Qualitative study design: Surveys & questionnaires

- Qualitative study design

- Phenomenology

- Grounded theory

- Ethnography

- Narrative inquiry

- Action research

- Case Studies

- Field research

- Focus groups

- Observation

- Surveys & questionnaires

- Study Designs Home

Surveys & questionnaires

Qualitative surveys use open-ended questions to produce long-form written/typed answers. Questions will aim to reveal opinions, experiences, narratives or accounts. Often a useful precursor to interviews or focus groups as they help identify initial themes or issues to then explore further in the research. Surveys can be used iteratively, being changed and modified over the course of the research to elicit new information.

Structured Interviews may follow a similar form of open questioning.

Qualitative surveys frequently include quantitative questions to establish elements such as age, nationality etc.

Qualitative surveys aim to elicit a detailed response to an open-ended topic question in the participant’s own words. Like quantitative surveys, there are three main methods for using qualitative surveys including face to face surveys, phone surveys, and online surveys. Each method of surveying has strengths and limitations.

Face to face surveys

- Researcher asks participants one or more open-ended questions about a topic, typically while in view of the participant’s facial expressions and other behaviours while answering. Being able to view the respondent’s reactions enables the researcher to ask follow-up questions to elicit a more detailed response, and to follow up on any facial or behavioural cues that seem at odds with what the participants is explicitly saying.

- Face to face qualitative survey responses are likely to be audio recorded and transcribed into text to ensure all detail is captured; however, some surveys may include both quantitative and qualitative questions using a structured or semi-structured format of questioning, and in this case the researcher may simply write down key points from the participant’s response.

Telephone surveys

- Similar to the face to face method, but without researcher being able to see participant’s facial or behavioural responses to questions asked. This means the researcher may miss key cues that would help them ask further questions to clarify or extend participant responses to their questions, and instead relies on vocal cues.

Online surveys

- Open-ended questions are presented to participants in written format via email or within an online survey tool, often alongside quantitative survey questions on the same topic.

- Researchers may provide some contextualising information or key definitions to help ‘frame’ how participants view the qualitative survey questions, since they can’t directly ask the researcher about it in real time.

- Participants are requested to responses to questions in text ‘in some detail’ to explain their perspective or experience to researchers; this can result in diversity of responses (brief to detailed).

- Researchers can not always probe or clarify participant responses to online qualitative survey questions which can result in data from these responses being cryptic or vague to the researcher.

- Online surveys can collect a greater number of responses in a set period of time compared to face to face and phone survey approaches, so while data may be less detailed, there is more of it overall to compensate.

Qualitative surveys can help a study early on, in finding out the issues/needs/experiences to be explored further in an interview or focus group.

Surveys can be amended and re-run based on responses providing an evolving and responsive method of research.

Online surveys will receive typed responses reducing translation by the researcher

Online surveys can be delivered broadly across a wide population with asynchronous delivery/response.

Limitations

Hand-written notes will need to be transcribed (time-consuming) for digital study and kept physically for reference.

Distance (or online) communication can be open to misinterpretations that cannot be corrected at the time.

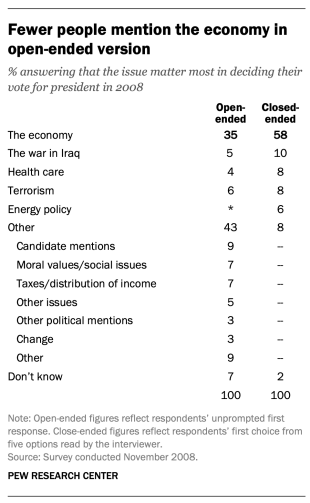

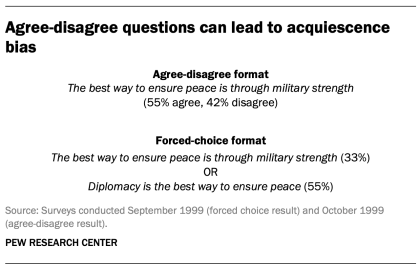

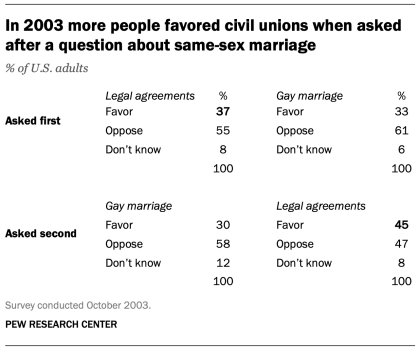

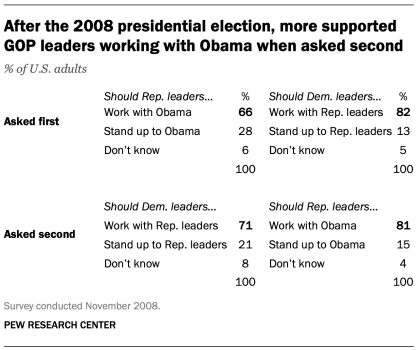

Questions can be leading/misleading, eliciting answers that are not core to the research subject. Researchers must aim to write a neutral question which does not give away the researchers expectations.

Even with transcribed/digital responses analysis can be long and detailed, though not as much as in an interview.

Surveys may be left incomplete if performed online or taken by research assistants not well trained in giving the survey/structured interview.

Narrow sampling may skew the results of the survey.

Example questions

Here are some example survey questions which are open ended and require a long form written response:

- Tell us why you became a doctor?

- What do you expect from this health service?

- How do you explain the low levels of financial investment in mental health services? (WHO, 2007)

Example studies

- Davey, L. , Clarke, V. and Jenkinson, E. (2019), Living with alopecia areata: an online qualitative survey study. British Journal of Dermatology, 180 1377-1389. Retrieved from https://onlinelibrary-wiley-com.ezproxy-f.deakin.edu.au/doi/10.1111%2Fbjd.17463

- Richardson, J. (2004). What Patients Expect From Complementary Therapy: A Qualitative Study. American Journal of Public Health, 94(6), 1049–1053. Retrieved from http://ezproxy.deakin.edu.au/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=s3h&AN=13270563&site=eds-live&scope=site

- Saraceno, B., van Ommeren, M., Batniji, R., Cohen, A., Gureje, O., Mahoney, J., ... & Underhill, C. (2007). Barriers to improvement of mental health services in low-income and middle-income countries. The Lancet, 370(9593), 1164-1174. Retrieved from https://www-sciencedirect-com.ezproxy-f.deakin.edu.au/science/article/pii/S014067360761263X?via%3Dihub

Below has more detail of the Lancet article including actual survey questions at:

- World Health Organization. (2007.) Expert opinion on barriers and facilitating factors for the implementation of existing mental health knowledge in mental health services. Geneva: World Health Organization. https://apps.who.int/iris/handle/10665/44808

- Green, J. 1961-author., & Thorogood, N. (2018). Qualitative methods for health research. SAGE. Retrieved from http://ezproxy.deakin.edu.au/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=cat00097a&AN=deakin.b4151167&authtype=sso&custid=deakin&site=eds-live&scope=site

- JANSEN, H. The Logic of Qualitative Survey Research and its Position in the Field of Social Research Methods. Forum Qualitative Sozialforschung, 11(2), Retrieved from http://www.qualitative-research.net/index.php/fqs/article/view/1450/2946

- Neilsen Norman Group, (2019). 28 Tips for Creating Great Qualitative Surveys. Retrieved from https://www.nngroup.com/articles/qualitative-surveys/

- << Previous: Documents

- Next: Interviews >>

- Last Updated: Apr 8, 2024 11:12 AM

- URL: https://deakin.libguides.com/qualitative-study-designs

.webp)

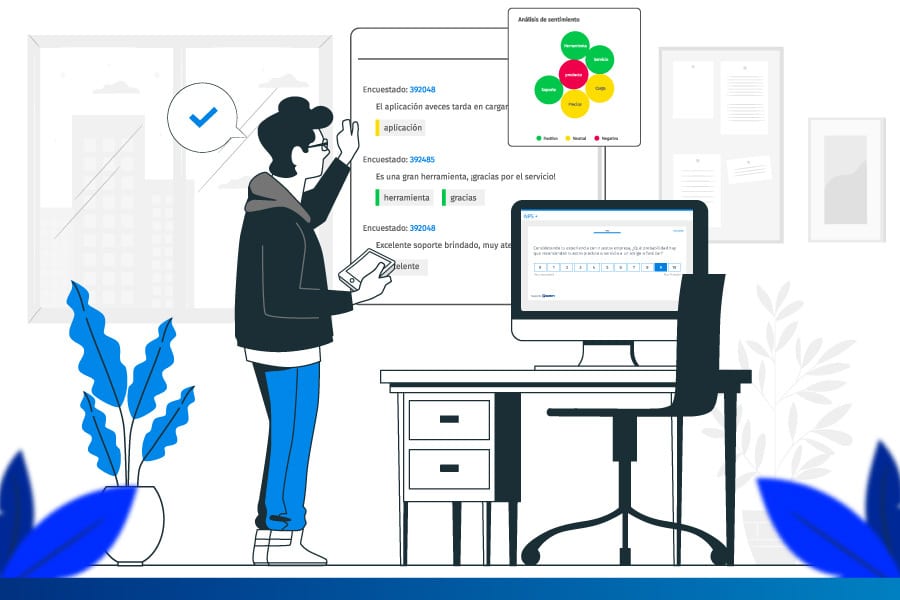

10+ Qualitative Survey Questions to Collect Deep Insights

Just like great ingredients are the basis for preparing an amazing meal, a great survey needs to have amazing questions. And unless you know the recipe by heart, choosing effective survey questions can be difficult. One of the most common choices you can make are qualitative survey questions.

