Trade and Globalization

How did international trade and globalization change over time? What is the structure today? And what is its impact?

By Esteban Ortiz-Ospina, Diana Beltekian and Max Roser

This page was first published in 2014 and last revised in April 2024.

On this topic page, you can find data, visualizations, and research on historical and current patterns of international trade, as well as discussions of their origins and effects.

Other research and writing on trade and globalization on Our World in Data:

- Is globalization an engine of economic development?

- Is trade a major driver of income inequality?

Related topics

Economic Growth

See all our data, visualizations, and writing on economic growth.

Economic Inequality

See all our data, visualizations, and writing on economic inequality.

See all our data, visualizations, and writing on migration.

See all interactive charts on Trade and Globalization ↓

Trade has changed the world economy

Trade has grown remarkably over the last century.

One of the most important developments of the last century has been the integration of national economies into a global economic system. This process of integration, often called globalization, has resulted in a remarkable growth in trade between countries.

The chart here shows the growth of world exports over more than the last two centuries. These estimates are in constant prices (i.e. have been adjusted to account for inflation) and are indexed at 1913 values.

The chart shows an extraordinary growth in international trade over the last couple of centuries: Exports today are more than 40 times larger than in 1913.

You can switch to a logarithmic scale under ‘Settings’. This will help you see that, over the long run, growth has roughly followed an exponential path.

The increase in trade has even outpaced economic growth

The chart above shows how much more trade we have today relative to a century ago. But what about trade relative to total economic output?

Over the last couple of centuries the world economy has experienced sustained positive economic growth , so looking at changes in trade relative to GDP offers another interesting perspective.

The next chart plots the value of traded goods relative to GDP (i.e. the value of merchandise trade as a share of global economic output).

Up to 1870, the sum of worldwide exports accounted for less than 10% of global output. Today, the value of exported goods around the world is around 25%. This shows that over the last hundred years, the growth in trade has even outpaced rapid economic growth.

Trade expanded in two waves

The first "wave of globalization" started in the 19th century, the second one after ww2.

The following visualization presents a compilation of available trade estimates, showing the evolution of world exports and imports as a share of global economic output .

This metric (the ratio of total trade, exports plus imports, to global GDP) is known as the “openness index”. The higher the index, the higher the influence of trade transactions on global economic activity. 1

As we can see, until 1800 there was a long period characterized by persistently low international trade – globally the index never exceeded 10% before 1800. This then changed over the course of the 19th century, when technological advances triggered a period of marked growth in world trade – the so-called “first wave of globalization”.

This first wave came to an end with the beginning of World War I, when the decline of liberalism and the rise of nationalism led to a slump in international trade. In the chart we see a large drop in the interwar period.

After World War II trade started growing again. This new – and ongoing – wave of globalization has seen international trade grow faster than ever before. Today the sum of exports and imports across nations amounts to more than 50% of the value of total global output. 2

Before the first wave of globalization, trade was driven mostly by colonialism

Over the early modern period, transoceanic flows of goods between empires and colonies accounted for an important part of international trade. The following visualizations provide a comparison of intercontinental trade, in per capita terms, for different countries.

As we can see, intercontinental trade was very dynamic, with volumes varying considerably across time and from empire to empire.

Leonor Freire Costa, Nuno Palma, and Jaime Reis, who compiled and published the original data shown here, argue that trade, also in this period, had a substantial positive impact on the economy. 3

The first wave of globalization was marked by the rise and collapse of intra-European trade

The following visualization shows a detailed overview of Western European exports by destination. Figures correspond to export-to-GDP ratios (i.e. the sum of the value of exports from all Western European countries, divided by the total GDP in this region). You can use “Settings” to switch to a relative view and see the proportional contribution of each region to total Western European exports.

This chart shows that growth in Western European trade throughout the 19th century was largely driven by trade within the region: In the period 1830-1900 intra-European exports went from 1% of GDP to 10% of GDP, and this meant that the relative weight of intra-European exports doubled over the period. However, this process of European integration then collapsed sharply in the interwar period.

After the Second World War trade within Europe rebounded, and from the 1990s onwards exceeded the highest levels of the first wave of globalization. In addition, Western Europe then started to increasingly trade with Asia, the Americas, and to a smaller extent Africa and Oceania.

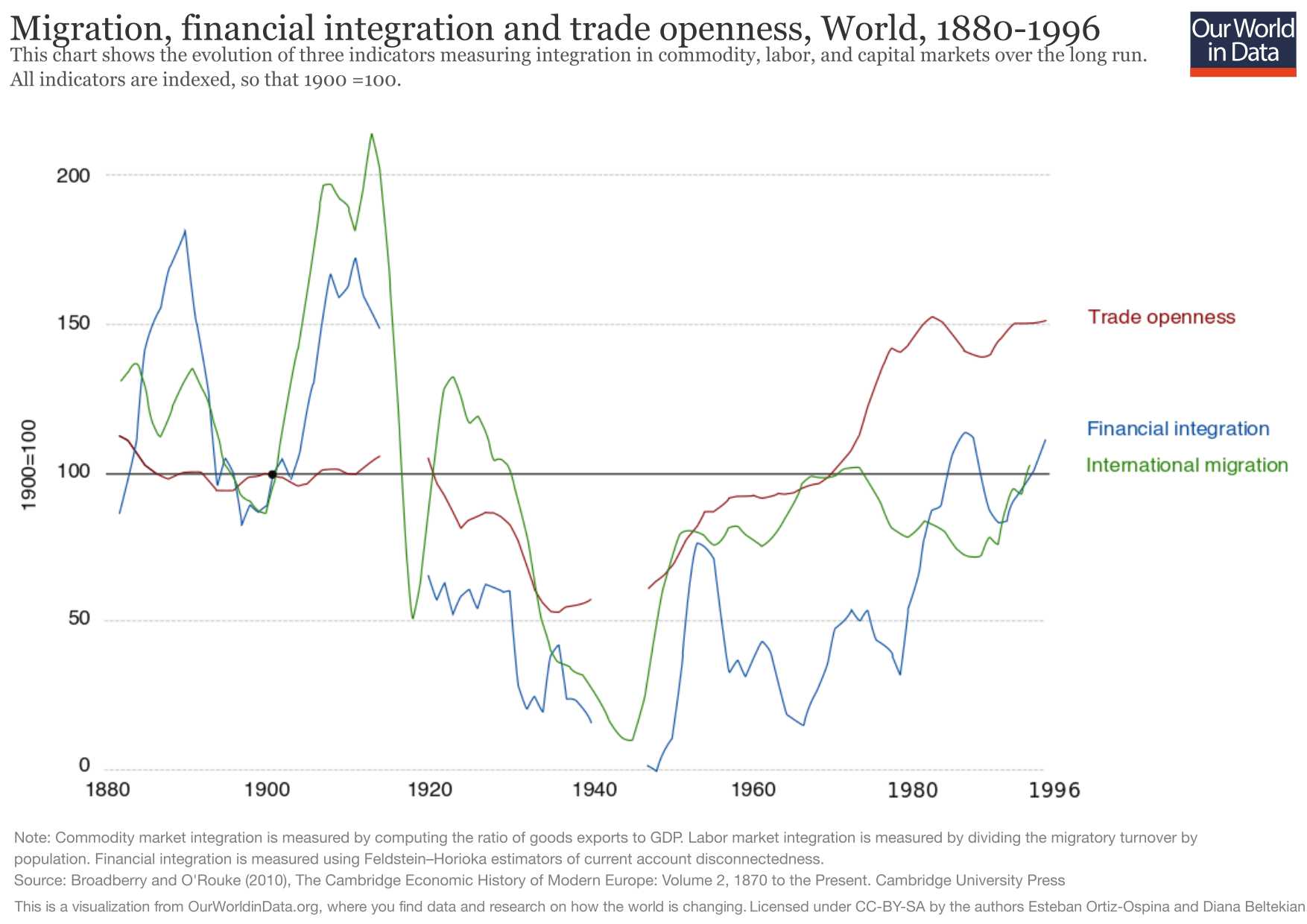

The next graph, using data from Broadberry and O'Rourke (2010) 4 , shows another perspective on the integration of the global economy and plots the evolution of three indicators measuring integration across different markets – specifically goods, labor, and capital markets.

The indicators in this chart are indexed, so they show changes relative to the levels of integration observed in 1900. This gives us another perspective on how quickly global integration collapsed with the two World Wars. 5

The second wave of globalization was enabled by technology

The worldwide expansion of trade after the Second World War was largely possible because of reductions in transaction costs stemming from technological advances, such as the development of commercial civil aviation, the improvement of productivity in the merchant marines, and the democratization of the telephone as the main mode of communication. The visualization shows how, at the global level, costs across these three variables have been going down since 1930.

Reductions in transaction costs impacted not only the volumes of trade but also the types of exchanges that were possible and profitable.

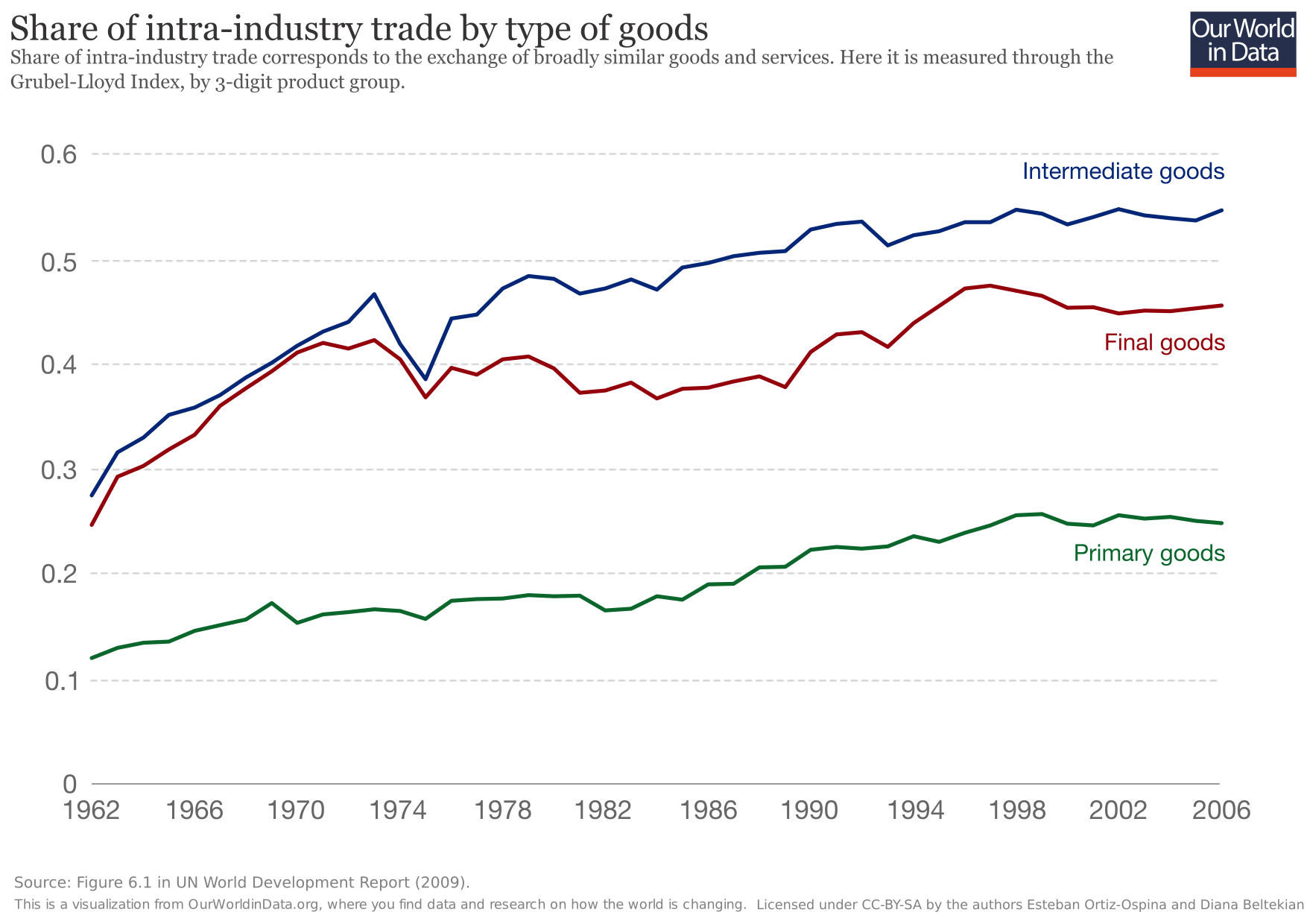

The first wave of globalization was characterized by inter-industry trade. This means that countries exported goods that were very different from what they imported – England exchanged machines for Australian wool and Indian tea. As transaction costs went down, this changed. In the second wave of globalization, we are seeing a rise in intra -industry trade (i.e. the exchange of broadly similar goods and services is becoming more and more common). France, for example, now both imports and exports machines to and from Germany.

