Wealth Management Business Plan Template

Written by Dave Lavinsky

Wealth Management Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their wealth management companies. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a wealth management business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Wealth Management Business Plan?

A business plan provides a snapshot of your wealth management business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Wealth Management Firm

If you’re looking to start a wealth management business or grow your existing wealth management company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your wealth management business to improve your chances of success. Your wealth management business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Wealth Management Businesses

With regard to funding, the main sources of funding for a wealth management business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for wealth management companies.

Finish Your Business Plan Today!

How to write a business plan for a wealth management business.

If you want to start a wealth management business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your wealth management business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of wealth management business you are running and the status. For example, are you a startup, do you have a wealth management business that you would like to grow, or are you operating a franchise of wealth management businesses?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the wealth management industry.

- Discuss the type of wealth management business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of wealth management business you are operating.

For example, you might specialize in one of the following types of wealth management businesses:

- Personal Financial Planning and Advice: As the most common form of wealth management, this type of advisory service includes an assessment of financial needs and decisions on investments.

- Asset Management and Allocation: This type of wealth management business assists with maximizing and protecting wealth over the long-term.

- Estate Planning: Wealth management advisory services include oversight of assets, investing for the future and protecting assets.

- Tax Accounting: A tax accounting wealth management advisor oversees all assets and tax preparation, filings, estimates and other tax-related business items.

In addition to explaining the type of wealth management business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients, the total portfolio assets managed, reaching X number of wealth management referrals, etc.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the wealth management industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the wealth management industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your wealth management business plan:

- How big is the wealth management industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your wealth management business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your wealth management business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, families, corporations, foundations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of wealth management business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regard to demographics, include a discussion of the ages, locations, occupations and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Wealth Management Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other wealth management businesses.

Indirect competitors are other options that customers may use that aren’t directly competing with your service. This includes tax accountants, online wealth-building services, and stock brokers. You need to mention such competition, as well.

For each direct competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them, such as

- What types of customers do they serve?

- What type of wealth management business are they?

- What is their pricing (premium, low, etc.)?

- Do they offer any unique or special values for customers?

- What are their weaknesses?

With regard to the last two questions, think about your answers from the customers’ perspective. And, don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide options for family trust management?

- Will you offer management services that your competition doesn’t?

- Will you provide better customer service than those of your competitors?

- Will you offer packaged services for corporations?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a wealth management business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of wealth management company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide free initial consultations, guaranteed profits on certain assets, or yearly analysis at low to no cost?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the services you offer and their prices.

Place : Place refers to the site of your wealth management company. Document where your company is situated and mention how the site will impact your success. For example, is your wealth management business located in an upper socioeconomic location? Does your business offer amenities for special clients, such as season tickets to venues of their choice? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your wealth management marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in wealth-building periodicals

- Reach out to individuals via personal referrals

- Offer introductory meetings to corporations

- Engage in email marketing by blogging in a Q & A section

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your wealth management business, including answering calls, setting appointments, planning and providing services, billing clients, managing and maintaining accounts, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth new client, or when you hope to reach $X in revenue. It could also be when you expect to expand your wealth management business to a new city.

Management Team

To demonstrate your wealth management business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing wealth management businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a wealth management business or successfully running a small brokerage firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you book 5 wealth management clients per week and offer on-site monthly advisory services for corporations? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your wealth management business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a wealth management business:

- Cost of advisory online access to investment information

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of contracted clients you serve.

Writing a business plan for your wealth management business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the wealth management industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful wealth management business.

Wealth Management Business Plan FAQs

What is the easiest way to complete my wealth management business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your wealth management company business plan.

How Do You Start a Wealth Management Business?

Starting a Wealth Management business is easy with these 14 steps:

- Choose the Name for Your Wealth Management Business

- Create Your Wealth Management Business Plan

- Choose the Legal Structure for Your Wealth Management Business

- Secure Startup Funding for Your Wealth Management Business (If Needed)

- Secure a Location for Your Business

- Register Your Wealth Management Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Wealth Management Business

- Buy or Lease the Right Wealth Management Business Equipment

- Develop Your Wealth Management Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Wealth Management Business

- Open for Business

Where Can I Download a Free Business Plan Template PDF?

Click here to download the pdf version of our basic business plan template.

Our free business plan template pdf allows you to see the key sections to complete in your plan and the key questions that each must answer. The business plan pdf will definitely get you started in the right direction.

We do offer a premium version of our business plan template. Click here to learn more about it. The premium version includes numerous features allowing you to quickly and easily create a professional business plan. Its most touted feature is its financial projections template which allows you to simply enter your estimated sales and growth rates, and it automatically calculates your complete five-year financial projections including income statements, balance sheets, and cash flow statements. Here’s the link to our Ultimate Business Plan Template.

Don’t you wish there was a faster, easier way to finish your Wealth Management business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan services can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

Wealth Management Business Plan Template

Written by Dave Lavinsky

Wealth Management Business Plan

You’ve come to the right place to create your Wealth Management business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Wealth Management companies.

Below is a template to help you create each section of your Wealth Management business plan.

Executive Summary

Business overview.

Ellis Wealth Management is a new wealth management firm located in Seattle, Washington. Our mission is to help the residents of Seattle create a financially sound future and achieve all their financial goals. We plan to do this by offering a wide range of wealth management services, including financial planning, estate planning, and retirement planning. We are a client-focused firm that is dedicated to helping our clients make all their dreams come true.

Ellis Wealth Management’s most valuable asset is the expertise and experience of its founder, Jared Ellis. Jared has been a certified financial advisor for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to Ellis Wealth Management once the company is established and running. Jared’s combination of skills, financial knowledge, and loyal following will ensure Ellis Wealth Management’s success.

Product Offering

Ellis Wealth Management will provide wealth management services to the residents of Seattle. These services will include financial planning, asset management, estate planning, and retirement planning. Ellis Wealth Management will prioritize client relationships and will hire a full-time assistant who will be dedicated to answering client questions and drafting newsletters and other communications.

The founder, Jared Ellis, will also focus on answering his clientele’s needs. In addition to newsletters and email updates, Jared Ellis will hold seminars on financial strategies and investment presentations for his clients.

Customer Focus

Ellis Wealth Management will serve the affluent and middle-class residents of Seattle and the surrounding areas. The area has a large demographic of residents with disposable income who are interested in managing their wealth and finances better. They have diverse needs, from needing to better manage their assets to planning their wills and estates. We will provide a wide range of wealth management services to serve this diverse demographic.

Management Team

Success factors.

Ellis Wealth Management will be able to achieve success by offering the following competitive advantages:

- Location: Ellis Wealth Management’s location is near the center of town, in the financial district of the city. It’s visible from the street with many working professionals walking to and from work on a daily basis; giving passersby a direct look at our firm, most of which are part of our target market.

- Client-oriented service: Ellis Wealth Management will have a full-time assistant to primarily keep in contact with clients and answer their everyday questions. Jared Ellis realizes the importance of accessibility to his clients, and will further keep in touch with his clients through monthly presentations, seminars, and updates per email and newsletters.

- Management: Jared has been extremely successful working in the financial services sector and will be able to use his previous experience to grant his clients detailed insight into the financial world. His unique qualifications will serve customers in a much more sophisticated manner than Ellis Wealth Management’s competitors.

- Relationships: Having lived in the community for 25 years, Jared Ellis knows many of the local leaders, newspapers and other influences. Furthermore, he will be able to draw from his ties to the community in order to build up a heavy asset base in a short amount of time.

Financial Highlights

Ellis Wealth Management is currently seeking $350,000 to launch. Specifically, these funds will be used as follows:

- Office design/build: $50,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

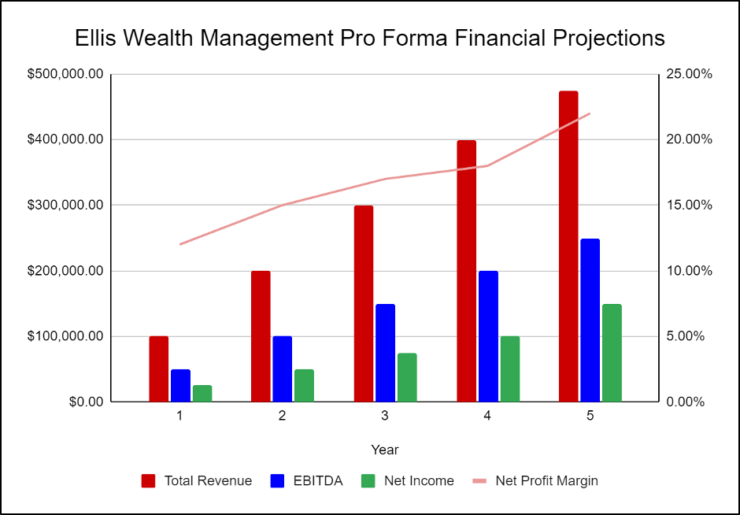

The following graph below outlines the pro forma financial projections for Ellis Wealth Management.

Company Overview

Who is ellis wealth management, ellis wealth management’s history.

Upon surveying the local customer base and finding a potential office, Jared Ellis incorporated Ellis Wealth Management as an S-Corporation in January 2023.

The business is currently being run out of Jared’s home office, but once the lease on Ellis Wealth Management’s office location is finalized, all operations will be run from there.

Since incorporation, the Company has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

Ellis Wealth Management’s Services

Industry analysis.

The wealth management industry is strongly correlated with the strength of the economy as a whole. When the wealth management industry (or the finance industry in general) is down, then that is a sign that the economy is struggling. The economy suffered greatly during the COVID pandemic but is now bouncing back to being stronger than ever.

According to Mordor Intelligence, the wealth management industry was valued at USD 3.67 billion in 2021 and is projected to grow at a CAGR of 14.67% from now until 2027. This is substantial growth and shows the economy is back in full swing. Wealth management firms both small and large can expect significant growth and an increase in profits over the next several years.

In addition to the economy bouncing back, there are a few other factors that affect this projected growth. First, more people have disposable income and are looking for wise ways to save or use that extra money. Furthermore, financial education is becoming far more popular than it was years ago. This means that more people are learning the importance of wealth management and are eager for services that will help them save and grow their money. The widespread interest in financial education has created a strong demand for wealth management services.

When considering all these factors, the wealth management industry is projected to boom in the next few years. This is good news for firms like Ellis Wealth Management and shows that our firm has a great chance to succeed.

Customer Analysis

Demographic profile of target market.

Ellis Wealth Management will serve the residents of Seattle, Washington, and the immediate surrounding areas. The area is populated by middle and upper-class residents who have diverse wealth management needs. They also have the disposable income to hire a wealth management firm to help manage their finances.

The precise demographics of Seattle are as follows:

Customer Segmentation

Ellis Wealth Management will primarily target the following customer profiles:

- Higher-income individuals

- Individuals 55+

- Middle-aged parents with children

Competitive Analysis

Direct and indirect competitors.

Ellis Wealth Management will face competition from other companies with similar business profiles. A description of each competitor company is below.

Merrill Lynch

Merrill Lynch is a longstanding financial firm that was acquired by Bank of America in 2009. The firm has a client-oriented focus that prioritizes the individual needs of each client. The firm offers a long list of wealth management services, including banking services and retirement planning. When clients choose Merrill Lynch, they are offered a wealth management strategy that is tailored to them and helps support their dreams and financial goals.

Edward Jones

Edward Jones is a global wealth management firm that assists over seven million investors worldwide. It is a privately owned company, which allows its advisors to focus on client relationships rather than shareholder returns. They offer a long list of financial advising and wealth management services, all of which are based on respect, attention, and service.

Morgan Stanley

Founded in 1935, Morgan Stanley started as a small Wall Street partnership but has now grown to be a global firm with 80,000 employees. Morgan Stanley is committed to its clients and provides them with a wide range of financial planning and wealth management services. Everything the company does is backed by its five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back. For nearly a century, Morgan Stanley has committed to these values, which has earned them a loyal following and tremendous success.

Competitive Advantage

Ellis Wealth Management will be able to offer the following advantages over the competition:

Marketing Plan

Brand & value proposition.

Ellis Wealth Management will offer a unique value proposition to its clientele:

- Client-focused financial services, where the Company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Ellis Wealth Management is as follows:

Targeted Cold Calls

Ellis Wealth Management will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need wealth management services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

Ellis Wealth Management understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer their friends and family by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

Ellis Wealth Management will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

Ellis Wealth Management will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of Ellis Wealth Management will be moderate and competitive so clients feel they are receiving great value when utilizing our wealth management services.

Operations Plan

The following will be the operations plan for Ellis Wealth Management.

Operation Functions:

- Jared Ellis will be the Owner of Ellis Wealth Management. In addition to providing wealth management services, he will also manage the general operations and executive aspects of the business.

- Jared Ellis is joined by a full-time administrative assistant, Jacob Hubert, who will take charge of the administrative tasks for the company. He will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Jared Ellis will hire more financial advisors to provide wealth management services, attract more clients, and grow our business further.

Milestones:

Ellis Wealth Management will have the following milestones completed in the next six months.

- 2/2023 Finalize lease agreement

- 3/2023 Design and build out Ellis Wealth Management

- 4/2023 Hire and train initial staff

- 5/2023 Kickoff of promotional campaign

- 6/2023 Launch Ellis Wealth Management

- 7/2023 Reach break-even

Financial Plan

Key revenue & costs.

Ellis Wealth Management’s revenues will primarily come from charging an hourly rate and fees for the wealth management services we provide.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Year 4: 100

- Year 5: 125

- Hourly Fee: $250

- Fee of Assets: 50%

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, wealth management business plan faqs.

What Is a Wealth Management Business Plan?

A wealth management business plan is a plan to start and/or grow your wealth management business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Wealth Management business plan using our Wealth Management Business Plan Template here .

What are the Main Types of Wealth Management Businesses?

There are a number of different kinds of wealth management businesses , some examples include: Personal Financial Planning and Advice, Asset Management and Allocation, Estate Planning, and Tax Accounting.

How Do You Get Funding for Your Wealth Management Business Plan?

Wealth Management businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Wealth Management Business?

Starting a wealth management business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Wealth Management Business Plan - The first step in starting a business is to create a detailed wealth management business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your wealth management business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your wealth management business is in compliance with local laws.

3. Register Your Wealth Management Business - Once you have chosen a legal structure, the next step is to register your wealth management business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your wealth management business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Wealth Management Equipment & Supplies - In order to start your wealth management business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your wealth management business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Item added to your cart

Here is a free business plan sample for a wealth management advisor.

Embarking on a journey as a wealth management advisor requires more than financial savvy—it demands a solid foundation for your business strategy.

In the following paragraphs, we will present to you a comprehensive business plan outline tailored for wealth management advisors.

As an aspiring or established financial expert, you're well aware that a meticulously formulated business plan is crucial for outlining your services, defining your niche, and setting a course for growth and client satisfaction.

To streamline your planning process and ensure you cover all critical aspects, feel free to utilize our wealth management advisor business plan template. Our team is also on standby to provide a professional review and offer feedback at no cost.

How to draft a great business plan for your wealth management advisor?

A good business plan for a wealth management advisor must be tailored to the nuances of the financial services industry.

Initially, it is crucial to provide a comprehensive overview of the financial advisory market. This includes current statistics and the identification of emerging trends within the wealth management sector, as illustrated in our wealth management advisor business plan template .

Your business plan should articulate your vision clearly, define your target clientele (such as high-net-worth individuals, families, or small businesses), and establish your unique value proposition (expertise in certain investment strategies, personalized service, etc.).

Market analysis is a key component. This requires an in-depth look at the competitive landscape, regulatory environment, investment trends, and client needs and behaviors.

For a wealth management advisor, it is imperative to outline your service offerings. Describe your portfolio management, financial planning, retirement planning, tax advisory services, and any other specialized services you provide, and explain how they align with the goals and risk profiles of your clients.

The operational plan should detail your business structure, office location, technology platforms for portfolio management and client reporting, and your approach to compliance and risk management.

Professional qualifications, certifications, and adherence to ethical standards are also of paramount importance in wealth management and should be highlighted.

Address your marketing and client acquisition strategies. How will you build trust and establish long-term relationships with clients? Discuss your networking approach, referral programs, and digital marketing strategies, including your website and presence on professional social networks like LinkedIn.

The financial section is critical. It should encompass your pricing model (fee-based, commission-based, or a hybrid), revenue projections, operating expenses, and profitability analysis.

In wealth management, trust and reputation are key, so it is essential to have a clear plan for building credibility and demonstrating expertise. For this, you can refer to our financial projections for a wealth management advisor .

Compared to other business plans, a wealth management advisor's plan must pay closer attention to regulatory compliance, ethical considerations, and the importance of personal relationships in client retention and acquisition.

A well-crafted business plan will not only help you to define your strategies and objectives but also to attract clients and potentially partners or investors.

Lenders and investors will be looking for a thorough market analysis, a robust financial plan, and a clear demonstration of your ability to manage client assets responsibly.

By presenting a detailed and substantiated plan, you showcase your professionalism and dedication to the success of your advisory practice.

To achieve these goals efficiently, you are welcome to utilize our wealth management advisor business plan template .

A free example of business plan for a wealth management advisor

Here, we will provide a concise and illustrative example of a business plan for a specific project.

This example aims to provide an overview of the essential components of a business plan. It is important to note that this version is only a summary. As it stands, this business plan is not sufficiently developed to support a profitability strategy or convince a bank to provide financing.

To be effective, the business plan should be significantly more detailed, including up-to-date market data, more persuasive arguments, a thorough market study, a three-year action plan, as well as detailed financial tables such as a projected income statement, projected balance sheet, cash flow budget, and break-even analysis.

All these elements have been thoroughly included by our experts in the business plan template they have designed for a wealth management advisor .

Here, we will follow the same structure as in our business plan template.

Market Opportunity

Market overview and statistics.

The wealth management industry is a dynamic sector with significant growth potential.

Recent reports estimate the global wealth management market to be valued at over 1 trillion dollars, with expectations for continued expansion as populations age and the number of high-net-worth individuals increases.

In the United States alone, there are thousands of wealth management advisors and firms, contributing to a substantial portion of the financial services industry's revenue, which is in the hundreds of billions of dollars annually.

These statistics underscore the critical role wealth management services play in the financial well-being of individuals and the broader economy.

Industry Trends

The wealth management sector is experiencing several key trends that are shaping its future.

There is a growing demand for personalized financial advice as clients seek tailored strategies to manage their wealth. Technological advancements, such as robo-advisors and AI-driven tools, are becoming more prevalent, offering new ways to optimize investment strategies and client interactions.

Environmental, Social, and Governance (ESG) investing is gaining traction, with clients increasingly interested in aligning their investments with their values and contributing to sustainable development.

The rise of fintech startups is disrupting traditional wealth management models, leading to more competitive pricing and innovative services.

Additionally, the importance of cybersecurity is at an all-time high, with advisors needing to protect sensitive financial data against an increasing number of cyber threats.

These trends highlight the evolving landscape of wealth management and the need for advisors to stay informed and adaptable to meet the changing preferences of their clients.

Key Success Factors

Several factors contribute to the success of a wealth management advisor.

Expertise and trustworthiness are paramount. Clients expect their advisors to have a deep understanding of financial markets and personal finance to guide them effectively.

Customized service offerings are also critical, as clients have unique financial goals and risk tolerances that require personalized attention.

Strategic location can influence success, with advisors in affluent areas or financial hubs often having greater opportunities to attract high-net-worth clients.

Exceptional client service is essential for client retention and referrals, which are vital for business growth.

Lastly, staying ahead of industry trends, such as regulatory changes and technological advancements, and maintaining a commitment to continuous learning and improvement are crucial for a wealth management advisor's long-term success.

The Project

Project presentation.

Our wealth management advisory firm is designed to cater to the sophisticated needs of individuals seeking to preserve and grow their wealth. Situated in a financial district with proximity to affluent neighborhoods, our firm will offer comprehensive wealth management services, including investment management, retirement planning, estate planning, tax strategies, and financial education. We will utilize top-tier financial tools and personalized strategies to ensure each client's portfolio is tailored to their unique financial goals and risk tolerance.

The emphasis will be on transparency, personalized service, and long-term financial health to provide an exceptional wealth management experience.

This wealth management advisory firm aims to become a trusted partner for clients, guiding them through the complexities of financial planning and asset management.

Value Proposition

The value proposition of our wealth management advisory firm is centered on delivering expert financial guidance and personalized investment strategies that align with our clients' life goals.

Our commitment to integrity, client education, and bespoke service offers a superior advisory experience, while contributing to the financial security and prosperity of our clients.

We are dedicated to fostering a relationship of trust where clients feel confident and informed about their financial decisions, and aim to empower them with the knowledge and resources to achieve financial independence.

Our firm aspires to be a cornerstone in the community, providing a reliable and ethical approach to wealth management and improving the financial well-being of our clients.

Project Owner

The project owner is a seasoned wealth management advisor with a comprehensive understanding of the financial markets and personal finance.

With a background in finance and a track record of successful client relationships, he is committed to establishing a wealth management advisory firm that stands out for its dedication to client success, ethical practices, and innovative financial solutions.

With a philosophy centered on client empowerment and education, he is determined to offer tailored advice that supports the financial objectives of each individual while contributing to their overall financial literacy.

His dedication to excellence and his expertise in wealth management make him the driving force behind this project, aiming to enhance the financial stability and prosperity of clients navigating the complexities of wealth accumulation and preservation.

The Market Study

Client segmentation.

The client segments for this wealth management advisory service are categorized into distinct groups.

Firstly, there are high-net-worth individuals who require personalized investment strategies and wealth preservation services.

Next, we have professionals and entrepreneurs seeking to optimize their financial assets and plan for future growth.

Retirees form another segment, looking for ways to manage their retirement funds effectively and ensure financial security.

Lastly, young adults and families who are beginning to build their wealth and need guidance on long-term financial planning and investments.

SWOT Analysis

A SWOT analysis of the wealth management advisory service highlights several key factors.

Strengths include a deep understanding of financial markets, personalized client service, and a robust network of financial experts.

Weaknesses might encompass the challenge of adapting to rapidly changing financial regulations and the high level of competition in the wealth management sector.

Opportunities can be found in the growing number of individuals seeking financial advice due to market volatility and the potential to leverage technology for improved client services.

Threats may include economic downturns affecting clients' investment portfolios and the rise of robo-advisors offering low-cost investment management services.

Competitor Analysis

Competitor analysis in the wealth management sector indicates a competitive landscape.

Direct competitors include other boutique wealth management firms, large financial institutions with wealth management divisions, and independent financial advisors.

These entities compete on the basis of investment performance, client service quality, and the comprehensiveness of their service offerings.

Potential competitive advantages are personalized client relationships, specialized expertise in niche markets, and the use of advanced technology for portfolio management.

Understanding the strengths and weaknesses of competitors is crucial for carving out a unique value proposition and retaining clients.

Competitive Advantages

Our wealth management advisory service stands out due to our commitment to creating tailored investment strategies that align with our clients' unique financial goals.

We offer a comprehensive suite of services, including estate planning, tax optimization, and retirement planning, all designed to provide maximum value to our clients.

Our focus on client education empowers individuals to make informed decisions about their financial futures, fostering trust and loyalty to our brand.

We pride ourselves on our transparency in fee structures and investment approaches, ensuring that clients feel secure and well-informed at every stage of their financial journey.

You can also read our articles about: - how to become a wealth management advisor: a complete guide - the customer segments of a wealth management advisor - the competition study for a wealth management advisor

The Strategy

Development plan.

Our three-year development plan for the wealth management advisory firm is designed to establish us as a leader in personalized financial planning.

In the first year, we will concentrate on building a robust client base by delivering exceptional service and establishing trust through transparency and financial education.

The second year will focus on expanding our services, including estate planning and retirement solutions, and leveraging technology to enhance client experience and operational efficiency.

In the third year, we aim to solidify our reputation by introducing innovative investment products and forming strategic alliances with fintech companies to broaden our offerings.

Throughout this period, we will adhere to the highest standards of fiduciary responsibility and adapt to the evolving financial landscape to serve our clients' best interests.

Business Model Canvas

The Business Model Canvas for our wealth management advisory firm targets affluent individuals, families, and small business owners seeking comprehensive financial strategies.

Our value proposition is centered on providing tailored wealth management solutions, personalized advice, and a commitment to long-term client relationships.

We deliver our services through one-on-one consultations, digital platforms, and client seminars, utilizing our key resources such as our team of certified financial planners and investment analysts.

Key activities include financial planning, asset management, and ongoing market research.

Our revenue streams are derived from management fees, financial planning fees, and potentially performance-based incentives, while our costs are mainly associated with personnel, technology, and compliance.

Access a comprehensive and editable real Business Model Canvas in our business plan template .

Marketing Strategy

Our marketing strategy is built on personalization and trust.

We aim to educate potential clients about the importance of wealth management and the unique benefits of our advisory services. Our approach includes targeted digital marketing, educational workshops, and personalized financial health assessments.

We will also develop partnerships with accountants and attorneys to create a referral network.

Additionally, we will leverage social media and content marketing to showcase our expertise and thought leadership in the financial industry.

Risk Policy

The risk policy of our wealth management advisory firm is to minimize financial and operational risks for our clients and our business.

We employ rigorous due diligence in our investment approach, adhere to strict compliance with financial regulations, and maintain a diversified investment portfolio to manage market volatility.

Regular audits and reviews ensure that we adhere to industry best practices and manage costs effectively.

We also carry professional liability insurance to protect against potential legal claims, ensuring that we can focus on providing the best possible advice and service to our clients.

Why Our Project is Viable

We are committed to establishing a wealth management advisory firm that addresses the complex financial needs of our clients.

With our dedication to personalized service, continuous education, and innovative financial solutions, we are poised to make a significant impact in the wealth management sector.

We are enthusiastic about empowering our clients to achieve their financial goals and are prepared to adapt our strategies to navigate the ever-changing financial landscape.

We are confident in the viability of our project and look forward to fostering enduring client relationships and building a reputable and successful advisory practice.

You can also read our articles about: - the Business Model Canvas of a wealth management advisor - the marketing strategy for a wealth management advisor

The Financial Plan

Of course, the text presented below is far from sufficient to serve as a solid and credible financial analysis for a bank or potential investor. They expect specific numbers, financial statements, and charts demonstrating the profitability of your project.

All these elements are available in our business plan template for a wealth management advisor and our financial plan for a wealth management advisor .

Initial expenses for our wealth management advisory firm include obtaining the necessary licenses and certifications, setting up a professional office environment, investing in high-quality financial planning software, and developing a robust cybersecurity infrastructure to protect client data. Additionally, costs will be incurred for creating a strong brand identity and implementing targeted marketing strategies to attract high-net-worth individuals and families.

Our revenue assumptions are based on a thorough analysis of the wealth management market, taking into account the increasing demand for personalized financial advice and the growing number of affluent individuals seeking expert investment management.

We anticipate a gradual increase in client acquisition, starting conservatively and expanding as our firm's reputation for delivering exceptional financial guidance and investment performance grows.

The projected income statement outlines expected revenues from our advisory fees, asset management charges, and potential performance-based incentives, while detailing expenses such as staff compensation, office lease, technology costs, and marketing expenditures.

This results in a forecasted net profit that is essential for assessing the long-term viability and profitability of our wealth management advisory firm.

The projected balance sheet presents assets unique to our firm, including office equipment, software, and intellectual property, and liabilities such as loans and operational expenses.

It provides a snapshot of the firm's financial standing at the conclusion of each fiscal period.

Our projected cash flow statement meticulously tracks the inflows from client fees and outflows for business expenses, enabling us to foresee our financial requirements. This is crucial for maintaining a healthy cash reserve and ensuring smooth operations.

The projected financing plan details the mix of equity and debt financing we intend to utilize to support our initial costs and growth strategies.

The working capital requirement for our wealth management advisory firm will be diligently managed to maintain sufficient liquidity for day-to-day activities, such as office maintenance, staff salaries, and client acquisition efforts.

The break-even analysis for our firm calculates the level of assets under management (AUM) required to cover all operating costs and begin generating profits.

It will signal the point at which our firm becomes financially sustainable.

Key performance indicators we will monitor include the assets under management growth rate, client retention rates, the profit margin on our advisory services, and the return on equity to gauge the efficiency of our capital utilization.

These metrics will assist us in measuring the financial health and success of our wealth management advisory firm.

If you want to know more about the financial analysis of this type of activity, please read our article about the financial plan for a wealth management advisor .

- Choosing a selection results in a full page refresh.

- Opens in a new window.

Ultimate Guide To Wealth Management Business Plan

- Amit Chandel

- No Comments

Are you looking to prepare a comprehensive wealth management business plan but unsure where to start? Understanding and implementing wealth management requires a well-thought-out strategy. A business plan is not just a document; it’s a roadmap for your financial advisory services.

Our Ultimate Guide to Wealth Management Business Plan offers an in-depth look into creating a successful plan. It covers everything from understanding your target market to financial forecasting, ensuring your wealth management business is set for success. Let’s dive in and explore how to build a robust foundation for your wealth management services.

What is a wealth management business plan?

A wealth management business plan is a comprehensive document that outlines the strategies, objectives, and operational framework for a firm that offers wealth management services. This plan serves as a roadmap for the business, detailing how it intends to manage and grow clients’ wealth.

It typically includes market analysis, target client demographics, service offerings, marketing strategies, revenue projections, and operational details. Such a plan aims to provide a clear direction for the wealth management business to achieve financial success and client satisfaction.

Why Financial Advisors Need a Business Plan?

Here’s why financial advisors need a business plan:

- Defining Goals and Objectives: A business plan helps financial advisors set clear, achievable goals, guiding their business strategies and decisions.

- Mapping Growth Strategies: It outlines strategies for growth, including client acquisition, service expansion, and scaling operations.

- Financial Management: A business plan includes financial projections and budgets, crucial for effective financial management.

- Risk Assessment: It helps in identifying potential risks and devising strategies to mitigate them.

- Securing Funding and Partnerships: A well-crafted business plan is essential for attracting investors or partners.

- Performance Tracking: The plan provides a framework for monitoring progress and performance, enabling adjustments as needed.

- Market Analysis: It includes market research to understand target clients and competition, vital for crafting effective marketing strategies.

- Operational Planning: Outlines the day-to-day operations, staffing needs, and technology requirements.

- Adaptability to Change: It allows financial advisors to be agile and adapt their strategies in response to market changes or new opportunities.

Get effective financial advisor business plan from experts. Discover our top-tier accounting service today! Take the first step towards effortless and expert financial management. Elevate your business with our professional accounting solutions now!

What are the Essential Elements of a Financial Advisor Business Plan?

The essential elements of a financial advisor business plan include:.

- Executive Summary: A brief overview of the business plan, highlighting the main goals and points.

- Company Overview: A snapshot of the financial advisory firm, including its history, structure, and services offered.

- Industry Analysis: An examination of the financial advisory industry, trends, and the overall economic environment.

- Customer Analysis: Details about the target client demographic, their needs, and how the firm plans to meet them.

- Competitive Analysis: An assessment of competitors in the market, their strengths, weaknesses, and the firm’s unique selling points.

- Marketing Plan: Strategies for attracting and retaining clients, including branding, channels, and tactics.

- Operations Plan: Describes the daily operations, such as client service processes, office management, and technology use.

- Management Team : Information about key team members, their roles, experience, and contributions to the firm’s success.

- Financial Plan : Financial projections, budgeting, revenue streams, and funding requirements.

Looking to effectively implement these key elements in your financial advisor business plan? Our CPA services for small business are here to assist. We offer expert guidance tailored to small businesses, ensuring your financial planning is sound and strategic.

Tips for Writing a Wealth Management Business Plan:

- Define Your Target Market : Identify and understand your ideal client demographic for personalized services.

- Outline Your Services : Clearly describe the range of wealth management services you offer.

- Competitive Analysis : Analyze your competitors to identify your unique value proposition.

- Marketing Strategies : Develop effective marketing approaches tailored to your target market.

- Operational Plan : Detail your operational processes, technology use, and office management.

- Financial Projections : Include realistic financial forecasts and budgeting.

- Risk Management: Address potential risks and strategies to mitigate them.

- Team Qualifications : Highlight the expertise and qualifications of your team.

- Growth Strategies : Plan for scaling your business and expanding services.

- Compliance and Legal Considerations : Ensure all regulatory requirements are addressed in your business plan for wealth management.

Ready to take your financial future to the next level? Explore our wealth management services designed to cater to your unique financial goals and needs. Let’s start building your success story together.

Myths Financial Advisors Believe About Business Plan

Financial advisors often hold several misconceptions about business plans:

- Some believe that a business plan is a one-time document, not realizing it needs regular updates as the business evolves.

- Another myth is that business plans are best created in isolation, whereas incorporating insights from team members and stakeholders can provide a more comprehensive view.

- Many think the main purpose of a business plan is to attract funding, overlooking its role in guiding strategic decisions and operations.

- There’s also a belief that simply having a business plan guarantees success, which is not true without implementation and ongoing revision.

Determining if You Require a Business Plan

For any business owner or entrepreneur, figuring out if you need a business plan is an essential first step. It’s a guide that helps you outline your business’s goals, strategies, and potential challenges.

Here’s a concise and formal approach to deciding if a business plan is necessary for you:

- Purpose and Goals : Are you clear about the purpose of your business and its long-term goals? If not, a business plan can help clarify these aspects.

- Seeking Investment : If you’re planning to seek external funding from investors or banks, a business plan is essential. It shows potential investors that you have a well-thought-out strategy for your business.

- New Business or Expansion : For new businesses, a business plan is crucial to mapping out the path ahead. Similarly, if you’re expanding or pivoting your current business, a plan helps to strategize this change.

- Market Understanding : A business plan forces you to research and understand your market, including potential customers and competitors. If you’re not familiar with your market, a business plan is a useful tool.

- Managing Growth: If your business is growing, a business plan can help manage and sustain this growth effectively.

- Measuring Success: A business plan provides benchmarks and performance indicators, which are essential for measuring success and making informed decisions.

- Team Alignment : If you have a team, a business plan ensures everyone is on the same page regarding the business’s direction and goals.

Maximize your savings with us!

Our professional tax planning services are designed to efficiently manage your taxes and maximize savings. Don’t miss out on potential benefits. Schedule your consultation today and make the most of your finances. Time is of the essence, so let’s get started!

Mr. Amit Chandel

Amit Chandel is a “Certified Tax Planner/Coach”, and “Certified Tax Resolution Specialist”. He has extensive experience in Tax Planning and Tax Problem Resolutions – helping his clients proactively plan and implement tax strategies that can rescue thousands of dollars in wasted tax.

Table of Contents

Related post.

Is a Virtual CFO the Right Move for Your Growing Startup?

What sets CEOs, CFOs, and COOs Apart? Exploring the Executive Triad?

CFO vs. Controller: Which Financial Leader Does Your Business Need?

- Business Best Practices

- Business Tax

- Comprehensive Guide

- Family office planning

- Financial Advisor

- Financial Deception

- Individual Tax

- Payroll Services

- Real Estate

- Small Business Accounting

- Incorporation Services

- QuickBooks Services

- Business and Financial Consulting

- Business Valuations

- Estate and Trust Planning

- Wealth Management

- Family Office Services

- Professional Accounting Services

- Tax Preparation

- Tax Planning

- Tax Resolution

- State and Local Taxes

- All Tax Services

- Consultation

- Case Studies

- What the Pros Say

Essential Parts of a Financial Advisor Business Plan

In the world of finance, foresight is everything, and that extends to how one manages their own business affairs. At the heart of a successful advisory firm lies a well-constructed financial planner business plan. But why is such a plan indispensable?

First and foremost, having a concrete business plan provides clarity. It allows financial advisors to map out their business goals with precision. This ensures every move is calculated and in line with their larger vision.

This isn’t a luxury—it's a necessity. You wouldn’t advise clients without a detailed financial strategy, right? Similarly, running an advisory firm without a plan can lead to haphazard decisions and missed opportunities.

Moreover, in the realm of small businesses, which many advisory firms fall under, the terrain is fraught with challenges. From competition to regulatory changes, the landscape is ever-evolving.

Through meticulous planning, including identifying potential risks and strategizing on growth opportunities, advisors can navigate these complexities with confidence.

Here's our breakdown of everything you need to include in your comprehensive wealth management business plan.

The Executive Summary

At the forefront of every robust business plan for financial advisors lies the executive summary. Think of it as the trailer to a blockbuster movie. It provides a concise overview of your business's entire narrative, touching on the highlights, the challenges, and the anticipated outcomes.

For a financial advisor, this section is vital. It encapsulates everything from your firm's mission and operational strategy to financial projections. The executive summary serves a dual purpose.

First, it's a quick reference tool for those already familiar with your firm. It’s also a comprehensive introduction for potential investors who might be pursuing your plan for the first time.

While the bulk of your business plan dives deep into specifics, the executive summary gives readers an aerial view. It captures the essence of your advisory venture and its potential trajectory.

The Company Overview

The next step is to delve into the specifics of your enterprise with a comprehensive company overview. This section acts as the backbone of your blueprint. It provides critical details about your advisory firm's inception, its goals, and how it operates in the financial landscape.

The company overview addresses the "who, what, and why" of your business. It's where you define your target market, specify your services, and highlight your unique selling propositions. For instance, your firm might lean heavily on social media for client acquisition or financial education. If so, this is the place to note that.

Furthermore, understanding the nuances of cash flow and the financial structure of your business is crucial. This overview provides a clear snapshot for stakeholders, ensuring that they grasp the operational and financial vitality of your advisory firm. It sets the stage, offering context and clarity for the subsequent sections of your plan.

Industry Analysis

The industry analysis is a pivotal section in a financial advisor's business plan. It sheds light on the larger financial landscape in which the advisor operates. It encompasses a thorough competitive analysis, allowing the business owner to understand where their firm stands in relation to peers.

Recognizing the strengths, weaknesses, opportunities, and threats in the industry provides invaluable insights. Such comprehension forms the bedrock of a sound marketing strategy. Staying informed about the industry's dynamics is essential. It allows an advisor to pivot when necessary, capitalize on emerging trends, and stay ahead in a competitive market.

Customer Analysis

In the realm of financial advising, understanding one's clientele is paramount. A thorough customer analysis provides insights into the specific needs and preferences of the clients in your target market.

Financial advising clients are all different. Some are seeking wealth management to grow their assets. Others want financial planning for long-term stability, or retirement planning for a secure future.

Still more need assistance with estate planning to ensure their legacy is passed on as intended. Recognizing these distinct requirements is crucial.

By comprehensively analyzing the diverse financial objectives of clients, advisors can tailor their services more effectively. Ultimately, this will ensure they meet the unique goals and expectations of each individual they serve.

Competitive Analysis

A competitive analysis is a cornerstone for any RIA business plan. It involves diving deep into the market to understand how your financial advisory firm stacks up against competitors. What strategies are other firms using in their marketing plans? Which financial advisor business models are proving to be the most successful?

By understanding the strengths and weaknesses of competitors, you can identify potential opportunities and threats in the marketplace. This information can be invaluable. It allows you to fine-tune your services, adjust your marketing strategies, and ultimately create a more resilient and successful business. After all, in the world of finance, knowledge truly is power.

Marketing Plan

Central to any investment advisor business plan is the marketing plan. It's where you lay out strategies to attract and retain clients. The marketing plan outlines how you'll position yourself in the industry. This includes the channels you'll use to reach potential clients and the tactics for engagement.

Whether it's through social media campaigns, seminars, or referral programs, the marketing plan gives direction on promoting your services effectively. By aligning marketing efforts with overall business goals, you ensure that resources are used efficiently. Ultimately, this will drive growth and enhance your firm's reputation in the financial advisory landscape.

Operations Plan

The operations plan is a blueprint for the day-to-day functioning of a financial advisory firm. It outlines the nuts and bolts of how the business will run. From the client onboarding process to the management of resources. From the roles of members on your team to protocols for service delivery, the operations plan covers it all.

A well-crafted operations plan ensures smooth operations, minimizes errors, and promotes a consistent, high-quality service experience for clients. Having this plan in place is essential to maintain efficiency, build trust, and nurture a growing client base.

Management Team

The management team section of a financial advisor's business plan highlights the individuals steering the firm towards its goals. It showcases the qualifications, experience, and expertise of key team members, underscoring their ability to execute the business's vision.

By detailing their backgrounds and roles, potential investors or partners can gauge the leadership's competence and the firm's potential for success. This section provides reassurance to stakeholders that the business is in capable hands and that the team possesses the requisite skills and experience to drive growth, navigate challenges, and make sound financial decisions.

Financial Plan

The financial plan is a pivotal section of a financial advisor's business strategy, mapping out the fiscal foundation and anticipated growth of the firm. This section details the company's current financial status, projected revenue, expenses, and profitability.

By laying out investment requirements, forecasting cash flows, and setting financial milestones, it offers a clear picture of the business's fiscal health and viability. Stakeholders, including potential investors and lenders, often scrutinize this portion to understand the sustainability of the business and to ascertain the potential return on investment.

Take Planning to the Next Level

Having created a business plan template is, unfortunately, only the first step to success. Lucky for you, Planswell has been perfecting the process of prospecting and closing deals for years. In fact, we’ve spent over $15 million on this learning process.

We’ve developed a complete system advisors can use to boost their booking and close rate. We guarantee it.

Sharing is caring!

How to Get Prospects to Pick Up the Phone When You Call

Everything You Need to Know about Planswell's FREE Software for Financial Planning

Your opportunities are waiting.

- At least 10 exclusive opportunities a month. Guaranteed.

- World-class sales training.

- Our beloved financial planning software.

Wealth Management Business Plan Template

Identify client demographic for wealth management services.

- 1 Wealth accumulation

- 2 Retirement planning

- 3 Estate planning

- 4 Education funding

- 5 Risk management

Conduct an in-depth market analysis

Identify service offerings to meet client needs, establish mission and vision for the wealth management business, determine pricing structure for various services, create a detailed financial forecast, approval: financial forecast by cfo.

- Create a detailed financial forecast Will be submitted

Prepare a marketing plan for wealth management services

Identify key risk areas and mitigation strategies, design an investment strategy guideline for clients, establish a client acquisition strategy, develop a training program for wealth management advisors, define a succession plan for key roles, plan for ongoing business development activities, prepare a plan for regular client communication and engagement, define key performance indicators (kpis) for business, approval: kpis by ceo.

- Define key performance indicators (KPIs) for business Will be submitted

Finalize Wealth Management Business Plan

Submit up-to-date plan to relevant regulatory bodies, approval: business plan by board of directors.

- Finalize Wealth Management Business Plan Will be submitted

Take control of your workflows today.

More templates like this.

How To Write a Business Plan for Wealth Management in 9 Steps: Checklist

By alex ryzhkov, resources on wealth management.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

Are you interested in entering the fast-growing field of wealth management? With the increasing number of high net worth individuals and families seeking expert financial guidance, now is the perfect time to start your own wealth management business. In this blog post, we will provide you with a 9-step checklist on how to write a business plan for wealth management. But before we dive into the details, let's take a look at some latest statistics about the industry and its promising growth.

The wealth management industry has been experiencing significant growth in recent years. According to a report by Grand View Research, the global wealth management market size was valued at $1.2 trillion in 2020 and is projected to reach $2.1 trillion by 2028, growing at a CAGR of 6.9% . This growth can be attributed to the rising disposable incomes, increasing wealth accumulation, and the need for expert financial advice in managing complex investment portfolios.

Now that you have a glimpse of the industry's potential, let's explore the 9-step checklist for writing a successful business plan for wealth management. By following these steps, you will be able to lay a strong foundation for your business and position yourself for long-term success in the market.

- Identify your target market and niche

- Conduct thorough market research

- Define your unique value proposition

- Assess the competitive landscape

- Develop a pricing and revenue model

- Identify key partners and stakeholders

- Determine your staffing and resource requirements

- Create financial projections

- Outline your marketing and sales strategies

Each of these steps is crucial in building a comprehensive business plan that will enable you to attract clients, generate recurring revenue, and deliver exceptional results. Remember, the wealth management industry thrives on trust, expertise, and a deep understanding of your clients' financial goals. By following this checklist, you will be well-equipped to embark on your journey as a wealth management entrepreneur.

Identify Target Market And Niche

Identifying your target market and niche is a crucial first step in developing a successful business plan for wealth management. By understanding who your ideal clients are and what specific needs you can meet, you will be able to tailor your services and marketing efforts to attract and retain valuable clientele.

When identifying your target market, consider factors such as age, income level, occupation, and geographic location. Determine the demographics that align with your expertise and the type of wealth management services you plan to offer. For example, you might choose to focus on serving high net worth individuals or families with specific generational wealth planning needs.