They let you uncover deep insights with qualitative research, but they do come with some challenges. In this article, we’ll show you how to write great qualitative questions, what makes them good (and bad) choices for your qualitative surveys, as well as some examples to get you inspired.

Qualitative vs. quantitative questions

Before we go any further, we need to make a distinction between qualitative and quantitative survey questions .

Qualitative questions help you get qualitative data. These are the questions that get behind the why, what, and how of a particular subject through qualitative research of your focus groups. An example of a qualitative question would be: Please describe your recent experience with our customer support.

Use qualitative research questions when you need customers to explain their experience in their own words and provide you with deeper insights.

Quantitative questions help you collect quantitative, numerical data. They help you put a numerical value on your customers’ feedback. An example of a quantitative question would be: “On a scale from 1 to 10, please rate your satisfaction with your recent experience with our customer support?”

Use quantitative research questions when you need data that is easy to analyze and quantify so that you can make an important decision based on data.

Both question types have their pros and cons, and depending on your needs, you’ll want to use one or the other or a combination of both research methods on your target audience.

How to write good qualitative survey questions

Qualitative survey questions can unearth impressive data. However, you need to be very careful about how you write them to get the best feedback from your focus groups. Here are some quick tips to get started.

Make the qualitative research questions specific

The first rule is very simple. A qualitative question leaves your audience with a space to write anything they want. And the truth is, they will literally write anything if you don’t point them in the right direction.

If your survey questions are too broad, they will result in broad answers and feedback that is not particularly useful. For example, asking “How do you like our dashboard?” is going to give you a wide range of answers.

Instead, ask something along the lines of “What do you think of the different visualization styles in our reporting dashboard?”

The more specific the survey questions, the better the feedback.

Have a clear purpose

Why are you asking a certain question? In the case of quantitative surveys, you don’t always need a specific reason, e.g. checking up on your NPS score .

However, qualitative questions demand lengthier answers and you need to motivate your target audience to provide that answer. The best way to do so? Just let them know why you’re asking.

For example, you could say that you’re asking about the checkout process in order to make it quicker to purchase and easier to choose a preferred payment method. The stronger the benefit for the customer, the more reasons for stating the purpose of the survey.

Focus on quality, not numbers

You won’t get the same number of answers with qualitative questions compared to quantitative ones such as CSAT surveys . Put simply, writing out an answer takes more time than selecting a number on a scale.

You may be tempted to simplify your survey questions to get more answers from your survey participants. However, try and resist the temptation.

Your aim is to get amazing feedback so don’t shy away from asking the survey questions that really interest you. Five good answers are much better than 50 superficial ones you can’t use.

Add subquestions when necessary

Sometimes, you can’t get all the info you need from one answer. If you want to ensure you get all the feedback you need, asking a subquestion makes sense.

For example, you could ask customers about their thoughts on a new feature you launched. A subquestion could be one where you ask the customers what would make them use that feature more.

You can actually ask this question in a matter of seconds by using this survey template:

Your customers are willing to provide feedback to help you out, but you sometimes need to nudge them in the right direction.

Pros and cons of using qualitative questions for surveys

Qualitative survey questions can yield amazing results. However, they have their good and bad sides, and you need to be aware of both before creating your next survey.

Advantages of using qualitative questions in surveys

Let’s start with the good stuff.

They help you get in-depth data

A quantitative question tells you how likely someone is to recommend you on a scale. While a number is a good piece of info, a few sentences describing why and how they would recommend you will provide the context. If you want in-depth data where customers describe how they feel about you in more detail, you need qualitative research questions.

They are more flexible by nature

The typical quantitative question has a standard form. Survey types such as CSAT, NPS, and CES have question formats that don’t vary much. On the other hand, the sky is the limit with qualitative research questions. You can phrase them in any way you want, using specific expressions to narrow down the type of feedback you want to get.

They encourage discussion

There is little that can happen once an NPS survey is complete. You get the results, analyze them (in minutes, thanks to Survicate’s dashboard ), and the conversation is over. Qualitative research questions encourage your customers to speak their minds and share how they feel.

Disadvantages of using qualitative survey questions

There are some downsides to keep in mind with this question type.

The sample size

Qualitative data is amazing when it comes to the insights that you get. But on the flip side, it requires detailed analysis, and you have to manually go through all the survey responses to find the gold nuggets in your feedback. As a result, the sample is usually much smaller than in quantitative surveys, and you have to use focus groups with limited respondent numbers.

Sample bias

With the smaller size sample usually comes the sample bias . This means that you’ll tend to pick customers who are similar in some way, including demographics, use cases, location, and your data might be skewed.

Lack of privacy

Lots of data is always a great thing for businesses, but there may be some concerns from the customers’ end.

If they give you detailed answers, you can accurately pinpoint the identity of the customer who supplied the answer. You can solve a part of the problem by making the survey anonymous , but bear in mind that some customers will be concerned about privacy issues regardless.

Difficulty with statistical analysis

Imagine 500 respondents filled in your NPS survey. You could get your NPS score within seconds using survey software like Survicate. On the other hand, getting qualitative research results from a focus group with 500 people could take weeks. Be prepared to set aside some time to go through the responses to your qualitative surveys manually.

Qualitative question examples

Here are some amazing qualitative question examples to get you inspired. You can adapt these to a specific use case depending on your industry and niche.

Exploratory questions

The most common of the qualitative research questions, the exploratory question aims to just… explore. You ask your survey participants about a particular topic so you can learn more about their thoughts, experiences, and attitudes.

- Describe the last interaction you had with our product.

- Does our product meet your overall expectations?

- What is the most valuable feature in our product?

- Why did you choose to use our product compared to the competitors?

- What is the one aspect of our product that you never use?

- What is your biggest objection to our checkout process and why?

Predictive questions

Predictive survey questions put survey participants in a certain situation. Based on past events, you ask them to predict what would happen in a hypothetical situation. If you phrase the questions correctly, they can provide a wealth of feedback about the respondents’ pain points and your product.

- If we added free returns on all orders above $50, would you shop more with us?

- If you could add one more feature to our product, what would that feature be and why?

- If we had a Zapier integration for our app, how often would you use it?

- If you were in charge of our customer support for a day, what would you change and why?

- Would you be more likely to buy our product if it was endorsed by a large company such as Microsoft?

Get ready for deep insights with qualitative questions in your surveys

Not everyone is born a great writer or a qualitative research expert. But nowadays, you don’t have to be either of those things to write amazing qualitative questions and have great qualitative surveys.

Survey software has come a long way and nowadays, it does more than just provide a platform for creating and distributing online surveys. Survicate comes with 125+ survey templates out of the box, packed with quantitative and qualitative questions, ready to use.

Kickstart your qualitative research today by choosing the right tool for the job. Try Survicate and see why online surveys are the future of conducting qualitative research.

We’re also there

Qualitative Research Questions: Gain Powerful Insights + 25 Examples

We review the basics of qualitative research questions, including their key components, how to craft them effectively, & 25 example questions.

Einstein was many things—a physicist, a philosopher, and, undoubtedly, a mastermind. He also had an incredible way with words. His quote, "Everything that can be counted does not necessarily count; everything that counts cannot necessarily be counted," is particularly poignant when it comes to research.

Some inquiries call for a quantitative approach, for counting and measuring data in order to arrive at general conclusions. Other investigations, like qualitative research, rely on deep exploration and understanding of individual cases in order to develop a greater understanding of the whole. That’s what we’re going to focus on today.

Qualitative research questions focus on the "how" and "why" of things, rather than the "what". They ask about people's experiences and perceptions , and can be used to explore a wide range of topics.

The following article will discuss the basics of qualitative research questions, including their key components, and how to craft them effectively. You'll also find 25 examples of effective qualitative research questions you can use as inspiration for your own studies.

Let’s get started!

What are qualitative research questions, and when are they used?

When researchers set out to conduct a study on a certain topic, their research is chiefly directed by an overarching question . This question provides focus for the study and helps determine what kind of data will be collected.

By starting with a question, we gain parameters and objectives for our line of research. What are we studying? For what purpose? How will we know when we’ve achieved our goals?

Of course, some of these questions can be described as quantitative in nature. When a research question is quantitative, it usually seeks to measure or calculate something in a systematic way.

For example:

- How many people in our town use the library?

- What is the average income of families in our city?

- How much does the average person weigh?

