11.4 The Business Plan

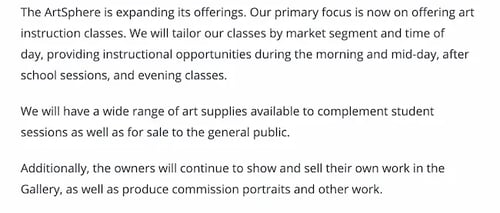

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

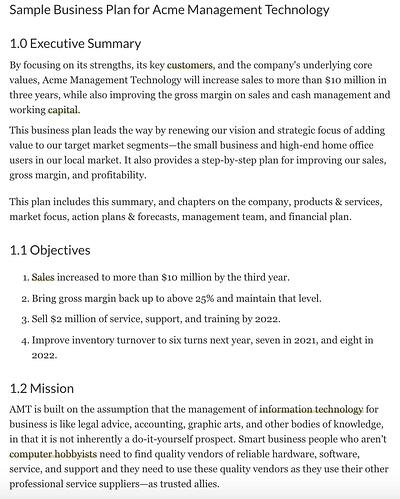

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

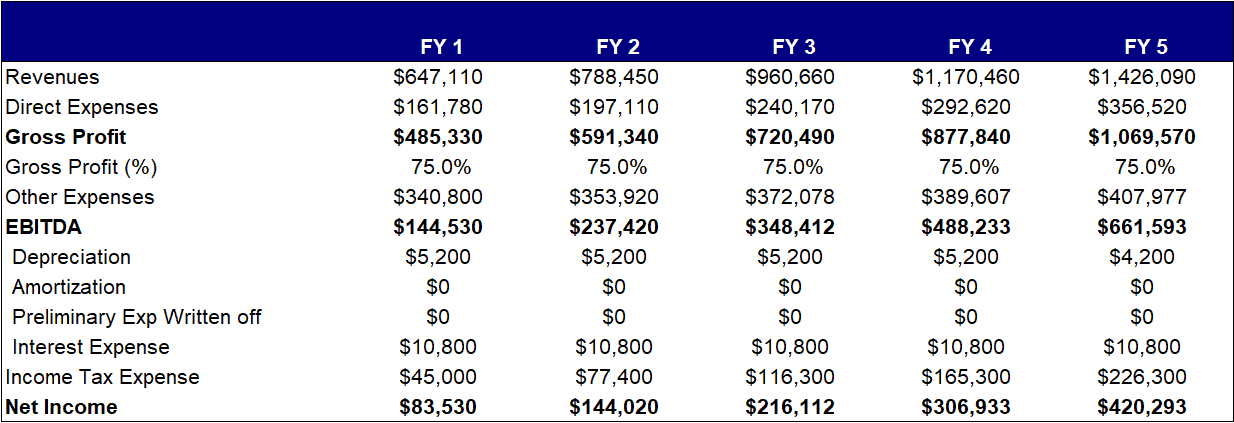

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Business Description

This section describes the industry, your product, and the business and success factors. It should provide a current outlook as well as future trends and developments. You also should address your company’s mission, vision, goals, and objectives. Summarize your overall strategic direction, your reasons for starting the business, a description of your products and services, your business model, and your company’s value proposition. Consider including the Standard Industrial Classification/North American Industry Classification System (SIC/NAICS) code to specify the industry and insure correct identification. The industry extends beyond where the business is located and operates, and should include national and global dynamics. Table 11.4 shows a sample business description for La Vida Lola.

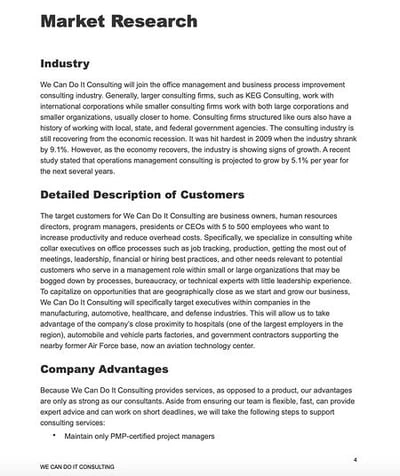

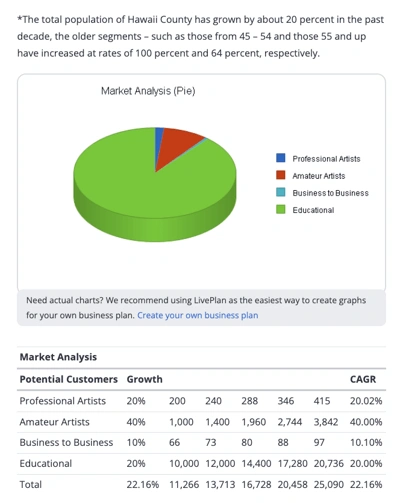

Industry Analysis and Market Strategies

Here you should define your market in terms of size, structure, growth prospects, trends, and sales potential. You’ll want to include your TAM and forecast the SAM . (Both these terms are discussed in Conducting a Feasibility Analysis .) This is a place to address market segmentation strategies by geography, customer attributes, or product orientation. Describe your positioning relative to your competitors’ in terms of pricing, distribution, promotion plan, and sales potential. Table 11.5 shows an example industry analysis and market strategy for La Vida Lola.

Competitive Analysis

The competitive analysis is a statement of the business strategy as it relates to the competition. You want to be able to identify who are your major competitors and assess what are their market shares, markets served, strategies employed, and expected response to entry? You likely want to conduct a classic SWOT analysis (Strengths Weaknesses Opportunities Threats) and complete a competitive-strength grid or competitive matrix. Outline your company’s competitive strengths relative to those of the competition in regard to product, distribution, pricing, promotion, and advertising. What are your company’s competitive advantages and their likely impacts on its success? The key is to construct it properly for the relevant features/benefits (by weight, according to customers) and how the startup compares to incumbents. The competitive matrix should show clearly how and why the startup has a clear (if not currently measurable) competitive advantage. Some common features in the example include price, benefits, quality, type of features, locations, and distribution/sales. Sample templates are shown in Figure 11.17 and Figure 11.18 . A competitive analysis helps you create a marketing strategy that will identify assets or skills that your competitors are lacking so you can plan to fill those gaps, giving you a distinct competitive advantage. When creating a competitor analysis, it is important to focus on the key features and elements that matter to customers, rather than focusing too heavily on the entrepreneur’s idea and desires.

Operations and Management Plan

In this section, outline how you will manage your company. Describe its organizational structure. Here you can address the form of ownership and, if warranted, include an organizational chart/structure. Highlight the backgrounds, experiences, qualifications, areas of expertise, and roles of members of the management team. This is also the place to mention any other stakeholders, such as a board of directors or advisory board(s), and their relevant relationship to the founder, experience and value to help make the venture successful, and professional service firms providing management support, such as accounting services and legal counsel.

Table 11.6 shows a sample operations and management plan for La Vida Lola.

