90 Survey Question Examples + Best Practices Checklist

What makes a good survey question, what is the importance of asking the right questions, 9 types of survey questions + examples, how to conduct surveys effectively, make surveys easier with fullsession, fullsession pricing plans, install your first website survey today, faqs about survey questions.

An effective survey is the best way to collect customer feedback. It will serve as your basis for multiple functions, such as improving your product, supplementing market research, creating new marketing strategies, and much more. But what makes an effective survey?

The answer is simple–you have to ask the right questions. Good survey questions gather concrete information from your audience and give you a solid idea of what you need to do next. However, the process of creating a survey is not that easy–you want to make every question count.

In this article we’ll cover everything you need to know about survey questions, with 90 examples and use cases.

Understanding the anatomy of a good survey question can transform your approach to data collection, ensuring you gather information that’s both actionable and insightful. Let’s dive deeper into the elements that make a survey question effective:

- Clarity is Key: Questions should be straightforward and leave no room for interpretation, ensuring uniform understanding across all respondents.

- Conciseness Matters: Keep questions short and to the point. Avoid unnecessary wording that could confuse or disengage your audience.

- Bias-Free Questions: Ensure questions are neutral and do not lead respondents toward a particular answer. This maintains the integrity of your data.

- Avoiding Ambiguity: Specify the context clearly and ask questions in a way that allows for direct and clear answers, eliminating confusion.

- Ensuring Relevance: Each question should have a clear purpose and be directly related to your survey’s objectives, avoiding any irrelevant inquiries.

- Easy to Answer: Design questions in a format that is straightforward for respondents to understand and respond to, whether open-ended, multiple-choice, or using a rating scale.

Keep these points in mind as you prepare to write your survey questions. It also helps to refer back to these goals after drafting your survey so you can see if you hit each mark.

The primary goal of a survey is to collect information that would help meet a specific goal, whether that be gauging customer satisfaction or getting to know your target audience more. Asking the right survey questions is the best way to achieve that goal. More specifically, a good survey can help you with:

Informed Decision-Making

A solid foundation of data is essential for any business decision, and the right survey questions point you in the direction of the most valuable information.

Survey responses serve as a basis for the strategic decisions that can propel a business forward or redirect its course to avoid potential pitfalls. By understanding what your audience truly wants or needs, you can tailor your products or services to meet those demands more effectively.

Uncovering Customer Preferences

Today’s consumers have more options than ever before, and their preferences can shift with the wind. Asking the right survey questions helps you tap into the current desires of their target market, uncovering trends and preferences that may not be immediately obvious.

This insight allows you to adapt your products, services, and marketing messages to resonate more deeply with the target audience, fostering loyalty and encouraging engagement.

Identifying Areas for Improvement

No product, service, or customer experience is perfect, but the path to improvement lies in understanding where the gaps are. The right survey questions can shine a light on these areas, offering a clear view of what’s working and what’s not.

This feedback is invaluable for continuous improvement, helping you refine your products and enhance the customer experience. In turn, this can lead to increased satisfaction, loyalty, and positive word-of-mouth.

Reducing Churn Rate

Churn rate is the percentage of customers who stop using your service or product over a given period. High churn rates can be a symptom of deeper issues, such as dissatisfaction with the product or service, poor customer experience, or unmet needs. Including good survey questions can help you identify the reasons behind customer departure and take proactive steps to address them.

For example, survey questions that explore customer satisfaction levels, reasons for discontinuation, or the likelihood of recommending the service to others can pinpoint specific factors contributing to churn.

Minimizing Website Bounce Rate

Bounce rate is the percentage of visitors leaving a website after viewing just one page. High bounce rates may signal issues with a site’s content, layout, or user experience not meeting visitor expectations.

Utilizing surveys to ask about visitors’ web experiences can provide valuable insights into website usability, content relevance, and navigation ease. Effectively, well-crafted survey questions aimed at understanding the user experience can lead to strategic adjustments, improving overall website performance, and fostering a more engaged audience.

A good survey consists of two or more types of survey questions. However, all questions must serve a purpose. In this section, we divide survey questions into nine categories and include the best survey question examples for each type:

1. Open Ended Questions

Open-ended questions allow respondents to answer in their own words instead of selecting from pre-selected answers.

“What features would you like to see added to our product?”

“How did you hear about our service?”

“What was your reason for choosing our product over competitors?”

