- Business Ideas

- Registered Agents

How to Start a Money Transfer Business in 14 Steps (In-Depth Guide)

Updated: February 22, 2024

BusinessGuru.co is reader-supported. When you buy through links on my site, we may earn an affiliate commission. Learn more

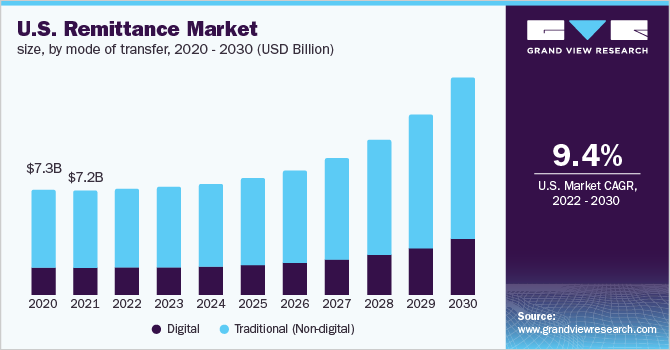

The money transfer industry is expected to reach $95.1 billion by 2032. With more people living abroad and sending money home, it’s a market ripe for new entrants.

The process of building your own money transfer business can seem daunting. You may wonder how to get started, what legal and regulatory requirements exist, and whether there is room to carve out a niche in this competitive space.

This guide breaks down startup costs, critical factors for long-term viability, and step-by-step instructions on acquiring licensure, launching marketing, and obtaining an EIN. With strategic planning and execution, you can be successful. Learn how to start a money transfer business here.

1. Conduct Money Transfer Market Research

Market research helps you develop a business plan for your remittance business. It offers insight into your target market, trends in the money transfer industry, and even which social media platforms are being used by competitors to get money transfer business posted online.

Some details you’ll learn through market research include:

- Global migration patterns mean more people than ever live abroad as expatriates and migrant workers.

- Improving economic conditions in developing countries leads to rises in disposable income available for family members to send home.

- Advances in digital transfer technology have significantly increased accessibility, convenience, and affordability compared to traditional cash-based means.

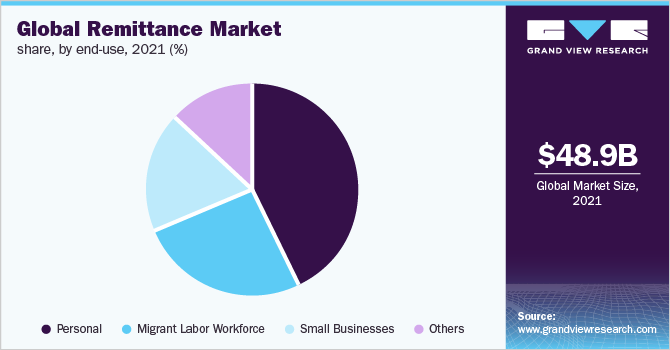

- A closer look at the underlying demographics reveals promising target consumer segments.

- Expatriate workers are the largest contributors, responsible for over 70% of money transfers.

- With over 164 million migrant workers globally, there is a huge addressable audience here.

- The end-user opportunity is immense, and systemic changes create space for new entrants.

- Stricter regulations have led some banks, including JP Morgan Chase and Bank of America , to pull back from the consumer remittance sector, opening a gap for non-bank specialists.

- Services like PayPal’s Xoom , Remitly and WorldRemit have all expanded operations, but still account for less than 5% of total volume, signaling ample remaining share up for grabs.

With accessible technology, low overhead costs compared to traditional models, and exponential end-market growth anticipated, the conditions for building a money transfer business are ideal. Capitalizing on this potential requires contending with regulatory requirements and significant competition.

2. Analyze the Competition

To understand the competitive landscape, first look at the traditional brick-and-mortar money transfer operators. Observe customer demographics, pain points in the process, and customer service quality. This will reveal targetable weaknesses alongside their brand dominance.

Complement this in-person competitive analysis by evaluating their online capabilities. Register accounts, try transferring funds, and scrutinize strengths like transfer speed, payment options, currency support, and loyalty programs.

While Western Union and MoneyGram ’s immense scale can seem daunting, don’t underestimate startups gaining traction in the digital space. Companies like Remitly and Azimo have managed to carve out multi-million dollar niches with more convenient, transparent, and affordable online-first offerings.

Replicate using their services to experience features that delight customers first-hand. Sign up for demos, explore integrations with payment platforms like PayPal , and evaluate customization for funding sources and payout methods. This reveals winning strategies to emulate and build upon.

By benchmarking both traditional big names and emerging digital disruptors, you gain invaluable insight into market positioning and customer priorities. Blend this with target user and region-specific research to identify strategic white space opportunities.

3. Costs to Start a Money Transfer Business

Launching a money transfer business demands a meticulous approach to financial planning. Let’s explore the initial expenses involved in getting your venture off the ground:

Startup Costs

- Licensing and Legal Fees: Ensuring compliance with regulatory requirements is paramount. Allocate funds for obtaining federal and state licenses, alongside adherence to regulations like the Bank Secrecy Act. Estimate these expenses to range from $1,000 to $5,000, varying by jurisdiction complexity.

- Location Costs: Securing a suitable commercial space is crucial for visibility and accessibility. Anticipate monthly rent or lease costs between $1,000 to $5,000, contingent on the location’s size and foot traffic.

- Equipment and Technology: Invest in essential equipment and technology infrastructure, including POS terminals and security systems. Initial expenses can range from $5,000 to $10,000, depending on operational scale.

- Staffing Expenses: Quality personnel are indispensable for customer service and regulatory compliance. Budget for salaries, benefits, and training, ranging from $3,000 to $10,000 monthly, based on staff numbers and local wage rates.

- Marketing and Advertising: Promotion is key to attracting customers. Allocate funds for marketing materials and online advertising, typically ranging from $500 to $5,000 initially.

- Insurance Coverage: Shield your business from potential risks with adequate insurance coverage. Estimate annual premiums between $1,000 to $5,000, factoring in coverage limits and operational risks.

Ongoing Costs

Maintaining operational continuity requires foresight in managing ongoing expenses. Let’s delve into the recurring costs:

- Rent or Lease Payments: Monthly rental or lease payments for commercial space are recurring. Expect costs between $1,000 to $5,000 per month, reflecting market rates and location.

- Staff Salaries and Benefits: Sustain business operations by budgeting for ongoing staff salaries, benefits, and training, ranging from $3,000 to $10,000 monthly.

- Technology Maintenance and Upgrades: Ensure seamless operations by allocating funds for technology upkeep and upgrades, typically ranging from $500 to $2,000 per period.

- Compliance and Regulatory Costs: Maintain adherence to regulatory standards with ongoing compliance costs, varying from $500 to $2,000 annually, dependent on operational complexity.

- Marketing and Advertising Expenses: Sustain brand visibility through periodic marketing campaigns, with expenses typically ranging from $500 to $2,000 per cycle.

- Insurance Premiums: Renew insurance coverage annually to mitigate risks, with premiums ranging from $1,000 to $5,000 per year.

By meticulously accounting for both startup and ongoing costs, aspiring entrepreneurs can chart a clear financial course for their money transfer business. Regular monitoring and adjustments are essential to ensure financial stability and adaptability in a dynamic market landscape.

4. Form a Legal Business Entity

When launching a money transfer business, one of the most important early decisions is selecting your legal entity structure. This carries major implications for legal liability, taxation, raising capital, and regulatory requirements. There are four main legal entities to choose from:

Limited Liability Company (LLC)

LLC maintenance tends to have less demand than corporations in most states. Record keeping and required meetings are typically simpler, with fewer forms and filings. LLC formalization separates legally from sole proprietors, makes clear financial accounting a necessity, and boosts perception among license-issuing bodies.

Sole Proprietorship

A sole proprietorship is best suited for a business with a single owner, or a married couple. It puts you in the driver’s seat in terms of ownership but comes with a downside. Sole proprietorships don’t separate personal and professional assets in cases of liability.

With money transmission licenses central to operations, the risks of non-compliance and handling client funds make limiting personal assets at stake prudent.

Partnership

A partnership works much the same as a sole proprietorship but is intended for a group of business owners. This is a good option for a business run by a family, where each member has an equal investment in the company. Like a sole proprietorship, a partnership doesn’t provide separation between personal and business assets.

Corporation

A corporation is the most advanced form of legal business entity there is. It offers the most protection and the greatest level of customization for owners. On the downside, a corporation is the most complicated and expensive to initiate.

