How to Research a Company: The Ultimate Guide

Good company research can take many forms. Depending on your research goals, you might want to look at the strengths, weaknesses, opportunities, and threats of a market, or drill down into key industry leaders and emerging players to unpack their successes.

If you want to beat the competition, you need to know their business as well (if not better) than your own. The more intel you have, the quicker you’ll be able to spot and leverage opportunities, respond to market changes, and grow.

Read on to discover how to research a company online, tear down its strategies, and take over its market share.

What is company research?

Company research gathers and analyzes information about a business and its customers. This means understanding its performance data and target audience so you can optimize your own strategy.

In today’s fiercely competitive markets, doing good company research is a game-changer. In fact, a 2022 report on competitive intelligence found that 98% of businesses believe researching their competitors is vital for success.

If you have the right tools to collect accurate competitive intelligence , you’ll be able to anticipate your competitors’ moves and emerging threats to stay ahead and succeed.

How to do company research in 8 steps

Researching a company is a bit like doing detective work. The deeper you go, the more questions you ask, and the more curious you are, the better the outcome will be.

Here are eight steps to steer you through the process of doing company research.

1. Track top competitors

You want to know exactly what your rivals are doing, where they’re going, and how the competitive landscape is changing. With this data, you can carefully plan your next move and take action when and where it’s needed most. Competitive tracking tools like Similarweb give you the ability to track what your rivals are up to. You can measure each competitor’s digital footprint, and identify any changes or growth over time.

Did someone experience a sudden uptick in website visits? Would you like to know why and how? Perhaps they launched a new feature or ad campaign, or maybe its social channel is driving growth.

With Similarweb Research Intelligence, you get alerts about changes so you can be sure you’ll never miss a beat.

Analyzing the top performers in your industry will give you new ideas and provide targets for what is achievable for you.

Similarweb’s Analyze Industry Leaders tool will tell you who is winning in your industry based on their website performance. A Market Quadrant Analysis graph, or competitive matrix , provides a visual snapshot of the websites in your industry and how they compare based on different metrics. The industry leaders may inspire you to try new things, while the weaker competitors in your industry can provide you with swift opportunities to chip into their market share.

Pro tip: Similarweb’s Similar Sites tool helps you uncover up to 40 domains that are similar to yours. Finding these domains can be infinitely useful when conducting a competitive content analysis . You can audit these domains to learn more about their content strategy and upgrade your own.

2. Benchmark

Now that you have a good view of the market, you need to drill down into your competitors’ performance. You want to understand their metrics and KPIs so you can benchmark them against your own.

A company research and analysis tool can help you understand your competitors’ digital reach and performance. You can look at multiple websites or domains owned by a single company to analyze their aggregated data or look at a specific market. This will give you a good idea of the business’ size and market share .

You’ll also want to look at their engagement metrics and any changes over time. If you see their metrics improving, they are probably investing in a digital strategy . You should look into this to see what has been working for them. We’ll show you how in the next section.

Pro Tip: Don’t forget to look at mobile app intelligence too. There are five key metrics you’ll want to track when benchmarking an app:

- Demographics

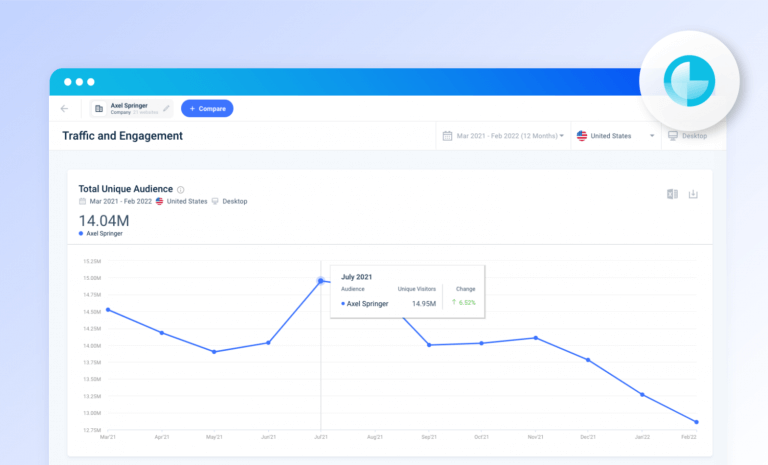

3. Compare traffic and engagement

These days, it’s no longer enough to consider website traffic and engagement metrics on their own. The complete digital perspective of any company includes mobile app intelligence, alongside traditional desktop and mobile web metrics. You need to see the full picture before you make any judgments or decisions.

Using Similarweb digital intelligence, I wanted to view the key players in the travel industry – specifically travel booking sites, like booking.com, Expedia, and Airbnb. First, I want my company research to focus on mobile web and desktop traffic alone.

Using Similarweb Digital Research Intelligence, I can see the overall benchmarks for traffic and engagement. This shows metrics like monthly visits, unique visitors, pages per visit, bounce rate, and visit duration.

The top websites include booking.com , Airbnb , Expedia , Agoda , and Hotels.com . So, in essence, these are my industry leaders .

However, knowing how important apps are these days to consumers, I want to consider app intelligence in my company research too. When I add this data into the mix, things look a little different.

On both Android and iOS: Expedia, Airbnb, VRBO, booking.com, and Hopper are my top five.

Now, my view of industry leaders has changed . We’ve got three key players who are leading desktop, mobile web, and app platforms; and four others, who respectively dominate different channels.

Here, you can see a range of engagement metrics that apply to mobile apps on Android. Including active users, number of sessions, and session times; which shows engagement, upturns, downturns, and opportunities at a glance.

So, when you view traffic and engagement metrics, make sure you explore desktop, mobile web, and app intelligence to get an accurate picture of what’s really going on.

4. View audience interests

Understanding cross-browsing behavior tells you what other sites your users are interested in. Maybe they are looking at other products and solutions like yours!

This audience interests tool allows you to evaluate the browsing behavior of your target audience, helping you understand user intent and their purchasing process. You might even discover new markets or a specific niche audience , and come up with new audience acquisition strategies.

5. Pinpoint audience overlap

Who else holds your potential customer’s attention? With Similarweb’s Audience Overlap feature, you can analyze metrics and insights on the overlap of visitors across up to five websites for a selected time period and geographical region. You’ll be able to determine the size of your total addressable audience , evaluate what part of the audience is shared, and pinpoint your unreached audience potential.

This is also a good way to gauge audience loyalty . You’ll see the proportion of monthly active users who look at multiple sites in the same category or just one site.

6. Analyze specific pages

While a company may be your competitor, you may not be competing on every front. You might only want to look at a particular segment of a business when doing your company research. This ensures that your insights are specific and useful, and leave out less relevant information.

Similarweb’s Segment Analysis tool lets you slice the URL of a website to analyze just the parts that are relevant to you. You can deconstruct their website to look at a specific category, topic, brand, or whatever else interests you. This can help you benchmark a specific line of business or individual products.

This analysis is extremely powerful for marketing and sales managers, data analysts, and BI specialists who want to optimize their strategies for specific business segments. For example, if you are a clothing retailer looking to launch a line of kids’ clothes, you can use this tool to analyze your competitors’ kids’ clothing lines.

7. Reveal successful conversion strategies

What makes customers convert? The only way to know for sure is to analyze conversion data across your industry. You need to understand the conversion funnel, which keywords and marketing channels drive traffic, and which trends your potential customers are interested in.

You can get a unique view of your industry’s conversion data with Similarweb’s Conversion Analysis tool . Check out each company’s conversion efficiency and how they scale over time. You can identify efficient marketing channels , go-to-market strategies, and their ROI for marketing spending. You can also benchmark your metrics across the industry average.

Understanding conversion strategies also reveals opportunities for your own growth. You can examine category performance at top retailers such as Amazon, Walmart, and Target, and identify what consumers are searching for at the different retailers and what converts. When you understand the customer journey, you can better position yourself to guide them toward purchasing from you.

8. Research mobile app performance

When you research a business, you need to look at all customer touchpoints. Today, that means analyzing apps alongside web and mobile web traffic. You want to know how well your competitors’ apps rank so you can focus on your own app strategy. With rapid consumer adoption of mobile-first spending ( 46% of people now complete a full purchase via mobile ), app intelligence is a key consideration for any type of company research. In almost every industry, the digital landscape changes when you add app intelligence metrics.

If you’re looking at apps competitively, you want to consider:

- Monthly/ Daily Active Users

- No. of sessions/session time

- Sessions per user

- Overall rank

- Category rank

- User retention

- App demographics

Similarweb App Intelligence Premium now provides a few ways to help you view app rankings , downloads, engagement, and usage metrics across both Android and iOS. From benchmarking an app to unpacking the successes of those with apps in your market; good company research should include app analysis. By unifying digital insights, you see a truer picture of a company’s successes online.

