Insurance Cover Letter: Sample & Guide [Entry Level + Senior Jobs]

Create a standout insurance cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Writing a cover letter for an insurance job can be intimidating. With this guide, you'll understand how to write a competitive and professional cover letter that will give you the best chance of landing the job. We'll walk you through crafting your cover letter, from understanding the basics of insurance cover letters to actionable tips for creating an impressive and unique document.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Community Health Nurse Cover Letter Sample

- Clinical Nurse Educator Cover Letter Sample

- Clinical Research Associate Cover Letter Sample

- Infusion Nurse Cover Letter Sample

- Hospital Pharmacist Cover Letter Sample

- Dental Lab Technician Cover Letter Sample

- General Practitioner Cover Letter Sample

- Athletic Trainer Cover Letter Sample

- Nursing Attendant Cover Letter Sample

- Assistant Director Of Nursing Cover Letter Sample

- Staff Pharmacist Cover Letter Sample

- ER Nurse Cover Letter Sample

- Orthodontist Cover Letter Sample

- Staff Nurse Cover Letter Sample

- Pediatric Nurse Cover Letter Sample

- Pharmacy Assistant Cover Letter Sample

- Care Manager Cover Letter Sample

- Experienced Psychiatrist Cover Letter Sample

- Director Of Nursing Cover Letter Sample

- Nursing Assistant Cover Letter Sample

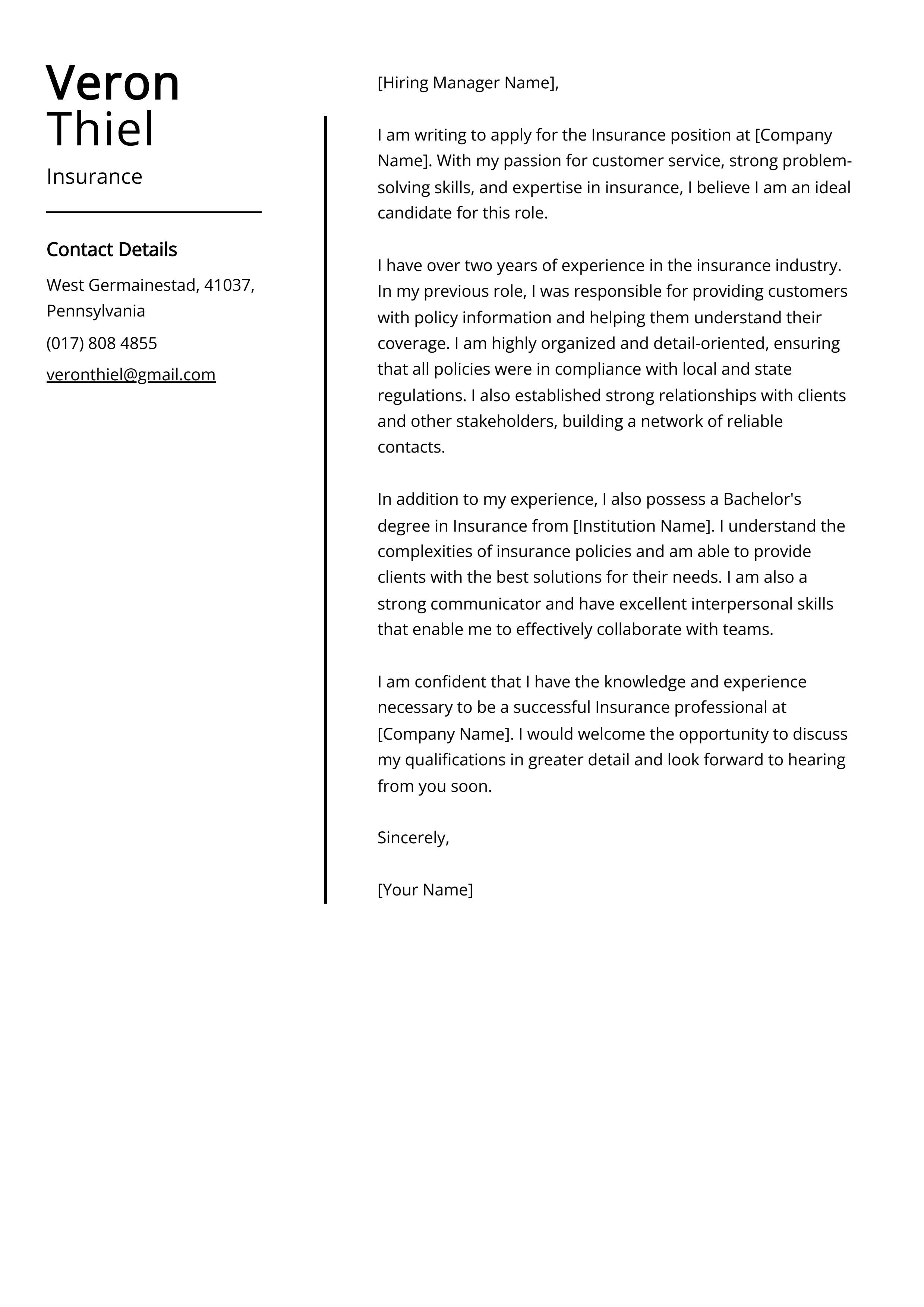

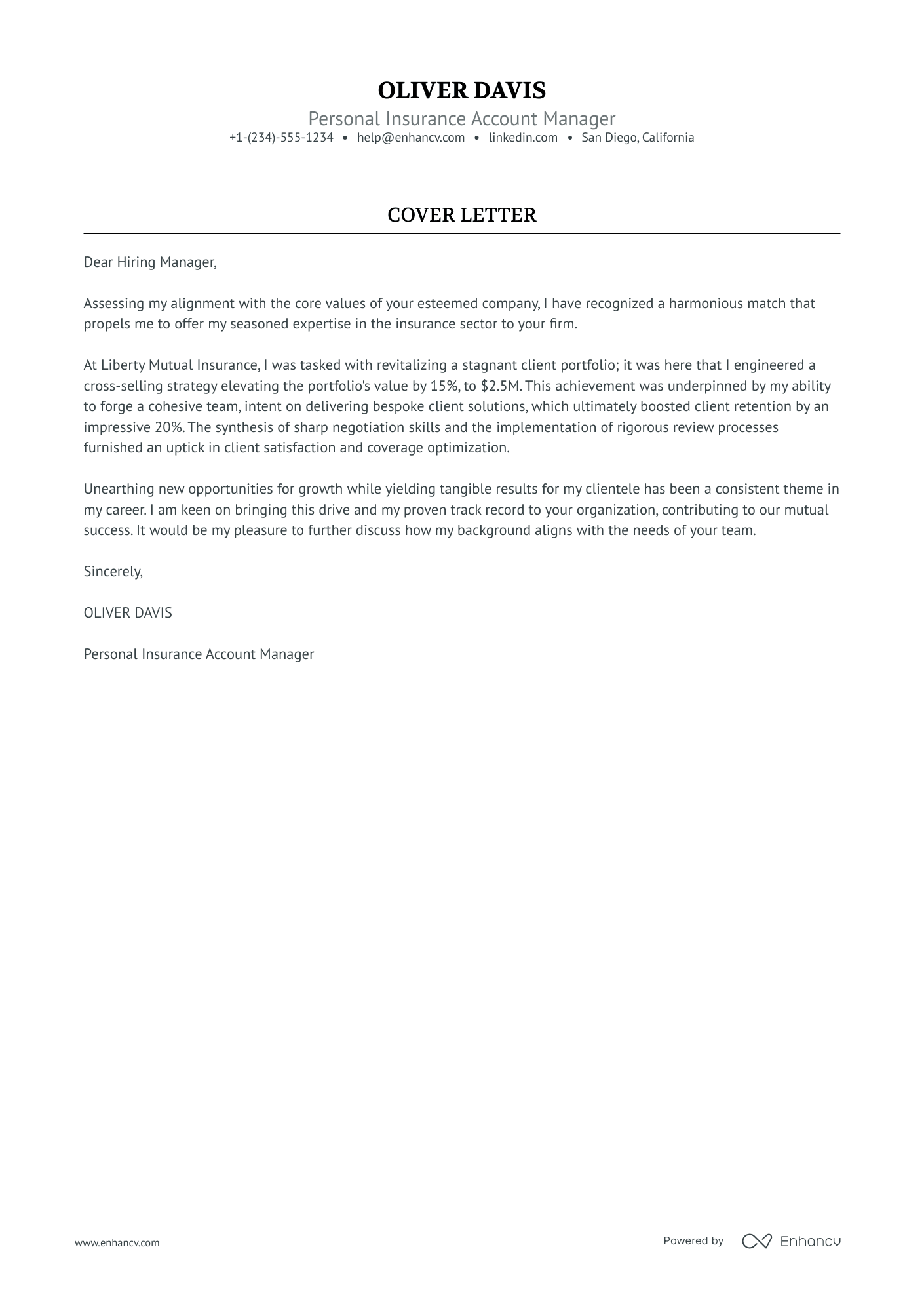

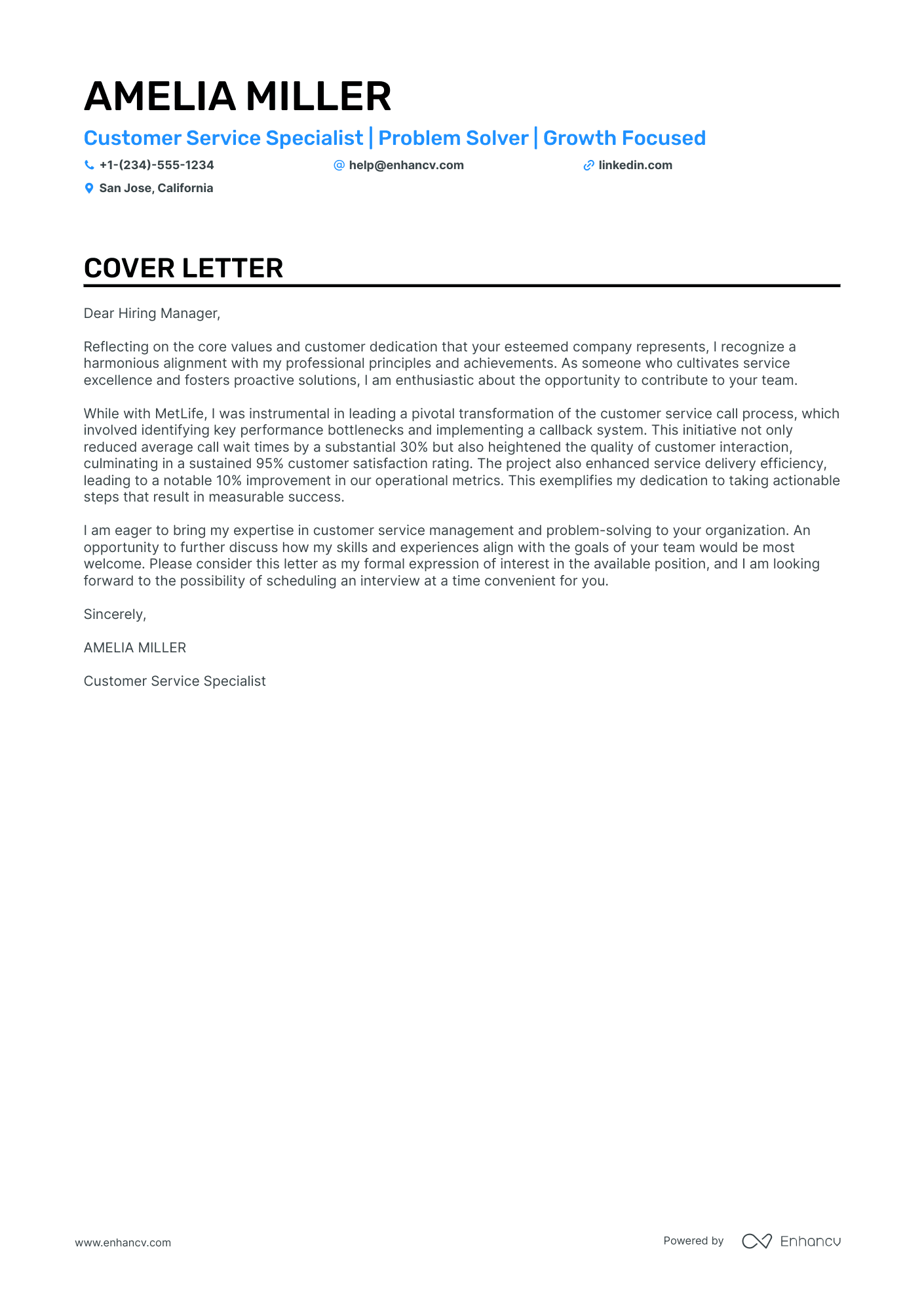

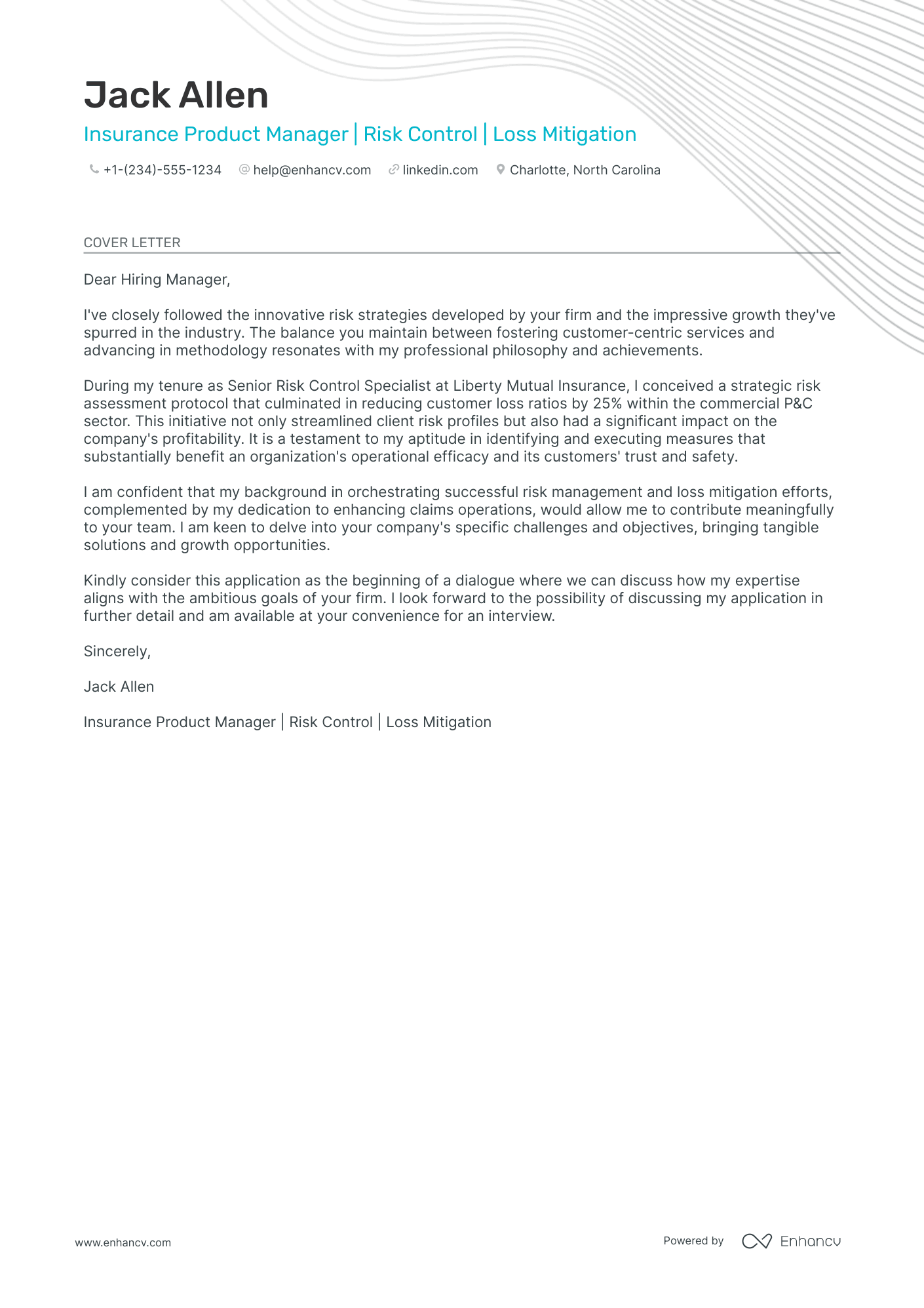

Insurance Cover Letter Sample

Dear Hiring Manager,

I am submitting my application for the position of Insurance with your organization. With over 10 years of experience in the insurance industry, I have the knowledge and expertise to be an effective member of your team.

I am currently working as an Insurance Agent with ABC Insurance Company, where I am responsible for providing customers with a variety of insurance products and services. I specialize in life and health insurance, and have been successful in helping customers develop comprehensive insurance plans tailored to their needs. My experience also includes providing customers with quotes, explaining policy coverage options, and negotiating premium rates.

In addition to my technical knowledge of the insurance industry, I possess strong customer service skills. I have had success in building relationships with customers and helping them to understand their policy coverage. I am also skilled in resolving customer complaints and handling difficult conversations with professionalism and empathy.

I am confident that my experience and qualifications make me an ideal candidate for the position. I am excited at the prospect of joining your team and contributing to the growth of your organization.

Thank you for your time and consideration. I look forward to hearing from you.

Sincerely, John Doe

Why Do you Need a Insurance Cover Letter?

- A insurance cover letter is a great way to make sure that you are adequately covered for any eventuality.

- It can help to protect you from financial losses and provide peace of mind in the event of an accident or other unexpected event.

- Insurance cover letters provide an assurance that any losses you suffer will be covered by the insurance company.

- Having an insurance cover letter also helps to ensure that you are not left with a large financial burden if something unexpected happens.

- Having a insurance cover letter is also important if you have any assets such as a house or a car that you would like to be protected.

- In the event of an accident, the insurance cover letter will provide you with the financial assistance that you need in order to recover any losses.

