- Media ›

U.S. Music industry - statistics & facts

Publishing companies dominate the market, music streaming is on the rise, key insights.

Detailed statistics

Global revenue of the recorded music industry 1999-2023

Digital Market Outlook: digital music revenue in selected countries 2023

Number of paying online music service subscribers worldwide 2010-2021

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Music industry revenue in the U.S. 2009-2023

Music consumption in the U.S. in 2021, by genre & format

U.S. music industry - revenue distribution 2017-2022, by source

Related topics

Recommended.

- Radio Industry

- Online radio

- Digital Music in the United States

- Grammy Awards

- Music in Canada

Recommended statistics

Global market overview.

- Premium Statistic Global revenue of the recorded music industry 1999-2023

- Premium Statistic Global digital music revenue 2004-2022

- Premium Statistic Digital Market Outlook: digital music revenue in selected countries 2023

- Premium Statistic Digital Music revenue in the World 2018-2027, by segment

- Premium Statistic Number of paying online music service subscribers worldwide 2010-2021

Global recorded music revenue from 1999 to 2023 (in billion U.S. dollars)

Global digital music revenue 2004-2022

Global digital music revenue from 2004 to 2022 (in billion U.S. dollars)

Digital music revenue in selected countries worldwide in 2023 (in million U.S. dollars)

Digital Music revenue in the World 2018-2027, by segment

Digital Music revenue in the World from 2018 to 2027 (in million U.S. dollar), by segment

Number of paying online music service subscribers worldwide from 2010 to 2021 (in millions)

U.S. market overview

- Premium Statistic Music industry revenue in the U.S. 2009-2023

- Basic Statistic U.S. music industry - revenue distribution 2017-2022, by source

- Basic Statistic Music album shipments in the U.S. 2017-2022, by type

- Basic Statistic Physical album shipments in the U.S. 1999-2022

- Premium Statistic Retail value of music shipments in the U.S. 1999-2022

- Basic Statistic Music streaming revenue in the U.S. 2010-2022

- Premium Statistic Change in music sales in the U.S. 2009-2023

Recorded music industry revenue in the United States from 2009 to 2023 (in billion U.S. dollars)

Distribution of music industry revenue in the United States from 2017 to 2022, by source

Music album shipments in the U.S. 2017-2022, by type

Music album shipments in the United States from 2017 to 2022, by type (in millions)

Physical album shipments in the U.S. 1999-2022

Physical CD shipments in the United States from 1999 to 2022 (in millions)

Retail value of music shipments in the U.S. 1999-2022

Retail value of music shipments in the United States from 1999 to 2022 (in billion U.S. dollars)

Music streaming revenue in the U.S. 2010-2022

Revenue from music streaming in the United States from 2010 to 2022 (in billion U.S. dollars)

Change in music sales in the U.S. 2009-2023

Change in music sales in the United States from 2009 to 2023, by category

Digital music sales

- Premium Statistic Digital Market Outlook: digital music revenue in the U.S. 2017-2027, by format

- Basic Statistic Digital music revenue in the U.S. 2008-2022, by type

- Premium Statistic Digital music track sales in the U.S. 2008-2023

- Premium Statistic Digital album sales in the U.S. 2008-2023

- Basic Statistic Mobile music revenue in the U.S. 2005-2022

- Premium Statistic Number of digital music album downloads in the United States 2004-2022

- Premium Statistic Top-selling digital songs in the U.S. 2023

- Premium Statistic Top-selling digital music albums in the U.S. 2021

Digital Market Outlook: digital music revenue in the U.S. 2017-2027, by format

Digital music revenue in the United States from 2017 to 2027, by format (in billion U.S. dollars)

Digital music revenue in the U.S. 2008-2022, by type

Digital music revenue in the United States from 2008 to 2022, by type (in million U.S. dollars)

Digital music track sales in the U.S. 2008-2023

Digital music track sales in the United States from 2008 to 2023 (in million units)

Digital album sales in the U.S. 2008-2023

Digital album sales in the United States from 2008 to 2023 (in millions)

Mobile music revenue in the U.S. 2005-2022

Mobile music revenue in the United States from 2005 to 2022 (in million U.S. dollars)

Number of digital music album downloads in the United States 2004-2022

Number of digital music album downloads in the United States from 2004 to 2022 (in millions)

Top-selling digital songs in the U.S. 2023

Top-selling digital songs in the United States in 2023 (in thousands)

Top-selling digital music albums in the U.S. 2021

Top-selling digital music albums in the United States in 2021 (in 1,000s)

Music streaming

- Premium Statistic Digital Market Outlook: users of digital music in the U.S. 2017-2027, by format

- Premium Statistic Music streaming revenue share in the U.S. 2009-2022

- Premium Statistic Paid streaming music subscribers in the U.S. 2014-2022

- Premium Statistic U.S. on-demand music streams volume 2013-2021

Digital Market Outlook: users of digital music in the U.S. 2017-2027, by format

Number of digital music users in the United States from 2017 to 2027, by format (in millions)

Music streaming revenue share in the U.S. 2009-2022

Share of streaming in total music revenues in the United States from 2009 to 2022

Paid streaming music subscribers in the U.S. 2014-2022

Number of paid music streaming subscribers in the United States from 1st half 2014 to 1st half 2022 (in millions)

U.S. on-demand music streams volume 2013-2021

Number of on-demand music streams in the United States from 2013 to 2021(in billions)

Concert business

- Basic Statistic The most successful music tours in North America in 2023

- Basic Statistic Most successful music tours in North America 2023, based on ticket sales

- Basic Statistic Live Nation Entertainment's concert revenue from 2008 to 2023

- Basic Statistic Number of events promoted by Live Nation from 2008 to 2023

The most successful music tours in North America in 2023

Most successful music tours in North America in 2023, based on gross revenue (in million U.S. dollars)

Most successful music tours in North America 2023, based on ticket sales

Most successful music tours in North America in 2023, based on ticket sales

Live Nation Entertainment's concert revenue from 2008 to 2023

Live Nation Entertainment's concert revenue from 2008 to 2023 (in billion U.S. dollars)

Number of events promoted by Live Nation from 2008 to 2023

Number of concerts and festivals promoted by Live Nation from 2008 to 2023

Record companies

- Premium Statistic Market share of the largest music publishers worldwide from 2007 to 2022

- Premium Statistic U.S. music publishers - revenue 2005-2022

- Basic Statistic U.S. music publishers - annual expenses 2007-2022

- Basic Statistic Universal Music Group's revenue 2004-2023

- Basic Statistic Universal Music Group: music publishing revenue 2007-2023

- Premium Statistic Revenue of the Warner Music Group 2004-2023

- Premium Statistic Warner Music Group: music publishing revenue 2004-2023

- Premium Statistic Annual revenue of Sony Corporation's music segment 2008-2023

- Premium Statistic Sony Corporation: music revenue source 2019-2023

Market share of the largest music publishers worldwide from 2007 to 2022

Revenue market share of the largest music publishers worldwide from 2007 to 2022

U.S. music publishers - revenue 2005-2022

Estimated revenue of U.S. music publishers from 2005 to 2022 (in billion U.S. dollars)

U.S. music publishers - annual expenses 2007-2022

Estimated expenses of U.S. music publishers from 2007 to 2022 (in billion U.S. dollars)

Universal Music Group's revenue 2004-2023

Universal Music Group's revenue from 2004 to 2023 (in billion euros)

Universal Music Group: music publishing revenue 2007-2023

Music publishing revenue of the Universal Music Group from 2007 to 2023 (in million euros)

Revenue of the Warner Music Group 2004-2023

Revenue of the Warner Music Group in fiscal years 2004 to 2023 (in million U.S. dollars)

Warner Music Group: music publishing revenue 2004-2023

Music publishing revenue of the Warner Music Group in fiscal years 2004 to 2023 (in million U.S. dollars)

Annual revenue of Sony Corporation's music segment 2008-2023

Annual sales and operating revenue of Sony Corporation's music segment in the fiscal years 2008 to 2023 (in billion U.S. dollars)

Sony Corporation: music revenue source 2019-2023

Music sales and operating revenue of the Sony Corporation from fiscal 2019 to 2023, by source (in million U.S. dollars)

Consumption

- Premium Statistic Music consumption in the U.S. in 2021, by genre & format

- Premium Statistic Streamed music consumption in the U.S. 2021, by genre

- Premium Statistic Popular online music brands in the U.S. 2023

- Premium Statistic Audio sources in cars in the U.S. 2018-2022

Music consumption in the U.S. in 2021, by genre & format

Distribution of music consumption in the United States in 2021, by genre and format

Streamed music consumption in the U.S. 2021, by genre

Distribution of streamed music consumption in the United States in 2021, by genre

Popular online music brands in the U.S. 2023

Online music services used most frequently in the United States as of January 2023

Audio sources in cars in the U.S. 2018-2022

Most common audio sources used in the car in the United States from 2018 to 2022

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

The State of the Music Industry in 2020

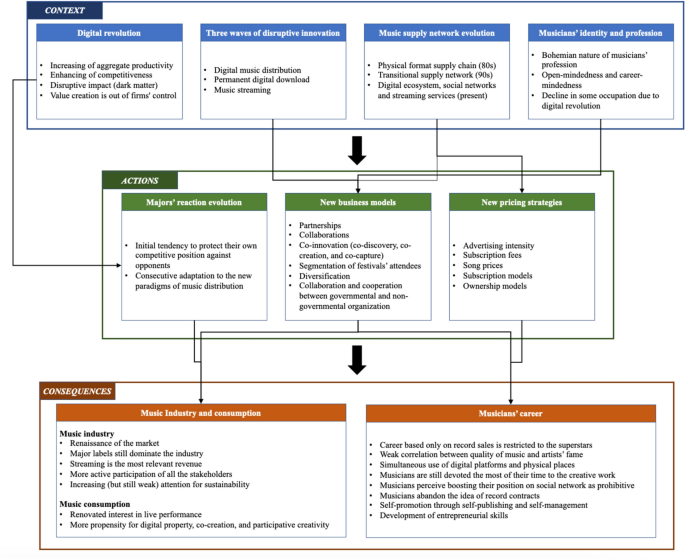

The music recording industry presents a great example of how businesses must continually transform and adapt to change. After piracy and unbundling drove 15 years of revenue decline, the global industry has returned to growth, primarily due to streaming.

