- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Interview Questions

Finance Interview Questions and Answers (44 Samples)

Common finance technical, behavioral, and logical questions with sample answer

Austin has been working with Ernst & Young for over four years, starting as a senior consultant before being promoted to a manager. At EY, he focuses on strategy, process and operations improvement, and business transformation consulting services focused on health provider, payer, and public health organizations. Austin specializes in the health industry but supports clients across multiple industries.

Austin has a Bachelor of Science in Engineering and a Masters of Business Administration in Strategy, Management and Organization, both from the University of Michigan.

Prior to becoming our CEO & Founder at Wall Street Oasis, Patrick spent three years as a Private Equity Associate for Tailwind Capital in New York and two years as an Investment Banking Analyst at Rothschild.

Patrick has an MBA in Entrepreneurial Management from The Wharton School and a BA in Economics from Williams College.

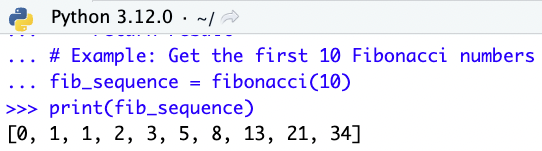

10 Basic Finance Technical Interview Questions

5 advanced finance technical interview questions for professionals / mba candidates, 5 investment banking interview questions, 5 private equity interview questions, 5 hedge funds interview questions, 5 equity research interview questions, 5 accounting interview questions, 4 logical puzzles - interview brain teasers, wso interview prep guides & additional resources.

You’re just starting the finance recruiting season. You’re an undergrad that needs to ace their finance job interviews. But, possibly, you’re an MBA student that needs to land that top-notch offer at your dream private equity firm.

Most importantly, you’re in luck!

We’ve compiled a list of the most common and frequently asked finance interview questions across various career paths, from investment banking and private equity to equity research and accounting!

If you want to ace your finance interview , make sure you review and perfect the answers to the questions below.

This guide is based on real questions asked at banks and is curated from Wall Street Oasis (WSO) global community with over 900,000 members that have been in your shoes.

In addition to this comprehensive guide to finance interview Q&A, you might also want to arm yourself with the complete Investment Banking Interview Prep Package and perfect your interview skills with some Mock Interviews with Experienced Wall St. Mentors .

Check out the full list of awesome Interview & Recruiting Prep Courses from WSO for more information.

For now, if you’re looking for just the basic fresher on Finance Interview questions, look no further!

This guide features a total of 44 of the most common technical, transactional, behavioral, and logical questions, as well as proven sample answers to them, that are asked in finance interviews to candidates during the hiring process.

We have also added links to our very own WSO free complete interview guides at the end of each section, so you can further tailor your training for the role you’re applying for and convert the interview into an offer!

This interview guide consists of 9 sections, starting with a section on general finance questions, followed by sections covering questions (technical and behavioral) for the respective job you’re applying for.

The Only Program You Need to Land in High Finance Careers

The most comprehensive curriculum and support network to break into high finance.

A candidate’s technical abilities and expertise are assessed critically in almost every finance recruiting and interview process.

Your interviewers expect detailed and accurate responses to general finance questions, often asked in the beginning stages of the interview. Your answers must demonstrate technical mastery and expertise of the topic at hand.

The following section features 15 common finance interview questions for undergraduates and students and experienced professionals and MBA candidates. At the end of each question, we also provide a sample answer.

We feature the career-specific technical and behavioral questions sections to further tailor your training towards the role you’re applying for at the end of these 15 questions.

1. What are the four financial statements?

Sample Answer: The four financial statements are,

- Income Statement,

- Balance Sheet,

- Statement of Cash Flows , and

- Statement of Stockholders’ Equity

2. How are the three main financial statements connected?

Sample Answer: The three main financial statements are,

- Income Statement

- Balance Sheet, and

- Statement of Cash Flows

They are connected as follows:

- Net income flows from the Income Statement into the Cash Flow from Operations on the Cash Flow statement

- Net income reduced by dividends are added to retained earnings from the prior period’s Balance Sheet to arrive at retained earnings as on the current period’s Balance Sheet

- Beginning cash on the Cash Flow Statement is cash from the prior period’s Balance Sheet and Ending cash on the Cash Flow statement is cash on the current period’s Balance Sheet

The following comprehensive chart summarizes the connections between the three main financial statements:

3. Briefly walk me through the Income Statement.

Sample Answer: The first line of the Income Statement represents revenues or sales. From that, we subtract the cost of goods sold , which equals gross margin .

Subtracting operating expenses from gross margin gives us operating income ( EBIT ). We then subtract (add) interest expense (income), taxes (refunds), and other expenses (income) to arrive at Net Income.

4. What is EBITDA?

Sample Answer: EBIDTA stands for Earnings before Interest, Depreciation, Taxes, and Amortization.

It allows us to gauge a rough estimate of a company’s profitability and is often a quick substitute for free cash flow . It allows you to determine how much cash is available from operations to pay interest, CAPEX , etc.

It can be calculated using the simplified formula of EBITDA = Revenue - Expense. Lastly, EBITDA is also used in rough valuation as a metric, such as EV/EBITDA.

5. What are the ways you can value a company?

Sample Answer: Some common valuation techniques are,

- Comparable Companies / Multiples Analysis

- Discounted Cash Flow ( DCF )

- Leveraged Buyout Model ( LBO )

- Precedent Transactions

- Liquidation Valuation

- Market Cap/Market Valuation

6. What is Enterprise Value?

Sample Answer: Enterprise Value (EV) is the value of the entire firm, inclusive of debt and equity. In the event of acquisition without a premium, it represents the price that would be paid for the company by the acquirer.

The formula for EV is,

EV = Market Value of Equity + Debt + Preferred Stock + minority interest - Cash

7. Can a company have a negative book equity value?

Sample Answer: Yes, a company can have a negative book equity value . Possible situations where this would occur are when there are large cash dividends or if the company has been operating at a loss for a long time, leading to taking on debt to stay operational.

8. What is WACC, and how do you calculate it?

Sample Answer: WACC stands for Weighted Average Cost of Capital . It reflects the cost of the company raising new capital and reflects the riskiness of a company.

9. When do you use an LBO model?

Sample Answer: LBO models are used when the firm uses a higher than normal amount of debt to finance the purchase of a company, then uses the company’s cash flows to pay off the debt over time.

In addition, the acquisition’s assets may be used as collateral. Ideally, the acquisitions debt has been partially retired at the exit.

10. What is Beta?

Sample Answer: Beta is a measure of the volatility of an investment relative to the market as a whole. We consider the market to have a beta of 1; investments considered more volatile than the market have a beta greater than 1, whereas contrasting investments less volatile have a beta of less than 1.

These are questions also asked for junior-year Summer Analyst , full-time Analyst, and MBA job interviews. These advanced finance questions require deeper thinking and understanding of corporate finance .

1. What are some possible reasons why a company would issue equity rather than debt to fund its operations?

Sample Answer: The company may decide to issue equity rather than debt for a variety of reasons, some of which are,

- The company considers its stock price to be inflated, and therefore it can raise a large amount of capital compared to the percentage of ownership sold

- The projects the company plans to invest in with proceeds may not produce immediate or consistent cash flows to pay the debt

- The company wants to adjust the cap structure or pay down debt

- The owners of the company want to sell off a portion of their ownership

2. What are the major factors that drive mergers and acquisitions?

Sample Answer: Some major factors that potentially drive mergers and acquisitions are,

- Diversification or sharpening on the market, or products of the company

- Implementation of new technologies

- Achieving synergies (cost savings)

- Eliminating a competitor from the market or growing market share

- Increase in supply-chain pricing power by buying a supplier or distributor

- Improvement of financial metrics

3. How is it possible for a company to have a positive net income but go bankrupt?

Sample Answer: The company may go bankrupt with a positive net income if working capital erodes (increasing accounts receivable and lowering accounts payable ). It is also worth noting that financial fraud can also be a possibility.

