- Crafting an Effective Partner Business Plan: Essential Elements for Success

Share this article

Print/Download PDF

By Harrison Barnes

Rate this article

932 Reviews Average: 5 out of 5

Discuss Partners on Top Law Schools

- ideas on how to network with judge's son who is partner?

- Networking/taking a partner at a firm out to lunch?

- NYC Study Partners- for those truly motivated

- 165+/Retake Study Partner?

- Arizona Study Partner

Partner Business Plans: Key Elements

- The Crucial Role of Business Plans in Law Firm Partner Success

- Maximize Portables in Your Business Plan in Order to Maximize Interest in You

The Importance of a Great Business Plan

Professional Goals For Partner Status

Making an evaluation of your existing practice, describing your vision as a partner, creating a strategy for growth.

- A partner's fit culturally

- The viability of a partner's practice for the long-term

- A partner's record of excellent client service to long-term clients and producing business

- A partner's history of consistently increasing collections

- A partner's practice fit in connection with the firm's strategic plan for expansion

- Whether a partner's practice area is one that is targeted for growth

- Whether the partner brings portable business and/or specific expertise needed in a particular practice area

- The opportunities the partner would bring for business development and significant cross-selling were the partner to join the firm

- Whether the partner's historical information is reflective of consistent productivity

- Whether the partner's client base fits within the firm's client structure

- Any potential conflicts that would preclude the firm from hiring the partner

- A partner's current compensation and compensation expectation

- A partner's potential contribution to the firm's bottom line/profitability

- A partner's fit within the firm's current attorney roster

- A partner's reason for leaving his or her current firm (voluntary/mutual arrangement) and whether the partner would be a problem

- Creative: Serve as a marketing piece on the partner and enable the firm to assess the partner's business potential. It should also provide an outlet to the partner to step out of the resume format and chart his or her previous performance and future prospects for business in a creative format.

- Illustrative: Illustrate to a firm that the partner is thinking about his or her practice as a business and set forth his or her plan for the future.

- Persuasive: Persuade the firm to hire the partner.

- Historical: Chart a historical record of the partner's history of creating business opportunities and his or her ability to develop and foster client relationships over an extended period of time.

- Demonstrative: Demonstrate a partner's business-development skills, initiative, and ability to contribute not only to his or her own success but also to the success of his or her colleagues through cross-selling efforts. It should also demonstrate ways a partner can contribute to a firm's financial bottom line, enhance its practice-group development, and ultimately bring added value to the team.

- Prophetic: Prophesy what the partner believes he or she will be able to accomplish in his or her practice and for the firm in the short and long term.

- Preparatory: Prepare the partner for the interviewing process.

Introduction

- Provide a narrative including professional history, practice overview, and a description of areas of expertise. This section may highlight briefly particular areas of expertise that the firm does not currently have.

- Describe the partner's role historically as a business developer.

- Briefly touch upon why the partner believes he or she would be a good fit for a particular firm.

Market Research/Analysis

- Give analysis of local need for services in partner's practice area.

- Describe local competition/other law firms with similar practices.

- Give overview of need in local market for partners with his or her expertise.

- Describe why partner believes firm provides the best platform in the marketplace for his or her particular practice area.

Current Client Base

- Describe current portable clients (use generic or specific).

- Describe key industries serviced.

- Discuss other partners' clients partner is servicing.

Additional Contacts to Develop

- Discuss contacts not yet tapped.

- Given market analysis, project possible targets in local, regional, national, or international markets.

- Discuss possible expansion of business from current client base.

Cross-Selling Opportunities

- Describe cross-selling opportunities with current clients.

- Describe cross-selling opportunities with known key clients of prospective firm.

- Discuss other practice areas at current firm to which partner is delegating work.

- Discuss services your clients are requesting that you cannot currently service at your firm and could otherwise capture at the new firm .

Other Business-Development Sources

- Describe additional business contacts you are pursuing or plan to pursue

- Speeches, publications

- Community organizations

- Bar associations

- Internal marketing initiatives

- Client seminars/newsletters

Long-Term Strategy Goals and Targets

- Set targets for expansion of practice in terms of collections, attorneys, and clients/industries.

- Consider possibility of local to regional to national growth patterns.

- Consider growth in other key competencies which may be affected by partner's long-term success.

- Discuss long-term strategies in connection with firm's overall strategic plan and practice-group development plans.

Historical Collections, Billing Rates, and Billable Hours

- If a partner with a lower billing rate structure, chart the anticipated rate increases by portable client or anticipated timeline for rate increases to current clients. Discuss any alternative billing arrangements you currently have in place with clients.

- Include three-year client collections history by client (as originating attorney and as billing attorney on other attorneys' matters). Include projection for current fiscal year.

- Include three-year billing rate history.

- Include three-year historical compensation history (including bonus information).

- Include three-year billable hour history.

- Note pending projects contributing to future collections.

- Include a summary of anticipated collection projections for the next three to five years.

- Business-development budget

- Time commitments from partners in other practice areas for cross-selling purposes

- Key staff needed (secretary, paralegals, etc.)

- Foreign-language skill requirements

- Travel expenses

- Marketing materials, presentations, etc.

Creative Conclusion

- Recap key points in plan, added value partner brings, and reasons he or she would be a good fit.

- Emphasize flexibility of plan and eagerness and willingness to discuss and modify in accordance with firm's plans and objectives.

- See 30 Ways to Generate Business as an Attorney for more information.

Want to continue reading?

Become a free bcg attorney search subscriber..

Once you become a subscriber you will have unlimited access to all of BCG’s articles.

There is absolutely no cost!

Harrison Barnes does a weekly free webinar with live Q&A for attorneys and law students each Wednesday at 10:00 am PST. You can attend anonymously and ask questions about your career, this article, or any other legal career-related topics. You can sign up for the weekly webinar here: Register on Zoom

Harrison also does a weekly free webinar with live Q&A for law firms, companies, and others who hire attorneys each Wednesday at 10:00 am PST. You can sign up for the weekly webinar here: Register on Zoom

You can browse a list of past webinars here: Webinar Replays

You can also listen to Harrison Barnes Podcasts here: Attorney Career Advice Podcasts

You can also read Harrison Barnes' articles and books here: Harrison's Perspectives

Harrison Barnes is the legal profession's mentor and may be the only person in your legal career who will tell you why you are not reaching your full potential and what you really need to do to grow as an attorney--regardless of how much it hurts. If you prefer truth to stagnation, growth to comfort, and actionable ideas instead of fluffy concepts, you and Harrison will get along just fine. If, however, you want to stay where you are, talk about your past successes, and feel comfortable, Harrison is not for you.

