Essay on Financial Management

After reading this essay you will learn about:- 1. Introduction to Financial Management 2. Definition of Financial Management 3. Scope 4. Role in a Business 5. Financial Goals and Objectives 6. Functions.

Essay Contents:

- Essay on the Functions of Financial Management

Essay # 1. Introduction to Financial Management:

A business organisation seek to achieve their objectives by obtaining funds from various sources and then investing them in different types of assets, such as plant, buildings, machinery, vehicles etc. Financial management is managing the finances through scientific decision-making.

For making right decisions, financial management needs to understand financial environment within which these decisions operate. Financial management will then be able to analyse these financial information’s to predict likely future results and to plan more carefully their proposed course of action.

ADVERTISEMENTS:

Financial management is concerned with the acquisition (investment), financing (arranging funds), and management of assets with some overall goal in mind. Investment decisions begin with a determination of the total amount of assets required by the firm and to determine the money value of the same. Assets that cannot be economically justified, may be reduced, eliminated or replaced.

Financing decisions include decisions regarding mix of financing, type of financing employed, dividend policy and method of acquiring funds i.e., getting a short term loan, or a long term lease arrangement, sale of bonds or stock.

Asset management decisions means managing the assets efficiently after their acquisition.

Success of a firm depends on the ability to raise funds, invest in assets and manage wisely.

Essay # 2. Definition of Financial Management:

Financial management is an internal part of overall management and not a staff function of the organization. It is not only restricted to fund raising process but also covers utilization of funds and monitoring its uses. The finance function is concerned with the process of acquiring an efficient utilization of funds of a business system, in order to maximize the value of the enterprise.

Financial management involves the application of principles of general management to the finance function. These functions influence the operations of other crucial functional areas of the enterprise or firm such as marketing production and personnel. Thus the overall survival of the firm is effected by it financial operations.

“The financial management deals with how the corporation obtains the funds and how it uses them.” —Hoagland

“The financial management refers to the application of skills in the manipulation, use and control of funds.” —Mock, Schultz and Schuckectat

Financial management can also be defined as that part of management, which is related mainly with raising or acquiring the funds for the enterprise or firm in the most economical way, utilizing those funds as profitably as possible, for a given risk level, planning the future investment of those funds and controlling the current performance plus future development by adopting budgeting, cost accounting and financial accounting.

Essay # 3. Scope and Functions of Financial Management :

The main objectives of financial management are to arrange the sufficient funds for meeting short term long term requirements of the enterprise. These finances are procured at minimum cost in order to maximize the profitability.

In view of these factors the financial management scope concentrates on the following areas of finance function.

(i) Estimating the Financial Requirements :

The first job of the finance manager of an enterprise is to estimate short term and long term financial requirements of his business. He will prepare a financial plan for present as well as future for this purpose.

The finance required for procuring fixed assets as well as the working capital needs will have to be ascertained. The estimations should be based on sound financial principles so that funds available with the firm are neither inadequate nor excess.

(ii) Determining the Capital Structure :

After estimating the financial requirements, the finance executives have to decide about the composition of capital. The capital structure refers to the type and proportion of different securities for raising funds. After deciding the quantum of funds needed it should be decided which type of securities should be raised.

The finance executives have to determine the relative proportions of owner’s risk capital and borrowed capital along with short term and long term debt equity ratio.

A decision regarding various sources of funds should be linked with the cost of raising funds. A decision about the kind of securities to be employed and the proportion in which these should be utilized is an important decision which affects the short term and long term financial planning of an enterprise.

(iii) Choice of Sources of Finance :

After preparing a capital structure an appropriate source of finance is chosen. Various sources from which finance may be raised include: shareholders’ debenture holders, banks and other financial institutions and public deposits etc. Finance executive has to evaluate each source or method of finance and select the best source keeping in view the various factors.

The need, purpose, objective, cost involved may be the factors affecting the selection of a suitable source of financing, for instance, if the finances are required for short periods then banks, public deposits and financial institutions may be appropriate, and for long term financial requirements, the share capital and debentures may be useful.

