PhD in Risk Management and Insurance

Program Overview

The PhD in Business Administration with a focus on Risk Management and Insurance (RMI) is designed to help students develop an understanding of both theoretical and applied aspects of insurance, risk management and employee benefits. The Terry College provides an excellent opportunity for those interested in pursuing a PhD in risk management and insurance. Some of the benefits of the Terry College include:

- Consistently highly ranked, the UGA RMI program is currently the top-ranked program in the country by U.S. News & World Report.

- A recent global study ranked the UGA RMI program among the top 10 universities in the world – and second among public universities — for the impact of its risk management and insurance research.

- Faculty members are among the top publishers in the premier risk management and insurance journal, the Journal of Risk and Insurance . View our departmental directory for a complete list of the faculty .

- RMI faculty have received numerous research awards from the Journal of Risk and Insurance , Risk Management and Insurance Review , Journal of Insurance Issues , the Journal of Insurance Regulation and others.

- Professor , Risk Management and Insurance Program

Preferred deadline: January 4

Applications after January 4 will also be considered until spots are filled

Prerequisites

Math courses.

- Calculus : Differential and integral

- Linear Algebra : A course elementary linear algebra is strongly recommended before taking doctoral level (8000 and 9000) courses.

Typical Course Sequence

- Years 2 and 3

- RMIN 7100 : Fundamentals of Risk Management

- RMIN 9450 / 9550 : Risk Management Seminar

- ECON 8000 : Math for Economics (taken in Summer leading to Fall Semester)

- ECON 8010 : Microeconomic Theory I

- ECON 8070 : Stats for Econometrics

- RMIN 7120 : Corporate Risk Management

- ECON 8080 : Intro to Econometrics

- ECON/STAT/FINA Elective

- RMIN 9000 : Doctoral Research

- ECON 8120 : Econometrics II

- FINA 9200 : Corporate Finance Theory

- ECON 8110 : Econometrics I

- Preliminary Exams

Graduates of the risk management and insurance program currently teach in leading risk management and insurance programs across the country including:

- Saul Adelman (1980 Graduate; Associate Professor of Finance at Miami University)

- David Cather (1985 Graduate; Clinical Professor of Risk Management at Penn State University)

- Robert Puelz (1990 Graduate; Dexter Trustee Professor of Risk Management at Southern Methodist University)

- Brenda Wells (1992 Graduate; Associate Professor and Director, Risk Management and Insurance Program at East Carolina University)

- Lee Colquitt (1995 Graduate; Professor and Chair, Department of Finance at Auburn University)

- William Ferguson (1995 Graduate; G. Frank Purvis, Jr./BORSF Eminent Scholar Endowed Chair in Insurance and Risk Management at the University of Louisiana at Lafayette)

- Randy Dumm (1998 Graduate; Professor of Research at Temple University)

- Tim Query (1999 Graduate; Mountain States Insurance Group Endowed Chair Holder and Associate Professor of Finance at New Mexico State University)

- Kathleen McCullough (2000 Graduate; State Farm Insurance Professor of Risk Management and Insurance and Associate Dean for Academic Affairs and Research at Florida State University)

- Lars Powell (2002 Graduate; Director of the Alabama Center for Insurance Information and Research at the University of Alabama)

- Ryan Lee (2001 Graduate; Initial Placement—University of Calgary)

- Cassandra Cole (2002 Graduate; Robert L. Atkins Professor in Risk Management and Insurance and Department Chair at Florida State University)

- Andre Liebenberg (2004 Graduate; Robertson Chair of Insurance and Associate Professor of Finance at the University of Mississippi)

- Enya He (2006 Graduate; Regional Director for Lloyd’s South Central U.S. Region)

- Joseph Ruhland (2006 Graduate; Chair and Associate Professor of Risk Management and Insurance at Georgia Southern University)

- Steve Miller (2010 Graduate; Associate Professor and Director, School of Risk Management and Insurance at University of South Florida)

- Leon Chen (2011 Graduate; Professor of Finance at Minnesota State University-Mankato)

- Jianren Xu (2014 Graduate; Assistant Professor of Finance at University of North Texas)

- In Jung Song (2016 Graduate; Hankuk University of Foreign Studies)

- Evan Eastman (2017 Graduate; Florida State University)

- Joshua Frederick (2019 Graduate; Ball State University)

- Jiyeon Yun (2019 Graduate; California State University-Northridge)

- Polin Wang (2020 Graduate; University of South Florida)

Departments and Program Offices

- PhD Program Office

- Risk Management and Insurance Program

UGA Resources

- Graduate School

- Financial Aid

Additional Information

- Current PhDs

- Faculty Research

Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

PhD Program

Program overview.

Now Reading 1 of 4

Rigorous, discipline-based research is the hallmark of the MIT Sloan PhD Program. The program is committed to educating scholars who will lead in their fields of research—those with outstanding intellectual skills who will carry forward productive research on the complex organizational, financial, and technological issues that characterize an increasingly competitive and challenging business world.

Start here.

Learn more about the program, how to apply, and find answers to common questions.

Admissions Events

Check out our event schedule, and learn when you can chat with us in person or online.

Start Your Application

Visit this section to find important admissions deadlines, along with a link to our application.

Click here for answers to many of the most frequently asked questions.

PhD studies at MIT Sloan are intense and individual in nature, demanding a great deal of time, initiative, and discipline from every candidate. But the rewards of such rigor are tremendous: MIT Sloan PhD graduates go on to teach and conduct research at the world's most prestigious universities.

PhD Program curriculum at MIT Sloan is organized under the following three academic areas: Behavior & Policy Sciences; Economics, Finance & Accounting; and Management Science. Our nine research groups correspond with one of the academic areas, as noted below.

MIT Sloan PhD Research Groups

Behavioral & policy sciences.

Economic Sociology

Institute for Work & Employment Research

Organization Studies

Technological Innovation, Entrepreneurship & Strategic Management

Economics, Finance & Accounting

Accounting

Management Science

Information Technology

System Dynamics

Those interested in a PhD in Operations Research should visit the Operations Research Center .

PhD Program Structure

Additional information including coursework and thesis requirements.

MIT Sloan Predoctoral Opportunities

MIT Sloan is eager to provide a diverse group of talented students with early-career exposure to research techniques as well as support in considering research career paths.

Rising Scholars Conference

The fourth annual Rising Scholars Conference on October 25 and 26 gathers diverse PhD students from across the country to present their research.

Now Reading 2 of 4

The goal of the MIT Sloan PhD Program's admissions process is to select a small number of people who are most likely to successfully complete our rigorous and demanding program and then thrive in academic research careers. The admission selection process is highly competitive; we aim for a class size of nineteen students, admitted from a pool of hundreds of applicants.

What We Seek

- Outstanding intellectual ability

- Excellent academic records

- Previous work in disciplines related to the intended area of concentration

- Strong commitment to a career in research

MIT Sloan PhD Program Admissions Requirements Common Questions

Dates and Deadlines

Admissions for 2024 is closed. The next opportunity to apply will be for 2025 admission. The 2025 application will open in September 2024.

More information on program requirements and application components

Students in good academic standing in our program receive a funding package that includes tuition, medical insurance, and a fellowship stipend and/or TA/RA salary. We also provide a new laptop computer and a conference travel/research budget.

Funding Information

Throughout the year, we organize events that give you a chance to learn more about the program and determine if a PhD in Management is right for you.

