Get Profressional help with your Academic Papers

We are an academic writing agency offering professional writing services to students all over the world

Timely Delivery

All our papers are written and delivered on time within client deadlines

High Quality Papers

We provide high-quality papers to all college students to guarantee top grades

Money-Back Guarantee

We offer a 100% money back guarantee for all unsatisfactory work delivered

Experienced Writers

Our writers are experienced to provide solutions for all kind of writings.

Affordable Prices

Choose your perfect pricing plan

Disciplines

We cover a wide range of disciplines to help you handle any topic.

High-Quality Papers

We have written 50,000+ custom papers with an average satisfaction score of 9.6 out of 10. Now, we have the academic writing industry down pat and are able to provide our customers with first-rate papers. The authenticity of our custom writing is ensured. All of our papers have a one-time value and are used solely for students’ personal purposes. We never reuse any part of previously-written academic assignments and always double-check them for plagiarism.

Professional Writers

We write fresh, unique and premium quality academic papers just for you. Our professional academic experts write for in a wide range of subjects. We have a crack team of professional academic and business writers with years of experience in crafting college and graduate papers. We only write from scratch. On top of that, we scan each paper for referencing mistakes and attach a plagiarism report. No third party associations.

Frequently Asked Questions

- Meet the Team

- Fractional CFO Service

- Testimonials

16 Best Bookkeeping Books to Read in 2023

You found our list of bookkeeping books !

Bookkeeping books are manuals that explain the principles of bookkeeping. These books serve as instructional guides for bookkeepers or small business owners who need to keep track of their business transactions. Examples include Bookkeeping for Dummies by Lita Epstein, Mastering QuickBooks by Crystalynn Shelton, CPA, and Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small Business by Mark Smith. In addition, these books contain terminology and examples of how to set up accounts, which are helpful for new bookkeepers just getting started and experienced bookkeepers encountering unexpected situations.

These books are similar to accounting books , payroll books and tax books .

- bookkeeping books for beginners

- bookkeeping books for small businesses

- bookkeeping business books

- bookkeeping training books

Here is the list!

List of bookkeeping books

Whether you are a business owner setting up your accounts for the first time or a bookkeeper searching for a solution to an unexpected problem, these bookkeeping books can provide helpful answers.

1. Bookkeeping For Dummies by Lita Epstein

For amateur bookkeepers, Bookkeeping for Dummies by Lita Epstein takes a simplified approach to explaining crucial bookkeeping concepts. Business owners looking to handle their own bookkeeping tasks will find clear instructions for setting up ledgers and journals and examples of how to prepare vital reports and manage taxes. Each chapter breaks down the requirements for small business record-keeping and includes screenshots and sample spreadsheets for visual guidance. There are helpful suggestions for better management of your company’s cash through effective bookkeeping. With simple explanations and clear examples, Bookkeeping For Dummies is one of the more helpful bookkeeping books for beginners to add to their collections.

Buy Bookkeeping for Dummies .

2. QuickBooks Online for Beginners by Thomas Newton

QuickBooks is essential bookkeeping software, but understanding how it works can be tricky. QuickBooks Online for Beginners by Thomas Newton takes the guesswork out of this helpful program by providing a step-by-step guide for setting up your own customized QuickBooks bookkeeping system. Adding bookkeeping to the list of business tasks can complicate a business owner’s life. This book attempts to simplify the process and is one of the more essential bookkeeping books for small businesses. References include a helpful how-to list with instructions for crucial tasks, such as connecting your bank accounts to QuickBooks and setting up your payroll. There are even instructions for correcting common mistakes in the day-to-day processing of your bookkeeping entries.

Buy QuickBooks Online for Beginners .

3. Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small Business by Mark Smith

Business owners without a financial background often struggle to grasp bookkeeping and accounting concepts. In this detailed guide, author Mark Smith explains important topics in easy-to-understand language. One of the more critical topics the author covers is the double-entry accounting method. This method keeps accounts in balance by pairing every debit entry in one account with a corresponding credit entry in an offsetting account. Readers can also learn how to handle assets, liabilities, and owner’s equity. In addition, the author explains the need to keep source documents to support account entries, a vital practice even for businesses using electronic bookkeeping systems. The book also details crucial month-end and year-end processes for clean and accurate closing of the books.

Buy Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small Business .

4. Beyond Bookkeeping: How to Partner with Your Clients, Add Tremendous Value, and Build a Profitable Business That Matters by Lisa Campbell

If you are searching for bookkeeping business books that can help advance your business, then this insightful title will provide guidance for using your knowledge to take your company to the next level. Author Lisa Campbell shares her secrets for partnering with small business clients to help their companies become more successful. You can learn to position yourself for success by becoming an advisor to your clients. The author explains how systemizing your work to make bookkeeping functions flow smoother can make you more efficient and improve the customer experience. There are also explanations of how specialized knowledge of cash flow can position you as a valuable resource for clients hoping to gain better control over their company’s finances.

Buy Beyond Bookkeeping: How to Partner with Your Clients, Add Tremendous Value, and Build a Profitable Business That Matters .

5. Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting Principles by Robert McCarthy

Business owners wondering about the difference between bookkeeping and accounting can consult Bookkeeping by Robert McCarthy. The author understands the complexity of maintaining financial records in a modern business setting. Small businesses can use the author’s knowledge and save money by bringing their bookkeeping in-house. The book includes comparisons of manual versus computerized bookkeeping, a guide for setting up your bookkeeping system, and explanations of crucial reports such as income statements and balance sheets. In addition, a helpful appendix provides a list of standard bookkeeping and accounting terminology for on-the-job reference.

Buy Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting Principles .

6. Xero: A Comprehensive Guide for Accountants and Bookkeepers by Amanda Aguillard

Xero is a popular online accounting software that allows businesses cloud-based tracking of transactions. Bookkeepers using the U.S. version of Xero can learn how to set up accounts and record transactions in Amanda Aguillard’s handy guide. You can also explore basic bookkeeping functions and read through the author’s recommended best practices to help you maximize Xero’s capabilities. If your company uses other cloud-based business software, then you can learn how to integrate those programs with your Xero setup. This book also includes helpful templates for invoices, bills, and vital financial reports.

Buy Xero: A Comprehensive Guide for Accountants and Bookkeepers

7. Nonprofit Bookkeeping and Accounting For Dummies by Sharon Farris

Nonprofit Bookkeeping and Accounting For Dummie s by Sharon Farris takes a dedicated approach to bookkeeping procedures specific to nonprofit-based companies. Bookkeepers can learn to plan budgets and create payroll accounts to make tax reporting a cinch. The author lists what to do and what not to do when handling grant money, including specific instructions for applying for grants and best practices for filing IRS 990 forms. Helpful tips regarding what you should do during a tax audit will take the guesswork out of the process, a handy resource should your nonprofit undergo an audit.

Buy Nonprofit Bookkeeping and Accounting For Dummies .

8. Mastering QuickBooks by Crystalynn Shelton, CPA

When you understand how to use QuickBooks to the best of its capabilities, you can rest assured that your books are accurate and complete. Mastering QuickBooks by Crystalynn Shelton, CPA, helps you gain the expertise needed to maintain control of your business’s finances. As a CPA and Advanced Certified QuickBooks ProAdvisor, author Shelton lends her expertise to help set up and maintain your accounts. With a focus on the online version of the software, even experienced QuickBooks users will find helpful information on advanced concepts and functions. As a bonus, the Kindle version of the book includes helpful links that provide quick and easy access to the necessary websites for getting your accounts up and running, entering transactions, and producing reports.

Buy Mastering QuickBooks .

9. Bookkeeping Made Simple: A Practical, Easy-to-Use Guide to the Basics of Financial Management by David A. Flannery

Bookkeeping Made Simple is the helping hand new bookkeepers need. The author follows a complete accounting cycle and explains bookkeeping terminology to clarify the main concepts. For example, readers can learn about cash control and how to prepare statements in a chapter layout that follows the accounting period from start to finish. Valuable advanced concepts such as depreciation and calculating interest appear in later chapters. These more complex accounting functions can make it easier for bookkeepers to expand their skills as their business grows.

Buy Bookkeeping Made Simple: A Practical, Easy-to-Use Guide to the Basics of Financial Management .

10. Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit Accounting by Murray Dropkin and James Halpin

Bookkeeping for Nonprofits explains concepts specific to nonprofit organizations. Topics range from entering transactions accurately to how bookkeeping and accounting overlap. Illustrations and checklists let readers make sure they understand key concepts. With easy-to-understand language and in-depth explanations of all necessary bookkeeping functions, this guide assists with day-to-day financial tasks that will help nonprofit leaders make essential budgeting decisions to guide their organizations toward success.

Buy Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit Accounting .

11. Master Intuit QuickBooks Online: From Setup to Tax Time by Alicia Katz Pollack

The online version of QuickBooks uses the power of the cloud to keep small businesses up to date with their bookkeeping work. In Master Intuit QuickBooks Online , readers can get guidance regarding tools and menus they will encounter when using the program. The author gives a rundown of the most common mistakes bookkeepers encounter and explains solutions to help users avoid similar errors. The best practices and procedures described in these pages come from real-world experience, providing important insight into situations users are likely to encounter.

Buy Master Intuit QuickBooks Online: From Setup to Tax Time.

12. Xero for Dummies by Heather Smith

This manual on popular bookkeeping software is the only book endorsed by Xero, which makes it an excellent choice for new users. Author Heather Smith simplifies setup and maintenance on Xero-based accounts. You can find instructions for converting to Xero from other software and importing existing data for the initial setup. Bookkeepers can learn basic tasks like setting up accounts, running reports, and utilizing templates for easier email communication. Chapters covering fixed assets and multi-currency transactions help clarify more complex topics. You can even find explanations of reporting to various international tax authorities and keep an updated overview of your financial position.

Buy Xero for Dummies .