- Having an insurance cover letter also helps to ensure that your medical costs are covered in the event of an illness or injury.

A Few Important Rules To Keep In Mind

- Start with a professional greeting. Address your letter to the hiring manager by name if you know it.

- Outline your most relevant qualifications and experience in your opening paragraph.

- Include specific details that relate to the position and demonstrate why you are the ideal candidate.

- Explain why you are interested in the position and why you are the best candidate for the job.

- Keep your letter brief and to the point. Avoid using flowery language and excessive detail.

- Provide examples that demonstrate your experience and qualifications.

- Close with a thank you and a call to action.

- Proofread your letter carefully to ensure that there are no spelling or grammar errors.

What's The Best Structure For Insurance Cover Letters?

After creating an impressive Insurance resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

A Insurance Cover Letter Body Should Typically Include:

- A brief introduction that states the position you are applying for and why you are a good fit for the role.

- A description of your relevant experience and skills, including any industry-specific knowledge.

- Examples of how you have demonstrated the required skills in past positions (if applicable).

- A statement of your enthusiasm for the job and the company.

- A closing paragraph that summarizes your qualifications and expresses your interest in the position.

When writing a cover letter for an insurance job, it is important to focus on the specific skills that you possess that make you a qualified candidate. It is important to demonstrate your knowledge of the insurance industry and your interest in the position. Your cover letter should also focus on the benefits that you can bring to the organization.

When highlighting my relevant experience, I focus on the skills and knowledge I have acquired through my past positions. For example, I have years of experience in the insurance industry, so I am well versed in the industry's regulations and procedures. I am also knowledgeable about the various types of insurance policies available and the various coverage levels. Additionally, I possess excellent customer service and communication skills, which I have utilized in my past roles.

In my previous positions, I have demonstrated my ability to handle customer inquiries and complaints in a timely and professional manner. I am also highly organized and have experience in processing and filing paperwork. My strong attention to detail ensures that all documents are accurate and up to date. I have the ability to work independently and as part of a team, and I am comfortable taking on additional tasks when needed.

I am excited about the opportunity to join your organization and am confident that I can make a positive contribution. I am eager to use my knowledge and experience to help your organization succeed. Please do not hesitate to contact me if you have any questions. I look forward to hearing from you.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Failing to customize the cover letter for the specific position and company.

- Including irrelevant personal information.

- Using a generic greeting such as "To whom it may concern" or "Dear Sir or Madam".

- Using too much technical jargon.

- Making spelling and grammar mistakes.

- Using overly flowery or fancy language.

- Including information that has already been included in the resume.

- Not mentioning any of the skills or qualifications the employer is looking for.