How to research a company like an expert

Follow these eight steps and you’ll quickly be able to research any company in any niche like a pro. Uncover key insights that tell you more about a market, target audience, or competitors to shape your own strategy for success.

Ready to get growing? Grab a free trial of Similarweb today.

See Similarweb In Action

Don't miss out! Have the latest data at your fingertips.

Why do company research?

Your business doesn’t exist in a vacuum. You’re competing with other companies and operating in an industry that has its own norms and expectations. If you want to succeed, you need to research other companies in your industry to ensure your strategy is aligned, but also positioned to give you a competitive advantage . You won’t be able to do this without researching other companies.

What to look for when researching a company?

You want to review all their company metrics, including traffic and engagement metrics, and look at their strategy, focus, processes, and content. You should search for any interesting ideas and identify where the company excels. All the data you collect will be valuable for you to compete.

What can company research tell you?

Good company research shows you how a market, company, and its target audience’s interests change over time. It can help you develop your own strategy for growth, and shows trends and emerging threats to watch out for.

Related Posts

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Most Popular Messaging Apps Worldwide 2023

Market Sizing: Measuring Your TAM, SAM, and SOM

How To Create Better Competitive Analysis Reports

Fresh Updates: Analyze Entire Companies With Company Analysis

Selling on Amazon vs. eBay: The eCommerce Showdown

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

Professional network data

Leverage our top B2B datasets

Job posting data

Get access to hundreds of millions of jobs

Employee review data

Get data for employee sentiment analysis

Enhanced professional network data

Employee data

Get data on global talent at scale

Funding data

Discover and analyze funding deals

Firmographic data

Unlock a 360° view of millions of companies

Technographic data

Analyze companies’ tech stacks

BY INDUSTRY

MOST POPULAR USE CASES

Company API

Find and get data on specific companies

Historical headcount API

See how company headcounts are changing

Employee API

Access millions of employee profiles

Jobs data API

Find relevant jobs with ease

Largest professional network

Company, employee, and jobs data

Company and jobs data

Company and review data

Company, jobs, review, salary data

Community and repository data

Leveraging web data for informed investing

Building or enhancing data-driven HR tech

Supercharging your lead generation engine

Transforming marketing with web data

Market research

Conducting comprehensive market research

Lead enrichment

Use Coresignal’s data for enrichment

Talent analytics

Analyze talent from multiple perspectives

Talent sourcing

Comprehensive talent data for recruitment

Investment analysis

Source deals, evaluate risk and much more

Target market analysis

Build a complete view of the market

Competitive analysis

Identify and analyze competitors

B2B Intent data

Lesser-known ways to find intent signals

Documentation

Detailed guides, samples, and dictionaries

Learn and get insipired

Find answers to popular questions

Resource center

Data insights, customer stories, expert articles

How to Conduct Company Research for Investment?

Updated on April 5, 2024

Is a company worth the investment? To answer this question accessing high-quality, reliable data is not just a preference—it's a necessity. Yet, the path to uncovering actionable insights is often littered with obstacles: outdated financial statements, inconsistent metrics, and biased market analyses can cloud judgment, leading investors astray.

In this article, we will discuss the various types of data critical to comprehensive company research, its sourcing, and evaluating both opportunities and risks within potential investments.

Types of information needed for researching a company

Any investment analysis is built on information. Researching a company for investment involves leveraging various types of data.

- Firstly, there is, of course, firmographic information like the company’s location, industry, revenue, and size. This is where the company research kicks off

- Then another crucial piece is Information about the key employees of the company, and it ranges from contact and professional to leisure and interest data.

- Further on we want to evaluate the growth trends and potential. For example, changes in online job postings or headcount data might indicate the firm’s growth or decline. Meanwhile, technographic data provides insight into how well the company adjusts to the fast-paced technological development.

- Finally, effective company and market research involves news data analysis. This includes company reviews and other direct mentions, as well as market events and industry trends that could affect the firm.

How to conduct effective company research?

1. identify the company.

The first step is, of course, identifying the object of our analysis. Thus, researching a company starts with finding out its defining features, for example, whether it is a public or private company. Public companies are easier to investigate as they are traceable by a ticker symbol and are required to disclose financial information. Other key identifiers of the company are its industry, market share, and where it is registered.

2. Clarify research questions

Research is effective when it has clearly defined goals. Think about what sort of questions need to be answered for you to be able to reach an investment decision about a specific company. Naturally, the main questions will revolve around the company’s products, services, sales, growth trends, management capabilities, and financial health.

3. Determine which sources are reliable and relevant

You are going to need a lot of data to answer the questions that you have raised. Thus, when choosing data sources, consider what information is relevant to your goals. If you seek to know more about company culture, for example, employer review sites are what you need.

The source should also be reliable. Financial data can come from the company’s annual reports and publicly available governmental sources. Meanwhile, market news should only be retrieved from trusted media outlets. Relevancy and reliability are the most important factors when choosing a third-party data provider.

4. Utilize data gathering and analysis tools

Finally, you will need to use the right tools to do the company analysis efficiently. While a manual google search or review of the company website might get you started, it won’t take you all the way.

Aggregating business news and analyzing public sentiment will require considerable automation. Below you will find more information on the tools and resources to use when researching companies.

Essential tools and resources for gathering information

Public companies operating in the US are required to file accounting and other reports with the Securities and Exchange Commission (SEC). You can use its Electronic Data Gathering and Retrieval (EDGAR) tool to search SEC filings.

EDGAR allows you to search for keywords in various documents describing everything from the company’s historical performance to current business operations and acquisitions. Thus, when it comes to traditional business data, EDGAR is certainly your friend.

Coresignal’s APIs

When it comes to public web data, Coresignal is the right place to be. Consider trying our APIs which allow searching for multiple data points and retrieve what you need immediately. The APIs will fetch you everything from general firmographics to in-depth information about the company’s employees .

Subscription resources

Library of congress provides multiple subscription-based tools that optimize company research for investment purposes. For example, Mergent Online archives past and present company information that can be searched by financial and textual criteria.

Meanwhile, Factiva holds premium business publications in 26 languages and from 200 countries all over the world. The complete list of subscription tools as well as the complete guide on how to access and use them can be found on the Library’s website .

Linkedin and other social media websites

When considering investing in a business, you want to know what kind of person or persons are running it, what they are interested in, who they network with, and other information found on social media profiles might make you aware of red flags that would otherwise be missed.

Linkedin is the leading social network where prospects on a job search gather information about a potential employer. It might just as well be used to research a company for investment decision-making. In addition to people’s data, social media pages are sources for public company reviews.

How to apply the gathered information to investment decisions?

Using the analysis results for investment decisions is all about putting it in the context of market trends and the competitive landscape faced by the business. Thus, your findings should be leveraged against the knowledge acquired by deeper market research into similar products and services.

First, look at the detailed information about the company’s performance and financial stance. If everything seems to be good there, check for red flags. News about the company and reviews by employees and customers will be the most useful for this purpose. Information from the news and social media websites will also help when considering market trends that will affect the business in question.

The final step of the analysis is scrutinizing every publicly available information about the key decision-makers in the company of interest. Insights from their online presence should supplement data on their department, role in the organization, and expertise.

The importance of company research

Investors need to research a company thoroughly before making their decision. Otherwise, they would have to pay not only the price of a bad investment but also that of a lost opportunity to invest in a better business. Only a deep analysis of the organization, its competitors, and industry conditions will give a good idea of its value.

Additionally, researching a company for its business model and the people that are involved has potential long-term benefits. The knowledge acquired might be used in deciding upon future opportunities when the same people or a similar business is encountered.

Thus, researching businesses is the smart thing to do before arriving at any important investment decision.

Boost your growth

See a variety of datasets that will help your business growth.

Don’t miss a thing

Subscribe to our monthly newsletter to learn how you can grow your business with public web data.

By providing your email address you agree to receive newsletters from Coresignal. For more information about your data processing, please take a look at our Privacy Policy .

Related articles

Data Analysis

Data-Driven Industry Benchmarks: How to Evaluate your Business Performance?

In the business world, knowing where you stand compared to the industry standards is a big part of...

Mindaugas Jancis

May 16, 2024

Sales & Marketing

10 Most Reliable B2C and B2B Lead Generation Databases

Not all lead databases are created equal. Some are better than others, and knowing how to pick the right one is key. A superior...

April 23, 2024

It’s a (Data) Match! Data Matching as a Business Value

With the amount of business data growing, more and more options to categorize it appear, resulting in many datasets....

April 9, 2024

Search our Database

Decode The Future

Decades Of Experience

An Insightful Approach

Trusted By Many

Why GlobalData?