The following visualization, from the UN World Development Report (2009) , plots the fraction of total world trade that is accounted for by intra-industry trade, by type of goods. As we can see, intra-industry trade has been going up for primary, intermediate, and final goods.

This pattern of trade is important because the scope for specialization increases if countries are able to exchange intermediate goods (e.g. auto parts) for related final goods (e.g. cars).

Trade and trade partners by country

Above, we examined the broad global trends over the last two centuries. Let's now examine country-level trends over this long and dynamic period.

This chart plots estimates of the value of trade in goods, relative to total economic activity (i.e. export-to-GDP ratios).

These historical estimates obviously come with a large margin of error (in the measurement section below we discuss the data limitations); yet they offer an interesting perspective.

You can edit the countries and regions selected. Each country tells a different story. 7

In the next chart we plot, country by country, the regional breakdown of exports. India is shown by default, but you can edit the countries and regions shown.

When switching to displaying relative values under ‘Settings’, we see the proportional contribution of purchases from each region. For example, we see that more than a third of Indian exports went to Asian countries in recent decades.

This gives us an interesting perspective on the changing nature of trade partnerships. In India, we see the rising importance of trade with Africa—a pattern that we discuss in more detail below .

Trade around the world today

How much do countries trade, trade openness around the world.

The metric trade as a share of GDP gives us an idea of global integration by capturing all incoming and outgoing transactions of a country.

The charts shows that countries differ a lot in the extent to which they engage in trade. Trade, for example, is much less important to the US economy than for other rich countries.

If you press the play button on the map, you can see changes over time. This reveals that, despite the great variation between countries, there is a common trend: over the last couple of decades trade openness has gone up in most countries.

Exports and imports in real dollars

Expressing the value of trade as a share of GDP tells us the importance of trade in relation to the size of economic activity. Let's now take a look at trade in monetary terms – this tells us the importance of trade in absolute, rather than relative terms.

The chart shows the value of exports (goods plus services) in dollars, country by country.

The main takeaway here is that the trend towards more trade is more pronounced than in the charts showing shares of GDP. This is not surprising: most countries today produce more than a couple of decades ago , and at the same time they trade more of what they produce. 8

What do countries trade?

Trade in goods vs. trade in services.

Trade transactions include goods (tangible products that are physically shipped across borders by road, rail, water, or air) and services (intangible commodities, such as tourism, financial services, and legal advice).

Many traded services make merchandise trade easier or cheaper—for example, shipping services, or insurance and financial services.

Trade in goods has been happening for millennia , while trade in services is a relatively recent phenomenon.

In some countries services are today an important driver of trade: in the UK services account for around half of all exports; and in the Bahamas, almost all exports are services.

In other countries, such as Nigeria and Venezuela, services account for a small share of total exports.

Globally, trade in goods accounts for the majority of trade transactions. But as this chart shows, the share of services in total global exports has slightly increased in recent decades. 9

How are trade partnerships changing?

Bilateral trade is becoming increasingly common.

If we consider all pairs of countries that engage in trade around the world, we find that in the majority of cases, there is a bilateral relationship today: most countries that export goods to a country also import goods from the same country.

The interactive visualization shows this. 10 In the chart, all possible country pairs are partitioned into three categories: the top portion represents the fraction of country pairs that do not trade with one another; the middle portion represents those that trade in both directions (they export to one another); and the bottom portion represents those that trade in one direction only (one country imports from, but does not export to, the other country).

As we can see, bilateral trade is becoming increasingly common (the middle portion has grown substantially). However, many countries still do not trade with each other at all.

South-South trade is becoming increasingly important

The next visualization here shows the share of world merchandise trade that corresponds to exchanges between today's rich countries and the rest of the world.

The 'rich countries' in this chart are: Australia, Austria, Belgium, Canada, Cyprus, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Israel, Italy, Japan, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom and the United States. 'Non-rich countries' are all the other countries in the world.

As we can see, up until the Second World War, the majority of trade transactions involved exchanges between this small group of rich countries. But this has changed quickly over the last couple of decades, and today, trade between non-rich countries is just as important as trade between rich countries.

In the past two decades, China has been a key driver of this dynamic: the UN Human Development Report (2013) estimates that between 1992 and 2011, China's trade with Sub-Saharan Africa rose from $1 billion to more than $140 billion. 11

The majority of preferential trade agreements are between emerging economies

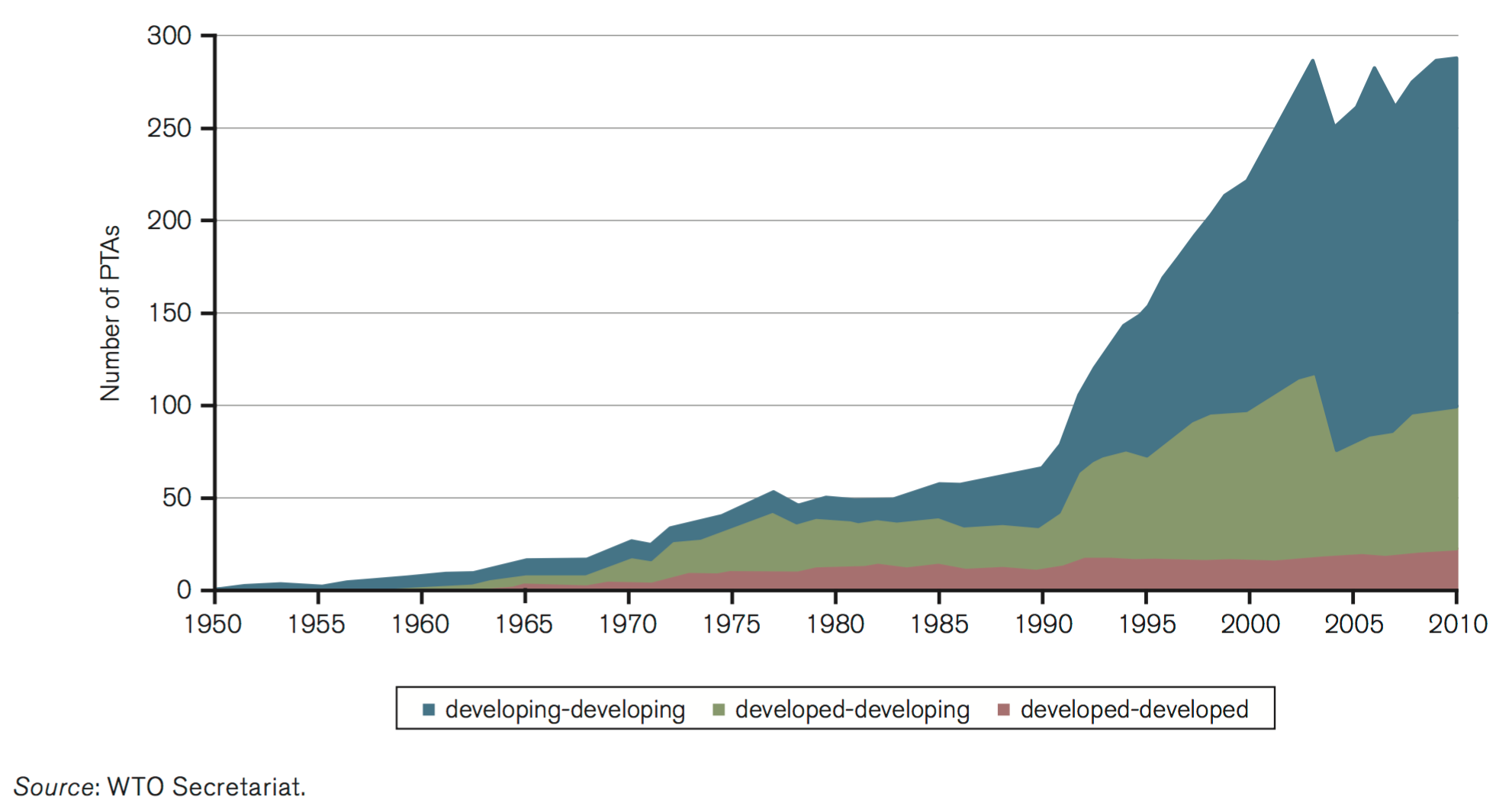

The last few decades have not only seen an increase in the volume of international trade, but also an increase in the number of preferential trade agreements through which exchanges take place. A preferential trade agreement is a trade pact that reduces tariffs between the participating countries for certain products.

The visualization here shows the evolution of the cumulative number of preferential trade agreements in force worldwide, according to the World Trade Organization (WTO). These numbers include notified and non-notified preferential agreements (the source reports that only about two-thirds of the agreements currently in force have been notified to the WTO) and are disaggregated by country groups.

This figure shows the increasingly important role of trade between developing countries (South-South trade), vis-a-vis trade between developed and developing countries (North-South trade). In the late 1970s, North-South agreements accounted for more than half of all agreements – in 2010, they accounted for about one-quarter. Today, the majority of preferential trade agreements are between developing economies.

Trading patterns have been changing quickly in middle-income countries

An important change in the composition of exported goods in these countries has accompanied the increase in trade among emerging economies over the last half century.

The next visualization plots the share of food exports in each country's total exported merchandise. These figures, produced by the World Bank, correspond to the Standard International Trade Classification, in which 'food' includes, among other goods, live animals, beverages, tobacco, coffee, oils, and fats.

Two points stand out. First, the relative importance of food exports has substantially decreased in most countries since the 1960s (although globally, it has gone up slightly more recently). Second, this decrease has been largest in middle-income countries, particularly in Latin America.

Regarding levels, as one would expect, in high-income countries, food still accounts for a much smaller share of merchandise exports than in most low- and middle-income-countries.

Trade generates efficiency gains

The raw correlation between trade and growth.

Over the last couple of centuries, the world economy has experienced sustained positive economic growth , and over the same period, this process of economic growth has been accompanied by even faster growth in global trade .

In a similar way, if we look at country-level data from the last half century we find that there is also a correlation between economic growth and trade: countries with higher rates of GDP growth also tend to have higher rates of growth in trade as a share of output. This basic correlation is shown in the chart here, where we plot the average annual change in real GDP per capita, against growth in trade (average annual change in value of exports as a share of GDP). 12

Is this statistical association between economic output and trade causal?