13. Bookkeeping Essentials: How to Succeed as a Bookkeeper by Steven M. Bragg

In Bookkeeping Essentials , author Steven M. Bragg offers a textbook-style reference guide for new and experienced bookkeepers. Early chapters provide concise definitions for concepts such as balance sheets, accounting cycles, and accrual accounting methods. By including helpful charts and concrete examples of various transactions, the author provides visual aids to help the reader to understand how to process their entries. A useful index in the back of the book simplifies your search for crucial subjects as new transactions arise, making this title a great ongoing resource for bookkeepers to include in their collection of bookkeeping training books.

Buy Bookkeeping Essentials: How to Succeed as a Bookkeeper .

14. 475 Tax Deductions for Businesses and Self-Employed Individuals: An A-to-Z Guide to Hundreds of Tax Write-Offs by Bernard B. Kamoroff C.P.A.

Bookkeepers working for small businesses and self-employed workers can learn how to claim overlooked tax deductions with 475 Tax Deductions for Businesses and Self-Employed Individuals . Author Bernard B. Kamaroff explains the benefits of deducting every allowable penny can and helps identify a wide range of deductions you may not have realized the IRS permitted. Early chapters include definitions of key terms and explanations of the various types of deductions, making it easier to understand how to be strategic when preparing tax filings. The remainder of the book is a handy list of deductions that can help business owners and bookkeepers retain as much money as possible at tax time.

Buy 475 Tax Deductions for Businesses and Self-Employed Individuals: An A-to-Z Guide to Hundreds of Tax Write-Offs .

15. DIY Small Business Bookkeeping the Easy Way: Learn How to Master Financial Statements, P&L Statements, Cash Flow, Balance Sheets, Ledgers, Journals & More by Simon Lawrence

Author Simon Lawrence provides easy methods for bookkeepers and small business owners to keep track of their financial records. Lawrence explains the functions of bookkeepers and accountants and details why business owners should have bookkeeping and accounting knowledge even if hiring others to perform those services. Chapters include visual guides for helpful reference, along with tips and tricks to help make bookkeeping work easier. With in-depth examinations of financial statements and step-by-step instructions for creating and maintaining a budget, readers have a detailed yet comprehensible bookkeeping manual.

Buy DIY Small Business Bookkeeping the Easy Way: Learn How to Master Financial Statements, P&L Statements, Cash Flow, Balance Sheets, Ledgers, Journals & More .

16. Bookkeeping and Accounting for Beginners: 2 Books in 1: The Definitive Guide to Learn How to Organize and Grow your Small Business for 2020 Step-by-Step by Warren Piper Ruell

Bookkeeping and Accounting for Beginners combines two complete titles into a single book that gives readers a comprehensive overview of small business financial functions. Book One breaks down the bookkeeping process and provides an essential guide for setting up an accounting system. Book Two explores high-level topics such as the difference between cash and accrual accounting and highlights important accounting principles for bookkeepers and business owners to keep in mind. Both titles together provide an insightful guide that gives bookkeepers and business owners a manual for creating a bookkeeping system based on sound accounting principles.

Buy Bookkeeping and Accounting for Beginners: 2 Books in 1: The Definitive Guide to Learn How to Organize and Grow your Small Business for 2020 Step-by-Step .

Small business owners looking to tackle their bookkeeping work can find a selection of bookkeeping books that explain fundamental concepts and processes. If in-house bookkeepers are unfamiliar with bookkeeping software, then manuals focusing on mastering cloud-based and desktop programs can help with setup and ongoing maintenance. In addition, bookkeepers can learn advanced concepts from these books to help build their bookkeeping business or expand their clientele.

Next, check out this list of bookkeeping software and this one with accounting software .

We also have a list of the best tax preparation software and one with software for payroll .

Let Rigits help you

Grow confidently Sleep better at night

Get stuff off your plate

FAQ: Bookkeeping books

Here are answers to frequently asked questions about bookkeeping books.

What are bookkeeping books?

Bookkeeping books are guides that clarify the process of bookkeeping. Many of these guides include step-by-step instructions for setting up accounts and entering transactions. You can also find manuals focusing on the proper use of QuickBooks and Xero, the most common bookkeeping programs used by small business bookkeepers.

What are the best books on bookkeeping for a small business?

The best books on bookkeeping for a small business include QuickBooks Online for Beginners by Thomas Newton, which introduces new bookkeepers to necessary software, and Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small Business by Mark Smith, a guide that leads novice bookkeepers through the process of recording transactions and producing reports. For nonprofit organizations, Nonprofit Bookkeeping and Accounting For Dummies by Sharon Farris and Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit Accounting by Murray Dropkin and James Halpin contain helpful information and special instructions for filing taxes, and processing grant money.

What are good books on the basics of bookkeeping?

Some good books on the basics of bookkeeping are Bookkeeping For Dummies by Lita Epstein and Bookkeeping Made Simple by David A. Flannery. These titles explain bookkeeping fundamentals in simple language. The concepts covered range from account setup through year-end reporting, providing a comprehensive view of the bookkeeping process, and explaining how accounting and bookkeeping differ.

Author: Julia Kelly

Co-founder at Rigits

I write about how small business owners can better understand and utilize their financials for growth.

