Resume Worded | Career Strategy

14 risk analyst cover letters.

Approved by real hiring managers, these Risk Analyst cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Risk Analyst

- Senior Risk Analyst

- Credit Risk Analyst

- Risk Management Specialist

- Alternative introductions for your cover letter

- Risk Analyst resume examples

Risk Analyst Cover Letter Example

Why this cover letter works in 2024, quantified achievement.

This cover letter provides a specific and impressive accomplishment, demonstrating the candidate's ability to make a significant impact in their previous role. Be sure to include quantifiable examples of your success.

Team Collaboration

Highlighting the candidate's ability to work with cross-functional teams shows that they are adaptable and can effectively collaborate with others. This is important for a risk analyst role where communication and teamwork are crucial.

Enthusiasm for the Role

By expressing excitement about the role and the company's ongoing efforts, the candidate shows genuine interest in the position and industry. This helps differentiate them from other applicants who may simply be applying to any job opening.

Polite and Professional Closing

The closing paragraph is short, polite, and expresses appreciation for the reader's time. This leaves a positive impression on the hiring manager and demonstrates the candidate's professionalism.

Tangible Results Are Golden

When you share measurable results, like a 20% reduction in potential financial risks, you give a clear picture of the impact you've had. It's not just about saying you did something, it's about showing what that something achieved. It's an effective way to demonstrate your capability and the kind of results you could bring to the new role.

Showcase Technological Expertise

Highlighting your experience with machine learning techniques is a smart move, especially in today's data-driven world. It tells me you're not only comfortable with advanced technology, but you can also use it to create real improvements - like enhancing risk prediction accuracy by 15%. It’s a sign of a forward-thinking risk analyst.

Quantifying Achievements

Hey there, let me tell you, your mentioning about how you reduced financial risk by 30% within the first quarter, is a killer move. It's not just about saying "I did great stuff," you're showing me exactly how great you did. Numbers talk, pal. Keep it up!

Promoting Innovation

So you're saying that your experiences sharpened your analytical skills and taught you the importance of innovative thinking in risk management. I love that. It tells me you're not just a one-trick pony, you've got adaptability. And in an ever-changing field like risk analysis, that's gold.

Appreciating Employer's Innovation

Recognition of the employer's initiatives, especially in incorporating AI and machine learning into risk management processes, is a brilliant touch. It shows you've done your homework, and you actually understand and appreciate what they're doing. That's a big tick in your favor.

Offering Your Expertise

And then, you go and tell them how you can contribute to their team with your expertise in data analytics and predictive modeling. You're selling your skills but not in a braggy way. You're showing how you can be a valuable addition to their team. Smart.

Show your alignment with the company's values

Explain why you're drawn to the company by mentioning its values or mission. This shows you've done your research and are genuinely interested in what the company stands for.

Highlight your relevant experience

Share specific examples of how your past work relates to the job you're applying for. It's important to show how your skills have been used to solve problems similar to what you might encounter in the new role.

Demonstrate your ability to communicate complex ideas

Being able to explain difficult concepts in simple terms is a key skill in risk analysis. Your ability to do this makes you a stronger candidate.

Connect your personal passions to the job

Mentioning your interest in areas like sustainability that the company is also passionate about can make your application more compelling.

Express your eagerness to contribute

Ending your cover letter by reiterating your interest in the role and the company shows your enthusiasm and proactive nature.

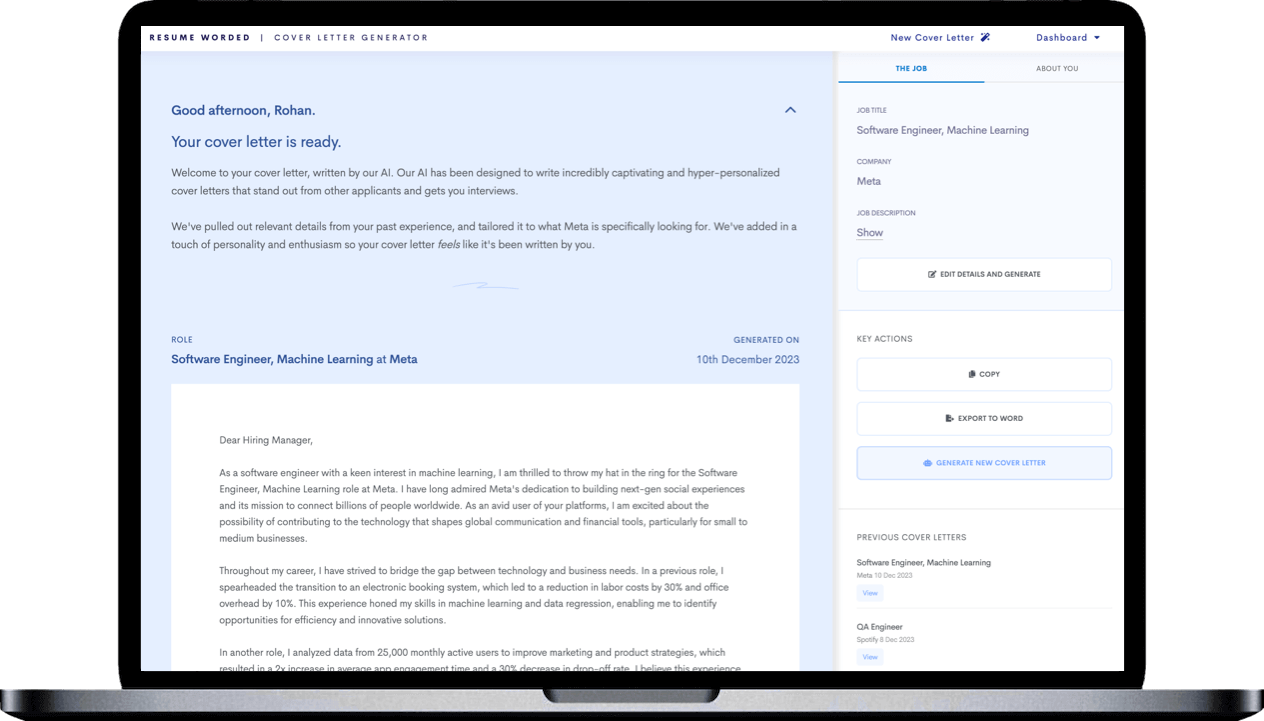

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Tell your discovery moment of risk management

Sharing when you found your career path adds a personal touch and shows genuine interest in the field.

Share your achievements in risk management

Describing specific accomplishments, like developing a new scoring model, gives concrete evidence of your capabilities.

State why you're a great fit for the role

Asserting your belief in your suitability tells me you have confidence in your skills and experience.

Highlight your adaptable risk management skills

Stressing your ability to handle different types of risks across industries shows versatility, a valuable asset for a risk analyst.

Show eagerness to contribute to the company's success

Expressing a desire to discuss how you can help the company succeed demonstrates you're team-oriented and ambitious.

