Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to Write a Business Plan for a Bank

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

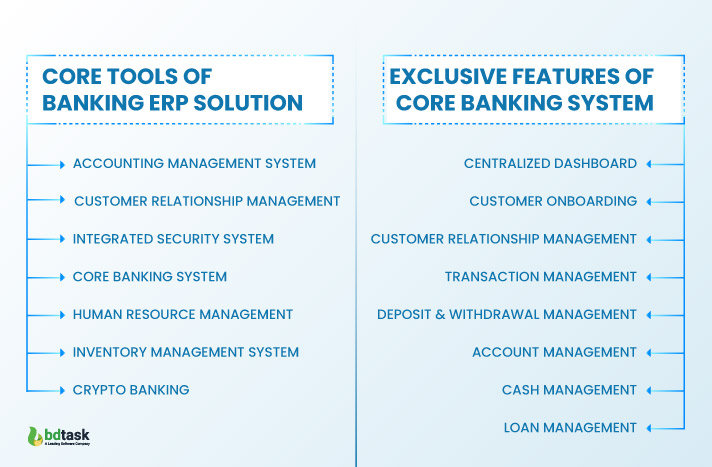

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

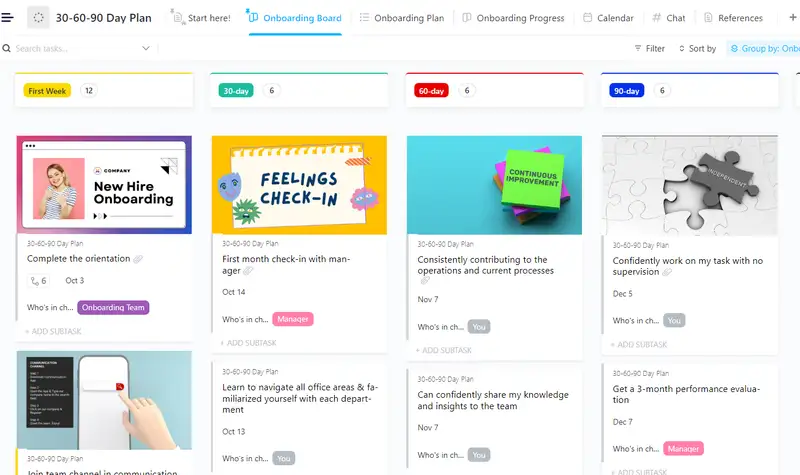

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. See how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Bank Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » Bank

Are you about starting a bank? If YES, here is a complete sample commercial bank business plan template & feasibility report you can use for FREE .

Okay, so we have considered all the requirements for starting a bank . We also took it further by analyzing and drafting a sample bank business marketing plan template backed up by actionable guerrilla marketing ideas for banks. So let’s proceed to the business planning section.

Suggested for You

- Investment Bank Business Plan [Sample Template]

- Microfinance Bank Business Plan [Sample Template]

- Private Banking Business Plan [Sample Template]

- Financial Coaching Business Plan [Sample Template]

- Fintech Startup Business Plan [Sample Template]

Why Start a Bank?

Starting your own bank is a huge step and needs a good deal of planning and preparation. Extensive information about the founders, the business plan, senior management team, finances, capital adequacy, risk management infrastructure, and other relevant factors must be provided to the appropriate authorities.

There are also a number of legal regulations and requirements that must be fulfilled in order to start your own bank. Some of these requirements are dependent upon the regulations in the niche you wish to establish your bank.

As hard as the task of starting a bank can be, anyone who wishes to start their own bank is able to enjoy the many benefits of making a major investment. Although the process of registering and setting up a bank involves lengthy planning and a relatively complex licensing procedure, once it is completed, the owner is able to conduct financial activity in their chosen niche.

Note that the very first step when starting your bank is to choose the niche and type of activity which you wish to engage in. Before you obtain the necessary licensing from the financial regulatory body, it is very crucial you identify whether you wish to specialize in investment banking or trade finance.

The advantages of owning your own bank are huge and include the potential to make large profits during a short period.

Note that if you know your target market and your target market’s specific requirements, you will be in a better position to provide a range of attractive services. To successfully start and run this business, it is advised you seek the help of a professional consultancy firm.

Through the advice and guidance of expert consultants, you will be able to establish a banking institution in a professional manner. Also have it in mind that any proposed bank must first receive the approval of a federal or state banking charter.

Before granting a charter, the chartering regulator must determine that the applicant bank has a reasonable chance for success and will operate in a safe and sound manner.

