Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how to create a financial forecast for a startup business plan.

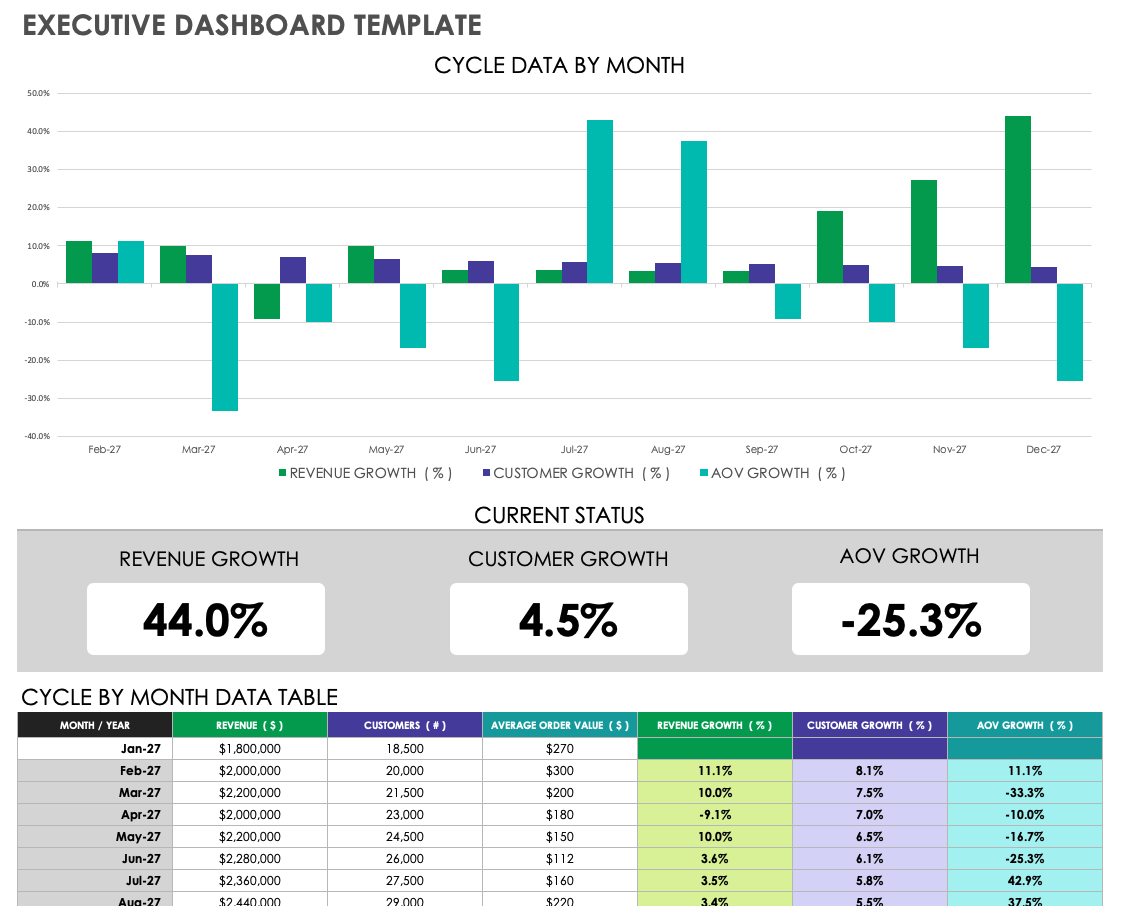

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

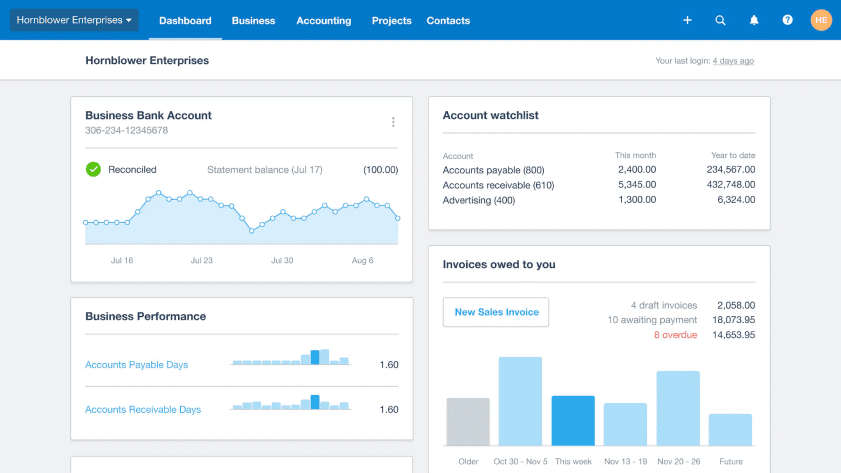

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

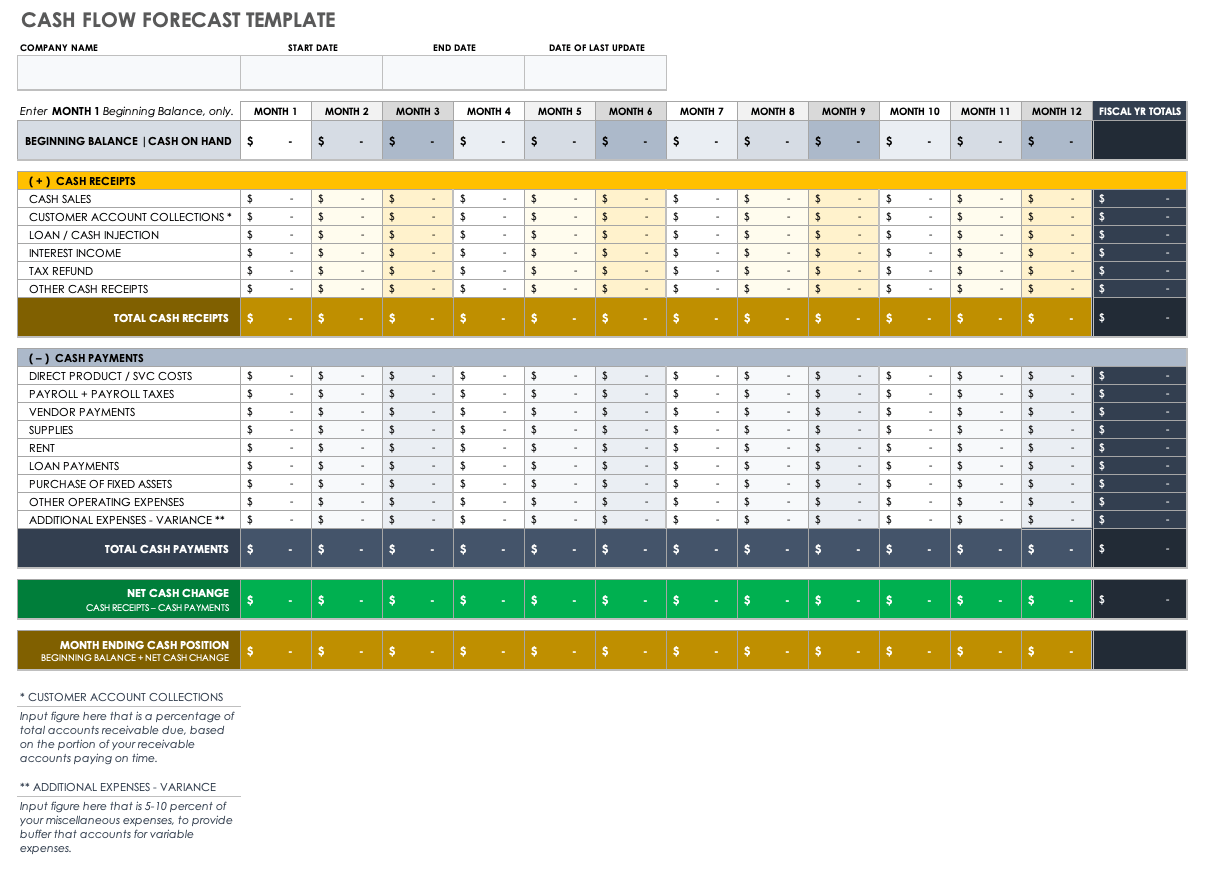

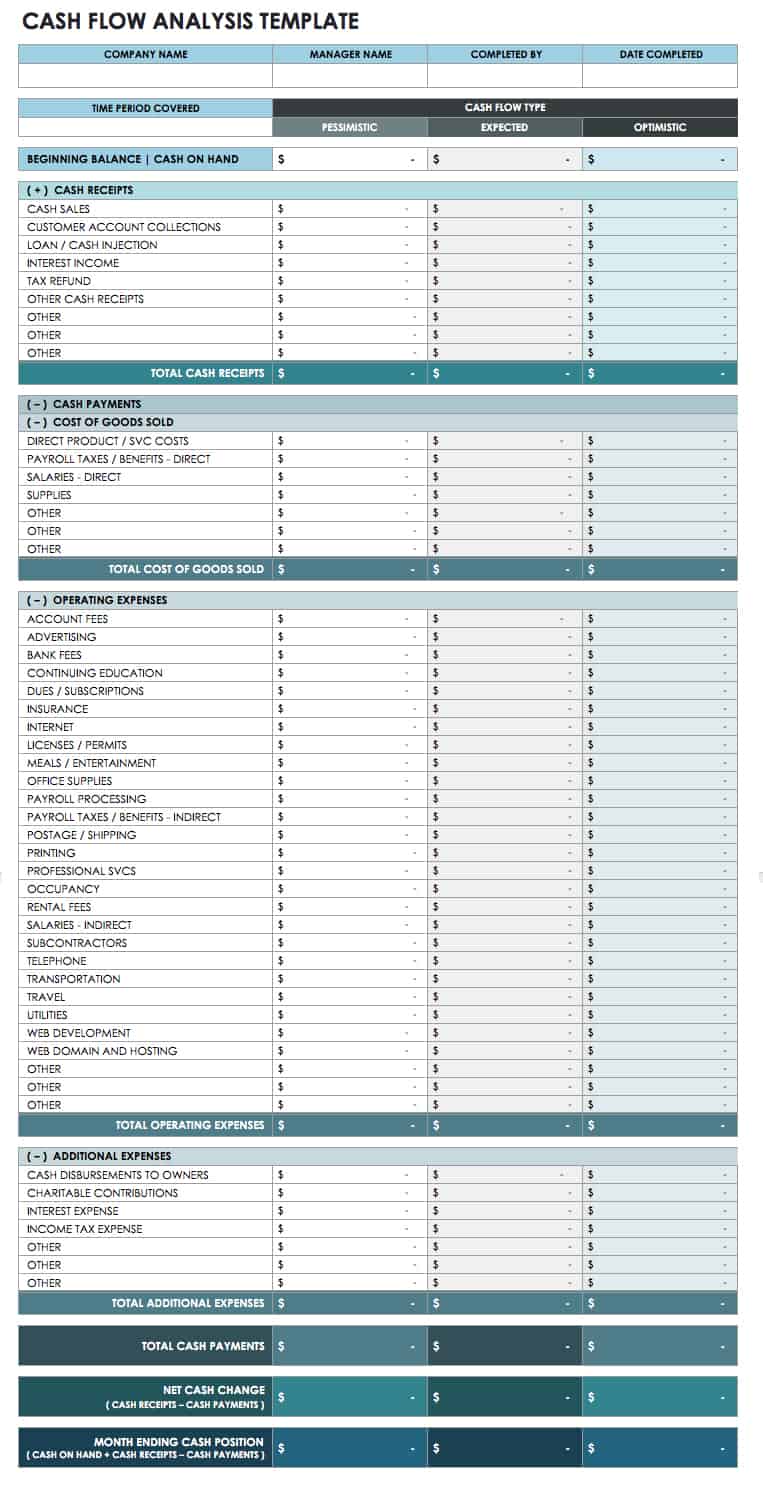

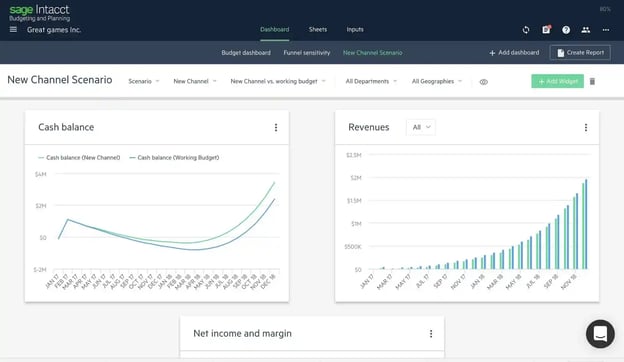

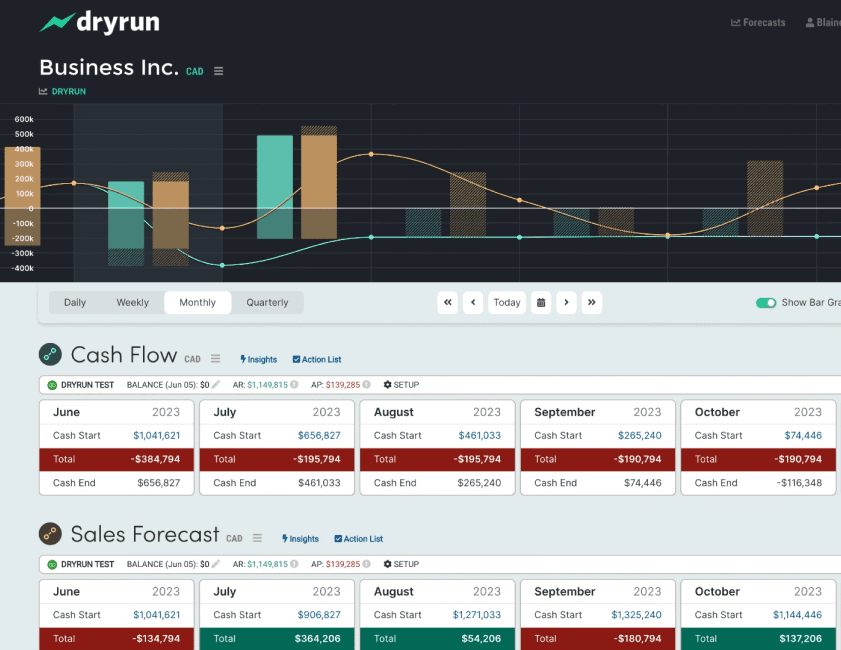

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

What is enterprise resource planning, 10 benefits of erp systems for small businesses, 10 free accounting tools for your small business.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