By Jimmy Stone

Jimmy has executed and evaluated $1+ billion in debt, equity, and M&A transactions across a range of industries.

PREVIOUSLY AT

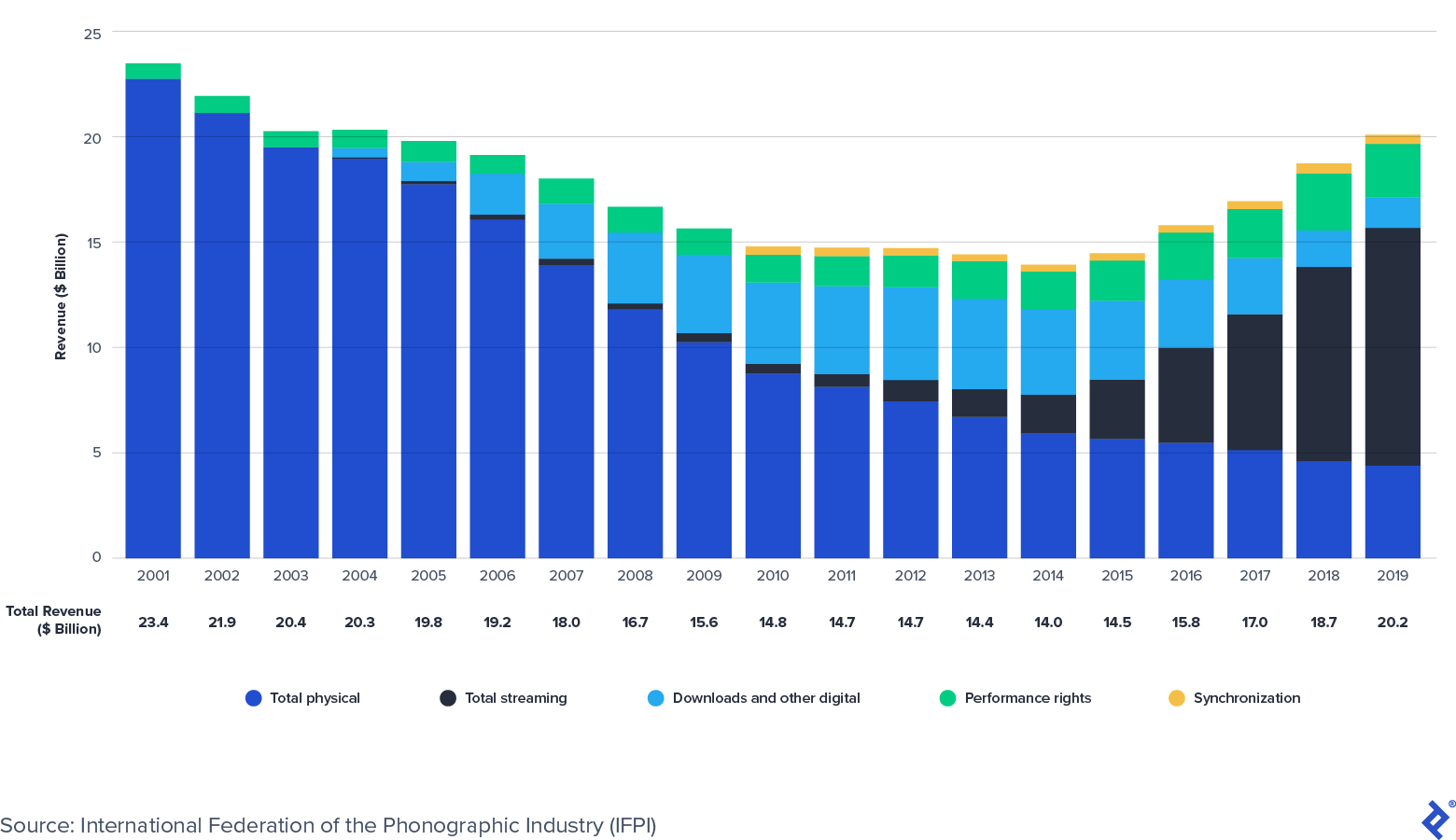

The global music recording industry is back in growth territory again. According to the International Federation of the Phonographic Industry (IFPI), recorded music revenue returned to growth in 2015, after nearly two decades of piracy-driven declines. The global industry’s revenue bottomed out at $14 billion in 2014 but grew to $20 billion in 2019, back in line with 2004 levels.

Streaming Is Driving Music’s Growth

The convenience and personalization of music streaming, combined with the accessibility afforded by smartphones and smart devices, has driven recorded music’s growth. IFPI notes that global streaming revenues grew at a 42% CAGR (compound annual growth rate) since 2015, compared to the entire recording industry’s 9% CAGR. The following chart from IFPI shows the evolution of the industry’s revenue composition and how streaming growth has more than offset declines in physical and downloaded formats over the past decade.

Global Music Recording Industry Revenues: 2001-2019 ($ Billion)

Meanwhile, the global music publishing industry has proven resilient throughout the economic cycles of the past decade. According to the International Confederation of Societies of Authors and Composers (CISAC), publishing collections (performance royalties) increased from €6.5 billion in 2013 to €8.5 billion in 2018. Will Page, the former chief economist at Spotify, estimates that the global publishing business - CISAC collections plus estimates of non-CISAC publisher revenues from Music & Copyright - is worth $11.7 billion in 2020.

Despite its seeming ubiquity, streaming is still in the early innings of mass adoption. The following statistics highlight how the market still has room to expand:

- The figure represents less than 11% of the 3.2 billion global smartphone users .

- For comparison, in Sweden (the home of Spotify ), global paid music streaming penetration is 52%.

- In May 2020, Goldman Sachs estimated the entire music industry’s revenue (live, recorded, and publishing) to increase from $62 billion in 2017 to $131 billion in 2030, representing a 6% CAGR. The 2030 estimate was an increase on its original prediction of $104 billion, made in October 2016.

Music Intellectual Property Rights in the Spotlight

Music royalty payments derive from the underlying intellectual property (IP) rights of songs. The most common types of IP are copyrights, trademarks, patents, and trade secrets. Music - including lyrics, composition, and sound recording - is protected under copyright law.

What Is Music Copyright?

When music is put into tangible form (e.g., recorded or written in sheet music), a copyright is created. Further protections are given under law once the work is registered with the U.S. Copyright Office. Copyright provides its owner(s) with exclusive rights for a period of time. In general, rights last for 70 years after an author’s death.

A song contains two copyrights:

- Sound recording copyright is “a fixation of a series of sounds” associated with a particular recording. The sound recording copyright is owned by an artist, who often assigns ownership to their representative record label.

- Musical composition copyright is the song’s composition (music and lyrics) by the songwriter(s). The musical composition copyright is owned by a songwriter, who often assigns ownership and representation to a music publisher.

Several positive catalysts for music IP rightsholders are currently on the horizon, including:

- New licensing opportunities

- Regulatory changes

- Emerging market growth

New Licensing Opportunities

There are new licensing opportunities for music IP owners that are just starting to emerge. Short-form videos (e.g., TikTok and Triller), e-fitness (e.g., Peloton), and other platforms (e.g., Facebook) are just starting to license music IP from rightsholders, creating new sources of future monetization. For example, in July 2020, the National Music Publishers’ Association (NMPA) reached a licensing agreement with TikTok, a platform with roughly 100 million US monthly active users and 700 million worldwide monthly active users. Before signing the licensing deal, the NMPA claimed that approximately 50% of the music publishing market was unlicensed with TikTok. Other large platforms, such as Facebook and Peloton, have recently signed inaugural licensing deals with music rightsholders. These licensing deals create exciting new future sources of income for music IP owners.

Regulatory Changes

Most music publishing rights are regulated, and recent regulatory announcements have been beneficial to music IP rightsholders’ interests. For example, US musical composition mechanical royalties are regulated by the Copyright Royalty Board (CRB), a panel of three judges who determine music royalty rates and terms over a period of time. In January 2018, the CRB ruled that on-demand subscription streaming services (e.g., Spotify and Apple Music) must increase the percentage of revenue paid to songwriters and publishers by 44% to 15.1% of revenue over the five years of 2018 to 2022. While several streaming services are currently appealing the decision, it could have a very positive impact on composition mechanical royalties for US rightsholders.