(iv) Investment Decisions :

When the funds have been poured then a decision regarding pattern of investment has to be taken. The funds raised are to be intelligently invested in various assets so as to optimize the returns on investment. The funds will have to be used first for the purchase of fixed assets and then an appropriate part will be retained as working capital.

The utilisation of long term funds requires a proper assessment of different alternatives through capital budgeting and opportunity cost analysis. While spending on various assets, management should be guided by three important principles of safety, liquidity and profitability. A balance should be struck even in these principles for the purpose of optimum returns on investment.

(v) Management of Profits :

The utilisation of surpluses or earnings is also an important factor in financial management. A judicious utilisation of earnings is essential for expansion and diversification plans of the enterprise.

A certain amount out of the total profit may be kept as reserve voluntarily, a portion of surplus may be distributed among the ordinary and preference shareholders, yet another portion may be reinvested. The finance executive must take into consideration the merits and demerits of the alternative scheme of utilizing the funds generated from the enterprise’s own earnings.

(vi) Management of Cash Flow :

Cash flow management is also an important task of finance executive. He has to assess the various cash requirements at different times and then make arrangements for cash needed. Cash may be required to (i) make payments to creditors (ii) for purchase of materials (iii) to meet wage bill (iv) to meet everyday expenses.

The cash management should be such that neither there is shortage of it and nor it is idle. Any shortage of cash will damage the credit worthiness of the firm. The idle cash with the enterprise will mean that it is not properly utilized. In order to know the cash requirements during different periods, the management should arrange for the preparation of cash flow statement in advance.

(vii) Implementation of Financial Controls :

An efficient system of financial management needs the use of various control of devices. Financial control devices generally adopted are (i) Return on Investment (ii) Budgetrary Control (iii) Cost control (iv) Break Even analysis (v) Ratio analysis. The use of various control techniques by the Finance Manager will help him in evaluating the performance in different areas and take corrective action whenever needed.

Essay # 4. Role of Financial Management in a Business:

An effective financial management plays a dynamic role in a modern company’s development.

In earlier days, financial managers were primarily engaged in:

(a) Raising funds, and

(b) Managing the firms cash flow.

But now-a-days with the developments and increasing complexities in the business, responsibility of the financial managers have increased and they are now concerned with the decision-making process involving finance, i.e., capital investment.

Today external factors, like competition, technological change, economic uncertainty, inflation problem etc., create financial managers problem more complicated. He must have flexibility to adopt to the changing external environment for the survival of his firm.

Thus in addition to the job of acquisition, financing and managing the assets, the financial manager is supposed to contribute to the fortunes of the firm and to the optimal growth of the economy as a whole.

He is required to take decisions on:

(i) Investing funds in assets, and

(ii) Obtaining best mix of financing and dividends.

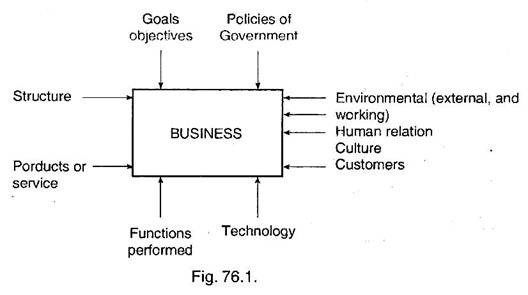

In order to understand the environment in which a finance manager is required to take decision, a sketch indicating business system is given hereunder:

The Financial Management’s main role is therefore to create profit on the capital invested (fixed as well as working capital). Each and every decision related to finance/economy must be optimal. Every business enterprise is set up to earn profit, and no one is interested in taking risk unless he is assured of fair return on the investment. However government organisations have no profit motive but are created to serve the public.

The profit earned by a firm is used for:

(a) Future expansion.

(b) Distributing profit as rewards to owners/shareholders.