4. How/ Why do you lever or unlever beta?

Sample Answer: When beta is unlevered, the financial effects of debt in the capital structure are removed. This will help you analyze the risk of a firm’s equity compared to the market.

Further, when you are valuing a company that is not on the market and doesn’t have a beta, you can compare it to a similar company on the market and unlever its beta as a proxy for the unlisted company’s beta.

5. What is the difference between cash-based accounting and accrual?

Sample Answer: Cash-based accounting recognizes sales and expenses when cash flows out of the company. Accrual-based accounting recognizes revenues and expenses as incurred regardless of whether cash flows out of the company at that exact time. In the finance industry, accrual-based accounting is the more popular method.

WSO Company Database

Gain Access to Exclusive Data on Compensation, Interviews, and Employee Reviews.

WSO’s Free 101 Investment Banking Interview Guide

All of the above questions have been taken from our WSO official free Investment Banking Interview Questions and Answers page.

The guide features 101 of the most common technical, behavioral, logical, and group-specific questions that investment banking professionals ask candidates during the hiring process, as well as sample answers to each one of them.

The resource includes 21 bank-specific questions from bulge bracket investment banks (Goldman Sachs, J.P Morgan, Citi, etc.).

Investment Banking (IB) remains one of the most sought-after jobs for recent graduates and professionals alike in the finance industry. Bulge bracket investment banks such as Goldman Sachs have reported 2% IB internship acceptance rates in 2013, and the number has likely only decreased since then.

With that being said, it comes as no surprise that the investment banking interview process is highly competitive and designed to rigorously filter out potential candidates. Consequently, answering the behavioral, technical, and logical questions that are asked in the interview with proven answers that we provide is key to converting an interview into an offer.

The following section features five questions (4 technicals + 1 behavioral) to kickstart your training for investment banking interviews . It is a great place to start before checking out our free comprehensive Investment Banking Interview Questions and Answers page.

1. Which valuation methodologies result in the highest valuations?

Sample Answer: The following list ranks the four valuation methodologies from highest valuation to lowest valuation:

- Precedent Transaction - Since a company will pay a control premium and a premium for synergies arising from the merger , values tend to be high.

- Discounted Cash Flow - Those building the DCF model are frequently optimistic in their projections.

- Market Comps - Based on other similar companies and how they are trading. There are no control premiums or synergies.

- Market Valuation - Based on how the market is valuing the target. This only accounts for equity value, no premiums or synergies.

2. What does an investment banking division do?

Sample Answer: The investment banking division is sometimes referred to as corporate finance and is broadly split into two sectors, products and industries. Both sectors service the purpose of providing advisory on transactions, mergers, and acquisitions and arranging (and sometimes even providing) financing for these transactions.

Investment banking product groups are broken down into

- Mergers and Acquisitions (M&A): Advisory on sale, merger, and purchase of companies.

- Leveraged Finance (LevFin) - Issuing high-yield debt to firms to finance acquisitions and other corporate activities.

- Equity Capital Markets (ECM) - Advice on equity and equity-derived products ( IPOs , shares, capital raises, secondary offerings, etc.)

- Debt Capital Markets (DCM) - Advice on raising and structuring debt to finance acquisitions and other corporate activities.

- Restructuring – Improving the structures of a company to make it more profitable or efficient.”

*Taken from WSO’s “ What is Investment Banking .”

3. If enterprise value (EV) is $80mm, and equity value is $40mm, what is the net debt?

Enterprise Value = Equity Value + Net Debt + Preferred Stock + Minority Interest

Sample Answer: If we assume there is no minority interest or preferred stock, the Net Debt will be $80mm – $40mm, or $40mm.

4. All else equal, should the WACC be higher for a company with a $100 million market cap or a $100 billion market cap?

Sample Answer 1: Typically, we consider the larger company to be “safer” and consequently should have a lower WACC, all other factors being equal. However, depending upon their respective capital structures, the larger company may potentially also have a higher WACC.

Sample Answer 2: Without knowing more information about the companies, this is impossible to say. If the capital structures are the same, the larger company should be less risky and therefore have a lower WACC. However, if the larger company has a lot of high-interest debt, it could have a higher WACC.

5. Why do you believe you will be a competent investment banking analyst?

Highlight three to four of the following points:

- Positive attitude

- Quantitative and analytical skills

- Team spirit

- Communication ability

- Eagerness to learn

- Appetite for work

- Efficiency of organization

- Detail orientation

- Ability to get everything done with a smile

Sample Answer: To be a successful analyst, you have to be well-rounded. But, of course, no single quality makes a good analyst. Still, I think three characteristics are probably most important: maintaining a positive attitude, being extremely hard-working, and knowing how to be a strong team player.

Professionals often consider Private Equity (PE) one of the hardest sectors to break into within the finance industry.

Nevertheless, vast amounts of talented professionals from various backgrounds (investment banking, asset management , etc.) apply to private equity firms, seeing them as the golden exit opportunity due to generally better pay and better hours.

Therefore, the competitive interview process is designed to rigorously filter out potential candidates, with less than 1% of candidates receiving job offers.

The following section features five questions (4 technicals + 1 behavioral) to kickstart your training for private equity interviews . It is a great place to start before checking out our free comprehensive Private Equity Interview Questions and Answers page.

1. How would you successfully close a deal if you and the seller disagree on the price of an asset due to different projections of its future operating performance?

Sample Answer: A classic PE solution to this common problem is an “Earn-out.” This is because sellers are typically more optimistic about a business’s future performance than what PE investors are willing to underwrite.

In such instances, either party may propose that the sellers are paid a portion of the total acquisition price up-front. In contrast, a portion is held back (frequently in an escrow account) until the business’ actual future performance is determined.

If the business performs in line with the seller’s expectations, then the seller is paid the remainder of the purchase price some months or years after the close of the deal. However, if the business under-performs the seller’s expectations, the buyer keeps some or all of the earn-out money.

This type of structure is a common way of bridging valuation gaps between buyers and sellers.

2. What are some common methods PE firms use to increase portfolio company value?

Sample Answer: How much value PE firms add is an open question, but the following methods are frequently mentioned:

- Recruit more competent management and board members

- Provide more aligned management incentives (typically via stock option pool)

- Identify and finance new organic growth opportunities (new geographies, product lines, adjacent market verticals, etc.)

- Find, finance, and execute add-on acquisitions

- Foster stronger relationships with key customers, suppliers, and Wall Street

- Support investment in better IT systems, financial reporting and control, research & development, etc.

3. What are some pros and cons of market value?

Sample Answer: Pros:

- Market value is always up-to-date and is instantly available for public companies .

- Market value is determined by and fundamentally based on the individual decisions of numerous investors, therefore reflecting the collective work and judgment of people.

- The market can be wrong, sometimes by a considerable margin. If it wasn’t, hedge funds and other public market investors (Warren Buffett) would seldom beat the market.

4. Tell me why each of the financial statements by themselves is inadequate for evaluating a company?

Sample Answer: There are many reasons why each of the financial statements is inadequate for evaluating a company. A few reasons for each one are listed below.

- Income Statement : The income statement alone won’t tell you whether a company generates enough cash to stay afloat or solvent. You need the balance sheet to tell you whether the company can meet its future liabilities, and you need the cash flow statement to ensure it is generating enough cash to fund its operations and growth.

- Balance Sheet: The balance sheet alone won’t tell you whether the company is profitable because it is only a snapshot on a particular date. For example, a company with few liabilities and many valuable assets could be losing a lot of money every year.

- Cash Flow Statement : The cash flow statement won’t tell you whether a company is solvent because it could have massive long-term liabilities which dwarf its cash-generating capabilities.

The cash flow statement won’t tell you whether the company’s ongoing operations are profitable because cash flows in any given period could look strong or weak due to timing rather than the underlying strength of the company’s business.

