An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Springer Nature - PMC COVID-19 Collection

Well-Being and Stability among Low-income Families: A 10-Year Review of Research

Yoshie sano.

1 Department of Human Development, Washington State University Vancouver, 14204 NE Salmon Creek Avenue, Vancouver, WA 98686 USA

Sheila Mammen

2 Department of Resource Economics, University of Massachusetts Amherst, 309 Stockbridge Hall, Amherst, MA 01003 USA

Myah Houghten

3 Child and Family Research Unit, Washington State University Extension, 412 E. Spokane Falls Blvd, Spokane, WA 99202 USA

Scholarship on families in poverty, in the last decade, documented various struggles and challenges faced by low-income families and expanded our understanding of their complicated life circumstances embedded within the contexts of community, culture, and policies. The research articles published in the Journal of Family and Economic Issues during this time, that highlighted poverty, focused primarily on three topic areas: economic security, family life issues, and food security. Overall, findings conclude that family well-being and stability cannot be promoted without the consideration of environmental factors. They depend on the interaction among individual (e.g., increased human capital), family (e.g., positive co-parental relationship), community (e.g., affordable childcare), and policy changes (e.g., realistic welfare-to-work programs). Collectively, the articles have provided a road map for future research directions.

Introduction

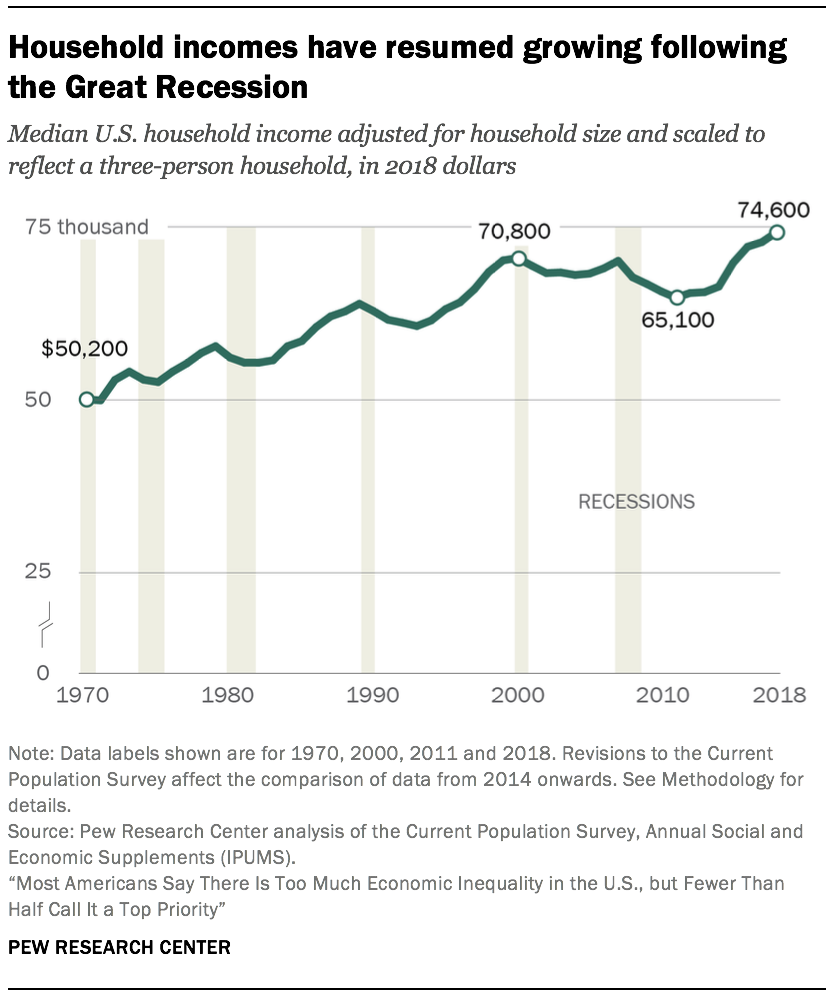

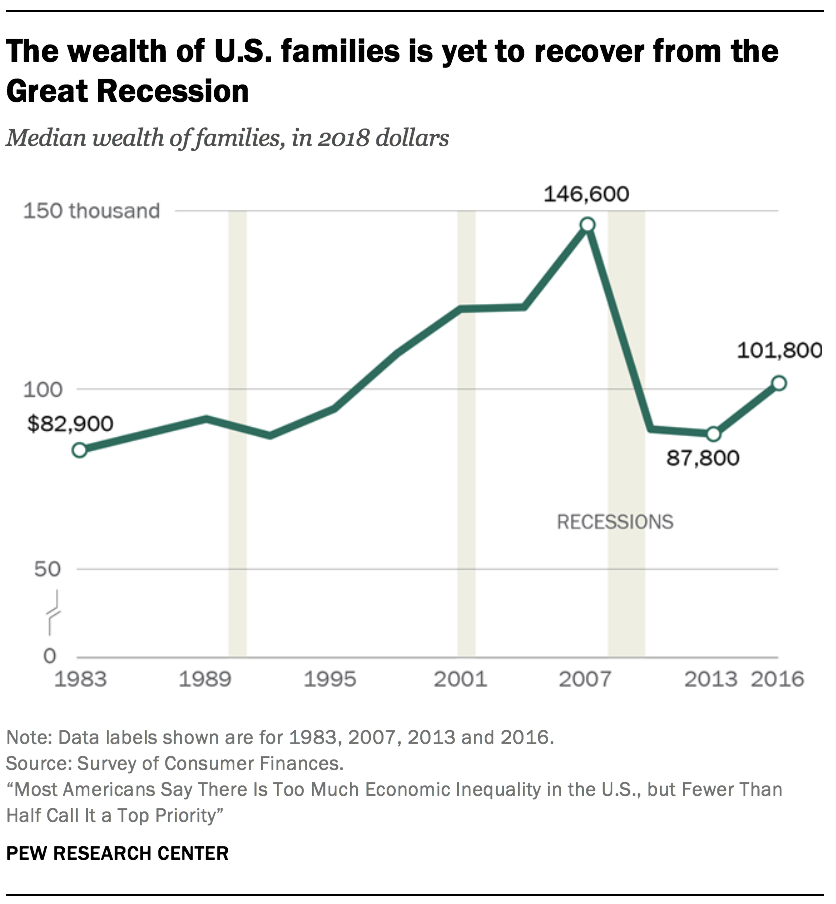

Family well-being, essential to the smooth functioning of communities and societies, is hindered when there is high incidence of poverty. Poverty rate in the US hovered around 14% prior to the enactment of the Personal Responsibility and Work Opportunity Reconciliation Act (PROWRA) of 1996 (U.S. Census 2019a ). Following welfare reform, the poverty rate started to decline (to a low of 11.3% in 2000) (U.S. Census 2019a ), although scholars have questioned if PROWRA is the cause of this decline. Uncertainties in the economy, including the 2008 Great Recession, caused the poverty rate to climb again and remain at around 15% until 2014. With the fading effects of the recession, the US poverty rate was at 11.8% in early 2020, right before the current Coronavirus pandemic. One group that is most vulnerable to poverty, however, are female-headed households, who consistently comprise 50% of all households living in poverty. Other vulnerable groups include non-Whites [poverty rate in 2018, Blacks: 22%; Hispanics: 19%; Native Americans: 24%] (Kaiser Family Foundation 2020 ); rural communities [poverty rate in 2018, non-metro: 16%; metro: 13%] (Economic Research Service 2020 ); and children [poverty rate in 2018, 16%; i.e. 1 in every 6 children] (US Census 2019b ).

Family well-being is a multidimensional concept that refers to a family’s subjective sense of overall welfare, taking into account the physical and emotional health of family members as well as their interconnectedness, which in turn results in family stability (a sense of consistency, predictability, and continuity). There are many components that contribute to the well-being of families such as income sufficiency, food security, stable family environment, mental and physical health security, safe housing and communities, employment opportunities, and adequate transportation. These components, taken as a whole, provide the necessary foundation for the well-being of families. For low-income families, in particular, the lack of some or all of these dimensions can be severely detrimental to their well-being since this could lead to poverty. Such a direct link between lack of well-being and poverty can ultimately lead to family instability.

In this paper, we will review select research findings of the past decade published in the Journal of Family and Economic Issues from 2010 to 2019 that have increased our understanding of low-income families living in poverty. Each study employed a unique approach to its particular topic. Some studies utilized large secondary datasets including both metropolitan and non-metropolitan residents while others collected their own data from a smaller sample generated by non-probability sampling. However, all studies focused on low-income families in the United States with the exception of one study that examined poverty-related social policy in Columbia. The 29 papers, 1 while highly diverse, all illustrated the strengths and challenges faced by individuals and families living with limited resources.

Our review was carried out in multiple stages. First, each author independently reviewed the 29 articles, and then the authors qualitatively compared and contrasted the main themes that emerged from these articles. In the last step, the authors identified three specific dimensions of well-being 2 : economic security, family life, and food security. Our objective was not to provide a comprehensive summary of all poverty-related issues addressed in these articles but, rather, to synthesize the research findings along these three dimensions to see how they have contributed to the current knowledge base regarding low-income families and to provide a path for future research in order to improve family well-being and stability.

