Crafting Fresher Resume for Bank Job: Format, Samples & Tips

Quick Summary

- The fresher resume format includes personal details, summary, education, projects, internships and certifications.

- Understanding job requirements, choosing the right format, highlighting skills, and customising for each application are the main steps to creating a banking resume.

- The tips for writing a fresher resume are to make it concise, easy to read and to tailor it according to the job specifications.

Table of Contents

In today’s competitive job market, a job opening receives around 250 resumes. Creating a great resume is important if you want to get a job at a bank. In the competitive banking industry, this will make you more marketable. If you aspire to become a banking professional, your resume plays a crucial role in achieving that goal.

You need a resume that sells you if you’re starting in banking and want to make a good first impression. It’s a fantastic way to sell yourself as an applicant with unique skills and experience. Your fresher resume for a bank job can get you the job you want. But you need the right mix of experience, education, and attention to detail. This blog will tell you the writing tips to write a great fresher resume for bank job.

Fresher Resume for Bank Job Format

Crafting a well-organized and professional resume can help you to differentiate yourself from other applicants. Here’s a way to make your resume format for bank job fresher look better.

| Full Name: Your full name in a clear and prominent font size Contact Information: Phone: [Phone Number] Email: [Email Address] LinkedIn: [LinkedIn Profile] |

| A statement summarizing your aim and qualities that make you a strong candidate. Highlight any relevant academic achievements or internships. |

| Provide details of any relevant projects or internships you have completed. Include the name of the project or organization. Add your role, key responsibilities, and notable accomplishments or outcomes. |

| Specify any banking- and finance-related credentials you have. It can be a CFP (Certified Financial Planner) or CTP (Certified Treasury Professional). |

| Specify any banking- and finance-related credentials you have. It can be CFP (Certified Financial Planner) or CTP (Certified Treasury Professional). |

| Mention any leadership roles, volunteer work, or participation in clubs or organizations. This will show your interpersonal skills, teamwork, or community involvement. |

| You can put “References available upon request” at the bottom of your resume, but it’s not required. |

Steps to Create a Fresher Resume for Bank Job

It is necessary to engage in careful planning and pay close attention to detail. You can follow the below steps to create an impressive fresher resume for bank job.

1. Understand the Job Requirements

- Review the job description. Understand all the necessary skills and qualifications.

- Identify keywords and specific requirements mentioned in the job posting.

2. Choose the Right Resume Format

- Opt for a clean and professional resume format. Follow the reverse-chronological format, which will highlight your most recent experiences first.

- If you need more work experience, consider a combination resume format. It emphasizes your skills and achievements.

3. Include a Powerful Aim or Summary Statement

- Begin your resume with a strong goal or profile summary statement. It should state your career goals and highlight your relevant skills and achievements.

- Tailor your statement to align with the specific banking job you’re applying for.

4. Highlight your Education

- List your educational qualifications, starting with your most recent degree or program.

- Include the name of the institution, the degree obtained, and your major or specialization. Also, include any relevant academic achievements or honors.

5. Showcase your Skills

- Create a dedicated section highlighting your key skills relevant to the banking industry.

- In your resume, include both hard and soft skills.

6. Emphasize Internships, Projects, and Relevant Experience

- If you have completed any internships or projects, highlight them.

- Describe your roles and responsibilities. Showcase the skills and knowledge gained during these experiences.

- If you have limited professional experience, focus on different skills. This can also include volunteer work, or extracurricular activities demonstrating your abilities.

7. Quantify Achievements

- Always try to put a number on your accomplishments to show off your skills more.

- For example, mention the size of the budgets you managed. You can also mention the percentage of sales achieved in a particular project.

8. Tailor your Resume for Each Application

- Customize your resume for each banking job application. It can be done by incorporating relevant keywords and addressing specific job requirements.

- Highlight experiences and skills that align with the position you’re applying for.

9. Proofread and Edit

- Check for typos and grammatical errors by reading over your resume.

- Ensure the formatting is consistent and easy to read.

- Seek feedback from mentors, professors, or career advisors. It is to improve the quality of your resume.

Remember, a fresher resume for bank job is your main opportunity. You should make a positive impression on potential employers. By following these steps you can showcase your qualifications. Also, you can increase your chances of securing a rewarding banking job.

