- Sample Business Plans

Trading Business Plan

Starting a trading business can be challenging because you have to build contacts, negotiate, and whatnot. But amidst worrying about all these things, planning is the last thing you want to worry about.

While anyone can start a new business, you need a detailed business plan when it comes to raising funding, applying for loans, and scaling it like a pro!

Need help writing a business plan for your trading business? You’re at the right place. Our trading business plan template will help you get started.

Free Business Plan Template

Download our free trading business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Trading Business Plan?

Writing a trading business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

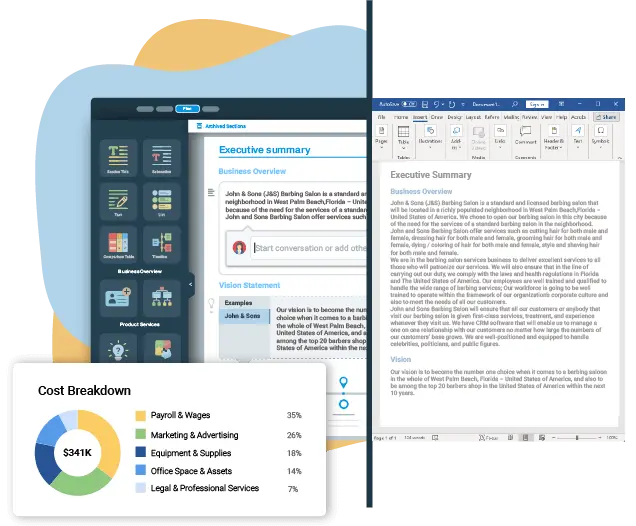

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Introduce your Business: Start your executive summary by briefly introducing your business to your readers. This section may include the name of your trading business, its location, when it was founded, the type of trading business (E.g., retail trading, wholesale trading, import-export), etc.

- Market Opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Mention your product range: Highlight the product range of your trading business you offer your clients. The USPs and differentiators you offer are always a plus. For instance, you may include consumer goods, industrial & construction supplies, or beverages as your product range.

- Marketing & Sales Strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

- Financial Highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to Action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

- Retail trading

- Wholesale trading

- Export-import

- Dropshipping

- Describe the legal structure of your trading company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

- Owners: List the names of your trading company’s founders or owners. Describe what shares they own and their responsibilities for efficiently managing the business.

- Mission Statement: Summarize your business’ objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

- Business History: If you’re an established trading business, briefly describe your business history, like—when it was founded, how it evolved over time, etc. Additionally, If you have received any awards or recognition for excellent work, describe them.

- Future Goals: It’s crucial to convey your aspirations and vision. Mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

- Target market: Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers. For instance, business owners, wholesalers, or retailers would be an ideal target audience for a trading business.

- Market size and growth potential: Describe your market size and growth potential and whether you will target a niche or a much broader market. For instance, the retail trading market size in the USA was $7.9 trillion in 2022, so it is crucial to define the segment of your target market and its growth potential.

- Competitive Analysis: Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your trading business from them. Point out how you have a competitive edge in the market.

- Market Trends: Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends. For instance, eCommerce has a booming market; explain how you plan on dealing with this potential growth opportunity.

- Regulatory Environment: List regulations and licensing requirements that may affect your trading company, such as business registration, insurance, licensing, etc.

Here are a few tips for writing the market analysis section of your trading business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

- Describe your products: Mention the trading products your business will offer. This may include product categories, product range, product features, product sourcing, etc.For instance; for wholesale trading business consumer goods, food & beverage, industrial & construction supplies, etc. are some of the product ranges.

- Logistics & shipping

- Warehousing & storage

- Distribution & fulfillment

- Additional Services: Mention if your trading company offers any additional services. You may include services like, product customization & branding, packaging & labeling, supply chain consultation, etc.

In short, this section of your trading plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Unique Selling Proposition (USP): Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies. For example, advanced equipment, vast product range, or experience & expertise could be some of the great USPs for a professional trading company.

- Pricing Strategy: Describe your pricing strategy—how you plan to price your products and stay competitive in the local market. You can mention any discounts you plan on offering to attract new customers.

- Marketing Strategies: Discuss your marketing strategies to market your services. You may include some of these marketing strategies in your business plan—social media marketing, brochures, email marketing, content marketing, and print marketing.

- Sales Strategies: Outline the strategies you’ll implement to maximize your sales. Your sales strategies may include direct sales calls, partnering with other businesses, offering referral programs, etc.

- Customer Retention: Describe your customer retention strategies and how you plan to execute them. For instance, introducing loyalty programs, discounts or offers, personalized service, etc.

Overall, this section of your trading business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your trading business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

- Staffing & Training: Mention your business’s staffing requirements, including the number of employees or traders needed. Include their qualifications, the training required, and the duties they will perform.

- Operational Process: Outline the processes and procedures you will use to run your trading business. Your operational processes may include inventory management, sales & marketing, order processing, customer service, etc.

- Equipment & Machinery: Include the list of equipment and machinery required for trading, such as office equipment, warehouse equipment, transportation vehicles, packaging & testing equipment, etc. Explain how these technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your trading business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

- Founders/CEO: Mention the founders and CEO of your trading company, and describe their roles and responsibilities in successfully running the business.

- Key managers: Introduce your management and key members of your team, and explain their roles and responsibilities. It should include, key executives(e.g. COO, CMO.), senior management, and other department managers (e.g. operations manager, customer services manager.) involved in the trading business operations, including their education, professional background, and any relevant experience in the industry.

- Organizational structure: Explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy.

- Compensation Plan: Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

- Advisors/Consultants: Mentioning advisors or consultants in your business plans adds credibility to your business idea. So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your trading business, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

- Profit & loss statement: Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement . Make sure to include your business’s expected net profit or loss.

- Cash flow statement: The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

- Balance Sheet: Create a projected balance sheet documenting your trading business’s assets, liabilities, and equity.

- Break-even point: Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal. This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

- Financing Needs: Calculate costs associated with starting a trading business, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your trading business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample trading business plan will provide an idea for writing a successful trading plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our trading business plan pdf .

Related Posts

How to write a Business Plan Cover Page

Write Business Plan Using ChatGPT

Important Components of an Effective Business Plan

Problem Statement in Business with Solution

Frequently Asked Questions

Why do you need a trading business plan.

A business plan is an essential tool for anyone looking to start or run a successful trading business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your trading company.

How to get funding for your trading business?

There are several ways to get funding for your trading business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought startup options.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your trading business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your trading business plan and outline your vision as you have in your mind.

What is the easiest way to write your trading business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any trading business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

IMAGES

VIDEO