Families in Poverty: Decade in Review

Economic security among low-income families.

In the last decade, research on the economic security of low-income families has centered around poverty dynamics, the effectiveness of welfare-to-work programs, employment issues, the Earned Income Tax Credit, and banking behavior.

Poverty Dynamics

Mammen et al. ( 2015 ) developed the Economic Well-Being Continuum (EWC) as a comprehensive measure to describe the circumstances of low-income families in eight specific dimensions (child care, employability, food security, health care security, housing security, transportation, reliance of assistance programs, and capabilities) and establish their level of economic functioning (persistently poor, struggling, and getting by). When certain life circumstances and trigger events experienced by low-income mothers, which contributed to their entry into and exit from poverty, were examined with the EWC, the authors found that family health issues and changes in mothers’ intimate relationships acted as significant trigger events that established or altered the economic functioning of the families. We believe that what mitigated families’ hardships was their support networks. Prawitz et al. ( 2013 ) reported on the centrality of locus of control among low-income individuals who expressed less financial distress and more hopefulness when locus of control was more internal to them. When low-income individuals were able to make financial adjustments, however, they had more financial distress, accompanied with more hopefulness, possibly implying that while the current situation may be bleak, their adaptive responses may have fostered hopefulness that things would improve.

Effectiveness of Welfare-to-Work Programs Among Low-Income Families

One of the goals of PRWORA was to enable recipients of Temporary Assistance for Needy Families (TANF) to exit the program and enter the job market. The transition from welfare to work, however, was not as effective when low-income individuals were trained only through labor force attachment (LFA) programs. Kim ( 2010 , 2012 ) found that former TANF recipients were more likely to obtain employment when LFA programs were combined with human capital development (HCD) programs as participation in HCD programs were related to longer employment durations and lower probability of TANF re-entry.

Participants in Welfare-to-Work programs, who succeeded leaving assistance and obtaining employment, disclosed low wages; informal labor market activity; notable levels of unmet needs; and continued government, community, and social support use (Livermore et al. 2011 ). Those with higher earnings and regular nonmonetary help from family and friends were likely to have more needs met; those who had fewer needs met reported lower wages, had more young children, used government support programs (including childcare subsidies), and engaged in informal labor market activity (Davis et al. 2018 ; Grobe et al. 2017 ; Livermore et al. 2011 ).

Employment Issues

An important way to exit poverty and attain economic security is through employment. Unfortunately, many low-income mothers, especially rural low-income mothers, face daunting challenges to remain employed. Son and Bauer ( 2010 ) reported that mothers who were able to remain in the same job did so because they utilized their limited resources and developed strategies to combine work and family life. These strategies included utilizing social support network for childcare and other household activities as well as relying, where possible, on flexibility at work such as non-standard work hours and supportive supervisors.

One way that low-income mothers were more likely to be employed, and especially employed full-time, was if they were provided state childcare subsidy (Davis et al. 2018 ) and the receipt of childcare subsidy was tied to their employment (Grobe et al. 2017 ). High level of job instability (job loss, major reduction in work hours), however, created a greater likelihood of losing the childcare subsidy. While job changes per se was not related to loss of childcare subsidy, parents required the subsidy to remain employed.

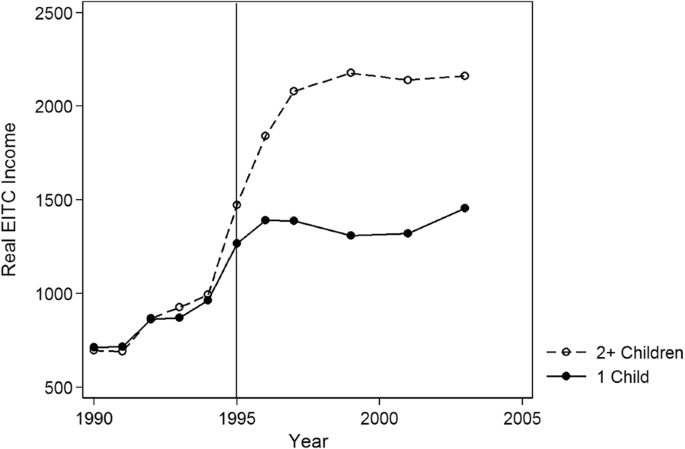

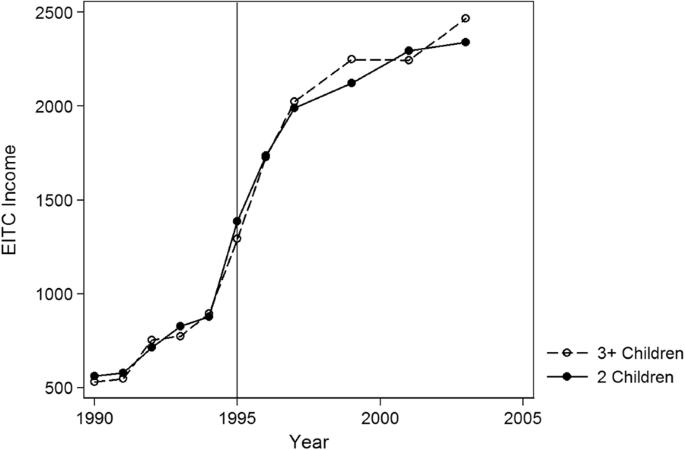

The Earned Income Tax Credit (EITC)

The EITC program, initiated in 1975, is the largest federal assistance program targeted towards working poor families in order to supplement their household wages and to offset their Social Security taxes (Mammen et al. 2011 ). Despite the many benefits of the EITC, a substantial portion of working families, especially in rural communities, do not participate in the program. Mammen et al. ( 2011 ) found that, among rural low-income women, the EITC non-participants were more likely to be Hispanic, be less educated, have larger families, perceive their income as being inadequate, live in more rural counties, and possess little understanding of the EITC. Participating rural working mothers, on the other hand, were more likely to be single, food secure, and satisfied with life.

One important element of the EITC program is the frequency with which the tax credit payments are received by the working families: lumpsum, periodic, or monthly. Kramer et al. ( 2019 ) reported that periodic EITC payment recipients experienced significantly lower levels of perceived financial stress. This relationship was partly mediated by less need to borrow money, lower levels of food insecurity, and fewer unpaid bills. Therefore, periodic EITC payments may enhance the positive association between the EITC and financial well-being of families.

Banking Behavior of Low-Income Families

Having a bank account is more likely to enable low-income families to build assets and to offset unexpected financial expenditures. According to the Federal Deposit Insurance Commission (FDIC), among households with incomes less than $30,000, 38% of them were unbanked in 2017 (Federal Deposit Insurance Corporation 2018 ). Grinstein-Weiss et al. ( 2010 ) found that low-income households who did not have a bank account (unbanked) were more likely to be younger, Black, unpartnered, have more children, and have less income. They were also less likely to have attended college and less likely to be employed full-time. Banked participants, however, were more likely to have better saving performance in Individual Development Accounts (IDA) 3 programs and lower risks of dropping out the IDA programs. According to Rao and Malapit ( 2015 ), for female-headed households, having an additional child increased their likelihood to be underbanked or unbanked. Such financial behavior is more prevalent among female-headed households compared to couples or male-headed households, likely due to the opportunity cost of time for women and the intimidation they feel, perhaps, based on their lack of banking sophistication.

Family Life Issues

Family is where individuals seek rest and support, take nutrition, promote good health and, perhaps, most importantly, raise the next generation. In this section we will discuss findings from the last decade on work-family balance, parenting dynamics, and child well-being and poverty.

Work and Family Life

Many rural low-income families face daunting challenges to balance work and family life. Katras et al. ( 2015 ) found low-income families were able to juggle the demands of work and family life if they had access to resources such as informal social support, could manage both work and family time, and were in jobs that supported work and family life. Difficulties regarding availability of resources or inflexibility in employment created problems in work and family life balance (Katras et al. 2015 ). As mentioned previously, low-income mothers relied on informal support for childcare and household tasks. They also depended on sympathetic supervisors who provided flexible work hours (Son and Bauer 2010 ).

Work-family life balance that working mothers try to achieve can be easily sabotaged by housing instability. Kull et al. ( 2016 ) reported that higher residential mobility was associated with changes in employment status and relationships, experiences of intimate partner violence, as well as private-market rentals, substandard housing, and bad neighborhoods.

Parenting Dynamics

In their study of unmarried couples who coparented children, Jamison et al. ( 2017 ) documented that the difficulties of living in poverty, combined with the demands of parenting young children, can create stress and chaos. Parents who were successful in coparenting were those who were able to manage their limited resources well. Jamison et al. concluded that the best way of assisting low-income couples manage day-to-day stress is by providing them with adequate resources as well as information on how to use these resources effectively.

Traditionally, poverty research has focused on low-income mothers. Myers ( 2013 ), however, studied how low-income fathers defined responsible fatherhood. Previous findings on middle-class fathers have emphasized the importance of breadwinning and childcare rearing roles (Schoppe-Sullivan and Fagon 2020 ). Low-income fathers, who did not provide finances or primary care, on the other hand, did not consider responsible fatherhood to include provision for either of these two functions. Instead they defined responsible fatherhood as spending time in non-caregiving activities, voluntarily distancing themselves from a child when it is in the child’s interest to do so, acknowledging paternity in non-legal settings, spending money on presents, engaging in fun activities, attending to special needs, keeping abreast of what is going on in the child’s home, and ensuring that they are not absent from the child’s life (Myers 2013 ).