Show your enthusiasm for the risk analyst role

Telling me you're excited to apply doesn't just show me you want the job, it makes me believe you'll bring that enthusiasm to work every day.

Quantify your achievements

When you talk about how you reduced potential losses by a specific percentage, it gives me a clear picture of the impact you can make.

Match your skills to the job

Saying your skills align with the job tells me you understand what the role entails and have what it takes to fill it.

Research the company

Expressing admiration for Moody's Analytics shows me you've done your homework and are genuinely interested in what we do.

Close with a call to action

Asking to discuss how you can contribute to our success tells me you're ready to jump in and start making a difference.

Senior Risk Analyst Cover Letter Example

Personalize your journey.

Recounting the moment of realization about your professional passion can be incredibly powerful. It gives a personal touch to your story and shows what drives you. This can really resonate with hiring managers.

Leadership With Influence

Leading a team that reduced potential financial risks by 25%? That's a big deal. It shows your leadership abilities and the influence you can have on a company's performance. It's not just about having leadership skills, it's about making things happen as a leader.

Align Your Values

Expressing excitement about contributing to a company with a robust risk management framework speaks volumes. It shows that you value what the company stands for and that you're keen to be part of it. This alignment is key when hiring managers look for a cultural fit.

Highlighting Career Milestones

You start off by talking about how you were instrumental in redesigning a risk assessment framework that improved risk detection efficiency by 40%. That's a big deal! You're not just saying "I'm good at my job," you're backing it up with hard data. Love it!

Aligning with Employer's Vision

You appreciate Goldman Sachs for their innovative use of data analytics and machine learning in identifying and managing risks. This is a good move. It shows you value their vision, and it aligns with where you thrive. It's a subtle way of saying "we're a good match."

Outlining Your Skills

You're eager to bring your strong analytical skills, deep understanding of financial markets, and a track record of implementing cutting-edge technologies to their team. This gives me a clear picture of what you bring to the table, and it sounds like a pretty tasty dish.

Showing Enthusiasm for Projects

You mentioning how you're excited about contributing to their projects, especially in developing resilient risk assessment models, shows your enthusiasm for the job. It tells me that you're not just there for a paycheck; you're genuinely interested in the work. That's refreshing.

Share your journey of skill development

Telling the story of how you've built your expertise over the years provides insight into your growth mindset and dedication to your profession.

Showcase your achievements in risk management

Describing a successful project you led highlights your ability to take initiative and your impact in your current role. This makes you stand out as a candidate who delivers results.

Emphasize your leadership and innovation

Mentioning your leadership in developing new solutions shows you're not just a team player but someone who's capable of guiding teams and innovating in your field.

Highlight your interest in cutting-edge technologies

Your excitement about technologies like AI and machine learning indicates you're forward-thinking and eager to apply these tools in risk analysis.

Close with a strong statement of intent

Reaffirming your desire to join the company and contribute to its mission strengthens your closing and leaves a memorable impression.

Connect personal excitement to the professional journey

Starting your cover letter with a moment that highlights both your passion and a key professional milestone grabs attention right away. It tells me you not only have the skills but also a deep interest in risk management work.

Quantify achievements in risk management

When you specify how your work directly led to a significant decrease in losses, it provides clear evidence of your ability to make a real impact. Including numbers makes your success tangible and memorable.

Show enthusiasm for the new role

Expressing eagerness to apply your expertise at the new company shows that you’ve done your research and are genuinely interested in contributing to their success, not just looking for any job.

Highlight relevant technology skills

By mentioning your experience with advanced analytics and machine learning, you align your skills with the future of risk management, making you a strong candidate for a company focused on innovation.

Close with a proactive approach

Ending your cover letter by expressing a desire to discuss your contribution further suggests you’re not just waiting for an opportunity, but are eager to actively engage and prove your value.

Highlight your senior risk analyst experience

Mentioning your years of experience and proven track record upfront tells me right away that you're a seasoned professional.

Demonstrate your strategic expertise

Detailing your experience with risk management strategies and financial analyses shows me you have the technical chops for this senior role.

Show admiration for the company

Expressing why you're drawn to Fitch Ratings gives me insight into your values and how they align with ours.

Express your desire to contribute

Saying you're excited to bring your skills to the team not only shows confidence but also a readiness to be a part of our mission.

Request a follow-up

Ending with a request to discuss your contribution further signals to me that you're proactive and serious about this opportunity.

Credit Risk Analyst Cover Letter Example

Show your passion for data and finance.

Explain why you are excited about the role. Mentioning specific interests like the blend of data, technology, and finance shows you know what the job involves.

Detail your experience in credit risk

Highlight your past work that's directly relevant to being a credit risk analyst. It tells me you have the skills needed for this job.

Connect your skills to the company's needs

Mention how your abilities will help you start making contributions quickly. It shows you're ready to help the company achieve its goals.

Express excitement about using data innovatively

Talking about using data in new ways indicates you're forward-thinking, an important trait for a risk analyst.

Align with the company's mission

Showing you share the company's values suggests you'll fit well with the team.

Highlight your credit analysis background

Starting your cover letter by stating your strong background in credit analysis and risk assessment immediately shows your relevance for the credit risk analyst role. It sets the tone for showcasing your expertise.

Quantify your achievements in risk management

Putting numbers to your achievements, like reducing the loan default rate by 12%, proves your impact in tangible terms. It tells me exactly what you have accomplished and hints at what you could do for us.

Show enthusiasm for the potential employer

Expressing excitement about working for the company indicates you've done your homework and are genuinely interested in the role beyond just the job description. It makes you memorable.

Connect your skills to the company's mission

Talking about how you can contribute to the company's mission of empowering people with reliable information demonstrates that you understand the bigger picture of your role and are aligned with the company’s values.

End with a strong call to action

Thanking the potential employer and expressing eagerness to discuss your contribution further shows politeness and initiative, which are good traits for a potential employee. It's a smooth way to invite yourself to the next stage of the hiring process.

Risk Management Specialist Cover Letter Example

Use personal stories to showcase key traits.

Sharing how your natural curiosity as a child led you to risk management is a creative way to show that your key strengths are deeply rooted, making you a passionate and dedicated candidate.

Demonstrate impact with innovative solutions

Describing your development of a real-time monitoring dashboard highlights your ability to innovate and address risks proactively, qualities that are highly valued in risk management roles.

Connect your goals with the company’s mission

When you align your career aspirations with the company’s objectives, it demonstrates that you have a shared vision, which is key to proving your fit within the organization.

Express interest in advancing risk management techniques

Showing a keen interest in exploring advanced analytics and predictive modeling positions you as a forward-thinking candidate eager to contribute to the evolution of risk management practices.