Among the potential growth-enhancing factors that may come from greater global economic integration are: competition (firms that fail to adopt new technologies and cut costs are more likely to fail and be replaced by more dynamic firms); economies of scale (firms that can export to the world face larger demand, and under the right conditions, they can operate at larger scales where the price per unit of product is lower); learning and innovation (firms that trade gain more experience and exposure to develop and adopt technologies and industry standards from foreign competitors). 13

Are these mechanisms supported by the data? Let's take a look at the available empirical evidence.

Evidence from cross-country differences in trade, growth, and productivity

When it comes to academic studies estimating the impact of trade on GDP growth, the most cited paper is Frankel and Romer (1999). 14

In this study, Frankel and Romer used geography as a proxy for trade to estimate the impact of trade on growth. This is a classic example of the so-called instrumental variables approach . The idea is that a country's geography is fixed, and mainly affects national income through trade. So if we observe that a country's distance from other countries is a powerful predictor of economic growth (after accounting for other characteristics), then the conclusion is drawn that it must be because trade has an effect on economic growth. Following this logic, Frankel and Romer find evidence of a strong impact of trade on economic growth.

Other papers have applied the same approach to richer cross-country data, and they have found similar results. A key example is Alcalá and Ciccone (2004). 15

This body of evidence suggests trade is indeed one of the factors driving national average incomes (GDP per capita) and macroeconomic productivity (GDP per worker) over the long run. 16

Evidence from changes in labor productivity at the firm level

If trade is causally linked to economic growth, we would expect that trade liberalization episodes also lead to firms becoming more productive in the medium and even short run. There is evidence suggesting this is often the case.

Pavcnik (2002) examined the effects of liberalized trade on plant productivity in the case of Chile, during the late 1970s and early 1980s. She found a positive impact on firm productivity in the import-competing sector. She also found evidence of aggregate productivity improvements from the reshuffling of resources and output from less to more efficient producers. 17

Bloom, Draca, and Van Reenen (2016) examined the impact of rising Chinese import competition on European firms over the period 1996-2007 and obtained similar results. They found that innovation increased more in those firms most affected by Chinese imports. They also found evidence of efficiency gains through two related channels: innovation increased and new existing technologies were adopted within firms, and aggregate productivity also increased because employment was reallocated towards more technologically advanced firms. 18

Trade does not only increase efficiency gains

Overall, the available evidence suggests that trade liberalization does improve economic efficiency. This evidence comes from different political and economic contexts and includes both micro and macro measures of efficiency.

This result is important because it shows that there are gains from trade. But of course, efficiency is not the only relevant consideration here. As we discuss in a companion article , the efficiency gains from trade are not generally equally shared by everyone. The evidence from the impact of trade on firm productivity confirms this: "reshuffling workers from less to more efficient producers" means closing down some jobs in some places. Because distributional concerns are real it is important to promote public policies – such as unemployment benefits and other safety-net programs – that help redistribute the gains from trade.

Trade has distributional consequences

The conceptual link between trade and household welfare.

When a country opens up to trade, the demand and supply of goods and services in the economy shift. As a consequence, local markets respond, and prices change. This has an impact on households, both as consumers and as wage earners.

The implication is that trade has an impact on everyone. It's not the case that the effects are restricted to workers from industries in the trade sector; or to consumers who buy imported goods. The effects of trade extend to everyone because markets are interlinked, so imports and exports have knock-on effects on all prices in the economy, including those in non-traded sectors.

Economists usually distinguish between "general equilibrium consumption effects" (i.e. changes in consumption that arise from the fact that trade affects the prices of non-traded goods relative to traded goods) and "general equilibrium income effects" (i.e. changes in wages that arise from the fact that trade has an impact on the demand for specific types of workers, who could be employed in both the traded and non-traded sectors).

Considering all these complex interrelations, it's not surprising that economic theories predict that not everyone will benefit from international trade in the same way. The distribution of the gains from trade depends on what different groups of people consume, and which types of jobs they have, or could have. 19

The link between trade, jobs and wages

Evidence from chinese imports and their impact on factory workers in the us.

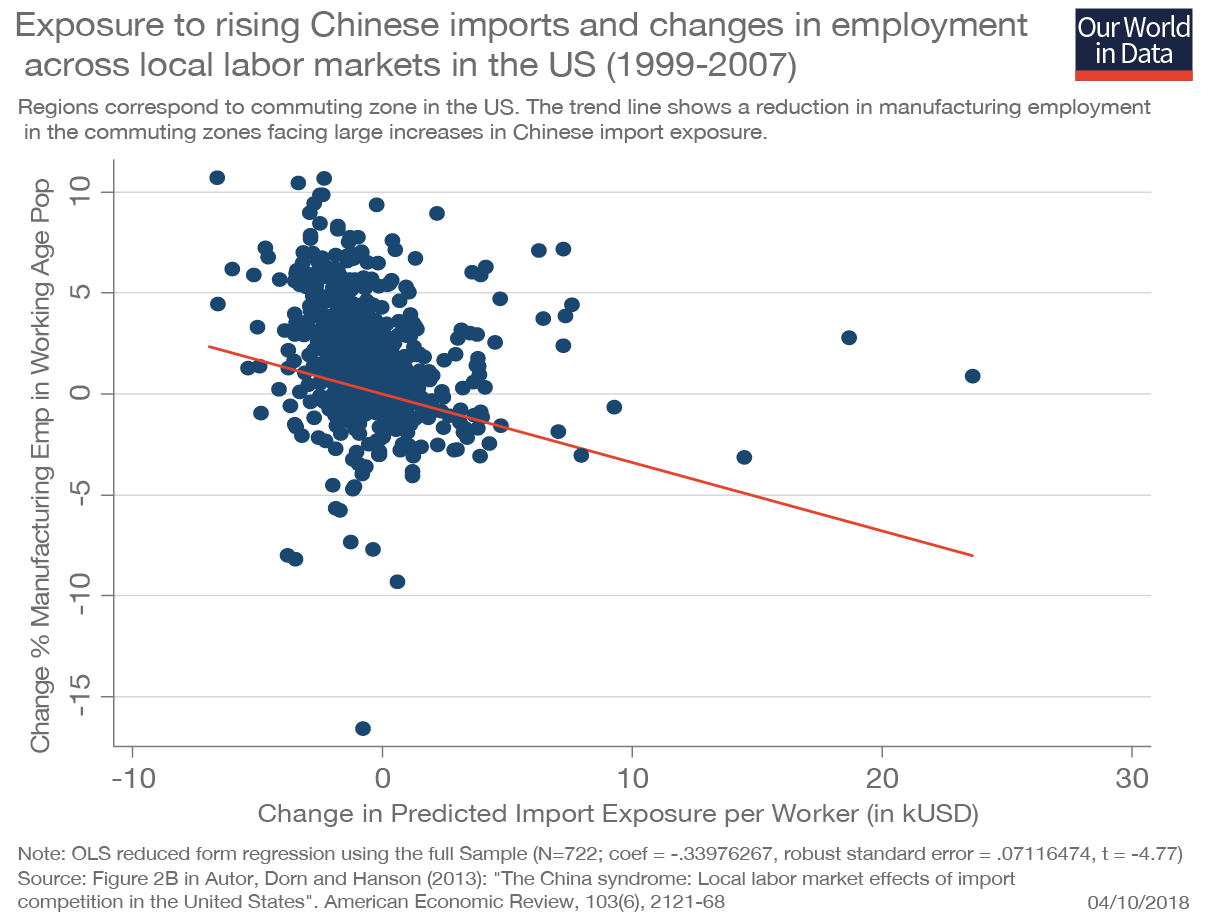

The most famous study looking at this question is Autor, Dorn and Hanson (2013): "The China syndrome: Local labor market effects of import competition in the United States". 20

In this paper, Autor and coauthors examined how local labor markets changed in the parts of the country most exposed to Chinese competition. They found that rising exposure increased unemployment, lowered labor force participation, and reduced wages. Additionally, they found that claims for unemployment and healthcare benefits also increased in more trade-exposed labor markets.

The visualization here is one of the key charts from their paper. It's a scatter plot of cross-regional exposure to rising imports, against changes in employment. Each dot is a small region (a 'commuting zone' to be precise). The vertical position of the dots represents the percent change in manufacturing employment for the working-age population, and the horizontal position represents the predicted exposure to rising imports (exposure varies across regions depending on the local weight of different industries).

The trend line in this chart shows a negative relationship: more exposure goes along with less employment. There are large deviations from the trend (there are some low-exposure regions with big negative changes in employment); but the paper provides more sophisticated regressions and robustness checks, and finds that this relationship is statistically significant.

This result is important because it shows that the labor market adjustments were large. Many workers and communities were affected over a long period of time. 21

But it's also important to keep in mind that Autor and colleagues are only giving us a partial perspective on the total effect of trade on employment. In particular, comparing changes in employment at the regional level misses the fact that firms operate in multiple regions and industries at the same time. Indeed, Ildikó Magyari found evidence suggesting the Chinese trade shock provided incentives for US firms to diversify and reorganize production. 22

So companies that outsourced jobs to China often ended up closing some lines of business, but at the same time expanded other lines elsewhere in the US. This means that job losses in some regions subsidized new jobs in other parts of the country.

On the whole, Magyari finds that although Chinese imports may have reduced employment within some establishments, these losses were more than offset by gains in employment within the same firms in other places. This is no consolation to people who lost their jobs. But it is necessary to add this perspective to the simplistic story of "trade with China is bad for US workers".

Evidence from the expansion of trade in India and the impact on poverty reductions

Another important paper in this field is Topalova (2010): "Factor immobility and regional impacts of trade liberalization: Evidence on poverty from India". 23

In this paper, Topalova examines the impact of trade liberalization on poverty across different regions in India, using the sudden and extensive change in India's trade policy in 1991. She finds that rural regions that were more exposed to liberalization experienced a slower decline in poverty and lower consumption growth.

Analyzing the mechanisms underlying this effect, Topalova finds that liberalization had a stronger negative impact among the least geographically mobile at the bottom of the income distribution and in places where labor laws deterred workers from reallocating across sectors.

The evidence from India shows that (i) discussions that only look at "winners" in poor countries and "losers" in rich countries miss the point that the gains from trade are unequally distributed within both sets of countries; and (ii) context-specific factors, like worker mobility across sectors and geographic regions, are crucial to understand the impact of trade on incomes.

Evidence from other studies

- Donaldson (2018) uses archival data from colonial India to estimate the impact of India’s vast railroad network. He finds railroads increased trade, and in doing so they increased real incomes (and reduced income volatility). 24

- Porto (2006) looks at the distributional effects of Mercosur on Argentine families, and finds this regional trade agreement led to benefits across the entire income distribution. He finds the effect was progressive: poor households gained more than middle-income households because prior to the reform, trade protection benefitted the rich disproportionately. 25

- Trefler (2004) looks at the Canada-US Free Trade Agreement and finds there was a group who bore "adjustment costs" (displaced workers and struggling plants) and a group who enjoyed "long-run gains" (consumers and efficient plants). 26

The link between trade and the cost of living

The fact that trade negatively affects labor market opportunities for specific groups of people does not necessarily imply that trade has a negative aggregate effect on household welfare. This is because, while trade affects wages and employment, it also affects the prices of consumption goods. So households are affected both as consumers and as wage earners.

Most studies focus on the earnings channel and try to approximate the impact of trade on welfare by looking at how much wages can buy, using as a reference the changing prices of a fixed basket of goods.

