AI Summary to Minimize your effort

AS 2 – Valuation of Inventories

Updated on : Aug 2nd, 2021

10 min read

This accounting standard is applicable to all companies irrespective of their level (Level I, II and III). This standard prescribes the accounting treatment for inventories and sets the guidelines to determine the value at which the inventories are carried in the financial statements.

It explains the different methods of accounting the inventory or closing stock which has a huge impact on the business revenue and the assets. Topics discussed in this article: In this article, we cover the following topics:

Valuation of Inventories

This Standard should be applied in accounting for all inventories except the following : (a) work in progress in the construction business, including directly related service contracts (b) work in progress of service business (consulting, banking etc) (c) shares, debentures and other financial instruments held as stock in trade (d) Inventories like livestock, agricultural and forest products, mineral oils etc These inventories are valued at net realizable value

I. Definition of the Inventory includes the following:

A. Held for sale in the normal course of business i.e finished goods

B. Goods which are in the production process i.e work in progress

C. Raw materials which are consumed during production process or rendering of services (including consumable stores item)

II. Net Realisable Value (NRV):

“Net realizable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale”

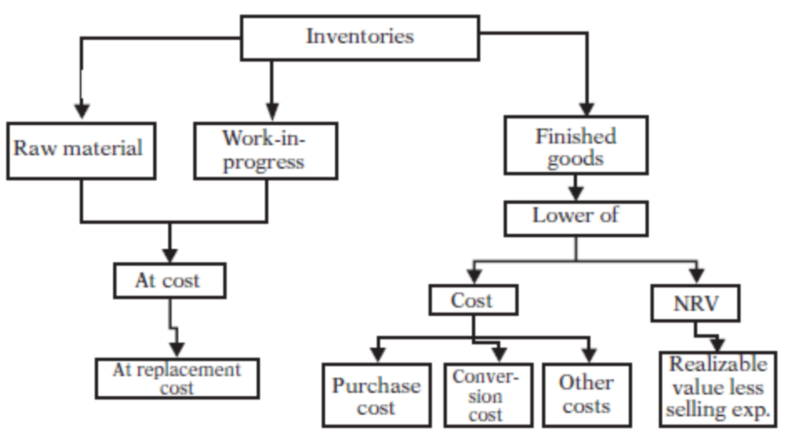

Inventories should be valued at lower cost and net realizable value. Following are the steps for valuation of inventories: A. Determine the cost of inventories B. Determine the net realizable value of inventories C. On Comparison between the cost and net realizable value, the lower of the two is considered as the value of inventory.

A comparison can be made the item by item or by the group of items. (Refer Case studies given at the end of the article)

Let’s discuss the important items of Inventory valuation in detail:

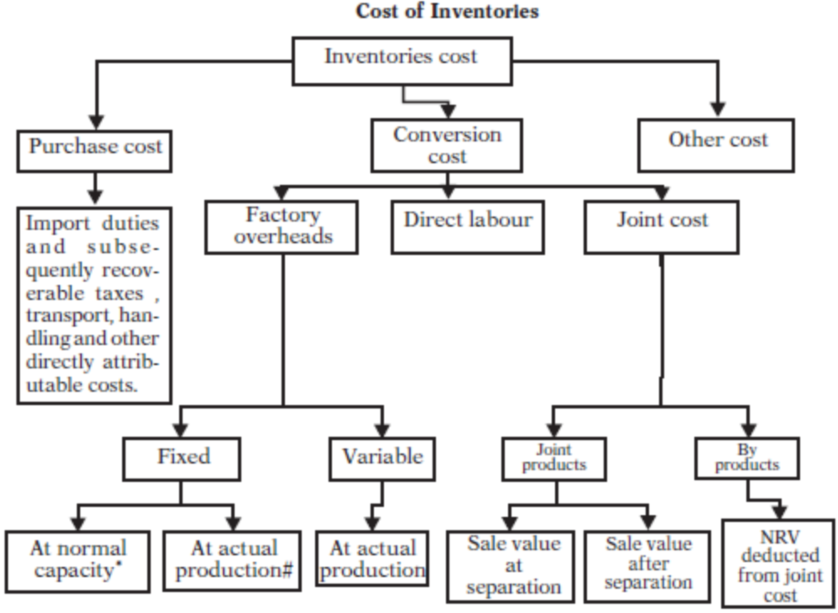

A. Cost of Inventories The cost of inventories includes the following

- Purchase cost

- Conversion cost

- Other costs which are incurred in bringing the inventories to their present location and condition.

B. Cost of Purchase While determining the purchase cost, the following should be considered:

- Purchase cost of the inventory includes duties and taxes (except those which are subsequently recoverable from the taxing authorities)

- Freight inwards

- Other expenditure which is directly attributable to the purchase

- Trade discounts, rebates, duty drawbacks and other similar items are deducted in determining the costs of purchase

C. Cost of Conversion Cost of conversion includes all cost incurred during the production process to complete the raw materials into finished goods. Cost of conversion also includes a systematic allocation of fixed and variable overheads incurred by the enterprise during the production process.

Following are the categories of conversion cost:

I. Direct Cost

All the cost directly related to the unit of production such as direct labor

II. Fixed Overhead Cost

Fixed overheads are those indirect costs which are incurred by the enterprise irrespective of production volume. These are the cost that remains relatively constant regardless of the volume of production, such as depreciation, building maintenance cost, administration cost etc.

The allocation of fixed production overheads is based on the normal capacity of the production facilities. In case of low production or idle plant allocation of these fixed overheads are not increased consequently.

III. Variable Overhead Cost

Variable overheads are those indirect costs of production that vary directly with the volume of production. These are the cost that will be incurred based on the actual production volume such as packing materials and indirect labor.

