Making capital structure support strategy

CFOs invariably ask themselves two related questions when managing their balance sheets: should they return excess cash to shareholders or invest it and should they finance new projects by adding debt or drawing on equity? Indeed, achieving the right capital structure the composition of debt and equity that a company uses to finance its operations and strategic investments has long vexed academics and practitioners alike. 1 1. Franco Modigliani and Merton Miller, “The cost of capital, corporate finance, and the theory of investment,” American Economic Review, June 1958, Number 48, pp. 261–97. Some focus on the theoretical tax benefit of debt, since interest expenses are often tax deductible. More recently, executives of public companies have wondered if they, like some private equity firms, should use debt to increase their returns. Meanwhile, many companies are holding substantial amounts of cash and deliberating on what to do with it.

The issue is more nuanced than some pundits suggest. In theory, it may be possible to reduce capital structure to a financial calculation to get the most tax benefits by favoring debt, for example, or to boost earnings per share superficially through share buybacks. The result, however, may not be consistent with a company’s business strategy, particularly if executives add too much debt. 2 2. There is also some potential for too little debt, though the consequences aren’t as dire. In the 1990s, for example, many telecommunications companies financed the acquisition of third-generation (3G) licenses entirely with debt, instead of with equity or some combination of debt and equity, and they found their strategic options constrained when the market fell.

Indeed, the potential harm to a company’s operations and business strategy from a bad capital structure is greater than the potential benefits from tax and financial leverage. Instead of relying on capital structure to create value on its own, companies should try to make it work hand in hand with their business strategy, by striking a balance between the discipline and tax savings that debt can deliver and the greater flexibility of equity. In the end, most industrial companies can create more value by making their operations more efficient than they can with clever financing. 3 3. Richard Dobbs and Werner Rehm, “ The value of share buybacks ,” McKinsey on Finance , Number 16, Summer 2005, pp. 16–20.

Capital structure’s long-term impact

Capital structure affects a company’s overall value through its impact on operating cash flows and the cost of capital. Since the interest expense on debt is tax deductible in most countries, a company can reduce its after-tax cost of capital by increasing debt relative to equity, thereby directly increasing its intrinsic value. While finance textbooks often show how the tax benefits of debt have a wide-ranging impact on value, they often use too low a discount rate for those benefits. In practice, the impact is much less significant for large investment-grade companies (which have a small relevant range of capital structures). Overall, the value of tax benefits is quite small over the relevant levels of interest coverage (Exhibit 1). For a typical investment-grade company, the change in value over the range of interest coverage is less than 5 percent.

Tax benefits of debt are often negligible.

The effect of debt on cash flow is less direct but more significant. Carrying some debt increases a company’s intrinsic value because debt imposes discipline; a company must make regular interest and principal payments, so it is less likely to pursue frivolous investments or acquisitions that don’t create value. Having too much debt, however, can reduce a company’s intrinsic value by limiting its flexibility to make value-creating investments of all kinds, including capital expenditures, acquisitions, and, just as important, investments in intangibles such as business building, R&D, and sales and marketing.

Managing capital structure thus becomes a balancing act. In our view, the trade-off a company makes between financial flexibility and fiscal discipline is the most important consideration in determining its capital structure and far outweighs any tax benefits, which are negligible for most large companies unless they have extremely low debt. 4 4. At extremely low levels of debt, companies can create greater value by increasing debt to more typical levels.

Mature companies with stable and predictable cash flows as well as limited investment opportunities should include more debt in their capital structure, since the discipline that debt often brings outweighs the need for flexibility. Companies that face high uncertainty because of vigorous growth or the cyclical nature of their industries should carry less debt, so that they have enough flexibility to take advantage of investment opportunities or to deal with negative events.

Not that a company’s underlying capital structure never creates intrinsic value; sometimes it does. When executives have good reason to believe that a company’s shares are under- or overvalued, for example, they might change the company’s underlying capital structure to create value either by buying back undervalued shares or by using overvalued shares instead of cash to pay for acquisitions. Other examples can be found in cyclical industries, such as commodity chemicals, where investment spending typically follows profits. Companies invest in new manufacturing capacity when their profits are high and they have cash. 5 5. Thomas Augat, Eric Bartels, and Florian Budde, “Multiple choice for the chemical industry,” The McKinsey Quarterly , 2003 Number 3, pp. 126–36. Unfortunately, the chemical industry’s historical pattern has been that all players invest at the same time, which leads to excess capacity when all of the plants come on line simultaneously. Over the cycle, a company could earn substantially more than its competitors if it developed a countercyclical strategic capital structure and maintained less debt than might otherwise be optimal. During bad times, it would then have the ability to make investments when its competitors couldn’t.

A practical framework for developing capital structure

A company can’t develop its capital structure without understanding its future revenues and investment requirements. Once those prerequisites are in place, it can begin to consider changing its capital structure in ways that support the broader strategy. A systematic approach can pull together steps that many companies already take, along with some more novel ones.

The case of one global consumer product business is illustrative. Growth at this company we’ll call it Consumerco has been modest. Excluding the effect of acquisitions and currency movements, its revenues have grown by about 5 percent a year over the past five years. Acquisitions added a further 7 percent annually, and the operating profit margin has been stable at around 14 percent. Traditionally, Consumerco held little debt: until 2001, its debt to enterprise value was less than 10 percent. In recent years, however, the company increased its debt levels to around 25 percent of its total enterprise value in order to pay for acquisitions. Once they were complete, management had to decide whether to use the company’s cash flows, over the next several years, to restore its previous low levels of debt or to return cash to its shareholders and hold debt stable at the higher level. The company’s decision-making process included the following steps.

Estimate the financing deficit or surplus.

Set a target credit rating., develop a target debt level over the business cycle., forecasting the financing debt or surplus.

In the example of Consumerco, executives used a simple downside scenario relative to the base case to adjust for the uncertainty of future cash flows. A more sophisticated approach might be useful in some industries such as commodities, where future cash flows could be modeled using stochastic-simulation techniques to estimate the probability of financial distress at the various debt levels illustrated in Exhibit 3.

Modeling future cash flows with stochastic simulation

The final step in this approach is to determine how the company should move to the target capital structure. This transition involves deciding on the appropriate mix of new borrowing, debt repayment, dividends, share repurchases, and share issuances over the ensuing years.

A company with a surplus of funds, such as Consumerco, would return cash to shareholders either as dividends or share repurchases. Even in the downside scenario, Consumerco will generate €1.7 billion of cash above its target EBITA-to-interest-expense ratio.

For one approach to distributing those funds to shareholders, consider the dividend policy of Consumerco. Given its modest growth and strong cash flow, its dividend payout ratio is currently low. The company could easily raise that ratio to 45 percent of earnings, from 30 percent. Increasing the regular dividend sends the stock market a strong signal that Consumerco thinks it can pay the higher dividend comfortably. The remaining €1.3 billion would then typically be returned to shareholders through share repurchases over the next several years. Because of liquidity issues in the stock market, Consumerco might be able to repurchase only about 1 billion, but it could consider issuing a one-time dividend for the remainder.

The signaling effect 6 6. The market’s perception that a buyback shows how confident management is that the company’s shares are undervalued, for example, or that it doesn’t need the cash to cover future commitments, such as interest payments and capital expenditures. is probably the most important consideration in deciding between dividends and share repurchases. Companies should also consider differences in the taxation of dividends and share buybacks, as well as the fact that shareholders have the option of not participating in a repurchase, since the cash they receive must be reinvested.