Julia Kelly

My OpenLearn Profile

Personalise your OpenLearn profile, save your favourite content and get recognition for your learning

About this free course

Become an ou student, download this course, share this free course.

Start this free course now. Just create an account and sign in. Enrol and complete the course for a free statement of participation or digital badge if available.

Acknowledgements

This free course was written by The Open University.

Except for third party materials and otherwise stated (see terms and conditions [ Tip: hold Ctrl and click a link to open it in a new tab. ( Hide tip ) ] ), this content is made available under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 Licence .

The material acknowledged below is Proprietary and used under licence (not subject to Creative Commons Licence). Grateful acknowledgement is made to the following sources for permission to reproduce material in this course:

Course image Jason Rogers in Flickr made available under Creative Commons Attribution 2.0 Licence .

Every effort has been made to contact copyright owners. If any have been inadvertently overlooked, the publishers will be pleased to make the necessary arrangements at the first opportunity.

Don't miss out

If reading this text has inspired you to learn more, you may be interested in joining the millions of people who discover our free learning resources and qualifications by visiting The Open University – www.open.edu/ openlearn/ free-courses .

This free course is adapted from a former Open University course called ' Introduction to bookkeeping and accounting (B190) '.

AI Summary to Minimize your effort

Bookkeeping in Accounting – Objectives, Types and Importance

Updated on : May 3rd, 2022

Bookkeeping means recording the financial transactions and information concerning the business of a company regularly. It is a systematic recording of financial transactions in a company. It ensures that the records of each financial transaction are up-to-date, correct and comprehensive.

The bookkeepers are individuals or entities who maintain the books of account of a company. They manage all the financial data of a company. The companies can track all their financial transactions on their books with accurate bookkeeping. Bookkeeping helps companies to make important investing, operating and financing decisions.

Connection Between Bookkeeping and Accounting

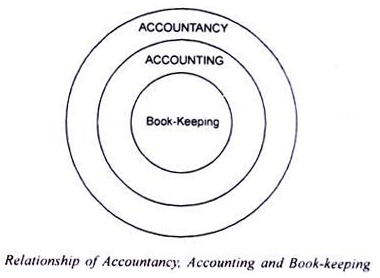

Bookkeeping is a separate process from accounting, which occurs within the broader scope of accounting. The accounts are prepared from the information provided by bookkeeping. A strong relationship between these two functions is necessary to take the business to the next level.

Bookkeeping is a segment of the whole accounting system. Bookkeeping is the basis for accounting as it contains the proper records of all financial transactions whereas, accounting involves organising, summarising, classification and reporting financial transactions.

If the bookkeeping is correct, the accounting of a company will be proper. Thus, accounting is broader than bookkeeping and accounting of a company relies on a proper and accurate bookkeeping system.

Bookkeeping helps to interpret the accounting information for decision making by both the internal and external users. Bookkeeping is a subset of accounting and clerical in nature which involves the following:

- Recording financial transactions

- Posting credits and debits

- Producing invoices

- Maintaining and balancing current account and general ledgers

- Completing payroll

Objectives of Bookkeeping

The objectives of bookkeeping are as follows:

To record the transactions

The first objective of bookkeeping is to maintain accurate and complete records of all financial transactions in an orderly manner. It systematically records all transactions and ensures that all financial transactions recorded are reflected in the books of accounts. These transactions can be used for future references.

To show the correct position

Bookkeeping helps to ascertain the overall impact of all financial transactions of a company. It reflects the financial effect of all business transactions that have taken place in a financial year. It provides financial information to the shareholders and management of the company, thus helping them formulate future policies and plans.

To detect errors and frauds

Bookkeeping helps to identify the transactions and summarise them chronologically in a systematic manner. It ensures that the books of accounts are correct, up-to-date, chronological and complete. Thus, it helps to detect any errors or frauds in the business.

Types of Bookkeeping System

There are two types of bookkeeping systems. The business entities can choose any one of the types of bookkeeping system. Some entities use a combination of both types. The following are the two types of bookkeeping system:

Single-entry system of bookkeeping

The single-entry system of bookkeeping is a basic system to record daily receipts or generate a weekly or daily report of a company’s cash flow. In the single-entry system of bookkeeping, the bookkeeper records one entry for each financial transaction or activity.

The single-entry system of bookkeeping involves recording only one side of the transaction or activity. It maintains only the purchases, cash receipts and payments and sales. It is used mainly by small businesses, which have minimal transactions.

Double-entry system of bookkeeping

The double-entry system of bookkeeping records a double entry for each financial activity or transaction. The double entry system provides balances and checks as it records the corresponding credit entry for every debit entry. It is not cash-based, and the transactions are entered when revenue is earned, or debt is incurred.

The double-entry system of bookkeeping is based on the duality concept, i.e. every financial transaction affects two accounts. It means that every debit entry to an account has a corresponding credit entry in another account and vice versa. This system is universally adopted and is considered accurate for recording business/financial transactions.

