- Our History and Mission

- Accreditation

- Academic Integrity

- Student Life

- Student Services

- Undergraduate Education

- Graduate Education

- Tuition, Fees and Other Expenses for Undergraduate Students

- Tuition, Fees and Other Expenses for Graduate Students

- Financing a Stevens Education

- Undergraduate Programs

- Master of Science in Business Intelligence and Analytics (BI&A)

- Master of Science in Information Systems (MSIS)

- Master of Science in Management (MSM)

- Master of Science in Finance (MFIN)

- Master of Science in Financial Analytics (MFA)

- Master of Science in Financial Engineering (MFE)

- Master of Science in Enterprise Project Management (MS-EPM)

- Master of Science in Network and Communication Management and Services (MS-NCMS)

- Master of Business Administration (MBA)

- Experienced Professional Master of Business Administration (EMBA)

- Master of Business Administration - Analytics

- Master of Science – Master of Business Administration

- Master of Science in Technology Management (MSTM)

- Dual Degree Programs

- Ph.D. in Business Administration

- Ph.D. in Data Science

Ph.D. in Financial Engineering

- Graduate Certificate Programs

- International Programs

- College of Arts and Letters

- Schaefer School of Engineering and Science

- Department of Biomedical Engineering

- Department of Chemistry and Chemical Biology

- Department of Chemical Engineering and Materials Science

- Department of Civil, Environmental, and Ocean Engineering

- Department of Computer Science

- Department of Electrical and Computer Engineering

- Department of Mathematical Sciences

- Department of Mechanical Engineering

- Department of Physics

- School of Systems and Enterprises (SSE)

- Catalog Home

- All Catalogs

Academic Catalog > School of Business > Graduate Programs > Ph.D. in Financial Engineering

As the first Financial Engineering doctoral program to be developed in the nation, the Doctor of Philosophy (Ph.D.) degree is designed to prepare students to perform research or high-level design in financial engineering.

With an emphasis on an interdisciplinary approach requiring knowledge in finance, economics, mathematics, probability/statistics, operations research, engineering, computer science and systems thinking, the program gives graduates substantial expertise in key disciplines such as financial mathematics, risk management, financial statistics, portfolio optimization, financial standards, systemic risk, behavioral finance, microstructure finance, investment banking, data analytics, securities trading to name a few examples.

Students work alongside with faculty and perform transformative research in four crucial areas: Quantitative Finance, Financial Services Analytics, Financial Risk & Regulation, and Financial Systems. Graduates of the program are typically employed in world-class financial investment firms and academic research institutions.

The Ph.D. program requires completion of 54 credits beyond a relevant and approved Master’s degree. The students are required to pass a qualifying exam within 2 years of starting their doctoral studies and maximum of 6 years to complete the program and defend their dissertation.

PhD | Finance

The Ph.D. in Finance

Stern’s Ph.D. program in finance trains scholars to conduct research at the leading edge of financial economics. The faculty represents one of the largest finance research groups in the world that has been ranked consistently as the leading publisher of academic research in top finance journals. Comprised of more than 40 researchers, including a Nobel-prize-winning economist, our faculty are active in all areas of finance—asset pricing, corporate finance, derivatives, market microstructure, and behavioral finance—with both theoretical and empirical focus, and with emerging specialization in the areas of financial intermediation, crises, and macro-finance. As a result of this unusual breadth, students have access to expertise in almost any topic that they might wish to explore.

Explore Finance

Discover our other fields of study.

Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

PhD Program in Finance

2023-24 curriculum outline.

The MIT Sloan Finance Group offers a doctoral program specialization in Finance for students interested in research careers in academic finance. The requirements of the program may be loosely divided into five categories: coursework, the Finance Seminar, the general examination, the research paper, and the dissertation. Attendance at the weekly Finance Seminar is mandatory in the second year and beyond and is encouraged in the first year. During the first two years, students are engaged primarily in coursework, taking both required and elective courses in preparation for their general examination at the end of the second year. Students are required to complete a research paper by the end of their fifth semester, present it in front of the faculty committee and receive a passing grade. After that, students are required to find a formal thesis advisor and form a thesis committee by the end of their eighth semester. The Thesis Committee should consist of at least one tenured faculty from the MIT Sloan Finance Group.

Required Courses

The following set of required courses is designed to furnish each student with a sound and well-rounded understanding of the theoretical and empirical foundations of finance, as well as the tools necessary to make original contributions in each of these areas. Finance PhD courses (15.470, 15.471, 15.472, 15.473, 15.474) in which the student does not receive a grade of B or higher must be retaken.

First Year - Summer

Math Camp begins on the second Monday in August.

First Year - Fall Semester

14.121/14.122 Micro Theory I/II

14.451/14.452 Macro Theory I/II ( strongly recommended)

14.380/14.381 — Statistics/Applied Econometrics

15.470 — Asset Pricing

First Year - Spring Semester

14.123/14.124 Micro Theory III/IV

14.453/14.454 Macro Theory III/IV (strongly recommended)

14.382 – Econometrics

15.471 – Corporate Finance

Second Year - Fall Semester

15.472 — Advanced Asset Pricing

14.384 — Time-Series Analysis or 14.385 — Nonlinear Econometric Analysis (Enrolled students receive a one-semester waiver from attending the Finance Seminar due to a scheduling conflict)

15.475 — Current Research in Financial Economics

Second Year - Spring Semester

15.473 — Advanced Corporate Finance

15.474 — Current Topics in Finance (strongly encouraged to take multiple times)

15.475 — Current Research in Financial Economics

Recommended Elective Courses

Beyond these required courses, students are expected to enroll in elective courses determined by their primary area of interest. There are two informal “tracks” in Financial Economics: Corporate Finance and Asset Pricing. Recommended electives are designed to deepen the student's grasp of material that will be central to the writing of his/her dissertation. Students also have the opportunity to take courses at Harvard University. There is no formal requirement to select one track or another, and students are free to take any of the electives.

- Youth Program

- Wharton Online

PhD Program

- Program of Study

Wharton’s PhD program in Finance provides students with a solid foundation in the theoretical and empirical tools of modern finance, drawing heavily on the discipline of economics.

The department prepares students for careers in research and teaching at the world’s leading academic institutions, focusing on Asset Pricing and Portfolio Management, Corporate Finance, International Finance, Financial Institutions and Macroeconomics.

Wharton’s Finance faculty, widely recognized as the finest in the world, has been at the forefront of several areas of research. For example, members of the faculty have led modern innovations in theories of portfolio choice and savings behavior, which have significantly impacted the asset pricing techniques used by researchers, practitioners, and policymakers. Another example is the contribution by faculty members to the analysis of financial institutions and markets, which is fundamental to our understanding of the trade-offs between economic systems and their implications for financial fragility and crises.

Faculty research, both empirical and theoretical, includes such areas as:

- Structure of financial markets

- Formation and behavior of financial asset prices

- Banking and monetary systems

- Corporate control and capital structure

- Saving and capital formation

- International financial markets

Candidates with undergraduate training in economics, mathematics, engineering, statistics, and other quantitative disciplines have an ideal background for doctoral studies in this field.

Effective 2023, The Wharton Finance PhD Program is now STEM certified.