Other research questions, however—and the ones we will be focusing on in this article—are qualitative in nature. Qualitative research questions are open-ended and seek to explore a given topic in-depth.

According to the Australian & New Zealand Journal of Psychiatry , “Qualitative research aims to address questions concerned with developing an understanding of the meaning and experience dimensions of humans’ lives and social worlds.”

This type of research can be used to gain a better understanding of people’s thoughts, feelings and experiences by “addressing questions beyond ‘what works’, towards ‘what works for whom when, how and why, and focusing on intervention improvement rather than accreditation,” states one paper in Neurological Research and Practice .

Qualitative questions often produce rich data that can help researchers develop hypotheses for further quantitative study.

- What are people’s thoughts on the new library?

- How does it feel to be a first-generation student at our school?

- How do people feel about the changes taking place in our town?

As stated by a paper in Human Reproduction , “...‘qualitative’ methods are used to answer questions about experience, meaning, and perspective, most often from the standpoint of the participant. These data are usually not amenable to counting or measuring.”

Both quantitative and qualitative questions have their uses; in fact, they often complement each other. A well-designed research study will include a mix of both types of questions in order to gain a fuller understanding of the topic at hand.

If you would like to recruit unlimited participants for qualitative research for free and only pay for the interview you conduct, try using Respondent today.

Crafting qualitative research questions for powerful insights

Now that we have a basic understanding of what qualitative research questions are and when they are used, let’s take a look at how you can begin crafting your own.

According to a study in the International Journal of Qualitative Studies in Education, there is a certain process researchers should follow when crafting their questions, which we’ll explore in more depth.

1. Beginning the process

Start with a point of interest or curiosity, and pose a draft question or ‘self-question’. What do you want to know about the topic at hand? What is your specific curiosity? You may find it helpful to begin by writing several questions.

For example, if you’re interested in understanding how your customer base feels about a recent change to your product, you might ask:

- What made you decide to try the new product?

- How do you feel about the change?

- What do you think of the new design/functionality?

- What benefits do you see in the change?

2. Create one overarching, guiding question

At this point, narrow down the draft questions into one specific question. “Sometimes, these broader research questions are not stated as questions, but rather as goals for the study.”

As an example of this, you might narrow down these three questions:

into the following question:

- What are our customers’ thoughts on the recent change to our product?

3. Theoretical framing

As you read the relevant literature and apply theory to your research, the question should be altered to achieve better outcomes. Experts agree that pursuing a qualitative line of inquiry should open up the possibility for questioning your original theories and altering the conceptual framework with which the research began.

If we continue with the current example, it’s possible you may uncover new data that informs your research and changes your question. For instance, you may discover that customers’ feelings about the change are not just a reaction to the change itself, but also to how it was implemented. In this case, your question would need to reflect this new information:

- How did customers react to the process of the change, as well as the change itself?

4. Ethical considerations

A study in the International Journal of Qualitative Studies in Education stresses that ethics are “a central issue when a researcher proposes to study the lives of others, especially marginalized populations.” Consider how your question or inquiry will affect the people it relates to—their lives and their safety. Shape your question to avoid physical, emotional, or mental upset for the focus group.

In analyzing your question from this perspective, if you feel that it may cause harm, you should consider changing the question or ending your research project. Perhaps you’ve discovered that your question encourages harmful or invasive questioning, in which case you should reformulate it.

5. Writing the question

The actual process of writing the question comes only after considering the above points. The purpose of crafting your research questions is to delve into what your study is specifically about” Remember that qualitative research questions are not trying to find the cause of an effect, but rather to explore the effect itself.

Your questions should be clear, concise, and understandable to those outside of your field. In addition, they should generate rich data. The questions you choose will also depend on the type of research you are conducting:

- If you’re doing a phenomenological study, your questions might be open-ended, in order to allow participants to share their experiences in their own words.

- If you’re doing a grounded-theory study, your questions might be focused on generating a list of categories or themes.

- If you’re doing ethnography, your questions might be about understanding the culture you’re studying.

Whenyou have well-written questions, it is much easier to develop your research design and collect data that accurately reflects your inquiry.

In writing your questions, it may help you to refer to this simple flowchart process for constructing questions:

Download Free E-Book

25 examples of expertly crafted qualitative research questions

It's easy enough to cover the theory of writing a qualitative research question, but sometimes it's best if you can see the process in practice. In this section, we'll list 25 examples of B2B and B2C-related qualitative questions.

Let's begin with five questions. We'll show you the question, explain why it's considered qualitative, and then give you an example of how it can be used in research.

1. What is the customer's perception of our company's brand?

Qualitative research questions are often open-ended and invite respondents to share their thoughts and feelings on a subject. This question is qualitative because it seeks customer feedback on the company's brand.

This question can be used in research to understand how customers feel about the company's branding, what they like and don't like about it, and whether they would recommend it to others.

2. Why do customers buy our product?

This question is also qualitative because it seeks to understand the customer's motivations for purchasing a product. It can be used in research to identify the reasons customers buy a certain product, what needs or desires the product fulfills for them, and how they feel about the purchase after using the product.

3. How do our customers interact with our products?

Again, this question is qualitative because it seeks to understand customer behavior. In this case, it can be used in research to see how customers use the product, how they interact with it, and what emotions or thoughts the product evokes in them.

4. What are our customers' biggest frustrations with our products?

By seeking to understand customer frustrations, this question is qualitative and can provide valuable insights. It can be used in research to help identify areas in which the company needs to make improvements with its products.

5. How do our customers feel about our customer service?

Rather than asking why customers like or dislike something, this question asks how they feel. This qualitative question can provide insights into customer satisfaction or dissatisfaction with a company.

This type of question can be used in research to understand what customers think of the company's customer service and whether they feel it meets their needs.

20 more examples to refer to when writing your question

Now that you’re aware of what makes certain questions qualitative, let's move into 20 more examples of qualitative research questions:

- How do your customers react when updates are made to your app interface?

- How do customers feel when they complete their purchase through your ecommerce site?

- What are your customers' main frustrations with your service?

- How do people feel about the quality of your products compared to those of your competitors?

- What motivates customers to refer their friends and family members to your product or service?

- What are the main benefits your customers receive from using your product or service?

- How do people feel when they finish a purchase on your website?

- What are the main motivations behind customer loyalty to your brand?

- How does your app make people feel emotionally?

- For younger generations using your app, how does it make them feel about themselves?

- What reputation do people associate with your brand?

- How inclusive do people find your app?

- In what ways are your customers' experiences unique to them?

- What are the main areas of improvement your customers would like to see in your product or service?

- How do people feel about their interactions with your tech team?

- What are the top five reasons people use your online marketplace?

- How does using your app make people feel in terms of connectedness?

- What emotions do people experience when they're using your product or service?

- Aside from the features of your product, what else about it attracts customers?

- How does your company culture make people feel?

As you can see, these kinds of questions are completely open-ended. In a way, they allow the research and discoveries made along the way to direct the research. The questions are merely a starting point from which to explore.

This video offers tips on how to write good qualitative research questions, produced by Qualitative Research Expert, Kimberly Baker.

Wrap-up: crafting your own qualitative research questions.

Over the course of this article, we've explored what qualitative research questions are, why they matter, and how they should be written. Hopefully you now have a clear understanding of how to craft your own.

Remember, qualitative research questions should always be designed to explore a certain experience or phenomena in-depth, in order to generate powerful insights. As you write your questions, be sure to keep the following in mind:

- Are you being inclusive of all relevant perspectives?

- Are your questions specific enough to generate clear answers?

- Will your questions allow for an in-depth exploration of the topic at hand?

- Do the questions reflect your research goals and objectives?

If you can answer "yes" to all of the questions above, and you've followed the tips for writing qualitative research questions we shared in this article, then you're well on your way to crafting powerful queries that will yield valuable insights.

Download Free E-Book

.png?width=2500&name=Respondent_100+Questions_Banners_1200x644%20(1).png)

Asking the right questions in the right way is the key to research success. That’s true for not just the discussion guide but for every step of a research project. Following are 100+ questions that will take you from defining your research objective through screening and participant discussions.

Fill out the form below to access free e-book!

Recommend Resources:

- How to Recruit Participants for Qualitative Research

- The Best UX Research Tools of 2022

- 10 Smart Tips for Conducting Better User Interviews

- 50 Powerful Questions You Should Ask In Your Next User Interview

- How To Find Participants For User Research: 13 Ways To Make It Happen

- UX Diary Study: 5 Essential Tips For Conducing Better Studies

- User Testing Recruitment: 10 Smart Tips To Find Participants Fast

- Qualitative Research Questions: Gain Powerful Insights + 25

- How To Successfully Recruit Participants for A Study (2022 Edition)

- How To Properly Recruit Focus Group Participants (2022 Edition)

- The Best Unmoderated Usability Testing Tools of 2022

50 Powerful User Interview Questions You Should Consider Asking

We researched the best user interview questions you can use for your qualitative research studies. Use these 50 sample questions for your next...

How To Unleash Your Extra Income Potential With Respondent

The number one question we get from new participants is “how can I get invited to participate in more projects.” In this article, we’ll discuss a few...