5. Why are you interested in X PE Firm?

The interviewer wants to make sure that you are truly serious about their firm and that there is likely to be a good fit between you and the firm.

Therefore, your goal should be to demonstrate your clear interest by showing you’ve spent time researching the firm and have specific reasons to be interested in it.

Before you go into an interview, dig up some of the basic information about it:

- Its origin, age, fund size, office locations, industry focus, investment criteria, etc.

- Bios of some of it investment professionals, especially those likely to interview you

- Existing and past deals/portfolio companies

- How they describe themselves / how they see themselves / what makes their investment process or culture unique

Great resources for learning the above include:

- The firm’s website is first and foremost. It frequently has an “about the firm” section, IP bios, investment criteria, existing portfolio, and past deal examples or case studies

- CapIQ and other similar data providers also frequently have some of the above data

- Google the company’s name for news articles, especially press releases on new investments and exits

- Search for WSO threads about the company and read the WSO database entries on the company

- If you have friends who work there or have worked there - they can, of course, be a great resource

WSO’s Free PE Interview Guide

All of the above questions have been taken from our WSO official free Private Equity Interview Questions and Answers page.

The guide features a total of 40 of the most common technical, transactional, behavioral, and logical questions, along with proven sample answers that private equity professionals ask candidates during the hiring process.

We have also added dedicated sections discussing previous deal experiences and featured a free LBO modeling test (video solution + modeling file) at the end of the guide to perfect your modeling skills!

Hedge Funds are one of the main movers of global markets and key influencers of global liquidity. With the lucrative bonus packages offered by hedge funds, it is not uncommon to hear hedge fund analysts in their mid-to-late-twenties making well into the half-million-dollar range per year or more.

Given this, it comes as no surprise that hedge funds are extremely selective with their hiring process, as they rigorously filter out thousands of potential applications annually to settle for only the best.

The following section features five questions (4 technicals + 1 behavioral) to kickstart your training for hedge fund interviews . It is a great place to start before checking out our free comprehensive Hedge Funds Interview Questions and Answers page.

1. What’s the difference between intrinsic and book value, and how can they deviate?

Sample Answer:

- Book value is what assets are carried out on a company’s balance sheet. Book value and Price to Book are common valuation measures for value-conscious investors.

- Intrinsic value is the belief of what a business is truly worth.

- The intrinsic value would consider intangible assets not properly valued or carried on the balance sheet – like the brand value of Coca-Cola.

- Additionally, sometimes when a holding company acquires a portfolio company, it is carried at cost on the balance sheet, and its value won’t be “written up” to its intrinsic value over time as the company grows.

- However, companies must write down intangible assets that lose value as per accounting standards.

2. What are Deferred Tax Assets (DTA) and Deferred Tax Liabilities (DTL)? How are they created in an M&A transaction?

- A DTL occurs when the company has paid fewer cash taxes than it owes therefore compensated for by paying additional taxes to the government sometime in the future.

- A deferred tax asset occurs when a company pays more taxes to the government than they show as an expense on their income statement in a reporting period.

- DTAs and DTLs are often created in an M&A transaction through the write-up or write-down of assets.

- If an asset is written up, the company will record a profit, and a DTL is created as the new asset will hold a higher depreciation expense in the short term, translating into the company paying lower taxes. These taxes must be paid back at some point, which is why liability is created.

- The opposite is true when an asset is written down in value.

3. Let’s suppose implied volatility (IV) for security is extremely high. Why could this be, and how would you profit from this?

- Implied volatility represents the expected volatility in a security and potentially may be high during times of company-specific events like earnings or due to volatility in the broader sector or market during a correction.

- You can chart a security’s implied volatility to see where it stands relative to historical levels.

- Suppose you believe that implied volatility is overstated for a company’s options. In that case, you should sell the one with the higher premium that is expected to fall, therefore allowing you to (1) Cover at a lower IV and lower price or (2) Hold your option trade through expiration and let them expire.

- You can sell premium by shorting calls or shorting puts, depending on if you have a view on the direction in the security. You could also write covered calls or short a straddle. A short straddle is writing puts and calls at the same strike and betting that the underlying security won’t move as much as the market expects by expiration. In other words, realized volatility will be less than what’s priced in.

4. What are typical default rates for high-yield bonds? What are typical recovery rates for these bonds? What impacts their recovery?

- The historical average default rate for high-yield bonds is just under 5%.

- Historically, it has doubled to around 10% in times of distress around recessions.

- The 1-year default rate for a bond that is already distressed is slightly higher at 15-20%.

- The recovery rate for a distressed bond depends on where a bond falls in the capital structure compared to other creditors. The higher the seniority, the greater the chances of recovering debt. The recovery rate has historically been around 40% for senior unsecured debentures. The type of recovery also impacts the recovery rate – Bankruptcy or distressed exchange. Distressed exchanges have had better recovery rates lately. Recovery rates are published annually by the credit rating agencies.

- Recently, distressed bonds have had better recovery rates, especially in energy defaults.

5. What’s the single most impressive experience on your resume?

Have one experience in mind that you feel is most impressive to the position you are applying for, and talk about it in depth. Then, explain the important facets of the experience and how they relate to the job you are applying for.

Sample Answer: “The most impressive experience on my resume was my experience last year as an intern at a hedge fund after my sophomore year. As the only intern at the firm, I effectively managed multiple tasks from multiple bosses. As a result, I learned throughout the summer how to accomplish everything asked of me efficiently and accurately.

I took on tasks such as some basic modeling of a company’s projected revenues based on different drivers and qualitative analysis of a few different industries, putting together PowerPoint presentations for the senior members of the team.

Even though I was just an unpaid intern, I was considered an integral part of the team and was expected to work long, intense hours, which gave me a feel of what I should be expecting as I enter the workforce.”

WSO’s Free Hedge Fund Interview Guide

All of the above questions have been taken from our WSO official free Hedge Funds Interview Questions and Answers page.

Our guide features a total of 40 of the most common technical, behavioral, and logical questions, along with p roven sample answers , that are asked by hedge funds professionals to candidates during the hiring process.

This resource includes 13 firm-specific questions from leading hedge funds (Bridgewater Associates, Citadel, etc.) and proven sample answers.

Equity Research (ER) attracts seasoned professionals and new hires with various talents and diversified skill sets across the world for a fulfilling career. New hires starting right out of school will start as research associates and move up the chain to becoming research analysts after gaining experience in the industry.

Given the limited number of positions for an incredibly large amount of applicants, it is no surprise that the interview process is designed to be incredibly competitive.

The following section features five questions (4 technicals + 1 behavioral) to kickstart your training for equity research interviews . It is a great place to start before checking out our free comprehensive Equity Research Interview Questions and Answers page.

1. How do you value a private company?

- You cannot use a straight market valuation as the company is not publicly traded.

- A DCF can be complicated by the absence of an equity beta, which increases the difficulty of calculating WACC . In such a situation, you have to use the equity beta of a close comp in your WACC calculation.

- Financial information for private companies is relatively harder to obtain because they are not required to make public online filings.

- An analyst may apply a discount on a comparable company’s valuation if the comps are publicly held because a public company will demand a 10-15% premium for the liquidity an investor enjoys when investing in a public company.

2. What is the market risk premium?

Sample Answer: The market risk premium is the excess return that investors require for choosing to purchase stocks over “risk-free” securities. It is calculated as the average return on the market (normally the S&P 500, typically around 10-12%) minus the risk-free rate (current yield on a 10-year Treasury).

3. When should an investor buy preferred stock?

- Preferred stock could be looked at as a cross between debt and equity. It will normally provide investors with a fixed dividend rate (like a bond) and allow for some capital appreciation (like a stock).

- Preferred stock may also have a conversion feature that allows shareholders to convert their preferred stock into common stock .

- It typically does not have voting rights like those of common stock.

- It is senior to common stock within the company’s capital structure.

