› Blog › Business Appraisal & Valuation: The Essential Guide

Business Appraisal & Valuation: The Essential Guide

There are various points through a business’s lifetime when business ownership must know the company’s actual economic value. Ideally, a small business owner can track and monitor the business’s value over time.

However, there’s no tried and true single method to determine a company’s value. You cannot calculate it in your accounting software or quickly determine it. A company’s value is also something of a moving target. It can change as market conditions shift or a company’s assets and liabilities shift.

That’s why most small businesses must rely on a business valuation from a third-party source. The most reliable way to value a company is with a certified appraisal.

But there are many considerations when ordering an appraisal for your company, not the least of which is the time and money costs. This guide covers what you must know about business appraisals to help you when you must get your company valued.

Specifically, we’ll answer these questions and more:

Join our Newsletter for great tips and updates.

We will help you grow your small business., what is a business appraisal.

A business appraisal is a valuation method to determine your business’s worth. The “gold standard” of a business valuation is the certified appraisal, which we will focus on in this article.

With a certified appraisal, a professional appraiser uses various methods to determine the true value of a company’s assets to determine its overall value. Small business owners need to have their company appraised periodically for multiple reasons, such as selling the company, buying out a partner, settling a lawsuit, or applying for certain small business loans.

Certified appraisers dig beneath the financial data when determining your company’s value. They typically use three valuation methods to estimate a company’s worth.

The Asset Method

The asset method, also called the cost valuation method, involves calculating the total value of your assets as listed on the balance sheet. Then the appraiser subtracts the value of your total liabilities from the balance sheet to determine your company’s total present equity.

When appraisers use the asset method, they usually use a book value approach or adjusted net asset approach. With a book approach, the appraiser uses the book value on the balance sheet. With the adjusted net asset approach, appraisers determine the fair market value of your assets.

The Income Method

The income approach is straightforward. Appraisers conduct a cost-benefit analysis to determine the overall value of the company. The benefits include profits, increased value, etc., while the costs include required operating capital, ownership risk, and liabilities. This is sometimes called the income capitalization technique.

The Market Value Method

The market approach is the most subjective of the three and is similar to how mortgage companies perform a home appraisal. The appraiser determines the value of the business based on comparable companies in the same industry and market . This includes looking at the sales price of similar businesses, especially those that are a similar size.

What’s the difference between a Business Valuation and an Appraisal?

The terms “business appraisal” and “business valuation” are largely synonymous and used interchangeably. However, some businesses might create a distinction between the two.

Business appraisal is more commonly associated with the total value of a business’s tangible assets. Business valuation often refers to a company’s total value, including intangibles like intellectual property, market share, and brand recognition.

Because of this, there’s been a recent trend to move away from business appraisal terminology and use business valuation instead. However, the most reliable form of business valuation remains certified appraisal.

Who performs a Business Appraisal?

Various financial professionals, such as certified public accountants (CPAs), can perform an uncertified valuation, but the most qualified business appraisers are certified. It may seem obvious, but only a certified business appraiser can conduct a certified appraisal.

Certified business appraisers follow industry-wide business valuation standards. They must pass certification criteria such as providing professional references, submitting a valuation for peer review, completing a training program, and passing an exam.

Several organizations issue the professional designation. Credentials will include at least one of these certifications:

- Accredited Senior Appraiser (ASA).

- Certified Valuation Analyst (CVA).

- Certified Business Appraiser (CBA).

- Accredited in Business Valuation (ABV).

What are the advantages of Business Appraisals?

Business appraisals give you a more accurate understanding of the value of your assets from an objective, third-party source. It’s an excellent way to look at the actual value of your business.

Understanding your company’s value, and having documentation to back it up, is essential for the sales process. Whether trying to sell your ownership stake or buy out a partner, having an appraisal lets you set a fair price.

The valuation also becomes useful during mergers and acquisitions. If a larger company approaches you about merging with your business, the appraisal lets you set the parameters of how that process will work. If you’re trying to acquire another company, getting it appraised helps you avoid overpaying.

Investors tend to check business valuation reports, and having your business appraised could help attract investors. This is especially true if you can demonstrate an increase in value over time.

What are the disadvantages of Business Appraisals?

Business valuations can be costly and time-consuming, especially when getting a certified appraisal. Your business might spend several thousand dollars, and it could take several days or weeks to get the report.

Most appraisals can’t predict a company’s ability to stay in business for a long time. While the appraisal gives you an idea of how much your company is worth now, that assumption could change.

Another drawback is that it could be challenging to find comparable businesses to your own. Appraisers might not be able to determine a market value for your company without that data.

The best business valuations use a combination of multiple approaches to determine a business’s worth. Relying on only one appraisal method could prevent you from getting your company’s true value.

Pros & Cons

- Provides an objective look at the value of your business assets.

- Looks at the overall true value of your business.

- Helps facilitate the sales process when selling a company or buying out a partner.

- Provides business owners with valuable information for mergers and acquisitions.

- Can help attract new investors when trying to grow the business.

- Costly & time-consuming.

- Can’t account for a company staying in business long-term.

- Difficult to find comparable companies.

- Relying on only one appraisal method won’t give an accurate business valuation .

Frequently Asked Questions

Here are the most common questions about business appraisals.

Why do businesses need Appraisals?

You might be wondering, “Why is a business valuation important?” There are several reasons why a small business owner might need to request a business valuation.

Selling the Business : One of the most common reasons business ownership needs an appraisal is when selling the business. You want to ensure you get or pay a fair value for the company.

This could include selling a business outright or a partner or partners buying out another partner. Sometimes, an uncertified business valuation can suffice in lieu of a certified appraisal.

But the prospective buyer might prefer a certified business valuation. Any buy-sell agreements should include the valuation method and the funding mechanism for the sale.

Court Order : Businesses that are the subject of a lawsuit or dealing with other legal issues are sometimes required to get a certified business valuation by court order.

Tax Purposes : Suppose a business owner wants to “gift” their ownership stake to a family member or as a bequest in their will. The IRS requires a certified business appraisal to determine the taxes owed on the transfer or bequest.

Business Loans : Some lenders will require a business appraisal when underwriting a loan request. The requirement is usually for larger business loans from traditional lenders .

Pre-IPO Valuation : Companies considering going public with an initial public offering (IPO) must conduct a valuation. Investment bankers and underwriters typically conduct these appraisals. Whether preparing for an IPO or selling a company privately, you should obtain a business valuation before putting the company on the open market.

How much do Business Appraisals cost?

The business valuation cost can vary significantly depending on your company’s size, industry, and appraisal type. Uncertified business valuations can start at $500 for small sole proprietorships .

However, most business valuations are much more expensive. Certified appraisals start at $5,000 and could go up to $20,000.

What documents are required for a Business Appraisal?

Small business owners must provide multiple financial documents when conducting a business valuation. Examples of documents you must provide include the following:

- Financial statements for the previous five years.

- Income statements.

- Balance sheets.

- Cash flow statements.

- Intellectual property (IP) documentation such as trademark licenses, patents, or copyrights .

- Documents on other intangible assets.

- Organization charts.

- Lists of products or services the company provides.

- Customer lists.

- Customer concentration.

- Supplier lists.

- Competitor lists.

- Financial forecasting documents.

- Any relevant contracts or service agreements.

- Business leases or deeds for commercial real estate.

How long do Business Appraisals take?

The appraisal process requires a fair amount of research and due diligence. It can take up to 20-40 hours of the expert’s time to conduct the appraisal.

Regarding turnaround, small business owners can typically expect the appraisal results in 5-10 business days. You should follow up with the appraiser if you haven’t received the report within two weeks.