- Failing to provide contact information.

Key Takeaways For an Insurance Cover Letter

- Highlight relevant skills and qualifications that are relevant to the insurance industry.

- Express a clear understanding of the job role and how your skills will help the company.

- Explain the value you can bring to the company in terms of experience and qualifications.

- Outline the unique benefits of the insurance product and explain how it can help the customer.

- Communicate your enthusiasm and commitment to the insurance company and the customer.

- Provide examples of how you have successfully solved customer problems in the past.

- Convey a deep understanding of the customer’s needs and explain how the insurance product can meet them.

- Be professional and courteous in your correspondence.

- Ensure that all relevant information is included in the letter.

15 Insurance Agent Cover Letters That Will Get Hired (NOW)

Are you are looking to write a cover letter for Insurance Agent jobs that will impress recruiters and get you noticed by hiring managers? You need one to apply for a job, but you don’t know what to say.

Cover letters can be a great way to introduce yourself before an in-person interview. They are not only a chance to highlight your strengths, but also to show off your personality and work ethic.

Here are 15 amazing Insurance Agent cover letters that are professionally written and will help you stand out and get that job!

Insurance Agent Cover Letters

Each cover letter is written with a different focus. Review all of them and pick the ones that apply to your situation. Take inspiration from multiple samples and combine them to craft your unique cover letter.

Insurance Agent Sample 1

Dear Employer,

I am a recent graduate from DeVry University with a degree in Business Administration and I believe my skill set will be advantageous to your organization. As an Insurance Agent, I am able to analyze and solve complex problems independently. My ability to think critically and work interactively is invaluable as well as my commitment to take ownership of any task assigned to me. I also have excellent interpersonal skills which help foster strong relationships with clients.

I would like the opportunity to interview for the Insurance Agent position you advertised on August 24th for your organization. Thank you for your time and consideration of this application.

Insurance Agent Sample 2

Dear Sir/Madame,

I hope this letter finds you well. My name is _______ and I am writing to inquire about the Insurance Agent position you advertised. I have a degree in business administration and am currently working as a sales representative for ______________. I would be excited to talk with you about this opportunity and my qualifications in more detail, so please don’t hesitate to contact me at your earliest convenience. I am looking forward to hearing from you soon.

Sincerely yours,

Insurance Agent Sample 3

Dear Company Representative,

I am writing to you to inquire about the Insurance Agent position. I would make a great addition to your team because of my strong work ethic and attention to detail. I will reply to this email with my resume in the next 24 hours. Thank you in advance for your time and consideration and I look forward to hearing from you soon.

Insurance Agent Sample 4

I am writing to express my interest in the Insurance Agent position with your company. I am a recent college graduate who is devoted to providing exceptional customer service and sales. I have extensive knowledge of life insurance, retirement planning, and risk management. What originally drew me to this position was your company’s dedication to delivering exemplary service and respect for their customers.

