Revenue models: 11 types and how to pick the right one

Finding the right revenue model for your company and products is an incredibly important part of starting and expanding your business. It's a key part of building a brand. Explore popular revenue models and how to choose the right one.

What is a revenue model?

- 11 different types of revenue models

Costs associated with revenue models

- How to choose your revenue model

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

In one of the most famous lines from the 1941 classic Citizen Kane , Mr. Bernstein proclaims: “ It's no trick to make an awful lot of money... if what you want is to do is make a lot of money .” If only that statement were as true as it seemed. It's probably more accurate to say, “There are a lot of ways to make a lot of money.”

That’s particularly true for software businesses, with the rise of the mobile internet stimulating an explosion in the number of viable revenue models. Choosing which revenue model works best for your SaaS business, though, is not easy (even if that's all you want to do is choose a revenue model for your SaaS business). Your choice will help determine your sales strategy , and from there the growth rates, the amount of money you’ll need to invest initially, and the kind of relationship you’re likely to build with your customers. More than that — the choice determines the future of your business. Let’s take a look at some of the most popular revenue models used today — why they’re popular, why they work, and why they will (or won’t) work for you.

A revenue model is the income generating framework that is part of a company’s business model. Common revenue models include subscription, licensing and markup. The revenue model helps businesses determine their revenue generation strategies such as: which revenue source to prioritize, understanding target customers, and how to price their products.

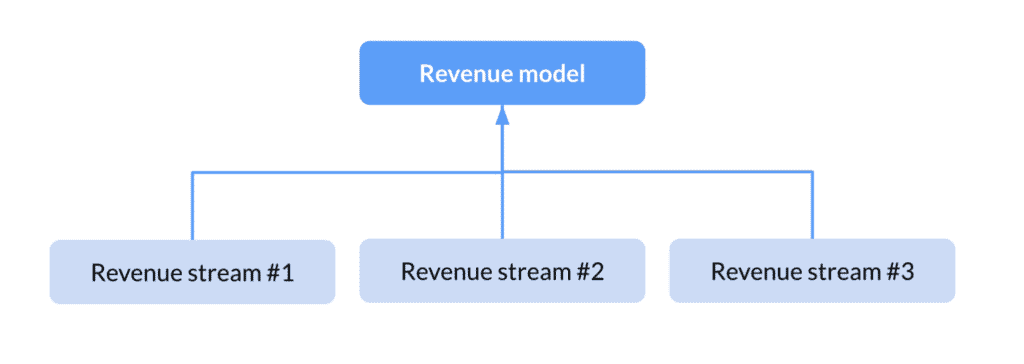

Revenue models often get conflated with revenue streams, probably because each is a single revenue generation source. They are also confused with business models, of which revenue models are a part. Revenue models help business owners determine how to manage their revenue streams and are required to complete a business model.

Without a considered revenue model, your business will incur costs it cannot sustain. With a revenue model, you can set, track, and forecast business growth based on specific customer segments.

11 different types of revenue models

There is no such thing as a perfect revenue model, but the popularity of some of the methods below suggests that many of them are well-tailored for the current state of the market. Here we’ll walk through each type of revenue model and when they may be most beneficial and applicable.

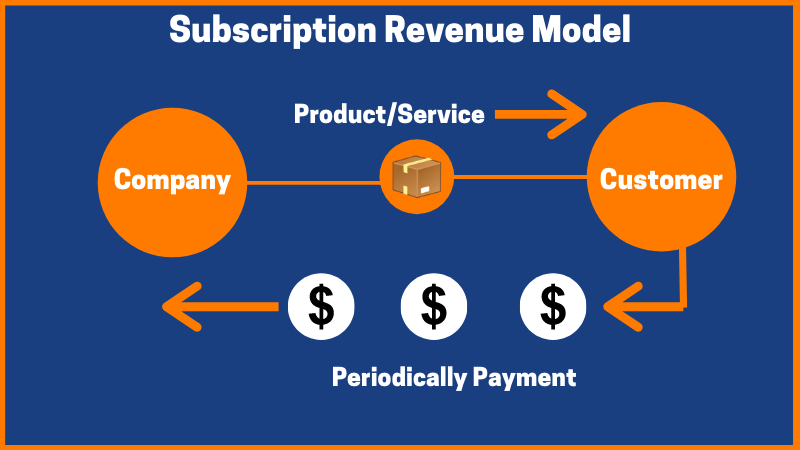

1. Subscription

The subscription model is the “vanilla” SaaS revenue model, not that there’s anything boring about a well-worked subscription plan. Businesses charge a customer every month or year for use of a product or service. All revenue is deferred and then fulfilled in installments. The subscription model is perhaps the most popular among SaaS companies because of its versatility, promise of recurring revenue , and high value:customer lifetime balance. Done right it's a one-way-ticket to sustainable growth .

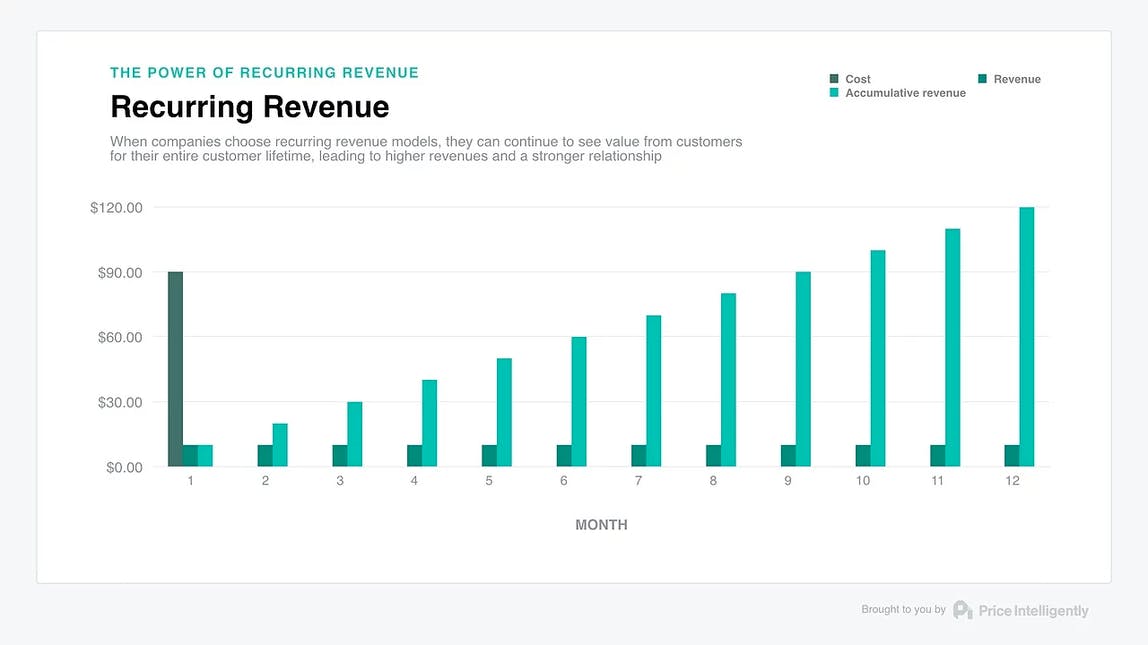

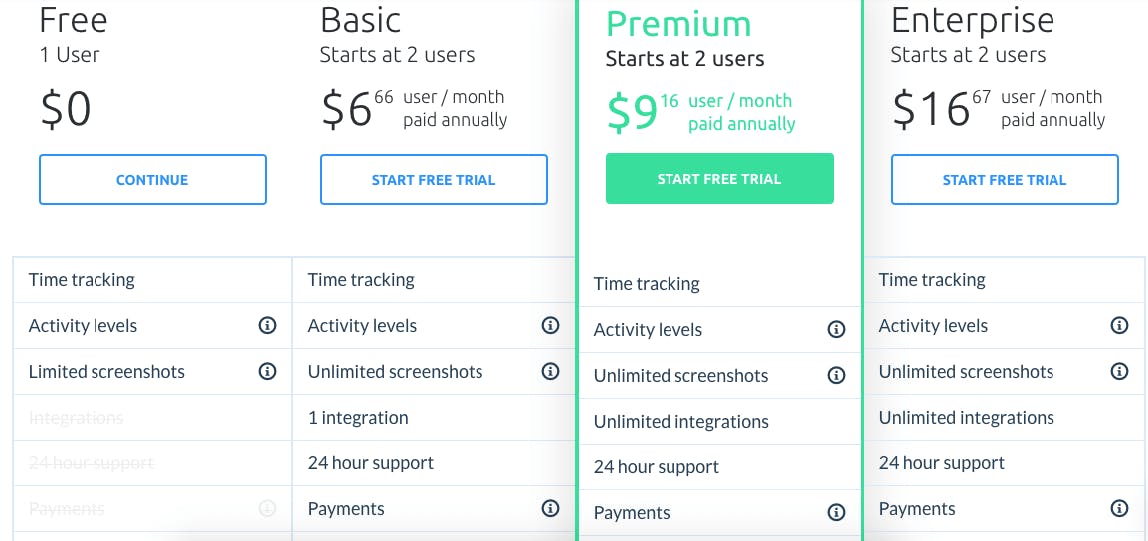

Companies working with recurring revenue models, such as subscription or licensing , see more value from a customer across a given customer lifetime. Being able to offer a variety of value options means your company can respond to more than one set of customer needs, expanding your appeal. Hubstaff’s subscription plan, seen below, is a classic of the genre:

Hubstaff’s various plans are distinct from one another in price and feature. This flexibility in the subscription model means that tentative or lower-budgeted customers can still get what they need, all the while maintaining visibility of what extra they could get for a few dollars more a month.