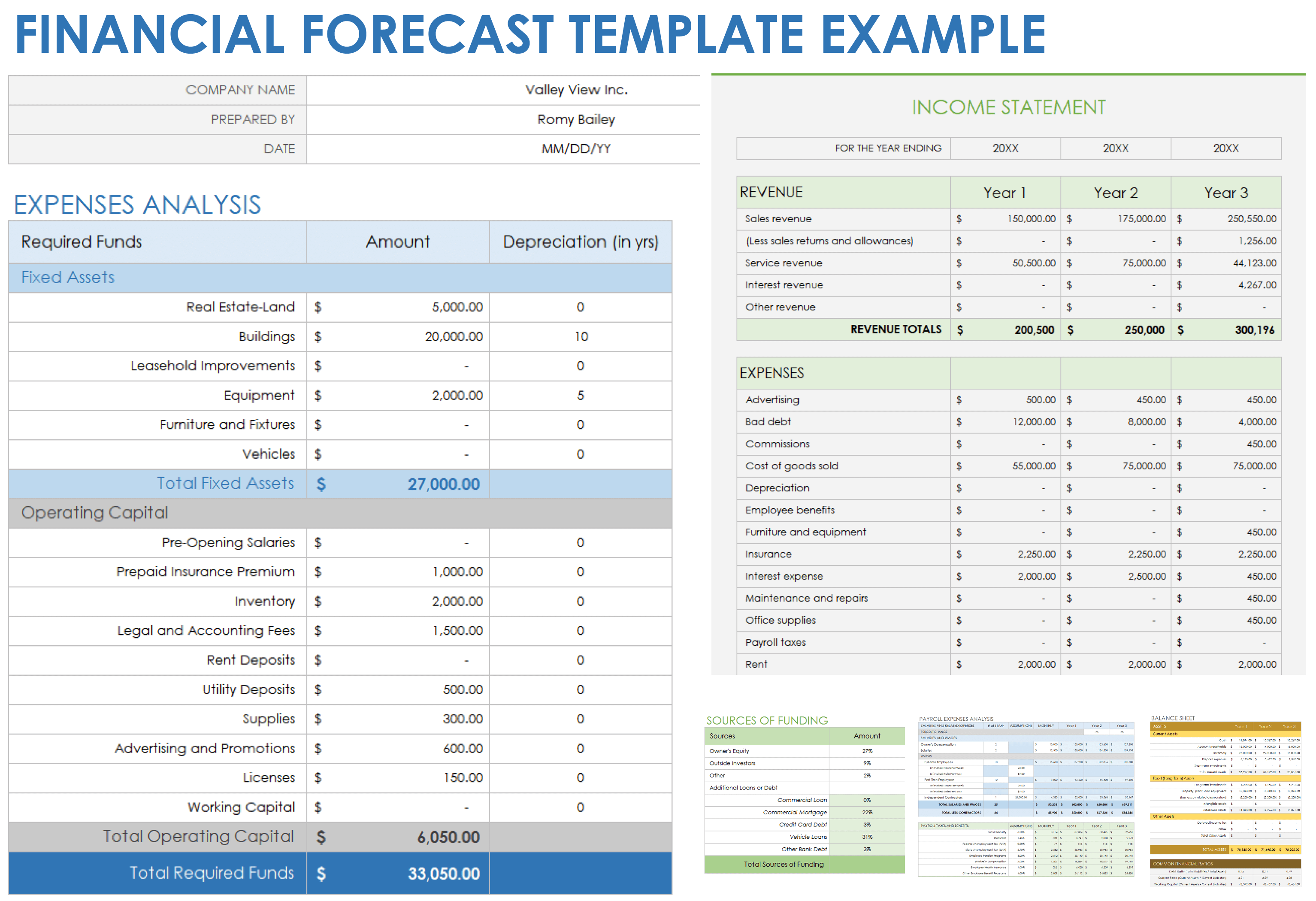

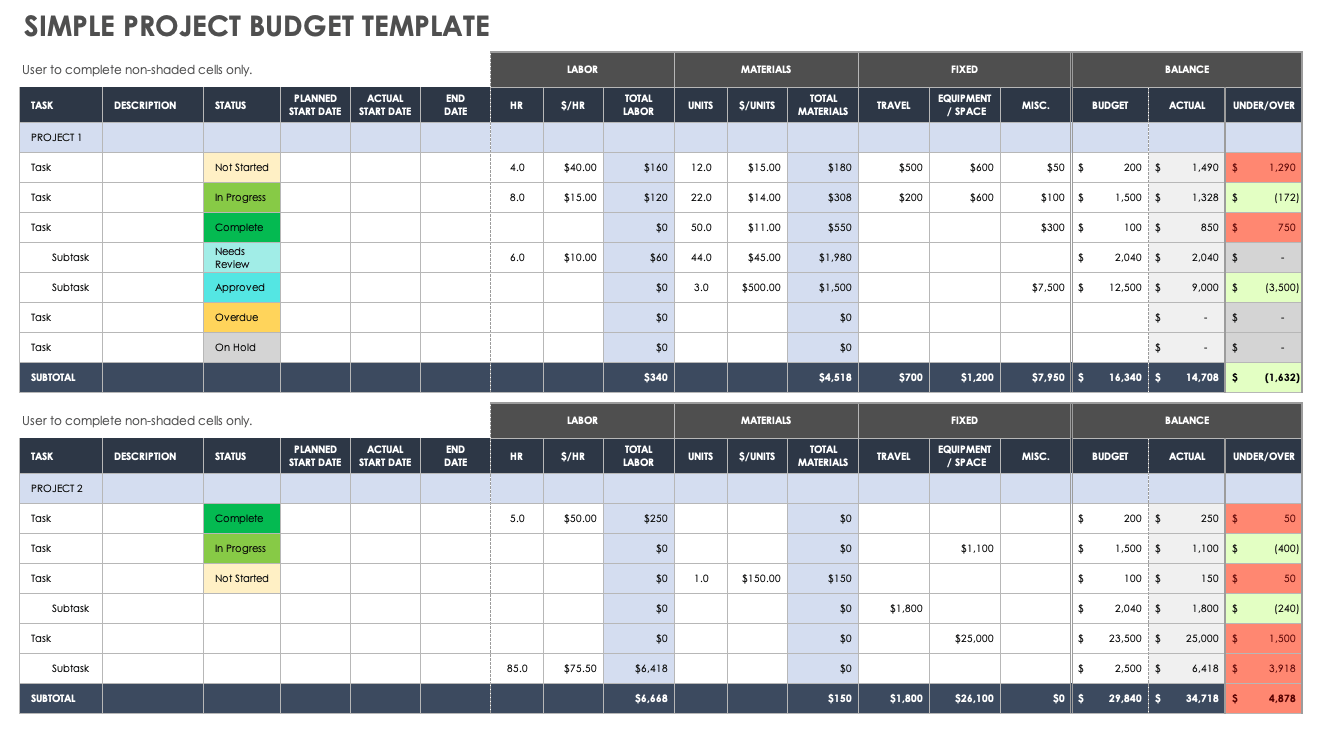

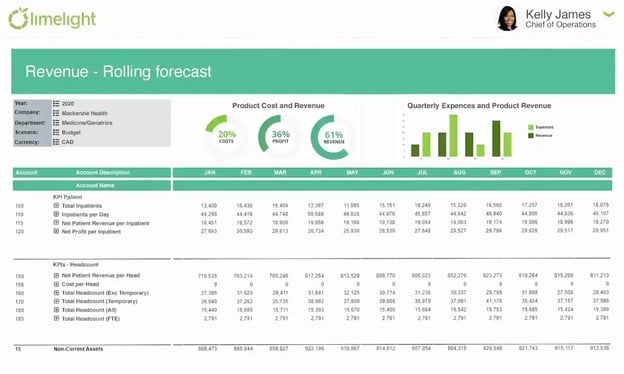

Financial forecast example for new businesses and startups

The financial forecast is an essential step when creating a business plan. The financial forecast allows you to anticipate the revenues and expenses of your new business over a given period.

Even if the exercise is sometimes delicate to carry out, it is nevertheless essential for any entrepreneur. Indeed, it allows you to define quantified objectives, which, if meticulously tracked, will allow you to grow your business in good conditions.

To help you, here's a financial forecast example as well as tools you can use to create yours.

Financial forecast examples for new businesses

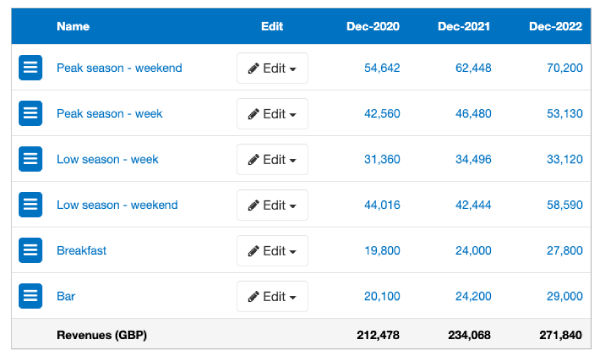

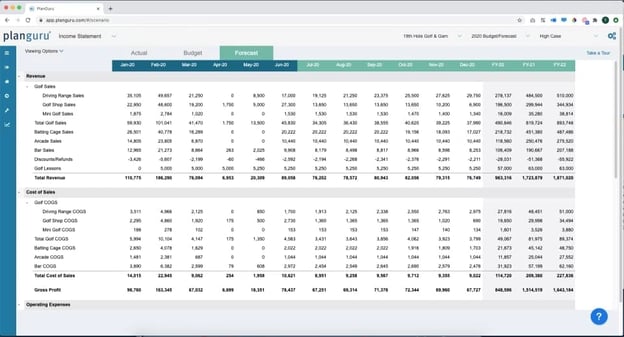

Example of a sales forecast.

The sales forecast is used to estimate the company's turnover. It is generally presented by category of products and services, types of customers, or time slots.

In our financial forecast example, we have included below a sales forecast for a hostel, organised by categories of services with the bed's occupancy forecast broken down based on seasonality:

To ensure a fair and realistic evaluation of your company's revenues, You will need to base your forecast on thorough and reliable market analysis, including an analysis of what your competition offers. You will also need to think carefully about your pricing policy and distribution strategy beforehand.

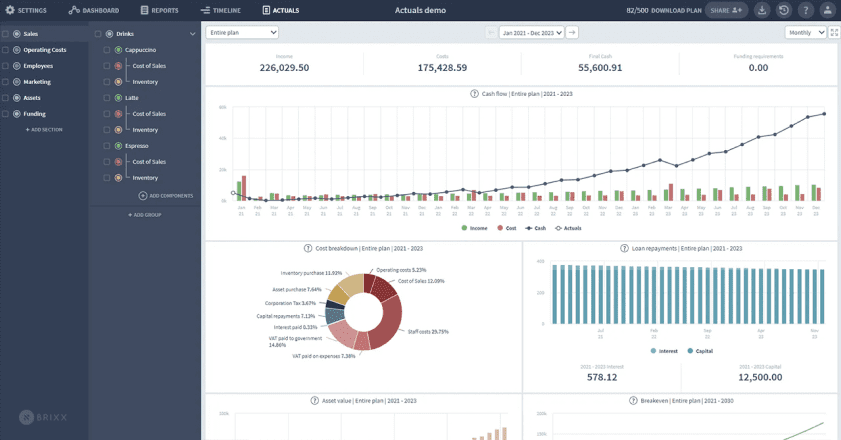

Examples of financial statements to include in your forecast

Your forecast will need to include 3 financial statements:

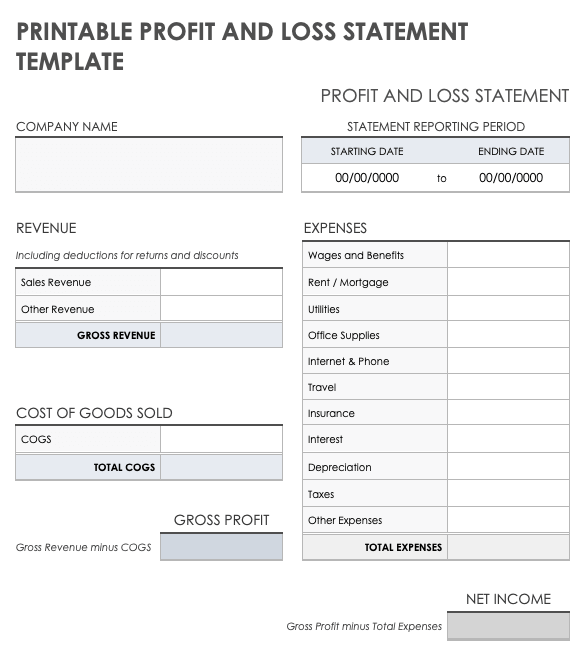

- The P&L statement

- The cash flow statement

- The balance sheet

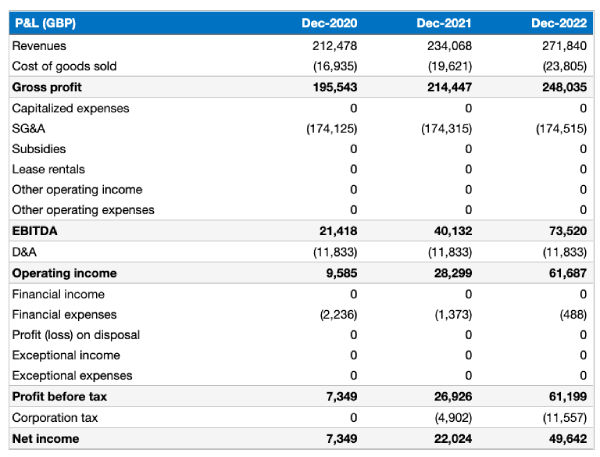

P&L statement

The profit and loss statement enables you to assess:

- the growth of the company by analyzing the evolution of the turnover over several years;

- the profitability of the company by looking at the difference between the expected revenues and the costs which will need to be incurred to generate these sales.