Marketing Plan

Here you should outline and describe an effective overall marketing strategy for your venture, providing details regarding pricing, promotion, advertising, distribution, media usage, public relations, and a digital presence. Fully describe your sales management plan and the composition of your sales force, along with a comprehensive and detailed budget for the marketing plan. Table 11.7 shows a sample marketing plan for La Vida Lola.

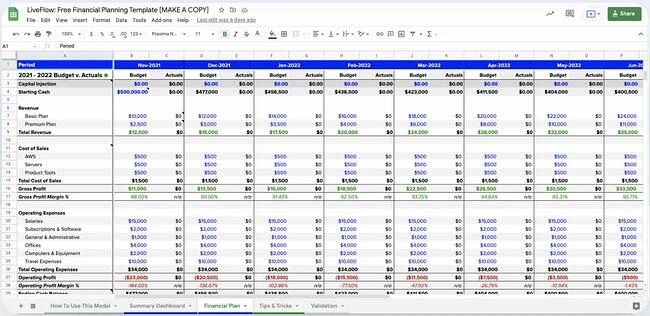

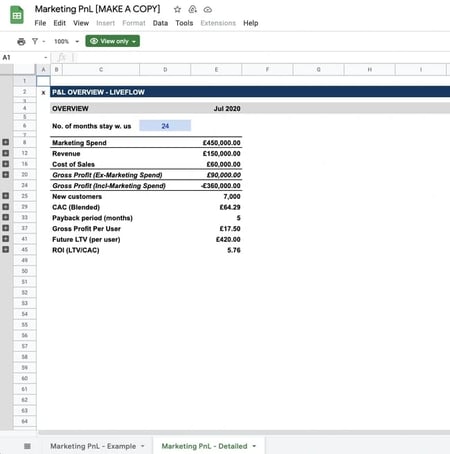

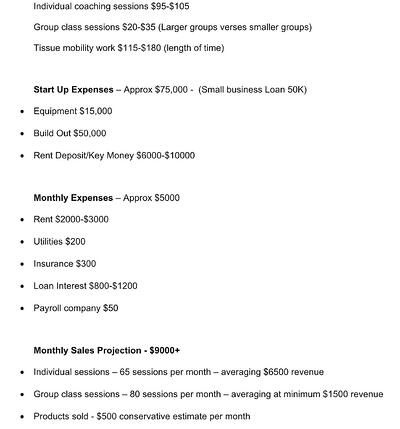

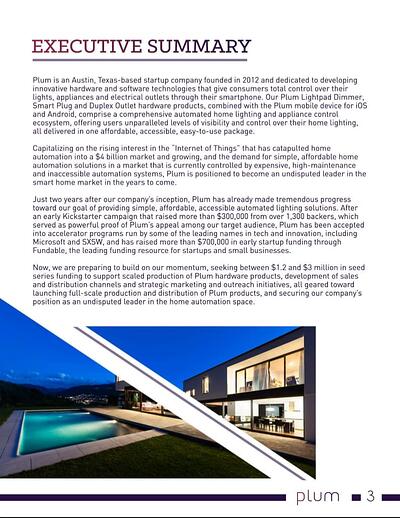

Financial Plan

A financial plan seeks to forecast revenue and expenses; project a financial narrative; and estimate project costs, valuations, and cash flow projections. This section should present an accurate, realistic, and achievable financial plan for your venture (see Entrepreneurial Finance and Accounting for detailed discussions about conducting these projections). Include sales forecasts and income projections, pro forma financial statements ( Building the Entrepreneurial Dream Team , a breakeven analysis, and a capital budget. Identify your possible sources of financing (discussed in Conducting a Feasibility Analysis ). Figure 11.19 shows a template of cash-flow needs for La Vida Lola.

Entrepreneur In Action

Laughing man coffee.

Hugh Jackman ( Figure 11.20 ) may best be known for portraying a comic-book superhero who used his mutant abilities to protect the world from villains. But the Wolverine actor is also working to make the planet a better place for real, not through adamantium claws but through social entrepreneurship.

A love of java jolted Jackman into action in 2009, when he traveled to Ethiopia with a Christian humanitarian group to shoot a documentary about the impact of fair-trade certification on coffee growers there. He decided to launch a business and follow in the footsteps of the late Paul Newman, another famous actor turned philanthropist via food ventures.

Jackman launched Laughing Man Coffee two years later; he sold the line to Keurig in 2015. One Laughing Man Coffee café in New York continues to operate independently, investing its proceeds into charitable programs that support better housing, health, and educational initiatives within fair-trade farming communities. 55 Although the New York location is the only café, the coffee brand is still distributed, with Keurig donating an undisclosed portion of Laughing Man proceeds to those causes (whereas Jackman donates all his profits). The company initially donated its profits to World Vision, the Christian humanitarian group Jackman accompanied in 2009. In 2017, it created the Laughing Man Foundation to be more active with its money management and distribution.

- You be the entrepreneur. If you were Jackman, would you have sold the company to Keurig? Why or why not?

- Would you have started the Laughing Man Foundation?

- What else can Jackman do to aid fair-trade practices for coffee growers?

What Can You Do?

Textbooks for change.

Founded in 2014, Textbooks for Change uses a cross-compensation model, in which one customer segment pays for a product or service, and the profit from that revenue is used to provide the same product or service to another, underserved segment. Textbooks for Change partners with student organizations to collect used college textbooks, some of which are re-sold while others are donated to students in need at underserved universities across the globe. The organization has reused or recycled 250,000 textbooks, providing 220,000 students with access through seven campus partners in East Africa. This B-corp social enterprise tackles a problem and offers a solution that is directly relevant to college students like yourself. Have you observed a problem on your college campus or other campuses that is not being served properly? Could it result in a social enterprise?

Work It Out

Franchisee set out.

A franchisee of East Coast Wings, a chain with dozens of restaurants in the United States, has decided to part ways with the chain. The new store will feature the same basic sports-bar-and-restaurant concept and serve the same basic foods: chicken wings, burgers, sandwiches, and the like. The new restaurant can’t rely on the same distributors and suppliers. A new business plan is needed.

- What steps should the new restaurant take to create a new business plan?

- Should it attempt to serve the same customers? Why or why not?

This New York Times video, “An Unlikely Business Plan,” describes entrepreneurial resurgence in Detroit, Michigan.

- 48 Chris Guillebeau. The $100 Startup: Reinvent the Way You Make a Living, Do What You Love, and Create a New Future . New York: Crown Business/Random House, 2012.