- Course Descriptions

- Course Schedule

- Dissertation Committee and Proposal Defense

- Meet our PhD Students

- Visiting Scholars

More Information

- Apply to Wharton

- Doctoral Inside: Resources for Current PhD Students

- Wharton Doctoral Program Policies

- Transfer of Credit

- Research Fellowship

15 Best Online PhD in Finance Programs [2024 Guide]

Looking for Online PhD in Finance Programs? Some schools have no GRE and offer accelerated courses to help you finish faster.

A doctoral degree in finance may be your ticket to the career you’ve always wanted.

Editorial Listing ShortCode:

This online finance degree can help you pursue an executive role or a teaching job related to accounting, banking, asset management, or financial policymaking.

Universities Offering Online PhD in Finance Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

1. Capella University

With Capella University in Minnesota, students can study online to earn a DBA with a concentration in Accounting or a PhD in Business Management with a concentration in Accounting.

These programs are designed to help students learn about theories, methods, rules and ethical issues that influence accounting practice and consider the implications of practicing accounting within a global marketplace.

Before graduation, DBA students are expected to complete two residencies and submit a major research project. PhD students are expected to do three residencies and complete a dissertation.

Both programs use Capella’s GuidedPath format with weekly discussions and specific deadlines for submitting assignments.

- PhD in Accounting

- DBA in Accounting

Capella University is accredited by the Higher Learning Commission.

2. City University of Seattle

When you study with City University of Seattle, you’ll have the opportunity to choose your own area of specialty for your DBA program.

Students who choose the Specialized Study concentration can submit a proposal for the graduate-level courses they would like to take as part of their studies.

If you’re interested in finance, you may be able to request courses on the topics of finance and accounting. During online classes, you’ll have opportunities to engage in live conversations with faculty.

You’ll be expected to submit a dissertation during your doctoral studies and complete three different residencies.

- DBA in Business Administration (Finance concentration)

The City University of Seattle is Accredited by the Northwest Commission on Colleges and Universities.

3. George Fox University

As you pursue a DBA with a concentration in Accounting from George Fox University, you may take classes like Advanced Applications of Ethical Reasoning and Compliance in Accounting and Advanced Topics in Accounting.

In addition, you’ll need to complete both a dissertation and a practicum for the program. During the practicum, you’ll have opportunities to try your hand at teaching or consulting.

Most of the work for this hybrid DBA program is online, but you’ll need to report to the school’s campus in Oregon a few times a year.

George Fox University is accredited by the Northwest Commission on Colleges and Universities.

4. Hampton University

If you’re interested in a PhD in Business Administration, check out Hampton University in Virginia. The program students to pursue a concentration in Accounting and Finance by taking multiple credit hours of elective courses.

These electives include classes like Financial Accounting and Reporting Research, Accounting Theory, Corporate and Financial Institutions, and Behavior Finance.

Students at this university take online courses during the traditional school year and come to campus for two summer residencies. This PhD program is appropriate for current professionals and for those straight out of a master’s program.

- PhD in Business Administration

Hampton U is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

5. Kansas State University

Do you believe that it is critical for individuals and families to have a solid financial plan for their future? If so, you may be interested in the PhD in Personal Financial Planning from Kansas State University.

You may choose to use this degree in the business world or spread your knowledge to others by working in an academic setting.

During the online doctoral program, you’ll need to come to the school’s Kansas campus for a few intensive sessions and go overseas to expand your knowledge about global markets. A dissertation is required for this program.

- Hybrid PhD in Personal Financial Planning

Kansas State University is accredited by the Higher Learning Commission.

6. Liberty University

For those interested in numbers and money, Liberty University’s online DBA offers two concentration options: Accounting and Finance.

Both programs begin with the same core courses, but Accounting students take specialized classes like Accounting for Decision Making and Advanced Auditing while Finance students focus on classes like Managerial Finance and Advanced Financial Statement Analysis.

Whichever track you choose, you will need to take a comprehensive exam and complete a dissertation before graduation from this Virginia university. Accounting graduates often work as auditors or budget supervisors, and Finance graduates may choose to become treasurers or financial managers.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

7. National University

You can pursue a DBA or a PhD in Business Administration from National University. NU is a network of nonprofit institutions headquartered in San Diego, CA.

The school encourages students of either program to pursue high-level leadership positions, but the PhD program is research-based, and the DBA involves the application of research findings that are already available.

Specialization options for both PhD and DBA students include Financial Management and Advanced Accounting. All faculty hold doctoral degrees, and many tracks can be completed fully online. Dissertations are required for PhD programs.

- PhD in Business Administration – Advanced Accounting

- DBA in Financial Management

- DBA in Advanced Accounting

National University is accredited by the WASC Senior College and University Commission.

8. Rutgers University

This university offers a PhD in Management; concentrations include Finance, Accounting or Accounting Information Systems. The concentration in finance offers courses like Investments, Corporate Finance, Theory of Corporate Disclosures, Control and Governance, and Econometrics.

The concentration in accounting offers courses like Current Topics in Auditing and Empirical Analysis of Financial Reporting. Students are expected to take a qualifying exam and defend a dissertation before graduating from these programs. The school recommends that students have master’s level education in mathematics, economics or computer science before applying for enrollment.

Rutgers University is accredited by the Middle States Commission on Higher Education.

9. Sacred Heart University

Although Sacred Heart University does require DBA in Finance students to come to its Connecticut campus, the program is described as “low-residency,” and it is structured to fit the schedules of people who are already in the workforce.

Each student is part of a cohort that provides opportunities for networking and group projects. During the course of the program, students study topics like mathematics and global markets and choose electives like Fixed Income Securities or Portfolio Management.

Students are also required to submit a dissertation before graduation. The school’s DBA graduates often find work in government, academia, and corporations.

- DBA in Finance

SHU is accredited by the New England Commission of Higher Education.

10. Saint Leo University

You can get an online DBA from Saint Leo University in Florida. The program offers classes like Analytics for Decision Making, Organizational Behavior and Social Responsibility, and A History of Applied Management Theory. It can help you acquire research skills and learn how to apply your findings to real-world business applications.

Before graduation, you will be expected to take a comprehensive exam, defend a dissertation and complete a practicum. This DBA course of study is particularly well-suited for students who want to go into consulting, but the school’s graduates also teach, work as CFOs, manage organizations and become investment analysts.

- Doctor of Business Administration

Saint Leo University is accredited by the Southern Association of Colleges and Schools.

11. Trident University

Whether you want to earn an online DBA or a PhD in Business Administration, you can pursue your degree from Trident University in California.

One available concentration for the PhD program is Accounting and Finance; students on that track study topics like auditing, global markets, corporation finance, and taxation.

The DBA is a generalist degree that doesn’t include specialization. If you go the PhD route, you’ll need to complete a dissertation, and if you choose a DBA, you will be expected to complete a doctoral study. To help you move through the online program, the university offers its Doctoral Positioning System tracker.

- PhD in Business Administration – Accounting

Trident University is accredited by the WASC Senior College and University Commission.

12. University of Dallas

Students at the University of Dallas can earn a DBA through a mix of online classes and time on the school’s Texas campus.

This program is designed for those who already hold leadership positions in the business world and desire increased advancement, and its flexible nature helps working professionals earn their doctoral degrees while remaining in their current jobs.

This generalist program includes classes like Agile Organizations and Emerging Technologies. If you choose this university, you will be expected to join a colloquium and defend a dissertation and will have the option to complete a teaching practicum.

The University of Dallas is accredited by the Southern Association of Colleges and Schools.

13. University of South Carolina

The Darla Moore School of Business at the University of South Carolina offers an on-campus program through which you can earn a PhD in Business Administration.