Truly great mentors are like parents, doctors, therapists, spiritual figures, and others because in order to help you they need to expose you to pain and expose your weaknesses. But suppose you act on the advice and pain created by a mentor. In that case, you will become better: a better attorney, better employees, a better boss, know where you are going, and appreciate where you have been--you will hopefully also become a happier and better person. As you learn from Harrison, he hopes he will become your mentor.

To read more career and life advice articles visit Harrison's personal blog.

Article Categories

- Legal Recruiter ➝

- Attorney Career Advice ➝

- Advice for Partners ➝

- Business Plans

Do you want a better legal career?

Hi, I'm Harrison Barnes. I'm serious about improving Lawyers' legal careers. My only question is, will it be yours?

About Harrison Barnes

Harrison is the founder of BCG Attorney Search and several companies in the legal employment space that collectively gets thousands of attorneys jobs each year. Harrison is widely considered the most successful recruiter in the United States and personally places multiple attorneys most weeks. His articles on legal search and placement are read by attorneys, law students and others millions of times per year.

Find Similar Articles:

- strategic Partnerships

- risk Analysis

- regulatory Compliance

- professional Development

- Partner Business Plans

- legal Advice

- law Firm Planning

- governance Strategies

- goal Setting

- financial Management

- crisis Management

- corporate Structure

- contract Negotiation

- conflict Resolution

- business Law

Active Interview Jobs

Featured jobs.

Location: California - Los Angeles

Location: New Jersey - Jersey City

Most Viewed Jobs

Location: Texas - Houston

Location: Florida - Miami

Location: Virginia - Leesburg

Upload Your Resume

Upload your resume to receive matching jobs at top law firms in your inbox.

Additional Resources

- Harrison's Perspectives

- Specific Practice Areas

- The Winning Mindset

BCG Reviews

I would be remiss if I did not tell you how valuable I believe it has been to work with my New York recruiter in this pr.... Read more >

Linda Brower

The outcome was incredible. I am exactly in the position that I always wanted to be in and dreamed of. This wouldn't hav.... Read more >

Michael Coopersmith

Sturm College of Law, University of Denver, Class Of 2016

My favorite part of working with BCG Attorney Search was that I got active notifications and seemed like they were reall.... Read more >

Cindy Lopez

American University Washington College of Law, Class Of 2020

My Chicago recruiter had good insight and was helpful throughout the process.

Richard Stanley

Baylor University School of Law, Class Of 1999

I love that I had to put in little to no effort to get this job, to be honest with you besides the actual interview I ha.... Read more >

Keith French

University of Virginia School of Law, Class Of 2013

The good thing about working with BCG in general is all of the resources and articles. The job search showed that the fi.... Read more >

Sergio Marin

University of Connecticut School of Law, Class Of 2018

Popular Articles by Harrison Barnes

- What is Bar Reciprocity and Which States Allow You to Waive Into the Bar?

- What Do Law Firm Titles Mean: Of Counsel, Non-Equity Partner, Equity Partner Explained

- Top 6 Things Attorneys and Law Students Need to Remove from Their Resumes ASAP

- Why Going In-house Is Often the Worst Decision a Good Attorney Can Ever Make

- Top 9 Ways For Any Attorney To Generate a Huge Book of Business

Helpful Links

- The BCG Attorney Search Guide to Basic Law Firm Economics and the Billable Hour: What Every Attorney Needs to Understand to Get Ahead

- Quick Reference Guide to Practice Areas

- Refer BCG Attorney Search to a Friend

- BCG Attorney Search Core Values

- Recent BCG Attorney Search Placements

- What Makes a World Class Legal Recruiter

- What Makes BCG Attorney Search The Greatest Recruiting Firm in the World

- Top 10 Characteristics of Superstar Associates Who Make Partner

- Off-the-Record Interview Tips From Law Firm Interviewers

- Relocating Overseas

- Writing Samples: Top-12 Frequently Asked Questions

- The 'Dark Side' of Going In-house

- "Waive" Goodbye To Taking Another Bar Exam: Typical Requirements and Tips to Effectively Manage the Waive-in Process

- Changing Your Practice Area

- Moving Your Career to Another City

- A Comprehensive Guide to Working with a Legal Recruiter

- A Comprehensive Guide to Bar Reciprocity: What States Have Reciprocity for Lawyers and Allow You to Waive into The Bar

Related Articles

A Career Guide for Law Firm Partners

Practice Management

Marketing Your Law Firm Through Practice Groups

Related Video

- What is a Counsel and How does it Compare to a Partner�

Related Podcast

- How Any Attorney Can Get a $100+ Million Book of Business, Become a Partner in a Major Law Firm, or Start a Successful Business and Retire Whenever They Want�

When you use BCG Attorney Search you will get an unfair advantage because you will use the best legal placement company in the world for finding permanent law firm positions.

Don't miss out!

Submit Your Resume for Review

Register for Unlimited Access to BCG

Sign-up to receive the latest articles and alerts

Already a subscriber? Sign in here.

Design for Business

How to Write a Partnership Proposal (Templates & Tips)

Written by: Raja Mandal

Are you planning to get into a partnership or joint venture with another business? Then you'll have to sell the idea, benefits and your future plans to the prospective partner. To win the partnership, you need to present the complete details in a compelling manner.

A partnership proposal template can help you write a stand-out proposal that will explain how you and the potential business partner can grow together.

In this article, we'll discuss how to write a partnership proposal and highlight actionable tips you can use to propose business partnerships. We've also included some partnership proposal templates you can use to get started quickly.

Table of Contents

What is a partnership proposal, how to write an effective partnership proposal, partnership proposal templates, tips for proposing a business partnership, partnership proposal faqs, create your partnership proposal with visme.

- A partnership proposal is a document that a business uses to explain to another business why they should collaborate and how both parties will benefit before creating a formal contract.

- Partnership proposals help you demonstrate your values, describe your goals, outline benefits for potential partners and establish long-term relationships.

- Follow these steps to write a partnership proposal: research your potential partner, create a solid structure for your proposal, apply your branding, add engaging media and data visualization, and get your team involved.

- Some tips for proposing a business partnership include picking the right company and understanding their needs, talking to the decision-maker, getting warm introductions first, sending a pre-meeting email, being a good listener, and not making it overly promotional.

- Visme can help you create professional, on-brand partnership proposals in minutes. Customize ready-made templates, apply one-click branding, drag and drop built-in design assets, incorporate multimedia and data visualization, and then download or share in multiple ways to win partners for your company.