This approach is problematic because it fails to consider welfare gains from increased product variety, and obscures complicated distributional issues such as the fact that poor and rich individuals consume different baskets so they benefit differently from changes in relative prices. 27

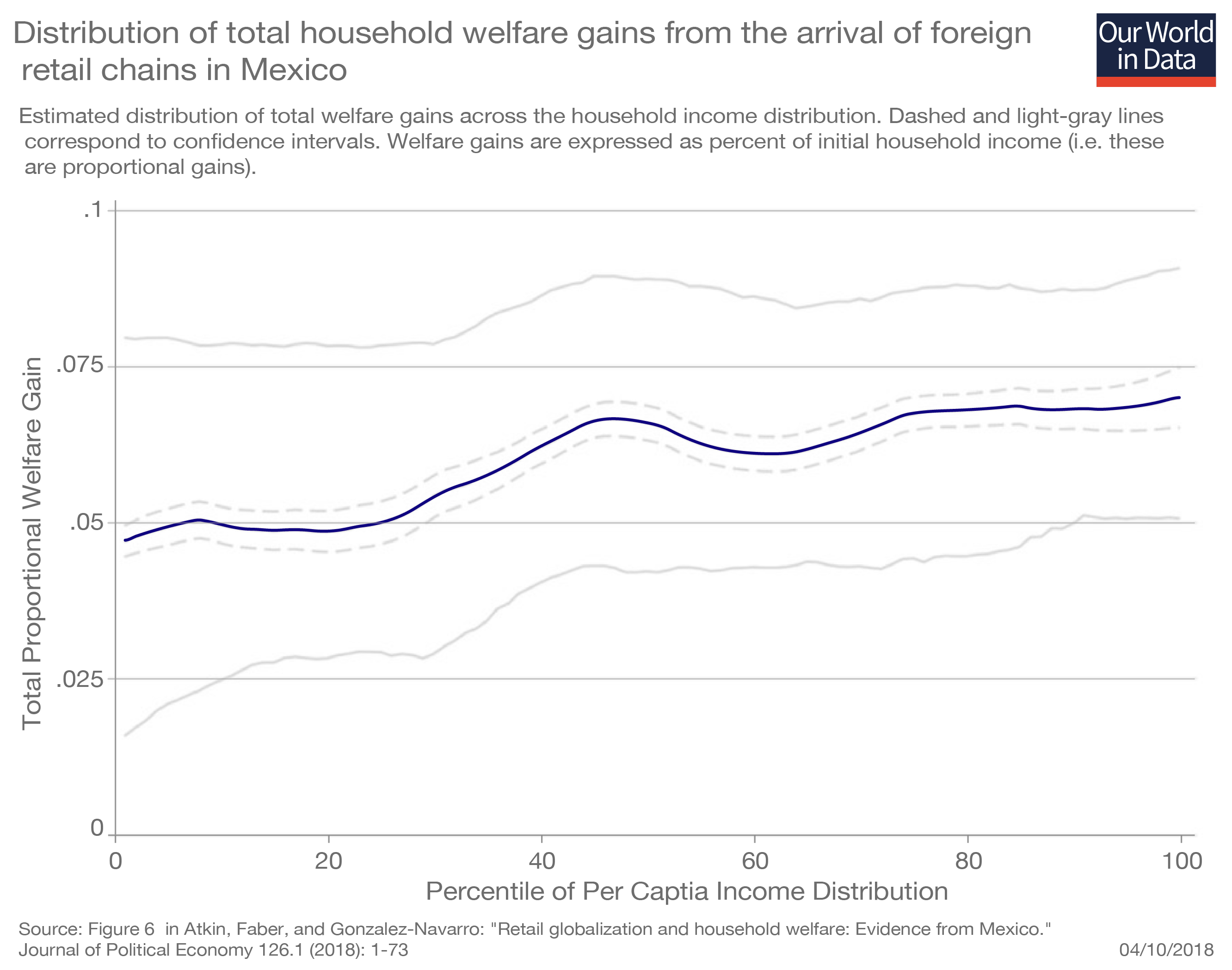

Ideally, studies looking at the impact of trade on household welfare should rely on fine-grained data on prices, consumption, and earnings. This is the approach followed in Atkin, Faber, and Gonzalez-Navarro (2018): "Retail globalization and household welfare: Evidence from Mexico". 28

Atkin and coauthors use a uniquely rich dataset from Mexico, and find that the arrival of global retail chains led to reductions in the incomes of traditional retail sector workers, but had little impact on average municipality-level incomes or employment; and led to lower costs of living for both rich and poor households.

The chart here shows the estimated distribution of total welfare gains across the household income distribution (the light-gray lines correspond to confidence intervals). These are proportional gains expressed as a percent of initial household income.

As we can see, there is a net positive welfare effect across all income groups; but these improvements in welfare are regressive, in the sense that richer households gain proportionally more (about 7.5 percent gain compared to 5 percent). 29

Evidence from other countries confirms this is not an isolated case – the expenditure channel really seems to be an important and understudied source of household welfare. Giuseppe Berlingieri, Holger Breinlich, Swati Dhingra, for example, investigated the consumer benefits from trade agreements implemented by the EU between 1993 and 2013; and they found that these trade agreements increased the quality of available products, which translated into a cumulative reduction in consumer prices equivalent to savings of €24 billion per year for EU consumers. 30

Implications of trade’s distributional effects

The available evidence shows that, for some groups of people, trade has a negative effect on wages and employment opportunities; at the same time, it has a large positive effect via lower consumer prices and increased product availability.

Two points are worth emphasizing.

For some households, the net effect is positive. But for some households that's not the case. In particular, workers who lose their jobs can be affected for extended periods of time, so the positive effect via lower prices is not enough to compensate them for the reduction in earnings.

On the whole, if we aggregate changes in welfare across households, the net effect is usually positive. But this is hardly a consolation for the worse off.

This highlights a complex reality: There are aggregate gains from trade , but there are also real distributional concerns. Even if trade is not a major driver of income inequalities , it's important to keep in mind that public policies, such as unemployment benefits and other safety-net programs, can and should help redistribute the gains from trade.

Explaining trade patterns: Theory and Evidence

Comparative advantage, theory: what is 'comparative advantage' and why does it matter to understand trade.

In economic theory, the 'economic cost' – or the 'opportunity cost' – of producing a good is the value of everything you need to give up in order to produce that good.

Economic costs include physical inputs (the value of the stuff you use to produce the good), plus forgone opportunities (when you allocate scarce resources to a task, you give up alternative uses of those resources).

A country or a person is said to have a 'comparative advantage' if it can produce something at a lower opportunity cost than its trade partners.

The forgone opportunities of production are key to understanding this concept. It is precisely this that distinguishes absolute advantage from comparative advantage.

To see the difference between comparative and absolute advantage, consider a commercial aviation pilot and a baker. Suppose the pilot is an excellent chef, and she can bake just as well, or even better than the baker. In this case, the pilot has an absolute advantage in both tasks. Yet the baker probably has a comparative advantage in baking, because the opportunity cost of baking is much higher for the pilot.

The freely available economics textbook The Economy: Economics for a Changing World explains this as follows: "A person or country has comparative advantage in the production of a particular good, if the cost of producing an additional unit of that good relative to the cost of producing another good is lower than another person or country’s cost to produce the same two goods."

At the individual level, comparative advantage explains why you might want to delegate tasks to someone else, even if you can do those tasks better and faster than them. This may sound counterintuitive, but it is not: If you are good at many things, it means that investing time in one task has a high opportunity cost, because you are not doing the other amazing things you could be doing with your time and resources. So, at least from an efficiency point of view, you should specialize on what you are best at, and delegate the rest.

The same logic applies to countries. Broadly speaking, the principle of comparative advantage postulates that all nations can gain from trade if each specializes in producing what they are relatively more efficient at producing, and imports the rest: “do what you do best, import the rest”. 31

In countries with a relative abundance of certain factors of production, the theory of comparative advantage predicts that they will export goods that rely heavily upon those factors: a country typically has a comparative advantage in those goods that use its abundant resources. Colombia exports bananas to Europe because it has comparatively abundant tropical weather.

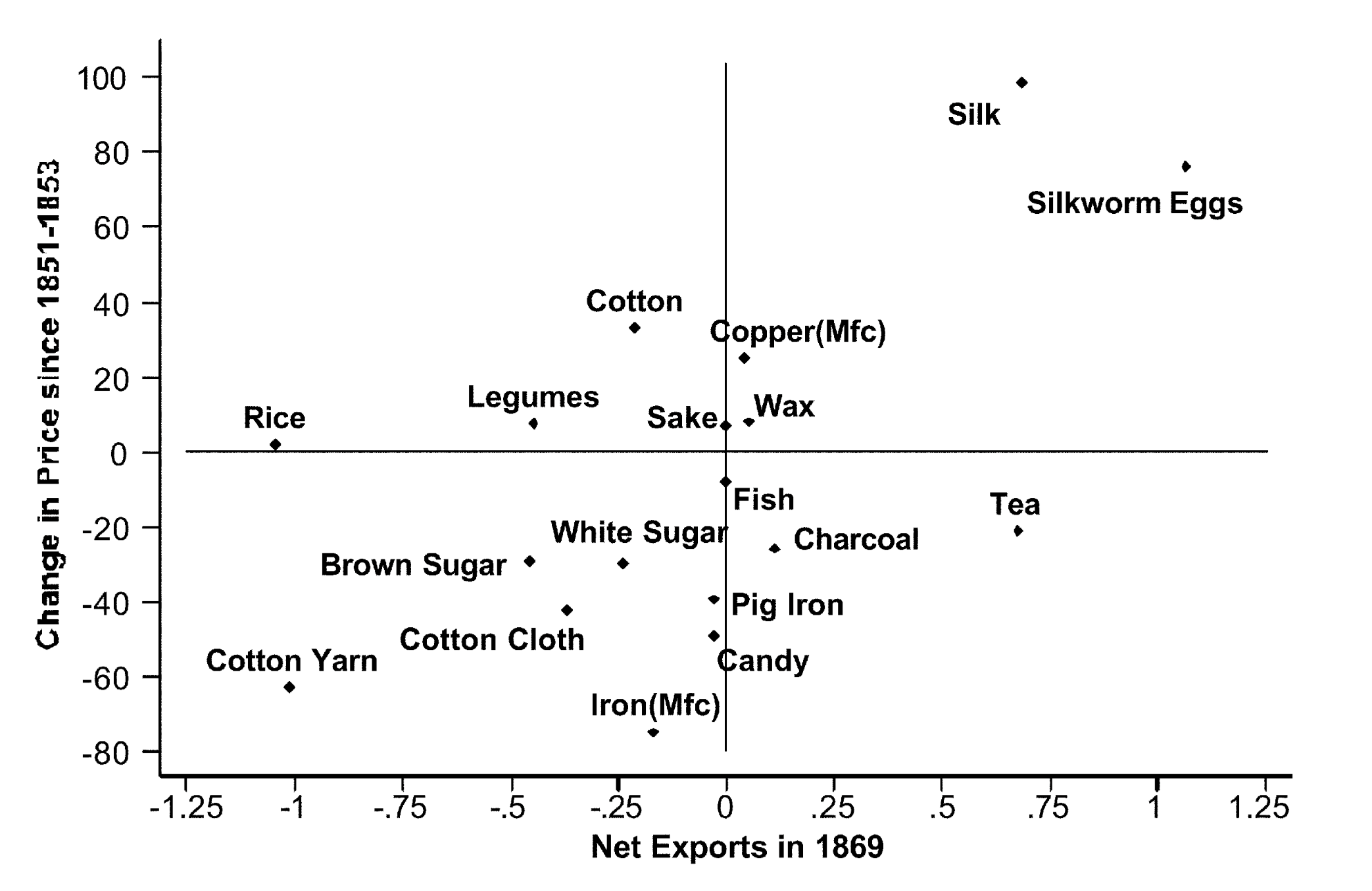

Is there empirical support for comparative-advantage theories of trade?