One available concentration for this program is Finance, and classes include Current Issues in Finance, Empirical Methods in Financial Research and Theory of Finance.

Faculty in this department have earned multiple recognitions, including the Alfred G. Smith, Jr. Excellence in Teaching Award and the Mortar Board Excellence in Teaching Award. A master’s degree is recommended before admission to the program, but it is not a requirement.

- Hybrid DBA in Business Administration – Finance

The University of South Carolina is accredited by the Southern Association of Colleges and Schools.

14. University of the Cumberlands

The PhD in Business program at the University of the Cumberlands takes business courses ranging from comparative economic and corporate finance to managerial ethics and responsibility. Students can choose one of their specialty areas like accounting, entrepreneurship, finance, etc. The Curriculum of this program will engage students in the theories, strategies, and tactics that they need to.

- PhD in Business (Finance concentration)

The University of the Cumberlands is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

15. Walden University

Whether you’re interested in DBA or a PhD, you can earn it from Walden University. The DBA program offers concentrations like Accounting and Finance. On the path to earning a DBA, you can complete a doctoral study, assemble a portfolio or take part in a consultation program in which you work with a local organization or company.

If you would prefer to earn a PhD in Management, you can select a 21st Century Finance concentration, which requires the completion of a dissertation. Both the DBA and PhD tracks can be completed through online study.

Walden University is accredited by the Higher Learning Commission.

Online PhD in Finance Programs

If you have a particular area of interest within the world of finance, then you may want to select a corresponding degree concentration.

PhD in Finance

Phd in financial management, phd in financial planning.

A concentration can give you opportunities to take an array of courses designed to hone your knowledge on that particular topic.

If you are a numbers person, there’s a good chance that you like accounting just as much as you enjoy general financial topics. This concentration can allow you to explore both of these areas of study.

You might put this degree to work in corporate or academic settings. You may also be interested in an Online PhD in Accounting program .

Being in charge of a company’s financial resources requires a special set of managerial leadership skills. A concentration in financial management can help you gain those skills.

This concentration is designed to teach topics like building a solid financial strategy and navigating international markets.

Helping individuals do their best with their money is the goal behind a concentration in financial management.

This concentration can help train you to guide wise financial choices as you learn not only about asset management and investment growth but also about how to influence smart decision-making through relational know-how.

With a PhD Financial Planning degree, you may help others manage their money, lead a financial advisement company, or teach future finance students.

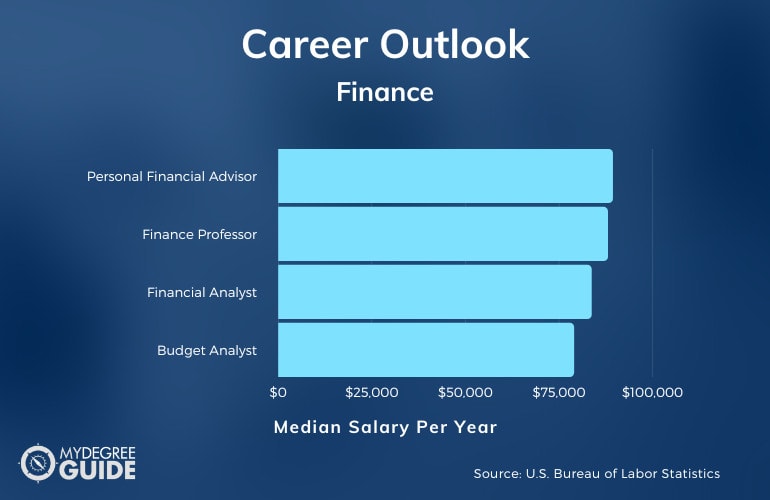

Doctorate in Finance Salary

Earning your doctoral degree in finance may open many career paths to you. Once you graduate with this degree, you may work in an academic setting, a nonprofit organization, the corporate world, or the public sector.

Here are a few jobs you may be able to look forward to, along with the U.S. Bureau of Labor Statistics job outlook and average salary information.

Budget Analyst

Budget analysts are responsible for setting an organization’s budget and helping the company stick to it.

- Outlook for job growth: 5% increase

- Median salary per year: $78,970

This may be an enjoyable career path for those who want to understand all facets of a company – tracking and justifying where each penny goes. Budget analysts make recommendations for investment and expenditure to boost their company’s profitability.

Financial Analyst

Financial analysts are responsible for paying attention to the market in order to make recommendations on how people or businesses should invest their resources.

- Outlook for job growth: 6% increase

- Median salary per year: $83,660

Rather than monitoring their business or organization, they monitor the economy as a whole. This career may be ideal for those who find financial markets interesting and have a deep understanding of investments.

Personal Financial Advisor

Consider this career path if you want the satisfaction of knowing that you’re helping others plan for their futures.

- Median salary per year: $89,330

You might also need to have a knack for marketing and sales as you attract and welcome new clients to your firm. In this role, you might work for a successful money management company or start your own practice.

Finance Professor

You may be able to pass your knowledge onto others by teaching students at the university level.

- Outlook for job growth: 7% increase

- Median salary per year: $88,010

Like many careers, you’ll need more than knowledge of the financial sector to be successful in this position. You’ll need organization and communication skills to be able to teach effectively. You’ll also need to be willing to prove your teaching effectiveness to your department via annual reviews.

If you enjoy teaching, researching, and discussing business, you may find yourself quite at home among the faculty of a business college.

Curriculum for Finance PhD Programs

Similar to a MBA in finance or online master’s in finance , when pursuing an advanced degree in finance, you’ll likely take a variety of courses designed to equip you with a thorough understanding of financial matters and how they relate to decision-making for individuals and businesses.

Your classes may include:

- Accounting and Control for Nonprofit Organizations

- Business Ethics

- Business Valuation

- Data Analysis for Investments

- Financial Management for International Business

- Human Resource Development

- Investment Portfolio Analysis

- Managerial Finance

- Mathematical Foundations for Finance

- Mergers & Acquisitions

- Money, Capital Markets & Economic Growth

- Quantitative Research Design & Methodology

- Real Estate Finance

- Real Option Valuation

- Risk Management

- Strategic Thinking for Decision-Making

- Stochastic Foundations of Finance

Since your program will likely encourage you to take a mix of both foundational classes and specialized electives, the coursework listed above includes both core classes and electives. Your PhD in finance requirements may also include a dissertation or capstone project. A growing number of doctorate programs have no dissertation required , but these tend to be professional doctorates, not PhDs.

Choose programs with a capstone project if you’d like to finish your degree faster. Dissertations can often take 2-3 years more to complete after you finish your coursework.

DBA in Finance vs. PhD in Finance

When you have your sights set on a finance degree, there are two different doctoral routes you can take. You could earn a doctorate of business administration (DBA) in finance or pursue a Doctor of Philosophy (PhD) in finance.

Although you can learn a great deal about numbers, money, and economics either way, the two different degrees will likely set you on divergent career tracks.

People often choose a professional doctorate, such as a DBA in Finance, if they want to put their education to work in the field — for example, working on Wall Street or in a Fortune 500 company.

A DBA in Finance:

- Is typically pursued by those who want to stay with their current company or work for another corporation.

- May involve drawing from others’ data and research for the culminating project.

- Is often pursued by those with several years of professional experience.

A PhD in finance is often pursued by people who want to work in an academic setting. You may find that a PhD program focuses more on the theoretical aspects of finance than the practical ones.