Understanding Why High-Quality Research Needs High-Quality Participants

Why are high-quality participants essential to your research? Read here to find out who they are, why you need them, and how to find them.

- (855) 776-7763

Training Maker

All Products

Qualaroo Insights

ProProfs.com

- Sign Up Free

Do you want a free Survey Software?

We have the #1 Online Survey Maker Software to get actionable user insights.

How to Write Qualitative Research Questions: Types & Examples

Sameer Bhatia

Founder and CEO - ProProfs

Review Board Member

Sameer Bhatia is the Founder and Chief Executive Officer of ProProfs.com. He believes that software should make you happy and is driven to create a 100-year company that delivers delightfully ... Read more

Sameer Bhatia is the Founder and Chief Executive Officer of ProProfs.com. He believes that software should make you happy and is driven to create a 100-year company that delivers delightfully smart software with awesome support. His favorite word is 'delight,' and he dislikes the term 'customer satisfaction,' as he believes that 'satisfaction' is a low bar and users must get nothing less than a delightful experience at ProProfs. Sameer holds a Masters in Computer Science from the University of Southern California (USC). He lives in Santa Monica with his wife & two daughters. Read less

Market Research Specialist

Emma David, a seasoned market research professional, specializes in employee engagement, survey administration, and data management. Her expertise in leveraging data for informed decisions has positively impacted several brands, enhancing their market position.

Qualitative research questions focus on depth and quality, exploring the “why and how” behind decisions, without relying on statistical tools.

Unlike quantitative research, which aims to collect tangible, measurable data from a broader demographic, qualitative analysis involves smaller, focused datasets, identifying patterns for insights.

The information collected by qualitative surveys can vary from text to images, demanding a deep understanding of the subject, and therefore, crafting precise qualitative research questions is crucial for success.

In this guide, we’ll discuss how to write effective qualitative research questions, explore various types, and highlight characteristics of good qualitative research questions.

Let’s dive in!

What Are Qualitative Research Questions?

Qualitative questions aim to understand the depth and nuances of a phenomenon, focusing on “why” and “how” rather than quantifiable measures.

They explore subjective experiences, perspectives, and behaviors, often using open-ended inquiries to gather rich, descriptive data.

Unlike quantitative questions, which seek numerical data, qualitative questions try to find out meanings, patterns, and underlying processes within a specific context.

These questions are essential for exploring complex issues, generating hypotheses, and gaining deeper insights into human behavior and phenomena.

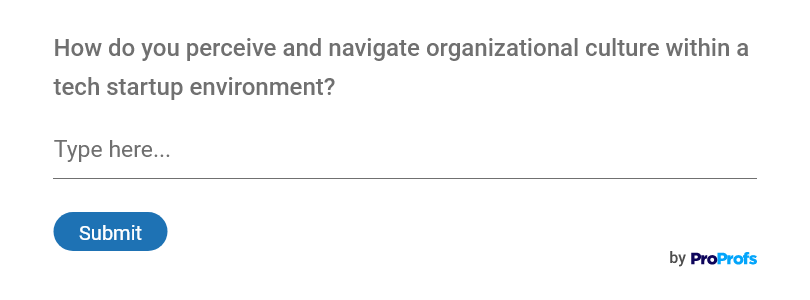

Here’s an example of a qualitative research question:

“How do you perceive and navigate organizational culture within a tech startup environment?”

This question asks about the respondent’s subjective interpretations and experiences of organizational culture within a specific context, such as a tech startup.

It seeks to uncover insights into the values, norms, and practices that shape workplace dynamics and employee behaviors, providing qualitative data for analysis and understanding.

When Should We Use Qualitative Research Questions?

Qualitative research questions typically aim to open up conversations, encourage detailed narratives, and foster a deep understanding of the subject matter. Here are some scenarios they are best suited for:

- Exploring Complex Phenomena : When the research topic involves understanding complex processes, behaviors, or interactions that cannot be quantified easily, qualitative questions help delve into these intricate details.

- Understanding Contexts and Cultures : To grasp the nuances of different social contexts, cultures, or subcultures, qualitative research questions allow for an in-depth exploration of these environments and how they influence individuals and groups.

- Exploring Perceptions and Experiences : When the aim is to understand people’s perceptions, experiences, or feelings about a particular subject, qualitative questions facilitate capturing the depth and variety of these perspectives.

- Developing Concepts or Theories : In the early stages of research, where concepts or theories are not yet well-developed, qualitative questions can help generate hypotheses, identify variables, and develop theoretical frameworks based on observations and interpretations.

- Investigating Processes : To understand how processes unfold over time and the factors that influence these processes, qualitative questions are useful for capturing the dynamics and complexities involved.

- Seeking to Understand Change : When researching how individuals or groups experience change, adapt to new circumstances, or make decisions, qualitative research questions can provide insights into the motivations, challenges, and strategies involved.

- Studying Phenomena Not Easily Quantified : For phenomena that are not easily captured through quantitative measures, such as emotions, beliefs, or motivations, qualitative questions can probe these abstract concepts more effectively.

- Addressing Sensitive or Taboo Topics : In studies where topics may be sensitive, controversial, or taboo, qualitative research questions allow for a respectful and empathetic exploration of these subjects, providing space for participants to share their experiences in their own words.

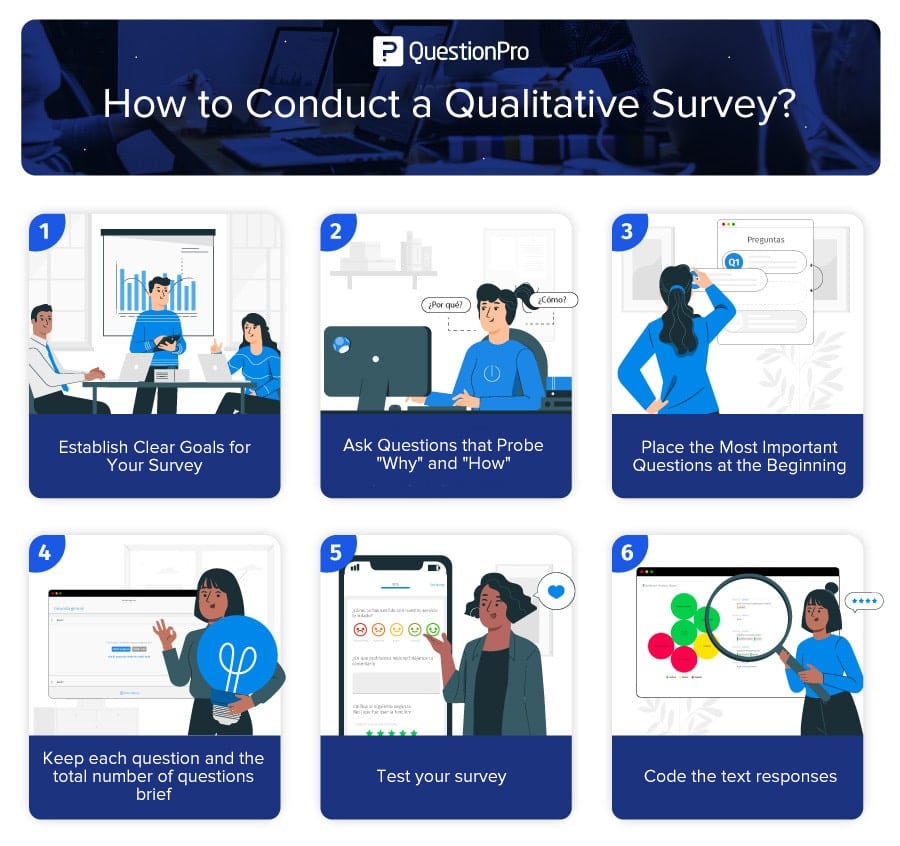

How to Write Qualitative Research Questions?

Read this guide to learn how you can craft well-thought-out qualitative research questions:

1. Begin with Your Research Goals

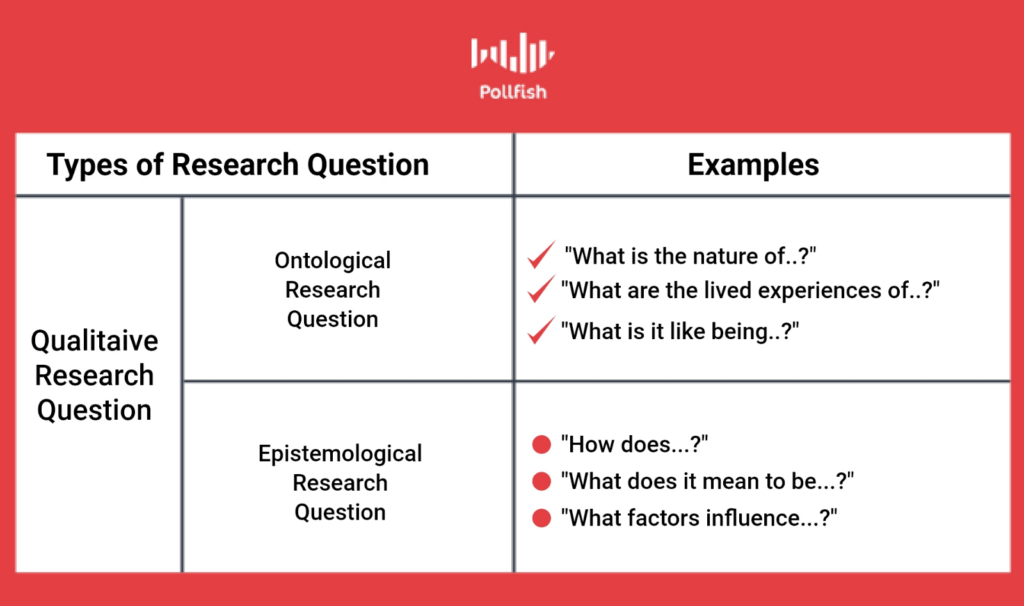

The first step in formulating qualitative research questions is to have a clear understanding of what you aim to discover or understand through your research. There are two types of qualitative questionnaires or research – Ontological and Epistemological.