Then, the proposed bank must obtain approval for deposit insurance from the Federal Deposit Insurance Corporation. Additional approvals are required from the Federal Reserve if, at formation, a holding company would control the new bank or a state-chartered bank would become a member of the Federal Reserve.

A Sample Bank Business Plan Template

1. industry overview.

According to global banking industry reports, part of the broad financial services market, bank credit remain the leading market segment, with around 60% of the overall market in terms of value. Statistics has shown that the EU is the largest regional market, with over 57% of the global market.

Note that the economic recession that began in 2008 affected the industry and resulted in the crash of several financial institutions, which in turn led to the examination of practices and deployment of new guidelines in the banking industry.

But reports have it that the sector is beginning to rebound, and cross-border investment is one area contributing to recovery, with a few big banks dominating certain national markets. Advantages of cross-border practices include economies of scale, though institutions must compete with established domestic banks.

It’s very important to state that in the world retail banking and bank lending sectors, mortgage lending represents the leading market segment, accounting for almost 76% of the overall market in terms of value. Other key segments of the banking industry include private banking and payments business.

Note that in the US banking sector, experts believe that market growth will be driven by cross-border expansion due to the breaking down of obstacles to cross-border investment.

Competition between international banks is also expected to aid market growth along with the introduction of new products, reduction of costs and launching of new services. Report also has it that mobile and internet banking are becoming increasingly intertwined, especially due to the advent and success of smartphones. This provides consumers with convenient access to internet banking.

Have it in mind that the global mobile internet market will continue to drive the expansion of the mobile banking services sector. Report has shown that banking institutions are responding by launching downloadable applications and encouraging consumers to bank online and through mobile devices by rolling out mobile and internet banking services.

2. Executive Summary

Apex Investment Bank, LLC (AIB LLC) is a Portland Oregon based investment bank that will provide investment packages, underwriting, proprietary trading, and investment management for its investors. Our objective at AIB LLC is to create value for owners, employees, and investors through the establishment of an investment bank designed for the Third Generation.

This Generation is explicitly defined in the ground breaking research effort by Lincoln Swan & Co., Inc. and Netley Strategic business Group as a stage in the investment industry requiring a special set of skills for success. We at AIB LLC have leveraged this study, with more other studies, and perhaps most importantly, our own experience in the industry, to define a plan for the success of our clients.

Portland’s location is beneficial for several industries. Relatively low energy cost, accessible resources, north–south and east–west Interstates, international air terminals, large marine shipping facilities, and both west coast intercontinental railroads are all economic advantages.

AIB LLC will be structured as a Limited Liability Company with excellent plans to make use of industry research performed by one of our founding entrepreneurs, Solomon Drane during his professional career in investment management research.

Within the past three years, Solomon Drane has conducted research visits at the investment offices of over 80 companies. He has also held countless meetings with key investment professionals from around the globe either in person or via telephone conference.

We at AIB LLC plan to offer our clients the opportunity to assume minority ownership positions in exchange for contributions to our operating capital and for providing seed assets to establish the investment products described herein.

It is very important to state that this document alone does not create an offer of any type, nor does it give any guarantee, financial, or otherwise. This is a well detailed business plan designed to strategically dictate AIB LLC plans and visions for the next five years. It is open to correction or improvement within or after the specified time.

3. Our Products and Services

We at AIB LLC will provide investment packages and underwrite securities for sale to private investors and the general public among companies that are seeking to raise capital. At the onset of operations, we at AIB LLC will solely seek to sell debt instruments on behalf of our customers.

The standard fee for this service is 8% of the total underwritten instrument. We at AIB LLC will also solicit capital from accredited investors with the purpose of making use of this capital to make investment marketable securities. Our goal is to generate compounded annual returns of 30% to 35% per year on capital invested into our Bank’s portfolio holdings. We also plan to make sure that our management retains a 25% ownership interest at AIB LLC.

4. Our Mission and Vision Statement

- Our vision at AIB LLC is to develop into a large scale investment bank that will provide underwriting income, advisory income, dividend income, capital appreciation, and interest income to investors.

- Our mission at AIB LLC is to ensure that investment decisions are implemented quickly and efficiently across all portfolios, to also make sure a trading research and rotation is used to avoid any type of systematic advantage or disadvantage an account may experience.

Our Business Structure

We at AIB LLC understand that the strength of our management team and board of directors is perhaps the most important factor in starting a bank and effectively providing for its future success. We also found out through our detailed research that for a new bank charter to be approved for us, all our senior management team must be experienced bankers with a history of relevant success.

The more reason we made sure our board of directors are made up of individuals with successful careers in business, banking, and other fields, and have representation in the necessary disciplines.