A PhD in Finance:

- Is typically pursued by people who want to conduct research, get published or teach.

- Typically requires conducting original research.

- May be good for those straight out of school, such as recent graduates of a master’s in finance or master’s in accounting program.

Think about what you want to do for your career, then choose the degree that best fits those goals.

Online vs. Traditional Finance Degree

When it comes to online versus traditional finance doctoral programs, the main difference is the format through which the material is presented. The content should remain about the same, and the rigors of the program likely will as well.

You may choose a fully online program, an on-campus one, or a hybrid mix.

Accreditation for a Doctorate in Finance Online

Universities receive accreditation as proof that their programs provide a thorough educational experience for students. Therefore, when you’re looking for a doctor of finance program, the school’s accreditation should be the first thing that you consider.

Reputable universities receive accreditation from a regional accrediting agency . These organizations give a broad stamp of approval to the entire school rather than to its individual programs. It is essential that you enroll in a school with regional accreditation.

In addition, there are several national and international organizations that provide accreditation specifically for business programs. Although this type of accreditation may not be absolutely essential, it’s certainly a valuable sign that the program is thorough, reputable, and excellent in quality.

A finance program may be accredited by:

- Accreditation Council for Business Schools and Programs (ACBSP)

- Association to Advance Collegiate Schools of Business International (AACSB)

- International Assembly for Collegiate Business Education (IACBE)

The top finance PhD programs are accredited both regionally and programmatically by one of these specialty boards. You can find your chosen university’s accreditation by searching the US Department of Education’s accreditation database .

Financial Aid for a Finance Degree

As you begin looking into finance PhD programs, don’t forget to also look into financial aid opportunities. At the doctorate level, you may still be eligible for federal financial aid as well as fellowships and scholarships from universities and scholarships from private organizations.

Your employer might even have tuition assistance programs available.

Can I Get My PhD Online?

Yes, many universities offer online PhD and professional doctorate programs. This includes doctoral degrees in finance, public health, education, nursing, and organizational leadership.

This approach can help you earn your advanced degree in a format that fits your schedule.

Is an Online PhD Respected and Credible?

In an online program, you should have to work just as hard as you do in an on-campus program. Additionally, your official records are unlikely to specify how you earned your degree.

The important thing is not the format in which you completed your coursework but whether you attended an accredited university.

Are There Any Online PhD In Finance Programs?

Earning a doctoral degree in finance doesn’t have to require moving onto campus or uprooting your whole life. Rather, there are programs for a DBA or PhD in finance online.

In these programs, you can engage in a computer-based educational experience as you work toward your degree.

Getting Your PhD in Finance Online

To take your finance education to the highest level, you may want to pursue a doctoral degree in this field, whether a PhD or a DBA.

Completing your coursework online can help you receive a solid education in a format that fits your lifestyle and prepare you for the next step on your career path.

Use the above list of schools to narrow down the finance PhD programs for you.

Related Guides:

- Best Online Masters in Finance No GMAT

- Finance vs. Accounting – What’s the Difference?

Master of Science in Financial Engineering

The Master of Science in Financial Engineering program (available both on-campus and online via DEN@Viterbi) trains graduate students with Engineering, Applied Mathematics or Physics backgrounds to apply mathematical and engineering tools to finance.

The MS in Financial Engineering is a multidisciplinary education program that involves the USC Viterbi School of Engineering, the USC Marshall School of Business and the USC Dana and David Dornsife College of Letters, Arts and Sciences (Department of Economics).

Using tools from finance and economics, engineering, applied mathematics and statistics, the Master of Science in Financial Engineering addresses problems unique to certain industries including: investment and commercial banks, trading companies, hedge funds, insurance companies, corporate risk managers, and regulatory agencies.

Such problems include derivative securities valuation, strategic planning and dynamic investment strategies and risk management.

Related Programs

In addition, the Ming Hsieh Department of Electrical and Computer Engineering is home to the following graduate program concentrations:

- MS in Computer Engineering

- MS in Electrical Engineering (EE)

- MS in EE-Computer Architecture (On-campus only)

- MS in EE-Computer Networks

- MS in EE-Electric Power

- MS in ECE-Machine Learning and Data Science (On-campus only)

- MS in ECE-Quantum Information Science (On-campus only)

- MS in EE-VLSI Design

- MS in EE-Wireless Health Technology (On-campus only)

- MS in EE-Wireless Networks (On-campus only)

- Dual Degree: MS in Electrical Engineering/MS in Engineering Management

For a complete list of graduate programs offered online in the USC Viterbi School of Engineering, please visit the DEN@Viterbi Program Offerings .

Career Opportunities

A variety of career opportunities exist, but primarily in the areas of:

- Information Technology

- Programming

- Risk Management

- Insurance and Trading Companies

- Regulatory Agencies

Earn your Master of Science in Financial Engineering online via DEN@Viterbi. Request information now.

Same Faculty. Same Program. Same Degree.

DEN@Viterbi strives to meet the needs of engineering professionals, providing the opportunity to advance your education while maintaining your career and other commitments. By breaking down geographical and scheduling barriers, DEN@Viterbi allows you to take your classes anytime and anywhere.

DEN@Viterbi students undergo the same academic requirements, curriculum, and must adhere to the same academic standards as on-campus students; therefore, your diploma is ultimately issued by the University of Southern California. There is no difference between remote students and on-campus students.

Related Online Graduate Programs

Top Ranked Online Graduate Engineering Programs

U.S. News & World Report (2022)

Financial Engineering

MS in Computer Engineering

The objective of the MS in Financial Engineering program is the training of graduate students with engineering, applied mathematics or physics backgrounds in the application of mathematical and engineering tools to finance.

This multidisciplinary education program involves the Viterbi School of Engineering, the Marshall School of Business and the College of Letters, Arts and Sciences (Department of Economics). Financial engineering uses tools from finance and economics, engineering, applied mathematics and statistics to address problems such as derivative securities valuation, strategic planning and dynamic investment strategies, risk management etc. Graduates with these skills are of interest to investment and commercial banks, trading companies, hedge funds, insurance companies, corporate risk managers and regulatory agencies etc.

Note: An undergraduate degree in engineering, math or a hard science from a regionally-accredited university is required.

Applicants with undergraduate degrees in finance, accounting, economics and similar are also eligible to apply.

DEGREES AVAILABLE ONLINE VIA DEN@VITERBI

MS in Electrical Engineering

DEN@Viterbi

The DEN@Viterbi online delivery method enables students to advance their graduate and professional education fully online. For online DEN@Viterbi students, on-campus attendance is not required. However, our unique blended model allows DEN@Viterbi students to come to the USC campus and attend class in-person, further engaging with their on-campus classmates and faculty.

In addition to over 40 graduate programs, professional (non-credit) courses are also available via DEN@Viterbi.

Complete the form below to receive the DEN@Viterbi Brochure and explore our 40+ online graduate engineering programs!

USC Viterbi School of Engineering will use the information provided on this form to send details on your program of interest, event invitation, application reminders and other relevant information. We may use email or phone calls to communicate these messages.

USC Viterbi School of Engineering | [email protected] | 213.740.4488 | Privacy Notice

USC Viterbi School of Engineering

P: 213.740.4488

Privacy Notice

Online Financial Engineering Degree & Certificate Programs

Find schools.