Finding out the nature of your research influences all aspects of your research design, including the formulation of research questions.

Subsequently:

- Identify your main objective : Consider the broader context of your study. Are you trying to explore a phenomenon, understand a process, or interpret the meanings behind behaviors? Your main objective should guide the formulation of your questions, ensuring they are aligned with what you seek to achieve.

- Focus on the ‘how’ and ‘why’ : Qualitative research is inherently exploratory and aims to understand the nuances of human behavior and experience. Starting your questions with “how” or “why” encourages a deeper investigation into the motivations, processes, and contexts underlying the subject matter. This approach facilitates an open-ended exploration, allowing participants to provide rich, detailed responses that illuminate their perspectives and experiences.

Take a quick look at the following visual for a better understanding:

So, if you are doing Ontological research, ensure that the questions focus on the “what” aspects of reality (the premise of your research) and opt for the nature of the knowledge for Epistemological research.

2. Choose the Right Structure

The structure of your research questions significantly impacts the depth and quality of data you collect. Opting for an open-ended format allows respondents the flexibility to express themselves freely, providing insights that pre-defined answers might miss.

- Open-ended format : These questions do not constrain respondents to a set of predetermined answers, unlike closed-ended questions. By allowing participants to articulate their thoughts in their own words, you can uncover nuances and complexities in their responses that might otherwise be overlooked.

- Avoid yes/no questions : Yes/no questions tend to limit the depth of responses. While they might be useful for gathering straightforward factual information, they are not conducive to exploring the depths and nuances that qualitative research seeks to uncover. Encouraging participants to elaborate on their experiences and perspectives leads to richer, more informative data.

For example, take a look at some qualitative questions examples shown in the following image:

3. Be Clear and Specific

Clarity and specificity in your questions are crucial to ensure that participants understand what is being asked and that their responses are relevant to your research objectives.

- Use clear language : Use straightforward, understandable language in your questions. Avoid jargon, acronyms, or overly technical terms that might confuse participants or lead to misinterpretation. The goal is to make your questions accessible to everyone involved in your study.

- Be specific : While maintaining the open-ended nature of qualitative questions, it’s important to narrow down your focus to specific aspects of the phenomenon you’re studying. This specificity helps guide participants’ responses and ensures that the data you collect directly relates to your research objectives.

4. Ensure Relevance and Feasibility

Each question should be carefully considered for its relevance to your research goals and its feasibility, given the constraints of your study.

- Relevance : Questions should be crafted to address the core objectives of your research directly. They should probe areas that are essential to understanding the phenomenon under investigation and should align with your theoretical framework or literature review findings.

- Feasibility : Consider the practical aspects of your research, including the time available for data collection and analysis, resources, and access to participants. Questions should be designed to elicit meaningful responses within the constraints of your study, ensuring that you can gather and analyze data effectively.

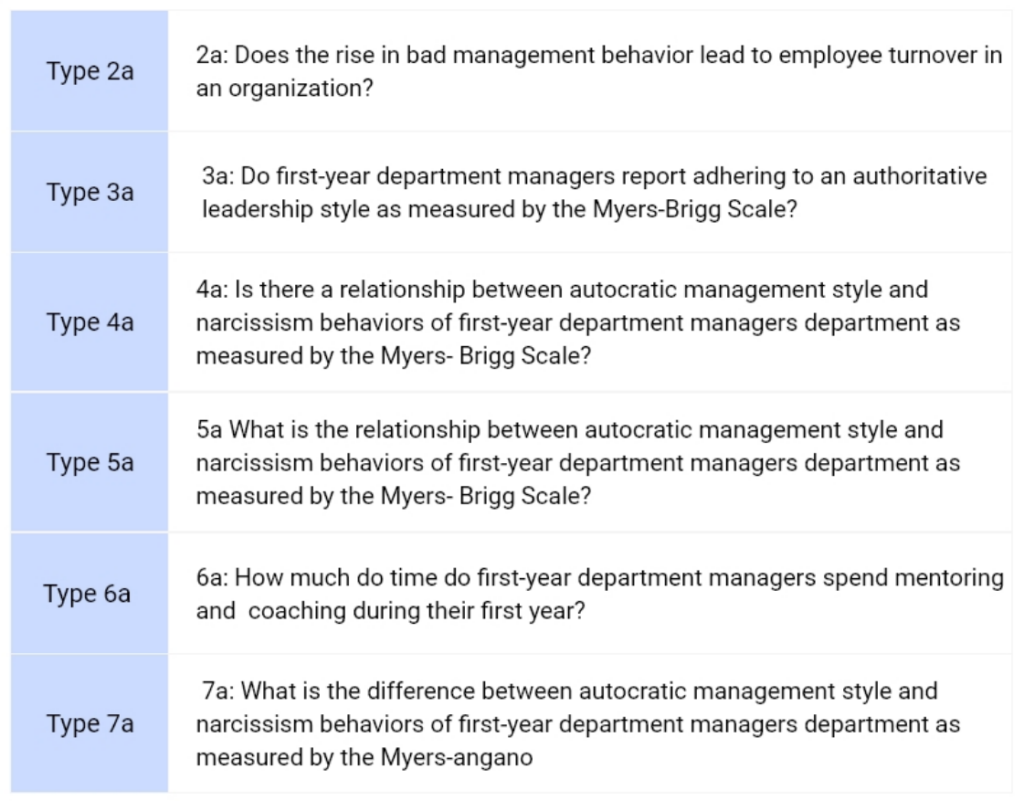

5. Focus on a Single Concept or Theme per Question

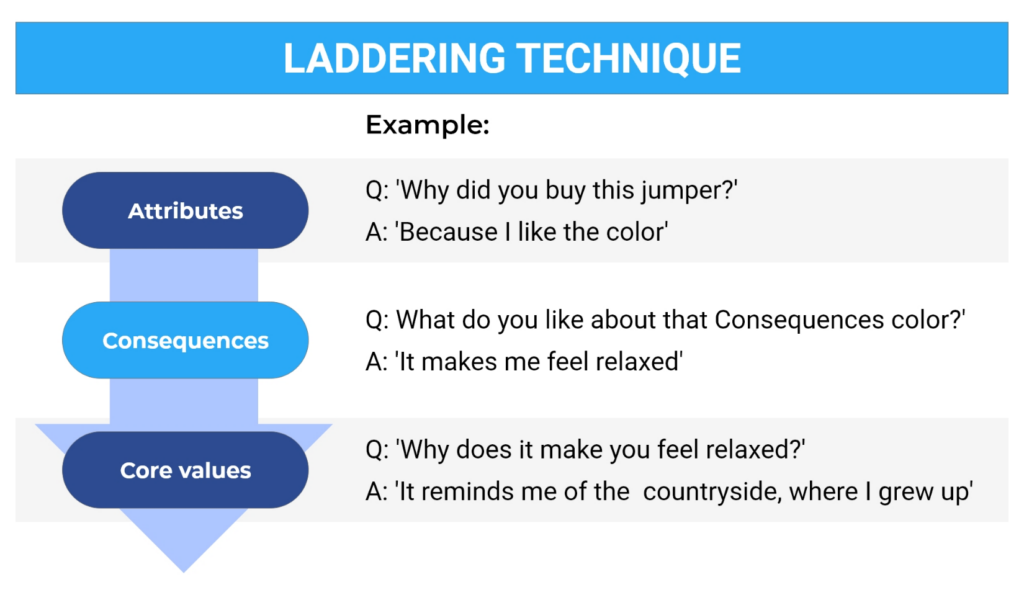

To ensure clarity and depth, each question should concentrate on a single idea or theme. However, if your main qualitative research question is tough to understand or has a complex structure, you can create sub-questions in limited numbers and with a “ladder structure”.

This will help your respondents understand the overall research objective in mind, and your research can be executed in a better manner.

For example, suppose your main question is – “What is the current state of illiteracy in your state?”

Then, you can create the following subquestions:

“How does illiteracy block progress in your state?”

“How would you best describe the feelings you have about illiteracy in your state?”