A partnership proposal is a document created before any contract or agreement is made in a business partnership to determine the benefits of running the business together.

In simple words, a business approaches another business to explain why they should work together and how the partnership will benefit both parties. And the document they use to propose the partnership before making the contract is called a partnership proposal.

Here's a sample partnership proposal.

Now let's discuss the potential benefits of a partnership proposal.

Demonstrate Values

According to a recent study, 89% of shoppers stay loyal to brands that share their values.

Maybe your potential partner is in the same industry as you and offers complementary products and services. But that doesn't make the company an automatic fit for a partnership. A successful partnership is made when the core values of involved businesses align.

The proposal helps you show how your brand values and work ethics align with the other business, giving them a strong reason to accept the proposal.

Describe Your Goals

What do you, as a business, want to achieve out of this partnership? How will the other business help with this? A partnership proposal will include all your future and current goals to help the other company understand how their vision and mission match yours.

Outline Benefits for Potential Partner

One of the critical aspects of a partnership proposal is to explain to the other business the benefits the partnership will bring to the table. You can emphasize the benefits that will help both organizations reach the shared goals you have explained.

Create a Long-Term Relationship

Businesses often want to pull out of a partnership ahead of schedule because the partnership fails to deliver the returns as promised. The primary reason for creating the proposal is that the partnership works out for a long time or draws an amicable conclusion.

Create reports, proposals, ebooks and more

- Dozens of content types to choose from

- Add your brand colors and fonts

- Team collaboration available

Sign up. It’s free.

Now you know what a partnership proposal is and its potential advantages. However, if you have written proposals in the past, you know that crafting a compelling partnership proposal that is also aesthetically appealing is not everyone's cup of tea.

As a business owner, you might have come across a good number of business proposals . Then you also know what it takes to make a proposal stand out and how time-consuming the process of creating a proposal can be.

Keeping that in mind, Visme offers professionally designed partnership proposal templates to help you so that you don't have to create the proposal from scratch.

Follow the steps below to create your partnership proposal.

Do Your Research

Doing your research before you start writing your proposal is the crucial first step of the process. Though you might know that the company is a match for your business and its vision and mission align with yours, it might not be enough.

Look online for information on the potential partner's history, accomplishments, leadership and work ethics. Read case studies , and spend time on their website and social media to conduct an in-depth analysis of the company.

Use your research to explain why you want to partner with the particular company and not others and how it's a win-win for both parties.

Structure Your Partnership Proposal

Once you've researched your potential partner, it's time to structure your partnership proposal. The proposal is your opportunity to create a great first impression of your company on your recipient. According to Forbes, first impressions in business settings may be formed in just seven seconds .

Therefore, you must structure your proposal well to win the deal. Here are some steps to follow when structuring a proposal.

1. Introduce Your Business

The goal of your proposal's introduction is to gain the recipient's interest. This section should include the basic information about you and your company and an overview of the topic to clarify what the proposal is about.

Mention any previous partnerships you have done, share the results, communicate your values and introduce your team . Also, don't forget to provide your contact information.

Look at the "about our company" section of the template below for inspiration.

2. State Your Purpose

Your purpose for the proposal is what you want to make out of this partnership or what problem exists that you need to fix through it. Provide clear information about the proposal and make the main message clear immediately.

3. Define Your Goals and Objectives

In this section, talk about how your goals match the other business and the objectives you will establish to get there together.

If you are having difficulty achieving your business goals, it could be because you aren't setting them wisely. Learn how to create SMART goals and achieve them easily. Here is a template to help you with that.

4. Explain the Benefits

Since you have researched enough about the other company, discuss all the benefits you will bring.

Explain the benefits they can expect from this partnership in the near future. If you are unable to provide an immediate benefit, your potential partner might not sign on.

5. Include Legal Considerations

Partnering with other businesses without any formal partnership agreements is not a wise decision. Also, partnerships, like all corporate structures, come with legal complications. So, include all the legal considerations in the partnership that your potential partner should consider before signing in.

If you're still unsure about putting together a partnership proposal, watch the video below for more information.

Keep Your Partnership Proposal On-Brand

Consistent branding is a crucial aspect of running a business. So, keep every page of your partnership proposal consistent with your brand identity .

Consider your brand colors , brand fonts , logo and other branding elements. If you haven't defined your brand identity yet, choose design elements that match your brand personality .

Visme's Brand Wizard can help you with this. It automatically imports your branded assets so that you can create branded content directly in Visme. Simply input your website URL, choose your brand colors and fonts, choose the branded templates theme and watch the magic happen.

Watch the video below to set up your branding kit in Visme.

Add Engaging Media and Data Visualization

Keep the recipient engaged by adding high-quality visuals such as icons , illustrations, images , videos , interactive content and more.

Attach supporting documents to your proposal, such as graphs, charts , reports , and other data visualizations . These visuals will make the proposal more engaging, helping your prospective partner better understand why you're the right partner for them.

Get Your Team Involved

A business partnership requires a lot of critical decision-making processes from the company's top management. But you should involve all your team members in the process of creating the proposal.

Get your team involved in creating the partnership proposal with Visme's collaboration features .

Leave comments, tag your team members, and edit your partnership proposal in real time.

Watch how easy it is to collaborate with your team in your Visme workspace.

1. Retail Store Partnership Proposal

The retail partnership proposal comes with a modern layout, striking visuals and professionally designed pages that you can easily customize in Visme.

This proposal covers key sections like about us, what makes us different, partnership details and benefits, next steps, and a clean, organized page for terms and conditions.

2. Finance Consultancy Partnership Proposal

This partnership proposal template features several eye-catching pages that are brought to life with unique icons, high-resolution images and stunning fonts. Personalize it by replacing the placeholder text and uploading your brand elements.

In fact, save yourself the hassle of manually uploading each design asset, and use Visme’s brand design tool instead. Simply enter your website URL and let the AI pull your logo, brand colors and fonts to create custom, branded designs.

3. Management Company Partnership Proposal

Make a lasting first impression in front of potential partners by using this company partnership proposal template. It has beautiful colors, attractive shapes and icons, unique data widgets and high-res photos that you can replace with your own.

This brand collaboration proposal template’s design, fonts and whitespace ensure potential partners read through the entire proposal, boosting your chances of signing lucrative deals.

4. Fashion Brand Partnership Proposal

With an attractive layout, colorful icons and on-theme imagery, this fashion partnership proposal template will instantly capture your audience’s attention. It features pre-designed pages to add your company information, partnership benefits and terms.

This partnership proposal example also includes a short case study highlighting how other companies profited by partnering with them.