While these tax and signaling effects are real, they mainly affect tactical choices about how to move toward a defined long-term target capital structure, which should ultimately support a company’s business strategies by balancing the flexibility of lower debt with the discipline (and tax savings) of higher debt.

Marc Goedhart is an associate principal in McKinsey’s Amsterdam office; Tim Koller is a partner and Werner Rehm is a consultant in the New York office.

This article was first published in the Winter 2006 issue of McKinsey on Finance .

Explore a career with us

Related articles.

The value of share buybacks

Measuring long-term performance

- Search Search Please fill out this field.

What Is Capital?

Understanding capital, how capital is used, business capital structure, types of capital, capital vs. money.

- Capital FAQs

The Bottom Line

Capital: definition, how it's used, structure, and types in business.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Capital is a broad term that can describe anything that confers value or benefit to its owners, such as a factory and its machinery, intellectual property like patents, or the financial assets of a business or an individual.

While money itself may be construed as capital, capital is more often associated with cash that is being put to work for productive or investment purposes. In general, capital is a critical component of running a business from day to day and financing its future growth.

Business capital may derive from the operations of the business or be raised from debt or equity financing. Common sources of capital include:

- Personal savings

- Friends and family

- Angel investors

- Venture capitalists (VC)

- Corporations

- Federal, state, or local governments

- Private loans

- Work or business operations

- Going public with an IPO

When budgeting, businesses of all kinds typically focus on three types of capital: working capital, equity capital, and debt capital. A business in the financial industry identifies trading capital as a fourth component.

Learn more about the types, sources, and structures of capital.

Key Takeaways

- The capital of a business is the money it has available to pay for its day-to-day operations and to fund its future growth.

- The four major types of capital include working capital, debt, equity, and trading capital. Trading capital is used by brokerages and other financial institutions.

- Any debt capital is offset by a debt liability on the balance sheet.

- The capital structure of a company determines what mix of these types of capital it uses to fund its business.

- Economists look at the capital of a family, a business, or an entire economy to evaluate how efficiently it is using its resources.

Investopedia / Matthew Collins

From the economists' perspective, capital is key to the functioning of any unit, whether that unit is a family, a small business, a large corporation, or an entire economy.

Capital assets can be found on either the current or long-term portion of the balance sheet. These assets may include cash, cash equivalents, and marketable securities as well as manufacturing equipment, production facilities, and storage facilities.

In the broadest sense, capital can be a measurement of wealth and a resource for increasing wealth. Individuals hold capital and capital assets as part of their net worth. Companies have capital structures that define the mix of debt capital, equity capital, and working capital for daily expenditures that they use.

Capital is typically cash or liquid assets being held or obtained for expenditures. In a broader sense, the term may be expanded to include all of a company’s assets that have monetary value, such as its equipment, real estate, and inventory. But when it comes to budgeting, capital is cash flow.

In general, capital can be a measurement of wealth and also a resource that provides for increasing wealth through direct investment or capital project investments. Individuals hold capital and capital assets as part of their net worth. Companies have capital structures that include debt capital, equity capital, and working capital for daily expenditures.

How individuals and companies finance their working capital and invest their obtained capital is critical for their prosperity.

Capital is used by companies to pay for the ongoing production of goods and services to create profit. Companies use their capital to invest in all kinds of things to create value. Labor and building expansions are two common areas of capital allocation. By investing capital, a business or individual seeks to earn a higher return than the capital's costs.

At the national and global levels, financial capital is analyzed by economists to understand how it is influencing economic growth. Economists watch several metrics of capital including personal income and personal consumption from the Commerce Department’s Personal Income and Outlays reports. Capital investment also can be found in the quarterly Gross Domestic Product report.

Typically, business capital and financial capital are judged from the perspective of a company’s capital structure. In the U.S., banks are required to hold a minimum amount of capital as a risk mitigation requirement (sometimes called economic capital ) as directed by the central banks and banking regulations.

Other private companies are responsible for assessing their capital thresholds, capital assets, and capital needs for corporate investment. Most of the financial capital analysis for businesses is done by closely analyzing the balance sheet.

A company’s balance sheet provides for metric analysis of a capital structure, which is split among assets, liabilities, and equity. The mix defines the structure.

Debt financing represents a cash capital asset that must be repaid over time through scheduled liabilities. Equity financing, meaning the sale of stock shares, provides cash capital that is also reported in the equity portion of the balance sheet. Debt capital typically comes with lower rates of return and strict provisions for repayment.

Some of the key metrics for analyzing business capital are weighted average cost of capital, debt to equity, debt to capital, and return on equity.

Below are the top four types of capital that businesses focus on in more detail

Debt Capital

A business can acquire capital by borrowing. This is debt capital, and it can be obtained through private or government sources. For established companies, this most often means borrowing from banks and other financial institutions or issuing bonds. For small businesses starting on a shoestring, sources of capital may include friends and family, online lenders, credit card companies, and federal loan programs.

Like individuals, businesses must have an active credit history to obtain debt capital. Debt capital requires regular repayment with interest. The interest rates vary depending on the type of capital obtained and the borrower’s credit history.

Individuals quite rightly see debt as a burden, but businesses see it as an opportunity, at least if the debt doesn't get out of hand. It is the only way that most businesses can obtain a large enough lump sum to pay for a major investment in the future. But both businesses and their potential investors need to keep an eye on the debt to capital ratio to avoid getting in too deep.

Issuing bonds is a favorite way for corporations to raise debt capital, especially when prevailing interest rates are low, making it cheaper to borrow. In 2020, for example, corporate bond issuance by U.S. companies soared 70% year over year, according to Moody's Analytics. Average corporate bond yields had then hit a multi-year low of about 2.3%.

Equity Capital

Equity capital can come in several forms. Typically, distinctions are made between private equity, public equity, and real estate equity.

Private and public equity will usually be structured in the form of shares of stock in the company. The only distinction here is that public equity is raised by listing the company's shares on a stock exchange while private equity is raised among a closed group of investors.

When an individual investor buys shares of stock, they are providing equity capital to a company. The biggest splashes in the world of raising equity capital come, of course, when a company launches an initial public offering (IPO). In 2021, the Duolingo IPO valued the company at $5 million and shook the Nasdaq market.

Working Capital

A company's working capital is its liquid capital assets available for fulfilling daily obligations. It is calculated through the following two assessments:

- Current Assets – Current Liabilities

- Accounts Receivable + Inventory – Accounts Payable

Working capital measures a company's short-term liquidity. More specifically, it represents its ability to cover its debts, accounts payable, and other obligations that are due within one year.

Note that working capital is defined as current assets minus its current liabilities. A company that has more liabilities than assets could soon run short of working capital.

Trading Capital

Any business needs a substantial amount of capital to operate and create profitable returns. Balance sheet analysis is central to the review and assessment of business capital.

Trading capital is a term used by brokerages and other financial institutions that place a large number of trades daily. Trading capital is the amount of money allotted to an individual or a firm to buy and sell various securities.

Investors may attempt to add to their trading capital by employing a variety of trade optimization methods. These methods attempt to make the best use of capital by determining the ideal percentage of funds to invest with each trade.

In particular, to be successful, traders need to determine the optimal cash reserves required for their investing strategies.

A big brokerage firm like Charles Schwab or Fidelity Investments will allocate considerable trading capital to each of the professionals who trade stocks and other assets for it.

At its core, capital is money. However, for financial and business purposes, capital is typically viewed from the perspective of current operations and investments in the future.