I hope you will consider me for this role and I look forward to hearing from you soon.

Insurance Agent Sample 5

I am a recent college graduate with an interest in insurance. I have always been interested in the way that people interact with one another when it comes to financial needs, and this position would be perfect for me. I have already had experience in customer service-driven roles at the bank, so the skills that I possess are ideal for this position.

A cover letter is mandatory when applying for jobs. It should not exceed 5 sentences and should include information about your qualifications, why you are specifically qualified to work for this company, any personal connections to the company or person you are writing to (if applicable), and what kind of work you are seeking.

Insurance Agent Sample 6

To whom it may concern, Hi! My name is ____ and I am interested in applying for the Insurance Agent position. I have a Bachelors degree in Business Administration with a concentration in Marketing from _____University. My marketing degree gave me excellent skills that would be beneficial to you as an insurance agent. I have experience managing social media accounts, coordinating events, creating flyers and posters for new products, creating press releases about our new products. These are all skills that would be very applicable to the Insurance Agent position which was what convinced me to apply for this position. I believe my skills are perfect for your company because I am not only creative but also organized–creativity is important because it’s how you find new customers

Insurance Agent Sample 7

I am writing to express interest in your Insurance Agent position. I have over 5 years of experience working in the insurance industry and would make a great addition to your team. Please consider me for this opportunity.

Sincerely, ____

Insurance Agent Sample 8

Dear ________, I am writing to express my interest in the Insurance Agent position at your company. I have experience as an agent, and am passionate about providing great customer service. My skills are diverse and include marketing, customer relations, problem-solving, negotiation skills and more. I would be grateful for the opportunity to interview with you personally. Thank you for your consideration of my application! Given the opportunity to represent your company as an insurance agent, I will work hard to meet all of the expectations that you have for this job position.

Insurance Agent Sample 9

Dear Hiring Manager, I am a Licensed Insurance Agent with 5 years of experience in selling life insurance. I have an excellent track record of success and have created relationships with my clients over the years. Please consider me for the position in your organization. Thank you for your time.

Insurance Agent Sample 10

To Whom It May Concern,

I am writing to you all in regards to the Insurance Agent position that has been posted. I would like to apply for the position and my skills and experience make me a perfect candidate. I graduated from _______ with a degree in Business Administration with an emphasis on Risk Management and Insurance. This is my fifth year as an insurance agent but my first as an independent agent at _____, where we work with Aetna, Blue Cross Blue Shield, United Healthcare and several other local carriers for both health care and auto insurance needs. Working as one of the top agents at this company has given me many opportunities to be successful in various areas of the industry such as client service skills, risk management skills

Insurance Agent Sample 11

I am writing with interest in the Insurance Agent position at _____. I am looking for an opportunity that will allow me to utilize my experience and skills, while also providing an opportunity for growth.

My background includes 10 years of customer service experience which includes working with both brokerage and retail clients with most recent position as a Client Service Representative at ABC Insurance Agency where I worked with brokers on new business opportunities, renewed policies, and created quotes for prospective customers.

Insurance Agent Sample 12

I am writing in response to your advertisement for a Insurance Agent position. I’m confident that my qualifications are a good fit for this opportunity. I am very communicative and enjoy meeting new people. As an insurance agent, I will be able to assist customers with their needs, while also working the on behalf of the company with clients and policy holders.

Insurance Agent Sample 13

Dear HR Dept, I am a graduate from University of Memphis pursuing a career in insurance. I have been in the industry for three years and understand the importance of customer service and providing quality products. My experience in this field has taught me how to build rapport with customers and make their experience seamless. I believe my skills make me an ideal candidate for this position and hope to hear from you soon.

Insurance Agent Sample 14

Dear Mr. Smith,

I am writing to express my interest in the Insurance Agent position that is currently available at your company. I have a degree from a top rated university and have extensive experience selling insurance to the general public. I would truly love an opportunity to work with you and can provide references upon request. Thank you for your time and consideration of my application, please contact me with any questions or for more information.

Insurance Agent Sample 15

April 1, 2017 I am writing to apply for the Insurance Agent position with ABC Company. I have a degree in Business Administration and 5 years’ experience working in the insurance industry. My education has qualified me to work closely with clients, understand their needs, and ultimately better serve them. I believe my experience will make me an excellent addition to your team. I am excited about speaking with you further about this opportunity and hope you will consider me for the position. Sincerely,

Recruiters and hiring managers receive hundreds of applications for each job opening.

Use the above professionally written Insurance Agent cover letter samples to learn how to write a cover letter that will catch their attention and customize it for your specific situation.

Related Careers:

- 15 Background Investigator Cover Letters That Will Get Hired (NOW)

- 15 School Secretary Cover Letters That Will Get Hired (NOW)

- 15 Retail Pharmacist Cover Letters That Will Get Hired (NOW)

- 15 Software Engineer Cover Letters That Will Get Hired (NOW)

- 15 Nanny Cover Letters That Will Get Hired (NOW)

- 15 Fashion Stylist Cover Letters That Will Get Hired (NOW)

- 15 Portfolio Manager Cover Letters That Will Get Hired (NOW)

- 15 Research Scientist Cover Letters That Will Get Hired (NOW)

- 15 Program Manager Cover Letters That Will Get Hired (NOW)

- 15 Postal Worker Cover Letters That Will Get Hired (NOW)

Leave a Comment Cancel reply

You must be logged in to post a comment.

Letter Templates & Example

The Ultimate Guide to Writing an Entry Level Insurance Cover Letter: Tips and Templates

Are you a recent college graduate looking for a job in the insurance industry? Are you struggling to put together a convincing cover letter that showcases your skills and experience? Look no further. We understand that writing an entry level insurance cover letter can be daunting, which is why we’ve compiled a list of examples for you to use as inspiration. These letters will help you take the first step in crafting a great cover letter that stands out to potential employers. So why wait? Dive in and start writing the perfect cover letter to land your dream job in the insurance field.

The Best Structure for an Entry Level Insurance Cover Letter

Writing a cover letter can be a daunting task, especially if you are an entry level candidate. However, a well-written cover letter can set you apart from other applicants and showcase your skills and qualifications. A good structure for an entry level insurance cover letter is essential to make a favorable impression on the hiring manager.

Introduction: Begin your cover letter with an introduction that captures the attention of the hiring manager. Start with a powerful and relevant statement that will make them interested in reading further. Mention the job position and where you found the job opening.

Body Paragraphs: In the body of the cover letter, explain why you are interested in the position and the company. Highlight your experience and skills that make you a good fit for the role. Showcase any internships or coursework relevant to insurance. Keep in mind that you are an entry level candidate, so focus on your potential and willingness to learn and grow. Use specific examples to demonstrate your abilities. Make sure to connect your experiences with the specific requirements of the job opening.

Value Proposition: The next section of your cover letter should explain how you can add value to the company. Highlight your strengths and what you can bring to the table. Explain why you want to work for the company and what you can contribute to their team as an entry level employee. Be sure to emphasize your ability to work in a team-oriented environment, as insurance is a collaborative industry.

Closing: In the conclusion, summarize your interest in the position and thank the hiring manager for their time. Indicate that you would like to discuss the position further and that you are available for an interview. Demonstrate your enthusiasm and take the opportunity to reiterate that you believe that your skills and qualifications make you an ideal candidate for the role.

Remember that the tone of your cover letter should be professional yet friendly. Proofread your cover letter for grammar and spelling errors before submitting it. A well-structured cover letter that showcases your potential as an entry level candidate can increase your chances of getting an interview and ultimately landing the job.

7 Entry-Level Insurance Cover Letter Templates

For recent graduate.