Emerging Market Growth

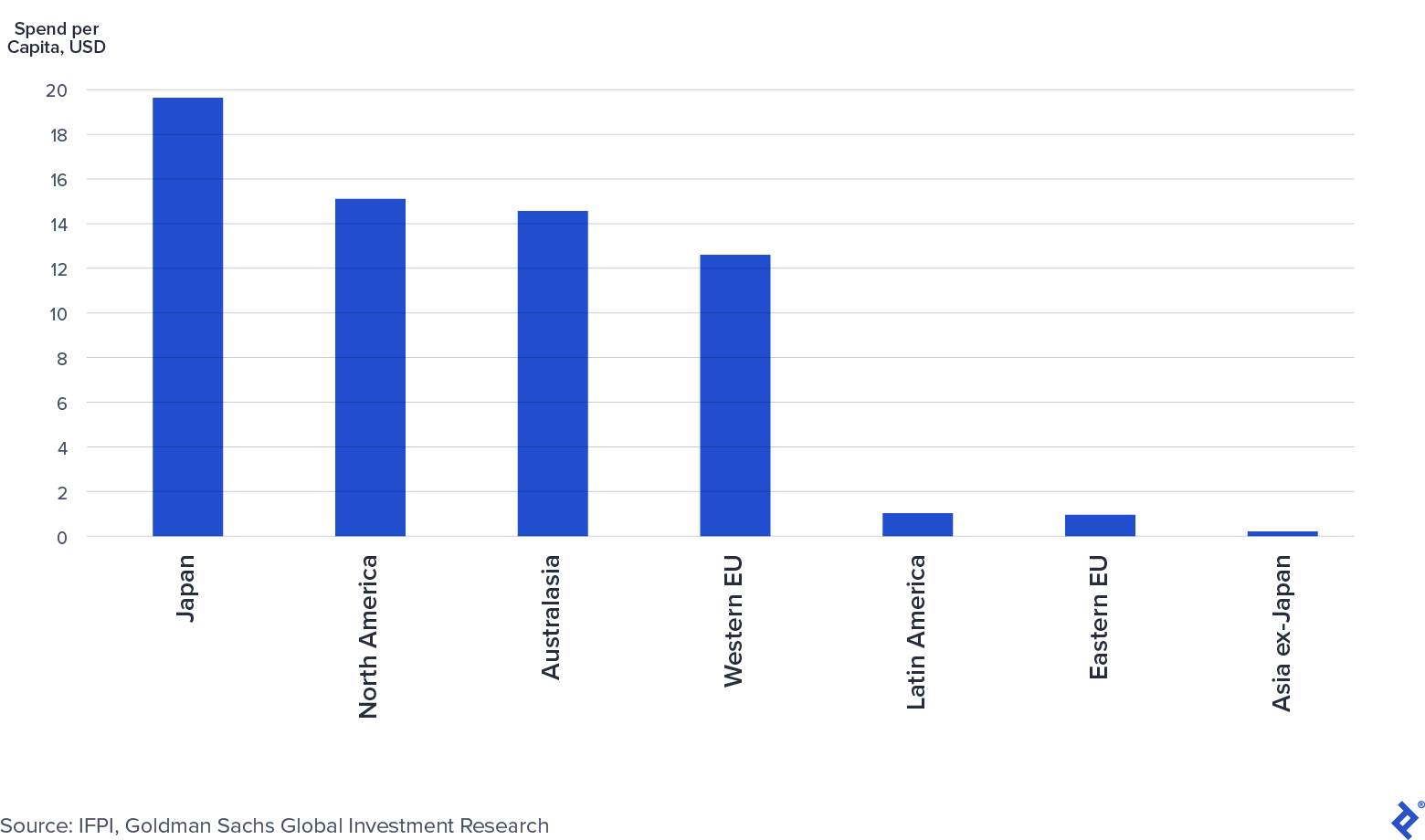

Emerging markets, such as China and India, are only just starting to pay for music IP. According to IFPI’s 2019 Global Music Report, China was the seventh-largest music recording market, and India was not even in the top 10, despite having the world’s two largest populations. Goldman Sachs’ “Music in the Air” analysis notes that paid streaming penetration rates in China and India are currently 4% and 3%, respectively. Furthermore, the following chart from Goldman shows how little is currently spent per capita on music in emerging markets relative to developed markets.

Music Spend per Capita Across Regions: 2015 (USD)

Despite the gulf in spending, IFPI reported strong 2019 recorded music revenue growth in China and India of 16% and 19%, respectively, attributed to progress in copyright enforcement and streaming adoption. If the trend continues, China and India will increasingly grow as a revenue source for the industry.

Who Are the Key Music Industry Players?

The music recording and publishing industries have many players. Record labels and music publishers are the traditional investors in the space. They sign performing artists and songwriters and help them create and monetize new music. Examples include Universal Music, Sony Music, Warner Music Group, and BMG, to name a few. Meanwhile, music royalty funds focus on acquiring existing music rights with a history of stable cash flows. Music royalty fund formation has increased significantly over the past several years. Prominent royalty funds include Hipgnosis Songs Fund, Round Hill Music, Kobalt Capital, Tempo Music Investments, and Shamrock Capital. In some instances, royalty funds have also signed artists and songwriters to release new music, blurring the line between them and traditional labels and publishers.

The music industry is concentrated and dominated by three main players. According to Music & Copyright, the three largest record labels - Universal Music Group (32% market share), Sony Music Entertainment (20%), and Warner Music Group (16%) - hold a 68% share of the music recording market. Similarly, the three largest music publishers - Sony (25%), Universal Music Publishing (21%), and Warner Chappell Music (12%) - maintain a 58% share of the music publishing market.

Universal, Sony, and Warner are collectively referred to as the “Majors,” or the “Big Three.” Industry concentration is relevant in music because the majors’ deals with streaming services benefit from their market share : As streaming services’ revenues grow, so should the majors’ income. Furthermore, streaming and digital download margins are roughly 50-60% , compared to physical margins of 40-50%, lower due to manufacturing and distribution costs. As streaming continues to take a greater share of sales, the majors’ operating margins will benefit.

How Has COVID-19 Impacted the Music Industry?

“The unique nature and the diversification of our sources of income mean music publishers are well protected compared to most businesses.”

Josh Gruss, CEO of Round Hill Music ( Source )

Music industry revenues have held up relatively well compared to other industries during the COVID-19 pandemic. The growth of digital streaming has allowed consumers to access and enjoy music regardless of social distancing restrictions. At the same time, other forms of music consumption, especially live, have suffered.

Streaming Remains Resilient

There have been modest disruptions to streaming as a result of COVID-19. At the start of the pandemic, audio streaming saw a decrease in listening hours as consumers drove less and focused on other platforms (e.g., video streaming) and forms of entertainment (e.g., TV and video gaming). However, according to Billboard, these declines returned to growth by the end of April.

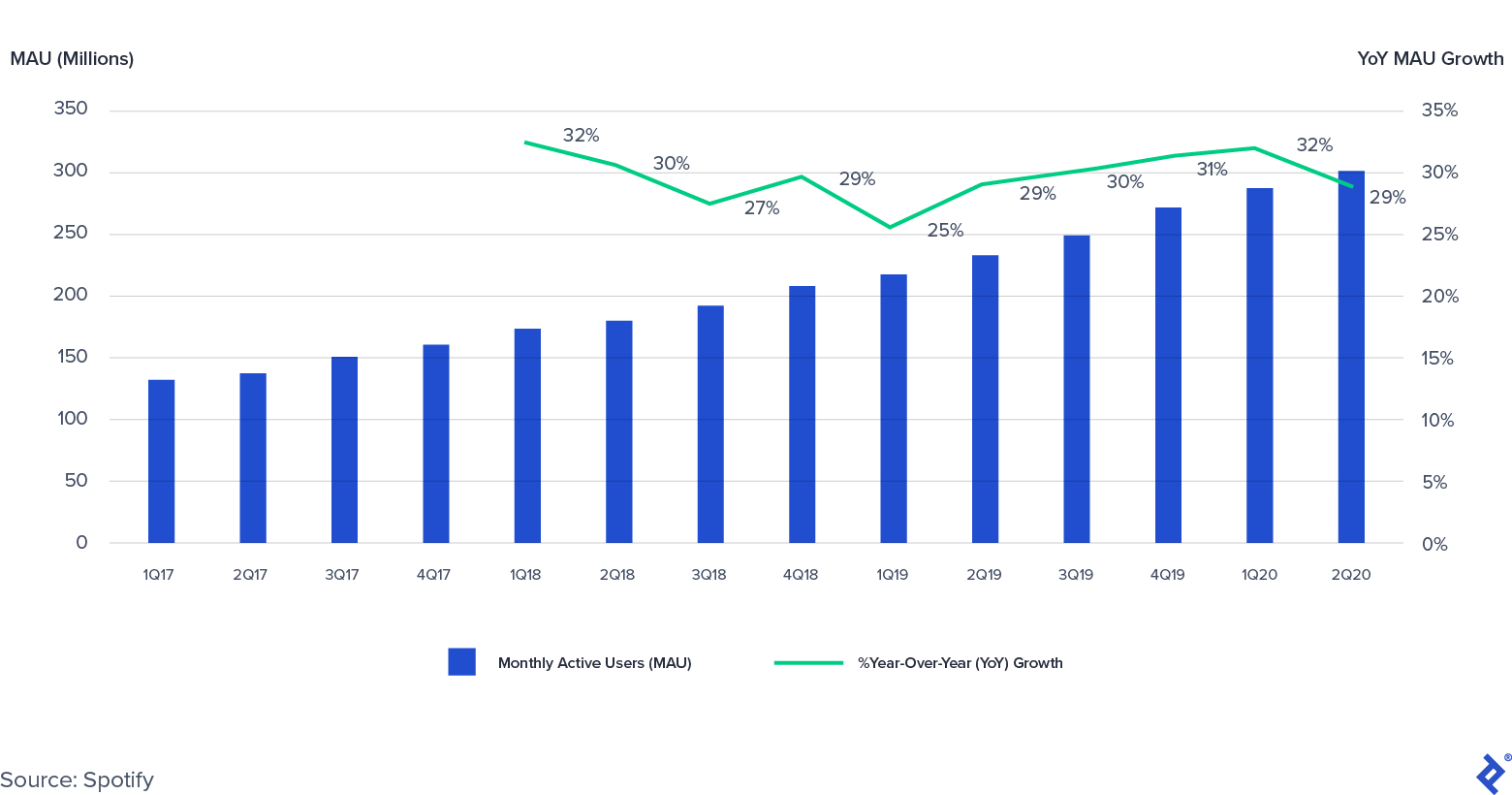

Indeed, the modest decline in engagement measured by listening hours has not impacted consumers’ willingness to pay for audio streaming. Spotify’s Q2 2020 Monthly Active Users (MAU) and paid streaming subscribers increased by 29% and 27% year-on-year, respectively, which was at the top of its guidance. As a result, Spotify’s Q2 2020 premium revenue increased by 17% year-on-year.

Spotify Monthly Active Users (MAUs): 2017-2020 (Q2)

Live Music Has Suffered

Other sources of music income, especially live music, have suffered during the pandemic. Social distancing restrictions have severely impacted the live music market. For example, Live Nation, a leading live entertainment company, experienced a 98% year-on-year revenue decline in Q2 2020, driven by global concert shutdowns. Live Nation management expects concerts to return to scale by summer 2021. Its view is corroborated by Goldman Sachs, which projects live music revenue to decrease 75% in 2020 before recovering in 2021 or 2022.