“Can you describe your experience with our customer service?”

“What improvements can we make to enhance your user experience?”

“Why did you cancel your subscription?”

“What challenges are you facing with our software?”

“How can we better support your goals?”

“What do you like most about our website?”

“Can you provide feedback on our new product launch?”

When to use open-ended questions: Using these survey questions is a good idea when you don’t have a solid grasp of customer satisfaction yet. Customers will have the freedom to express all their thoughts and opinions, which, in turn, will let you have an accurate feel of how customers perceive your brand.

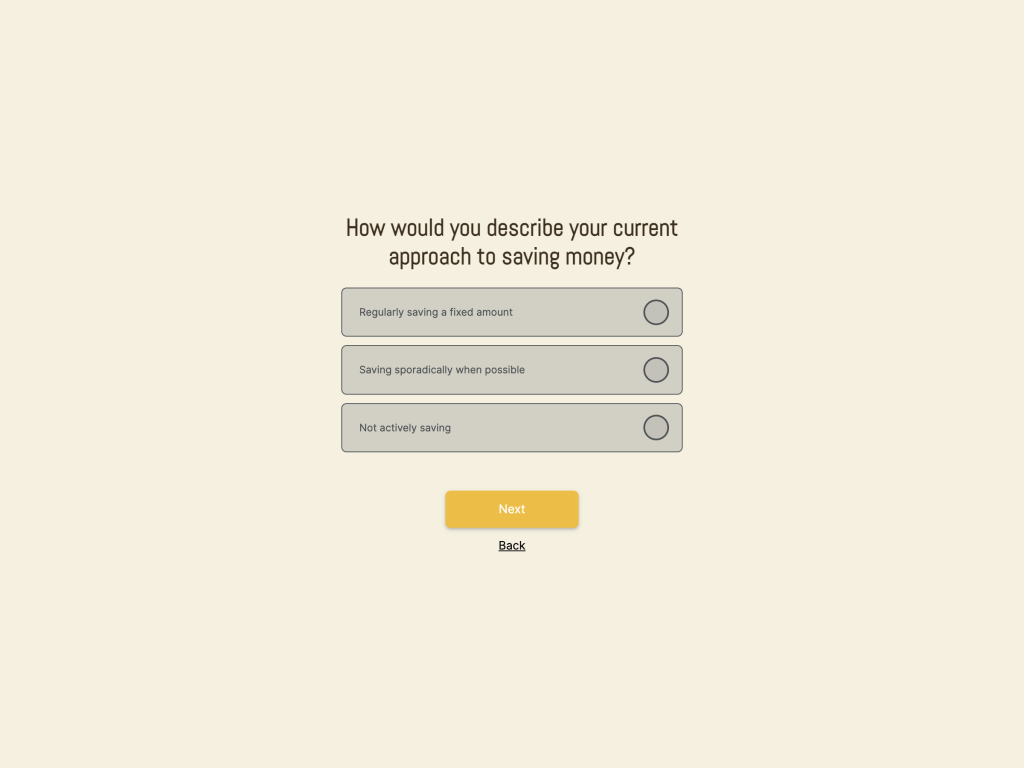

2. Multiple Choice Questions

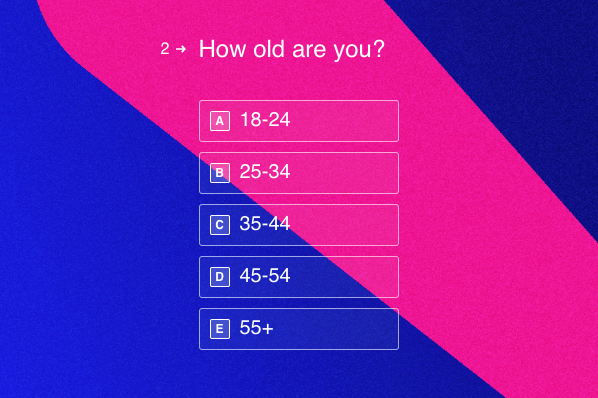

Multiple-choice questions offer a set of predefined answers, usually three to four. Businesses usually use multiple-choice survey questions to gather information on participants’ attitudes, behaviors, and preferences.