The empirical evidence suggests that the principle of comparative advantage does help explain trade patterns. Bernhofen and Brown (2004) 32 , for instance, provide evidence using the experience of Japan. Specifically, they exploit Japan’s dramatic nineteenth-century move from a state of near complete isolation to wide trade openness.

The graph here shows the price changes of the key tradable goods after the opening up to trade. It presents a scatter diagram of the net exports in 1869 graphed in relation to the change in prices from 1851–53 to 1869. As we can see, this is consistent with the theory: after opening to trade, the relative prices of major exports such as silk increased (Japan exported what was cheap for them to produce and which was valuable abroad), while the relative price of imports such as sugar declined (they imported what was relatively more difficult for them to produce, but was cheap abroad).

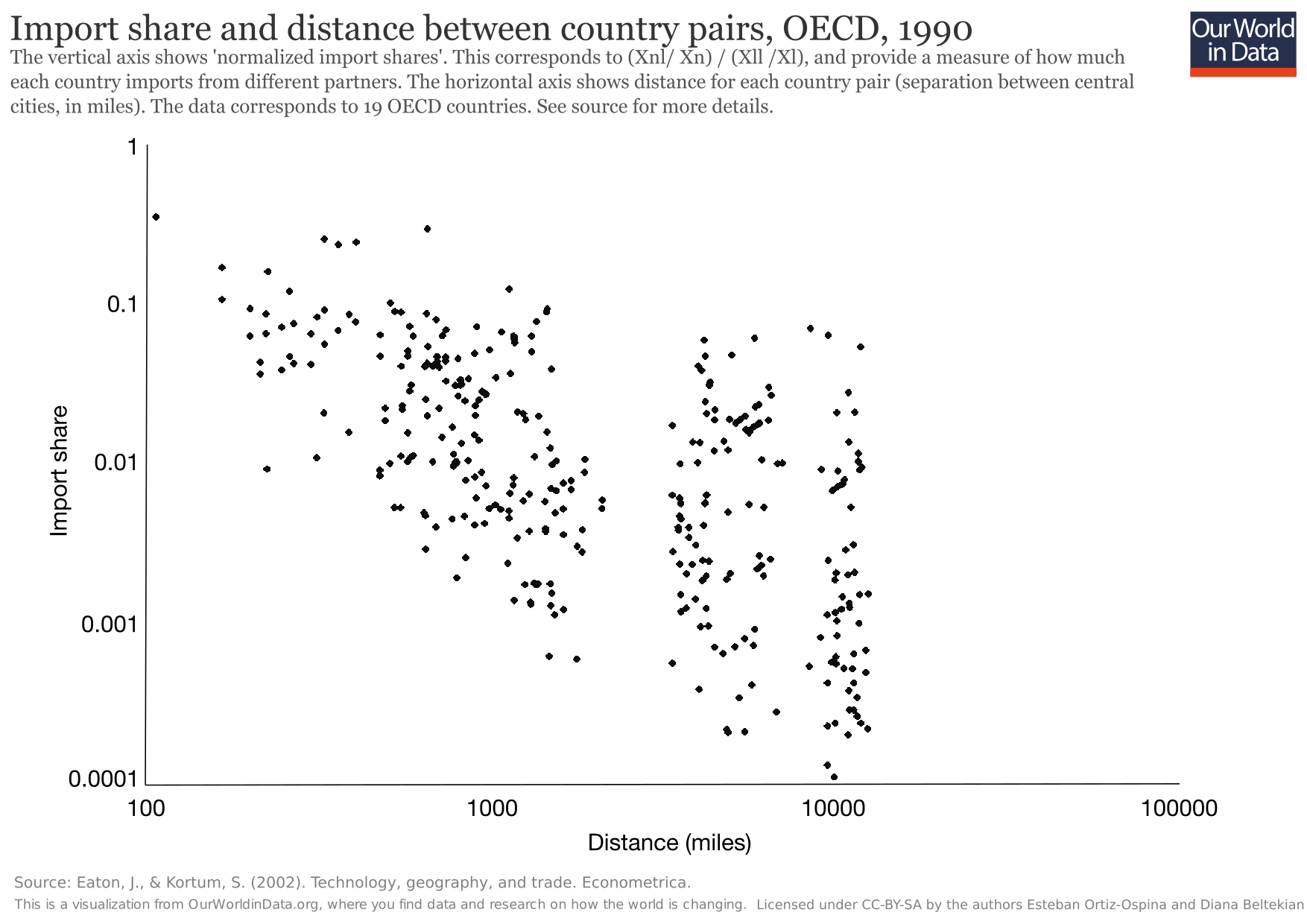

Trade diminishes with distance

The resistance that geography imposes on trade has long been studied in the empirical economics literature – and the main conclusion is that trade intensity is strongly linked to geographic distance.

The visualization, from Eaton and Kortum (2002), graphs 'normalized import shares' against distance. 33 Each dot represents a country pair from a set of 19 OECD countries, and both the vertical and horizontal axes are expressed on logarithmic scales.

The 'normalized import shares' in the vertical axis provide a measure of how much each country imports from different partners (see the paper for details on how this is calculated and normalized), while the distance in the horizontal axis corresponds to the distance between central cities in each country (see the paper and references therein for details on the list of cities). As we can see, there is a strong negative relationship. Trade diminishes with distance. Through econometric modeling, the paper shows that this relationship is not just a correlation driven by other factors: their findings suggest that distance imposes a significant barrier to trade.

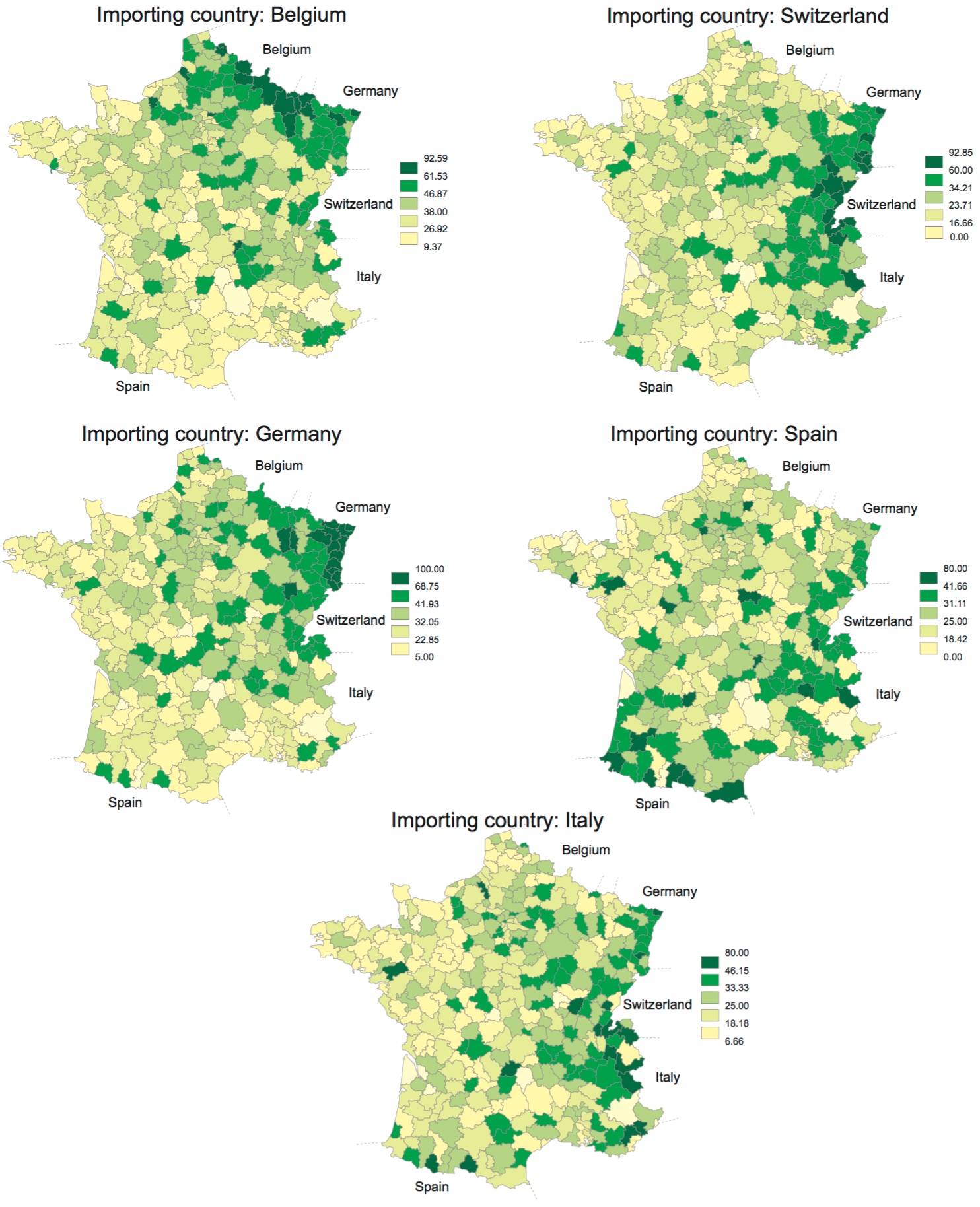

The fact that trade diminishes with distance is also corroborated by data on trade intensity within countries. The visualization here shows, through a series of maps, the geographic distribution of French firms that export to France's neighboring countries. The colors reflect the percentage of firms that export to each specific country.

As we can see, the share of firms exporting to each of the corresponding neighbors is the largest close to the border. The authors also show in the paper that this pattern holds for the value of individual-firm exports – trade value decreases with distance to the border.

Institutions

Conducting international trade requires both financial and non-financial institutions to support transactions. Some of these institutions are fairly obvious (e.g. law enforcement); but some are less obvious. For example, the evidence shows that producers in exporting countries often need credit in order to engage in trade.