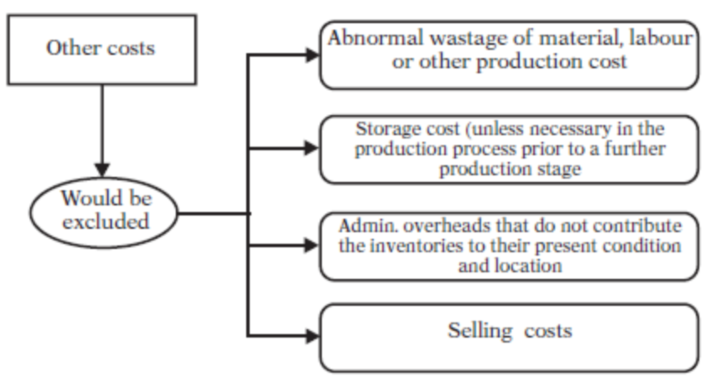

D. Other Cost

All the other cost which are incurred in bringing the inventories to the current location and condition. For (eg) design cost which is incurred for the specific customer order. If there are by-products during the production of main products, their cost has to be separately identified. If they are not separately identifiable, then allocation can be made on the relative sale value of the main product and the by-product. Some of the cost which should not be included are:

a. Cost of any abnormal waste materials cost

b. Selling and distribution cost unless those costs are necessary for the production process

c. A normal loss which occurs during the production process is apportioned over the remaining no of units and abnormal loss is treated as an expense

(Refer Case studies given at the end of the article)

Methods of Inventory Valuation

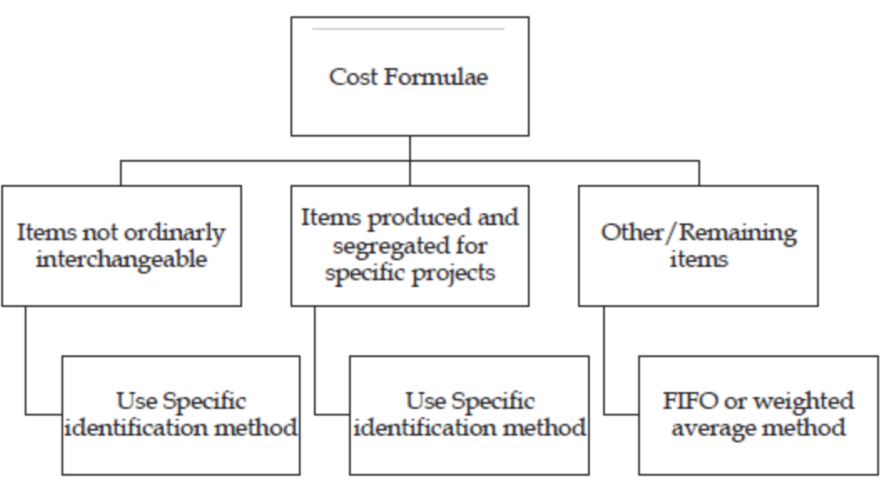

The cost of inventories of items which can be segregated for specific projects should be assigned by specific identification of their individual costs (Specific identification method). All other items cost should be assigned by using the first-in, first-out (FIFO), or weighted average cost (WAC) formula. The formula used should reflect the fairest possible approximation to the cost incurred in bringing the items of inventory to their present location and condition.

However, when it is difficult to calculate the cost using above methods, Standard cost and Retail cost can be used if the results approximate the actual cost.

Accounting Disclosure

The following should be disclosed in the financial statements:

- Accounting policy adopted in inventory measurement

- Cost formula used

- Classification of the of inventory such as finished goods, raw material & WIP and stores and spares etc

- Carrying amount of inventories carried at fair value less sale cost

- Amount of inventories recognized as expense during the period

- Amount of any write-down of inventories recognized as an expense and its subsequent reversal if any.

Comparison between AS 2 and ICDS

Given below are some of the key differences between As 2 and Income Computation and Disclosure Standards (ICDS):

Some of the Major Differences between Ind AS (IAS) and AS 2

- Scope of AS 2 does not deal with the inventory treatment related to Service Providers whereas IAS 2 details the treatment related to the cost of inventories of Service Providers

- AS 2 requires lesser disclosure in the financial statements when compared to IAS 2

- Cost of Inventories does not include “selling and distribution costs” under AS 2 and it is expensed in the period in which they are incurred whereas IAS 2 specifically excludes only “Selling Costs” and not “Distribution Costs”.

- AS 2 requires the inventory value of goods which cannot be segregated for specific projects should be assigned using FIFO or WAC whereas IAS requires the same formula to be used for all the inventories with similar nature.

Case Studies and Examples

- Cost is 500 and NRV is 300 then Inventory value as per AS-2 is 300

- Cost is 500 and NRV is 600 then Inventory value as per AS-2 is 600

- Cost is 500, Sale Price is 700 and 30% commission, NRV is 490 (700-30%*700) then, Inventory value as per AS-2 is 490

- Treatment of Normal loss and abnormal loss: Company A purchased 100 items at the cost of Rs.10 each. Of which 10% is normal loss in general, there were no sales in that period and closing stock was 80. Calculate the Inventory value: Normal Loss = 100*10% = 10 Cost per item considering normal loss = 100*10/ 90 = RS 11.11 Abnormal Loss is 90-80 (Normal – closing stock) = 10 Cost of abnormal loss = Rs 111.11 Closing stock Value = Rs 888.89

- Chainrup Samapatram vs. C.I.T. (24 I.T.R. 481, 485);

- C.I.T. vs. Chari & Ram (17 I.T.R. 1, 7);

- Utting & Co. Ltd vs. Hughes (8 I.T.R. Supp. 57, 60) The assessee can get an allowance in respect of future unrealised loss, the Department is not entitled, by putting on the stock the market value where it exceeds cost, to bring in and charge the unrealised notional profit , unless the assessee’s regular basis of valuation is the market rate right from the inception of his business.

- To the same effect is the judgment in the case of C.I.T. vs. British Paints India Ltd (188 I.T.R. 44) it was held that it is a well-recognised principle of commercial accounting to enter in the profit and loss account the value of the stock-in-trade at the beginning and at the end of the accounting year at cost or market price, whichever is the lower. To know more click here

Related Articles

- What is Accounting Standard?

- What are Financial Reports?

- Financial Accounting – Introduction, Accounting Concepts, Preparation and Presentation of Financial Statements

- How To Prepare Cash Flow Statement?

Public Discussion

Get involved!

Share your thoughts!

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

AS 2 - Valuation of Inventories

Sakshi Shah

AS 2 is the Accounting Standard for the valuation of inventories and their accounting treatment. This accounting standard covers methods to value the inventory of a business and its disclosure in the financial statements. The general rule mentions valuing inventories i.e. closing stock of a business at cost or market value whichever is lower. Let us understand AS 2 in detail.

Applicability of AS 2

Valuation of inventory, methods of inventory valuation, accounting disclosure, as 2 for manufacturers & traders.

AS 2 applies to the valuation of following types of inventory:

- Raw Materials – input goods or services consumed during the production process of rendering of services.

- Work In Progress – input goods or services that are in the process of production.

- Finished Goods – final goods or services held for sale in the normal course of business.

AS 2 for Valuation of Inventories is not applicable in the following cases:

- Work in progress i.e. WIP stock in the construction business

- WIP stock in the service business

- Shares, debentures, or other financial instruments held as stock-in-trade

- Stock of livestock, mineral oils, agricultural and forest product, etc. In the above cases, inventory valuation is at net realisable value.

Follow these steps for valuation of inventory:

Cost of Inventory is the sum of purchase cost, conversion cost and other direct costs to bring the inventory in its present condition.