When you click on a sponsoring school or program advertised on our site, or fill out a form to request information from a sponsoring school, we may earn a commission. View our advertising disclosure for more details.

Financial engineering is also known as mathematical finance, computational finance, or financial mathematics. In simple terms, financial engineers use principles of applied mathematics, computer science, economics, and statistics to provide solutions for financial issues. What kind of issues do they deal with? Most commonly, financial engineers are involved with developing new investment products, structuring portfolios, assessing risks, and valuing securities among other responsibilities.

Students opting for this dynamic career path will get an opportunity to influence financial markets and make the investment process more efficient. As technology permeates finance at a rapid rate, the need for skilled financial analysts is only expected to rise.

Financial engineers are expected to be in the know about the latest financial models, systems, and software. Professionals with a background in mathematics, statistics, and computer science can opt for a master’s program in financial engineering. This lucrative degree is also offered online, allowing professionals to study at their own pace. A master’s degree in financial engineering can be completed in two years, while an online graduate certificate generally takes a year.

While each program has a unique curriculum, students can expect to delve into high-level coursework in statistics, investment analysis, portfolio management, and programming languages. Armed with advanced skills and knowledge, students can take up managerial positions in banks, insurance companies, hedge funds, governmental organizations, and regulatory agencies.

The following guide provides a comprehensive overview of the best online financial engineering programs, noteworthy faculty in the field, common admission requirements, and program accreditation.

Is An Online Financial Engineering Degree Right For Me?

Online programs allow students to study at their own pace while continuing their professional and personal endeavors. Professionals can earn advanced skills and knowledge that help them further their careers. However, students must understand the nuts and bolts of taking an online course before signing up for an distance-based financial engineering degree.

Unlike other engineering disciplines that require hands-on work, a degree in financial engineering can be completed exclusively online, without ever setting foot on campus. Almost all programs detailed in this guide do not require on-campus attendance.

Students can expect to learn from pre-recorded as well as live lectures. Online programs also have dedicated discussion forums to enable interaction between students and faculty members.

An important prerequisite to succeeding in an online program is being disciplined with one's time. Along with professional commitments, students must dedicate time to viewing lectures, participating in class discussions, and taking tests. Being self-motivated is an essential trait of online learners who thrive.

While online programs offer ample flexibility, it's also important for students to maintain accountability if they want to succeed in an online degree program.

Admissions Requirements For Online Financial Engineering Programs (What To Expect)

While applying to an online financial engineering program can be different for graduate and undergraduate admissions, there are some commonalities that are helpful to understand.

Applying for Undergraduate-Level Online Financial Engineering Programs

The online application process for undergraduate online programs generally comes along with a nominal fee and must include test scores (e.g, SAT, ACT), transcripts, personal essays, and letters of recommendation.

Students must view start dates for programs they wish to pursue. Generally, undergraduate programs begin in the fall semester, and applications are due by the beginning of the year (January or February). Programs may also accept applications for the spring semester in the fall of the previous year (that is, September or October).

Applying for Graduate-Level Online Financial Engineering Programs

Graduate programs for financial engineering can be quite competitive and have stricter experience and academic requirements for admission. The majority of financial engineering graduate programs require that entering students already have a bachelor of science (BS) degree in engineering, science, mathematics, computer science, or a related field from an accredited academic institution.

Common application requirements might include academic transcripts from one’s previous education, a statement of purpose, a current resume, recommendation letters, and English language proficiency. Some programs might also require students to submit GRE or (less frequently) GMAT scores.

Financial Engineering Program Accreditation

Typically, master’s of science in financial engineering degrees are accredited by the International Association of Quantitative Finance , a not-for-profit professional society that works towards advancing the field of quantitative finance. However, it has only accredited a handful of US universities—none of which offer online programs.

A limited number of US schools offer online programs in financial engineering. These programs have been accredited by reputable regional accrediting bodies such as the Western Association of Schools and Colleges, the Middle States Commission on Higher Education, and the Southern Association of Colleges and Schools Commission on Colleges. Regional accreditation institutions recognize only the most competitive and deserving universities in a given field.

Financial Engineering Curriculum & Specializations

As with most academic programs, the exact curriculum for one online financial engineering program will not be the same as another, but there are similarities.

Master's Degrees in Financial Engineering Courses

In general, master’s degrees in financial engineering include advanced versions of courses in undergraduate programs.

Students can expect to study higher-level courses in computational finance, portfolio theory, financial markets, financial engineering, portfolio management, and investment analysis. Additionally, financial engineering master’s students also delve into various mathematics and programming related courses such as linear programming, programming systems design, and differential equations.

While there are several universities that offer a master of science in financial engineering programs online, a few colleges also offer master’s in related subjects such as computational finance and risk management.

A few programs also offer concentrations such as financial statistics, algorithmic trading strategies, financial risk engineering, financial services analytics, and financial computing. Students can expect to complete a master’s program in financial engineering in two years.

Graduate Certificates in Financial Engineering Courses

Students who don’t wish to commit to a two-year master’s degree can also take up an online graduate certificate in financial engineering. Several renowned institutions such as Columbia University and the University of Central Florida offer a graduate certificate program in financial engineering.

Graduate certificates generally comprise 12 to 15 credit-hours and can be completed in a year. With a combination of required and elective courses, they allow students to build a stronger foundation in risk management, financial mathematics, dynamic pricing, revenue models, and stochastic models.

Highly Regarded Online Financial Engineering Programs

University of Southern California

The University of Southern California offers an online MS in financial engineering program through the Viterbi School of Engineering. The program is ideal for those who have a foundation in applied mathematics, engineering, or physics, as they learn how to apply these skills to finance.

Major admission requirements for the program include a bachelor’s degree in engineering or an engineering-related field from an accredited institution, official transcripts, letters of recommendation, GRE scores, a current resume, letters of recommendation, a personal statement, and TOEFL or IELTS scores for international students with English as their second or third language.

The curriculum comprises 30 credit-hours in topics such as financial engineering, probability for electrical and computer engineers, corporate finance, stochastic processes, mathematics and tools for financial engineering, investment analysis and portfolio management, linear programming and extensions, and programming systems design.

On successful completion of the program, students can take up lucrative opportunities in myriad fields such as programming, insurance and trading information technology finance, banking, regulation, and risk management.

- Location: Los Angeles, California

- Accreditation: Western Association of Schools and Colleges (WASC)

- Expected Time to Completion: Full-time enrollment (1.5 to two years); part-time enrollment (2.5 to 3.5 years)

- Estimated Tuition: $2,148 per credit-hour

Johns Hopkins University

Johns Hopkins University offers a master of science in financial mathematics, a graduate certificate in financial risk management, a graduate certificate in quantitative portfolio management, and a graduate certificate in securitization.

These programs can be completed online, thus allowing students to manage their work, family, and life simultaneously. In order to enhance students' understanding of the subject matter, the programs include real-life case studies on topics such as risk management, financial derivatives, data analysis, quantitative portfolio theory, and Monte Carlo methods.

Admission requirements for the program include an undergraduate or graduate degree in a quantitative discipline from an accredited college or university, a minimum of two years of relevant work experience in finance or a related field, transcripts, and TOEFL or IELTS scores for international students.

The master's degree consists of ten courses, while the certificates are made up of four courses each. The curriculum includes courses such as an introduction to financial derivatives, interest rate and credit derivatives, financial risk management and measurement, financial engineering and structured products, statistical methods and data analysis, optimization in finance, Monte Carlo methods, and time series analysis, among others.