5. Register Your Business For Taxes

One of the key regulatory requirements for launching a money transmission company is obtaining an Employer Identification Number (EIN) from the IRS. The EIN serves as a unique taxpayer ID that identifies your business to federal and state authorities for reporting and filing purposes.

Registering for an EIN is free and can be completed online via the IRS website in just minutes.

To apply, you will need to provide basic information about your LLC such as name, address, and ownership details. The online wizard will guide you through a simple 7-step process that includes reviewing and submitting supporting documentation for your entity.

Upon completion, you will be provided an EIN confirmation notice containing your new tax ID number. This universal business identifier will be used on state money transmitter license applications and down the line for employee onboarding, banking, and payment provider integrations.

In addition to the federal EIN, be sure to look at state and local licensing bureaus to understand sales tax permit requirements for money transfer provider services in your geographic areas of operation. The costs are typically minimal ($50 or less).

While EIN receipt alone does not require filing regular business tax returns, integration with payment systems and employing workers down the line will trigger tax and information reporting obligations. The EIN serves as the consistent tracking number tied to your LLC as these tax scenarios emerge over time.

Obtaining an EIN only takes a few minutes but is a mandatory step to operate legally as a money services business in the United States. With the EIN secured, you can proceed to acquire requisite state money transmitter licenses with confidence.

6. Setup Your Accounting

Maintaining rigorous accounting is crucial for money transfer businesses to track high transaction volumes across customer payments. Money transfer businesses must carefully reconcile payroll for expanding local agents and staff, monitor contractor payout pipelines, and more.

Some ways to optimize your accounting include:

Accounting Software

All complex financial workflows are made smoother by leveraging meticulous accounting software like QuickBooks . QuickBooks works to centralize real-time tracking to reconcile and organize every expense. It streamlines accounting services and allows small businesses to avoid an in-house accounting team.

Hire an Accountant

Along with using accounting software, you should work with an accountant part-time or at the end of the year. Accountants are trained in the intricate methods and tools involved in maintaining and balancing records and can help you meet the part-time requirements of your money transfer license as far as the government is concerned.

Open a Business Bank Account

Another way to organize business finances is to open a business bank account. Remittance services should never mix personal and business funds. Adhering to the Bank Secrecy Act is made easier by having separate accounts to remain transparent to shareholders, customers, and partners.

7. Obtain Licenses and Permits

Obtaining the proper money transmitter and related financial services licenses is essential for legally facilitating cross-border transactions and handling customer funds as a money transfer provider. Find federal license information through the U.S. Small Business Administration . The SBA also offers a local search tool for state and city requirements.

For example, requirements to research may include:

- Money transmitter licensing in states where operations will be based

- Registration as a licensed MSB (Money Services Business) with entities like FINCEN on the federal level

- Acquiring positive background checks and compliance histories for owners/officers

- Securing bonds and meeting minimum capitalization requirements

Because policies frequently evolve, it is advisable to enlist guidance from legal and compliance advisors with a specialized understanding of updated changes proposed by complex regulators like the Conference of State Bank Supervisors .

8. Get Business Insurance

Comprehensive business insurance is considered a prudent move for any company handling sensitive customer data and funds. For regulated financial services like money transmission, insurance can provide an added backstop that demonstrates good faith risk management to licensing authorities.

Potential risks include internal fraud, cybersecurity breaches, failing compliance audits, or events like fires or floods that physically destroy servers and records. Having policies that reimburse customers and restore business operations quickly after disasters minimizes business continuity disruptions.

Common coverage includes:

- Employee theft insurance

- Data breach plans

- Errors & omissions liability

- Property/casualty

With manufacturers crafting over 150 niche solutions, expert guidance is key. Evaluating local transmission regulations to quantify specific coverage gaps, projected customer base value, disaster likelihoods, and growth trajectories can inform smarter buys.

Collaborating closely with an independent broker well-versed in the financial technology sector can illuminate advantageous products unknown to laypersons. They can also assist in interfacing with carriers negotiating tailored solutions like enhanced cyber plans with breach coaches.

While more affordable than some industries, underinsured transmission businesses still risk major continuity threats, hefty non-compliance fines or lawsuits, and even shutdown orders. But those taking a proactive rather than reactive stance on comprehensive insurance enjoy peace of mind as a worthy investment.

9. Create an Office Space

Having a professional office can facilitate customer meetings, support staff collaboration, safely store sensitive documents, and establish legitimacy for licensing boards. Locations projecting security and financial competence may strengthen trust in handling client funds.

Home Office

Many founders launch from home offices minimizing overhead until revenue stabilizes. This allows concentrating resources on core business operations rather than real estate early on. Upgrading later as needs emerge can work well for web-based models.

Coworking Office

For location flexibility at affordable monthly rates, coworking spaces like WeWork provide turnkey environments configurable as teams grow. Built-in amenities, networking events, and central locations offer cost-efficient flexibility difficult to replicate elsewhere.

Retail Office

The option of a retail storefront could provide neighborhood visibility and convenience for cash pay-ins/payouts. But weigh higher fixed costs against target customer digital expectations and foot traffic potential.

Commercial Office

Long-term, strict security and compliance needs may merit eventually overseeing internal spaces like stand-alone commercial offices. This enables highly customized build-outs aligning to data and money-handling best practices as businesses scale up.

10. Source Your Equipment

Many money transmitters function predominantly through web-based platforms, minimizing extensive physical equipment needs early on. But some key components could include:

- Computer hardware/software for building digital platforms and interfaces

- Smartphones/tablets for testing, demos, communications

- Office equipment like printers, and scanners for customer onboarding

When starting, relying on modern personal devices to develop minimally viable technology can suffice and cost little. As efforts grow more sophisticated, upgrading to commercial-grade equipment may support resilience and capacity.

Buying new equipment ensures modern furniture and electronics, extended warranty options, and a longer life span. You can obtain new supplies for your business office through retailers like Staples and Office Depot .

To save money as you start, your transferring money business could invest in used equipment. Check platforms like Facebook Marketplace or Craigslist for deals. Be sure to check that everything is in working order before paying for products.

11. Establish Your Brand Assets

Entering an industry reliant on consumer confidence in the safe, reliable passage of hard-earned funds internationally. Branding your business helps potential clients recognize you, and for your brand to in turn grow in value online.

Some ways to begin developing your brand include:

Design a Logo

Logos offer a visual indicator of who your company is and what it can do. It helps set you apart from competitors and even inspires consumers and business owners to make a change from a competing service. A great place to get started with logo design is Looka .

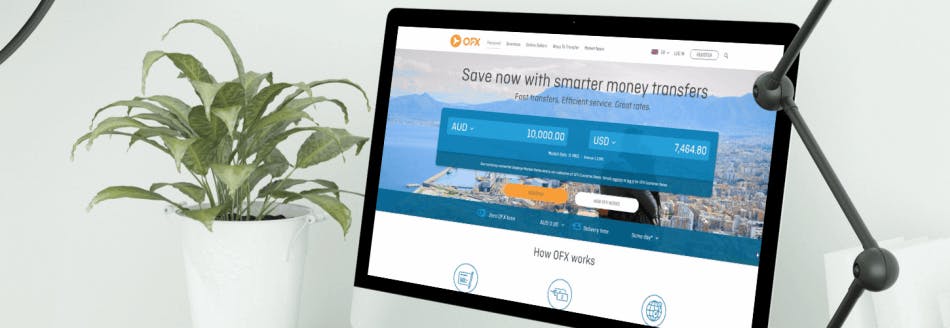

Design a Website

In the digital age, it’s more important than ever before for businesses to develop easily navigable websites. Designing websites has become easy, even for newcomers. Wix is a great do-it-yourself option. You can also invest in freelance platforms like Fiverr for a more professional custom design.

Print Business Cards

Business cards provide a professional jumping-off point for referrals and word-of-mouth marketing. As a tangible marketing resource, business cards give potential customers memorable access to your business phone number, website, and more. Try Vistaprint for quick, affordable, and professionally printed business cards.

Get a Business Phone Number

Business phone services from RingCentral provide a focused point of contact for customers, investors, and more. A business phone line helps maintain organization between personal and business calls.

Get a Business Domain Name

An indicator of serious long-term market commitment comes through seemingly small touches. Official domain names, like your logo, help brand your business and offer a memorable way for customers to find you. Check out providers like Namecheap for affordable .com addresses.