Dear Hiring Manager,

As a recent graduate with a Bachelor’s degree in Finance and a deep interest in the insurance industry, I am confident that I would make a great addition to your team as an entry-level insurance specialist. Through my academic and internship experience, I have developed strong analytical, problem-solving, and communication skills that I aim to put to use in the insurance sector. I am eager to learn more about the various types of insurance and work with clients to help them manage and mitigate their risks.

Thank you for considering my application. I look forward to the opportunity to further discuss my experience and qualifications with you.

For Career Change

I am excited to express my interest in the entry-level insurance specialist position currently available at your company. After reading through the job description and researching the role, I am certain that my skill set and career goals align perfectly with the requirements of this position.

Although my background is in retail management, as a detail-oriented individual with a passion for helping clients, I have always been drawn to the insurance industry. I am confident that my attention to detail, customer service experience, and ability to understand complex information and communicate it in a clear way would make me a valuable asset to your team.

Thank you for considering my application. I am excited about the opportunity to further explore how my skills and experience can contribute to your company.

Best regards,

For Internship Experience

I am writing to express my interest in the entry-level insurance specialist position at your company. As a recent graduate with a Bachelor’s degree in Mathematics and an insurance industry internship under my belt, I am confident that I would make a great entry-level insurance specialist for your organization.

Through my internship, I was able to gain hands-on experience with insurance policy analysis, claims handling, and customer service. These experiences have allowed me to develop strong analytical and communication skills while learning industry-specific jargon. With a passion for problem-solving and attention to detail, I am confident in my ability to handle the dynamics of the insurance industry.

Thank you for considering my application. I would love the opportunity to further discuss my potential qualifications with you.

For Customer Service Experience

I am excited to apply for the entry-level insurance specialist position with your company. With a background in customer service, I am confident in my ability to handle the fast-paced environment of the insurance industry while keeping communication and satisfaction with our clients at a priority.

Through my experience working in hospitality and retail, I have developed excellent interpersonal and problem-solving skills. My experience working with customers has enabled me to communicate complex information accurately and concisely to them while ensuring they feel comfortable and reassured, which would be identical to insurance policyholders. I am confident that I will be able to utilize these skills working with your company.

Thank you for your consideration of my application. I am grateful for the opportunity to further discuss how my skills and experience can benefit your team.

For Effective Communication Skills

I am excited to submit my application for the entry-level insurance specialist position open at your company. As a recent graduate with a degree in Communications, I understand the importance of effective communication in managing client expectations and handling complex information. I have honed my communication skills as an intern in an insurance company developed an ability to relay critical data and analyses in a clear, concise, and consistent manner to clients and colleagues effortlessly.

Through classes and internships, I have been able to develop leadership abilities. My ability to communicate effectively in groups and one-to-one management has been demonstrated repeatedly. Additionally, my interest in the industry has grown, and I have been extremely proactive in learning about the multiple types of policies you offer.

Thank you for the opportunity to apply. Please feel free to contact me if you need additional information.

For Detail-Oriented Applicant

I am writing this application to express my passionate interest in the entry-level insurance specialist position open at your organization. With a degree in Accounting, I have developed excellent attention to detail and strong analytical skills that make me an ideal fit for the role. As someone who enjoys analyzing data and performing audit work during school, I have decided to pursue a career in insurance to make a meaningful impact on people.

With this goal in mind, I am highly confident that my detail-oriented, analytical, and problem-solving abilities will make me an asset to your team. I have always considered insurance an extraordinary part of money management, and I am excited about the opportunity to apply my knowledge and experience to work with your expert team.

Thank you for considering my application. I look forward to further discussing my qualification with you.

For Passionate Applicant

I am delighted to apply for the entry-level insurance specialist position available at your company. As an enthusiast for the insurance business, I am confident that my passion for this industry would match up to the requirements of the application. I find the scope of insurance dynamic and forms a considerable challenge and importance in our modern society.

Being in the customer service industry for two years, I have consistently demonstrated a passion for supporting clients by providing reliable details about the products and services they need. My natural inclination to problem-solving has allowed me to be adept at creating tailor-made solutions by thoroughly analyzing the client’s needs. My courage to try the hard way allows me to stay motivated and excel in a fast-paced environment.

Thank you for considering my application. I aspire to learn more and contribute to a company as highly reputed as yours that values growth, innovation, and excellence.

Tips for an Entry Level Insurance Cover Letter

Writing a cover letter for an entry-level insurance job can seem challenging, especially when you have little to no experience in the insurance industry. Your cover letter needs to grab the employer’s attention and highlight your skills and strengths. Here are some tips that can help you create an effective cover letter:

Research the Company

Before writing your cover letter, research the company. Find out more about its culture, values, and mission. Use this information to tailor your letter to the company’s needs and show how you align with their values. It will also help you show that you genuinely care about working for the company.

Focus on Transferable Skills

Since you don’t have much experience in the insurance industry, focus on the transferable skills that you possess. Such skills include communication, teamwork, problem-solving, and attention to detail. Be sure to provide examples of these skills and how you’ve used them in the past.

Mention Your Education

Even though you don’t have much practical experience, mentioning your educational background can help strengthen your cover letter. Highlight the degree you earned, any relevant coursework, and any academic achievements, such as a high GPA. This information can show that you have a strong foundation in insurance and are committed to learning and growing in the field.

Reflect on Your Motivation

Insurance is a dynamic field that requires individuals with strong motivation. Reflect on why you are interested in working in the insurance industry. Is it because of the challenges this industry presents or the opportunities to help people protect their property and well-being? Sharing your motivation can show the employer that you are committed to the field.

Don’t Ignore the Basic Cover Letter Etiquette

Lastly, don’t ignore the basic cover letter etiquette. This includes addressing the letter to the right person, proofreading your letter, and using a professional tone. Showing that you put effort into your cover letter can make all the difference when it comes to landing an interview.

By using these tips, you can create a cover letter that stands out and gets you noticed by potential employers in the insurance industry.

Entry Level Insurance Cover Letter FAQs What should be included in my entry level insurance cover letter?

Your entry level insurance cover letter should include a brief introduction about yourself, your relevant skills and experience, enthusiasm about the company, and why you are interested in the position.

How do I make my entry level insurance cover letter stand out?

You can make your cover letter stand out by emphasizing your relevant skills and experiences that match the job requirements, addressing the hiring manager by name, and showcasing genuine enthusiasm for working with the company.

Do I need to have insurance experience to apply for an entry level insurance position?

No, you do not necessarily need insurance experience to apply for an entry level insurance position. However, having relevant skills like attention to detail, strong communication, and analytical skills can be helpful.

How long should my entry level insurance cover letter be?

Your entry level insurance cover letter should be no longer than one page. It should be concise and to the point, highlighting your relevant skills and experience.

What should I do if I don’t have any relevant experience?

If you don’t have any relevant experience, focus on highlighting your transferable skills, education, and any volunteer work or extracurricular activities that demonstrate your work ethic and ability to work in a team.

When should I follow up after submitting my entry level insurance cover letter?

You should follow up within a week after submitting your entry level insurance cover letter. This shows your enthusiasm for the position and your commitment to securing an interview.

What should I do if I don’t hear back after submitting my entry level insurance cover letter?

If you don’t hear back after submitting your entry level insurance cover letter, you can follow up with the hiring manager via email or phone call to inquire about the status of your application. Be polite and respectful in your communication.

Thanks for stopping by!

I hope this article has given you some valuable insights into crafting an entry level insurance cover letter. Remember to focus on your strong qualities, tailor each letter to the specific job and company you’re applying to, and highlight any relevant experience or certifications. As always, keep it professional, but don’t be afraid to show a bit of your personality. Thanks for reading, and be sure to visit again soon for more career advice and tips. Best of luck in your job search!