Unique data.

We continuously collect and analyze data to create comprehensive, authoritative, and granular intelligence on a global scale.

Expert Analysis

We leverage the collective expertise of our in-house research analysts, consultants, and data scientists, as well as thousands of external industry thought-leaders.

Innovative Solutions

We help you work smarter and faster with powerful analytics, customizable workflow tools, and advanced solutions tailored to your role.

One Platform

We fully integrate our Unique Data, Expert Analysis, and Innovative Solutions into One Platform –offering a connected view of the world’s largest industries.

Access Free Intelligence

Experience what our intelligence has to offer with free access to highlights of our data, insights and analysis.

Industry Coverage

Our unrivalled coverage gives decision-makers the confidence to decode the future of the world’s largest industries.

Click on an industry below to find out more about our capabilities.

Audience Coverage

Our intelligence solutions are curated for users across global industries and job functions to enable you to make strategic decisions for your organization.

Services we offer: C-Suite Market & Competitive Intelligence Innovation and R&D Strategic Planning & M&A Marketing Business Development Investment Banking Equity Research Investment Management Private Equity & Venture Capital Management Consulting Legal & Accounting Academia Government Media & Advertising

DECODED Your daily industry news round-up

Envisioning Proteins: John Jumper, BS’07, uses AI to work on the “protein folding problem”

Media inquiries.

- 615-322-6397 Email

Latest Stories

- Driving Tennessee Innovation: Insights from Competitiveness Conversations Across America

- Imagining Wholeness uplifts experiences of cancer and community through the expressive arts

- Vanderbilt researchers receive $2 million ARPA-H contract to improve software security in medical devices

Share this Story

May 17, 2024, 5:00 PM

It’s one thing to know what a protein looks like on paper—it’s another to know how it looks in real life.

The “protein folding problem” has been one of the most vexing in biology. Even if a scientist knows the DNA sequence for a protein, it’s virtually impossible to predict how the long chains of amino acids will interact and fold in upon themselves to create a three-dimensional model.

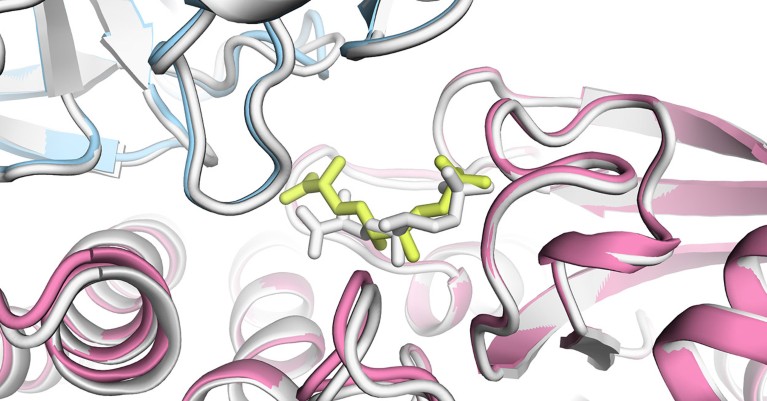

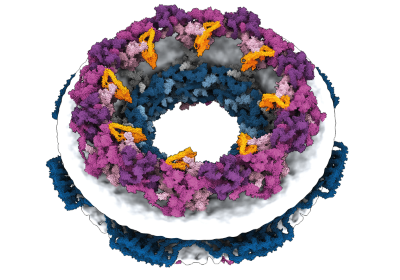

“The genome gives us the wrong view of proteins—it gives us a linear view,” John Jumper, BS’07, said at the Apex Lecture, a series sponsored by the Vanderbilt School of Medicine Basic Sciences this past August. You might see several mutations associated with cancer spread out along the chain “and then you look at the structure, and they are all right next to each other,” he said. Such particularities are essential in understanding how a protein functions and how it might be targeted. “It gives us a great tool for making hypotheses about how the cell works that we can ultimately test.”

Jumper is a senior staff research scientist for DeepMind, a London-based company that made a huge leap forward in solving the protein folding problem using artificial intelligence. It first released its prediction software, AlphaFold, in 2018, following it up with the even more accurate AlphaFold 2 in late 2020. The method has produced extremely accurate 3D models of all 200 million or so proteins known to science—all freely available on the cloud. In a competition, it outperformed all other methods of protein structure prediction, including those that are much more labor intensive and time-consuming. The work is so significant that Jumper was awarded the 2023 Albert Lasker Award for Basic Medical Research, which is often considered a precursor prize to the Nobel.

The implications of AlphaFold’s work are vast, allowing for quick, cost-effective predictions that let scientists custom-design drugs to target certain proteins involved in disease, design synthetic enzymes for chemical reactions, speed production of new vaccines and even personalize medical treatments. “AlphaFold represents a revolutionary advance in structural biology, one that has brought the holy grail of predictive protein folding into the toolkit of biochemistry and molecular biology,” said John Kuriyan, dean of the School of Medicine Basic Sciences, in announcing Jumper’s selection for the Apex Lecture, which focuses on breakthroughs in biomedical science. “The impact of these advances on drug discovery and, ultimately, on human health will be enormous.”

At the lecture, Jumper took a deep dive into how he and his fellow scientists trained a neural network on the Protein Database (PDB) to create the model that became AlphaFold. There was no magic bullet, he said. Rather, researchers painstakingly trained the model on pairs and sequences of amino acids using various techniques, knocked out particular genes to observe effects, and even asked the model to critique itself on the road to ever more accurate predictions. “We had many small effects that we were able to put together and many, many ways in which we got a little bit better,” Jumper said. “We found that everything mattered a bit, and nothing mattered a lot.”

— MICHAEL BLANDING

Keep Reading

Combining unique methods, kuriyan lab discovers new protein functions; explores physical space of proteins.

Vanderbilt chemist Ben Brown awarded $2.375M to develop nonaddictive painkillers with AI

Daring to Grow: The stories that shaped Vanderbilt in 2023

Explore story topics.

- Cover Feature

- Featured VMAG

- Features - VMAGAZINE

- publications

- Vanderbilt Magazine

- Winter/Spring 2024

- Apex Lecture Series

- artificial intelligence

- John Jumper

- protein folding problem

- Vanderbilt Magazine – Featured

- Vanderbilt School of Medicine Basic Sciences

- Newsletter Signup

- Client Login

John Burns Research and Consulting (JBREC) provides independent research and consulting services related to the US housing industry.

GUIDING LIGHTS

Solving today to help you navigate tomorrow ..

To be the most trusted and respected US housing market analysts and consultants.

To help executives make informed housing industry investment decisions.

Trusted by executive decision makers

Trusted by executive decision makers, we service our clients in two ways, research memberships.

We provide our research members with subscription packages of informative, timely analysis supported by data and dashboards. We also service our members by answering their individual questions and hosting them at our client-only events.

Consulting Services

We provide our consulting clients with customized analysis to help them answer specific questions on topics ranging from developing strategy to acquiring a specific property or company.

OUR EXPERTISE

We understand the housing industry ., residential for sale, residential for rent, building products, consumer and design trends.

We provide the most comprehensive view of the residential for-sale market, covering new construction and resale market dynamics at every level—from individual communities to the nation.

We give our clients a competitive edge in all aspects of the residential rental market, from established asset classes like multifamily to growing institutional asset classes like single-family rental and build-to-rent.

We analyze and forecast the residential new home construction and repair and remodeling markets by major product category, installer type (DIY or pro), and project size, providing strategic recommendations customized for you.

Our multifamily clients outperform their competition because they have made educated strategic decisions using our analysis.

We understand how residential and commercial uses fit together to maximize value, helping clients create a seamless, connected lifestyle for residents and users.

We provide proprietary insight into the consumer and design trends that will inform your community development, home design, marketing, and material-manufacturing decisions.

A Holistic View of the Housing Industry

We provide trusted analysis for executive decisions ..

We provide logical, unbiased recommendations and advice, trusted by the best and brightest in the real estate industry.

Trusted Integrity

We do not recommend stock investments or take contingency fees. We aim to be as accurate and honest as possible, with no conflicting agendas.

Our team includes national housing-market leaders, many with direct industry experience, as well as regional experts who live and work in their markets. Our experts have learned from multiple housing cycles.

Client Service

Some of the biggest names in the industry use JBREC's products and services. Our clients have personal access to our team of market and industry experts. We also connect clients to opportunities for new business.

Proprietary Tools

We have created many tools to provide unique and timely insight. Our surveys, indices, and interactive dashboards allow our clients to accurately track the market at any time.

Timely Data

We create, collect, and buy the best industry data available, enabling our analysts to evaluate market conditions. At JBREC, we focus exclusively on housing and strive to have the most current data at our fingertips.