PhD Program Events

May phd program overview.

During this webinar, you will hear from the PhD Program team and have the chance to ask questions about the application and admissions process.

June PhD Program Overview

July phd program overview, august phd program overview.

Complete PhD Admissions Event Calendar

Unlike formulaic approaches to training scholars, the PhD Program at MIT Sloan allows students to choose their own adventure and develop a unique scholarly identity. This can be daunting, but students are given a wide range of support along the way - most notably having access to world class faculty and coursework both at MIT and in the broader academic community around Boston.

Now Reading 3 of 4

Profiles of our current students

MIT Sloan produces top-notch PhDs in management. Immersed in MIT Sloan's distinctive culture, upcoming graduates are poised to innovate in management research and education.

Academic Job Market

Doctoral candidates on the current academic market

Academic Placements

Graduates of the MIT Sloan PhD Program are researching and teaching at top schools around the world.

view recent placements

MIT Sloan Experience

Now Reading 4 of 4

The PhD Program is integral to the research of MIT Sloan's world-class faculty. With a reputation as risk-takers who are unafraid to embrace the unconventional, they are engaged in exciting disciplinary and interdisciplinary research that often includes PhD students as key team members.

Research centers across MIT Sloan and MIT provide a rich setting for collaboration and exploration. In addition to exposure to the faculty, PhD students also learn from one another in a creative, supportive research community.

Throughout MIT Sloan's history, our professors have devised theories and fields of study that have had a profound impact on management theory and practice.

From Douglas McGregor's Theory X/Theory Y distinction to Nobel-recognized breakthroughs in finance by Franco Modigliani and in option pricing by Robert Merton and Myron Scholes, MIT Sloan's faculty have been unmatched innovators.

This legacy of innovative thinking and dedication to research impacts every faculty member and filters down to the students who work beside them.

Faculty Links

- Accounting Faculty

- Economic Sociology Faculty

- Finance Faculty

- Information Technology Faculty

- Institute for Work and Employment Research (IWER) Faculty

- Marketing Faculty

- Organization Studies Faculty

- System Dynamics Faculty

- Technological Innovation, Entrepreneurship, and Strategic Management (TIES) Faculty

Student Research

“MIT Sloan PhD training is a transformative experience. The heart of the process is the student’s transition from being a consumer of knowledge to being a producer of knowledge. This involves learning to ask precise, tractable questions and addressing them with creativity and rigor. Hard work is required, but the reward is the incomparable exhilaration one feels from having solved a puzzle that had bedeviled the sharpest minds in the world!” -Ezra Zuckerman Sivan Alvin J. Siteman (1948) Professor of Entrepreneurship

Sample Dissertation Abstracts - These sample Dissertation Abstracts provide examples of the work that our students have chosen to study while in the MIT Sloan PhD Program.

We believe that our doctoral program is the heart of MIT Sloan's research community and that it develops some of the best management researchers in the world. At our annual Doctoral Research Forum, we celebrate the great research that our doctoral students do, and the research community that supports that development process.

The videos of their presentations below showcase the work of our students and will give you insight into the topics they choose to research in the program.

How Should We Measure the Digital Economy?

2020 PhD Doctoral Research Forum Winner - Avinash Collis

Watch more MIT Sloan PhD Program Doctoral Forum Videos

Keep Exploring

Ask a question or register your interest

Faculty Directory

Meet our faculty.

2024 Best Online PhD in Risk Management [Doctorate Guide]

Analytical individuals with a passion for research might consider pursuing a PhD in Risk Management.

Risk management professionals can shape the way a company handles risk assessment and manages threats to their operation. A doctoral degree can set you apart from the crowd, signaling that you have research skills and expert knowledge of the industry.

Editorial Listing ShortCode:

Many people who obtain their Ph.D. in Risk Management choose to work in a variety of business or finance roles.

Universities Offering Online Doctorate in Risk Management Degree Program

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Capella University

At Capella University, the online Doctor of Information Technology program is designed to help students acquire the knowledge and skills needed to excel as leaders in the IT industry. The program’s 13 courses and 2 virtual residencies can be completed at a student’s own pace. The curriculum covers topics like complex adaptive systems, system security, and project and risk management.

Capella University is accredited by the Higher Learning Commission.

Capitol Technology University

The courses for the Doctor of Philosophy in Occupational Risk Management at Capitol Technology University are taught by industry leaders and academic experts. The curriculum is built on key concepts in the growing safety and occupational construction field and the direct application of these concepts. The program consists of 60 credits and can be completed fully online.

Capitol Technology University is accredited by the Commission on Higher Education of the Middle States Association of Universities and Schools.

Liberty University

Liberty University offers a PhD in Organization and Management with an emphasis in Entrepreneurship. The curriculum is designed to teach strategic business concepts focused on organizational growth and advanced entrepreneurship. The program aims to help students step into dynamic leadership roles after graduation. Students can typically complete the 60 credit, online program in about 3 academic years.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

St. Thomas University

St. Thomas University offers a Doctor of Business Administration in Cyber Security Management. Graduates of the program often secure positions as chief information security officers, directors of financial systems, and high-level IT managers. This online, 60 credit program culminates in a final project. Students can choose between a traditional dissertation, an article dissertation, or action-based research.

St. Thomas University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of the Cumberlands

The University of the Cumberlands offers a Doctor of Philosophy in Information Technology. Students in the program can specialize in one of four specialties: Information Systems Security, Information Technology, Digital Forensics, or Blockchain. The program requires the completion of 60 credits. The curriculum covers topics like robotics, programming, machine learning, network technology, and information security.

The University of the Cumberlands is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Online PhD in Risk Management Programs

All organizations face risks to their operations, such as security breaches, theft, or a fluctuating market. Risk management plays a key part in protecting business by recognizing, addressing, and controlling potential threats.

Doctoral programs in risk management cover subjects in a range of fields, including finance, law, and economics. It’s also beneficial to have a strong understanding of advanced econometrics concepts, as these are used to create and analyze risk models.

A risk management doctoral program will likely include courses topics similar to those listed below:

- Regulatory and legal risk

- Organizational risk

- Econometrics

- Probability theory

- Applied regression methods

- Limited dependent variables

- Doctoral research

You can also choose to specialize in a particular area of risk management. This can be the topic that you choose to focus your research on as well. Risk management specialties can include:

- Financial intermediaries

- Risk and crisis management

A doctorate in risk management can help prepare you for leadership or research roles in the field. Risk management positions include:

- Risk management director

- Market research analyst

- Quantitative risk analyst

- Business analyst

- Claims adjuster

There are many benefits to a career in risk management, including the opportunity to work for a variety of companies. Some professionals also travel for work.

While pursuing your PhD in Risk Management, you can learn how to quantify risks and can enhance your financial knowledge and analytical skills. With experience, these abilities may help you qualify you for career advancements in the risk management industry.

Risk Management Careers & Salaries

Much like with a masters in risk management , earning a PhD in Risk Management can open up professional opportunities in finance, economics, and education.