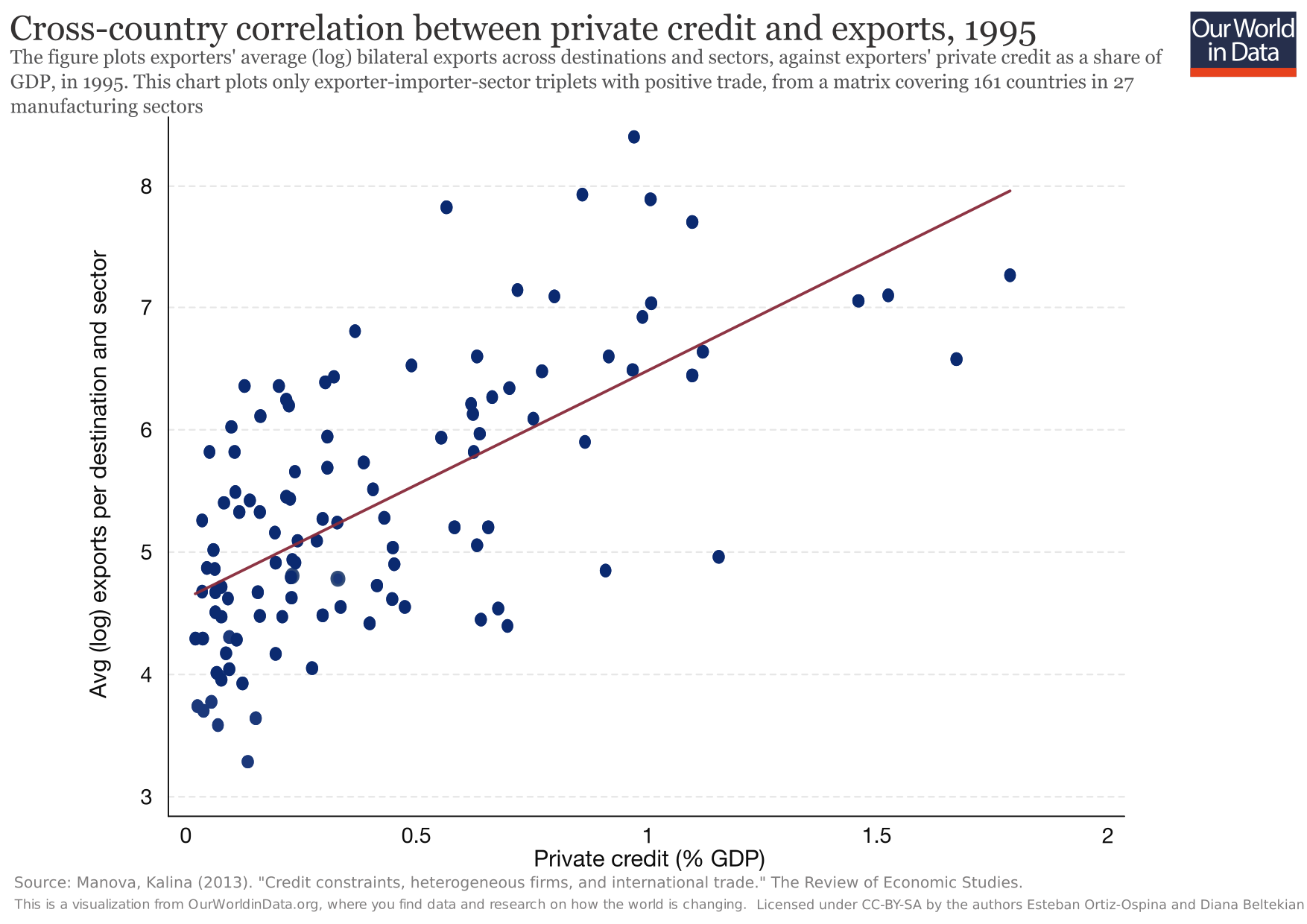

The scatter plot, from Manova (2013), shows the correlation between levels in private credit (specifically exporters’ private credit as a share of GDP) and exports (average log bilateral exports across destinations and sectors). 35 As can be seen, financially developed economies – those with more dynamic private credit markets – typically outperform exporters with less evolved financial institutions.

Other studies have shown that country-specific institutions, like the knowledge of foreign languages, for instance, are also important to promote foreign relative to domestic trade. 36

Increasing returns to scale

The concept of comparative advantage predicts that if all countries had identical endowments and institutions, there would be little incentive for specialization because the opportunity cost of producing any good would be the same in every country.

So you may wonder: why is it then the case that in the last few years, we have seen such rapid growth in intra-industry trade between rich countries?

The increase in intra-industry between rich countries seems paradoxical under the light of comparative advantage because in recent decades we have seen convergence in key factors, such as human capital , across these countries.

The solution to the paradox is actually not very complicated: Comparative advantage is one, but not the only force driving incentives to specialization and trade.

Several economists, most notably Paul Krugman, have developed theories of trade in which trade is not due to differences between countries, but instead due to "increasing returns to scale" – an economic term used to denote a technology in which producing extra units of a good becomes cheaper if you operate at a larger scale.

The idea is that specialization allows countries to reap greater economies of scale (i.e. to reduce production costs by focusing on producing large quantities of specific products), so trade can be a good idea even if the countries do not differ in endowments, including culture and institutions.

These models of trade, often referred to as “New Trade Theory”, are helpful in explaining why in the last few years we have seen such rapid growth in two-way exchanges of goods within industries between developed nations.

In a much-cited paper, Evenett and Keller (2002) show that both factor endowments and increasing returns help explain production and trade patterns around the world. 37

You can learn more about New Trade Theory, and the empirical support behind it, in Paul Krugman's Nobel lecture .

Measurement and data quality

There are dozens of official sources of data on international trade, and if you compare these different sources, you will find that they do not agree with one another. Even if you focus on what seems to be the same indicator for the same year in the same country, discrepancies are large.

Such differences between sources can also be found in rich countries where statistical agencies tend to follow international reporting guidelines more closely.

There are also large bilateral discrepancies within sources: the value of goods that country A exports to country B can be more than the value of goods that country B imports from country A.

Here we explain how international trade data is collected and processed, and why there are such large discrepancies.

What data is available?

The data hubs from several large international organizations publish and maintain extensive cross-country datasets on international trade. Here's a list of the most important ones:

- World Bank Open Data

- WTO Statistics

- UN Comtrade

- UNCTAD World Integrated Trade Solutions

In addition to these sources, there are also many other academic projects that publish data on international trade. These projects tend to rely on data from one or more of the sources above, and they typically process and merge series in order to improve coverage and consistency. Three important sources are:

- The Correlates of War Project . 38

- The NBER-United Nations Trade Dataset Project .

- The CEPII Bilateral Trade and Gravity Data Project . 39

How large are the discrepancies between sources?

In the visualization here, we compare the data published by several of the sources listed above, country by country, from 1955 to today.

For each country, we exclude trade in services, and we focus only on estimates of the total value of exported goods, expressed as shares of GDP. 40

As this chart clearly shows, different data sources often tell very different stories. If you change the country or region shown you will see that this is true, to varying degrees, across all countries and years.

Constructing this chart was demanding. It required downloading trade data from many different sources, collecting the relevant series, and then standardizing them so that the units of measure and the geographical territories were consistent.

All series, except the two long-run series from CEPII and NBER-UN, were produced from data published by the sources in current US dollars and then converted to GDP shares using a unique source (World Bank).

So, if all series are in the same units (share of national GDP) and they measure the same thing (value of goods exported from one country to the rest of the world), what explains the differences?

Let's dig deeper to understand what's going on.

Why doesn't the data add up?

Differences in guidelines used by countries to record and report trade data.

Broadly speaking, there are two main approaches used to estimate international merchandise trade:

- The first approach relies on estimating trade from customs records , often complementing or correcting figures with data from enterprise surveys and administrative records associated with taxation. The main manual providing guidelines for this approach is the International Merchandise Trade Statistics Manual (IMTS).

- The second approach relies on estimating trade from macroeconomic data , typically National Accounts . The main manual providing guidelines for this approach is the Balance of Payments and International Investment Position Manual (BPM6), which was drafted in parallel with the 2008 System of National Accounts of the United Nations (SNA 2008). The idea behind this approach is to record changes in economic ownership. 41

Under these two approaches, it is common to distinguish between 'traded merchandise' and 'traded goods'. The distinction is often made because goods simply being transported through a country (i.e., goods in transit) are not considered to change a country's stock of material resources and are hence often excluded from the more narrow concept of 'merchandise trade'.

Also, adding to the complexity, countries often rely on measurement protocols developed alongside approaches and concepts that are not perfectly compatible to begin with. In Europe, for example, countries use the 'Compilers guide on European statistics on international trade in goods'.

Measurement error and other inconsistencies

Even when two sources rely on the same broad accounting approach, discrepancies arise because countries fail to adhere perfectly to the protocols.

In theory, for example, the exports of country A to country B should mirror the imports of country B from country A. But in practice this is rarely the case because of differences in valuation. According to the BPM6, imports, and exports should be recorded in the balance of payments accounts on a ' free on board (FOB) basis', which means using prices that include all charges up to placing the goods on board a ship at the port of departure. Yet many countries stick to FOB values only for exports, and use CIF values for imports (CIF stands for 'Cost, Insurance and Freight', and includes the costs of transportation). 42

The chart here gives you an idea of how large import-export asymmetries are. Shown are the differences between the value of goods that each country reports exporting to the US, and the value of goods that the US reports importing from the same countries. For example, for China, the figure in the chart corresponds to the “Value of merchandise imports in the US from China” minus the “Value of merchandise exports from China to the US”.

The differences in the chart here, which are both positive and negative, suggest that there is more going on than differences in FOB vs. CIF values. If all asymmetries were coming from FOB-CIF differences, then we should only see positive values in the chart (recall that, unlike FOB values, CIF values include the cost of transportation, so CIF values are larger).

What else may be going on here?

Another common source of measurement error relates to the inconsistent attribution of trade partners. An example is failure to follow the guidelines on how to treat goods passing through intermediary countries for processing or merchanting purposes. As global production chains become more complex, countries find it increasingly difficult to unambiguously establish the origin and final destination of merchandise, even when rules are established in the manuals. 43

And there are still more potential sources of discrepancies. For example differences in customs and tax regimes, and differences between "general" and "special" trade systems (i.e. differences between statistical territories and actual country borders, which do not often coincide because of things like 'custom free zones'). 44

Even when two sources have identical trade estimates, inconsistencies in published data can arise from differences in exchange rates. If a dataset reports cross-country trade data in US dollars, estimates will vary depending on the exchange rates used. Different exchange rates will lead to conflicting estimates, even if figures in local currency units are consistent.

A checklist for comparing sources

Asymmetries in international trade statistics are large and arise for a variety of reasons. These include conceptual inconsistencies across measurement standards and inconsistencies in the way countries apply agreed-upon protocols. Here's a checklist of issues to keep in mind when comparing sources.

- Differences in underlying records: is trade measured from National Accounts data rather than directly from custom or tax records?

- Differences in import and export valuations: are transactions valued at FOB or CIF prices?

- Inconsistent attribution of trade partners: how is the origin and final destination of merchandise established?

- Difference between 'goods' and 'merchandise': how are re-importing, re-exporting, and intermediary merchanting transactions recorded?

- Exchange rates: how are values converted from local currency units to the currency that allows international comparisons (most often the US-$)?

- Differences between 'general' and 'special' trade system: how is trade recorded for custom-free zones?

- Other issues: Time of recording, confidentiality policies, product classification, deliberate mis-invoicing for illicit purposes.

Many organizations producing trade data have long recognized these factors. Indeed, international organizations often incorporate corrections in an attempt to improve data quality.

The OECD's Balanced International Merchandise Trade Statistics , for example, uses its own approach to correct and reconcile international merchandise trade statistics. 45

The corrections applied in the OECD's 'balanced' series make this the best source for cross-country comparisons. However, this dataset has low coverage across countries, and it only goes back to 2011. This is an important obstacle since the complex adjustments introduced by the OECD imply we can't easily improve coverage by appending data from other sources. At Our World in Data we have chosen to rely on CEPII as the main source for exploring long-run changes in international trade, but we also rely on World Bank and OECD data for up-to-date cross-country comparisons.

There are two key lessons from all of this. The first lesson is that, for most users of trade data out there, there is no obvious way of choosing between sources. And the second lesson is that, because of statistical glitches, researchers and policymakers should always take analyses of trade data with a pinch of salt. For example, in a recent high-profile report , researchers attributed mismatches in bilateral trade data to illicit financial flows through trade mis-invoicing (or trade-based money laundering). As we show here, this interpretation of the data is not appropriate, since mismatches in the data can, and often do arise from measurement inconsistencies rather than malfeasance. 46

Hopefully, the discussion and checklist above can help researchers better interpret and choose between conflicting data sources.

Interactive charts on Trade and Globalization

The openness index, when calculated for the world as a whole, includes double-counting of transactions: When country A sells goods to country B, this shows up in the data both as an import (B imports from A) and as an export (A sells to B).