Net Realisable Value is the estimated selling price of the inventory in the market i.e. the market value of the inventory.

Valuation of inventory is the lower of cost or net realisable value (NRV).

For valuation of inventory, we should understand the following terms:

- Purchase Cost – It is the price at which inventory is purchased. It also includes freight inwards, duties and taxes, trade discounts, rebates, duty drawbacks, and other expenses directly related to purchase.

- Conversion Cost – It is the cost incurred in the process of production to convert the raw materials into finished goods. Conversion Costs include both fixed costs ( depreciation , maintenance expense, etc) and variable cost (labour cost, raw material cost, etc) incurred in the process of production.

- Other Cost – Any other cost incurred to bring the inventory in its current location and condition should form part of inventory valuation. Other costs include selling and distribution expense, abnormal loss of material or labour, storage cost, etc.

- Net Realisable Value – NRV is the estimated selling price of the inventory after deducting the estimated costs of completion and expenses on the sale of such inventory.

- First In First Out (FIFO) – As per this method, it is assumed that the goods that come in first are sold out first. The cost of goods sold comprises the cost of goods produced first. The closing inventory will include the goods purchased recently.

- Weighted Average Cost Method (WAC) – Under this method, the average cost of each sale item is calculated. The closing inventory is calculated by taking the weighted average cost of items at the beginning of the year and purchased during the year.

- Specific Identification Method – If each item in the closing inventory is easily identifiable, the business should use a specific identification method to value the inventory. Thus, include the items sold at a specific cost in the cost of goods sold and the cost of items left on hand in the closing stock.

As per AS 2, the financial statements must reflect the following details of inventory of a business:

- Accounting policy and method used for valuation of inventory

- Classification of inventory i.e. raw material, work-in-progress, or finished goods

- Carrying amount of inventory = Fair Value – Sale Cost

- Amount of inventory that business recognizes as an expense

- Amount of inventory that business writes down and recognizes as an expense

- Reversal amount of a write-down identified as a reduction in the inventory amount

Any manufacturing or trading business that has inventory or stock must follow the accounting principles for the valuation of a stock.

- Opening Stock – Value of the closing stock of the previous year

- Purchases – Sum of the purchase value and direct expenses incurred during the financial year

- Sales – Sum of sales value during the financial year

- Closing Stock – Value of closing inventory should be lower of cost or market value

- Gross Profit = Opening Stock + Purchases – Sales – Closing Stock

The business should calculate the net profit by deducting other expenses from gross profit, report it as taxable income under the head PGBP and file ITR on income tax website .

The cost of inventory for a service provider includes labour cost and the cost of personnel who provide the services. It does not include the expenses not directly related to the service.

As per the weighted average cost method, you should calculate the value of closing inventory by using the average price of inward values of the inventory. The formula is as below: Average cost per unit = Total inward value / Total inward quantity

Got Questions? Ask Away!

Not all the tax payers have to disclose their assets and liabilities. Only the individuals or HUFs having total income exceeding INR 50 lakh should fill in Schedule AL. Your total income is calculated by subtracting Chapter VI A deductions from Gross Total Income.

@AkashJhaveri @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani @Sakshi_Shah1 @Saad_C can you?

Hey @Sreeraag_Gorty

Schedule AL has to be mandatorily filled up in case of tax payer’s income exceeds INR 50 lakhs for particular financial year.

For your doubt, you can read below article for more insights:

Hope, it helps!

There is no such requirements to mandatory report in ITR immovable property even if tax payer doesn’t own in particular financial year.

Other assets such as financial assets viz. bank deposits, shares and securities, insurance policies, loans and advances given, cash in hand, movable assets viz. jewellery, bullion, vehicles should be disclosed in AL schedule.

Continue the conversation on TaxQ&A

2 more replies

Participants

Last Updated on 3 years by Maharshi Shah

- Browse All Articles

- Newsletter Sign-Up

Accounting →

- 23 Apr 2024

- In Practice

Getting to Net Zero: The Climate Standards and Ecosystem the World Needs Now

What can companies and regulators do as climate predictions grow grimmer? They should measure impact, strengthen environmental institutions, and look to cities to lead, say Robert Kaplan, Shirley Lu, and Rosabeth Moss Kanter.

- 17 Jan 2024

- Research & Ideas

Are Companies Getting Away with 'Cheap Talk' on Climate Goals?

Many companies set emissions targets with great fanfare—and never meet them, says research by Shirley Lu and colleagues. But what if investors held businesses accountable for achieving their climate plans?

- 23 Jun 2023

This Company Lets Employees Take Charge—Even with Life and Death Decisions

Dutch home health care organization Buurtzorg avoids middle management positions and instead empowers its nurses to care for patients as they see fit. Tatiana Sandino and Ethan Bernstein explore how removing organizational layers and allowing employees to make decisions can boost performance.

- 07 Feb 2023

Supervisor of Sandwiches? More Companies Inflate Titles to Avoid Extra Pay

What does an assistant manager of bingo actually manage? Increasingly, companies are falsely classifying hourly workers as managers to avoid paying an estimated $4 billion a year in overtime, says research by Lauren Cohen.

- 13 Jan 2023

Are Companies Actually Greener—or Are They All Talk?

More companies than ever use ESG reports to showcase their social consciousness. But are these disclosures meaningful or just marketing? Research by Ethan Rouen delves into the murky world of voluntary reporting and offers advice for investors.

- 24 Feb 2022

Want to Prevent the Next Hospital Bed Crisis? Enlist the SEC

After two years of COVID-19, many hospitals still haven't figured out how to manage the overwhelming wave of patients that flood ICUs during each surge. Regina Herzlinger and Richard Boxer offer a novel solution. Open for comment; 0 Comments.

- 28 Feb 2021

- Working Paper Summaries

Connecting Expected Stock Returns to Accounting Valuation Multiples: A Primer

This paper introduces a framework to investors and researchers interested in accounting-based valuation. The framework connects expected stock returns to accounting valuation anchors. It can be generalized to evaluate an enterprise's expected returns, and can be adapted to correct for the use of stale accounting data.

Measuring Employment Impact: Applications and Cases

Employment impact-weighted accounting statements quantify the positive and negative effects of firm practices for employees and the broader labor community. This analysis of companies in different sectors shows how these statements are beneficial both at an aggregate and more specific level.

- 02 Nov 2020

Accounting for Organizational Employment Impact

Impact-weighted accounting methodology standardizes previously disparate measures of impact, in this case the impact of employment. This paper’s methodology and analysis of Intel, Apple, Costco, and Merck shows the feasibility of measuring firm employment impact for insight into firm practices and performance. Closed for comment; 0 Comments.