When is an Appraisal required for Small Business Loans?

Business valuation requirements for small business loans depend on the lender and the type of loan. The US Small Business Administration (SBA) requires approved lenders to obtain an appraisal (along with other extensive documentation) for most SBA loan types .

However, some SBA loans might not require it. Always check with your SBA-approved lender if you are unsure about the documentation requirements.

Many traditional lenders (commercial banks and credit unions) also require a business valuation, especially for larger, long-term loans. For example, commercial lenders typically order an appraisal for commercial real estate loans .

Fortunately, many alternative lenders provide various working capital loans with much more lenient documentation requirements. Alternative lenders are non-bank, online funders using fintech tools to quickly analyze your business’s financial health.

The flexible underwriting requirements also result in fast approval and funding times. Some examples of small business loans you could obtain from an alternative lender or marketplace without an appraisal include:

- Business term loans .

- Business lines of credit .

- Equipment financing .

- Bad credit business loans .

- Merchant cash advances .

- Invoice factoring .

- ERTC advances .

Business Appraisal & Valuation – Final Thoughts

As a small business owner, it would be best to have a working knowledge of your company’s value. That information proves invaluable when trying to sell your business, buy out a partner, or acquire or merge with another business.

The most reliable form of business valuation is the certified appraisal. With this method, appraisers look at your company’s worth from multiple approaches, including its total assets, current equity, market value, and income. The certified appraiser may come up with more than one value, but they will try to synthesize that data into a single estimated value.

When ordering a business valuation, look for accredited appraisers. You want to ensure that the appraisal is as accurate as possible.

Contact us if you have more questions on business appraisals or want to apply for a small business loan . Our loan experts can answer any questions you might have.

Share this post:

- Categories: Business Tips

United Capital Source

Lenders Loss Payable vs Loss Payee Explained: The Essential Guide

Best Financial Affiliate Programs: The Essential Guide

Banks Tightening Credit Criteria for Small Business: Exploring Your Options

What Is An APR?: The Comprehensive Guide

Net Working Capital Formula: The Comprehensive Guide

Purchasing Existing Businesses: The Essential Guide

Most recent articles, ready to grow your business see how much you qualify for:.

Current monthly sales deposit average to your business bank account?

I don't own a business & want to learn about your loan programs $ 0 - $ 5,000 $ 5,000 - $ 10,000 $ 10,000 - $ 25,000 $ 25,000 - $ 50,000 $ 50,000 - $ 100,000 $ 100,000 +

How much Working Capital would you like for your business?

$ 5,000 - $ 10,000 $ 10,000 - $ 50,000 $ 50,000 - $ 100,000 $ 100,000 +

State Alabama Alaska Alberta Arizona Arkansas British Columbia California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Manitoba Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Brunswick New Hampshire New Jersey New Mexico New York Newfoundland and Labrador North Carolina North Dakota Northwest Territories Nova Scotia Nunavut Ohio Oklahoma Ontario Oregon Pennsylvania Prince Edward Island Quebec Rhode Island Saskatchewan South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming

Need Instant Help?

Quick links.

- To be eligible, it’s necessary to have a business bank account with a well-established U.S. bank such as Chase, Wells Fargo, Bank of America, Citibank, or other major banks. Unfortunately, online-based bank accounts like PayPal, Chime, CashApp, etc., are not permitted.

- When describing your current average monthly sales deposits to your business bank account, please provide accurate information. Our approval process is based on your current business performance, and it’s essential to provide accurate details about your current sales in the first question on the application form. We cannot approve applications based on projected revenues after receiving funding.

Take a minute, Get a FREE Consultation

- No Cost, No Obligation Quote

- Multiple products offered

- A few minutes can shape the next few years

$1.2+ Billion Matched to US Businesses

- Search for a Business

- Established Businesses

- Asset Sales

- How to Buy a Business

- BizBuySell Edge

- Search Franchises For Sale

- Low Cost Franchises

- Restaurant and Food Franchises

- Business Opportunities

- Retail Franchises

- Sell a Business on BizBuySell

- Sell Multiple Businesses

- How to Sell a Business

- Value a Business

- Find a Broker

- Learning Center

- Market Insights

- Business for Sale Blog

- For Brokers

- My Saved Listings

- My Saved Searches

- My Listings

- Guide to Selling

- Add a New Listing

- Franchise Recommendations

- Edge Profile

- Recommendations

- Location Insights

- Buyer Video Series

- Guide to Buying

- My Valuation Reports

- Get Valuation Report

- Email Preferences

- My Billing Info

- Seller Learning Center

- Step 2: Set an Asking Price

What is a Business Appraisal and When a Small Business Owner Might Need One

A business appraisal is a process involving a professional appraiser assessing a business's fair market value. It is a widely recognized method used to determine the worth of a business for various reasons, including mergers and acquisitions, buy-sell agreements, selling a business, lender financing, and business investments. While larger corporations typically undergo regular business appraisals, small business owners may also significantly benefit from obtaining an independent business appraisal, as it gives them an accurate understanding of their business's value.

This article aims to provide an overview of the fundamentals of business appraisals. We will explore why small business owners may require a business appraisal, the various methods used to calculate a business's value, and the benefits of obtaining an independent appraisal.

Additionally, we will discuss the cost of hiring a certified appraiser and provide guidance on selecting the right appraiser to assess your business's worth thoroughly. By the end of this article, you will better understand the importance of business appraisals and how they can help small business owners make more informed decisions.

Business Appraisal Fundamentals

When conducting a business appraisal, professional appraisers use three primary approaches to evaluate a business's value: the market approach, the income approach, and the asset approach. The market approach uses market data to compare the subject business to similar businesses sold in the past. This method considers various factors, such as the subject business's size, performance, industry, and trends, to determine its value.

The income approach uses the current value of expected future cash flows the subject business generates as the basis for its valuation. This method focuses on the business's financial performance and considers the risks associated with its future cash flow projections to determine its worth.

On the other hand, the asset approach uses the sum of all tangible and intangible assets owned by the subject business to determine its value. This approach assesses the business's balance sheet to arrive at its value.

Each valuation method is suitable for different types of transactions. For instance, when valuing a business for sale , an appraiser may use a combination of all three approaches to ensure a more comprehensive and accurate assessment of the business's worth. By understanding these different methods and when to apply them, business owners can make informed decisions about their value and how to maximize it.

Do You Need a Business Appraisal?

Small business owners can benefit from obtaining an independent business appraisal in several situations, including buy-sell agreements, business mergers, selling a business, lender financing, and business investments.

In the case of buy-sell agreements, an independent appraisal is used to determine the fair market value of a company to buy out some portion of an owner’s stake in the business. Such an agreement outlines how ownership will be transferred in specific scenarios, such as death or disability, and having a clear and accurate assessment of the company's worth is crucial.

If two companies are considering a merger, an independent appraisal can be used to determine both companies' fair market value for an equitable exchange ratio. This assessment ensures that both parties receive a fair share of the merged entity's value.

When selling a business, an independent appraisal provides an objective analysis of the company's fair market value. This valuation helps the owner price the business appropriately to ensure a successful sale.

For lender financing, an independent appraisal can be used to determine the collateral value of the company so the lender can adequately determine the amount of funding. This assessment helps the lender minimize the risk of taking a loss if the company cannot repay them.

Lastly, business investments involve investors investing capital in a company in exchange for equity or other types of compensation. Therefore, an independent appraisal of the company's fair market value can provide investors with an informed assessment of its worth, enabling them to make sound investment decisions.

