of the conclusion is to provide a sense of closure to the research paper and to emphasize the importance of the research and its potential impact. It should leave the reader with a clear understanding of the main findings and why they matter. The conclusion serves as the writer’s opportunity to showcase their contribution to the field and to inspire further research and action.

When to Write Research Paper Conclusion

The conclusion of a research paper should be written after the body of the paper has been completed. It should not be written until the writer has thoroughly analyzed and interpreted their findings and has written a complete and cohesive discussion of the research.

Before writing the conclusion, the writer should review their research paper and consider the key points that they want to convey to the reader. They should also review the research question, hypotheses, and methodology to ensure that they have addressed all of the necessary components of the research.

Once the writer has a clear understanding of the main findings and their significance, they can begin writing the conclusion. The conclusion should be written in a clear and concise manner, and should reiterate the main points of the research while also providing insights and recommendations for future research or action.

Characteristics of Research Paper Conclusion

The characteristics of a research paper conclusion include:

- Clear and concise: The conclusion should be written in a clear and concise manner, summarizing the key findings and their significance.

- Comprehensive: The conclusion should address all of the main points of the research paper, including the research question or problem, the methodology, the main results, and their implications.

- Future-oriented : The conclusion should provide insights and recommendations for future research or action, based on the findings of the research.

- Impressive : The conclusion should leave a lasting impression on the reader, emphasizing the importance of the research and its potential impact.

- Objective : The conclusion should be based on the evidence presented in the research paper, and should avoid personal biases or opinions.

- Unique : The conclusion should be unique to the research paper and should not simply repeat information from the introduction or body of the paper.

Advantages of Research Paper Conclusion

The advantages of a research paper conclusion include:

- Summarizing the key findings : The conclusion provides a summary of the main findings of the research, making it easier for the reader to understand the key points of the study.

- Emphasizing the significance of the research: The conclusion emphasizes the importance of the research and its potential impact, making it more likely that readers will take the research seriously and consider its implications.

- Providing recommendations for future research or action : The conclusion suggests practical recommendations for future research or action, based on the findings of the study.

- Providing closure to the research paper : The conclusion provides a sense of closure to the research paper, tying together the different sections of the paper and leaving a lasting impression on the reader.

- Demonstrating the writer’s contribution to the field : The conclusion provides the writer with an opportunity to showcase their contribution to the field and to inspire further research and action.

Limitations of Research Paper Conclusion

While the conclusion of a research paper has many advantages, it also has some limitations that should be considered, including:

- I nability to address all aspects of the research: Due to the limited space available in the conclusion, it may not be possible to address all aspects of the research in detail.

- Subjectivity : While the conclusion should be objective, it may be influenced by the writer’s personal biases or opinions.

- Lack of new information: The conclusion should not introduce new information that has not been discussed in the body of the research paper.

- Lack of generalizability: The conclusions drawn from the research may not be applicable to other contexts or populations, limiting the generalizability of the study.

- Misinterpretation by the reader: The reader may misinterpret the conclusions drawn from the research, leading to a misunderstanding of the findings.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

How to Cite Research Paper – All Formats and...

Data Collection – Methods Types and Examples

Delimitations in Research – Types, Examples and...

Research Paper Format – Types, Examples and...

Research Process – Steps, Examples and Tips

Research Design – Types, Methods and Examples

- How to Cite

- Language & Lit

- Rhyme & Rhythm

- The Rewrite

- Search Glass

How to Write a Conclusion on a Marketing Research Paper

Writing a marketing research paper is a challenging undertaking that requires a great deal of time and preparation. Writing the conclusion to a marketing research paper is relatively straightforward because you've already done all the hard work. A good conclusion summarizes the main argument of your paper and points to the strengths and limitations of your research. A successful conclusion answers the "so what?" question and paves the road for future studies pertaining to your topic. With a nudge in the right direction, you'll write a conclusion that will bring your paper to an effective close.

Summarize the main argument of your paper without repeating too much. Point out why the argument is significant to the research and issue at hand to bring them to a concluding point.

Explain the strengths and limitations of your research and arguments to suggest what future work is required.

Explain the importance of your work and the significance it has to the real world. Answer the question: "How are my arguments and research useful?"

Demonstrate how all the ideas and research you put forth in the paper work together without having to present new information.

Echo the introduction without repeating it word for word to tie the paper together neatly. Explain how the insights and information found in the body of the paper reinforce the ideas suggested by the thesis in the introduction.

End the conclusion with something you want your readers to think about by issuing a challenge to your readers pertaining to how the information presented in the paper can influence their lives.

- Do not present new information in your conclusion; instead, structure your conclusion to reinforce and validate the arguments and research already presented.

- Don't write more than one concluding paragraph. Exercise brevity by writing to the point without exaggerating the content of your paper.

- LEO: Strategies for Writing a Conclusion; Randa Holewa et. al.; February 2004

- ACC: Tips for Writing a Strong Conclusion; Barry Hamilton; October 2005

Based in Victoria, British Columbia, Sebastian Malysa began his writing career in 2010. His work focuses on the general arts and appears on Answerbag and eHow. He has won a number of academic awards, most notably the CTV Award for best proposed documentary film. He holds a Master of Arts in contemporary disability theater from the University of Victoria.

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![conclusion for a market research → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.