Indeed, if you compare the chart showing the global trade openness index and the chart showing global merchandise exports as a share of GDP , you find that the former is almost twice as large as the latter.

Why is the global openness index not exactly twice the value reported in the chart plotting global merchandise exports? There a three reasons.

First, the global openness index uses different sources. Second, the global openness index includes trade in goods and services, while merchandise exports include goods but not services. And third, the amount that country A reports exporting to country B does not usually match the amount that B reports importing from A.

We explore this in more detail in our measurement section below .

Klasing and Milionis (2014), one of the sources in the chart, published an additional set of estimates under an alternative specification. Similarly, for the period 1960-2015, the World Bank's World Development Indicators published an alternative set of estimates similar but not identical to those included from the Penn World Tables (9.1). You find all these alternative overlapping sources in this comparison chart .

Leonor Freire Costa, Nuno Palma, and Jaime Reis (2015) – The great escape? The contribution of the empire to Portugal's economic growth, 1500–1800 Leonor Freire Costa Nuno Palma Jaime Reis European Review of Economic History, Volume 19, Issue 1, 1 February 2015, Pages 1–22, https://doi.org/10.1093/ereh/heu019

Broadberry and O'Rourke (2010) - The Cambridge Economic History of Modern Europe: Volume 2, 1870 to the Present. Cambridge University Press.

Integration in the goods markets is measured here through the 'trade openness index', which is defined by the sum of exports and imports as a share of GDP. In our interactive chart you can explore trends in trade openness over this period for a selection of European countries.

Broadberry and O'Rourke (2010) - The Cambridge Economic History of Modern Europe: Volume 2, 1870 to the Present. Cambridge University Press. The graph depicts the “evolution of three indicators measuring integration in commodity, labor, and capital markets over the long run. Commodity market integration is measured by computing the ratio of exports to GDP. Labor market integration is measured by dividing the migratory turnover by population. Financial integration is measured using Feldstein–Horioka estimators of current account disconnectedness.”

We also have the same chart but showing imports .

We also have the same chart, but showing imports .

This interactive chart shows trade in services as a share of GDP across countries and regions.

This chart was inspired by a chart from Helpman, E., Melitz, M., & Rubinstein, Y. (2007). Estimating trade flows: Trading partners and trading volumes (No. w12927). National Bureau of Economic Research.

We also have the same data, but as a stacked-area chart .

There are different ways of capturing this correlation. I focus here on all countries with data over the period 1945-2014. You can find a similar chart using different data sources and time periods in Ventura, J. (2005). A global view of economic growth. Handbook of economic growth, 1, 1419-1497. Online here .

The textbook The Economy: Economics for a Changing World explains this in more detail.

Frankel, J. A., & Romer, D. H. (1999). Does trade cause growth? American Economic Review, 89(3), 379-399.

Alcalá, F., & Ciccone, A. (2004). Trade and productivity . The Quarterly Journal of Economics, 119(2), 613-646.

There are many papers that try to answer this specific question with macro data. For an overview of papers and methods see: Durlauf, S. N., Johnson, P. A., & Temple, J. R. (2005). Growth econometrics. Handbook of economic growth, 1, 555-677.

Pavcnik, N. (2002). Trade liberalization, exit, and productivity improvements: Evidence from Chilean plants . The Review of Economic Studies, 69(1), 245-276.

Bloom, N., Draca, M., & Van Reenen, J. (2016). Trade induced technical change? The impact of Chinese imports on innovation, IT and productivity. The Review of Economic Studies, 83(1), 87-117. Available online here .

You can read more about these economic concepts, and the related predictions from economic theory, in Chapter 18 of the textbook The Economy: Economics for a Changing World .

David, H., Dorn, D., & Hanson, G. H. (2013). The China syndrome: Local labor market effects of import competition in the United States . American Economic Review, 103(6), 2121-68.

It's important to mention here that the economist Jonathan Rothwell wrote a paper suggesting these findings are the result of a statistical illusion. Rothwell's critique received some attention from the media , but Autor and coauthors provided a reply , which I think successfully refutes this claim.

Magyari, I. (2017). Firm Reorganization, Chinese Imports, and US Manufacturing Employment . US Census Bureau, Center for Economic Studies.

Topalova, P. (2010). Factor immobility and regional impacts of trade liberalization: Evidence on poverty from India . American Economic Journal: Applied Economics, 2(4), 1-41.

Donaldson, D. (2018). Railroads of the Raj: Estimating the impact of transportation infrastructure . American Economic Review, 108(4-5), 899-934.

Porto, G (2006). Using Survey Data to Assess the Distributional Effects of Trade Policy. Journal of International Economics 70 (2006) 140–160.

Trefler, D. (2004). The long and short of the Canada-US free trade agreement . American Economic Review, 94(4), 870-895.

See: (i) Feenstra, R. C., & Weinstein, D. E. (2017). Globalization, markups, and US welfare . Journal of Political Economy, 125(4), 1040-1074. (ii) Fajgelbaum, P. D., & Khandelwal, A. K. (2016). Measuring the unequal gains from trade . The Quarterly Journal of Economics, 131(3), 1113-1180.

Atkin, David, Benjamin Faber, and Marco Gonzalez-Navarro. "Retail globalization and household welfare: Evidence from Mexico." Journal of Political Economy 126.1 (2018): 1-73.

In the paper, Atkin and coauthors explore the reasons for this and find that the regressive nature of the distribution is mainly due to richer households placing higher weight on the product variety and shopping amenities on offer at these new foreign stores.

Berlingieri, G., Breinlich, H., & Dhingra, S. (2018). The Impact of Trade Agreements on Consumer Welfare—Evidence from the EU Common External Trade Policy. Journal of the European Economic Association.

Nobel laureate Paul Samuelson (1969) was once challenged by the mathematician Stanislaw Ulam: "Name me one proposition in all of the social sciences which is both true and non-trivial." It was several years later than he thought of the correct response: comparative advantage. "That it is logically true need not be argued before a mathematician; that is is not trivial is attested by the thousands of important and intelligent men who have never been able to grasp the doctrine for themselves or to believe it after it was explained to them."

(NB. This is an excerpt from https://www.wto.org/english/res_e/reser_e/cadv_e.htm)

Bernhofen, D., & Brown, J. (2004). A Direct Test of the Theory of Comparative Advantage: The Case of Japan. Journal of Political Economy, 112(1), 48-67. doi:1. Retrieved from http://www.jstor.org/stable/10.1086/379944 doi:1

Eaton, J., & Kortum, S. (2002). Technology, geography, and trade. Econometrica, 70(5), 1741-1779.

Crozet, M., & Koenig, P. (2010). Structural Gravity Equations with Intensive and Extensive Margins. The Canadian Journal of Economics / Revue Canadienne D'Economique, 43(1), 41-62. Retrieved from http://www.jstor.org/stable/40389555

Manova, Kalina. "Credit constraints, heterogeneous firms, and international trade." The Review of Economic Studies 80.2 (2013): 711-744.

Melitz, J. (2008). Language and foreign trade. European Economic Review, 52(4), 667-699.

Evenett, S. J., & Keller, W. (2002). On theories explaining the success of the gravity equation . Journal of Political Economy, 110(2), 281-316.

For more information on how the COW trade datasets were constructed see: (i) Barbieri, Katherine, and Omar M. G. Omar Keshk. 2016. Correlates of War Project Trade Data Set Codebook, Version 4.0. Available at http://correlatesofwar.org and (ii) Barbieri, Katherine, Omar M. G. Keshk, and Brian Pollins. 2009. TRADING DATA: Evaluating our Assumptions and Coding Rules. Conflict Management and Peace Science, 26(5): 471–491.

Further information on CEPII's methodology can be found in their working paper .

The chart includes series labeled by the sources as 'merchandise trade' and 'goods trade'. As we explain below, part of the asymmetries in trade data comes from the fact that, although 'merchandise' and 'goods' are equivalent in the dictionary, these two terms often measure related but different things.

For example, if there is no change in ownership (e.g. a firm exports goods to its factory in another country for processing, and then re-imports the processed goods) the manual says that statistical agencies should only record the net difference in value. You can find more details about this in an OECD Statistics Briefing .

This issue is actually also a source of disagreement between National Accounts data and customs data. You can read more about it in this report: Harrison, Anne (2013) FOB/CIF Issue in Merchandise Trade/Transport of Goods in BPM6 and the 2008 SNA, Twenty-Fifth Meeting of the IMF Committee on Balance of Payments Statistics, Washington, D.C .

Precisely because of the difficulty that arises when trying to establish the origin and final destination of merchandise, some sources distinguish between national and dyadic (i.e. 'directed') trade estimates.

For more details about general and special trade see the Eurostat glossary .

The OECD approach consists of four steps, which they describe as follows: "First, data are collected and organized, and imports are converted to FOB prices to match the valuation of exports. Secondly, data are adjusted for several specific large problems known to drive asymmetries. Presently these include “modular” adjustments for unallocated and confidential trade; for exports by Hong Kong, China; for Swiss non-monetary gold; and for clear-cut cases of product misclassifications. The list of modules is expected to grow over time. In the third step, adjusted data are balanced using a “Symmetry Index” that weights exports and imports. As the final step, the data are also converted to Classification of Products by Activity (CPA) products to better align with National Accounts statistics, such as in national Supply-Use tables." You can read more about it here . In addition to the OECD, other sources also use corrections. The IMF's DOTS dataset, for example, uses a 6 percent rule for converting import valuations (in CIF) into export values (in FOB). More information can be found in the IMF's (2018) working paper on 'New Estimates for Direction of Trade Statistics'.

For more details on this see Forstater, M. (2018) Illicit Financial Flows, Trade Misinvoicing, and Multinational Tax Avoidance: The Same or Different? , CGD Policy Paper 123.

Cite this work

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

Globalization and Economic Growth

- Living reference work entry

- First Online: 14 April 2021

- Cite this living reference work entry

- Ishak Demir 7 , 10 ,

- Mehmet Canakci 8 &

- Taha Egri 9

Part of the book series: Encyclopedia of the UN Sustainable Development Goals ((ENUNSDG))

482 Accesses

1 Citations

Economic Growth , Integration and growth , Economic development.

Definitions

Globalization, or the increased interconnectedness and interdependence of peoples, companies, institutions and countries. It is generally understood to include two inter-related elements: the opening of international borders to increasingly fast flows of goods, services, finance, investment, people, information, ideas and technology; and the changes in institutions and policies at national and international levels that facilitate or promote such flows (WHO 2020 ). Globalization process has impacts on economies, prosperity, development of societies, political systems, environment, and cultures around the world.

Economic globalization can be defined as the increasing interdependence of world economies as a result of the growing scale of cross-border trade of commodities and services, flow of international capital and wide and rapid spread of technologies. It reflects the continuing expansion and mutual...