Capital usually comes with a cost. For debt capital, this is the cost of interest required in repayment. For equity capital, this is the cost of distributions made to shareholders. Overall, capital is deployed to help shape a company's development and growth .

What Does Capital Mean in Economics?

To an economist, capital usually means liquid assets. In other words, it's cash in hand that is available for spending, whether on day-to-day necessities or long-term projects. On a global scale, capital is all of the money that is currently in circulation, being exchanged for day-to-day necessities or longer-term wants.

What Is the Capital in a Business?

The capital of a business is the money it has available to fund its day-to-day operations and to bankroll its expansion for the future. The proceeds of its business are one source of capital.

Capital assets are generally a broader term. The capital assets of an individual or a business may include real estate, cars, investments (long or short-term), and other valuable possessions. A business may also have capital assets including expensive machinery, inventory, warehouse space, office equipment, and patents held by the company.

Many capital assets are illiquid—that is, they can't be readily turned into cash to meet immediate needs.

A company that totaled up its capital value would include every item owned by the business as well as all of its financial assets (minus its liabilities). But an accountant handling the day-to-day budget of the company would consider only its cash on hand as its capital.

What Are Examples of Capital?

Any financial asset that is being used may be capital. The contents of a bank account, the proceeds of a sale of stock shares, or the proceeds of a bond issue all are examples. The proceeds of a business's current operations go onto its balance sheet as capital.

What Are the 3 Sources of Capital?

Most businesses distinguish between working capital, equity capital, and debt capital, although they overlap.

- Working capital is the money needed to meet the day-to-day operation of the business and pay its obligations promptly.

- Equity capital is raised by issuing shares in the company, publicly or privately, and is used to fund the expansion of the business.

- Debt capital is borrowed money. On the balance sheet, the amount borrowed appears as a capital asset while the amount owed appears as a liability.

The word capital has several meanings depending on its context.

On a company balance sheet, capital is money available for immediate use, whether to keep the day-to-day business running or to launch a new initiative. It may be defined on its balance sheet as working capital, equity capital, or debt capital, depending on its origin and intended use. Brokerages also list trading capital; that is the cash available for routine trading in the markets.

When a company defines its overall capital assets, it generally will include all of its possessions that have a cash value, such as equipment and real estate.

When economists look at capital, they are most often looking at the cash in circulation within an entire economy. Some of the major national economic indicators are the ups and downs of all of the cash in circulation. One example is the monthly Personal Income and Outlays report from the U.S. Bureau of Economic Analysis.

Federal Reserve Board. " Policy Tools: Reserve Requirements ."

Moody's Analytics. " Corporate Bond Issuance Boom May Steady Credit Quality, On Balance ."

St. Louis Fed. " Moody's Seasoned Aaa Corporate Bond Yield ."

CNBC. " Duolingo Closes Up 36% in Nasdaq Debut ."

Bureau of Economic Analysis. " Personal Income ."

:max_bytes(150000):strip_icc():format(webp)/71017529-5bfc2b8dc9e77c0026b4f91d.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Business Capital Structure

Business capital structure refers to the mix of financing a company uses to fund its operations and growth. This structure typically includes a combination of debt and equity. Debt may come in the form of loans, bonds, or other borrowings, while equity generally refers to shares of stock in the company, which could be common or preferred shares.

The choice of capital structure is crucial because it influences the company’s risk profile, cost of capital, and value and ability to compete in the marketplace. A well-balanced capital structure is critical to maintaining financial flexibility and stability, enabling companies to weather economic downturns and capitalize on growth opportunities.

Companies strive to optimize their capital structure by finding the right balance between debt and equity to minimize the overall cost of capital. This balance depends on various factors, including market conditions, the company’s operational risk, tax considerations, and the costs associated with different financing options.

Creating an optimal capital structure for a business involves several steps and considerations. The goal is to balance debt and equity to minimize the company’s cost of capital while maximizing its value and maintaining financial flexibility.

Financial Strategy: Full Explanation with Examples

Here’s a general approach to designing a business capital structure:

Step 1: assess business goals and strategy.

Assessing business goals and strategy is a crucial first step in developing an optimal capital structure, as it sets the foundation for all subsequent financial decisions. This process involves a comprehensive evaluation of where the company wants to go and how it plans to get there. Here’s a detailed look into this step:

- Growth Objectives: Identify the company’s growth targets, including expanding into new markets, increasing product lines, or scaling operations. Understanding these goals helps determine the amount and type of capital required.

- Profitability Targets: Set clear profitability goals, as these will influence the company’s risk tolerance and financing preferences.

- Market Expansion: Strategies for entering new markets or segments can significantly influence capital needs, particularly regarding the timing and size of investments.

- Product Development: New product or service plans may require upfront investment, impacting the choice between debt and equity financing.

- Operational Efficiency: Initiatives to improve efficiency might reduce the need for external funding by freeing up internal cash flows.

- Industry Analysis: Understanding the industry’s competitive dynamics, including competitors’ actions, can influence strategic priorities and the urgency of capital needs.

- Market Position: Evaluate the company’s current market position and how it aims to evolve in the context of its industry. This can affect risk tolerance and the preferred pace of growth.

- Financial Risk: Determine the level of financial risk the company is willing to take on, considering factors like market volatility, operational risks, and the predictability of cash flows.

- Strategic Risk: Assess the willingness to pursue aggressive growth strategies or enter new, untested markets, which can influence the preference for more flexible or conservative financing options.

- Shareholders: Understand the expectations of existing and potential shareholders regarding growth, risk, and returns. This can shape decisions around equity issuance and dividend policies.

- Debt Holders: Consider the perspectives of current and potential lenders, as their tolerance for risk and expectations for repayment can affect the terms and availability of debt financing.

- Sustainability and Social Responsibility: Align strategic goals with the company’s core values, such as sustainability practices or community engagement, which can influence brand perception and customer loyalty.

- Innovation Focus: If innovation is a core strategic pillar, the capital structure should support sustained investment in research and development.

Step 2: Analyze Current Financial Position

Analyzing the current financial position of a business is a critical step in developing an adequate capital structure. This process involves a detailed examination of the company’s financial statements and performance metrics to understand its financial health, strengths, and weaknesses. Here’s a breakdown of how to conduct this analysis:

- Balance Sheet: Examine assets, liabilities, and equity to understand the company’s financial stability, liquidity, and capital base. Key ratios like the debt-to-equity ratio can provide insights into the current capital structure.

- Income Statement: Analyze revenues, expenses, and profits to assess the company’s earning capacity and operational efficiency. Profit margins and trends over time are significant.

- Cash Flow Statement: Evaluate cash flows from operating, investing, and financing activities to understand the company’s liquidity and cash management practices.

- Liquidity Ratios: Calculate current and quick ratios to evaluate the company’s ability to meet short-term obligations. This can influence decisions regarding the need for working capital financing.

- Solvency Ratios: Use ratios like the debt-to-equity and interest coverage ratios to assess the company’s long-term solvency and capacity to take on additional debt.

- Return on Equity (ROE): Measure how effectively the company uses shareholders’ equity to generate profit. A higher ROE indicates efficient use of equity financing.

- Return on Assets (ROA): Assess how efficiently the company utilizes its assets to generate earnings. This can indicate the effectiveness of the company’s capital investments.

- Debt Maturity Profile: Review the schedule of debt maturities to understand upcoming refinancing needs and potential liquidity pressures.

- Cost of Debt: Examine the interest rates and terms of existing debt to gauge the cost of debt and the company’s attractiveness to lenders.