The freemium model is often described as a subscription revenue model, but in fact it’s an acquisition model, not a revenue model. Freemium involves giving users free access to an app and then selling subscriptions for a premium tier that includes more features.

Markup is a very common revenue model for buyer companies (i.e., companies that buy the products they sell). It’s as simple as can be: Take the cost of goods you just bought, mark it up X%, and make a profit margin on the original purchase. There are various subgenres of the markup model, including the following:

- Wholesale: Sale of goods or merchandise to retailers, business users, or other wholesalers

- Retail: Identification of demand, and satisfaction of it through a supply chain via a number of possible outlets, including physical and ecommercial ones

Markup is particularly used by mediators like ecommerce marketplaces — Amazon, for example. On average, Amazon charges a seller who uses their site 15% of the sale, plus FBA fees (including storage, pick & pack, shipping).

5. Pay-Per-User

One of the most enduring legacies of SaaS in the world of business is the introduction of pay-per-user (PPU). It involves giving a customer potentially unlimited to access to a range of features while charging them only for the services they use. At the dawn of SaaS, as the software required no physical delivery and deployed so quickly and cheaply, PPU appeared to be the most sensible revenue model. However, as natural as it seemed back in the day, pay-per-user is not popular anymore. Ascribing value to your product is one of the key considerations of your revenue model, and that includes demonstrating why it’s worth your target customers’ valuable dollars, not just making everything so cheap and easy that they can’t refuse. The issue with PPU, then, is that it’s rarely where value is ascribed to your product. Moreover, PPU kills your Monthly Active User metric. The per-user metric is not the most useful to customers in terms of deriving value — its take-it-or-leave-it approach actively works against your Daily Active Users number, and thus contributes to your churn rate.

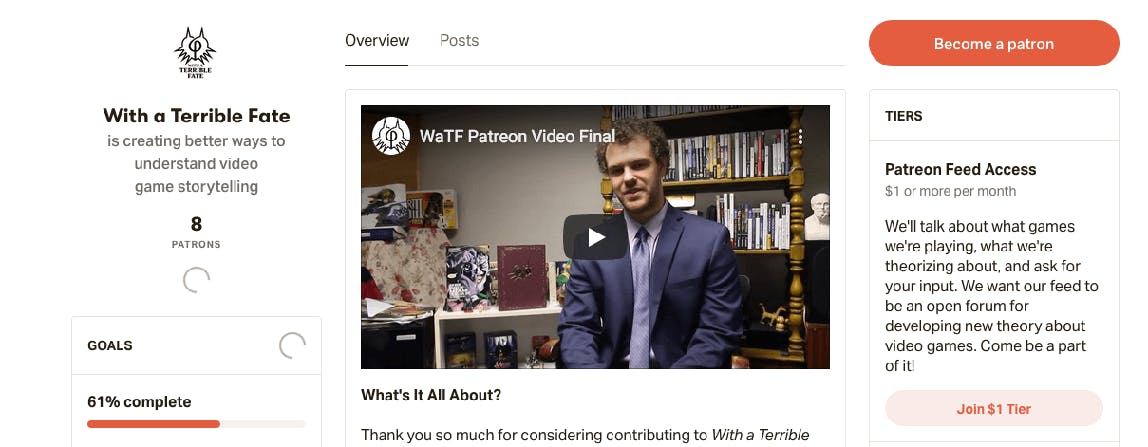

6. Donation

As evidenced by the rise and rise of Kickstarter - and Patreon -based ventures, altruism is, if unpredictable, a pretty effective revenue model by itself. Relying on the donations of regular users is a common revenue model for nonprofits, online media (i.e., YouTubers) and independent news outlets.

7. Affiliate

What is affiliate marketing ? This new, popular model works by promoting referral links to relevant products and collecting commission on any subsequent sales of those products. Leverage your product’s synergy with another product in an adjacent space and you both stand to gain. The affiliate model can be as simple as including in an article an outlink to a book or other product mentioned or offering your customers specialized recommendations relative to purchase history (again, Amazon is a master of this art). Some companies, such as Etsy, even have a specific program for their affiliates, where other companies can earn a commission on qualifying sales that result from featuring links to Etsy products and services. The affiliate revenue model is increasingly popular, owing to the way it dovetails effectively with other revenue models, particularly ad-based models.

8. Arbitrage

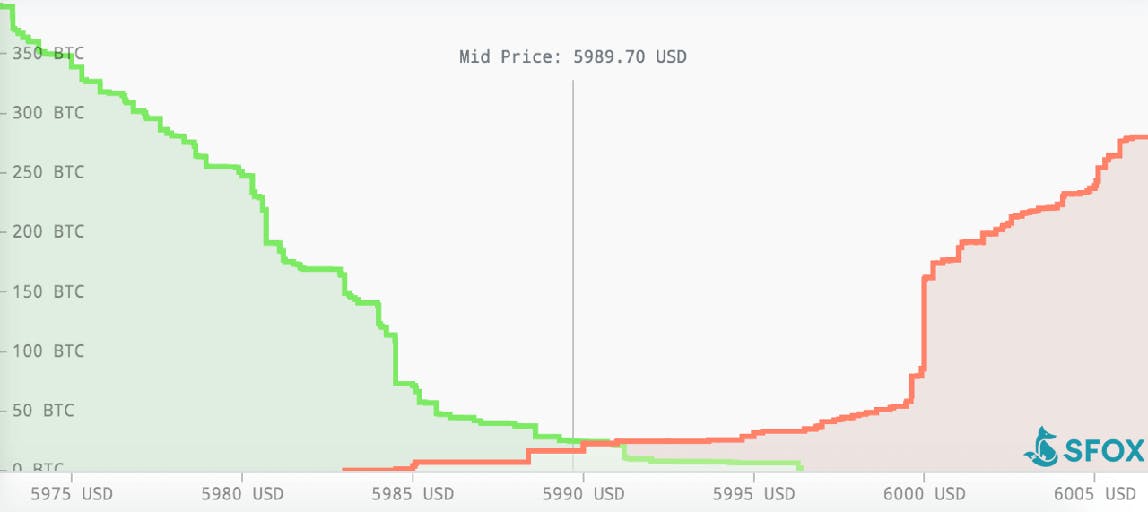

Applicable mainly to sellers or marketplace-oriented companies, the arbitrage revenue model uses the price difference in two different markets of the same good/service to make a profit. You buy in one market (a security/currency/commodity) and simultaneously sell in another market, at a higher price, what you just bought, pocketing the temporary price difference. Arbitrage is popular with affiliate marketers , as well as with many cryptocurrency firms, SFOX being a prime example.

9. Commission

This transactional revenue model involves a middleman charging commission for each transaction it handles between two parties or for any lead it provides to the other party. It’s particularly popular with online marketplaces and aggregators, as well as businesses like independent music distributors. It’s particularly easy to get up and running with a commission-based business model because you’re working off of existing products. However, unless your field is well-conditioned for a monopoly, and unless your company is (or can become) that monopoly, you’ll find the commission model very tough to scale .

10. Data Sales

Ever heard the phrase, “If you can’t see how the money’s made, you’re the product”? That’s data-selling in action. Many companies selling digital goods and services could not exist without core underlying data assets. In the data sale revenue model, this data is sold directly to a consumer or business customer. While certain companies will use data sale as their primary revenue model, the use of data sales to augment another revenue model is virtually ubiquitous. While some are using it as an entrepreneurial venture , it is also the subject of considerable justified public concern and should be handled with care in the event you decide to go with it as your revenue model.

11. Web/Direct Sales

The old-fashioned revenue model made new, web sales and direct sales involve payment for goods or services through a digital medium. Web sales involve a customer finding your product via outbound marketing (or a web search) and can used for software, hardware, and subscription-based offerings. Direct sales revolve around inbound marketing and is good for handling multiple buyers and influencers in big-ticket markets.

A good revenue model is not just about squeezing as much revenue possible out of a sales cycle; it’s also about balancing your ambitions in the market with your resourcing requirements. A startup revenue model may be significantly different than one for an established business because their resources are vastly different. When choosing your model, factoring in costs is paramount to ensure profitability.

Cost of revenue

The first cost you’ll be likely to factor in is your cost of goods — how much it costs to produce the goods or service that you then sell. For hardware, this can comprise testing and manufacture; for software, it’ll include the whole development cycle. Regardless of what you produce, administrative overheads will also apply. You will find cost of goods a considerably less comprehensive metric than cost of revenue, which is the total cost of manufacturing and delivering a product or service to consumers. That includes everything we’ve just covered, plus distribution and marketing costs. Cost of revenue is more often used in SaaS and other service-oriented industries because it makes the many costs incurred outside of production in SaaS easier to track.

Prototyping costs

Prototyping is a fundamental aspect of any production cycle and, unfortunately, is one of the most expensive. While testing prototypes or beta versions of your new product, even the smallest revisions can necessitate costly changes to your production/development process. This usually comprises a base-level cost, plus iteration costs on top of that. When forecasting prototyping costs, it’s wise to plan for several iterations; it’s highly unlikely you’ll get everything right the first time around, especially if your product is innovative or is composed of a number of features.

Equipment costs

One of the beautiful things about being a SaaS company is that there are no production lines to run. Nevertheless, equipment costs still factor into the bottom line. Firmware, app development tools , server rental, plus any other administrative services bought on subscription (e.g. Slack or Hubstaff) will play a part in your equipment costs, but, generally, equipment costs should be the easiest of all to forecast.

Labor costs

An underpaid workforce is an unhappy workforce (if it’s a workforce at all); wage costs come out of your bottom line. Based on the interaction of salary and commission in your compensation plan , as well as the type of commission you offer (entirely open-ended or capped? Will there be accelerators/decelerators involved?), you will have to plan for your expenditure on labor costs differently.

Advertising & marketing costs

Your advertising and marketing costs will be determined by the following:

- The size of your respective advertising and marketing teams

- The scale of exposure you’re shooting for

- Your method of approach to advertising and marketing: undefinedundefinedundefined

Take the headache out of growing your software business

We handle your payments, tax, subscription management and more, so you can focus on growing your software and subscription business.

Your revenue model is unique

So many revenue sources, so many revenue models, so little time. There are some fundamental differences between revenue models. For instance, if you’re a SaaS company producing your own software product, you’re unlikely to get all that far with an arbitrage model. Likewise, if your product is a medium or if you’re a seller, a subscription-based revenue model won’t do the trick. A product with a high ceiling for potential revenue is not best served by a donation model. Nevertheless, the choice of a main revenue model out of the batch that do work for your product, and how you then combine them with appropriate aspects of other models, is yours, and yours only. Your product and the market should be in mind at all times while you’re settling on, adding to, and refining your model. After that, bringing in the revenue itself should be as easy as Citizen Kane said.

Related reading

Revenue Models: 17 Types, Examples & Template [2023]

Revenue Models

How does (or will ) your business make money? It sounds almost too simple to ask, but having a clear understanding of your business' revenue model can be one of the most important ways to focus on key activities--and actually move the needles you care about most.

For indie businesses, settling on the right revenue model type rarely happens on first attempt. Instead, it's common to bounce around from subscriptions to digital products, membership communities and affiliate offerings until something finally *clicks* for you and your business.

This revenue models list component and template is intended to help you sort, consider and rank a list of common revenue models. In future, I'll be linking this table to related marketing channels, real data from other indie businesses and related templates--for now, let's take a quick look at the revenue models listed.

17 Common Revenue Model Examples

- Subscription

- Licensing (Digital Prod.)

- Advertising

- Affiliate Commission

- Project-Based Services

- Retainer-Based Services

- Tickets, Events, Workshops

- Manufacture (D2C)

- Library Access

- Community Access

- Marketplace

1. Subscription

The most common revenue model for SaaS and membership-based businesses. Customers pay a recurring fee, typically on a monthly or yearly basis, in exchange for access to your product or service.

Pros of subscription model

- Recurring revenue is more predictable and can be helpful in forecasting

- Can be a great way to build long-term relationships with customers

- Customers who are paying on a recurring basis are typically more engaged and have a higher lifetime value

Cons of subscription model:

- Can be difficult to acquire customers who are willing to pay a recurring fee

- Can be difficult to increase prices without losing customers

- There is always the risk of churn (customers cancelling their subscription)

The markup revenue model is most common in retail and ecommerce businesses, where goods are bought at wholesale prices and then sold to customers at a higher price.

Pros of markup model:

- Can be easier to get started since you don't need to develop a unique product or service

- There is less risk involved since you're not investing in developing or producing a good or service

- Can be easier to scale since you can simply buy more inventory as needed

Cons of markup model:

- Can be difficult to compete on price alone

- You may need to invest in marketing and branding to differentiate your business

- There can be slim margins if you're not careful with your pricing

3. Licensing (Digital Prod.)

The licensing revenue model is most common for digital products, where customers pay a one-time fee for access to your product.

Pros of licensing model:

- Can be a great way to generate one-time revenue from customers

- Customers who pays for a license typically have a higher perceived value of your product

- Can be easier to scale since you're not selling a physical good or service

Cons of licensing model:

- Can be difficult to acquire customers who are willing to pay a one-time fee

- There is always the risk of piracy (customers sharing your product without paying)

- Can be difficult to upsell customers or generate recurring revenue

4. Advertising

The advertising revenue model is most common for online businesses, where businesses sell advertising space on their website or in their email newsletter.

Pros of advertising model:

- Can be a great way to generate revenue from customers who are not ready to buy your product or service

- Advertising can be a complementary revenue stream to other revenue models

Cons of advertising model:

- Advertising can be disruptive to the user experience

- Advertising rates can fluctuate based on market conditions

- You may need to invest in marketing and branding to attract advertisers

5. Donation

The donation revenue model is most common for non-profit organizations, where customers donate money to support the cause or organization.

Pros of donation model:

- Can be a great way to generate revenue from customers who are passionate about your cause

- Donations are typically tax-deductible for the donor

- There is less pressure to generate revenue since donations are not expected to be recurring

Cons of donation model:

- Can be difficult to acquire customers who are willing to donate money

- May need to invest in marketing and branding to attract donors

- Donations can fluctuate based on economic conditions

6. Affiliate commission

The affiliate commission revenue model is another common for online businesses, where businesses pay a commission to affiliates for referring customers.

Pros of affiliate commission model:

- Can be a great way to generate revenue from customers who are already interested in your content

- Affiliates can provide valuable marketing and promotion for your business

- Can be easier to scale since you're not producing all the products you sell

Cons of affiliate commission model:

- Not always easy to find good affiliate programs

- You may need to invest in marketing and branding to attract affiliates, as well as readers

- Commissions can vary based on affiliate performance

7. Sponsors

The sponsorship revenue model is becoming increasingly common for online creators.

Pros of sponsorship model:

- Can be a great way to generate revenue from businesses or individuals who support your cause

- Sponsors typically have a high perceived value of your organization

Cons of sponsorship model:

- Can be difficult to acquire sponsors who are willing to pay

- May need to invest in marketing and branding to attract sponsors

- Sponsorship can fluctuate based on economic conditions

8. Data Sales

The data sales revenue model is most common for online businesses, where businesses sell data that they have collected.

Pros of data sales model:

- Scale advantages

- Data can be a valuable commodity for businesses

Cons of data sales model:

- Difficult to acquire unique data sets

- Longer sales cycle

- Data rates can fluctuate based on market conditions

9. Project-Based Services

The project-based services revenue model is most common for businesses that provide consulting or other services.

Pros of project-based services model:

- Can be a great way to generate revenue from customers who need your services

- Projects can be customized to the customer's needs

Cons of project-based services model:

- Very hands-on

- Need to keep your pipeline filled

- Projects can fluctuate based on economic conditions

10. Retainer-based services

The retainer-based services revenue model is most common recurring stream for businesses that provide consulting or other services.

Pros of retainer-based services model:

- Can be a good way to introduce recurring revenue to a services business

- Customers typically pay upfront for your services

Cons of retainer-based services model:

- Need to find a service that's profitable on retainer;

- Reducing churn;

- Pricing your retainer.

11. Tickets, Events, Workshops

The ticketing revenue model is most common for businesses that host events or workshops.

Pros of ticketing model:

- Can be a great way to generate revenue from customers who are interested in your event

- Tickets can be sold in advance of the event

- Virtual events and workshops can be easier to scale since you're not selling a physical good or service

Cons of ticketing model:

- Need to consistently market events

- Margins need to be high for it to be sustainable

- Often need to pay staff to help facilitate event

12. Royalties

The royalty revenue model is most common for businesses that sell digital content, such as books, music, or software.

Pros of royalty model:

- Royalties can be collected on a per-sale or per-use basis

- Highly asynchronous

Cons of royalty model:

- Can be difficult to track sales and commissions

- Typically low % commission

- Royalties can be volatile from year to year

13. Manufacture (D2C)

The manufacture model, going direct to customer, is probably the most familiar. You make a product and then sell it to the customer, whether that’s through your own store, a third-party retailer, or some other means.

Pros of Manufacture (D2C)

- You have complete control over your product

- You can build your own brand

- You can reach customers directly

Cons of Manufacture (D2C)

- It can be expensive to get started

- You have to invest in marketing and branding

- You have to manage inventory and shipping

14. Library Access

The library access model is common for businesses that offer digital content, such as books, music, or software. Customers can access your content through a subscription or pay-per-use basis.

Pros of Library Access

- Can reach a wide audience of potential customers

- Can generate revenue from customers who are interested in your content

Cons of Library Access

- Possibility of duplicating digital content without license

- Retaining users after they pay for first access

- Offering a unique library

15. Rent/Lease

The rent/lease revenue model is common for businesses that offer physical goods, such as equipment or vehicles. Customers can rent or lease your products on a short-term basis.

Pros of Rent/Lease

- Can generate revenue from customers who need your equipment

- Can be quite 'Passive' income

- Scalable if margins and demand are high enough

Cons of Rent/Lease

- High expenses upfront

- Potential damages costs

16. Community Access

The community access revenue model is common for businesses that offer physical goods or services. Customers can access your product or service through a subscription or pay-per-use basis.

Pros of Community Access

- Compounding as the community grows

- Plenty of online community software and tech popping up

Cons of Community Access

- Difficult to upgrade to a 'paid tier'

- Community moderation can be time-consuming

- Sustaining high community engagement

17. Marketplace

The marketplace revenue model is common for businesses that offer a platform for other businesses to sell their products or services. Customers can access the marketplace through a subscription or pay-per-use basis.

Pros of Marketplace

- Buyers will typically bring their own customers

- Can generate revenue from both sides of the market: buyers and sellers

- Don't need to produce your own products (beyond the marketplace itself)

Cons of Marketplace

- Quality control can be difficult

- Chicken-egg problem: getting your very first buyers and sellers

- Settling disputes and investing in customer support

Choosing A Revenue Model For Your Business

This Notion template database also includes some properties to help you understand more about the various revenue models listed, and how they compare with one another on a few important factors. These are:

- Volume needed;

- Typical Margins;

- Capital needed upfront;

- Relationship to customer (direct or indirect);

- Scalability;

- Revenue model examples; and

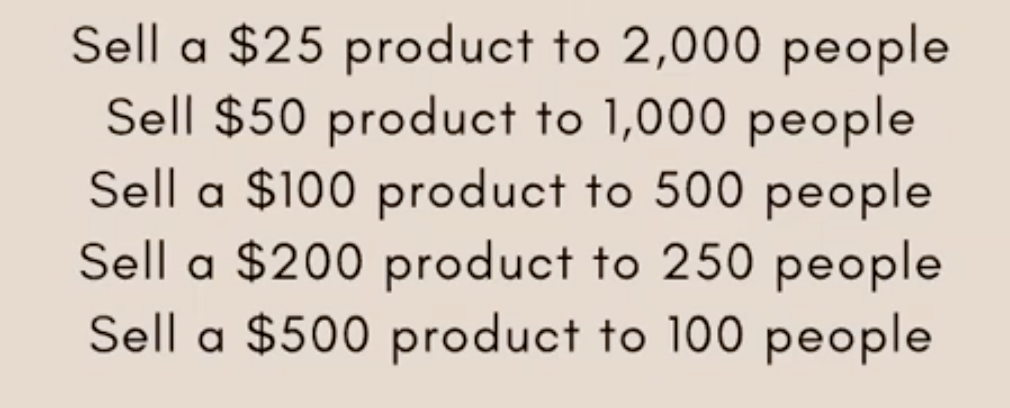

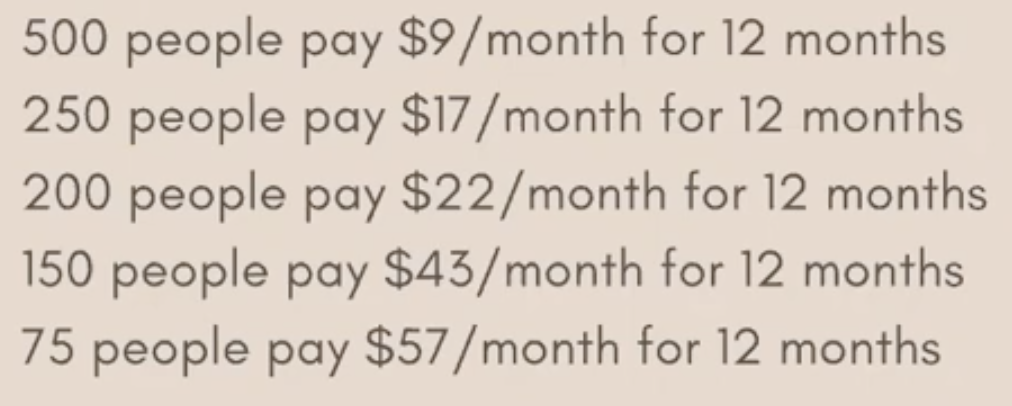

Volume Needed

The volume needed property gives an indication (on a scale from 'Very Low' to 'Very High') of how many customers are typically needed for this type of revenue model to work. For example, a subscription revenue model that charges $1.99/month will need a Very High volume of customers in order for the model to work; whereas a high-ticket services business may only need 1 or 2 big clients per year.

Typical Margins

The typical margins property is there to help you understand how profitable this revenue model can be, given the right circumstances, per sale or customer. For example, a business selling digital products will typically have very high margins (if they are priced correctly), whereas a business that relies on advertising as its primary revenue source may have lower margins.

Capital Needed Upfront

The capital needed upfront column describes (loosely) of how much money you will need to spend in order to get the business up-and-running. For example, a subscription business can be started with very little capital as there are no inventory or product development costs; whereas a manufacturing business may need a lot of money to get started as there are significant inventory and product development costs.

Relationship to Customer (Direct or Indirect)

The relationship to customer property gives an indication of whether the revenue model is direct, indirect or two-sided (e.g. marketplaces). A direct revenue model is one where you have a direct relationship with the customer; whereas an indirect revenue model is one where you do not have a direct relationship with the customer.

For example, a subscription business has a direct relationship with the customer as they are paying the business directly for a product/service; whereas an advertising-based revenue model has an indirect relationship with the customer as they are paying the advertiser, not the business.

Scalability

The scalability property gives an indication of how easy it is to scale this type of revenue model. A scalable revenue model is one that can grow without a significant increase in costs; whereas a non-scalable business is one that has fixed costs which limit its growth.

For example, a subscription business is usually more scalable than a manufacturing business as there are no inventory or product development costs; whereas a business that relies on a small number of high-value clients is usually less scalable as it is difficult for you to service more such clients with the same number of hours in a day.

Revenue Model Examples

This column provides an example of a real business that is deploying this revenue model. I've tried to select primarily indie businesses, however this isn't the case for all of the businesses listed (where I couldn't find an indie business, I chose something that may be relevant or a company that I just generally like).

It's also worth noting that many of the businesses listed under a certain revenue model type employ multiple revenue models, alongside the stream that they're listed under. This is quite common for indie businesses (to have multiple revenue streams) and can be a good hedge against any single revenue stream going dry.

As you look through the list of possible revenue models, you can give each a ranking and sort the list based on those that are best suited.

Getting Started

Duplicate this template into your own Notion workspace, and start ranking the various revenue models as they suit your own business, today.

.png)

Level up your Notion workspace, today⚡

"By far the most comprehensive Notion for business templates I've come across."

Components Library

Landmark All Access

All Access: Annual

Landmark Lifetime Access

%20(1).png)

Revenue Climb

Revenue Modeling: A Comprehensive Guide to Growth Planning and Execution

As a business leader, one of your most critical responsibilities is to develop a thoughtful revenue model that projects growth targets and outlines the strategies and resources needed to achieve them. An accurate and well-constructed model provides clarity on the investments required to scale efficiently. It also enables your leadership team to course-correct when projections diverge from actual performance.

This comprehensive guide will provide readers with research-backed best practices, real-world examples, data, and actionable tactics to build a robust revenue model that connects strategic planning to execution.

Why Revenue Modeling Matters

Before diving into the components of an effective revenue model, it's helpful to understand why it's a foundational exercise for any scaling SaaS company. Here are some key reasons:

Capital allocation planning - A revenue model allows you to match expenses to growth targets so you can determine funding requirements. This prevents over- or under-investment.

Capacity planning - By modeling growth against current capabilities, you can identify resource gaps in sales, marketing, product, engineering, support, etc.

Goal setting - Models provide a benchmark for performance goals across the customer journey, from acquisition to renewal.

Risk mitigation - Models surface potential bottlenecks or unrealistic projections, giving you time to course correct.

Investor relations - For startups raising capital, a thoughtful model demonstrates planning rigor and execution readiness.

According to research by Bain & Company, companies that take a strategic approach to revenue modeling grow 19% faster on average and are 29% more profitable compared to peers. The data shows why this exercise is so critical.

Key Components of a Strategic Revenue Model

Now that we've covered why modeling matters, let's explore the key planning elements that compose a comprehensive model.

Growth Target

Every model starts with a growth target which is often represented in revenue or ARR (annual recurring revenue). Common goal timeframes are annual or multi-year. Growth targets are based on assessing market opportunity, competition, current customer traction, and other inputs. Setting an ambitious but achievable target provides focus and orients the remaining model.

Go-to-Market Roadmap

The GTM roadmap outlines the strategies across marketing, sales, and customer success required to hit growth goals. It connects high-level planning to tactical execution across stages:

Top of funnel - The advertising, content marketing, email nurturing, and other programs that generate pipeline

Middle of funnel - The sales development and customer success teams and playbooks that qualify and close new business

Bottom of funnel - The account management, cross-sell, upsell, and renewal tactics that expand existing accounts

Sales Capacity Model

To understand what revenue is possible, you need to model sales team capacity and productivity. Key elements include:

Headcount - How many sales reps and customer success managers needed to hit goals based on market segment specialization

Ramp time - The number of months for reps to ramp up to full quota capacity

Productivity - Revenue targets for each rep mapped to their ramp

Expenses - Cost of expansion factored in, including salaries, commissions, tech stack, and other operational needs

New Customer Acquisition

This section models the strategies that drive new customer growth. Key factors include:

Total addressable market (TAM) - The target market opportunity broken down by customer segment, industry, region, etc.

Target buyer personas - The customer profiles determined to have the highest propensity to buy your product(s)

Sales funnel metrics - Projected lead velocity, sales qualified lead (SQL) conversion rates, opportunity creation, win rates, etc. which contribute to new ARR forecast

Go-to-market costs - The total investment required across marketing, sales, and revenue operations to acquire new customers

Expansion Revenue

To complement new ARR, your model needs to project expansion revenue from your existing customer base through:

Upsells - Adding higher tiered products, premium features, and additional seats/licenses

Cross-sells - Selling complementary products that increase account value

Account-based sales - Strategic sales approaches to grow enterprise and commercial accounts

Customer marketing - Loyalty programs, referrals, and other tactics that generate expansion pipeline

Retention Revenue

Retaining and renewing existing revenue is more cost effective than acquiring net-new ARR. Model out:

Gross revenue retention (GRR) - Total renewal revenue from active contracts

Net revenue retention (NRR) - Renewal revenue minus any lost revenue from churn and downsells

Renewal sales capacity - Customer success and account management resources needed to maximize renewals

Churn risks - Analysis of historical churn causes to inform retention programs

Customer health scoring - Leading indicators to measure renewal propensity and prevent churn

Revenue Waterfall

The revenue waterfall ties everything together into a financial projection based on new business growth, expansion, renewals, and churn. The model flows from the top-level target down through every stage of the customer lifecycle. Graphing the waterfall provides a visual representation of the growth levers and helps identify potential gaps vs. the plan.

Turning Your Model Into Action

An insightful revenue model is useless without consistent tracking and execution. Here are best practices to activate your model:

Establish a revenue rhythm - Hold monthly and quarterly reviews of model projections, surfacing risks and opportunities. Adapt quickly.

Report on metrics - Manage sales, marketing, and customer success to key performance indicators aligned to model assumptions.

Forecast accurately - Build a sales forecasting process and pipeline hygiene discipline tied to the revenue plan.

Resource and invest - Use the model to support budget, headcount, and capacity planning to meet growth.

Iterate annually - Reassess market potential and rebuild the model annually as you expand and conditions change.

Case Study: HubSpot's Revenue Model Evolution

HubSpot, the leading SaaSinbound marketing and sales platform, provides a compelling case study in revenue model maturation. Their ability to accurately model growth and execute led to a highly successful IPO and market leadership. Examining their model evolution shows what's possible.

HubSpot started with a bottoms-up model driven by rep-level productivity assumptions. As they scaled, they strengthened model accuracy by:

Factoring in customer acquisition costs, sales ramps, and churn

Adding functionality to model renewals, upsells, and cross-sells

Incorporating marketing attribution and funnel metrics

Building a specialized SMB vs. Enterprise model

Testing model accuracy quarterly and annually

According to HubSpot, their revenue modeling competence increased overall sales forecast accuracy by up to 10%. The model and rigorous approach to testing assumptions led them from $15M to over $1B in revenue.

Key Takeaways

Strategic revenue modeling addresses the most pressing challenge for SaaS companies - scaling efficiently and predictably. The companies that invest in models and process will compound growth faster. To recap:

Model to match revenue goals to required resources. Avoid over or under investing.

Project new customer acquisition, land & expand, renewals, and churn accurately.

Map modeled growth to sales, marketing, and customer success capacity.

Use the model to guide budgeting and goal setting across the org.

Review model accuracy frequently and iterate annually.

With a rigorous approach to modeling, your leadership team will have the insights required to confidently accelerate growth and gain market share. If you make modeling a competency across your org, it will enable the speed, efficiency and value creation potential of a truly scalable business model.

Leave a comment

Ready for more?

What Is a Revenue Model?

Published: October 06, 2021

Deciding how you’ll generate revenue is one of the most challenging decisions for a business to make, aside from coming up with what you’ll actually sell.

You want to ensure that you’re accounting for production costs, salaries for workers, what your consumers are willing to pay, and that you generate enough to continue business operations. You also want to make sure that your strategy fits with what you’re trying to sell.

Various revenue models will help you set your business on the right path. In this post, we’ll outline what they are and how to choose the right one for your company.

![revenue model for a business plan Download Now: Annual State of RevOps [Free Report]](https://no-cache.hubspot.com/cta/default/53/78dd9e0f-e514-4c88-835a-a8bbff930a4c.png)

What is a revenue model?

A revenue model dictates how a business will charge customers for a product or service to generate revenue. Revenue models prioritize the most effective ways to make money based on what is offered and who pays for it.

Revenue models are not to be confused with pricing models , which is when a business considers the products’ value and target audience to establish the best possible price for what they are selling to maximize profits. Once the pricing strategy is set, the revenue model will dictate how customers pay that price when they purchase.

RevOps teams also use pricing models to predict and forecast revenue for future business planning. Knowing where your money is coming from and how you’ll get it makes it easier to predict how often it will come in.

There are various revenue models that businesses use, and we’ll cover some below.

Types of Revenue Models

Recurring revenue model.

Recurring revenue model , sometimes called the subscription revenue model, generates revenue by charging customers at specific intervals (monthly, quarterly, annually, etc.) for access to a product or service. Businesses using this model are guaranteed to receive payment at each interval so long as customers don’t cancel their plans.

Recurring Revenue Model Example

Businesses that benefit from recurring revenue models are service-based (like providing software), product-based (like subscription boxes), or content-based (like newspapers or streaming services). Businesses you may be familiar with that use this strategy are Spotify, Amazon, and Hello Fresh.

Affiliate Revenue Model

Businesses using affiliate revenue models generate revenue through commission, as they sell items from other retailers on their site or vice versa.

Sellers work with different businesses to advertise and sell their products, tracking transactions with an affiliate link . When someone makes a purchase, the unique link notes the responsible affiliate, and commission is paid.

Affiliate Revenue Model Example

Businesses you may be familiar with that use the affiliate revenue model include Amazon affiliate links and ticket promoting services. Influencers also use this model to advertise products from businesses and entice users to purchase them through custom links.

Advertising Revenue Model

The advertising revenue model involves selling advertising space to other businesses. This space is sought after because the advertiser (who is selling the space) has high traffic and large audiences that the buyer (who is purchasing the space) wants to benefit from to give their business, product, or service visibility.

Advertising Revenue Model Example

Various types of online businesses use this model, like YouTube and Google, and so do traditional outlets like newspapers and magazines.

Sales Revenue Model

The sales revenue model states that you make money by selling goods and services to consumers, online and in person. Therefore, any business that directly sells products and services uses this model.

Sales Revenue Model Example

Clothing stores that only sell their products in a storefront or business-specific retail website use the sales revenue model as they sell directly to consumers with no third-party involvement.

SaaS Revenue Model

The Software as a Service (SaaS) revenue model is similar to the recurring revenue model as users are charged on an interval basis to use software. Businesses using this model focus on customer retention, as revenue is only guaranteed if you keep your customers. The image below is the HubSpot Marketing Hub pricing page that uses the SaaS recurring subscription model pricing.

SaaS Revenue Model Example

Businesses using this revenue model include video conferencing tool Zoom, communication platform Slack, and Adobe Suite.

How to Choose a Revenue Model

Choosing a revenue model is entirely dependent on your specific business needs and your pricing strategy.

There is no one-size-fits-all solution, and some businesses have multiple revenue streams within their revenue model. For example, if you use a recurring revenue model, you still may sell advertising space on your website to other businesses because you have a high-traffic page.

There are some key factors to keep in mind, though:

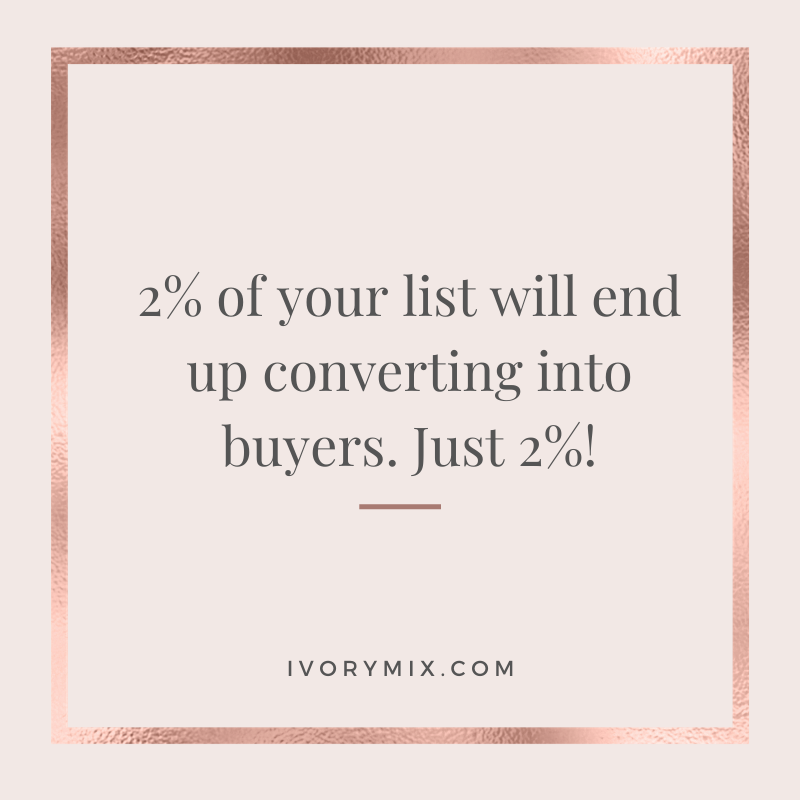

1. Understand your audience.

When picking a revenue model, the most important thing to remember is the target market and audience your pricing strategy has identified. You want to understand their pain points and what model makes the most sense for charging them.

For example, if you’re a service that sells meal kits, your target audience is likely busy and wants the convenience of food that is set up and easy to make after a long day. Using the recurring revenue model makes sense, as you’ll automatically charge them on an interval basis, and they won’t have to remember to submit payment — speaking directly to their desire for convenience .

2. Understand your product or service.

It’s also essential to have an in-depth understanding of your product or service and how your audience will use it. For example, if you sell shoes, your audience likely won’t need a new pair every month, so it may make sense to go with the Sales Revenue Model. Instead, your customers can come to you directly every time they need a new pair.

Choose the Model That Best Fits Your Needs

Ultimately, choosing a revenue model is centered around understanding what makes the most sense for what you’re selling and what makes the most sense (and will be most convenient) for the audiences you’re targeting.

Take time to develop your pricing strategy, choose a revenue model aligned with it, and begin generating revenue.

Don't forget to share this post!

Related articles.

A Simple Guide to Lean Process Improvement

The Marketer's Guide to Process Mapping

Data Tracking: What Is It and What Are the Best Tools

What is a Data Warehouse? Everything You Need to Know

![revenue model for a business plan Why Every Company Needs an Operating Model [+ Steps to Build One]](https://blog.hubspot.com/hubfs/Operating%20Model.webp)

Why Every Company Needs an Operating Model [+ Steps to Build One]

What is Data as a Service (DaaS)?

Data Ingestion: What It Is Plus How And Why Your Business Should Leverage It

Data Mapping: What Is It Plus The Best Techniques and Tools

Marketing vs. Operations: The Battle for a Small Business' Attention

![revenue model for a business plan What Is an Enterprise Data Model? [+ Examples]](https://blog.hubspot.com/hubfs/woman%20working%20on%20enterprise%20data%20.jpg)

What Is an Enterprise Data Model? [+ Examples]

Free data that will get your RevOps strategy on the right track.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Hey there! Free trials are available for Standard and Essentials plans. Start for free today.

Maximizing Profitability: Explore Effective Revenue Models for Your Business

Choosing the right revenue model can help you earn more and create an effective pricing strategy. Explore the different types of revenue models here.

Imagine you're walking down the street on a hot summer day and see the neighborhood kids setting up a lemonade stand. Nothing sounds better on a day like this than an ice-cold lemonade. You approach their stand and find the price is $2 for a cup. While you know it wouldn't cost $2 to make just a glass of lemonade at home, you are willing to pay this price because you are thirsty and also want to support the kids.

From a business perspective, these kids are making a good amount of profit from their lemonade stand. They're actually using a markup revenue model where they increase the price of a cup of lemonade to account for their operating costs. It seems like the perfect model for making money. However, this might not be the case in every business situation. Depending on the scale and complexity of your business model , you need to consider different methods of developing revenue streams.

There are various revenue models implemented by businesses across the board. Many business models are far more complex than a simple lemonade stand and thus require a different revenue model strategy. There are subscription-based, advertising, and commission-based models, to name a few—but what is a revenue model, and how do you choose one?

If you're considering which revenue model to incorporate into your business strategy, keep reading to learn more.

What is a revenue model?

A revenue model is a blueprint for how a company produces income from its services or products. Simply put, it outlines the methods through which a business makes money. There are several components within a revenue model, including how you price your products and which sales channels you choose. A revenue model is established to answer how a company plans to financially optimize its business model.

Revenue models can be seen as roadmaps for understanding how your business will operate financially. They define how a company generates revenue, covers costs, and eventually turns a profit. A revenue model should outline the various sources of income to help guide decision-making related to the overall business strategy.

Benefits of implementing revenue models

Developing a revenue model is an essential step for growing your business. Here are some of the main benefits of implementing revenue models:

Financial sustainability

An effective revenue model establishes consistent income streams, providing financial security and sustainability. Your revenue model should help you understand how much revenue to expect so you can properly plan expenses, growth, and investments.

Pricing strategy

Factors such as market demand, competition, and product costs are considered within a revenue model. Each of these factors can inform your pricing strategy. Based on the revenue model, you can determine which prices maximize revenue while remaining appealing to customers.

Profitability analysis

Revenue models show how your business generates revenue. Understanding the costs incurred by creating your products or services, along with the generated revenue, allows you to analyze the profit margin of your business. Subsequently, you can make informed decisions to improve your resource allocation and pricing strategy.

Scalability

Growth is key to your business revenue model thriving. Implementing a revenue model provides insight into the scalability potential of your business. You can easily assess potential revenue growth by attracting more customers and introducing new products or services. Knowledge is power—the more information you have about how your business operates, the better you can plan for the future and make smarter investments.

Decision-making

A sound revenue model produces meaningful insights to influence strategic decision-making. Your revenue model indicates which products or services generate the highest income, enabling you to better allocate resources and focus on areas with the highest profitability potential.

Investor confidence

A smart revenue model will inspire investor and stakeholder confidence. Potential investors will be impressed by a well-defined revenue model that demonstrates a clear plan for generating multiple revenue streams.

Types of revenue models

There are various revenue models that can be implemented based on your specific business operations and needs. Understanding when and how to choose different types of revenue models will help you better calculate revenue growth rates.

Here are just a few revenue model examples:

Advertisement-based

An advertising revenue model is a popular type of revenue model. The main source of income is generated by displaying advertisements. In this model, your company sells advertising space to other businesses or brands who want to advertise with your customer base and users. How your business earns revenue is by charging advertisers for ad placements.

Pros of advertising-based revenue models

- Successful advertisement-based revenue models typically generate significant income.

- An advertising model can greatly boost revenue streams if you have a large user base or a popular platform.

- There's a low barrier to entry, meaning it's relatively easy to set up and requires minimal investment upfront.

- This revenue model also offers flexibility and opportunities for diversification since you can provide many ad types and have a full roster of advertisers.

Cons of advertising-based revenue models

- Advertisers aren't guaranteed.

- You need to attract advertisers who are willing to pay for placements on your platform.

- The advertising market constantly fluctuates, meaning your revenue may fluctuate whenever advertisers reduce their budgets and don't buy ad space.

- You must also consider user experience and how incorporating display ads will impact your engagement.

YouTube is well-known for using an advertising model. Content creators on the platform can monetize their content by displaying ads on their videos. YouTube earns revenue by selling advertising space to companies that want to reach a vast audience. In this case, content creators can also receive a share of the ad revenue based on several metrics, including clicks, view time, and impressions.

The affiliate model is a more common type of revenue model. It's where a company or person makes a profit by promoting and selling products on behalf of another business. In the affiliate revenue model, an affiliate acts as the middleman between potential customers and the products or services.

Pros of affiliate revenue models

- Affiliate models are generally low-risk and cost-effective.

- As an affiliate, you don't need to create your own products, nor do you handle inventory or customer segments.

- It offers the potential for passive income by earning commissions without active involvement.

- You can also generate income from various affiliate partners, making this model great for diversification and scalability.

Cons of affiliate revenue models

- As an affiliate, you have little to no control over the products or services you promote. This means that negative customer experiences may harm your reputation.

- This type of model also creates revenue dependence on partners.

- Generating a profit with affiliate marketing may be easy, but intense competition and market saturation can make it difficult to generate significant income.

Affiliate marketing is a common revenue model. Amazon Associates is an example of an affiliate revenue model that allows individuals or businesses to make money through commissions on Amazon products they promote. Amazon provides unique affiliate links that lead to participants earning a percentage of the sales on products they advertise.

Commission-based

Similar to the affiliate model, commission-based revenue models allow companies to generate revenue by receiving a commission from each transaction it facilitates. Again, the company acts as a mediator between sellers and buyers.

Pros of commission-based revenue models

- The commission-based revenue model can be extremely scalable.

- The more users you gain, the more transactions will occur, leading to an increase in revenue growth.

- Another benefit of this model type is risk-sharing between the company and the sellers.

Cons of commission-based revenue models

- One of the major downsides to this model is dependency on transaction volume. If there are few transactions happening, the opportunities for generating revenue significantly decrease.

- You'll also experience limited control over pricing, which can lead to price competition among sellers and lower commission rates.

Airbnb uses a commission-based model. The platform makes money by connecting individuals with accommodation. Airbnb earns a commission on every booking made on the platform, making the company reliant on users securing lodging through their platform in order to generate revenue.

Another popular revenue model is donation-based. This strategy is implemented by soliciting and accepting voluntary donations instead of selling services or products.

Pros of donation revenue models

- One of the main benefits of a donation revenue model is the flexibility of revenue generation.

- Organizations can receive revenue streams from diverse donors.

- It's one of the most common revenue models implemented by charitable organizations and comes with tax benefits.

Cons of donation revenue models

- The downside of relying on donations is having an unsteady and uncertain revenue stream.

- Organizations are dependent on donors and are also required to spend money and time on fundraising.

- There are certain stipulations associated with receiving donations and how that money can be used

The Red Cross uses a donation revenue model. As a global humanitarian organization, the Red Cross relies on voluntary contributions to fund its services and programs. The Red Cross doesn't sell products, but they provide services for the community. The donation model is used to support the execution of these services.

The markup model entails a pricing strategy of marking up the cost or adding a margin on top to ensure financial viability. This strategy is used to cover expenses and generate profit despite external factors.

Pros of markup revenue models

- A markup revenue model is simple in practice.

- It doesn't require complex calculations and ensures the profit calculation is straightforward and transparent.

- The markup model also offers flexibility in pricing, meaning businesses can adjust the markup percentage depending on market conditions, supply, competition, and more.

Cons of markup revenue models

- The markup model can be difficult to implement in competitive markets.

- Competing while maintaining profit margins can be challenging when competitors implement aggressive pricing.

The retail industry generally relies on the markup model. There are specific production costs associated with making a pair of shoes. Retailers typically purchase the shoes from wholesalers at a fixed price. Then, they add a markup percentage to determine the selling price so it covers operating expenses and allows the retailer to earn money.

An interest revenue model refers to businesses generating income by earning interest. In this case, companies are making money by leveraging interest rates rather than making direct sales.

Pros of interest revenue models

- Interest models allow companies to earn passive income and diversify their revenue streams.

- This revenue model is also highly scalable and can benefit from changes in interest rates, leading to enhanced earning potential.

Cons of interest revenue models

- There's a level of risk associated with the interest revenue model. Risks include borrowers defaulting on loans, interest rate fluctuations, regulatory and compliance laws, and intense market competition.

Credit card companies use the interest operating model. They lend money to borrowers and earn interest back based on interest rates. These companies manage credit and loan portfolios while taking advantage of interest rates to increase profitability.

Subscription

A subscription revenue model relies on customers who subscribe and pay for your products or services. Customers pay fees to access the company's collection of products or services, allowing for steady revenue sources. The subscription-based revenue model allows a company to generate revenue by offering long-term subscriptions, resulting in consistent income such as monthly recurring revenue .

Pros of subscription revenue models

- The subscription model provides a reliable and predictable revenue stream.

- Customers pay in regular installments, allowing businesses to easily forecast finances.

- This revenue model also promotes customer retention and loyalty while lending itself to upselling and cross-selling opportunities.

Cons of subscription revenue models

- Acquiring customers with the subscription model can be challenging, meaning you may need to spend more time and money on marketing and sales.

- Customers can also cancel their subscriptions, leading to an increase in customer turnover.

Netflix is one of the most popular subscription revenue model examples. Users pay a monthly fee to access the streaming platform. Revenue generation results from monthly subscriptions. Not all subscription models are successful, but Netflix is the best example of how a subscription model can succeed in making money.

Which revenue model is right for you?

Choosing which revenue model is right for your business will depend on a variety of factors, such as your target audience, operating costs, and overall business model.

The first step for choosing a revenue model is to understand your market and the needs of your target audience. For example, media organizations will have different audiences than healthcare companies. Conduct market research to understand your customers and their needs, preferences, and pain points. These findings will inform your business strategy and how you decide to conduct business operations.

The next step is to specify your value proposition by clearly defining the unique value of your product or service. Identify key benefits and determine what sets your business apart from the competition. Consider how your business performs in terms of innovation, convenience, and quality. Communicating these benefits clearly and concisely enables your target customers to connect with your company.

Know your product or service inside-out. Understanding how your product functions, what it offers to target customers, and what your mission is will help you determine your company's business model. The ultimate goal is to generate revenue, so the more you understand your product or service, the better you can make sound business decisions.

There are several common revenue models to choose from. Online businesses, such as an e-commerce platform, might consider an advertising revenue model to diversify income streams. A local bakery may opt for other revenue models more suitable for their needs and production model. Select a revenue model after thorough research and consideration to ensure a steady and effective revenue stream.

Grow your profits with the right revenue model

Business models rely on generating income. The best way to grow your profits is to choose a revenue model that fits your company's unique needs. A company's revenue streams are dependent on more than just direct sales. Make sure to consider all different revenue model types when developing your strategy. A smart strategy is essential for a scalable business .

Whether you're just getting started or considering a switch in your revenue model, you can land more sales by leveraging market insights . Unlock your full earning potential by exploring the different tools and resources available for choosing a revenue model and growing your business. Rely on actionable data to make informed business decisions and hit your targets.

500+ business plans and financial models

8 Most Popular Startup Revenue Models Explained

- October 1, 2022

- Forecast your business

There have different ways to earn revenue. A business’ revenue model is very important as it is a component of its business model: which product/services it sells to whom and how.

You might haven’t yet decided which revenue model to opt for. Or you might simply be wondering which is one is best for your business. In this article we explain you what are the 8 revenue models and their pros and cons. Read on.

What is a revenue model?

A revenue model defines how a business generates revenue. For instance, a clothing shop sells clothes to its customers for a one-time fixed payment. Instead, Netflix charges its customers a recurring fee, every month, so they can continue watching content on their platform. Both companies make money, yet differently.

Revenue model vs. revenue stream

You might have heard of revenue stream (instead of revenue model). Whilst both terms are similar, they don’t exactly mean the same thing:

- Revenue model : how a business generates revenue

- Revenue stream : a business’ source of revenue

For instance, while a business might have a subscription revenue model, it might have 2 different revenue streams: subscription “Premium” and “Corporate”.

Instead, the clothing store above has a transaction-based revenue model. Yet, it might have 3 revenue streams: shirts, trousers and accessories.

Can a business have different revenue models?

The short answer is yes. For instance, a software company (e.g. Enterprise SaaS) might offer subscriptions to all its customers. In addition it can also provide on-demand consulting services to some of its customers: its sales team might offer onboarding and training paid services for instance. Therefore, the software company is combining 2 revenue models: a subscription and a service-based revenue model.

Why a business might have different revenue models?

Multiplying the sources of revenue a business has can make it more resilient. Indeed, revenue models have different characteristics which make them more or less prone to risks and, ultimately, impact growth.

Combining different revenue models can also bring other benefits, among others:

- It broadens the types of products and services a company might offer, expanding revenue

- It might increase profitability, as some revenue models may be more profitable than others

1. Subscription revenue model

Subscription businesses have become quite popular over the past 10 years. Originally a new form of licensing (see below) created by the first software companies, subscription revenue business now spans virtually all industries globally. Whether sold to businesses (B2B) or consumers, subscription businesses are everywhere: gym memberships, phone subscriptions, SaaS, ecommerce subscription, etc.

- Scalable : once you have created a product (e.g. software) for one customer, you can sell it to another without any additional production costs

- Predictable : because customers are paying a fee periodically, revenue is easier to forecast

- High customers acquisition cost : due to competition from other players, the costs to acquire one customers are usually quite high. See our article on CAC and LTV for SaaS businesses for more information

- High retention costs : because customers keep paying until they churn, subscription businesses typically as much (if not more) in customer retention than customer acquisition.

Expert-built financial model templates for tech startups

2. Transaction revenue

Transaction revenue is the oldest, and most common source of revenue model. Typically, a business that uses transaction-based revenue falls into one of the 3 following categories:

- Companies which produces and sells the products to a reseller

- Direct-to-consumer (DTC) businesses which produces the products and sell them straight to the end consumer

- Companies who buy products / services from a company to sell it to another, or to an end-consumer instead. These businesses do not manufacture nor produce anything, they simply make money from the spread between the supply cost and the sale price.

- Low customer acquisition cost

- Simple sales process

- Difficult to scale

- Margins might be low for some businesses (e.g. retail, airlines) and profitability requires a very large volume of orders

- Can be subject to cyclicality and/or seasonality

3. Ads revenue

- Can be very profitable in the long term . Indeed, the costs to produce content (videos, articles) and maintain a website or a blog for instance can be limited. As such, the running costs are very low: once content is produced, maintenance is limited

- Scalable : the larger the audience, the more revenues you generate. If your blog, website or youtube channel starts to benefit from network effects , growth can be exponential

- Low startup costs : building a targeted audience doesn’t necessarily need substantial investment upfront. Instead, you will have to invest in curated, targeted content for your audience which you will need to publish periodically. As such, ad revenue businesses can be one people businesses (e.g. Youtube channels)

- Audience needs to be targeted , else publishers will not agree to pay attractive price for your ad space. Remember: publishers are buying ad space to generate revenues for themselves, or their clients. If publishers do not see a minimum ROI on their investment, they will go somewhere else

- Large volume is required to start generating meaningful revenues . Average eCPM varies between channels (videos, rewarded videos, articles, etc.) yet is in average $4-$10 : you will need 1,000 ad impressions to generate only $4-$10 in revenue

- Building an audience typically takes time .

4. Commission (affiliate) revenue

The transaction can be done either on your website (e.g. marketplace) or processed on another merchant’s platform (e.g. affiliation).

The commission can either be variable (a percentage of the value of the product or service) or fixed (fixed fee per transaction).

Like ads, commission and affiliate revenue business models are often not the primary source of revenue for a business. Instead, it can be a very attractive additional source of revenue. For instance, a IT consulting firm selling advisory services might resell some of its leads (the newsletter signups for example) to a software company it partnered with. By doing so, the IT advisory company may earn a 20% revenue share with the software company.