Profit earned also serves as an indicator of efficiency and performance of the firm. So as to enable to perform the role of financial management, financial managers must be given proper authority, autonomy, freedom of actions, supporting staff, system for providing necessary information. He should be accountable also for his role.

Essay # 5. Financial Goals and Objectives :

There may be various objectives of a firm, but the goal of a firm is to maximise the wealth of the firm’s owners. Thus we can say that, “the improvement of shareholders value is the one mission that continually guides all corporate decisions and actions” or “the goal of a firm is maximizing the shareholders’ value”. This maximisation of value should be achieved from long term point of view.

The financial goal can be expressed as:

(a) Required profit levels,

(b) Earnings per shares, and

(c) Required rate of return on investment.

For a large firm, where shareholders do not have direct say and the firm is managed by the management, an ordinary shareholder can judge the performance by the market price of the firm’s share. Market price serves as a gauge for business performance, it indicates how well management is doing on behalf of its shareholders.

Management is the agents of the owners or shareholders, and financial management acts for achieving the goal of profit maximization in the shareholders’ best interests.

Social Goals :

While profit maximisation is the primary goal for any business organisation, social responsibility is also important for them. In case of Government organisations and public sector organisations, social responsibility is the primary goal and profit is secondary.

Social responsibility includes service to the people, protecting the consumer, paying fare wages to the employees, upliftment of the weaker sections, welfare facilities like medical education, environment improvement programmes etc.

Financial Objectives :

In making financial decisions, it is important to set out clear objectives.

Following are the basic financial objectives:

(a) Profit maximisation.

(b) Maximisation of shareholders’ owners’ wealth.

(c) Reduction in cost.

(d) Minimising risks.

(e) Sustained increase in the value of firm

(f) Wealth maximisation.

Essay # 6. Functions of Financial Management :

Financial manager is concerned with the following aspects:

1. Identifying the present strengths and weaknesses of the organisation, and the scope for improvement, by conducting the financial analysis.

2. Planning the financial strategies. This involves the consideration of methods and levels of funds raising, profitability and the financing of expansion plan of the organisation.

3. Arranging the funds when required, in the form needed in the most economical way.

4. Conducting financial appraisal of the possible courses of action. The appraisals are needed in respect of possible take overs and mergers, analysis of capital projects, or alternative methods of funding.

5. Advising about capital structure.

6. Consideration of an appropriate level for drawings by dividends to the owners/ shareholders.

7. Ensuring that assets are controlled and used in an efficient manner.

8. Cash management. Preparation of detailed cash budgets and/or forecast funds flow statement so that future problems can be foreseen and remedial measures taken in advance. These take care of both shortage and excess of cash. Finance managers must find ways of raising more funds needed, or investing excess funds for an appropriate length of time.

9. Finance managers are likely to draw attention on other disciplines also, like accounting and budgeting.

In order to enable financial managers to perform above functions satisfactorily, he must have good knowledge of accounting, economics, mathematics, statistics, law especially taxation, financial market etc.

The functions of finance thus involve three major decisions the firm must make:

(a) The investment decisions,

(b) The financing decisions, and

(c) The dividend decisions.

Each of these decisions are taken in relation to the objective of the firm, an optimal combination of these three will maximise the value of the firm to its shareholders. Since the decisions are interrelated, their joint impact on the market price of the firm’s stock must be considered.

(a) Investment Decisions:

This is the most important decision. Capital investment, i.e., allocation of capital to investment proposals is the most important aspect, whose benefits are to be realised in future. As future benefits are not known with certainty, the investment proposals involve risk.

These should, therefore, be evaluated in relation to expected return and risk. Considerable attention is paid to determine the appropriate required rate of return on the investment.

In addition to taking capital investment decisions, finance managers are concerned with the management of current assets efficiently in order to maximise profitability relative to the amount of funds tied up in asset. Investment decisions also include the decisions about mergers and acquisition of another company.