Top-Down, Bottom-Up Analysis

We analyze the housing industry from every angle. Our company has both a top-down (cyclical analysis, demographic trends, macroeconomic trends, policy changes) and a bottom-up (local market consulting, local market surveying, local market analysis) approach to our products and services.

National Footprint

We have one of the largest and most geographically diverse real estate consulting groups in the US. Our executives live in many of the major housing markets across the country and regularly travel to others.

Rigorous Review

Before sending any of our reports, our peer-review team checks facts, calculations, methodology, graphics, and language for the highest possible quality.

John Burns founded the company in 2001 because he saw a need for better analysis of the housing market. The company has grown to a highly passionate team of research analysts and consultants in offices across the country, who work together to provide the most trusted source of US housing analysis.

The Beginning

First consulting assignment.

JBREC lands its first consulting assignment for a large land developer.

The company hires its first of many team members, who we now call PALS (Passionate, Articulate, Likable, Smart).

First Research Subscription

A Western US home builder becomes JBREC’s first research client.

First Securities Investor Clients

JBREC research on rising investor risk is featured in a Wall Street report, leading to our expansion to inform stock market investors.

Early Calls for Housing Downturn

JBREC publicly proclaims the severity of the housing downturn. These predictions prove accurate as the downturn worsens.

Lands First $1 Million+ Assignment

The firm lands its first $1 million+ consulting assignment to help restructure a large, bankrupt home builder.

Inaugural Client-Exclusive Summit Conference

JBREC hosts its first-ever client conference in Laguna Beach, highlighted by a soon-to-be-famous hedge fund panelist correctly telling a prominent bank exec that they will soon need to be rescued but he need not worry because his firm is “too big to fail.”

JBREC Presents to Government Officials

Multiple presentations to government officials create significant Wall Street interest in becoming a big single-family rental home landlord.

Consulting Team Expansion

JBREC acquires an eight-person consulting firm to help with explosive growth for distressed private equity investor groups.

New Research Reports for Building Products and Apartments

New research reports for building products companies and apartment developers are introduced.

New Single-Family Rental Research Product

Geographic expansion.

The company invests in a significant consulting geographic expansion.

Inaugural Housing Market Outlook Conference in New York

Jbrec purchases designlens™.

The company purchases DesignLens™, leading to what is now the New Home Trends Institute.

Big Shifts Ahead

JBREC publishes the book Big Shifts Ahead: Demographic Clarity for Businesses.

Burns Interactive Dashboards

The first set of Burns Interactive Dashboards is made available to research subscribers.

Inaugural Housing Design Summit

In the same year JBREC is named ULI Orange County’s Outstanding Employer of the Year, the company hosts the inaugural New Home Trends Institute client conference.

JBREC Becomes Certified Evergreen®

JBREC becomes one of the first companies to be named a Certified Evergreen® Employer by The Tugboat Institute.

JBREC Becomes Great Place To Work® Certified™

New company purpose.

The company defined its purpose of “solving today to help you navigate tomorrow” and achieved 100% employee retention for 12 consecutive months during a period commonly referred to as “The Great Resignation.”

Catching Up to Our Growth

The company finishes its first full year of Open Book Management, with every team member earning JBREC U credentials that certify their understanding of company financials. Each team member is trained on how they can make our short- and long-term financial results even better.

Company Rebrand

The company is renamed John Burns Research and Consulting (JBREC) and introduces a brand new logo and brand identity.

Achievements

Certified evergreen.

John Burns Research and Consulting was the first company to receive the certification from the prestigious organization, Tugboat Institute. Evergreen businesses are led by purpose-driven leaders with the grit and resourcefulness to build and scale private, profitable, enduring, and market-leading businesses that make a dent in the universe.

Great Place To Work® Certified™

98% of employees at JBREC say it is a great place to work compared to 57% of employees at a typical US-based company. Thanks to our people, we’re proud to have earned Great Place to Work® Certification™.

Inc. 5000 2023

We’ve made the Inc. 5000 list of fastest-growing private companies in America! This remarkable milestone wouldn’t have been possible without the help of our passionate, hardworking JBREC team.

Gallup Employee Engagement Results

In our latest survey, JBREC scored 4.41 out of 5 in overall employee satisfaction.

Integrity Research Compliance Accreditation

How i made it: john burns, real estate guru, joined the industry by 'accident', los angeles times, may 2017.

John Burns is chief executive of John Burns Real Estate Consulting, an Irvine company that provides research and business advice to home builders across the country. The firm has hundreds of clients nationwide.

Burns describes his job as running around and talking to a lot of “insanely smart people all the time.” He then takes knowledge gleaned from industry leaders, small contractors and economic data and figures out where the housing market is headed.

Burns makes his money by selling that knowledge to clients. Those who’ve signed up for the research include major home builders like Lennar Corp. and single-family rental companies like Invitation Homes.

Respected business news and trade media outlets turn to our team for clarification on important and timely issues.

Contact us to maximize your opportunities in the housing market.

If you have any questions about our services or would like to speak to one of our experts about how we can help your business, please contact Client Relations at [email protected] .

Subscribe To Our Newsletter

Already a jbrec client, reach us on social media.

Latest Research

Argus fundamental universe of coverage, daily spotlight, market watch {date:this.formatdateshort}, opportunities in clean energy.

The rise in global land and sea temperatures, the melting of Arctic Sea ice, and the frequency of extreme weather events provide evidence that climate change is underway. United in concern over greenhouse gas emissions (GHG) stemming from fossil fuel power plants and car and truck tailpipes, 194 member states of the United Nations signed the Paris Agreement in 2015. This legally binding international treaty on climate change seeks to limit global warming to well-below two, preferably 1.5 degrees Celsius, compared to pre-industrial levels. Concerns over the health of the planet and its inhabitants and a reluctance to be reliant on overseas fuel sources prompted governments around the globe to develop and deploy clean, renewable sources of energy. In the U.S., the Inflation Reduction Act (IRA) of 2022 called for the investment of $391 billion in programs and incentives related to energy security and climate change, including over $120 billion for renewable energy and grid energy storage, tax credits for wind power, solar power, clean energy manufacturing, electric vehicle incentives, and other energy efficiency measures. We expect the IRA to kick clean energy into a higher gear. Already, wind power as a percentage of U.S. electricity generation has grown from less than 1% in 1990 to 10% by 2022. The global solar power market is also large and growing. It generated $235 billion in 2022 revenues, and is projected to rise at a compound annual growth rate of 7% to $293 billion in 2029. For more insights and ideas into the Clean Energy sector, see our latest Industry Review & Outlook for Clean Energy. ... compared to pre-industrial levels. Concerns over the health of the planet and its inhabitants and a reluctance to be reliant on overseas fuel sources prompted governments around the globe to develop and deploy clean, renewable sources of energy. In the U.S., the Inflation Reduction Act (IRA) of 2022 called for the investment of $391 billion in programs and incentives related to energy security and climate change, including over $120 billion for renewable energy and grid energy storage, tax credits for wind power, solar power, clean energy manufacturing, electric vehicle incentives, and other energy efficiency measures. We expect the IRA to kick clean energy into a higher gear. Already, wind power as a percentage of U.S. electricity generation has grown from less than 1% in 1990 to 10% by 2022. The global solar power market is also large and growing. It generated $235 billion in 2022 revenues, and is projected to rise at a compound annual growth rate of 7% to $293 billion in 2029. For more insights and ideas into the Clean Energy sector, see our latest Industry Review & Outlook for Clean Energy. more

Market Podcast

Argus president john eade reviews his 8 fundamental forecasts for 2023, analyst quick notes, weekly stock list: companies raising guidance, weekly stock list: focus list changes, weekly stock list: innovative companies, our favorite energy stocks, leaning into higher rates, news & media.

Webinar - Financial Services: Opportunities in a Higher Rate Environment 5/09/2024

Webinar - Consumer Economy: Opportunities in a Mixed Environment 4/10/2024

Webinar - Semiconductors: Powering Digital Transformation 3/6/2024

New Portfolio Update

The United States economy is full of innovation. It has to be. Manufacturing industries that dominated the economy decades ago – textiles, televisions, even automobiles to a large degree – have moved overseas, where labor and materials costs are lower. more

Yet the U.S. economy, even during the pandemic and the current period of high inflation, has expanded to record levels. If U.S. corporations weren’t innovating, creating new products (such as vaccines and AI) and services (such as Zoom calls) and moving into new markets, the domestic economy would not be growing, and capital would not be flooding into the country. The current high level of the U.S. dollar relative to currencies around the world attests to the confidence that global investors have in the durable and innovative U.S. economy.

Market View

Stocks gently higher midday monday.