For an even better understanding, you can see the various examples of qualitative research questions in the following image:

Types of Qualitative Research Questions With Examples

Qualitative survey questions primarily focus on a specific group of respondents that are participating in case studies, surveys, ethnography studies, etc., rather than numbers or statistics.

As a result, the questions are mostly open-ended and can be subdivided into the following types as discussed below:

1. Descriptive Questions

Descriptive research questions aim to detail the “what” of a phenomenon, providing a comprehensive overview of the context, individuals, or situations under study. These questions are foundational, helping to establish a baseline understanding of the research topic.

- What are the daily experiences of teachers in urban elementary schools?

- What strategies do small businesses employ to adapt to rapid technological changes?

- How do young adults describe their transition from college to the workforce?

- What are the coping mechanisms of families with members suffering from chronic illnesses?

- How do community leaders perceive the impact of gentrification in their neighborhoods?

2. Interpretive Questions

Interpretive questions seek to understand the “how” and “why” behind a phenomenon, focusing on the meanings people attach to their experiences. These questions delve into the subjective interpretations and perceptions of participants.

- How do survivors of natural disasters interpret their experiences of recovery and rebuilding?

- Why do individuals engage in voluntary work within their communities?

- How do parents interpret and navigate the challenges of remote schooling for their children?

- Why do consumers prefer local products over global brands in certain markets?

- How do artists interpret the influence of digital media on traditional art forms?

3. Comparative Questions

Comparative research questions are designed to explore differences and similarities between groups, settings, or time periods. These questions can help to highlight the impact of specific variables on the phenomenon under study.

- How do the strategies for managing work-life balance compare between remote and office workers?

- What are the differences in consumer behavior towards sustainable products in urban versus rural areas?

- How do parenting styles in single-parent households compare to those in dual-parent households?

- What are the similarities and differences in leadership styles across different cultures?

- How has the perception of online privacy changed among teenagers over the past decade?

4. Process-oriented Questions

These questions focus on understanding the processes or sequences of events over time. They aim to uncover the “how” of a phenomenon, tracing the development, changes, or evolution of specific situations or behaviors.

- How do non-profit organizations develop and implement community outreach programs?

- What is the process of decision-making in high-stakes business environments?

- How do individuals navigate the process of career transition after significant industry changes?

- What are the stages of adaptation for immigrants in a new country?

- How do social movements evolve from inception to national recognition?

5. Evaluative Questions

Evaluative questions aim to assess the effectiveness, value, or impact of a program, policy, or phenomenon. These questions are critical for understanding the outcomes and implications of various initiatives or situations.

- How effective are online therapy sessions compared to in-person sessions in treating anxiety?

- What is the impact of community gardening programs on neighborhood cohesion?

- How do participants evaluate the outcomes of leadership training programs in their professional development?

- What are the perceived benefits and drawbacks of telecommuting for employees and employers?

- How do residents evaluate the effectiveness of local government policies on waste management?

6. One-on-One Questions

The one-on-one questions are asked to a single person and can be thought of as individual interviews that you can conduct online via phone and video chat as well.

The main aim of such questions is to ask your customers or people in the focus group a series of questions about their purchase motivations. These questions might also come with follow-ups, and if your customers respond with some interesting fact or detail, dig deeper and explore the findings as much as you want.

- What makes you happy in regard to [your research topic]?

- If I could make a wish of yours come true, what do you desire the most?

- What do you still find hard to come to terms with?

- Have you bought [your product] before?

- If so, what was your initial motivation behind the purchase?

7. Exploratory Questions

These questions are designed to enhance your understanding of a particular topic. However, while asking exploratory questions, you must ensure that there are no preconceived notions or biases to it. The more transparent and bias-free your questions are, the better and fair results you will get.

- What is the effect of personal smart devices on today’s youth?

- Do you feel that smart devices have positively or negatively impacted you?

- How do your kids spend their weekends?

- What do you do on a typical weekend morning?

8. Predictive Questions

The predictive questions are used for qualitative research that is focused on the future outcomes of an action or a series of actions. So, you will be using past information to predict the reactions of respondents to hypothetical events that might or might not happen in the future.

These questions come in extremely handy for identifying your customers’ current brand expectations, pain points, and purchase motivation.

- Are you more likely to buy a product when a celebrity promotes it?

- Would you ever try a new product because one of your favorite celebs claims that it actually worked for them?

- Would people in your neighborhood enjoy a park with rides and exercise options?

- How often would you go to a park with your kids if it had free rides?

9. Focus Groups

These questions are mostly asked in person to the customer or respondent groups. The in-person nature of these surveys or studies ensures that the group members get a safe and comfortable environment to express their thoughts and feelings about your brand or services.

- How would you describe your ease of using our product?

- How well do you think you were able to do this task before you started using our product?

- What do you like about our promotional campaigns?

- How well do you think our ads convey the meaning?

10. In-Home Videos

Collecting video feedback from customers in their comfortable, natural settings offers a unique perspective. At home, customers are more relaxed and less concerned about their mannerisms, posture, and choice of words when responding.

This approach is partly why Vogue’s 73 Questions Series is highly popular among celebrities and viewers alike. In-home videos provide insights into customers in a relaxed environment, encouraging them to be honest and share genuine experiences.

- What was your first reaction when you used our product for the first time?

- How well do you think our product performed compared to your expectations?

- What was your worst experience with our product?

- What made you switch to our brand?

11. Online Focus Groups

Online focus groups mirror the traditional, in-person format but are conducted virtually, offering a more cost-effective and efficient approach to gathering data. This digital format extends your reach and allows a rapid collection of responses from a broader audience through online platforms.

You can utilize social media and other digital forums to create communities of respondents and initiate meaningful discussions. Once you have them started, you can simply observe the exchange of thoughts and gather massive amounts of interesting insights!

- What do you like best about our product?

- How familiar are you with this particular service or product we offer?

- What are your concerns with our product?

- What changes can we make to make our product better?

Ask the Right Qualitative Research Questions for Meaningful Insights From Your Respondents

Watch: How to Create a Survey Using ProProfs Survey Maker

By now, you might have realized that manually creating a list of qualitative research questions is a daunting task. Keeping numerous considerations in mind, it’s easy to run out of ideas while crafting qualitative survey questions.

However, investing in smart survey tools, like ProProfs Survey Maker, can significantly streamline this process, allowing you to create various types of surveys in minutes.

With this survey tool , you can generate forms, NPS surveys , tests, quizzes, and assessments.

It’s also useful for conducting polls, sidebar surveys, and in-app surveys. Offering over 100 templates and more than 1,000,000 ready-to-use examples of phenomenological research questions, this software simplifies the task immensely.

Equipped with the right tools and the professional tips shared here, you’re well-prepared to conduct thorough research studies and obtain valuable insights that drive impactful results.

Frequently Asked Questions

1. how do you choose qualitative research questions.

To choose qualitative research questions, identify your main research goal, focus on exploring ‘how’ and ‘why’ aspects, ensure questions are open-ended, and align them with your theoretical framework and methodology.

2. Why are good qualitative research questions important?

Good qualitative research questions are important because they guide the research focus, enable the exploration of depth and complexity, and facilitate the gathering of rich, detailed insights into human experiences and behaviors.

About the author

Emma David is a seasoned market research professional with 8+ years of experience. Having kick-started her journey in research, she has developed rich expertise in employee engagement, survey creation and administration, and data management. Emma believes in the power of data to shape business performance positively. She continues to help brands and businesses make strategic decisions and improve their market standing through her understanding of research methodologies.

Popular Posts in This Category

Top 5 Benefits of Post-Event Surveys You Need to Know

Decoding Hiring Manager Satisfaction Surveys: What, Why & How

How to Create Online Questionnaire Easily

Quantitative Data: Types, Analysis & Examples

15 Best Typeform Alternatives in 2024 (Affordable + Better)

Top 10 SurveyPlanet Alternatives for Better Data Collection

83 Qualitative Research Questions & Examples

Ready to start digging into the data?

Backed by the world's most intelligent and comprehensive view of digital traffic, our platform gives you the data and insights you need to win – and win big – online.

Qualitative research questions help you understand consumer sentiment. They’re strategically designed to show organizations how and why people feel the way they do about a brand, product, or service. It looks beyond the numbers and is one of the most telling types of market research a company can do.

The UK Data Service describes this perfectly, saying, “The value of qualitative research is that it gives a voice to the lived experience .”

Read on to see seven use cases and 83 qualitative research questions, with the added bonus of examples that show how to get similar insights faster with Similarweb Research Intelligence.

What is a qualitative research question?

A qualitative research question explores a topic in-depth, aiming to better understand the subject through interviews, observations, and other non-numerical data. Qualitative research questions are open-ended, helping to uncover a target audience’s opinions, beliefs, and motivations.