- 49 Jonathan Chan. “What These 4 Startup Case Studies Can Teach You about Failure.” Foundr.com . July 12, 2015. https://foundr.com/4-startup-case-studies-failure/

- 50 Amy Feldman. “Inventor of the Cut Buddy Paid YouTubers to Spark Sales. He Wasn’t Ready for a Video to Go Viral.” Forbes. February 15, 2017. https://www.forbes.com/sites/forbestreptalks/2017/02/15/inventor-of-the-cut-buddy-paid-youtubers-to-spark-sales-he-wasnt-ready-for-a-video-to-go-viral/#3eb540ce798a

- 51 Jennifer Post. “National Business Plan Competitions for Entrepreneurs.” Business News Daily . August 30, 2018. https://www.businessnewsdaily.com/6902-business-plan-competitions-entrepreneurs.html

- 52 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition . March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf

- 53 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition. March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf; Based on 2019 RBPC Competition Rules and Format April 4–6, 2019. https://rbpc.rice.edu/sites/g/files/bxs806/f/2019-RBPC-Competition-Rules%20-Format.pdf

- 54 Foodstart. http://foodstart.com

- 55 “Hugh Jackman Journey to Starting a Social Enterprise Coffee Company.” Giving Compass. April 8, 2018. https://givingcompass.org/article/hugh-jackman-journey-to-starting-a-social-enterprise-coffee-company/

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-4-the-business-plan

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Plan Your Business

A well-written business plan is your path to a successful business. Learn to write, use, and improve your business plan with exclusive guides, templates, and examples.

What is a business plan?

- Types of plans

- How to write

Industry business plans

Explore Topics

How to Write a Business Plan

Noah Parsons

May. 7, 2024

Learn to write a detailed business plan that will impress investors and lenders—and provide a foundation to start, run, and grow a successful business.

May. 11, 2024

May. 10, 2024

Angelique O'Rourke

Free Download

Business Plan Template

A lender-approved fill-in-the-blanks resource crafted by business planning experts to help you write a great business plan.

Simple Business Plan Outline

Follow this detailed outline for a business plan to understand what the structure, details, and depth of a complete plan looks like.

550+ Sample Business Plans

Explore our industry-specific business plan examples to understand what details should be in your own plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

How to Write a Nonprofit Business Plan

While a nonprofit business plan isn’t all that different from a traditional plan—there are unique considerations around fundraising, partnerships, and promotions that must be made.

How to Write a One-Page Business Plan

Jan. 30, 2024

How to Write a Franchise Business Plan + Template

Elon Glucklich

Feb. 7, 2024

New to business planning? Start here

What should i include in my business plan.

You must have an executive summary, product/service description, market and competitive analysis, marketing and sales plan, operations overview, milestones, company overview, financial plan, and appendix.

Why should I write a business plan?

Businesses that write a business plan typically grow 30% faster because it helps them minimize risk, establish important milestones, track progress, and make more confident decisions.

What are the qualities of a good business plan?

A good business plan uses clear language, shows realistic goals, fits the needs of your business, and highlights any assumptions you’re making.

How long should my business plan be?

There is no target length for a business plan. It should be as long as you need it to be. A good rule of thumb is to go as short as possible, without missing any crucial information. You can always expand your business plan later.

How do I write a simple business plan?

Use a one-page business plan format to create a simple business plan. It includes all of the critical sections of a traditional business plan but can be completed in as little as 30 minutes.

What should I do before writing a business plan?

If you do anything before writing—figure out why you’re writing a business plan. You’ll save time and create a far more useful plan.

What is the first step in writing a business plan?

The first thing you’ll do when writing a business plan is describe the problem you’re solving and what your solution is.

What is the biggest mistake I can make when writing a business plan?

The worst thing you can do is not plan at all. You’ll miss potential issues and opportunities and struggle to make strategic decisions.

Business planning guides

Learn what a business plan is, why you need one, when to write it, and the fundamental elements that make it a unique tool for business success.

Types of business plans

Explore different business plan formats and determine which type best suits your needs.

How to write a business plan

A step-by-step guide to quickly create a working business plan.

Tips to write your business plan

A curated selection of business plan writing tips and best practices from our experienced in-house planning experts.

Explore industry-specific guides to learn what to focus on when writing your business plan.

Create your plan the paint by numbers way.

Business planning FAQ

What is business planning?

Business planning is the act of sitting down to establish goals, strategies, and actions you intend to take to successfully start, manage, and grow a business.

What are the 7 steps of a business plan?

The seven steps to write a business plan include:

- Craft a brief executive summary

- Describe your products and services

- Conduct market research and compile data into a market analysis

- Describe your marketing and sales strategy

- Outline your organizational structure and management team

- Develop financial projections for sales, revenue, and cash flow

- Add additional documents to your appendix

What should a business plan include?

A traditional business plan should include:

- An executive summary

- Description of your products and services

- Market analysis

- Competitive analysis

- Marketing and sales plan

- Overview of business operations

- Milestones and metrics

- Description of your organization and management team

- Financial plan and forecasts

Do you really need a business plan?

You are more likely to start and grow into a successful business if you write a business plan.

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to Write a Business Plan in 2024

Written by Dave Lavinsky

Whether you’re looking to secure $5,000, $50,000, $500,000 or $5 million for your business, you’ll need a business plan. Knowing how to write a business plan that captures the attention of lenders and investors can pay big. While entrepreneurs and startup owners often feel overwhelmed at the thought of writing a business plan, don’t worry, we walk you through what a prospective lender or investor expects in this step-by-step guide. Better yet, it’s based on 20 years of experience helping companies, just like yours, not only create their business plan, but land their ideal funding arrangement and improve their strategies for long-term success. If you read this article and still feel overwhelmed, using the best business plan template is likely a good choice.

Download our Ultimate Business Plan Template here

Your business plan highlights your unique value to the market, your strategy for business success and your financial outlook. It communicates that your business is meeting a need for which there is a demand. It conveys that your product or service demand is sustainable and your business is uniquely positioned to capture an increasing share of the market year-over-year. That means consistent business growth and profitability. This is achieved by describing your company, your product or service and your marketing strategy. Within your business plan, you’ll also specify your funding request and provide financial reports including projections.

Writing a Business Plan

The following is an overview of each segment of a business plan and how to confidently craft the document to showcase a business strategy.

You can also download our how to write a business plan pdf to help you get started.

1. Executive Summary

An executive summary is where you impress the reader by highlighting a businesses’ market strengths and qualities. In one-to-two pages, establish a reason for the investor or lender to consider your funding request. Because the executive summary is an overview, you’ll write it last. This way you are consolidating the key messages from throughout the plan in one place.

An effective business plan executive summary defines your mission and lays out your strategy for success. It communicates that you have a firm grasp of the market. It also explains what you expect from the reader. But most of all, it captivates the reader’s attention and persuades them to strongly consider becoming your funding source.

2. Company Analysis

Now it’s time to describe the nuts and bolts of your venture through a company description and analysis. Investors are interested in your company’s mission, history, structure and achievements. They are assessing who you are and what your capabilities are. The mission statement within your business plan summarizes why you are operating and describes the effect your company has on its clients and in society. Mission statements are short and impactful. A mission statement for a new day care center might read: At XYZ Day Care, our mission is to care for children from tot to toddler in a safe, fun and loving environment.

A company history includes some basic information such as your inception date and location. The value of this section of your business plan lies in sharing your origin story. Investors are interested in knowing how you developed the business concept and took it to market. For start-ups, this section may be brief. Established organizations can expand this section to highlight major accomplishments since inception.