Certified Business Appraisals

In some cases, such as when dealing with taxes or litigation, it may be necessary to get a certified appraisal from a qualified certified public accountant accredited in business valuation (ABV). A certified appraisal is a valuation based on accepted standards and methods that have been reviewed and approved by a third party. In addition, a certified appraiser must have experience in business valuation and adhere to ethical standards set forth by professional organizations such as the American Society of Appraisers (ASA) .

When is it recommended to get a certified appraisal? Generally speaking, getting a certified appraisal when dealing with taxes or litigation is recommended, since these require higher levels of accuracy and expertise than other types of transactions.

How to find a certified appraiser? You can find qualified appraisers through professional organizations such as ASA or online directories of accredited appraisers.

Cost of Hiring a Business Appraiser

The cost of hiring a business appraiser varies depending on several factors, including the size and complexity of the company, the type of transaction, and the experience and reputation of the appraiser. Larger and more complex businesses typically require a more comprehensive valuation process, which can result in higher appraisal fees.

One can imagine the level of difficulty involved in valuing a business with multiple business units or product lines that operates across several geographies relative to a small, one-location, one-product business.

The type of transaction is also a factor in the cost of hiring an appraiser. Different transactions have unique valuation requirements, and the appraiser's scope of work will depend on the transaction type. For example, the valuation requirements for a merger or acquisition will differ from those of a buy-sell agreement , which will impact the appraiser's fees.

Finally, the experience level of the appraiser can also meaningfully impact the cost. Experienced appraisers with a proven track record of delivering high-quality work will typically charge higher fees for their services. On average, you can expect to pay anywhere from $3,000-$35,000 for a valuation report from an experienced appraiser.

However, remember that the fees for a comprehensive valuation can go much higher, particularly for large and complex businesses or unique transaction types. Ultimately, the cost of hiring an appraiser should be viewed as an investment in obtaining a fair and accurate assessment of a business's worth.

Benefit of Independent Valuation

As a small business owner, it's crucial to know the actual value of your business, especially when preparing your business for sale and engaging in critical transactions. A business appraisal is an independent valuation of your business based on accepted standards and methods. This provides an accurate value of your business that can be used for various types of transactions.

Ultimately, an independent business appraisal is essential for any small business owner who wants to make informed business decisions. Feel free to reach out to a certified appraiser to gain a better understanding of your business's value so you're prepared for any important transaction.

Business Plan Evaluation

What’s a rich text element, static and dynamic content editing.

para link here

What is Business Plan Evaluation?

A business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business. The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team.

The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives. The evaluation process also helps identify areas where improvements can be made to enhance the chances of success. This process is particularly important for solopreneurs who are solely responsible for the success or failure of their business.

Importance of Business Plan Evaluation

The evaluation of a business plan is an essential step in the business planning process. It provides an opportunity for the entrepreneur to critically examine their business idea and identify potential challenges and opportunities . The evaluation process also provides valuable insights that can help improve the business plan and increase the chances of success.

For investors, a business plan evaluation is a crucial tool for risk assessment. It allows them to assess the viability of the business idea, the competence of the management team, and the potential for return on investment. This information is vital in making investment decisions.

For Solopreneurs

For solopreneurs, the evaluation of a business plan is particularly important. As they are solely responsible for the success or failure of their business, it is crucial that they thoroughly evaluate their business plan to ensure that it is feasible, viable, and has the potential to be profitable.

The evaluation process can help solopreneurs identify potential challenges and opportunities, assess the feasibility of their business idea, and determine the likelihood of achieving their business objectives. This information can be invaluable in helping them make informed decisions about their business.

For Investors

Investors use the evaluation process to determine whether or not to invest in a business. They look at various aspects of the business plan, including the business model, market analysis, financial projections, and management team, to assess the potential for success. If the evaluation reveals that the business plan is solid and has a high potential for success, the investor may decide to invest in the business.

Components of a Business Plan Evaluation

A business plan evaluation involves the analysis of various components of the business plan. These components include the executive summary, business description, market analysis, organization and management, product line or service, marketing and sales, and financial projections.

Each of these components plays a crucial role in the overall success of the business, and therefore, they must be thoroughly evaluated to ensure that they are realistic, achievable, and aligned with the business objectives.

Executive Summary

The executive summary is the first section of a business plan and provides a brief overview of the business. It includes information about the business concept, the business model, the target market, the competitive advantage, and the financial projections. The executive summary is often the first thing that investors read, and therefore, it must be compelling and persuasive.

In the evaluation process, the executive summary is assessed to determine whether it clearly and concisely presents the business idea and the plan for achieving the business objectives. The evaluator also assesses whether the executive summary is compelling and persuasive enough to attract the attention of investors.

Business Description

The business description provides detailed information about the business. It includes information about the nature of the business, the industry, the business model, the products or services, and the target market. The business description also provides information about the business's competitive advantage and how it plans to achieve its objectives.

In the evaluation process, the business description is assessed to determine whether it provides a clear and comprehensive description of the business. The evaluator also assesses whether the business description clearly outlines the business's competitive advantage and how it plans to achieve its objectives.

Methods of Business Plan Evaluation

There are several methods that can be used to evaluate a business plan. These methods include the SWOT analysis, the feasibility analysis, the competitive analysis, and the financial analysis. Each of these methods provides a different perspective on the business plan and can provide valuable insights into the potential for success.

It's important to note that no single method can provide a complete evaluation of a business plan. Therefore, it's recommended to use a combination of these methods to get a comprehensive understanding of the business plan.

SWOT Analysis

SWOT analysis is a strategic planning tool that is used to identify the strengths, weaknesses, opportunities, and threats related to a business. This method involves examining the internal and external factors that can affect the success of the business.

In the evaluation process, a SWOT analysis can provide valuable insights into the potential for success of the business. It can help identify the strengths and weaknesses of the business plan, as well as the opportunities and threats in the market.

Feasibility Analysis

A feasibility analysis is a process that is used to determine whether a business idea is viable. This method involves assessing the practicality of the business idea and whether it can be successfully implemented.

In the evaluation process, a feasibility analysis can provide valuable insights into the feasibility of the business plan. It can help determine whether the business idea is practical and whether it can be successfully implemented.

In conclusion, a business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business.

The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team. The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives.

Whenever you're ready, there are 4 ways I can help you:

1. The Creator MBA : Join 4,000+ entrepreneurs in my flagship course. The Creator MBA teaches you exactly how to build a lean, focused, and profitable Internet business. Come inside and get 5 years of online business expertise, proven methods, and actionable strategies across 111 in-depth lessons.

2. The LinkedIn Operating System : Join 22,500 students and 50 LinkedIn Top Voices inside of The LinkedIn Operating System. This comprehensive course will teach you the system I used to grow from 2K to 550K+ followers, be named a Top Voice and earn $7.5M+ in income.

3. The Content Operating System : Join 10,000 students in my multi-step content creation system. Learn to create a high-quality newsletter and 6-12 pieces of high-performance social media content each week.

4. Promote yourself to 215,000+ subscribers by sponsoring my newsletter.

Get the newsletter everyone is talking about

Drop your email to get weekly small business advice

- SMALL BUSINESS TOOLS

- LIFE AT GOSITE

- Starting Your Business

- Growing Your Business

- Running Your Business

- Marketing Tips

- Success Stories

- Contact Hub

- Contracting

- Auto Services

- Beauty & Spa

- Pest Control

- Pool Cleaning

Business Appraisals: Everything You Need to Know Before Getting One

A business appraisal is the process of valuing your business. If you’re considering hiring an appraiser, here’s what you need to know.

To you, your business is invaluable.