We also understand the role of the board and management as investors and how important they are. Regulators and other investors will look to the investment of these directors and senior officers as an important sign of their commitment to the bank.

We also understand that the typical investment bank is operated on a rigid, strict hierarchy, than most corporate or financial institutions. We have taken our time to analyse our market and what we need that is why we have decided to start with the listed workforce.

Managing director

- Senior vice president

Vice president

Investment Banking Associate

Investment Banking Analyst

- Marketing manager

- Security man

5. Job Roles and Responsibilities

- Broaden and/or enhance the bank’s industry coverage,

- Will partner with the firm’s leadership to grow and build the bank

- Will tirelessly work to deliver superior results to the firms’ clients

- Participate as a key member of the senior leadership team, contributing to the strategy, growth and success of the firm

- Lead efforts on sell-side and buy-side acquisition assignments, refinancing, recapitalization and restructuring assignments

- Interact seamlessly with prospects, clients, acquirors, investors and attorneys on all aspects of a M&A deal and/or capital raise

- Direct a team of junior bankers to support all elements of deal sourcing and execution.

Senior Vice president

- Involved in executing and managing equity offerings that will include the drafting and structuring of material, logistics management, issue identification, its analysis and the resolution.

- Responsible for mergers and acquisitions and manages the creation of buyers list, their contacts, drafting the relevant material, financial analysis and private equity placement.

- Researches and identify deal opportunities by formulating and issuing factual financial analyses and creating different kinds of financial plans.

- Involved in pitching or selling the organization’s products and services to new clients and may be involved in other projects as well.

- May participate in due diligence meetings with non-proprietary or proprietary investment managers and create relevant call reports that include their opinions.

- May be involved in analyzing the investment products and screening them by making effective use of a variety of investment data and the relevant software applications

- Monitors the investment products and their performance.

- Analyses the relevant statistics to evaluate the appropriateness of the product.

- Manages relationships with the investment management organizations and regularly gets him/her updated by getting valuable information from them.

- Attends industry conferences and training sessions so as to present innovative ideas to clients

- Responsible for providing leadership and overseeing the work of the subordinate members.

- Call on prospective clients such as privately held business owners, publicly traded companies and private equity firms.

- Conceptualize, organize and deliver new business presentations.

- Lead transaction implementation across industry groups.

- Manage, educate and develop banking analysts and associates.

- Develop marketing and new business presentations.

- Monitor financial analysis and modeling.

- Perform and analyze industry research.

- Create client presentations, proposals, engagement letters term sheets, legal agreements and offer memorandums.

- Create and foster client relationships.

- Managing and assisting in the preparation of financial models and business valuations

- Creating client marketing presentations

- Attending client meetings

- Conducting industry and company-specific due diligence related to transactions

- Drafting memoranda for sale assignments

- Assisting in the preparation of fairness opinions

- Attending drafting sessions for equity offerings

- Creating marketing materials for our equity sales organization

- Assisting in the development and continued cultivation of client relationships

- Developing an understanding of the underlying trends that affect equity capital markets.

- Development of various types of financial models to value debt and equity for mergers, acquisitions, and capital raising transactions.

- Perform various valuation methods: comparable companies, precedents, and DCF.

- Develop recommendations for product offerings, private equity transactions, mergers and acquisitions, and valuations.

- Conduct preparation and review of materials used in the financing of clients, including investment memoranda, management presentations and pitchbooks.

- Develop relationships with new and existing clients in order to expand the business.

- Perform due diligence, research, analysis, and documentation of live transactions.

- Create presentations for client portfolios.

Sales and Marketing director

- In charge of organizing external research and coordinating all the internal sources of information to retain the organizations’ best customers and attract new ones

- Expected to understand, prioritizes, and reaches out to new partners, and business opportunities et al

- Tasked with understanding development opportunities; follows up on development leads and contacts

- It’s the job of the director to supervise implementation, advocate for the customer’s needs, and communicate with clients

- Keep all customer contact and information

- Represents the company in strategic meetings

- Aid to increase sales and growth for the business

- Keep note and make sure the toiletries and supplies don’t run out of stock

- Ensures that both the interior and exterior of the firm are always clean

- Handles any other duty as assigned by the Vice president

Security guard

- The security guard is in charge of protecting the firm and its environs

- Also controls traffic and organize parking

- He is Tasked with giving security tips when necessary

- Should also Patrol around the building on a 24 hours basis

- It’s expected to give security reports weekly

6. SWOT Analysis

We at AIB LLC understand that the very first step of starting a new bank is to build a strong business and strategic plan. We believe that this plan must consider the proposed business of the new bank, its financial and managerial resources and prospects for success, the convenience and needs of the public, and the effect of competition.