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Institutional subscriptions

Alesina A et al (1994) The political economy of capital controls. In: Leiderman L, Razin A (eds) Capital mobility: the impact on consumption, investment and growth. Cambridge University Press, Cambridge, pp 289–321

Google Scholar

Bauman Z (1998) Globalization the human consequences. Columbia University Press, New York

Berger PL (1997) Four faces of global culture. Nat Int 49:23–29

Brenner N (1999) Beyond state-centrism? Space, territoriality, and geographical scale in globalization studies. Theory Soc 28(1):39–78

Article Google Scholar

Castells M (2000) Materials for an exploratory theory of the network society. Br J Soc 51(1):5–24

Demirguc-Kunt A, Levine R (2008) Finance, financial sector policies, and long-run growth. The World Bank

Dollar D (1992) Outward-oriented developing economies really do grow more rapidly: evidence from 95 LDCs. Econ Dev Cult Chang 40(3):523–544

Dowrick S, DeLong JB (2003) Globalization and convergence. In: Bordo MD et al (eds) Globalization in historical perspective. University of Chicago Press, pp 191–226

Dreher A (2006) Does globalization affects growth? Empirical evidence from a new index. Appl Econ 38(10):1091–1110

Easterly W (2004) Channels from globalization to inequality: productivity world vs factor world. Paper presented at the Brookings Trade Forum on Globalization, Poverty and Inequality, 13–14 May, Washington, DC

Edwards S (1998) Openness, productivity and growth: what do we really know? Econ J 108:383–398

Edwards S (2005) Capital controls, sudden stops, and current account reversals. NBER Working Paper No. 11170. https://www.nber.org/papers/w11170.pdf . Accessed 15 May 2020

Falk R (1999) Predatory globalization: a critique. Polity Press, Cambridge

Fouquin M, Hugot J (2016) Two centuries of bilateral trade and gravity data: 1827–2014. CEPII Working Paper, 2016–14. http://www.cepii.fr/pdf_pub/wp/2016/wp2016-14.pdf . Accessed 15 May 2020

Frankel JA, Romer DH (1999) Does trade cause growth? Am Econ Rev 89(3):379–399

Gao S (2000) Economic globalization: trends, risks and risk prevention. CDP Background Papers 001, United Nations, Department of Economics and Social Affairs

Georgantzas N, Katsamakas E, Solowiej D (2010) Giddens’ globalization: exploring dynamic implications. Syst Res Behav Sci 27(6):622–638

Giddens A (1990) Consequences of modernity. Standford University Press, Standford

Gilpin R (2000) The challenge of global capitalism: the world economy in the 21 st century. Princeton University Press, Princeton

Book Google Scholar

Gu XH, Dong BM (2011) A theory of financial liberalisation: why are developing countries so reluctant? World Econ 34:1106–1123

Held D et al (1999) Global transformations: politics, economics and cultures. Polity Press, Cambridge

Hernández RA (2003) Neoclassical and endogenous growth models: theory and practice. Warwick University. https://doi.org/10.13140/RG.2.1.5069.1600

Hirst P, Thompson G (2001) Globalization in question: the international economy and the possibilities of governance

Intriligator MD (2004) Globalization of the world economy: potential benefits and costs and a net assessment. J Policy Model 26(4):485–498

Lane DC, Husemann E (2008) Steering without Circe: attending to reinforcing loops in social systems. Syst Dyn Rev 24(1):27–61

Levine R (2001) International financial liberalization and economic growth. Rev Int Econ 9:688–702

Luhmann N (1982) The world society as a social system. Int J Gen Syst 8(3):131–138

Nissanke M, Thorbecke E (2007) The impact of globalization on the world’s poor: transmission mechanisms. Palgrave Macmillan

Nye J (2002) The paradox of American power: why the world’s only superpower can’t go it alone. Oxford University Press, New York

OECD (2002) Foreign direct investment for development: maximising benefits, minimising costs. OECD Publications

Rodriguez F, Rodrik D (2000) Trade policy and economic growth: a sceptic’s guide to the cross-national evidence. NBER Mac Ann 15:261–325

Stiglitz J (2003) Globalization and growth in emerging markets and the new economy. J Policy Model

Stiglitz J (2007) Making globalization work. Penguin Books, New York

Wallerstein I (2016) The scholarly mainstream and reality: we at a turning point. In: Wallerstein I (ed) Modern world-system in the longue Duree. Routledge, London\New York

World Health Organizations (2020) www.who.int/topics/globalization/en (visited on 25.05.2020)

Download references

Author information

Authors and affiliations.

University of Lincoln, Lincoln, UK

Ishak Demir

Inonu University, Battalgazi/Malatya, Turkey

Mehmet Canakci

Kirklareli University, Merkez/Kırklareli, Turkey

Ekonomi Arastirmalari Platformu, Istanbul, Turkey

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Ishak Demir .

Editor information

Editors and affiliations.

European School of Sustainability, Hamburg University of Applied Sciences, Hamburg, Hamburg, Germany

Walter Leal Filho

Center for Neuroscience & Cell Biology, University of Coimbra, Coimbra, Portugal

Anabela Marisa Azul

Faculty of Engineering and Architecture, Passo Fundo University Faculty of Engineering and Architecture, Passo Fundo, Brazil

Luciana Brandli

HAW Hamburg, Hamburg, Hamburg, Germany

Amanda Lange Salvia

International Centre for Thriving, University of Chester, Chester, UK

Section Editor information

Polimoda Fashion Institute, Florence, Italy

Marco Tortora

Fair Association, Florence, Italy

School of Economics and Management, University of Florence, Florence, Italy

Rights and permissions

Reprints and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this entry

Cite this entry.

Demir, I., Canakci, M., Egri, T. (2021). Globalization and Economic Growth. In: Leal Filho, W., Azul, A.M., Brandli, L., Lange Salvia, A., Wall, T. (eds) Decent Work and Economic Growth. Encyclopedia of the UN Sustainable Development Goals. Springer, Cham. https://doi.org/10.1007/978-3-319-71058-7_90-1

Download citation

DOI : https://doi.org/10.1007/978-3-319-71058-7_90-1

Received : 29 May 2020

Accepted : 29 May 2020

Published : 14 April 2021

Publisher Name : Springer, Cham

Print ISBN : 978-3-319-71058-7

Online ISBN : 978-3-319-71058-7

eBook Packages : Springer Reference Earth and Environm. Science Reference Module Physical and Materials Science Reference Module Earth and Environmental Sciences

- Publish with us

Policies and ethics

- Find a journal

- Track your research

This website uses cookies.

By clicking the "Accept" button or continuing to browse our site, you agree to first-party and session-only cookies being stored on your device to enhance site navigation and analyze site performance and traffic. For more information on our use of cookies, please see our Privacy Policy .

- Journal of Economic Literature

Inequality and Globalization: A Review Essay

- Martin Ravallion

- Article Information

Additional Materials

- Author Disclosure Statement(s) (26.59 KB)

JEL Classification

- F63 Economic Impacts of Globalization: Economic Development

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The State of Globalization in 2023

- Steven A. Altman

- Caroline R. Bastian

Data disproves the notion that the world has become more regionalized in recent years.

Plummeting flows of trade, capital, and people at the beginning of the Covid-19 pandemic prompted a wave of speculation about the end of globalization, and Russia’s invasion of Ukraine brought even more predictions of a retreat toward national self-sufficiency. But, according to research for the latest DHL Global Connectedness Index, international flows show no signs of a sustained downturn. The data shows a broad pattern of decoupling between the U.S. and China, but the flows of countries that are geopolitically aligned with the U.S. and China do not — at least yet — indicate a broader split between rival blocs. Nor is there evidence that globalization is giving way to regionalization. While companies do need to adjust for heightened geopolitical tensions, they should not abandon global strategies. Corporate deglobalization, in fact, could be a riskier path than making focused adjustments to mitigate geopolitical risks.

Three key questions lie at the heart of debates about whether global crises and escalating geopolitical tensions have begun to reverse globalization: Has the growth of cross-border trade, capital, information and people flows gone into reverse? Are geopolitical tensions fracturing the world economy into rival blocs? And is globalization giving way to regionalization? The answer to all three questions — despite evidence of U.S.-China decoupling — is still “no.”

- Steven A. Altman is a senior research scholar, adjunct assistant professor, and director of the DHL Initiative on Globalization at the NYU Stern Center for the Future of Management .

- CB Caroline R. Bastian is a research scholar at the DHL Initiative on Globalization.

Partner Center

ENCYCLOPEDIC ENTRY

Globalization.

Globalization is a term used to describe the increasing connectedness and interdependence of world cultures and economies.

Anthropology, Sociology, Social Studies, Civics, Economics

Freight Trains

Freight trains waiting to be loaded with cargo to transport around the United Kingdom. This cargo comes from around the world and contains all kinds of goods and products.

Photograph by Bloomberg

Globalization is a term used to describe how trade and technology have made the world into a more connected and interdependent place. Globalization also captures in its scope the economic and social changes that have come about as a result. It may be pictured as the threads of an immense spider web formed over millennia, with the number and reach of these threads increasing over time. People, money, material goods, ideas, and even disease and devastation have traveled these silken strands, and have done so in greater numbers and with greater speed than ever in the present age. When did globalization begin? The Silk Road, an ancient network of trade routes across China, Central Asia, and the Mediterranean used between 50 B.C.E. and 250 C.E., is perhaps the most well-known early example of exchanging ideas, products, and customs. As with future globalizing booms, new technologies played a key role in the Silk Road trade. Advances in metallurgy led to the creation of coins; advances in transportation led to the building of roads connecting the major empires of the day; and increased agricultural production meant more food could be trafficked between locales. Along with Chinese silk, Roman glass, and Arabian spices, ideas such as Buddhist beliefs and the secrets of paper-making also spread via these tendrils of trade. Unquestionably, these types of exchanges were accelerated in the Age of Exploration, when European explorers seeking new sea routes to the spices and silks of Asia bumped into the Americas instead. Again, technology played an important role in the maritime trade routes that flourished between old and newly discovered continents. New ship designs and the creation of the magnetic compass were key to the explorers’ successes. Trade and idea exchange now extended to a previously unconnected part of the world, where ships carrying plants, animals, and Spanish silver between the Old World and the New also carried Christian missionaries. The web of globalization continued to spin out through the Age of Revolution, when ideas about liberty , equality , and fraternity spread like fire from America to France to Latin America and beyond. It rode the waves of industrialization , colonization , and war through the eighteenth, nineteenth, and twentieth centuries, powered by the invention of factories, railways, steamboats, cars, and planes. With the Information Age, globalization went into overdrive. Advances in computer and communications technology launched a new global era and redefined what it meant to be “connected.” Modern communications satellites meant the 1964 Summer Olympics in Tokyo could be watched in the United States for the first time. The World Wide Web and the Internet allowed someone in Germany to read about a breaking news story in Bolivia in real time. Someone wishing to travel from Boston, Massachusetts, to London, England, could do so in hours rather than the week or more it would have taken a hundred years ago. This digital revolution massively impacted economies across the world as well: they became more information-based and more interdependent. In the modern era, economic success or failure at one focal point of the global web can be felt in every major world economy. The benefits and disadvantages of globalization are the subject of ongoing debate. The downside to globalization can be seen in the increased risk for the transmission of diseases like ebola or severe acute respiratory syndrome (SARS), or in the kind of environmental harm that scientist Paul R. Furumo has studied in microcosm in palm oil plantations in the tropics. Globalization has of course led to great good, too. Richer nations now can—and do—come to the aid of poorer nations in crisis. Increasing diversity in many countries has meant more opportunity to learn about and celebrate other cultures. The sense that there is a global village, a worldwide “us,” has emerged.

Media Credits

The audio, illustrations, photos, and videos are credited beneath the media asset, except for promotional images, which generally link to another page that contains the media credit. The Rights Holder for media is the person or group credited.

Production Managers

Program specialists, specialist, content production, last updated.

March 6, 2024

User Permissions

For information on user permissions, please read our Terms of Service. If you have questions about how to cite anything on our website in your project or classroom presentation, please contact your teacher. They will best know the preferred format. When you reach out to them, you will need the page title, URL, and the date you accessed the resource.

If a media asset is downloadable, a download button appears in the corner of the media viewer. If no button appears, you cannot download or save the media.

Text on this page is printable and can be used according to our Terms of Service .