Graduates of the program will have access to leadership positions in finance as well as governmental organisations. They will be able to harness engineering-driven methods for deploying financial processes and transactions.

- Location: Baltimore, Maryland

- Accreditation: Middle States Commission on Higher Education

- Expected Time to Completion: Degree, part-time (five years); certificates, part-time (three years each)

- Estimated Tuition: $4,595 per course

Stevens Institute Of Technology

The Stevens Institute of Technology offers an online master's in financial engineering program providing students with a basic understanding of financial systems and the structure of financial markets and products. The master’s program combines statistical analysis, mathematical modeling, finance, computer programming skills, systems thinking, and economics to help students solve financial problems at the systemic and enterprise level.

For admission to the program, students must have a bachelor’s degree; official transcripts from all universities attended; completed courses in calculus and differential equations, probability and statistics, linear algebra, and programming; a current resume; GMAT or GRE scores; and two letters of recommendation. International students also must include TOEFL or IELTS scores.

Consisting of 30 credit-hours, the degree includes six required courses: stochastic calculus for financial engineers, pricing and hedging, computational methods in finance, portfolio theory and applications, advanced derivatives, and special problems in financial engineering.

Apart from these, students can either select four electives or pursue one of the following five concentrations: algorithmic trading strategies, financial services analytics, financial risk engineering, financial statistics, and financial computing.

- Location: Hoboken, New Jersey

- Expected Time to Completion: 12 months

- Estimated Tuition: $1,686 per credit-hour

University of Washington

The University of Washington offers an online master’s degree in computational finance and risk management (CFRM) program, which is ideal for working professionals. Students in this program will not be required to visit campus and will be taught by the same instructors as the on campus students. The CFRM program provides students with a rigorous statistical and mathematical foundation, as well as extensive instruction in the use of open-source R-programming.

The program requires a minimum of 42 credits (26 credits of mandatory coursework and 16 credits of elective coursework). Students receive instruction in investment science, financial data science, asset allocation and portfolio management, options and other derivatives, Monte Carlo methods in finance, ethics in the finance profession, and optimization methods in finance, among others.

Applicants to this degree program must show proficiency in calculus, probability and statistics, and a programming language such as Java. Additional admission requirements include academic transcripts from undergraduate or previous graduate education, a statement of purpose, a current resume, recommendation letters, a completed application, and English language proficiency for students whose native language is not English. Applicants with limited professional experience must take the GRE exam.

- Location: Seattle, Washington

- Accreditation: Northwest Commission on Colleges and Universities (NWCCU)

- Expected Time to Completion: Three years

- Estimated Tuition: Contact UW for a customized assessment

University of Central Florida (Graduate Certificate)

The University of Central Florida offers a mathematical science graduate certificate in financial mathematics. It has been designed especially for students who wish to advance their knowledge of mathematical finance and pursue a career in financial services. The program is available 100 percent online.

Admission is open to students who have a bachelor’s degree from an accredited institution. An application to the graduate certificate program and official transcripts must be submitted, while no GRE is required.

This graduate certificate consists of 12 credit-hours; nine credit-hours comprise required courses and three credit-hours are elective courses. The curriculum includes courses such as financial mathematics, risk management for financial mathematics, differential equations for financial mathematics, and computational methods for financial mathematics.

Upon successful completion, graduates can take up roles such as commercial analyst, investment specialist or manager, financial advisor, portfolio manager, senior financial data analyst, and regulatory scientist.

- Location: Orlando, Florida

- Accreditation: Southern Association of Colleges and Schools Commission on Colleges (SACSCOC)

- Estimated Tuition: In-state ($327.32 per credit-hour); out-of-state ($1,151.72 per credit-hour)

Columbia University (Graduate Certificate)

Columbia University offers an online certificate program in financial engineering, designed to nurture an understanding of applying quantitative and engineering methods to finance. All courses can be completed online, and are delivered through the university's Columbia Video Network (CVN).

To get accepted into the program, applicants must have an undergraduate degree in engineering, computer science, mathematics, science or a related field from an accredited institution; a background in mathematics; official transcripts; three letters of recommendation; a personal-professional statement; a current resume; and $150 application fee.

The program comprises 12 credit-hours (four graduate-level classes). The curriculum includes courses such as optimization models and methods, stochastic models, corporate finance for engineers, and dynamic pricing and revenue management.

At the end of the program, graduates will be prepared to take up roles in banking, securities, and financial management, as well as quantitative roles in corporate treasury, consulting industries, and finance departments of service firms.

- Location: New York, New York State

- Expected Time to Completion: Two years

- Estimated Tuition: $2,196 per credit-hour

WorldQuant University (Alternative Program)

WorldQuant University offers an 100 percent online master of science (MSc) in financial engineering, which integrates statistics, computer science, and mathematics with finance theory. Graduates of the program go on to have successful careers in highly collaborative, professional environments.

Comprising 30 credit-hours, this program consists of nine graduate-level courses and one capstone course. Courses include financial markets, econometrics, discrete-time stochastic processes, continuous-time stochastic processes, computational finance, portfolio theory and asset pricing, machine learning in finance, and data feeds and technology.

Admission requirements include a bachelor’s degree, a completed online application with all required documents, a passing score of 75 percent on a quantitative proficiency test, official transcripts from one’s highest college or university degree earned, and proof of English proficiency.

Students will learn the applications of machine learning to financial markets and become adept at applying forecasting and economic modeling to finance. They will be able to evaluate financial global trends, apply calculus to pricing and hedging, and analyze and design financial programs using distributed ledger technologies. Graduates can take up careers in banking, financial management, and securities, and general manufacturing and service firms.

- Location: New Orleans, Louisiana

- Accreditation: Currently not accredited but has applied for accreditation through DEAC

- Estimated Tuition: Free

Campus Visitation Requirements For Online Financial Engineering Programs

Most programs that offer online financial engineering degrees, be it a master’s degree or a graduate certificate program, do not require students to visit campus to complete their degree.

In general, students can complete all coursework and assignments in their state of residence without ever traveling to the university campus.

Other Considerations For Selecting The Right Financial Engineering Program

With a wide range of online programs on offer, students may find it daunting to choose a program that perfectly fits their needs and career goals. It is important to consider what one’s larger goals are before selecting an online program. Students may want to consider if they will be able to cope with a 100 percent online education with limited face-to-face guidance.

It is also important to consider if a given program helps students to identify local internship or other hands-on professional opportunities to supplement their online learning. Some institutions help students find resources through their vast alumni network and industry connections, while others may leave the responsibility of finding these largely on the students.

Influential Financial Engineering Professors

Most online financial engineering programs utilize their on-campus professors for their online courses as well, meaning that distance learning students get the same quality education as their peers on campus.

The following are five highly regarded financial engineering professors who teach both online and on-campus.

Cesar Acosta , PhD - University of Southern California

Cesar Acosta is an associate professor of industrial and systems engineering at the University of Southern California, Daniel J. Epstein Department of Industrial & Systems Engineering. He teaches numerous classes in the master’s financial engineering program and the masters’s program in data analytics.

Dr. Acosta’s research efforts are focused on machine learning methods to solve real-world problems using advanced statistics. He has been published in prominent journals such as Communications in Statistics and Quality Engineering . He completed his PhD in industrial engineering at Texas A&M University, a PhD in statistics at the University of Texas at Dallas, and a BS in industrial engineering at the Catholic University of Peru.