- Shareholder Equity: Analyze the composition of shareholder equity, including standard and preferred shares, to understand the equity base and potential for dilution.

- Dividend Policy: Consider the company’s dividend policy and history, as this can impact retained earnings and the availability of internal funds for reinvestment.

- Highlight areas of financial strength, such as strong cash flow generation or a solid equity base, which can support strategic initiatives and investments.

- Identify weaknesses or vulnerabilities, such as high leverage or liquidity constraints, which could limit the company’s financial flexibility and risk tolerance.

- Market Conditions: Evaluate how current market conditions, such as interest rates and investor sentiment, might impact the company’s financial position and access to capital.

- Industry Benchmarks: Compare the company’s financial metrics with industry benchmarks to identify areas of competitive advantage or concern.

Step 3: Determine Capital Needs

Determining capital needs is a critical step in creating an adequate capital structure. It involves estimating the funding a company will require to meet its strategic objectives, such as expansion, acquisition, or investment in new technology. This process ensures that the company secures the right amount of financing at the right time to support its growth and operational goals without unnecessarily increasing its cost of capital or financial risk. Here’s how to approach this:

- Business Expansion: Estimate the costs associated with expanding the business, including market entry, new facilities, additional staff, and increased production capacity.

- Capital Expenditures: Plan investments in long-term assets such as property, plant, and equipment necessary to increase or maintain the company’s productive capacity.

- Research and Development: Budget for R&D activities if innovation and product development are critical to the company’s competitive strategy.

- Inventory Needs: Assess the capital needed to maintain or increase inventory levels to support sales growth or production demands.

- Receivables and Payables: Consider the impact of credit terms and payment cycles on cash flow and working capital needs.

- Cash Reserves: Determine the need for cash reserves to manage operational fluctuations and unexpected expenses.

- Existing Debt: Identify upcoming debt maturities and the need to refinance existing obligations. Consider the potential impact of refinancing on interest costs and cash flow.

- Repayment Capacity: Assess the company’s ability to generate sufficient cash flow to meet its debt repayment obligations without compromising its operational needs.

- Mergers and Acquisitions: Estimate the financial outlay for potential M&A activities, including purchase price, integration costs, and any necessary restructuring.

- Strategic Partnerships: Budget for investments or contributions required to enter into strategic alliances or joint ventures.

- Market and Economic Risks: Factor in potential market volatility and economic fluctuations that could affect revenue projections and capital requirements.

- Operational Risks: Consider supply chain disruptions or regulatory changes that might necessitate unplanned expenditures.

- Growth Opportunities: Reserve some capacity for seizing unexpected opportunities that align with the company’s strategic objectives.

- Contingency Planning: Include a buffer to address unforeseen challenges or emergencies that could impact the company’s financial position.

- Develop a comprehensive financial model that projects the company’s income statement, balance sheet, and cash flow statement under various scenarios. This model should incorporate all identified capital needs and assumptions about revenue growth, cost trends, and investment requirements.

- Regularly revisit and update the capital needs assessment to reflect changes in the business environment, operational performance, and strategic direction.

Step 4: Evaluate Financing Options

Evaluating financing options is a key step in developing a capital structure that supports a company’s strategic goals while minimizing costs and risks. This process involves considering various sources of financing, each with its advantages, disadvantages, and implications for the company’s financial health and ownership structure. Here’s a detailed look into how to evaluate these options:

- Bank Loans: Examine terms, interest rates, and covenants of traditional bank loans. Consider the impact of these loans on cash flow and financial flexibility.

- Bonds: Assess the feasibility of issuing corporate bonds, which offer lower interest rates than bank loans but come with fixed payment obligations and potential market risks.

- Mezzanine Financing: Explore mezzanine debt, a debt and equity financing hybrid that often includes options or warrants that lenders can convert into equity.

- Interest payments are tax-deductible, potentially lowering the overall cost of capital.

- Debt does not dilute ownership stakes in the company.

- Requires regular interest payments, which can strain cash flow.

- May include restrictive covenants that limit operational flexibility.

- Issuing Shares: Consider raising capital by issuing new shares of common or preferred stock. Evaluate the potential impact on existing ownership and control.

- Venture Capital and Private Equity: For startups and growth companies, look into equity investments from venture capital or private equity firms, which may also provide strategic support.

- Does not require regular interest payments, thus lessening immediate cash flow pressures.

- Equity investors often bring valuable expertise and networks.

- Dilutes existing ownership and potentially reduces control over the company.

- It may involve higher expectations for growth and returns from new equity holders.

- Leasing: Consider leasing to reduce upfront capital expenditure instead of purchasing assets.

- Crowdfunding: For specific projects or ventures, crowdfunding platforms can be a source of capital from a broad base of small investors.

- Government Grants and Incentives: Explore available grants, subsidies, or tax incentives that can provide funding or reduce costs without repayment.

- Calculate the cost of each financing option, including interest rates for debt and expected returns for equity investors.

- Use the Weighted Average Cost of Capital (WACC) to assess the overall cost of combining various financing sources.

- Evaluate each financing option’s financial and operational risks, including the impact on the company’s debt levels and operational flexibility.

- Consider the market and economic risks that could affect the availability and cost of different financing sources.

- Align financing choices with the company’s strategic objectives, risk tolerance, and growth plans. For example, companies with volatile earnings might prefer equity to avoid the cash flow pressures of debt repayment.

- For each potential financing source, negotiate the best possible terms, including interest rates, repayment schedules, and covenants for debt, as well as valuation and ownership stakes for equity.

- Ensure that the chosen financing options comply with all relevant regulations and reporting requirements, especially for publicly traded companies.

Step 5: Consider the Cost of Capital

Considering the cost of capital is essential when structuring a business’s capital to ensure that the financing strategy supports the company’s goals without imposing undue financial burden. The cost of capital represents the return investors expect the company to generate to justify the risk of investing in it. It includes the cost of debt (interest payments) and the cost of equity (dividends or capital gains expected by shareholders). Here’s how to approach this:

- Interest Rates: Determine the interest rates on existing and potential new debt. This rate reflects the lender’s assessment of the company’s lending risk.

- Tax Impact: Since interest payments on debt are typically tax-deductible, calculate the after-tax cost of debt by adjusting the interest rate for the company’s tax rate.

- Dividend Discount Model (DDM): If the company pays regular dividends, use the DDM, which calculates the cost of equity based on the dividend per share, expected growth in dividends, and current stock price.

- Capital Asset Pricing Model (CAPM): The CAPM considers the risk-free rate, the equity beta (which measures the stock’s volatility relative to the market), and the expected market return to estimate the cost of equity.

- Weighting Components: Combine the cost of debt and the cost of equity according to their proportions in the company’s capital structure to calculate the WACC. The WACC provides a comprehensive view of the company’s average capital cost.

- Formula: WACC = (% Equity × Cost of Equity) + (% Debt × Cost of Debt × (1 – Tax Rate))

- Benchmark for Projects: Use the WACC to assess the expected returns on new investments or projects. Projects with returns above the WACC can potentially add value to the company.

- Strategic Decisions: Consider the WACC when making strategic decisions about financing, such as issuing new equity or debt, to ensure that these actions do not unfavorably impact the company’s cost of capital.

- Market Conditions: Understand that the cost of capital can fluctuate with market interest rates, investor sentiment, and the company’s financial performance and risk profile.

- Company-Specific Factors: Credit ratings, industry sector, operational risks, and growth prospects can significantly influence the cost of debt and equity.