Here’s an example of a company history for a restaurant:

You’ll also specify the legal structure of your company in the company analysis. A business can be a sole-proprietorship, a partnership, a corporation, a limited liability firm or a non-profit organization.

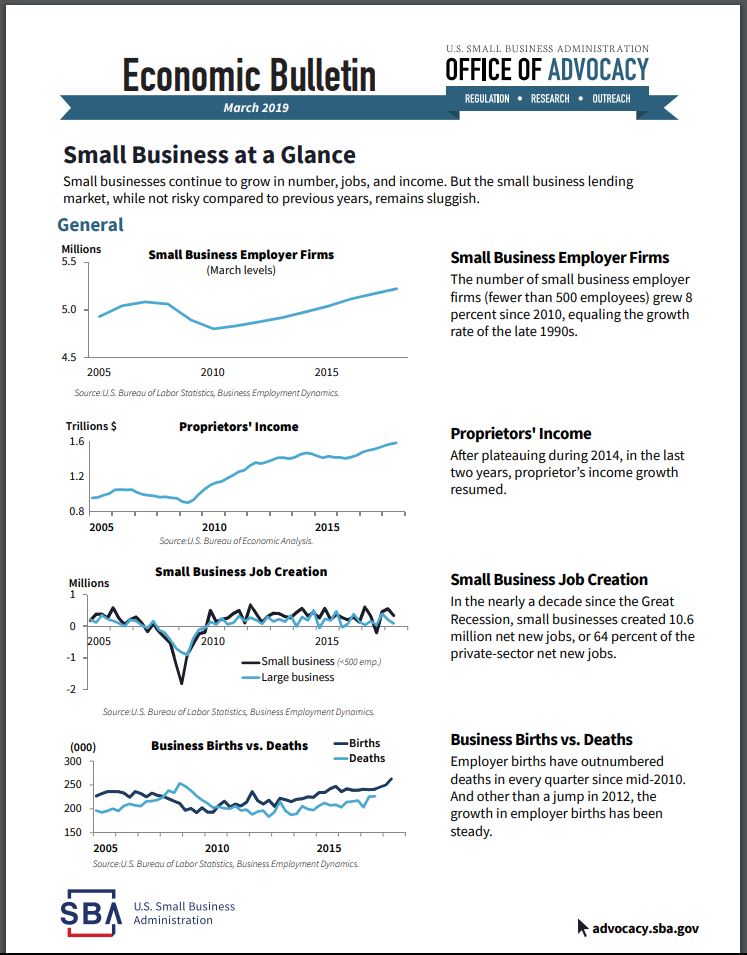

3. Industry Analysis

Your company is not operating in a vacuum, and your business plan needs to reflect that through a market analysis business plan . There are socio-economic factors that have implications for your business’ performance in the marketplace. An industry analysis or market analysis sheds light at a local, national or global level of how all firms offering similar products or services are performing. This section identifies historical trends that have shaped the industry and pinpoints recent developments that must be considered when creating your business strategy. Research from credible sources is central to your industry analysis. Review both past and present reports to form the broadest understanding of all external factors.

Some key statistics to include in the market analysis section of your business plan are:

- total market size

- relevant market size

- historical market growth

- future growth estimates

You’ll also want to include your market share estimates. While many sources provide a total market size, it may take some additional work to calculate the relevant market size. That’s because this figure is based upon your niche rather than the entire industry market.

Your relevant market size is an estimate of the annual revenue your business could attain if it realized 100% market share. You calculate it by multiplying the following two figures:

- Estimate the number of people who might be interested in purchasing your products or services each year.

- Estimate the dollar amount these customers might be willing to spend, on an annual basis, on your products or services.

Let’s look at a partial industry analysis example for a startup food truck business:

4. Customer Analysis

An effective customer analysis describes your target market, whether a business or consumer, and their specific needs. For starters, a potential funding source is ascertaining how well you understand the buying behaviors and patterns of your customers. They are also assessing the proximity of your business to the customers and the size of the potential customer pool.

In addition, the customer analysis section of your business plan answers two key questions: what is the problem your customer is experiencing and how are you solving it? Customer problems, or pain points, are myriad. You’ll need to hone in on the vital ones you are resolving with your products and services. For example, customers may be looking to reduce time or costs to complete projects, or they may want to work with an organization that has a good reputation for customer service.

One approach to writing your customer analysis is to develop an ideal client avatar or persona. An avatar is a figure that represents your client. It defines their age (or years in business), behaviors, values, aspirations, needs and concerns.

Here’s a potential client avatar for a nail salon business:

5. Competitive Analysis

As previously mentioned, your business is not operating in a vacuum. There are other firms, competing for your ideal client, offering similar products and services. That’s why you need a competitive analysis business plan . A crucial section for a small business, startup or entrepreneur, the competitive analysis outlays your strengths as compared to other firms. It unequivocally answers the question, “why this business?” for prospective customers and more importantly potential investors or lenders.

The competitive analysis communicates how you will outperform the competition. This is the place for you to highlight your advantages – your strengths and the opportunities you can seize in the marketplace. Keep in mind that your strengths can be related to people, products, services, processes as well as intellectual property.

Competitors can be direct or indirect. A direct competitor offers a similar product or service to satisfy a customer need. An indirect competitor offers a different product, service or approach that may meet the same customer need as your business. For instance, an indirect competitor for a coffee shop could be a gas station, fast food restaurant or a donut shop.

To write your competitive analysis, you may prepare a competitor profile or a matrix. The profile focuses on a single company while the matrix provides a high-level comparison of the revenues, products, services, pricing, strengths and weaknesses for each key competitor.

Here’s an example of a competitor profile for a real estate agent:

6. Marketing Plan

Let’s face it, people need to know that your business exists. People also need to know the benefits of your products and services. A sales and marketing section or marketing plan section is where your marketing and sales plan is showcased within your business plan. A marketing plan lays out your strategy for communicating this information. It convinces investors and lenders that you know how to reach your ideal client and generate sales. In some cases, your marketing plan may be a separate document from your business plan.

The marketing plan has three components: products and services, promotions and distribution. Begin with thoroughly defining your products and services. Spell out the features and benefits. Features are the attributes of your product and service, while benefits communicate the value of your product or service to the customer. Be sure to also include your pricing in this section.

A marketing plan for a coffee shop could list coffee, espresso and tea as its products. The shop may sell additional products such as mugs, coasters, pastries and sandwiches. A beauty salon may have shampoo, dry, trim and curl as its primary services. They may provide complementary services including manicures, pedicures and eyebrow waxing.

Once your products and services are defined. You’ll focus on getting the word out. This is your promotion plan – your strategy for attracting customers. Are you using social media or content marketing? Are you advertising, and if so what are the best advertising channels for your business? Will you have periodic sales and product giveaways? What about referral bonuses? What market segment are you going to target with what promotional activity? In developing your promotional plan within your business plan, make sure you convey which channels are most effective for your ideal client. A strong marketing and promotional can be a source of the important competitive advantages you need.