Invite further discussion with enthusiasm

Closing your cover letter on a note of anticipation for a discussion about your role at the company indicates your eagerness to engage and share more about how you can contribute to their success.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Risk Analyst Roles

- Financial Risk Manager Cover Letter Guide

- Health Care Risk Manager Cover Letter Guide

- Risk Analyst Cover Letter Guide

- Risk Manager Cover Letter Guide

Other Finance Cover Letters

- Accountant Cover Letter Guide

- Auditor Cover Letter Guide

- Bookkeeper Cover Letter Guide

- Claims Adjuster Cover Letter Guide

- Cost Analyst Cover Letter Guide

- Credit Analyst Cover Letter Guide

- Finance Director Cover Letter Guide

- Finance Executive Cover Letter Guide

- Financial Advisor Cover Letter Guide

- Financial Analyst Cover Letter Guide

- Financial Controller Cover Letter Guide

- Loan Processor Cover Letter Guide

- Payroll Specialist Cover Letter Guide

- Purchasing Manager Cover Letter Guide

- VP of Finance Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Risk Analyst Cover Letter Examples

Use these Risk Analyst cover letter examples to help you write a powerful cover letter that will separate you from the competition.

Risk analysts help businesses to identify, assess, and manage risks. They use their knowledge of risk management to make sure that businesses are prepared for any potential problems.

When you apply for a risk analyst position, you need to show that you have the skills and experience necessary to do the job. Use these examples to write a cover letter that will help you stand out from the competition.

Formal/Professional Writing Style Example

With a Bachelor’s degree in Finance and a strong background in risk analysis, I am confident that my combination of education and experience make me the ideal candidate to contribute significantly to your team.

In my previous role as a Risk Analyst at XYZ Company, I was responsible for monitoring and analyzing a portfolio of clients for potential credit and market risks. As a part of the risk management team, I employed various quantitative models and tools to evaluate credit exposure, financial ratios, and stress test scenarios. My ability to identify areas of concern and communicate potential risks effectively with colleagues and clients allowed for proactive decision-making that contributed to the organization’s growth.

In addition to my technical skills, I am a strong communicator, able to efficiently relay complex information to both technical and non-technical audiences. My collaborative nature and ability to adapt to change have granted me the experience of working alongside multidisciplinary teams, enabling me to contribute to effective teamwork and deliver prompt and accurate results.

I was particularly drawn to your organization due to its renowned commitment to innovation, growth, and employee development. I believe that my background and skill set align well with your company’s needs, and I am confident that my strong work ethic and commitment to excellence would make me a valuable addition to your team.

Thank you for considering my application. I am excited about the opportunity to contribute my expertise as a Risk Analyst at your prestigious organization and look forward to the possibility of discussing my qualifications further.

[Your Name]

Entry-Level Writing Style Example

As a recent graduate with a Bachelor of Science in Finance from XYZ University, I am confident in my ability to analyze and mitigate potential risks and contribute to the success of your organization. My strong analytical skills, attention to detail, and passion for problem-solving make me a suitable candidate for this role, despite my entry-level status.

During my academic career, I completed several courses in Financial Risk Management, Financial Modeling, and Investment Analysis, which provided me with the foundations necessary for this position. Furthermore, my experience as an intern at ABC Corporation allowed me to apply these concepts to real-world situations and develop a strong understanding of the risk management process.

In addition to my academic and professional experiences, I am a self-motivated individual with a keen interest in developing my knowledge within the finance industry. I am confident in my ability to quickly familiarize myself with the processes in place at your organization, and I believe that my fresh perspective and enthusiasm can bring a significant contribution to the team.

I am excited about the opportunity to further my career in risk analysis and would be honored to join your esteemed organization. I have included my resume for your review, and I look forward to discussing my qualifications in more detail during an interview.

Thank you for considering my application. I am eager to contribute my skills and passion to your company.

[Your Full Name]

Networking/Referral Writing Style Example

Jane Smith, a current employee and trusted colleague of mine, referred me to this opportunity and spoke highly of the team and work environment at your company. Knowing Jane’s professionalism and commitment to excellence, I believe that her recommendation speaks volumes to my suitability for this role.

My background as a Financial Analyst for the past three years at XYZ Industries has equipped me with the necessary skills and experience to excel as a Risk Analyst. I have a strong understanding of risk management principles, financial modeling, and data analysis techniques that I believe will translate well in this position.

I pride myself on my ability to identify and analyze potential risk factors, develop effective mitigation strategies, and communicate complex financial data to stakeholders clearly and concisely. Additionally, my strong analytical and problem-solving abilities, combined with my collaborative and adaptive nature, make me confident in my capacity to contribute effectively to your team’s success.

I am excited by the prospect of joining your esteemed organization and leveraging my skills and experience to aid in identifying, analyzing, and managing risks. I believe that my strong professional background, recommendations from trusted colleagues, and passion for risk management make me a suitable candidate for the Risk Analyst position.

I look forward to the opportunity to discuss my suitability further and to learn more about the role and your organization. Thank you for considering my application.

Enthusiastic/Passionate Writing Style Example

Ever since I began my studies in risk management, I knew that I wanted to make an impact in this field. I have eagerly followed your company’s progress and success as it solidifies its place as an industry leader, and I cannot think of a more inspiring place to begin my career.

As a recent graduate with a degree in Financial Risk Management, my strong academic achievements illustrate my dedication and commitment to mastering the art of risk management. However, nothing excites me more than the chance to put my knowledge into practice.

During my internship at ABC Corporation, I had the opportunity to work on a risk evaluation project that involved a comprehensive analysis of potential threats and their impact on business performance. My supervisors commended me for my analytical skills and the ability to communicate complex concepts in a clear and concise manner. This experience not only ignited my passion for risk analysis but also equipped me with the necessary skills to excel in this role.

Furthermore, I possess strong collaboration skills and always strive to maintain a positive attitude that resonates within my team. I am confident that my combination of technical knowledge, hands-on experience, and exuberant enthusiasm make me an ideal candidate for the Risk Analyst position.

I would be thrilled to contribute my passion and expertise to your esteemed company and be part of your journey towards continued success. Thank you for considering my application, and I am looking forward to the opportunity to discuss my candidacy further.

Problem-Solving Writing Style Example

Having conducted thorough research into the company, I have identified a key challenge you may be facing – staying ahead in the ever-changing regulatory landscape and maintaining your competitive advantage in the risk management field. As a highly motivated Risk Analyst with extensive experience in risk management and proven problem-solving abilities, I believe that my unique skill set is a perfect match to help your company overcome this challenge.

In my past professional experience working as a Risk Analyst in a top-tier financial institution, I was responsible for conducting risk assessments, analyzing trends, and performing audits that directly contributed to mitigations of potential financial losses. This experience has honed my skills in risk identification and quantification, which I am confident would make a valuable impact at your organization.

Additionally, my educational background in finance and certifications in risk management, along with my commitment to staying current with the ever-evolving regulations, have equipped me with the knowledge to preemptively address any regulatory changes that may threaten your company. I have experience in implementing changes to risk assessment methodologies and monitoring systems, which would enable a swift and smooth adaptation process in your organization.

I am certain that my strong analytical skills, attention to detail, and proactive approach will help alleviate the regulatory challenges your organization faces. I am excited about the opportunity to work with your team on developing efficient risk management strategies, ultimately maximizing your company’s performance and maintaining a competitive edge.