Sample Answer: An investor should buy preferred stock for the upside potential of equity while limiting risk and assuring stability of current income in the form of a dividend. Preferred stock’s dividends are more secure than those from common stock.

In addition, owners of preferred stock enjoy a superior right to the company’s assets, though inferior to those of debt holders, should the company go bankrupt.

4. When should a company buy back stock?

Sample Answer: A company should buy back its stock if it believes it is undervalued when it has extra cash or wants to increase its stock price by increasing its EPS by reducing outstanding shares or sending a positive signal to the market.

However, if it believes it can make money by expanding its operations, it might not be a good idea to buy back stock. Also, a stock buyback is the best way to return money to shareholders, as they are tax-efficient compared to dividends.

5. What makes you think you can put up with the stress, pressure, and long hours of a career in finance?

Tell a story of a time in your life when you managed many different tasks and worked long hours.

The story can be from school, work, home, or a combination of all of them.

For example, maybe during finals week, you wrote three papers while studying for two exams, finalizing the school newspaper, and still going to soccer practice.

Make sure to explain that you know your experience has not been as intense as what you will face as a finance professional. Still, you feel as well prepared as anyone, and you are 100% dedicated to succeeding, whatever it takes.

Sample Answer: “I genuinely feel I am as prepared as anyone else coming out of college to handle the long hours. When you add up all the time I spent doing all my different activities, school hours were almost as long.

Every day I was up at 7:30 for classes that ran from 8:15 until 1:00. Then, after class, I would grab lunch and then go to soccer practice, which meant I didn’t get back until 5:00.

Then I would grab dinner and work in either my room or the library until I was done, which usually wasn’t until pretty late at night or into the morning. So while I know it isn’t the same stress and time commitment as finance requires, I feel my experience has left me well prepared.”

WSO’s free Equity Research Interview Guide

All of the above questions have been taken from our WSO official free Equity Research Interview Questions and Answers page.

Our guide features a total of 40 of the most common technical, behavioral, and logical questions, along with proven sample answers , that are asked by hedge funds professionals to candidates during the hiring process.

This resource includes eight firm-specific questions from leading hedge funds (Point72, D.E. Shaw Group, etc.) and proven sample answers .

Accounting has been considered the benchmark for a stable and growing career path in the vast world of finance for decades now.

Therefore, it establishes itself as a compelling career prospect for various professionals, from individuals looking for long-term job security to professionals beginning their career at a Big Four accounting firm before lateraling to other financial fields, such as investment banking or private equity.

The competitive interview process seeks to identify and reward well-equipped applicants with strong technical and financial skills as well as good attention to detail.

The following section features five questions (4 technical + 1 behavioral) to kickstart your training for accounting interviews . It is a great place to start before checking out our free comprehensive Accounting Interview Questions and Answers page.

1. What is the purpose of the changes in the working capital section of the cash flow statement?

Sample Answer: Due to accrual accounting, certain non-cash items affect both the income statement and balance sheet, examples of which are accounts payable and accounts receivable. Therefore, to reverse the effects of the non-cash items, we adjust for them in the “Changes in working capital” section.

Sample Follow-up Question: What does it mean if your change in net working capital is negative on the statement of cash flow? Is negative working capital a bad thing for a company?

Sample Follow-up Answer: While negative working capital by pure definition (i.e., current liabilities > current assets ) may indicate a solvency issue for a company or an inability to satisfy its obligations, negative working capital may not necessarily be considered a bad thing.

Suppose a company is making a concerted effort to stretch out its payment terms with its vendors as much as possible to preserve its cash position (which is not included in the calculation of working capital).

In that case, this will lead to negative working capital (since Accounts Payable would likely cause an excess of current liabilities over current assets). The company still has the liquidity to satisfy its obligations, but stretching out the vendor payment provides the company with the most flexibility.

2. What is the difference between accounts payable and accrued expenses?

Sample Answer: Accounts payable and accrued expenses are fundamentally similar. The main difference is that accounts payable is typically a one-time expense with an invoice (such as the purchase of inventory).

In contrast, accrued expenses are recurring (like employee expenses). It is worth noting that both accounts are reflected in working capital calculations.

3. What is a deferred tax liability, and why might one be created?

- Deferred tax liability is a tax expense amount reported on a company’s income statement, although not actually paid in cash during that accounting period but expected to be paid in the future. This occurs when a company pays fewer taxes to the government than they show as an expense on their income statement.

- This can be caused due to differences in depreciation expense between book reporting ( GAAP ) and tax reporting. This will lead to differences in tax expenses reported in the financial statements and taxes payable to the government.

4. Give some examples of accounting events typically involved in compound entries.

Sample Answer: Examples of such accounting events would be:

- Bank deductions which are associated with a bank reconciliation

- Deduction of expenses related to payroll payments

- Sales transactions subject to sales tax

5. Discuss your mathematical and quantitative skills relative to what a career in accounting requires.

You will need to be comfortable with numbers, generate formulas, and perform calculations using Excel.

It is beneficial to talk about how you have managed your portfolio, completed a self-study modeling course , took the accounting or finance courses offered at your school, etc.

Sample Answer: Although I majored in English, I have had an independent interest in accounting since I interned at a Big Four accounting firm in my first year of university.

Ever since I completed that project, I have managed my portfolio of limited savings, investing in companies that I view as safe, long-term growth plays through simple fundamental analysis . As a result, I have achieved an average annual return of 15 % on my portfolio over four years.

WSO’s Free Accounting Interview Guide

All of the above questions have been taken from our WSO official free Accounting Interview Questions and Answers page.

Our guide features a total of 33 of the most common technical, behavioral, and logical questions, along with proven sample answers .

This resource further includes 12 firm-specific questions from the big four accounting firms (Deloitte, KPMG, etc.) and proven sample answers to them.

Finance interviews also generally consist of a component dedicated to testing the logical thinking abilities of the candidate, which are indicative of their performance on the job later on.

Logical puzzles, brainteasers , and riddles have cemented themselves as important components of the interview process due to their nature, allowing the interviewer to determine your critical thinking abilities.

It is worth noting that for this section of the interview, interviewers aren’t focused on whether you get the right answers or not. Rather, they are interested in your thought process while solving the riddles you are presented with.

Given this, it is key to walk your interviewer through your thinking as you progress through the riddle, who may even probe you with questions to assist you. Giving them a rundown of your thoughts and occasionally asking if you’re headed in the right direction demonstrates your capabilities to reflect and approach a problem with composure.

However, it is still extremely useful to anticipate these logical puzzles beforehand to avoid being put on the spot and caught off guard in the interview. The following section has four commonly asked logical puzzles that you can prepare beforehand to impress your interviewer.

1. What’s 17 squared? What’s 18x22?

Answer: Don’t worry; they want to know how you will handle this question, and it is not difficult if you think about it correctly.

- Think 17 x 17 is just 17x10 plus 17x7. You know, 17 x 10 is 170. Now17 x 7 is 10 x 7 and 7 x 7. This gives you 170 + 70 + 49, or 289. Whatever you do, don’t panic!

- Now see if you can do 18 x 22: 18 x 20 + 18 x 2. Easy, 360 + 36 = 396.

- As far as brainteasers go, this is a rather common one. You will do better if you have practiced these types of questions.

2. A stock is trading at 10 and 1/16. There are 1 million shares outstanding. What is the stock’s market cap?

Answer : This is just a test of your mental math. If a fourth is .25, an eighth is .125, and a sixteenth is .0625. The stock price is 10.0625, and the Market Cap is 10.0625 million.

3. What is the probability that the first business day of the month is a Monday?

Answer: Each day has a 1 in 7 chance of being the first day of the month. However, if the month starts on a Saturday or a Sunday, the first business day of the month will be a Monday.

Therefore, the chances of the first business day being a Monday is 3 in 7 since if the month starts on Saturday, Sunday, or Monday, the first business day is a Monday.