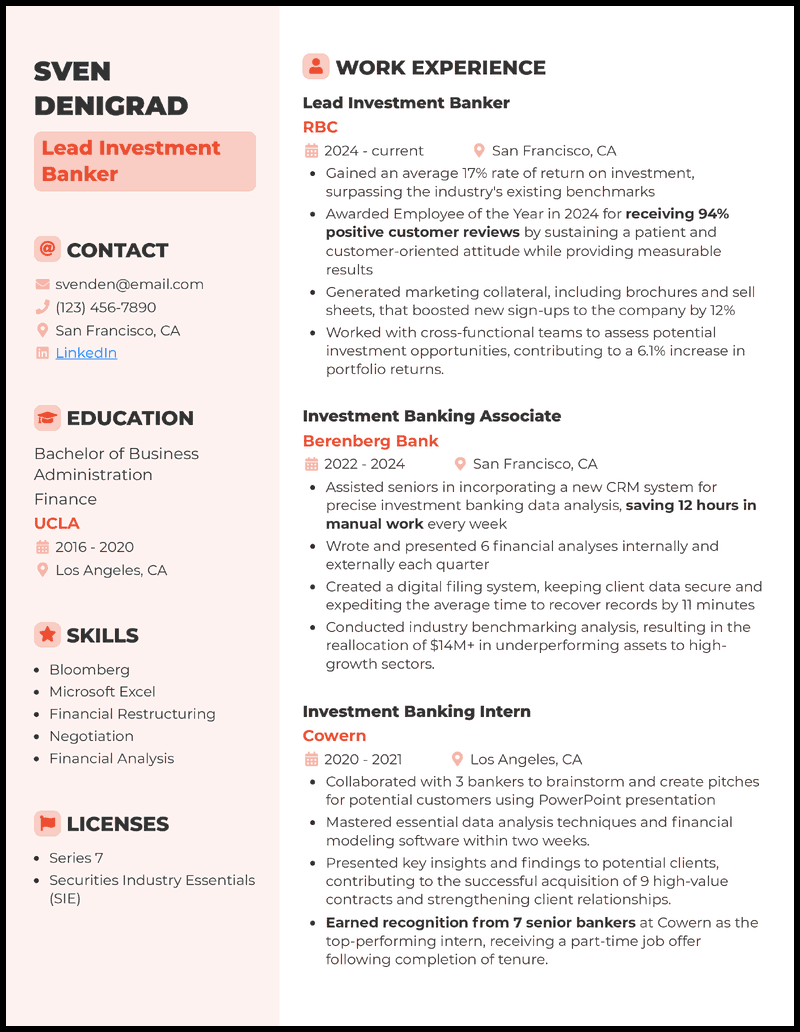

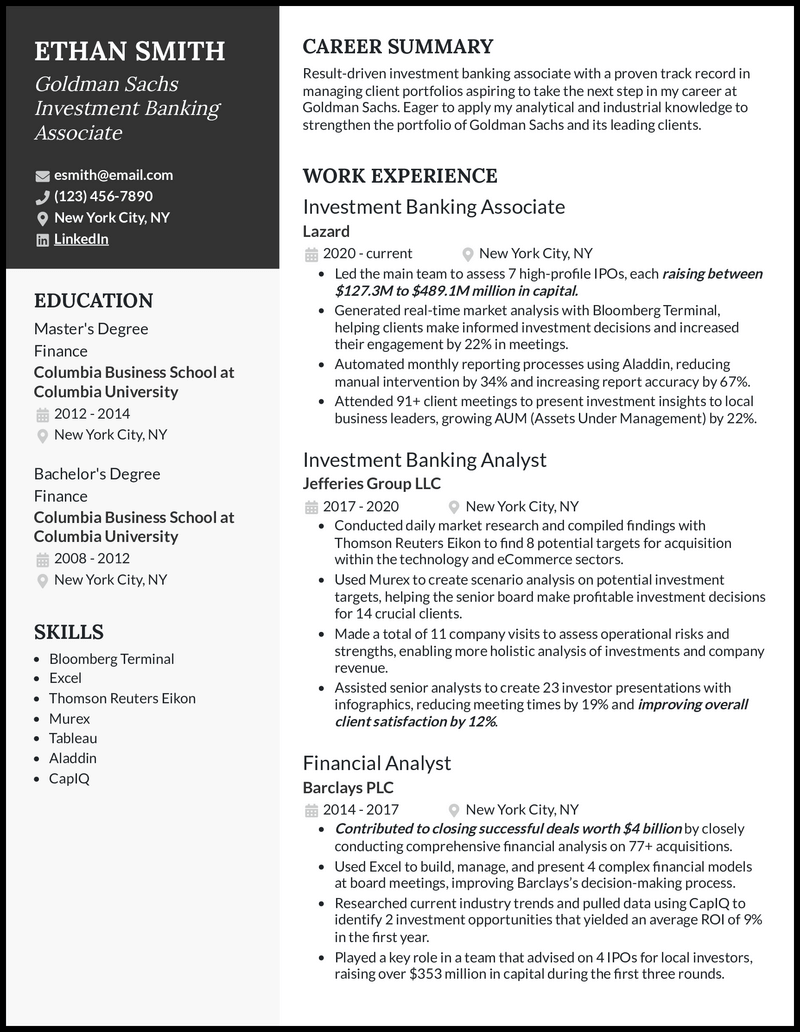

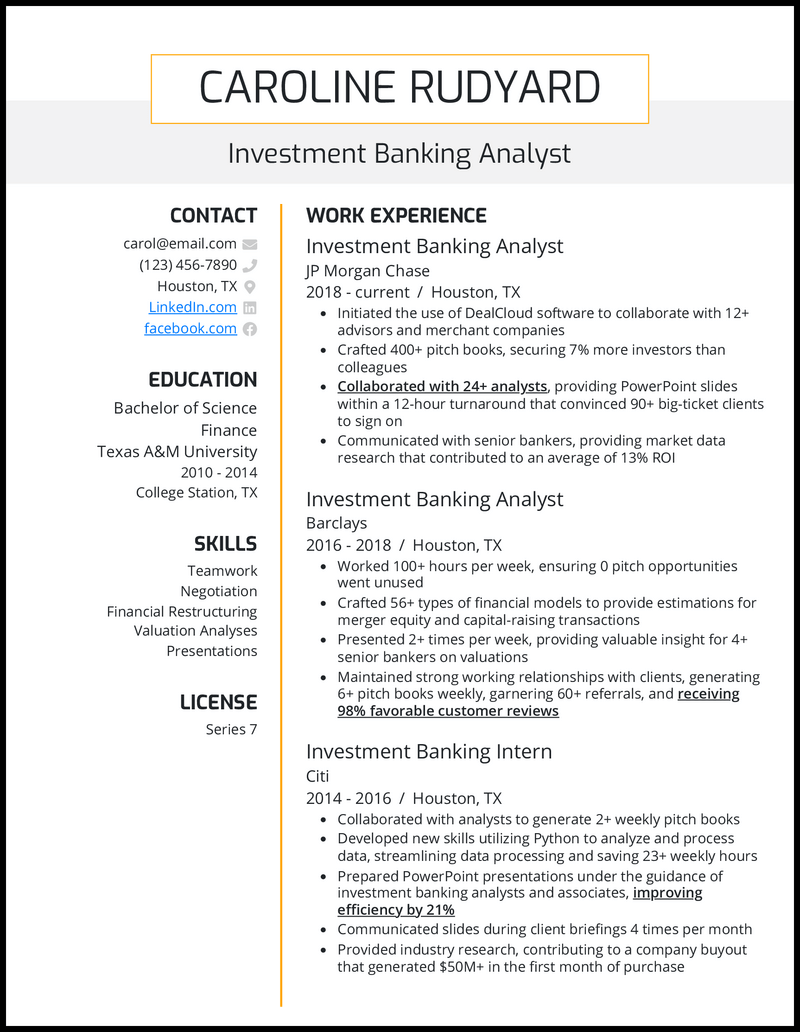

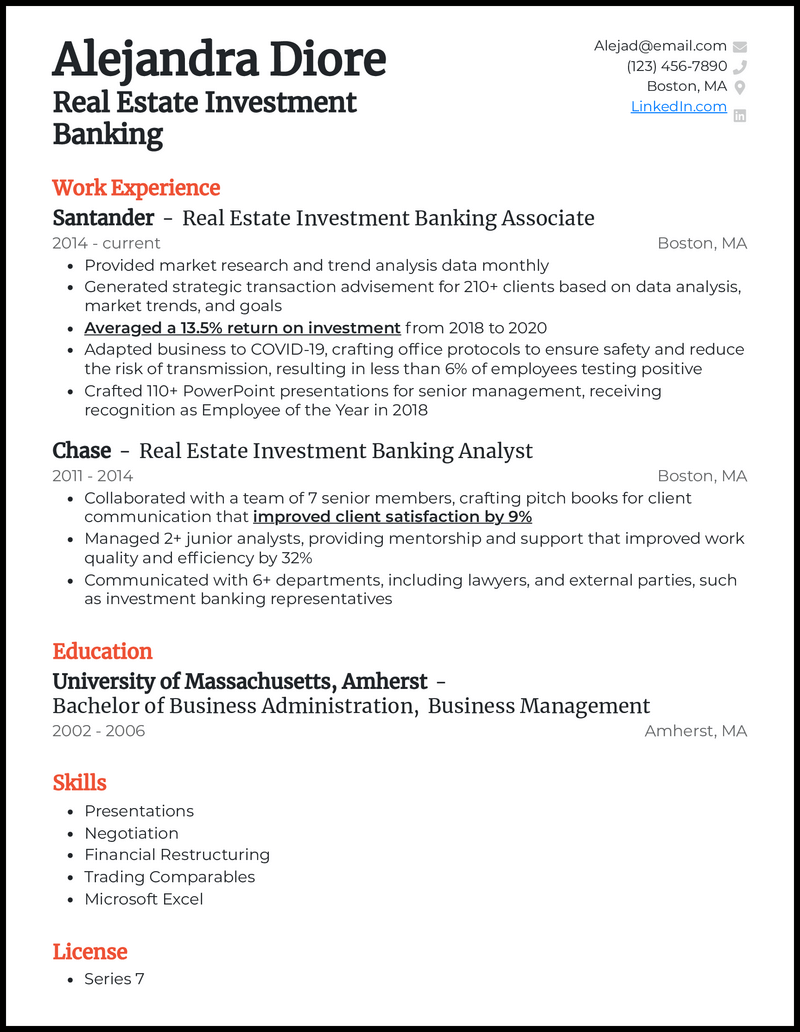

Sample Fresher Resume for Bank Job

Here is a sample resume for bank jobs with no experience that you can use for reference whenever you create a CV for a bank job fresher.

| [Your Name] [Address] [City, State, PIN Code] [Phone Number] [Email Address] | |

| To secure an entry-level position in the banking sector where I can utilize my academic background in finance and my strong analytical skills to contribute to the growth and success of the organization. | |

| Bachelor of Commerce in Finance XYZ University City, State Year of Graduation: 20XX Masters of Commerce in Finance (if applicable) | |

| Cash handling, management, customer service, interpersonal skills, attention to detail, accurate knowledge of banking procedures and regulations, strong written and verbal communication skills, experience with Microsoft Office and financial software | |

| Customers were assisted with a variety of transactions, including deposits, withdrawals, and account queries. Processed cash transactions, ensuring balanced cash drawers at the end of each day. Provided exceptional customer service. | |

| Conducted a comprehensive financial analysis of a traded company. Analyzed financial ratios and balance sheets. Presented findings and recommendations and demonstrated analytical skills and financial acumen. Conducted market research on consumer preferences and trends in the banking industry. Analyzed survey data and prepared a comprehensive report outlining key findings. And also recommendations for improving customer satisfaction and product offerings. | |

| Language Proficiency: Fluent in English and [Indian Language(s)] Volunteer Experience: Community Financial Literacy Program, XYZ Organization Member, Finance Club, XYZ University | |

| Available upon request | |

Sample Fresher Resume for Bank Associate

| [Your Name] [Address] [City, State, PIN Code] [Phone Number] [Email Address] | |

| Motivated and detail-oriented fresher with a strong academic background in banking. Seeking a challenging role as a banking associate to utilize my analytical skills. And also knowledge of financial products, and passion for delivering exceptional client service. | |

| Bachelor of Business Administration in Banking and Finance XYZ University City.State Year of Graduation: 20XX. | |

| Financial knowledge, customer service skills, problem-solving skills, attention to detail, analytical skills, strong written and verbal communication skills and financial software knowledge. | |

| I assisted senior banking associates in evaluating loan applications and assessing creditworthiness. Conducted market research and prepared reports on industry trends and potential investment opportunities. Collaborated with team members to create detailed financial strategies for clients. Assisted in organizing client meetings and presentations. | |

| Constructed and managed a virtual investment portfolio. Also by considering risk-return tradeoffs and asset allocation strategies. Monitored portfolio performance and made informed investment decisions. It should be based on thorough research and analysis. Analyzed the operations and processes of a commercial bank. Identify areas for improvement in efficiency and customer service. | |

| Language Proficiency: Fluent in English and [Indian Language(s)]Volunteer Experience: Financial Literacy Program, XYZ OrganizationMember, Finance Society, XYZ University | |

| Available upon request | |

Tips For Fresher Resume For Bank Job

Some of the tips to create a fresher resume for bank job are as follows:

1. Keep it Short : Limit your resume to one or two pages. Highlight key skills, relevant experience, and educational background without unnecessary details. Employers appreciate candidates who can communicate effectively and efficiently.

2. Use Bullet Points : Make your resume easy to read by using bullet points. Organize your information clearly so hiring managers can quickly identify your qualifications. Each bullet point should be a brief statement that highlights a specific achievement or responsibility. This format ensures that your fresher resume for bank job stands out.

3. Tailor Your Resume : Customize your resume for each banking job you apply to, emphasizing the skills and experiences most relevant to the job description. Highlight any specific knowledge or expertise that aligns with the requirements of the banking role.

4. Extra Section : If you have extra space on your resume, include a section for additional skills and achievements. You can add anything that would make the hiring managers take a look at your resume. For example, the languages you have learned or any notable achievements.

5. Proofread : Carefully review your resume for any grammatical errors, typos, or formatting inconsistencies. Consider asking a trusted friend or mentor to review your resume as well, as it can help you catch mistakes you might have missed.

Key Takeaways for Your Resume for Bank Job

Crafting an impressive, fresher resume for bank job is crucial. It helps to secure a promising career in the banking industry. This article provided valuable insights and guidelines to help you create a standout resume. By following the steps outlined in this article, you can develop a structured resume. Understanding the job requirements and including a powerful goal is essential. Remember to proofread and edit your resume summary for bank job freshers. Seeking feedback from mentors or career advisors can provide valuable insights for improvement.

By following these guidelines, you can unlock opportunities in the banking industry. You can also position yourself as a competitive candidate. Your well-crafted, banking resume sample for fresh graduates will be a powerful tool. It will help you in securing your dream bank job. It will also help you in starting a successful career in the financial sector.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice .

Frequently Asked Questions ( FAQ’s )

How do i write a cv for a bank with no experience.

1. Highlight your educational qualifications, focusing on relevant coursework or projects. 2. Emphasize transferable skills gained from internships, part-time jobs, or volunteer work. 3. Showcase any relevant certifications or training programs. 4. Highlight your passion for the banking industry and your willingness to learn.

Which resume is best for freshers?

A functional resume that highlights skills and achievements is the best resume for freshers. This is suitable for students who have limited professional experience.

What is the best resume format for banking?

1. The reverse-chronological format is accepted in the banking industry. 2. It presents your work experience in reverse order. 3. This allows recruiters to track your career progression.