Importance of Bookkeeping

Bookkeeping is necessary for all businesses, irrespective of the size, nature, business transactions, or any specific industry. Upon the commencement of a business, maintaining proper records is essential. The following points state the importance of bookkeeping:

Records the source of transactions

Bookkeeping acts as a source of all the financial transactions of a business since it records all the financial transactions from the source of the transaction, like receipts, invoices, payment notes, etc.

Bookkeeping keeps track of payments, receipts, purchases, sales and records every transaction made from and by the business. The financial statements or other accounting reports of a business are summarised from their books of accounts. Thus, all businesses irrespective of their size, need to have proper bookkeeping in place.

Helps in decision making

A correct and proper bookkeeping process provides companies with an accurate measure of their performance. It also provides information for making general strategic decisions and a benchmark for its income and revenue goals. Bookkeeping is a reliable source for companies to measure their financial performance.

One of the main reasons for bookkeeping is maintaining all financial records of a business that shows the financial position of every head or account of income and expenditure. The companies can obtain detailed information about each income or expense instantaneously through bookkeeping.

Gives information to prepare financial statements

Bookkeeping summarises the expenditures, income and other ledger records periodically. Since bookkeeping records and tracks all financial transactions, it becomes the starting point of accounting. If the bookkeeping of a company is not proper, the accounting of the company will not be accurate.

Bookkeeping provides information to prepare financial reports, which states the specific information about the business on how much profits it has made or the worth of the business at a specific point in time.

Legal requirement

The maintenance of financial statements and books of accounts is a legal requirement under many acts. In the case of banks or companies or insurance companies, the acts that regulate them require such firms to maintain and keep financial records. Thus, bookkeeping becomes necessary for such companies.

About the Author

Mayashree Acharya

I am an advocate by profession and have a keen interest in writing. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. I put words in a simplified manner and write easy-to-understand articles. Read more

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Bookkeeping and Accounting and Financial Statements

Related Papers

Rahimi Karimi

Accounting information is a part and parcel of today's life which is necessary to understand the accurate financial situation of the organization and used as the basis of making strategic decisions. Since strategic decisions have long-term effect on the business and therefore it is important to analyze accounting information for making long-term strategic decisions. The present study is an endeavor to evaluate the usage of accounting information by the decision makers in practices in strategic decision areas. Five strategic decision areas such as basic strategic decision, manufacturing decision, human resource decision, long term investment decision and marketing decision were considered for the study. The results of the study prove that there is significant relationship between accounting information and strategic decisions and strategic decisions in all the selected areas significantly depend on accounting information and it is also observed from the analysis of the opinion of the respondents that 44.44% of the respondents always use accounting information in making strategic decision in manufacturing industries in Bangladesh. Abstract-Accounting information is a part and parcel of today's life which is necessary to understand the accurate financial situation of the organization and used as the basis of making strategic decisions. Since strategic decisions have long-term effect on the business and therefore it is important to analyze accounting information for making long-term strategic decisions. The present study is an endeavor to evaluate the usage of accounting information by the decision makers in practices in strategic decision areas. Five strategic decision areas such as basic strategic decision, manufacturing decision, human resource decision, long term investment decision and marketing decision were considered for the study. The results of the study prove that there is significant relationship between accounting information and strategic decisions and strategic decisions in all the selected areas significantly depend on accounting information and it is also observed from the analysis of the opinion of the respondents that 44.44% of the respondents always use accounting information in making strategic decision in manufacturing industries in Bangladesh.

Dewsun Riseon

Accounting: Accounting is the process of recording, classifying, summarizing, analyzing, interpreting and communicating the result of financial transactions. Features: Financial character: 1. Assets that can be evaluated in terms of money such as furniture purchased, computer purchased etc. 2. The things which cannot be evaluated in terms of money such as honesty, discipline which are non – financial character 3. Accounting keeps records of things that can be evaluated in terms of money. Continuous and dynamic process: 1. Accounting is the dynamic process and continuous process it is performed continuously. Based on principle/ assumption/ concept: 1. Accounting is based on the principles that are analyzed developed on the basis of assumption of past and conceptualized and developed. Ascertainment of profit and loss: 1. Accounting keeps record of every transaction of organization keeping record of them. Ascertainment of financial position: 1. Accounting helps in keeping record of every asset and liabilities of organization keeping record of them.

Abid Ariffin

PraiseGod Anglican Chapel Polynekede

UTILISATION OF FINANCIAL STATEMENTS IN MANAGEMENT OF MEDIUM SCALE ENTERPRISES CHAPTER ONE

Rafeal Noble

No business of any kind could succeed as a profit making organisation without utilising accounting as the basis for providing financial information to owners for economic decisions. According to Rommey and Steinbart (2012), accounting is the recording, classifying, interpreting, communicating and summarising of financial transactions or events in terms of money and reporting the results to management and other information users for decision purposes. Pandey (2005) stated that an accountant is a person who is specialised in book-keeping and the preparation of accounts and who is competent to analyse financial statements of the business. It is seen that the whole bulk of financial reports are in the hand of accountants and other qualified accounting personnel. Zhou (2010) maintained that management of medium scale enterprises, like any other category of business concern, requires financial statements which are the basic financial accounting information. The enterprise deals with financial transactions which involve receipts and payments of goods and services in terms of money. The management of medium scale enterprises involves effective and efficient utilisation of available financial information for the planning and control of the enterprise in order to achieve its objectives.