4. A car drives from point A to point B at 60 MPH. It then returns from point B to point A at 30MPH. What is the average speed of the total round trip?

Answer: A lot of people say 45mph, which is wrong. Average speed equals total distance over total time. In this case, let’s assume the distance between A and B is 60 miles.

The first leg of the journey takes one hour, and the return trip takes 2 hours. Therefore, the total distance traveled is 120 miles, and the total time the trip takes is 3 hours. Therefore, the average speed of the round trip is 120 miles / 3 hours = 40mph.

Over recent years, breaking into a lucrative finance career has tremendously increased in difficulty with an extremely high number of qualified applicants applying for a limited number of positions. Given this, professionals and students alike should capitalize upon every resource available to ensure success in their job search.

WSO offers premium 1:1 services, such as the WSO Resume Review and WSO Mentor Service, that will match you with an elite professional in your target industry for one-on-one help to drastically increase your odds of landing your dream job.

With a successful track record of delivering results to over 2300 clients over the last ten years, you can rest assured our premium service will deliver results.

Check out WSO Resume Review and WSO Mentor Service by clicking on the buttons below.

WSO Resume Review

WSO Mentor Service

Additionally, finetune your preparation and training towards your dream position. From our comprehensive Investment Banking Interview Prep Course , which features 7,548 questions across 469 investment banks, to our WSO Elite Modeling Package covering Excel, 3 Statements , LBO, M&A, Valuation + DCF Modeling , we’ve got you covered for every career path of finance!

Check out our complete collection of courses offered by clicking the button below.

WSO Courses

Additional WSO resources:

WSO recommends the following additional resources for taking a look at.

- WSO Salary Guides for Finance and Business

- WSO Investment Banking Industry Report

- WSO Financial Dictionary

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

- Investment Banking Interview Questions and Answers

- Private Equity Interview Questions and Answers

- Hedge Funds Interview Questions and Answers

- FP&A Interview Questions and Answers

- Accounting Interview Questions and Answers

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Top 15 Finance Interview Questions and Answers

In this article

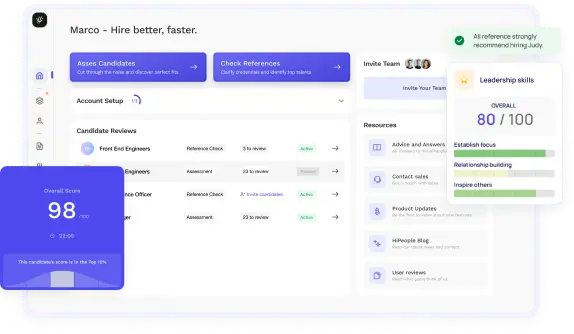

Streamline hiring withour effortless screening.

Optimise your hiring process with HiPeople's AI assessments and reference checks.

Are you ready to ace your finance interviews with confidence? In this guide, we'll dive deep into the world of finance interview questions, equipping you with the knowledge and strategies to tackle even the most challenging inquiries head-on.

Whether you're a seasoned finance professional looking to brush up on your interview skills or a job seeker preparing for that crucial finance interview, we've got you covered. Let's unlock the secrets to mastering finance interview questions and securing your dream job in the financial sector.

What are Finance Interviews?

Finance interviews are a critical component of the hiring process in the financial industry. These interviews serve as a means for employers to evaluate candidates for various roles within the finance sector. Finance interviews encompass a range of positions, from investment banking and financial analysis to corporate finance, asset management, and more.

Types of Finance Interviews

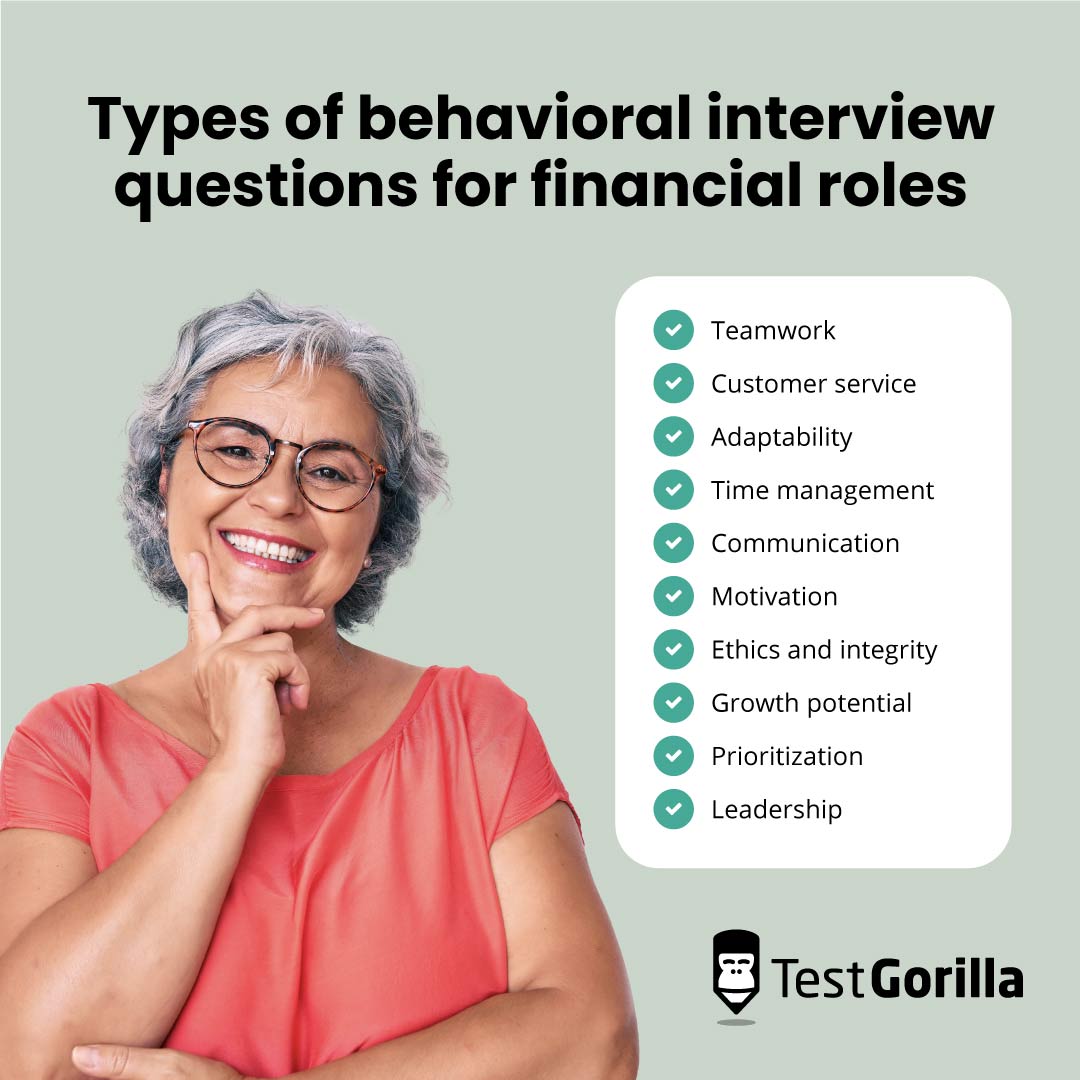

Finance interviews can take various forms, depending on the nature of the role and the organization's hiring practices. Some common types of finance interviews include:

- Traditional Interviews : These interviews involve asking candidates about their qualifications, experiences, and motivations for pursuing a career in finance.

- Behavioral Interviews : In behavioral interviews, candidates are asked to share past experiences and describe how they handled specific situations. This helps assess their soft skills and behavioral competencies.

- Technical Interviews : Technical interviews assess candidates' knowledge of financial concepts, quantitative skills, and ability to apply financial principles to real-world scenarios.

- Case Interviews : Case interviews require candidates to analyze complex business scenarios or financial problems, demonstrate problem-solving skills, and communicate their solutions effectively.