Child Well-Being and Poverty

The association between poverty and negative child outcomes has been well-established. Children growing up in poverty are more likely to experience negative health outcomes, poor academic performance, higher dropout rates, and behavioral issues compared to children in middle- and upper-income households (Brooks-Gunn and Duncan 1997 ). Focusing on three economic indicators (income, material hardship, and non-liquid assets), Kainz et al. ( 2012 ) found an association among them and variations in 36-month old children’s social and cognitive development. Poverty status, measured by income-to-needs ratio, was related to lower cognitive skills while the presence of non-liquid assets was associated with higher cognitive skills. Greater material hardship was correlated with more social problems for these children.

Investing in children’s education produces positive child outcomes (Chaudry and Wimer 2016 ). Child subsidy programs expand childcare options for low-income parents. De Marco and Vernon-Feagans ( 2015 ) found that parents who received child subsidies tended to choose center-based care. They concluded that childcare, regardless of type, was of higher quality when these families received child subsidies. Okech ( 2011 ), whose focus was on parents’ decision to enroll in preschool children’s college education accounts, found that decisions were influenced by parental education level as well as parents’ participation in information sessions about the account.

Another indicator of child well-being is good health. According to Valluri et al. ( 2015 ), low-income mothers chose healthcare visits for themselves and their child simultaneously. Pediatric visits increased with new medical conditions and greater number of chronic conditions among children, and maternal healthcare use increased with higher maternal depression scores, chronic conditions, new medical conditions, more children, more pediatric visits, prenatal/post-partum needs, and having health insurance coverage. Maternal health visits, on the other hand, decreased with maternal depression, pregnancy, being Latina or Black, having more children, and if mothers were covered through private health insurance.

Food Insecurity

Consumption of nutritious food is necessary for a healthy, productive life for both adults and children. Having enough food at home contributes to an enhanced sense of family well-being. In this section, we will discuss findings related to the measurement of food insecurity, factors influencing food insecurity, and food-related assistance programs.

Measurement of Food Insecurity

Balistreri ( 2016 ) argued that the commonly used measure of food security (18-item U.S. Household Food Security Survey) only captures the prevalence of food insecurity, not its depth or severity. He has, instead, proposed the Food Insecurity Index (FII) to assess the degree of food insecurity. Using the FII, Balistreri found that low-income households without children experienced the most rapid increases in the depth and severity of food insecurity since the 2008 Great Recession until 2018. Although White non-Hispanic households, with or without children, had lower food insecurity prevalence rates, they experienced steeper increases in both depth and severity throughout the last decade. Finally, Black non-Hispanic households, with and without children, were most likely to suffer food insecurity.

Factors Leading to Food Insecurity

Guo ( 2011 ) documented that, regardless of socio-economic status, family food security is related to household assets. This is because the interaction between household assets and income loss buffered changes in food consumption patterns. Further, regardless of household income level, the risk of food insecurity increased, when faced with liquidity constraint and asset inadequacy (Chang et al. 2014 ). This relationship was strongest among low-income families. Financial constraint was found to be an exogenous factor in the determination of food insecurity. Food insecurity also resulted partly from the interaction between unstable income and nonstandard work schedules (multiple jobs, part-time, varied hours). While this association differed across household types, it was most pronounced in male- and female-headed households, and weakest among married couples (Coleman-Jensen 2011 ). The above findings, taken together, implies that food insecurity should be considered in the broader context of asset building and work environment.

The food security of Latino immigrant families in rural communities was influenced by multiple ecological layers. This included family characteristics (higher literacy and life skills), community conditions (state of the local economy, embrace of diversity, affordable housing, and access to health care), cultural values (familism), as well as federal immigration policy (Sano et al. 2011 ). The rapidly expanding growth among Latino families in rural areas of the US requires that attention be paid to the food security needs of this mostly vulnerable population (Hanson 2016 ). In rural Colombia, conditional cash transfers (CCT) increased the perception of food insecurity and subjective poverty among marginalized families (Morales-Martínez and Gori-Maia 2018 ). The conditionalities (families’ commitment to education, good health, and proper nutrition) imposed on the beneficiary families reduced their dissatisfaction with health and education.

Food-Related Assistance Programs

In 2005 and 2010, metro and non-metro households had relatively similar levels of food insecurity. Yet, Nielsen et al. ( 2018 ) reported that a higher proportion of non-metro households received government food assistance (Supplemental Nutrition Assistance Program [SNAP], Special Supplemental Nutrition Program for Women, Infants and Children [WIC], free and/or reduced school meals, and related local and/or federal programs) compared to metro households. After the Great Recession, when government resources were expanded, this assistance gap widened even further. Nonetheless, according to Chang et al. ( 2015 ), participation in SNAP and WIC programs increased fruit and vegetable consumption significantly among disadvantaged families. Other factors such as exercise habits, family support, and willingness to adopt a healthy lifestyle played a bigger role in increasing consumption of fruits and vegetables. For some families, however, nutrition knowledge seemed to decrease actual intake of the same.

In a study that identified nonfood needs of low-income households who patronized food pantries, Fiese et al. ( 2014 ) classified product needs into three categories: products for survival (water, food, medicine), products to keep the household together (soap, toilet paper, hygiene products), and products to “make do” (paper plates, dish soap, household cleaning supplies). When households went without these products, it resulted in stress, personal degradation, and in illegal activities.

Overall Summary of Findings

The research findings from JFEI articles presented above have identified multiple challenges and have suggested future research directions to improve the well-being and stability of vulnerable families. Taken together, the findings imply that family economic functioning depends on the interaction among individual, family, and contextual factors (e.g., social network, culture, policies). Additionally, emphasizing employment alone, without consideration of factors such as childcare (availability, accessibility, affordability) or jobs (availability, flexibility), is not adequate to successfully enable welfare recipients to exit the program. Governmental and institutional support also play an important role in the economic security of low-income families, such as participation in the EITC, for those who are eligible, and in the banking sector.

In order to balance work and family life, which would contribute to family well-being, working poor mothers require informal social support, especially for childcare and household tasks. In addition to effective resource management skills, it is important for low-income mothers to have a reliable co-parent who is more likely to decrease day-to-day stress and chaos in the household. Even those low-income fathers, unable to provide finances and primary care, may provide support in non-traditional ways, thereby, contributing to family stability. Utilizing available resources such as childcare subsidies, college savings programs, or local financial institutions enhance child well-being.

Food security is another important aspect of family well-being. New measures combined with traditional approaches should be used to capture the true extent of the depth and severity of food insecurity. Multidimensional in nature, food insecurity is impacted, not only by income, but also by household assets, food management knowledge and skills, cultural values, community resources, as well as federal policies. This is particularly true for racial/ethnic minorities and rural immigrant families.

Future Research Directions

The 29 articles from the Journal of Family and Economic Issues, that are reviewed here, suggest strategies for improved family well-being and increased stability. These strategies incorporate the true needs of low-income families with a variety of support systems at the individual (e.g., increase human capital), family (e.g., positive co-parental relationship), community (e.g., affordable childcare), and policy (e.g., realistic welfare-to-work programs) levels. The findings of these studies have provided a road map for future research directions. In this section, we will present a general direction for future research; detailed research recommendations, tied to specific findings, can be found in Table Table1 1 (Economic Security), Table 2 (Family Life Issues), and Table 3 (Food Security).

Summary of findings and suggested areas of future research on economic security among low-income families

Summary of findings and suggested areas of future research questions on family life issues among low-income families

Summary of findings and suggested areas of future research questions on food insecurity among low-income families

Future research should examine life circumstances and trigger events that may affect changes in families’ economic functioning including the size and duration of its impact. Recent examples of trigger events that could cause a cascading effect on low-income families include natural disasters, the opioid crisis, technological displacement of jobs, and the novel Coronavirus pandemic. Research should also look at how such events may be mitigated in vulnerable families by individuals’ agencies such as internal locus of control, hopefulness, and financial literacy. The evaluation of current welfare programs and policies strongly suggest that future research must explore the impact of variations of state welfare policies including work requirements, strategies to incentivize employers to provide flexible work policies, and community-based support systems for parents of young children. Scholars should also explore low-income families’ attitudes, knowledge, and decision-making processes in the area of finances including their reluctance to participate in the banking sector and, for those who qualify, in the EITC program. At the same time, scholars should also not neglect to identify disincentives created by financial institutions that stand in the way of families participating in the banking system.

Previous research has established that work-family balance is vital for low-income mothers to obtain and maintain their employment in order to promote family well-being. Future research should focus on strategies to incentivize employers to provide flexible work policies and to establish community-based support systems. This current pandemic has created a loss of employment opportunities and loss of income especially for low-income working families; future research should, therefore, evaluate the meaning of work flexibility to include off-site work and job sharing.

Positive child development is embedded in family and social contexts. To prevent generational poverty, future lines of inquiry should go beyond mothers’ perspectives alone to include multiple voices of other family members such as co-parents (especially fathers), older and step-children, and grandparents. Additionally, research should focus on the impact of parental decisions regarding childcare enrollment and healthcare visits on the long-term outcome of children. Finally, the association between receipt of governmental assistance and the stigma experienced by low-income families, particularly among rural families, would be another important area of study.