5. Organization Partnership Proposal

The professional design of this business partnership proposal is ideal for various industries. It features a simple, minimalistic layout with colorful pages, relevant images and ample whitespace—all of which can be customized with a few clicks of a button.

If you’re facing writer's block while writing your partnership proposal, try Visme’s AI text generator . Enter a detailed prompt with your requirements including your tone, audience and objective and sit back as our tool creates ready-to-use drafts for you.

Now that you know how to write a partnership proposal, here are some tips to attract that strategic partner for your business.

Pick the Right Company and Understand Their Needs

The first thing you should do before anything else is pick the right company to propose your partnership. Your future business partner might be from another industry or might offer different products or services from yours. But, you need to make sure that you have shared goals, objectives, vision and mission.

Once you find a business you can partner with, understand their needs and incentives to work with you.

Talk To The Decision-Maker

Working with big companies means dealing with a lot of people, which can really drag things out. Therefore, you want to reach out to the company's decision-maker.

For example, you can talk to the CEO, head of business development and vice president of the finance department who approves the budget. Reaching out to the other people in the company who are not in a decision-making position could slow down the process.

Get Warm Introductions First

One of the best ways to approach your potential partner is through an introduction from a shared connection. Here, you can leverage your relationship with your investors, advisors, and mentors.

Provide the mutual contact with an overview of your partnership proposal that can be forwarded easily. Once the introduction part is complete, follow up regularly and set the next steps.

Send a Pre-Meeting Email

To prepare your client for the meeting, it's wise to send a pre-meeting email. Include quick, scannable information explaining what to expect at the meeting. This will help you set the right expectations and keep you both on the same page.

Design your email using Visme to make the process quick and easy. Our email header templates will help you convey your message visually and make your email as compelling as possible.

Be a Good Listener

Once you're done presenting your proposal, listen to your potential business partner's goals and objectives carefully. Allow the other person to do the talking and share their thoughts. This is one of the strongest foundations for the strategic business partnership to develop and grow.

Don't Make It Overly Promotional

Don't miss an opportunity to highlight your company's achievements. Let the brand voice sound loud, but don't make the proposal overly promotional. You are proposing a mutually beneficial business relationship, not selling a product or service to a customer.

After all, it's a partnership proposal and not a sales letter. Keep your partnership proposal honest and professional.

Learn more about some business proposal presentation tips to present your proposal confidently.

Q. How do you structure a partnership proposal?

A partnership proposal format should include an executive summary, company overview, partnership goals, potential benefits, and terms and conditions.

Q. How do you pitch a partnership?

The best way to pitch a partnership is to create a proposal that defines your value proposition, highlights mutual benefits, shows market potential and presents a clear implementation plan.

Q. How do you write a partnership proposal email?

An effective partnership proposal email includes your company's introduction, a clear statement of your partnership idea, key benefits for both parties and a request for a follow-up meeting. It’s important to keep your partnership letter or email concise, personalized and focused on mutual value.

Q. When do you need a partnership proposal presentation?

You need a partnership proposal presentation when you want to collaborate with other firms, such as for co-marketing or sponsorship purposes. They are used to pitch ideas, communicate complex partnership details and secure investments.

Q. What should a partnership agreement include?

Some of the key elements of a partnership agreement include:

- Partnership goals and objectives

- Roles, responsibilities and commitments of each partner

- Duration of the partnership and renewal terms

- Intellectual property rights and confidentiality clauses

- Dispute resolution procedures

- Termination clauses and conditions

Q. How do you respond to a partnership proposal?

There are several ways to respond to a partnership proposal. You can express appreciation for the offer, ask follow-up questions, request a meeting to discuss further details, or politely decline and explain your reasons.

Use this article and the partnership proposal template to write your partnership proposal and win the deal confidently. When partnering with a business, you might need to create various other documents. Visme's partnership templates can help you acquire a strategic partnership. You can also streamline the creation process with Visme's AI Proposal Generator . Allow AI to do the heavy lifting with your design so you can wrap up your proposal in minutes, not hours.

But that's not enough. Once you gain the business partnership, ensure that all the stakeholders learn about this great news. Use Visme's partnership press release template to get media coverage and partnership announcement LinkedIn post to share the information on LinkedIn.

Sign up for a free account in Visme today and start creating professional documents for all your business needs.

Easily put together a professional partnership proposal with Visme.

Trusted by leading brands

Recommended content for you:

Create Stunning Content!

Design visual brand experiences for your business whether you are a seasoned designer or a total novice.

About the Author

Raja Antony Mandal is a Content Writer at Visme. He can quickly adapt to different writing styles, possess strong research skills, and know SEO fundamentals. Raja wants to share valuable information with his audience by telling captivating stories in his articles. He wants to travel and party a lot on the weekends, but his guitar, drum set, and volleyball court don’t let him.

Recommended content for you

11 SBAR Templates for Effective Communication: How to Use Them + Top Tips

Olujinmi Oluwatoni Aug 30, 2024

Content Authoring: Best Tools, Process & Practices to Use

Mahnoor Sheikh Aug 30, 2024

A Complete Guide to Service Level Agreement (SLA) + Template

Zain Zia Aug 23, 2024

How to Create the Perfect User Guide + Templates

Idorenyin Uko Aug 23, 2024

How to Start a Partnership Business in 10 Steps

At some point you may have wondered—whether idly or seriously—if it's a good idea to start a business with a close friend, family member, or colleague whose work ethic you admire. It’s exciting to think about building something together and combining your strengths to create a thriving venture. If you're considering taking the leap in forming a partnership, it's crucial to understand the process—and we’ll help you through it.

We’ve created a step-by-step guide on how to start a partnership business, along with answers to common questions about it.

What is a partnership business?

At its core, a partnership business is just what it sounds like—a business owned and run by two or more people who share responsibilities, profits, and sometimes, the headaches that come with running a company.

Think of it as co-parenting a business baby. There are different ways to structure your partnership, and understanding these options can help you choose the one that’s best for you and your partner(s).

Know the types of partnership business

The type of partnership you choose determines the blueprint of what your business is going to look like. Here are a few common types:

- General partnership (GP): This is the most straightforward arrangement where all partners share equal responsibility for managing the business and are equally liable for any debts. It’s like co-owning a home where both of you are equally responsible for everything from paying the mortgage to fixing a leaky roof.

- Limited partnership (LP): In this setup, one partner (or more) runs the business and has unlimited liability (like managing the household), while the other partners are silent investors with limited liability (like co-signing a loan without living in the house).