However, there are many different reasons why a small business owner may need to appraise their business. Whether you’re bringing on a business partner , applying for a loan, or selling, knowing the monetary value of your business can come in handy.

If you think you may need an appraisal and don’t know where to start, keep reading. We’ll guide you through what you can expect, the process of hiring an appraiser, costs, and other alternatives that could be a better option for you.

If you’re still planning on running your business after the appraisal, don’t forget to download our guide on how to turn your website into a small business apps to generate steady revenue and growth.

What is a Business Appraisal?

An appraisal is the best way to get a fair and unbiased assessment of the value of your business, property, or assets. It requires you to hire a certified professional to conduct a thorough analysis of your business’s economic prospects, property or physical assets, market value, and financials.

The process of conducting an appraisal varies, however, it’s important to note that all comprehensive appraisals take time—avoid hiring any appraisers that promise a quick turnaround.

Why Would My Business Need One?

As we mentioned above, there are multiple reasons to hire a business appraiser. Below are some of the most common:

- Buying or selling a business: An appraisal will help you come up with the dollar amount that both parties feel comfortable with.

- Buying or selling a business property: Not all businesses have real estate but if you do, you’ll need to hire an appraiser that specializes in real property.

- Getting divorced: A divorce oftentimes involves the splitting of assets, which can include business properties—especially if you run a family-owned business.

- Filing for bankruptcy: An appraisal will help with creditor negotiations and preparing a financial restructuring plan.

- Applying for a loan: Some business loans, such as EIDL loans , require you to use your business or certain parts of your business as collateral. In this case, an appraiser will evaluate those assets.

- Separating from or bringing on a new partner: Hire an appraiser if you’re looking to settle a dispute with a business partner or draft a buy-sell agreement.

- Filing an insurance claim: After a natural disaster or damages, an appraiser may be called in by your insurer to determine repair costs.

How Will My Business Be Valuated

Depending on your needs, your appraiser will choose the appropriate approach to estimate the value of your businesses. Here are some of the most common ways:

Market Value

A market value approach can involve an analysis of your business’s economic performance, such as revenue, profit, and both tangible and intangible assets. It’s then compared to similar businesses in an open market to determine a potential selling price.

Asset Value

This approach is commonly used when a business is expected to close. It involves subtracting your liabilities from the value of your assets based on their fair market value to obtain your business’s overall appraisal.

Earning Value

For this approach, appraisers use projected income earnings or cash flow. Based on the method used—such as capitalization of earnings or discounted cash flow—a capitalization or discount rate is applied to those projections.

Hiring an Appraiser

A good appraiser will be able to determine the best method to evaluate your business and give you an unbiased assessment. Below is what you can expect when looking for and hiring a business appraiser.

First, it’s important to note that there are a few specializations for appraisers. If you’re looking to appraise your business’s real estate or intellectual property, there are appraisers who specialize in each. If you’re just looking for a general business appraiser, be sure to look for one with experience in your area and industry.

Hiring an appraiser is not cheap. Unfortunately, many legal proceedings such as divorce or a partner dispute may require it. On average, appraisers charge between $20 to $500 per hour and take 20 to 50 hours to complete an appraisal.

If your needs aren’t very complex, you may be able to get an appraisal for $1,000. However, the range is typically between $3,000 to $35,000—the figure tends to be on the higher end when litigation is involved.

When hiring an appraiser, you will first need to discuss the reason why you need a valuation and your main goal. Prepare to go over the financial and operational structure of your business and gather all documentation including financial records, tax returns, payroll, inventory reports, shareholder agreements, lease and loan documents, business plans and projections, etc.

You’ll then want to verify that you both agree on the scope, timeline, and fee. It’s also good to keep in mind that an appraiser is there to conduct their evaluation fairly and independently—they are not your business’s employee or advocate.

Doing Your Own Business Valuation

If there aren’t any legal requirements to hire an independent appraiser, you may also choose to do it yourself. Although there’s plenty of room for bias, doing your own valuation is a great way to understand what your business is worth and how to measure it. It also makes for a perfect practice run if you’re planning on selling your business down the line.

We suggest researching the valuation methods we discussed above in-depth and choosing the one that best suits your goals. Use any knowledge you gain from your own business valuation to help with pitching, negotiating, or growing your business .

Speaking of growing your business—if you’re ready to transform your website into a revenue-generating, digital storefront , be sure to check out this guide!

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)

Keep Reading

How to Set Up Your Google Business Profile for Local ...

7 Creative Ways to Drive Traffic in the Pest Control ...

Leveraging Google My Business Listings for Local Success

- Corporate Finance

- Financial Analysis

Valuing a Company: Business Valuation Defined With 6 Methods

- Search Search Please fill out this field.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

What Is a Business Valuation?

A business valuation, also known as a company valuation, is the process of determining the economic value of a business. During the valuation process , all areas of a business are analyzed to determine its worth and the worth of its departments or units.

A company valuation can be used to determine the fair value of a business for a variety of reasons, including sale value, establishing partner ownership, taxation, and even divorce proceedings. Owners will often turn to professional business evaluators for an objective estimate of the value of the business.

Key Takeaways

- Business valuation determines the economic value of a business or business unit.

- Business valuation can be used to determine the fair value of a business for a variety of reasons, including sale value, establishing partner ownership, taxation, and even divorce proceedings.

- Several methods of valuing a business exist, such as looking at its market cap, earnings multipliers, or book value, among others.

Investopedia / Katie Kerpel

The Basics of Business Valuation

The topic of business valuation is frequently discussed in corporate finance. Business valuation is typically conducted when a company is looking to sell all or a portion of its operations or looking to merge with or acquire another company. The valuation of a business is the process of determining the current worth of a business , using objective measures, and evaluating all aspects of the business.

A business valuation might include an analysis of the company's management, its capital structure , its future earnings prospects or the market value of its assets. The tools used for valuation can vary among evaluators, businesses, and industries. Common approaches to business valuation include a review of financial statements, discounting cash flow models and similar company comparisons.

Valuation is also important for tax reporting. The Internal Revenue Service (IRS) requires that a business is valued based on its fair market value. Some tax-related events such as sale, purchase or gifting of shares of a company will be taxed depending on valuation.

Estimating the fair value of a business is an art and a science; there are several formal models that can be used, but choosing the right one and then the appropriate inputs can be somewhat subjective.

Methods of Valuation

There are numerous ways a company can be valued . You'll learn about several of these methods below.

1. Market Capitalization

Market capitalization is the simplest method of business valuation. It is calculated by multiplying the company’s share price by its total number of shares outstanding. For example, as of January 3, 2018, Microsoft Inc. traded at $86.35. With a total number of shares outstanding of 7.715 billion, the company could then be valued at $86.35 x 7.715 billion = $666.19 billion.

2. Times Revenue Method

Under the times revenue business valuation method, a stream of revenues generated over a certain period of time is applied to a multiplier which depends on the industry and economic environment. For example, a tech company may be valued at 3x revenue, while a service firm may be valued at 0.5x revenue.

3. Earnings Multiplier

Instead of the times revenue method, the earnings multiplier may be used to get a more accurate picture of the real value of a company, since a company’s profits are a more reliable indicator of its financial success than sales revenue is. The earnings multiplier adjusts future profits against cash flow that could be invested at the current interest rate over the same period of time. In other words, it adjusts the current P/E ratio to account for current interest rates.

4. Discounted Cash Flow (DCF) Method

The DCF method of business valuation is similar to the earnings multiplier. This method is based on projections of future cash flows, which are adjusted to get the current market value of the company. The main difference between the discounted cash flow method and the profit multiplier method is that it takes inflation into consideration to calculate the present value.