Akm Mahfuj Ullah

Accounting is the precise and thorough chronicle of monetary exchanges (transactions only, not events) pertaining to a business concern and it additionally alludes to the way toward identifying, summarizing, analyzing and hitting off these transactions to the concerned gatherings. Transparent accounting information consents commercial banks to come up with opportunity of striking business in location, resource attraction and uses as well as goodwill in the long run. Accounting information are some of a banking organization's most valuable assets. Accounting information is data/information about a business entity's transactions or that arises from business transactions (Laura Chapman, 2018). Transparent accounting information simply implies some significant qualitative characteristics like fundamental qualitative characteristics (relevance and faithful representation) and enhancing qualitative characteristics (comparability, timeliness, verifiability and understandability).The role of accounting information in everyday banking activities is extremely important for ensuring stability and consistency of bank management towards successful strategies that of course play a vital role to have a sound banking industry in a country. It is obviously significant that without exercising the main functions, consecrated by banking law, banks can't generate extremely useful accounting information for both clients and bank management. There are different users of bank accounting information like primary (internal) users (business owners/partners, managers and other employees in bank office) and secondary (external) users (clients, NBFCs, lenders, Government, tax authorities, insurance companies, other banks).Accounting information in bank activity can be gathered mainly from different bank accounts of its client, bank computerized programs where AIS plays a significant role and many other records and reports preserved and prepared by a bank itself. Bank operations can be classified into direct and indirect operations which detect the significance of accounting information in the transparent whole bank activity. These bank operations provide accounting information regarding the attraction and uses of bank capital. In this era of globalization every bank wants its identity and for this reason they fight ferociously for supremacy where only accounting information and the transparency of their accounting systems can lead banks to success that they want.

Igor Zdravkoski

laxmikant avhad

Accounting: "the fairest invention of the human mind." (Goethe) 2.1 Introduction As intimated by its title, this thesis proposes the inclusion of information on flexibility as a means of enhancing the accounting information systems of business organisations. However, the inclusion of such information would be incomplete without a prior discussion of the purpose of Accounting and its product, accounting information. In this chapter the nature and role of Accounting is considered and the classification of information as management accounting information and financial accounting information is discussed. The purpose of providing accounting information, as well as the qualitative characteristics of decision-useful information, is addressed. In the conclusion the users of accounting information are identified and their needs summarised. 2.2 The nature of Accounting Before the nature of Accounting can be addressed, the field of study must first be delineated. This entails an identification of the area of interest and of the borders of the discipline in relation to neighbouring disciplines. Thus a successful definition of Accounting should clearly delineate the boundaries of the discipline at a point in time, give a precise statement of its essential nature, and be flexible so that innovation and growth in the discipline can be accommodated. A number of definitions of Accounting have appeared in the literature, each attempting to demarcate its field of study. Developing a single definition of Accounting is however beset with difficulties. The first difficulty stems from the dynamic nature of Accounting. Glautier and Underdown (1986, p.3) point out that the University of Pretoria.etd

CERN European Organization for Nuclear Research - Zenodo

Aliona Lîsîi

Echoes Minds

okufuye samuel

Accounting is often viewed as being limited to the recording process. No distinction is perceived between the recording and the reporting of accounting data. The recording process involves measuring business transactions. This process according to Stamford (1978) “may take form of hand written records, records produced mechanically or on cards or magnetic tape in a computerized system”. The reporting function is much broader according to Stamford (1978) because it consists of “classifying and summarizing accounting data into financial statements, as well as preparing any other interpretive disclosures necessary to make the data understandable.” The process is highly technical and requires an accountant with extensive training, experience and also professional judgement. In addition to record and report, accounting information according to Chris (1990) also include “the designing of account systems, the audit of financial statements, cost of studies and the preparation of tax returns”.

RELATED PAPERS

Boletín de Arqueología PUCP

Ann H Peters

John Wandeto

EDUKATIF : JURNAL ILMU PENDIDIKAN

latifatus saniyyah

MATHEdunesa

Siti Khabibah

Revista De Salud Publica

Santiago Henao

Revista Ciencias Marinas y Costeras

Revista Ciencias Marinas y Costeras REVMAR , Silvia Chacón-Barrantes

Klaudio Pap

Dhita Safitri

IOP Conference Series: Materials Science and Engineering

Deni Ferdian

Brazilian Journal of Development

Júlia Veloso Romão

Chemistry - A European Journal

Elena Selli

Reihan Putra

Carlo Alberto Nucci

arXiv: Learning

Palash Goyal

Cadernos do IL

Jose Ribamar Lima de Souza

Postharvest Biology and Technology

THEMIS Michailides

Aquatic Microbial Ecology

Natalia Bojanić

INTERNATIONAL PERSPECTIVE ON INDIGENOUS RELIGIOUS RIGHTS

Leslie Cloud

فصلنامه علمی مطالعات بنیادین و کاربردی جهان اسلام Fundamental and Applied Studies of the Islamic World

Revista Latino-americana De Enfermagem

Sinara de Lima Souza

Veronica Chamorro

European Journal of Rheumatology

Ömer Metehan Karadağ

Frontiers in Medicine

Mona duggal

Frontiers in Oncology

Rizki Diposarosa

World journal of gastroenterology

P.Martin Padilla

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Maharashtra State Board Book Keeping and Accountancy 11th Solutions Digest | 11th Class Accounts Book Solution

Maharashtra state board std 11th commerce book keeping & accountancy textbook solutions digest | class 11 accounts solutions.