12. Join Associations and Groups

Joining localized trade organizations, chambers of commerce chapters, or money transmitter alliances creates opportunities to regularly exchange guidance with specialists navigating similar regulatory nuances, banking bottlenecks, and risk climates within overlapping regions.

Local Associations

There are many groups designed to support newcomers in the financial business sector. The International Association of Money Transfer Networks and Money Services Business Association will connect you with like-minded professionals.

Local Meetups

In-person venues provide local mentorship opportunities. Meetup is a great avenue to find events and trade shows in your area. Don’t see one you like? Create a meetup of your own.

Facebook Groups

Tapping forums comprised of principal compliance officers and licensed transmitters via Facebook Groups is a good place to begin. Check out How to Money and Money Transfer Hub to get started. LinkedIn is also a great digital platform to network. It provides mentorship from long-tenured practitioners over common pitfalls.

13. How to Market a Money Transfer Business

Marketing is essential to starting a money transfer services business. It draws in new interest and encourages current customers to use your service again and share it with others. Some of the major ways to market your business as a money transfer operator include:

Referral Marketing

Gaining visibility and trust in a highly regulated industry often hinges on referral networks stemming from exemplary customer service. Providing transfer fee discounts or cash bonuses to satisfied customers who refer other senders could incentivize organic word-of-mouth promotion.

Digital Marketing

Digital tactics useful for amplifying reach may include:

- Search ads on Google Ads to drive users from relevant money-oriented keyword searches

- Social media ads on platforms like Facebook to target expatriate demographics

- Optimized blogging and video content to organically appear for searched money questions

- Email nurture tracks guiding interested leads through account signup

- Retargeting ads remarketing the brand to site visitors

Traditional Marketing

More traditional outlets typically demanding higher spending like billboards or radio may prove less traceable but still contextually valuable:

- Transit posters in high-traffic pickup and delivery locales

- TV or radio ads placed strategically around key cultural events when sending spikes

- Community sponsorships aligned with relevant diaspora organizations

With heavy compliance considerations, however, professional guidance would be advisable before deploying ads to confirm acceptable creative approaches across mediums.

14. Focus on the Customer

In an industry dependent on deep trust to protect clients’ sensitive, hard-earned money, delivering highly responsive, individualized support helps forge meaningful relationships that fuel referrals. Doing whatever it takes to ensure customers feel taken care of can pay dividends.

Consider this scenario: Throwing in a small transfer fee discount for a repeat customer who frequently sends remittances to cover a loved one’s medical bills abroad costs little but signals meaningful support. When their grateful friend later asks where to send their niece’s college tuition, a heartfelt personal recommendation carries far more weight than any advertisement.

Even providing customized guidance to new customers overwhelmed by the transfer options, compliance documentation required, and international policies cements your brand as an ongoing resource at their side rather than just a transactional platform.

By consistently making people the bottom line by nurturing consumer experiences you put yourself in a prime position for return customers.

You Might Also Like

April 9, 2024

0 comments

How to Start a Dog Clothing Business in 14 Steps (In-Depth Guide)

Have you ever considered turning your love for canine couture into a thriving business? ...

How to Start a Vintage Clothing Business in 14 Steps (In-Depth Guide)

The vintage apparel and second hand clothing industry reached an evaluation of $152.5 billion ...

How to Start a Bamboo Clothing Business in 14 Steps (In-Depth Guide)

The global bamboo fiber market is expected to grow at a compound annual growth ...

How to Start a Garage Cleaning Business in 14 Steps (In-Depth Guide)

Starting a garage cleaning business could be the perfect solution! The U.S. garage and ...

Check Out Our Latest Articles

How to Start a Money Transfer Business: Step-by-Step Guide!

Envisioning a world where transferring money across borders is as easy as clicking. This is not a distant dream but today’s reality in the digital age. In today’s digital age, the concept of how to start a money transfer business has become more than just a financial venture, It’s a bridge connecting global economies.

The journey of starting a money transfer business has evolved from traditional methods to innovative digital money transfer services. The rise of this industry isn’t just about technology, it’s about connecting lives and fueling economies. With each transaction, there’s a story of someone supporting a loved one or a business expanding its reach.

As we explore this thriving sector, we will uncover the essentials of licensing, compliance, and business setup. These are more than just regulatory hurdles. They are stepping stones to building a trusted and successful venture. fer business. Now, let’s explore this realm where fintech ventures address global problems and generate opportunities for both consumers and entrepreneurs.

Table of Contents

Mapping the $930 Billion Money Transfer Industry

The global remittance space is undergoing tremendous growth, expected to reach a staggering $930 billion by 2026 according to World Bank estimates. Driving this expansion is the growing migrant workforce seeking to support families internationally through convenient money transfer channels.

Key trends like migration, globalization, digitization, and increasing financial inclusion are catalysts for the rising cross-border money flows. We examine the market dynamics powering this expansion.

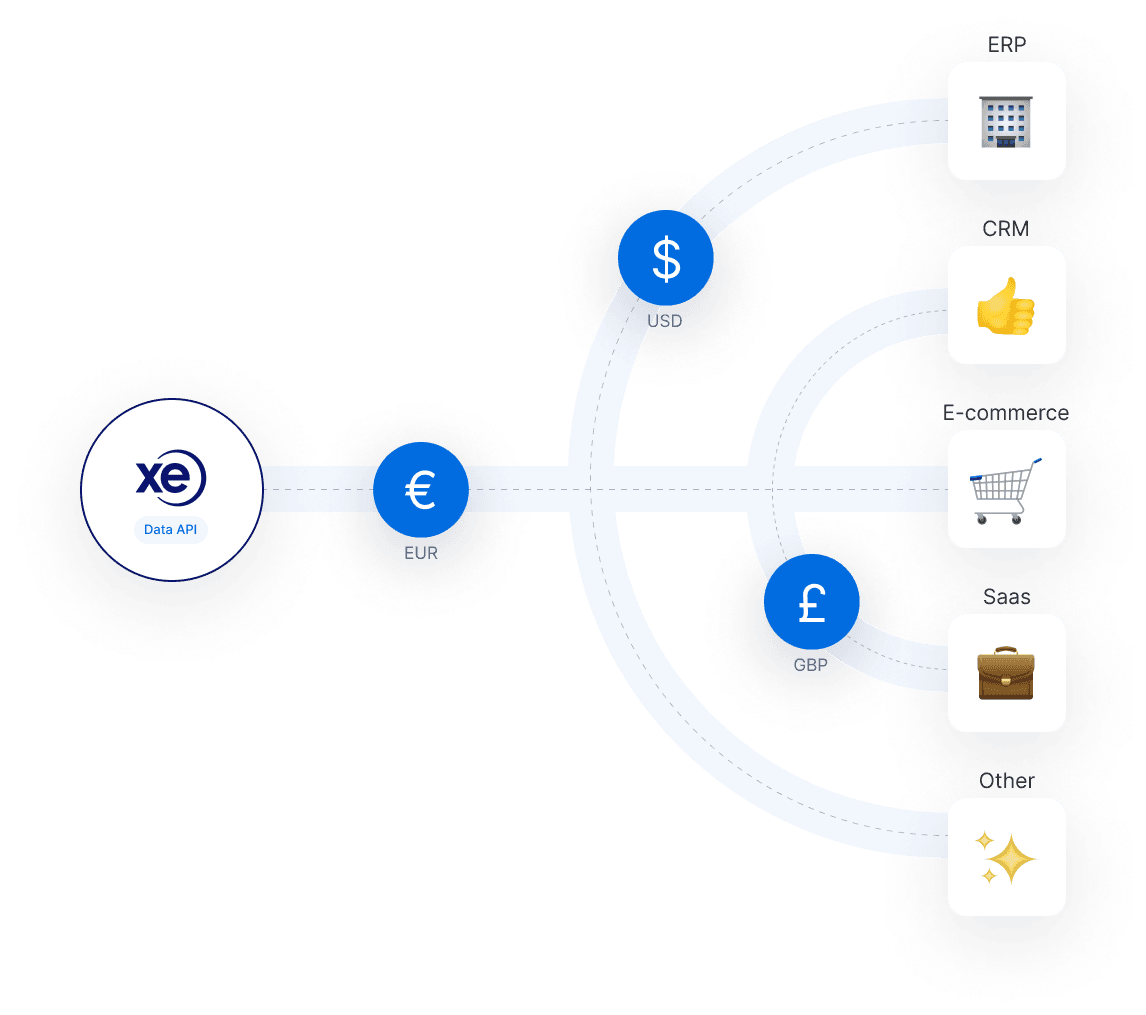

Navigating the Spectrum of Money Transfer Models

From traditional agents to emerging cryptocurrency platforms, transmitters now integrate various transfer modalities to facilitate affordable convenience. We outline prevalent structures like bank-centric wire transfers, online platforms, mobile apps, and peer-to-peer (P2P) networks. Underpin the global conveyance infrastructure today, weighing their strengths and weaknesses.