David Audley , PhD - Johns Hopkins University

Dr. David Audley is the senior lecturer and executive director of the financial mathematics master’s program in the Department of Applied Mathematics & Statistics at the Whiting School of Engineering. He currently teaches courses such in financial derivatives, as well as financial risk management and measurement.

Dr. Audley’s current research explores financial mathematics, fixed income derivatives, term structure models, and quantitative portfolio strategies. He has been published in influential journals such as the AIAA Journal of Guidance and Control and Automatica . He earned his PhD in applied mathematics and electrical engineering from Johns Hopkins University, his BSEE from the Citadel college, and his MSEE from the University of Southern California.

Dragos Bozdog , PhD - Stevens Institute of Technology

Dr. Dragos Bozdog is an associate professor in the financial engineering division at the Stevens Institute of Technology. He also serves as the deputy director of the Hanlon Financial System Laboratory, which was built especially to facilitate hands-on learning. He teaches courses in financial engineering, pricing and hedging, advanced derivatives, mathematics for finance, and macroeconomics, among others.

Primarily, Dr. Bozdog’s research focuses on the mathematics of finance, emerging markets, and early warning systems and threat assessment. He has been published in top-notch journals such as Tire Science and Technology , the Journal of the Applied Vision Association , and the Wilmott Journal . He holds a PhD in financial engineering and an MS in financial engineering from the Stevens Institute of Technology, a PhD in mechanical engineering from the University of Toledo, and a BS in mechanical engineering from the Polytechnic University of Bucharest.

Zhenyu Cui , PhD - Stevens Institute of Technology

Dr. Zhenyu Cui is an assistant professor of financial engineering at the Stevens Institute of Technology. He teaches classes such as stochastic calculus for financial engineers, applied stochastic differential equations, computational methods in finance, the master’s thesis in financial engineering, and the volatility surface.

Dr. Cui’s research efforts are focused on financial derivatives pricing, Monte Carlo simulation, stochastic models, financial systemic risk and contagion effects, and stochastic volatility models. Renowned journals such as the European Journal of Operational Research , the Journal of Banking and Finance , and the Journal of Financial Econometrics have published his work. He holds his PhD and master’s from the University of Waterloo, and a BSc from University of Hong Kong.

Tim Leung , PhD - University of Washington

Dr. Tim Leung serves as the director of the computational finance and risk management (CFRM) program at the University of Washington in Seattle. An excellent mathematics professor who has won tenure, he teaches courses such as Monte Carlo methods in finance, investment science, data analysis for financial engineers, and the foundations of financial engineering, among others.

Dr. Leung’s research efforts explore areas such as optimal stochastic control and financial mathematics. His work has been published in prominent journals such as the Journal of Economic Dynamics and Control, Stochastic Models , and Studies in Economics and Finance . He holds his PhD from Princeton University and his BS from Cornell University.

Farheen Gani has researched a wide array of topics related to engineering since 2018. She has written about electrical and computer engineering programs, structural engineering programs, mechanical engineer salaries, environmental engineering programs, and many other subfields of engineering. She writes about healthcare, technology, education, and marketing. Her work has appeared on websites such as Tech in Asia and Foundr, as well as top SaaS blogs such as Zapier and InVision. You can connect with her on LinkedIn and Twitter (@FarheenGani).

Related Programs

- Mathematics

- Cloud Computing

- Computer Engineering

- Computer Science

- Construction Management

Related FAQS

- 1. How Do I Become a Mathematician or Applied Math Expert?

- 2. What Can I Do With a Degree in Mathematics?

- 3. Any No GMAT / No GRE Online Computer Science Programs?

- 4. Any No GMAT / No GRE Online Engineering Programs?

- 5. Business Analyst vs. Systems Analyst

Related Articles

Online bachelor’s degree programs in software engineering.

Software powers a large part of today’s world. From hailing taxi cabs to ordering food, there is an app for everything. As a result, there is a growing demand for software engineers to develop new applications and websites.

Universities with an Outstanding Mathematics Faculty

These mathematics professors have demonstrated expertise gained through years of study, research, experience, and service. Their contributions to the field consist of innovative research, an extensive body of published works, and teaching excellence.

What Blockchain Is (and Isn’t): A Primer on How It’s Used

In a society that runs on data and rewards that data’s accuracy, timeliness, and security, blockchain technology has a lot of promise. But its applicability isn’t universal, and the tech still faces significant hurdles to widespread adoption.

Artificial Intelligence in Job Recruitment: How AI Can Identify Top Talent

Diversity and inclusivity aren’t purely idealistic goals. A growing body of research shows that greater diversity, particularly within executive teams, is closely correlated with greater profitability. Today’s businesses are highly incentivized to identify a diverse pool of top talent, but they’ve still struggled to achieve it. Recent advances in AI could help.

Artificial Intelligence Systems & Specializations: An Interview with Microsoft’s Sha Viswanathan

The ability of a computer to learn and problem solve (i.e., machine learning) is what makes AI different from any other major technological advances we’ve seen in the last century. More than simply assisting people with tasks, AI allows the technology to take the reins and improve processes without any help from humans.

The Mathematical and Computational Finance Program at Stanford University (“MCF”) is one of the oldest and most established programs of its kind in the world. Starting out in the late 1990’s as an interdisciplinary financial mathematics research group, at a time when “quants” started having a greater impact on finance in particular, the program formally admitted masters students starting in 1999. The current MCF program was relaunched under the auspices of the Institute for Computational and Mathematical Engineering in the Stanford School of Engineering in 2014 to better align with changes in industry and to broaden into areas of financial technology in particular. We are excited to remain at the cutting edge of innovation in finance while carrying on our long tradition of excellence.

The MCF Program is designed to have smaller cohorts of exceptional students with diverse interests and viewpoints, and prepare them for impactful roles in finance. We are characterized by our cutting edge curriculum marrying traditional financial mathematics and core fundamentals, with an innovative technical spirit unique to Stanford with preparation in software engineering, data science and machine learning as well as the hands-on practical coursework which is the hallmark skill-set for leaders in present day finance.

- Open Search box

- Master of Financial Engineering

- Admissions Overview

- Admissions Ambassadors

- Requirements

- International Applicants

- Academics Overview

- Capstone Project

- Career Impact Overview

- Career Paths Overview

- Quant Trading and Sales Trading

- Data Science

- Quantitative Research and Analysis

- Strats and Modeling

- Portfolio Management

- Risk Management

- Consulting and Valuation

- Employment Report

- Alumni Coaches

- Advisory Board

- Student Life

- For Companies Overview

- Recruit An MFE

- Meet our Team Overview

- MFE Admit Central Home

- Admit Checklist

- Campus Resources

- Career Support

- Curriculum and Academics

- For International Students

- Meet Our Team

- Prep Before You Start

- Program Calendar and Fees

- Student Health

- Housing and Utilities

- Transportation and Parking

UCLA Anderson Master of Financial Engineering

Join a top 10-ranked mfe program*, leverage your skill with numbers.

*UCLA Anderson MFE is Ranked #3 in the U.S. by QS World University Rankings

Stay up to date on the UCLA Anderson MFE Program

A few numbers to get you started:, expand your career readiness through these exclusive offerings:.

Leading-edge elective courses , including classes focused on cryptocurrency, data analytics and machine learning

The Applied Finance Project, a course where students solve a problem for a company or organization with faculty advisors’ guidance

The Master of Financial Engineering Advisory Board, an esteemed group of industry leaders who help steer the program’s curriculum, guest lecture for courses and support career services’ efforts.