At midday, the major benchmarks are modestly higher, with individual stocks moving on earnings news. The yield on the benchmark 10-year Treasury note is two basis points higher at 4.44%. Crude oil is up at $80 per barrel. Gold is also up, while Bitcoin is down. ... more

Turning to stocks, the power of raising guidance is evidenced today in stocks making big moves higher. Wix.com (WIX, up 21%) is up after the company beat earnings and increased its outlook. Norwegian Cruise (NCLH, up 8%) also boosted guidance and reported record bookings. On the flipside, Li Auto (LI, down 15%) is getting crushed after the Chinese EV-maker said profits fell by more than one-third. The stock star of the week is Nvidia (NVDA, up 2%) with earnings out on Wednesday. Ahead of that, the stock is getting attention. The AI darling has blown out earnings the last few quarters and AI fans are waiting to see if that’s going to happen again. Also, Nvidia is seen as a proxy for the overall state and pace of artificial intelligence. The S&P 500 is up 0.91%, the Dow is up 0.85%, the Nasdaq is up 1.51%, and the Russell 2000 is up 1.81%. Industries trading higher today include: Semiconductor & Semiconductor Equipment, Electronic Equipment, Instruments & Components , and Building Products. Industries trading lower today include: Automobiles, Energy Equipment & Services, and Specialty Retail. The VIX is up 0.26 at 12.25 after closing yesterday at 11.99. Options on At&T Inc (T) have appeared on the most-active list today with more than 20,961 contracts of the Jul. 19 18 call, changing hands. The put/call ratio is 1.17 (1,824,211)/(1,565,567). NYSE Adv/Dec (1,631/1,103). Nasdaq Adv/Dec (2,221/1,798). [Argus Research, various news and data sources]

Turning to stocks, the power of raising guidance is evidenced today in stocks making big moves higher. Wix.com (WIX, up 21%) is up after the company beat earnings and increased its outlook. Norwegian Cruise (NCLH, up 8%) also boosted guidance and reported record bookings. On the flipside, Li Auto (LI, down 15%) is getting crushed after the Chinese EV-maker said profits fell by more than one-third. The stock star of the week is Nvidia (NVDA, up 2%) with earnings out on Wednesday. Ahead of that, the stock is getting attention. The AI darling has blown out earnings the last few quarters and AI fans are waiting to see if that’s going to happen again. Also, Nvidia is seen as a proxy for the overall state and pace of artificial intelligence.

The S&P 500 is up 0.91%, the Dow is up 0.85%, the Nasdaq is up 1.51%, and the Russell 2000 is up 1.81%.

Industries trading higher today include: Semiconductor & Semiconductor Equipment, Electronic Equipment, Instruments & Components , and Building Products. Industries trading lower today include: Automobiles, Energy Equipment & Services, and Specialty Retail.

The VIX is up 0.26 at 12.25 after closing yesterday at 11.99. Options on At&T Inc (T) have appeared on the most-active list today with more than 20,961 contracts of the Jul. 19 18 call, changing hands. The put/call ratio is 1.17 (1,824,211)/(1,565,567). NYSE Adv/Dec (1,631/1,103). Nasdaq Adv/Dec (2,221/1,798).

[Argus Research, various news and data sources] less

Weekly Economic Commentary

May recoups april losses, but inflation risks remain.

Not quite halfway through May, the stock market has largely recouped losses recorded during April. The recovery actually got underway in the final week of April, when investors decided that slower GDP growth (1.6% for 1Q24) might be positive for the long-term trajectory of inflation. Late-April momentum in stocks stepped up early in May when April nonfarm payrolls signaled some cooling in the jobs economy, along with an unemployment rate (3.9%) close to the Fed’s unofficial 4% target. ... more

- How to Answer, “What Do You Know About Our Company?”

- The Lookingglass

Recruitment specialists or hiring managers tend to ask similar questions during job interviews. Some are the expected “tell us about yourself” and the standard “ why did you apply for this job ?” One other common interview question is about uncovering your knowledge about the company with the open opportunity.

A thoughtful and well-researched response to the common interview question, “What do you know about our company?” is crucial for making a positive impression on your potential employer. It’s a question that offers you an opportunity to demonstrate your interest in the company, your understanding of its industry, and how your skills and experiences align with its goals and values.

But how do you respond to it?

Tips to Answering What You Know About the Company

Research the company.

Is the business one of the top companies in the country ? Before your interview, dedicate time to thoroughly research the company. Visit their official website, read their mission statement, explore their products or services, and familiarize yourself with their history, key milestones, and recent news or developments. Additionally, check their social media profiles, press releases, and any articles or publications about the company.

Understand the Company Culture and Values

Look for information about the company’s culture, values, and workplace environment. Understand what sets them apart from competitors and what they prioritize in their operations. The insight will help you tailor your response to align with their culture and values .

Know the Industry

Gain a solid understanding of the industry in which the company operates. Research industry trends, challenges, and opportunities. Consider how the company positions itself within the industry and how it differentiates itself from competitors.

Identify Key Competitors

Be aware of the company’s main competitors and how they compare in terms of products, services, market share, and reputation. Highlight any unique strategies or offerings that set the company apart from its competitors.

Study Recent Achievements and Initiatives

Familiarize yourself with the company’s recent achievements, awards, or initiatives. The knowledge demonstrates that you’re up-to-date with their progress and invested in their success.

Connect Your Skills and Experiences

When discussing what you know about the company, find opportunities to connect your skills, experiences, and achievements with the company’s needs and objectives. For example, if the company values innovation, highlight any innovative projects you’ve worked on or your ability to adapt to new technologies.

Prepare Specific Examples

Back up your knowledge with specific examples or anecdotes related to the company. For instance, if the company recently launched a sustainability initiative, you could mention your passion for environmental sustainability and any relevant experiences you’ve had in that area.

Tailor Your Response

Customize your response based on the role you’re applying for and how it fits into the company’s objectives. Emphasize how your background and qualifications make you a good fit for the position and how you can contribute to the company’s success.

Be Authentic

It’s important to impress the interviewer with your knowledge, but be genuine in your response. Avoid exaggerating or providing information that you can’t substantiate. Interviewers appreciate authenticity and sincerity.

Practice Your Response

Rehearse your response to ensure clarity, conciseness, and confidence. Practice speaking naturally and avoid sounding rehearsed or scripted. Ask a friend or family member to listen to your response and provide feedback.

Sample Response to “What Do You Know About Our Company?”

“From my research, I’ve learned that your company is a leader in [industry/sector], known for its commitment to [specific value or initiative]. I’m particularly impressed by your recent efforts to [mention recent achievement or initiative], which aligns with my own passion for [relevant interest or skill]. I also noticed that your company emphasizes [specific aspect of company culture or values], which resonates with me because [provide a brief example]. As someone with experience in [relevant skill or field], I’m excited about the opportunity to contribute to your team and help further your mission of [mention company mission or goal].”

Why You Need to Give a Clear, Specific Answer

When answering the interview question, “What do you know about our company?” it’s crucial to provide a clear and specific response for several reasons:

Demonstrates Preparation and Interest

Offering a detailed understanding of the company showcases your preparation for the interview and your genuine interest in the organization. It indicates that you’ve taken the time to research the company thoroughly, signaling your commitment to the role.

Highlights Alignment with Company Values

A specific answer allows you to align your skills, experiences, and values with those of the company. By demonstrating an understanding of the company’s culture, mission, and values, you show that you’re a good fit for the organization and its objectives.

Differentiates You from Other Candidates

Providing specific examples and insights sets you apart from other candidates who may offer generic or superficial responses. It demonstrates your depth of knowledge and your ability to connect your background with the company’s needs and goals.

Facilitates a Meaningful Conversation

A clear and specific response opens the door for a more meaningful dialogue during the interview. It gives the interviewer an opportunity to delve deeper into your understanding of the company, allowing you to showcase your insights and engage in a constructive discussion.

Why Companies Ask This Question During Interviews

Assesses candidate’s research skills.

By asking about the candidate’s knowledge of the company, interviewers can evaluate the candidate’s research skills and initiative. Candidates who have taken the time to learn about the company are more likely to be proactive and engaged employees.

Evaluates Cultural Fit

Understanding the company’s culture, values, and mission is essential for assessing cultural fit. Companies want to ensure that candidates share their values and will thrive in their work environment.

Tests Motivation and Interest

Candidates who demonstrate a genuine interest in the company are more likely to be motivated and committed employees. By asking about the candidate’s knowledge of the company, interviewers can gauge the candidate’s level of enthusiasm for the role and the organization.

Provides Insight into Candidate’s Preparedness

The question serves as an initial screening tool to assess the candidate’s level of preparation for the interview. Candidates who provide a well-researched and thoughtful response are more likely to be prepared for the demands of the role.