5. Book Value

This is the value of shareholders’ equity of a business as shown on the balance sheet statement. The book value is derived by subtracting the total liabilities of a company from its total assets.

6. Liquidation Value

Liquidation value is the net cash that a business will receive if its assets were liquidated and liabilities were paid off today.

This is by no means an exhaustive list of the business valuation methods in use today. Other methods include replacement value, breakup value, asset-based valuation , and still many more.

Accreditation in Business Valuation

In the U.S., Accredited in Business Valuation (ABV) is a professional designation awarded to accountants such as CPAs who specialize in calculating the value of businesses. The ABV certification is overseen by the American Institute of Certified Public Accountants (AICPA) and requires candidates to complete an application process, pass an exam, meet minimum Business Experience and Education requirements, and pay a credential fee (as of Mar. 11, 2022, the annual fee for the ABV Credential was $380).

Maintaining the ABV credential also requires those who hold the certification to meet minimum standards for work experience and lifelong learning. Successful applicants earn the right to use the ABV designation with their names, which can improve job opportunities, professional reputation and pay. In Canada, Chartered Business Valuator ( CBV ) is a professional designation for business valuation specialists . It is offered by the Canadian Institute of Chartered Business Valuators (CICBV).

Internal Revenue Service. " Sale of a Business ."

Yahoo Finance. " Microsoft Corporation (MSFT) ."

Association of International Certified Professional Accountants. " Distinguish Yourself. Obtain the Accredited in Business Valuation (ABV) Credential ."

Association of International Certified Professional Accountants. " AICPA Annual Membership Dues ."

- Valuing a Company: Business Valuation Defined With 6 Methods 1 of 37

- What Is Valuation? 2 of 37

- Valuation Analysis: Meaning, Examples and Use Cases 3 of 37

- Financial Statements: List of Types and How to Read Them 4 of 37

- Balance Sheet: Explanation, Components, and Examples 5 of 37

- Cash Flow Statement: How to Read and Understand It 6 of 37

- 6 Basic Financial Ratios and What They Reveal 7 of 37

- 5 Must-Have Metrics for Value Investors 8 of 37

- Earnings Per Share (EPS): What It Means and How to Calculate It 9 of 37

- P/E Ratio Definition: Price-to-Earnings Ratio Formula and Examples 10 of 37

- Price-to-Book (PB) Ratio: Meaning, Formula, and Example 11 of 37

- Price/Earnings-to-Growth (PEG) Ratio: What It Is and the Formula 12 of 37

- Fundamental Analysis: Principles, Types, and How to Use It 13 of 37

- Absolute Value: Definition, Calculation Methods, Example 14 of 37

- Relative Valuation Model: Definition, Steps, and Types of Models 15 of 37

- Intrinsic Value of a Stock: What It Is and Formulas to Calculate It 16 of 37

- Intrinsic Value vs. Current Market Value: What's the Difference? 17 of 37

- The Comparables Approach to Equity Valuation 18 of 37

- The 4 Basic Elements of Stock Value 19 of 37

- How to Become Your Own Stock Analyst 20 of 37

- Due Diligence in 10 Easy Steps 21 of 37

- Determining the Value of a Preferred Stock 22 of 37

- Qualitative Analysis 23 of 37

- How to Choose the Best Stock Valuation Method 24 of 37

- Bottom-Up Investing: Definition, Example, Vs. Top-Down 25 of 37

- Financial Ratio Analysis: Definition, Types, Examples, and How to Use 26 of 37

- What Book Value Means to Investors 27 of 37

- Liquidation Value: Definition, What's Excluded, and Example 28 of 37

- Market Capitalization: What It Means for Investors 29 of 37

- Discounted Cash Flow (DCF) Explained With Formula and Examples 30 of 37

- Enterprise Value (EV) Formula and What It Means 31 of 37

- How to Use Enterprise Value to Compare Companies 32 of 37

- How to Analyze Corporate Profit Margins 33 of 37

- Return on Equity (ROE) Calculation and What It Means 34 of 37

- Decoding DuPont Analysis 35 of 37

- How to Value Private Companies 36 of 37

- Valuing Startup Ventures 37 of 37

:max_bytes(150000):strip_icc():format(webp)/cropped-image-of-insurance-agent-discussing-with-client-at-desk-1036263996-ea426af87ce2474b8c4a0b0391af2418.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

What Is a Business Appraiser?

Definition & Examples of Business Appraisers

How Does a Business Appraiser Work?

- Do I Need an Appraiser?

Types of Business Appraisers

Cost of hiring a business appraiser, can i do my own business valuation.

MoMo Productions / Getty Images

In general, an appraiser is someone who assesses the value of a piece of property, particularly to determine a fair sale price. A business appraiser specializes in evaluating tangible and intangible property to determine what a business is worth.

Business owners may need a fair appraisal for many different reasons, from preparing for a sale to making an initial public offering. Any time an owner or prospective buyer needs an unbiased, outsider opinion of the business's value, they would hire a business appraiser. Learn more about what these specialists do and when you might need their help.

All types of property have value, including business property, and the value of that property is best determined by hiring an expert called an appraiser. Appraisers work in all types of situations:

- A property/real estate appraiser evaluates the value of homes and other real property.

- Some appraisers specialize in certain types of property, such as livestock appraisers and art appraisers.

Regardless of the type of appraiser, they are required to use unbiased methods to provide a fair valuation of the property. Business appraisers are required to operate independently to prepare a business valuation or to value business assets, using financial analysis, physical review, and industry comparisons.

Business appraisers must meet specific standards to achieve what's called Certification in Entity and Intangible Valuations (CEIV). Several organizations offer pathways to this certification, such as the American Society of Appraisers. Appraisers can also be certified/licensed by state regulatory boards for the states in which they practice.

There are several ways to get certified to appraise businesses. Certified Public Accountants, for example, can receive a certification called Accredited in Business Valuation.

An appraiser can value a business in several different ways. These might include:

- The fair market value method usually considers the value of all equipment, furniture and fixtures, vehicles, and intangible assets. Fair market value is defined as what the property would sell for in an open market, with the price determined by a willing buyer and willing seller.

- A liquidation value assumes that the business has stopped and all assets must be sold quickly. This is the most drastic valuation because it means that the business owner will receive only the minimum value.

- A capitalization of earnings valuation seeks to determine a company's value today based on its projected future earnings. That is, working backward from a point in the future and using assumptions on how much the earnings will increase from the present. This can also be done in terms of future cash flows.

There are many other ways to value a business, and a trained appraiser will usually use several different valuation methods to come up with a few estimates for a business's value.

The valuation of shares of business stock is different from valuing the business or its assets. This type of valuation typically involves investment bankers, not a business appraiser.

Do I Need a Business Appraiser?

There are many situations that might necessitate a business appraisal, including:

- Business buying and selling: Before selling a business, many business owners get an appraisal. For an ongoing business, there may be a need for an appraiser in a buy-sell situation, where one of the owners leaves the company.

- Real estate : Within a business, there may be times when an appraiser is needed to value real estate, for sale or purchase. In this case, a real property appraiser is needed.

- Business disputes : Appraisers may be needed to value a business within the process of business disputes, such as shareholder disagreements or divorces where the business property is involved.

- Business damages/disaster : An appraiser may be needed to value a business for insurance purposes, after a disaster or other damage to the property and assets.

- Bankruptcy : The process of business bankruptcy usually includes an appraisal for valuation.

These are just a few examples. A business owner can seek out an appraisal at any time.

Given the many possible scenarios for a business valuation, there are a variety of different kinds of business appraisers. Some specialize in valuing businesses for sale or for other purposes. Others focus on intellectual property (patents, copyrights, and trademarks) and other intangible assets .