(b) Financing Decisions:

Finance manager is required to determine the best financing mix or capital structure. An optimal financing mix is one in which market price per share could be maximised. Financing decision are taken in relation to the overall valuation of the firm.

Various methods of obtaining short, intermediate, and long term financing are also explored, examined, analysed and a decision is taken. While taking financing decisions, the influence of inflammation on financial markets and on the cost of funds to the firm is also considered.

(c) Dividend Decision:

The dividend decision includes the percentage of earnings paid to stockholders in cash dividends, stock dividends and splits, and the repurchase of stock.

To Meet Funds Requirement of a Firm :

Funds requirement is assessed for different purposes, namely for feasibility study of a project, detailed planning of a project, and for operation and expansion of the business.

For feasibility study, only broad estimates are sufficient and are generally obtained from the past experience of the similar works by interpolating the present trends and the condition of the proposed project in comparison to the one whose figures are being adopted. While during detailed planning, estimated requirement is comparatively more realistic, and prepared after going into details more thoroughly.

Here we are discussing the funds requirement for a running business including its long term planning for expansion.

The main function of financial management is to ensure that the firm must have sufficient funds to meet financial obligations when they are needed and to take advantage of investment opportunities. To achieve this objective, a thorough study is conducted about ‘flow of funds’ i.e., statement of funds requirement indicating the amount of fund needed and at what time.

This ‘statement of funds’ is a summary of a firm’s changes in financial position from one period to another. This indicates that how the funds will be used and how it will be financed over specific period of time. This includes the cash as well as non-cash transactions.

Forecast, financial statements are prepared for selected future dates, generally for middle term and long term plans of the firm. Budgets are used for one year, and are prepared only to fulfill the firms’ objectives envisaged in the forecast for that particular year.

These forecast financial statements are based on the sales forecast and future strategies for expanding the business, and includes, forecast income statements, forecast assets, liabilities, shareholders, equity etc.

Related Articles:

- Essay on Financial Management: Objectives, Scope and Functions

- Essay on Financial Management: Top 5 Essays | Branches | Management

- Top 3 Types of Financial Decisions

- Shareholder Value Analysis (SVA) | Firm | Financial Management

We use cookies

Privacy overview.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

FINANCIAL MANAGEMENT ESSAY Capital Raising

Related Papers

IJAR Indexing

The Venture Capital Industry in India has grown significantly since last few years. The Venture capital sector is the most vibrant industry in the financial market today. Venture capitalists are professional investors who specialize in funding to companies and building young, innovative enterprises to support business expansion with strategically. Venture capitalists are long-term investors who take a hands-on approach with all of their investments and actively work with entrepreneurial management teams in order to build great companies which will have the potential to develop into significant economic contributors. The duration for entry and exit such venture capitalist for 5-7 years to maximize their profit and return back. Venture capital is an important source of equity for start-up companies. Venture capitalists are people or companies who pool financial resources from high net worth individuals, pension funds, corporate insurance companies, etc. to invest in high risk - high return ventures that are unable to source funds from regular channels like banks and capital markets. The venture capital industry in India has really taken off in and it unbelievable role in Indian Economy. Venture capitalists not only provide monetary resources but also help the entrepreneur with guidance in formalizing his ideas into a viable business venture with existing resources or import new technology.

Howard H Frederick

“Attract financial backing will be essential”. Entrepreneurs don’t have a lot of time and yet they have many urgent needs. In turn, the world has always been and will always be in desperate need of entrepreneurs. They take a brilliant idea and make a flourishing business out of it. They are the life blood of the economy that is required to create new wealth. They help sustain people within their economies and communities across the world. That’s why I’ve written this easily digestible book. It’s packed with information condensed down to a form that you can consume easily about how to attract that financial backing. Entrepreneurship is what has made many nations great historically. New Zealand is a good example. This is the challenge for New Zealanders today and for government of whatever hue. We need to create an environment in which the next generation of entrepreneurs will pick up the challenge, and grow the wealth back into this country for the benefit of themselves and for our people as a whole. It is my hope that this small book will motivate the many people who articulate the value of entrepreneurship to ask the next set of questions and do something about them so that New Zealand becomes a magnet for entrepreneurs and we all benefit from their energy and efforts. This book is a great starting point for those who are up to the challenge!