“Which of the following age groups do you fall into? (Under 18, 19-25, 26-35, 36-45, 46-55, 56+)”

“What is your primary use of our product? (Personal, Business, Educational)”

“How often do you use our service? (Daily, Weekly, Monthly, Rarely)”

“Which of our products do you use? (Product A, Product B, Product C, All of the above)”

“What type of content do you prefer? (Blogs, Videos, Podcasts, eBooks)”

“Where do you usually shop for our products? (Online, In-store, Both)”

“What is your preferred payment method? (Credit Card, PayPal, Bank Transfer, Cash)”

“Which social media platforms do you use regularly? (Facebook, Twitter, Instagram, LinkedIn)”

“What is your employment status? (Employed, Self-Employed, Unemployed, Student)”

“Which of the following best describes your fitness level? (Beginner, Intermediate, Advanced, Expert)”

When to use multiple-choice questions: Asking multiple-choice questions can help with market research and segmentation. You can easily divide respondents depending on what pre-determined answer they choose. However, if this is the purpose of your survey, each question must be based on behavioral types or customer personas.

3. Yes or No Questions

Yes or no questions are straightforward, offering a binary choice.

“Have you used our product before?”

“Would you recommend our service to a friend?”

“Are you satisfied with your purchase?”

“Do you understand the terms and conditions?”

“Was our website easy to navigate?”

“Did you find what you were looking for?”

“Are you interested in receiving our newsletter?”

“Have you attended one of our events?”

“Do you agree with our privacy policy?”

“Have you experienced any issues with our service?”

When to use yes/no questions: These survey questions are very helpful in market screening and filtering out certain people for targeted surveys. For example, asking “Have you used our product before?” helps you separate the people who have tried out your product, a.k.a. the people who qualify for your survey.

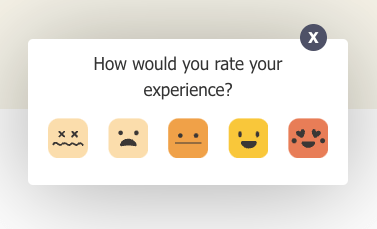

4. Rating Scale Questions

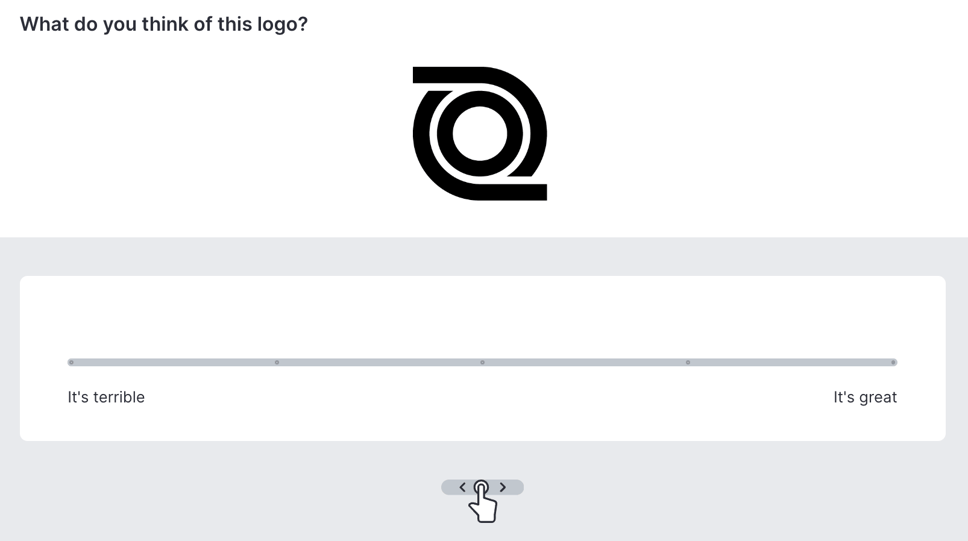

Rating scale questions ask respondents to rate their experience or satisfaction on a numerical scale.

“On a scale of 1-10, how would you rate our customer service?”

“How satisfied are you with the product quality? (1-5)”

“Rate your overall experience with our website. (1-5)”

“How likely are you to purchase again? (1-10)”

“On a scale of 1-10, how easy was it to find what you needed?”

“Rate the value for money of your purchase. (1-5)”

“How would you rate the speed of our service? (1-10)”

“Rate your satisfaction with our return policy. (1-5)”

“How comfortable was the product? (1-10)”

“Rate the accuracy of our product description. (1-5)”

When to use rating scale questions: As you can see from the survey question examples above, rating scale questions give you excellent quantitative data on customer satisfaction.