The main shortcoming of the projected income statement is that it does not take into account cash flows. Your profits should turn into cash at some point, but based on when your clients pay you, how much inventory you keep, or when you pay your suppliers, the cash flow could be very different from your profit.

To overcome this shortcoming, we need to look at the forecasted cash flow statement included in our financial forecast example.

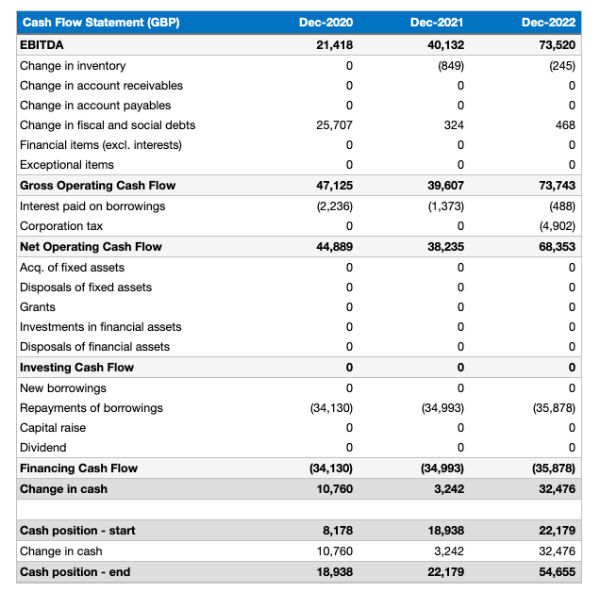

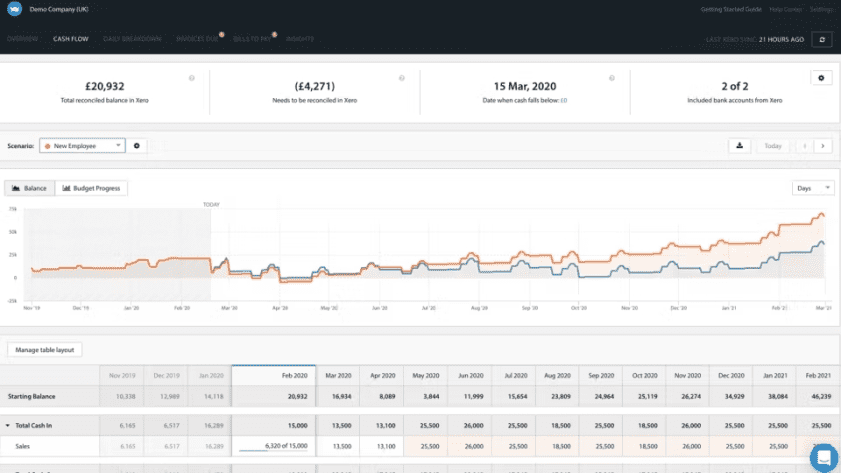

Cash flow statement

The cash flow statement shows all anticipated cash movements for a given year.

It enables you to evaluate:

- the ability to generate operating cash flow;

- the company's investment and financing policies.

The cash flow statement is highly complementary to the P&L statement. Together they provide a clear view of the company's profitability, the cash generated by the operations, the investments made and the financing flows.

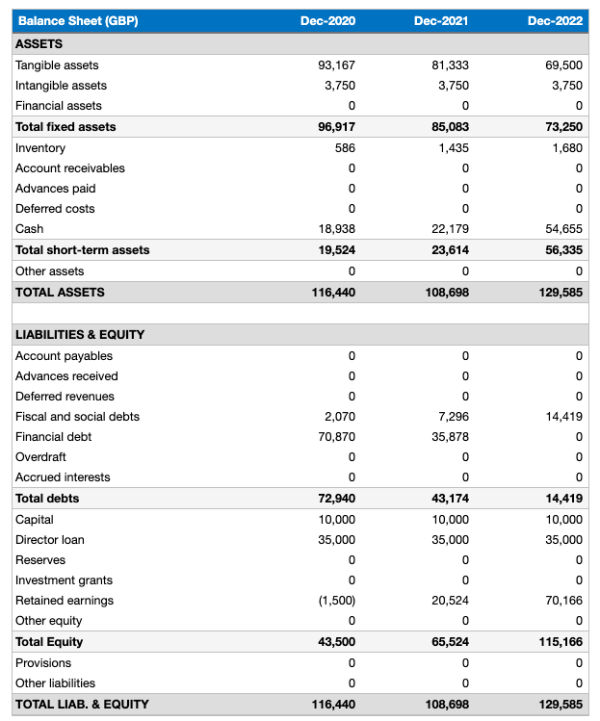

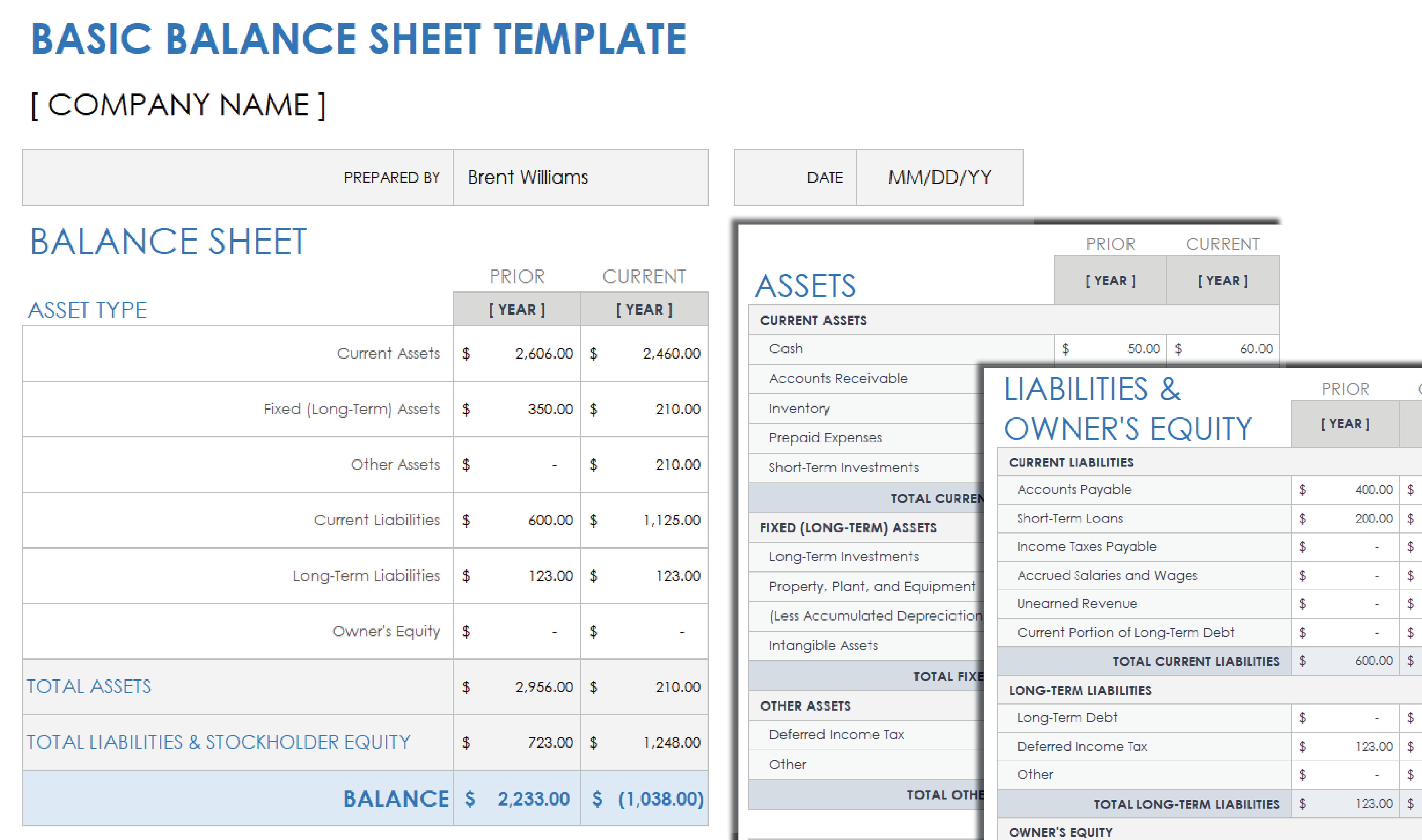

Balance sheet

The forecasted balance sheet, the last link in the chain, provides an overview of the company's net worth at a given moment in time and is part of our financial forecast example. It enables you to evaluate:

- the value of the company's assets;

- the weight of its working capital;

- the level of financial indebtedness;

- the book value of shareholders' equity.

The forecasted balance sheet complements the other two tables. Nevertheless, it has two weak points:

- It provides a snapshot of the company's net worth at a specific moment in time - giving a very static view of the company. Especially given the balance sheet is usually produced several months after the end of the financial year (and therefore the information it contains is already stale!)

- It gives an accounting vision of the company, based on historical cost, and not a financial vision, based on market value.

Where can I find other financial forecast examples?

At The Business Plan Shop, we offer an online software that includes a financial forecasting tool and helps you throughout the drafting of the business plan on top of financial forecast examples included in our business plan templates .

Using a software like ours to realize your business plan has several advantages:

- You can easily create your financial forecast by letting the software take care of the calculations and financial aspects for you.

- You are guided in the drafting process by detailed instructions and examples for each part of the plan.

- You get a professional document, formatted and ready to be sent to your bank or investors.

If you are interested in our solution, you can try our software for free here .

Our article is coming to an end. We hope that our financial forecast example has given you a better understanding of what this exercise is all about.

The forecast is a crucial element of a business plan that will be of particular interest to your financial partners if you are looking for financing; but don't forget that it is also a mean for you, as an entrepreneur, to evaluate the viability of your new business idea.

Also on The Business Plan Shop

- How to do financial projections for a new business?

- How to establish a Profit & Loss forecast in your business plan?

- How to do a financial forecast for a restaurant?