Skip the Interview

To read more related articles, click here.

Got a question on this topic?

Related Articles

- Privacy Policy

- Chegg Study

- Learn a language

- Writing Support

- Expert Hiring and Payment Dashboard

- ज्ञानकोश Earn Online

- Career Guidance

- General Knowledge

- Web Stories

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

- Chegg Inc. Compliance

© 2024 Chegg Inc. All rights reserved.

Banking Resume - Examples & How-to Guide for 2024

As someone who works in banking, you’re a trusted professional who knows their way around the finance world.

You give financial advice and guidance to your clients.

But when it comes to creating a job-winning resume, you’re the one who needs advice.

What does a good banking resume look like, anyway?

With so many people competing for the top banking jobs, you can’t afford to leave any questions unanswered.

But don’t worry! Our field-tested resume examples and tips will get your feet through the door of employment.

- A job-winning banking resume example

- How to create a banking resume that hiring managers love

- Specific tips and tricks for the banking industry

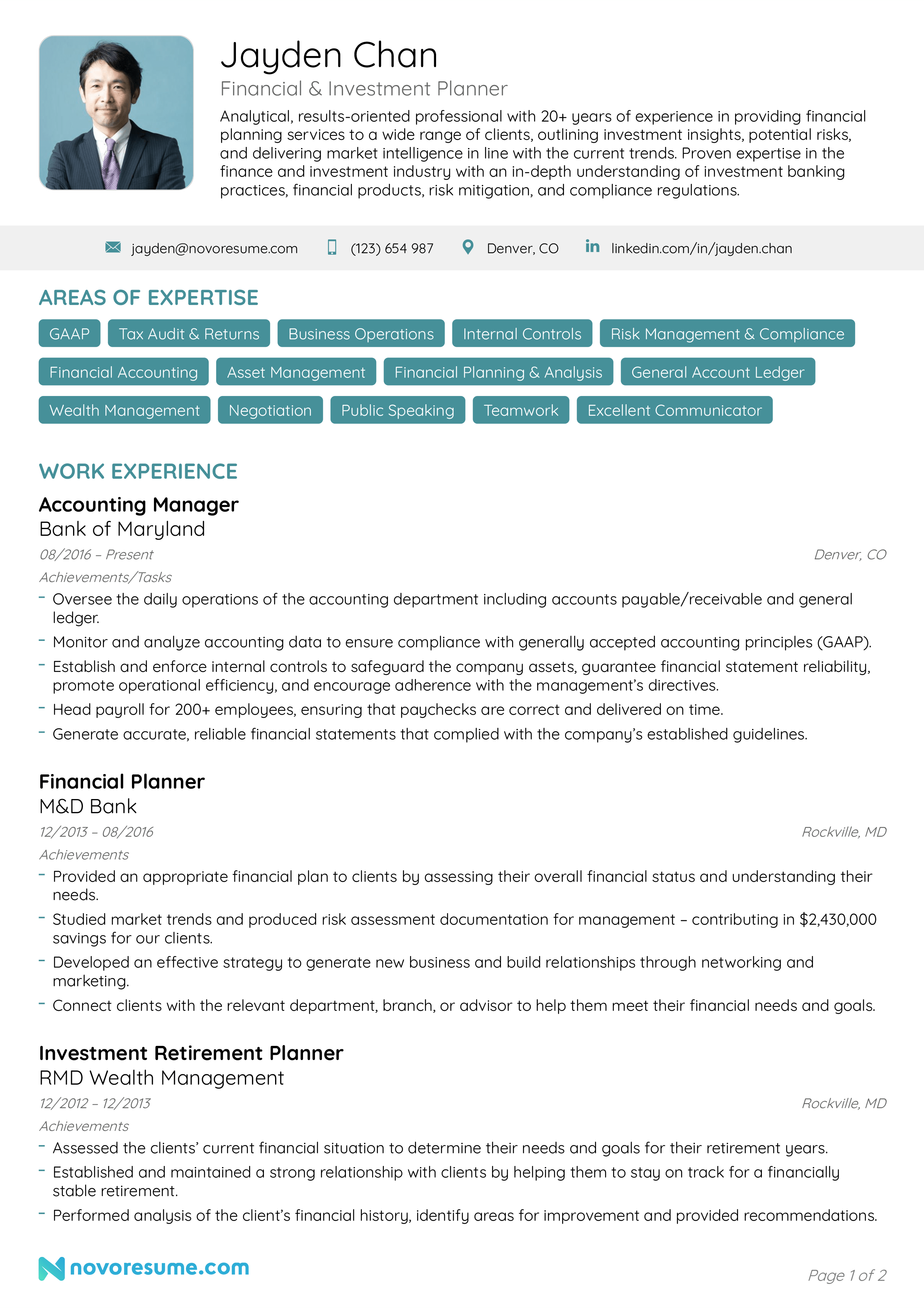

Here’s a banking resume example, built with our own resume builder :

Follow the steps below to create a banking resume of your own.

Are you looking for a resume example for a different job position? Head on over to one of our related resume examples instead:

- Bank Teller Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Financial Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

How to Format a Banking Resume

Banking is one of the fiercest industries you can enter.

As such, you really need to put your money where your mouth is.

This involves creating a resume that stands out from the competition.

But before you can get writing, you need to choose the correct format.

You see, even the richest of experience won’t impress a hiring manager that is struggling to read the content.

Have relevant banking experience? Then you’ll want to use the most popular format, known as the “ reverse-chronological ” format. It starts with your most recent work experience and then works backward through your banking history and skills.

You may also want to try these two popular formats:

- Functional Resume - This format focuses on your banking skills, which makes it the best format for those who have the relevant skills, but don’t a wealth of experience as a banker.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, making it perfect for those with both the relevant skills AND banking work experience.

- For a professional and precise resume, keep your banking resume to one-page. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins – Use one-inch margins on all sides

- Font - Pick a professional font that stands out

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As professional banker, the recruiter expects to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Banking Resume Template

Word is great for a lot of things.

Well, except for building resumes.

You see, you need a banking resume with a professional structure.

Those who have used word to create their own resume will know that one tiny change can ruin the whole structure.

For a professional banking resume, you can use a resume template .

What to Include in a Banking Resume

The main sections in a banking resume are:

- Contact Information

- Work Experience

For a banking resume that rises above the other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

So that’s a general overview, now it’s time to get specific about each of the sections.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a banker, you know that accuracy is vital.

And it’s no different than with your contact information section.

In fact, just one digit out of place can render your whole application useless.

For your resume contact information section, include:

- Title – Make this specific to the exact job you’re applying for

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Hannah Atkinson - Banker. 101-358-6095. [email protected]

- Hannah Atkinson - Banking Angel. 101-358-6095. [email protected]

How to Write a Banking Resume Summary or Objective

Creating a professional resume that stands out is the #1 goal .

But HOW is this done?

By using an opening paragraph that brings home the bacon!

These opening paragraphs come in two types: resume summary or objective.

Although slightly different, both are introductory paragraphs that sum up the main points of your resume.

The difference between a summary and objective is that:

A resume summary summarizes your most notable banking experiences and achievements. It’s designed for individuals who have multiple years of finance industry experience.

- Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

A resume objective gives a quick breakdown of your professional goals and aspirations, which makes it perfect for junior bankers. Now, even though you’re talking about your own goals, it’s important to align your message to what the employer wants.

- Enthusiastic finance student looking for a banking role at BANK XYZ. Two years of experience at a local accounting firm. Excellent organization, communication, and analytical skills. Keen to support your banking team, where my interpersonal skills can be leveraged to achieve the best quality of service.

So, which one is best for bankers?

Well, a summary is suited for bankers who have been crunching the numbers for a few years, whereas an objective is suited for individuals who are new to the banking world (student, graduate, or switching careers).

- The hiring manager wants to see the benefits you will bring to the bank, not what it will do for your career. Also, banks want employees who have strong quantitative and communication skills, so use powerful action verbs and be as specific as possible.

How to Make Your Banking Work Experience Stand Out

What’s the best way to impress a recruiter?

Work experience!

Sure, the recruiter wants to hear about your education and skill-set, but nothing proves your talents like a wealth of banking experience.

Use this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

02/2017 - 01/2020

- Voted “Banker of the Year” in 2018 and 2019

- Followed best practises to process over 1000 loan applications

- Studied market trends and produced risk assessment documentation for management – contributing in $430,000 savings for our clients

- Trained and empowered a team of eight new bank tellers

For a resume that shows your best qualities, make sure to mention your achievements, rather than your daily responsibilities.

Instead of saying:

“Risk assessment”

“Studied market trends and produced risk assessment documentation for management – contributing to $430,000 in savings for our clients”

So, how exactly do the two differ?

Well, the second statement goes into much greater detail. It’s a clear example of how your abilities will have a direct impact on the success of the bank.

What if You Don’t Have Work Experience?

Maybe you’ve got a finance degree but have yet to work in a bank?

Or maybe you’re transitioning from a junior position at a competing bank?

Whatever your personal situation, you have options.

You see, despite a lack of bank experience, you are still able to include relevant skills and experiences from other previous jobs.

For example, if you’ve worked as a junior accountant, you can talk about the crossover experiences. Just like a banker, you would have to pay great attention to detail, work with customers, and enjoy working with numbers.

For the students reading this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Banking Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these exact words on nearly all banking resumes.

And since you need your banking resume stand out, we’d recommend using some power words instead:

- Spearheaded

- Conceptualized

How to List Your Education Correctly

Up next in your banker resume comes the education section.

Now, there’s more than one educational path to becoming a bank employee.

The bank manager just wants to know your education to date.

Follow this format:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Chicago State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Finance and Economics, Bank Lending and the Legal Environment, Quantitative Methods for Banking, and more]

Still have questions? If so, here are the most frequently asked questions:

What if I’m still studying?

- No matter if you’re still studying or not, you should still mention every year that you have studied to date

Is my high school education important?

- Only list your high school education if that is your highest form of education

What is more important for a banker, education or experience?