This strong business and strategic plan supported by detailed financial projections and appropriate policies and procedures form the basis of successful regulatory applications of a bank charter.

We at AIB LLC hope to establish a lucrative investment bank that will serve the needs of our clients and also bring in profits for our founders. We took time to conduct a detailed SWOT analysis for AIB LLC. The details and results are explained below.

According to our SWOT analysis, our strength at AIB LLC rests on the expertise and experience of our management team. With the experience and discipline of our team, our SWOT analysis predict we can build a robust company profile even before bidding for investment banking contracts from corporate organizations.

As the investment banking industry expands and grows in revenue and market reach, so does the level of competition in the industry. Due to the very low barriers to entry, any individual or business may register itself as an investment bank after completing the proper examinations and filings.

- Opportunities

The banking sector has become one of the fastest growing business sectors in the U.S. economy. Note that computerized technologies allow financial firms to operate advisory, investment banking, and brokerage services anywhere in the country.

In time past, most financial firms needed to be within a close proximity to Wall Street in order to provide their clients the highest level of service. This is no longer the case as a firm can access almost every facet of the financial markets through Internet connections and specialized trading and investment management software.

According to our SWOT analysis, the risks we will be facing include;

- Market Risk – A high correlation exists between the growth rate of the investment industry and the performance of equity markets. While evidence suggests an attractive environment for equities in the future, no forecasts can be made with absolute certainty.

- Performance Risk – It is understood that our products are measured by their performance. Although the goal is to achieve competitive performance over three to five-year time periods, short-term periods may result in underperformance based on the critical measures.

- Business/Operating Risk – Beyond the third full year of operation, assets under management must produce revenues that will be sufficient to support operations in their entirety. Otherwise our options will be to acquire additional funding or to reduce costs.

7. MARKET ANALYSIS

- Market Trend

Experts believe this industry will continue to experience growth in all parts of the world especially in developed countries such as united states of America, Canada, United Kingdom , Germany, Australia, South Korea, Japan, China et al.

According to industry data, the industry brings in a whooping sum of $105 billion annually with an annual growth rate projected at -13.0 percent within 2011 and 2016. Although the number of industry activities has not deviated dramatically over the five-year period, the share of revenue that each activity accounts for has undergone substantial volatility.

It is believed that the products and services in the Investment industry differ considerably on a company-by-company basis, largely depending on operator size.

It’s very important to state that small and medium size investment banks target niche industries and small companies and depend more heavily on traditional investment banking activities such as underwriting and financial advisory. Alternatively, major industry players earn a substantial share of revenue from trading activities.

Note that one factor that attract entrepreneurs to the investment banking business despite the huge capital requirements and the high risk is that the venture is profitable. We have made plans to always stay ahead of industry trend and also to get the required certifications and license and also meet the standard capitalization for an investment bank in the United States.

8. Our Target Market

Our target market at AIB LLC will be greatly dependent on the phase of our product in its development cycle. Have it in mind that most of the marketing opportunities will happen beyond the first year of product development. But we remain very certain that some initial opportunities do exist.

For instance, our bank can utilize its transfer agent’s distribution services, which would put the product in a highly visible online platform. Note that extra opportunities include marketing to programs that invest specifically in “emerging managers.”

We at AIB LLC also believe that the high net worth and retail marketplace can be accessed to a limited degree, even in the early stages, through similar innovative opportunities and already-established relationships with clients. Just like manufacturing organizations, investment businesses are expected to develop products to provide to their customers.

Our hallmark product offering will be our well designed Market Equity strategy, an investment product offering based on the evidence supporting investor’s desires to outperform the overall market via a single, diversified vehicle and to avoid the need to create complex investment structures.

Our competitive advantage

Our Competitive Advantage at AIB LLC is specified in the three P’s commonly associated with investment firms: People, Process, and Performance. The first two determine the latter. Although our business plan highlights many areas (market research, financial projections, etc.), we believe there are two areas that will surely determine the level of success achieved by AIB LLC.

We believe that the very first is the people. Bright, energetic, talented, and knowledgeable individuals compose the core of the team we have at AIB LLC. We were able to note from our rigorous research that the most qualified investment professionals are attracted to efficient investment banks that are free from bureaucracy. Process is the second most important element of our bank.

We have made sure cutting-edge research will be provided in support of our portfolio management process. The implementation of our process is maximized by outsourcing virtually all functions not related to portfolio management and research, thereby making full use of the bank’s human capital.

9. SALES AND MARKETING STRATEGY

We at AIB LLC understand that the key to marketing an investment product is to create a successful and attractive product, develop a pattern of success, and show that pattern can be repeated in the future. After that, successful products should be aggressively marketed if capacity to manage additional assets exists.