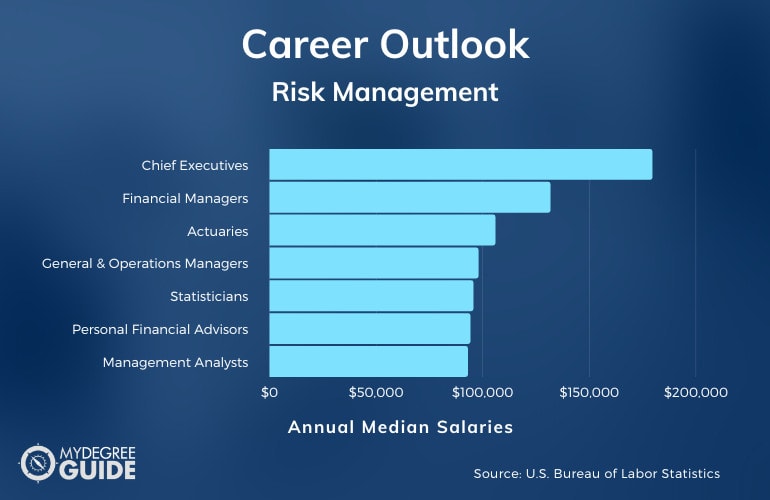

A typical curriculum in a risk management program consists of courses in finance theory, econometrics, and research. Having a firm foundation in these areas can help you qualify for positions at a variety of companies. According to the Bureau of Labor Statistics , experts in risk management may pursue the following career paths.

Many of the careers connected to risk management and insurance offer higher than average median salaries. Earning a doctorate may also increase your earning potential, though a certain pay range is not guaranteed to graduates.

When it comes to finding a job, there are a number of determining factors, such as your prior work experience, your specialized skill sets, and your geographic location.

Risk Management PhD Curriculum & Courses

The curriculum for a risk management doctoral program can change based on several factors, such as specialization or school, but you’ll likely take some courses similar to the following:

- Regulatory and Legal Risk : This course focuses on managing risk in a business setting, covering topics like managing operational and legal risks.

- Operational Risk : In this class, you’ll develop an understanding of the concepts included in a risk framework, exploring subjects such as fraud and security breaches.

- Econometrics : Designed to ready students for empiric economic work, this course explores a range of topics, including data analysis, testing, and forecasting.

- Probability Theory : This course is concerned with modeling events with uncertain results, spanning topics from conditional probability to distribution theory.

- Applied Regression Methods : This course is a study of regression models, and your lessons will include analysis of variance and covariance, along with case studies and examples.

- Limited Dependent Variables : This course focuses on specific regression models that involve dependent variables.

- Doctoral Research : You’ll have the opportunity to develop and strengthen your research skills as well as begin the process of putting together your dissertation.

- Corporate Finance Theory : In this course, you’ll study key topics in corporate finance theory, including asset pricing models and capital budgeting.

- Market Microstructure : This course explores the ways in which the interactions of traders impact pricing, and it focuses on areas such as strategic trading, market fragmentation, and liquidity.

- Risk Management Fundamentals : You’ll learn the fundamentals of risk management, including risk maturity and action, monitoring, and identification techniques.

As you apply to doctoral programs, you can read through each curriculum to ensure that it provides learning opportunities that match your interests and career goals.

Admissions Requirements

As you begin applying to doctoral risk management programs, you’ll likely notice some similarities in the application materials between schools.

Many colleges and universities will ask for the following:

- GRE or GMAT test scores (only some schools require them)

- Personal statement

- Letters of recommendation

- Official college transcripts

Because a doctorate is the highest-level degree, it is beneficial for your transcripts to reflect a strong academic performance during your undergraduate and graduate school years.

Accreditation

Have you ever wondered how employers and the general public know whether a college program is up to standard? The answer lies in the accreditation process .

Regional accreditation is a process that schools can elect to undergo in order to prove that they offer high-quality educational programs and student services. Accrediting agencies ensure that a school’s faculty is experienced and that its curriculum covers the necessary information for each subject area. Colleges and universities are also motivated to continuously improve their programs in order to maintain their accreditation status.

Financial Aid and Scholarships

Financial aid generally operates on an as-needed basis, providing monetary support for the families and individuals that need it most. There are a number of scholarships opportunities, though, that are based on other criteria, such as academic merit, field of study, and more.

To see how much financial aid you can receive from the government, you can fill out the Free Application for Federal Student Aid (FAFSA) . In addition to federal aid, you can apply for grants, loans, tuition reimbursement programs, or scholarships. These options will all look different depending on your location, personal financial history, and employer.

There are also financial aid options that are specific to certain family situations, such as aid for military families or international students.

What Can You Do with a Doctorate Degree in Risk Management?

A doctorate in risk management can lead to a number of lucrative and growing careers. Many risk management graduates go on to accept roles as financial managers, actuaries, or market research analysts.

Professionals in this sector combine their financial and regulation knowledge with their management and communication skills to help companies identify and manage potential risks. A doctoral program can also help you become well-versed in current research methods and tools. Professionals with a PhD often work in academia, typically as postsecondary teachers or researchers.

How Long Does It Take to Get a PhD in Risk Management Online?

A PhD is considered the highest degree one can earn, and a doctorate generally takes 3 to 5 years to complete with full-time enrollment.

How long it takes you to complete your online management degree can depend on the number of credit hours required by your program and the time it takes you to finish your dissertation. If there is no dissertation requirement in a doctoral program, it can generally be completed in 3 years with full-time study.

What’s the Difference Between a DBA vs. PhD in Risk Management?

A Doctor of Business Administration (DBA) and a Doctor of Philosophy (PhD) in Risk Management are both advanced degrees. A DBA is a professional doctorate, though, while a PhD is a research-based degree.

The doctoral path that’s right for you will likely depend on your professional goals.

Is a PhD in Risk Management Degree Worth It?

Yes, a PhD in Risk Management is worth it for many students. Many risk management careers are experiencing employment growth at a rate higher than the national average. For instance, postsecondary teachers, financial managers, and actuaries are expected to see 12%, 17%, and 24% job growth, respectively, over the next ten years (Bureau of Labor Statistics).

Additionally, risk management professionals have an impact on the security of the companies they work for, making them an essential part of an organization’s team. Not only do they identify potential risks, but they can work to eliminate future risks as well.

Getting Your PhD in Risk Management Online

Strong communication, financial acumen, and analytical skills are all essential for success in the field of risk management.

Earning your doctoral degree in risk management can help you improve and hone these skills while you study industry-specific knowledge and conduct original research. A doctoral degree can also help you advance your professional qualifications.

Just as they do with online masters in negotiation , a growing number of regionally accredited universities now offer risk management PhD programs both on campus and online. If you’re ready to enhance your expertise in this lucrative field, you can start exploring risk management doctoral programs today!

Departments

- Applied Physics

- Biomedical Engineering

- Center for Urban Science and Progress

- Chemical and Biomolecular Engineering

- Civil and Urban Engineering

- Computer Science and Engineering

- Electrical and Computer Engineering

Finance and Risk Engineering

- Mathematics

- Mechanical and Aerospace Engineering

- Technology, Culture and Society

- Technology Management and Innovation

Degrees & Programs

- Bachelor of Science

- Master of Science

- Doctor of Philosophy

- Digital Learning

- Certificate Programs

- NYU Tandon Bridge

- Undergraduate

- Records & Registration

- Digital Learning Services

- Teaching Innovation

- Explore NYU Tandon

- Year in Review

- Strategic Plan

- Diversity & Inclusion

News & Events

- Social Media

Looking for News or Events ?

If you’ve ever been drawn to a field that some people are calling “the rocket science of Wall Street,” Finance and Risk Engineering might be the course of study for you.

Latest News and Announcements

Columbia-nyu financial engineering colloquium brings emerging research to wider audience.