- If you’re an experienced banker, your work experience should be listed before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 16 Skills for a Banking Resume

Being a successful banker requires a certain set of skills.

And the bank manager needs to know you have what it takes!

Now, you could be the most skilled banker in the world, but they still need to be clearly displayed on your resume – not locked away in a bank vault!

Here are the main skills a hiring manager wants to see from a banker:

Hard Skills for a Banker:

- Balancing Ledgers

- Risk Assessment

- Mortgages and Loans

- Deposits and Withdrawals

- Account Maintenance

- Foreign Currency Exchange

- Investment Management

- Safety Deposit Boxes

- Cash Handling

Soft Skills for a Banker:

- Excellent Communicator

- Problem Solving

- Confident & Professional Manner

- Organization

- Negotiation

- Time Management

- Although bankers need soft skills, we recommend only including the main skills on your resume. It is also wise to only include soft skills that you posses, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have a resume that’ll get you through the doors of any bank.

Your #1 goal is a resume that stands above the competition.

And this is not the time to leave your future to chance!

The following sections will set you apart from the other candidates.

Awards & Certifications

Have you been awarded at your previous place of work?

Did you win any competitions at university?

Have you completed any certifications to enhance your expertise?

Whatever your case may be, the manager will want to see any relevant awards and certifications.

Awards & Certificates

- Certified Financial Planner (CFP)

- Certified Financial Analyst (CFA)

- “Learning How to Learn” - Coursera Certificate

- “Banker of the Year” 2019 - XYZ Bank

Able to speak other languages?

Whether or not the job description specifically requires it, the ability to speak another language is an impressive skill.

So if you’re able to speak another language, even to a basic standard, feel free to include it inside your resume, but only if there is space.

Order the languages by proficiency:

- Intermediate

Now, you may be wondering, “ why does the bank manager need to know about my love of golf? ”

Well, the manager doesn’t need to know, but it does show them more about who you really are.

And this is great, as banks want an employee who they’ll get along with.

As such, listing your hobbies and interests can be a good idea, especially if it involves social interaction.

If you want some ideas of hobbies & interests to put on your banking resume , we have a guide for that!

Match Your Cover Letter with Your Resume

You don’t need us to tell you how competitive the finance job market is.

And when competing with experienced professionals, you need an edge.

But HOW can you get one?

Well, with a convincing cover letter!

You see, a letter is the perfect tool for communicating with more depth and personality.

Oh, and it shows that you want THIS banking position in THIS bank.

Just like when building the resume, your cover letter also needs the correct structure.

Here’s how to do that:

We recommend writing the following for each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website.

Hiring Manager’s Contact Information

Their full name, position, location, email

Opening Paragraph

Create a powerful introduction that hooks the reader. Make sure to mention:

- The specific position you’re applying for – Banker

- An impactful summary of your most notable experiences achievements

Once you’ve impressed the hiring manager with your opener, you can delve deeper into the rest of your working history. Some of the points you can mention here are:

- Why you want to work for this specific bank

- What you know about the bank’s culture and vision

- Your most notable experiences and how they relate to this job

- If you’ve worked in similar positions at other banks

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragraph

- Thank the hiring manager for reading

- End with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “ Sincerely ” or “ Best regards. ”

Now, if you’re not a professional wordsmith, creating a job-winning cover letter is a difficult task. But don’t worry, you can use our how to write a cover letter article for guidance.

Key Takeaways

You’ve now unlocked the bank vault and discovered how to create a job-winning resume.

Let’s quickly review everything we’ve covered:

- Based on your specific circumstances, choose the correct format. We recommend starting with a reverse-chronological format, and then following the best layout practices

- Use a captivating resume summary or objective

- In the work experience section, highlight your most notable achievements, not your daily duties

- Match your banking resume with a convincing cover letter

Suggested Reading:

- How to Write a Bank Teller Resume in 2024

- How to Ace Interviews with the STAR Method [9+ Examples]

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

- +91-7272000034

- [email protected]

Approved Training Partner of NSDC

- Our Gallery

- About Franchise

- Current Affairs

- North Delhi

- Noida - Sector 2

- Noida - Sector 96

- Sri Ganganagar

- Uttarakhand

- Uttar Pradesh

- Bhubaneswar

- Madhya Pradesh

- Andhra Pradesh

- Maharashtra

- Navi Mumbai

- resume for freshers , resume for freshers with no experience , resume with no work experience college student , resume with no work experience college student free download , simple resume for freshers

Indian Bank Recruitment 2024: Job Roles, Salary Structure

Banking Courses that Guarantee a Bank Job 2024 Certificate & Placement Assistance

Banking Courses After 12th And Graduation Online

Banking Courses After Graduation 2024: What You Need to Know

Central Bank of India Recruitment 2024: Eligibility Criteria, Notification Last Date

Bank Of India Recruitment 2024 Eligibility Criteria, Last Date of Application

For Admission

Call: 7272000034 Email: [email protected]

For Student Helpline

Call: 7341125633 Email: [email protected]

For Franchise

Call: 9779190150 Email: [email protected]

First Step Towards a Successful Banking Career

- IPB Corporate Office: F-464, NP Tower, Industrial Area, Sector 74, Mohali, Punjab - 160055

Quick LInks

- PGCRB Course

- About Franchise

Useful Links

- Privacy Policy

- Terms & Conditions

- Cancellation & Refund Policy

Working Hours

- 9:00 AM - 6:00 PM, Monday - Saturday

Copyright © 2024 IPB. All rights reserved. | A unit of Success Steps Pvt. Ltd.

Entry-Level Bank Teller Resume No Experience

Bank tellers work in financial institutions where their job is to manage routine financial transactions. They need to possess at least a high school diploma or GED in order to obtain a job offer.

As this is a highly skilled position, people seeking an entry-level position as a bank teller will need to ensure that they make an excellent first impression when creating a bank teller resume.

How to Write a Compelling Resume to Apply for a Bank Teller Job With No Experience in Hand?

Follow the 4 tips below in order to write a near-perfect entry-level cover letter for a bank teller:

- Introduce your related knowledge and skills to prospective employers.

- Write only relevant information that supports your suitability as a perfect bank teller.

- Give information about your relevant education and training.

- Mention any internship or apprenticeship experience.

The following template and sample will help you craft an exceptional resume.

Entry-Level Bank Teller Resume With No Experience (Template)

[Your Name] [Your Address] [City, State, ZIP Code] [Your Email Address] [Your Phone Number]

Objective A detail-oriented individual seeking an entry-level Bank Teller position to leverage strong customer service skills and a passion for accuracy in a reputable banking institution.

Education [Your High School Name] , [City, State] High School Diploma Graduated: [Month, Year]

- Excellent communication and interpersonal skills

- Strong aptitude for numerical and financial accuracy

- Proficient with Microsoft Office Suite (Word, Excel, PowerPoint)

- Strong organizational skills and keen attention to detail

- Ability to work independently and as part of a team

- Reliable and trustworthy in handling confidential information

Experience [Customer Service Representative] , [Company Name], [City, State] Dates of Employment: [Month, Year] – [Month, Year]

- Delivered exceptional customer service, addressing customer inquiries and complaints

- Managed cash registers, processed transactions, and reconciled daily sales

- Assisted in training new employees on store procedures and customer service techniques

- Maintained a clean and organized work environment

[Cashier] , [Another Company Name], [City, State] Dates of Employment: [Month, Year] – [Month, Year]

- Accurately handled cash and credit transactions in a fast-paced retail environment

- Balanced cash drawers and maintained transaction records

- Provided information and assistance to customers on products and services

- Collaborated with team members to meet sales targets and improve customer satisfaction

Volunteer Experience Volunteer , [Organization Name], [City, State] Dates of Involvement: [Month, Year] – [Month, Year]

- Assisted with community outreach programs and events

- Performed administrative tasks such as data entry and filing

- Supported team efforts in organizing fundraising events and activities

Honors and Activities

- Member, [High School Club/Organization], [Years Active]

- Volunteer, [Community Service Program], [Years Active]

- Recipient, [Scholarship/Award Name], [Year]

References Available upon request.

I am poised to work hard and go beyond the employer’s expectations.

Entry Level Bank Teller Resume No Experience (Sample)

FARNEY MARSHA 440 Lincoln Street East Hanover, NJ 07936-1080 (000) 456-7890 Email

BANK TELLER

Strong academic background in accounting, coupled with a track record of providing exceptional customer service.

OBJECTIVE Friendly and approachable Bank Teller seeking a position with ABC Bank. Enthusiastic about creating a positive first impression by using my knowledge of cash handling, customer service, and banking products. Able to understand the concerns of others and practice the “listen-first” policy. Recognized for defusing tense situations and anticipating others’ needs before expression.

EDUCATION Bachelor of Business Administration Hanover College – Hanover, IN | 2022

Coursework :

- Financial Management

- Entrepreneurship

- Human Resources Management

CORE KNOWLEDGE & SKILLS

Organizational

- Special talent for payment processing payments and cash handling

- Complete knowledge of accounting and bookkeeping

- Able to multitask efficiently

- Exceptional attention to detail

- Strong clerical skills

- Able to organize and implement group activities

- MS Word and Excel, PowerPoint, and Outlook

- Internet and Email

- Proficient in mathematics, arithmetic, and statistics

WORK HISTORY

Cashier (Part-Time) WinCo Foods – Hillsboro, OR 1/2024 – 3/2024

- Provided fast and friendly customer service

- Operated check-stand equipment: cash register, scanner, and scale to process customer orders

- Engaged in suggestive selling

- Processed monetary transactions including Cash, checks, gift certificates, travelers’ checks, food stamps, coupons, and refunds

VOLUNTEER EXPERIENCES

Customer Service Volunteer ABC Company, Hillsboro, OR 3/2023 – 4/2023

- Provided exceptional services to the project group in selling t-shirts

- Enhanced sales through effective interpersonal skills

Treasurer Hanover Business Club, Hillsboro, OR 1/2023 – 12/2023

- Managed club budget

- Allocated funds appropriately

Excellent professional references are available.