Promotions are how you communicate. Distribution is how you sell. You need both to succeed in business. So now that you’ve laid out your promotion plan, it’s time to focus on getting your products and services to the client. Three common distribution channels are retail, wholesale and direct. In retail and wholesale distribution, you are selling your product to another entity who then sells to the customer. Your strategy should include how you’ll best fulfill the needs of your select retailers and wholesalers.

With direct distribution, the customer buys from you either online, by telephone or at your physical location. When developing your distribution plan, study the purchasing tendencies of your ideal client. Do they shop in certain geographies? Are they primarily online shoppers? How long will it take for the package to arrive? Armed with this information, you can effectively determine which distribution mode will get you the greatest results.

Consider an example from ABC Planners, an e-commerce business:

7. Operations Plan

Successful businesses have a strong operations foundation. As a result, the operations plan is a key part of the business planning process and business plan.

Defined processes, metrics and milestones are essential to ensure you will effectively manage the business and its associated costs. A thorough operations plan conveys to investors your business results are intentional. It also demonstrates you’ve considered what could go wrong and have preventative and recovery plans intact.

The operations plan can cover a number of functions from human resources and product development to legal. Your business operations are interconnected. Each operation supports how you sell your product or service. Give adequate attention to your production process and quality control. Production describes how you make your product or service. Quality control measures how effectively and efficiently you produce your product or deliver your service. Depending on the size of your business, some of the functions may be outsourced to specialty providers. In this case, you may list your suppliers.

Strategic planning is an internal part of operations. Here’s where you’ll detail your key milestones for the next three years. Milestones can be related to all aspects of your business: financial, products and services as well as operations.

A sample operations plan for a start-up bakery follows:

- Secure building lease by month, year

- Remodel space for modern bakery operations by month, year

- Hire bakery manager and staff by month, year

- Achieve $xx in sales by month, year

8. Management Team

Just as investors want to be assured you have a viable product or service, they are especially interested in who’s running the business. Plans spell out your intentions, and it is the management team business plan that provides a comprehensive roadmap for achieving those intentions. People carry out those plans. The caliber of your team and business partners conveys a great deal about your ability to achieve your business goals. That’s why investors need to know who’s on the team and what expertise they bring to the table.

Here you’ll provide the names and biographies of your management team members and indicate any management gaps. If it applies, you may also highlight your Board of Directors. The background information may contain the individual’s educational achievements, relevant work experience, skills and accomplishments. Sharing personal details helps investors to get to know your management team and provides another layer of transparency. According to the Small Business Administration, some business plans, may also include supplementary organization charts.

At the writing of your business plan, it’s possible to have openings on your management team. In this case, you’ll list the position, define the job responsibilities and specify the hiring requirements for the ideal candidate.

For example, the background for a software company’s president may read:

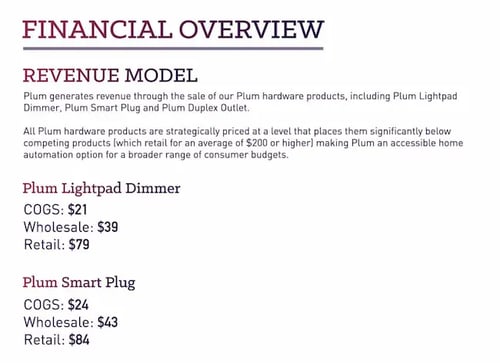

9. Financial Plan

Remember, an important part of securing funding for your business is conveying it will be financially sound and you can repay the potential funding source in the near future. This is why the financial plan is critical to your business plan. It presents your revenue model, financial projections and funding requirements. You are basically sharing the different ways you will generate income, your plans for financial solvency and your rationale for your funding request.

The revenue model describes how you make money. Some common revenue models are subscriptions, advertising, affiliate marketing, markups, direct sales and commissions.

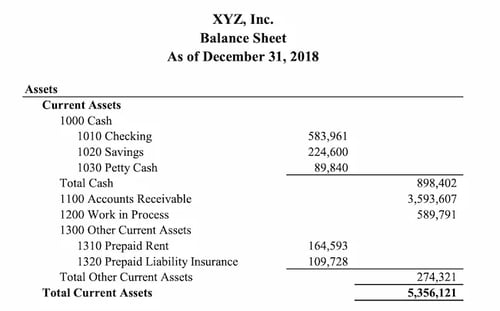

Financial highlights are essential. Your plan must include a three-to-five-year financial forecast that presents your projected income and expenses while painting a realistic picture of your profitability. It will highlight several reports with the details included in your Appendix. The financial reports include your projected income statement, balance sheet and cash flow statement. Established businesses may choose to include historical financial data. Charts and graphs work well for depicting your financial highlights.

Lastly, you will detail your funding request. Specify how much funding you’ll require and how you will use the funding. Some potential uses are to purchase equipment, pay bills and salaries, rent office space or conduct marketing research for product development.

Here’s an example financial plan summary:

10. Appendix

The Appendix is the final section of your business plan . It’s used to provide supporting documentation for materials referenced in any of the previous sections. Additionally, it allows the reader to review detailed financials. Investors expect to see your full financial forecast in the Appendix. These are the projected income statement, balance sheet and cash flow statement referenced in your financial plan. Some lenders may request your personal or business credit history as part of the appendix business plan .

Investors also use this section to verify your business idea and business credentials. Consider including some of these items in your Appendix: resumes for the management team, sample marketing materials, lists of key customers, patents and trademarks in the section.

How to Write a Business Plan Video

Summary of How to Write a Business Plan

We’ve just covered 10 essential sections of a complete business plan. By now you should be confident that you understand what you need to build a business plan and what investors look for in a traditional business plan and that you can write one to meet their needs. Just in case you’d like some additional information or examples, check out additional articles and resources covering topics such as marketing and sales plans, financial health, business plan market research, or try a business plan builder .

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Free Business Plan Resources

START YOUR ECOMMERCE BUSINESS FOR JUST $1

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, how to write a business plan (tips, templates, examples).

Written by Jesse Sumrak | May 14, 2023

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Business plans might seem like an old-school stiff-collared practice, but they deserve a place in the startup realm, too. It’s probably not going to be the frame-worthy document you hang in the office—yet, it may one day be deserving of the privilege.

Whether you’re looking to win the heart of an angel investor or convince a bank to lend you money, you’ll need a business plan. And not just any ol’ notes and scribble on the back of a pizza box or napkin—you’ll need a professional, standardized report.

Bah. Sounds like homework, right?

Yes. Yes, it does.

However, just like bookkeeping, loan applications, and 404 redirects, business plans are an essential step in cementing your business foundation.

Don’t worry. We’ll show you how to write a business plan without boring you to tears. We’ve jam-packed this article with all the business plan examples, templates, and tips you need to take your non-existent proposal from concept to completion.

Table of Contents

What Is a Business Plan?

