Industry research with unrivaled coverage.

The industry analysis and forecasts you need to make strategic decisions, backed by data..

Every sector of the economy, at your fingertips

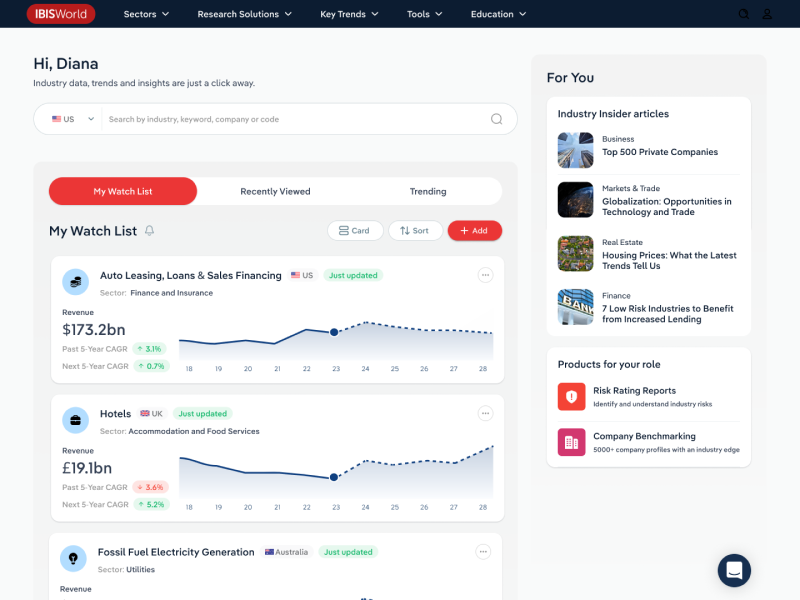

No more scrambling for credible information. Fill knowledge gaps instantly with the largest collection of industry research reports.

Manufacturing

Construction, finance & insurance, real estate, healthcare & social assistance services, administration & business support services, information, retail trade, transportation & warehousing, professional, scientific & technical services, agriculture, forestry, fishing & hunting, accommodation & food services, educational services, industry analysis with an eye on the future.

Learn what’s behind today’s industry trends and where your market is headed next so you can future-proof your business decisions.

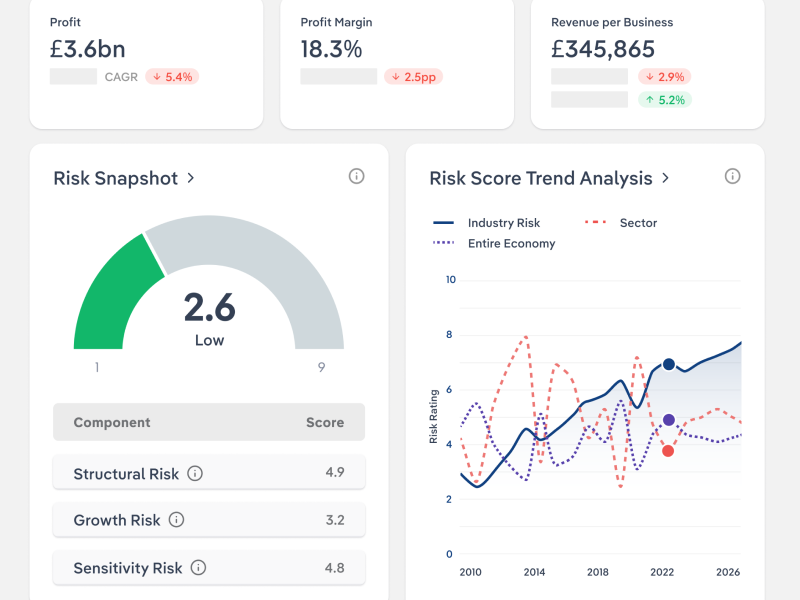

Mitigate risk with Industry research

Assess the industry from all sides to avoid blind spots and make smarter strategic decisions.

- check_circle_outline Leverage industry reports and risk ratings to mitigate the threats you can control and plan for the ones you can’t.

- check_circle_outline Compare industry financial ratios and benchmarks to help quantify the risk of doing business.

- check_circle_outline Identify opportunities and threats present in any industry to bolster your risk management frameworks.

Find your competitive edge

Discover the forces working for or against you in any industry to help you rise above the competition.

- check_circle_outline Understand which companies compete in the industry and the barriers to entry new businesses face.

- check_circle_outline Uncover geographic nuances and opportunities using business concentration and global trade data.

- check_circle_outline Ready your talking points with accessible key takeaways and call prep questions.