One of the best parts about our jobs is the opportunity to talk with business owners and aspiring entrepreneurs about their ventures and ideas. Entrepreneurs and small business owners share their successes, failures, goals and difficulties encountered. A frequent concern expressed is the ability to attract sufficient financial backing to start and grow their firms. We have written this easily digestible book for entrepreneurs interested in attracting financial backing. It’s packed with information condensed down to a form that you can consume easily about how to attract that financial backing. It is our hope that this small book will motivate Australian entrepreneurs to ask the right set of questions and carry out the right set of actions so that we all benefit from their energy and efforts. This book is a great starting point for those who are up to the challenge!

Haven Allahar

Chameera Liyanage

This paper presents the development of start-up companies, their types and potential sources of financing with special emphasis on financing ventures in Croatia. The expected scientific contribution supports the defining stages of development for start-ups, as well as their financing sources at each stage. The goal of the research was to investigate whether Croatia has made a shift from traditional to newer methods of financing. Scientific and research contributions of the paper are reflected in the fact that there is a relatively small number of papers, especially in the domestic literature, that address these issues. Therefore, this research can contribute to a better understanding of the financing strategy of entrepreneurial ventures. Presented and interpreted results could be a useful basis and encouragement for a further research in this and similar topics related to the start-up scene at the local as well as the global level.

Sophie Manigart

We study the financing strategies of 191 start-ups after they have received venture capital (VC) and thereby contribute to the staging literature. The VC backed start-ups have raised financing on 345 occasions over a five-year period after the initial VC investment. Surprisingly, bank debt is the most important source of funding for these young and growth-oriented companies, supporting the view that VC investors have a certifying role in their portfolio companies. Bank debt is available to firms with a lower demand for money, lower levels of risk and of information asymmetries, implying that staging of equity funding is less important for these firms. A firm only raises equity when it’s debt capacity is exhausted, hinting that equity investors are investors of last resort. New equity is provided by the existing shareholders in 70% of the equity issues, supporting earlier findings that staged financing is important in venture capital financing. New shareholders invest when large amou...

Oxford Handbooks Online

Geoff Gregson

Many business ventures today are looking to attract external financing, with an emphasis on business angel investment. Inside this text, the author incorporates the views of business angels, venture capitalists, entrepreneurs, and legal advisors; and draws upon the latest academic thinking on financing new ventures, providing comparisons between business angel and venture capital investing to further inform the reader. The concepts, principles, and guidelines presented can help you and any entrepreneur, business support agency, business student, and others interested in raising external investment and in developing an “investable” business. The book is organized into seven chapters covering: • Fundamental concepts of entrepreneurial venturing and entrepreneurial finance • Market conditions from which investable businesses emerge • The investment process • Deal negotiations • The post-investment relationship between entrepreneur and investor • Recent trends affecting how entrepreneurs raise finance that include strategic exits, “super angels,” and the emergence of “crowdfunding.”

JOHNNI PAZOS

(*) Como el título lo indica, este apunte trata los conceptos básicos de los controladores lógicos programables. El material fue pensado para ser complementado, necesariamente, con las copias de determinados capítulos del Manual de Usuario del PLC S7-200 de Siemens y que forman parte de este " dossier " .

RELATED PAPERS

miguel eduardo incio diaz

Sergey Abashin

Imam Al-Anshori

P. Pfälzner, H. Niehr, E. Pernicka, and A. Wissing (eds.), (Re-)Constructing Funerary Rituals in the Ancient Near East, pp. 59-78. Wiesbaden: Harrassowitz.