Tips to Make Your Small Business Plan Ironclad

How to Write a Business Plan in 6 Steps

Startup Business Plan Template

Business Plan Examples

Work on Making Your Business Plan

How to Write a Business Plan FAQs

What is a business plan why do you desperately need one.

A business plan is a roadmap that outlines:

- Who your business is, what it does, and who it serves

- Where your business is now

- Where you want it to go

- How you’re going to make it happen

- What might stop you from taking your business from Point A to Point B

- How you’ll overcome the predicted obstacles

While it’s not required when starting a business, having a business plan is helpful for a few reasons:

- Secure a Bank Loan: Before approving you for a business loan, banks will want to see that your business is legitimate and can repay the loan. They want to know how you’re going to use the loan and how you’ll make monthly payments on your debt. Lenders want to see a sound business strategy that doesn’t end in loan default.

- Win Over Investors: Like lenders, investors want to know they’re going to make a return on their investment. They need to see your business plan to have the confidence to hand you money.

- Stay Focused: It’s easy to get lost chasing the next big thing. Your business plan keeps you on track and focused on the big picture. Your business plan can prevent you from wasting time and resources on something that isn’t aligned with your business goals.

Beyond the reasoning, let’s look at what the data says:

- Simply writing a business plan can boost your average annual growth by 30%

- Entrepreneurs who create a formal business plan are 16% more likely to succeed than those who don’t

- A study looking at 65 fast-growth companies found that 71% had small business plans

- The process and output of creating a business plan have shown to improve business performance

Convinced yet? If those numbers and reasons don’t have you scrambling for pen and paper, who knows what will.

Don’t Skip: Business Startup Costs Checklist

Before we get into the nitty-gritty steps of how to write a business plan, let’s look at some high-level tips to get you started in the right direction:

Be Professional and Legit

You might be tempted to get cutesy or revolutionary with your business plan—resist the urge. While you should let your brand and creativity shine with everything you produce, business plans fall more into the realm of professional documents.

Think of your business plan the same way as your terms and conditions, employee contracts, or financial statements. You want your plan to be as uniform as possible so investors, lenders, partners, and prospective employees can find the information they need to make important decisions.

If you want to create a fun summary business plan for internal consumption, then, by all means, go right ahead. However, for the purpose of writing this external-facing document, keep it legit.

Know Your Audience

Your official business plan document is for lenders, investors, partners, and big-time prospective employees. Keep these names and faces in your mind as you draft your plan.

Think about what they might be interested in seeing, what questions they’ll ask, and what might convince (or scare) them. Cut the jargon and tailor your language so these individuals can understand.

Remember, these are busy people. They’re likely looking at hundreds of applicants and startup investments every month. Keep your business plan succinct and to the point. Include the most pertinent information and omit the sections that won’t impact their decision-making.

Invest Time Researching

You might not have answers to all the sections you should include in your business plan. Don’t skip over these!

Your audience will want:

- Detailed information about your customers

- Numbers and solid math to back up your financial claims and estimates

- Deep insights about your competitors and potential threats

- Data to support market opportunities and strategy

Your answers can’t be hypothetical or opinionated. You need research to back up your claims. If you don’t have that data yet, then invest time and money in collecting it. That information isn’t just critical for your business plan—it’s essential for owning, operating, and growing your company.

Stay Realistic

Your business may be ambitious, but reign in the enthusiasm just a teeny-tiny bit. The last thing you want to do is have an angel investor call BS and say “I’m out” before even giving you a chance.

The folks looking at your business and evaluating your plan have been around the block—they know a thing or two about fact and fiction. Your plan should be a blueprint for success. It should be the step-by-step roadmap for how you’re going from Point A to Point B.

How to Write a Business Plan—6 Essential Elements

Not every business plan looks the same, but most share a few common elements. Here’s what they typically include:

- Executive Summary

- Business Overview

- Products and Services

- Market Analysis

- Competitive Analysis

- Financial Strategy

Below, we’ll break down each of these sections in more detail.

1. Executive Summary

While your executive summary is the first page of your business plan, it’s the section you’ll write last. That’s because it summarizes your entire business plan into a succinct one-pager.

Begin with an executive summary that introduces the reader to your business and gives them an overview of what’s inside the business plan.

Your executive summary highlights key points of your plan. Consider this your elevator pitch. You want to put all your juiciest strengths and opportunities strategically in this section.

2. Business Overview

In this section, you can dive deeper into the elements of your business, including answering:

- What’s your business structure? Sole proprietorship, LLC, corporation, etc.

- Where is it located?

- Who owns the business? Does it have employees?

- What problem does it solve, and how?

- What’s your mission statement? Your mission statement briefly describes why you are in business. To write a proper mission statement, brainstorm your business’s core values and who you serve.

Don’t overlook your mission statement. This powerful sentence or paragraph could be the inspiration that drives an investor to take an interest in your business. Here are a few examples of powerful mission statements that just might give you the goosebumps:

- Patagonia: Build the best product, cause no unnecessary harm, use business to inspire and implement solutions to the environmental crisis.

- Tesla: To accelerate the world’s transition to sustainable energy.

- InvisionApp : Question Assumptions. Think Deeply. Iterate as a Lifestyle. Details, Details. Design is Everywhere. Integrity.

- TED : Spread ideas.

- Warby Parker : To offer designer eyewear at a revolutionary price while leading the way for socially conscious businesses.

3. Products and Services

As the owner, you know your business and the industry inside and out. However, whoever’s reading your document might not. You’re going to need to break down your products and services in minute detail.

For example, if you own a SaaS business, you’re going to need to explain how this business model works and what you’re selling.

You’ll need to include:

- What services you sell: Describe the services you provide and how these will help your target audience.

- What products you sell: Describe your products (and types if applicable) and how they will solve a need for your target and provide value.

- How much you charge: If you’re selling services, will you charge hourly, per project, retainer, or a mixture of all of these? If you’re selling products, what are the price ranges?

4. Market Analysis

Your market analysis essentially explains how your products and services address customer concerns and pain points. This section will include research and data on the state and direction of your industry and target market.

This research should reveal lucrative opportunities and how your business is uniquely positioned to seize the advantage. You’ll also want to touch on your marketing strategy and how it will (or does) work for your audience.

Include a detailed analysis of your target customers. This describes the people you serve and sell your product to. Be careful not to go too broad here—you don’t want to fall into the common entrepreneurial trap of trying to sell to everyone and thereby not differentiating yourself enough to survive the competition.

The market analysis section will include your unique value proposition. Your unique value proposition (UVP) is the thing that makes you stand out from your competitors. This is your key to success.

If you don’t have a UVP, you don’t have a way to take on competitors who are already in this space. Here’s an example of an ecommerce internet business plan outlining their competitive edge:

FireStarters’ competitive advantage is offering product lines that make a statement but won’t leave you broke. The major brands are expensive and not distinctive enough to satisfy the changing taste of our target customers. FireStarters offers products that are just ahead of the curve and so affordable that our customers will return to the website often to check out what’s new.