Stay up-to-date with department news whether on the go or at your desk. Follow FRE on Twitter , Instagram , LinkedIn , Facebook , and YouTube .

Financial Engineering, M.S.

With a dynamically changing global world, our program trains our financial engineers to adapt theoretical and financial constructs into profitable and innovative opportunities.

Undergraduate Minor in Finance

BS/MS Program in Financial Engineering

Current Students

Information about our grading policy, Capstone requirements, Transfer Admissions, Cross-Registration, and more.

Prospective Students

Pre-Program Boot Camp

Meet our Faculty and Staff

Peter Carr Brooklyn Quant Experience (BQE) Seminar Series

Columbia-NYU Financial Engineering Colloquium

Career Resources and Employment Stats

Hire Our Students

Research is at the heart of the Department of Finance and Risk Engineering’s activities.

Bloomberg Lab

FRE Department News

News highlights for the Department of Finance and Risk Engineering

Event Highlights

Events held by the FRE Department that supplement the learning experience for both current students and alumni.

Catching FiRE

The official newsletter of the NYU Tandon Department of Finance and Risk Engineering

Featured People

Nizar Touzi

Barry Blecherman

David Shimko

Agnes Tourin

Amine Mohamed Aboussalah

Latest Stories & Events

A longtime Financial and Risk Engineering professor celebrates the past but keeps his eyes fixed on the future

Meet Nizar Touzi, the new Chair of the Department of Finance and Risk Engineering

After an intensive summer boot camp, tandon’s fre students are ready to tackle the semester head-on.

Another win for Tandon financial trading teams!

Nyu tandon’s department of finance and risk engineering stays strong.

Florida State University

FSU | College of Business

College of Business

Ph.d. in business administration with a major in risk management and insurance, request information, deadline to apply.

Begin your application today by entering the Graduate Admissions Portal .

Submit your application by: January 15 – Application review begins and will continue until positions are filled. March 1 – Application submission deadline. All supporting materials must be received by March 15.

Contact Us

- Contact Dr. Patricia Born , program director, for more information on the RMI major, its content and curriculum.

- Email Elizabeth Kistner , Ph.D. graduate advising director, for more information about the admissions process.

Graduate Programs Office 850-644-6458 877-587-5540 (toll free) [email protected]

Join us for a virtual info session at 5:30 p.m., Wednesday, April 3!

Risk Management and Insurance is one of seven majors offered through FSU’s College of Business’ Ph.D. in Business Administration. Housed in the Dr. William T. Hold/The National Alliance Program in Risk Management and Insurance , the RMI major admits one candidate each fall (on average), and the program takes four to five years to complete.

- Offers faculty with research expertise in insurer operations, insurance market performance and regulation, catastrophe risk management and the economics of risk and uncertainty

- Includes primary courses covering the fundamentals of risk management/insurance and research courses in mathematical economics and applied quantitative methods

- Encourages support area studies in finance econometrics, real estate and statistics

- Includes two to three years of coursework culminating in a comprehensive exam, followed by two years of research and teaching, culminating with a dissertation

For an overview of FSU’s Ph.D. in Business Administration and its seven majors, download the brochure .

Student Accomplishments

East Carolina University; University of Akron; University of Connecticut; Illinois State University; Troy University

Courtney Bass, 2013-14 Spencer Educational Foundation Pre-Dissertation Award Jill Bisco, Best Student Paper Award, Southern Risk and Insurance Association Annual Meeting Dana Telljohann , 2022 Spencer Scholarship award recipient

Defended Dissertation

- "Value and Strategy: An Analysis of the Surplus Line Insurance Market" by Courtney Bass Baggett ; Dr. Cassandra Cole, major professor

- “The Role of Asymmetric Information in the U.S. Health Insurance Market,” by E. Tice Sirmans ; Dr. Patricia Born, major professor

Program Requirements

The RMI doctoral program emphasizes current research topics in Risk Management, Insurance Operations and Performance, Insurance Regulation, and Risk Theory. In addition, students are taught a variety of theoretical and empirical research methods and tools using statistics, econometrics, and mathematical economics.

Prerequisites

All Risk Management and Insurance Doctoral students must have completed undergraduate level courses in Calculus I, Calculus II, and Linear Algebra.

Major Requirements

All RMI doctoral students must complete courses in three areas: Tools for Analytical Research (TAR), Primary RMI and Support.

I. Tools for Analytical Research (TAR) Area

Students must take the following three courses:

- ECO 5403 Static Optimization

- ECO 5416 Econometrics I

- ECO 5423 Econometric Theory

Students must also take three additional quantitative courses in Statistics, or Economics numbered 5000 and above with the approval of the doctoral program adviser. Examples include:

- ECO 5424 Econometrics/Panel Data

- ECO 5427 Limited Dependent Variables

- STA 5440 Probability Theory

- STA 5206 Analysis of Variance

- STA 5207 Applied Regression Methods

RMI doctoral students are expected to have or acquire computer literacy through coursework or self-study

II. Primary RMI Coursework

The primary area courses and seminars provide opportunities for in-depth study. RMI doctoral students must take the following doctoral seminars and courses:

- RMI 6195 Seminar in Life and Health Insurance

- RMI 6296 Seminar in Property and Liability Insurance

- RMI 6395 Seminar in the Theory of Risk and Insurance

Students must take an additional three RMI elective courses approved by the doctoral adviser. Examples include RMI 5136 (Employee Benefit Plans), RMI 5345 (Risk Management in the Business Enterprise).

Students will take at least two additional doctoral-level economics courses that are not included in the Tools and Research area above. The two economics courses will be chosen in consultation with the program director. RMI doctoral students also are expected to have or acquire computer literacy through course work or self-study.

In addition to these courses, first-year and second-year students will participate in a professional development series that will be an additional registered course in each semester of the first two years of the program. The development series is designed to introduce doctoral students to the roles and responsibilities of faculty, including research ethics, communication with faculty at other universities, the research review process, balancing research, teaching and service, among other topics.

In addition to the regularly scheduled seminars, the RMI faculty and doctoral students meet periodically to share the results of recent research conducted by FSU faculty and doctoral students and by invited scholars from other universities. RMI doctoral students are required to attend these RMI brown bag seminars and invited lectures.

III. Support Area Coursework

RMI doctoral students typically choose a support area in Finance. The courses for this support area include:

- FIN 6804 Foundations of Financial Theory

- FIN 6809 Markets and Institutions

- FIN 6842 Empirical Methods

- FIN 6527 Seminar: Corporate Finance/Investments

Normally, three or four courses are required in the support area. In addition, at least two of the courses required in the support area cannot be used to satisfy other requirements. The support area is chosen in consultation with the RMI doctoral program adviser.

There is also a required research paper that must be completed by the end of the second year. The paper is directed by the RMI faculty and is designed to prepare the student for the dissertation and subsequent research.

Sample Course Sequence*

*Actual schedule subject to course offerings and availability.

Application Process

Admission decisions are made by the college’s Doctoral Admissions Committee and are based on a combination of factors, including prior academic record from accepted universities; GRE or Graduate Management Admission Test (GMAT) scores taken within the past five years; letters of recommendation; experience; record of accomplishments. Admission is competitive and focused on students with grade-point averages of 3.5 or higher and GMAT scores of at least 600 or GRE scores of at least 155 on each section of the revised GRE.

Application Checklist

- Login to admissions.fsu.edu/gradapp (applications will only be accepted through this portal).