I look forward to discussing my candidacy further and exploring how my skills can contribute to the continued success of your organization. Thank you for considering my application.

Storytelling/Narrative Writing Style Example

I still remember the day when my friend and I decided to embark on an ambitious road trip across the country. It was a journey filled with excitement, and as the designated planner, I found myself immersed in the process of evaluating risks and identifying potential challenges. From assessing the condition of our vehicle to charting out the safest routes, I made it my mission to ensure our journey was as smooth as possible.

This experience, though not directly related to the financial sector, speaks to my innate ability to analyze situations, weigh risks, and devise strategic solutions. As a recent graduate with a degree in finance, I am excited to leverage my academic knowledge, along with my innate risk assessment skills, in the role of a Risk Analyst at your esteemed organization. Throughout my studies, I’ve developed a strong understanding of risk management, financial modeling, and statistical analysis, which would allow me to excel in this role.

During my time as a finance intern at XYZ Corporation, I had the opportunity to apply my risk assessment skills in a professional setting. I was tasked with monitoring and evaluating the credit risk profiles of potential clients. This experience allowed me to develop my analytical and problem-solving abilities, and I was praised for my keen eye for detail and my ability to communicate my findings effectively to the team.

I am confident that my combination of academic knowledge, practical experience, and personal passion for risk assessment make me a strong candidate for the Risk Analyst position at your organization. I am eager to contribute my skills and grow professionally within your team. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

Store Supervisor Cover Letter Examples

Customer service associate cover letter examples, you may also be interested in..., property accountant cover letter examples & writing tips, digital product manager cover letter examples & writing tips, cyber security engineer cover letter examples, channel account manager cover letter examples & writing tips.

Risk Analyst Cover Letter Examples (Template & 20+ Tips)

Create a standout risk analyst cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Are you looking to land a job as a Risk Analyst? Our Risk Analyst Cover Letter Guide is here to help you craft the perfect introduction to your job application. We'll show you how to highlight your experience, skills and qualifications to make a lasting impression. Read on for more tips and advice on how to write a winning cover letter!

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Budget Analyst Cover Letter Sample

- Credit Analyst Cover Letter Sample

- Commercial Analyst Cover Letter Sample

- Relationship Banker Cover Letter Sample

- Finance Director Cover Letter Sample

- Credit Manager Cover Letter Sample

- Junior Loan Processor Cover Letter Sample

- Treasury Analyst Cover Letter Sample

- Payroll Accountant Cover Letter Sample

- Personal Financial Advisor Cover Letter Sample

- Junior Financial Analyst Cover Letter Sample

- Financial Business Analyst Cover Letter Sample

- Certified Public Accountant Cover Letter Sample

- Investment Accountant Cover Letter Sample

- Compensation Manager Cover Letter Sample

- Financial Controller Cover Letter Sample

- Real Estate Salesperson Cover Letter Sample

- Junior Analyst Cover Letter Sample

- Financial Risk Analyst Cover Letter Sample

- Account Analyst Cover Letter Sample

Risk Analyst Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the Risk Analyst position at [Company Name]. After researching your company, I became intrigued by your mission to [add company mission]. As a highly analytical and detail-oriented professional, I am confident that I will be a great asset to your team.

I have a Bachelor's degree in Risk Management and over 6 years of experience as a Risk Analyst. I am well-versed in analyzing and assessing risk for organizations, and am adept at developing strategies to mitigate potential risks. My experience includes conducting risk assessments for financial products, assessing and managing operational risk, and providing recommendations for improving risk management processes. I am also highly skilled in analyzing financial documents to identify potential risks, and have experience in developing regulatory compliance policies and procedures.

I am a motivated and determined professional, and I am passionate about my work. I am capable of working independently and as part of a team, and I am comfortable taking on challenges and finding creative solutions. I am also highly organized and excel at multitasking and managing competing deadlines.

I am confident that I can make a positive contribution to your organization. I am eager to discuss my qualifications in more detail and look forward to hearing from you.

Thank you for your time and consideration.

Why Do you Need a Risk Analyst Cover Letter?

- A Risk Analyst cover letter can help you stand out from other applicants.

- It can showcase your relevant skills and experience in the field to a potential employer.

- It can also be used to highlight your accomplishments and any awards or recognitions you have achieved.

- A Risk Analyst cover letter can also be used to explain why you are a great fit for the job and why you should be considered for the role.

- It can also be used to demonstrate your knowledge of financial and risk management principles and your ability to assess and analyze risk.

- A Risk Analyst cover letter can also provide evidence of your ability to communicate effectively with clients and colleagues.

A Few Important Rules To Keep In Mind

- Keep it brief. The cover letter should not exceed one page; the shorter the better.

- Open with an attention grabbing sentence about why you are the ideal candidate for the position.

- Outline your qualifications and experience that match the role.

- Highlight your achievements in your current or past roles.

- Explain why you are passionate about the risk analyst role.

- Provide details of any specific skills or knowledge that make you an ideal candidate.

- Focus on how you can benefit the employer.

- Include contact information so the employer can reach out to you.

- Proofread the letter carefully to ensure it is free of errors.

What's The Best Structure For Risk Analyst Cover Letters?

After creating an impressive Risk Analyst resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Risk Analyst cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Risk Analyst Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

As an experienced Risk Analyst, I am confident that I can offer the perfect combination of skills, knowledge, and experience for your organization. With a proven track record of success in assessing and mitigating risks, I am confident that I can help your company achieve its objectives.

Throughout my career, I have developed a comprehensive understanding of risk assessment, analysis, and mitigation. I have experience with a wide variety of risk management strategies and approaches, and I am capable of creating clear risk reports that can be used to make informed decisions. I am also well-versed in a variety of software packages and tools, including Microsoft Excel, Access, and Power BI.

In addition to my technical skills, I have a strong background in communication, collaboration, and problem-solving. I am comfortable working with teams to identify and address risks, and I am adept at developing effective solutions to complex challenges. I am also highly organized and detail-oriented, allowing me to ensure that all risks are appropriately identified and addressed.

I believe that my expertise and experience make me an ideal candidate for the Risk Analyst position at your company. I am confident that I can bring a valuable perspective to your team and help your organization reach its goals.

Thank you for your time and consideration. I look forward to hearing from you.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Risk Analyst Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not mentioning the position for which you are applying.

- Not providing specific examples of your relevant experience and skills.

- Not demonstrating enthusiasm for the role.

- Failing to proofread your cover letter for any typos or grammatical errors.

- Using a generic cover letter for multiple positions.

- Not customizing the letter to the specific company.

- Not addressing the person to whom you are sending the letter.

- Including unnecessary or irrelevant information.

- Using an unprofessional email address.

- Not including a call to action.