5. Competitive Analysis

Your competitive analysis examines the strengths and weaknesses of competing businesses in your market or industry. This will include direct and indirect competitors. It can also include threats and opportunities, like economic concerns or legal restraints.

The best way to sum up this section is with a classic SWOT analysis. This will explain your company’s position in relation to your competitors.

6. Financial Strategy

Your financial strategy will sum up your revenue, expenses, profit (or loss), and financial plan for the future. It’ll explain how you make money, where your cash flow goes, and how you’ll become profitable or stay profitable.

This is one of the most important sections for lenders and investors. Have you ever watched Shark Tank? They always ask about the company’s financial situation. How has it performed in the past? What’s the ongoing outlook moving forward? How does the business plan to make it happen?

Answer all of these questions in your financial strategy so that your audience doesn’t have to ask. Go ahead and include forecasts and graphs in your plan, too:

- Balance sheet: This includes your assets, liabilities, and equity.

- Profit & Loss (P&L) statement: This details your income and expenses over a given period.

- Cash flow statement: Similar to the P&L, this one will show all cash flowing into and out of the business each month.

It takes cash to change the world—lenders and investors get it. If you’re short on funding, explain how much money you’ll need and how you’ll use the capital. Where are you looking for financing? Are you looking to take out a business loan, or would you rather trade equity for capital instead?

Read More: 16 Financial Concepts Every Entrepreneur Needs to Know

Startup Business Plan Template (Copy/Paste Outline)

Ready to write your own business plan? Copy/paste the startup business plan template below and fill in the blanks.

Executive Summary Remember, do this last. Summarize who you are and your business plan in one page.

Business Overview Describe your business. What’s it do? Who owns it? How’s it structured? What’s the mission statement?

Products and Services Detail the products and services you offer. How do they work? What do you charge?

Market Analysis Write about the state of the market and opportunities. Use date. Describe your customers. Include your UVP.

Competitive Analysis Outline the competitors in your market and industry. Include threats and opportunities. Add a SWOT analysis of your business.

Financial Strategy Sum up your revenue, expenses, profit (or loss), and financial plan for the future. If you’re applying for a loan, include how you’ll use the funding to progress the business.

5 Frame-Worthy Business Plan Examples

Want to explore other templates and examples? We got you covered. Check out these 5 business plan examples you can use as inspiration when writing your plan:

- SBA Wooden Grain Toy Company

- SBA We Can Do It Consulting

- OrcaSmart Business Plan Sample

- Plum Business Plan Template

- PandaDoc Free Business Plan Templates

Get to Work on Making Your Business Plan

If you find you’re getting stuck on perfecting your document, opt for a simple one-page business plan —and then get to work. You can always polish up your official plan later as you learn more about your business and the industry.

Remember, business plans are not a requirement for starting a business—they’re only truly essential if a bank or investor is asking for it.

Ask others to review your business plan. Get feedback from other startups and successful business owners. They’ll likely be able to see holes in your planning or undetected opportunities—just make sure these individuals aren’t your competitors (or potential competitors).

Your business plan isn’t a one-and-done report—it’s a living, breathing document. You’ll make changes to it as you grow and evolve. When the market or your customers change, your plan will need to change to adapt.

That means when you’re finished with this exercise, it’s not time to print your plan out and stuff it in a file cabinet somewhere. No, it should sit on your desk as a day-to-day reference. Use it (and update it) as you make decisions about your product, customers, and financial plan.

Review your business plan frequently, update it routinely, and follow the path you’ve developed to the future you’re building.

Keep Learning: New Product Development Process in 8 Easy Steps

What financial information should be included in a business plan?

Be as detailed as you can without assuming too much. For example, include your expected revenue, expenses, profit, and growth for the future.

What are some common mistakes to avoid when writing a business plan?

The most common mistake is turning your business plan into a textbook. A business plan is an internal guide and an external pitching tool. Cut the fat and only include the most relevant information to start and run your business.

Who should review my business plan before I submit it?

Co-founders, investors, or a board of advisors. Otherwise, reach out to a trusted mentor, your local chamber of commerce, or someone you know that runs a business.

Ready to Write Your Business Plan?

Don’t let creating a business plan hold you back from starting your business. Writing documents might not be your thing—that doesn’t mean your business is a bad idea.

Let us help you get started.

Join our free training to learn how to start an online side hustle in 30 days or less. We’ll provide you with a proven roadmap for how to find, validate, and pursue a profitable business idea (even if you have zero entrepreneurial experience).

Stuck on the ideas part? No problem. When you attend the masterclass, we’ll send you a free ebook with 100 of the hottest side hustle trends right now. It’s chock full of brilliant business ideas to get you up and running in the right direction.

About Jesse Sumrak

Jesse Sumrak is a writing zealot focused on creating killer content. He’s spent almost a decade writing about startup, marketing, and entrepreneurship topics, having built and sold his own post-apocalyptic fitness bootstrapped business. A writer by day and a peak bagger by night (and early early morning), you can usually find Jesse preparing for the apocalypse on a precipitous peak somewhere in the Rocky Mountains of Colorado.

Related Posts

MaryRuth Ghiyam: From $700K in Debt to $100M in Revenue

His Ecommerce Funnel Generated $70M Last Year

How Do You Launch a Product?

Why Erin Deering Sold Swimwear Sensation Triangl

How Suneera Madhani’s Rejected Pitch Led to a Billion-Dollar Startup

When to Quit Your Job and Go All-in on Your Side Hustle

How to Choose the Right Color for Your Logo: The Ultimate Cheat Sheet

How becx’s Becky Verma Gained the Confidence to Become an Entrepreneur

How the D’Amelios Built an Empire Using TikTok

Almost Failed Startups: What You Can Learn from 8 Startups That Made It Big

How to Implement AI in Your Business from Consultant Nat Choprasert

Self-Made Mogul Emma Grede on Building SKIMS and Good American – Exclusive

20 Reasons to Start Your Own Business Today

The Horror Stories and Surprises from Nathan Chan’s 500 Founder Interviews

Dany Garcia on Building Her Business Empire with Dwayne Johnson

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

Don't Miss Out! Get Instant Access to foundr+ for Just $1!

1000+ lessons. customized learning. 30,000+ strong community..

How to Write a Business Plan in 2023: The Ultimate Guide for Every Entrepreneur

Are you starting a new business or trying to get a loan for your existing venture? If so, you’re going to need to know how to write a business plan. Business plans give entrepreneurs the opportunity to formally analyze and define every aspect of their business idea .

In this post, you’ll learn how to put together a business plan and find the best resources to help you along the way.

Start selling online now with Shopify

What is a Business Plan?

A business plan is a formal document that outlines your business’s goals and how you will achieve those goals. Entrepreneurs who start out with business plans are 16 percent more likely to build successful companies , according to the Harvard Business Review. Developing a business plan ensures sustainable success, guiding you as you grow your business, legitimizing your venture, and helping you secure funding (among countless other benefits).

What Are the Main Purposes of a Business Plan?