Although a three to five-year period tend to seem like a century compared to the technology world, it is really quite reasonable considering the fact that private equity investors in limited partnership vehicles are generally satisfied with a 10-year waiting period that exists prior to a return of their capital investment.

AIB hallmark investment product will be the AIB Total Market Equity strategy and will be initially offered through an SEC registered mutual fund. Technological advancements also permit for other economically feasible distribution channels such as separately managed portfolios for large account sizes.

Sources of Income

We believe that our primary income at AIB LLC will come from providing our clients with investment packages, securities underwriting and advisory services in regards to mergers and acquisitions. AIB LLC will earn substantial fees for the equity and debt instruments that it underwrites and then resells to the general public.

We also believe that we will engage primarily in debt instruments among middle market companies that will be sold on a best efforts basis. This will place minimal risk on our capital reserve.

We will also earn substantial per hour management and deal fees regarding advisory services for mergers and acquisition operations. We also plan to make investments directly into marketable securities and hedge funds that specialize in specific areas of trading.

Our intention is to develop a number of trading strategies including options trading, LEAPs trading, long position/short position trading, and other methods of trading that will produce small but consistent gains on a weekly and monthly basis.

We plan to engage in a covered call strategy that would allow the fund to assure return on investment for securities that are held for an extended period of time.

10. Sales Forecast

We at AIB LLC expect to turn over approximately 1/3 of our portfolio each year. We strongly believe that this is consistent with an average holding period of three years. Generally, we would love for all holdings to be long-term investments, so we will identify stocks we will be comfortable with if we were “locked in” for three years.

This forces us to look beyond short-term noise in quarter-to-quarter results and focus on the big picture, such as our management’s vision for the future and their probability of executing their plan.

11. Publicity and Advertising Strategy

We understand the importance of creating a good publicity plan that will boost our brand and help us stay consistent in the industry.

That is why we contacted Advertising Experts called Kinks Global, to help us create publicity and advertising strategies that will help us at AIB LLC to attract and keep our target audience interested. Listed below is the summary of strategies detailed by Kinks Global for our Bank.

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms; we will also advertise AIB LLC on financial magazines, real estate and other relevant financial programs on radio and TV

- Introduce AIB LLC by sending introductory letters with our business brochure to individuals, households, corporate organizations, schools, players in the real estate sector, and all the people of Alexandria.

- Advertise AIB LLC in important financial and business related magazines, newspapers, TV and radio stations.

- Place AIB LLC on yellow pages ads (local directories)

- Attend important international and local real estate, finance and business expos, seminars, and business fairs et al

- Encourage word of mouth marketing from loyal and satisfied clients

- Sponsor relevant community based events / programs

- Leverage various online platforms to promote the business. This will make it easier for people to enter our website with just a click of the mouse. We will take advantage of the internet and social media platforms such as; Instagram, Facebook , twitter, YouTube, Google + et al to promote our brand

- Place our billboards at strategic locations

- Share our fliers and handbills in target areas all around Portland

12. Our Pricing Strategy

Firms in this industry get funds from investors who are interested in investing, and charge them for assisting them in investing their funds over a period of time as agreed by both parties. Even though investment banking is a very risky venture, it is still profitable, hence there is an agreement between the investment bank and the client as it relates to the commission they are expected to make from the deal.

We at AIB LLC plan to charge based on percentage and also a fix consultancy/business administrative fee. We believe that in the coming years and as we progress, that we can decide to improvise or adopt any business process and structure that will guarantee us good return on investment (ROI), efficiency and flexibility.

- Payment options

We plan to make sure we provide our clients with a wide variety of payment options for our services. We understand the diverse platforms people prefer and we plan to provide a suitable platform that will suit all equally. Listed below are the payment options that we will make available to AIB LLC.

- Payment through bank transfer

- Payment through online bank transfer

- Payment with check

- Payment with bank draft

13. Startup Expenditure (Budget)

We have noted that banks are expected raise their initial capital from investors after completing regulatory processes before they can open. In the industry, all insured banks must comply with the capital adequacy guidelines of their primary federal regulator.

The guidelines require a bank to demonstrate that it will have enough capital to support its risk profile, operations, and future growth even in the event of unexpected losses.

We believe that new established banks are generally subject to additional criteria that remain in place until the bank’s operations become well established and profitable. We at AIB LLC plan for an effective minimum capital of between $15 million to $25 million.

Successful capital generation in these amounts is generally the result of a well formulated and executed plan for developing local and other investors in the bank. We have analyzed our needs and we plan to spend our startup funds judiciously. Outlined below is a detailed financial projection and costing for starting AIB LLC;

- Price of incorporating the Business in the United States of America – $750.