- 20 Sep 2020

Updating the Balanced Scorecard for Triple Bottom Line Strategies

Society increasingly expects businesses to help solve problems of environmental degradation, inequality, and poverty. This paper explains how the Balanced Scorecard and Strategy Map should be modified to reflect businesses’ expanded role for society.

- 24 Aug 2020

Performance Hacking: The Contagious Business Practice that Corrodes Corporate Culture, Undermines Core Values, and Damages Great Companies

Performance hacking (or p-hacking for short) means overzealous advocacy of positive interpretations to the point of detachment from actuals. In business as in research there are strong incentives to p-hack. If p-hacking behaviours are not checked, a crash becomes inevitable.

- 27 Feb 2020

- Sharpening Your Skills

How Following Best Business Practices Can Improve Health Care

Why do Harvard Business School scholars spend so much time and money analyzing health care delivery? Open for comment; 0 Comments.

- 18 Feb 2020

A Preliminary Framework for Product Impact-Weighted Accounts

Although there is growing interest in environmental, social, and governance measurement, the impact of company operations is emphasized over product use. A framework like this one that captures a product’s reach, accessibility, quality, optionality, environmental use emissions, and end of life recyclability allows for a systematic methodology that can be applied to companies across many industries.

- 16 Oct 2019

Core Earnings? New Data and Evidence

Using a novel dataset of earnings-related disclosures embedded in the 10-Ks, this paper shows how detailed financial statement analysis can produce a measure of core earnings that is more persistent than traditional earnings measures and forecasts future performance. Analysts and market participants are slow to appreciate the importance of transitory earnings.

- 28 May 2019

Investor Lawsuits Against Auditors Are Falling, and That's Bad News for Capital Markets

It's becoming more difficult for investors to sue corporate auditors. The result? A weakening of trust in US capital markets, says Suraj Srinivasan. Open for comment; 0 Comments.

- 22 Jan 2019

Corporate Sustainability: A Strategy?

Between 2012 and 2017, companies within most industries adopted an increasingly similar set of sustainability practices. This study examines the interplay between common and strategic practices. This dynamic distinction helps for understanding whether and how sustainability practices can help companies establish a competitive advantage over time.

- 03 Jan 2019

Financing the Response to Climate Change: The Pricing and Ownership of US Green Bonds

Green bonds are used for environmentally friendly purposes like renewable energy. Complementing previous research, this paper explores the US corporate and municipal green bond and shows that a subset of investors is willing to give up some return to hold green bonds.

- 03 Dec 2018

How Companies Can Increase Market Rewards for Sustainability Efforts

There is a connection between public sentiment about a company and how the market rewards its corporate social performance, according to George Serafeim. Is your company undervalued? Open for comment; 0 Comments.

- 19 Nov 2018

Lazy Prices

The most comprehensive information windows that firms provide to the markets—in the form of their mandated annual and quarterly filings—have changed dramatically over time, becoming significantly longer and more complex. When firms break from their routine phrasing and content, this action contains rich information for future firm stock returns and outcomes.

- 24 Sep 2018

How Cost Accounting is Improving Healthcare in Rural Haiti

The cost of healthcare in rural Haiti was found to vary widely, even inside the same health organization. A pioneering cost accounting system co-developed by Robert Kaplan was called in to determine the cause. Open for comment; 0 Comments.

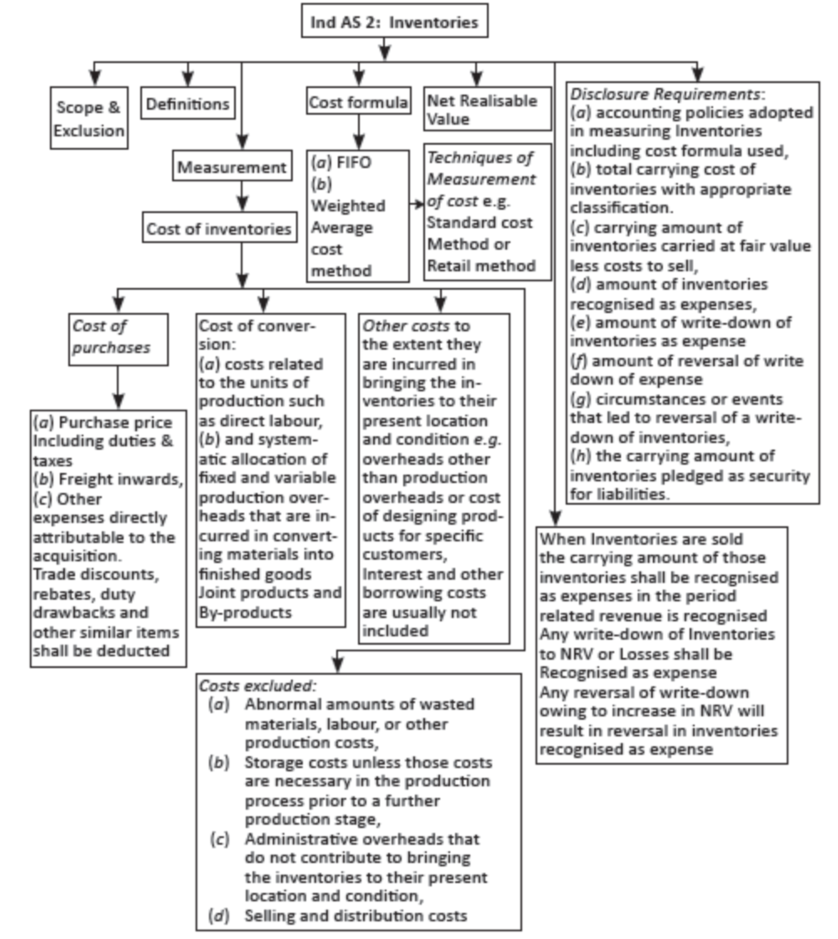

Home » Blog » A Comprehensive Guide to Ind AS 2 | Inventories

A Comprehensive Guide to Ind AS 2 | Inventories

- Blog | Account & Audit |

- Last Updated on 5 June, 2023

Recent Posts

News, Blog, FEMA & Banking

RBI Notifies Directions on ‘Margin for Derivative Contracts’ After Review Based on Market Feedbacks

Blog, News, Account & Audit

Quality Review Board of ICAI Has Issued Guidance on Non-compliances Observed During the Quality Review

Latest from taxmann.