- Limited liability partnership (LLP): Think of this as sharing a duplex. Each partner is involved in the business but isn’t personally liable for the others’ mistakes or debts. It’s popular among professionals like lawyers and accountants.

- Joint venture: This is more like flipping a house. You team up with someone for a specific project, and once it’s done, you go your separate ways.

Partnership business advantages and disadvantages

Before jumping into a partnership, let’s go over the ups and downs you might encounter. It’s a bit like deciding whether or not to get a roommate—you want to make sure it’s a good fit before signing the lease.

Pros of forming a partnership:

- Shared responsibility: You’ve got someone to share the load with, from tough decisions to day-to-day tasks.

- Complementary skills: Two heads are better than one, especially when you and your partner bring different strengths to the table.

- Pooled resources: Combining financial resources makes it easier to start and grow your business.

- Tax benefits: Partnerships often enjoy pass-through taxation, meaning profits are only taxed once at the partners' personal income tax rates.

Cons of forming a partnership:

- Shared liability: In a general partnership, you’re each on the hook for any debts or legal issues, which means your personal assets could be at risk.

- Potential conflicts: Different opinions on running the business can lead to disagreements that can affect both professional and personal life.

- Profit sharing: You’ll need to split the profits, which might be less lucrative than being a sole proprietor.

- Dependence on each other: If one partner isn’t pulling their weight, it can strain the business and the relationship.

Choose partners wisely and think carefully about whether partnerships align with your goals. With due diligence and professional guidance, the rewards of a partnership can far outweigh the risks.

How to start a partnership business in 10 steps

Now that you’ve got a good grasp on the topic, let’s get into the details of how to start a partnership business. These steps are a roadmap to help you and your partner(s) set up your business for success:

1. Find the right partner(s)

Choosing the right partner is like picking the co-captain for your boat—a crucial and maybe difficult step. You want someone who shares your vision, values, and work ethic. This person should complement your skills and bring something unique to the table. And, just like in any relationship, good communication is key.

Brian Hipp, co-owner and president of CH Ellis , shares his experience forming a partnership for his business. “My business partner and I bonded over a desire to revitalize a historic company and had complementary skill sets, with my engineering background and his operations experience,” he says. “Combining expertise allows us to take on more complex projects; my partner’s support has helped us overcome obstacles that I may not have survived alone.”

2. Decide on the partnership type

Once you’ve decided who you're launching your business with, it’s time to choose the type of partnership that suits your business goals. Whether you go with a general partnership, LP, LLP, or joint venture, make sure it aligns with how you want to operate and manage risks.

3. Draft a partnership agreement

Think of the partnership agreement as a prenup for your business. It’s crucial to put everything in writing—who’s responsible for what, how decisions will be made, how profits will be split, and what happens if one of you wants out.

“Beyond responsibilities and profit sharing, a partnership agreement should outline intellectual property ownership and restrictions on competition to protect the business,” says Christopher Lyle, attorney and founder of KickSaaS Legal .

4. Register your business

Depending on your location, you’ll need to register your partnership with the appropriate government body. This could involve registering your business name, obtaining licenses, and filing any necessary paperwork.

5. Set up your finances

Open a business bank account and decide how you’ll handle finances. Will you use accounting software? How will you track expenses and revenues? Establishing a clear financial plan now will make it easier to manage your money and avoid any surprises later.

6. Secure funding

If you need more capital to get started, consider your options—whether it’s combining personal savings, applying for loans , or seeking outside investors. Having a solid financial base will give you the confidence to take risks and grow.

You can also fund your dream business with the help of a high-paying job—browse open jobs on The Muse and start today »

7. Define roles and responsibilities

Make sure each partner knows their role and responsibilities—clear expectations help avoid conflict and ensure everything runs smoothly.

8. Create a business plan

Your business plan is the roadmap for your partnership. It should outline your goals, target market, competitive analysis, marketing strategies, and financial projections. Having a well-thought-out plan keeps everyone on the same page and focused on the end goal.

9. Launch and market your business

Now comes the fun part—launching your business! Whether you’re opening a physical location, launching an online store, or offering services, make sure to let everyone know you’re open for business.

10. Keep communication open and adapt

Even after your business is up and running, keep the lines of communication open. Regular check-ins with your partner(s) will help you address any issues early on and adapt to changes in the market. This relationship requires regular maintenance to keep everything in good working order.

Bottom line

If done correctly, a partnership business can be very rewarding. Make sure you choose the right format for your business and always do the work to maintain a healthy relationship with your business partners

How do I start a new partnership business?

Start by choosing the right partner, deciding on the type of partnership, drafting a partnership agreement, registering your business, setting up finances, securing funding, and creating a business plan. Clear communication and shared goals are key.

How is a partnership business started?

Creating a partnership business starts with two or more people agreeing to run a business together. They create a partnership agreement, register the business, and launch their operations, sharing responsibilities and profits.

Is a partnership easy to start?

Forming a partnership can be straightforward if you and your partner(s) have clear goals, good communication, and a solid agreement in place. However, it requires careful planning and commitment from all parties involved.

Are partnerships profitable?

Partnerships can be very profitable, especially when partners bring complementary skills and resources. However, profits are shared, which means your earnings depend on the success of the entire business.

Is it expensive to start a partnership?

The cost of creating a partnership varies depending on your business type, location, and industry. Common expenses include legal fees for drafting the partnership agreement, registration costs, and initial investments.

What do I need for a partnership business?

You’ll need a solid partnership agreement, a business plan, necessary licenses and permits, a business bank account, and funding. Equally important are trust and strong communication between partners.

How do you start a partnership agreement?

A partnership agreement is drafted by outlining each partner’s roles, responsibilities, and contributions. It should also cover profit-sharing, decision-making processes, and procedures for resolving disputes or dissolving the partnership.

How do you approach a new partnership?

Approach a new partnership with open communication, clear expectations, and a shared vision. Make sure your goals align and that you’re both committed to the success of the business.

What are the legal requirements for starting a partnership business?

Legal requirements for starting a partnership business vary by location but typically include registering your business name, obtaining necessary licenses and permits, and filing any required paperwork with local or state authorities.

How to register a partnership?

Registering a partnership typically involves choosing a business name, filing a Doing Business As (DBA) name with local authorities, obtaining necessary licenses, and completing any state-required paperwork.

How to set up a partnership?

Setting up a partnership involves choosing the right partner(s), deciding on the type of partnership, drafting a partnership agreement, registering your business, setting up finances, and developing a business plan.