- Begin your application by logging in with your FSUID or clicking the link to register to get one.

- Complete your online application form and submit.

- This will generate automated email sent to your references by our system to request that they submit a recommendation for you and answer a series of standardized questions.

- Submit your Statement of Purpose (2-3 pages).

- Submit a current resume or C.V.

- Pay the nonrefundable $30 application fee.

- Request that each college or university you have attended submit an official transcript to FSU (see below for email/address).

- Transcripts are considered official if they are sent directly to FSU (either through the U.S. mail or electronically) by your undergraduate or graduate institution.

- Request that official GMAT or GRE scores (and TOEFL/IELTS/PTE/DuoLingo/Cambridge C1 Advanced/Michigan Language, if applicable) be submitted to FSU (see below for email/address)

- Test scores will only be considered official if sent directly from the testing service. The code for ETS to send (GRE and TOEFL) scores to FSU is 5219. The code to send GMAT scores to FSU is PN8K567.

- An English proficiency exam score (TOEFL/IELTS/PTE) must be submitted for international applicants whose native language is not English or who have not received a college degree from an institution where the instruction is primarily in English.

Have transcripts and test scores sent to [email protected] or:

Graduate Admissions Office 222 S. Copeland St. 314 Westcott Building Florida State University Tallahassee, FL 32306-1410 USA

International Applicants

International applicants should visit gradschool.fsu.edu/admissions/international-admissions for information concerning financial responsibilities, degree equivalency, etc.

English Language Proficiency Exam International applicants whose native language is not English or who have not completed an undergraduate or graduate degree in an English-speaking country are required to take either the Test of English as a Foreign Language (TOEFL,) the International English Language Testing System (IELTS,) the Pearson Test of English (PTE,) Duolingo, Cambridge C1 Advanced Level, or Michigan Language Assessment and submit official test results in order to be admitted to Florida State University. The College of Business requires a minimum TOEFL score of 100 on the internet-based test, a minimum of 7.0 on the IELTS exam , or a minimum of 66 on the PTE , a minimum score of 120 on Duolingo , a minimum score of 180 on Cambridge C1 Advanced Level , or a minimum score of 55 on the Michigan Language Assessment taken within the past two (2) years.

Program Costs

Ph.D. students typically take 27-33 credit hours each year. Here are the estimated program costs for the 2023-2024 academic year:

- Florida residents: $479.32 (tuition plus fees) per credit hour. Total estimated program cost is $12,941.64 - $15,817.56 per year.

- Non-Florida residents: $1,110.72 (tuition plus fees) per credit hour. Total estimated program cost is $29,989.44 - $36,653.76 per year.

Note: These costs do not include required books, supplies for courses, or required health insurance. Costs are subject to change. Fees above do not include some per-term flat fees for FSUCard and facilities use. For a breakdown of on-campus student fees and their explanations, visit the university’s Tuition Rates page.

Residency Information

The doctoral program is a full-time program that lasts four to five years. Students should plan to live in the Tallahassee area year-round, including summers. Our program is not set up for individuals who wish to take courses part time or online.

Financial Assistance

The College of Business awards financial assistance to applicants based on academic criteria and performance. The goal of the college is to provide assistantships and/or fellowships to all of our admitted doctoral students, subject to overall enrollment and fiscal limitations. Most doctoral students who request funding, who maintain a satisfactory level of academic and work performance, and who are in residence receive financial assistance from the college. Annual stipends and supplementary assistance such as travel expenses for conference attendance will vary among cohorts and programs. Students who are not Florida residents should note that tuition waivers associated with assistantships only cover the out-of-state portion of their tuition for year one of the program. Out-of-state tuition waivers are generally not available for years two through five. Doctoral students on assistantship are supported for four full academic years, contingent upon satisfactory performance in the program. Eligibility for fifth-year support is considered for a student having made substantial progress toward placement at a research-oriented university. For a full list of Florida State University funding and awards, visit gradschool.fsu.edu . Applicants are strongly encouraged to submit all completed application materials before January 15 to be eligible for additional funding opportunities at the university level.

Awards/Scholarships

The College of Business awards financial assistance to applicants based on academic criteria and performance. There are various scholarships available for graduate students. Visit our graduate scholarships page to learn more.

(Applicants are strongly encouraged to submit all completed application materials before January 15 to be eligible for additional funding opportunities at the university level.)

- For a full list of Florida State University funding and awards, visit gradschool.fsu.edu

- For more information on Florida State University's research and research funding, visit research.fsu.edu

- For more information on Florida State University's graduate fellowships and awards, visit ogfa.fsu.edu

Risk Management Faculty

Directory College Calendar

For Faculty & Staff

Undergraduate Programs

Graduate programs .

Request Graduate Programs Info Contact the Webmaster

Address 821 Academic Way, Tallahassee, FL 32306-1110 | Phone 850-644-3090 | Fax 850-644-0915 Copyright © 2023, Florida State University - College of Business , All Rights Reserved. Accredited by AACSB International.

RMA/Wharton Advanced Risk Management Program

Program overview.

As the volatility and interdependencies of markets increase, senior executives must make organizational risk management a high priority. The RMA/Wharton Advanced Risk Management Program gives banking executives analytical frameworks, strategies, and resources to better measure, manage, and monitor risk at their organizations.

You also will use tools for modeling risk analysis, critical thinking, and risk scenario planning, while applying your knowledge to current issues facing your organization through risk evaluations to give you an enterprise view of risk. In between the two program weeks, you will examine a new area of risk in your organization, reporting findings to the class.

Academic Director Richard Herring describes the curriculum of the RMA/Wharton Advanced Risk Management Program .

Date, Location, & Fees

If you are unable to access the application form, please email Client Relations at [email protected] .

May 5 – 10, 2024 Philadelphia, PA and June 9 – 14, 2024 Philadelphia, PA $29,995

In Partnership With

Drag for more

Program Experience

Who should attend, testimonials, highlights and key outcomes.

In the RMA/Wharton Advanced Risk Management Program , you will:

- Network and interact with banking industry peers and renowned Wharton faculty

- Use tools for modeling risk analysis, critical thinking, and risk scenario planning

- Apply your knowledge to current issues facing your bank or financial institution through risk evaluations

Experience & Impact

In today’s global economy, the environment for risk has become much more complex. The RMA/Wharton Advanced Risk Management Program introduces the latest thinking around risk, including macroeconomic drivers, and equips you with the tools to evaluate your exposure.

Wharton faculty — led by Richard Herring, PhD, the author of more than 150 articles, monographs, and books on various topics in financial regulation, international banking, and international finance — apply their field-based research and the latest strategic insights to help you broaden your view the major drivers of risk, with a framework for measuring and monitoring it. Unique to the RMA/Wharton program is the integration of academic analytics, which provide the professional bankers who participate in the program with a theoretical foundation, along with the insights of star practitioners, who show how these ideas can be implemented.

Session topics include:

Risk management as a strategic competitive strength:

- Macroeconomic drivers of risk

- Distinctive features of regulated financial intermediaries and how the regulatory environment has evolved since the 2007–09 crisis

- The connection between corporate finance and managerial decision making and risk management

- The study of systemic risk and the unique challenges of being a financial intermediary in today’s interconnected world

The analytical framework for measuring, managing, and monitoring risk:

- Methods and issues in measuring risk exposure

- Modeling challenges and practices

- Scenario-based strategic planning

- Unique risk characteristics presented by derivatives and real estate assets

- Economic capital

The enterprise perspective, including culture, governance, and relationships with stakeholders:

- Peripheral vision and critical decision making

- Defining risk appetites

- Communicating risk profiles to both internal and external stakeholders

- Tension between economic capital and regulatory capital

- Enterprise risk management

Through highly interactive lectures, exercises, and case studies, both in the classroom and in smaller work groups, this deep dive into risk will help you be a more capable enterprise risk management leader within your financial institution.