Future research must investigate the role of economic volatility, market conditions, and policy changes in understanding the relationship between family finances and employment of low-income families and food insecurity. For poor immigrant families, the effect of documentation status and immigration policy changes on food insecurity cannot be understated and, to capture the nuances of their food needs, qualitative and mixed-methods studies would be preferred. Future studies should also incorporate geographical information to identify reasons why urban–rural disparity occurs among food insecure families when attempting to access food and possible strategies that would enable food-insecure metro families to access food. It is equally important to assess family income and food budgeting on families’ dietary habits as well as parental modeling and family food environment on healthy food behavior.

Biographies

is an Associate Professor in the Department of Human Development at Washington State University Vancouver. She received her Ph.D. in Human Development and Family Sciences from Oregon State University. Her research focuses on well-being of rural, low-income families including family relations, health issues, and food insecurity. Her current research projects include a multi-state longitudinal research projects, Rural Families Speak about Heath (RFSH) and Rural Families Speak about Resilience (RFSR) which examine interactions of individual, family, community, and policy contexts on the family outcomes among diverse rural, low-income families.

is Professor Emerita in the Department of Resource Economics at the University of Massachusetts Amherst. She received her Ph.D. in Family Economics from the University of Missouri Columbia. The major thrust of her research has been on the economic well-being of families. For the last two decades, she has focused on rural low-income families with special emphasis on issues of income sufficiency, employment, and health security.

is a Project Associate with the Washington State University Extension, Child and Family Research Unit. Myah holds graduate degrees in Landscape Architecture and Public Administration, and she is currently a Ph.D. Candidate within the WSU Prevention Science program. Her work and research seek to better understand school and community conditions that help buffer against ACEs and trauma and that best contribute to increased academic achievement. Current research includes program development, evaluation, and technical assistance in support of trauma-informed professional development within diverse schools and learning communities.

1 The 29 articles reviewed in this paper were assigned by the special editor of this issue of the Journal of Family and Economic Issues. More information is in the introduction to the special issue.

2 Other dimensions of family well-being are being reviewed by other authors in this special issue. A topic of “health” was covered by Chaudhuri and “health and family” issues were covered by Tamborini.

3 An individual development account (IDA) is an asset building program designed to enable low-income families to connect to the financial mainstream by saving towards a targeted amount usually used for building assets.

This is one of several papers published together in Journal of Family and Economic Issues on the “Special Issue on Virtual Decade in Review”.

The original online version of this article was revised due to a retrospective Open Access cancellation.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Change history

A Correction to this paper has been published: 10.1007/s10834-020-09746-0

Contributor Information

Yoshie Sano, Email: ude.usw@onas_eihsoy .

Sheila Mammen, Email: ude.ssamu.noceser@nemmams .

Myah Houghten, Email: ude.usw@nethguoh .

- Balistreri KS. A decade of change: Measuring the extent, depth and severity of food insecurity. Journal of Family and Economic Issues. 2016; 37 (3):373–382. doi: 10.1007/s10834-016-9500-9. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Brooks-Gunn J, Duncan GJ. The effects of poverty on children. The Future of Children. 1997; 7 (2):55–71. doi: 10.2307/1602387. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Chang Y, Chatterjee S, Kim J. Household finance and food insecurity. Journal of Family and Economic Issues. 2014; 35 (4):499–515. doi: 10.1007/s10834-013-9382-z. [ CrossRef ] [ Google Scholar ]

- Chang KL, Zastrow M, Zdorovtsov C, Quast R, Skjonsberg L, Stluka S. Do SNAP and WIC programs encourage more fruit and vegetable intake? A household survey in the northern Great Plains. Journal of Family and Economic Issues. 2015; 36 (4):477–490. doi: 10.1007/s10834-014-9412-5. [ CrossRef ] [ Google Scholar ]

- Chaudry A, Wimer C. Poverty is not just an indicator: the relationship between income, poverty, and child well-being. Academic Pediatrics. 2016; 16 (3):523–529. doi: 10.1016/j.acap.2015.12.010. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Coleman-Jensen AJ. Working for peanuts: nonstandard work and food insecurity across household structure. Journal of Family and Economic Issues. 2011; 32 (1):84–97. doi: 10.1007/s10834-010-9190-7. [ CrossRef ] [ Google Scholar ]

- Davis EE, Carlin C, Krafft C, Forry ND. Do child care subsidies increase employment among low-income parents? Journal of Family and Economic Issues. 2018; 39 (4):662–682. doi: 10.1007/s10834-018-9582-7. [ CrossRef ] [ Google Scholar ]

- De Marco A, Vernon-Feagans L. Child care subsidy use and child care quality in low-wealth, rural communities. Journal of Family and Economic Issues. 2015; 36 (3):383–395. doi: 10.1007/s10834-014-9401-8. [ CrossRef ] [ Google Scholar ]

- Economic Research Service. (2020). Rural poverty & Well-being. United States Department of Agriculture. https://www.ers.usda.gov/topics/rural-economy-population/rural-poverty-well-being/

- Federal Deposit Insurance Corporation. (2018). National survey of unbanked and underbanked households: 2017. https://www.fdic.gov/householdsurvey/2017/2017report.pdf

- Fiese BH, Koester BD, Waxman E. Balancing household needs: the non-food needs of food pantry clients and their implications for program planning. Journal of Family and Economic Issues. 2014; 35 (3):423–431. doi: 10.1007/s10834-013-9381-0. [ CrossRef ] [ Google Scholar ]

- Grinstein-Weiss M, Yeo YH, Despard MR, Casalotti AM, Zhan M. Banked and unbanked in individual development accounts. Journal of Family and Economic Issues. 2010; 31 (2):212–227. doi: 10.1007/s10834-010-9184-5. [ CrossRef ] [ Google Scholar ]

- Grobe D, Davis EE, Scott EK, Weber RB. Using policy-relevant administrative data in mixed methods: a study of employment instability and parents’ use of child care subsidies. Journal of Family and Economic Issues. 2017; 38 (1):146–162. doi: 10.1007/s10834-016-9501-8. [ CrossRef ] [ Google Scholar ]

- Guo B. Household assets and food security: evidence from the survey of program dynamics. Journal of Family and Economic Issues. 2011; 32 (1):98–110. doi: 10.1007/s10834-010-9194-3. [ CrossRef ] [ Google Scholar ]

- Hanson, B. (2016). Immigrants and Latinos bring population growth to rural communities. Center for Rural Affairs. https://www.cfra.org/news/160622/part-1-immigrants-and-latinos-bring-population-growth-rural-communities

- Jamison TB, Ganong L, Proulx CM. Unmarried coparenting in the context of poverty: understanding the relationship between stress, family resource management, and resilience. Journal of Family and Economic Issues. 2017; 38 (3):439–452. doi: 10.1007/s10834-016-9518-z. [ CrossRef ] [ Google Scholar ]

- Kainz K, Willoughby MT, Vernon-Feagans L, Burchinal MR. Modeling family economic conditions and young children’s development in rural United States: implications for poverty research. Journal of Family and Economic Issues. 2012; 33 (4):410–420. doi: 10.1007/s10834-012-9287-2. [ CrossRef ] [ Google Scholar ]

- Kaiser Family Foundation. (2020). Poverty rate by race/ethnicity. https://www.kff.org/other/state-indicator/poverty-rate-by-raceethnicity/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

- Katras MJ, Sharp EH, Dolan EM, Baron LA. Non-standard work and rural low-income mothers: making it work. Journal of Family and Economic Issues. 2015; 36 (1):84–96. doi: 10.1007/s10834-014-9410-7. [ CrossRef ] [ Google Scholar ]

- Kim JJ. Welfare-to-work programs and the dynamics of TANF use. Journal of Family and Economic Issues. 2010; 31 (2):198–211. doi: 10.1007/s10834-010-9180-9. [ CrossRef ] [ Google Scholar ]

- Kim JJ. The effects of welfare-to-work programs on welfare recipients’ employment outcomes. Journal of Family and Economic Issues. 2012; 33 (1):130–142. doi: 10.1007/s10834-011-9272-1. [ CrossRef ] [ Google Scholar ]

- Kramer KZ, Andrade FCD, Greenlee AJ, Mendenhall R, Bellisle D, Blanks RL. Periodic earned income tax credit (EITC) payment, financial stress and well-being: a longitudinal study. Journal of Family and Economic Issues. 2019; 40 (3):511–523. doi: 10.1007/s10834-019-09618-2. [ CrossRef ] [ Google Scholar ]

- Kull MA, Coley RL, Lynch AD. The roles of instability and housing in low-income families’ residential mobility. Journal of Family and Economic Issues. 2016; 37 (3):422–434. doi: 10.1007/s10834-015-9465-0. [ CrossRef ] [ Google Scholar ]

- Livermore M, Powers RS, Davis BC, Lim Y. Failing to make ends meet: Dubious financial success among employed former welfare to work program participants. Journal of Family and Economic Issues. 2011; 32 (1):73–83. doi: 10.1007/s10834-010-9192-5. [ CrossRef ] [ Google Scholar ]