Glenn Schwartz

IEEE Transactions on Industrial Electronics

Antonio M . N . Lima

Anne-Sophie Lartigot-Campin

La lingua italiana in ispanofonia. Traiettorie linguistiche e culturali. Quaderni dil CIRSIL 16

Soledad Chávez Fajardo

Leonam L S Guimaraes

Biology of Blood and Marrow Transplantation

Journal of the Mathematical Society of Japan

De-Qi Zhang

bayu adjie sunarto

Vitorino Santos

redalyc.uaemex.mx

Paulo Henrique

Ludus Vitalis

Miguel Ángel Toro

Process Safety Progress

Russell Ogle

Paul-Francois Muzindutsi

Archivos Españoles de Urología (Ed. impresa)

Octavio Castillo

Journal of Molecular Structure

Claudia Torres

Bladimir Homero Serrano Rugel

International Journal of Morphology

Carlos Manterola

Tuấn Dương Lương

Diagnostic Cytopathology

elif Ozdemir

BMC Pulmonary Medicine

Gilda SANDRI

Luís Capucha

Christopher Huang

Brain Research

Marietta Hugyecz

Manuela Parente

Education Research International

zeleke berie

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Popular Courses

- Drafting of Appeal

- More classes

- GST Audit Course

- More Courses

- CA Final Advanced Financial Management (AFM) Paper New Course May 2024

on 11 May 2024

Download Other files in Exams category

Trending Downloads

- Auto TDS other than Salary calculator

- Salary Income Tax Computation Utility

CA Final Direct Tax Laws & International Taxation (DT) Question Paper New Course May 2024

- CA Intermediate Taxation Question Paper New Course May 2024

- CA Final Financial Reporting (FR) Paper New Course May 2024

Trending Online Classes

Certification Course on Practical Filing of Income Tax Returns

5th Live Batch for Basic and Advanced MS Excel

Live Course on Drafting of appeal and reply of penalty notice, Rectification and stay of demand (with recording)

Popular Files

- CA Final Direct Tax Laws & International Taxation (DT) Question Paper New Course May 2024

- Corporate Compliance Calendar for the m/o May, 2024

- IT Calculator FY 2022-23 AY 2023-24 !

- CA Final Advanced Auditing, Assurance And Professional Ethics Question Paper New Course May 2024

- CA Intermediate Advanced Accounting Question Paper New Course May 2024

Quick Links

- Submit File

- Top Downloads

- New Downloads

- Contributors List

- Top Rated Files

- Top downloads of the month

- Top Weekly Downloads

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

- IMF at a Glance

- Surveillance

- Capacity Development

- IMF Factsheets List

- IMF Members

- IMF Timeline

- Senior Officials

- Job Opportunities

- Archives of the IMF

- Climate Change

- Fiscal Policies

- Income Inequality

Flagship Publications

Other publications.

- World Economic Outlook

- Global Financial Stability Report

- Fiscal Monitor

- External Sector Report

- Staff Discussion Notes

- Working Papers

- IMF Research Perspectives

- Economic Review

- Global Housing Watch

- Commodity Prices

- Commodities Data Portal

- IMF Researchers

- Annual Research Conference

- Other IMF Events

IMF reports and publications by country

Regional offices.

- IMF Resident Representative Offices

- IMF Regional Reports

- IMF and Europe

- IMF Members' Quotas and Voting Power, and Board of Governors

- IMF Regional Office for Asia and the Pacific

- IMF Capacity Development Office in Thailand (CDOT)

- IMF Regional Office in Central America, Panama, and the Dominican Republic

- Eastern Caribbean Currency Union (ECCU)

- IMF Europe Office in Paris and Brussels

- IMF Office in the Pacific Islands

- How We Work

- IMF Training

- Digital Training Catalog

- Online Learning

- Our Partners

- Country Stories

- Technical Assistance Reports

- High-Level Summary Technical Assistance Reports

- Strategy and Policies

For Journalists

- Country Focus

- Chart of the Week

- Communiqués

- Mission Concluding Statements

- Press Releases

- Statements at Donor Meetings

- Transcripts

- Views & Commentaries

- Article IV Consultations

- Financial Sector Assessment Program (FSAP)

- Seminars, Conferences, & Other Events

- E-mail Notification

Press Center

The IMF Press Center is a password-protected site for working journalists.