Reduced Advertising Weighs on Radio and General Licensing Income

Sirius XM, the satellite and digital radio broadcaster, saw total company sales decline 5% year-on-year in Q2 2020, driven by a 34% decline in advertising revenue. For the full year, Sirius XM management expects total company sales to decline by 3%.

Lower advertising spending has also impacted terrestrial radio, although the pullback may be reversing. iHeartMedia, the owner of 800+ AM/FM radio stations, saw an even larger impact than Sirius XM, with Q2 2020 sales declining 47% year-on-year. iHeartMedia did note that annual revenue declines had improved each month from April (down 50% year-on-year) through July (down 27% year-on-year).

As a result, royalties paid by radio stations to Performance Rights Organizations (PROs) will likely fall sharply over the next couple of quarters. ASCAP (one of the largest PROs) President Paul Williams noted in April 2020 that as more licensee businesses shut down, the pandemic will “have a material and negative impact financially on almost every category of licensing.”

The “Majors” Are Impacted, Positively and Negatively, by All Factors

The three “major” record labels and publishers have seen industry trends begin to play out in recent earnings reports. Universal Music Group was the only label to see revenue increase year-on-year up to June 30, 2020 ( +6% ), while Sony ( -12% ) and Warner Music Group ( -5% ) reported declines. Inside the results, all three attributed positive growth trends to streaming, but pandemic-related lockdowns negatively impacted non-digital revenues, especially in the areas of merchandise, physicals (e.g., CDs), and artist services.

Recent Music IP Acquisition and Capital Markets Activity

Wall Street has been taking notice of the music industry’s secular growth story. In recent years, billions of dollars have been raised, privately and publicly, to invest in music intellectual property rights and the companies that own them:

- Warner Music Group recently went public, raising just under $2 billion at a $13 billion valuation.

- Hipgnosis Songs Fund raised more than £850 million in its July 2018 IPO and four subsequent equity offerings.

- Universal Music announced that it is planning an IPO in the next three years.

Meanwhile, several private equity firms have raised funds focused on music IP rights:

- December 2019: Providence Equity Partners announced $650 million of equity and debt capacity for Tempo Music Investments, its music IP acquisition platform.

- July 2020: Shamrock Capital closed its second Content IP Fund, which focuses on different types of intellectual property, including music IP.

- August 2020: Concord Music closed a $1 billion debt financing.

Overall, there is a significant amount of activity in the equity and debt capital markets for music IP assets.

With capital pouring into the space, music IP acquisition activity has been hot. Recent years have seen several significant deals:

- January 2018: Round Hill Music purchased Carlin Music Publishing - home to songs by Elvis Presley, James Brown, and Billie Holiday - for an estimated $240 million.

- June 2019: Scooter Braun’s Ithaca Holdings and Carlyle Group acquired independent label and publisher Big Machine Label Group for an estimated $300 million.

- March 2020: A consortium led by China’s Tencent Holdings bought a 10% stake in Universal Music Group (UMG) at a €30 billion valuation.

Since going public in July 2018, Hipgnosis Songs Fund has also spent more than $1 billion, acquiring more than 60 catalogs. In short, the M&A market is very active, with BMG’s CEO Hartwig Masuch even calling the current environment “a feeding frenzy.”

The combination of capital formation and increased acquisition activity has led music IP valuations to trend upward over the past few years. In a future article, I will go deeper into the asset class of royalties and, in particular, why music royalties are considered an attractive asset class in the current market environment. The article will review the main levers that active investors use when attempting to increase music IP’s value, the potential pitfalls to look out for, and the instruments used for IP investing.

More Resilient: The Music Industry in 2020

The music industry has experienced a dramatic turnaround over the past five years. Technological advances driven by streaming have ushered in a period of growth. While COVID-19 has created several challenges, the industry is holding up relatively well with several new licensing opportunities on the horizon. As a result, capital is flowing into music IP investing, with acquisition activity remaining high.

Further Reading on the Toptal Blog:

- Why Music Royalties Are an Attractive Asset Class

- Will Spotify's Non-IPO Pave the Way for Tech Companies?

- Industry Analysis and Porter’s 5 Forces: A Deeper Look at Buyer Power

- Exploring the Post-crash Cryptocurrency Market: Blockchain, Regulations, and Beyond

- After All These Years, the World Is Still Powered by C Programming

Understanding the basics

Is the music recording industry growing.

After nearly two decades of piracy-driven declines, the global music recording industry’s revenue bottomed out at $14 billion in 2014. Since then, due in large part to streaming, revenue has grown to $20 billion in 2019, back in line with 2004 levels.

Is streaming good for the music industry?

The music industry has benefited from the growth of streaming services, which have been the main driver of global music recording revenue growth since 2015. For music labels, streaming margins are generally higher (50-60%) than physical music products (40-50%).

Is live music an industry in decline?

Between 2007 and 2019, global live music revenue grew by 5% annually. The market has been severely impacted by 2020 lockdowns, with Live Nation experiencing a 98% year-on-year revenue decline in Q2. Goldman Sachs projects global live music revenue to decrease 75% in 2020 before recovering in 2021 or 2022.

- MarketResearch

- MarketSizing

Jimmy Stone

New Orleans, LA, United States

Member since May 23, 2019

About the author

World-class articles, delivered weekly.

By entering your email, you are agreeing to our privacy policy .

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Consultants

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal ® community.

Your browser is ancient! Upgrade to a different browser to experience our site.

- Facts & Research

- Gold & Platinum

- RIAA Members

- Become an RIAA Member

- Board & Executives

- Music Organizations

- Internship Program

- International

- Parental Advisory Label

- PAL Standards

- For Students & Educators

- About Piracy

- Copyright Infringement Notices

- Diversity and Social Change

- Technical Standards

- Music Services

- U.S. Music Revenue Database

- Report Piracy

Facts & Research

- 9/10 social media users do music related social media activity

- Americans spend more than 4 hours a day listening to music

- Breaking an artist into a major market can cost $2 million

Year-End 2023 RIAA U.S. Latin Music Revenue Report / Informe de Fin del Año 2023 de RIAA Sobre Ingresos de Música Latina en Estados Unidos

2024 | Sales & Revenue

2023 Year-End Music Industry Revenue Report | RIAA

Riaa mid-year 2023 latin music revenue report / informe semestral de ingresos de la música latina en ee. uu. según riaa 2023.

2023 | Sales & Revenue

RIAA Mid-Year 2023 Revenue Report

2022 u.s. consumer music profile | musicwatch inc..

2023 | Consumer Trends

Year-End 2022 RIAA U.S. Latin Music Revenue Report / Informe de Fin del Año 2022 de RIAA Sobre Ingresos de Música Latina en Estados Unidos

2022 year-end music industry revenue report | riaa, mid-year 2022 us latin music revenues / datos de riaa sobre ingresos en el primer semestre de 2022.

2022 | Sales & Revenue

2022 Mid-Year Music Industry Revenue Report | RIAA

September 2022 | Sales & Revenue

2021 U.S. Consumer Music Profile | MusicWatch Inc.

2022 | Consumer Trends

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 27 July 2021

Cultural Divergence in popular music: the increasing diversity of music consumption on Spotify across countries

- Pablo Bello ORCID: orcid.org/0000-0003-2343-9617 1 &

- David Garcia ORCID: orcid.org/0000-0002-2820-9151 2 , 3 , 4

Humanities and Social Sciences Communications volume 8 , Article number: 182 ( 2021 ) Cite this article

31k Accesses

12 Citations

42 Altmetric

Metrics details

- Cultural and media studies

The digitization of music has changed how we consume, produce, and distribute music. In this paper, we explore the effects of digitization and streaming on the globalization of popular music. While some argue that digitization has led to more diverse cultural markets, others consider that the increasing accessibility to international music would result in a globalized market where a few artists garner all the attention. We tackle this debate by looking at how cross-country diversity in music charts has evolved over 4 years in 39 countries. We analyze two large-scale datasets from Spotify, the most popular streaming platform at the moment, and iTunes, one of the pioneers in digital music distribution. Our analysis reveals an upward trend in music consumption diversity that started in 2017 and spans across platforms. There are now significantly more songs, artists, and record labels populating the top charts than just a few years ago, making national charts more diverse from a global perspective. Furthermore, this process started at the peaks of countries’ charts, where diversity increased at a faster pace than at their bases. We characterize these changes as a process of Cultural Divergence, in which countries are increasingly distinct in terms of the music populating their music charts.

Similar content being viewed by others

Revival of positive nostalgic music during the first Covid-19 lockdown in the UK: evidence from Spotify streaming data

The role of population size in folk tune complexity

Elites, communities and the limited benefits of mentorship in electronic music

Introduction.

Digitization is arguably the biggest change the music market has undergone over the last decades. In 2016, digital sales already accounted for more than half of the revenues of the music industry (Coelho and Mendes, 2019 ). There are innumerable aspects on which digitization has impacted how we listen, produce, and commercialize music. For example, digital music is distributed at a null marginal cost, meaning that digital audio can be reproduced ad infinitum without an extra cost on the side of the record label. For the consumer, streaming has had homologous effects. In streaming platforms, listening to new music does not carry an extra monetary cost, as a listener only pays a flat monthly fee to subscribe to a platform like Spotify Footnote 1 . This way, time and search costs are the only ones remaining in the way of music exploration. On the distribution side, online catalogs of music are orders of magnitude larger than those of physical stores due to the lack of space constraints, making a more diverse offer of music (Anderson, 2006 ). There is evidence that the increased availability of music has been accompanied by an enhanced diversity and quantity of music consumption (Datta et al., 2018 ). In this paper, we explore the evolution of global diversity in the past years and find a clear trend towards global diversity in the music market.