Bookkeeping and Accountancy 11th Solutions | Accounts Class 11 Solutions

- Chapter 1 Introduction to Book Keeping and Accountancy

- Chapter 2 Meaning and Fundamentals of Double Entry Book-Keeping

- Chapter 3 Journal

- Chapter 4 Ledger

- Chapter 5 Subsidiary Books

- Chapter 6 Bank Reconciliation Statement

- Chapter 7 Depreciation

- Chapter 8 Rectification of Errors

- Chapter 9 Final Accounts of a Proprietary Concern

- Chapter 10 Single Entry System

Maharashtra State Board Class 11 Textbook Solutions

Your Article Library

Relationship between book-keeping, accounting and accountancy.

ADVERTISEMENTS:

Read this article to learn about the relationship between book-keeping, accounting and accountancy.

For a layman, these words are used by him interchangeably thinking that all of them have the same meaning. However, fundamentally this is not correct.

Book-Keeping :

Book-keeping is a primary and basic function in the process of accounting and concerned with recording and maintenance of books of accounts only.

In this process the following basic activities are considered essential:

(i) Identification of the transactions from the various business transactions, which have financial character;

(ii) Measurement of those transactions in terms of money;

(iii) Recording those transactions in the books of original entry;

(iv) Classification of the transactions keeping in view the respective ledger accounts.

Accounting :

Accounting is the secondary function and it starts where function of book-keeping ends.

(i) Summarisation of the classified transactions in the shape of final accounts;

(ii) Analysis and interpretation of the results disclosed by final accounts and drawing meaningful conclusions;

(iii) Communicating the required information to all the concerned parties.

Accountancy:

Accountancy is a study of systematic knowledge and contains those rules, regulations, procedures, principles, concepts, conventions and techniques, which are to be applied in the process of accounting. In this sense, we can say that accountancy is a broader term that acts as a guide for the preparation of books of accounts, summarisation of information and communicating the results to all the concerned parties.

Related Articles:

- Systems of Accounting for Recording Business Transactions

- Book-Keeping and Accounting | Difference

Comments are closed.

Define book-keeping, accounting, and accountancy? With the help of the diagram explain the relationship between book-keeping, accounting, and accountancy.

Book-keeping book-keeping is an art of recording in the books of accounts, the monetary aspect of commercial and financial transactions. it is a part of accounting. it is concerned with identifying, recording and classifying economic transactions and events. accounting accounting is a wider concept than book-keeping. it starts where book-keeping ends. it is concerned with summarising the economic transactions, analysis, and interpretation of economic transactions and events and communicating the results of final users. accountancy 'accountancy' refers to the entire body of the theoretical knowledge of accounting. it is the theory part of accounting, whereas accounting relates to applying the knowledge of accountancy. diagrammatically, the relationship can be viewed as:.

Differentiate between book-keeping and accounting.

Answer the following questions : Explain the difference between Book-keeping and Accountancy.

IMAGES

VIDEO

COMMENTS

Introducing the Reliable Series Book-keeping and Accountancy book for Std. XII, which has been designed meticulously based on the newly reconstructed syllabus 2020-21. For the past 35 years, Reliable Publications has been serving a large number of students with their learner-friendly language and effective study material, making a mark among ...

We have written 50,000+ custom papers with an average satisfaction score of 9.6 out of 10. Now, we have the academic writing industry down pat and are able to provide our customers with first-rate papers. The authenticity of our custom writing is ensured. All of our papers have a one-time value and are used solely for students' personal purposes.

Preface. "Std. XII Commerce: Book‐Keeping and Accountancy Solutions" has been designed to complement the "Std. XII Commerce: Book‐Keeping and Accountancy" book. This book will enable the student to verify the solutions and solve the questions independently. The book includes accurate solutions to all the Textual and Practice Problems ...

In addition, a helpful appendix provides a list of standard bookkeeping and accounting terminology for on-the-job reference. Buy Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting Principles. 6. Xero: A Comprehensive Guide for Accountants and Bookkeepers by Amanda Aguillard.

Bookkeeping involves the recording, on a regular basis, of a company's financial transactions. With proper bookkeeping, companies are able to track all information on its books to make key operating, investing, and financing decisions. Bookkeepers are individuals who manage all financial data for companies. Without bookkeepers, companies ...