How to Write an Effective Entry Level Insurance Agent Cover Letter How to Write an Effective Entry Level Insurance Adjuster Cover Letter How to Write an Effective Cover Letter for Entry Level Insurance Agents Crafting the Perfect Cover Letter for Insurance Advisor Positions Creating a Winning Cover Letter for Entry Level Insurance Position How to Write a Stand-Out Cover Letter for an Insurance Company with No Experience

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Insurance Agent Cover Letter Samples & Examples That Worked in 2024

Your insurance agent cover letter plays a pivotal role in persuading the hiring manager that you're the right person for the job. But how can one document do so much heavy lifting?

Our comprehensive guide is here to answer all your questions. Inside, you'll find professional looking templates, cover letter samples submitted by actual people, detailed examples, and valuable tips. In short, everything you need to know to make your cover letter stand out from the rest .

Keep reading to learn all about how to:

- Craft your insurance agent cover letter header & headline

- Personalize the greeting on your insurance agent cover letter

- Write an eye-catching insurance agent cover letter introduction

- Showcase your professional value as an insurance agent

- Conclude your cover letter with a strong closing statement

- Access top resources for job-seeking insurance agents

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

1. Properly craft your insurance agent cover letter header & headline

The first step to writing an effective cover letter is to craft a well-formatted header and headline.

Your cover letter header is where you'll list all the necessary identifying information about yourself and the company you're applying to. As for your cover letter headline , this is a brief title statement used to hook an employer’s attention and serve as a preview for the information to come.

Below are more in-depth explanations and examples of each of these cover letter elements:

Formatting the header

A cover letter header isn't bound by a strict set of formatting rules and can vary in appearance depending on your personal stylistic preferences. However, a header should always contain between 3 to 4 lines of text that include:

- The name of the company & department you are applying to

- Your name and professional title

- Your professional contact information (phone number, email address, LinkedIn, etc.)

Here is an example of a well-formatted header on an insurance agent cover letter

To: Cigna Health, Hiring Department From: Jane Doe , Insurance Agent (123) 456-7890 | [email protected] | linkedin.com/in/jane-doe

Writing the headline

To write the headline of your cover letter, you should always use a keyword related to the position, an eye-catching number or trigger word, a powerful adjective or verb, and a promise.

Here is an example of a well-written headline from an Insurance Agent cover letter:

My 3-Step Approach to Matching Customers with Insurance Plans & How It Can Benefit Your Clients

Trigger Word/Number : 3-Step Approach Keyword: Insurance Plans Adjective/Verb: Matching, Benefit Promise: Your Clients – this addition at the end of the headline shows the employer that you will relate your skills and approach directly to the needs of their company and clients.

Let your cover letter write itself — with AI!

2. personalize the greeting on your insurance agent cover letter.

The greeting of your cover letter follows the headline. While generalized greetings – such as “To Whom It May Concern” – are the simplest options, personalized greetings help to make your cover letter more memorable to employers.

A personalized greeting will address a specific person or department within the company by name. In doing so, this helps to show the employer you have excellent attention to detail and have taken the time to research their company beforehand.

In some cases, you may be unable to pinpoint an exact person or department that will review your application. If this is true for you, try out one of the following alternatives:

To the [Company Name] Team

To the [Company Name] Hiring Manager

3. Write an eye-catching insurance agent cover letter introduction

With your header, headline, and greeting now in place, your next step is to write a compelling and eye-catching cover letter introduction .

A strong introductory paragraph will typically include:

- A brief overview of your professional history and goals

- A statement on why you are enthusiastic about applying to this company

- A mutual acquaintance (when possible)

Here is an example to help demonstrate how to write an insurance agent cover letter introduction

To the [Company Name] Hiring Manager,

I am an Insurance Agent with 5+ years of experience matching clients with the ideal home and property insurance plans. While working as an independent broker, I had the pleasure of meeting your company’s Head of Communications – Jack Smith – who encouraged me to apply for this position after learning of my growing client pool.

Find out your resume score!

4. Showcase your professional value as an insurance agent

Following the introduction of your cover letter are the body paragraphs. We generally recommended aiming for between 2 to 4 body paragraphs that offer more in-depth answers to the following questions:

- What excites you about working at this company?

- What do you hope to learn from working at this company?

- What accomplishments or qualifications make you stand out as an applicant?

- What key skills do you possess that are relevant to the position?

Focusing on your accomplishments is especially important, as they help to show employers the real-life value you can bring to the company.

Here is an example of how to describe an accomplishment in an insurance agent cover letter

As an Insurance Agent at [Former Employer], I achieved a 35% success rate in selling customers extra coverage with their base plans. Additionally, I regularly surpassed the monthly sales quota of $25K at an average of 10% higher sales.

5. Conclude your cover letter with a strong closing statement

To finalize your cover letter, you'll need an effective closing statement that includes:

- An enthusiastic sentence saying you are looking forward to hearing from them

- An additional sentence stating you will follow up, including how you will contact them or how they can contact you

- A formal sign-off

Here is an example of a strong closing statement from an insurance agent cover letter

As your new Insurance Agent, I will bring a large pool of loyal clients to your company and a high level of excellence in sales and consulting. I am eager to hear from you and would love to plan a formal meeting to further discuss this opportunity. I am available all weekdays from 9 a.m. to 4 p.m., and the best way to reach me is at (123) 456-7890.

If I do not hear back within a week, I will reach back out to check on the status of my application.

Best Regards,

[Applicant Name]

Follow this cover letter outline for maximum success.

6. Job-search resources for insurance agents

Armed with the perfect cover letter and your insurance agent resume , it's time to get to the grand finale — the actual job hunt! But this is easier said than done. Don't worry, we thought about this too. So, we've prepared a list of helpful resources for you to use:

- Industry-specific job boards: The most straightforward option is to look at websites that cater specifically to your profession. For example: InsuranceJobs.co.uk , iHireInsurance , or InsuranceJobs.com .

- Online job search engine: By filtering your search through location and keywords, you can find plenty of suitable opportunities with platforms like Indeed , Glassdoor , ZipRecruiter , and SimplyHired .

- Insurance associations: Organizations such as the Chartered Insurance Institute (CII), the National Association of Insurance and Financial Advisors (NAIFA), or the Independent Insurance Agents & Brokers of America (IIABA) offer unique opportunities for networking, further training, as well as job listings and so much more.

- Networking: Networking is king! And with a powerhouse of a platform like LinkedIn , you'll be able to connect with industry experts and potential employers from the comfort of your home.

- Specialized publications: Apart from occasional job postings, media like “ Insurance Journal ,” “ PropertyCasualty360 ,” or “Insurance Networking News (INN),” can help you stay up-to-date with latest industry trends, news, and strategies.

- Courses & certificates: Online learning platforms like Coursera , Udemy , edX , or even LinkedIn Learning offer a wide selection of courses and certificates that can help you stay sharp and keep developing.

It doesn't matter how many job postings you end up responding to, remember to always custom tailor every single cover letter to align as closely as possible to whatever the job description calls for.

Insurance Agent Cover Letter FAQ

Write about your skills in a real-life context. Don't just say you're great at customer service; give specific examples of how your outstanding service led to increased client satisfaction or retention. Start by describing the situation, which skills you utilized to solve it, and mention what results you achieved.Ideally you'll also support your words with quantifiable results.

When it comes to cover letter writing, nothing is set in stone. But we recommend following the structure outlined in our article. It's simple, professional, and it stood the test of time for a reason. Just make sure to always include: a greeting, introduction, main body, conclusion, and sign off.

Unless specifically requested in the job posting, it's usually best to avoid the salary discussion at this stage. You want the focus to be on your skills, experiences and fit for the role. Any further discussions about salary expectations should be left to later stages of job interviews.

In this case, less is definitely more. Your cover letter should not exceed one page. Anything longer than that, and your job application goes straight in the bin. Aim for three to four well-crafted paragraphs. The idea behind a cover letter is to pique the hiring manager's interest, not give them your life story. Stay succinct, engaging, and relevant!