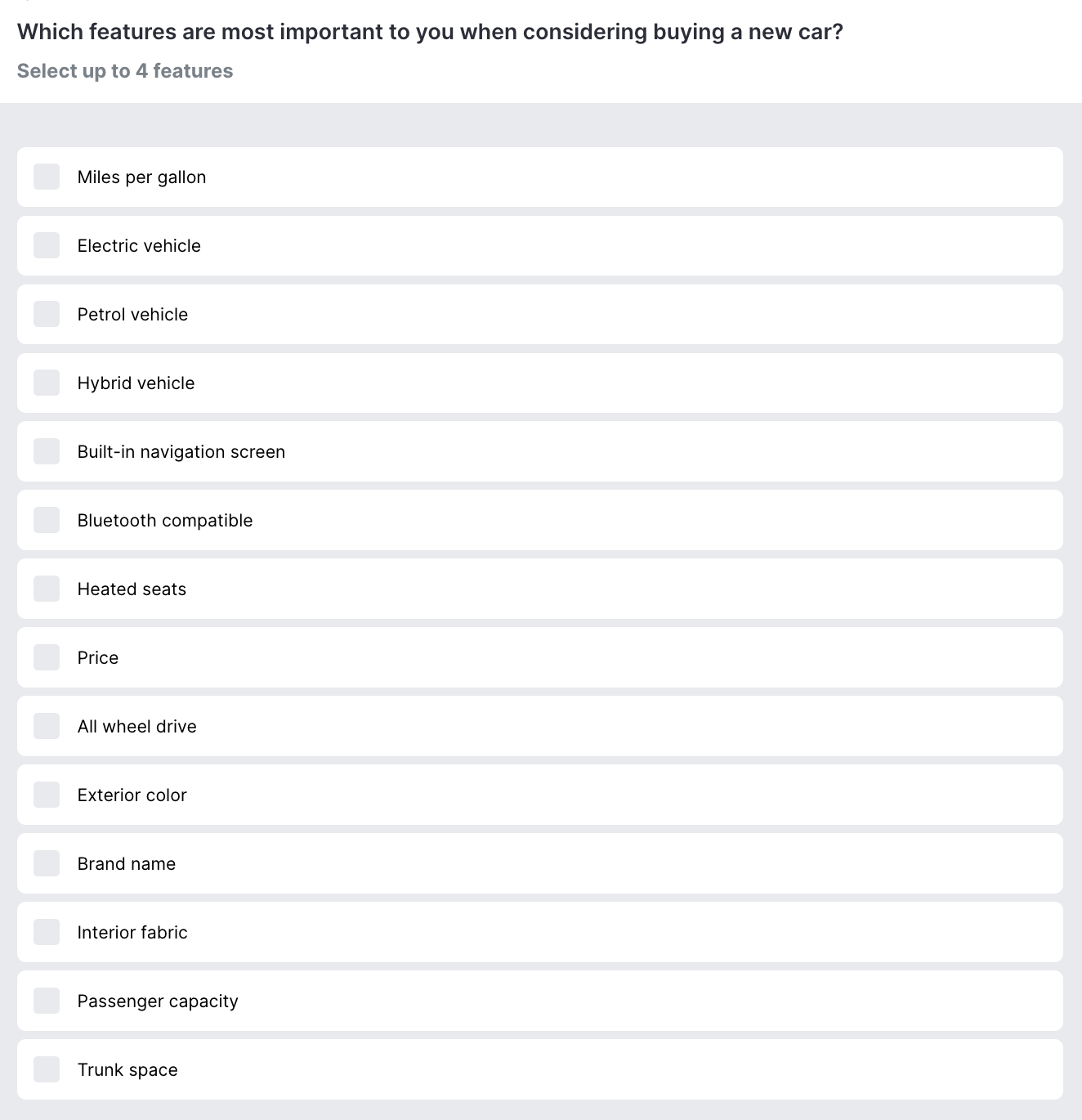

5. Checkbox Questions

Checkbox questions allow respondents to select multiple answers from a list. You can also include an “Others” option, where the respondent can answer in their own words.