An equipment appraiser, on the other hand, evaluates equipment for sale as part of a business transaction. For example, if a business wants a loan, and pledges specific business assets as collateral for that loan, an appraiser will review the condition of the assets and the fair market value.

The cost of a business appraisal depends on the circumstances. Most appraisers work by the hour, so the size and complexity of the company (the number of assets) play a big part in the cost. According to Mariner Capital Advisers, the cost of a business appraisal can vary from $5,000 to over $30,000.

If you are looking for an appraiser for your business, check one of the Institute of Business Appraisers and The American Society of Appraisers . Both of these organizations formally accredit business appraisers.

You can run an informal valuation of your small business at any time. However, if you need a valuation for insurance or for selling a business, you will typically need an outside independent appraiser. Likewise, if your business is a corporation or partnership, or if you have multiple subsidiaries or other complex situations, you will definitely need the services of an independent appraiser.

Key Takeaways

- A business appraiser is someone who performs an independent assessment of a business's value.

- Business appraisers can be trained and certified by several different organizations to use unbiased methods to conduct business valuations.

- Business owners can seek an appraisal at any time but do so most often when preparing for a sale or dealing with certain disputes.

Appraisal Institute. " The Appraisal Profession ." Accessed July 17, 2020.

American Society of Appraisers. " CEIV™ Certification ." Accessed July 17, 2020.

American Institute of CPAs. " Credentials ." Accessed July 17, 2020.

U.S. Small Business Administration. " Determining the Value of a Business ." Accessed July 17, 2020.

Mariner Capital Advisors. " 10 Things To Know About Business Valuation ." Accessed July 17, 2020.

How to Set, Track, and Achieve Business Objectives with 60 Examples

By Kate Eby | April 10, 2023

- Share on Facebook

- Share on LinkedIn

Link copied

Businesses that set objectives make better decisions. Business objectives allow companies to focus their efforts, track progress, and visualize future success. We’ve worked with experts to create the most comprehensive guide to business objectives.

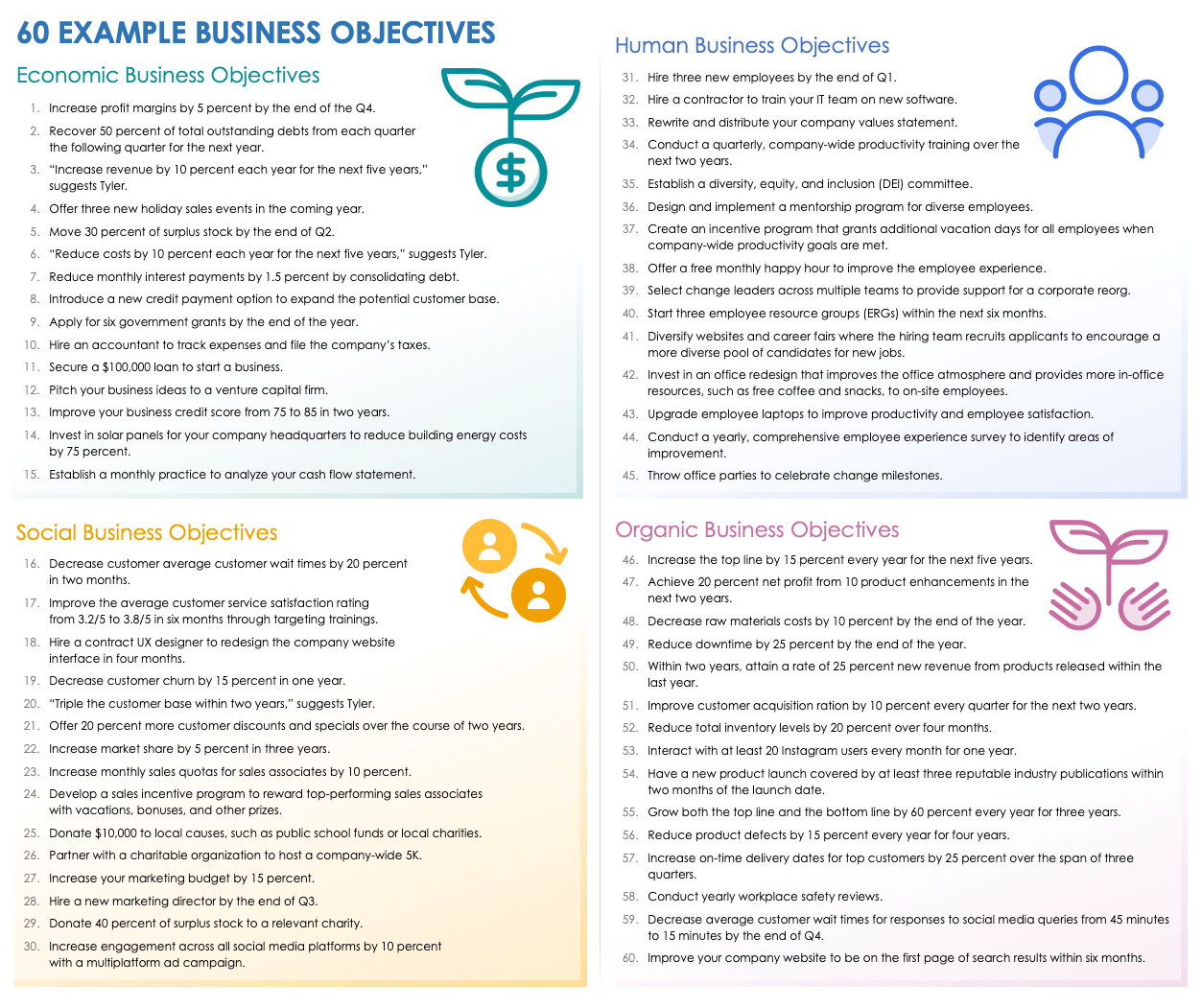

Included in this article, you’ll find the differences between business objectives and business goals , the four main business objectives , and the benefits of setting business objectives . Plus, find 60 examples of business objectives , which you can download in Microsoft Word.

What Is a Business Objective?

A business objective is a specific, measurable outcome that a company works to achieve. Company leaders set business objectives that help the organization meet its long-term goals. Business objectives should be recorded so that teams can easily access them.

Business objectives cover many different factors of a company’s success, such as financial health, operations, productivity, and growth.

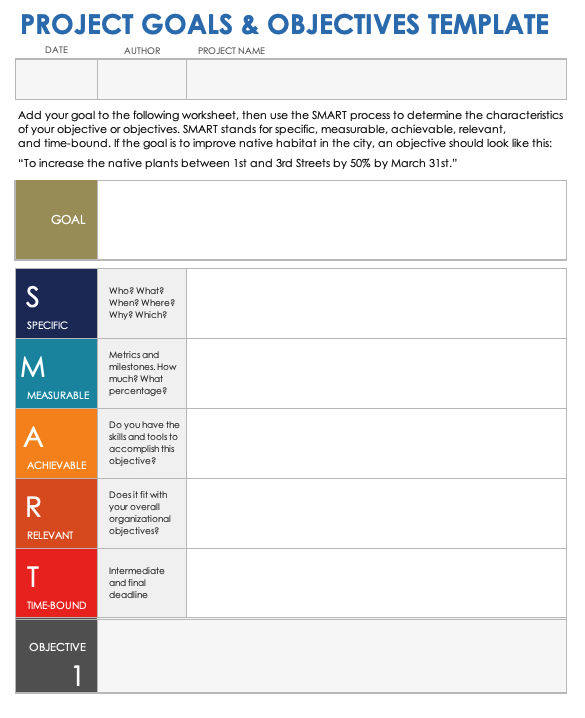

One easy way to make sure that you are setting the right business objectives is to follow the SMART goal framework . SMART objectives are specific, measurable, achievable, relevant, and time-bound.