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

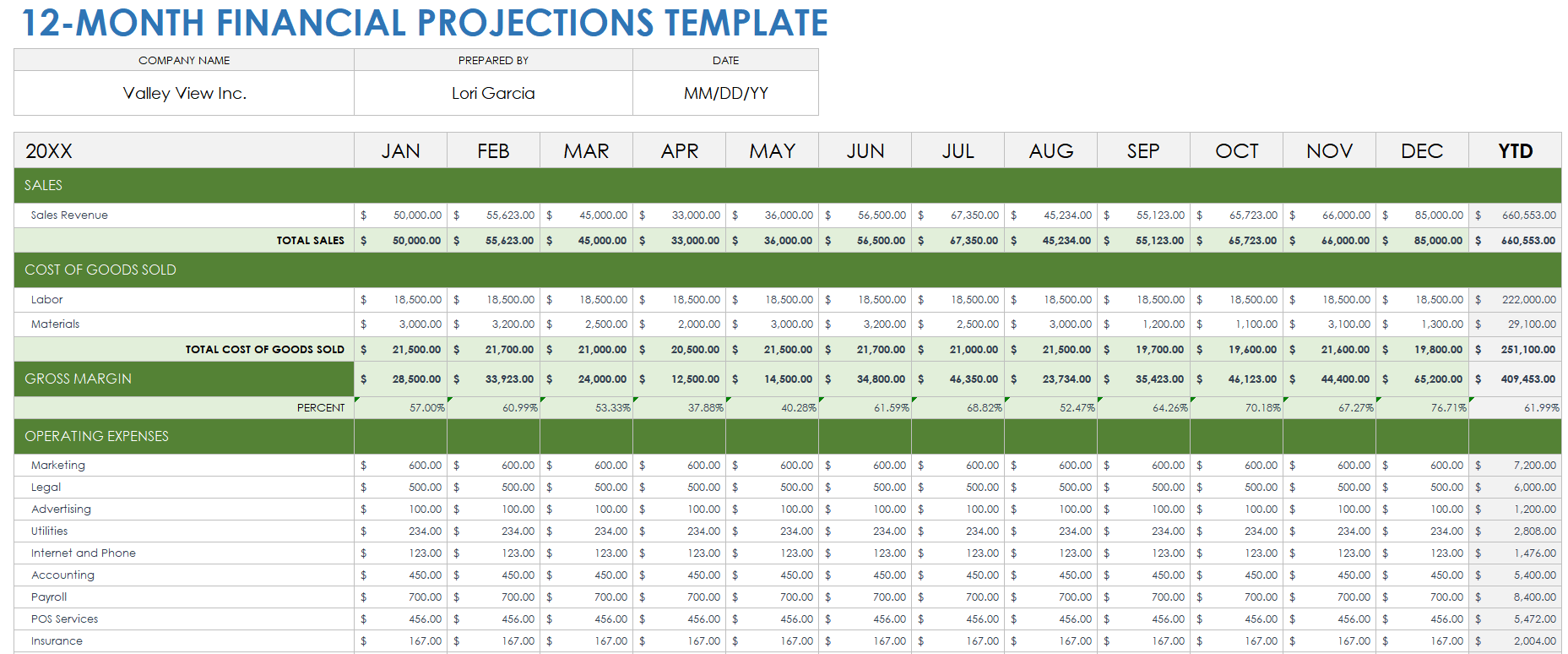

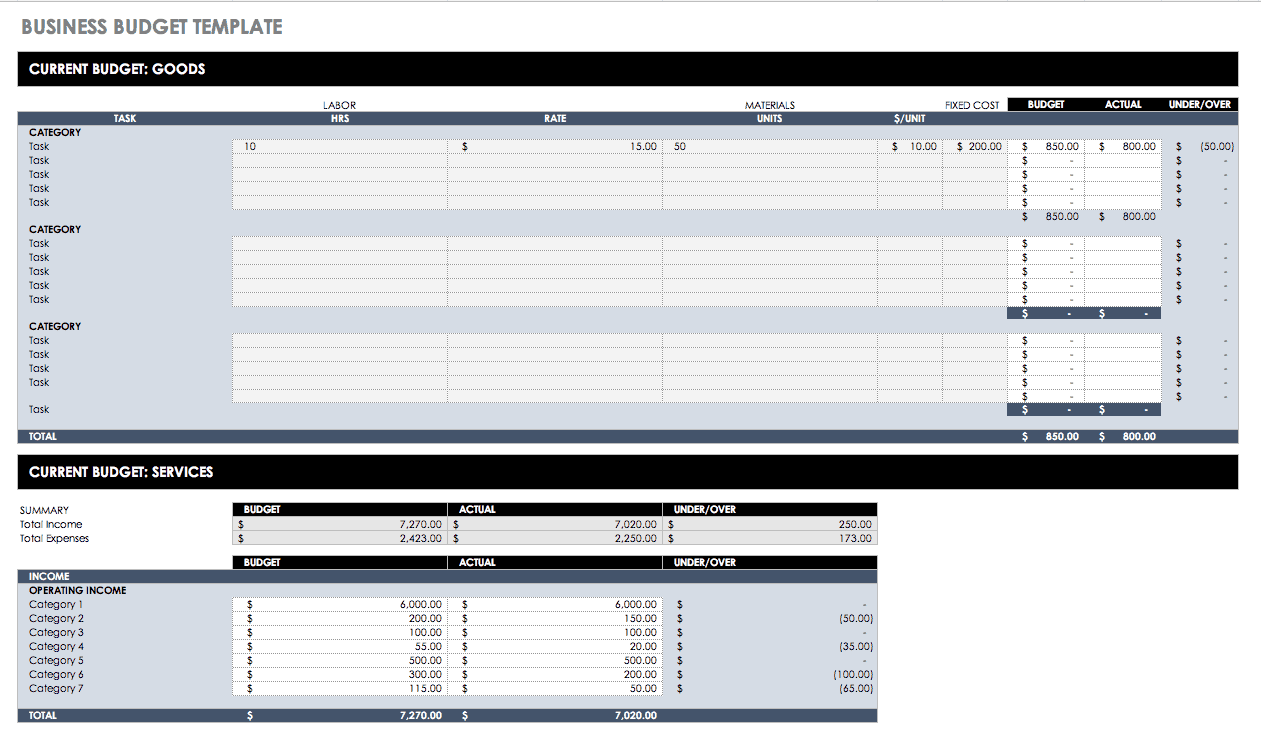

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

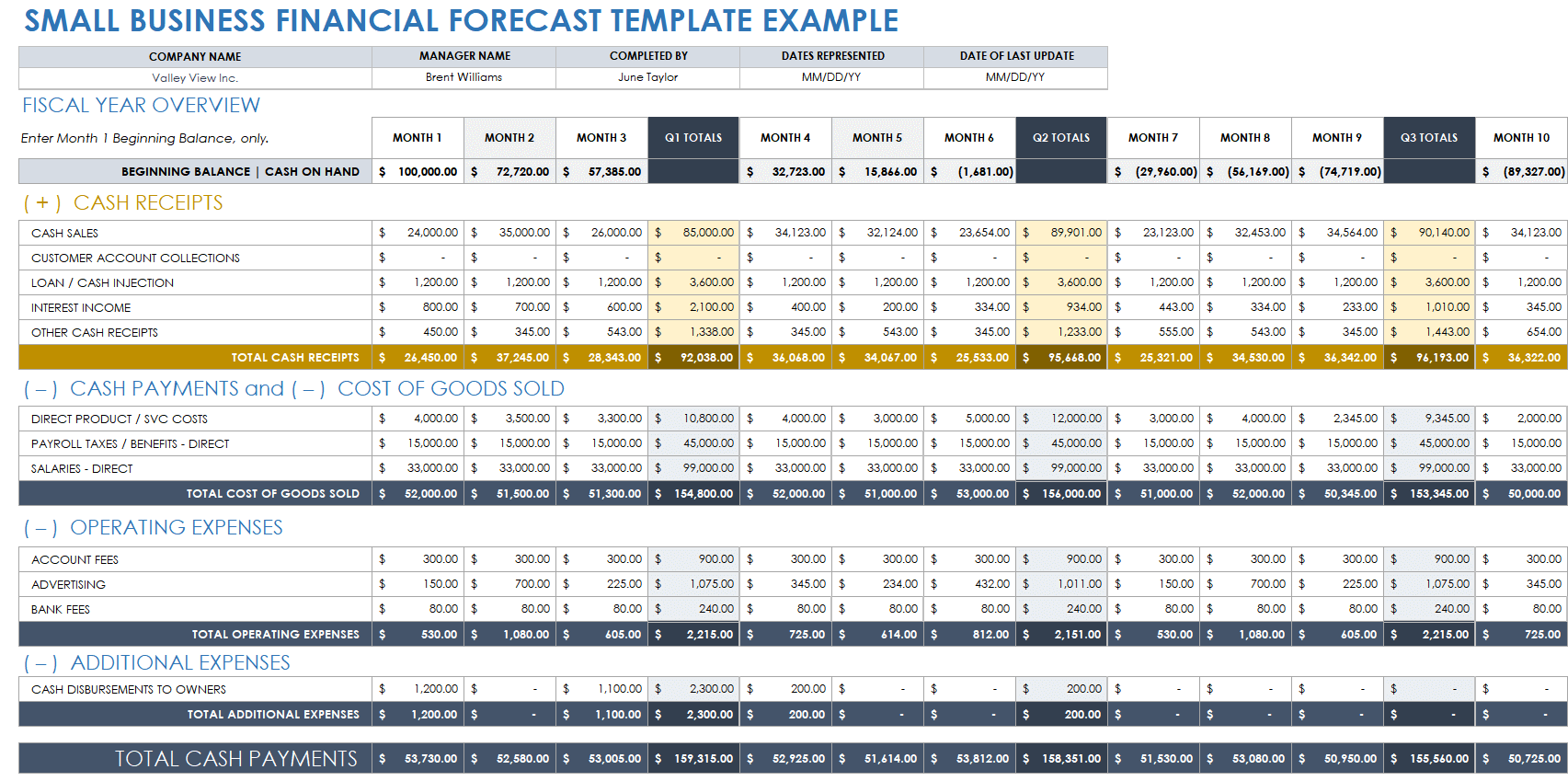

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

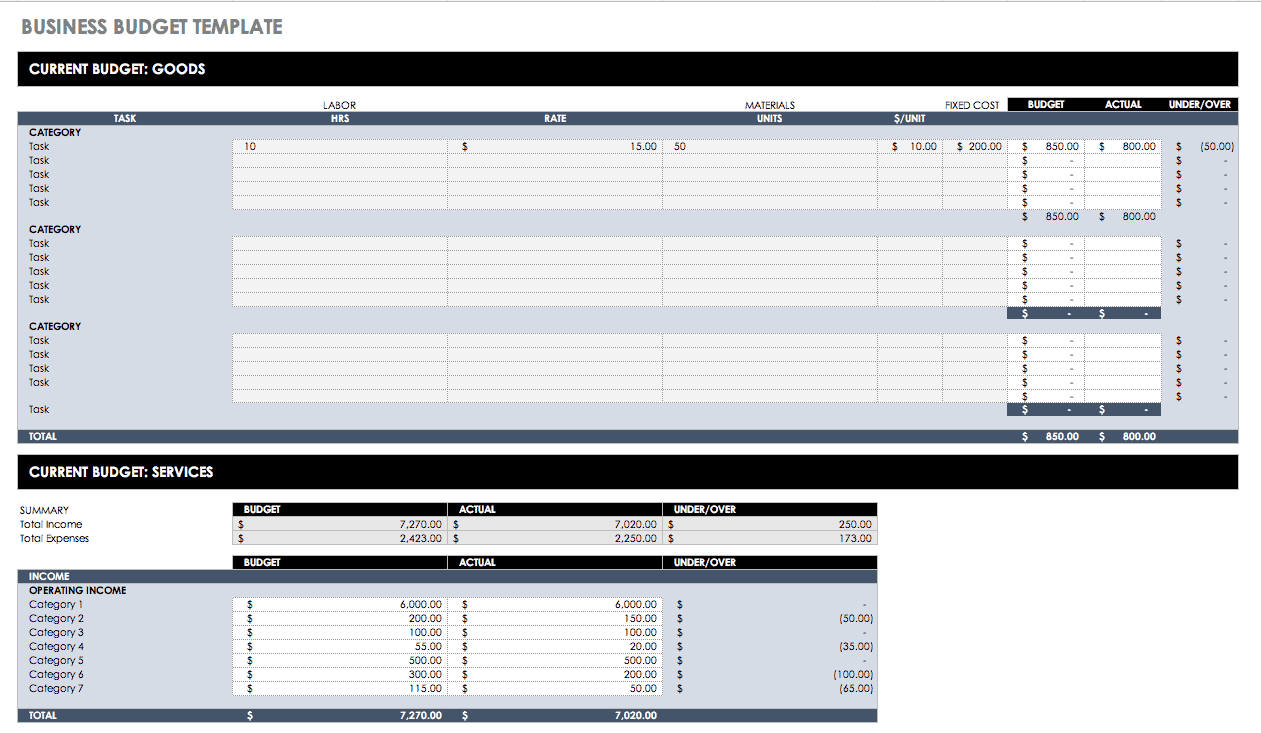

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Set and Use Milestones in Your Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

How to Write the Company Overview for a Business Plan

How to Write a Competitive Analysis for Your Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

7 Financial Forecasting Methods to Predict Business Performance

- 21 Jun 2022

Much of accounting involves evaluating past performance. Financial results demonstrate business success to both shareholders and the public. Planning and preparing for the future, however, is just as important.

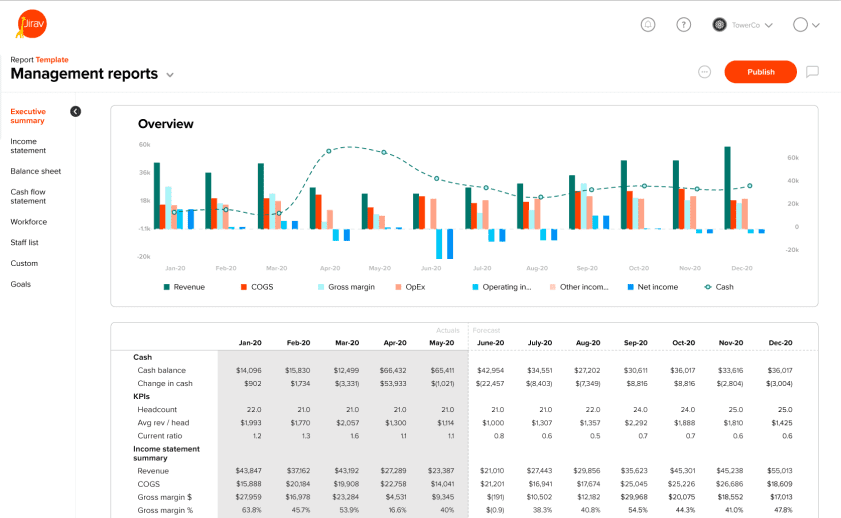

Shareholders must be reassured that a business has been, and will continue to be, successful. This requires financial forecasting.

Here's an overview of how to use pro forma statements to conduct financial forecasting, along with seven methods you can leverage to predict a business's future performance.

What Is Financial Forecasting?

Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. This involves guesswork and assumptions, as many unforeseen factors can influence business performance.

Financial forecasting is important because it informs business decision-making regarding hiring, budgeting, predicting revenue, and strategic planning . It also helps you maintain a forward-focused mindset.

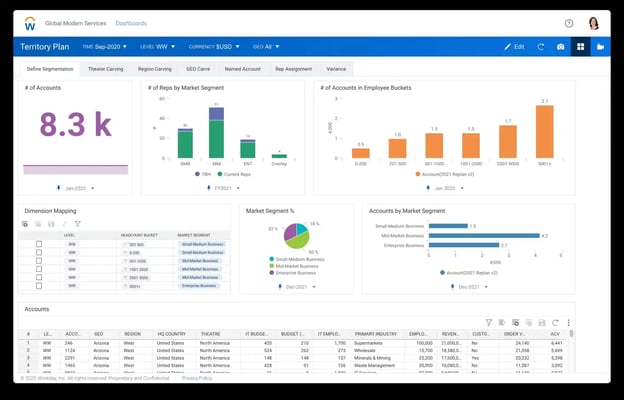

Each financial forecast plays a major role in determining how much attention is given to individual expense items. For example, if you forecast high-level trends for general planning purposes, you can rely more on broad assumptions than specific details. However, if your forecast is concerned with a business’s future, such as a pending merger or acquisition, it's important to be thorough and detailed.

Access your free e-book today.

Forecasting with Pro Forma Statements

A common type of forecasting in financial accounting involves using pro forma statements . Pro forma statements focus on a business's future reports, which are highly dependent on assumptions made during preparation, such as expected market conditions.

Because the term "pro forma" refers to projections or forecasts, pro forma statements apply to any financial document, including:

- Income statements

- Balance sheets

- Cash flow statements

These statements serve both internal and external purposes. Internally, you can use them for strategic planning. Identifying future revenues and expenses can greatly impact business decisions related to hiring and budgeting. Pro forma statements can also inform endeavors by creating multiple statements and interchanging variables to conduct side-by-side comparisons of potential outcomes.

Externally, pro forma statements can demonstrate the risk of investing in a business. While this is an effective form of forecasting, investors should know that pro forma statements don't typically comply with generally accepted accounting principles (GAAP) . This is because pro forma statements don't include one-time expenses—such as equipment purchases or company relocations—which allows for greater accuracy because those expenses don't reflect a company’s ongoing operations.