- Our budget for basic insurance policy covers, permits and business license – $200,000

- Acquiring a suitable Office facility opposite the city hall at Portland Delta State (Re – Construction of the facility inclusive) – $75,000

- The budget envisaged for capitalization (working capital) – $30 million

- Budget for settling other legal processes (acquiring business license and all city dues et al) – $2,500

- Equipping the office with suitable and standard equipment(computers, software applications, printers, fax machines, furniture, telephones, filing cabins, safety gadgets and electronics et al) – $10,000

- Purchasing of the required software applications (CRM software, Accounting and Bookkeeping software and Payroll software et al) – $10,500

- Launching AIB LLC official Website – $600

- Our expenditure for paying employees for 3 months plus utility bills – $36, 000

- Other Additional Expenditure (Business cards, Signage, Adverts and Promotions et al) – $4,000

- Miscellaneous: $10,000

With the above detailed cost analysis , we need $349,350 and $30 million working capital to successfully set up AIB LLC.

- Generating Startup Capital for AIB LLC

AIB LLC is a licensed and registered investment bank which is capitalized by five principal investors, Mr Solomon Drane, Mrs Agnes Church, Dr Mel Stanford, Mr Kelvin Cruff and Prof. John Thomas.

Our founders plan to become the very first financiers of the business, although we have plans of selling shares and stocks as the business matures. Due to less constraint in financing, we have outlined the few ways we can acknowledge funding. These ways may include;

- Generate part of the startup capital from the five principal investors

- Agreeing to angel investors

- Apply for business loan from the Federal Reserve Bank (if need be)

Note: AIB LLC has been able to generate an enormous $15 million from its five principal investors, who aligned and individually dished out $3,000,000 each. We have also aligned with angel investors to inject $20 million into AIB LLC, with the hope of making profits and establishing a solid business.

14. Sustainability and Expansion Strategy

Our primary goal of the first full quarter of operation (February- May 2019) is to secure funding from outside sources. Before that, our management team at AIB LLC has a budget of $300,000 to be used for finding investors, forming a legal LLC, and registering the bank and its products with the SEC.

The amount sought from investors will be approximately $20 million, which should see the business through to profitability near the completion of the third year. We at AIB LLC believe that this break-even point equates roughly to an asset under management level of approximately $130 million.

One can easily see that even modest points beyond this break-even level can be highly lucrative. It is also important to note that excess cash will be re-deployed into the business once a level of sustainability in revenue has been reached. Our primary purpose for this type of reinvestment would solely focus on a “second stage” marketing plan to increase distribution.

We also believe that a word of note is also warranted as it relates to the cash flow statement of our bank. Have it in mind that one appealing feature of the investment industry is that collection of fees (i.e. revenues) is highly certain because fees are frequently charged directly to the client’s accounts (or to the mutual fund).

That is the more reason why revenue certainty is very high and is directly related to the amount of assets under management.

Also note that common practice in the investment industry is to bill at each quarter-end. For instance, our annual fee of 1% would be applied to our clients’ accounts five times per year at 0.20%. We at AIB LLC can strongly attest to the fact that economic motivation is great.

Growth rates for the investment industry are projected to range from 25% to 24% in each of the next three years. We believe that the demographic, economic, political and social evidence supporting these projections make this industry one of the most attractive industries due to the high degree of certainty in the estimates.

We at AIB LLC believe that the certainty coupled with the above average growth rate differentiates this opportunity from other venture investments. Also have it in mind that our conservative estimates outline a plan-to-profitability over a period much shorter than typical venture investments that sometimes need up to ten years to make profits.

Check List/Milestone

- Business Name Availability Check : Completed

- Business Incorporation: Completed

- Opening of Corporate Bank Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Conducting feasibility studies: Completed

- Leasing, renovating and equipping our facility: Completed

- Generating part of the start – up capital from the founder: Completed

- Applications for Loan from our Bankers: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: Completed

- Recruitment of employees: In Progress

- Purchase of software applications, furniture, office equipment, electronic appliances and facility facelift: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business (Business PR): In Progress

- Health and Safety and Fire Safety Arrangement: In Progress

- Establishing business relationship with banks, financial lending institutions, vendors and key players in the industry: In Progress

- Commercial Lending

- Community Banking

- Compliance and Risk

- Cybersecurity

- Human Resources

- Mutual Funds

- Retail and Marketing

- Tax and Accounting

- Wealth Management

- Magazine Archive

- Newsletter Archive

- Sponsored Archive

- Podcast Archive

A Marketer’s Guide to Branch Planning

When was the last time you, as a bank marketer, visited a branch? Do you know what the branch managers are doing on the front lines every day to market the bank’s products and services? Have you asked for their insights on the customer experience? Or what they think about bank sales goals and marketing plans?