Concerns of Cultural Convergence have been part of the public debate for decades. European governments, in particular, have made attempts to protect national cultural industries either directly (e.g. radio quotas) or indirectly (e.g. subsidizing national film production) (Ferreira and Waldfogel, 2010 ; Waldfogel, 2018 ). Because digitization granted easier access to imported goods, predictions were that national cultural products were doomed, especially in smaller countries. Nonetheless, scientific research has not yet provided a definitive answer to whether this fear was well-grounded or not. There is evidence that digitization might have accelerated cultural convergence across countries in popular music (Gomez-Herrera et al., 2014 ; Verboord and Brandellero, 2018 ) while others find an increasing interest in national artists (Achterberg et al., 2011 ; Ferreira and Waldfogel, 2010 ). Discrepancies most likely stem from the inconsistency in the sample of countries included in these studies and the limited granularity of data available. Therefore, the question of whether digitization and streaming are currently propelling cultural convergence is open for debate. For similar cultural products, such as YouTube videos, global convergence is limited by cultural values (Park et al., 2017 ).

The recent availability of datasets on music consumption across large numbers of countries has provided a way of overcoming some limitations of previous studies. In a recent example, Way and his collaborators, look at Spotify users’ listening behavior and find that “home bias”—the preference towards national artists—is on the rise globally (Way et al., 2020 ). A source of concern is the possible influence of a platform’s endogenous processes on the behavior of its users. For instance, what appears as an enhanced preference for national artists could be the result of changes in the recommendation algorithm. Alternatively, increased popularity of playlists like the New Music Friday, which are biased towards national artists (Aguiar and Waldfogel, 2018a ) could produce a similar effect. Although far from common, major changes in the recommendation system of Spotify happen, the latest one being announced in March of 2019 (Spotify, 2019 ). As a result, recommendations are now more personalized, which, if the nationality of a user is taken into account, could generate increasing divergence between countries by feeding users with national music. According to Spotify, up to one-fifth of their streams can be attributed to algorithmic recommendations (Anderson et al., 2020 ), which may be enough to sway macro-level trends in music consumption.

We deal with platform-specific confounders by supplementing our analysis of Spotify data with a dataset from iTunes. It must be noted, however, that changes similarly affecting both platforms may exist, such as the increasing use of recommendation systems or catalog expansions, as well as the mutual influence that would make these observations non-independent. Another caveat of using platform-specific data is the fact that users of such platforms might not be representative of the entire population. Spotify users are disproportionately young and male when compared to their countries’ population (Datta et al., 2018 ). Furthermore, the composition of users of a platform is in constant change and the timing of adoption correlates with individual listening habits. For instance, in Spotify, late adopters have a stronger preference for local music than those who joined the platform early on (Way et al., 2020 ). To minimize the impact of these issues, we reduce the sample of countries from the 59 available to 39, keeping those in which Spotify is strongly established. Therefore, we expect the population of users in these countries to be more stable than in recently incorporated ones such as India, in which market penetration is quickly expanding. Additionally, this can be considered as a within-sample comparison (Salganik, 2019 ), which, given the large user base of Spotify, is of interest in and on itself.

In this paper, we tackle the question of whether digitized music consumption is globalizing or not by looking at the ecology of the national music charts of Spotify and iTunes in the past few years. In other words, by observing the global diversity in the charts we can discern whether popular music is converging or diverging across countries. More diversity across countries would be a sign of Cultural Divergence. On the other hand, a decrease in diversity would be indicative of a process of Cultural Convergence across countries. We utilize the Rao-Stirling measure of diversity and its components (Stirling, 2007 ) to describe these trends. We find upward trends in the cross-national diversity of songs, artists, and labels, starting in 2017 in Spotify as well as in iTunes and ending in 2020 for Spotify. Popular music is thus diverging across countries in what we define as Cultural Divergence. To complement previous studies, we also look at the diversity of artists and labels and find that these have increased in parallel. Ultimately, this paper describes trends in popular music across a large sample of countries, giving a more clear perspective of the cultural dynamics in the digital era.

Research background

Winner-takes-all.

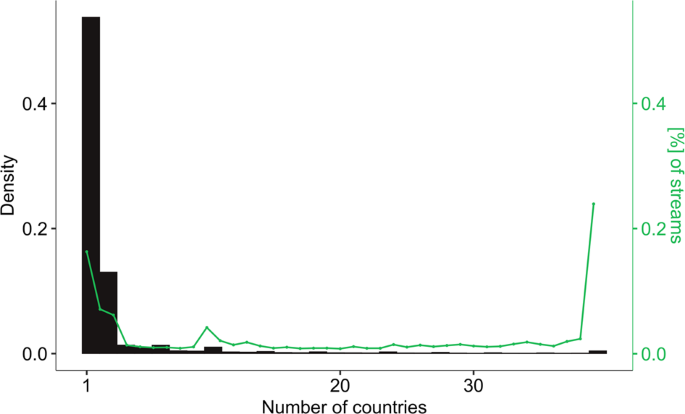

Cultural markets often exhibit a highly skewed distribution of success (e.g. Keuschnigg, 2015 , Salganik et al., 2006 ). In the music market in particular, a few hits expand across the globe while the majority of popular songs only hoard local success (see Fig. 1 ). Such inequalities are partly due to the scalability of cultural products, a property that refers to the fact that most of their cost is fixed – although this property does not apply to all cultural markets, being the art field an exception – while marginal costs are relatively low. For instance, once a song is recorded or a book is written, the cost of making another copy is insignificant when compared to the initial cost of producing it, measured in time, creativity, or money, making these products scalable to large audiences. As a result, demand is highly concentrated on the best alternatives, even when they are only marginally better than the rest (Rosen, 1981 ).

Bars represent the percentage of songs that got to the charts of exactly x countries. The green line represents the total number of streams that songs on each bin have accumulated while in the charts, as a measure of popularity in the period of analysis (2017-mid 2020).

Oftentimes this is an oversimplified view, since quality in cultural products is hard to define, and it is perceived (between others) as a function of previous success, thus creating path dependencies in the popularity of cultural products and artists. This process can be viewed as one in which information is accumulated, with consumers relying on it to moderate the quality uncertainty of their selection of cultural products (Giles, 2007 ). Information is aggregated in the form of consumer reviews, sales rankings, or top charts. In a pathbreaking experimental study, Salganik et al. ( 2006 ) found that information on other listener’s musical preferences results in an amplified inequality of popularity when compared to a world of independent listeners. Using social cues in the form of aggregated information might be beneficial for individuals in cultural markets in which preference is a matter of taste, but there are multiple strategies to leverage such information and its fit varies between individuals (Analytis et al., 2018 ). In the case of artists, during their careers, “small differences in talent become magnified in larger earning differences” (Rosen, 1981 ). This “superstar effect”—defined as the previous success of an artist—is the most important predictor of the popularity of a song, even when controlling for other factors (Interiano et al., 2018 ). Thus, the huge inequalities of success stemming from the scalability of cultural products and the social influence mechanisms intervening in their spread allows for the possibility of a few songs and artists to dominate the charts across the globe.

In principle, both scalability, as well as social influence processes, may have gained bearing after digitization and streaming. On the one hand, digitization reduced the marginal costs of music production by eliminating the need to manufacture an album. Some transaction costs for digital music remain, such as copyrights and distributing platform fees, but overall, the barriers for music to flow across countries are substantially lower than in the pre-digital era. On the other hand, information is more abundant than ever before. Users can get near-real-time data on the listening decisions of millions of other users. On Spotify, anyone can search through the Top 50 playlists tailored for every country. Each of them contains the most popular songs on the platform, which are updated daily. These playlists are extremely popular among users, for instance, the Top 50 Global has over 15 million followers. This deluge of information is complemented with second-order feedback effects (Easley and Kleinberg, 2010 ) such as recommender systems, which might be luring listeners towards the most popular songs. For Spotify, there is evidence that users who rely more heavily on algorithmic recommendations listen to less diverse music and podcasts than those who discover music for themselves (Anderson et al., 2020 , Holtz et al., 2020 ). In short, there are arguments to think that the winner-takes-all effects characteristic of the music market might be gaining bearing under the digital regime, decreasing the diversity and increasing the concentration of the market in the hands of a few hit songs, superstar artists, and major labels.

The long tail

The idea of the long tail, first proposed by Anderson ( 2004 ) in a widely circulated press article sustains that online retailing has led to increased diversity in the consumption of music. This happened because online retailers do not have the limitations of shelf space that traditional brick-and-mortar stores have, and so their catalogs can be virtually unlimited in size. The unlimited digital space can be filled with niche products that do not attract huge audiences but, bit by bit, make a difference in terms of profits generated. In the book following his article, Anderson ( 2006 ) goes beyond the original argument, suggesting that the Internet has a carrying capacity for cultural products previously unattainable and its impact on cultural markets has been broader than initially expected. Not only the distribution but also the production of cultural goods has thrived as a result of the new technologies for distribution (e.g. online retailers), production (e.g. cheaper software), and consumption (e.g. flat fees). Some have even qualified these changes as a renaissance of cultural markets (Waldfogel, 2018 ).

More recently, Aguiar and Waldfogel have argued that the idea of the long tail fails to account for the unpredictability of success in cultural markets (Aguiar and Waldfogel, 2018b ; Waldfogel, 2017 , 2020 ). When confronted with new artists, for instance, record labels have a scant capacity to assess what will be the success of those artists. Under such uncertainty, producers strive to pick those with better prospects but there will inevitably be miscalculations (e.g. the infamous Decca audition of The Beatles) and artists that were deemed unworthy of being promoted will end up reaping huge success, and the same in the opposite direction. In other words, before digitization, market intermediaries held most of the decision power over which products or artists were worthy of being produced and which ones did not, the inevitable result of which was that some hits were lost. The reduced costs of production and promotion of digital cultural goods have made possible the production of these products. Unlike what the original idea of the long tail proposed, not all of them will be niche products and some will end up achieving unexpected popularity. The same goes for independent record labels, which now have better opportunities to promote their artists even with small budgets. There is evidence that indie artists and labels have gained relevance under the digital music regime (Coelho and Mendes, 2019 ). For instance, top-selling albums in the US produced by independent labels increased from 12% in 2000 to 35% in 2010 (Waldfogel, 2015 ).