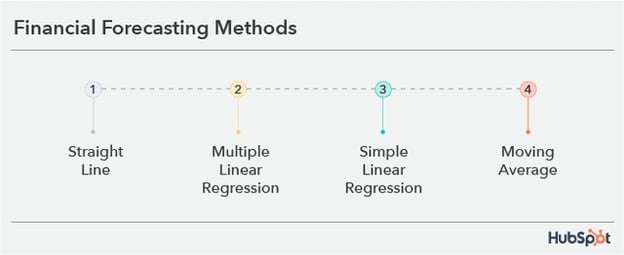

7 Financial Forecasting Methods

Pro forma statements are incredibly valuable when forecasting revenue, expenses, and sales. These findings are often further supported by one of seven financial forecasting methods that determine future income and growth rates.

There are two primary categories of forecasting: quantitative and qualitative.

Quantitative Methods

When producing accurate forecasts, business leaders typically turn to quantitative forecasts , or assumptions about the future based on historical data.

1. Percent of Sales

Internal pro forma statements are often created using percent of sales forecasting . This method calculates future metrics of financial line items as a percentage of sales. For example, the cost of goods sold is likely to increase proportionally with sales; therefore, it’s logical to apply the same growth rate estimate to each.

To forecast the percent of sales, examine the percentage of each account’s historical profits related to sales. To calculate this, divide each account by its sales, assuming the numbers will remain steady. For example, if the cost of goods sold has historically been 30 percent of sales, assume that trend will continue.

2. Straight Line

The straight-line method assumes a company's historical growth rate will remain constant. Forecasting future revenue involves multiplying a company’s previous year's revenue by its growth rate. For example, if the previous year's growth rate was 12 percent, straight-line forecasting assumes it'll continue to grow by 12 percent next year.

Although straight-line forecasting is an excellent starting point, it doesn't account for market fluctuations or supply chain issues.

3. Moving Average

Moving average involves taking the average—or weighted average—of previous periods to forecast the future. This method involves more closely examining a business’s high or low demands, so it’s often beneficial for short-term forecasting. For example, you can use it to forecast next month’s sales by averaging the previous quarter.

Moving average forecasting can help estimate several metrics. While it’s most commonly applied to future stock prices, it’s also used to estimate future revenue.

To calculate a moving average, use the following formula:

A1 + A2 + A3 … / N

Formula breakdown:

A = Average for a period

N = Total number of periods

Using weighted averages to emphasize recent periods can increase the accuracy of moving average forecasts.

4. Simple Linear Regression

Simple linear regression forecasts metrics based on a relationship between two variables: dependent and independent. The dependent variable represents the forecasted amount, while the independent variable is the factor that influences the dependent variable.

The equation for simple linear regression is:

Y = Dependent variable (the forecasted number)

B = Regression line's slope

X = Independent variable

A = Y-intercept

5. Multiple Linear Regression

If two or more variables directly impact a company's performance, business leaders might turn to multiple linear regression . This allows for a more accurate forecast, as it accounts for several variables that ultimately influence performance.

To forecast using multiple linear regression, a linear relationship must exist between the dependent and independent variables. Additionally, the independent variables can’t be so closely correlated that it’s impossible to tell which impacts the dependent variable.

Qualitative Methods

When it comes to forecasting, numbers don't always tell the whole story. There are additional factors that influence performance and can't be quantified. Qualitative forecasting relies on experts’ knowledge and experience to predict performance rather than historical numerical data.

These forecasting methods are often called into question, as they're more subjective than quantitative methods. Yet, they can provide valuable insight into forecasts and account for factors that can’t be predicted using historical data.

6. Delphi Method

The Delphi method of forecasting involves consulting experts who analyze market conditions to predict a company's performance.

A facilitator reaches out to those experts with questionnaires, requesting forecasts of business performance based on their experience and knowledge. The facilitator then compiles their analyses and sends them to other experts for comments. The goal is to continue circulating them until a consensus is reached.

7. Market Research

Market research is essential for organizational planning. It helps business leaders obtain a holistic market view based on competition, fluctuating conditions, and consumer patterns. It’s also critical for startups when historical data isn’t available. New businesses can benefit from financial forecasting because it’s essential for recruiting investors and budgeting during the first few months of operation.

When conducting market research, begin with a hypothesis and determine what methods are needed. Sending out consumer surveys is an excellent way to better understand consumer behavior when you don’t have numerical data to inform decisions.

Improve Your Forecasting Skills

Financial forecasting is never a guarantee, but it’s critical for decision-making. Regardless of your business’s industry or stage, it’s important to maintain a forward-thinking mindset—learning from past patterns is an excellent way to plan for the future.

If you’re interested in further exploring financial forecasting and its role in business, consider taking an online course, such as Financial Accounting , to discover how to use it alongside other financial tools to shape your business.

Do you want to take your financial accounting skills to the next level? Consider enrolling in Financial Accounting —one of three courses comprising our Credential of Readiness (CORe) program —to learn how to use financial principles to inform business decisions. Not sure which course is right for you? Download our free flowchart .

About the Author

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

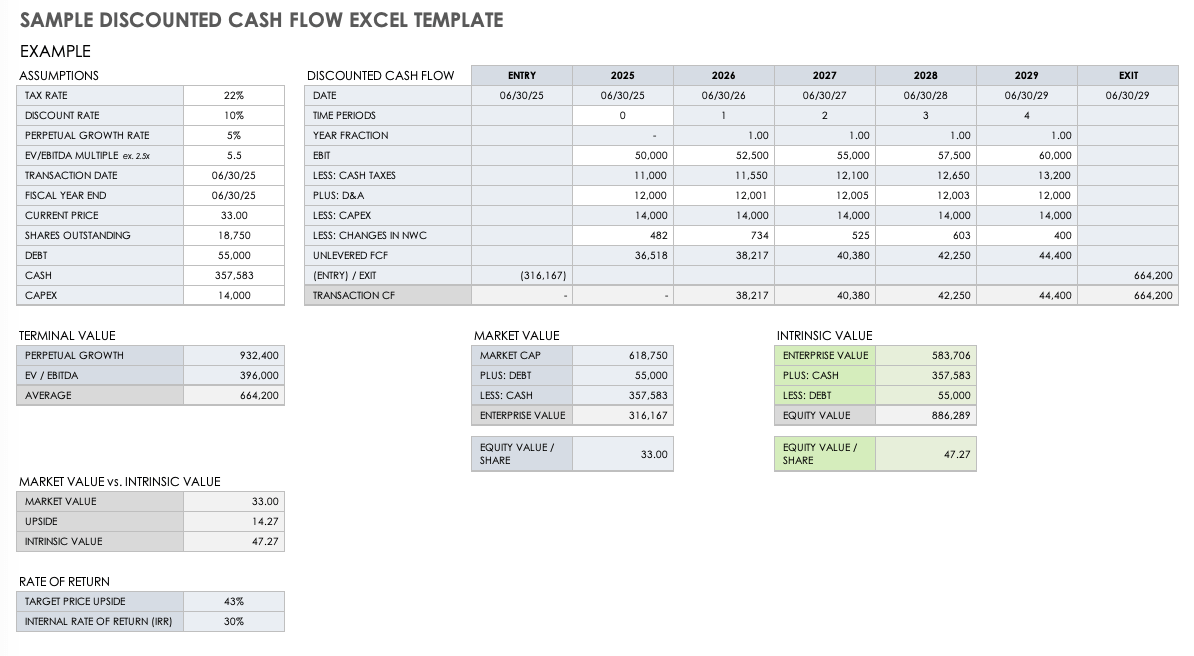

Financial projections are an important part of your business plan. The projections give investors and lenders an idea of how well your business is likely to do in the future. Financial projections include both income statements and balance sheets.

Financial projections are important for a number of reasons. First, they give investors and lenders an idea of how well your business is likely to do in the future. This can help you secure the funding you need to get your business off the ground. Financial projections also help you track your progress over time. You can use them to make sure your business is on track to meet its goals. Finally, financial projections can help you spot potential problems early on, so you can take corrective action.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