- Panel Interviews : Panel interviews involve multiple interviewers from different departments or teams within an organization, each evaluating the candidate from their respective perspectives.

Importance of Finance Interviews

Finance interviews play a pivotal role in the hiring process for several reasons, highlighting their significance within the finance industry:

1. Skill Assessment

Finance interviews provide a platform to assess candidates' technical skills and expertise. Whether it's evaluating their financial modeling proficiency, understanding of valuation methods, or knowledge of market trends, interviews allow employers to gauge the depth of a candidate's financial knowledge.

2. Cultural Fit

In addition to technical competence, finance interviews help organizations evaluate whether candidates align with their culture and values. Cultural fit is essential, as it influences an employee's ability to collaborate effectively and adapt to the organization's working environment.

3. Problem-Solving Abilities

Finance roles often require employees to navigate complex financial challenges and make data-driven decisions. Case interviews, in particular, assess candidates' problem-solving abilities, analytical thinking, and their capacity to apply financial concepts to real-world situations.

4. Soft Skills Assessment

Finance interviews go beyond technical skills and assess candidates' soft skills, such as communication, teamwork, leadership, adaptability, and stress management. These skills are critical for success in the finance industry, as finance professionals often work in dynamic and high-pressure environments.

5. Hiring Quality Talent

Finance interviews enable organizations to select candidates who not only possess the requisite technical skills but also exhibit the qualities and competencies needed for long-term success. Identifying and hiring top finance talent is essential for the growth and stability of financial institutions.

6. Risk Mitigation

Through thorough interview processes, organizations can mitigate the risk of hiring candidates who may lack the essential skills or values needed to excel in finance roles. This helps prevent costly hiring mistakes and turnover.

Finance interviews are a strategic and comprehensive approach to selecting the most qualified candidates for finance positions. These interviews serve as a bridge between candidates and employers, allowing organizations to identify individuals who not only meet the technical requirements but also align with the organization's culture and values. Ultimately, finance interviews are instrumental in building a talented and cohesive finance team that can drive an organization's financial success.

How to Prepare for Finance Interviews?

In this section, we'll delve deeper into the crucial steps you need to take as an HR professional to prepare for finance interviews effectively.

Understanding the Finance Industry

Understanding the finance industry is a fundamental requirement for conducting successful interviews. As an HR professional, you should:

- Stay Updated : Keep yourself informed about the latest trends, regulations, and developments in the finance industry. Subscribe to industry publications, attend webinars, and network with professionals to gain insights.

- Learn Finance Basics : While you don't need to become a finance expert, having a foundational knowledge of financial concepts, such as balance sheets , income statements, and financial ratios, will enable you to ask more informed questions.

- Industry Jargon : Familiarize yourself with common industry jargon and terminology to communicate effectively with candidates and assess their fluency in finance.

Identifying Key Competencies

Identifying the key competencies required for finance roles is essential to ensure you're evaluating candidates accurately. Key competencies typically include:

- Financial Analysis : Assess candidates' ability to analyze financial statements, identify trends, and make data-driven decisions.

- Risk Management : Evaluate their understanding of risk assessment and mitigation strategies, especially in roles like risk management and compliance.

- Communication Skills : Effective communication is crucial, as finance professionals often need to convey complex information to non-finance stakeholders.

- Adaptability : Assess their ability to adapt to changing financial markets and industry conditions, which is particularly relevant in roles like trading and investments.

Resume and Cover Letter Preparation

Before conducting interviews, thoroughly review the resumes and cover letters of candidates. Pay attention to:

- Relevant Experience : Identify relevant work experience, internships, or projects related to finance. Look for accomplishments that demonstrate their skills and achievements in the field.

- Education and Certifications : Verify their educational background and any finance-related certifications, such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant).

- Alignment with Job Requirements : Ensure that the candidate's qualifications align with the specific job requirements. This will help you tailor your interview questions more effectively.

Networking and Referrals

Networking and referrals can be powerful tools for finding top finance talent. Here's how to make the most of them:

- Leverage Your Network : Tap into your professional network and industry contacts to identify potential candidates. Attend finance industry events, webinars, and conferences to expand your network.

- Employee Referrals : Encourage your current employees to refer candidates they believe would be a good fit for finance roles. Employee referrals often lead to high-quality hires.

- Online Platforms : Utilize professional networking platforms like LinkedIn to connect with finance professionals and share job postings.

Finance Interview Types and Formats

Finance interviews come in various types and formats, each serving a unique purpose. Let's explore these interview types in greater detail:

Traditional Interviews

Traditional interviews are often the first step in assessing a candidate's fit for a finance role. During traditional interviews:

- Structured Questions : Prepare a set of structured questions to learn about the candidate's background, motivations, and career goals.

- Behavioral Assessment : Use behavioral questions to gauge their past experiences and how they align with the role's requirements. For example, you might ask about their experience managing financial projects or handling tight deadlines.

- Cultural Fit : Assess whether the candidate's values and work style align with your organization's culture.

Behavioral Interviews

Behavioral interviews are designed to uncover a candidate's past behavior in specific situations. These interviews aim to assess:

- Problem-Solving Skills : Through questions like "Tell me about a challenging financial problem you solved," you can evaluate their ability to navigate complex financial issues.

- Teamwork and Leadership : By asking about experiences working in teams or leading projects, you can gauge their interpersonal skills and leadership potential.

- Adaptability : Understanding how candidates handled unexpected challenges or changes can reveal their adaptability, a crucial trait in finance.

Technical Interviews

Technical interviews are vital for roles that require strong quantitative and analytical skills. In these interviews:

- Finance Concepts : Assess candidates' knowledge of core finance concepts, including valuation, financial modeling, and investment analysis.

- Excel Proficiency : Evaluate their proficiency in using Microsoft Excel for financial analysis and modeling. You might ask them to solve financial problems using Excel during the interview.

- Industry-Specific Knowledge : Tailor questions to assess their knowledge of industry-specific topics relevant to the role, such as derivatives in investment banking.

Case Interviews

Case interviews are common in finance, especially for consulting and advisory roles. These interviews simulate real-world problem-solving scenarios:

- Structured Approach : Candidates are expected to follow a structured approach to solve complex financial cases. Encourage them to outline their thought process and methodology.

- Analytical Thinking : Assess their ability to analyze data, make sound recommendations, and communicate their findings effectively.

- Market Knowledge : Evaluate their understanding of market dynamics and the implications of various financial decisions.

Panel Interviews

Panel interviews involve multiple interviewers simultaneously assessing a candidate. Here's how to conduct effective panel interviews:

- Role Definitions : Ensure that each panel member understands their role and the specific competencies they are responsible for evaluating.

- Coordination : Coordinate questions and avoid redundancy to provide a comprehensive assessment.

- Candidate Comfort : Create a welcoming atmosphere to help candidates feel at ease despite facing a panel.

By understanding the nuances of these interview types and formats, you'll be better equipped to tailor your approach to the specific finance role you're hiring for and assess candidates more effectively.

Finance Technical Skills Assessment

Assessing technical skills is a critical part of finance interviews. Let's explore various aspects of technical skills assessment in finance interviews:

Assessing Financial Analysis Skills

Financial analysis is at the core of many finance roles. When assessing financial analysis skills:

- Scenario-Based Questions : Present candidates with real or hypothetical financial scenarios and ask them to analyze the data, identify key insights, and make recommendations.

- Financial Statement Analysis : Evaluate their ability to interpret and analyze financial statements, including balance sheets, income statements, and cash flow statements.

- Ratios and Metrics : Assess their knowledge of financial ratios and performance metrics used to assess a company's financial health.

Excel Proficiency Tests

Proficiency in Microsoft Excel is often a critical requirement for finance roles:

- Excel Tasks : During interviews, provide candidates with Excel tasks that require them to perform financial calculations, create charts, or manipulate data.

- Shortcuts and Functions : Assess their knowledge of Excel shortcuts and functions commonly used in finance, such as VLOOKUP, PivotTables, and financial modeling functions.