Key Takeaways For a Risk Analyst Cover Letter

- Highlight experience in risk management, analysis, and assessment

- Mention expertise in regulatory compliance, risk modeling, and enterprise risk management

- Demonstrate knowledge in data analysis and reporting

- Detail an understanding of market risk, operational risk, and credit risk

- Show strong communication and presentation skills

- Mention any relevant certifications or qualifications

- Display strong problem-solving and organizational skills

Risk Analyst Cover Letter Example

A Career as a Risk Analyst includes helping businesses in identifying, assessing, and managing risks. These professionals use their risk management knowledge and ensure that the business is prepared for meeting and solving potential problems. When you apply for this role, you should show that you have the skills and experience necessary to do the job.

An attractive Risk Analyst Cover letter allows you to direct the reader’s attention to aspects of your resume that are most relevant, demonstrate your knowledge of the company you’re writing to and express your interest and enthusiasm for the position. Want one super quick? Have a look at our Risk Analyst Cover Letter Sample and download it easily!

- Cover Letters

- Accounting & Finance

Risk Analysts work for large organizations and a variety of start-up companies and provide financial and risk management solutions. The job profile includes identifying risks bothering the company’s assets, monitoring market trends, reviewing legal documents, using financial analysis software, and developing plans to use during emergencies. The primary duty, however, is to calculate the risk associated with various business decisions.

What to Include in a Risk Analyst Cover Letter?

Roles and responsibilities.

- Making recommendations for mitigating risks, including diversification, currency exchanges, and portfolio investment.

- Using analytical software for calculating the risk of a decision.

- Creating reports and anticipating the losses of certain business decisions.

- Consulting with business decision-makers and understanding the data needs.

- Evaluating business and finance records and determining the level of risks.

- Assessing financial documents, economic conditions, and potential clients.

Education & Skills

Risk analyst skills:.

- Researching skills to evaluate business decisions.

- Strong analytical skills to quickly analyze a large collection of data.

- Report writing abilities.

- The ability to make quick decisions.

- Strong verbal and written communication skills.

- The ability to handle multiple projects simultaneously.

Risk Analyst Education Requirements:

- A bachelor’s degree in statistics, economics, finance, or business-related degree.

- Relevant software proficiency and qualification.

Risk Analyst Cover Letter Example (Text Version)

Dear Mr./Ms.,

As soon as I learned of **** need for an experienced Risk Analyst, I felt compelled to write this letter, and submit the enclosed resume. Owing to my 15+years of experience in spearheading capital investment, financial risk management, and risk mitigation for various top-tier companies, I feel that I am more than prepared to meet and surpass your expectations for this role.

My background includes demonstrable experience in conducting and assessing top-flight risk assessments, driving policy development, leading productive teams, and minimizing financial losses for XYZ company. Throughout my career, I have been successful in monitoring strategic business planning and aimed at mitigating risks to the utmost base. All these skills position me to undertake any challenging role and make a significant impact on any organization in which I am employed.

Some of my core skills relevant to the position include –

- Well-acquainted and experienced in risk evaluation, analysis, helping plan internal risk audits, and delivering stats reports.

- In my previous role at ***, I was responsible for risk assessment for new and renewal businesses; created and managed loss prevention programs apart from risk management.

- Proven track record to identify potential risks and recommend solutions for mitigating risks.

- Bachelor’s degree in economics- enables me to understand well various insurance products and the insurance industry.

- Proficiency in data analysis, and experience in using various software programs, including MS Excel, and Access.

With my detailed oversight of risk analysis, and management, coupled with my ability to direct all facets of risk management, I am ready to provide outstanding service to *** and look forward to discussing the position with you in further detail.

Thank you for your consideration, and I hope to hear from you soon.

Sincerely, [Your Name]

Risk Analyst Cover Letter Example with No Experience(Text Version)

I am excited to be applying for the Risk Analyst position at ***. I have recently received my bachelor’s degree in Finance from **** University. I had always admired your company and how well it copes with this challenging and ever-changing technological world. My strong background in finance along with my ability to conduct risk assessment positions me to undertake this role and I also assure you that I can easily surpass your expectations for this role, and be a valuable member of your team.

Because of my solid theoretical knowledge and practical knowledge in Risk analysis and risk management, I was immediately interested in your job posting for a Risk Analyst. While my resume gives an elaborate picture of my qualifications, allow me to use this document to highlight some of my core competencies –

- The ability to identify and mitigate risks and recommend proper solutions.

- Well-versed in financial and insurance risk analysis.

- Proficiency in data analysis and modeling.

- Strong background in statistics.

- Superior communication skills which will allow me to effectively communicate with senior management.

Having said this, I believe that my strong academic background and my inner strength to assess risks would allow me to contribute to the success of your organization. I am also sure that I could quickly become proficient with the tools and techniques your company is using at present. I am available for an interview at your earliest convenience.

Thank you for your consideration.

If you want to stay on top of the list and make your cover letter stand out, read through our tips and tricks. Let’s dive deep –

- Ensure that you stick to a tone of voice – be it formal or a traditional one, or one that completely matches the hiring company’s culture.

- Make sure you aren’t reproducing the same matter as shown in your resume, Rather, build upon it.

- Focus on your achievements, and motivation, instead of merely listing your hard skills.

- Prove that you are familiar with the company – research and gather some vital points about the hiring company.

- Lastly, link your own skills, and experience to some potential challenges the company might face in the future.

Worried your resume is past the expiration date? We’ll help you create a new one that leaves a positive impression and beats luck. Refer to our Risk Analyst Resume Samples !