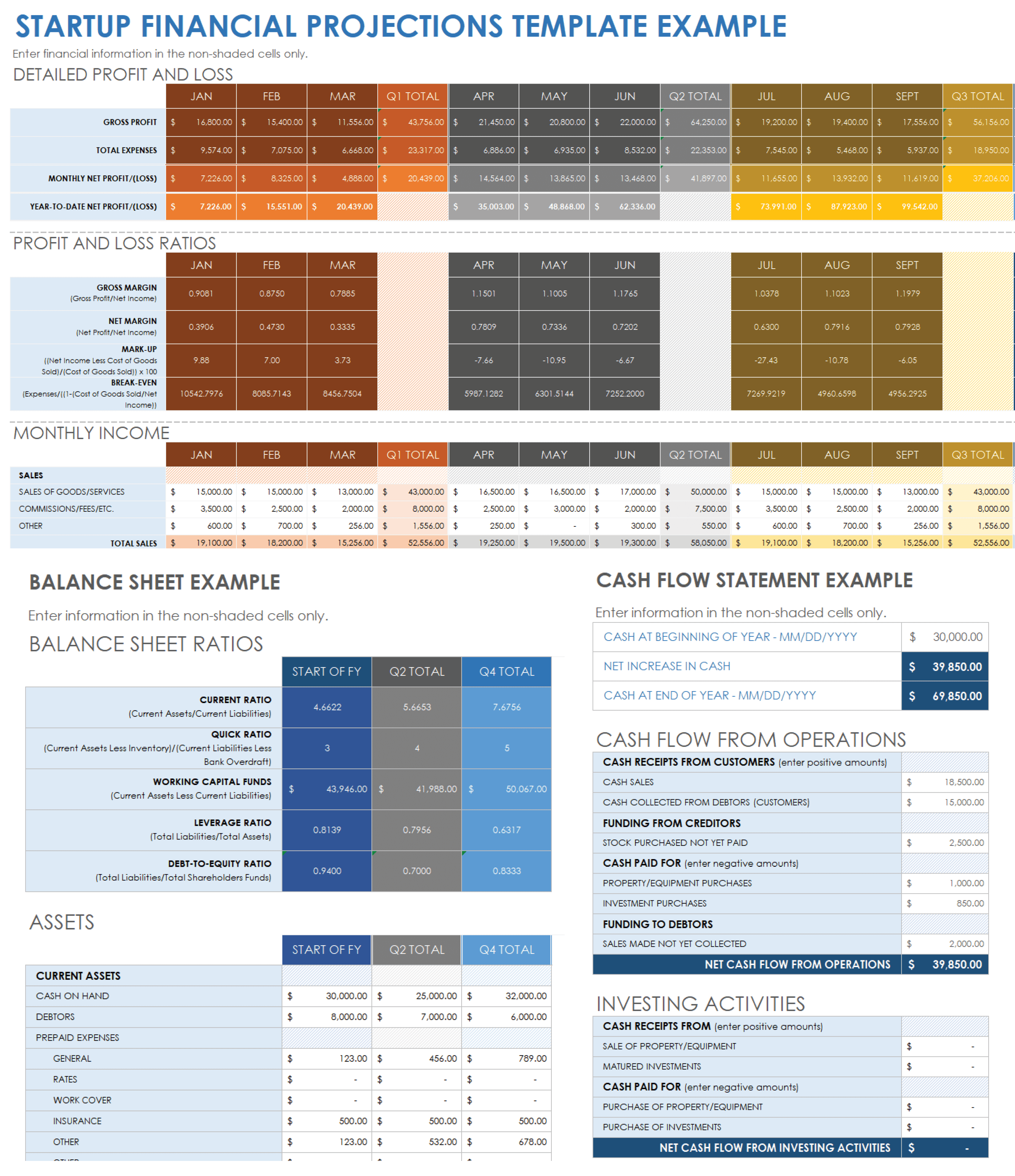

Sample Income Statement

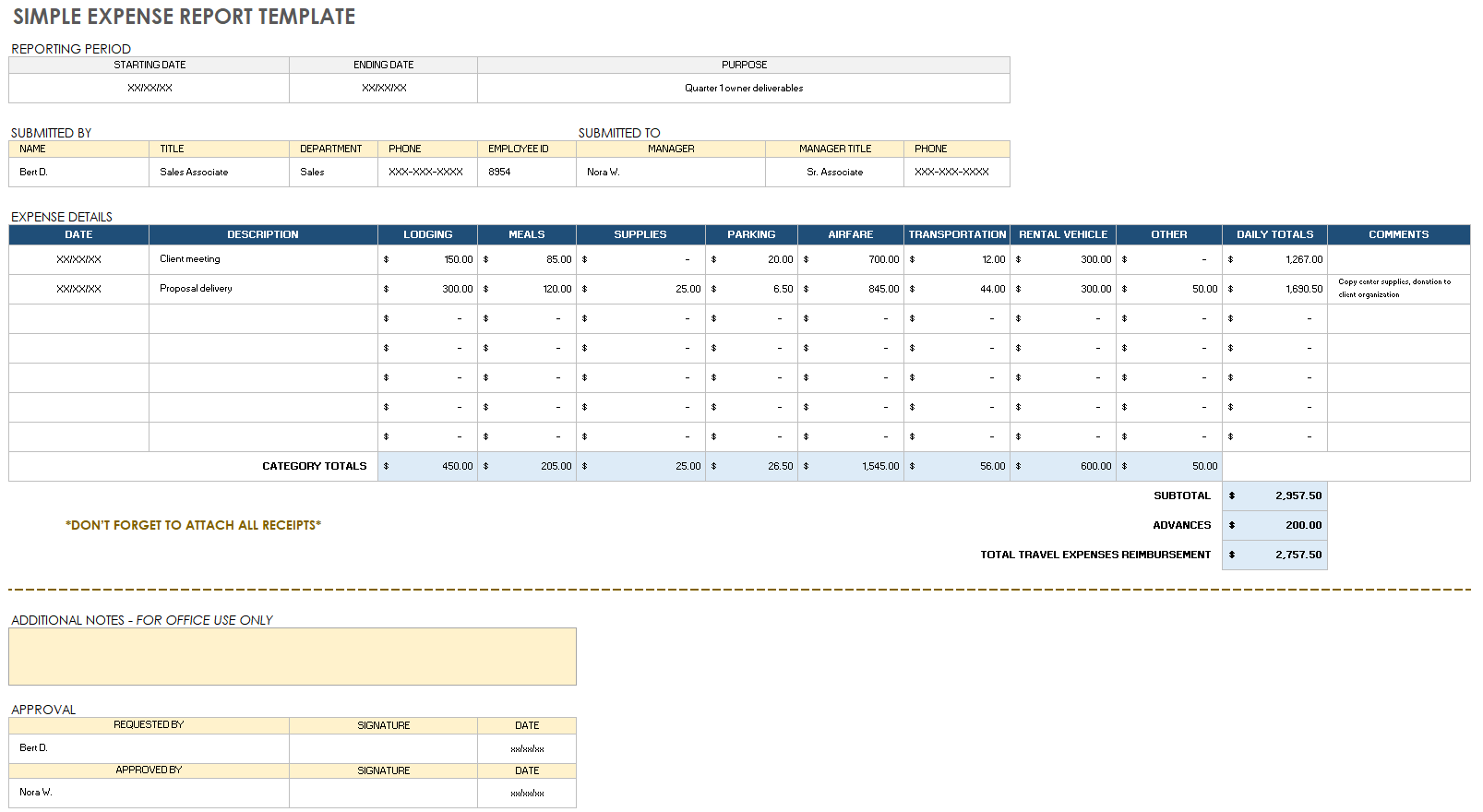

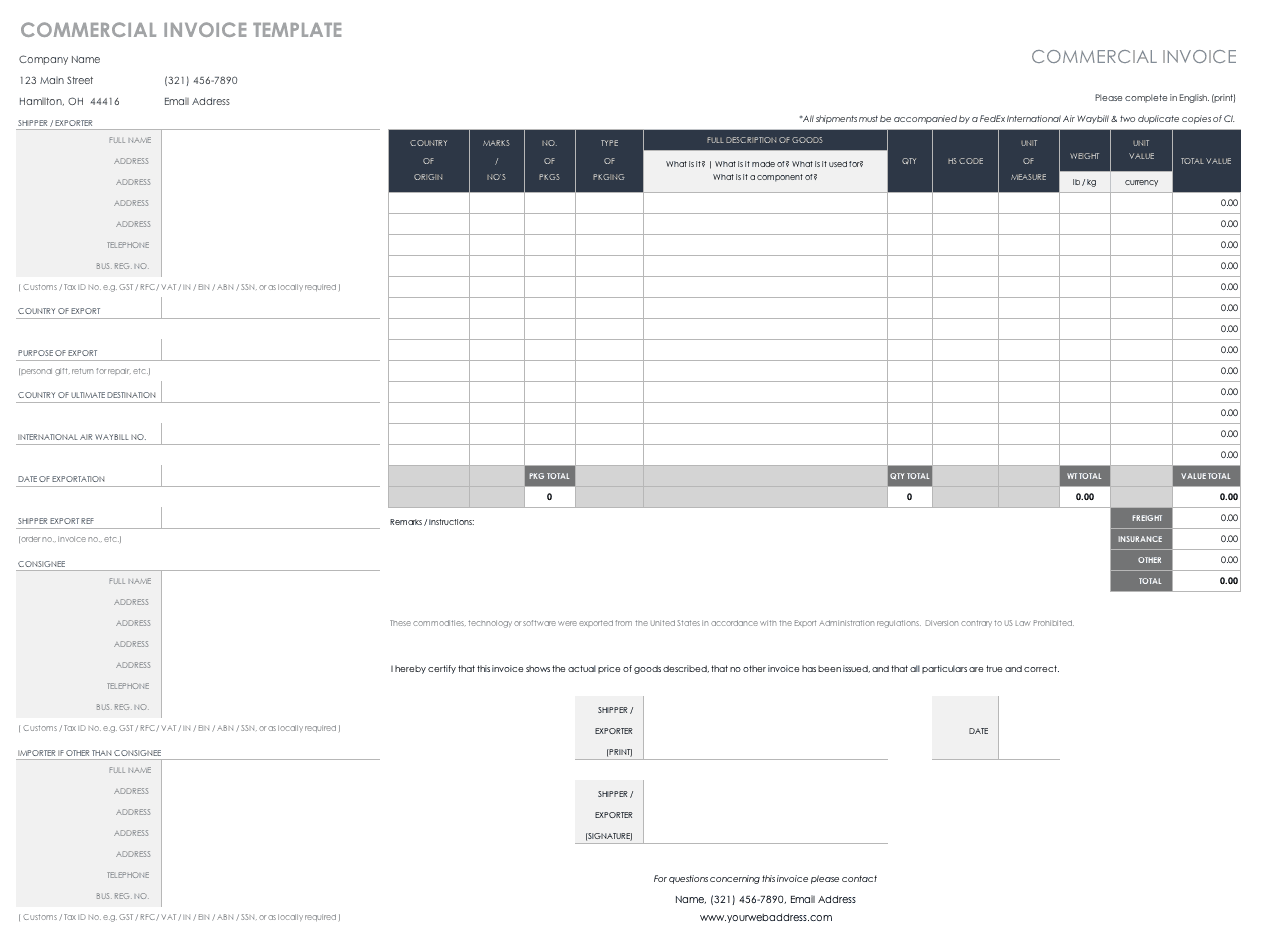

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

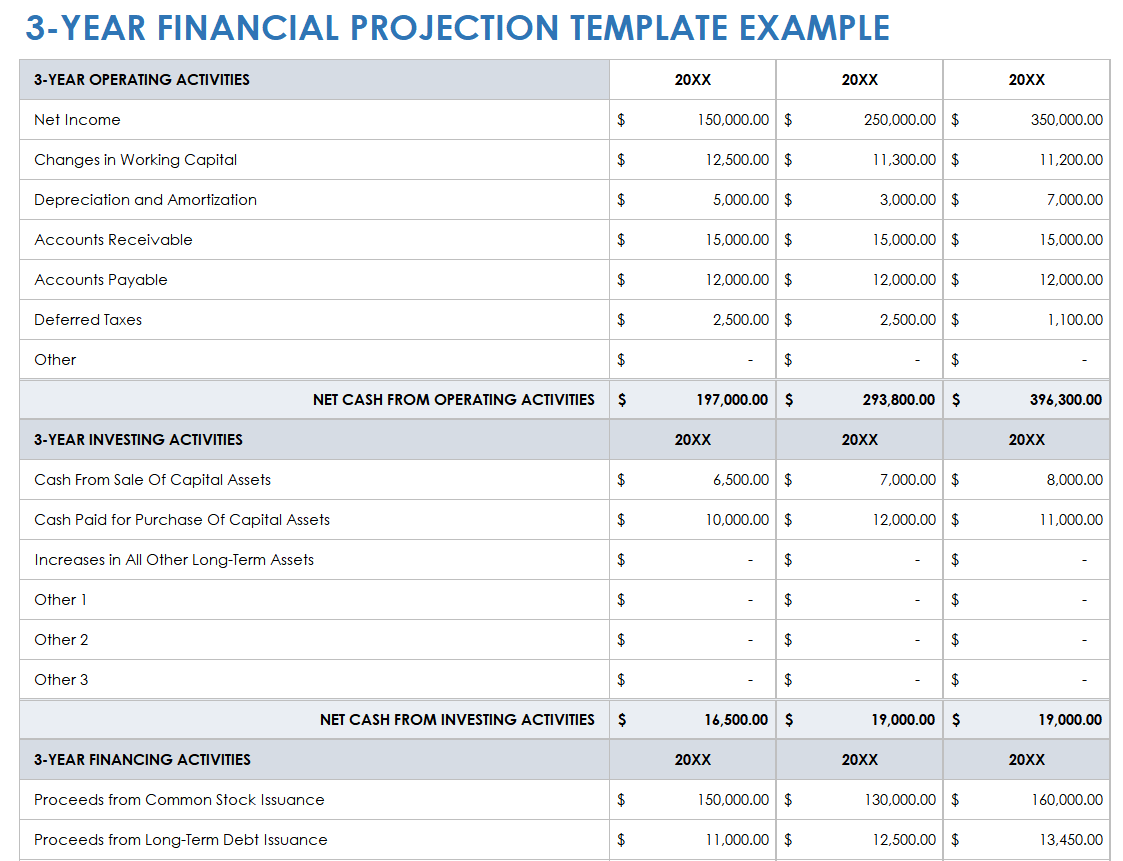

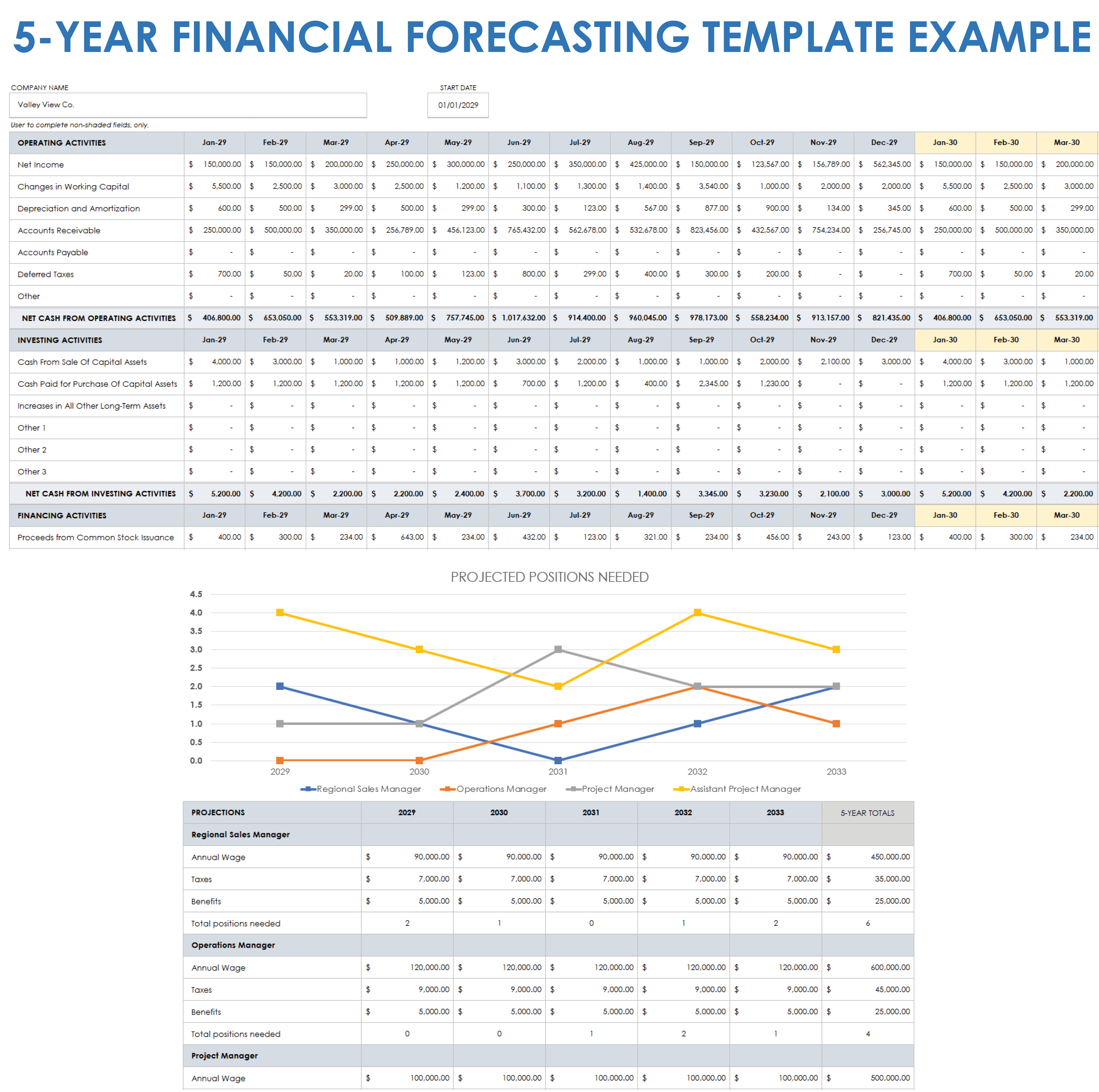

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

7-step guide to financial forecasting & planning for any business

What is financial forecasting, why is it important, and how to properly conduct financial planning and forecasting

- What is financial forecasting?

- Why is it important?

- 4 common types of financial forecasting

- How to do financial forecasting in 7 steps

- Financial forecasting FAQs

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

Uncertainty is one of the constant aspects of doing business. Many factors beyond your control can potentially influence the market in ways you didn't expect. For example, new technologies are constantly changing operations across almost all industries at a fundamental level.

It pays to know what to expect in the near future and plan ahead, hence the need for financial forecasting. Every business (including monopolies) could benefit incredibly from regular financial forecasting . Here is a comprehensive guide on the importance of financial forecasting for your business model and how to do it.

Failure to conduct regular financial forecasting leaves you flying blind.

What is financial forecasting?

Financial forecasting refers to financial projections performed to facilitate any decision-making relevant for determining future business performance. The financial forecasting process includes the analysis of past business performance, current business trends , and other relevant factors.

However, some aspects of financial forecasting may change depending on the type and purpose of the forecast, as will be discussed later.

Importance of financial forecasting

Hypothetically speaking, failure to conduct regular financial forecasting leaves you flying blind. Regular forecasting has extensive benefits for some of your business' fundamental operations, including:

Annual budget planning

A budget represents your business' cash flow, financial positions, and future goals and expectations for a set fiscal period. Financial forecasting and planning work in tandem, as forecasting essentially offers an insight into your business' future—these insights help make budgeting accurate.