Most financial institutions and service providers require you to submit a detailed business plan to obtain funding for your business. Online businesses will likely have a low overhead to start, so they may not need funding and therefore may not feel the need to write a business plan. That said, writing a business plan is still a good idea as it can help you secure a drastic increase limit on your credit card as your business grows or open a business account. This varies per bank.

If you’re growing your business, use it to help you raise expansion capital, create a growth strategy, find opportunities, and mitigate risks.Palo Alto software found that companies who make business plans are twice as likely to secure funding . .

→ Click Here to Launch Your Online Business with Shopify

If you’re just starting your business, making a business plan can help you identify your strengths and weaknesses, communicate your vision to others, and develop accurate forecasts.

How to Make a Business Plan: The Prerequisites

Here are the prerequisites to creating a solid business plan:

- Establish goals

- Understand your audience

- Determine your business plan format

- Get to writing!

Establish Goals

There are two key questions to ask here:

- What are you hoping to accomplish with your business?

- What are you hoping to accomplish with your business plan?

Approaching your business plan through that lens will help you focus on the end goal throughout the writing process. These also provide metrics to measure success against.

Before writing your business plan, gather the content and data needed to inform what goes in it. This includes researching your market and industry – spanning everything from customer research to legalities you’ll need to consider. It’s a lot easier to start with the information already in front of you instead of researching each section individually as you go.

Turn to guides, samples, and small business plan templates to help. Many countries have an official administration or service dedicated to providing information, resources, and tools to help entrepreneurs and store owners plan, launch, manage, and grow their businesses.

The following will take you to online business plan guides and templates for specific countries.

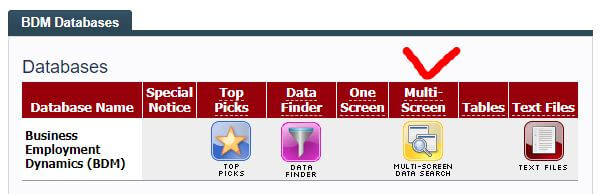

- United States Small Business Administration (SBA) – The “write your business plan page” includes traditional and lean startup business plan formats, three downloadable sample business plans, a template, and a step-by-step build a business plan tool.

- Australian Government – The “business plan template” page includes a downloadable template, guide, and business plan creation app.

- UK Government Business and Self-Employed – The “write a business plan” page includes links to a downloadable business plan template and resources from trusted UK businesses. .

- Canada Business Network – The “writing your business plan” page includes a detailed guide to writing your business plan and links to business plan templates from Canadian business development organizations and banks.

These business resource sites also offer a wealth of valuable information for entrepreneurs including local and regional regulations, structuring, tax obligations, funding programs, market research data, and much more. Visit the sites above or do the following Google searches to find official local business resources in your area:

- your country government business services

- your state/province government business services

- your city government business services

Some Chamber of Commerce websites offer resources for business owners, including business plan guides and templates. Check your local chapter to see if they have any.

Banks that offer business funding also often have a resource section for entrepreneurs. Do a Google search to find banks that offer business funding as well as business plan advice to see the business plans that get funding. If your bank doesn’t offer any advice, search for the largest banks in your area:

- business plan guide bank name

- business plan samples bank name

- business plan template bank name

If you’re looking for more sample business plans, Bplans has over 500 free business plan samples organized by business type as well as a business plan template. Their collection includes 116 business plans for retail and online stores. Shopify also offers business plan templates intended to help small business owners and aspiring entrepreneurs identify functional areas of a business they may not have considered.

Understand Your Audience

Because business plans serve different purposes, you’re not always presenting it to the same audience. It’s important to understand who’s going to be reading your business plan, what you’re trying to convince them to do, and what hesitations they might have.

That way, you can adapt your business plan accordingly. As such, your audience also determines which type of business plan format you use. Which brings us to our next point…

Which Business Plan Format Should You Use?

The United States Small Business Administration (SBA) presents two business plan formats:

- The traditional business plan format is for entrepreneurs who want to create a detailed plan for themselves or for business funding.

- The lean startup business plan format, on the other hand, is for business owners that want to create a condensed, single-page business plan.

If the business plan is just for you and internal folks, draft a lean startup business plan or a customized version of the traditional business plan with only the sections you need. If you need it for business funding or other official purposes, choose the formal business plan and thoroughly complete the required sections while paying extra attention to financial projections.

If your business operates outside the U.S., clarify the preferred format with your bank.

How to Create a Business Plan: Questions to Ask Yourself

As you write a business plan, take time to not only analyze your business idea, but yourself as well. Ask the following questions to help you analyze your business idea along the way:

- Why do I want to start or expand my business?

- Do my goals (personal and professional) and values align with my business idea?

- What income do I need to generate for myself?

- What education, experience, and skills do I bring to my business?

How to Write a Business Plan Step by Step

According to the business plan template created by SCORE, Deluxe, and the SBA , a traditional business plan encompasses the following sections.

- Executive summary

- Company description

- Products & services

- Market analysis

- Marketing & sales

- Management & organization

- Funding request

- Financial projections

- SWOT analysis

Since not everyone is aware of the key details to include in each section, we’ve listed information you can copy to fill in your business plan outline. Here’s how to build a business plan step by step.

Executive Summary

The Executive Summary is the first part of your business plan, so this is where you need to hook readers in. Every business plan starts this way — even a simple business plan template should kick off with the Executive Summary. Summarize your entire business plan in a single page, highlighting details about your business that will excite potential investors and lenders.

Explain what your business has to offer, your target market , what separates you from the competition, a little bit about yourself and the core people behind your business, and realistic projections about your business’ success.

While this is the first section of your business plan, write it after you’ve completed the rest of your business plan. It’s a lot easier because you can pull from the sections you’ve already written, and it’s easier to identify the best parts of your business plan to include on the first page.

Company Description

In the Company Description, share 411 about your business. Include basic details like:

- Legal structure (sole proprietor, partnership, corporation, etc.)

- Business and tax ID numbers

- When the business started

- Ownership information

- Number of employees

Your mission statement , philosophy and values, vision, short- and long-term goals, and milestones along with a brief overview of your industry, market, outlook, and competitors should also be in the Company Description.

Pro tip: These are the details you’ll use each time you create a business profile, whether that's on social media, business directories, or other networks. Keep your information consistent to reduce confusion and instill more confidence in potential customers.

Products & Services

The Products & Services section details what you plan to sell to customers. For a dropshipping business , this section should explain which trending products you’re going to sell, the pain points your products solve for customers, how you’ll price your products compared to your competitors, expected profit margin, and production and delivery details.

Remember to include any unique selling points for specific products or product groupings, such as low overhead, exclusive agreements with vendors, the ability to obtain products that are in short supply / high demand based on your connections, personalized customer service, or other advantages.

For dropshipping businesses selling hundreds or even thousands of products, detail the main categories of products and the number of products you plan to offer within each category. By doing this, it’s easier to visualize your business offerings as a whole to determine if you need more products in one category to fully flesh out your online store.

Market Analysis