- Error Handling : Evaluate their ability to troubleshoot errors and resolve issues within Excel spreadsheets.

Financial Modeling Evaluation

Financial modeling is essential in roles like investment banking and corporate finance:

- Case Studies : Present candidates with financial modeling case studies. Ask them to build or modify financial models to analyze investment opportunities or financial scenarios.

- Sensitivity Analysis : Test their ability to perform sensitivity analysis to assess the impact of changing variables on financial models.

- Communication Skills : In addition to technical skills, assess their ability to explain their modeling approach and findings clearly.

Valuation and Investment Analysis

Valuation and investment analysis are crucial skills in finance roles:

- Valuation Methods : Assess candidates' knowledge of various valuation methods, such as discounted cash flow (DCF), comparable company analysis (CCA), and precedent transactions analysis.

- Risk Assessment : Evaluate their ability to assess and quantify risks associated with investment opportunities.

- Investment Recommendations : Ask candidates to provide investment recommendations based on their analysis, considering factors like risk and return.

By focusing on these technical skills assessments, you can identify candidates who possess the quantitative and analytical abilities required for finance positions, ultimately making more informed hiring decisions.

Financial Analysis and Modeling Interview Questions

1. can you explain the concept of financial modeling, and why is it important in finance.

How to Answer: Start by defining financial modeling and its significance in decision-making processes. Discuss how it helps in forecasting, budgeting, and evaluating investment opportunities. Provide examples of models you've worked on and their impact.

Sample Answer: Financial modeling is the process of creating a representation of a company's financial performance and future projections using mathematical and statistical techniques. It's crucial in finance because it aids in making informed decisions, assessing risk, and planning for the future. For instance, I recently developed a discounted cash flow (DCF) model to analyze the potential profitability of an investment project, helping our team decide whether to proceed.

What to Look For: Look for a clear understanding of financial modeling's purpose and practical experience in creating and using financial models.

2. How do you perform a valuation of a company?

How to Answer: Explain the various valuation methods such as DCF, comparable company analysis (CCA), and precedent transactions, and discuss when each method is appropriate. Emphasize the importance of using multiple methods for a comprehensive valuation.

Sample Answer: Valuing a company involves assessing its worth, and there are several methods for doing so. The Discounted Cash Flow (DCF) method estimates a company's value based on its future cash flows. Comparable Company Analysis (CCA) compares the target company to similar public companies. Precedent Transactions looks at past M&A deals in the industry. It's essential to use a combination of these methods to arrive at a more accurate valuation.

What to Look For: Evaluate the candidate's knowledge of valuation techniques, their ability to choose the right method for a given situation, and their understanding of the limitations and challenges associated with valuation.

Financial Statements and Analysis Interview Questions

3. can you explain the key components of a company's financial statements.

How to Answer: Describe the main financial statements (Income Statement, Balance Sheet, and Cash Flow Statement) and their key components. Discuss how these statements are interconnected and provide insights into a company's financial health.

Sample Answer: A company's financial statements consist of the Income Statement, which shows revenues and expenses, the Balance Sheet, which presents assets and liabilities, and the Cash Flow Statement, which tracks cash inflows and outflows. These statements provide a comprehensive view of a company's financial performance, position, and liquidity.

What to Look For: Seek a clear and concise explanation of financial statements and their significance in financial analysis.

4. How do you analyze a company's liquidity using financial ratios?

How to Answer: Explain the concept of liquidity and discuss key liquidity ratios like the current ratio and quick ratio. Demonstrate how to calculate these ratios and interpret their results to assess a company's short-term financial stability.

Sample Answer: Liquidity refers to a company's ability to meet its short-term obligations. The current ratio (current assets divided by current liabilities) and the quick ratio (current assets excluding inventory divided by current liabilities) are common liquidity ratios. If a company has a current ratio above 1 and a quick ratio above 0.5, it indicates good liquidity.

What to Look For: Look for a candidate's ability to calculate and interpret financial ratios accurately to evaluate a company's financial health.

Investment and Risk Management Interview Questions

5. how do you assess the risk associated with an investment.

How to Answer: Explain the concept of risk assessment in investment, mentioning factors like market risk, credit risk, and operational risk. Discuss how diversification and risk-return trade-offs play a role in making investment decisions.

Sample Answer: Risk assessment involves analyzing various factors that could impact an investment's returns, such as market volatility, creditworthiness of issuers, and operational stability. Diversification, by spreading investments across different asset classes, can help mitigate risk while optimizing the risk-return trade-off.

What to Look For: Evaluate the candidate's understanding of investment risk, their ability to identify and quantify different types of risks, and their strategies for managing and mitigating risk.

6. How do you determine the appropriate cost of capital for a project?

How to Answer: Discuss the components of the cost of capital, including the cost of debt and the cost of equity. Explain the Weighted Average Cost of Capital (WACC) and how it is calculated. Provide insights into the factors that influence the cost of capital.

Sample Answer: The cost of capital for a project is determined by considering the cost of debt and the cost of equity. The WACC is calculated by weighting these costs based on the company's capital structure. Factors such as the risk-free rate, market risk premium, and beta play a role in determining the cost of equity, while the cost of debt is influenced by interest rates and credit risk.

What to Look For: Look for a candidate's ability to explain the cost of capital concept and calculate it accurately, considering both debt and equity components.

Behavioral and Situational Questions Interview Questions

7. can you describe a challenging financial project you've worked on and how you overcame obstacles.

How to Answer: Share a specific example of a challenging financial project, outlining the obstacles you encountered and the steps you took to address them. Emphasize problem-solving, teamwork, and results achieved.

Sample Answer: In my previous role, we faced a complex financial restructuring project where the company was burdened with high debt. We had to negotiate with creditors, optimize the capital structure, and improve cash flow. I led a cross-functional team, collaborated closely with legal and finance experts, and successfully reduced debt levels, saving the company millions in interest payments.

What to Look For: Assess the candidate's ability to handle challenging financial situations, their problem-solving skills, and their effectiveness in teamwork and achieving positive outcomes.

8. How do you stay updated with financial market trends and industry developments?

How to Answer: Explain your strategies for staying informed about financial markets and industry trends, such as reading financial news, following market reports, attending conferences, or participating in professional associations.

Sample Answer: I stay updated by subscribing to financial news outlets, reading research reports, and actively participating in industry webinars and conferences. Additionally, I'm a member of a professional finance association, which provides networking opportunities and access to the latest research and insights.

What to Look For: Look for candidates who demonstrate a proactive approach to staying informed about finance-related developments and show a genuine interest in the industry.

9. Can you provide an example of a time when you had to make a difficult financial decision under pressure?

How to Answer: Share a specific scenario where you faced a high-pressure financial decision. Describe the context, the decision you had to make, and the steps you took to handle the situation effectively.

Sample Answer: During a market downturn, our portfolio faced significant losses, and we had to decide whether to sell certain assets or hold onto them. I analyzed the market conditions, consulted with colleagues, and ultimately recommended a strategic reallocation of assets, which minimized losses and positioned us for a strong recovery when the market improved.

What to Look For: Assess the candidate's ability to make sound financial decisions under pressure, their analytical thinking, and their ability to communicate their decisions effectively.

10. How do you handle conflicts or disagreements within your team or with colleagues in a professional setting?

How to Answer: Describe your approach to resolving conflicts or disagreements, emphasizing your ability to maintain professionalism and collaboration. Provide an example of a conflict situation and how you successfully resolved it.

Sample Answer: In a previous role, I encountered a disagreement with a colleague over the valuation of a potential investment. Instead of escalating the situation, I initiated a one-on-one discussion, actively listened to their perspective, and presented my reasoning with supporting data. We were able to find common ground and reach a consensus that benefited the team's decision-making process.

What to Look For: Look for candidates who can handle conflicts constructively, demonstrate effective communication and conflict resolution skills, and prioritize collaboration and teamwork.