Waldfogel and Aguiar refer to this phenomenon as the random long tail of music production. The random long tail contains those cultural goods that despite not being attractive to traditional intermediaries can be brought into production and, due to the inherent unpredictability of cultural markets, sometimes reach unexpected success. Accordingly, the more unpredictable a cultural market is, the greater the number of unexpected hits. For instance, the success of songs is more difficult to predict than that of movies, whose box-office earnings heavily depend on the budget and cast of the film (Aguiar and Waldfogel, 2018b ). In summary, these studies put forward a vision of the music market in the digital era as more diverse and unpredictable.

Methods and data

Although there are multiple approaches to the study of diversity in social phenomena, Stirling’s ( 2007 ) is one of the most influential and widely applied. More importantly, the Rao–Stirling diversity index has already been used to study diversity in music taste, although at a different level of analysis than here (Park et al., 2015 ; Way et al., 2019 ). The Rao–Stirling index consists of three components: variety, balance, and disparity.

Variety is a function of the number of distinct units (songs, artists, or labels) in the charts on a given day. The more unique units the more variety there is in the charts. Naturally, in the case of songs variety is bounded by the fact that the same song cannot occupy more than one chart position per country so changes in variety should be interpreted, rather than the absolute size of the indicators (which also applies to the other measures of song diversity). We measure variety as the number of distinct units divided by the total number of chart positions. Balance refers to how evenly distributed the system is across units. Here we measure balance as 1−Gini, a common measure of the inequality of a distribution. In this case, it is the distribution of chart positions across songs, artists, or labels. The more equally distributed positions are the higher the balance in the system. Importantly, balance does not give any information about the number of units in the charts (variety). For instance, label balance would be highest if two labels produce all the songs in the charts with equal shares as well as if every song in the charts was produced by a different label (and there were no songs in more than one chart-country). The disparity is defined not by categories themselves but by the qualities of such categories or elements. In other words, the disparity is a measure of how different the elements of a system are. We define the qualities of a song by its acoustic features Footnote 2 and then calculate the euclidean distance between songs. In the case of artists, we define them by the central tendency of the acoustic features of their songs on the charts. The Rao–Stirling index combines variety, balance, and disparity into a single indicator of diversity Footnote 3 .

Additionally, we introduce Zeta diversity, a measure from biology. Zeta diversity was developed by Hui and McGeoch ( 2014 ) to tackle the issues with pairwise measures of diversity. Aggregated pairwise distance measures are consistently biased (Baselga, 2013 ) and, when the number of sites (countries) is large, they approximate their upper limit (Hui and McGeoch, 2014 ). More importantly, Zeta diversity gives a more nuanced view of the interplay between global and local hits. The distribution of the number of countries in which a song reaches the charts is right-skewed, as shown in Fig. 1 , meaning that most songs enter the charts of just one or two countries. As a consequence, what aggregated measures such as Rao–Stirling mainly capture is the effect of local hits. The influence of global hits is mostly null in such measures because of their paucity. Zeta diversity, on the other hand, measures distances at multiple orders. For instance, Zeta of order 3 ( ζ 3 ) represents the expected number of songs shared by groups of three countries. It is calculated by looking at all possible combinations of three countries and calculating the number of songs that each group shares. Higher orders or Zeta (e.g. songs shared by groups of 10 or more countries) capture the prevalence of more global hits. Here, we characterize Zeta by its central tendency, but other options are possible. As the order of Zeta increases its value decreases monotonically since there are always fewer songs charting in groups of three countries than in groups of two. In short, Zeta diversity gives us a more nuanced view of the distribution of success of songs across the charts compared to other diversity measures.

The data for the study comes from Spotify’s top 200 charts and iTunes’ top 100. We illustrate the analysis focusing on Spotify’s data because of the larger sample of countries (39 vs. 19). The entire list of countries can be found in Supplementary Table S1 online. Because iTunes data could not be retrieved from an official source (instead we obtained it through Kworb.com), the results are reported only as a means of externally validating our main findings. Spotify’s data covers the period from 2017-01-01 to 2020-06-20, iTunes top 100 daily charts for the period 2013-08-14 to 2020-07-16.

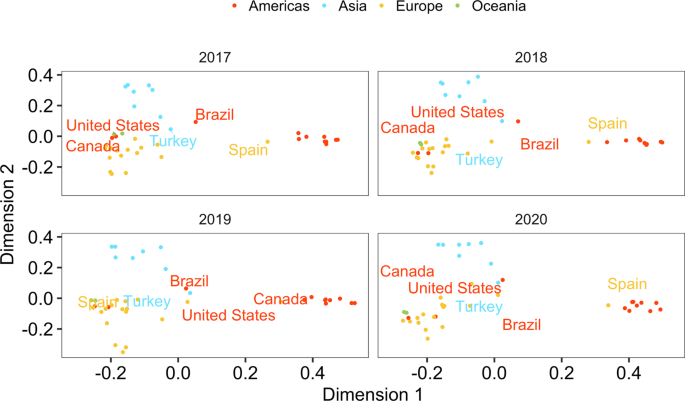

Figure 2 shows distances between countries as a function of the songs shared between their charts within a year. Countries appear geographically clustered. One cluster is formed by Western countries of which Spain is the exception, being part of a different cluster, together with the Latin American countries. The third cluster encapsulates the Asian countries and Brazil. There are some noticeable anomalies, such as the closeness between Turkey and Brazil. Upon closer examination, most of the songs shared between them are produced in the United States. This is likely the result of the small market penetration of Spotify, making for a user base of early adopters more internationally oriented. Alternatively, it could be the result of a small catalog of local music. In any case, the observable consequence is an over-representation of international (and mainly US) hits in both countries’ charts.

Jaccard distances calculated over annually constructed incidence matrices. Countries are colored according to the continent they belong to (red: Americas, yellow: Europe, blue: Asia, Green: Oceania).

Although positions are fairly stable over the years, if anything, clusters of countries seem to consolidate, being these three groups more clearly discernible in 2020 than in 2017. Following Park et al. ( 2017 ) we also look at the relationship between countries as a projection of the two-mode network between countries and songs. The modularity of the network indicates the degree to which countries are clustered into modules beyond what would be expected on a random network. Modularity increased consistently from 2017 up to 2020 (see Supplementary Fig. S4 ) indicating that countries within clusters are becoming more similar in their music charts and, at the same time, drifting away from other clusters. These results are consistent with general notions of cultural, geographical, and linguistic distance which elsewhere have been proved to be the main determinants of music taste similarities between countries (Moore et al., 2014 ; Pichl et al., 2017 ; Schedl et al., 2017 ) although with a few exceptions such as the above-mentioned.

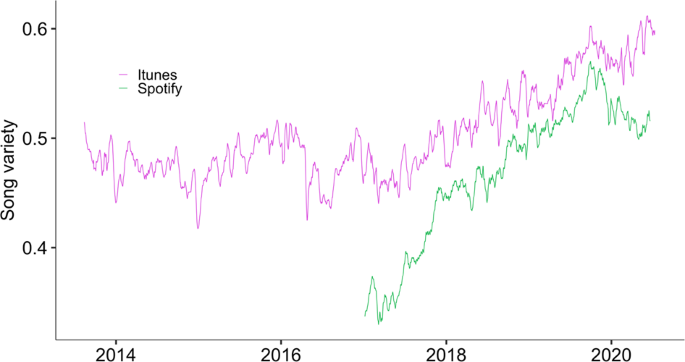

Seen as a whole, the diversity of songs, artists, and labels has increased during this period. Variety has grown not only on Spotify but on iTunes as well (Fig. 3 ). The resemblance between the two trends is startling, especially if we consider how different these platforms are, one being a streaming platform with growing popularity (Spotify) while the other (iTunes) is a digital music shop whose user base is in decay. The resemblance between the trends points to the external validity of the observations, although there could be some degree of influence between the platforms and thus they cannot be regarded as completely independent observations. The upward tendency in variety starts in 2017 and plateaus at the end of 2019 on Spotify while it keeps increasing in iTunes.

Values range from 0 (same set of songs in every country) to 1 (no overlap between the charts). Calculated for countries in both datasets (16 countries) and the same chart size (100 positions). Time series are calculated with daily frequency and smoothed over a 10-day window. Both Spotify and iTunes display consistent trends of increasing variety over time.

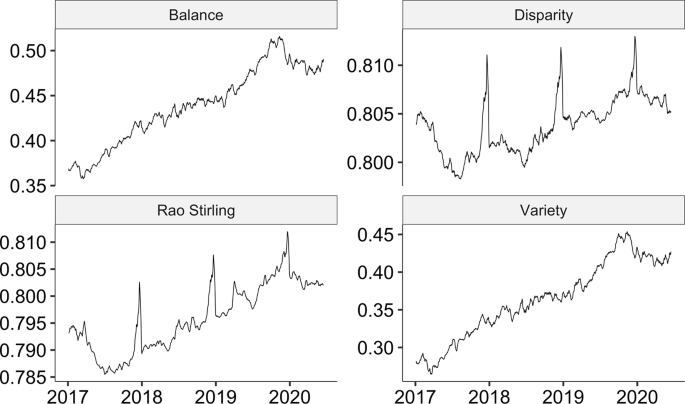

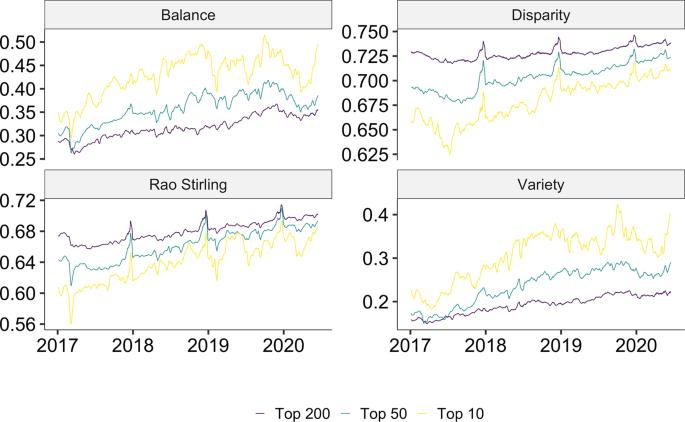

The increase in song diversity can be observed in Fig. 4 . Balance, disparity, and variety have all increased during the period. The disparity indicator also shows a strong seasonal burst around Christmas. This is consistent with other findings, suggesting that in countries in the Northern Hemisphere musical intensity declines around Christmas while the opposite is true for the Southern Hemisphere (Park et al., 2019 ). Overall diversity (Rao–Stirling index) rises from 2017 up to 2020 and then plateaus. Hence, not only there are more distinct songs in the charts (variety) but these are acoustically more dissimilar (disparity) and their distribution over the chart slots is more equal (balance) than at the beginning of the period.