Related : Bank Teller Cover Letter No Experience

- 10 Entry Level Bank Teller Resume Summary Examples – No Experience

- Entry-Level Bank Teller Cover Letter No Experience [2 Samples]

- 28 Entry Level Bank Teller Resume Objective Examples

- Bank Teller Resume Objective and Summary: 25 Examples

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of new posts by email.

Banking Resume Examples and Templates for 2024

- Resume Examples

- Resume Text Examples

How To Write a Banking Resume

- Entry-Level

- Senior-Level

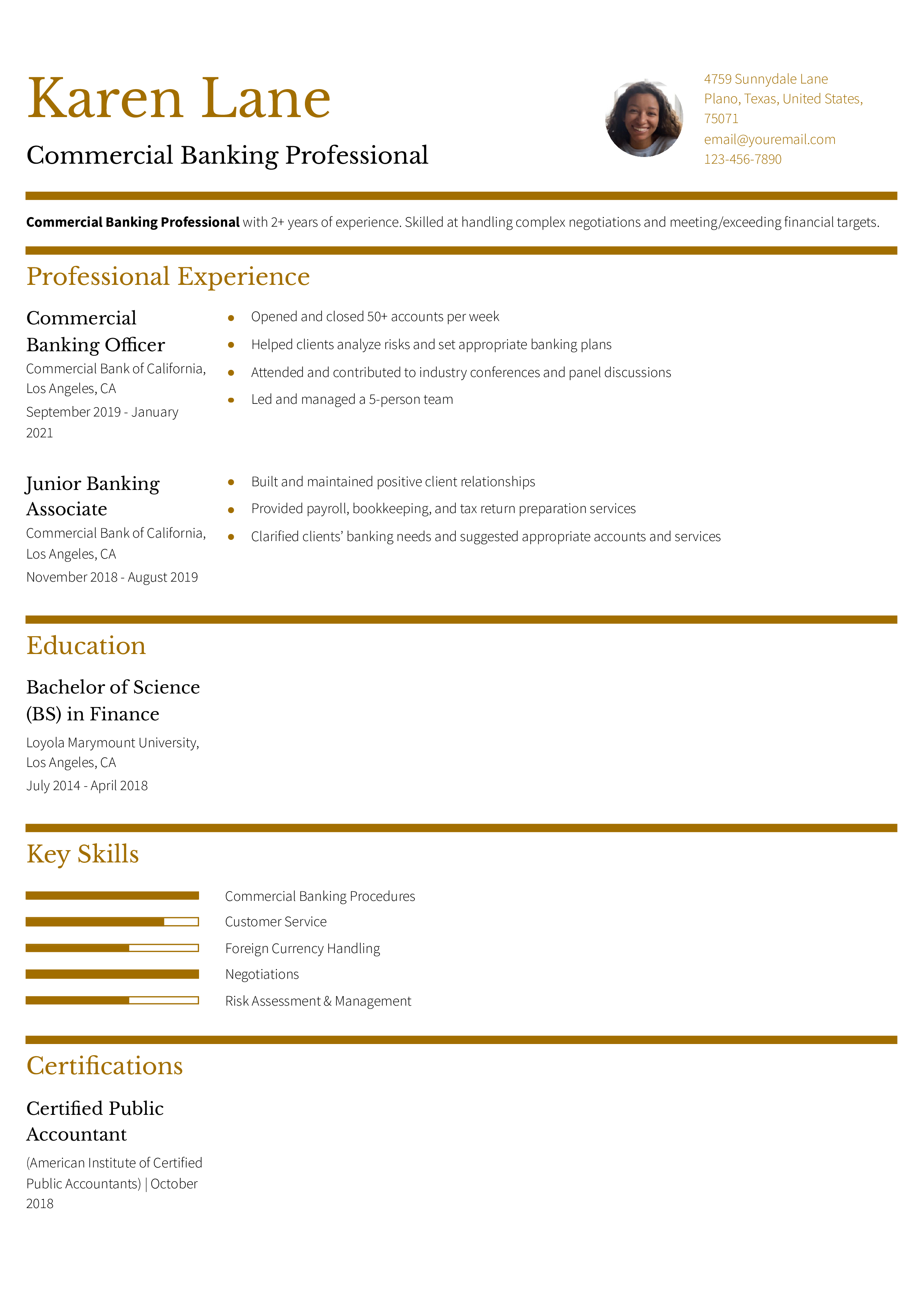

Banking Text-Only Resume Templates and Examples

Karen Lane (655) 863-6548 | [email protected] | 72 Light Lane, Los Angeles, CA 90003

Commercial Banking Professional with 2+ years of experience. Skilled at handling complex negotiations and meeting/exceeding financial targets.

- Commercial Banking Procedures

- Customer Service

- Foreign Currency Handling

- Negotiations

- Risk Assessment & Management

- Team Leadership

- Wealth Management

Professional Experience

Commercial Bank of California, Los Angeles, CA | November 2018 to January 2021

Commercial Banking Officer (September 2019 to January 2021)

- Opened and closed 50+ accounts per week

- Helped clients analyze risks and set appropriate banking plans

- Attended and contributed to industry conferences and panel discussions

- Led and managed a 5-person team

Junior Banking Associate (November 2018 to August 2019)

- Built and maintained positive client relationships

- Provided payroll, bookkeeping, and tax return preparation services

- Clarified clients’ banking needs and suggested appropriate accounts and services

Education & Credentials

Bachelor of Science (BS) – Finance, Loyola Marymount University, Los Angeles, CA

Certified Public Accountant, American Institute of Certified Public Accountants

Jerry Jones (738) 274-2648 | [email protected] | 91 Riverside Avenue, Los Angeles, California, 90001

High achieving and analytical investment banker with seven years of experience in the banking industry. Proven ability to work alongside a wide variety of clients to provide useful investment insights and outline any potential risks. Possesses a bachelor’s degree in finance from California State University and a master’s degree from Claremont McKenna College. Excellent communication skills, in-depth knowledge of the current trends in the investment banking industry, and success-orientated attitude.

Investment Banker, 1st Capital Bank, Los Angeles, CA June 2017 – March 2021

- Oversaw and managed the relationship-banking team, which resulted in a 15% increase in revenue and increased profitability

- Prepared and organized the execution of equity transactions

- Successfully achieved the 2020 target of $15M

- Participated in industry conferences and panel discussions

Investment Associate, American First National Bank, Los Angeles, CA November 2014 – June 2017

- Helped to increase the yearly revenue by 6% via regular client-orientated sales events

- Performed company equity research

- Contributed to the preparation of fact-based growth opportunity reports

Master of Finance Claremont McKenna College, Claremont, CA, September 2012 – July 2013

Bachelor of Science in Finance California State University, Northridge, CA, September 2009 – July 2012

- Risk management and compliance

- Wealth management

- Knowledge of commercial and private banking

- Team leadership

- Exceptional communication skills

- Impressive ability to build and maintain working relationships

Certifications:

- CFA Institute certified Chartered Financial Analyst (CFA), August 2013

Monica Reese (246) 802-4680 | [email protected] | 135 Main Avenue, San Francisco, CA 35791

Commercial Banking Associate with 10+ years’ experience providing quality services to personal and business clients. Expertly address and solve client problems, drawing on deep knowledge of bank products. Confident leader who trains and motivates junior associates to deliver consistent positive results. Bilingual: Fluent in English and Spanish.

Commercial Banking Associate, Bank of San Francisco, San Francisco, CA | November 2017 to Present

- Lead and performance-manage a team of 12 associates

- Help customers open new bank accounts and access online services

Highlights:

- Consistently earned 98%+ client satisfaction rating

- Drove a 45% increase in customer use of online services

- Trained and mentored 7 new hires in 2021

Banking Associate, Bank of America, San Francisco, CA | September 2012 to October 2017

- Delivered prompt, thorough service to 50+ small business clients

- Gathered information for new account holders by completing CIP and Enhanced Due Diligence forms

- Clarified each client’s needs and suggested appropriate credit cards, personal loans, and other bank products

- Consistently ranked in top 5% of team for upselling

Bachelor of Science in Business Administration (Finance), University of San Francisco, CA | 2012

- Customer Service & Relations

- New Hire Training & Mentoring

- Regulatory Compliance

- Task Prioritization

Fluency in Spanish

An effective banking resume should demonstrate a thorough understanding of financial regulations and services, as well as customer service ability . Whether you’re new to the banking industry or taking the next step in your career, a solid resume that highlights your skills and achievements can help land your next job.

1. Write a dynamic profile summarizing your banking qualifications

The first section of your resume is one of the most important because it’s what hooks the hiring manager and makes them interested enough to keep reading. The profile summary section goes at the top of your resume after the header with your name and contact information. It is designed to give a reviewer an overall idea of who you are and what you can offer. Draw attention to your most valuable qualities, such as extensive experience or the ability to speak more than one language.

Senior-Level Profile Example

Commercial banking associate with over 10 years of experience providing quality services to personal and business clients. Expertly address and solve client problems, drawing on deep knowledge of bank products. Confident leader who trains and motivates junior associates to deliver consistent positive results. Bilingual: Fluent in English and Spanish.

Entry-Level Profile Example

Commercial banking professional with over two years of experience. Skilled at handling complex negotiations and meeting/exceeding financial targets.

2. Outline your banking experience in a compelling list

The professional experience section of your resume should explain what your duties and responsibilities have been in previous positions. Also, it must be a soft sales pitch about the value you can bring to your next position. It can be helpful to separate each job listing into sections: one for your job duties and one to highlight achievements. What’s worth mentioning depends on the position you’re applying for, but most banking positions rely on customer satisfaction and efficiency, so these are good places to start.

Senior-Level Professional Experience Example

Commercial Banking Associate Bank of San Francisco, San Francisco, CA | November 2017 – present

- Consistently earned 98% and higher client satisfaction rating

- Trained and mentored seven new hires in 2021

Entry-Level Professional Experience Example

Commercial Banking Officer Commercial Bank of California, Los Angeles, CA | November 2018 – January 2021

- Opened and closed over 50 accounts per week

- Led and managed a five-person team

3. Include banking-related education and certifications

A degree in finance or business or accounting-related certifications can put you ahead of the pack when applying for a job in the banking industry. Some jobs may require a certain educational background, such as being a certified financial planner. Customer-facing positions like tellers may focus more on cash-handling experience and sales skills. List your education and any relevant credentials or certifications clearly on your resume so the hiring manager can determine if you have the necessary qualifications.