- Login or Register

- Information of interest

- About the IMF

- Conferences

- Press briefings

- Special Features

- Middle East and Central Asia

- Economic Outlook

- Annual and spring meetings

- Most Recent

- Most Popular

- IMF Finances

- Additional Data Sources

- World Economic Outlook Databases

- Climate Change Indicators Dashboard

- IMF eLibrary-Data

- International Financial Statistics

- G20 Data Gaps Initiative

- Public Sector Debt Statistics Online Centralized Database

- Currency Composition of Official Foreign Exchange Reserves

- Financial Access Survey

- Government Finance Statistics

- Publications Advanced Search

- IMF eLibrary

- IMF Bookstore

- Publications Newsletter

- Essential Reading Guides

- Regional Economic Reports

- Country Reports

- Departmental Papers

- Policy Papers

Selected Issues Papers

- All Staff Notes Series

- Analytical Notes

- Fintech Notes

- How-To Notes

- Staff Climate Notes

Recent Challenges to the Conduct of Monetary Policy in the WAEMU

Author/Editor:

Alain Feler ; Lawrence Norton

Publication Date:

May 17, 2024

Electronic Access:

Free Download . Use the free Adobe Acrobat Reader to view this PDF file

This paper discusses recent challenges in BCEAO monetary policy, from a recent spike in inflation, the persistent erosion of external reserves, and strains in the regional financial market. In response to these shocks, the BCEAO operated via both policy rates and liquidity management, including by shifting from fixed to variable rate auctions. The paper finds that the conduct of monetary policy became progressively more constrained by financial stability and external viability challenges, arguing for enhanced monetary-fiscal policy coordination to help the BCEAO meet its reserves objectives.

Selected Issues Paper No. 2024/013

International organization Monetary policy

9798400274121/2958-7875

SIPEA2024013

Please address any questions about this title to [email protected]

IMAGES

VIDEO

COMMENTS

Accepted June 21, 2023. ABSTRACT. Effective financial management is critical to the success of any. organization. This review paper comprehensively analyzes f inancial. management as a network of ...

Essays in Banking and Corporate Finance Abstract This dissertation studies the role of different types of frictions in preventing optimal resource allocation in the economy. In chapter 1, I focus on financial frictions and consider the distorted incentives of banks to lend to zombie firms. I show that bank supervision, in

The CIIF, International Center for Financial Research, is an interdisciplinary center with an international outlook and a focus on teaching and research in finance. It was ... 1 Professor, Financial Management, PricewaterhouseCoopers Chair of Finance, IESE. IESE Business School-University of Navarra 100 QUESTIONS ON FINANCE

Introduction to Financial Management and Analysis inance is the application of economic principles and concepts to busi-ness decision-making and problem solving. The field of finance can be considered to comprise three broad categories: financial management, investments, and financial institutions: Financial management. Sometimes called

Professor John Y. Campbell. Author: Christopher Anderson. Essays in Financial Economics. Abstract. The first essay studies consumption-based asset pricing models in which consumers make mistakes. I build a model in which a portfolio manager selects portfolio weights on behalf of a potentially non-optimizing consumer.

Essay Writing and Career Success 109 drives or lacks in their business. Just as your adeptness in researching for essays led to good results, so knowing where to look and who to talk to will be the key to your success. Elsewhere during your business studies you will have come across tools such as SWOT analysis and have learned that in order

universities reduce costs through partnerships with local universities or through financial support from local governments, the savings are not passed on to local students in the form of lower tuition. The third essay is coauthored with Cong Wang at Chinese University of Hong Kong and Fei Xie at George Mason University.