What Drives Money Transfer Costs and Friction

While innovation aims to minimize fees, pricing pressure persists as a barrier for many migrants. Variables like forex fluctuations, provider margins, and licensing overheads contribute to costs frequently amounting to 7% of send amounts. New entrants must balance affordability and profitability concerns amidst structural cost drivers. As newcomers enter this arena, understanding these variables is vital to stand out.

Understanding Compliance Requirements

Navigating the compliance landscape is a critical step in establishing a money transfer business. Before finalizing services, analyzing state-level expectations across bond mandates, capital thresholds, reporting, and application timelines is imperative.

Key Points:

- Researching federal and state regulatory frameworks to ensure your business aligns with legal standards.

- The pivotal role of obtaining a money transmitter license is a non-negotiable aspect of legal operation.

- Outlining essential prerequisites such as net worth requirements and surety bonds.

- A detailed look at the application procedure, demystifying processing times, and documentation intricacies.

Crafting a Strategic Business Plan

A well-crafted business plan is more than a document; it’s a strategic compass guiding your money transfer business toward industry success. It serves as a strategic plan that directs every facet of your company’s path, not just a document. It’s the plan that deftly combines your vision with reality. Laying the groundwork for an enterprise that speaks to both the modern financial services industry and the digital era.

- Breaking down the essential components of a business plan: from the executive summary to the management team.

- The significance of thorough market research in understanding the digital remittance market and identifying target demographics.

- Strategies for establishing competitive pricing and navigating the complexities of regulatory compliance.

- Practical advice on financial planning and risk assessment, crucial for sustaining and growing in the fintech venture.

Structuring Your Money Services Business

Choosing the right business structure is a pivotal decision in the journey of setting up a money transfer business . It’s about aligning your business goals with legal and financial frameworks.

- Deciding on the business entity: Partnerships, limited liability companies (LLC), corporations, etc., and understanding their implications.

- Navigating taxation policies, registration formalities, and business registration requirements with relevant authorities, including the U.S. Treasury Department.

- Reviewing capital requirements, exploring sources of investment, and formulating an investment strategy.

- Planning the organizational hierarchy and reporting structures to optimize business operations.

Establishing a Strong Market Position

Gaining visibility amidst veterans like Western Union requires crisp messaging rooted in customer insights. We analyze your niche potential across retail, business, and program remittance segments to shape differentiated propositions.

- Evaluating the Competitive Landscape: Assess offerings from global and regional players through dimensions like transfer modes, corridor coverage, pricing models, and target groups to identify whitespace opportunities.

- Sizing Market Potential: Analyze World Bank migration data and segment flow patterns to quantify addressable consumers and business partners in key send-receive corridors.

- Crafting Value Propositions: Interview customer panels and journey map needs of prime prospects to shape messaging conveying unique strengths over substitutes.

- Building Partnership Networks: Explore strategic tie-ups with post offices, mobile wallets, banks, and SMB aggregators as a cost-effective consumer acquisition strategy.

- Detailing promotional schemes and partnerships : Plan out promotional activities and explore partnerships that can enhance your visibility and credibility. This might include collaborations with local businesses, financial institutions, or technology providers in the financial technology sector.

- Deploying Digital Campaigns: To reach your target audience, develop a thorough digital marketing strategy that makes use of social media, content marketing, and SEO. Utilize marketing strategies that align with the latest trends in the digital age, ensuring your services are visible to those looking for digital money transfer solutions.

Using the above model, you may create outreach plans and positioning strategies that are specific to the target segments and proposition pillars of your endeavor.

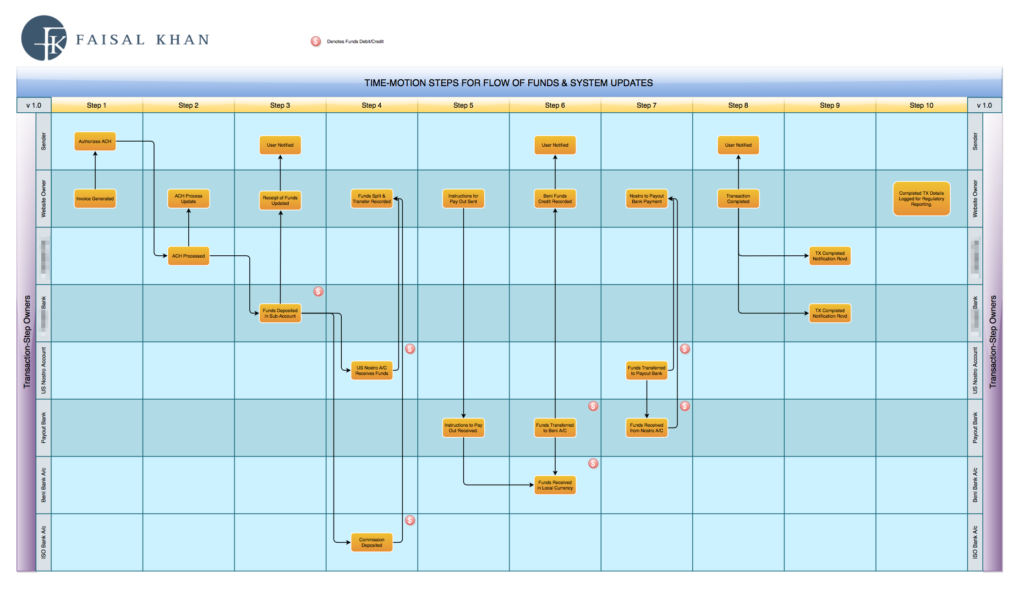

Architecting Robust Operational Capabilities

Before accepting first transfers, designing an end-to-end process flow spanning compliance, payments infrastructure, and customer experience is vital. We provide actionable advice on:

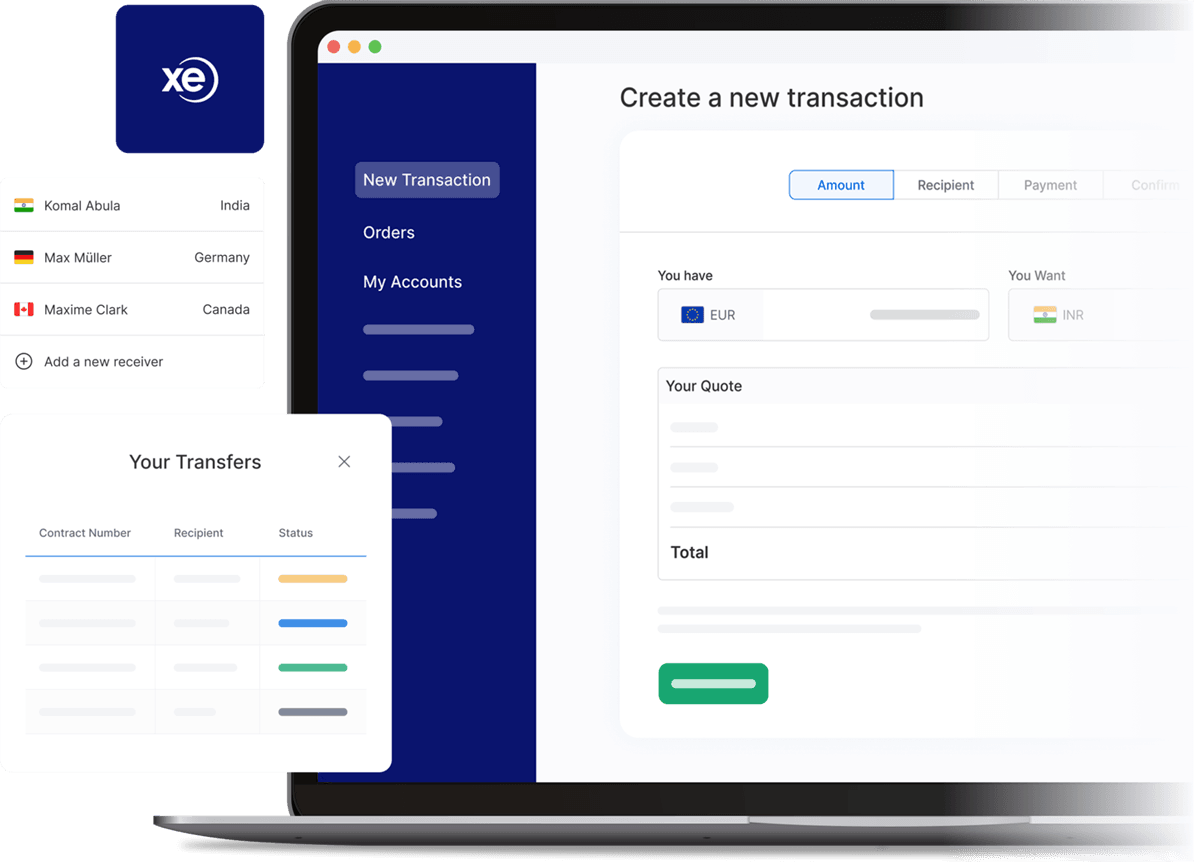

- Selecting Banking and Technology Partners: Assess leading payment rails and core banking providers that enable reliable global coverage. Consider platform capabilities, i ntegration mechanisms, and compliance-centric KYC/AML procedures.