Conclusion. This free course Introduction to bookkeeping and accounting has covered the skills and knowledge required to understand double-entry bookkeeping, the trial balance and the two principal financial statements: the balance sheet and the profit and loss account. Perhaps the most important aspect of accounting that you learnt is the knowledge that for all organisations and individuals ...

Now going into its 9th edition, the successful textbook Book-keeping and Accounts is a vital guide for students undertaking studies of book-keeping and accounting for the first time. Through its gradual introduction of topics, explanation of technical terminology in a clear, easy to understand way, this text provides an accessible and reliable guide for any student in their undergraduate career.

Best Online Bookkeeping Services. 1-800Accountant: Best for full-service bookkeeping. QuickBooks Live: Best for cleanup bookkeeping. Botkeeper: Best for accounting firms. Ignite Spot Accounting ...

1 Essential numerical skills required for bookkeeping and accounting. 1.1 Use of BODMAS and brackets. 1.2 Use of calculator memory. 1.3 Rounding. 1.4 Fractions. 1.5 Ratios. 1.6 Percentages. ... 3.6 The accounting equation and the double-entry rules for income and expenses. 3.7 Post trial balance nominal ledger accounts. 3.8 Summary. Conclusion ...

Reliable Publications presents Assignment Book for Book Keeping & Accountancy. This book includes Application Based Tests covering full portion. This book is available for other commerce subject as well i.e. Organisation of Commerce & Management, Economics, and Secretarial Practice.

Studying BF1O Bookkeeping And Financial Accounting - Level I at CDI College? On Studocu you will find 11 practical, mandatory assignments, practice materials, ... Books. You don't have any books yet. Add Books. Studylists. You don't have any Studylists yet. ... FCMO v2-0 Assignment 2 - sdd. 1 page 2022/2023 100% (1) 2022/2023 100% (1) Save.

The best bookkeeping services include Bookkeeper360, Merritt Bookkeeping, Bench Accounting, Pilot, QuickBooks Live, 1-800Accountant, Decimal and inDinero.

Bookkeeping is a segment of the whole accounting system. Bookkeeping is the basis for accounting as it contains the proper records of all financial transactions whereas, accounting involves organising, summarising, classification and reporting financial transactions. If the bookkeeping is correct, the accounting of a company will be proper.

Accounting. Definition. 1. Bookkeeping is mainly related to the process of identifying, measuring, recording, and classifying financial transactions. 1. Accounting is the process of summarizing, interpreting, and communicating financial transactions that were classified in the ledger account as a part of bookkeeping. Stage.

We take great pleasure in presenting the Book-keeping and Accountancy book of "Reliable Series" Std. XI which is based on the newly reconstructed syllabus 2019-20. Reliable Publications, since 31 years, has been catering a large number of students using learner-friendly language and created it's own marks among the students.

Done - Assignment - Fundamentals of Book-Keeping & Accountancy - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. Bookkeeping is the recording of financial transactions. Bookkeeping should not be confused with accounting. Double-entry bookkeeping requires posting (recording) each transaction twice.

The formats of subsidiary books like purchase book, sales book, cashbook, bankbook and stock register are given here along with a brief explanation for its usage. Format of a Purchase Book Date Party's Name Bill No. Ledger Item Folio Name Quantity Rate Amount Terms Total Bookkeeping and Accounting and Financial Statements 127 chp-12.qxd 10/18 ...

Bookkeeping and Accountancy 11th Solutions | Accounts Class 11 Solutions. Chapter 1 Introduction to Book Keeping and Accountancy; Chapter 2 Meaning and Fundamentals of Double Entry Book-Keeping; Chapter 3 Journal; Chapter 4 Ledger; Chapter 5 Subsidiary Books; Chapter 6 Bank Reconciliation Statement; Chapter 7 Depreciation; Chapter 8 ...

Accounting: Accounting is the secondary function and it starts where function of book-keeping ends. In this process the following basic activities are considered essential: ADVERTISEMENTS: (i) Summarisation of the classified transactions in the shape of final accounts; (ii) Analysis and interpretation of the results disclosed by final accounts ...

Bookkeeping includes the Supplier's Ledger, customer's ledger, and general ledger, whereas Accounting involves the preparation of Financial Statements like Income statements, Balance sheets, and Cash flows. Thus, the accounting finalization needs to be done by an accountant and should be verified through the Auditing process.

You can solve the 12th Standard Board Exam Accounts Book Solutions Maharashtra State Board textbook questions by using Shaalaa.com to verify your answers, which will help you practise better and become more confident. ... Balbharati Solutions for 12th Standard Board Exam Book Keeping and Accountancy Chapter 1: Introduction to Partnership and ...

The explicit topic of Fear and Trembling's third Problema (the longest single section, accounting for a third of the book's total length), the theme of Abraham's silence stands not far in the ...

Accounting is a wider concept than book-keeping. It starts where book-keeping ends. It is concerned with summarising the economic transactions, analysis, and interpretation of economic transactions and events and communicating the results of final users. Accountancy 'Accountancy' refers to the entire body of the theoretical knowledge of accounting.