- [Degree Name]

- [School Name], [City, State Abbreviation] – [Graduation Month and Year]

- Bachelor of Science in Finance

- California State University, Northridge, CA – July 2012

Certifications

- [Certification Name], [Awarding Organization], [Completion Year]

- Certified Chartered Financial Analyst, CFA Institute, 2013

4. List your banking-related skills and proficiencies

The objective of your resume is to show the person reviewing it you’re a good fit for the position and that you will add value once you’re hired. Make it easy to see your skills and proficiencies. A bulleted list works well for this and can be divided into two sections: technical and banking-related skills and general professional skills.

| Action Verbs | |

|---|---|

| Client relationship management | Compliance with banking regulations |

| Credit risk assessment | Cross-selling abilities |

| Customer service skills | Data-driven decision making |

| Financial statement analysis | Fraud detection and prevention |

| Investment portfolio management | Loan underwriting |

| Regulatory reporting | Retail banking operations |

| Risk management | Sales skills |

How To Pick the Best Banking Resume Template

Using a banking resume template lets you spend more time crafting compelling copy that positions you as a top candidate and less time messing with spacing and bolding. But all templates aren’t created equal. Look for non-fussy designs that prioritize readability and organization. Your resume is a professional document, and a hiring manager must quickly and easily determine if you’re a match for the position. Use headings, bullets, and lines for easier skimming.

Frequently Asked Questions: Banking Resume Examples and Advice

What are common action verbs for banking resumes -.

Action verbs take your bullets from bland descriptions of your job duties to compelling marketing materials for yourself as an applicant. It’s important to use various action verbs to avoid repetition and keep your resume as engaging as possible. If you’re getting stuck while writing this section, try these options that work well for banking positions. Another useful technique is to quickly read through the job description and identify any matching phrasing for the job responsibilities.

| Action Verbs | |

|---|---|

| Analyzed | Assisted |

| Documented | Educated |

| Highlighted | Informed |

| Liaised | Prepared |

| Presented | Proposed |

| Qualified | Trained |

| Underwrote | Valued |

How do you align your resume with a job description? -

Targeting your resume to a specific job description can increase the chances that a hiring manager identifies you as a good fit. Look for keywords, qualifications, skills, and other must-haves listed in the job description and use these when creating your resume. Consider including a specific software in your list of key skills or adding a bullet point in your work experience section that highlights your knowledge of loans and other related products. This is especially important for those applying for competitive positions, such as loan officers , who are expected to experience just average growth, and tellers , who are expected to see a 12% decline through 2031.

What is the best banking resume format? -

The right format for a banking resume depends on how much experience you have, what kind of position you’re applying for, and the company, but you can’t go wrong with a reverse chronological format in this industry. This traditional design will be what most hiring managers expect and lets you list your work history, skills, and education in an organized, easy-to-read manner. You can also play around with this format, such as listing key skills first or using a double-column design to make more use of white space.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Including a cover letter with your resume shows you're serious about the position and willing to put in extra effort. It provides an additional opportunity to describe your achievements and qualifications. If you need help writing a banking cover letter , this guide provides tips and examples.

Jacob Meade

Certified Professional Resume Writer (CPRW, ACRW)

Jacob Meade is a resume writer and editor with nearly a decade of experience. His writing method centers on understanding and then expressing each person’s unique work history and strengths toward their career goal. Jacob has enjoyed working with jobseekers of all ages and career levels, finding that a clear and focused resume can help people from any walk of life. He is an Academy Certified Resume Writer (ACRW) with the Resume Writing Academy, and a Certified Professional Resume Writer (CPRW) with the Professional Association of Resume Writers & Career Coaches.

Check Out Related Examples

Chief Financial Officer (CFO) Resume Examples and Templates

Finance Resume Examples and Templates

Personal Banker Resume Examples and Templates

Build a Resume to Enhance Your Career

- How Many Jobs Should You List on a Resume? Learn More

- How to Add a Resume to LinkedIn Learn More

- How to Show Analytical Skills on Your Resume Learn More

Essential Guides for Your Job Search

- How to Write a Resume Learn More

- How to Write a Cover Letter Learn More

- Thank You Note Examples Learn More

- Resignation Letter Examples Learn More

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Professional Banker Resume Examples

If you are looking to apply for a position as a professional banker, having a well-written and effective resume can make all the difference. Your resume should accurately reflect your qualifications, experience, and skills, which will set you apart from the competition. To make sure your resume stands out, it’s helpful to look at professional banker resume examples. This resume writing guide will provide you with some useful tips and examples on how to create an effective resume that can help you stand out to employers. With this guide, you will be able to craft a resume that will showcase your qualifications and increase your chances of getting the job.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Professional Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

I am a professional banker with over 10 years of banking industry experience. I have a proven track record of providing innovative solutions to complex financial challenges and exceeding customer expectations. I am adept at delivering effective customer service and maintaining positive relations with all stakeholders. I am a team player and have strong communication, problem- solving, and analytical skills. I am confident that I can be a valuable asset to any organization.

Core Skills :

- Excellent customer service skills

- Detail- oriented

- Strong problem solving and analytical skills

- Knowledge of banking industry trends and regulations

- Proficient in MS Office Suite and banking software

- Excellent communication and interpersonal skills

Professional Experience : Banker, ABC Bank, NY

- Provided excellent customer service to all clients

- Resolved complex customer inquiries in a timely manner

- Performed loan and account closings, as well as account reviews

- Identified banking and financial services needs of customers

- Assisted with the development of new banking products and services

- Maintained banking industry knowledge by attending monthly seminars

Education : Bachelor of Science in Finance, New York University, NY

- Graduated with honors

- Received the Dean’s Award for Outstanding Academic Performance

Create My Resume

Build a professional resume in just minutes for free.

Professional Banker Resume Examples Resume with No Experience

- Recent college graduate with a Bachelor of Business Administration degree in Banking and Finance

- Strong understanding of banking principles, processes and procedures

- Well- developed analytical and problem- solving skills

- Excellent written and verbal communication skills

- Ability to work independently or in a team setting

- Proficiency in Microsoft Office Suite (Word, Excel and PowerPoint)

- Knowledge of financial analysis and reporting

- Familiarity with banking systems and software

- Excellent organizational, time management, and multitasking skills

- Ability to maintain confidentiality in financial matters

Responsibilities :

- Processing banking transactions, such as deposits, withdrawals, and transfers

- Providing customer service to banking clients

- Performing account reconciliation and balancing

- Assisting customers with questions and concerns about their banking accounts

- Identifying and recommending banking products and services

- Managing daily banking operations and reporting

- Recommending banking procedures and policies to management

Experience 0 Years

Level Junior

Education Bachelor’s

Professional Banker Resume Examples Resume with 2 Years of Experience

Dynamic and self- motivated professional banker with more than 2 years of experience in the financial services industry. Possess strong knowledge of banking regulations, customer service techniques, and loan evaluation process. Proven ability to identify and analyze financial trends, create reports, and develop customized solutions for clients. Possess excellent communication, interpersonal, and organizational skills.

- Knowledge about banking regulations, products, and services

- Customer service and problem- solving abilities

- Proficiency in Microsoft Office applications (Word, Excel, PowerPoint)

- Strong analytical and research capabilities

- Ability to identify and capitalize on market trends

- Excellent verbal and written communication skills

- Assisting customers in understanding banking services and products

- Developing customized loan and investment plans

- Evaluating investment and loan requests

- Monitoring and researching economic and market trends

- Analyzing client financial data

- Supporting sales and marketing initiatives

- Maintaining customer relationships

- Ensuring compliance with banking regulations

Experience 2+ Years

Professional Banker Resume Examples Resume with 5 Years of Experience

I am a professional banker with over 5 years of experience in the banking industry. During my career, I have been responsible for a wide range of banking operations, from loan processing to customer service. I am a highly motivated and organized individual, with excellent communication and problem- solving skills. My experience has allowed me to develop a deep understanding of banking operations, regulations, and customer service. I am confident that I will be an asset to any organization that requires my banking skills.

- Financial analysis

- Loan processing

- Customer service

- Risk assessment

- Banking operations

- Regulatory compliance

- Problem- solving

- Communication

- Processed loan applications and obtained credit checks

- Assisted customers with banking needs such as deposits, withdrawals, and transfers

- Reviewed financial documents and ensured compliance with banking regulations

- Assessed risk associated with loan applications

- Developed and maintained relationships with customers

- Resolved customer inquiries and complaints in a timely manner

- Monitored financial market trends and advised clients on investment decisions

- Processed payment requests and reviewed accounts for accuracy

- Developed and implemented strategies to improve banking operations

Experience 5+ Years

Level Senior

Professional Banker Resume Examples Resume with 7 Years of Experience

Highly experienced and knowledgeable banking professional with 7+ years of experience in banking operations, customer service and sales. Proven ability to develop strong working relationships with clients and colleagues, optimize processes in order to increase operational efficiency and manage complex projects. Fully equipped to review, analyze and assess financial data while delivering top- notch customer service.

- Extensive experience in banking operations.

- Excellent customer service and interpersonal skills.

- Strong problem- solving and analytical skills.

- Proficiency in MS Office Suite and financial software applications.

- Ability to quickly assess financial and market trends.

- Ability to explain complex financial topics in an easy- to- understand manner.

- Conducted financial analysis on various banking products and services.

- Managed customer accounts, ensuring compliance with banking regulations.

- Responded to customer inquiries regarding account statements, loans, rates and services.

- Developed and implemented strategies to maximize customer satisfaction.

- Provided support in managing branch operations, including daily banking activities and audits.

- Performed financial analysis on customer’s portfolio to assess investment opportunities.