After reading this essay you will learn about:- 1. Introduction to Financial Management 2. Definition of Financial Management 3. Scope 4. Role in a Business 5. Financial Goals and Objectives 6. Functions. Essay Contents: Essay on the Introduction to Financial Management Essay on the Definition of Financial Management Essay on the Scope of Financial Management Essay on the Role of Financial ...

Essays on Finance and Economic Policy Abstract This dissertation presents three empirical studies on how financial frictions shape the transmission and effects of economic policy. The dissertation investigates three settings: financial regulation, corporate tax policy, and monetary policy. The first study reveals how

6.1 Conclusion. This study has investigated the influence of several board characteristics on firms financial performances. This relationship is tested by performing an ordinary least square regression, using a sample of 78 Dutch companies listed on Euronext Amsterdam for the period 2014 till 2016.

3.1.3 Step 3: Developing financial plan A decent financial plan is well-designed, which matches one's personal goals. Flexibility, li-quidity, protection, and tax are all ought to be taken into account. For example, Antti lost his job all of a sudden, and yet, he still had a mortgage to pay.

Download Free PDF. View PDF. FINANCIAL MANAGEMENT ESSAY Capital Raising SUDHEENDRA JAHAGIRDAR MPE - 12 02-022014 NMIMS BANGALORE fCapital Raising for Start ups Starting a new business can be a challenging project especially raising the necessary amount of startup capital to get your dreams off the ground and running.

1. Detect the role was played by financial management in commercial companies. 2. Become acquainted with the financial management decisions and the extent responsibility of the Board of Directors for these decisions. 3. Participation of financial management in the position of investment decisions in companies. 4.

2 I MBA - Semester - II Course Code FINANCIAL MANAGEMENT L T P C 22MBA121 3 1 0 4 Course Educational Objectives (CEO): CEO1: To provide basic knowledge on importance and applications of financial management in business, the role and functions of chief financial officer.

FINANCIAL MANAGEMENT (PAPER 2.4) CHIEF EXAMINER'S REPORT, QUESTIONS AND MARKING SCHEME ... about 38%, which had more essays this time than the previous sitting of 70% quantitative and 30% essay. This development also partially contributed to the high pass rate. This was a further shift from previous sittings, which were over 75%

This dissertation consists of three essays on financial economics, specifically focusing on the role of government banks in the aggregate economy and in the role of capital utilization to determine leverage. The first essay shows the empirical relevance of state-owned banks nowadays and their implications for economic growth.

Activities, such as financial management in schools, should be conducted using proper decision-making processes. Section 34 of the Schools Act prescribes that it is the duty of the government to fund public schools from the public income on an impartial basis to redress the inequalities of previous education provision.

Download CA Final Advanced Financial Management (AFM) Question Papers New Course May 2024 in PDF. For older question papers of CA final May 2024, Nov 2023, May 2023, Nov 2022, May 2022, Dec 2021, Nov 2020, May 2019, Nov 2018,CA final May 2018, Nov 2017, May 2017, CA final may 2016, CA final Nov 2016 check similar section.

This paper discusses recent challenges in BCEAO monetary policy, from a recent spike in inflation, the persistent erosion of external reserves, and strains in the regional financial market. In response to these shocks, the BCEAO operated via both policy rates and liquidity management, including by shifting from fixed to variable rate auctions. The paper finds that the conduct of monetary ...

FINANCIAL EMPOWERMENT a Asset Protection WORKSHOP TUESDAY, MAY 21 In-person * light refreshments TOPICS WILL INCLUDE: Budgeting & Money Management Reducing Debt Increasing Savings Establishing & Improving Credit Preparing for Emergencies Communities. Lives. RUGBY DELIVERENCE TABERNACLE 4901 Snyder Avenue Brooklyn, NY 11203 REGISTER

Financial Analyst (Risk Management & Localization) based in Jerusalem. Dear Prospective Offerors: The United States Government, represented by the U.S. Agency for International Development (USAID), is seeking offers from qualified persons to provide personal services under contract as described in this solicitation.