“Which of the following features do you value the most? (Select all that apply)”

“What topics are you interested in? (Select all that apply)”

“Which days are you available? (Select all that apply)”

“Select the services you have used. (Select all that apply)”

“What types of notifications would you like to receive? (Select all that apply)”

“Which of the following devices do you own? (Select all that apply)”

“Select any dietary restrictions you have. (Select all that apply)”

“Which of the following brands have you heard of? (Select all that apply)”

“What languages do you speak? (Select all that apply)”

“Select the social media platforms you use regularly. (Select all that apply)”

When to use checkbox questions: Checkbox questions are an excellent tool for collecting psychographic data , including information about customers’ lifestyles, behaviors, attitudes, beliefs, etc. Moreover, survey responses will help you correlate certain characteristics to specific market segments.

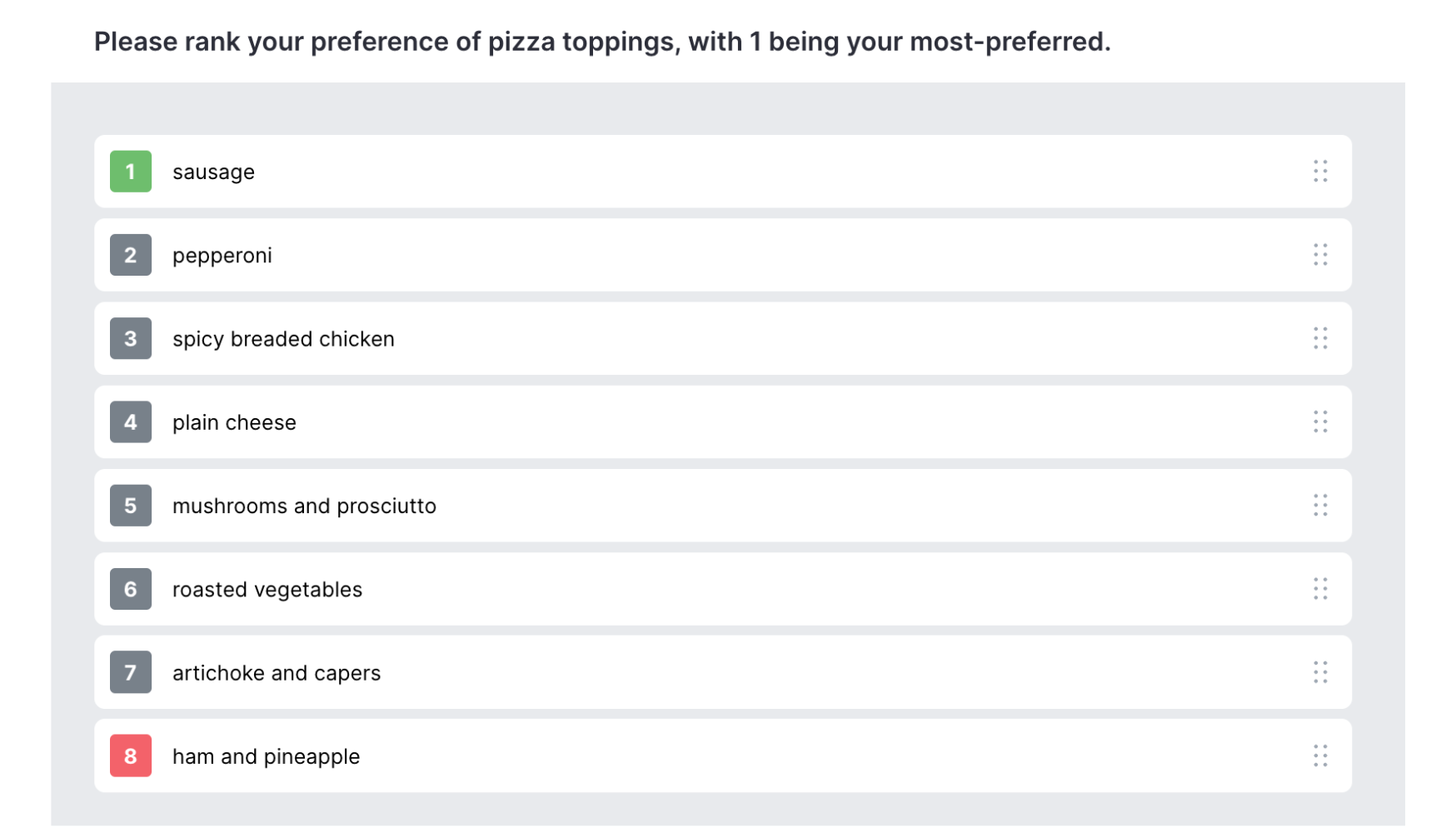

6. Rank Order Questions

Rank order questions ask respondents to prioritize options according to their preference or importance.