Technical Finance Questions Interview Questions

11. what is the capital asset pricing model (capm), and how is it used in finance.

How to Answer: Explain the CAPM theory, its components (risk-free rate, market risk premium, and beta), and how it's used to determine the expected return on an investment. Discuss its applications in portfolio management and investment decision-making.

Sample Answer: The Capital Asset Pricing Model (CAPM) is a financial theory that helps estimate the expected return on an investment. It incorporates the risk-free rate, market risk premium, and the asset's beta (systematic risk). By applying CAPM, we can assess whether an investment offers an adequate return given its risk level, making it valuable for portfolio management and investment evaluation.

What to Look For: Assess the candidate's understanding of CAPM, its components, and its practical applications in finance.

12. How do changes in interest rates impact the valuation of fixed-income securities?

How to Answer: Describe the relationship between interest rates and the valuation of fixed-income securities, including bonds. Explain how changes in interest rates affect bond prices and yields.

Sample Answer: When interest rates rise, the value of existing fixed-income securities, especially bonds, decreases. This is because newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. Conversely, when interest rates fall, bond prices tend to rise as the fixed interest payments become more appealing in a lower-yield environment.

What to Look For: Evaluate the candidate's knowledge of the impact of interest rate changes on fixed-income securities and their ability to explain the concept clearly.

13. What are the key factors to consider when conducting due diligence for a merger or acquisition?

How to Answer: Explain the due diligence process for M&A transactions and discuss the key factors that should be thoroughly investigated, including financial statements, legal contracts, operational performance, and potential risks.

Sample Answer: Due diligence in M&A involves a comprehensive examination of the target company's financial statements, contracts, customer relationships, and operational performance. It's crucial to assess potential risks, legal compliance, and synergies to ensure a successful acquisition. Additionally, understanding cultural fit and integration challenges is vital.

What to Look For: Look for candidates who demonstrate a clear understanding of the due diligence process in M&A and can identify the critical factors for evaluation.

14. How do you assess the creditworthiness of a potential borrower or client in a lending or credit analysis role?

How to Answer: Describe the steps involved in assessing the creditworthiness of a borrower or client, including evaluating financial statements, credit history, and risk factors. Explain how you determine the borrower's ability to repay debt.

Sample Answer: Assessing creditworthiness involves analyzing financial statements, credit history, and risk factors. I review the borrower's income statement, balance sheet, and cash flow statement to evaluate their financial stability and ability to service debt. Additionally, I examine their credit history, collateral, and industry-specific risks to make an informed lending decision.

What to Look For: Evaluate the candidate's knowledge of credit analysis, their ability to assess risk factors, and their decision-making process in lending roles.

15. How do you prioritize and manage multiple financial projects or tasks with competing deadlines?

How to Answer: Explain your approach to prioritizing and managing multiple financial projects or tasks efficiently. Discuss time management strategies, delegation, and the use of tools or systems to stay organized.

Sample Answer: To manage multiple financial projects effectively, I start by assessing each project's urgency and importance. I create a prioritized task list, set clear deadlines, and allocate resources appropriately. Regularly communicating progress and potential challenges with the team helps ensure everyone is aligned and focused on meeting our goals.

What to Look For: Look for candidates who can demonstrate strong organizational and time management skills, as well as the ability to handle multiple tasks and deadlines in a finance role.

These finance interview questions cover a wide range of topics, allowing interviewers to assess candidates' technical knowledge, problem-solving abilities, and interpersonal skills essential for success in finance-related roles.

Behavioral Assessment

Assessing behavioral aspects is crucial in finance interviews to ensure that candidates possess the soft skills and qualities necessary for success in the role. Let's explore the key elements of behavioral assessment:

Evaluating Soft Skills

Soft skills are interpersonal and communication skills that are highly valued in finance roles:

- Communication : Assess how well candidates can articulate their thoughts and ideas clearly, both in written and verbal communication.

- Adaptability : Evaluate their ability to adapt to changing situations, as finance roles often require quick responses to market fluctuations.

- Time Management : Assess their time management skills, which are essential for meeting deadlines in the finance industry.

Teamwork and Leadership

Finance professionals often work in collaborative environments. Assessing teamwork and leadership skills is crucial:

- Teamwork : Ask candidates to provide examples of their experiences working effectively in teams. Evaluate their ability to contribute to a team's success.

- Leadership : For leadership roles or positions with leadership potential, assess candidates' ability to lead and motivate teams, make strategic decisions, and drive projects forward.

- Conflict Resolution : Evaluate their ability to handle conflicts and disagreements within a team in a constructive manner.

Problem-Solving and Decision-Making

Finance professionals regularly encounter complex problems that require effective problem-solving and decision-making skills:

- Problem-Solving : Present candidates with scenarios or case studies that require creative and analytical problem-solving. Assess their approach to identifying and addressing financial challenges.

- Decision-Making : Evaluate their ability to make sound decisions under pressure, considering the potential impact on financial outcomes.

- Critical Thinking : Assess their critical thinking skills by asking them to analyze financial data and draw meaningful conclusions.

Adaptability and Stress Management

The finance industry is known for its fast-paced and high-stress environment. Evaluate candidates' adaptability and stress management abilities:

- Adaptability : Ask about their experiences in adapting to changes in financial markets, regulations, or job roles. Look for their ability to learn and adjust quickly.

- Stress Management : Inquire about how they handle stressful situations and tight deadlines. Assess their strategies for staying calm and focused under pressure.

- Resilience : Determine their level of resilience by discussing how they have bounced back from setbacks or challenging situations in their careers.

Finance Case Interview Preparation

Case interviews are a common assessment method in finance interviews, particularly for consulting and advisory roles. Let's delve into the specifics of preparing for case interviews:

Understanding the Case Interview Format

Case interviews typically follow a structured format:

- Scenario Introduction : Candidates are presented with a real or hypothetical business scenario, often related to finance or strategy.

- Problem Statement : They are given a specific problem or challenge to solve within the context of the scenario.

- Data and Information : Candidates receive data, information, and relevant documents to help them analyze the situation.

- Recommendations : They are expected to analyze the data, develop recommendations, and communicate their findings and solutions to the interviewer.

Frameworks for Problem Solving

To succeed in case interviews, candidates often use problem-solving frameworks. Common frameworks include:

- SWOT Analysis : Assessing strengths, weaknesses, opportunities, and threats relevant to the case.

- PESTEL Analysis : Analyzing political, economic, social, technological, environmental, and legal factors.

- Porter's Five Forces : Evaluating the industry's competitive forces, including suppliers, buyers, competitors, substitutes, and barriers to entry.

- 3 C's Framework : Examining the company, customer, and competition to understand market dynamics.

Practice Cases and Mock Interviews

Preparation is key to performing well in case interviews. Candidates should:

- Practice Cases : Encourage candidates to practice solving case interview questions independently. They can find case books, online resources, and sample cases to work on.

- Mock Interviews : Offer mock interviews to simulate the case interview experience. Provide feedback on their problem-solving approach, communication, and presentation skills.

- Time Management : Emphasize the importance of managing time during case interviews, as candidates typically have a limited timeframe to solve the case.

Tips for Handling Case Interviews

To excel in case interviews, candidates should keep the following tips in mind:

- Structure Your Approach : Emphasize the need for a structured approach to problem-solving. Candidates should outline their methodology before diving into the analysis.

- Ask Clarifying Questions : Encourage candidates to seek clarification if any part of the case is unclear. Effective communication with the interviewer is essential.

- Think Out Loud : Advise candidates to verbalize their thought process as they work through the case. This helps interviewers understand their analytical approach.

- Stay Calm and Confident : Remind candidates to stay composed and confident during the interview, even if they encounter challenging scenarios.

By providing candidates with the knowledge and skills to excel in case interviews, you can identify individuals who possess the problem-solving abilities required for finance roles in your organization.