Events, programs and competitions in collaboration with UCLA Anderson’s Fink Center for Finance , a highly regarded organization in the field.

Hear From Our Graduates

Key Strengths of the MFE Program

Business School Advantage

UCLA Anderson offers exceptional academic preparation, a cooperative and congenial student culture, and access to a thriving business community, as well as support services for scholastic and career advancement. Our MFE program affords a dynamic curriculum that combines theory, analytical skills and current business practice. UCLA Anderson MFEs join one of the world’s largest and most renowned alumni networks, with more than 36,000 members in over 100 countries.

Learn From Renowned Finance Thought Leaders

Our trailblazing faculty are respected professors and researchers, as well as revered leaders in the world of finance. They will teach you in a curriculum that merges quantitative finance theories with up-to-the-minute business practices, you can more effectively apply what you learn. Outside of our curriculum, our Financial Institutions Seminar brings industry leaders to you, giving you a window into the trends and dynamics that drive their businesses.

Learn More About Our Academics

Real-World Projects

Beyond the classroom, UCLA Anderson MFE students apply their knowledge to real-world settings through a summer internship and our Applied Finance Project (AFP). The hands-on AFP pairs student teams with real client projects, providing valuable exposure to potential employers and broadening their professional networks.

What You Can Do Next

Stay in touch.

- Request Information

Learn First-Hand

Register for an event, take the first step, start your mfe application, application deadlines.

The application for the entering Class of 2025, which will begin in the fall quarter of 2024 is LIVE!

The application period is divided into three rounds/deadlines:

- About UCLA Anderson

- Our Character

- Our Strategic Plan

- Our Leadership

- Our History

- Office of Development Home

- Impact Stories

- The Anderson Fund

- Student Fellowships

- Equity, Diversity and Inclusion

- Centers@Anderson

- Faculty Research

- Dean’s Society Leadership Giving

- Reunion Giving

- Anderson Affiliates

- Ways to Give

- Contact Development

- Our Centers Home

- Center for Global Management Home

- For Students Overview

- Specialize In Global Management

- On-Campus and/or Hybrid Global Management Courses

- Global Immersion Courses

- Global Nonprofit Capstone Projects

- MBA Research Assistants

- Career and Personal Development

- UCLA-NUS Executive MBA

- F/EMBA International Exchange

- EMBA International Business Residency

- Global Management Seminars

- International Exchange

- Events and Discussions Overview

- Global Conferences

- Greater China and LatAm Series

- Global Management Speaker Series

- Global Management Lecture Series

- Global Business & Policy Forums

- World Today Discussion Series

- Robertson Lecture Series on Global Business Leadership

- Lunch and Dinner Series

- External Collaborative Partnerships

- Upcoming Events

- Past Center Sponsored Events

- Other UCLA Events

- Faculty & Global Research

- Video Gallery

- Support The Center

- Center for Media, Entertainment & Sports Home

- Events Overview

- Pulse Conference Home

- Entertainment Case Competition

- Game Day Sports Case Competition

- Global Sports Business Forum

- INSIGHTS - Big Data Conference

- Real Madrid Global Sports Leadership

- Research & Insights

- Corporate Partnership

- Student Experience Overview

- Industry Network

- Undergraduate Summer Institute Overview

- Howard University Initiative

- High School Summer Discovery

- About The Center for Media, Entertainment & Sports

- Board of Directors

- Easton Technology Management Center

- Innovation Challenge Home

- Sustainability Track

- Healthcare Track

- Generative AI Track

- Mentors & Advisors

- Competition Details

- Past Events

- Easton Courses

- Specialization

- Innovate Conference

- Tech + Society Conference

- The Embracing AI Summit

- Easton Instructors

- Get Involved

- About The Easton Technology Management Center

- Board of Advisors

- Faculty Advisory Board

- Fink Center for Finance & Investments Home

- Career Impact

- Student Fellowships Overview

- Investment Banking Fellowship

- Kayne Investment Management Fellowship

- Brown Private Equity and Alternatives Fellowship

- Quantitative Finance Fellowship

- News and Events Overview

- Conference on Financial Markets

- Fink Investing Conference Home

- Private Equity Roundtable

- Fink Credit Pitch Competition

- Faculty & Research

- Meet Our Board

- Center for Impact Home

- Specializations and Certificates

- Impact Investing

- Social Impact Consulting

- Open For Good Transparency Index

- Environmental Metrics

- Social Metrics

- Governance Metrics

- Our Methodology

- State of Corporate Sustainability Disclosure

- 2023 Report

- 2022 Report

- Sustainability Workshops

- Corporate Partnership Program

- Faculty and Research

- Research and Seminars

- Research in Energy

- Research in Sustainability

- Research in Social Responsibility

- Alliance for Research on Corporate Sustainability ARCS

- Impact Week

- Morrison Center for Marketing & Data Analytics Home

- Gilbert Symposium

- Research Overview

- Funded Research

- Student Programs Overview

- Affiliated Student Organizations

- Case Competitions

- Ph.D. Students

- Morrison Center Advisory Board

- Price Center for Entrepreneurship & Innovation Home

- Fellowships

- Undergraduate Minor in Entrepreneurship

- Student Investment Fund

- For Professionals Overview

- Health Care Executive Program

- Entrepreneurship Bootcamp for Veterans

- UCLA Head Start Management Fellows Program

- Steinbeck Family Business Seminar

- Management Development for Entrepreneurs

- UCLA Health Care Institute

- Anderson Venture Accelerator Home

- Our Programs

- Our Companies

- Mentors and Advisors

- Showcase 2023

- Showcase 2022

- Showcase 2021

- Showcase 2020

- Knapp Venture Competition

- Entrepreneur Association (EA)

- Past Winners

- Hire an Anderson Intern

- UCLA Anderson Forecast Home

- Research and Reports Overview

- Forecast Direct Podcast

- Projects and Partnerships Overview

- Forecast Fellows Program

- Allen Matkins

- Cathay Bank

- City Human Capital Index

- Los Angeles City Employment

- Engage with Us Overview

- Become A Member

- Become A Sponsor

- Speaking Engagements

- Member Login

- Renew Membership

- Join Email List

- UCLA Ziman Center for Real Estate

- Howard and Irene Levine Fellows

- Peter Bren Fellows in Entrepreneurial Real Estate

- Corporate Concierge Recruiting

- Howard and Irene Levine Affordable Housing Development Program

- Alumni (UCLA REAG)

- UCLA Ziman Center Symposium

- Howard J. Levine Distinguished Lecture on Business Ethics & Social Responsibility

- UCLA Distinguished Speaker Series in Affordable Housing

- Faculty & Research Overview

- UCLA Gilbert Program in Real Estate, Finance and Urban Economics

- UCLA Economic Letter

- UCLA Affordable Housing Policy Brief

- Working Papers

- Eviction Moratoria and Other Rental Market COVID-19 Policy Interventions

- Mortgage Default Risk Index (MDRI)

- CRSP/Ziman REIT Data Series

- Conference on Low-Income Housing Supply and Housing Affordability

- Impact on Our Community Overview

- Housing as Health Care Initiative

- Howard and Irene Levine Program in Housing and Social Responsibility

- Board Leadership

- Ziman Campaign

- Clubs & Associations Home

- Anderson Student Association (ASA)