Establishing realistic business goals

Accurate forecasting will help predict whether (and by how much) your business will grow or decline. As such, you can set realistic and achievable goals—and manage your expectations.

Identifying problem areas

Financial forecasting can help you identify ongoing problems by analyzing the business' past performance. Additionally, you can identify potential problems by getting an insight into what the future holds.

Reduction of financial risk

You risk overspending by creating a budget without financial forecasting. In fact, most of your financial decisions would be ill-informed without the input of a financial forecast's results.

Greater company appeal to attract investors

Investors use a company's financial forecast to predict its future performance—and the potential ROIs on their investments. Additionally, regular forecasting shows your investors that you are in control and have a solid business plan prepared for the future.

4 common types of financial forecasting

Businesses conduct financial forecasting for varying purposes. Consequently, forecasting practices are categorized into four types:

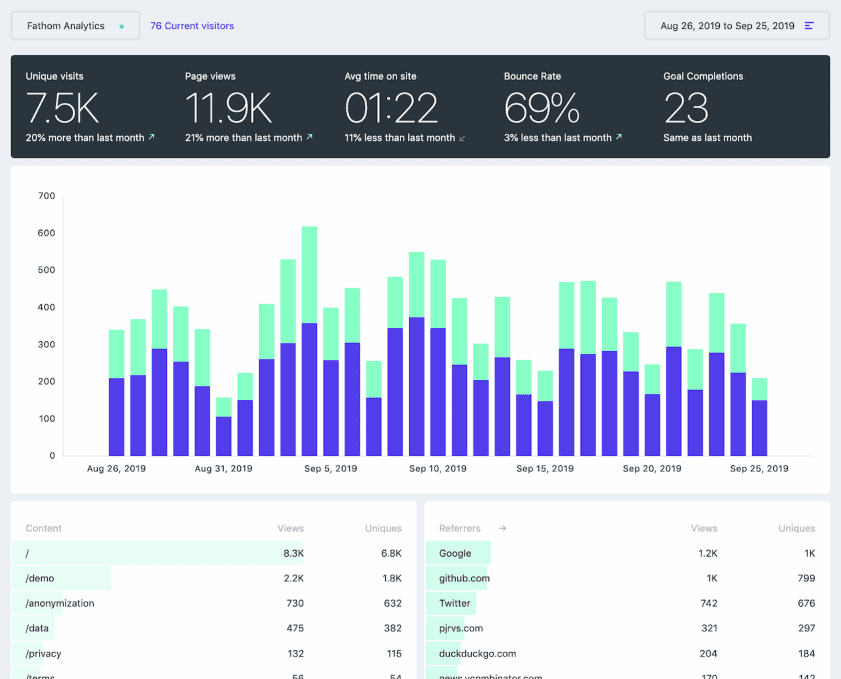

1. Sales forecasting

Sales forecasting entails predicting the amounts of products/services you expect to sell within a projected fiscal period. There are two sales forecasting methodologies: top-down forecasting and bottom-up forecasting.

Sales forecasting has many uses and benefits, including budgeting and planning production cycles. It also helps companies manage and allocate resources more efficiently.

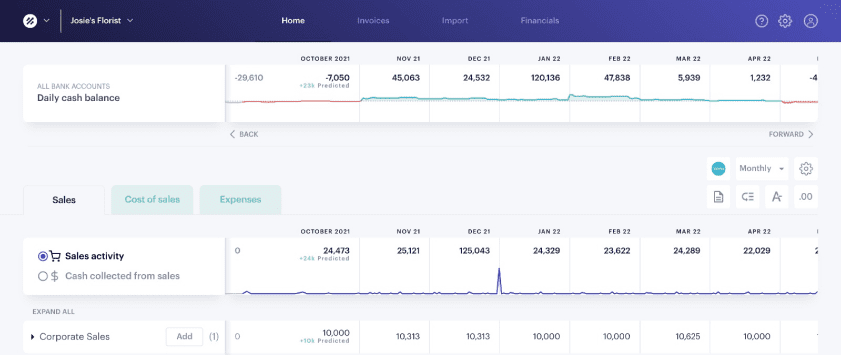

2. Cash flow forecasting

Cash flow forecasting entails estimating the flow of cash in and out of the company over a set fiscal period. It's based on factors such as income and expenses. It has many uses and benefits, including identifying immediate funding needs and budgeting. However, it is worth noting that cash flow financial forecasting is more accurate over a short term.

3. Budget forecasting

As a financial guide for your business' future, a budget creates certain expectations about your company's performance. Budget forecasting aims to determine the ideal outcome of the budget, assuming that everything proceeds as planned. It relies on the budget's data, which relies on financial forecasting data.

4. Income forecasting

Income forecasting entails analyzing the company's past revenue performance and current growth rate to estimate future income. It is integral to doing cash flow and balance sheet forecasting. Additionally, the company's investors, suppliers, and other concerned third parties use this data to make crucial decisions. For example, suppliers use it when determining how much to credit the company in supplies.

How to do financial forecasting in 7 steps

Many integral aspects of your company's current and future operations hinge on the results of your financial forecasts. For example, forecasting results will influence investors' decisions, determine how much your company can get in credit, and more.

As such, accuracy cannot be overemphasized. Here is a step-by-step guide to ensure that you do it right:

1. Define the purpose of a financial forecast

What do you hope to learn from the financial forecast? Do you hope to estimate how many units of your products or services you will sell? Or perhaps you wish to see how the company's current budget will shape its future? Defining your financial forecast's purpose is essential to determining which metrics and factors to consider when doing it.

2. Gather past financial statements and historical data

One of the components of financial forecasting involves analyzing past financial data, as explained. As such, it is important to gather all relevant historical data and records , including:

- Liabilities

- Investments

- Expenditures

- Comprehensive income

- Earnings per share

- Fixed costs

It's important to ensure that you gather all required information as your financial forecast's results will be inaccurate if you exclude relevant data.

3. Choose a time frame for your forecast

Financial forecasts are designed to give business owners an insight into the company's future. You get to decide how far into the future to look, and it can range from several weeks to several years. However, most companies do forecasts for one fiscal year.

Financial forecasts change over time as factors such as business and market trends change. Consequently, it is worth noting that financial forecasting is more accurate in the short term than in the long term.

4. Choose a financial forecast method

There are two financial forecasting methods:

- Quantitative forecasting uses historical information and data to identify trends, reliable patterns, and trends.

- Qualitative forecasting analyzes experts' opinions and sentiments about the company and market as a whole.

Each method is suitable for different uses and has its strengths and shortcomings. However, qualitative forecasting is more suitable for startups without past data to which they can refer.

5. Document and monitor results

Financial forecasts are never 100% accurate and tend to change over time. As such, it is important to document and monitor your forecast's results over time, especially after major internal and external developments. It is also important to update your forecasts to reflect the latest developments. Using forecasting software to automate related tasks may help too.

6. Analyze financial data

Regularly analyzing financial data is the best way to tell whether your financial forecasts are accurate. Additionally, continuous financial management and analysis helps you prepare better for the next financial forecast and gives you crucial insights into the company's current financial performance.

7. Repeat based on the previously defined time frame

Smart companies conduct regular financial forecasting to stay in the know and in control. As such, it is advisable to repeat the process once the time period set for the current financial forecast elapses. It's also prudent to keep collecting, recording, and analyzing data to improve your financial forecasts' accuracy.

Get accurate metrics for financial forecasting—absolutely free

An efficient system of collecting, storing, and analyzing data is necessary for accurate financial forecasting. ProfitWell Metrics is a subscription analytics software designed to do all of this on one platform. Some of the metrics that you can get using this program include:

- Monthly and annual recurring revenues

- Market and customer segments

- Customer acquisition and retention

- Customer lifetime value

- Churn rate

- The average revenue per user

ProfitWell Metrics collects and records all important metrics , giving you enough data to work with when conducting a financial forecast. Additionally, the data collected in real-time offers crucial insights to help you update your forecasts and other projects accordingly.

ProfitWell Metrics also integrates seamlessly with other popular data analytics programs, including Google Sheets and Stripe. More importantly, it's 100% free and secure.

Take the headache out of growing your software business

We handle your payments, tax, subscription management and more, so you can focus on growing your software and subscription business.

Financial forecasting FAQs

Some of the most frequently asked questions regarding financial forecasting include:

What is the role of forecasting in financial planning?

Financial forecasting estimates important financial metrics such as sales, income, and future revenue. These metrics are crucial for finance-related operations such as budgeting and financial planning as a whole. Consequently, forecasting functions as a guiding tool (or marking scheme) for financial planning.

What is the difference between financial forecasting and modeling?

On the one hand, financial forecasting entails predicting the business' future performance. On the other hand, financial modeling entails simulating how financial forecasts and other data may affect the company's future if everything goes according to plan. Financial modeling is done for very specific and often discrete purposes.

What is the difference between financial forecasting and budgeting?

Financial forecasting and budgeting work in tandem and are often misinterpreted as meaning the same thing. However, financial forecasting entails estimating and predicting the company's future performance (financially and in other aspects). On the other hand, budgeting is the company's financial expectations for the future (expectations based on financial forecasts and other data).

What are the three pro forma statements needed for financial forecasting?

Pro forma statements are financial reports designed to give insights into how different scenarios would play out based on hypothetical circumstances. There are three pro forma statements:

- Pro forma statements of income

- Pro forma cash flow statements

- Pro forma balance sheets

Pro forma statements may be hypothetical, but they help companies prepare for an uncertain future. Consequently, they're useful when conducting financial forecasts.

Related reading

Original text

Financial projections use existing or estimated financial data to forecast your business’s future income and expenses. They often include different scenarios to see how changes to one aspect of your finances (such as higher sales or lower operating expenses) might affect your profitability.

If you need to create financial projections for a startup or existing business, this free, downloadable template includes all the necessary tools.

What Are Financial Projections Used for?

Financial projections are an essential business planning tool for several reasons.

- If you’re starting a business, financial projections help you plan your startup budget, assess when you expect the business to become profitable, and set benchmarks for achieving financial goals.

- If you’re already in business, creating financial projections each year can help you set goals and stay on track.

- When seeking outside financing, startups and existing businesses need financial projections to convince lenders and investors of the business’s growth potential.

What’s Included in Financial Projections?

This financial projections template pulls together several different financial documents, including:

- Startup expenses

- Payroll costs

- Sales forecast

- Operating expenses for the first 3 years of business

- Cash flow statements for the first 3 years of business

- Income statements for the first 3 years of business

- Balance sheet

- Break-even analysis

- Financial ratios

- Cost of goods sold (COGS), and

- Amortization and depreciation for your business.

You can use this template to create the documents from scratch or pull in information from those you’ve already made. The template also includes diagnostic tools to test the numbers in your financial projections and ensure they are within reasonable ranges.

These areas are closely related, so as you work on your financial projections, you’ll find that changes to one element affect the others. You may want to include a best-case and worst-case scenario for all possibilities. Make sure you know the assumptions behind your financial projections and can explain them to others.

Startup business owners often wonder how to create financial projections for a business that doesn’t exist yet. Financial forecasts are continually educated guesses. To make yours as accurate as possible, do your homework and get help. Use the information you unearthed in researching your business plans, such as statistics from industry associations, data from government sources, and financials from similar businesses. An accountant with experience in your industry can help fine-tune your financial projections. So can business advisors such as SCORE mentors.

Once you complete your financial projections, don’t put them away and forget about them. Compare your projections to your financial statements regularly to see how well your business meets your expectations. If your projections turn out to be too optimistic or too pessimistic, make the necessary adjustments to make them more accurate.

*NOTE: The cells with formulas in this workbook are locked. If changes are needed, the unlock code is "1234." Please use caution when unlocking the spreadsheets. If you want to change a formula, we strongly recommend saving a copy of this spreadsheet under a different name before doing so.

We recommend downloading the Financial Projections Template Guide in English or Espanol .

Do you need help creating your financial projections? Take SCORE’s online course on-demand on financial projections or connect with a SCORE mentor online or in your community today.

Simple Steps for Starting Your Business: Financial Projections In this online module, you'll learn the importance of financial planning, how to build your financial model, how to understand financial statements and more.

Business Planning & Financial Statements Template Gallery Download SCORE’s templates to help you plan for a new business startup or grow your existing business.

Why Projected Financial Statements Are Essential to the Future Success of Startups Financial statements are vital to the success of any company but particularly start-ups. SCORE mentor Sarah Hadjhamou shares why they are a big part of growing your start-up.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

How to Create a Financial Forecast

Bryce Warnes

Reviewed by

July 15, 2022

This article is Tax Professional approved

Maybe your goal is world domination. Maybe you just want a sustainable side hustle. Either way, financial forecasting helps you understand the steps you need to take—and the numbers you need to hit—to make growth happen for your business.

I am the text that will be copied.

Plus, if you ever go looking for more funding, you’ll need financial forecasts to prove that your business is on track for growth.

Here’s everything you need on hand, and the steps you can take, to produce a reliable financial forecast.

What is a financial forecast?

A financial forecast tries to predict what your business will look like (financially) in the future. Pro forma financial statements are how you make those predictions somewhat concrete.

Pro forma statements are just like the financial statements you use each month to see how your business is performing. The only difference is that you prepare pro forma statements in advance, for future months and years.

There are three key pro forma statements you should be familiar with:

- The Income Statement

- The Cash Flow Statement

- The Balance Sheet

Helpful resource: How to Read and Analyze Financial Statements

Depending on your goals, these statements will cover different time spans. If you’re creating a financial forecast for your planning purposes, you should create pro forma statements covering six months to one year in the future.

If you’re presenting your forecast to a lender or investor, though, you should create pro forma statements covering the next one to three years.

Financial forecasting vs. budgeting

When you create a budget for your business , you plan to set aside money for certain costs, taking into account your income and expenses. The budget you make may be based on info from your financial forecast, but it’s distinct from the forecast itself.