Customize Risk Analyst Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

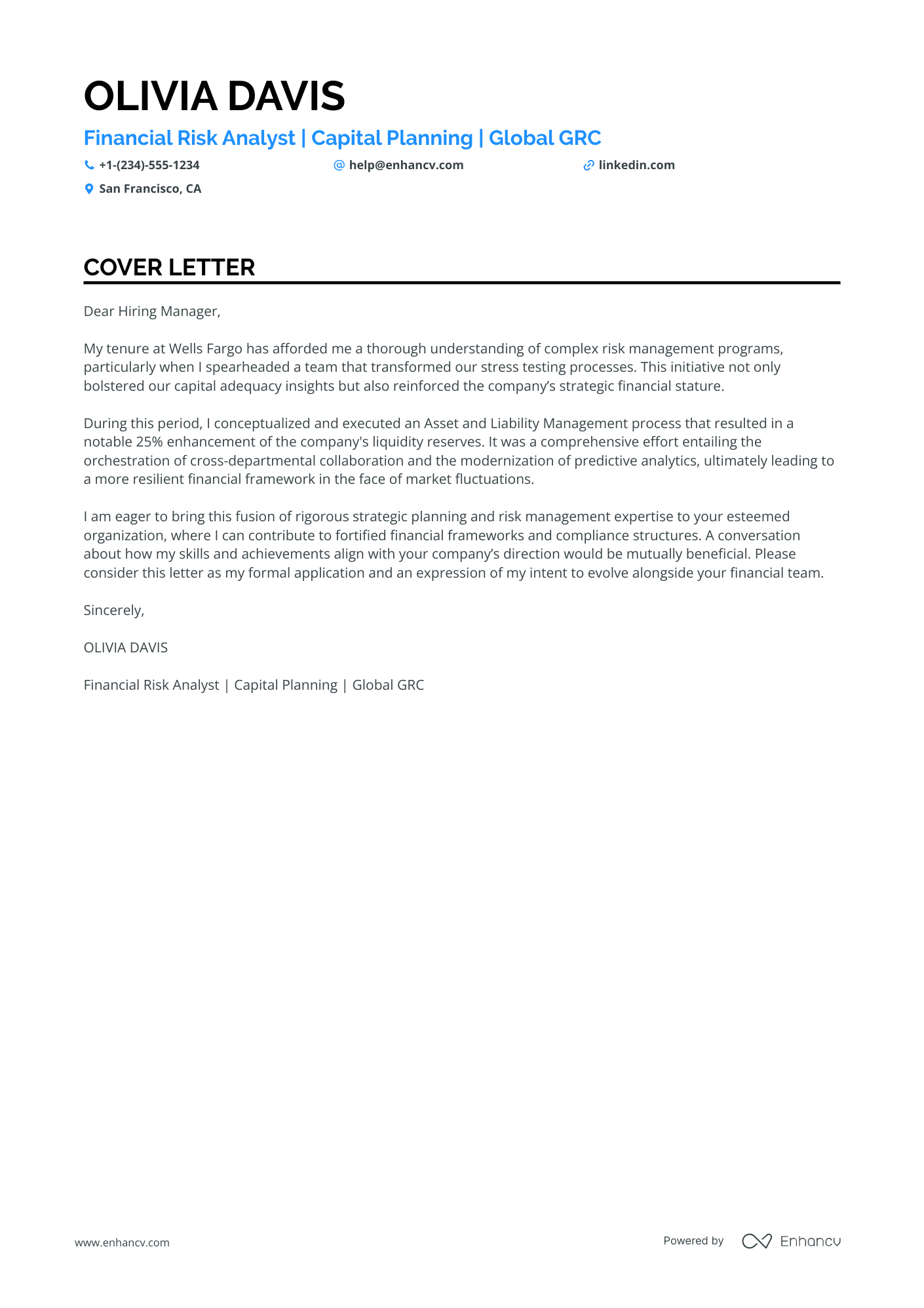

Professional Financial Risk Analyst Cover Letter Examples for 2024

Your financial risk analyst cover letter must demonstrate an acute understanding of risk assessment strategies. Display your proficiency in predictive modeling and statistical analysis. Highlight your track record of using financial software to identify potential risks. Convey your ability to communicate complex risk assessments to stakeholders effectively.

Cover Letter Guide

Financial Risk Analyst Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Financial Risk Analyst Cover Letter

Key Takeaways

Writing a financial risk analyst cover letter can often be a daunting task. Perhaps you've begun job applications and realized you need a stellar cover letter to stand out. It should highlight your proudest professional moment, not just echo your resume. Crafting a narrative that's both formal and free of clichés, all within a single page, may seem challenging. Fear not—our guide is here to help you navigate this process with ease and confidence.

- Making excellent use of job-winning real-life professional cover letters;

- Writing the first paragraphs of your financial risk analyst cover letter to get attention and connect with the recruiters - immediately;

- Single out your most noteworthy achievement (even if it's outside your career);

- Get a better understanding of what you must include in your financial risk analyst cover letter to land the job.

Let the power of Enhancv's AI work for you: create your financial risk analyst cover letter by uploading your resume.

If the financial risk analyst isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Financial Risk Analyst resume guide and example

- Financial Auditor cover letter example

- Compliance Officer cover letter example

- Finance Associate cover letter example

- Government Accounting cover letter example

- Accounts Receivable cover letter example

- Treasury Analyst cover letter example

- Accounts Payable Specialist cover letter example

- Private Equity cover letter example

- External Auditor cover letter example

- Corporate Accounting cover letter example

Financial Risk Analyst cover letter example

OLIVIA DAVIS

San Francisco, CA

+1-(234)-555-1234

- Emphasize relevant experience: The cover letter highlights significant accomplishments at a previous employer, such as enhancing stress testing processes and improving liquidity reserves by 25%, which directly relate to the skills required in financial risk management and capital planning.

- Demonstrate impact: By quantifying success with concrete metrics (e.g., "a notable 25% enhancement"), the applicant showcases their ability to deliver measurable results which is crucial in risk management roles.

- Showcase leadership and collaboration skills: The cover letter mentions spearheading a team and orchestrating cross-departmental collaboration, underlining the candidate's capability to lead initiatives and work effectively with various stakeholders, a vital aspect of a role in global Governance, Risk, and Compliance (GRC).

- Express alignment with the organization's goals: The applicant states a desire to contribute to the company's financial frameworks and compliance structures, indicating an understanding of and alignment with the company's objectives in risk and strategic financial management.

Structuring and formatting your financial risk analyst cover letter

Here's what the structure of your financial risk analyst cover letter should include:

- Header (with your name, the position you're applying for, and the date);

- Salutation (or greeting);

- Introductory paragraph (or your opening statement);

- Body paragraph (or further proof of your experience);

- Closing paragraph (with a call to action);

- Signature (that is optional).

Use the same font for your financial risk analyst resume and cover letter - modern fonts like Lato and Rubik would help you stand out.

Your financial risk analyst cover letter should be single-spaced and have a one-inch margins - this format is automatically set up in our cover letter templates and our cover letter builder .

When submitting your cover letter, always ensure it's in PDF, as this format keeps the information intact (and the quality of your document stays the same).

On one final note - the Applicant Tracker System (ATS or the software that is sometimes used to initially assess your application) won't read your financial risk analyst cover letter.

The top sections on a financial risk analyst cover letter

Header: The header should include your contact information, date, and the employer's details. It is essential for making a professional first impression and ensures the recruiter can easily know who you are and how to contact you.

Greeting: A personalized greeting addresses the hiring manager by name. It demonstrates attention to detail, which is critical for a financial risk analyst who must be meticulous in their work.

Introduction: The introductory paragraph should captivate the reader's attention by succinctly stating your interest in the role and your unique value proposition, such as your experience with quantitative risk assessment tools or strategic decision-making support.

Professional Experience and Skills: This section is where you tie your past work experiences, quantifiable achievements, and risk assessment skills directly to the job description, showcasing how you can address the specific needs of the company with your expertise.

Closing and Call to Action: A strong closing paragraph should reaffirm your interest in the position and suggest a next step, such as a meeting or interview. It displays your proactive approach, which is vital for someone who anticipates and mitigates financial risks.

Key qualities recruiters search for in a candidate’s cover letter

- Proficiency with statistical software and financial modeling tools: Essential for analyzing complex financial data and forecasting risk.

- Strong understanding of financial regulations and compliance: Vital for ensuring that risk management strategies adhere to legal standards.