If you can’t remember the last time you visited a branch or talked with a branch manager…

You’ll want to finish reading this article and make an appointment to visit a branch as soon as possible. You’ll be amazed at what you learn and—if you are open to it—just how many insights and aha! moments you can have at a branch. These insights will help you build stronger value propositions, create more effective sales and cross-sell campaigns, make smarter spending decisions, and understand better what your customers really think of your bank.

You might be thinking that’s a crazy idea. Branch traffic is down, after all, and the number of U.S. bank branches is in decline. But consider these three things:

- About half of new customers still choose a bank based on branch location.

- Over half of new checking account sales occur in the branch channel.

- For most banks, branches remain the most critical channel for delivering essential customer interactions and experiences.

Digital channels have not outmoded personal advice, guidance, or even certain transactions for many people—including millennials. This is especially true when it comes to big-ticket credit and investment decisions. Customer experience is about using all channels in a seamless way, including the branch.

Don’t assume branches are going away. Assume instead that you can help your branch managers find a better, more productive use of the branch space.

You’ve heard of banks reconfiguring branches or using extra branch space as a yoga studio, a community meeting space, or a coffee bar with free Wifi. Of course, it may not be logical or practical to turn every branch into the neighborhood coffee bar. The point is to identify the particular features most needed in each specific branch location. That could mean:

- Work space for independent contributors—especially sole proprietors and small businesses—with secure Wifi and a quiet work environment

- Small, hyper-efficient transaction zones—dedicated to high volume, digitally-oriented activity

- Credit and lending answer centers staffed by knowledgeable advisors

These innovative ideas have the potential to bring more people into the branches for a specific purpose, utilize the space in a more cost-effective and profitable way, and introduce your brand to people who may not have considered your bank for their financial needs. Now, maybe they will.

Overcoming the consistency conundrum.

For years being a mass market retailer has meant consistency—an idea that has manifested as a cookie cutter approach to branches, offering all branch capabilities in all locations. The underlying philosophy was that every branch had to be all things to all people. But by sharing and analyzing better data from customer channel usage and branch traffic, we can challenge that philosophy and create branches that cater to the needs of the neighborhood.

At many institutions, bank management sets branch-level sales and retention goals from their offices. And in many cases, goals are based solely on historic performance—without real knowledge of what’s happening in the branches. As we’ve seen, this can lead to overly-aggressive behavior and poor sales protocols. Perhaps we’ve been looking at this all wrong. Perhaps we should be supporting each branch manager, and looking at each branch as an independent small business.

Here’s how to build a plan for branch success from the ground up, based on the knowledge we use in marketing every day.

Apply market opportunity analytics.

- Determine whether market households and businesses are growing or shrinking in your bank’s geographies.

- Identify which consumer and business segments are large and growing—and which are small and decreasing in size.

- Assess what the branch manager knows about his or her neighborhood. Which Main Street businesses are opening/closing? Are home values increasing or decreasing? What about shifts in the local workforce, unemployment trends, and product inquiries and sales?

- Realize that micro-trends could be one of the keys to success for the branch of the future. The branch manager is probably in the best position to know what’s happening in their neighborhood—and can help the bank capitalize on micro-trends and happenings.

Define bank strategy and value proposition.

- Ensure there is a clearly articulated and differentiated value proposition that every bank employee can understand and communicate to customers and prospects.

- Utilize the value proposition as ‘guide rails’ for assisting branch managers in creating and prioritizing sales and marketing plans.

Measure branch transaction trends.

- Provide branch managers with a consistent set of key performance metrics and a performance dashboard so that they can see how they are doing against their own plan—and that of other branch managers.

- Don’t forget that some of the most important performance metrics include omni-channel transaction and product usage patterns of customers domiciled in the branch, in addition to sales and customer retention stats.

Understand branch performance relative to peers.

- Work with branch managers to conduct a strategic assessment of market and branch analytics. Perhaps some branches should be targeting cost savings and efficiencies while others should be hotbeds of sales and new customer acquisition.

- Set appropriate goals for the appropriate branch by providing context, such as market and branch performance rankings. This allows the marketing team and senior management to help guide the direction of each branch plan. And it sets each branch manager up for success.

Devise appropriate marketing and sales programs.

- Define branch-specific marketing and sales campaigns to fuel new-to-bank acquisition and raise awareness among key segments.