- Optimization: Aim to optimize the capital structure to achieve the lowest possible WACC without compromising financial flexibility or taking on excessive risk.

- Regular Review: Continuously monitor the capital structure and cost of capital, especially in response to significant changes in the business environment, market conditions, or the company’s operational performance.

- Adjustments: Be prepared to adjust the capital structure as needed to maintain an optimal cost of capital, which may involve refinancing debt, issuing or repurchasing equity, or altering investment strategies.

Step 6: Analyze Risk and Flexibility

Analyzing risk and flexibility is critical to developing an adequate capital structure. This step involves assessing the financial and operational risks associated with different financing options and ensuring that the capital structure allows the company to adapt to changes and seize opportunities. Here’s how to approach this analysis:

- Debt Levels: High debt levels increase financial risk due to the obligation to make regular interest payments and repay the principal. Assess the company’s ability to meet these obligations under various economic scenarios.

- Interest Rate Risk: For debt with variable interest rates, consider the risk of rising interest rates increasing the cost of debt and impacting cash flows.

- Refinancing Risk: Evaluate the risk associated with refinancing existing debt, especially in adverse market conditions where refinancing might be more costly or complicated.

- Business Cycle Sensitivity: Analyze how sensitive the company’s operations and cash flows are to economic cycles. Companies in cyclical industries may need a more conservative capital structure to weather downturns.

- Industry-Specific Risks: Consider risks unique to the company’s industry, such as regulatory changes, technological advancements, or supply chain disruptions, that could affect operational stability and financial performance.

- Access to Capital: Evaluate the company’s access to various sources of capital, including banks, capital markets, and alternative financing. A diverse range of accessible financing options enhances flexibility.

- Cash Reserves: Assess the adequacy of cash reserves to cover unexpected needs or take advantage of strategic opportunities without needing immediate external financing.

- Covenant Restrictions: Review the covenants associated with any existing debt to understand the constraints they may place on the company’s operations and financial decisions.

- Market Volatility: Consider how market volatility could affect the company’s ability to raise capital through equity or debt and the potential impact on the company’s valuation and cost of capital.

- Economic Conditions: Assess the impact of broader economic conditions, including inflation, unemployment rates, and GDP growth, on the company’s business model and financial health.

- Growth Opportunities: Ensure that the capital structure allows the company to pursue growth opportunities, such as acquisitions, new product launches, or geographic expansion, without undue financial constraint.

- Adaptability to Change: Consider the company’s ability to adapt to changes, such as shifts in consumer preferences, technological advancements, or competitive dynamics, which might require reallocating resources or changing strategic direction.

- Hedging: Explore hedging strategies to mitigate specific risks associated with international operations or debt financing, such as currency or interest rate risks.

- Diversification: Consider diversifying revenue streams, supply chains, and financing sources to reduce reliance on any single market, supplier, or capital source.

- Conduct scenario analyses and stress tests to evaluate how adverse conditions would affect the company’s financial position, cash flows, and ability to maintain its capital structure.

- Use these analyses to identify potential vulnerabilities and develop contingency plans.

Step 7: Factor in Tax Considerations

Factoring in tax considerations is an important aspect of developing an optimal capital structure for a business. Tax laws can significantly influence the relative costs and benefits of different financing options, such as debt and equity. By understanding and leveraging these tax implications, a company can enhance its financial efficiency and reduce its overall cost of capital. Here’s how to approach this:

- Tax Deductibility of Interest: One of the key tax advantages of debt financing is that interest payments on debt are generally tax-deductible. This reduces the company’s taxable income and, consequently, its tax liability, effectively lowering the net cost of borrowing.

- Calculating the Tax Shield: To quantify this benefit, calculate the tax shield as the interest expense multiplied by the corporate tax rate. This amount represents the savings in taxes due to the interest deduction.

- Dividends and Capital Gains: Unlike interest on debt, dividends paid to shareholders are not tax-deductible for the company. Moreover, investors may be subject to taxes on dividends received and capital gains, which can influence their required rate of return on equity.

- Retained Earnings: Reinvesting profits into the business (retained earnings) is another form of equity financing. While these earnings have already been taxed at the corporate level, they do not incur additional taxes when reinvested, making them a cost-effective funding source.

- Effect on Capital Structure Choices: The corporate tax rate plays a significant role in determining the attractiveness of debt financing. Higher tax rates increase the value of the debt interest tax shield, making debt more attractive. Conversely, lower tax rates reduce the benefit of the tax shield, making equity financing more favorable.

- International Considerations: For multinational companies, varying tax rates and regulations across jurisdictions can complicate capital structure decisions. Companies must consider the tax implications in each country where they operate.

- Government Incentives: Be aware of any tax incentives, credits, or deductions available for particular investments, such as renewable energy projects, research and development, or capital investments in specific regions. These incentives can significantly affect the net cost of these projects and should be factored into financing decisions.

- Utilizing Tax Credits: Analyze how to utilize available tax credits best to offset tax liabilities, which can influence the timing and structure of financing arrangements.

- Monitoring Tax Law Changes: Stay informed about current and proposed changes in tax laws that could impact the company’s capital structure. Tax reforms can alter the relative costs of debt and equity financing and may require adjustments to the company’s financing strategy.

- Strategic Planning: Incorporate potential tax law changes into strategic financial planning to anticipate and mitigate their impacts on the company’s capital structure and overall financial health.

- Comprehensive Tax Planning: Develop a comprehensive tax strategy that aligns with the company’s overall financial and business strategies, considering capital structure decisions’ current and future tax implications.

- Professional Advice: Engage tax professionals and advisors to ensure that the company’s capital structure decisions are tax-efficient and compliant with all applicable tax laws and regulations.

Step 8: Make Strategic Decisions

Making strategic decisions about a company’s capital structure is a complex process that involves integrating all the insights gathered from the previous steps—assessing business goals and strategies, analyzing the current financial position, determining capital needs, evaluating financing options, considering the cost of capital, analyzing risk and flexibility, and factoring in tax considerations. These decisions should align with the company’s long-term objectives and market conditions, ensuring financial stability and growth potential. Here’s how to approach making these strategic decisions:

- Align with Business Goals and Strategy: Ensure that the chosen capital structure supports the company’s strategic goals: growth, stability, or entering new markets. The capital structure should provide the necessary resources to achieve these objectives without compromising the company’s financial health.

- Optimize the Balance Between Debt and Equity: Find the right mix of debt and equity that minimizes the company’s cost of capital while considering the trade-offs between risk and return. This balance should reflect the company’s risk tolerance, industry standards, and the economic environment.

- Leverage Tax Benefits: Utilize the tax advantages of debt financing to the extent that it supports the company’s overall financial strategy without overleveraging. Be mindful of changes in tax laws that could affect the benefits of certain financial decisions.

- Manage Financial and Operational Risks: Develop a capital structure that mitigates financial risks, such as high leverage or liquidity constraints, and aligns with the company’s operational risk profile. This involves considering the volatility of cash flows, the cyclical nature of the industry, and the company’s ability to respond to unexpected events.

- Ensure Financial Flexibility: Maintain financial flexibility that allows the company to seize growth opportunities, invest in innovation, and navigate economic downturns. This may involve keeping some borrowing capacity in reserve or maintaining access to diverse sources of capital.

- Evaluate Market Conditions: Consider current and anticipated market conditions, including interest rates, investor sentiment, and access to capital markets. Market conditions can significantly impact the cost and availability of different types of financing.

- Stakeholder Considerations: Consider the expectations and requirements of various stakeholders, including shareholders, debt holders, and potential investors. Decisions should balance these interests while focusing on long-term value creation.