Think of financial forecasting as a prediction, and budgeting as a plan. When you make a financial forecast, you see what direction your business is headed in, based on past performance and other factors, and use that to anticipate the future.

When you make a budget, you plan how you’re going to spend money based on what you expect your finances to look like in the future (your forecast).

For instance, if your financial forecast for next year says you’ll have an extra $5,000 in revenue, you might create a budget to decide how it will be spent—$2,000 for a new website, $1,000 for Facebook ads, and so on.

Three steps to creating your financial forecast

Ready to peer into the crystal ball and see the future of your business? There are three steps you need to follow:

- Gather your past financial statements. You’ll need to look at your past finances in order to project your income, cash flow, and balance.

- Decide how you’ll make projections. Besides past records, there’s other data you can draw on to make your projections more accurate.

- Prepare your pro forma statements. Pour a coffee and get ready to crunch some numbers.

Step one: Gather your records

If you’re not looking into the past to see how your business has grown, you’re not really forecasting—you’re just guessing.

You’ll need to gather past financial statements so you can see how your business has developed over time, and then project that development into the future.

Your bookkeeper or bookkeeping software should generate financial statements for you. If you don’t have either, and you don’t have financial statements, you’ll need to take care of that before you can start forecasting. You need complete bookkeeping in order to get the transaction history you base your financial statements on.

Put aside the task for financial forecasting for the moment, and learn how to catch up on your bookkeeping .

Once your books and financial statements are up to date, you’ll have everything you need to start planning for the future.

Step two: Decide how you’ll make your forecast

Depending what resources you choose to use, the type of forecast you create will fall between two poles— historical and researched-based.

Almost every financial forecast includes a little bit of historical forecasting, and a little bit that’s research-based. The blend you choose will depend on your needs and the resources at your disposal.

Remember, the goal is to create a realistic, useful forecast—without breaking the bank or eating up all your time.

Historical forecasting

When you use your financial history to plot the future, it’s historical forecasting . You’re looking at your last few annual Income Statements, Cash Flow Statements, and Balance Sheets to see how fast you’ve grown in the past. From there, you can make a guess about how fast you’ll grow this year.

The benefit of this is that it’s relatively easy to do and doesn’t take a lot of time, money, or expertise. The drawback is that you’re only using info about your own business, and not looking at broader market trends—like what your competition has been up to.

Historical forecasting is a good bet if you’re forecasting for modest growth, or else creating a quick-and-dirty forecast for your own use—not putting together a presentation for potential investors.

Research-based forecasting

When you do research about broader market trends, you’re using research-based forecasting . You may look at how your industry has performed over the past ten years, investigate new technologies and consumer trends, or try to measure the progress of your competitors. You might look at how companies similar to yours have planned their own growth.

The benefit of research-based forecasting is that you get a detailed, nuanced view of how your business could grow, taking into account a lot of different factors. And it’s the kind of forecast that investors and lenders want to see.

The drawback is that researched-based forecasting can be expensive. You may find you need to hire outside consultants and researchers to handle the heavy lifting.

Research-based forecasting is a good choice if you’re courting investors, or planning on rapid, aggressive growth. It’s also good if your company is brand new, and doesn’t have a lot of financial history to draw on for making projections

Step three: Create pro forma statements

Once you’ve collected the information you need to build your forecast, you can create pro forma statements.

We’ll cover the three key financial statements here. Whether you use all of them is up to you.

If you’re creating a quick forecast for your own planning, you may only need to create pro forma Income Statements. If you’re presenting to lenders or investors, you’ll want to use all three.

Rule of thumb: Any form you’d use in the month-to-month operation of your business should be created pro forma. For instance, if you move a lot of cash around every month, and you rely on Cash Flow Statements to make sure you’ve got enough money on hand to pay your vendors, then it’s wise to create pro forma Cash Flow Statements as part of your forecast.

Creating the pro forma Income Statement

First, set a goal—a projection—for sales in the period you’re looking at.

Let’s say you made $30,000 in sales this year. Next year, you want to make $60,000. So, your total sales will increase by $30,000.

Set a production schedule that will let you reach that goal, and map it out over the time period you’re covering. In our example, there will be 12 Income Statements in the year to come (one each month). Map out that $30,000 increase in sales over the 12 statements.

You could do this by increasing sales a fixed amount every month, or gradually increasing the amount of sales you make per month. It’s up to your instincts and experience as a business owner.

Then, it’s time for the “loss” part of “ profit and loss .” Calculate the cost of goods sold for each month, and deduct it from your sales. Deduct any other operating expenses you have, as well.

It’s important to take every expense into account so you get an accurate projection. If part of your plan is quadrupling your online advertising, be sure to include an expense that reflects that.

Once you’re done, your pro Forma Income Statements show you how much you can expect to earn and how much you can expect to spend in the time ahead.

Example Pro Forma Income Statement:

Karen’s Falafel Warehouse

Creating the pro forma Cash Flow Statement

You create a pro forma Cash Flow Statement a lot like the way you’d create a regular Cash Flow Statement. That means taking info from the Income Statement, and using the Cash Flow Statement format to plot out where your money is going, and how much you’ll have on hand at any one time.

Your projected cash flow can tell you a few things. If it’s in the negative, it means you’re not going to have enough cash on-hand to run your business, according to your current trajectory. You’ll need to make plans to borrow money and pay it off.

If your net cash flow is positive, you can plan on having enough surplus cash on hand to pay off loans, or save for a big investment.

Example Pro Forma Cash Flow Statement:

Ruth’s Raccoon Rescue and Rehabilitation Center

Creating the pro forma Balance Sheet

Drawing on info from the Income Statement and the Cash Flow Statement lets you create pro forma Balance Sheets. But you’ll also need previous Balance Sheets to make this useful—so you can follow the story of how your business got from “Balance A” to “Balance B.”

The Balance Sheet will project changes in your business accounts over time. That way, you can plan where to move money, when.

Example Pro Forma Balance Sheet:

Big Bill’s Budget Wedding Videos

Forecast vs. actuals

Once you’ve created a financial forecast, your work isn’t done. The vital second stage is to go back and record what your actual financials were in comparison to your forecast once the month or year is over.

Why is this so vital?

It helps you learn to forecast better next year, and when your forecast is way off, you can take notes for yourself on why that was.

For example:

- March revenue was much higher than I forecasted for. I didn’t realize there would be a seasonal boost over spring break.

- Sales were lower than I forecasted in the June. There was a miscommunication with the supplier and I didn’t have all the inventory I needed.

These mundane notes to yourself accumulate into invaluable business knowledge that help make every year more successful than the last.

Best, worst, and normal case projections

Whether you’re the kind of person who always sees the glass half full, or the kind who always sees it half empty, it’s a good idea to take into account different possible outcomes for your business.

Humans aren’t very good at predicting the future. Consider creating three different forecasts: One for the best case scenario, one for the worst, and one for the middle or “regular” scenario.

- Maybe the t-shirts you buy wholesale for your online store go up in price, like they did last year. Factor that into your worst case scenario .

- Maybe t-shirt prices stay the same, plus your new advertising plan takes off, and you get more business. Consider that the best case.

- Maybe everything more or less stays the same. Let’s call that the regular case.

The best/worst/regular trifecta is also useful when you’re making a budget for your business. For example, in January you might budget for a regular scenario. In this case, that means monthly sales revenue of $8,000.

However, in February say your revenue hits $10,000, and in March it’s $11,000. At that point, you may want to adjust your budget to the best case to scenario—since you’ll now have more money to reinvest in your business.

At the end of the day, the more robust your forecast, the better you’ll be able to plan the future of your business, and think on your feet. Plus, you’ll impress investors and lenders, by proving you’ve considered (almost) every possible outcome.

The better you understand how financial statements work, the easier you’ll find it to create financial forecasts. Before you start forecasting, take a look at our other helpful resources for understanding your small business financials:

- Financial Literacy 101 for Small Business Owners

- 10 Financial Ratios Every Small Business Owner Should Know

Accounting Solutions: The Top 7 Ways to Get Your Accounting Done

Related posts.

Property Management Accounting: A Simple Guide

A simple guide to accounting, recordkeeping, and taxes for property management businesses.

Return On Assets: What It Is and How to Calculate

Want to understand how efficiently you use your capital? You need to know your return on assets (ROA), a metric used by investors and owners alike.

Looking for an accounting solution? Here are the most popular options—including one you should definitely avoid.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

What's Planergy?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

Cristian Maradiaga

Download a free copy of "preparing your ap department for the future", to learn:.

- How to transition from paper and excel to eInvoicing.

- How AP can improve relationships with your key suppliers.

- How to capture early payment discounts and avoid late payment penalties.

- How better management in AP can give you better flexibility for cash flow management.

Business Plan Financial Projections: How To Create Accurate Targets

- Written by Keith Murphy

- 16 min read

Small businesses and startups have a lot riding on their ability to create effective and accurate financial projections as part of their business plan. Solid financials are a strong enticement for investors, after all, and can help new businesses chart a course that will take them beyond the legendendarily difficult first year and into a productive and profitable future.

But the need for business owners to look ahead in order to secure funding, increase profits, and make intelligent financial decisions doesn’t end when startups become full-fledged businesses—and business plan financial projections aren’t just for startups. Existing businesses can also put them to good use by harvesting insights from their existing financial statements and creating sales projections and other financial forecasts that guide and improve their ongoing business planning.

What Are Business Plan Financial Projections?

Successful companies plan ahead, looking as best they can into the near and distant future to chart a course to growth, innovation, and competitive strength. Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Most businesses use two types of financial projections:

- Short-term projections are broken down by month and generally cover the coming 12 months. They provide a guide companies can use to monitor and adjust their financial activity to set and hit targets for the financial year. In the first year, short-term projections will be entirely estimated, but in subsequent years, historical data can be used to help fine-tune them for greater accuracy and strategic utility.

- Long-term projections are focused on the coming three to five years and are generally used to secure investment (both initial and ongoing), provide a strategic roadmap for the company’s growth, or both.

For startups, creating financial projections is part of their initial business plan. Providing financial forecasts banks and potential investors can use to determine the financial viability of a business is key to obtaining financing and investments needed to get the business off the ground.

For existing businesses—for whom an initial business plan has evolved into business planning—financial projections are useful in attracting investors who want to see clear estimates for upcoming revenue, expenses, and potential growth. They’re also helpful in securing loans and lines of credit from financial institutions for the same reason. And even if you’re not trying to get funding or investments, financial projections provide a useful framework for building budgets focused on growth and competitive advantage.

So whether you’re a small business owner, an aspiring tycoon starting a new business, or part of the financial team at a well-established corporation, what matters most is viewing financial projections as a living, breathing reference tool that can help you plan and budget for growth in a realistic way while still setting aspirational goals for your business.

Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Financial Projections: Core Components

Whether you’re preparing them as part of your business plan or to enhance your business planning, you’ll need the same financial statements to prepare financial projections: an income statement, a cash-flow statement, and a balance sheet.

- Income statements , sometimes called profit and loss statements , provide detailed information on your company’s revenue and expenses for a given period (e.g., a quarter, year, or multi-year period).

- Cash flow statements provide a comprehensive view of cash flowing into and out of a business. They record all cash flow from operations, investment, and financing activities.

- Balance sheets are used to showcase a company’s assets, liabilities, and owner’s equity for a specific period.

How to Create Financial Projections

The process of creating financial projections is the same whether you’re drafting a business plan or creating forecasts for an existing business. The primary difference is whether you’ll draw on your own research and expertise (a new business or startup business) or use historical data (existing businesses).

Keep in mind that while you’ll create the necessary documents separately, you’ll most likely finish them by consulting each of them as needed. For example, your sales forecast might change once you prepare your cash-flow statement. The best approach is to view each document as both its own piece of the financial projection puzzle and a reference for the others; this will help ensure you can assemble comprehensive and clear financial projections.

1. Start with a Sales Projection

A sales forecast is the first step in creating your income statement. You can start with a one, three, or five-year projection, but keep in mind that, without historical financial data, accuracy may decrease over time. It’s best to start with monthly income statements until you reach your projected break-even , which is the point at which revenue exceeds total operating expenses and you show a profit. Once you hit the break-even, you can transition to annual income statements.

Also, keep in mind factors outside of sales; market conditions, global environmental, political, and health concerns, sourcing challenges (including pricing changes and increased variable costs) and other business disruptors can put the kibosh on your carefully constructed forecasts if you leave them out of your considerations.

Start with a reasonable estimate of the units sold for the forecast period, and multiply them by the price per unit. This value is your total sales for the period.

Next, estimate the total cost of producing these units (i.e., the cost of goods sold , or COGS; sometimes called cost of sales ) by multiplying the per-unit cost by the number of units produced.

Deducting your COGS from your estimated sales yields your gross profit margin.

From the gross margin, subtract expenses such as wages, marketing costs, rent, and other operating expenses. The result is your projected operating income , or net income .

Using these figures, you can create an income statement:

2. Cash Flow Statement

Tracking your estimated cash inflows and outflows from investment and financing, combined with the cash generated by business operations, is the purpose of a cash flow projection .

Investment activities might include, for example, purchasing real estate or investing in research and development outside of daily operations.

Financing activities include cash inflows from investor funding or business loans, as well as cash outflows to repay debts or pay dividends to shareholders.

A reliable and accurate cash flow projection is essential to managing your working capital effectively and ensuring you have all the cash you need to cover your ongoing obligations while still having enough left to invest in growth and innovation or cover emergencies.

Drawing from our income statement, we can create a basic cash flow statement:

3. The Balance Sheet

Providing a “snapshot” of your businesses’ financial performance for a given period of time, the balance sheet contains your company’s assets, liabilities, and owner’s equity.

Assets include inventory, real estate, and capital, while liabilities represent financial obligations and include accounts payable, bank loans, and other debt.

Owner’s equity represents the amount remaining once liabilities have been paid.

Ideally, over time your company’s balance sheet will reflect your growth through a reduction of liabilities and an increase in owner’s equity.

We can complete our triumvirate of financial statements with a basic balance sheet:

Best Practices for Effective Financial Projections