- Mammen S, Dolan E, Seiling SB. Explaining the poverty dynamics of rural families using an economic well-being continuum. Journal of Family and Economic Issues. 2015; 36 (3):434–450. doi: 10.1007/s10834-014-9405-4. [ CrossRef ] [ Google Scholar ]

- Mammen S, Lawrence FC, Marie PS, Berry AA, Knight SE. The earned income tax credit and rural families: differences between non-participants and participants. Journal of Family and Economic Issues. 2011; 32 (3):461–472. doi: 10.1007/s10834-010-9238-8. [ CrossRef ] [ Google Scholar ]

- Morales-Martínez D, Gori-Maia A. the impacts of cash transfers on subjective well-being and poverty: the case of Colombia. Journal of Family and Economic Issues. 2018; 39 (4):616–633. doi: 10.1007/s10834-018-9585-4. [ CrossRef ] [ Google Scholar ]

- Myers MJU. A big brother: new findings on how low-income fathers define responsible fatherhood. Journal of Family and Economic Issues. 2013; 34 (3):253–264. doi: 10.1007/s10834-012-9327-y. [ CrossRef ] [ Google Scholar ]

- Nielsen RB, Seay MC, Wilmarth MJ. The receipt of government food assistance: differences between metro and non-metro households. Journal of Family and Economic Issues. 2018; 39 (1):117–131. doi: 10.1007/s10834-017-9528-5. [ CrossRef ] [ Google Scholar ]

- Okech D. Enrollment decisions in a child development accounts program for low-income families. Journal of Family and Economic Issues. 2011; 32 (3):400–410. doi: 10.1007/s10834-010-9234-z. [ CrossRef ] [ Google Scholar ]

- Prawitz AD, Kalkowski JC, Cohart J. Responses to economic pressure by low-income families: financial distress and hopefulness. Journal of Family and Economic Issues. 2013; 34 (1):29–40. doi: 10.1007/s10834-012-9288-1. [ CrossRef ] [ Google Scholar ]

- Rao S, Malapit HJL. Gender, household structure and financial participation in the United States. Journal of Family and Economic Issues. 2015; 36 (4):606–620. doi: 10.1007/s10834-014-9426-z. [ CrossRef ] [ Google Scholar ]

- Sano Y, Garasky S, Greder KA, Cook CC, Browder DE. understanding food insecurity among Latino immigrant families in rural America. Journal of Family and Economic Issues. 2011; 32 (1):111–123. doi: 10.1007/s10834-010-9219-y. [ CrossRef ] [ Google Scholar ]

- Schoppe-Sullivan SJ, Fagon J. The evolution of fathering research in the 21st Century: persistent challenges, new directions. Journal of Marriage and Family. 2020; 82 (1):175–197. doi: 10.1111/jomf.12645. [ CrossRef ] [ Google Scholar ]

- Son S, Bauer JW. Employed rural, low-income, single mothers’ family and work over time. Journal of Family and Economic Issues. 2010; 31 (1):107–120. doi: 10.1007/s10834-009-9173-8. [ CrossRef ] [ Google Scholar ]

- US Census. (2019a). Historical poverty tables: People and families—1959 to 2018. https://www.census.gov/data/tables/time-series/demo/income-poverty/historical-poverty-people.html

- US Census. (2019b). Poverty: 2017 and 2018. American Community Survey Briefs. https://www.census.gov/content/dam/Census/library/publications/2019/acs/acsbr18-02.pdf

- Valluri S, Mammen S, Lass D. Health care use among rural, low-income women and children: results from a 2-stage negative binomial model. Journal of Family and Economic Issues. 2015; 36 (1):154–164. doi: 10.1007/s10834-014-9424-1. [ CrossRef ] [ Google Scholar ]

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 15 February 2024

Systematic comparison of household income, consumption, and assets to measure health inequalities in low- and middle-income countries

- Mathieu J. P. Poirier 1 , 2

Scientific Reports volume 14 , Article number: 3851 ( 2024 ) Cite this article

788 Accesses

1 Altmetric

Metrics details

- Epidemiology

- Health care economics

- Health policy

- Malnutrition

- Public health

- Risk factors

There has been no systematic comparison of how the three most common measures to quantify household SES—income, consumption, and asset indices—could impact the magnitude of health inequalities. Microdata from 22 Living Standards Measurement Study surveys were compiled and concentration indices, relative indices of inequality, and slope indices of inequality were calculated for underweight, stunting, and child deaths using income, consumption, asset indices, and hybrid predicted income. Meta-analyses of survey year subgroups (pre-1995, 1995–2004, and post-2004), outcomes (child deaths, stunting, and underweight), and World Bank country-income status (low, low-middle, and upper-middle) were then conducted. Asset indices and the related hybrid income proxy result in the largest magnitudes of health inequalities for all 12 overall outcomes, as well as most country-income and survey year subgroupings. There is no clear trend of health inequality magnitudes changing over time, but magnitudes of health inequality may increase as country-income levels increase. There is no significant difference between relative and absolute inequality measures, but the hybrid predicted income measure behaves more similarly to asset indices than the household income it is supposed to model. Health inequality magnitudes may be affected by the choice of household SES measure and should be studied in further detail.

Similar content being viewed by others

Reassessing the econometric measurement of inequality and poverty: toward a cost-of-living approach

Harmonized disposable income dataset for Europe at subnational level

Measuring inequality beyond the Gini coefficient may clarify conflicting findings

Introduction.

All bivariate measures of health inequality require two variables—a health outcome and a measure of socioeconomic status (SES). In the field of global health, much scrutiny has been paid to the way health outcomes are measured, modeled, scaled, weighted, and quantified; but relatively little research has been conducted on how different methods of measuring SES itself can impact magnitudes of health inequalities. Despite the myriad of methods that have been employed to measure SES in global health, there has not been a systematic comparison how these choices impact magnitudes of social health inequality. In order to address this gap in the global health literature, this study empirically evaluates how four different measures of SES affect the magnitude of wealth-related health inequalities across 22 nationally representative household surveys conducted in low and middle-income countries (LMICs).

The three most widely used measures of SES that are used to calculate health inequalities in global health are income, consumption, and asset indices 1 . Income is the primary method of quantifying SES in high-income countries, but in many LMICs, income can be highly variable from month to month, may be incorrectly reported by survey respondents, and may be an inaccurate signifier of a household’s SES if a large part of a household’s spending comes from savings or loans 2 , 3 , 4 , 5 . One widely utilized solution to many of these issues in international household surveys and development literature is to measure households’ expenditures over a certain time interval, often broken down into broad consumption categories. Proponents of these household consumption measures cite advantages of capturing the impacts of income smoothing through savings and loans, resulting in measures that are more consistent from month to month, and that may be more representative of a household’s permanent SES 6 , 7 . In practice, however, household expenditure data usually takes at least an hour to collect, resulting in lengthy and expensive surveys, and even then, may be affected by recall bias, observer bias, and high attrition rates 5 , 8 .

In response to these challenges, a method of quantifying a household’s assets into a single SES index was developed using household assets widely available in standardized household surveys in a seminal work by Filmer and Pritchett 9 . Asset indices are now the most widely used method to quantify SES in global health household surveys of LMICs because assets can be quickly and objectively measured by surveyors, remain relatively stable over time, and pre-calculated indices are now included in the most widely used health surveys including Demographic and Health Surveys (DHS) and Multiple Indicator Cluster Surveys (MICS) 5 , 10 , 11 . Despite their relative speed and ease of collection, there has been considerable debate over how best to calculate asset indices 12 , 13 , 14 , 15 and the resulting measures can be difficult to interpret due to the lack a meaningful interval scale 9 , 16 . Because they do not have an interval scale, asset indices can only be used to compare relative orderings of households across contexts and over time, and only if care is taken to account for changes in the social value of household assets such as smartphones or access to sanitation 17 , 18 .

A more recent innovation to address asset indices’ lack of scale proposes to simulate household income by assigning each centile of the SES spectrum—as ranked by asset indices—a country- and year-specific simulated income distribution 19 . The researchers developing this method justify its use with the argument that relative rankings of households according to asset wealth and income are generally similar, and the simple step of interpolating income distribution data allows us to convert asset indices to a meaningful context-specific interval scale. Although this method has shown promise when applied to household surveys in LMICs 20 , there is no published systematic comparison with real-world household income and consumption-based health inequality measures. This means that although relative household rankings are based on the asset index and absolute differences between those households are based on simulated income distributions, there is little evidence of whether this new construct results in health inequality magnitudes that more closely resemble those based on asset indices or on household income.

Although other measures of SES such as education, social class, subjective social standing, and multidimensional poverty have been used to measure health inequalities; income, consumption, and asset indices are unique in that they share a common goal of measuring social standing through financial well-being regardless of country or social institutions present in those countries. Education level is widely used as a proxy of SES, especially in lower income countries, but takes aim at a different dimension of social wellbeing than financial indicators. Educational strata can be affected by methodological issues such as assumptions that each year of education is equally indicative of an increase in SES and is of equal quality for each student 5 . For the purposes of proxying household SES, what is even more important than the incomparability of education levels across even sub-national jurisdictions is the fact that it is often more indicative of community-level social development than of household-level SES.