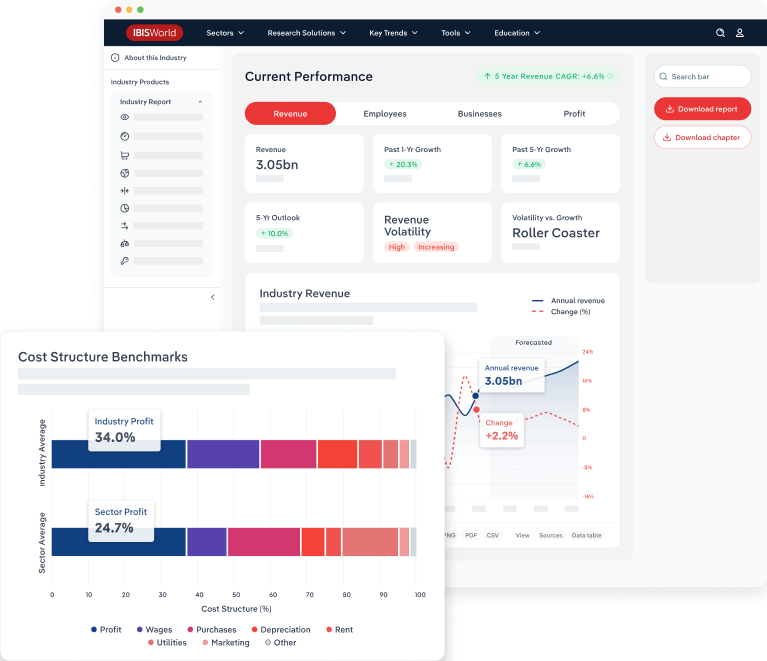

Understand market dynamics

Turn days of research into hours or minutes using actionable industry insights that paint a holistic picture of the market.

- check_circle_outline Discover the driving forces behind supply, demand, market size, risks and revenue trends.

- check_circle_outline Understand the growth trajectory of any industry with five-year data forecasts.

- check_circle_outline Present industry statistics, pain points and key success factors to help you gain credibility with your audience.

Need a closer look? Download a sample report?

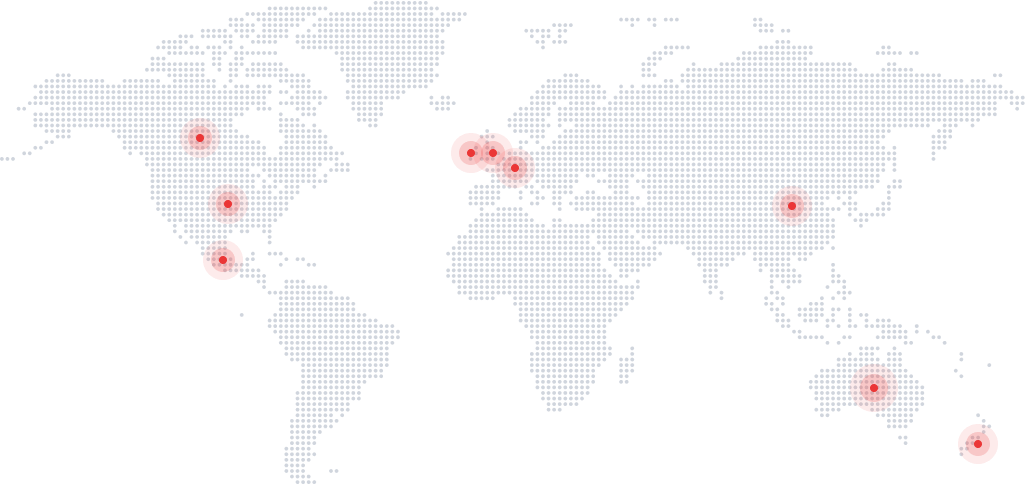

Global coverage written by local analysts.

Streamline your research process with industry reports covering everything from established sectors to emerging markets across four continents.

Trusted by 7,000+ companies around the world

Independent, accurate and written by experienced analysts. Our industry analysis, company database and economic insights support businesses of all sizes, across all markets.

“IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating people on industry issues, IBISWorld brings real value.”

“IBISWorld has revolutionised business information - which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.”

“You could spend hours researching for the information that IBISWorld has at your fingertips. IBISWorld gives you far more than most resources do.”

Want industry statistics and news delivered to your inbox monthly?

IMAGES

VIDEO

COMMENTS

WEBDiscover the driving forces behind supply, demand, market size, risks and revenue trends. Understand the growth trajectory of any industry with five-year data forecasts. Present industry statistics, pain points and key success factors to …