Of course they do! Every single detail of your job application speaks volumes about your professionalism. For example, consistent formatting shows attention to detail. So, stick to a simple, clean font, keep margins even, and use a logical order - your contact details, the date, the recipient's details, then your letter content. But our cover letter templates will take care of any such details.

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

All accounting / finance cover letter examples

- Finance Analyst

- Investment Advisor

- Tax Services

All insurance agent cover letter examples

Related insurance agent resume examples.

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Resume Worded | Career Strategy

14 insurance agent cover letters.

Approved by real hiring managers, these Insurance Agent cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Insurance Agent

- Senior Insurance Agent

- Senior Insurance Advisor

- Insurance Sales Representative

- Entry-Level Insurance Sales Agent

- Commercial Insurance Account Manager

- Alternative introductions for your cover letter

- Insurance Agent resume examples

Insurance Agent Cover Letter Example

Why this cover letter works in 2024, increase in policy sales.

Highlighting specific achievements, such as increasing policy sales by a significant percentage, shows your ability to deliver results and make a positive impact on the company.

Client Retention Rate

Mentioning a high client retention rate demonstrates your ability to build strong relationships and provide excellent customer service, which is essential in the insurance industry.

Excitement About Company Values

Expressing your enthusiasm for the company's values, such as community involvement, shows you care about more than just the job and are genuinely interested in being a part of the company culture.

Highlight Relevant and Impressive Metrics

Here's the thing, numbers tell a story. When you showcase your success with numbers like a 95% client satisfaction rate, it provides a tangible measure of your abilities. It tells me, that not only are you good with people and handling clients, but you're exceptionally good at it.

Showcase Your Sales Acumen

You managed to increase policy upgrades by 20%? That's impressive. It demonstrates that you have a knack for sales and can effectively persuade customers to invest more in their insurance, which is a key skill for an Insurance Agent. It's this kind of information that makes me want to speak with you more.

Highlight Relevant Experience and Skills

Pointing out your relevant experience and skills in the insurance sector sends the message that you're not a newbie. It shows you've honed your skills in the industry and understand the complexities of dealing with clients on a personal level. Not to mention how this gives a sneak peek into how you've handled responsibilities in similar roles before.

Demonstrate Problem-Solving Skills

Showing that you've used data analytics to enhance client satisfaction is a practical way of saying, "Hey, I can solve problems using modern tools." It's a strong indicator that you're technologically adept and can use data to make informed decisions, which is crucial in today's data-driven business world.

Show Alignment With Company Culture

Saying that you're excited about the company's culture tells me that you've done your homework. You know what the company stands for and that you resonate with it. This not only shows that you'd fit in but also that you're likely to stick around longer because you share the same values.

Indicate Eagerness to Contribute

Explicitly stating that you're looking forward to contributing to the company's excellence shows confidence and commitment. It suggests that you're not just looking for any job, but specifically want this one and are ready to bring your A-game.

Close With Warmth

The sign-off is your final impression. "Warm regards" feels personal and leaves a positive, friendly last impression. It's a small detail that subtly reinforces your interpersonal skills.

Show your personal connection to insurance

Telling a story about how insurance positively impacted your life makes your interest genuine. It shows you understand the real value of what you're selling.

Highlight customer service success

Detailing your experience in customer service with clear examples, like exceeding sales targets, proves you have the skills to understand and meet client needs.

Demonstrate eagerness to learn

Expressing confidence in your interpersonal skills and a willingness to learn about new products shows you're ready to grow and succeed in the insurance field.

Align with the company's mission

Showing you've researched the company and are excited to support its goals indicates you'll be a dedicated team member.

Close with gratitude

Thanking the hiring manager for considering your application is polite and leaves a positive impression.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Align with the company's client focus

Starting off by acknowledging the company's dedication to personalized service and long-term relationships sets a positive tone, showing that your values match those of the company you want to join.

Demonstrate your service excellence

Describing your ability to build trust and deliver exceptional service, backed by specific achievements, highlights your direct impact on customer satisfaction and revenue growth.

Highlight your communication and client needs identification skills

Stating your confidence in these key areas reassures the hiring manager of your capability to excel in the role and contribute to the team's success.

Express your product knowledge and personalized service

Showing your deep understanding of insurance products and commitment to customizing services to meet client needs emphasizes your readiness to support the company's mission effectively.

Close with appreciation and readiness to contribute

Ending your cover letter by thanking the hiring manager and expressing eagerness to discuss how you can contribute showcases your professionalism and proactive attitude.

Show your excitement for the insurance agent role

Starting your cover letter with genuine excitement shows you're not just looking for any job, but you're passionate about working in insurance. This can make a strong first impression.

Highlight real-world experience in insurance sales

Detailing your internships and how you improved processes and satisfaction rates demonstrates practical experience and a proven track record of success, which is very appealing to hiring managers.

Demonstrate your sales and communication skills

Mentioning your ability to exceed sales targets and simplify complex terms shows you have both the technical knowledge and the soft skills to be successful in insurance sales.

Connect with the company’s values

Expressing why you're drawn to the company’s commitment to innovation and community involvement indicates that you've researched the company and see yourself as a good fit, aligning with its goals and values.

Express gratitude and eagerness to contribute

Closing with a thank you and an expression of looking forward to discussing your role further shows politeness and eagerness, rounding off the cover letter on a positive note.

Senior Insurance Agent Cover Letter Example

Lead with leadership success.

Leading a team and exceeding sales targets by 30%? That's the kind of leadership success we need in a Senior Insurance Agent role. It tells me that you not only understand the insurance industry but how to inspire a team towards a common goal. This is a big tick in my book.

Retention is Crucial

Having the highest client retention rate is a clear indicator of excellent customer service. In the insurance industry, keeping a client can be even more valuable than acquiring a new one. This little nugget of information tells me you understand the value of keeping clients happy and your team is doing an incredible job at it.

Show your senior insurance agent impact

As a senior insurance agent, highlighting over a decade of industry experience and a proven leadership track record immediately shows you're a valuable team player committed to the company's goals.

Quantify team leadership successes

Pointing out specific achievements like a 30% increase in sales and a 95% customer retention rate under your leadership provides clear, measurable evidence of your ability to drive success and manage a high-performing team.

Connect with the company's vision

Expressing your alignment with the company's commitment to innovation and enhanced customer experiences demonstrates that you not only understand their values but are also eager to contribute towards these goals.

Emphasize passion for industry growth

Your enthusiasm for continuous learning and development in the insurance field shows a forward-thinking mindset that is crucial for the growth of both the organization and its team members.

Express gratitude and eagerness for the next steps

A simple thank you can go a long way. It wraps up your cover letter on a polite note, showing your appreciation for the reader's time while expressing anticipation for further discussions.

Connect your values with the company's

Starting by aligning your personal expertise and values with the company's mission, like prioritizing exceptional service and relationship-building, sets a strong foundation for your application.

Demonstrate leadership and results in past roles

Detailing your leadership experience and quantifiable results, such as a significant sales increase under your guidance, showcases your potential to drive success as a senior insurance agent.

Highlight alignment with the company's community focus

Expressing your draw to the company’s community involvement emphasizes your shared values and suggests you'll be a culturally fit candidate who will advance those initiatives.

State your potential to meet customer needs

Asserting your position to contribute effectively to the company's vision indicates your confidence in your ability to perform well in the role, making you an appealing candidate.

Express your passion for the insurance industry

Closing with a strong statement about your passion and eagerness to discuss your contributions to the company’s success demonstrates both your commitment and enthusiasm for the role.

Senior Insurance Advisor Cover Letter Example

Share your motivation and achievements.

Explaining your dedication to enhancing client understanding and engagement combined with sharing a quantifiable achievement is a powerful one-two punch. It gives me a sense of your drive, your work ethic, and the tangible results you've delivered.

Illustrate Your Ability to Innovate

By mentioning how you've integrated technology into client engagement processes, you're showing that you're not just comfortable with change - you drive it. It's a clear signal that you're resourceful and proactive at addressing inefficiencies, which any company would appreciate.