To learn about setting project objectives using the SMART framework, see this comprehensive guide to writing SMART project objectives .

Business Objectives vs. Business Goal

A business goal is a broad, long-term outcome that a company works toward. Goals usually inform which strategies that department leaders will implement. A business objective , however, is a specific, short-term outcome or action that helps the company achieve long-term goals.

Although the terms are often used interchangeably, goals and objectives are not the same . In general, goals are broad in scope and describe an outcome, while objectives are narrow in scope and describe a specific action or step.

While these differences are important to understand, many of the common frameworks for successful goal-setting — such as SMART, objectives and key results ( OKRs ), and management by objectives (MBO) — can be useful when writing business objectives.

When deciding on objectives for a team or department, keep in mind the overarching goals of a business. Each objective should move the company closer to its long-term goals.

Project Goals and Objectives Template

Download the Project Goals and Objectives Template for Excel | Microsoft Word | Adobe PDF

Use this free, printable template to learn how to break down project goals into individual objectives using the SMART framework. Write the primary goal at the top of the worksheet, then follow the SMART process to create one or more specific objectives that will help you achieve that goal.

For resources to help with setting and tracking goals at your company, see this all-inclusive list of goal tracking and setting templates .

What Are the Four Main Business Objectives?

The four main business objectives are economic, social, human, and organic. Each can help a business ensure their prolonged health and growth. For example, human objectives refer to employees’ well-being, while economic objectives refer to the company’s financial health.

These are the four main business objectives:

- Example: Reduce spending on paid advertisements by 20 percent.

- Example: Reduce average customer wait times from eight minutes to four minutes.

- Example: Hire two new chemical engineers by the end of Q2.

- Example: Improve the efficiency of a specific software product by 15 percent.

Types of Business Objectives

There are many types of business objectives beyond the main four. These range from regulation objectives to environmental objectives to municipal objectives. For example, a global objective might be to distribute a product to a new country.

In addition to economic, social, human, and organic objectives, here are some other types of business objectives companies might set:

- Regulatory: These objectives relate to compliance requirements, such as meeting quality standards or conducting internal audits.

- National: These objectives relate to a company’s place in and how they contribute to the country they operate in, such as promoting social justice causes and creating employment opportunities.

- Global: These objectives relate to a company’s place in and its contribution to many countries, such as improving living standards and responding to global demands for products and services.

- Environmental: These objectives relate to a company’s environmental impact, such as reducing chemical waste or making eco-friendly investments.

- Healthcare: These objectives relate to the health and well-being of a population, whether within or outside an organization. These objectives might be improving healthcare benefit options for employees or refining a drug so that it has fewer side effects.

The Importance of Having Business Objectives

Teams need business objectives to stay focused on the company’s long-term goals. Business objectives help individual employees understand how their roles contribute to the larger mission of the organization. Setting business objectives facilitates effective planning.

Here are some benefits to setting business objectives:

- Develops Leadership: Company leaders are more effective when they have a clear vision and can delegate tasks to make it a reality. Setting objectives is a great way to improve one’s leadership skills.

- Increases Motivation: People tend to be more invested in work when they have clear, attainable objectives to achieve. Plus, each completed objective provides a morale boost to keep teams happy and productive.

- Encourages Innovation and Productivity: With increased motivation and workplace satisfaction come more innovations. Set attainable but challenging objectives, and watch teams come up with creative solutions to get things done.

- Improves Strategy: Setting objectives that align with overarching company goals means that everyone across the company can stay aligned on strategic implementation.

- Enhances Customer Satisfaction: Overall customer satisfaction is more likely to increase over time when measurable quality improvements are in place.

- Improves Prioritization: When they are being able to see all of the current objectives, team members can more easily prioritize their work, which in turn makes their workloads feel more manageable.

- Improves Financial Health: Setting economic objectives in particular can help companies stay on top of their financial goals.

60 Examples of Business Objectives

Company leaders can use business objectives to improve every facet of an organization, from customer satisfaction to market share to employee well-being. Here are 60 examples of business objectives that can help a company achieve its goals.

Economic Business Objectives

- Increase profit margins by 5 percent by the end of the Q4.

- Recover 50 percent of total outstanding debts from each quarter the following quarter for the next year.

- “Increase revenue by 10 percent each year for the next five years,” suggests Tyler.

- Offer three new holiday sales events in the coming year.

- Move 30 percent of surplus stock by the end of Q2.

- “Reduce costs by 10 percent each year for the next five years,” suggests Tyler.

- Reduce monthly interest payments by 1.5 percent by consolidating debt.

- Introduce a new credit payment option to expand the potential customer base.

- Apply for six government grants by the end of the year.

- Hire an accountant to track expenses and file the company’s taxes.

- Secure a $100,000 loan to start a business.

- Pitch your business ideas to a venture capital firm.

- Improve your business credit score from 75 to 85 in two years.

- Invest in solar panels for your company headquarters to reduce building energy costs by 75 percent.

- Establish a monthly practice to analyze your cash flow statement.

Social Business Objectives

- Decrease customer average customer wait times by 20 percent in two months.

- Improve the average customer service satisfaction rating from 3.2/5 to 3.8/5 in six months through targeting trainings.

- Hire a contract UX designer to redesign the company website interface in four months.

- Decrease customer churn by 15 percent in one year.

- “Triple the customer base within two years,” suggests Tyler.

- Offer 20 percent more customer discounts and specials over the course of two years.

- Increase market share by 5 percent in three years.

- Increase monthly sales quotas for sales associates by 10 percent.

- Develop a sales incentive program to reward top-performing sales associates with vacations, bonuses, and other prizes.

- Donate $10,000 to local causes, such as public school funds or local charities.

- Partner with a charitable organization to host a company-wide 5K.

- Increase your marketing budget by 15 percent.

- Hire a new marketing director by the end of Q3.

- Donate 40 percent of surplus stock to a relevant charity.

- Increase engagement across all social media platforms by 10 percent with a multiplatform ad campaign.

Human Business Objectives

- Hire three new employees by the end of Q1.

- Hire a contractor to train your IT team on new software.

- Rewrite and distribute your company values statement.

- Conduct a quarterly, company-wide productivity training over the next two years.

- Establish a diversity, equity, and inclusion (DEI) committee.

- Design and implement a mentorship program for diverse employees.

- Create an incentive program that grants additional vacation days for all employees when company-wide productivity goals are met.

- Offer a free monthly happy hour to improve the employee experience.

- Select change leaders across multiple teams to provide support for a corporate reorg.

- Start three employee resource groups (ERGs) within the next six months.

- Diversify websites and career fairs where the hiring team recruits applicants to encourage a more diverse pool of candidates for new jobs.

- Invest in an office redesign that improves the office atmosphere and provides more in-office resources, such as free coffee and snacks, to on-site employees.

- Upgrade employee laptops to improve productivity and employee satisfaction.

- Conduct a yearly, comprehensive employee experience survey to identify areas of improvement.

- Throw office parties to celebrate change milestones.

Organic Business Objectives

- Increase the top line by 15 percent every year for the next five years.

- Achieve 20 percent net profit from 10 product enhancements in the next two years.

- Decrease raw materials costs by 10 percent by the end of the year.

- Reduce downtime by 25 percent by the end of the year.

- Within two years, attain a rate of 25 percent new revenue from products released within the last year.