Diversity, measured as balance, disparity, variety, or a combination of them, has been increasing consistently across countries with a plateau at the beginning of the year 2020. Besides the secular growth, disparity shows a strong seasonal component centered around Christmas.

As for songs, the diversity of artists has also grown. However, the trend is distinct at the head of the charts than at the bottom. By slicing charts at certain ranking positions we create a top 10, top 50, and top 200 for each country. When it comes to balance and variety, the increase has been more pronounced at the head of the charts, which already presented a higher level at the beginning of the observed period. However, disparity is lowest within the top 10, indicating that the group of artists with songs on the head of the charts are stylistically more similar than those who just make it to the charts (a group that subsumes the former). What we can derive from these trends is that, while there are proportionally more unique artists at the top of the charts, the music that those artists produce is relatively similar, as if there was an acoustic “recipe” for reaching the peak of the charts. In general, artist diversity as a whole has increased at a similar pace across strata of the charts (Fig. 5 c).

All the components of artist diversity have increased steadily during the period. As for songs, artist disparity bursts around Christmas. While balance and variety are higher at the peak of the charts, disparity shows the opposite pattern.

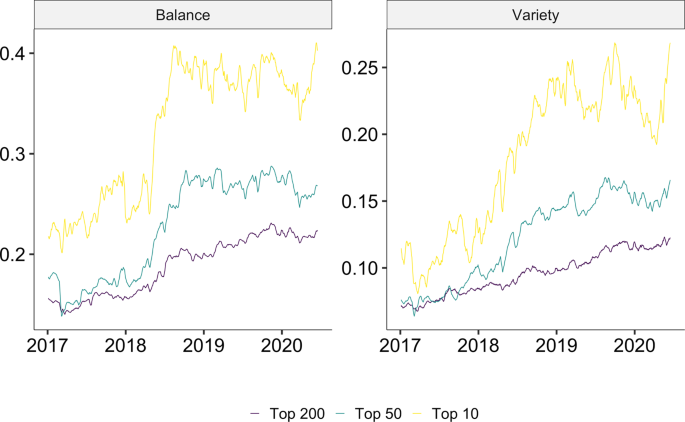

The increasing diversity of songs and artists in the charts has been accompanied by a more equally distributed market for record labels (Fig. 6 a). Again, the trend is steeper if we look only at the head of the charts. The number of distinct labels with at least one song in the charts has also increased in a stratified manner (Fig. 6 b). In general, labels had on average fewer artists and songs on the charts at the end of the period. While in the first 6 months of 2017 labels had on average 5.88 songs on the charts (and 2.19 artists), for the first half of 2020 it was one less song (and only 1.66 artists). Interestingly, the number of songs that each artist got on the charts has increased slightly, going from 2.67 in 2017 to 2.96 in 2020 (comparing the first half of each year).

The left panel shows the balance of labels over time for three sizes of the top chart, displaying increases over time especially for the highest positions in the chart. The right panel shows the variety of labels on the charts. The same patterns as for balance can be observed.

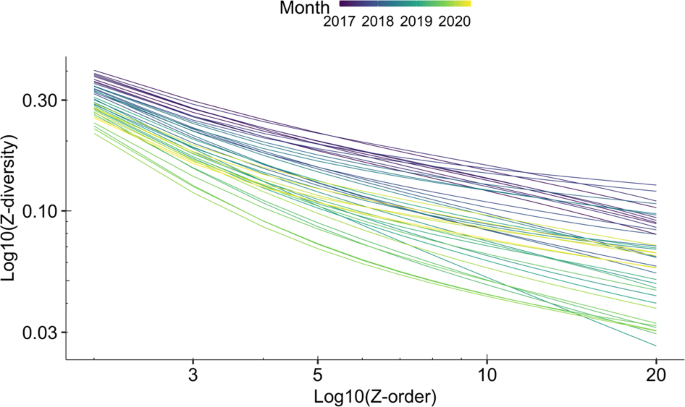

We can take a closer look at the interplay between local and global hits through the Zeta diversity measure. Figure 7 presents the results for monthly Zeta diversity measures of orders 2—which is equivalent to pairwise distances—up to 20—the mean number of common songs shared by groups of 20 countries. We observe that across all orders of Zeta the mean diversity tends to decrease with time (brighter colors) which is consistent with the previous results Footnote 4 . When we look at the decay of Z -values along orders of Zeta ( x -axis) we observe that it gets steeper over time. In other words, the slope of the regression with Z -values ( y -axis) as a dependent variable and Z -order ( x -axis) as a predictor gets greater with time. Table 1 presents the results of a linear regression model that shows the increase in steepness over time. The substantive interpretation is that global hits have taken the lion’s share of the increase in diversity, becoming an increasingly rare phenomenon.

The x -axis represents the order of Zeta and the y -axis the z -value, or mean percentage of songs shared across groups of x countries. Both axes are represented on a log10 scale. The function of Zeta with order shifts down over time and becomes steeper.

By analyzing 4 years of data of music charts in 39 countries, we find clear evidence of increased diversity in the music charts across countries. In the short period covered by this study, the number of unique songs, artists, and labels on the charts in our sample of countries has grown considerably. Despite the concerns expressed by several governments, particularly in Europe (Waldfogel, 2018 , p. 220), popular music is not increasingly globalized. Instead, countries’ popular music was amidst a process of Cultural Divergence that seemed to have come to a halt at the end of the observed period. The increase in diversity seems to be driven by a segmentation of the music market rather than an evenly heightened idiosyncrasy of music consumption. In other words, countries that were already close to one another in taste are becoming more similar but increasingly different from other clusters of countries. Such clusters appear strongly determined, but not only, by geographical and cultural distance. Research shows that regional clusters also differ in the acoustic properties of the music that their populations listen to (Park et al., 2019 ). Therefore, although diversity is usually taken as a positive trait of a system, the segmentation which is driving the increase in diversity can be a source of concern.

We also show that diversity has been on the rise in terms of artists and record labels. Particularly, the rise of label diversity rules out the possibility that the big labels are producing pop music fitted to different markets, as the proponents of glocalization would argue. As a consequence of these trends, not only songs might be increasingly distinct across countries, but also their production and distribution.

Whether it is the preferences of users or shifts in the production and distribution of music that are driving these changes is not clear. The possibility that Cultural Divergence is the result of a random long tail in music production is more consistent with the pace and ubiquity of these changes than preference-based accounts of the same phenomenon. Therefore, as an alternative to preference-based explanations of the increase in home bias (Way et al., 2020 ) and global diversity, we propose that these observations could be explained by changes in music production. One first source of concern with the preference-based explanation stems from the speed and ubiquity of the observed changes. Cultural shifts of this scale are generally slow, comparable in speed to the evolution of traits in animal populations (Lambert et al., 2020 ). Also, there is evidence that changes in the aggregated preferences of a population are mostly driven by generational replacement (Vaisey and Lizardo, 2016 ). Instead, we argue that field configurations can more rapidly sway macro-patterns by conditioning the opportunities of individuals. In the case of music, the random long tail of music production may have increased the available options of users to express their idiosyncratic preferences, which, being to some extent geographically determined (Ferreira and Waldfogel, 2010 ; Gomez-Herrera et al., 2014 ; Way et al., 2020 ), would likely result in national music charts drifting away from each other.

Methodologically, this research shows the potential of Zeta diversity, a measure devised for the study of biodiversity, to gauge the globalization of cultural products at different levels. Since truly global hits are extremely rare phenomena when compared to songs that reach in small groups of culturally similar countries, they carry very low weight when calculating pairwise distances, which is a common way of looking at cross-national diversity. National charts could drift apart without affecting the likelihood of the eventual hit to spread globally and conventional pairwise measures would not pick this dynamic. As we show, this has not been the case for the music market, in which the positive trend in diversity has been accompanied by a significant decrease in the spread of global hits. The application of Zeta diversity is not without issues, one of them being that its calculation is computationally demanding when compared with the other measures of diversity presented here, because of its combinatorial nature. In return, it offers relatively stable estimates of rare events, a useful feature when studying heavy-tailed distributions in general, and cultural markets in particular, in which global hits are highly unlikely but more consequential in terms of collective attention than the more common local hits. More broadly, our analysis applies mathematical methods from ecology to analyze the consumption of cultural content. This interface between disciplines has other applications, for example, to understand the dynamical reorganization of user activity on social media (Palazzi et al., 2020 ). Furthermore, our work builds on existing literature utilizing methods from ecology to study musical taste and consumption (Park et al., 2015 ; Way et al., 2019 ).

To conclude, our results run counter to the notion of an unbounded market that can be distilled from the idea of globalization. It also challenges the expectations of the winner-takes-all set of theories that predict heightened inequality in the distribution of success under decreased restrictions to global expansion. Instead, the music market has become, in this short period, more hostile to the spread of hits across the globe. From a positive perspective, this means that “national cultures” are not disappearing, although this might come at the expense of a more segmented market in bundles of culturally similar countries, and the risks associated with such segmentation if spread, for instance, from esthetic to normative judgments.

Data availability

Data and code for the analyses are available at https://github.com/PabloBelloDelpon/Spotify_paper .