- Modeling Process Workflows: Map approval protocols, transfer steps, reconciliation, and settlements outside core systems.

- Masking Infrastructure Costs: Size up expenditure across talent, licensing, banking, software, security, and administration to project realistic overheads.

- Installing Security Safeguards: Implement layered defenses spanning perimeter, network, application, data, and physical realms to continually manage risks.

In wrapping up, we have navigated the intricate licensing pathway and business setup essentials for launching a successful money transfer business. This journey, while demanding, opens doors to the vast and ever-expanding fintech sector.

The digital age has revolutionized how we handle money, making services like online money transfers not just convenient but essential. For aspiring entrepreneurs, the digital remittance market offers immense potential. It’s a realm where innovative marketing strategies and cutting-edge technology converge, creating opportunities for substantial growth and success.

Let’s draw inspiration from the success stories within this industry. These narratives aren’t just tales of triumph but are testaments to the power of entrepreneurial spirit, resilience, and strategic business pro-planning . They encourage risk-taking and innovation, essential ingredients for success in the financial technology world.

As you embark on this venture, remember that the journey of establishing a money services organization or a remittance service provider is not just about navigating regulatory requirements or securing a money transmitter license. It’s about finding a place in a fast-paced field and having a significant influence on the financial sector.

Muhammad Asif Saeed has extensive experience in commerce and finance. Specifically, He holds a Bachelor of Commerce degree specializing in Accounts and Finance and an MBA focusing on Marketing. These qualifications underpin his understanding of business dynamics and financial strategies.

With an impressive 20-year career in Pakistan’s textile sector, including roles at Masood Textile (MTM) and Sadaqat Limited, excelling in business & financial management. His expertise in financial and business management is further evidenced by his authoritative articles on complex finance and business operation topics for various renowned websites including businessproplanner.com,businesprotips.com,distinctionbetween.com, trueqube.com, and bruitly.com, demonstrating his comprehensive knowledge and professional expertise in the field.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

How to Start a Money Transfer Business

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry

Do you want to start a money transfer business? If YES, here is a complete guide to starting a money transfer business with NO money and no experience plus a sample money transfer agency business plan template.

The money transfer business is one where you help two parties transmit a certain amount of money. It is an ideal business to start up as money transactions happen daily. You however will need to possess certain skills and abilities so that you can effectively manage financial transactions on behalf of your clients.

The criteria for starting this business however depends on the state where you intend to operate your business from, your start-up capital as well as licensing. To start and run a standard and successful money transfer business, you will need to obtain a license that will allow you to transmit money and this is dependent on the state where you intend to operate from.

The reason why it varies is because of the money transmitting act of the National Money Transmitters Association; this is why it is necessary to know what the requirements of your state are. You might need to submit an online application to the appropriate department.

The next step will be to file for a FinCEN Form 107 with the FinCEN which is at the Department of Treasury. The purpose of filing with this agency is to enable them classify your money transfer business.

It is only after you have established the money transfer business that you can then register your business with FinCEN and not before. The registration must not be done later than six months and the aim is to ensure that illegal acts like money laundering are not taking place.

Then comes the part where you will need to set up your transactions with commercial banks that you are comfortable with. An alliance with a bank or several banks is very necessary so that you can carry out your full functions as a business.

If you are however still confused about certain parts of the business, this article will help in clearing any confusion or questions you might have about the money transfer business.

Steps to Starting a Money Transfer Business

1. understand the industry.

The money transfer industry is one that greatly contributes to the economic growth of countries participating in it. The reason for the growth of this industry is due to several factors such as increase in the labour force of the sending countries, increase in the number of migrants as well as the development of the global economy.

According to a report from World Bank, the money sent back by migrants to families in their home countries amount to $441 billion, which is thrice the amount that is being spent on official aid by international non-profit organizations. The cash that flows in through these money transfers constitute over 10 percent of the GDP in more than 25 developing countries.

As at 2014, $583 billion was transferred globally, with the top three money transfer companies dominating the market with more than 1.1 million combined retail outlets across 200 countries. This has led to an imbalance in the money transfer industry as certain countries dominate the receive volumes while certain other countries dominate the send volumes.

The united states of America for instance was responsible for about 22% of the money transferred globally in the year 2015, while India topped the receiving money transfer countries globally at 12%. Even though this industry is heavily dominated by banks and money transfer businesses, digital players have started entering the industry and are poised to disrupt how things are done.

According to a report from the Aite Group, the global revenue from the money transfer industry will grow to about 6% CAGR between the periods of 2006 and 2010. This means that by 2010, the industry will have generated close to $18.3 billion in revenue as compared to the $13 billion it generated in 2004.

The group also predicts that cross border transfers will increase by 8% CAGR between the same periods as well. By the group’s estimate, the remittances globally will amount to $456 billion which is up from $369 billion in 2007. The increase is not only due to new players in the industry, but also increased competition that has been caused by so many players forcing them to expand the range of their products and differentiate their services.

The increase that has been experienced in the money transfer industry is one that has been fuelled by the increase in demand from migrants.

This has caused new entrants into the market with smaller companies making use of new technology to compete with the already established companies and their traditionally high costs, limited payment systems as well as limited distribution methods.

The World Bank, United Nations and the G8 countries have also strived to make money transferring become more common and transparent, thereby causing an increase in the industry amongst the players. The growth that has been experienced by the money transfer industry cannot be pinned to just the increasing demand from migrants or increase in the number of players, as the internet has played a huge role as well.

In the early 2000s, only about 27.6% of households has access to the internet; by 2011, this number jumped to 74.9%, which was caused by an increase in the ownership of smart phones, as nearly a quarter of the global population now own one.

The top three countries in 2014 that are on the receiving end of the money transfer industry are India, China and the Philippines , and these positions haven’t changed in 2016. Asia as a continent is the biggest recipient especially as migrants from China and india sent 0 billion back to their home countries as at 2012.

According to the World Bank as at 2015, global money transfer exceeded $601 billion. Out of this amount, developing countries got about $441 billion officially as it is believed that this is actually larger because a number of formal and informal channels that aren’t being recorded are used.

2. Conduct Market Research and Feasibility Studies

- Demographics and Psychographics

The demographic and psychographic composition of those that require the services of a money transfer business include migrants from Asian, African and Middle Eastern countries working in the United States of America. According to statistics, more male migrants, from young adult to middle aged are mostly the ones who are involved in sending money back to their home countries.

This does not however exclude nationals from the United States of America as well; the money transfer business is not only done internationally but nationally as well, therefore making it an all-encompassing business.

3. Decide Which Niche to Concentrate On

The money transfer business is one where you help two parties transmit a certain amount of money and it is an ideal business if you are looking for a lucrative business to start up because money transactions happens daily. There really aren’t many niches in the industry as players are mostly concerned with privacy, data security, ease of transactions as well as other factors.

However, due to the evolvement of the industry and the financial industry at large, more niches are opening up as new players are looking toward these sort of niches such as;

- Digital transfer

- Cyrptocurrency

- Money transfer services

The Level of Competition in the Industry

The level of competition in the money transfer industry has no relationship whatsoever to the area where the business is located because a money transfer business can operate from any part of the world via physical or virtual location, or even from both.

This is not to however say that any player can get into the industry and compete with already established players. The big players in the industry have a lot of advantage as their services are spread in strategic locations across the country; even as they have acquired the trust and confidence of their clients.