- Provide calling lists of prospects, informed by branch goals, segmentation strategy, and analytics.

- Design product bundles and communication standards that help managers to easily sell new products and upsell existing customer relationships.

You have an abundance of data that could help branch managers better understand their own small business.

But marketers aren’t always so good at sharing data with the front line. What if everyone in the organization could benefit from the huge trove of data being collected, so that across your network, branch managers are looking at consistent data? How cool it would be to have something analogous to a Google Analytics dashboard for every branch?

Branch managers would likely use the data to make decisions in diverse ways, and that’s the point. That’s because different branches should have different strategic directions, which might include:

- Targeting efficiencies

- Maintaining the base

- Accelerating new-to-bank acquisition

Using data on a branch’s current and past performance, customer base, and potential of the market, each branch manager can create an informed plan for success.

Given the option to either close a branch or find a better way to utilize the space…

Branch managers often become extremely resourceful in suggesting creative ways to maintain branches and jobs. That’s because they understand the importance of their branch to the local community. And with guidance, they can create a business plan that ensures a level of profitability and the continued ability to contribute to a vibrant local community.

Branch managers have to know bank regulations, operations, financial product sets for consumers and businesses, security measures, and sales practices. Simultaneously, they need to manage and motivate a team of people while also being great at customer service and relationship management. That’s one tall order. As banks increasingly embrace the capabilities that digital innovations bring to the customer experience, why not capitalize on the knowledge of your branch managers to help create your version of the bank of the future?

Or, at the very least, get their help in understanding options to make their branch and your marketing programs the best they can be.

If there is branch downstairs in your building, I challenge you to take a walk down there right now and introduce yourself to the branch manager. Make an appointment to grab lunch together—if they can spare the time—then spend an hour or two observing what happens in the branch. Observe the operation, the customers and the transactions. Then think about how your bank could make every customer experience better and what impact your findings have on how you do your job.

You might be surprised at your findings.

Mary Ellen Georgas is an experienced banking industry consultant and firm leader at Capital Performance Group, LLC , providing strategy, marketing, and digital channel consulting services to the financial services industry. Email: [email protected] .

Related Posts

Workplace banking: A multiplier for new-account sales

The value of tailored banking offerings delivered as employee benefits.

Spreading out the asset risk

With community bank guidance, a new national marketplace aims to help small and midsize banks manage asset risk related to being tied to local and regional resources.

Survey: Cybersecurity, customer acquisition top challenges for community banks

Community banks see cybersecurity as a top challenge, with customer acquisition and retention a close second, according to a recent survey of community banks by BNY.

Podcast: ‘At the end of the day, it’s all about financial empowerment’

As chief corporate responsibility officer for Webster Bank, Marissa Weidner works across the bank's footprints and business lines to help advance the bank's goals of financial empowerment.

A banking career dedicated to making a difference

‘Bankers can bring a passion for economic mobility and really meet people where they are in their journey.’

Marketing Money Podcast: Is the new CMO growth-oriented or data-driven?

Considering the implications of this shift for marketing strategies and bank branding.

ABA DataBank: Mortgage rates fall and refinances surge

Lawmakers urge fdic to give banks more time to implement new signage rule, report: hsa assets grew to $137b in 2024, sponsored content.

New Nacha Rules and Tools Aim to Enhance Fraud Funds Recovery

Scheduled for Delivery

The Top 5 Forces to Ignite FI Strategies

Rethink Your Digital Experience: 7 Benefits of Embracing Digital Transformation

Podcast: when going through a core conversion pays off, podcast: more tools to tackle check fraud.

American Bankers Association 1333 New Hampshire Ave NW Washington, DC 20036 1-800-BANKERS (800-226-5377) www.aba.com About ABA Privacy Policy Contact ABA

© 2024 American Bankers Association. All rights reserved.

Need a consultation? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- E1 Treaty Trader Visa

- E2 Treaty Investor Visa

- Innovator Founder Visa

- UK Start-Up Visa

- UK Expansion Worker Visa

- Manitoba MPNP Visa

- Start-Up Visa

- Nova Scotia NSNP Visa

- British Columbia BC PNP Visa

- Self-Employed Visa

- OINP Entrepreneur Stream

- LMIA Owner Operator

- ICT Work Permit

- LMIA Mobility Program – C11 Entrepreneur

- USMCA (ex-NAFTA)

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Online Boutique

- Mobile Application

- Food Delivery

- Real Estate

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- Business Valuation

- How it works

- Business Plan Templates

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Sep.27, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing. By preparing a solid E2 visa business plan sample , entrepreneurs can utilize such banking models to secure their business immigration status in the U.S.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf