Efficient Market Hypothesis (EMH)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 12, 2023

Get Any Financial Question Answered

Table of contents, efficient market hypothesis (emh) overview.

The Efficient Market Hypothesis (EMH) is a theory that suggests financial markets are efficient and incorporate all available information into asset prices.

According to the EMH, it is impossible to consistently outperform the market by employing strategies such as technical analysis or fundamental analysis.

The hypothesis argues that since all relevant information is already reflected in stock prices, it is not possible to gain an advantage and generate abnormal returns through stock picking or market timing.

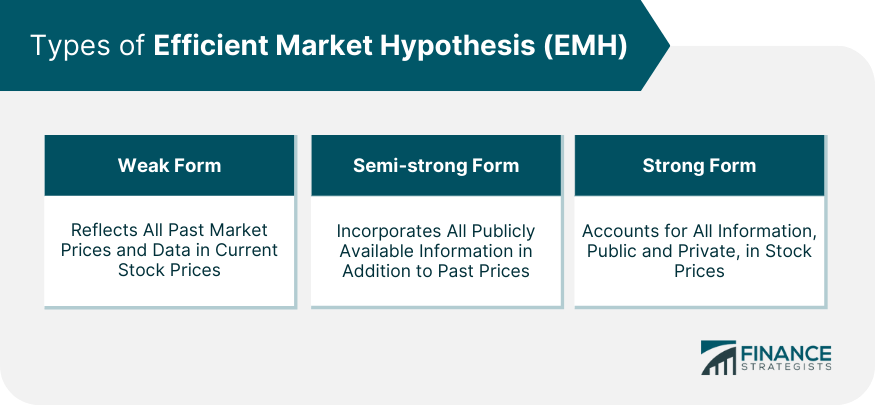

The EMH comes in three forms: weak, semi-strong, and strong, each representing different levels of market efficiency.

While the EMH has faced criticisms and challenges, it remains a prominent theory in finance that has significant implications for investors and market participants.

Types of Efficient Market Hypothesis

The Efficient Market Hypothesis can be categorized into the following:

Weak Form EMH

The weak form of EMH posits that all past market prices and data are fully reflected in current stock prices.

Therefore, technical analysis methods, which rely on historical data, are deemed useless as they cannot provide investors with a competitive edge. However, this form doesn't deny the potential value of fundamental analysis.

Semi-strong Form EMH

The semi-strong form of EMH extends beyond historical prices and suggests that all publicly available information is instantly priced into the market.

This includes financial statements, news releases, economic indicators, and other public disclosures. Therefore, neither technical analysis nor fundamental analysis can yield superior returns consistently.

Strong Form EMH

The most extreme version of EMH, the strong form, asserts that all information, both public and private, is fully reflected in stock prices.

Even insiders with privileged information cannot consistently achieve higher-than-average market returns. This form, however, is widely criticized as it conflicts with securities regulations that prohibit insider trading .

Assumptions of the Efficient Market Hypothesis

Three fundamental assumptions underpin the Efficient Market Hypothesis.

All Investors Have Access to All Publicly Available Information

This assumption holds that the dissemination of information is perfect and instantaneous. All market participants receive all relevant news and data about a security or market simultaneously, and no investor has privileged access to information.

All Investors Have a Rational Expectation

In EMH, it is assumed that investors collectively have a rational expectation about future market movements. This means that they will act in a way that maximizes their profits based on available information, and their collective actions will cause securities' prices to adjust appropriately.

Investors React Instantly to New Information

In an efficient market, investors instantaneously incorporate new information into their investment decisions. This immediate response to news and data leads to swift adjustments in securities' prices, rendering it impossible to "beat the market."

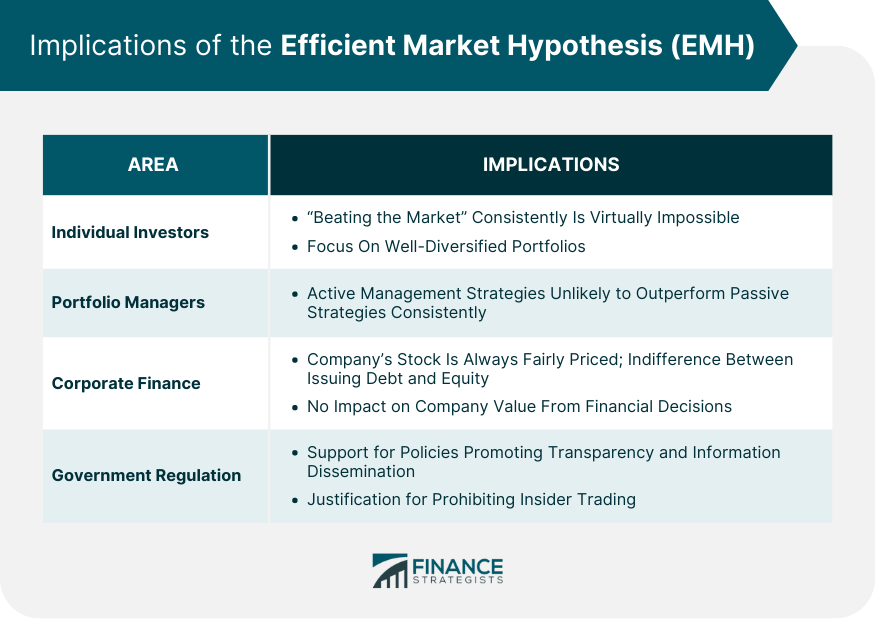

Implications of the Efficient Market Hypothesis

The EMH has several implications across different areas of finance.

Implications for Individual Investors

For individual investors, EMH suggests that "beating the market" consistently is virtually impossible. Instead, investors are advised to invest in a well-diversified portfolio that mirrors the market, such as index funds.

Implications for Portfolio Managers

For portfolio managers , EMH implies that active management strategies are unlikely to outperform passive strategies consistently. It discourages the pursuit of " undervalued " stocks or timing the market.

Implications for Corporate Finance

In corporate finance, EMH implies that a company's stock is always fairly priced, meaning it should be indifferent between issuing debt and equity . It also suggests that stock splits , dividends , and other financial decisions have no impact on a company's value.

Implications for Government Regulation

For regulators , EMH supports policies that promote transparency and information dissemination. It also justifies the prohibition of insider trading.

Criticisms and Controversies Surrounding the Efficient Market Hypothesis

Despite its widespread acceptance, the EMH has attracted significant criticism and controversy.

Behavioral Finance and the Challenge to EMH

Behavioral finance argues against the notion of investor rationality assumed by EMH. It suggests that cognitive biases often lead to irrational decisions, resulting in mispriced securities.

Examples include overconfidence, anchoring, loss aversion, and herd mentality, all of which can lead to market anomalies.

Market Anomalies and Inefficiencies

EMH struggles to explain various market anomalies and inefficiencies. For instance, the "January effect," where stocks tend to perform better in January, contradicts the EMH.

Similarly, the "momentum effect" suggests that stocks that have performed well recently tend to continue performing well, which also challenges EMH.

Financial Crises and the Question of Market Efficiency

The Global Financial Crisis of 2008 raised serious questions about market efficiency. The catastrophic market failure suggested that markets might not always price securities accurately, casting doubt on the validity of EMH.

Empirical Evidence of the Efficient Market Hypothesis

Empirical evidence on the EMH is mixed, with some studies supporting the hypothesis and others refuting it.

Evidence Supporting EMH

Several studies have found that professional fund managers, on average, do not outperform the market after accounting for fees and expenses.

This finding supports the semi-strong form of EMH. Similarly, numerous studies have shown that stock prices tend to follow a random walk, supporting the weak form of EMH.

Evidence Against EMH

Conversely, other studies have documented persistent market anomalies that contradict EMH.

The previously mentioned January and momentum effects are examples of such anomalies. Moreover, the occurrence of financial bubbles and crashes provides strong evidence against the strong form of EMH.

Efficient Market Hypothesis in Modern Finance

Despite criticisms, the EMH continues to shape modern finance in profound ways.

EMH and the Rise of Passive Investing

The EMH has been a driving force behind the rise of passive investing. If markets are efficient and all information is already priced into securities, then active management cannot consistently outperform the market.

As a result, many investors have turned to passive strategies, such as index funds and ETFs .

Impact of Technology on Market Efficiency

Advances in technology have significantly improved the speed and efficiency of information dissemination, arguably making markets more efficient. High-frequency trading and algorithmic trading are now commonplace, further reducing the possibility of beating the market.

Future of EMH in Light of Evolving Financial Markets

While the debate over market efficiency continues, the growing influence of machine learning and artificial intelligence in finance could further challenge the EMH.

These technologies have the potential to identify and exploit subtle patterns and relationships that human investors might miss, potentially leading to market inefficiencies.

The Efficient Market Hypothesis is a crucial financial theory positing that all available information is reflected in market prices, making it impossible to consistently outperform the market. It manifests in three forms, each with distinct implications.

The weak form asserts that all historical market information is accounted for in current prices, suggesting technical analysis is futile.

The semi-strong form extends this to all publicly available information, rendering both technical and fundamental analysis ineffective.

The strongest form includes even insider information, making all efforts to beat the market futile. EMH's implications are profound, affecting individual investors, portfolio managers, corporate finance decisions, and government regulations.

Despite criticisms and evidence of market inefficiencies, EMH remains a cornerstone of modern finance, shaping investment strategies and financial policies.

Efficient Market Hypothesis (EMH) FAQs

What is the efficient market hypothesis (emh), and why is it important.

The Efficient Market Hypothesis (EMH) is a theory suggesting that financial markets are perfectly efficient, meaning that all securities are fairly priced as their prices reflect all available public information. It's important because it forms the basis for many investment strategies and regulatory policies.

What are the three forms of the Efficient Market Hypothesis (EMH)?

The three forms of the EMH are the weak form, semi-strong form, and strong form. The weak form suggests that all past market prices are reflected in current prices. The semi-strong form posits that all publicly available information is instantly priced into the market. The strong form asserts that all information, both public and private, is fully reflected in stock prices.

How does the Efficient Market Hypothesis (EMH) impact individual investors and portfolio managers?

According to the EMH, consistently outperforming the market is virtually impossible because all available information is already factored into the prices of securities. Therefore, it suggests that individual investors and portfolio managers should focus on creating well-diversified portfolios that mirror the market rather than trying to beat the market.

What are some criticisms of the Efficient Market Hypothesis (EMH)?

Criticisms of the EMH often come from behavioral finance, which argues that cognitive biases can lead investors to make irrational decisions, resulting in mispriced securities. Additionally, the EMH has difficulty explaining certain market anomalies, such as the "January effect" or the "momentum effect." The occurrence of financial crises also raises questions about the validity of EMH.

How does the Efficient Market Hypothesis (EMH) influence modern finance and its future?

Despite criticisms, the EMH has profoundly shaped modern finance. It has driven the rise of passive investing and influenced the development of many financial regulations. With advances in technology, the speed and efficiency of information dissemination have increased, arguably making markets more efficient. Looking forward, the growing influence of artificial intelligence and machine learning could further challenge the EMH.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- AML Regulations for Cryptocurrencies

- Advantages and Disadvantages of Cryptocurrencies

- Aggressive Investing

- Asset Management vs Investment Management

- Becoming a Millionaire With Cryptocurrency

- Burning Cryptocurrency

- Cheapest Cryptocurrencies With High Returns

- Complete List of Cryptocurrencies & Their Market Capitalization

- Countries Using Cryptocurrency

- Countries Where Bitcoin Is Illegal

- Crypto Investor’s Guide to Form 1099-B

- Cryptocurrency Airdrop

- Cryptocurrency Alerting

- Cryptocurrency Analysis Tool

- Cryptocurrency Cloud Mining

- Cryptocurrency Risks

- Cryptocurrency Taxes

- Depth of Market

- Digital Currency vs Cryptocurrency

- Fiat vs Cryptocurrency

- Fundamental Analysis in Cryptocurrencies

- Global Macro Hedge Fund

- Gold-Backed Cryptocurrency

- How to Buy a House With Cryptocurrencies

- How to Cash Out Your Cryptocurrency

- Inventory Turnover Rate (ITR)

- Largest Cryptocurrencies by Market Cap

- Pros and Cons of Asset-Liability Management

- Types of Fixed Income Investments

Ask a Financial Professional Any Question

Discover wealth management solutions near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

11.5 Efficient Markets

Learning outcomes.

By the end of this section, you will be able to:

- Understand what is meant by the term efficient markets .

- Understand the term operational efficiency when referring to markets.

- Understand the term informational efficiency when referring to markets.

- Distinguish between strong, semi-strong, and weak levels of efficiency in markets.

Efficient Markets

For the public, the real concern when buying and selling of stock through the stock market is the question, “How do I know if I’m getting the best available price for my transaction?” We might ask an even broader question: Do these markets provide the best prices and the quickest possible execution of a trade? In other words, we want to know whether markets are efficient. By efficient markets , we mean markets in which costs are minimal and prices are current and fair to all traders. To answer our questions, we will look at two forms of efficiency: operational efficiency and informational efficiency.

Operational Efficiency

Operational efficiency concerns the speed and accuracy of processing a buy or sell order at the best available price. Through the years, the competitive nature of the market has promoted operational efficiency.

In the past, the NYSE (New York Stock Exchange) used a designated-order turnaround computer system known as SuperDOT to manage orders. SuperDOT was designed to match buyers and sellers and execute trades with confirmation to both parties in a matter of seconds, giving both buyers and sellers the best available prices. SuperDOT was replaced by a system known as the Super Display Book (SDBK) in 2009 and subsequently replaced by the Universal Trading Platform in 2012.

NASDAQ used a process referred to as the small-order execution system (SOES) to process orders. The practice for registered dealers had been for SOES to publicly display all limit orders (orders awaiting execution at specified price), the best dealer quotes, and the best customer limit order sizes. The SOES system has now been largely phased out with the emergence of all-electronic trading that increased transaction speed at ever higher trading volumes.

Public access to the best available prices promotes operational efficiency. This speed in matching buyers and sellers at the best available price is strong evidence that the stock markets are operationally efficient.

Informational Efficiency

A second measure of efficiency is informational efficiency, or how quickly a source reflects comprehensive information in the available trading prices. A price is efficient if the market has used all available information to set it, which implies that stocks always trade at their fair value (see Figure 11.12 ). If an investor does not receive the most current information, the prices are “stale”; therefore, they are at a trading disadvantage.

Forms of Market Efficiency

Financial economists have devised three forms of market efficiency from an information perspective: weak form, semi-strong form, and strong form. These three forms constitute the efficient market hypothesis. Believers in these three forms of efficient markets maintain, in varying degrees, that it is pointless to search for undervalued stocks, sell stocks at inflated prices, or predict market trends.

In weak form efficient markets, current prices reflect the stock’s price history and trading volume. It is useless to chart historical stock prices to predict future stock prices such that you can identify mispriced stocks and routinely outperform the market. In other words, technical analysis cannot beat the market. The market itself is the best technical analyst out there.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Authors: Julie Dahlquist, Rainford Knight

- Publisher/website: OpenStax

- Book title: Principles of Finance

- Publication date: Mar 24, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-finance/pages/11-5-efficient-markets

© Jan 8, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

BUS614: International Finance

Market Efficiency

There are generally two theories to assist pricing. The Efficient Market Hypothesis (EFM) and the Behavioural Finance Theory. Understanding the limitations of each of the theories is critical. Read the three concepts on this page to have a comprehensive understanding of EFM. What are the limitations of the EMH?

The Efficient Market Hypothesis

Strong-form efficiency.

In strong-form efficiency, share prices reflect all information, public and private, and no one can earn excess returns. If there are legal barriers to private information becoming public, as with insider trading laws, strong-form efficiency is impossible, except in the case where the laws are universally ignored. To test for strong-form efficiency, a market needs to exist where investors cannot consistently earn excess returns over a long period of time. Even if some money managers are consistently observed to beat the market, no refutation even of strong-form efficiency follows–with hundreds of thousands of fund managers worldwide, even a normal distribution of returns (as efficiency predicts) should be expected to produce a few dozen "star" performers.

Market Efficiency Hypothesis

- Reference work entry

- First Online: 01 January 2022

- Cite this reference work entry

- Melody Lo 3

174 Accesses

Market efficiency is one of the most fundamental research topics in both economics and finance. Since (Fama, Journal of Finance 25(2): 383–417, 1970) formally introduced the concept of market efficiency, studies have been developed at length to examine issues regarding the efficiency of various financial markets. In this chapter, we review elements, which are at the heart of market efficiency literature: the statistical efficiency market models, joint hypothesis testing problem, and three categories of testing literature.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Alexander, S.S. 1961. Price movements in speculative markets: Trends or random walks. Industrial Management Review 2: 7–26.

Google Scholar

Ball, R., and P. Brown. 1968. An empirical evaluation of accounting income numbers. Journal of Accounting Research 6: 159–178.

Article Google Scholar

Chang, E.C., and W.G. Lewellen. 1984. Market timing and mutual fund investment performance. Journal of Business 57: 57–72.

Compbell, J.Y., and R. Shiller. 1988. Stock prices, earnings and expected dividends. Journal of Finance 43: 661–676.

Conrad, J., and G. Kaul. 1988. Time-variation in expected returns. Journal of Business 61 (4): 409–425.

Fama, E.F. 1965. The behavior of stock market price. Journal of Business 38 (1): 34–105.

———. 1970. Efficient capital markets: A review of theory and empirical work. Journal of Finance 25 (2): 383–417.

———. 1991. Efficient capital markets: II. Journal of Finance 46 (5): 1575–1617.

Fama, E.F., and M. Blume. 1966. Filter rules and stock market trading profits. Journal of Business (Special Supplement) 39: 226–241.

Fama, E.F., and K.R. French. 1988. Dividend yields and expected stock returns. Journal of Financial Economics 22: 3–25.

Fama, E.F., L. Fisher, M.C. Jensen, and R. Roll. 1969. The adjustment of stock prices to new information. International Economic Review 5: 1–21.

Fisher, L. 1966. Some new stock-market indexes. Journal of Business, 39(1), Part 2: 191–225.

Godfrey, M.D., C.W.J. Granger, and O. Morgenstern. 1964. The random walk hypothesis of stock market behavior. Kyklos 17: 1–30.

Henriksson, R.T. 1984. Market timing and mutual fund performance: An empirical investigation. Journal of Business 57: 73–96.

Jensen, M.C. 1968. The performance of mutual funds in the period 1945–64. Journal of Finance 23: 389–416.

———. 1969. Risk, the pricing of capital assets, and the evaluation of investment portfolios. Journal of Business 42: 167–247.

Kendall, M.G. 1953. The analysis of economic time-series, Part I: Prices. Journal of the Royal Statistical Society , 96 (Part I): 11–25.

Lintner, J. 1965. Security prices, risk, and maximal gains from diversification. Journal of Finance 20: 587–615.

Lo, A.W., and A.C. MacKinlay. 1988. Stock market prices do not follow random walks: Evidence from a simple specification test. Review of Financial Studies 1 (1): 41–66.

Moore, A. 1962. A statistical analysis of common stock prices. PhD thesis, Graduate School of Business, University of Chicago.

Niederhoffer, V., and M.F.M. Osborne. 1966. Market making and reversal on the stock exchange. Journal of the American Statistical Association 61: 897–916.

Roberts, H.V. 1959. Stock market ‘patterns’ and financial analysis: Methodological suggestions. Journal of Finance 14: 1–10.

Scholes, M. (1969). A test of the competitive hypothesis: The market for new issues and secondary offering. PhD thesis, Graduate School of Business, University of Chicago.

Sharpe, W.F. 1964. Capital assets prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19: 425–442.

Waud, R.N. 1970. Public interpretation of federal discount rate changes: Evidence on the ‘Announcement Effect’. Econometrica 38: 231–250.

Download references

Author information

Authors and affiliations.

University of Texas at San Antonio, San Antonio, TX, USA

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Melody Lo .

Editor information

Editors and affiliations.

Department of Finance & Economics, Rutgers University, Piscataway, NJ, USA

Cheng-Few Lee

Center for PBBEF Research, Phoenix, AZ, USA

Alice C. Lee

Rights and permissions

Reprints and permissions

Copyright information

© 2022 Springer Nature Switzerland AG

About this entry

Cite this entry.

Lo, M. (2022). Market Efficiency Hypothesis. In: Lee, CF., Lee, A.C. (eds) Encyclopedia of Finance. Springer, Cham. https://doi.org/10.1007/978-3-030-91231-4_30

Download citation

DOI : https://doi.org/10.1007/978-3-030-91231-4_30

Published : 13 September 2022

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-91230-7

Online ISBN : 978-3-030-91231-4

eBook Packages : Economics and Finance Reference Module Humanities and Social Sciences Reference Module Business, Economics and Social Sciences

Share this entry

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Search Search Please fill out this field.

- Assets & Markets

- Mutual Funds

Efficient Markets Hypothesis (EMH)

EMH Definition and Forms

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-23at2.04.43PM-59de96b153e540c498f1f1da8ce5c965.png)

What Is Efficient Market Hypothesis?

What are the types of emh, emh and investing strategies, the bottom line, frequently asked questions (faqs).

The Efficient Market Hypothesis (EMH) is one of the main reasons some investors may choose a passive investing strategy. It helps to explain the valid rationale of buying these passive mutual funds and exchange-traded funds (ETFs).

The Efficient Market Hypothesis (EMH) essentially says that all known information about investment securities, such as stocks, is already factored into the prices of those securities. If that is true, no amount of analysis can give you an edge over "the market."

EMH does not require that investors be rational; it says that individual investors will act randomly. But as a whole, the market is always "right." In simple terms, "efficient" implies "normal."

For example, an unusual reaction to unusual information is normal. If a crowd suddenly starts running in one direction, it's normal for you to run that way as well, even if there isn't a rational reason for doing so.

There are three forms of EMH: weak, semi-strong, and strong. Here's what each says about the market.

- Weak Form EMH: Weak form EMH suggests that all past information is priced into securities. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. But no "patterns" exist. Therefore, fundamental analysis does not provide a long-term advantage, and technical analysis will not work.

- Semi-Strong Form EMH: Semi-strong form EMH implies that neither fundamental analysis nor technical analysis can provide you with an advantage. It also suggests that new information is instantly priced into securities.

- Strong Form EMH: Strong form EMH says that all information, both public and private, is priced into stocks; therefore, no investor can gain advantage over the market as a whole. Strong form EMH does not say it's impossible to get an abnormally high return. That's because there are always outliers included in the averages.

EMH does not say that you can never outperform the market . It says that there are outliers who can beat the market averages. But there are also outliers who lose big to the market. The majority is closer to the median. Those who "win" are lucky; those who "lose" are unlucky.

Proponents of EMH, even in its weak form, often invest in index funds or certain ETFs. That is because those funds are passively managed and simply attempt to match, not beat, overall market returns.

Index investors might say they are going along with this common saying: "If you can't beat 'em, join 'em." Instead of trying to beat the market, they will buy an index fund that invests in the same securities as the benchmark index.

Some investors will still try to beat the market, believing that the movement of stock prices can be predicted, at least to some degree. For that reason, EMH does not align with a day trading strategy. Traders study short-term trends and patterns. Then, they attempt to figure out when to buy and sell based on these patterns. Day traders would reject the strong form of EMH.

For more on EMH, including arguments against it, check out the EMH paper from economist Burton G. Malkiel. Malkiel is also the author of the investing book "A Random Walk Down Main Street." The random walk theory says that movements in stock prices are random.

If you believe that you can't predict the stock market, you would most often support the EMH. But a short-term trader might reject the ideas put forth by EMH, because they believe that they are able to predict changes in stock prices.

For most investors, a passive, buy-and-hold , long-term strategy is useful. Capital markets are mostly unpredictable with random up and down movements in price.

When did the Efficient Market Hypothesis first emerge?

At the core of EMH is the theory that, in general, even professional traders are unable to beat the market in the long term with fundamental or technical analysis . That idea has roots in the 19th century and the "random walk" stock theory. EMH as a specific title is sometimes attributed to Eugene Fama's 1970 paper "Efficient Capital Markets: A Review of Theory and Empirical Work."

How is the Efficient Market Hypothesis used in the real world?

Investors who utilize EMH in their real-world portfolios are likely to make fewer decisions than investors who use fundamental or technical analysis. They are more likely to simply invest in broad market products, such as S&P 500 and total market funds.

Corporate Finance Institute. " Efficient Markets Hypothesis ."

IG.com. " Random Walk Theory Definition ."

What is Efficient Market Hypothesis? | EMH Theory Explained

The efficient market hypothesis (EMH) can help explain why many investors opt for passive investing strategies, such as buying index funds or exchange-traded funds ( ETFs ), which generate consistent returns over an extended period. However, the EMH theory remains controversial and has found as many opponents as proponents. This guide will explain the efficient market hypothesis, how it works, and why it is so contradictory.

Best Crypto Exchange for Intermediate Traders and Investors

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

Copy top-performing traders in real time, automatically.

eToro USA is registered with FINRA for securities trading.

What is the efficient market hypothesis?

The efficient market hypothesis (EMH) claims that all assets are always fairly and accurately priced and trade at their fair market value on exchanges. If this theory is true, nothing can give you an edge to outperform the market using different investing strategies and make excess profits compared to those who follow market indexes.

Efficient market definition

An efficient market is where all asset prices listed on exchanges fully reflect their true and only value, thus making it impossible for investors to “beat the market” and profit from price discrepancies between the market price and the stock’s intrinsic value. The EMH claims the stock’s fair value, also called intrinsic value , is much the same as its market value , and finding undervalued or overvalued assets is non-viable.

Intrinsic value refers to an asset’s true, actual value, which is calculated using fundamental and technical analysis, whereas the market price is the currently listed price at which stock is bought and sold. When markets are efficient, the two values should be the same, but when they differ, it poses opportunities for investors to make an excess profit.

For markets to be completely efficient, all information should already be accounted for in stock prices and are trading on exchanges at their fair market value, which is practically impossible.

Hypothesis definition

A hypothesis is merely an assumption, an idea, or an argument that can be tested and reasoned not to be true. Something that isn’t fully supported by full facts or doesn’t match applied research.

For example, if sugar causes cavities, people who eat a lot of sweets are prone to cavities. And if the same applies here – if all information is reflected in a stock’s price, then its fair value should be the same as its market value and can not differ or be impacted by any other factors.

Beginners’ corner:

- What is Investing? Putting Money to Work ;

- 17 Common Investing Mistakes to Avoid ;

- 15 Top-Rated Investment Books of All Time ;

- How to Buy Stocks? Complete Beginner’s Guide ;

- 10 Best Stock Trading Books for Beginners ;

- 15 Highest-Rated Crypto Books for Beginners ;

- 6 Basic Rules of Investing ;

- Dividend Investing for Beginners ;

- Top 6 Real Estate Investing Books for Beginners ;

- 5 Passive Income Investment Ideas .

Fundamental and technical analysis in an efficient market

According to the EMH, stock prices are already accurately priced and consider all possible information. If markets are fully efficient, then no fundamental or technical analysis can help investors find anomalies and make an extra profit.

Fundamental analysis is a method to calculate a stock’s fair or intrinsic value by looking beyond the current market price by examining additional external factors like financial statements, the overall state of the economy, and competition, which can help define whether the stock is undervalued.

Also relevant is technical analysis , a method of forecasting the value of stocks by analyzing the historical price data, mainly looking at price and volume fluctuations occurring daily, weekly, or any other constant period, usually displayed on a chart.

The efficient market theory directly contradicts the possibility of outperforming the market using these two strategies; however, there are three different versions of EMH, and each slightly differs from the other.

Three forms of market efficiency

The efficient market hypothesis can take three different forms , depending on how efficient the markets are and which information is considered in theory:

1. Strong form efficiency

Strong form efficiency is the EMH’s purest form, and it is an assumption that all current and historical, both public and private, information that could affect the asset’s price is already considered in a stock’s price and reflects its actual value. According to this theory, stock prices listed on exchanges are entirely accurate.

Investors who support this theory trust that even inside information can’t give a trader an advantage, meaning that no matter how much extra information they have access to or how much analysis and research they do, they can not exceed standard returns.

Burton G. Malkiel, a leading proponent of the strong-form market efficiency hypothesis, doesn’t believe any analysis can help identify price discrepancies. Instead, he firmly believes in buy-and-hold investing, trusting it is the best way to maximize profits. However, factual research doesn’t support the possibility of a strong form of efficiency in any market.

2. Semi-strong form efficiency

The semi-strong version of the EMH suggests that only current and historical public (and not private) information is considered in the stock’s listed share prices. It is the most appropriate form of the efficient market hypothesis, and factual evidence supports that most capital markets in developed countries are generally semi-strong efficient.

This form of efficiency relies on the fact that public news about a particular stock or security has an immediate effect on the stock prices in the market and also suggests that technical and fundamental analysis can’t be used to make excess profits.

A semi-strong form of market efficiency theory accepts that investors can gain an advantage in trading only when they have access to any unknown private information unknown to the rest of the market.

3. Weak form efficiency

Weak market efficiency, also called a random walk theory, implies that investors can’t predict prices by analyzing past events, they are entirely random, and technical analysis cannot be used to beat the market.

Random walk theory proclaims stock prices always take a randomized path and are unpredictable, that investors can’t use past price changes and historical data trends to predict future prices, and that stock prices already reflect all current information.

For example, advocates of this form see no or limited benefit to technical analysis to discover investment opportunities. Instead, they would maintain a passive investment portfolio by buying index funds that track the overall market performance.

For example, the momentum investing method analyzes past price movements of stocks to predict future prices – it goes directly against the weak form efficiency, where all the current and past information is already reflected in their market prices.

A brief history of the efficient market hypothesis

The concept of the efficient market hypothesis is based on a Ph.D. dissertation by Eugene Fama , an American economist, and it assumes all prices of stocks or other financial instruments in the market are entirely accurate.

In 1970, Fama published this theory in “Efficient Capital Markets: A Review of Theory and Empirical Work,” which outlines his vision where he describes the efficient market as: “A market in which prices always “fully reflect” available information is called “efficient.”

Another theory based on the EMH, the random walk theory by Burton G. Malkiel , states that prices are completely random and not dependent on any factor. Not even past information, and that outperforming the market is a matter of chance and luck and not a point of skill.

Fama has acknowledged that the term can be misleading and that markets can’t be efficient 100% of the time, as there is no accurate way of measuring it. The EMH accepts that random and unexpected events can affect prices but claims they will always be leveled out and revert to their fair market value.

What is an inefficient market?

The efficient market hypothesis is a theory, and in reality, most markets always display some inefficiencies to a certain extent. It means that market prices don’t always reflect their true value and sometimes fail to incorporate all available information to be priced accurately.

In extreme cases, an inefficient market may even lead to a market failure and can occur for several reasons.

An inefficient market can happen due to:

- A lack of buyers and sellers;

- Absence of information;

- Delayed price reaction to the news;

- Transaction costs;

- Human emotion;

- Market psychology.

The EMH claims that in an efficiently operating market, all asset prices are always correct and consider all information; however, in an inefficient market, all available information isn’t reflected in the price, making bargain opportunities possible.

Moreover, the fact that there are inefficient markets in the world directly contradicts the efficient market theory, proving that some assets can be overvalued or undervalued, creating investment opportunities for excess gains.

Validity of the efficient market hypothesis

With several arguments and real-life proof that assets can become under- or overvalued, the efficient market hypothesis has some inconsistencies, and its validity has repeatedly been questioned.

While supporters argue that searching for undervalued stock opportunities using technical and fundamental analysis to predict trends is pointless, opponents have proven otherwise. Although academics have proof supporting the EMH, there’s also evidence that overturns it.

The EMH implies there are no chances for investors to beat the market, but for example, investing strategies like arbitrage trading or value investing rely on minor discrepancies between the listed prices and the actual value of the assets.

A prime example is Warren Buffet, one of the world’s wealthiest and most successful investors, who has consistently beaten the market over more extended periods through value investing approach, which by definition of EMH is unfeasible.

Another example is the stock market crash in 1987, when the Dow Jones Industrial Average (DJIA) fell over 20% on the same day, which shows that asset prices can significantly deviate from their values.

Moreover, the fact that active traders and active investing techniques exist also displays some evidence of inconsistencies and that a completely efficient market is, in reality, impossible.

Contrasting beliefs about the efficient market hypothesis

Although the EMH has been largely accepted as the cornerstone of modern financial theory, it is also controversial. The proponents of the EMH argue that those who outperform the market and generate an excess profit have managed to do so purely out of luck, that there is no skill involved, and that stocks can still, without a real cause or reason, outperform, whereas others underperform.

Moreover, it is necessary to consider that even new information takes time to take effect in prices, and in actual efficiency, prices should adjust immediately. If the EMH allows for these inefficiencies, it is a question of whether an absolute market efficiency, strong form efficiency, is at all possible. But as this theory implies, there is little room for beating the market, and believers can rely on returns from a passive index investing strategy.

Even though possible, proponents assume neither technical nor fundamental analysis can help predict trends and produce excess profits consistently, and theoretically, only inside information could result in outsized returns.

Moreover, several anomalies contradict the market efficiency, including the January anomaly, size anomaly, and winners-losers anomaly, but as usual, factual evidence both contradicts and supports these anomalies.

Parting opinions about the different versions of the EMH reflect in investors’ investing strategies. For example, supporters of the strong form efficiency might opt for passive investing strategies like buying index funds. In contrast, practitioners of the weak form of efficiency might leverage arbitrage trading to generate profits.

Marketing strategies in an efficient and inefficient market

On the one side, some academics and investors support Fama’s theory and most likely opt for passive investing strategies. On the other, some investors believe assets can become undervalued and try to use skill and analysis to outperform the market via active trading.

Passive investing

Passive investing is a buy-and-hold strategy where investors seek to generate stable gains over a more extended period as fewer complexities are involved, such as less time and tax spent compared to an actively managed portfolio.

People who believe in the efficient market hypothesis use passive investing techniques to create lower yet stable gains and use strategies with optimal gains through maximizing returns and minimizing risk.

Proponents of the EMH would use passive investing, for example:

- Invest in Index Funds;

- Invest in Exchange-traded Funds (ETFs).

However, it is important to note that other mutual funds also use active portfolio management intending to outperform indices, and passive investing strategies aren’t only for those who believe in the EMH.

Active investing

Active portfolio managers use research, analysis, skill, and experience to discover market inefficiencies to generate a higher profit over a shorter period and exceed the benchmark returns.

Generally, passive investing strategies generate returns in the long run, whereas active investing can generate higher returns in the short term.

Opponents of the EMH might use active investing techniques, for example:

- Arbitrage and speculation;

- Momentum investing ;

- Value investing .

The fact that these active trading strategies exist and have proven to generate above-market returns shows that prices don’t always reflect their market value.

For instance, if a technology company launches a new innovative product, it might not be immediately reflected in its stock price and have a delayed reaction in the market.

Suppose a trader has access to unpublished and private inside information. In that case, it will allow them to purchase stocks at a much lower value and sell for a profit after the announcement goes public, capitalizing on the speculated price movements.

Passive and active portfolio managers are often compared in terms of performance, e.g., investment returns, and research hasn’t fully concluded which one outperforms the other,

Efficient market examples

Investors and academics have divided opinions about the efficient market hypothesis, and there have been cases where this theory has been overturned and proven inaccurate, especially with strong form efficiency. However, proof from the real world has shown how financial information directly affects the prices of assets and securities, making the market more efficient.

For example, when the Sarbanes-Oxley Act in the United States, which required more financial transparency through quarterly reporting from publicly traded businesses, came into effect in 2002, it affected stock price volatility. Every time a company released its quarterly numbers, stock market prices were deemed more credible, reliable, and accurate, making markets more efficient.

Example of a semi-strong form efficient market hypothesis

Let’s assume that ‘stock X’ is trading at $40 per share and is about to release its quarterly financial results. In addition, there was some unofficial and unconfirmed information that the company has achieved impressive growth, which increased the stock price to $50 per share.

After the release of the actual results, the stock price decreased to $30 per share instead. So whereas the general talk before the official announcement made the stock price jump, the official news launch dropped it.

Only investors who had inside private information would have known to short-sell the stock , and the ones who followed the publicly available information would have bought it at a high price and incurred a loss.

What can make markets more efficient?

There are a few ways markets can become more efficient, and even though it is easy to prove the EMH has no solid base, there is some evidence its relevance is growing.

First , markets become more efficient when more people participate, buy and sell and engage, and bring more information to be incorporated into the stock prices. Moreover, as markets become more liquid, it brings arbitrage opportunities; arbitrageurs exploiting these inefficiencies will, in turn, contribute to a more efficient market.

Secondly , given the faster speed and availability of information and its quality, markets can become more efficient, thus reducing above-market return opportunities. A thoroughly efficient market, strong efficiency, is characterized by the complete and instant transmission of information.

To make this possible, there should be:

- Complete absence of human emotion in investing decisions;

- Universal access to high-speed pricing analysis systems;

- Universally accepted system for pricing stocks;

- All investors accept identical returns and losses.

The bottom line

At its core, market efficiency is the ability to incorporate all information in stock prices and provide the most accurate opportunities for investors; however, it isn’t easy to imagine a fully efficient market.

Research has shown that most developed capital markets fall into the semi-strong efficient category. However, whether or not stock markets can be fully efficient conclusively and to what degree continues to be a heated debate among academics and investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on the efficient market hypothesis

The efficient market hypothesis (EMH) claims that prices of assets such as stocks are trading at accurate market prices, leaving no opportunities to generate outsized returns. As a result, nothing could give investors an edge to outperform the market, and assets can’t become under- or overvalued.

What are three forms of the efficient market hypothesis?

The efficient market hypothesis takes three forms: first, the purest form is strong form efficiency, which considers current and past information. The second form is semi-strong efficiency, which includes only current and past public, and not private, information. Finally, the third version is weak form efficiency, which claims stock prices always take a randomized path.

What contradicts the efficient market hypothesis?

The efficient market hypothesis directly contradicts the existence of investment strategies, and cases that have proved to generate excess gains are possible, for example, via approaches like value or momentum investing.

When more investors engage in the market by buying and selling, they also bring more information that can be incorporated into the stock prices and make them more accurate. Moreover, the faster movement of information and news nowadays increases accuracy and data quality, thus making markets more efficient.

Weekly Finance Digest

By subscribing you agree with Finbold T&C’s & Privacy Policy

Related guides

How to Buy Chubb Stock [2024] | Invest in CB

How to Buy NVAX Stock [2023] | Investing in Novavax

How to Buy FFIE Stock [2024] | Invest in Faraday Future

10 Biggest Semiconductor Companies in the World [2024]

Introducing price alerts.

Create price alerts for stocks & crypto. Get started

- Search Search Please fill out this field.

Market Efficiency: Effects and Anomalies

:max_bytes(150000):strip_icc():format(webp)/0__mary_hall-5bfc262446e0fb005118b2a7.jpeg)

When you place money in the stock market, the goal is to generate a return on the capital invested. Many investors try not only to make a profitable return, but also to outperform, or beat, the market.

However, market efficiency —championed in the Efficient Market Hypothesis (EMH) first formulated by Eugene Fama in the late 1960s and expounded upon in 1970—suggests at any given time, prices fully reflect all available information about a particular stock and/or market. Fama was awarded the Nobel Memorial Prize in Economic Sciences jointly with Robert Shiller and Lars Peter Hansen in 2013. According to the EMH, no investor has an advantage in predicting a return on a stock price because no one has access to information not already available to everyone else.

Key Takeaways

- According to market efficiency, prices reflect all available information about a particular stock or market at any given time.

- As prices respond only to information available in the market, no one can out-profit anyone else.

- One view of EMH suggests that not even insider information can give one investor an edge over others.

The Effect of Efficiency: Non-Predictability

The nature of information does not have to be limited to financial news and research alone; indeed, information about political, economic, and social events, combined with how investors perceive such information, whether true or rumored, will be reflected in the stock price. According to the EMH, as prices respond only to information available in the market, and because all market participants are privy to the same information, no one will have the ability to out-profit anyone else.

In efficient markets, prices become not predictable but random, so no investment pattern can be discerned. A planned approach to investment, therefore, cannot be successful.

This random walk of prices, commonly spoken about in the EMH school of thought, results in the failure of any investment strategy that aims to beat the market consistently. In fact, the EMH suggests that given the transaction costs involved in portfolio management, it would be more profitable for an investor to put his or her money into an index fund .

Anomalies: The Challenge to Efficiency

In the real world of investment, however, there are obvious arguments against the EMH. There are investors who have beaten the market, such as Warren Buffett , whose investment strategy focused on undervalued stocks made billions and set an example for numerous followers. There are portfolio managers who have better track records than others, and there are investment houses with more renowned research analysis than others. So how can performance be random when people are clearly profiting from and beating the market?

Counter-arguments to the EMH state consistent patterns are present. For example, the January effect is a pattern that shows higher returns tend to be earned in the first month of the year; and the weekend effect is the tendency for stock returns on Monday to be lower than those of the immediately preceding Friday.

Studies in behavioral finance , which look into the effects of investor psychology on stock prices, also reveal investors are subject to many biases such as confirmation, loss aversion, and overconfidence biases.

The EMH Response

The EMH does not dismiss the possibility of market anomalies that result in generating superior profits. In fact, market efficiency does not require prices to be equal to fair value all the time. Prices may be over- or undervalued only in random occurrences, so they eventually revert back to their mean values. As such, because the deviations from a stock's fair price are in themselves random, investment strategies that result in beating the market cannot be consistent phenomena.

Furthermore, the hypothesis argues that an investor who outperforms the market does so not out of skill but out of luck. EMH followers say this is due to the laws of probability: at any given time in a market with a large number of investors, some will outperform while others will underperform .

How Does a Market Become Efficient?

For a market to become efficient, investors must perceive the market is inefficient and possible to beat. Ironically, investment strategies intended to take advantage of inefficiencies are actually the fuel that keeps a market efficient.

A market has to be large and liquid . Accessibility and cost information must be widely available and released to investors at more or less the same time. Transaction costs have to be cheaper than an investment strategy's expected profits. Investors must also have enough funds to take advantage of inefficiency until, according to the EMH, it disappears again.

Degrees of Efficiency

Accepting the EMH in its purest form may be difficult; however, three identified EMH classifications aim to reflect the degree to which it can be applied to markets:

- Strong efficiency - This is the strongest version, which states all information in a market, whether public or private, is accounted for in a stock price. Not even insider information could give an investor an advantage.

- Semi-strong efficiency - This form of EMH implies all public information is calculated into a stock's current share price. Neither fundamental nor technical analysis can be used to achieve superior gains.

- Weak efficiency - This type of EMH claims that all past prices of a stock are reflected in today's stock price. Therefore, technical analysis cannot be used to predict and beat the market.

The Bottom Line

In the real world, markets cannot be absolutely efficient or wholly inefficient. It might be reasonable to see markets as essentially a mixture of both, wherein daily decisions and events cannot always be reflected immediately in a market. If all participants were to believe the market is efficient, no one would seek extraordinary profits, which is the force that keeps the wheels of the market turning.

In the age of information technology (IT) however, markets all over the world are gaining greater efficiency. IT allows for a more effective, faster means to disseminate information, and electronic trading allows for prices to adjust more quickly to news entering the market. However, while the pace at which we receive information and make transactions quickens, IT also restricts the time it takes to verify the information used to make a trade. Thus, IT may inadvertently result in less efficiency if the quality of the information we use no longer allows us to make profit-generating decisions.

The Nobel Prize. " Eugene F. Fama: Biographical ."

:max_bytes(150000):strip_icc():format(webp)/usa-stock-market-crash-827585890-bb854fc8911b4026990b0152db976fd6.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Serial Killer Quick Reference Guides

#1 Stranglers

- Killer.Cloud

- Serial Killers

- Necrophiliacs

Sergei Ryakhovsky

The balashikha ripper, the hippopotamus, active for 6 years (1988-1993) in russia, confirmed victims, possible victims.

- Serial Killer Profile

- Serial Killer Type

- General Information

- Characteristics

- Cognitive Ability

- Incarceration

- 8 Timeline Events

- Serial Killers Active During Spree

- Boolean Statistical Questions

- 12 Books Written About Sergei Ryakhovsky

- 3 External References

Internal References

Sergei Ryakhovsky (Sergei Vasilyevich Ryakhovsky) a Soviet-Russian serial killer known as the Balashikha Ripper and The Hippopotamus. Ryakhovsky was convicted for the killing of nineteen people in the Moscow area between 1988 and 1993. Ryakhovsky's mainly stabbed or strangulated his victims, he mutilated some bodies, mainly in the genital area. Allegedly Ryakhovsky carried out necrophilic acts on his victims and stole their belongings. Ryakhovsky standing 6’5" tall and weighting 286 pounds, gaining him the nickname, The Hippo. Sergei Ryakhovsky died on January 21st 2005 from untreated tuberculosis while serving his life sentence in prison.

Sergei Ryakhovsky Serial Killer Profile

Serial Killer Sergei Ryakhovsky (aka) the Balashikha Ripper, The Hippopotamus, was active for 6 years between 1988-1993 , known to have ( 19 confirmed / 19 possible ) victims. This serial killer was active in the following countries: Russia

Sergei Ryakhovsky was born on December 29th 1962 in Balashikha, Moscow Oblast, Soviet Union. He had a physically defect. During his education he had academic, social or discipline problems including being teased or picked on.

Sergei Ryakhovsky a necrophile male citizen of Russia.

Prior to his spree he had killed, commited crimes, and served time in jail.

In 1988 (Age 25/26) Sergei Ryakhovsky started his killing spree, during his crimes as a serial killer he was known to rob, commit acts of necrophilia , torture , strangle , rape , mutilate, and murder his victims.

He was arrested on April 13th 1993 (Age 30), sentenced to death by firing squad at a maximum-security penal colony in Solikamsk, Perm Oblast, Russia. He was convicted on charges of murder and other possible charges during his lifetime.

Sergei Ryakhovsky died on January 21st 2005 (Age 42), cause of death: natural causes, untreated tuberculosis at a maximum-security penal colony in Solikamsk, Perm Oblast, Russia.

Profile Completeness: 62%

Sergei Ryakhovsky has been listed on Killer.Cloud since November of 2016 and was last updated 4 years ago.

Sergei Ryakhovsky a known:

( 651 killers ) serial killer.

The unlawful killing of two or more victims by the same offender(s), in separate events. Serial Killer as defined by the FBI at the 2005 symposium.

( 308 killers ) RAPIST

Rape is usually defined as having sexual intercourse with a person who does not want to, or cannot consent.

( 60 killers ) NECROPHILIAC

Necrophilia, also called thanatophilia, is a sexual attraction or sexual act involving corpses. Serial Killer Necrophiliacs have been known to have sex with the body of their victim(s).

( 89 killers ) TORTURER

Torture is when someone puts another person in pain. This pain may be physical or psychological. Tourturers touture their victims.

( 251 killers ) STRANGLER

Strangulation is death by compressing the neck until the supply of oxygen is cut off. Stranglers kill by Strangulation.

Sergei Ryakhovsky Serial Killer Profile:

Updated: 2019-06-30 collected by killer.cloud, 8 timeline events of serial killer sergei ryakhovsky.

The 8 dates listed below represent a timeline of the life and crimes of serial killer Sergei Ryakhovsky. A complete collection of serial killer events can be found on our Serial Killer Timeline .

Back to top Serial Killers Active During

The following serial killers were active during the same time span as Sergei Ryakhovsky (1988-1993).

Jack Harold Jones 2 Victims during 13 Years

Gao chengyong 11 victims during 15 years, michael lee lockhart 3 victims during 2 years, pedro lopez 110 victims during 34 years, serial killers by active year, books that mention sergei ryakhovsky.

Kevin Smith

Serial killer stranglers.

Serial Killer Rapists

Sergey Kuznetsov

Butterfly skin.

Geraldine Fagan

Believing in russia.

Danny Schäfer

Freedom of religion or belief. anti-sect move....

100 of the Most Famous Serial Killers of All...

Stanley M. Burgess

The new international dictionary of pentecost....

External References

- Sergei Ryakhovsky on en.wikipedia.org , Retrieved on Sep 18, 2018 .

- Juan Ignacio Blanco , Sergei Vasilyevich RYAKHOVSKY on murderpedia.org , Retrieved on Sep 18, 2018 .

- Q372816 on www.wikidata.org , Retrieved on Oct 9, 2018 .

Sergei Ryakhovsky is included in the following pages on Killer.Cloud the Serial Killer Database

- #3 of 45[ Page 1 ] of Serial Killers with birthdays in December

- #10 of 60[ Page 1 ] of Serial Killer Necrophiliacs sorted by Confirmed Victims

- #10 of 29[ Page 1 ] of Serial Killers active in Russia

- #10 of 55[ Page 1 ] of Capricorn Serial Killers sorted by Confirmed Victims

- #11 of 89[ Page 1 ] of Serial Killer Torturers sorted by Confirmed Victims

- #27 of 250[ Page 2 ] of Serial Killer Stranglers sorted by Confirmed Victims

- #35 of 307[ Page 3 ] of Serial Killer Rapist sorted by Confirmed Victims

- #63 of 651[ Page 5 ] of serial killers sorted by Confirmed Victims

- #264 of 651[ Page 18 ] of serial killers sorted by Years Active

- #381 of 651[ Page 26 ] of serial killers sorted by Profile Completeness

- #516 of 651[ Page 35 ] of the A-Z List of Serial Killers

Proceedings of the 2nd International Conference on Architecture: Heritage, Traditions and Innovations (AHTI 2020)

The Academy of Construction and Architecture of the USSR: Formation of the Idea of a New Goal in the Conditions of Transition to “Industrial Rails”

Article details Download article (PDF)

Modern Challenges and the Outline of the Future of Architecture