Business Plan for Partnership Firm

A business plan for partnership firm is recommended for anyone entering into a business partnership. 3 min read updated on November 02, 2020

A business plan for a partnership firm is recommended for anyone entering into a business partnership. A business partnership is two or more people working together to run a business. Each person takes on equal risks and rewards that come from the business. A proper business plan is ideal for handling current and future business decisions.

Steps For Planning a Business Partnership

- Write a mission statement to clearly state the direction and goals the business plans to take. By writing a mission statement, the partners agree to the company's direction now and in the future.

- Develop a reimbursement plan for the costs and investments incurred during startup. The amount of money provided for the startup is not always equal. Therefore, it is beneficial to make a plan that takes this into account with repayment and returns on investment. Avoiding arguments over the value of the startup amount versus levels of sweat equity will be removed with a reimbursement plan.

- Create a method to resolve partner disputes. If an odd number of members are part of the partnership, you can choose to vote democratically. In the case of two partners, the partners may split areas of the business having the final say. For example, one person can make final decisions on marketing and sales planning, while the other person makes final decisions on financial planning.

- Appoint an outside panel of advisors, or ombudsman , to resolve any internal disputes. Trusted experts should always be used to avoid ruining the partner relationship.

- Divide all the responsibilities of the partners related to labor and management and assign the amount of compensation they will receive. The compensation is not always equal based on the workload the partner takes on.

- Request that outside experts review the partnership agreement for any legal or accounting mistakes. The experts may be able to point out unknown problems that exist in the agreement. This review should take place before the partnership begins business operations.

Partnership Deed

A partnership deed and partnership agreement are the same, but the partnership deed is in writing . A partnership agreement can exist solely through verbal communications or actions. A partnership deed is recommended for businesses as it clearly defines the terms of the partnership.

The partnership deed helps prove the agreed-upon terms if there are any conflicts. Without a deed, the rules to settle disputes will fall to the state laws where the partnership exists. This creates another issue where one partner may file suit to benefit from the existing laws. Legal action can be avoided with a partnership deed that lists all details of the business that the partners agreed to when they began the business.

Partner Business Plans

When legal firms are looking to add a new partner, a well-written business plan that shows the new partners' intent to grow the business will make them stand out from the rest of the applicants. The business plan should exceed the expectations of the firm.

The key elements of the business plan are:

- Create an introduction that details your professional history, areas of expertise, and why you are the right fit for the firm.

- Provide market research and analysis of the needs of the local area, what competition exists, and why the firm offers the best way to reach this marketplace.

- Describe your current client base, prospective clients, and untapped areas you'd like to reach.

- Include any cross-selling opportunities that exist with current and prospective clients.

- Share ways you can develop business sources including publications, speeches, client seminars, newsletters, and similar.

- Explain your long-term strategy to meet the goals and targets that will benefit the firm.

- Show a history of collections, billing rates, and billable hours and projections for the current year, three-years, and five-years.

- Time the partners must invest.

- Key staff will be needed (paralegals, secretaries, etc.)

- Travel expenses.

- Marketing materials,

- Presentations.

- Foreign language skill requirements.

End with a conclusion that is creative recaps the important points in the plan, what value will be added to the firm, and why you are the best fit for the firm.

If you need help with a business plan for a partnership firm, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Purpose of Partnership: Everything You Need To Know

- Authority of Partners in Partnership: What You Need to Know

- Partnership Agreement Between Company and Individual

- How to Make a Partnership Agreement Legally Binding?

- Disadvantages of Partnership

- What Is Transfer of Partnership Interest?

- Difference Between Sole Proprietorship and Partnership

- Can a Partnership Be Incorporated: Everything to Know

- Types of Business Partnerships: Everything You Need To Know

- What Do You Need to Start a Partnership?

Newly Launched - AI Presentation Maker

Researched by Consultants from Top-Tier Management Companies

AI PPT Maker

Powerpoint Templates

PPT Bundles

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Partnership Plan Templates with Examples and Samples

DivyanshuKumar Rai

When partners enter a business at the outset, they are motivated and excited to embark on this exciting new adventure together. Initially, they agree on almost everything. These new entrepreneurs think they will be in business together for the rest of their lives or until they sell the company for untold millions of dollars.

They believe that nothing can or will go wrong. They are so sure of each other that they never bother to get a written partnership plan. What could possibly go wrong in this scenario? The short answer is, "A LOT!"

The reality is that, despite dreams of longevity and unwavering trust, business owners' desires and expectations change over time. A written partnership plan can manage these expectations and give each partner confidence in the business's future. A written plan can serve as a safeguard that protects both the business venture and the investment of each partner.

Now, you might be thinking, “How to get an effective partnership plan in place?” The quick answer: Partnership Plan Templates .

Every business requires a partnership plan. Small businesses seek out partnerships more to achieve their goals and objectives. Building a strategic partnership is more complicated than creating a partnership document, but it is the first step toward action. SlideTeam’s partnership plan templates maneuver your ship to the shore.

Let’s explore these!

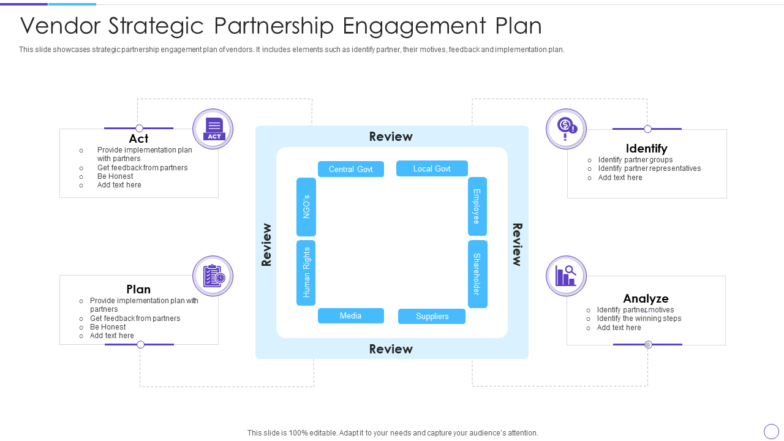

Template 1: Vendor Strategic Partnership Engagement Plan

Get this Strategic Partnership Plan PPT Template and deliver an impactful presentation to your audience. Its layout is divided into four sections, each describing a critical aspect: Plan, Analyze, Identify, and Act. There’s a specified section for review to ensure you have that extra cushion to make amendments, wherever necessary. Get this template now.