Convince Your Supervisor

Here’s a justification letter you can edit and send to your supervisor to help you make the case for attending this Wharton program.

Due to our application review period, applications submitted after 12:00 p.m. ET on Friday for programs beginning the following Monday may not be processed in time to grant admission. Applicants will be contacted by a member of our Client Relations Team to discuss options for future programs and dates.

Participants are mid-level to senior executives in banking and banking-related industries with several years of experience, including:

- Chief Risk Officers

- Business-line Risk Managers

- Enterprise-wide and Operational Risk Managers

Firms that have sent executives to this program in the past include:

- BBVA Compass

- Capital One

- Discover Financial

- First Republic

- Morgan Stanley

- TD Ameritrade

Fluency in English, written and spoken, is required for participation in Wharton Executive Education programs unless otherwise indicated.

Plan Your Stay

This program is held at the Steinberg Conference Center located on the University of Pennsylvania campus in Philadelphia. Meals and accommodations are included in the program fees. Learn more about planning your stay at Wharton’s Philadelphia campus .

Group Enrollment

Banks sending four participants will receive a 10% discount on each enrollment. Please note that all four participants must register for the program at the same time. Please contact the Wharton Client Relations Team at +1.215.898.1776 or [email protected] , for more details.

Richard Herring, PhD See Faculty Bio

Academic Director

Jacob Safra Professor of International Banking; Professor of Finance, The Wharton School

Research Interests: International banking, international finance, money and banking

Peter Conti-Brown, PhD See Faculty Bio

Class of 1965 Associate Professor of Financial Regulation, Associate Professor of Legal Studies & Business Ethics, The Wharton School

Research Interests: Central banking, financial history, financial regulation, fiscal crises, political history, public finance, the Federal Reserve

Mauro Guillén, PhD See Faculty Bio

William H. Wurster Professor of Multinational Management; Vice Dean, MBA Program for Executives, The Wharton School

Research Interests: Globalization, international political economy, multinational management

Ethan Mollick, PhD See Faculty Bio

Ralph J. Roberts Distinguished Faculty Scholar; Associate Professor of Management; Academic Director, Wharton Interactive, The Wharton School

Research Interests: Innovation, entrepreneurship, crowdfunding, games, AI

Todd Sinai, PhD See Faculty Bio

David B. Ford Professor; Professor of Real Estate; Professor of Business Economics and Public Policy; Chairperson, Real Estate Department, The Wharton School

Research Interests: Commercial real estate and real estate investment trusts, real estate and public economics, risk and pricing in housing markets, taxation of real estate and capital gains

Robert Stine, PhD See Faculty Bio

Professor Emeritus of Statistics, The Wharton School

Research Interests: Credit scoring, model selection, pattern recognition and classification, forecasting

What initially attracted me to the program was the breadth of topics covered together with the opportunity to learn from the experiences of other banks, especially in North America. Having completed the program, I could not recommend it more highly — it easily surpassed my expectations. The program content served not only as a timely reminder of core risk management fundamentals but was also rich with practical insights born out of the experiences of practitioners. The content was delivered by a superb mix of academic and C-suite executives which blended to create a wonderful learning experience in terms of how to apply what we were learning in practice. Another impressive element of the program was the engagement within the class, which resulted in many insightful conversations which continued long after the allotted time of the session! The dialogue drew not only on the theory but also, and more importantly, on the hands-on, lived experience from participants. It was this “compare and contrast’ that really produced enormous value and insights. If you are thinking about the Advanced Risk Management program, I would say you should have no hesitation. In my own case not only did I learn a lot but I have made very good friends and a network that I know will support me throughout my career. "

John Kelly Group Head of Risk Management, AIB (Ireland)

Antoine Avril Vice President and Chief Credit Officer, Desjardins Group

I was recommended to attend the RMA/Wharton Advanced Risk Management Program by Mr. Ed Schreiber. I met Ed when I was president and CEO of a small minority depository institution headquartered in Houston, Texas. My small community bank was undergoing an amazing transformation and he was assisting me in addressing my staffing and training challenges. At that time, he strongly suggested that I attend this RMA program because he believed it would round out my experience and provide me with the blueprint needed in leading a banking institution. And he was right! This RMA program has provided me with all the tools and access to resources I need to be successful. The staff, academic directors, and the program team made me feel welcomed and valued. But more important, they facilitated a program that addressed risk in a very comprehensive and strategic way. And all the instructors were outstanding! I came into the program feeling a bit insecure and out of my league with my class of highly experienced and seasoned chief risk officers and managers from many of the top 10 banks from around the world — but ended with a new network of amazing colleagues that will be my lasting friends. The highlight of this program for me was preparing and delivering our Bridge Project. Our differences became our strengths. It was amazing! As I embark on my new journey of creating a new de novo minority depository institution, I will use each risk model to guide how I manage my institution. This Advanced Risk Program is not limited to risk officers only. I highly recommend and strongly encourage bank executives leading small community and MDI banks attend this program. You will not be disappointed!"

Laurie Vignaud CEO, ViZ Bank

I head the team of credit adjudication and portfolio management at the National Bank of Canada. I took the RMA/Wharton Advanced Risk Management program to broaden my horizons. I had a strong credit background but not as much exposure to the entire suite of risks present in a large bank (operational, market, compliance, reputational, cyber, emerging risks, etc.) The program was excellent. It was really about opening your eyes on different practices and angles, to give you a more holistic view of risks. The length of time and the intensity of the course were perfect for an executive. The assignments between the sessions, and the relationships you could create with people, were just stellar. The learnings were actionable and I had a ton of ideas about things that I could really apply or improve upon at my bank. Another key takeaway was the quality of the faculty. I appreciated the mix of academia and real-life practitioners; it was the best of both worlds. I particularly enjoyed Professor Dick Herring’s presentation about what happened in 2007-2008, which gave a general understanding of the mechanics of what can go wrong. That’s what we have applied in our team to think about detecting patterns in our own bank. There can be “unknown unknowns,” questions I did not even know to ask. The program made me better at asking the right questions. The course gave me many industry contacts. It was a very diverse group geographically, in the types of risk in which people operate, and the types of financial institutions. This yielded really unique perspectives. The way you interact with the other participants, and the questions that they ask in class—especially deep domain experts in a certain risk that you’re not absolutely familiar with—to academia members who are also deep experts in that risk, brings you an exponential level of learning. I would give the program a ten out of ten. It was above expectations.”