Table of Contents

- Definitions (Para 6)

- Recognition Principles

- Measurement of Inventories (Para 9)

- Cost of Inventories

- Costs Excluded from Valuation of Inventories

- Borrowing Costs and Inventories

- Inventories Purchased on Deferred Settlement Terms

- Cost of Agricultural Produce Harvested from Biological Assets

- Techniques for the Measurement of Cost

- Inventories: Cost Formulaes

1. Objective

The objective of this Ind AS is to prescribe the accounting treatment for inventories. This standard deals in determination of cost of inventories as an asset and its subsequent recognition as expense, when the related revenues are recognised. It also provides guidance on the cost formulas that are used to assign costs to inventories.

This Standard applies to all inventories, except:

(a) Financial instruments (Ind AS 109, Financial Instruments and Ind AS 32, Financial Instruments : Presentation ); and

(b) Biological assets (i.e., living animals or plants) related to agricultural activity and agricultural produce at the point of harvest (Ind AS 41, Agriculture).

3. Exclusion

This Standard does not apply to the measurement of inventories held by:

(a) Producers of agricultural and forest products, agricultural produce after harvest, and minerals and mineral products, to the extent that they are measured at net realisable value in accordance with well- established practices in those industries. When such inventories are measured at net realisable value, changes in that value are recognised in profit or loss in the period of the change.

(b) Commodity broker-traders who measure their inventories at fair value less costs to sell. When such inventories are measured at fair value less costs to sell, changes in fair value less costs to sell are recognised in profit or loss in the period of the change.

The inventories referred to in paragraph 3( a ) are measured at net realisable value at certain stages of production and therefore, these inventories are excluded from only the measurement requirements of this Standard.

This occurs, for example, when agricultural crops have been harvested or minerals have been extracted and sale is assured under a forward contract or a government guarantee, or when an active market exists and there is a negligible risk of failure to sell.

The inventories referred to in paragraph 3( b ) are principally acquired with the purpose of selling in the near future and generating a profit from fluctuations in price or broker-traders’ margin. When these inventories are measured at fair value less costs to sell, they are excluded from only the measurement requirements of this Standard.

4. Definitions (Para 6)

Inventories are assets:

(a) Held for sale in the ordinary course of business;

(b) In the process of production for such sale; or

(c) In the form of materials or supplies to be consumed in the production process or in the rendering of services.

Net realisable value (NRV) is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (See Ind AS 113, Fair Value Measurement. )

Net realisable value vs. Fair value

- Net realisable value refers to the net amount that an entity expects to realise from the sale of inventory in the ordinary course of business. Whereas fair value reflects the price at which an orderly transaction to sell the same inventory in the principal (or most advantageous) market for that inventory would take place between market participants at the measurement date.

- The former is an entity-specific value; the latter is not.

- Net realisable value for inventories may not equal fair value less costs to sell.

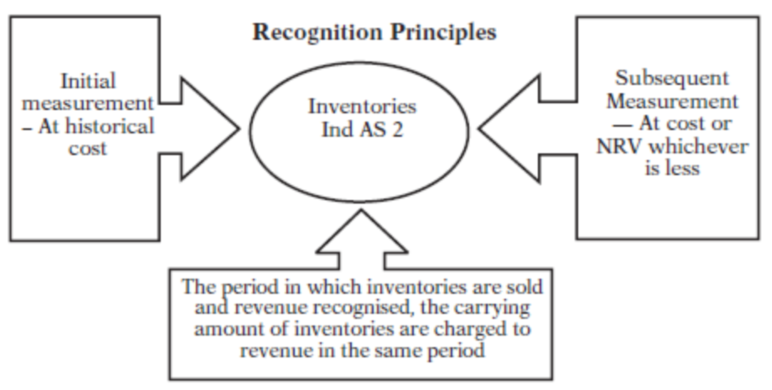

5. Recognition Principles

Recognition principle enunciated by the Standard is diagrammatically represented as under:

6. Measurement of Inventories (Para 9)

Inventories shall be measured at lower of cost and net realisable value as shown below :

Ind AS 2: Inventories

Inventories shall be measured at the lower of cost and net realizable value

7. Cost of Inventories

According to para 10, the cost of inventories shall comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition.

7.1 The cost of purchase of inventories comprise

The purchase price, import duties and other taxes (other than those subsequently recoverable by the entity from the taxing authorities), and transport, handling and other costs directly attributable to the acquisition of finished goods, materials and services. Trade discounts, rebates and other similar items are deducted in determining the costs of purchase.

7.2 The costs of conversion of inventories include

(a) Costs directly related to the units of production, such as direct labour.

(b) They also include a systematic allocation of fixed and variable production overheads that are incurred in converting materials into finished goods.

7.3 Fixed production overheads

The allocation of fixed production overheads for the purpose of their inclusion in the costs of conversion is based on the normal capacity of the production facilities.

7.4 Normal capacity

The actual level of production may be used if it approximates normal capacity. The amount of fixed overhead allocated to each unit of production is not increased as a consequence of low production or idle plant. Unallocated overheads are recognised as an expense in the period in which they are incurred. In periods of abnormally high production, the amount of fixed overhead allocated to each unit of production is decreased so that inventories are not measured above cost.

Illustration 1

Beta Ltd. incurs a fixed production of ` 1,00,00,000 every year. Its normal capacity of production is 1,00,000 units. In the year 2018, 90,000 units were produced and in 2019, 1,10,000 units were produced.

In 2018 the actual production is short of normal capacity and therefore production overhead will be allocated on the basis of normal capacity. Therefore fixed production overhead will be ` 1,00,00,000/1,00,000 units = ` 100 per unit.

In 2019 the actual production is more than the normal capacity and therefore production overhead will be allocated on the basis of actual production. Therefore fixed production overhead will be ` 1,00,00,000/1,10,000 units = ` 90.9 per unit.

7.5 Variable production overheads

Variable production overheads are assigned to each unit of production on the basis of the actual use of the production facilities.

Illustration 2

At Mc B’s store, the fuel consumed for cooking French fries is a variable overhead (indirect material). For every 100 meals which include French fries, Mc B needs fuel of ` 5. Therefore, per meal overhead cost is Re. 0.05. Mc B uses raw material of Re. 1 and pays wages of Re. 0.50 per unit.

Accordingly, total variable cost of the product is Re. 1.00 raw material + Re. 0.50 wages + Re. 0.05 variable overheads which is equal to ` 1.55.

7.6 Other costs

It included in the cost of inventories only to the extent that they are incurred in bringing the inventories to their present location and condition.