No matter which of these measures is used, each has a legitimate claim to measuring at least one real dimension of household SES while also suffering from some degree of theoretical and practical disadvantage. Nevertheless, many authors have taken the explicit or implicit assumption that one method is superior to other alternatives rather than empirically studying the effect each method has on the magnitude of social health inequalities 1 , 20 . This study makes no normative assumption that any method of measuring SES is implicitly superior, nor that measures that result in larger magnitudes of wealth-related inequalities in health are more accurately representing household SES. Rather, each measure has utility for global health research that is contingent on careful measurement and interpretation.

Despite the possibility that SES measures can have a large impact on the magnitude of social health inequalities, a critical interpretive synthesis of existing literature 21 found that only three studies have compared the use of different methods with the same microdata in more than one country, and none have compared all three measures of income, consumption, and asset indices. The largest study of its type conducted by Wagstaff and Watanabe 22 compared equivalized household consumption with asset indices using Living Standards Measurement Study (LSMS) data in 19 countries. Their findings suggest that there was likely no difference between the two measures, although significant differences were found in fewer than a quarter of the cases, with concentration indices of underweight and stunting found to be slightly larger using consumption. Another study by Sahn and Stifel 1 predicted standardized anthropometric height-for-age Z-scores for 12 country-years, finding little difference between the two measures, but highlighting cases where the asset index did point to larger inter-quintile (rich-poor) differences than consumption. Filmer and Scott 23 analyzed the ratio of child deaths to births, finding that per capita expenditures result in smaller inter-quintile differences than asset indices in four out of eight countries analyzed, with the remainder having no significant difference. Although not a primary study of SES measures’ impacts on health inequalities, Howe et al 24 . review of asset index and consumption concordance (including single-country studies) found that health inequalities were larger for asset indices in three studies, larger for consumption in two studies, with one study finding mixed results. In sum, the few studies that have compared wealth-related health inequalities using both consumption and asset indices have resulted in conflicting conclusions.

Howe et al 24 . speculate on reasons for this discordance. Among the entire 17 study set included for analysis, there was higher agreement between consumption and asset indices in middle income settings, urban areas, and when more and diverse indicators were included in asset indices. Country-income level could therefore theoretically affect asset index performance if a household’s spending on non-asset goods, such as food expenses, is systematically correlated with country-level income 23 . Alternatively, if the amount of household spending that is captured by asset indices increases as countries become richer, then asset index comparability with income and consumption will tend to increase as time goes on due to the general tendency of country income-levels to increase. Relatedly, the tendency of asset prices to fall as importation of cheaper household durables from emerging markets has become more common may result in a divergence between asset wealth and both income and consumption 25 . Bivariate health inequality measures also depend heavily on the health outcome being measured. There is evidence, for example, that inequality in child mortality measured using the DHS asset index becomes larger with increasing urbanization 26 or when countries decrease their overall rates of child mortality over time 27 . This means that the effect of global improvements in child mortality and other health outcomes 28 may systematically affect the measurement of wealth-related health inequalities over time.

Lastly, the methods used to calculate social health inequalities influence the conclusions that are reached, and especially depending on whether relative or absolute differences are emphasized. In theory, measures of absolute difference, such as interquartile differences or slope index of inequality (SII), would result in greater inequalities and be more sensitive to differences in scale of measures of SES 29 . The concentration index, which measures relative inequality and may be more sensitive to changes in health outcomes at the middle of the SES spectrum can be affected by different orderings of households depending on the measure of SES used 30 , 31 . If the goal of these summary measures is to capture the entirety of the SES spectrum, then some measures such as the concentration index, the relative index of inequality (RII), and the SII are more appropriate than other measures such as interquartile differences, but generally, each measure can be said to represent different normative judgements applied to the measurement of health inequalities 32 , 33 . In sum, the methods by which inequality is calculated, the health outcomes under study, the year in which the study is conducted, and the country-income level of the population may all affect how different SES measures affect inequalities in health.

To establish a baseline association among the three primary measures of SES, this study compiled 22 country-years of LSMS data and calculated concentration indices, RIIs, and SIIs for child deaths, stunting, and underweight using household income, consumption, and asset indices as measures of SES. Every publicly available survey containing data on income, consumption, household assets, and child health outcomes was then systematically compiled, followed by calculating asset indices and assigning a hybrid income proxy according to the relevant country-year. Three measures of social health inequality—the concentration index, RII, and SII—were then calculated for each outcome, after which the magnitudes of each summary measure were compared using meta-analytic techniques and broken down according to survey year, country-income level, and health outcome to investigate the ways in which each SES measure may be shifting across time and space.

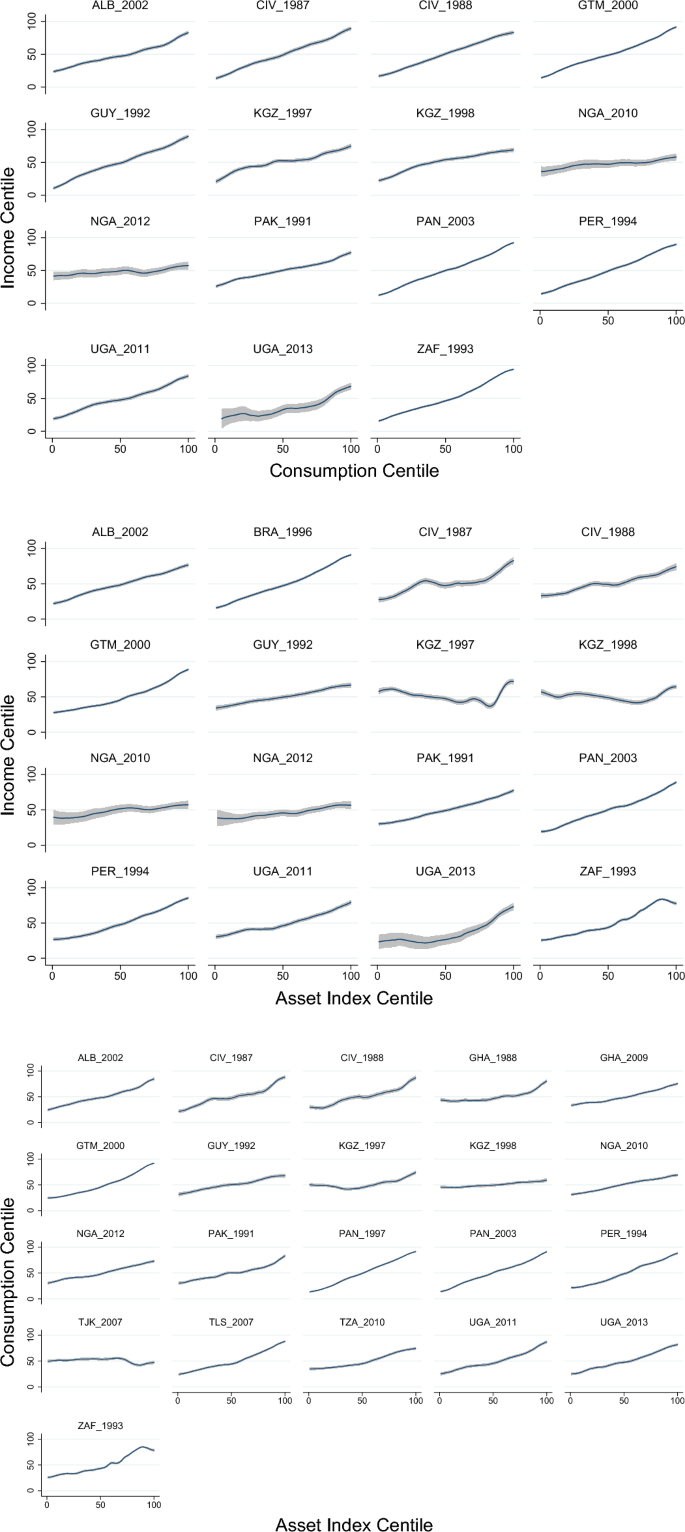

In most countries, there was a positive association between all three measures of income, consumption, and the asset index. Centiles of income, consumption, and asset indices were plotted against alternate measures for each country in Fig. 1 to examine the strength of association at different points in the SES distribution. There is a fairly strong and monotonic increase in income for an equivalent increase in consumption in almost every country, with the exception of a relatively flatter distribution in Nigeria for both 2010 and 2012; possibly due to the relatively small sample sizes for Nigerian income data (N = 501; 471, respectively). Consumption centiles are also positively associated with asset centiles, albeit somewhat less monotonically, except for a small decrease at the top of the South African asset wealth spectrum and a flat distribution with small decrease at the top of the Tajikistani asset wealth spectrum. Finally, income centiles display a highly variable association with asset index centiles in Cote d’Ivoire and Kyrgyzstan, although a positive overall association is maintained. There is no inherent reason to expect strong concordance between these measures in every context, but the strength of agreement between all three measures is notable and indicates that all three measures of SES are related at some level.

Kernel-weighted local polynomial plot of income centiles vs consumption centiles (top), income centiles vs asset index centiles (middle), and consumption centiles vs asset index centiles (bottom). No graphs of the predicted income hybrid measure were generated because these would have been identical to asset index graphs.