- Improve customer acquisition ration by 10 percent every quarter for the next two years.

- Reduce total inventory levels by 20 percent over four months.

- Interact with at least 20 Instagram users every month for one year.

- Have a new product launch covered by at least three reputable industry publications within two months of the launch date.

- Grow both the top line and the bottom line by 60 percent every year for three years.

- Reduce product defects by 15 percent every year for four years.

- Increase on-time delivery dates for top customers by 25 percent over the span of three quarters.

- Conduct yearly workplace safety reviews.

- Decrease average customer wait times for responses to social media queries from 45 minutes to 15 minutes by the end of Q4.

- Improve your company website to be on the first page of search results within six months.

Download 60 Example Business Objectives for

Microsoft Word | Adobe PDF

Track the Progress of Business Objectives with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Real Estate Appraisal Business Plan Template & Guidebook

Financing a real estate appraisal business is no small feat. This #1 Real Estate Appraisal Business Plan Template & Guidebook offers guidance on the process of structuring a business plan, as well as practical advice for staying ahead of the competition. It's an essential resource for any aspiring real estate appraiser looking to up their game.

Get worry-free services and support to launch your business starting at $0 plus state fees.

- How to Start a Profitable Real Estate Appraisal Business [11 Steps]

How to Write a Real Estate Appraisal Business Plan in 7 Steps:

1. describe the purpose of your real estate appraisal business..

The first step to writing your business plan is to describe the purpose of your real estate appraisal business. This includes describing why you are starting this type of business, and what problems it will solve for customers. This is a quick way to get your mind thinking about the customers’ problems. It also helps you identify what makes your business different from others in its industry.

It also helps to include a vision statement so that readers can understand what type of company you want to build.

Here is an example of a purpose mission statement for a real estate appraisal business:

Our mission at ABC Real Estate Appraisals is to provide fair and reliable appraising services to our clients that are derived from our experience, knowledge of the market, and respect for all parties involved. We strive to continuously expand our services through innovation and best practices that are tailored to each customer, while respecting the value of their property.

2. Products & Services Offered by Your Real Estate Appraisal Business.

The next step is to outline your products and services for your real estate appraisal business.

When you think about the products and services that you offer, it's helpful to ask yourself the following questions:

- What is my business?

- What are the products and/or services that I offer?

- Why am I offering these particular products and/or services?

- How do I differentiate myself from competitors with similar offerings?

- How will I market my products and services?

You may want to do a comparison of your business plan against those of other competitors in the area, or even with online reviews. This way, you can find out what people like about them and what they don’t like, so that you can either improve upon their offerings or avoid doing so altogether.

3. Build a Creative Marketing Stratgey.

If you don't have a marketing plan for your real estate appraisal business, it's time to write one. Your marketing plan should be part of your business plan and be a roadmap to your goals.

A good marketing plan for your real estate appraisal business includes the following elements:

Target market

- Who is your target market?

- What do these customers have in common?

- How many of them are there?

- How can you best reach them with your message or product?

Customer base

- Who are your current customers?

- Where did they come from (i.e., referrals)?

- How can their experience with your real estate appraisal business help make them repeat customers, consumers, visitors, subscribers, or advocates for other people in their network or industry who might also benefit from using this service, product, or brand?

Product or service description

- How does it work, what features does it have, and what are its benefits?

- Can anyone use this product or service regardless of age or gender?

- Can anyone visually see themselves using this product or service?

- How will they feel when they do so? If so, how long will the feeling last after purchasing (or trying) the product/service for the first time?

Competitive analysis

- Which companies are competing with yours today (and why)?

- Which ones may enter into competition with yours tomorrow if they find out about it now through word-of-mouth advertising; social media networks; friends' recommendations; etc.)

- What specific advantages does each competitor offer over yours currently?

Marketing channels

- Which marketing channel do you intend to leverage to attract new customers?

- What is your estimated marketing budget needed?

- What is the projected cost to acquire a new customer?

- How many of your customers do you instead will return?

Form an LLC in your state!

4. Write Your Operational Plan.

Next, you'll need to build your operational plan. This section describes the type of business you'll be running, and includes the steps involved in your operations.

In it, you should list:

- The equipment and facilities needed

- Who will be involved in the business (employees, contractors)

- Financial requirements for each step

- Milestones & KPIs

- Location of your business

- Zoning & permits required for the business

What equipment, supplies, or permits are needed to run a real estate appraisal business?

- License and/or certifications

- Computer/tablet

- Software for appraisals, property analysis, and report writing

- Digital camera/camera

- Office supplies (printer, paper, pens, etc.)

- Business cards

- Insurance (professional liability)

5. Management & Organization of Your Real Estate Appraisal Business.

The second part of your real estate appraisal business plan is to develop a management and organization section.

This section will cover all of the following:

- How many employees you need in order to run your real estate appraisal business. This should include the roles they will play (for example, one person may be responsible for managing administrative duties while another might be in charge of customer service).

- The structure of your management team. The higher-ups like yourself should be able to delegate tasks through lower-level managers who are directly responsible for their given department (inventory and sales, etc.).

- How you’re going to make sure that everyone on board is doing their job well. You’ll want check-ins with employees regularly so they have time to ask questions or voice concerns if needed; this also gives you time to offer support where necessary while staying informed on how things are going within individual departments too!

6. Real Estate Appraisal Business Startup Expenses & Captial Needed.

This section should be broken down by month and year. If you are still in the planning stage of your business, it may be helpful to estimate how much money will be needed each month until you reach profitability.

Typically, expenses for your business can be broken into a few basic categories:

Startup Costs

Startup costs are typically the first expenses you will incur when beginning an enterprise. These include legal fees, accounting expenses, and other costs associated with getting your business off the ground. The amount of money needed to start a real estate appraisal business varies based on many different variables, but below are a few different types of startup costs for a real estate appraisal business.

Running & Operating Costs

Running costs refer to ongoing expenses related directly with operating your business over time like electricity bills or salaries paid out each month. These types of expenses will vary greatly depending on multiple variables such as location, team size, utility costs, etc.

Marketing & Sales Expenses

You should include any costs associated with marketing and sales, such as advertising and promotions, website design or maintenance. Also, consider any additional expenses that may be incurred if you decide to launch a new product or service line. For example, if your real estate appraisal business has an existing website that needs an upgrade in order to sell more products or services, then this should be listed here.

7. Financial Plan & Projections

A financial plan is an important part of any business plan, as it outlines how the business will generate revenue and profit, and how it will use that profit to grow and sustain itself. To devise a financial plan for your real estate appraisal business, you will need to consider a number of factors, including your start-up costs, operating costs, projected revenue, and expenses.

Here are some steps you can follow to devise a financial plan for your real estate appraisal business plan:

- Determine your start-up costs: This will include the cost of purchasing or leasing the space where you will operate your business, as well as the cost of buying or leasing any equipment or supplies that you need to start the business.

- Estimate your operating costs: Operating costs will include utilities, such as electricity, gas, and water, as well as labor costs for employees, if any, and the cost of purchasing any materials or supplies that you will need to run your business.

- Project your revenue: To project your revenue, you will need to consider the number of customers you expect to have and the average amount they will spend on each visit. You can use this information to estimate how much money you will make from selling your products or services.

- Estimate your expenses: In addition to your operating costs, you will need to consider other expenses, such as insurance, marketing, and maintenance. You will also need to set aside money for taxes and other fees.

- Create a budget: Once you have estimated your start-up costs, operating costs, revenue, and expenses, you can use this information to create a budget for your business. This will help you to see how much money you will need to start the business, and how much profit you can expect to make.