Jean-Sébastien Grisé Vice President, Credit Risk, Commercial, Retail and Wealth Management, National Bank of Canada, Montreal, Canada

I enrolled in the RMA/Wharton Advanced Risk Management Program hoping to broaden and deepen my perspectives on the practice of risk management. I’d developed my career in a singular risk discipline and wanted to have some insights on the other risk types. The program was a great overall experience. The quality of the instruction was first-class and the facilities are outstanding. Some highlights for me were working with Professor Bob Stine, who simplified some pretty complex issues around model development, model risk, the statistics of risk management, and thinking about how we can employ those ideas in our businesses. Coming from my background that was still a new science for me, so it was great to get that perspective. I also enjoyed hearing from Professor Mauro Guillen on global macro trends. That was a great presentation with important insights about looking beyond today and thinking about emerging risks and evolving trends. The program elevated the practice of risk management in a way that I think positions me to help my organization deal with new challenges in the financial services industry. I can better serve my company’s stakeholders as we deal with the pace of change. I really appreciated the opportunity to engage with the other professionals. I’ve been to other seminars and discussions, but at Wharton we had a really candid and open group, all willing to share ideas and concerns. I think those relationships are of incalculable value over and above the education. For me it was one of the great takeaways from the experience. I would recommend the program highly. I definitely see an opportunity to identify the right kind of talent within our risk management organization and sponsor them into the program for the lessons that they could learn, contacts they could make in the industry, and to help them understand the broader practice of risk management.”

Eric Ensmann Director of Enterprise Risk Management, BBVA Compass

As head of operational risk management for a U.S. bank, I’m responsible for making sure that our bank has implemented our operational risk management framework. We work with all of our respective business lines to make sure that they understand their key processes, risks, and controls, and that key controls are designed and operating effectively. The RMA/Wharton Advanced Risk Management Program broadened my knowledge beyond just operational risk. The course includes all the different risk disciplines, from operational risk, retail and commercial credit risk to market and liquidity risks. It was a great curriculum, and the Wharton faculty and the presenters were exceptional. I particularly enjoyed the enterprise risk management section. Also, the fact that this program brings in industry leaders is a big benefit. It’s not a 100% academic; we’re actually getting real perspectives from different business leaders coming in. The professors had great presentation styles. Even in an intensive program where it’s hard to sit still all day, I never found myself looking at my watch, because I was so engaged. The whole class was very engaged as well. The expertise of my classmates as well as the presenters made for an overall wonderful experience. Another benefit is the contacts that you make in the program. These are people I can reach out to now because we’ve built that relationship. I can say, I’m dealing with this type of issue; how have you dealt with it at your institution? What I really took away from the course is that operational risk is embedded in all the different disciplines that we talked about. So whether we’re talking about market risk, commercial credit, retail credit, third party, whatever it may be, it was all relevant to me. Having a better understanding of those areas allows me to be a better operational risk professional. I can now better interact with those areas at my own institution. I also appreciated the facilities and the amenities of the program, and enjoyed the vibe of being on Wharton’s campus in May when school was still in session. I would recommend the program 100 percent. I thought it was fantastic!”

Christopher Nestore Head of Operational Risk Management, TD Bank

The participants were a good mix of people from different types of institutions — I also liked that the program was held over two separate weeks so you have an opportunity to get to know people and reflect on course content at home before coming back to the classroom. There were two types of lectures that were really outstanding — one was star academic lectures on topics such as global risk the first week and ethics and strategic thinking the second week. The Wharton faculty really knew their subject matter and had applicable experience as well as being really engaging lecturers who connected with the audience. The other standout lectures were by colleagues from different financial institutions. Two that stick in my mind were the CRO from one of the major Canadian banks, covering risk appetite, and a board director of a major international bank who shared insight on the expectations and perspectives from the board and board risk committee. Since the financial crisis of 2007 and more recently Brexit in the UK, there is heightened uncertainty in how the economy might turn. Wharton’s program was very helpful in providing me with specific insights and an appreciation for common topics and current challenges in the industry, including how regulation works in different jurisdictions. Having that perspective means when I am talking to the chief executive or other directors in my organization, I’ve got a greater understanding of how a risk issue fits not only within our organization but also in a wider context. This is a premium program that I would recommend to the right person at the right stage in their career. It’s not often you get that time to really engage with the wide range of risk management issues this program addresses. I would absolutely recommend it to senior colleagues who are thinking about how to lift their career up a step and contribute more strategic insights to their organization.”

James Tebboth Chief Credit Officer, Nationwide, UK

Dennis Winkel Chief Risk Officer, Exchange Bank of Canada

With the cost of executive search fees reaching upwards of $300,000, effective retention tools represent a solid investment strategy. One of the most powerful tools for retaining top performers is to send them to the RMA/Wharton Advanced Risk Management Program . In fact, I’ve already sent 13 executives to the program. This program gives me a tremendous development and retention tool. By sending our executives through the program, we’re making a commitment to our employees about their personal and professional development. It also delivers impressive ROI in terms of building depth and experience on our team. We have realized significant savings by staffing senior positions from within the company. It is a world-class program that balances the quantitative with the qualitative, the theoretical with the practical.”

Tom Whitford Executive vice president, PNC Financial Services

Download the program schedule , including session details and format.

Hotel Information

This program consists of two non-consecutive sessions. Both sessions are required for completion.

Fees for the on-campus program include accommodations and meals. Prices are subject to change.

Read our COVID-19 Safety Policy »

International Travel Information »

Plan Your Stay »

Related Programs

- Mergers and Acquisitions

- The CFO: Becoming a Strategic Partner

For more information on The Risk Management Association , please contact Amanda Good, Senior Manager, Academic Programs: [email protected]

+1.215.898.1776

Still considering your options? View programs within Finance and Wealth Management , Industry Association Programs or:

Find a new program

Financial Risk Management MSc

London, Bloomsbury

Finance is driven by technology. Becoming an expert in both will enable you to thrive in risk management roles in the financial sector. The Financial Risk Management MSc brings together traditional theories in finance, data analytics, quantitative and computational modelling techniques – designed to produce talented practitioners in this field.

UK tuition fees (2024/25)

Overseas tuition fees (2024/25), programme starts, applications accepted.

Applications closed

Applications open

- Entry requirements

A minimum of an upper second-class UK Bachelor's degree (or an international qualification of an equivalent standard) in a relevant discipline with a strong quantitative component evidenced by good performance in mathematics and statistics examinations. Good performance is defined as scores in these subjects not falling below a UK upper second-class or international equivalent level. There is not an exhaustive list of relevant disciplines, but individuals with a background mathematics, statistics, physics, computer science, engineering, economics, or finance are encouraged to apply.

The English language level for this programme is: Level 2

UCL Pre-Master's and Pre-sessional English courses are for international students who are aiming to study for a postgraduate degree at UCL. The courses will develop your academic English and academic skills required to succeed at postgraduate level.

Further information can be found on our English language requirements page.

This programme is suitable for international students on a Student visa – study must be full-time, face-to-face, starting September.

Equivalent qualifications

Country-specific information, including details of when UCL representatives are visiting your part of the world, can be obtained from the International Students website .

International applicants can find out the equivalent qualification for their country by selecting from the list below. Please note that the equivalency will correspond to the broad UK degree classification stated on this page (e.g. upper second-class). Where a specific overall percentage is required in the UK qualification, the international equivalency will be higher than that stated below. Please contact Graduate Admissions should you require further advice.

About this degree

A distinctive finance programme taught from a computer science perspective, the Financial Risk Management MSc enables you to become an expert in computing, mathematics, and technology to manage and predict financial risk.

You will experience an innovative programme that blends core financial concepts with opportunities to place yourself at the cutting edge of computational techniques and technology, through topics such as machine learning, algorithmic trading and blockchain technologies.