- Implement a Dynamic Approach: Adopt a dynamic approach to capital structure decisions, recognizing that the optimal structure may evolve as the business grows, market conditions change, and new opportunities and challenges arise.

- Monitor and Adjust: Continuously monitor the company’s financial performance, the effectiveness of its capital structure, and external market conditions. Be prepared to adjust the capital structure in response to internal developments or external economic changes.

Related Posts

Financial Strategy of a Technology Startup

Tax Loss Harvesting

Business Funding Strategies

Best Budgeting Strategy for Businesses

Cash Management Strategies

Working Capital Management Strategies

Debt Recycling Strategy: Types | Advantages | Examples

What are Retirement Investment Strategies?

Type above and press Enter to search. Press Esc to cancel.

17.1 The Concept of Capital Structure

By the end of this section, you will be able to:

- Distinguish between the two major sources of capital appearing on a balance sheet.

- Explain why there is a cost of capital.

- Calculate the weights in a company’s capital structure.

The Basic Balance Sheet

In order to produce and sell its products or services, a company needs assets. If a firm will produce shirts, for example, it will need equipment such as sewing machines, cutting boards, irons, and a building in which to store its equipment. The company will also need some raw materials such as fabric, buttons, and thread. These items the company needs to conduct its operations are assets . They appear on the left-hand side of the balance sheet.

The company has to pay for these assets. The sources of the money the company uses to pay for these assets appear on the right-hand side of the balance sheet. The company’s sources of financing represent its capital . There are two broad types of capital: debt (or borrowing) and equity (or ownership).

Figure 17.2 is a representation of a basic balance sheet. Remember that the two sides of the balance sheet must be Assets = Liabilities + Equity Assets = Liabilities + Equity . Companies typically finance their assets through equity (selling ownership shares to stockholders) and debt (borrowing money from lenders). The debt that a firm uses is often referred to as financial leverage . The relative proportions of debt and equity that a firm uses in financing its assets is referred to as its capital structure .

Attracting Capital

When a company raises money from investors, those investors forgo the opportunity to invest that money elsewhere. In economics terms, there is an opportunity cost to those who buy a company’s bonds or stock.

Suppose, for example, that you have $5,000, and you purchase Tesla stock. You could have purchased Apple stock or Disney stock instead. There were many other options, but once you chose Tesla stock, you no longer had the money available for the other options. You would only purchase Tesla stock if you thought that you would receive a return as large as you would have for the same level of risk on the other investments.

From Tesla’s perspective, this means that the company can only attract your capital if it offers an expected return high enough for you to choose it as the company that will use your money. Providing a return equal to what potential investors could expect to earn elsewhere for a similar risk is the cost a company bears in exchange for obtaining funds from investors. Just as a firm must consider the costs of electricity, raw materials, and wages when it calculates the costs of doing business, it must also consider the cost of attracting capital so that it can purchase its assets.

Weights in the Capital Structure

Most companies have multiple sources of capital. The firm’s overall cost of capital is a weighted average of its debt and equity costs of capital. The average of a firm’s debt and equity costs of capital, weighted by the fractions of the firm’s value that correspond to debt and equity, is known as the weighted average cost of capital (WACC) .

The weights in the WACC are the proportions of debt and equity used in the firm’s capital structure. If, for example, a company is financed 25% by debt and 75% by equity, the weights in the WACC would be 25% on the debt cost of capital and 75% on the equity cost of capital. The balance sheet of the company would look like Figure 17.3 .

These weights can be derived from the right-hand side of a market-value-based balance sheet. Recall that accounting-based book values listed on traditional financial statements reflect historical costs. The market-value balance sheet is similar to the accounting balance sheet, but all values are current market values.

Just as the accounting balance sheet must balance, the market-value balance sheet must balance:

This equation reminds us that the values of a company’s debt and equity flow from the market value of the company’s assets.

Let’s look at an example of how a company would calculate the weights in its capital structure. Bluebonnet Industries has debt with a book (face) value of $5 million and equity with a book value of $3 million. Bluebonnet’s debt is trading at 97% of its face value. It has one million shares of stock, which are trading for $15 per share.

First, the market values of the company’s debt and equity must be determined. Bluebonnet’s debt is trading at a discount; its market value is 0.97 × $ 5,000,000 = $ 4,850,000 0.97 × $ 5,000,000 = $ 4,850,000 . The market value of Bluebonnet’s equity equals Number of Shares × Price per Share = 1,000,000 × $ 15 = $ 15,000,000 Number of Shares × Price per Share = 1,000,000 × $ 15 = $ 15,000,000 . Thus, the total market value of the company’s capital is $ 4,850,000 + $ 15,000,000 = $ 19,850,000 $ 4,850,000 + $ 15,000,000 = $ 19,850,000 . The weight of debt in Bluebonnet’s capital structure is $ 4 , 850 , 000 $ 19 , 850 , 000 = 24.4% $ 4 , 850 , 000 $ 19 , 850 , 000 = 24.4% . The weight of equity in its capital structure is $ 15 , 000 , 000 $ 19 , 850 , 000 = 75.6% $ 15 , 000 , 000 $ 19 , 850 , 000 = 75.6% .

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Authors: Julie Dahlquist, Rainford Knight

- Publisher/website: OpenStax

- Book title: Principles of Finance

- Publication date: Mar 24, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-finance/pages/17-1-the-concept-of-capital-structure

© Jan 8, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

What Is Capital in Business?

Capital Structure of a Business Explaineed

- What is Capital in a Business?

- Capital Structure of a Business

Other Terms for Business Capital

Business capital and taxes.

- Asset Information for Taxes

Frequently Asked Questions (FAQs)

Jetta Productions Inc / Getty Images

The term capital has several meanings, and it is used in several areas in business. In general, capital is accumulated assets or ownership. The roots of the term "capital" go back to Latin, where the term was capitālis, "head," and Latin capitale "wealth.

Capital is important to businesses because the cost of buying and owning these investments can affect the business's value and tax situation.

Key Takeaways

- Business capital is all of the long-term assets of the business that have value while the business is operating and in the sale of a business.

- Capital in accounting terms is the accumulated wealth or net worth of a business and the owners, expressed as the value of its assets minus its liabilities.

- Capital in taxes is assets that a business uses to make a profit.

- A business can lower its business taxes by spreading out its tax deductions for capital expenses over several years.

Capital in Business

Business capital is in the form of assets (things of value). Capital is a necessary part of business ownership because businesses use assets to create products and services to sell to customers. Capital can have one of three specific meanings:

- The amount of cash and other assets (owned by a business, including accounts receivable, equipment, inventory, and buildings of the business)

- The accumulated wealth or net worth of a business, represented on a balance sheet by its owner's equity (ownership) minus liabilities

- Stock or ownership in a company, the capital account of a stockholder

Capital for Tax Purposes

The Internal Revenue Service (IRS) uses the term capital assets to describe assets that are used to generate a profit. These assets aren't easily turned into cash and they are expected to last more than one year. A building, equipment, and vehicles are examples of capital assets for tax purposes.

Capital Structure of a Business

The capital structure of a business is the mix of types of debt (borrowing) and equity (ownership). Business capital is shown on the business's balance sheet . The format for this report shows all the asses of the business in one column and the liabilities and owner equity in the other. Total assets must equal total liabilities plus total owner equity.

Another way to express capital in business is through its debt to equity ratio. This ratio divides the company's total liabilities by its shareholder equity, measuring how much of the company is financed by debt. An acceptable ratio is 2:1, meaning that debt can be two times equity.