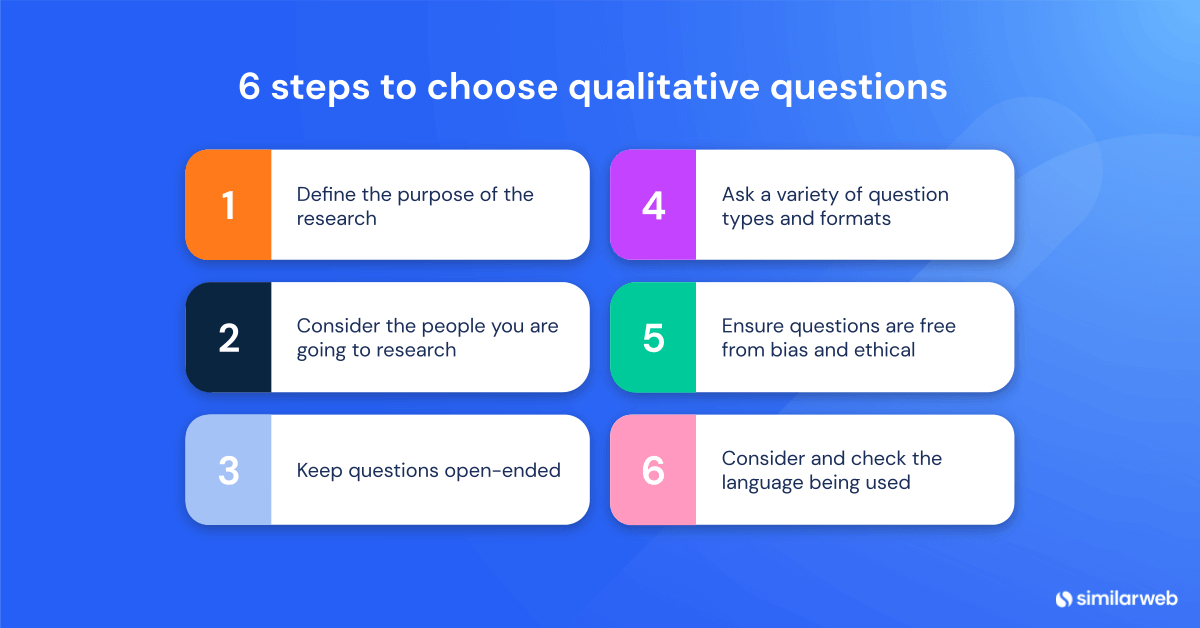

How to choose qualitative research questions?

Choosing the right qualitative research questions can be incremental to the success of your research and the findings you uncover. Here’s my six-step process for choosing the best qualitative research questions.

- Start by understanding the purpose of your research. What do you want to learn? What outcome are you hoping to achieve?

- Consider who you are researching. What are their experiences, attitudes, and beliefs? How can you best capture these in your research questions ?

- Keep your questions open-ended . Qualitative research questions should not be too narrow or too broad. Aim to ask specific questions to provide meaningful answers but broad enough to allow for exploration.

- Balance your research questions. You don’t want all of your questions to be the same type. Aim to mix up your questions to get a variety of answers.

- Ensure your research questions are ethical and free from bias. Always have a second (and third) person check for unconscious bias.

- Consider the language you use. Your questions should be written in a way that is clear and easy to understand. Avoid using jargon , acronyms, or overly technical language.

Types of qualitative research questions

For a question to be considered qualitative, it usually needs to be open-ended. However, as I’ll explain, there can sometimes be a slight cross-over between quantitative and qualitative research questions.

Open-ended questions

These allow for a wide range of responses and can be formatted with multiple-choice answers or a free-text box to collect additional details. The next two types of qualitative questions are considered open questions, but each has its own style and purpose.

- Probing questions are used to delve deeper into a respondent’s thoughts, such as “Can you tell me more about why you feel that way?”

- Comparative questions ask people to compare two or more items, such as “Which product do you prefer and why?” These qualitative questions are highly useful for understanding brand awareness , competitive analysis , and more.

Closed-ended questions

These ask respondents to choose from a predetermined set of responses, such as “On a scale of 1-5, how satisfied are you with the new product?” While they’re traditionally quantitative, adding a free text box that asks for extra comments into why a specific rating was chosen will provide qualitative insights alongside their respective quantitative research question responses.

- Ranking questions get people to rank items in order of preference, such as “Please rank these products in terms of quality.” They’re advantageous in many scenarios, like product development, competitive analysis, and brand awareness.

- Likert scale questions ask people to rate items on a scale, such as “On a scale of 1-5, how satisfied are you with the new product?” Ideal for placement on websites and emails to gather quick, snappy feedback.

Qualitative research question examples

There are many applications of qualitative research and lots of ways you can put your findings to work for the success of your business. Here’s a summary of the most common use cases for qualitative questions and examples to ask.

Qualitative questions for identifying customer needs and motivations

These types of questions help you find out why customers choose products or services and what they are looking for when making a purchase.

- What factors do you consider when deciding to buy a product?

- What would make you choose one product or service over another?

- What are the most important elements of a product that you would buy?

- What features do you look for when purchasing a product?

- What qualities do you look for in a company’s products?

- Do you prefer localized or global brands when making a purchase?

- How do you determine the value of a product?

- What do you think is the most important factor when choosing a product?

- How do you decide if a product or service is worth the money?

- Do you have any specific expectations when purchasing a product?

- Do you prefer to purchase products or services online or in person?

- What kind of customer service do you expect when buying a product?

- How do you decide when it is time to switch to a different product?

- Where do you research products before you decide to buy?

- What do you think is the most important customer value when making a purchase?

Qualitative research questions to enhance customer experience

Use these questions to reveal insights into how customers interact with a company’s products or services and how those experiences can be improved.

- What aspects of our product or service do customers find most valuable?

- How do customers perceive our customer service?

- What factors are most important to customers when purchasing?

- What do customers think of our brand?

- What do customers think of our current marketing efforts?

- How do customers feel about the features and benefits of our product?

- How do customers feel about the price of our product or service?

- How could we improve the customer experience?

- What do customers think of our website or app?

- What do customers think of our customer support?

- What could we do to make our product or service easier to use?

- What do customers think of our competitors?

- What is your preferred way to access our site?

- How do customers feel about our delivery/shipping times?

- What do customers think of our loyalty programs?

Qualitative research question example for customer experience

- ♀️ Question: What is your preferred way to access our site?

- Insight sought: How mobile-dominant are consumers? Should you invest more in mobile optimization or mobile marketing?

- Challenges with traditional qualitative research methods: While using this type of question is ideal if you have a large database to survey when placed on a site or sent to a limited customer list, it only gives you a point-in-time perspective from a limited group of people.

- A new approach: You can get better, broader insights quicker with Similarweb Digital Research Intelligence. To fully inform your research, you need to know preferences at the industry or market level.

- ⏰ Time to insight: 30 seconds

- ✅ How it’s done: Similarweb offers multiple ways to answer this question without going through a lengthy qualitative research process.

First, I’m going to do a website market analysis of the banking credit and lending market in the finance sector to get a clearer picture of industry benchmarks.

Here, I can view device preferences across any industry or market instantly. It shows me the device distribution for any country across any period. This clearly answers the question of how mobile dominate my target audience is , with 59.79% opting to access site via a desktop vs. 40.21% via mobile

I then use the trends section to show me the exact split between mobile and web traffic for each key player in my space. Let’s say I’m about to embark on a competitive campaign that targets customers of Chase and Bank of America ; I can see both their audiences are highly desktop dominant compared with others in their space .

Qualitative question examples for developing new products or services

Research questions like this can help you understand customer pain points and give you insights to develop products that meet those needs.

- What is the primary reason you would choose to purchase a product from our company?

- How do you currently use products or services that are similar to ours?

- Is there anything that could be improved with products currently on the market?

- What features would you like to see added to our products?

- How do you prefer to contact a customer service team?

- What do you think sets our company apart from our competitors?

- What other product or service offerings would like to see us offer?

- What type of information would help you make decisions about buying a product?

- What type of advertising methods are most effective in getting your attention?

- What is the biggest deterrent to purchasing products from us?

Qualitative research question example for service development

- ♀️ Question: What type of advertising methods are most effective in getting your attention?

- Insight sought: The marketing channels and/or content that performs best with a target audience .

- Challenges with traditional qualitative research methods: When using qualitative research surveys to answer questions like this, the sample size is limited, and bias could be at play.

- A better approach: The most authentic insights come from viewing real actions and results that take place in the digital world. No questions or answers are needed to uncover this intel, and the information you seek is readily available in less than a minute.

- ⏰ Time to insight: 5 minutes

- ✅ How it’s done: There are a few ways to approach this. You can either take an industry-wide perspective or hone in on specific competitors to unpack their individual successes. Here, I’ll quickly show a snapshot with a whole market perspective.

Using the market analysis element of Similarweb Digital Intelligence, I select my industry or market, which I’ve kept as banking and credit. A quick click into marketing channels shows me which channels drive the highest traffic in my market. Taking direct traffic out of the equation, for now, I can see that referrals and organic traffic are the two highest-performing channels in this market.

Similarweb allows me to view the specific referral partners and pages across these channels.