- Advanced knowledge of risk assessment techniques and methodologies: Important for identifying and evaluating potential risks to the organization effectively.

- Experience with portfolio management and investment strategies: Helps in understanding the financial products and the associated risks being analyzed.

- Exceptional analytical and critical thinking skills: Crucial for interpreting data, identifying trends, and making informed decisions.

- Excellent communication and report-writing abilities: Necessary for conveying complex risk assessments to stakeholders in an understandable manner.

How to personalize your financial risk analyst cover letter greeting

Before you start writing your financial risk analyst cover letter, take the time to find out who is recruiting for the role.

Search for the recruiter's name on LinkedIn or the corporate website to address them personally in your financial risk analyst cover letter salutation .

What if you can't find out who's recruiting for the role?

Always aim to avoid the very impersonal "Dear Sir/Madam" - instead, opt out for "Dear HR Team" or "Dear Hiring Manager" to make a better first impression.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Recruitment Team,

- Dear [Company Name] Hiring Committee,

- Dear [Mr./Ms. Last Name],

- Dear Director of Risk Management,

- Dear Chief Financial Officer,

Your financial risk analyst cover letter intro: showing your interest in the role

On to the actual content of your financial risk analyst cover letter and the introductory paragraph .

The intro should be no more than two sentences long and presents you in the best light possible.

Use your financial risk analyst cover letter introduction to prove exactly what interests you in the role or organization. Is it the:

- Company culture;

- Growth opportunities;

- Projects and awards the team worked on/won in the past year;

- Specific technologies the department uses.

When writing your financial risk analyst cover letter intro, be precise and sound enthusiastic about the role.

Your introduction should hint to recruiters that you're excited about the opportunity and that you possess an array of soft skills, e.g. motivation, determination, work ethic, etc.

Choosing your best achievement for the middle or body of your financial risk analyst cover letter

Now that you have the recruiters' attention, it's time to write the chunkiest bit of your financial risk analyst cover letter .

The body consists of three to six paragraphs that focus on one of your achievements.

Use your past success to tell a story of how you obtained your most job-crucial skills and know-how (make sure to back these up with tangible metrics).

Another excellent idea for your financial risk analyst cover letter's middle paragraphs is to shine a light on your unique professional value.

Write consistently and make sure to present information that is relevant to the role.

Final words: writing your financial risk analyst cover letter closing paragraph

The final paragraph of your financial risk analyst cover letter allows you that one final chance to make a great first impression .

Instead of going straight to the "sincerely yours" ending, you can back up your skills with a promise of:

- how you see yourself growing into the role;

- the unique skills you'd bring to the organization.

Whatever you choose, always be specific (and remember to uphold your promise, once you land the role).

If this option doesn't seem that appealing to you, close off your financial risk analyst cover letter with a follow-up request.

You could even provide your availability for interviews so that the recruiters would be able to easily arrange your first meeting.

What to write on your financial risk analyst cover letter, when you have zero experience

The best advice for candidates, writing their financial risk analyst cover letters with no experience , is this - be honest.

If you have no past professional roles in your portfolio, focus recruiters' attention on your strengths - like your unique, transferrable skill set (gained as a result of your whole life), backed up by one key achievement.

Or, maybe you dream big and have huge motivation to join the company. Use your financial risk analyst cover letter to describe your career ambition - that one that keeps you up at night, dreaming about your future.

Finally, always ensure you've answered why employers should hire precisely you and how your skills would benefit their organization.

Key takeaways

Turning your financial risk analyst cover letter into a success is all about staying authentic to yourself and relevant to the job:

- Be creative with your financial risk analyst cover letter introduction by stating something you enjoy about the company (that is genuine) or about your skill set (to get the recruiters' interested);

- Use single spacing and have a one-inch margin wrapping all around the content of your financial risk analyst cover letter;

- Select just one past achievement from your career or life to tell a story of how you've obtained job-crucial skills and how they'd be beneficial to the role;

- The finishing paragraph of your financial risk analyst cover letter doesn't necessarily have to be a signature but could be a promise of what you plan to achieve in the role;

- Instead of focusing on your lack of experience, spotlight your transferable skills, one relevant achievement, and career dreams.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

How To Write A Farewell Email To Colleagues (Plus 4 Examples)

The 11 tools you should use to create your personal brand, how to list an internship on your resume, should you have a photo on your resume, how far back to go on your resume, should i put my resume on linkedin.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

Security Risk Analyst Cover Letter

15 security risk analyst cover letter templates.

How to Write the Security Risk Analyst Cover Letter

I am excited to be applying for the position of security risk analyst. Please accept this letter and the attached resume as my interest in this position.

In my previous role, I was responsible for information Security Program and Risk Management support by defining key risk indicators, gathering metrics, and analyzing the efficiency of information security programs and policies.

Please consider my experience and qualifications for this position:

- Excellent verbal and written communication skills to technical and non-technical audiences of various levels within or outside the organization (executives, regulators, clients)

- Proven work experience in accuracy of gathering and data keying information

- Excellent grammar and style skills

- Knowledge of system processes to coordinate responses and interviews with subject matter experts

- Knowledge of security program to be able to respond high level to policies, controls, BCP/DR, Incident Response, risk, overall security practices and processes

- Assist in the development of an assessment process to include coordination of resources, evidence/artifacts, remediation processes and ensure controls are in place and functioning as designed

- Provide reports and dashboards on security controls and programs as directed

- Leads the planning, design, development and execution control effectiveness testing

Thank you for considering me to become a member of your team.

Skyler Hackett

- Microsoft Word (.docx) .DOCX

- PDF Document (.pdf) .PDF

- Image File (.png) .PNG

Responsibilities for Security Risk Analyst Cover Letter

Security risk analyst responsible for varied technical support for Information Security Services’ governance risk and compliance system and Defend Your Data information security awareness program.

Security Risk Analyst Examples

Example of security risk analyst cover letter.

In my previous role, I was responsible for strategic direction and planning in regards to the Security Risk Framework and Program in alignment with CGI’s Enterprise Security Management Framework (ESMF) but inspired in security industry best practices.

Please consider my qualifications and experience:

- Very good understanding of risk assessment and management principles

- Good knowledge of current IT Infrastructure platforms, practices and trends

- Experience of popular IT security risk assessment methodologies

- Broad knowledge of technology generally and Information Security technology and methodologies particularly, including for example, web server security / firewalls / networks / encryption / PKI / TCP/IP / UNIX / Windows / PCI DSS / ISO 27001&2

- Professional certification (CISSP, CISA)

- Certification in information security disciplines such as CISM, CISA or CISSP is highly preferred

- Tertiary education in Information Technology

- IT Risk Management / Audit industry certification (such as CISSP, GSNA, CISA, CRISC)

Hayden Murazik

I submit this application to express my sincere interest in the security risk analyst position.

Previously, I was responsible for analysis of potential risk to information security and recommends solutions Creates and maintains information security documentation.