Users also have the option to get free access to a limited version of the platform, which is ad-supported.

Spotify measures the acoustic features of each song and groups them into the followingcategories, all of which we include in the analysis: danceability, energy, key, loudness, mode,speechiness, acousticness, instrumentalness, liveness, valence, tempo, and duration.

More precisely, Rao–Stirling is calculated as in Stirling ( 2007 ): D = ∑ it ( i ≠ j ) d ij ⋅ p i ⋅ p j , where p i and p j are the proportions of elements i and j in the system and did is the euclidean distance between their respective acoustic representations.

Zeta diversity is measured in the opposite direction than the previous indicators of diversity. Higher values indicate more overlap of songs across charts and smaller values indicate less overlap.

Achterberg P, Heilbron J, Houtman D, Aupers S (2011) A cultural globalization of popular music? American, Dutch, French, and German popular music charts (1965 to 2006). Am Behav Sci 55(5):589–608

Article Google Scholar

Aguiar L, Waldfogel J (2018a) Platforms, promotion, and product discovery: Evidence from spotify playlists. JRC digital economy working paper, 2018/04

Aguiar L, Waldfogel J (2018b) Quality predictability and the welfare benefits from new products: evidence from the digitization of recorded music. J Polit Econ. https://doi.org/10.1086/696229

Analytis PP, Barkoczi D, Herzog SM (2018) Social learning strategies for matters of taste. Nat Hum Behav 2(6):415–424

Anderson A, Maystre L, Anderson I, Mehrotra R, Lalmas M (2020) Algorithmic effects on the diversity of consumption on spotify. In: Proceedings of the web conference 2020, Taipei, Taiwan. ACM, pp. 2155–2165

Anderson C (2004) The long tail. Wired. https://www.wired.com/2004/10/tail . Accessed 20 Jul 2021

Anderson C (2006) The long tail: why the future of business is selling less of more. Hachette

Google Scholar

Baselga A (2013) Multiple site dissimilarity quantifies compositional heterogeneity among several sites, while average pairwise dissimilarity may be misleading. Ecography 36(2):124–128

Coelho MP, Mendes JZ (2019) Digital music and the death of the long tail. J Bus Res 101:454–460

Datta H, Knox G, Bronnenberg BJ (2018) Changing their tune: how consumers’ adoption of online streaming affects music consumption and discovery. Market Sci 37(1):5–21

Easley D, Kleinberg J (2010) Networks, crowds, and markets: reasoning about a highly connected world. Cambridge University Press

Ferreira F, Waldfogel J (2010) Pop internationalism: has a half century of world music trade displaced local culture? Technical Report w15964. National Bureau of Economic Research, Cambridge

Giles DE (2007) Increasing returns to information in the US popular music industry. Appl Econ Lett 14(5):327–331

Gomez-Herrera E, Martens B, Waldfogel J (2014) What’s going on? Digitization and global music trade patterns since 2006. SSRN Scholarly Paper ID 2535803. Social Science Research Network, Rochester

Holtz D, Carterette B, Chandar P, Nazari Z, Cramer H, Aral S (2020) The engagement-diversity connection: evidence from a field experiment on spotify. SSRN Scholarly Paper ID 3555927, Social Science Research Network, Rochester, NY

Hui C, McGeoch MA (2014) Zeta diversity as a concept and metric that unifies incidence-based biodiversity patterns. Am Nat 184(5):684–694

Interiano M, Kazemi K, Wang L, Yang J, Yu Z, Komarova NL (2018) Musical trends and predictability of success in contemporary songs in and out of the top charts. R Soc Open Sci 5(5):171274

Article ADS Google Scholar

Keuschnigg M (2015) Product success in cultural markets: the mediating role of familiarity, peers, and experts. Poetics 51:17–36

Lambert B, Kontonatsios G, Mauch M, Kokkoris T, Jockers M, Ananiadou S, Leroi AM (2020) The pace of modern culture. Nat Hum Behav 4(4):352–360

Moore JL, Joachims T, Turnbull D (2014) Taste space versus the world: an embedding analysis of listening habits and geography. In: Proceedings of the 15th International Society for Music information retrieval conference, Taipei, Taiwan

Palazzi MJ, Solé-Ribalta A, Calleja-Solanas V, Meloni S, Plata CA, Suweis S, Borge-Holthoefer J (2020) Resilience and elasticity of co-evolving information ecosystems. Preprint at https://arxiv.org/abs/2005.07005

Park M, Park J, Baek YM, Macy M (2017) Cultural values and cross-cultural video consumption on YouTube. PLoS ONE 12(5). https://doi.org/10.1371/journal.pone.0177865

Park M, Thom J, Mennicken S, Cramer H, Macy M (2019) Global music streaming data reveal diurnal and seasonal patterns of affective preference. Nat Hum Behav 3(3):230–236

Park M, Weber I, Naaman M, Vieweg S (2015) Understanding musical diversity via online social media. In: Proceedings of the ninth international AAAI conference on web and social media, Oxford, UK

Pichl M, Zangerle E, Specht G, Schedl M (2017) Mining culture-specific music listening behavior from social media data. In: 2017 IEEE International Symposium on Multimedia (ISM), Taichung. IEEE, pp. 208–215

Rosen S (1981) The economics of superstars. Am Econ Rev 71:845–858

Salganik MJ (2019) Bit by bit: social research in the digital age. Princeton University Press, Princeton

Salganik MJ, Dodds PS, Watts DJ (2006) Experimental study of inequality and unpredictability in an artificial cultural market Science 311(5762):854–856 https://doi.org/10.1126/science.1121066 American Association for the Advancement of Science Section: Report

Article ADS CAS PubMed Google Scholar

Schedl M, Lemmerich F, Ferwerda B, Skowron M, Knees P (2017) Indicators of country similarity in terms of music taste, cultural, and socio-economic factors. In: 2017 IEEE International Symposium on Multimedia (ISM), Taichung. IEEE, pp. 308–311

Spotify (2019) Our playlist ecosystem is evolving: here’s what it means for artists & their teams—news—spotify for artists. https://artists.spotify.com/blog/our-playlist-ecosystem-is-evolving . Accessed 10 Nov 2020

Stirling A (2007) A general framework for analysing diversity in science, technology and society. J R Soc Interface 4(15):707–719

Vaisey S, Lizardo O (2016) Cultural fragmentation or acquired dispositions? a new approach to accounting for patterns of cultural change. Socius 2:1–15

Verboord M, Brandellero A (2018) The globalization of popular music, 1960–2010: a multilevel analysis of music flows. Commun Res 45(4):603–627

Waldfogel J (2015) Digitization and the quality of new media products: the case of music. In Economic analysis of the digital economy. The University of Chicago Press, pp. 407–442

Waldfogel J (2017) The random long tail and the golden age of television. Innov Policy Econ 17:1–25

Waldfogel J (2018) Digital renaissance: what data and economics tell us about the future of popular culture. Princeton University Press, Princeton

Book Google Scholar

Waldfogel J (2020) Digitization and its consequences for creative-industry product and labor markets. In: The role of innovation and entrepreneurship in economic growth. The University of Chicago Press, p. 42

Way SF, Garcia-Gathright J, Cramer H (2020) Local trends in global music streaming. In: Proceedings of the international AAAI conference on web and social media, vol. 14. pp. 705–714

Way SF, Gil S, Anderson I, Clauset A (2019) Environmental changes and the dynamics of musical identity. In: Proceedings of the 13th international AAAI conference on web and social media, vol. 13. pp. 527–536

Download references

Acknowledgements

D.G. acknowledges funding from the Vienna Science and Technology Fund (WWTF) through project VRG16-005. We thank Marc Keuschnigg and Paul Schuler for their insightful comments on previous versions of this article.

Open access funding provided by Linköping University.

Author information

Authors and affiliations.

Department of Management and Engineering, The Institute for Analytical Sociology, Linköping University, Linköping, Sweden

Pablo Bello

Graz University of Technology, Vienna, Austria

David Garcia

Complexity Science Hub Vienna, Vienna, Austria

Medical University of Vienna, Vienna, Austria

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Pablo Bello .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplemental material, marked-up paper, rights and permissions.

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Bello, P., Garcia, D. Cultural Divergence in popular music: the increasing diversity of music consumption on Spotify across countries. Humanit Soc Sci Commun 8 , 182 (2021). https://doi.org/10.1057/s41599-021-00855-1

Download citation

Received : 19 November 2020

Accepted : 21 June 2021

Published : 27 July 2021

DOI : https://doi.org/10.1057/s41599-021-00855-1

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

This article is cited by

The soundtrack of a crisis: more positive music preferences during economic and social adversity.

- Marco Palomeque

- Juan de-Lucio

Journal of Happiness Studies (2024)

A simple cognitive method to improve the prediction of matters of taste by exploiting the within-person wisdom-of-crowd effect

- Itsuki Fujisaki

- Hidehito Honda

- Kazuhiro Ueda

Scientific Reports (2022)

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Music Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

The Global Music Market is Segmented by Revenue Generation Format (Streaming, Digital (except Streaming), Physical Products, Performance Rights, Synchronization Revenues) and Geography (North America (United States, Canada), Europe (Germany, UK, France, Italy, and Rest of Europe), Asia Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Music Market Size

Need a report that reflects how COVID-19 has impacted this market and its growth?

Music Market Analysis

The Music Market size is estimated at USD 30.70 billion in 2024, and is expected to reach USD 45.65 billion by 2029, growing at a CAGR of 8.54% during the forecast period (2024-2029).

- The music industry has reached a new level of internationalization. The international music community has never been more connected, and fans and artists alike are seizing the opportunities of this new era to enjoy and share the music they love.

- Throughout the projected period, it is anticipated that the use of intelligent devices will increase along with the increased penetration of digital platforms. Music streaming services include websites that let users watch music videos, listen to audio, and subscribe to podcasts. Due to functions like automatic playlist customization, song recommendations, and hassle-free connectivity on apps and browsers, these platforms are becoming more and more popular. Additionally, these portals' expanding podcast genres fuel the market's expansion.