Other associated terms which relate to capital in business situations are:

- Capital gains : Capital gains and losses are increases or decreases in the value of stock and other investment assets when they are sold.

- Capital improvements : Improvements made to capital assets, to increase their useful life, or add to the value of these assets. Capital improvements may be structural improvements or other renovations to a building to enhance usefulness or productivity.

- Venture capital : Private funding (capital investment) provided by individuals or other businesses to new business ventures.

- Capital lease : A lease of business equipment that represents ownership and is shown in the company's balance sheet as an asset.

- Capital contribution : A contribution to the business by an owner, partner, or shareholder in the form of money or property. The contribution increases the owner's equity (investment) in the company.

Businesses with capital assets must deal with two types of tax reporting. The business must report depreciation, amortization, and deductions for income taxes during the time the business owns the asset. It must also report and pay capital gains taxes when the asset is sold.

Income Taxes

The expense of buying or improving an asset must be capitalized for income tax purposes. That means the assets must be spread out over a number of years, rather than being deducted in one year. Each year, the business can take a tax deduction for the yearly deduction for all capital assets.

The two processes for capitalizing assets are:

- Depreciation : For tangible assets like vehicles, equipment, furniture, and buildings

- Amortization : For intangible assets like patents, trademarks, and trade secrets

Capital improvements on an asset, which add to an asset's value and must be capitalized, are distinguished from repairs, which are deductible.

Some deductible repairs are painting, repairing a roof, or fixing an elevator. Some capital improvements that must be depreciated including replacing a roof or improving a storefront.

Business startup costs are considered capital assets and they must be amortized. But you may be able to up to $5,000 of business startup costs and $5,000 of organization costs (for forming and registering your new business) in the first year you are in business.

Capital Gains Tax

Businesses that have capital assets must pay capital gains tax on those assets when they are sold. Capital gains taxes are payable at a different rate from ordinary business gains. Short-term capital gains are taxed as ordinary income to the individual, and corporations pay short-term capital gains tax at the regular corporate tax rate of 21%. Long-term capital gains (held more than a year) are taxed at different rates, depending on the individual's income.

Gathering Asset Information for Taxes

Capitalizing business assets is probably the most difficult and complicated part of business taxes; it's not something you should attempt yourself. Before you turn over your yearly records to your tax preparer, gather all the information you can on the original costs of each asset, called " asset basis ."

Information for asset basis for physical assets includes:

- Sales price

- Installation and training

- Recording fees

- Permits and inspection fees

The asset basis for intangible assets like patents, copyrights, trademarks, trade names, and franchises is usually the cost to buy or create it. For a patent, for example, the basis is the cost of development, including costs of research and experiment, drawings, working models, attorney fees, and application fees. You can't include your time as the inventor, but you can include the time for workers you paid to help you.

What is capital in business?

Capital is the assets (things of value) in a business that the business uses as collateral for loans and to pay expenses. For tax purposes, business capital assets are the long-term assets (like equipment, vehicles, and furniture) used to make a profit.

You can see the types of business capital by looking at the "Assets" column on a business balance sheet. A balance sheet shows assets on one side and liabilities (what's owed to others) plus owner's equity (ownership) on the other side, with total assets equal to total liability + owner's equity.

What is an example of capital in a business?

Here's a list of all the types of business capital as they are shown on a business balance sheet. They are in order by how quickly they can be turned into cash, and categorized by short-term and long-term assets.

Short-term assets are used up or paid within a year.

- Accounts receivable (money owed by others)

- Prepaids (like insurance)

Long-term assets (capital assets) are used over a number of years:

- Furniture and Fixtures

- Equipment and Machinery

- Land and Buildings

How do businesses use capital?

Capital is important to a business in both short-term and long-term situations. In the short term, it's used to fund operations. For example, cash is an important asset to a business because it is used to pay expenses.

In the long term, capital assets like buildings and can be used as collateral for a business loan. For example, the equity in a business building can be used to get a second mortgage. To finance short-term cash flow shortages, a business can sell accounts receivable to a factoring service for quick cash.

Why do businesses need capital?

Businesses need capital to attract investors. Investors can use capital to analyze the strength of a business, using a debt-to-equity ratio. This ratio compares long-term capital to owner's equity; an acceptable ratio of 2:1, meaning that debt is twice equity.

Capital is also important in selling a business because buyers also look at the strength of business assets and their usefulness to fund the business purchase or make changes. For example, a buyer could sell off several buildings to get cash to expand into other markets.

Legal Information Institute. " Capital Assets ." Accessed Aug. 12, 2021.

International Journal of Management Sciences, " Financial Ratio Analysis of Firms: A Tool for Decision Making ," Page 136-37. Accessed Aug. 19, 2021.

Tax Policy Center. " How Does Corporate Income Tax Work ?" Accessed Aug. 19, 2021.

IRS. " Capital Gains and Losses - 10 Helpful Facts to Know ." Accessed Aug. 19, 2021.

IRS. " Publication 551 Basis of Assets ." Accessed Aug. 19, 2021.

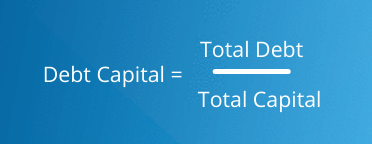

Capital Structure for Startups

by Sarath | April 15, 2021 | Capital structure , Debt Capital , Equity Capital

You must have heard the term “capital structure” at least once in your life, especially if your family or friends have businesses. For people who are investment analysts, professional investors , or corporate officers, this concept is essential.

This article will tell you about capital structure, the types of capital , and why a sound capital structure is essential for startups .

All you need to know about Capital Structure

Capital structure is an essential part of a company. It helps the organisation run smoothly and lowers financial burden . Without a strong capital structure, the company is at risk down the road. Having an ideal capital structure is important for startups.

What is a capital structure?

Startups have to finance their operations in order to attain growth, which can be done by structuring the combination of debt and equity in a way that suits the business. This structure of finance is called the capital structure. They have to choose their approach from all the different available options. They can create equity through common or preferred stock , and/or debt (long & short-term) as loans and bonds . The route they choose will depend on the product they offer and the industry they are in.

There are trade-offs when the business uses debt or equity to finance the operations. Depending on the industry, the management will have to decide the amount to use and balance both to find a point of equilibrium suitable for their company.

Why is capital structure important for a startup?

Capital structure is an essential factor that contributes to the stability of the company. Startups need to have a good capital structure as this will determine if they will s urvive the initial stages . Other factors that also show this importance are:

- A startup with a good capital structure will draw investors

- The business will be efficient as all the funds and resources will be effectively used, preventing under or overcapitalization .

- As per the startup’s situation, the company will have the flexibility of changing its debt capital .

- Having a proper capital structure minimizes the overall cost of capital while maximizing the shareholder’s capital.

- In the form of higher returns to the shareholders , an effective capital structure will increase their profit .

- If your startup has a sound capital structure, the chances of share prices increasing are high , leading to an overall higher business valuation .