- Knowledge of products (CA-TSS, Lotus Notes, Identity Management products) and Hyperion, Digital Certs and ACL Management

- Certification in information security disciplines such as CISM, CISA or CISSP

- Tertiary education in IT

- Professional certifications in Information Security, Risk Management and/or Compliance preferred (e.g., Security+, CISSP, CISA, CISM, CRISC)

- Able to quickly establish credibility, confidence and

- CISSP, CRISC, CISM/CISA, CIPP or similar certifications

- Experience with Cloud Framework

- Will constantly work towards being the best and to succeed at current assignment/project

Thank you for taking your time to review my application.

Justice Grady

In response to your job posting for security risk analyst, I am including this letter and my resume for your review.

In the previous role, I was responsible for engineering guidance based on DoD and Industry Security Best Practices, security requirements and cyber security trends and solutions; focused towards risk assessments and mitigations.

I reviewed the requirements of the job opening and I believe my candidacy is an excellent fit for this position. Some of the key requirements that I have extensive experience with include:

- Self-motivation, high commitment/energy level, results oriented and flexible nature

- Familiar with methods to apply system security settings to domains and standalones workstations

- Strong technical familiarization with at least one major OS (Windows, LINUX, UNIX)

- Hold or capable of obtaining within 6 months a certification as directed in DoD Directive 8570.01M

- Proficient understanding of network security technologies including firewalls, Intrusions Detection and Prevention Systems, Router ACLs, Enterprise Anti-Virus, Content Filtering

- Network / System Administration experience / background preferred

- Cobit and ITIL experience

- Act as an advocate for business units in security strategy setting and planning

Indigo Hintz

In my previous role, I was responsible for subject matter expertise to executive management on a broad range of information security and risk best practices.

- Solid understanding and experience with security development lifecycle (SDL) processes for internally developed applications, including the web-based and Internet facing components

- Solid knowledge and experience with IT security aspects of operating systems, Active Directory, database (SQL) access, LDAP, Microsoft SharePoint, web server configurations, and networks

- Experience with information risk management

- Experience working in a regulated industry and be familiar with government and industry regulations that involve information security

- Experience managing security related projects involving multiple teams, utilizing project management tools (task allocation, check point meetings, project milestones)

- Experience using common security assessment and analysis tools such as nmap, Nessus, TippingPoint, HP ArcSight, Fidelis, and FireEye

- Familiarity with software/application/database security, system hardening, and secure code analysis (static/run-time) tools

- Incident handling and forensics experience

Thank you in advance for taking the time to read my cover letter and to review my resume.

Previously, I was responsible for guidance and expertise in the development of security standards, architectural governance, design patterns, and security best practices that align with our clients policies and ever changing cyber security marketplace.

- Will build relationship by making self highly approachable, will seek input from others and will actively listen to concerns and alternate points of view, will make others feel valued and supported

- Experience with Enterprise Network devices

- Risk related certifications

- Performing cyber risk assessments, IT risk assessments, and application risk assessments against OWASP, PCI, GLBA, NIST, ISO, SIG/AUP or other standards

- Collecting, analyzing, and interpreting qualitative and quantitative data from multiple sources to analyze findings in the context of the overall security assessment as it applies to client IP reputational data, phishing, DLP assessments

- Documenting and presenting findings and observations

- Experience with GRC tools (Archer, MetricStream, Process Unity)

- Knowledge of financial services industry and relevant regulations and requirements

Thank you for your time and consideration.

Dakota Hand

Related Cover Letters

Create a Resume in Minutes with Professional Resume Templates

Create a Cover Letter and Resume in Minutes with Professional Templates

Create a resume and cover letter in minutes cover letter copied to your clipboard.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Credit Risk Analyst Cover Letter Example

In the sentenceWriting a cover letter for a credit risk analyst position can be a challenging task. It requires careful consideration of the job position and how to best showcase your qualifications. To make the task easier, this guide provides an overview of what to include when writing your cover letter, followed by an example of a successful credit risk analyst cover letter. With this information and guidance, you can craft an effective and attention-grabbing cover letter.

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Credit Risk Analyst Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the Credit Risk Analyst position at [Company name], which was recently advertised on [Job site]. With a deep understanding of credit risk management and a passion for data analysis, I believe I am the perfect candidate to fill this role.

I am currently a Credit Risk Analyst at [Company], where I am responsible for analyzing credit data to identify trends, make predictions and recommend strategies. In my current role, I have used predictive analytics to identify problems with credit portfolios and develop appropriate solutions. I am also well- versed in regulatory frameworks and financial reporting standards, such as CECL, GDPR and IFRS 9.

I am confident that I possess the necessary skills to excel in this role. In addition to my technical abilities, I have excellent communication and interpersonal skills, which I have utilized to build strong relationships with internal and external stakeholders.

It would be an honor to join the team at [Company name] and contribute to the success of the organization. I have attached my resume which includes more information about my qualifications and experience. I look forward to hearing from you and discussing my potential contributions to the company.

Thank you for your time and consideration.

Sincerely, [Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Credit Risk Analyst cover letter include?

A strong cover letter for a Credit Risk Analyst position should include several key elements.

First, it should clearly explain why you believe you are the best candidate for the position. Explain your qualifications, experience, and skills that make you an ideal fit for the position. Additionally, you should include a list of your relevant accomplishments, such as reducing credit risk exposure, increasing profitability, and improving customer service.

Second, showcase your ability to analyze data and make smart decisions. Explain your proficiency in evaluating financial data and credit reports, determining creditworthiness, and developing strategies for minimizing risk.

Third, demonstrate your familiarity with current banking laws and regulations, as well as risk management best practices. Showcase your ability to use tools such as SAS, Oracle, and Microsoft Excel to analyze data and identify areas of risk.

Finally, explain how you would be an asset to the company. Highlight how you would use your knowledge and experience to identify and address risk opportunities, create policies and procedures, and ensure compliance with all applicable regulations.

Your cover letter should be professional, well- written, and tailored to the position you are applying for. By including these key elements, you can demonstrate your suitability as a Credit Risk Analyst, and increase your chances of securing an interview.

Credit Risk Analyst Cover Letter Writing Tips

Writing a great cover letter as a credit risk analyst can be a daunting task. However, if you follow a few key tips, you can create a compelling letter that can set you apart from other applicants. Here are some writing tips to help you craft the perfect cover letter for a credit risk analyst:

- Start with an attention- grabbing introduction. Explain why you are interested in the position and why you are the perfect fit for the job.

- Highlight any prior experience you have that is relevant to the job and the industry. Show the hiring manager why you would be a valuable asset to their team.

- Provide an overview of your skills and qualifications. Explain what sets you apart from other applicants.

- Demonstrate your research skills. Show that you have done your research on the company and position.

- Show that you understand the job responsibilities and how you would approach them.

- Close your letter with a strong call to action. Ask for an interview and provide your contact information.

By following these tips, you can create an effective cover letter for a credit risk analyst position that will impress potential employers. Good luck with your job search!

Common mistakes to avoid when writing Credit Risk Analyst Cover letter