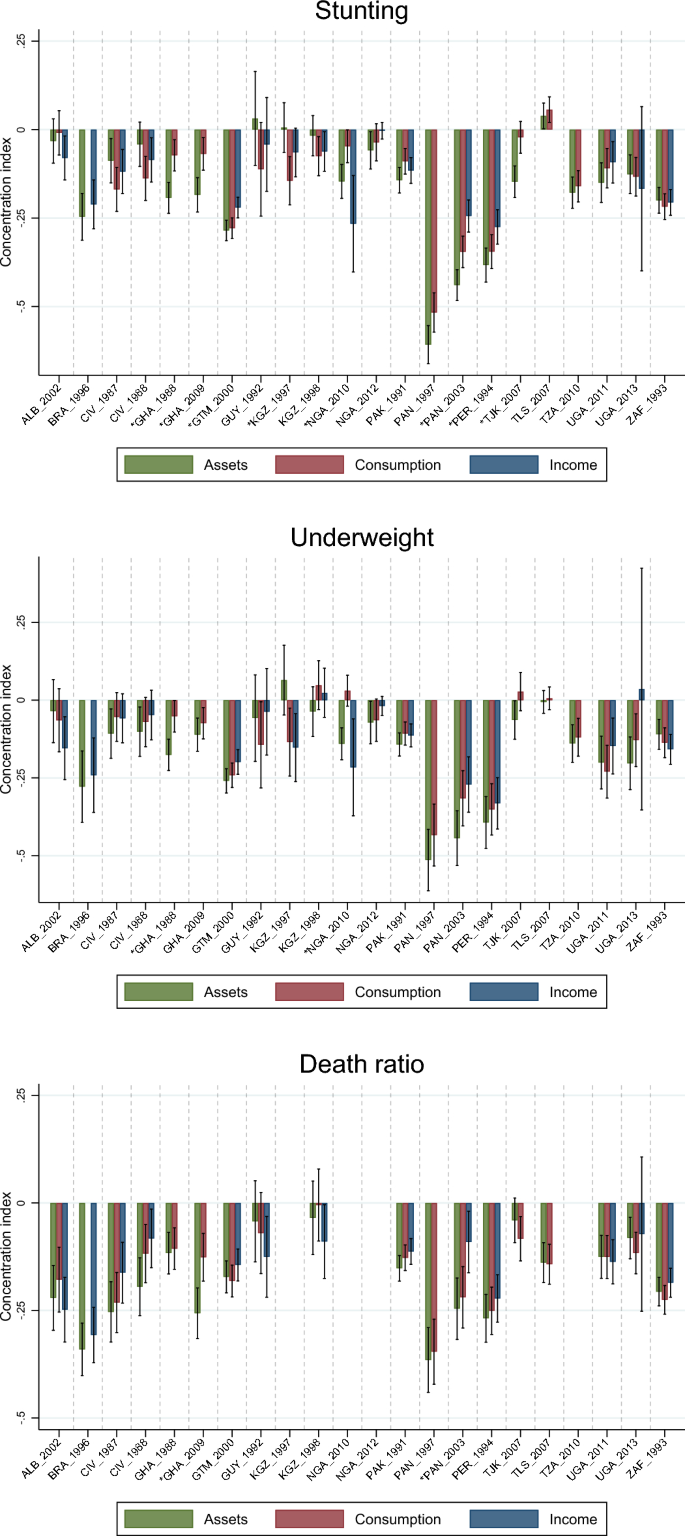

Disaggregated health outcome prevalence for stunting, underweight, and child death ratios are presented for survey-specific quintiles in Supplementary Information Tables S1 - S2 . As expected, there is a decline in prevalence for nearly every outcome as quintiles increase using all three SES measures. A simple proxy of national poverty lines based on the lowest quintiles of households ordered by assets, consumption, and income reveals differences in the concentration of each outcome (Supplementary Information Fig. S1 ). A household asset-based poverty line most frequently results in the highest prevalence of underweight (12 of 22 country-years), while a consumption-based poverty line results in the highest prevalence of stunting (11 of 22 country-years) and mean death ratio (10 of 18 country-years). Moving beyond this simple poverty-based approach, survey-specific social inequality measures for stunting, underweight, and child death ratios are presented for income, consumption, and asset indices using concentration indices in Fig. 2 , and in greater detail for all inequality measures in Supplementary Information Tables S3 - S11 and Fig. S2 .

Concentration indices for stunting (top), underweight (middle), and death ratio (bottom) for every country-year and SES measure with 95% confidence intervals.

Concentration index values are larger in magnitude (i.e., higher inequality) using asset indices for all three outcomes. Overall, there are significant concentration index differences between SES measures in 12 of 52 comparisons for stunting, 2 of 52 comparisons for underweight, and 2 of 42 comparisons for child deaths. RII values are larger in magnitude (i.e., higher inequality) using hybrid income proxies for all three outcomes. Overall, there are significant RII differences between SES measures in 9 of 52 comparisons for stunting, 4 of 52 comparisons for underweight, and 0 of 42 comparisons for child deaths. SII values are larger in magnitude (i.e., higher inequality) using asset indices for all three outcomes. Overall, there are significant SII differences between SES measures in 11 of 51 comparisons for stunting, 4 of 49 comparisons for underweight, and 0 of 42 comparisons for child deaths. Most inequality indices were not significantly different from each other, but when they were, asset index-derived indices most often resulted in larger inequalities.

Meta-analysis of all concentration indices indicates no significant difference in the magnitude of inequality between SES measures for outcomes of stunting, underweight, and child deaths (Table 1 ; Supplementary Information Fig. S3 ). Combining all health outcomes for meta-analysis does not change the result, but asset indices result in the largest magnitudes of inequality for every outcome. Meta-analysis of RIIs (Table 2 ; Supplementary Information Fig. S4 ) reveals a very similar pattern, with all SES measures resulting in magnitudes of inequality that are not statistically different. The hybrid income proxy, which is based on the household asset index, results in the largest magnitudes of inequality for all RII outcomes. Finally, SII results also indicate non-statistically different magnitudes of inequality for every outcome and SES measure (Table 3 ; Supplementary Information Fig. S5 ). Like the RII, the SII is largest in magnitude using the hybrid income proxy for all four outcomes.

Next, inequality measures were broken down by country-income level and by survey year (Tables 1 , 2 , 3 ). Concentration index values clearly increase as countries become richer. Asset indices again result in higher concentration index values in 11 out of 12 instances, although none of the differences are statistically significant. While there are no clear secular changes in concentration index levels, magnitudes are higher in the 1995–2004 era. Yet again, there are no statistically different index values, but a suggestive trend emerges, with asset indices resulting in the largest values in seven out of eight comparisons prior to 2005, but income resulting in the largest magnitudes in all four post-2005 comparisons.

The clear trend of higher inequalities among richer countries is replicated with RII measures. There are no significant differences between SES measures, and the hybrid income proxy results in the highest inequality levels in 11 of 12 comparisons. Over time, RII values are highest in the 1995–2004 era and appear to have decreased after 2005. Once again, a suggestive trend emerges with the hybrid income proxy resulting in the largest values in seven out of eight comparisons prior to 2005, but income resulting in the largest magnitudes in all four post-2005 comparisons.

Finally, SII magnitudes are also largest in higher-income countries (albeit with smaller differences than concentration indices and RIIs), but the dominant SES measures change depending on country-income level. The largest SII magnitudes in low-income countries result from the hybrid income proxy in all four cases, but income results in the largest magnitudes in three of four cases for low-middle income countries and consumption in for three of four cases in upper-middle income countries. The SII points to generally decreasing absolute inequality over time, and there is no clear time trend mediating SES measures and inequality magnitudes.

This first systematic empirical investigation of the effect of SES measures on health inequality magnitudes suggests that the use of asset indices, and the hybrid income proxy based on them, may result in larger magnitudes of wealth-related inequality than either household consumption or income. These results are tenuous because the relatively small number of studies available for analysis result in wide confidence intervals, but the fact that asset indices (and hybrid income proxy) result in the largest magnitudes of health inequalities for all 12 overall outcomes, as well as most country-income and survey year subgroupings, is strongly indicative of a true underlying difference. Thinking through these results using the lens of risk may allow for even stronger interpretation. A global health researcher faced with the risk that a change in SES measure could result in a concentration index jumping from -0.07 to -0.19 for stunting in Ghana or from 0.03 to -0.14 for underweight in Nigeria would surely conclude that there is a real risk that SES measures can have a large impact on the magnitudes of health inequalities.

Although there is no clear time trend for health inequality magnitudes postulated by other authors 27 , the findings do replicate results suggesting larger magnitudes of health inequality as country-income levels increase 23 . In theory, asset indices may be more appropriate measures of household SES in lower income countries because a greater percentage of survey respondents receive no regular income and consumption patterns may be more irregular and difficult to measure 5 , 8 . The results do not provide clear evidence to support this theory, although SII magnitudes were largest in magnitude with the hybrid income proxy (which is based on the asset index) for low-income countries only. This study also finds mixed evidence supporting the assertion that any of the three SES measure is producing larger magnitudes of social health inequality as time goes on. Although larger concentration index and RII values shifted from asset indices and hybrid income proxy to household income in more recent survey years, SII trends are inconclusive. If future research is able to demonstrate continued reductions in the magnitude of health inequalities based on asset indices—as compared to consumption and income—analysts may need to evaluate the degree to which the standard basket of household assets should be revised in light of newly emerging asset classes, such as smartphones 17 .