Throughout this programme, you will learn from renowned lecturers who also undertake research or are practitioners in the finance industry. You will gain a core understanding of market risk, credit risk, operational risk, systemic risk, and financial engineering, complemented by topics that range from market microstructure to probability, stochastic processes, and data-driven modelling. As well as this, you will combine knowledge about how the financial system works with computational techniques.

You will undertake a substantial project as the culmination of your programme, bringing opportunities to work with an industry partner on a real-world problem, or to embark on an academic project supervised by one of our leading academics.

This programme gives you key skills to become a professional in financial markets and related technical aspects, while you immerse yourself in London life and the benefits of living in a global financial centre.

Who this course is for

The programme is aimed at students with a first degree in mathematics, finance, economics, physics, or computing who wish to gain the skills necessary to work within quantitative risk management. You will be expected to have established competency in probability, statistics, differential equations and the use of a computer to solve numerical problems.

What this course will give you

UCL is ranked 9th globally in the latest QS World University Rankings (2024) , giving you an exciting opportunity to study at one of the world’s best universities.

UCL Computer Science is recognised as a world leader in teaching and research. The department was ranked 1st in England and 2nd in the UK for research power in Computer Science and Informatics in the UK's most recent Research Excellence Framework ( REF2021 ). You will learn from leading academic experts at the forefront of computer science innovation.

This finance programme is distinct as it is based in a computer science department. You will learn about how financial systems work, while keeping up with the latest technologies and computational techniques use by the financial sector.

The programme team takes a data-driven approach to our subject, enjoy the challenge and opportunity of entrepreneurial partnerships, and place a high value on our extensive range of industrial collaborations. You will have opportunities to get hands-on experience working on real-world projects with leading industry partners through the Department’s Industry Exchange Network (IXN) .

London is a global financial centre and technology hub, so you will benefit from proximity to top technology and finance companies, entrepreneurial projects and practitioners in central London.

The foundation of your career

Graduates from this programme have pursued careers in the accountancy and financial services sectors. Others have gone into banking and investment, IT, technology and telecoms, publishing, journalism and translation, consultancy, logistics and distribution.

Employers include Credit Suisse, Deutsche Bank, Bloomberg, China Development Bank, Deloitte, Ernst & Young, Google, JP Morgan Chase, Moody’s Analytics, People’s Bank of China, PriceWaterhouseCoopers, Santander, Standard Chartered Bank and Royal Bank of Scotland.

Employability

A programme with exceptional relevance in the modern day, you will graduate from the Financial Risk Management MSc with expertise in how financial markets work, and with the mathematical and computational skills required for quantitative roles in the financial industry. This includes handling data, extracting information from data, and developing data driven models – including the know-how to validate and deploy them in international markets.

UCL is proud to support innovation and link our students and research directly to real-world business applications. From internships to solving complex problems with commercial partners, UCL Engineering has a collaborative, innovative spirit at its core.

As a student and later as a graduate, you will have access to a UCL Engineering careers events programme, connecting you with employers and alumni. This programme provides invaluable insight into the reality of different roles, sectors, and current application processes.

Entrepreneurial minds thrive at UCL. For example, UCL’s IDEALondon was the first innovation centre led by a university in London, and incubates companies post-seed to reach technical and business milestones. Our academic and industrial networks provide a safe and supportive environment to grow a company.

Teaching and learning

The programme’s core curriculum is typically delivered through a combination of lectures, tutorials, and lab classes, as well as directed and self-directed learning supported by teaching materials and resources, published through each module’s online virtual learning environment. Each module employs a teaching strategy that aligns with and supports its intended learning outcomes.

You will be assessed through a range of methods across the programme, which will vary depending on any optional or elective module choices. The programme’s core curriculum is typically assessed by methods including coursework, lab work, individual and group projects, class tests, written examinations, oral assessments, and, in all cases, culminating in a final research project/dissertation.

Contact time takes various forms, including lectures, seminars, tutorials, project supervisions, demonstrations, practical classes and workshops, visits, placements, office hours (where staff are available for consultation), email, videoconferencing, or other media, and situations where feedback on assessed work is given (one-to-one or group).

Each module has a credit value that indicates the total notional learning hours a learner will spend to achieve its learning outcomes. One credit is typically considered equal to 10 hours of notional learning, which includes all contact time, self-directed study, and assessment.

The contact time for each of your 15 credit taught modules will typically include 22-30 hours of teaching activity over the term of its delivery, with the balance then comprised of self-directed learning and working on your assessments. You will have ongoing contact with teaching staff via each module’s online discussion forum, which is typically used for discussing and clarifying concepts or assessment matters and will have the opportunity to access additional support via regular office hours with module leaders and programme directors.

Your research project/dissertation module is 60 credits and will include regular contact with your project supervisor(s), who will guide and support you throughout your project. You will dedicate most of your time on this module to carrying out research in connection with your project and writing up your final report.

The MSc Financial Risk Management is a one-year programme.

In term 1, you will study topics that introduce you to the applied mathematical and computational aspects of quantitative finance, probability theory, stochastic processes and their applications, and key concepts and models of asset pricing, portfolio theory, and risk measurement. You will choose from a range of optional topics, which may include numerical methods, market microstructure, operational risk management, financial institutions and markets, and digital finance.

In term 2, you study topics that introduce you to the instruments used to analyse, characterise, validate, parametrise, and model complex financial datasets. You will choose from a range of optional topics, which may include algorithmic trading, applied computational finance, machine learning with applications in finance, networks and systemic risk, quantitative modelling of operational risk and insurance analytics, and blockchain technologies. You will also begin preparation for your final research project/dissertation.

In term 3, you will primarily focus on your final research project/dissertation and any examinations that take place in the main examination period.

Compulsory modules

Optional modules.

Please note that the list of modules given here is indicative. This information is published a long time in advance of enrolment and module content and availability are subject to change. Modules that are in use for the current academic year are linked for further information. Where no link is present, further information is not yet available.

Students undertake modules to the value of 180 credits. Upon successful completion of 180 credits, you will be awarded an MSc in Financial Risk Management.

Accessibility

Details of the accessibility of UCL buildings can be obtained from AccessAble accessable.co.uk . Further information can also be obtained from the UCL Student Support and Wellbeing team .

Online - Open day

Graduate Open Events: Department of Computer Science

Join us for a live online information session to hear from Computer Science staff. We will cover areas such as the general admission process, careers support, and industry links/placements. There will also be an opportunity for you to ask staff and current students any questions you may have. Two sessions will run for this event. These sessions are the same and are repeated to cater to people in different time zones.

Fees and funding

Fees for this course.

The tuition fees shown are for the year indicated above. Fees for subsequent years may increase or otherwise vary. Where the programme is offered on a flexible/modular basis, fees are charged pro-rata to the appropriate full-time Master's fee taken in an academic session. Further information on fee status, fee increases and the fee schedule can be viewed on the UCL Students website: ucl.ac.uk/students/fees .

Additional costs

All full-time students are required to pay a fee deposit of £2,000 for this programme. All part-time students are required to pay a fee deposit of £1,000.

Students will require a modern computer (PC or Mac) with minimum specifications 8GB RAM and 500GB SSD storage. A computer with the stated specifications is estimated to cost £500 or greater.

For more information on additional costs for prospective students please go to our estimated cost of essential expenditure at Accommodation and living costs .

Funding your studies

For a comprehensive list of the funding opportunities available at UCL, including funding relevant to your nationality, please visit the Scholarships and Funding website .

UCL East London Scholarship