- Similar to ad revenue, it can be very profitable in the long term . Indeed, you need to build an audience first to acquire leads. Yet, maintenance costs can be quite low and therefore commission revenue highly profitable (note this is especially true for affiliation businesses)

- No inventory costs : because you act as intermediary between a supplier and a buyer, you do not hold any inventory. This significantly reduces your risks

- Commissions rates can vary significantly . They can be as high as 20-30% for marketplaces, and lower than 5% for some affiliation businesses. The level of commission you manage to negotiate with the seller depends on your bargaining power which itself is a function of your audience: the larger and more targeted your audience is, the higher the commission rate

5. Service-based revenue

- Virtually no startup costs . Starting your own advisory services firm needs very little upfront investment. Usually, a website and, if any, some digital ads costs are enough to acquire customers. Some freelancers on marketplaces such as Upwork or Fiverr do not even have any website, for them startup costs are close to zero

- Highly profitable . Because you are selling your expertise (your time), typically you do not have any ongoing expenses nor production costs: a significant part of revenues are profits (usually >90% profit margin)

- Origination can be costly . Because service-based businesses typically provide customised solutions, each new customers requires time to assess workload, define the job scope and draft a contract. All of this time spent originating transactions cannot be spent elsewhere, and therefore is a cost to take into account

- It is not scalable . Because revenue is a function of the time spent, more revenues mean more manpower. By definition it isn’t scalable at all.

- After-sale customer requests can be tricky to manage . Customers might ask for follow-up questions, discuss potential amendments or even tweak the original job scope. Often, a service contract might generate more work than expected, and therefore be less profitable.

6. Interest revenue model

- Interest revenue business models often have very little variable costs . Because you’re charging an interest for lending capital (to an individual or a business), the only variable costs are processing, clearing and currency conversion fees.

- Whilst you typically have very low variable costs, interest revenue business models typically have high fixed costs instead . These fixed costs mostly are salaries. Think about banks: they need substantial manpower to review business opportunities (e.g. loan applications for example) and run the business.

- This business model is only viable at scale : you typically need a lot of volume (for example you would need to process many loans) to be profitable. This is due to 3 factors: low interest rates, high fixed costs and credit risk

- Credit risk : when you run an interest revenue business model, you need to factor in that a certain percentage of your customers will default

7. Leasing model

The most common businesses that use a leasing model include: real estate companies, equipment or car rental businesses , etc.

- Little variable costs (see interest revenue model above)

- Lower risk of default : because you’re leasing a physical asset, this asset has a value. Therefore, unlike interest revenue, if your customer isn’t able to pay interest, you can always get back the asset and sell it at salvage value

- Unlike interest revenue model, there are some variable costs related to the assets you lease (installation, maintenance, etc.)

8. Licensing

For instance, Microsoft has historically sold access to its most common softwares (e.g. Word, Powerpoint, Excel) as licenses (vs. subscriptions)

- Like subscriptions, it’s very scalable . You can sell as many licenses as you want without increasing production costs.

- Unlike subscription revenue, you earn a fixed time fee. As such, there is no retention and limited upsell opportunities

- Because you need to charge a higher upfront fee vs. the subscription fee you would typically charge for the same product, you may lose customers to your subscription competitors . Indeed, some customers may not be able to afford to pay a high upfront fee and/or may be reluctant vs. a smaller annual/monthly fee

Privacy Overview

Revenue Model Types in Software Business: Examples and Model Choice

- 12 min read

- 28 Dec, 2022

- No comments Share

Here's our video breakdown of revenue models

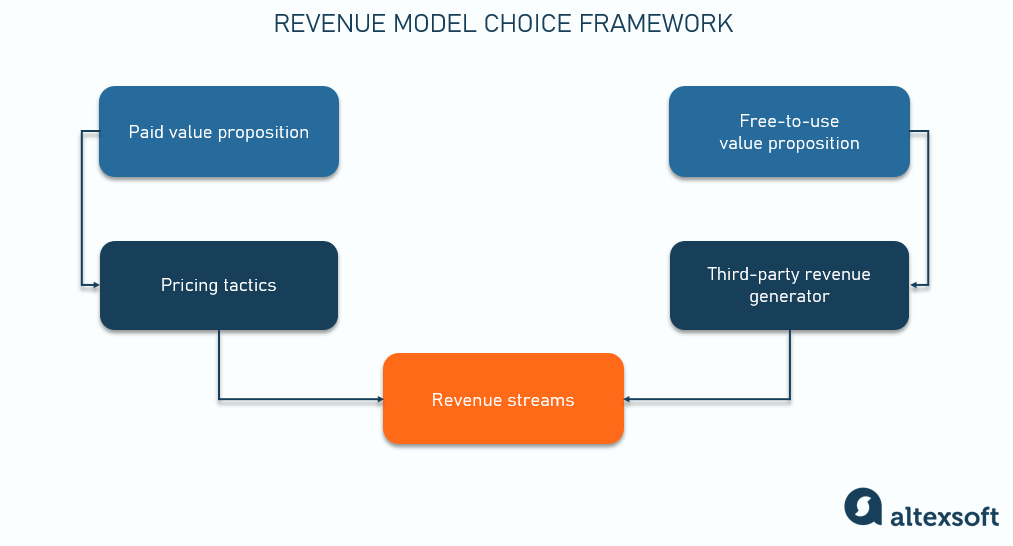

For those exploring the world of business strategy planning, we’ll elaborate on the definition of the revenue model, and the correlation between business models and revenue streams. We’ll also analyze different types of revenue models and look at some examples to scrutinize the pros and cons of each approach. Finally, we’ll reflect on how to choose or develop a model for your business.

What is a revenue model?

A revenue model is a plan for earning revenue from a business or project. It explains different mechanisms of revenue generation and its sources. Since selling software products is an online business, a plan for making money from it is also called an eCommerce revenue model. The simplest example of a revenue model is a high-traffic blog that places ads to make money. Web resources that present content, e.g., news (value), to the public will make use of its traffic (audience) to place ads. The ads in turn will generate revenue that a website will use to cover its maintenance costs and staff salaries, leaving the profit. Revenue models are often confused with business models and revenue streams. To avoid any misinterpretations, let’s quickly define these three terms that form a business strategy.

Revenue model vs business model

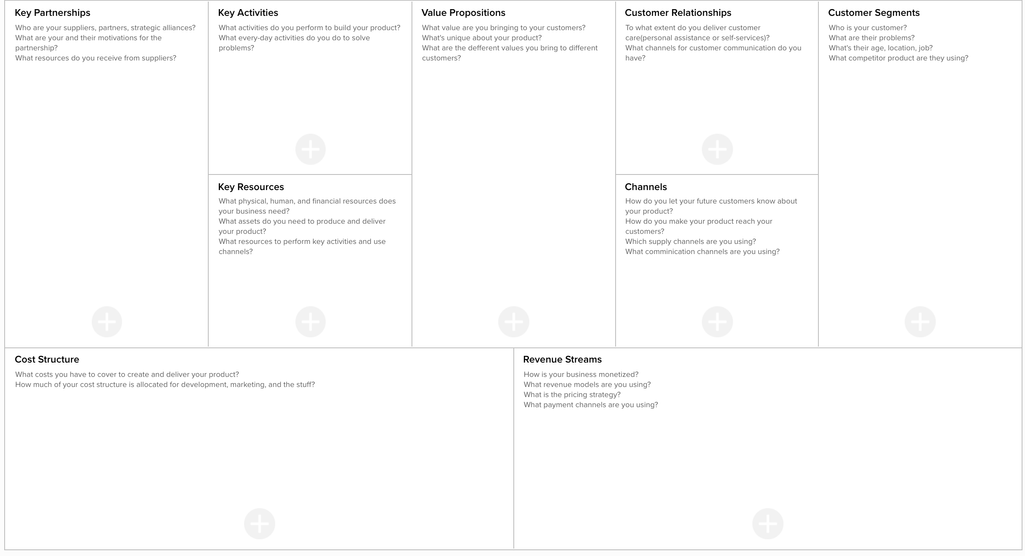

A business model (BM) is a broad term outlining everything concerning the main aspects of the business, all of which are contained in the answers to the following questions.

- What value will we create?

- How will we deliver it?

- How will we bring in revenue?

- How will we earn profit?

Numerous forms of business models can’t be classified in a single list because each part is highly individual to the industry, type of product/service, audience, or profitability. Business models are often depicted strategically on a business model canvas . This is a compound representation of all the key elements of a BM.

A business model canvas template by AltexSoft

So the BM describes how a business will work from the standpoint of value generation. Revenue models, on the other hand, are a part of the business model used to describe how the company gets gross sales.

Revenue model vs revenue stream

A revenue model is used to manage a company’s revenue streams, predict income, and modify revenue strategy. The revenue itself is one of the main KPIs for a business. Measuring it annually or quarterly allows you to understand how your business operates in general and whether you should change the way you sell the products or charge for them. But what are revenue streams ? A revenue stream is a single source of revenue that a business has. There can be many of them. Streams are often divided by customer segments that bring revenue via a given method. The two terms – revenue stream and revenue model – are often used interchangeably, since, from a business perspective, the subscription revenue model will have a revenue stream coming from subscriptions. However, models can name multiple streams divided into customer segments, while the principle of revenue generation (subscription) will remain the same.

Revenue model types

Any start-up, tech company, or digital business may combine different revenue models. The revenue model will look different depending on the industry and the product/service type. Here we will pay more attention to the most common revenue models used in the software industry and online business.

Transaction-based revenue model