To be able to compete effectively with these big players, new operators are going digital and offering their services mostly via the internet. This is advantageous because almost every country in the world is connected to the internet and more than a quarter of the world’s population has a smart phone which allows them to carry out transactions anywhere in the world.

4. Know Your Major Competitors in the Industry

Every industry has brands that are well known due to a number of factors such as how long they have been in business, their publicity or advertising strategies, how huge they are and several other important factors, and a money transfer business is no different.

Therefore some of the leading money transfer businesses both in the United States of America and around the globe are;

- Western Union Company

- MoneyGram International Inc (MGI)

- Transferwise

- Currencyfair

- World Remit

Economic Analysis

The money transfer business is one that involves the offering of a service by two parties – where one party sends money to a beneficiary somewhere else using a platform. The service can either be done locally or between two or more countries.

To start this kind of business, you would need to create a business plan so that you have a clear vision of what your business would look like and how the flow of funds will work. You should realize that when running this business that every single penny you make must be accounted for, therefore you must be familiar with every aspect of the business.

One of the major issues that this industry faces is the that of compliance, which is why regulators globally are advocating for players into the industry to adopt platforms that are not only secure and robust but compliant, so as to effectively enforce proper procedures such as KYC (Know Your Customers) and block list checks against beneficiaries as well as remitters in order to efficiently track all transactions and the information attached.

Another reason why automated remittance platforms are seriously encouraged by the government is because such platforms make use of the latest technology so as to not only improve transaction speed but its efficiency as well.

These platforms can then be used to conduct the required checks and also provide the needed information to the correct delivery agent. The platforms also store all the relevant identification information as well as enhance customer service by ensuring that critical business information is made available instantly.

Also, these automated platforms can help provide financial information that is accurate about the money transfer business and the profit or loss incurred per transaction. It is also useful for auditing and other compliance purposes.

5. Decide Whether to Buy a Franchise or Start from Scratch

How you decide to start your business depends on the vision and goals you had in mind for the business. Starting your business from scratch versus buying a franchise comes with its own pros and cons; it should however be noted that the money transfer business does not operate via franchise and the closest thing to that is being an affiliate.

Starting your business from scratch means that you are in control of your business and are able to determine how best to achieve your goals and objectives. You can also know what strategies aren’t working and have them modified or removed to be able to make your business achieve the level of success you want for it.

6. Know the Possible Threats and Challenges You Will Face

Every business when established newly is faced with threats and challenges and the money transfer business is not different. Therefore, if you are going to start this business, bear in mind that there are several challenges you are going to face, and how you address these challenges will determine the success of failure of your business.

Some of the threats and challenges that you are going to face are; arrival of a competitor into the industry, unfavorable and stringent government and industry policies and the downturn of the global economy.

7. Choose the Most Suitable Legal Entity (LLC, C Corp, S Corp)

The moment that you decide to turn your business idea into reality is the moment you would need to decide on what kind of legal entity to choose for your business. Even though there are 4 basic types of legal entities in the United States, but the legal entity you would choose must take the industry you will be operating in into consideration.

This means that the legal entity you should choose for your money transfer business should take into consideration; protection of your assets, tax issues, how to take money out of the company, your personal responsibility should your business lose money as well as estate planning. Also, the legal structure you finally choose will affect how you open your business legally.

The good thing about a legal entity is that once you find out that the needs of your business can no longer be met by your legal entity, you are free to change it. It is however beneficial if you have basic knowledge of business laws as it will be highly beneficial to your business or you can engage the services of a law attorney to help guide you on what is best for your business.

8. Choose a Catchy Business Name

Choosing the right name for your money transfer business is very important because it would portray the kind of business you are going into. Therefore, if you are considering some unique and catchy names for your money transfer business, here are some names you can choose from;

- Transferpay International

- Currency Wise International

- Pennywise International

- Cash Central Inc

- Payable International

9. Discuss with an Agent to Know the Best Insurance Policies for You

Having insurance is very important and for a business as sensitive as a money transfer business, it is very vital that you buy an insurance policy that would protect you from any form of liability. Knowing the right insurance policies to choose from can be quite tasking, which is why it is necessary to approach an insurance agent or broker to advise you on which policies you would need to buy for your business.

Some of the basic insurance policies that you would need to consider purchasing if you intend to start your money transfer business in the United States of America are;

- General Insurance

- Liability insurance

- Workers’ Compensation Insurance

- Health Insurance

- Errors and Omission Insurance

- Payment Protection Insurance

- Data Breach Insurance

10. Protect your Intellectual Property With Trademark, Copyrights, Patents

While the money transfer business is one that is very sensitive and requires a solid and secure database to protect the information of clients, it is however not a business that requires getting an intellectual property protection. This is due to the fact that this kind of business is a service based business that does not require inventions of any sort.

However, certain money transfer businesses have overtime applied for intellectual property protection for their company logo, slogan or jingle, and if you consider this as a priority, you can do yours as well, especially your logo or company name.

11. Get the Necessary Professional Certification

You would not need a professional certification in order to start a money transfer business. However, there are certain professionals you would need to have on board in your organization if you intend to run a standard money transfer business.

A compliance officer is very necessary to boost the profile of your business and there are certain certifications that must be taken by the compliance officer. Some of the certifications that a compliance officer must have include;

- Certified Anti-Money Laundering Specialist (CAMS)

The more certifications the compliance officer possesses, the easier it is for you to legally transact your business.

12. Get the Necessary Legal Documents You Need to Operate

The money transfer business is one that is very serious and sensitive, therefore certain documentations must be in place before the business can be started in the United States of America. However, it is necessary to point out that no business can be effectively run without proper documentations in the United States of America.

Some of the basic legal documents that you are expected to have in place if you want to legally run your money transfer business in the United States of America are;

- Certificate of Incorporation

- Operating Agreement

- Business License and Certification

- Business Plan

- Non Disclosure Agreement

- Insurance Policy

- Employment Agreement

- Money Services Business Application form

- Money transferring license

- FinCEN Form 107

- Online terms of use

- Online Privacy Policy Document

13. Raise the Needed Startup Capital

The money transfer business just like any other business, would need certain amount of capital from you. While seeking for start-up capital for a business is not an easy affair, it is very important that you have a good business plan in place that will help you convince your banks, investors and friends to invest in your business.

Some of the options that you might need to explore when sourcing for start-up capital for your money transfer business include;

- Raising money from personal savings, sale of stock or properties

- Raising money from business partners

- Sourcing for soft loans from family members and friends

- Pitching your business idea to angel investors for a loan

- Applying for Loan from your Bank

14. Choose a Suitable Location for your Business

The money transfer business is one that can be run from home or from the internet. Whether you choose the traditional brick and mortar building or the internet to run your business, a suitable location is very important to the success and growth of your money transfer business.

One factor that would come to bear greatly on your location issue is the scale of the business you intend to run. If you are a bit constrained by budget, then you might need to choose a location that would not add more financial strain to you.

If you carefully study the money transfer business, you would see that the popular and dominant industry players operate from both a physical location as well as from the internet in order to capture a large share of the market.

The location where you choose to locate your physical offices must be strategic; while it must be close to your banks, it must also not be far from your clients. In the money transfer business, most of the clients are migrants who want to send money to relatives or loved ones in their home countries, so it would be unwise to locate it far from where a lot of migrants live or work.

If you indeed intend to locate your business far away, a competitor might seize this advantage and use it to get a huge share of the target market.

While your physical location must be conspicuous and easily accessible, your website which should be your virtual office should also be as well. Clients who need to conduct transactions via your website shouldn’t have to experience difficulties, insecure website or downtime.

This is why you should search for a good web host and developer to ensure that you offer your clients a safe place to carry out secure transactions.

15. Hire Employees for your Technical and Manpower Needs

Due to the fact that the money transfer business is a licensed one, there are certain paths you would need to take to be able to run your business successfully in the United States of America. You could decide to follow the affiliate, correspondent, correspondent/ISO, authorized delegate, licensed or banking agent route.

There are also several players in the business such as the sender, the sender’s bank, beneficiary, beneficiary’s bank, money transfer operator (sending side), money transfer operator bank (sending side), correspondent bank (sending side) and money transfer operator/bank (receiving side).

In order to fully set up and run your money transfer business, you would need basic office supplies such as computers, printers, phones and software (security, customer and transfer software) to enable you run a business that is reliable and trustworthy for your clients.