* When actual production is almost equal or lower than normal capacity

# When actual production is higher than normal capacity.

8. Costs Excluded from Valuation of Inventories

According to para 16, costs which are excluded from valuation of inventories and recognised as expenses for the period in which they are incurred are:

(a) Abnormal amounts of wasted materials, labour or other production costs

(b) Storage costs, unless those costs are necessary in the production process before a further production stage

(c) Administrative overheads that do not contribute to bringing inventories in their present location and condition and

(d) Selling costs

Illustration 3

Alpha Ltd. purchased raw materials for ` 2,00,000 less a rebate of 5%. It paid ` 30,000 as customs duty including ` 15,000 towards a special duty, against which it will avail credit. It spent ` 5,000 on ocean freight, clearing agents charges of ` 4,000, ` 10,000 on warehouse rent and ` 5,000 on security guard’s wages.

Please determine the cost of inventory.

Please note Warehouse rent of ` 10,000 and Security guard’s wages of ` 5,000 not included as they are not incurred in acquiring the inventory.

9. Borrowing Costs and Inventories

Ind AS 23, Borrowing costs identifies limited circumstances where borrowing costs are included in the cost of inventories .

10. Inventories Purchased on Deferred Settlement Terms

Para 18: An entity may purchase inventories on deferred settlement terms. When the arrangement effectively contains a financing element, that element, for example a difference between the purchase price for normal credit terms and the amount paid, is recognised as interest expense over the period of the financing.

Company A purchased Material X on April 01 202X. The cash equivalent price of the material is Rs 100,000. Company A negotiated with suppliers and the final terms and conditions are as below:

- Payment terms: To be paid after 1 year

- Amount: Rs 150,000

In this case, the payment is deferred beyond normal credit terms and therefore the difference of Rs 50,000 (150,000 – 100,000) will be recognised as interest cost over the period of 1 year and Material X will be recorded only at Rs 100,000 which is the cash equivalent price of the material.

11. Cost of Agricultural Produce Harvested from Biological Assets

In accordance with Ind AS 41, Agriculture, inventories comprising agricultural produce that an entity has harvested from its biological assets are measured on initial recognition at their fair value less costs to sell at the point of harvest.

This is the cost of the inventories at that date for application of this Standard.

12. Techniques for the Measurement of Cost

According to para 21, techniques for the measurement of the cost of inventories, such as the standard cost method or the retail method, may be used for convenience if the results approximate cost. Standard costs take into normal levels of materials and supplies, labour, efficiency and capacity utilisation. They are regularly reviewed and revised where necessary.

In accordance with para 22, the retail method is often used in the retail industry for measuring inventories of large number of rapidly changing items with similar margins for which it is impracticable to use other costing methods. The cost of the inventory is determined by reducing the sales value of the inventory by the appropriate percentage gross margin. The percentage used takes into consideration inventory that has been marked down to below its original selling price. An average percentage for each retail department is often used.

13. Inventories: Cost Formulaes

The cost of inventories of items that are not ordinarily interchangeable and goods or services produced and segregated for specific projects shall be assigned by using specific identification of their individual costs.

The cost of inventories, other than those dealt above shall be assigned by using the first-in, first-out (FIFO) or weighted average cost formula. An entity shall use the same cost formula for all inventories having a similar nature and use to the entity. For inventories with a different nature or use, different cost formulas may be justified.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

Browse accounting learning materials including case studies, simulations, and online courses. Introduce core concepts and real-world challenges to create memorable learning experiences for your students.

Browse by Topic

- Accounting Standards

- Accrual Accounting

- Cash Accounting

- Cost Accounting

- Customer Profitability

- Interest Rates

- Management Accounting

- Tax Accounting

Fundamentals of Case Teaching

Our new, self-paced, online course guides you through the fundamentals for leading successful case discussions at any course level.

New in Accounting

Explore the latest accounting learning materials

Looking for something specific?

Explore materials that align with your accounting learning objectives

Accounting Cases with Female Protagonists

Explore a collection of accounting cases featuring female protagonists curated by the HBS Gender Initiative.

Accounting Core Curriculum

These readings cover the fundamental concepts and frameworks that business students must learn.

Finance & Accounting Cases with Protagonist of Color

Discover finance & accounting cases featuring protagonists of color that have been recommended by Harvard Business School faculty.

Accounting Simulations

Give your students hands-on experience making accounting decisions.

Bestsellers in Accounting

Explore what other educators are using in their accounting courses

1417 word count

Start building your courses today

Register for a free Educator Account and get exclusive access to our entire catalog of learning materials, teaching resources, and online course planning tools.

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Quick Links

- Trace a Member

- Official Directory

- Copyright 2021 ICAI.

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.

IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting body within the IFRS Foundation.

IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

IFRS Accounting

Standards and frameworks, using the standards, project work, products and services.

IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation.

IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. The ISSB is supported by technical staff and a range of advisory bodies.

IFRS Sustainability

Education, membership and licensing, ifrs foundation publishes case study report: better communication—making disclosures more meaningful.

You need to Sign in to use this feature

The IFRS ® Foundation has today published a case study report showing how companies from different parts of the world have improved communication in their IFRS financial statements.

Better Communication in Financial Reporting—Making disclosures more meaningful contains six case studies from varied industries. Its aim is to illustrate how improvements can be made and inspire other companies to initiate their own improvement projects.

The report explains the process these companies have gone through to improve disclosures in the notes to their IFRS financial statements and shows examples of the improvements made. By identifying what information is relevant, prioritising it appropriately and presenting it in a clear and simple manner, they have made their financial statements easier for investors to read and understand. Through the use of examples, the report shows that relatively small changes can significantly improve the quality of the financial information that companies provide.

The report forms part of the Board’s work under the theme of Better Communication in Financial Reporting. It complements other initiatives, including the Principles of Disclosure project and the recently published IFRS Practice Statement 2 Making Materiality Judgements .

Hans Hoogervorst, chairman of the Board, said:

The information in financial statements has to be communicated clearly and effectively to help investors make investment decisions. We hope that this report will inspire companies to start or continue their journeys to improve the communication of information in their financial statements.

Notes to editors

The case studies included in the report are Fonterra Co-operative Group Limited, Wesfarmers Limited, PotashCorp, ITV plc, Orange S.A. and Pandora A/S.

Press enquiries:

Kirstina Reitan, head of communications, IFRS Foundation Telephone: +44 (0)20 72466960 Email: [email protected]

Technical enquiries:

Mariela Isern, senior technical manager, IFRS Foundation Telephone: (0)20 7246 6483 Email: [email protected]

Related Information

The work plan

Principles of Disclosure project

Your privacy

IFRS Foundation cookies

We use cookies on ifrs.org to ensure the best user experience possible. For example, cookies allow us to manage registrations, meaning you can watch meetings and submit comment letters. Cookies that tell us how often certain content is accessed help us create better, more informative content for users.

We do not use cookies for advertising, and do not pass any individual data to third parties.

Some cookies are essential to the functioning of the site. Other cookies are optional. If you accept all cookies now you can always revisit your choice on our privacy policy page.