Download this template

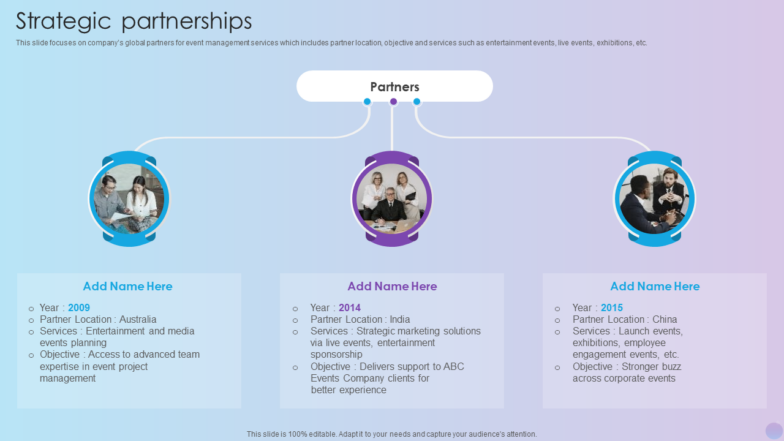

Template 2: Strategic Partnerships Event Planning Service Company Profile PPT Template

This PowerPoint Template works wonders when you want to explain the role of strategic partnerships within an organization. It has ample space to highlight points you want to deliver in your presentation. You can use its standard layout to emphasize key details, including partner location, services they monitor, objectives, and more. Download it now.

Template 3: Internal Communication Plan For Partnership Firm

The importance of proper communication in the successful accomplishment of business objectives can’t be overstated. With SlideTeam’s handpicked internal communication plan template, you can enjoy the convenience of an uninterrupted flow of information across departments in your company. This plan layout describes:

- Reasons for communication

- Communication activity

- Communication channel

- Individual responsible

Download now.

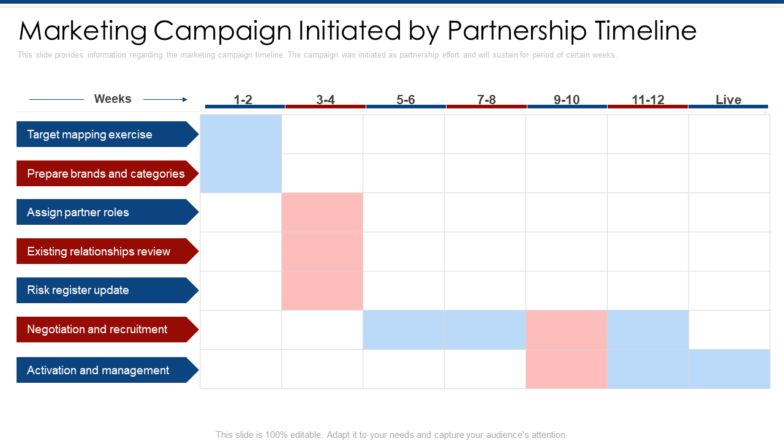

Template 4: Marketing Campaign Initiated by Partnership Timeline

Build a weekly timeline for your marketing campaign using this fantastic PPT Template. Till the campaign goes live, you can include and track KPIs to ensure your effort is successful. Here, there are some predefined parameters that you can use: Target mapping exercises, Prepare brands and categories, Assign partner roles, risk register update, Negotiation and recruitment, and Activation and management. Download it now.

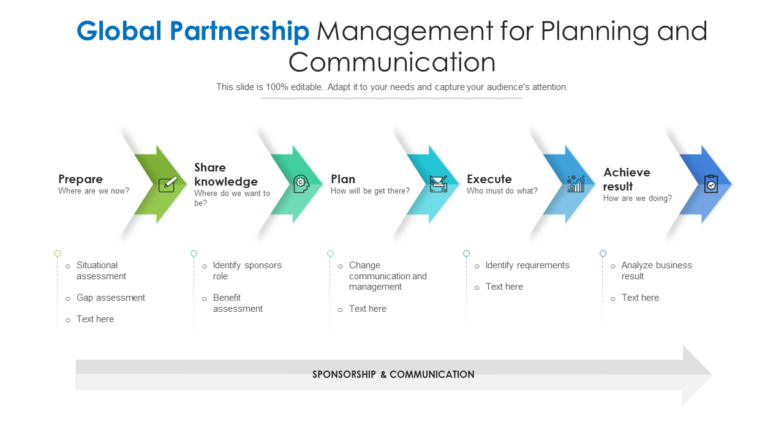

Template 5: Global Partnership Management for Planning and Communication

Global partnership management is a painstaking task that can be made easy with our exemplary template. It has a unique framework that explains key insights encompassing the five stages, namely: Prepare, Share Knowledge, Plan, Execute, and Achieve Results. Being 100% editable, you can tweak the design and include points in this template to serve your purpose. Download it now.

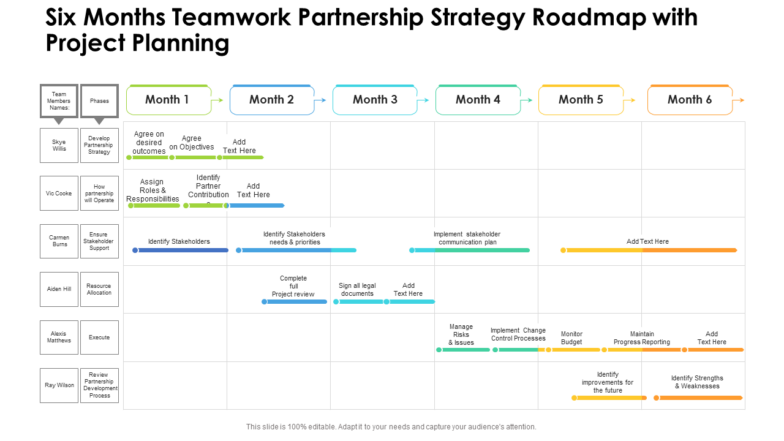

Template 6: Six Months Teamwork Partnership Strategy Roadmap

Teamwork is the key to success! We know you would have heard this phrase at least a million times, but it doesn’t take away even a slight bit of truth. Build a six-month teamwork partnership framework using our exceptional PowerPoint Template. It highlights the team member and phases spread across a month-wise timeline. The phases include:

- Develop partnership strategy

- How the partnership will operate

- Ensure stakeholder support

- Resource allocation

- Review the partnership development process

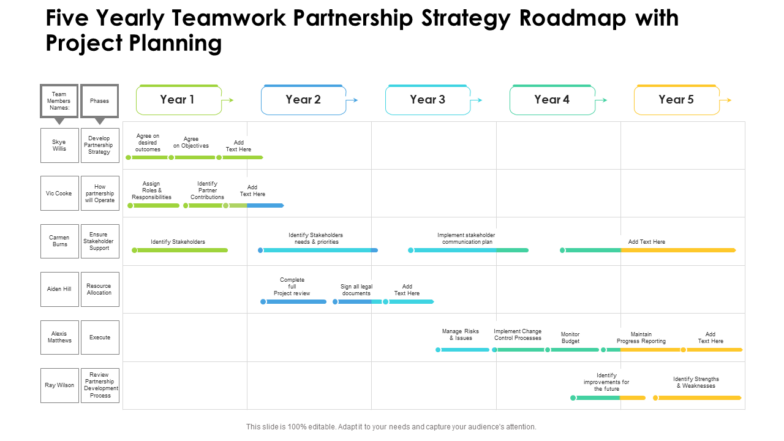

Template 7: Five-yearly Teamwork Partnership Strategy Roadmap

With a similar design to the previous template, this template accelerates the process of building a five-year teamwork partnership strategy roadmap. It has some predefined phases which you can change to suit your business requirements. You can present it to higher management to get their approval on the partnership roadmap you are long working on. Get it now.

Template 8: Planned Partnership Strategy PPT Template

If you need a pre-built framework for drafting a planned partnership strategy, this is the perfect piece for you. Its layout is designed into five stages that you can use to explain critical insights that underline your strategy. You can also use it to highlight KPIs as well. Get it now.

Template 9: Strategic Partnership Showing Teamwork

‘Strategic partnership’ is a complex subject that commands resources to spark clarity in your audience. Lucky for you, SlideTeam has prepared this template that touches every essential parameter that encompasses it. This template highlights the points of collaboration, teamwork, strategy, plan, performance, and success. It is a roadmap with checkpoints you need to surpass to foster better partnerships within your organization. Download it now.

Template 10: Partnership Action Plan PPT Presentation

A partnership action plan boiled down into three stages! Hard to believe, isn’t it? SlideTeam presents a PPT Template that displays a layout that does just that. It has three levels: Action, Planning, and Partnership. The idea behind these stages is, you have to define relevant actions to ensure your organizational plans aren’t affected. Doing so will ensure there’s a more inclusive partnership forging in your company across departments. Get it now.

Partnerships are critical to the success of any business. Merchants and traders have used the principles of strategic partnership to conduct their businesses since the genesis of trade and commerce; the trend continues today.

A partnership can take many forms, from business owners working together to invest in a project to firms sharing technical knowledge and ideas. Whatever a company does, finding the right partnership plan template that benefits both parties is critical. (And that’s why SlideTeam has put together this list of top 10 partnership plan templates!)

FAQs on Partnership Plan

What is a partnership plan.

A partnership plan is a way two or more parties in a business agree on conducting the venture together. Each party takes different functions to perform, helping the business run more efficiently. This plan is documented in the form of an agreement. This document lays down the ground rules on how the partners will handle business responsibilities, ownership and investments, profits and losses, and company management.

While "partners" usually refers to two people, there is no limit to how many partners can form a business partnership in this context.

How do you create a partnership plan?

When forming a business partnership, it is critical to draft a partnership plan contract that outlines all of the terms and conditions of the professional relationship. Your business partnership plan should include a list of all partners and should address the following issues:

- Name of the partnership

- Partnership goals

- Partnership duration

- Contribution amounts of each partner (cash, property, services, future contributions)

- Each partner ownership interest (assets)

- Management roles and terms of authority of each partner

- Accounting obligations

- Distribution of profits and losses between the partners

- Salaries, work hours, sick leaves, and vacation times of each partner

- Permissions and restrictions on any outside business activity

- Buyout options of partners

- Process for adding new partners or removing original partners

- Terms and conditions of termination of the partnership

What are the stages of partnership?

Here are the five stages of partnership:

Stage I. The Singles Stage (Non-Partnering)

Stage II. The Searching Stage (Pre-Partnering)

Stage III. The Courtship Stage (Active Partnering)

Stage IV. The Bonding Stage (Consolidated Partnering)

Stage V. The Commitment Stage (Going to Scale)

What are the 5 principles of partnership?

There are five basic tenets that work together to form a framework for establishing a solid foundation for effective business relationships.

- Shared knowledge

- Agreed Goals

- Balance of return

While some of these are easier to quantify than others, each has a significant impact on the partnership's strength.

Related posts:

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

- [Updated 2023] How to Design The Perfect Product Launch Presentation [Best Templates Included]

- 99% of the Pitches Fail! Find Out What Makes Any Startup a Success

Liked this blog? Please recommend us

Top 10 Partnership Agreement Templates for Harmonious Synchronization

Top 10 Strategic Partnership Proposal Templates To Form Successful Alliances (Free PDF Attached)

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

--> Digital revolution powerpoint presentation slides

--> Sales funnel results presentation layouts

--> 3d men joinning circular jigsaw puzzles ppt graphics icons

--> Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

--> Future plan powerpoint template slide

--> Project Management Team Powerpoint Presentation Slides

--> Brand marketing powerpoint presentation slides

--> Launching a new service powerpoint presentation with slides go to market

--> Agenda powerpoint slide show

--> Four key metrics donut chart with percentage

--> Engineering and technology ppt inspiration example introduction continuous process improvement

--> Meet our team representing in circular format

IMAGES

VIDEO

COMMENTS

The key elements of a successful partner business plan include a clear vision and strategy, objectives, strategies, tactics, metrics and data, budget, and execution. By considering and including these key elements, companies can increase their likelihood of success.

Business plans can help you get funding or bring on new business partners. Investors want to feel confident they’ll see a return on their investment. Your business plan is the tool you’ll use to convince people that working with you — or investing in your company — is a smart choice.

Follow these steps to write a partnership proposal: research your potential partner, create a solid structure for your proposal, apply your branding, add engaging media and data visualization, and get your team involved.

How to Start a Partnership Business in 10 Steps. by. The Muse Editors. Updated. 9/4/2024. Getty Images. At some point you may have wondered—whether idly or seriously—if it's a good idea to start a business with a close friend, family member, or colleague whose work ethic you admire.

A business plan for a partnership firm is recommended for anyone entering into a business partnership. A business partnership is two or more people working together to run a business. Each person takes on equal risks and rewards that come from the business. A proper business plan is ideal for handling current and future business decisions.

Every business requires a partnership plan. Small businesses seek out partnerships more to achieve their goals and objectives. Building a strategic partnership is more complicated than creating a partnership document, but it is the first step toward action. SlideTeam’s partnership plan templates maneuver your ship to the shore. Let’s explore these!