Secure that Job Offer

Job interviews offer a good opportunity to pitch yourself as the best candidate from a pool of applicants. When you come prepared, you have a good chance of getting a favorable outcome. Fortunately, many interview questions are common and standard, like “what do you know about our company?” By following these guidelines and tailoring your response to the specific company and role, you’ll be well-prepared to impress the interviewer with your knowledge and enthusiasm for the opportunity.

Ready for those job interviews? Talk to us today about professional opportunities you want to explore.

Share this Post

- The Lookingglass Editorial Team

Since its inception in 1974, John Clements Consultants, Inc. has grown into one of the largest consulting firms in the Philippines today, with a leadership position in the local market and a strengthening presence in the international scene, notably in Asia, the Middle East, and the US.

Quick Links

- For Jobseekers

Client Solutions

- Privacy Policy

- Talent Community Data Privacy

- Executive Search and Selection Division

- Professional Staffers Division

- Staffbuilders Asia Division

- EDI - Staffbuilders International

- Leadership Development Division

Signup To Our Newsletter

Connect with john clements.

Powered by: Web Designer Philippines

Contact Numbers:

- (+632) 8884-1227

- (+632) 8991-1400

Email Address:

Automated page speed optimizations for fast site performance

- Bio-Integrated Microsystems: Electronic, Optoelectronic, Microfluidic, MEMS

- Unusual Format Electronics: Large Area, Flexible and Stretchable

- Optofluidics, Liquid Crystals, Plasmonics, Metamaterials and Photonic Crystals

- Unconventional Techniques for Nanofabrication

- Photovoltaics and Solid State Lighting

- Microstructural Acoustics and Picosecond Ultrasonics

- 1995 and earlier

- research recognition

- teaching awards

- group awards

Rogers Research Group

Linkedin: john rogers, x: @profjohnarogers.

We seek to understand and exploit interesting characteristics of 'soft' materials, such as polymers, liquid crystals, and biological tissues, and hybrid combinations of them with unusual classes of inorganic micro/nanomaterials -- ribbons, wires, membranes, tubes or related. Our aim is to control and induce novel electronic and photonic responses in these materials, and to develop new 'soft lithographic' and biomimetic approaches for patterning them and guiding their growth. This work combines fundamental studies with forward-looking engineering efforts in a way that promotes positive feedback between the two. Our current research focuses on soft materials for conformal electronics, nanophotonic structures, microfluidic devices, and microelectromechanical systems, all lately with an emphasis on bio-inspired and bio-integrated technologies. These efforts are highly multidisciplinary, and combine expertise from nearly every traditional field of technical study.

Professor John A. Rogers

From 2003-2016, he was on the faculty at University of Illinois at Urbana/Champaign, where he held a Swanlund Chair, the highest chaired position at the university, with a primary appointment in the Department of Materials Science and Engineering, and joint appointments in the Departments of Chemistry, Bioengineering, Mechanical Science and Engineering, and Electrical and Computer Engineering. He served as the Director of a Nanoscale Science and Engineering Center on nanomanufacturing, funded by the National Science Foundation, from 2009-2012 and as Director of the Seitz Materials Research Laboratory from 2012 to 2016.

In September of 2016, he joined Northwestern University as the Louis Simpson and Kimberly Querrey Professor of Materials Science and Engineering, Biomedical Engineering, Mechanical Engineering, Electrical Engineering and Computer Science, Chemistry and Neurological Surgery, where he is also the founding Director of the newly endowed Center on Bio-Integrated Electronics, recently elevated to the status of the Querrey-Simpson Institute of Bioelectronics.

Rogers’ research includes fundamental and applied aspects of nano and molecular scale fabrication as well as materials and patterning techniques for unusual electronic and photonic devices, with an emphasis on bio-integrated and bio-inspired systems. He has published more than 800 papers, and is an inventor on over 100 patents and patent applications, more than 70 of which are licensed or in active use by large companies and startups that he has co-founded.

His research has been recognized with many awards including, most recently, the Sigma Xi William Procter Prize for Scientific Achievement (2023), the 2024 IEEE Biomedical Engineering Award (2023), the James Prize in Science and Technology Integration from the National Academy of Sciences (2022), the Washington Award (2022), the Sigma Xi Monie Ferst Award (2021), a Guggenheim Fellowship (2021), the Nano Research Award from the Springer/Nature journal Nano Research (2020), Nancy DeLoye Fitzroy and Roland V. Fitzroy Medal of the ASME (2020), the Herbert Pardes Clinical Research Excellence Award (2020), the Benjamin Franklin Medal from the Franklin Institute (2019), the MRS Medal from the Materials Research Society (2018), the Samuel R. Natelson Award from the American Association for Clinical Chemistry (2018), the Nadai Medal from the American Society of Mechanical Engineers (2017), the IEEE EMBS Trailblazer Award (2016), the ETH Zurich Chemical Engineering Medal (2015), the A.C. Eringen Medal from the Society for Engineering Science (2014), the Smithsonian Award for American Ingenuity in the Physical Sciences (2013), the Robert Henry Thurston Award from the American Society of Mechanical Engineers (2013), the Mid-Career Researcher Award from the Materials Research Society (2013), the Lemelson-MIT Prize (2011), a MacArthur Fellowship from the John D. and Catherine T. MacArthur Foundation (2009), the George Smith Award from the IEEE (2009), the National Security Science and Engineering Faculty Fellowship from the Department of Defense (2008), the Daniel Drucker Eminent Faculty Award from the University of Illinois (2007) and the Leo Hendrick Baekeland Award from the American Chemical Society (2007). Rogers is a member of the National Academy of Engineering (NAE; 2011), the National Academy of Sciences (NAS; 2015), the National Academy of Medicine (NAM; 2019) and the American Academy of Arts and Sciences (AAAS; 2014), a Fellow of the Institute for Electrical and Electronics Engineers (IEEE; 2009), the American Physical Society (APS; 2006), the Materials Research Society (MRS; 2007), the American Association for the Advancement of Science (AAAS; 2008) and the National Academy of Inventors (NAI; 2013). He received an Honoris Causa Doctorate from the Ecole Polytechnique Federale de Lausanne (EPFL), a Doctor of Humane Letters, honoris causa, from the University of Houston, a Doctor of Science, Honoris Causa, from the University of Missouri at Columbia, and holds Honorary Professorships at Fudan University, Shanghai Jiaotong University and Zhejiang University. Rogers was elected as a Laureate of the Order of Lincoln, the highest award bestowed on an individual by the state of Illinois, in 2021 (fewer than 400 laureates have been elected since the program started in 1964).

Rogers has also been named to many distinguished lectureships, including:

Dr R A Mashelkar Endowment Lecture, CSIR-NCL, 2015.

IEEE Distinguished Lecturer, Indian Institute of Technology, Bombay, 2015.

SNU-Dongjin Lectureship, Seoul National University, 2015.

Claritas Distinguished Speaker in Science, Susquehanna University, 2015.

Weissberger/Williams/Farid Lectureship, Kodak Research Labs, 2015.

Fowler Distinguished Lecture, Texas A&M University, 2015.

Inaugural Lecturer for the Institute for Materials Science, Los Alamos National Laboratory, 2015.

'Science at the Edge' Lecturer at Michigan State University, 2015.

College of Engineering Distinguished Lecturer at University Georgia, 2015.

Etter Memorial Lectureship at University of Minnesota, 2015.

Laufer Lectureship at University of Southern California, 2014.

Presidential Lectureship at Northeastern University, 2014.

College of Engineering Distinguished Speaker at University of Texas at Arlington, 2014.

Plenary Lecture, Annual Meeting of the American Association for the Advancement of Science, 2014.

Kavli Foundation Innovations in Chemistry Lecture, American Chemical Society, 2014.

Xingda Lectureship at Peking University, 2013.

Adams Lectureship at Purdue University, 2013.

Presidents Distinguished Lectureship at KAUST, 2013.

Bircher Lectureship at Vanderbilt University, 2013.

Deans Distinguished Lectureship at Northwestern University, 2013.

ET Distinguished Speaker at Applied Materials, 2012.

Wulff Lectureship at M.I.T., 2012.

DB Robinson Distinguished Speaker at University of Alberta, 2012.

GT-COPE Lectureship at Georgia Institute of Technology, 2012.

Nyquist Lectureship at Yale University, 2011.

Judd Distinguished Lecturer at University of Utah, 2011.

ASU Distinguished Scholar and Lecturer at Arizona State University, 2011.

Rohsenow Lectureship at M.I.T., 2011.

Eastman Lectureship in Polymer Science, University of Akron, 2011.