Cookie preferences

Essential cookies, always active.

Essential cookies are required for the website to function, and therefore cannot be switched off. They include managing registrations.

Analytics cookies

We use analytics cookies to generate aggregated information about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It also helps us ensure that the website is functioning correctly and that it is available as widely as possible. None of this information can be tracked to individual users.

Preference cookies

Preference cookies allow us to offer additional functionality to improve the user experience on the site. Examples include choosing to stay logged in for longer than one session, or following specific content.

Share this page

Accounting Standards 2

- Harvard Case Studies

Harvard Business Case Studies Solutions – Assignment Help

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

Harvard Case Study Solutions

STEP 2: Reading The Harvard Accounting Standards 2 Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

STEP 3: Doing The Case Analysis Of Accounting Standards 2:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Accounting Standards 2 and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Accounting Standards 2 Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Accounting Standards 2 is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

STRENGTHS :

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Accounting Standards 2.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

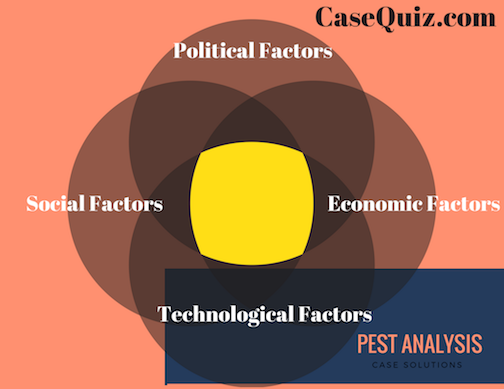

STEP 5: PESTEL/ PEST Analysis of Accounting Standards 2 Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

Pest analysis

PEST FACTORS:

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Accounting Standards 2.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

case study solutions

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Accounting Standards 2 Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

porter’s five forces model

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS: as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES: this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY: the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS: it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS: this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: Generating Alternatives For Accounting Standards 2 Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 8: Selection Of Alternatives For Accounting Standards 2 Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

EVALUATION OF ALTERNATIVES FOR Accounting Standards 2 CASE SOLUTION:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

Recommendations For Accounting Standards 2 Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

myCBSEguide

- Accountancy

- Class 11 Accountancy Case...

Class 11 Accountancy Case Studies Questions

Table of Contents

myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

CBSE introduced case-based questions in class 11 accountancy question papers last year to enhance and develop analytical and reasoning skills among students. Class 11 Accountancy Case Studies Questions are given in CBSE model question papers too. Last year sample case-based questions were released by the CBSE and immediately an air of confusion was created among all. This concept was uncharted territory for both students and teachers.

A hypothetical text was provided on the basis of which the student was required to solve the given case-based question asked by CBSE in the accountancy class 11 exam. Initially, the case-based questions appeared to be tedious for both the students and the teachers as they were unprepared to deal with the new pattern of questions but now a lot more clarity is there that has made the question paper quite student-friendly.

Case Study Questions in class 11 (Accountancy)

Case-based questions in Accountancy are considered to be quite challenging by the class 11 students. The questions need to be well prepared and adequately practiced before attempting the class 11 accountancy exam. The accountancy class 11 syllabus is a well-integrated program that facilitates the students to comprehend and learn the basic accounting theories/principles. The subject is the base of major accounting fundamentals that are studied in depth at an advanced level in class 12. For students appearing for grade 11 exams from the Commerce stream, Accountancy is a prime subject. Accountancy is considered to be the most difficult of all other core subjects in the class 11 commerce stream.

The subject is consuming and the case studies are termed to be troublesome for they do require conceptual clarity. To ace this CBSE exam, students need to put in the extra effort. Among all the core subjects of the Commerce stream i.e accountancy, economics and business studies, it’s accountancy that renders a tough time for the students because of its complex theories and principles. It is an arduous task to score well in the 11-grade accountancy examination without adequate practice and knowledge. Many students who opt for the commerce stream after their 10-grade exams target chartered accountancy as a career option, so the subject is of paramount importance for them.

Accountancy syllabus of class 11 CBSE

The entire Accountancy course is divided into 2 parts:

- Part A, Financial Accounting _ I

- Part B, Financial Accounting _ II

Most of the case study questions are centered around the exercises of NCERT textbooks. It is recommended to read the textbooks religiously. There are 2 prescribed textbooks for class 11 Accountancy that have been published by NCERT. But Accountancy has an extensive curriculum and students need to go through other reference books too. Adhering only to NCERT textbooks will not be adequate to achieve proficiency in this subject.

CBSE Class – 11

Accountancy (Code No. 055) Syllabus

Case Study Passage (Accountancy class 11)

In these questions, the students would go through a paragraph with a hypothetical situation, based on which critical reasoning type questions will have to be answered by them. It is important for the students to inspect the passage carefully before trying to attempt the questions. In the coming examination cycle (2022-23), case-based questions will carry a weightage of around 15 to 20%. These questions can be centered on any chapter from the NCERT textbook for accountancy, class 11. Students need to brace well for the case-based questions prior to appearing for their accountancy examination as these questions require a thorough understanding of the key concepts in their syllabus. CBSE aims to increase the weightage of such questions in the years to come.

Kind of case-based Questions in Accountancy

Accountancy is a subject that deals with trade and commerce. The subject records allocate and outline the transactions of a business. The subject is for sure demanding thus requiring a greater effort from the students in order to strive for a perfect score. It is believed to be demanding but at the same time, it is scoring.

The case-based questions asked in the CBSE accountancy question paper for class 11 are of two types:

- Objective- Such questions are asked in the MCQ format

- Subjective- The questions would be answered briefly only but these questions are the ones that would require detailed analysis and application of some fundamental accountancy theories.

How To Prepare For Case-based Questions in Accountancy Grade 11

Students need to prepare well for the case-based questions before appearing for their class 11 Accountancy exams. Here are some tips which will help the student to solve the case-based questions at ease:

- Go through the provided text carefully

- Analyze the situation provided as part of the question asked

- Focus on following correct formats in your responses, accountancy is one subject where apart from the concepts students need to be careful about the formats.

- Brush up well on the theory portion of accountancy, this is the key to scoring a perfect score.

- Practice rigorously

- Provide to-the-point responses

Students need to solidify their concepts in order to ace the accountancy class 11 exam. Case studies can be easily solved if your key fundamentals are crystal clear. These simple points if kept in mind will definitely help the students to fetch good marks in case study questions in class 11 Accountancy .

Case study question examples in accountancy

Here are some given case study questions for CBSE class 11 Accountancy. If you wish to get more case study questions and other study material, download the myCBSEguide app now. You can also access it through our student dashboard.