- Analyzed and monitored the performance of financial markets and indices.

Experience 7+ Years

Professional Banker Resume Examples Resume with 10 Years of Experience

Highly motivated and experienced banking professional with 10 years of experience in the banking industry. Possess a proven track record of providing financial services and advice to customers, managing portfolios, and providing solutions to challenging situations. Possess a strong work ethic, excellent interpersonal and communication skills, and the ability to work well in a team environment.

- Client Relationship Management

- Business Development

- Portfolio Management

- Financial Analysis

- Credit Risk Management

- Banking and Financial Regulations

- Sales and Marketing

- Actively engaging with clients to understand their financial needs, developing relationships, and providing advice

- Managing a portfolio of clients and providing solutions to their financial situations

- Analyzing financial data and conducting risk assessments

- Developing and adhering to banking and financial regulations

- Identifying and developing new business opportunities

- Promoting the bank’s products and services to potential customers

- Providing sales and marketing support for the bank’s products and services

Experience 10+ Years

Level Senior Manager

Education Master’s

Professional Banker Resume Examples Resume with 15 Years of Experience

Highly experienced Professional Banker with 15 years of experience in the banking sector. Expert in financial analysis and risk management, with a solid understanding of the banking industry. Skilled at developing and managing client relationships, analyzing financial data, and supervising staff. Proven success in developing strategies to increase profitability and create financially sound portfolios.

- Risk management

- Client relations

- Investment strategy

- Staff supervision

- Asset management

- Loan origination

- Portfolio management

- Develop and manage client relationships, providing tailored advice to them

- Analyze financial data, identify trends and recommend solutions to increase profitability

- Supervise and train staff, hold regular performance reviews, and address any issues

- Develop investment strategies to create financially sound portfolios

- Manage assets, originate loans and adhere to relevant regulations

- Identify and mitigate risk in the portfolio, while working to optimize returns

Experience 15+ Years

Level Director

In addition to this, be sure to check out our resume templates , resume formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

What should be included in a Professional Banker Resume Examples resume?

A professional banker resume should be a reflection of your qualifications, certifications, and experience that is tailored to your desired banking industry. Here is a list of the components you should include in a professional banker resume:

- Contact Information: Your name, address, phone number, and email address.

- Professional Summary: A brief overview of your skills, qualifications, and objectives.

- Work Experience: Include all relevant banking positions, including job titles, the name of the company you worked for, the length of time in the position, and the duties you performed.

- Education: Include all relevant degrees, certificates, and other qualifications.

- Professional Skills: List all skills related to the banking industry, such as risk management, financial analysis, customer service, and loan processing.

- Achievements: Include any awards or recognition you have received in the banking industry.

- Certifications: Include any banking or financial certifications you may have.

- References: Include contact information for two to three professional references.

By including all of the above components in your professional banker resume, you will be better equipped to stand out in the competitive banking industry.

What is a good summary for a Professional Banker Resume Examples resume?

A professional banker resume example should include a brief summary that highlights the individual’s experience and qualifications in the banking industry. This summary should include any relevant certifications, such as those from the American Bankers Association or the Institute of Financial Professionals, as well as any relevant experience in the financial services sector. Additionally, the summary should touch on the individual’s skillset in areas such as financial analysis, asset management, credit risk management, and other areas of banking. Finally, the summary should also include any relevant education and qualifications, such as a Bachelor’s degree in finance or accounting. By providing a brief summary of the individual’s qualifications and experience, a professional banker resume example can help employers quickly assess the individual’s credentials and determine whether they are suitable for a banking position.

What is a good objective for a Professional Banker Resume Examples resume?

A professional banker resume should have an objective that emphasizes your career goals and accomplishments. The objective should be tailored to the specific job you are applying for and should be succinct, yet compelling. Here are some examples of good objectives for a professional banker resume:

- To leverage my five years of banking experience and financial acumen to lead a high-performing team and grow the bank’s assets.

- To utilize my MBA in Finance and banking experience to develop and implement strategies that increase the value of bank assets.

- To leverage my expertise in financial analysis, banking regulations, and customer service to maximize profitability and ensure customer satisfaction.

- To use my strong interpersonal and communication skills to build strong relationships with customers and colleagues, while providing superior customer service.

- To use my experience in financial analysis, risk management, and banking regulations to identify and exploit opportunities for growth and expansion.

- To employ my experience in credit analysis, banking operations, and portfolio management to increase the efficiency and profitability of the bank.

How do you list Professional Banker Resume Examples skills on a resume?

When writing a resume for a banking position, it’s important to focus on skills that are pertinent to the position. This is especially true for banking positions, as employers in the banking industry require specific skills and knowledge to complete the job.

When creating a resume, it’s important to make sure that you list the skills you have that are relevant to the position. Here are some of the skills that you should consider including in a professional banker resume example:

- Analytical Thinking: Analytical thinking skills are important for banking professionals, as they help you to analyze financial trends, identify potential problems, and solve them.

- Risk Analysis: Risk analysis is a crucial part of any banking job. Being able to assess the risks associated with a particular financial move is key to making the right decisions for the bank’s customers and the bank itself.

- Financial Planning: Bankers need to be able to create comprehensive financial plans for their customers. This includes helping customers develop budgets, developing retirement plans, and more.

- Negotiation Skills: Bankers need to be able to negotiate with customers and other financial institutions in order to get the best possible deals.

- Customer Service: Bankers must have excellent customer service skills in order to provide their customers with the best banking experience possible.

- Organizational Skills: Being organized is essential for a banker. Bankers must be able to keep track of customer information, documents, and more in order to ensure that everything runs smoothly.

By including these skills in your professional banker resume example, you will be able to show employers that you have the skills and knowledge necessary to excel in the position.

What skills should I put on my resume for Professional Banker Resume Examples?

A professional banker resume should highlight your relevant expertise and experiences in the banking industry. When creating your resume, make sure to include the following skills:

- Understanding of banking regulations: As a professional banker, you must have a thorough knowledge of financial regulations and banking laws. Your resume should emphasize your understanding of banking regulations and compliance.

- Financial analysis: As a banker, you must be able to analyze financial data and trends in order to make informed decisions. Make sure to include your ability to analyze financial data on your resume.

- Risk management: In banking, risk management is key. Make sure to emphasize your experience in managing risk and developing strategies to mitigate risk.

- Customer service: A successful banker must be able to provide excellent customer service. Make sure to include your customer service experience on your resume.

- Problem-solving: In banking, problem-solving skills are essential. Showcase your problem-solving abilities on your resume.

- Communication: As a banker, you will need to be able to communicate effectively with customers, colleagues, and other stakeholders. Showcase your communication skills on your resume.

By including these skills and experiences on your professional banker resume, you will be able to demonstrate to potential employers that you have the skills and knowledge necessary to be a successful professional banker.

Key takeaways for an Professional Banker Resume Examples resume

A professional banker resume is an important tool for any individual who is entering the world of banking and finance. It is essential to ensure that your resume stands out from the crowd and accurately reflects your skills, knowledge, and experience. Here are some key takeaways to consider when creating a professional banker resume:

- Focus on your achievements – When creating a professional banker resume, it is important to emphasize your accomplishments. Make sure to include any awards, honors, or other accomplishments that you have achieved in the banking field. This will demonstrate to potential employers your level of expertise and dedication to the industry.

- Highlight relevant skills – When crafting a professional banker resume, be sure to emphasize any relevant skills and knowledge that you possess. These could include knowledge of banking regulations, experience with financial analysis, or familiarity with financial software.

- Keep it concise – A professional banker resume should be succinct, yet comprehensive. Avoid long paragraphs and instead focus on providing key information in an organized and easily readable format.

- Utilize a professional design – When creating a professional banker resume, make sure to utilize a professional design. This will help ensure that the document is visually appealing and communicates the information in an effective manner.

By following these key takeaways, you can ensure that your professional banker resume is both effective and impressive.

Let us help you build your Resume!

Make your resume more organized and attractive with our Resume Builder

- • Managed relationships with over 300 high-value clients, leading to a 20% increase in account retention.

- • Developed and implemented a new cross-selling strategy that resulted in a 15% increase in product uptake among existing customers.

- • Conducted detailed financial needs analysis for clients, effectively boosting the sale of tailored financial solutions by 25%.

- • Led a team of 5 in organizing community financial literacy workshops, significantly enhancing community engagement.

- • Spearheaded the adoption of digital banking tools among clients, increasing digital transactions by 40%.

- • Negotiated and renewed business banking relationships, securing contracts worth over $5M in deposits.

- • Advised over 200 clients on investment strategies, retirement planning, and wealth management, growing managed assets by 30%.

- • Implemented new client acquisition techniques that increased the customer base by 20%.

- • Led quarterly financial review meetings to ensure client satisfaction and adjust financial plans as needed.

- • Provided training and mentorship to new advisors, improving team performance and efficiency.

- • Designed and executed marketing strategies that enhanced brand visibility and attracted new business.

- • Processed daily customer transactions and identified opportunities for introducing new banking products.

- • Enhanced customer service by addressing and resolving issues, resulting in a 10% decrease in complaints.

- • Collaborated with the compliance department to ensure all transactions adhered to regulatory standards.

- • Educated customers on digital banking services, leading to a 35% increase in digital engagement.

6 Banking Resume Examples & Guide for 2024

Banking plays a pivotal role in managing financial transactions, providing loans, and facilitating investments. When crafting your resume, focus on your experience with financial analysis, customer relationship management, and regulatory compliance. Highlight abilities such as attention to detail, analytical thinking, and effective communication. Additionally, mentioning successful project outcomes and your capacity for driving revenue can greatly enhance your appeal to potential employers.

All resume examples in this guide

Commercial Banking

Corporate Banking

Loan Officer

Loan Processor

Phone Banking

Resume guide, banking resume sample.

Resume format

Resume experience

Resume with no experience

Hard & soft skills

Certifications & education

Resume summary

Additional sections

In conclusion

If AI advances, will it automate entry-level finance jobs?

What happens to the finance market if the economy dips?