Deans Distinguished Lectureship at Columbia University, 2010.

Nakamura Lectureship at University of California at Santa Barbara, 2010.

Chapman Lectureship (inaugural) at Rice University, 2009.

Zhongguancun Forum Lectureship, Chinese Academy of Sciences, 2007.

Dorn Lectureship at Northwestern University, 2007.

Xerox Distinguished Lectureship at Xerox Corporation, 2006.

Robert B. Woodward Scholar and Lectureship at Harvard University, 2001.

Highlights from 2023/2024 include the first:

- multi-point acousto-mechanical sensing of lung and GI health

- battery-free wireless systems for physiological montoring of small animals

- bioresorbable ultrasound 'tags' for monitoring deep tissue homeostasis

- wireless implants for early detection of kidney failure

Highlights from 2022/2023 include the first:

- responsive materials for safety in bioelectronic systems

- wireless, optoelectronically controlled biobots

- dynamic, shape programmable mechanical metasurfaces

- high performance bio/ecoresobable primary batteries

- passive microfliers for environmental monitoring

Highlights from 2021/2022 include the first:

- soft, bioresorbable coolers for reversible block of pain

- submillimeter-scale, remote controlled multimaterial terrestrial robots

- transient closed-loop wireless body-networked systems for programmed electrotherapy

- eco/bioresorbable microelectromechanical systems

- photocurable bioresorbable adhesives for bioelectronic devices

Highlights from 2020/2021 include the first:

- wireless, skin-interfaced biosensors for cerebral hemodynamic monitoring in pediatric care

- 3D frameworks as multifunctional neural interfaces to cortical spheroids and as frameworks for forming engineered assembloids

- advanced sweat microfluidic systems for real-time tracking of sweat rate/loss for monitoring nutrition and for screening for cystic fibrosis

- wireless, bioresorbable devices as temporary pacemakers

- wirelessly programmable, implantable optoelectronic probes for studies of the neuroscience of social interactions in small animal models

Highlights from 2019/2020 include the first:

- epidermal haptic interfaces for virtual and augmented reality

- physiological sensor systems for the suprasternal notch, from sleep studies to COVID19 monitoring

- advanced wireless devices for neonatal/fetal health, with scaled deployments into Africa

- kiloscale flexible devices for chronic electrocorticography, with demonstrations in non-human primates

- flexible, wireless, fully implantable optoelectronic/fluidic probes as interfaces to the brain, spinal cord and peripheral nerves

Highlights from 2018/2019 include the first:

- bioresorbable electronic medicines for accelerated nerve healing

- closed-loop bio-optoelectronic systems for peripheral neuromodulation

- skin-interfaced platforms for non-invasive monitoring of flow through cerebrospinal shunts

- skin-like wireless devices for clinical grade monitoring of vital signs in neonates

- full brain-scale flexible electronic platforms for high resolution electrocorticography

Highlights from 2017/2018 include the first:

- injectable, optoelectronic filaments for measuring brain activity, in vivo

- hair-like modulus sensors for targeted biopsies

- wireless epidermal sensors for full-body pressure and temperature mapping

- two dimensional semiconductors for bioresorbable electronics

- two dimensional materials for three dimensional cameras

Highlights from 2016/2017 include the first:

- wireless, battery-free fingernail electronics for blood oximetry and PPG

- fully implantable, NFC light emitting probes for optogenetics

- capacitive, active matrix techniques for high resolution electrophysiology

- capillary bursting valves for chrono-sampling and pressure measurements of sweating

- self-assembled 3D coil interconnects in functional electronic systems

Highlights from 2015/2016 include the first:

- thin film encapsulation strategies for chronic, flexible electronic implants

- soft, skin-like microfluidic systems for capture, storage and analysis of sweat

- wireless power harvesting systems and optical sensors for epidermal electronics

- epidermal mechano-acoustic sensing electronics for cardiovascular diagnostics

- bioresorbable silicon electronic sensors for the brain

Highlights from 2014/2015 include the first:

- mechanically driven self-assembly of 3D micro/nanostructures in device-grade silicon

- wireless, injectable optofluidic needles for in vivo pharmacology and optogenetics

- epidermal piezoelectric systems for characterization of soft tissue biomechanics

- auricle-mounted electrodes for persistent brain-computer interfaces

- silk-based resorbable electronics for wireless infection abatement

Highlights from 2013/2014 include the first:

- soft, microfluidic assemblies of sensors, circuits and radios for the skin

- flexible devices for harvesting and storing electrical power from motions of the heart, lung and diaphragm

- 3D electronic integumentary membranes for sensing, actuating across the entire epicardium

- quadruple junction solar cells and modules with world record efficiencies

- biodegradable batteries

Highlights from 2012/2013 include the first:

- physically transient forms of silicon electronics

- injectable, cellular-scale optoelectronics

- compound apposition, 'bug-eye' cameras

- strechable lithium ion batteries

- scalable routes to arrays of semiconducting carbon nanotubes

Highlights from 2011/2012 include the first:

- flexible electronics for high resolution mapping of brain function

- 3D cavity-coupled plasmonic crystals

- electronically 'instrumented' sutures and surgical gloves

- wireless, implantable LEDs and sensors

- stretchable photovoltaics

Highlights from 2010/2011 include the first:

- 'epidermal' electronics

- electronic 'eyeball' cameras with continuously adjustable zoom magnification

- microcell luminescent concentrator photovoltaics

- 'cloak-scale' negative index metamaterials

- multi-functional electronic balloon catheters for interventional cardiology

Highlights from 2009/2010 include the first:

- multilayer, releasable epitaxy for photovoltaics, RF electronics and imaging

- first principles theory for aligned growth of carbon nanotube arrays

- bio-integrated electronics for high resolution cardiac EP mapping

- bio-resorbable devices for neural electrocorticography

- geometrically controlled adhesion in elastomers and use in deterministic assembly

Highlights from 2008/2009 include the first:

- printed microLED lighting systems and displays

- silicon-on-silk electronics for bioresorbable implants

- curvilinear electronics and paraboloid eye cameras

- high resolution, jet printed patterns of charge

- rubber-like silicon CMOS

Highlights from 2007/2008 include the first:

- electronic eye cameras

- stretchable silicon CMOS integrated circuits

- flexible, semi-transparent solar modules based on monocrystalline silicon

- flexible digital logic circuits based on SWNT thin films

- chemically synthesized, 2D carbon nanomaterials

Highlights from 2006/2007 include the first:

- observation and analysis of buckling mechanics in SWNTs

- quasi-3D plasmonics crystals for biosensing and imaging

- SWNT-based RF analog electronics, including the first all-nanotube transistor radios

- methods for electrohydrodynamic jet printing with sub-micron resolution

- routes to multilayer superstructures of aligned SWNTs

Highlights from 2005/2006 include the first:

- stretchable form of single crystal silicon

- GHz flexible transistors on plastic substrates

- single-step two photon 3D nanofabrication technique

- lithographic method with molecular scale (~1 nm) resolution

- printing approach for 3D, heterogeneous integration

- method for growing high density, horizontally aligned SWNTs

copyright 2023

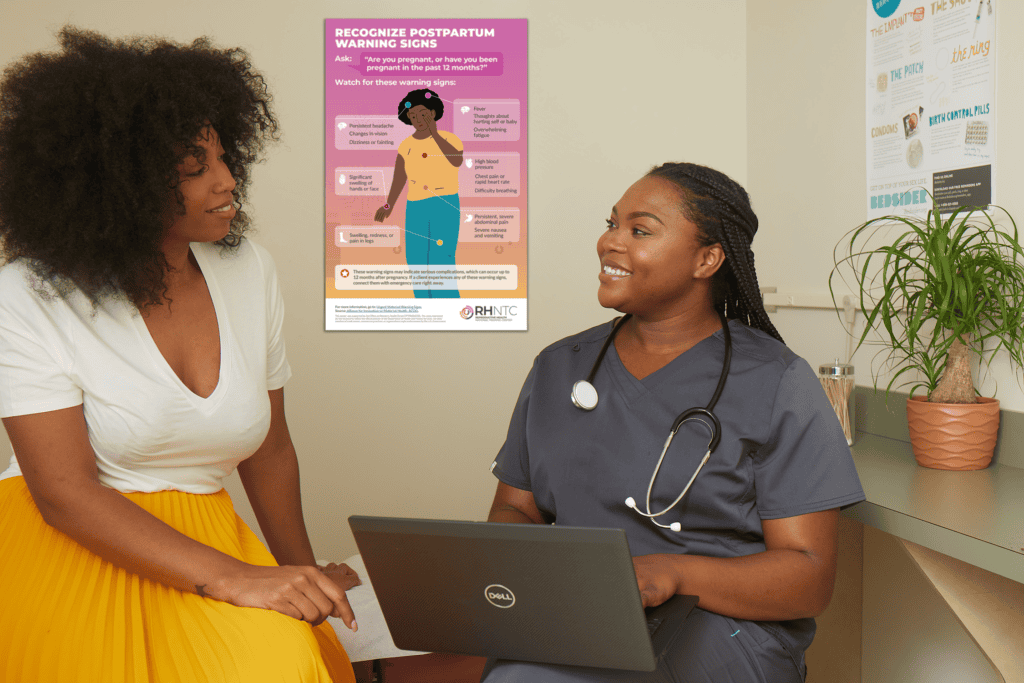

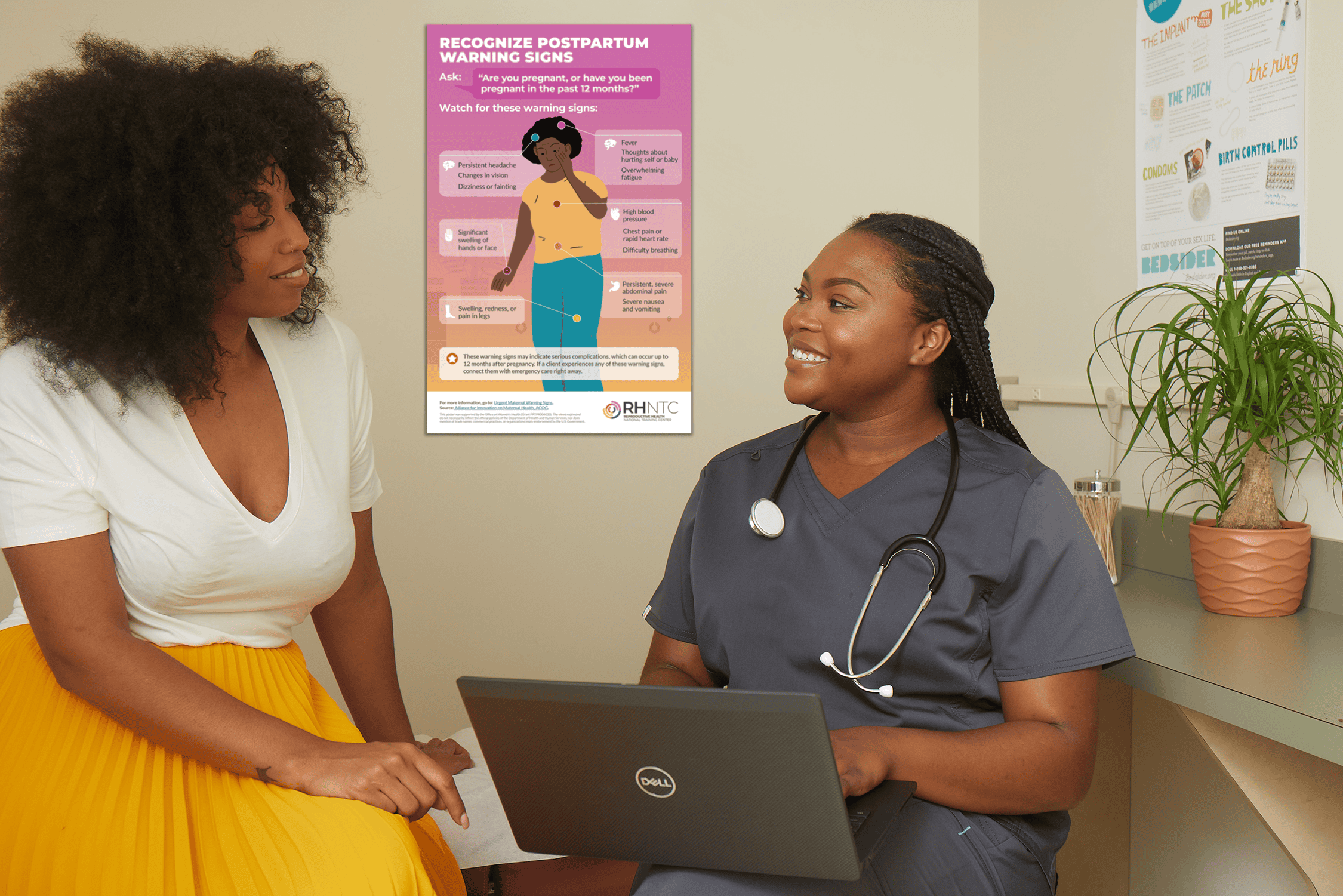

JSI is a global nonprofit dedicated to improving lives around the world through greater health, education, and socio-economic equity for individuals and communities.

LATEST NEWS & STORIES

View all news.

The Value of Strategic Partnerships for Improving Maternal Health

JSI Recognized by 2024 Indigo Design Awards

How We Define Quality in Health Care: Finding Common Ground for Better Outcomes

Women’s Community Groups Connect Urban Areas to Primary Health Care Services in India

Lessons Learned and Relearned to Improve Routine Childhood Vaccination: Six Insights from the COVID-19 Pandemic

Localized Solutions and Strategic Partnerships to Eliminate TB

JSI Elects Four New Members to its Board of Directors

Celebrating Tuberculosis Reduction in the Kyrgyz Republic

Injectable HIV-prevention Drug Launches in Zambia

International improving the health of people & communities.

Our international work improves quality, access, and equity within health systems worldwide. We focus on multidisciplinary, gender-sensitive development approaches that galvanize countries, communities, families, and individuals to advance their own skills and create lasting solutions to their priority health and development challenges. Drawing on our experience in the field—with others in the private, governmental, and nongovernmental sectors—we shape and advance the global public health agenda.

UNITED STATES Strengthening public health systems in the United States

We address complex public health problems to effect systems and policy changes in pursuit of health and equity. We develop innovative and inclusive methods to evaluate and strengthen publicly funded health systems and collaborate with clients and partners using customized approaches. All of our partnership work is rooted in a shared desire to improve the health of individuals and communities.

WHERE WE WORK

Subscribe To Our Newsletter

Email Please leave this field empty.

Check out our past newsletters .

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Research: What Companies Don’t Know About How Workers Use AI

- Jeremie Brecheisen

Three Gallup studies shed light on when and why AI is being used at work — and how employees and customers really feel about it.

Leaders who are exploring how AI might fit into their business operations must not only navigate a vast and ever-changing landscape of tools, but they must also facilitate a significant cultural shift within their organizations. But research shows that leaders do not fully understand their employees’ use of, and readiness for, AI. In addition, a significant number of Americans do not trust business’ use of AI. This article offers three recommendations for leaders to find the right balance of control and trust around AI, including measuring how their employees currently use AI, cultivating trust by empowering managers, and adopting a purpose-led AI strategy that is driven by the company’s purpose instead of a rules-heavy strategy that is driven by fear.

If you’re a leader who wants to shift your workforce toward using AI, you need to do more than manage the implementation of new technologies. You need to initiate a profound cultural shift. At the heart of this cultural shift is trust. Whether the use case for AI is brief and experimental or sweeping and significant, a level of trust must exist between leaders and employees for the initiative to have any hope of success.

- Jeremie Brecheisen is a partner and managing director of The Gallup CHRO Roundtable.

Partner Center

McKinsey Global Private Markets Review 2024: Private markets in a slower era

At a glance, macroeconomic challenges continued.

McKinsey Global Private Markets Review 2024: Private markets: A slower era

If 2022 was a tale of two halves, with robust fundraising and deal activity in the first six months followed by a slowdown in the second half, then 2023 might be considered a tale of one whole. Macroeconomic headwinds persisted throughout the year, with rising financing costs, and an uncertain growth outlook taking a toll on private markets. Full-year fundraising continued to decline from 2021’s lofty peak, weighed down by the “denominator effect” that persisted in part due to a less active deal market. Managers largely held onto assets to avoid selling in a lower-multiple environment, fueling an activity-dampening cycle in which distribution-starved limited partners (LPs) reined in new commitments.

About the authors

This article is a summary of a larger report, available as a PDF, that is a collaborative effort by Fredrik Dahlqvist , Alastair Green , Paul Maia, Alexandra Nee , David Quigley , Aditya Sanghvi , Connor Mangan, John Spivey, Rahel Schneider, and Brian Vickery , representing views from McKinsey’s Private Equity & Principal Investors Practice.

Performance in most private asset classes remained below historical averages for a second consecutive year. Decade-long tailwinds from low and falling interest rates and consistently expanding multiples seem to be things of the past. As private market managers look to boost performance in this new era of investing, a deeper focus on revenue growth and margin expansion will be needed now more than ever.

Perspectives on a slower era in private markets

Global fundraising contracted.