Accountancy Case Study 1

Read the hypothetical text given and answer the following questions:

Sachin and Dravid are partners in firm sharing profits and losses in the ratio of 3:2. Their balance sheet is given below:

Balance Sheet as on 31.03.2017

On 01.04.2017, they admit Ashwin as a new partner into partnership on the following terms a) He brings in 40,000 as capital and 18,000 towards goodwill for 1/4th share in future profits b) Depreciate furniture by 10% and buildings are revalued at 45,000

- c) PDD is increased to 3,500

- d) Prepaid insurance * 2,000.

Prepare: i) Revaluation Account

. ii) Partners’ Capital Accounts

iii) New Balance

Accountancy Case Study 2

Ram and Shyam are two friends who both have just attended their first class of accountancy. The friends were intrigued by the different branches of accounting and their widespread application. Ram personally liked the branch of accounting in which fund flow statement and budgetary control is used and that branch helps in planning and controlling of operations. As the concept of accounting was further explored, they began discussing the different users of accounting. Ram said that he finds it interesting that even the employees demand information relating to business. Shyam said he finds more interesting the fact that even competitors want information on the relative strengths and weaknesses of the enterprise and for making comparisons, Shyam further said that even accounting helps owners to compare one year’s costs, expenses, and sales with those of other years. However, they were quite shocked by the fact that the management-worker relations were not taken into consideration in the accounting. Meanwhile, Ram and Shyam had an argument at the end of the discussion. Ram was saying that accounting is an art whereas Shyam was saying that accounting is a science. Their teacher came in and said something to them which made them stop the argument.

Q1. What might their teacher have said to solve their argument?

- Ram, please understand, Shetty is correct in this situation

(b) Shyam, please understand, Ram is correct In this situation.

(c) Both are correct

(d) None is correct

Q2. Shyam talked about which type of users of accounting?

(a) Internal users

(b) External users

(c) Both (a) and (b)

(d) None of these.

Q3. Which limitation of accounting is being talked about by them?

(a) Influenced by personal judgment

(b) Omission of qualitative information.

(c) Incomplete information

(d) Based on historical costs

Q4. Which advantage of accounting is being talked about by Shyam in the last part of the first para?

(a) Provides information regarding profit and loss

(b) Provides completes and systematic record

(c) Enables comparative study

(d) Evidence in legal matters

Q5. Which branch of accounting is liked by Ram?

(a) Financial accounting

(b) Cost accounting

(c) Management accounting

(d) Tax accounting

Accountancy Case Study 3

Read the following case study and answer questions

Sam and Jay started with Cash 10,000 and Machinery 1,00,000. They decided to set up a production line for PPE kits for. the protection from Covid 19 virus. As their demand rose, they decided to buy one more piece of machinery. For the same, they took bank overdraft and purchased the machinery. The quality of the company’s product was extremely high and therefore, it could develop a reputation for itself in the market and business was flourishing. After 1.5 years, their old machinery turned obsolete so they decided to sell the same. They sold it and got some cash proceeds. To further increase the brand presence among the concerned stakeholders, they decided to run advertisements from the cash proceeds of machinery sold. As more and more customers demanded their product, they decided to launch a discount for bulk purchases. The discount was not to be recorded in the books of accounts. This campaign was successful and they earned a lot of profits from the same.

Q1. Which type of discount is being discussed in the last part of the passage?

(a) Trade discount

(b) Cash discount

(d) Can’t be determine

Q2. Which asset is discussed in the line, “The quality of the company’s product was very high and therefore, it could develop a reputation for itself in the market and business was flourishing”?

(a) Tangible

(b) Intangible

(c) Current.

(d) Both (a) and (c)

Q3. Which type of liability is discussed in the passage?

(a) Non-current

(b) Current

(d) Can’t be determined

Q4. What was the capital initially invested?

(b) 1,00,000

(c) 1,10,000

Q5. The passage involves capital receipts (apart from initial capital invested).

Advantages of case study questions in Accountancy

The entire class 11 Accountancy syllabus is divided into 2 textbooks that are prescribed by NCERT. The examiner can ask case study questions from any chapter or concept. Students are expected to prepare themselves thoroughly. They ought to practice class 11 Accountancy case-based questions from the various options available to them, so as to ace the subject.

- Uplift the analytical skills of students

- Provide a well-rounded understanding of the concepts

- Enhance intellectual capabilities in students

- Help students to retain knowledge in their long-term memory

- The questions would help to discard the concept of rote learning

- Case studies encourage practical learning.

“Procrastination is the thief of time”

Test Generator

Create question paper PDF and online tests with your own name & logo in minutes.

Question Bank, Mock Tests, Exam Papers, NCERT Solutions, Sample Papers, Notes

Related Posts

- Competency Based Learning in CBSE Schools

- Class 11 Physical Education Case Study Questions

- Class 11 Sociology Case Study Questions

- Class 12 Applied Mathematics Case Study Questions

- Class 11 Applied Mathematics Case Study Questions

- Class 11 Mathematics Case Study Questions

- Class 11 Biology Case Study Questions

- Class 12 Physical Education Case Study Questions

Leave a Comment

Save my name, email, and website in this browser for the next time I comment.

COMMENTS

Cost is 500 and NRV is 600 then Inventory value as per AS-2 is 600. Cost is 500, Sale Price is 700 and 30% commission, NRV is 490 (700-30%*700) then, Inventory value as per AS-2 is 490. Treatment of Normal loss and abnormal loss: Company A purchased 100 items at the cost of Rs.10 each.

Which of the following is true: A. AS are not applicable to charitable trusts B. There is no exemption to Section 8 company from applicability of accounting standards C. SMC (business income of INR 50 lakhs) D. Non SMC (donation receipts of INR 50 crores) Case Study.

AS 2 is the Accounting Standard for the valuation of inventories and their accounting treatment. This accounting standard covers methods to value the inventory of a business and its disclosure in the financial statements. The general rule mentions valuing inventories i.e. closing stock of a business at cost or market value whichever is lower.

3. The following terms are used in this Standard with the meanings specified: 3.1. Inventories are assets: held for sale in the ordinary course of business; in the process of production for such sale; or. in the form of materials or supplies to be consumed in the production process or in the rendering of services. 3.2.

The following thesis contains solutions to case studies performed on various accounting standards in accordance with Generally Accepted Accounting Principles, GAAP. Each case study focuses on a different area of financial reporting with some focusing on the principles and others on the documentation. The case studies were done in conjunction

by David Freiberg, Katie Panella, George Serafeim, and T. Robert Zochowski. Impact-weighted accounting methodology standardizes previously disparate measures of impact, in this case the impact of employment. This paper's methodology and analysis of Intel, Apple, Costco, and Merck shows the feasibility of measuring firm employment impact for ...