As regards your website, you will need to create a firewall so that hackers do not hack into your database and steal customers’ information as this could make your money transfer business to quickly lose credibility and eventually fail.

In employing the right people to work in your money transfer business, you would need to conduct security and background checks so as to not employ criminals or those with a bad financial history.

The business structure that you would build for your money transfer business are; the chief executive officer, the admin and human resources manager, accountant, customer care officer for both online and offline inquiries, marketing officer, ethical hackers, cleaner, security guard.

The number of people you would need to employ in order to run a successful money transfer business that is of medium scale is at least 10 people.

The Service Delivery Process of the Business

The money transfer business is one that includes several types of operators to be able to function effectively and this includes banks and money transfer operators. For a service to be delivered well, the remitter of cash usually goes to a physical location where he or she hands over cash to a money transfer operator teller.

The money transfer operator will have agreed with the agent (a bank) as to the exchange rate as well as any additional charges that will be incurred during the transaction and these charges are passed on to the remitter before the money can be sent to the beneficiary in another country.

The remitter is given a receipt showing the details of the transaction which will include who the beneficiary is and how much will be given.

It is only after this that the money is deposited by the money transfer operator into its bank account and when it has reached a certain amount, make a transfer to the delivery agent in the destination country. This arrangement which depends on the agreement between the money transfer operator and delivery agent can be daily, weekly or monthly.

Once instructions have been received from the money transfer operator, the delivery agent then delivers the money to the beneficiary via the agent’s physical location. A commission is usually charged by the delivery agent for this service. This cycle is usually referred to as a transaction.

16. Write a Marketing Plan Packed with ideas & Strategies

The money transfer industry is one that is not only stiff with competition but also filled with dominant players as well; this is why you must ensure that all is in place before you proceed to market your business to your potential clients.

Because marketing not only helps generate revenue for your business but equally increases awareness for the business; it is important that you conduct a market survey that will help you identify your target market as well as ways to penetrate the market using certain strategies.

Conducting a market survey will also help you study the strengths and weaknesses of your competitors and then help you develop strategies that you can use to compete with them and get a huge share of the target market.

The result of your market survey would help you determine the right marketing strategies that would be effective for your business. It is also from your market survey that you would determine the budget that you will need to market your business.

The internet has made it possible these days to reach customers from far and wide and so combined with physical form of marketing, any enterprising entrepreneur can achieve all its corporate goals and objectives. Therefore some of the platforms you would need to market our money transfer business are;

- Ensure you introduce your business to stakeholders in the industry by having your marketing team approach corporate organizations and international businesses with letters and brochures listing the benefits of your money transfer business.

- Ensure that you place advertisements in newspapers, business and money related magazines, as well as on radio and television stations.

- Ensure that your business is listed in yellow pages as well as on online directories.

- Empower your marketing executives to engage in physical and direct marketing.

- Use your website as well as social media platforms such as Linkedin, Facebook, Twitter, and Google Plus to vigorously market and advertise your business.

- Place billboards in strategic locations in order to enable your target market be aware of your money transfer business

17. Develop Strategies to Boost Brand Awareness and Create a Corporate Identity

If you are serious about starting your money transfer business, then you should be ready to engage in activities that would promote your brand and create a corporate identity for you. Boosting of awareness is what all companies engage in no matter how long they have been in business, because the more you publicize your business, the more you attract new customers and retain already existing customers.

Because the money transfer business is majorly an international kind of business, you would need to understand the international market when creating the necessary strategies for promoting your business.

The importance of publicity has made it imperative for businesses to get a brand consultant that understands the national and international market and can therefore draft the right strategies that would boost the awareness of the brand.

The money transfer business is one that has a lot of competition and so it is absolutely necessary to create the best strategies that would help the business stand out and be able to compete favorably against its competitors. Below therefore are the platforms that you can leverage on to boost your brand and communicate the corporate identity of your business;

- Ensure that you leverage on social media platforms such as Facebook, Instagram, YouTube, Twitter to promote your money transfer business

- Place adverts in popular websites and blogs

- Ensure that your website is search engine optimized so that it can appear tops in search engines when clients are looking for a money transfer business to use

- Hand out handbills and business cards and paste fliers in strategic locations

- Set up branches in countries where you are likely to have enough potential clients and carry out adverts there as well

- Use your official website to advertise your business

Related Posts:

- How to Start a Forex Trading Company

- How to Start a Private Equity Real Estate Fund Firm

- How to Start a Grant Writing Business

- How to Start a Local Escrow Business

- How to Start an Internet Bank

Business Ideas

How to start a money transfer business.

How to Start a Money Transfer Business. Starting a money transfer business can be lucrative, especially in today’s globalized economy, where people frequently send money across borders. With the right strategy and careful planning, you can establish a successful money transfer business that helps people send and receive funds securely and efficiently. This comprehensive guide will walk you through the step-by-step process of starting your own money transfer business. From understanding the market to complying with regulations and marketing your services, we’ve got you covered.

Table of Contents

Market Research and Niche Selection

- Identify Your Niche: Identify the niche within the money transfer market you want to target. Will you cater to remittances, international business transfers, or a specific community with unique needs? Keywords: “money transfer niche,” “target market in money transfer.”

- Market Analysis: Conduct thorough market research to understand your potential customers, competitors, and industry trends. Analyze the demand for money transfer services in your chosen niche. Keywords: “money transfer market analysis,” “competitive analysis in the money transfer industry.”

Legal and Regulatory Considerations

- Compliance and Licensing: Understand the legal and regulatory requirements for operating a money transfer business in your country. Obtain the necessary licenses and permits to ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations. Keywords: “money transfer compliance,” “money transfer licenses.”

- Banking Partnerships: Establish partnerships with banks or financial institutions to facilitate the transfer of funds. Ensure that your partners comply with regulations and have robust security measures. Keywords: “bank partnerships for money transfer,” “financial institution collaboration.”

Technology and Infrastructure

- Secure Software: Invest in secure and reliable money transfer software that ensures the confidentiality and integrity of customer data and transactions. Implement strong encryption and data protection measures. Keywords: “money transfer software,” “secure money transfer technology.”

- Network and Connectivity: Set up a robust network infrastructure to facilitate real-time transfers. Ensure that your system can handle high volumes of transactions securely. Keywords: “money transfer network,” “reliable connectivity for money transfer.”

Funding and Financial Management

- Initial Capital: Determine the capital required to launch and operate your money transfer business. Consider factors like licensing fees, technology costs, and working capital needs. Keywords: “money transfer startup capital,” “financial requirements for money transfer business.”

- Financial Partners: Establish relationships with financial partners who can provide liquidity to support your operations. These partners can include banks, liquidity providers, or investors. Keywords: “financial partners for money transfer,” “liquidity providers.”

Marketing and Branding

- Brand Identity: Develop a strong brand identity that conveys trust and reliability. Emphasize factors like security, speed, and customer service in your branding. Keywords: “money transfer brand identity,” “branding for money transfer business.”

- Digital Marketing: To reach a broader audience, build a user-friendly website and utilize digital marketing techniques, such as search engine optimization (SEO) and pay-per-click (PPC) advertising. Keywords: “money transfer website,” “digital marketing for money transfer.”

Customer Service and Security

- Customer Support: Offer excellent customer service through multiple channels, including phone, email, and chat. Provide prompt assistance to resolve issues and address customer inquiries. Keywords: “money transfer customer service,” “customer support in money transfer.”

- Security Measures: Implement strict security protocols to protect customer data and transactions. Regularly audit your security measures to stay ahead of potential threats. Keywords: “money transfer security,” “cybersecurity in money transfer.”

How can I compete with established money transfer companies?

Differentiate your business by offering competitive exchange rates, lower fees, faster transaction processing, and exceptional customer service. Focus on the specific needs of your target niche.

What technology do I need to start a money transfer business?

You will need secure money transfer software, a reliable network infrastructure, and a user-friendly website or mobile app for customers to initiate transfers.

How do I ensure compliance with money laundering regulations?

Invest in robust KYC and AML procedures, train your staff on compliance measures, and regularly update your policies to align with changing regulations.

Starting a money transfer business requires careful planning, compliance with regulations, and a commitment to customer service and security. By following the steps outlined in this guide and continuously adapting to industry changes, you can establish a successful money transfer business that meets the needs of your target market. Trust and reliability are paramount in this industry, so prioritize these qualities to build a strong and reputable brand. Best of luck on your journey as a money transfer entrepreneur!