Looking closely at referrals in this market, I’ve chosen chase.com and its five closest rivals . I select referrals in the channel traffic element of marketing channels. I see that Capital One is a clear winner, gaining almost 25 million visits due to referral partnerships.

Next, I get to see exactly who is referring traffic to Capital One and the total traffic share for each referrer. I can see the growth as a percentage and how that has changed, along with an engagement score that rates the average engagement level of that audience segment. This is particularly useful when deciding on which new referral partnerships to pursue.

Once I’ve identified the channels and campaigns that yield the best results, I can then use Similarweb to dive into the various ad creatives and content that have the greatest impact.

These ads are just a few of those listed in the creatives section from my competitive website analysis of Capital One. You can filter this list by the specific campaign, publishers, and ad networks to view those that matter to you most. You can also discover video ad creatives in the same place too.

In just five minutes ⏰

- I’ve captured audience loyalty statistics across my market

- Spotted the most competitive players

- Identified the marketing channels my audience is most responsive to

- I know which content and campaigns are driving the highest traffic volume

- I’ve created a target list for new referral partners and have been able to prioritize this based on results and engagement figures from my rivals

- I can see the types of creatives that my target audience is responding to, giving me ideas for ways to generate effective copy for future campaigns

Qualitative questions to determine pricing strategies

Companies need to make sure pricing stays relevant and competitive. Use these questions to determine customer perceptions on pricing and develop pricing strategies to maximize profits and reduce churn.

- How do you feel about our pricing structure?

- How does our pricing compare to other similar products?

- What value do you feel you get from our pricing?

- How could we make our pricing more attractive?

- What would be an ideal price for our product?

- Which features of our product that you would like to see priced differently?

- What discounts or deals would you like to see us offer?

- How do you feel about the amount you have to pay for our product?

Get Faster Answers to Qualitative Research Questions with Similarweb Today

Qualitative research question example for determining pricing strategies.

- ♀️ Question: What discounts or deals would you like to see us offer?

- Insight sought: The promotions or campaigns that resonate with your target audience.

- Challenges with traditional qualitative research methods: Consumers don’t always recall the types of ads or campaigns they respond to. Over time, their needs and habits change. Your sample size is limited to those you ask, leaving a huge pool of unknowns at play.

- A better approach: While qualitative insights are good to know, you get the most accurate picture of the highest-performing promotion and campaigns by looking at data collected directly from the web. These analytics are real-world, real-time, and based on the collective actions of many, instead of the limited survey group you approach. By getting a complete picture across an entire market, your decisions are better informed and more aligned with current market trends and behaviors.

- ✅ How it’s done: Similarweb’s Popular Pages feature shows the content, products, campaigns, and pages with the highest growth for any website. So, if you’re trying to unpack the successes of others in your space and find out what content resonates with a target audience, there’s a far quicker way to get answers to these questions with Similarweb.

Here, I’m using Capital One as an example site. I can see trending pages on their site showing the largest increase in page views. Other filters include campaign, best-performing, and new–each of which shows you page URLs, share of traffic, and growth as a percentage. This page is particularly useful for staying on top of trending topics , campaigns, and new content being pushed out in a market by key competitors.

Qualitative research questions for product development teams

It’s vital to stay in touch with changing consumer needs. These questions can also be used for new product or service development, but this time, it’s from the perspective of a product manager or development team.

- What are customers’ primary needs and wants for this product?

- What do customers think of our current product offerings?

- What is the most important feature or benefit of our product?

- How can we improve our product to meet customers’ needs better?

- What do customers like or dislike about our competitors’ products?

- What do customers look for when deciding between our product and a competitor’s?

- How have customer needs and wants for this product changed over time?

- What motivates customers to purchase this product?

- What is the most important thing customers want from this product?

- What features or benefits are most important when selecting a product?

- What do customers perceive to be our product’s pros and cons?

- What would make customers switch from a competitor’s product to ours?

- How do customers perceive our product in comparison to similar products?

- What do customers think of our pricing and value proposition?

- What do customers think of our product’s design, usability, and aesthetics?

Qualitative questions examples to understand customer segments

Market segmentation seeks to create groups of consumers with shared characteristics. Use these questions to learn more about different customer segments and how to target them with tailored messaging.

- What motivates customers to make a purchase?

- How do customers perceive our brand in comparison to our competitors?

- How do customers feel about our product quality?

- How do customers define quality in our products?

- What factors influence customers’ purchasing decisions ?

- What are the most important aspects of customer service?

- What do customers think of our customer service?

- What do customers think of our pricing?

- How do customers rate our product offerings?

- How do customers prefer to make purchases (online, in-store, etc.)?

Qualitative research question example for understanding customer segments

- ♀️ Question: Which social media channels are you most active on?

- Insight sought: Formulate a social media strategy . Specifically, the social media channels most likely to succeed with a target audience.

- Challenges with traditional qualitative research methods: Qualitative research question responses are limited to those you ask, giving you a limited sample size. Questions like this are usually at risk of some bias, and this may not be reflective of real-world actions.

- A better approach: Get a complete picture of social media preferences for an entire market or specific audience belonging to rival firms. Insights are available in real-time, and are based on the actions of many, not a select group of participants. Data is readily available, easy to understand, and expandable at a moment’s notice.

- ✅ How it’s done: Using Similarweb’s website analysis feature, you can get a clear breakdown of social media stats for your audience using the marketing channels element. It shows the percentage of visits from each channel to your site, respective growth, and specific referral pages by each platform. All data is expandable, meaning you can select any platform, period, and region to drill down and get more accurate intel, instantly.

This example shows me Bank of America’s social media distribution, with YouTube , Linkedin , and Facebook taking the top three spots, and accounting for almost 80% of traffic being driven from social media.

When doing any type of market research, it’s important to benchmark performance against industry averages and perform a social media competitive analysis to verify rival performance across the same channels.

Qualitative questions to inform competitive analysis

Organizations must assess market sentiment toward other players to compete and beat rival firms. Whether you want to increase market share , challenge industry leaders , or reduce churn, understanding how people view you vs. the competition is key.

- What is the overall perception of our competitors’ product offerings in the market?

- What attributes do our competitors prioritize in their customer experience?

- What strategies do our competitors use to differentiate their products from ours?

- How do our competitors position their products in relation to ours?

- How do our competitors’ pricing models compare to ours?

- What do consumers think of our competitors’ product quality?

- What do consumers think of our competitors’ customer service?

- What are the key drivers of purchase decisions in our market?

- What is the impact of our competitors’ marketing campaigns on our market share ? 10. How do our competitors leverage social media to promote their products?

Qualitative research question example for competitive analysis

- ♀️ Question: What other companies do you shop with for x?

- Insight sought: W ho are your competitors? Which of your rival’s sites do your customers visit? How loyal are consumers in your market?

- Challenges with traditional qualitative research methods: Sample size is limited, and customers could be unwilling to reveal which competitors they shop with, or how often they around. Where finances are involved, people can act with reluctance or bias, and be unwilling to reveal other suppliers they do business with.

- A better approach: Get a complete picture of your audience’s loyalty, see who else they shop with, and how many other sites they visit in your competitive group. Find out the size of the untapped opportunity and which players are doing a better job at attracting unique visitors – without having to ask people to reveal their preferences.

- ✅ How it’s done: Similarweb website analysis shows you the competitive sites your audience visits, giving you access to data that shows cross-visitation habits, audience loyalty, and untapped potential in a matter of minutes.

Using the audience interests element of Similarweb website analysis, you can view the cross-browsing behaviors of a website’s audience instantly. You can see a matrix that shows the percentage of visitors on a target site and any rival site they may have visited.

With the Similarweb audience overlap feature, view the cross-visitation habits of an audience across specific websites. In this example, I chose chase.com and its four closest competitors to review. For each intersection, you see the number of unique visitors and the overall proportion of each site’s audience it represents. It also shows the volume of unreached potential visitors.

Here, you can see a direct comparison of the audience loyalty represented in a bar graph. It shows a breakdown of each site’s audience based on how many other sites they have visited. Those sites with the highest loyalty show fewer additional sites visited.

From the perspective of chase.com, I can see 47% of their visitors do not visit rival sites. 33% of their audience visited 1 or more sites in this group, 14% visited 2 or more sites, 4% visited 3 or more sites, and just 0.8% viewed all sites in this comparison.

How to answer qualitative research questions with Similarweb

Similarweb Research Intelligence drastically improves market research efficiency and time to insight. Both of these can impact the bottom line and the pace at which organizations can adapt and flex when markets shift, and rivals change tactics.

Outdated practices, while still useful, take time . And with a quicker, more efficient way to garner similar insights, opting for the fast lane puts you at a competitive advantage.

With a birds-eye view of the actions and behaviors of companies and consumers across a market , you can answer certain research questions without the need to plan, do, and review extensive qualitative market research .

Wrapping up

Qualitative research methods have been around for centuries. From designing the questions to finding the best distribution channels, collecting and analyzing findings takes time to get the insights you need. Similarweb Digital Research Intelligence drastically improves efficiency and time to insight. Both of which impact the bottom line and the pace at which organizations can adapt and flex when markets shift.