Offer Your Expertise

Telling me that you're eager to bring your expertise in team leadership, process improvement, and tech-savvy client solutions to the company, reassures that you're not just applying randomly. You've considered what the company needs and you're confident that you can provide it.

Express Professional Alignment

Stating your enthusiasm about contributing to a company that cares for its clients and employees alike shows that you value a balanced work environment. It suggests that you'll fit in well with a team that shares these priorities.

Propose a Follow-Up

Mentioning that you're looking forward to discussing your potential contribution signals that you're serious about the role and are ready to move forward. Plus, it's a polite way of nudging the hiring manager to invite you for an interview.

Insurance Sales Representative Cover Letter Example

Emphasize sales achievements and passion.

Mentioning your track record in sales and passion for helping people showcases your drive and suitability for the insurance sales role.

Showcase problem-solving skills

Describing how you tailored an insurance package for a client highlights your ability to address unique needs, an essential skill in insurance sales.

Express enthusiasm for the company

Stating your admiration for the company's service and support to customers demonstrates your alignment with their values and dedication to the role.

Highlight desire for professional growth

Showing eagerness to learn from experienced professionals indicates you're proactive about your development, a trait valued in any role.

End with a polite thank you

A courteous closure to your application reinforces your professionalism and respect for the hiring manager's time.

Show your interest in the company's mission

When you express genuine admiration for the company's goals, like innovation and helping others, it shows you're not just looking for any job. You want to be part of what they are doing.

Highlight your ability to connect with clients

Talking about how you exceed sales targets by building relationships and understanding client needs demonstrates your skills in communication and empathy, which are crucial for an insurance sales representative role.

Bring your sales expertise to the forefront

Mentioning your excitement to utilize your sales skills and customer-focused approach helps me see you're ready to contribute positively and effectively from the start.

Emphasize your work ethic and desire to learn

Stressing your strong work ethic and enthusiasm for continuous learning makes you stand out as a candidate who will grow and adapt, benefiting the company long-term.

Show eagerness to contribute to the company's success

Ending with a strong statement of eagerness to discuss your fit for the role shows initiative and a proactive attitude, which are attractive qualities in a potential hire.

Entry-Level Insurance Sales Agent Cover Letter Example

Share your passion for the insurance industry.

Mentioning your fascination with insurance and how it impacts lives immediately shows your interest in the field, making you a more compelling candidate for the entry-level position.

Quantify your contributions during internships

By quantifying your achievements, like assisting in a 10% increase in policy renewals, you provide concrete evidence of your ability to make a positive impact, which is exactly what hiring managers are looking for.

Emphasize your alignment with company culture

Highlighting your attraction to the company’s focus on professional development and a supportive team shows that you’re not just interested in the job, but also in growing with the company, making you a more attractive candidate.

Convey your enthusiasm for joining the team

Expressing excitement about the possibility of contributing to the company’s success illustrates a proactive and positive attitude, traits highly valued in any new hire.

Show eagerness for a personal meeting

Stating your desire to discuss how you can contribute to the team in a meeting indicates that you are ready and willing to take the next steps, demonstrating initiative and confidence.

Commercial Insurance Account Manager Cover Letter Example

Show your commercial insurance expertise.

When you highlight your experience in managing client relationships and understanding of insurance products, it sets a foundation for your capability to add value to the company. This is what hiring managers look for.

Demonstrate impact with numbers

Mentioning specific achievements, like a high client retention rate and increase in policy upgrades, shows you're not just doing the job—you're excelling at it. This quantifiable success makes your application memorable.

Connect with the company's values

Expressing admiration for the company's commitment to innovation and customized solutions shows that your values align with theirs. It's important to show you've researched the company and see yourself fitting into their culture.

Summarize your fit for the role

A concise summary of your qualifications and enthusiasm for the industry underlines your fit for the role. It reiterates your suitability and passion, making a strong closing argument for your candidacy.

Express eagerness for a discussion

Inviting further conversation demonstrates your proactive approach and eagerness to engage. It’s a positive note to end on, leaving the door open for the next step in the application process.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Insurance Agent Roles

- Health Insurance Agent Cover Letter Guide

- Insurance Agent Cover Letter Guide

- Insurance Case Manager Cover Letter Guide

- Insurance Claims Manager Cover Letter Guide

- Insurance Investigator Cover Letter Guide

- Insurance Sales Agent Cover Letter Guide

- Insurance Underwriter Cover Letter Guide

- Life Insurance Agent Cover Letter Guide

Other Other Cover Letters

- Business Owner Cover Letter Guide

- Consultant Cover Letter Guide

- Correctional Officer Cover Letter Guide

- Demand Planning Manager Cover Letter Guide

- Executive Assistant Cover Letter Guide

- Operations Manager Cover Letter Guide

- Orientation Leader Cover Letter Guide

- Plant Manager Cover Letter Guide

- Production Planner Cover Letter Guide

- Recruiter Cover Letter Guide

- Recruiting Coordinator Cover Letter Guide

- Site Manager Cover Letter Guide

- Supply Chain Planner Cover Letter Guide

- Teacher Cover Letter Guide

- Vice President of Operations Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

1 Insurance Agent Cover Letter Example

Insurance Agents excel at assessing risk, tailoring policies to individual needs, and providing peace of mind in uncertain situations. Similarly, your cover letter is your opportunity to assess and present your own professional 'risks' and 'policies' - your skills, experiences, and unique value - in a way that provides recruiters with confidence in your potential. In this guide, we'll navigate through top-notch Insurance Agent cover letter examples, ensuring your application stands out in the competitive insurance industry.

Cover Letter Examples

Cover letter guidelines, insurance agent cover letter example, how to format a insurance agent cover letter, cover letter header, what to focus on with your cover letter header:, cover letter header examples for insurance agent, cover letter greeting, get your cover letter greeting right:, cover letter greeting examples for insurance agent, cover letter introduction, what to focus on with your cover letter intro:, cover letter intro examples for insurance agent, cover letter body, what to focus on with your cover letter body:, cover letter body examples for insurance agent, cover letter closing, what to focus on with your cover letter closing:, cover letter closing paragraph examples for insurance agent, pair your cover letter with a foundational resume, cover letter writing tips for insurance agents, highlight your expertise in the insurance industry, showcase your sales skills, demonstrate your customer service abilities, emphasize your attention to detail, express your adaptability, cover letter mistakes to avoid as a insurance agent, failing to highlight relevant skills, using generic language, not proofreading, being too lengthy, not showing enthusiasm, cover letter faqs for insurance agents.

The best way to start an Insurance Agent cover letter is by addressing the hiring manager directly, if their name is known. Then, introduce yourself and state the position you're applying for. Make sure to include a compelling hook in your opening paragraph that highlights your relevant experience, skills, or achievements. For instance, you could mention how your expertise in risk management strategies led to a significant decrease in claims at your previous company. This not only grabs the reader's attention but also shows that you understand the role and its requirements.

Insurance Agents should end a cover letter by summarizing their key skills and experiences that make them a suitable candidate for the role. They should express enthusiasm for the opportunity and show interest in the company's mission or values. It's also crucial to include a call to action, such as a request for an interview or a meeting. For example: "I am excited about the opportunity to bring my unique blend of skills and experience to your team and am confident that I can contribute to your company's success. I look forward to the possibility of discussing my application with you further. Thank you for considering my application." Remember to end the letter professionally with a closing like "Sincerely" or "Best regards," followed by your full name and contact information.

An Insurance Agent's cover letter should ideally be about one page long. This length is sufficient to introduce yourself, explain why you're interested in the insurance field, highlight your relevant skills and experiences, and express your interest in the specific agency you're applying to. It's important to keep it concise and to the point, as hiring managers often have many applications to review and may not spend a lot of time on each one. A well-written, one-page cover letter can effectively convey your qualifications and enthusiasm for the job without overwhelming the reader with too much information.