How to Start a Poke Bowl Business

How to Start a Charcuterie Business

You may like

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Farmers Market Ideas: Tips to Attract More Your Customers

Farmers Market Ideas – Are you looking for a new method to earn money? Or are you confused about where to sell your local product? Let’s try selling it at the farmer’s market! Take a deep dive for farmers market ideas.

A farmer market is typically a local market that operates on specific days of the week or on weekends. Because this market does not open every day, it makes people excited come the day the farmer market opens. Actually, it also gives you an opportunity to sell your product. Moreover, this market is a local destination that successfully steals the attention of tourists. You can see the potential profit of this market.

It is a great idea to open a stand in the farmers market for selling your local product. However, you must realize that selling in there is also a strategy of marketing to give you profit. Surely, you need tips on farmers market ideas that we will discuss in this article!

It can be interesting to open a stand in the farmer market, which can motivate you to sell something there. Did you need reference for what to sell at the farmers market? Why not sell your local product?

For beginners that are interested in selling there, most of the sellers at Farmers Market sell local products. There, you will easily find fresh fruits, vegetables, processed fruits and/or vegetables, and local products. The uniqueness of each farmers market is they sell different ‘local products’ that you might not find in other places. And it can also be a reason for tourists to come there as well.

Apart from unique products that you want to sell, creating a different stand that looks more interesting than the other can also be a marketing strategy. Look different from the others, make your stand unique and it can influence people to come. Here, we can give you tips on how to create unique stands in farmers market.

Tips: Unique Farmers Market Stands

How to attract customers to come to your stand? What is suitable for your design? Any recommended colors for the stand?

It is usual in the business area to make a unique for branding our product. Including the farmer market, you need to show your uniqueness. Do you know to attract more customers, you can do with optimize your stand design. Give attention on these tips:

First, let’s begin by defining your goals and objectives for the farmer’s market. Identifying the special message or experience of yourself that you want to convey to your target customers. Furthermore, the design that you choose as your identity stand, will guide the customer of the message that you build.

It is important to understand your target crearly. At least you have knowledge about the demographics of the market and products customers are interested in. Then, offering will be nice for building a friendly impression and feeling satisfied.

When you are talking about the purpose and design of something, consider using a theme that is related . With the theme, you show how you are communicating about your message. It can be by the color, imaginary, or branding elements that you choose.

The other tip for standing looking unique is focusing on your visuals . By visual means, you can strike and grab attention from a distance. Captivating visual impact of design also by putting eye-catching elements. Also, always have an interaction with your target customers.

Actually, with a unique design, it can also boost your stand to look different and affect your marketing target as well. The last one, for getting to know more about farmer market ideas for your business, let’s go to scroll!

Top Farmers Market Ideas for Your Business

Taking many opportunities for yourself to earn money, could be to do it, including in the farmer market. Additionally, besides of selling the fresh fruits and vegetables, here are some categories of items that can be successfully sold:

Homemade baked desserts

For sure, each home has its own secret receipt like bread, pies, cookies, or other cakes. Selling your product offers an opportunity of your own baked dessert for something unique.

Bee products

If you are a beekeeper, you can also maximize your farm turnover. Considering selling the golden nectar of honey, beeswax, or other bee-related products. Look at the opportunity for the product that has more interest among customers.

Crafting Idea

The next one that excited tourists are looking for is crafting. In creativity, there are no bounds, you can sell it for souvenirs. Moreover, if you get a material of your own, it can potentially increase your high profit.

A Common Questions about Farmers Market Ideas

What makes the farmers market great?

Mostly, people go there to get fresh fruits or vegetables and tastiest available. Moreover, you don’t need long distance shipping as well. All the fresh products also do not sit for weeks in storage. Then, for those who go there for a unique product, it also can be a reason.

Why is the market important for farmers?

Actually, farmers markets stimulate local economies that are common for those who start small, test the market or grow the businesses. Moreover, that can increase access to fresh nutritional food.

Earning money by selling the fruits or vegetables of your plantation also can be a great idea. Beside you can provide a fresh product, the customer also can be happy with their nutrition needs. Moreover, in there you can find the other local unique and a way for each stand to brand their product. Following the tips of Allmost Gone can open your chance to earn extra money there. Let’s try! Any information about business that you want to know more about, let’s visit Allmost Gone .

Any information about business that you want to know more about, let’s visit Allmost Gone .

Business Tips

8 tips on how to open a small business in florida: a comprehensive guide.

8 Tips On How to Open a Small Business in Florida: A Comprehensive Guide

Are you considering starting a small business in the vibrant state of Florida? With its booming economy, favorable business climate, and strategic location, Florida offers abundant opportunities for entrepreneurs. From the sunny beaches of Miami to the bustling streets of Orlando, the Sunshine State is teeming with potential for aspiring business owners. However, navigating the process of opening a small business can be daunting without the right guidance. In this comprehensive guide, we’ll walk you through everything you need to know about starting a small business in Florida, from crafting your business plan to registering your company with Sunbiz .

Chapter 1: Research and Planning How to Open a Small Business in Florida

Before diving into the entrepreneurial world, it’s essential to conduct thorough research and develop a solid business plan. Start by identifying your target market, analyzing competitors, and assessing the demand for your products or services. Florida’s diverse population and booming tourism industry offer ample opportunities for businesses in various sectors, from hospitality and tourism to technology and healthcare. Utilize resources such as the Florida Small Business Development Center (SBDC) to gather market insights and industry trends.

Chapter 2: Legal Structure and Registration

Choosing the right legal structure for your business is crucial for liability protection, tax implications, and operational flexibility. In Florida, common business structures include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its advantages and disadvantages, so it’s essential to weigh your options carefully. Once you’ve decided on a legal structure, you’ll need to register your business with the Florida Division of Corporations through Sunbiz , the state’s official business registry.

Chapter 3: Financing Your Business

Securing funding is often one of the biggest challenges for small business owners. Fortunately, Florida offers various financing options for entrepreneurs, including small business loans, grants, venture capital, and crowdfunding. Explore resources such as the Florida Small Business Emergency Bridge Loan Program, which provides short-term loans to businesses impacted by disasters. Additionally, consider alternative funding sources such as angel investors, peer-to-peer lending platforms, and government-sponsored initiatives.

Chapter 4: Licenses, Permits, and Regulations

Navigating the regulatory landscape can be overwhelming for new business owners. In Florida, certain industries require specific licenses and permits to operate legally. Whether you’re starting a restaurant, construction company, or home-based business, it’s crucial to research and obtain the necessary licenses and permits from local, state, and federal authorities. Check with the Florida Department of Business and Professional Regulation (DBPR) and local government agencies to ensure compliance with zoning regulations, health codes, and other legal requirements.

Chapter 5: Taxation and Accounting

Understanding your tax obligations is essential for maintaining financial health and compliance with state and federal laws. Florida boasts a favorable tax environment for businesses, with no state income tax and various tax incentives for small businesses. However, businesses are still subject to federal taxes, sales tax, and other levies. Consider hiring a certified public accountant (CPA) or tax professional to help you navigate tax planning, bookkeeping, and financial reporting.

Chapter 6: Marketing and Branding

Effective marketing and branding are essential for attracting customers and establishing a strong presence in the marketplace. Leverage digital marketing strategies such as social media, search engine optimization (SEO), and content marketing to reach your target audience online. Additionally, invest in offline marketing tactics such as networking events, local partnerships, and community outreach. Building a memorable brand identity and providing exceptional customer experiences will set your business apart from competitors.

Chapter 7: Hiring and HR Compliance

As your business grows, you may need to hire employees to support your operations. Familiarize yourself with Florida’s labor laws, including minimum wage requirements, employee benefits, and workplace safety regulations. Consider outsourcing HR functions or investing in HR software to streamline payroll, benefits administration, and compliance management. Prioritize employee training and development to foster a positive work culture and retain top talent.

Chapter 8: Growth and Expansion

Once your business is up and running, focus on growth and expansion opportunities to maximize your success. Explore avenues such as franchising, e-commerce, and international markets to broaden your reach and increase revenue. Continuously innovate and adapt to changing market trends to stay ahead of the competition. Join industry associations, attend trade shows, and seek mentorship from seasoned entrepreneurs to accelerate your growth trajectory.

Opening a small business in Florida can be a rewarding journey filled with opportunities and challenges. By conducting thorough research, planning diligently, and leveraging available resources, you can navigate the complexities of entrepreneurship and build a thriving business in the Sunshine State. Remember to stay resilient, stay informed, and stay focused on your goals as you embark on this exciting venture.

**External Resources:**