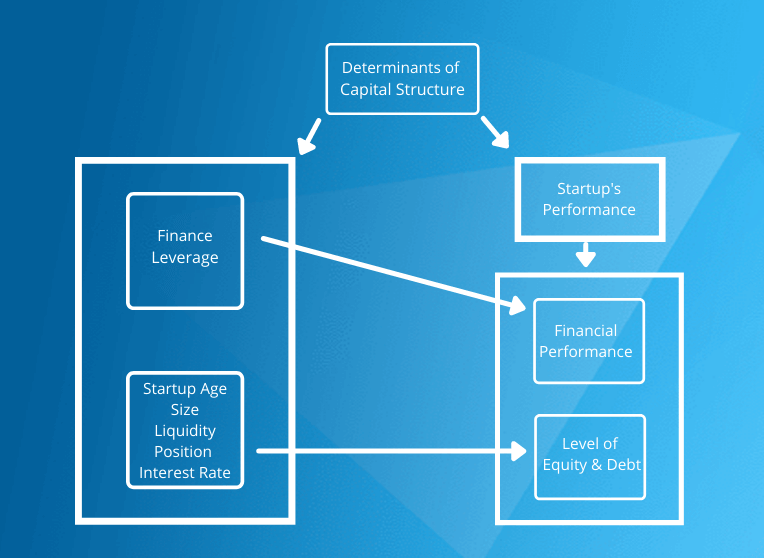

Factors determining capital structure

There are many factors that affect and influence the capital structure of a startup. This is why it’s necessary to focus on the important factors, including:

- Control – The shareholders type will determine the degree of control. If the startup has more equity shareholders than preference shareholders, they will have control and higher voting rights .

- Government Policies – It is important as a startup to stay informed on all the policies that the government has set, as it influences your capital structure choice. If there are significant changes in the fiscal and monetary policies, you may have to change your capital structure choice.

- Cost of Capital – Startups raise capital for its operations, and there are costs to do so. These costs that they incur is called the cost of capital . A company should generate enough revenue to negate this cost, and the growth can be sufficiently funded. One way of reducing the cost of capital is by balancing the debt and equity to get an optimal capital structure.

- Trading on Equity – To increase returns, startups borrow new funds using more equity as the source . When the rate of interest the startup pays on debt is less than the rate of return on the total capital or when the rate of interest is higher than the return, they choose to trade on equity.

Types of Capital Structure

The plan by which a business finances its assets by combining debt and equity optimally is called a capital structure. A business sources funds from various areas to finance its operations, some of them are retained earnings, equity shares, long-term loans, preference shares, and others. Startups have to make a crucial decision and choose the type of source they want to use to raise their capital. Choosing the right type of capital structure will show the strength of the business and also the cost of capital.

The types of capital structures have been explained below.

Equity Capital

In exchange for common or preferred stock , equity capital is the funds received from investors. Equity is the core of the business, and you can further add debt to this for more funding. The moment an investor invests in this, their investment is at risk. The reason for this is that in a scenario where the firm is liquidated , the company will settle the creditors’ claims before the business pays the shareholders.

Irrespective of the risks, investors put their money into equity for many more reasons. Investing in equity shares gives the investor a degree of control in the business. Through this, they can make sure that the company is efficient, generating sufficient funds , and can pay dividends to the shareholders.

From a valuation perspective, equity capital is considered the total amount given back to the investor after all liabilities are settled in the case of a liquidated company. In the balance sheet, the par value of stocks sold, retained earnings, offsetting amount of the treasury stock, and the additional paid-in capital are components of the equity capital according to an accounting perspective. Equity capital is of two types :

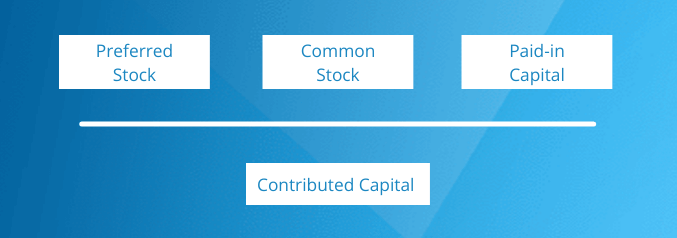

#1 Contributed Capital

The total amount of money initially invested into the company by the owners and from shareholders as a cost for ownership is known as contributed capital. In other words, it is a part of the total equity recorded by the company. The contributed capital can be in the shareholders’ equity section as a separate account.

Contributed Capital can further be divided into two parts: the regular stock account and the additional paid-in capital account . Here the regular stock account records the par value of a share sold. In the additional paid-in account, all excess payments are recorded. These accounts are created to record the amounts for legal purposes and do not provide any extra information. This is because investors look at the company’s total equity rather than the single amount given in these accounts.

The common entry written down when an investor buys shares from a company is to debit the cash account and credit the contributed capital account . Other transactions also involve contributed capital, such as receiving liability for stock and stock for fixed assets.

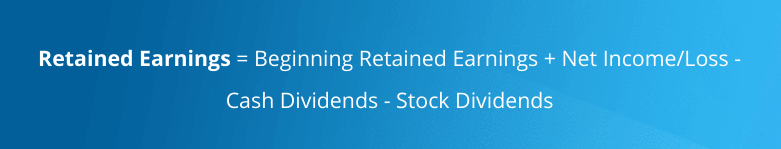

#2 Retained Earnings

Retained earnings is a part of the profit earned that the business keeps separately, for use to grow the business. In other words, it is the profits less dividends and any distributions paid to shareholders . This amount is always adjusted when an entry affects the revenue or expenses in the company accounts. If a company has a considerable amount in the retained earnings account, it means that they are financially strong. The formula to calculate retained earnings (RE) is: retained earnings at the beginning + net profit/loss – Dividends.

Debt capital

Debt capital is the type of capital the company raises by taking loans . This loan is also known as growth capital and is paid back at a future date. Debt capital is different from share or equity capital. This is because the lender does not become part owner in the company; they are just creditors. Normally, the creditor is entitled to a fixed interest rate on the loan annually, known as the coupon rate . In some cases, the loan is repaid depending on the company’s monthly revenue; this scenario is similar to revenue-based financing.

Equity holders, unlike debt holders, have rights in the company. But debt ranks higher than equity when it comes to annual repayment. Similarly, if a company is liquidated, the debt is paid off in full before the shareholders get repaid.

Note: In a startups capital structure, these loans are often in the form of convertible notes , like SAFE notes or KISS notes . They have a principal amount, may contain interest terms , and can convert to equity later on .

What is the optimal capital structure for a startup?

The ideal balance between debt and equity that results in a low WACC ( weighted average cost of capital) is known as the optimal capital structure. The definition does not reflect the same in practice as companies have their own aspect of what they think represents the optimal capital structure. The reason every company has a different perspective also comes down to the industry they are in.

For example , a company in the petroleum industry will not find it suitable to have a high debt ratio as they deal in products with high liquidity. The ideal ratio should be 1:1 . Whereas for a business in the banking industry, it is ideal to have a high debt ratio as they borrow capital to lend it to customers. Even though creditors charge financial institutions high interests, banks charge customers high-interest rates to counter it and earn profits.

Capital structure vs Financial structure

Capital structure is the long-term funds that are sourced by the business. In the balance sheet, it comes under the non-current liabilities and shareholders’ funds . The capital structure includes long-term borrowings, equity capital, debentures, preference shares, retained earnings, and others.

The financial structure is the plan through which company assets are financed . Financial structure is a more extensive concept than capital structure. It represents the entire liabilities and equity side of the balance sheet.

When you compare the capital structure vs financial structure , the main difference is that the financial structure includes the capital structure.

Interested to Optimize your Company’s Capital Structure?

Startups have a hard time dealing with the hurdles that come their way during the first couple of years. It is essential that they find their optimal point. Finding the ideal capital structure will depend on various factors such as the industry of the business and the owners’ willingness to give up control of the company. Setting a strong and optimal capital structure allows the company to secure healthy finances.