How will cryptocurrency popularity impact the industry?

These questions reflect common concerns in banking. It's true that working in a bank can be stressful with all the risk and compliance issues. The industry is always changing, and keeping up can be a challenge.

Despite these concerns, job opportunities in finance are still projected to grow by 3.65% over the next 10 years, indicating that adapting to ongoing changes will be crucial for success.

For a career in banking, your resume must be as clear and detailed as a financial statement.

This guide will walk you through the process step-by-step. By the end, you'll have a banking resume that reflects your financial skills and impresses hiring managers. Here’s a quick look.

Key takeaways

- The reverse-chronological format provides a clear view of your banking career progression.

- A clean design with light colors and an eye-catching font can help your banking resume get noticed.

- Emphasize your experience section with measurable achievements and specific results to grab hiring managers' attention.

- Use metrics to showcase the impact of your banking work.

- Dedicate a section to your technical banking skills, and seamlessly incorporate your soft skills throughout the resume.

- A relevant educational background is important in banking and will always be appreciated.

Starting with the basics, here are the core principles for successful resume formatting.

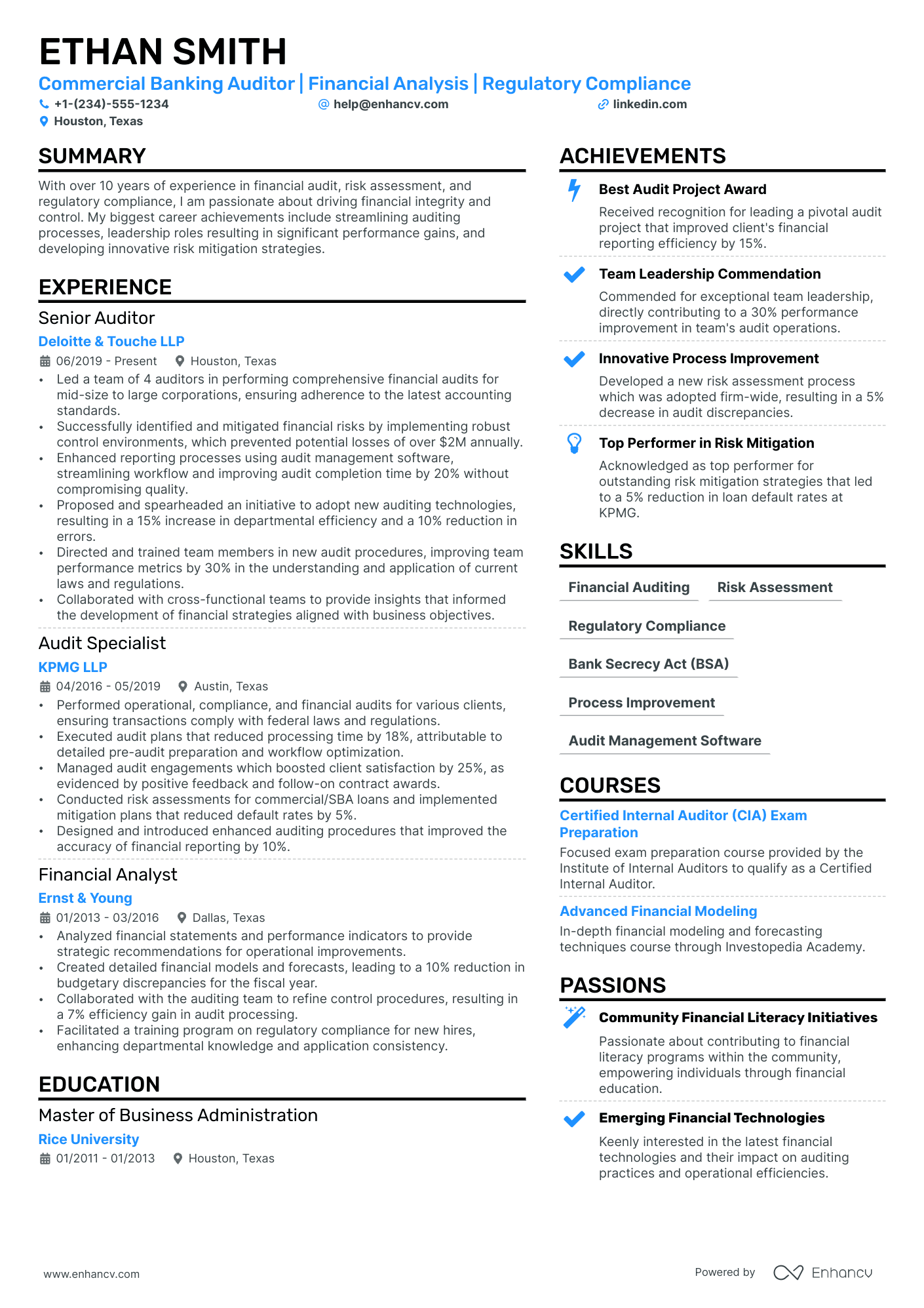

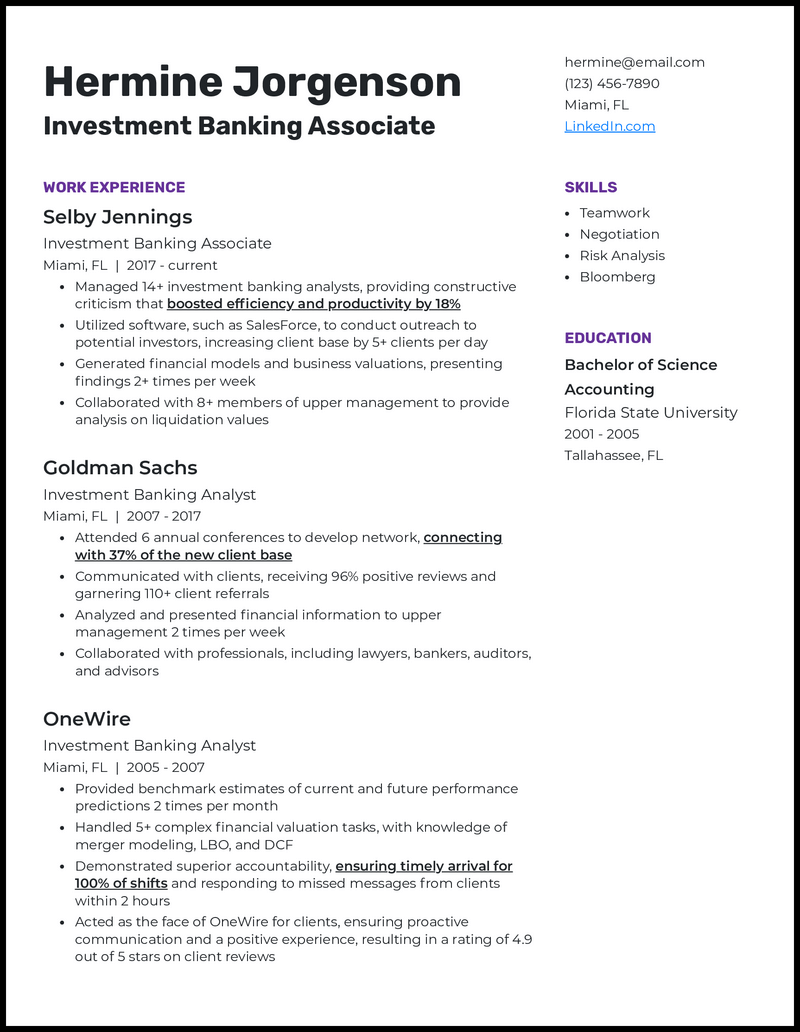

Tailor this banking resume sample or design your own easily using the Enhancv resume builder .

James Jones

[email protected] | LinkedIn | Washington, D.C.

Customer-focused banking professional with over 1 year of experience as a Bank Teller. Proven expertise in handling customer transactions, managing accounts, and providing financial advice. Adept at building long-term relationships and recommending products based on customer needs. Strong sales initiative with a commitment to delivering exceptional service and sensible advice.

Bank Teller

Wells Fargo, Washington, D.C.

06/2022 - Present

- Processed customer transactions, handled account maintenance, and managed cash inventories.

- Identified financial needs and recommended suitable products, contributing to a 15% increase in product adoption.

- Originated new deposit accounts, including checking, savings, money market, CDs, and IRAs.

- Provided advice on consumer loan products, resulting in a 10% increase in loan originations.

- Educated customers on digital banking services, leading to a 20% increase in e-statement adoption.

Customer Service Representative

Bank of America, Washington, D.C.

01/2020 - 05/2022

- Assisted customers with account inquiries, transaction processing, and resolving issues, achieving a 95% customer satisfaction rate.

- Promoted financial products and services, resulting in a 25% increase in cross-sell opportunities.

- Conducted account reviews and identified discrepancies, improving account accuracy by 10%.

- Trained new hires on customer service protocols and company policies, enhancing team performance.

- Handled large volumes of customer transactions, ensuring compliance with company standards and regulations.

Bachelor of Science in Finance

George Washington University, Washington, D.C.

Graduated: 2022

- Related coursework : Financial Accounting, Managerial Accounting, Corporate Finance, Investment Analysis, Money and Banking, Business Law, Financial Markets and Institutions

- Certifications

- Certified Banking & Credit Analyst (CBCA)

- Certified Financial Services Auditor (CFSA)

- Consultative sales

- Product knowledge

- Effective questioning

- Prospecting and referring

- Relationship building

- Basic mathematical computations

- Typing and computer skills

- English (Fluent)

- Spanish (Intermediate)

How to format a banking resume

When crafting your banking resume, consider 3 main formats : reverse chronological, functional, and combination. The reverse chronological format is typically the most effective for banking professionals.

This layout arranges your job history beginning with your most recent role, highlighting your professional development and hands-on experience. It's perfect for applicants with a continuous banking career, reflecting their advancement and relevant abilities.

Here's the ideal order for your resume sections, which we'll cover in detail later:

- Summary/objective

- Professional experience

Recruiters favor this format for its logical and easy-to-follow arrangement.

Let's get into the details.