Differences between SES measures according to health outcomes did emerge, with more statistically significant differences between SES measures for stunting and underweight than child deaths. This may be a statistical effect driven by higher prevalence levels of these outcomes affecting magnitudes of difference between SES measures, or it may be indicative of differences between permanent and transitory household SES levels affecting shorter-term and longer-term health outcomes differently. Regardless of the cause, analysts should be aware of the higher risk for these SES measure-driven differences to emerge when studying these outcomes.

Lastly, the similarities between absolute and relative inequality measures reveal two important findings. First, smaller differences in absolute inequalities between lower and higher-income countries than of relative health inequalities may be due to lower overall disease prevalence along the entire SES spectrum in the richer countries, with greater reductions among higher earners within richer countries 32 . Second, the finding that, just like the asset indices they are based on, the hybrid income proxy method results in larger inequality measures than income or consumption in most of the cases observed provides evidence that this new method may perform more similarly to asset indices than the household incomes they are supposed to simulate 19 , 20 . Researchers using the new method should recognize that although the absolute scale of predicted income appears similar to actual household income, the underlying SES construct it is measuring may be closer to that measured by asset indices.

A major strength of this study is that it is the first systematic comparison of income, consumption, and asset indices on magnitudes of health inequalities using the same microdata for several countries. While compiling disparate estimations of inequality magnitudes can be suggestive 24 , systematic analysis of microdata is the only way to overcome the uncertainty associated with these efforts. This study also compared only health outcomes that are directly measured and comparable across countries and survey years, and every survey used in analysis is a standardized LSMS. In addition, this is the first study to incorporate the new hybrid income proxy measure to investigate the impact of SES measures on health inequality magnitudes.

However, by limiting the study to these directly comparable household surveys containing income, consumption, and assets, the size of the compiled dataset was effectively limited to a small number of studies. If more surveys were included for analysis, either by obtaining non-public surveys or by analyzing surveys that did not contain household income or consumption modules, the suggestive differences observed may have become statistically significant at the 95% confidence level. The study was also limited by small sample sizes reporting household income in some survey waves, but this is a limitation inherent in the collection of income data from low-income countries motivating many to use consumption or asset measures rather than income data. It is also possible that the countries sampled by the World Bank or the countries that chose to include health modules may be systematically different than countries sampled for DHS or MICS surveys.

These results matter for global health researchers, for multilateral organizations, and for development economists. Global health researchers should be cognizant that their choice of SES measure is not innocuous, as choosing an asset index over household income may represent a more permanent marker of household SES and may result in larger measured magnitudes of inequality. Although this study takes no normative stance on the presence of larger inequalities being a marker of a superior SES measure, the mere presence of difference must be acknowledged and accounted for. This is why multilateral organizations such as the World Bank, USAID, and UNICEF should investigate the effects of their preferred SES measures more thoroughly and inform country partners and researchers of the implications of their choices. Finally, development economists should begin studying the pathways linking SES, whether it is measured using income, consumption, or household assets, with health outcomes. If magnitudes of social health inequality are systematically different depending on the choice of household SES measure, there must be a causal link mediating SES and health through one or more pathways that have yet to be fully identified. There is clearly more research to be done with a more comprehensive set of household surveys and health outcomes, but the apparent increase in the magnitude of health inequalities with the use of asset indices to measure household SES suggests that income, consumption, and asset indices are not as equal as commonly assumed.

The largest internationally standardized survey of household living standards is the World Bank’s LSMS, which has been conducted over 100 times in LMICs around the world 31 . Due to their focus on living standards, some, but not all, of these studies capture data on household income, consumption, and/or assets; a feature which is not present in DHS or MICS. Additionally, a subset of LSMS surveys capture information on select health outcomes, although these are limited in number compared to health-focused surveys. This study used the World Bank’s LSMS Dataset Finder 34 to identify every survey that contained each of income, consumption data, household assets, and data on either (1) child deaths, or (2) child anthropometrics. These outcomes were selected because they were the most commonly available measures in LSMS surveys, can be easily and objectively compared across borders, and are widely accepted as sensitive indicators of the population’s health as a whole 35 , 36 , 37 .

Inclusion criteria limited the search to any nationally representative LSMS with all three household SES measures and at least two health outcomes conducted from inception to 2014. Surveys conducted after 2014 were excluded because the country- and year-specific simulated income distributions needed to calculate the hybrid income proxy have not been updated since their initial release 20 . A maximum of two survey years per country were included, in order of most recently conducted survey, to prevent overrepresentation of select countries. Only surveys that contained pre-calculated household consumption and income modules and were available for public use were compiled for this study (i.e., no special permission needed from a country statistical agency). The data search was originally conducted in April 2018 and subsequently updated in August 2022, with no new datasets meeting inclusion criteria found in the most recent search.

Every survey was closely examined to ensure direct comparability, and data from each of 22 surveys summarized in Table 4 was compiled. Each health measure was calculated by the author from raw height, weight, age, and fertility data, even if the survey already included precalculated variables, in order to ensure comparability. Child deaths and births for women aged 15–49 were included for analysis to replicate commonly used DHS methods 38 , and a simple ratio of deaths to births was used as a proxy for infant mortality. No survey weights were used because the outcome of interest is the household SES measure itself, not population-level health or SES estimates. Mortality ratios could not be calculated for Nigeria because a births per woman variable was not present in LSMS data. Child nutrition outcomes of stunting and underweight were calculated as being more than two standard deviations from the 2006 WHO child growth standards for height and weight for age (in months) using Stata zscore06 package for all children under the age of five 39 , 40 .

Household income and consumption data were extracted directly from their respective modules and kept in local currencies, since all health inequality calculations were conducted within single survey country-years. Although some researchers choose to use per capita or equivalized household income and consumption 1 , 23 , aggregate household income and consumption were selected for this study. Aggregate household income and consumption are more directly comparable to the dimension of SES measured by the asset index because the unit of measurement is the household rather than the individual, and household SES is more stable due to intra-household income or consumption substitution in the case of income shocks 6 , 41 .

Asset indices were then calculated using Kolenikov and Angeles’ 12 update of Filmer and Pritchett’s 9 original PCA methods. This method was chosen because a review of the literature on asset index construction using household surveys identified polychoric PCA as a more statistically appropriate, easily calculated, and reliable indicator of household SES 21 . Despite these advantages, the two methods are almost always highly correlated (Spearman correlation coefficient > 0.90). Every household commodity in each survey wave was included for calculation of the asset indices, resulting in a range of 10 to 37 assets per survey. Finally, a “hybrid” income proxy method was used to map an estimated household income to each household’s relative ranking of asset index wealth centiles for the survey’s country-year. This was done by dividing each survey’s households into 100 equal parts according to the relative ranking determined by the asset index, and then assigning each of those centiles a predicted income according to the year and country in which the survey was conducted using an open-access dataset developed for this purpose 20 , 42 . Summary statistics of all health outcomes are presented in Table 5 .

Wealth-related inequalities in health outcomes were then calculated using a national poverty line proxy, the concentration index, RII, and SII. For illustrative purposes, a simple proxy of national poverty lines was created by identifying the lowest quintile of households ordered by assets, consumption, and income. This approach reflects the fact that national poverty lines commonly result in approximately 20% of the population being classified as poor 43 , but it does not take into account health outcomes for the remaining 80% of the population. The value of the concentration index corresponds to two times the area between the line of equality and the concentration curve, which can be interpreted as the percentage of the total outcome of interest that would have to be redistributed from the richest half to the poorest half of the population. It is worth noting that concentration index magnitudes will not change if health and rank difference do not covary, because even if the relative ranking of households changes, a lack of correlation with health would result in no change to the index value 22 . O’Donnell et al 44 . conindex command based on the convenient regression method was used to calculate index values and standard errors, with Wagstaff corrections for bounded health outcome of stunting, underweight, and ratio of child deaths 31 , 45 , 46 . Concentration index values were calculated for income, consumption, and asset index values as measures of SES, but the hybrid income proxy method was not used because household orderings are based entirely on asset index values, meaning there would be no difference except for loss of granularity after converting to centiles.

The SII can be interpreted as the absolute difference in health outcome between the richest and poorest household, taking into account the entire distribution of households in a regression, while the RII is a ratio measure of the prevalence of the health outcome of the poorest households compared to the richest households, again taking the entire distribution of households into account via regression 47 , 48 These health inequality measures were calculated using a generalized linear model (GLM) with a logarithmic link for RIIs and an identity link for SIIs using methods described by Ernstsen et al 49 . Household rankings for these methods use ridits of income, consumption, and hybrid income proxy calculated using methods described by Bross 50 , meaning that the scale of differences in household wealth is taken into account. Unlike the concentration index, the hybrid income proxy was used in lieu of the asset index, because both the SII and RII require an interval rather than ordinal SES measure. SIIs could not be calculated for Panama 1997 and Peru 1994 (underweight only) because GLM models would not converge. Taken together, these three metrics measure scale-independent SES against relative health inequality (concentration index), scale dependent SES against relative health inequality (RII), and scale dependent SES against absolute health inequality (SII).