“Rank the following features in order of importance to you. (Highest to Lowest)”

“Please rank these product options based on your preference. (1 being the most preferred)”

“Rank these factors by how much they influence your purchase decision. (Most to Least)”

“Order these services by how frequently you use them. (Most frequent to Least frequent)”

“Rank these issues by how urgently you think they need to be addressed. (Most urgent to Least urgent)”

“Please prioritize these company values according to what matters most to you. (Top to Bottom)”

“Rank these potential improvements by how beneficial they would be for you. (Most beneficial to Least beneficial)”

“Order these content types by your interest level. (Most interested to Least interested)”

“Rank these brands by your preference. (Favorite to Least favorite)”

“Prioritize these activities by how enjoyable you find them. (Most enjoyable to Least enjoyable)”

When to use rank order questions: Respondents must already be familiar with your brand or products to answer these questions, which is why we recommend using these for customers in the middle or bottom of your conversion funnel .

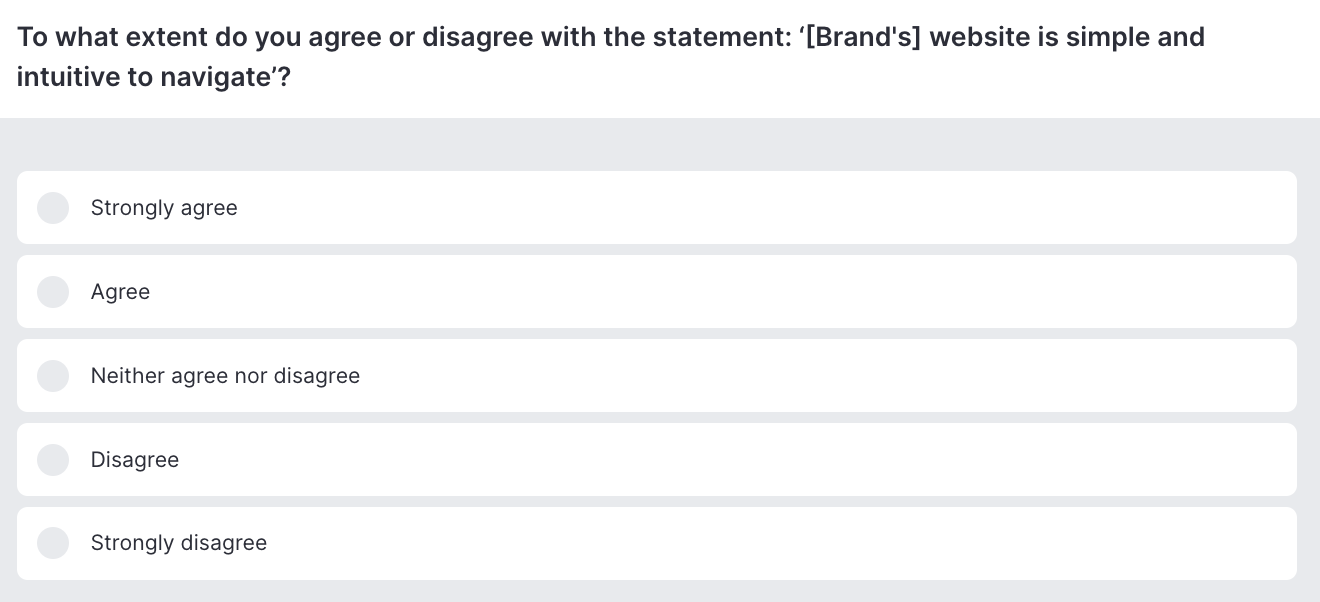

7. Likert Scale Questions

Likert scale questions measure the intensity of feelings towards a statement on a scale of agreement or satisfaction. Usually, these survey questions use a 5 to 7-point scale, ranging from “Strongly Agree” to “Strongly Disagree” or something similar.

- “I am satisfied with the quality of customer service. (Strongly Agree, Agree, Neutral, Disagree, Strongly Disagree)”

- “The product meets my needs. (Strongly Agree to Strongly Disagree)”

- “I find the website easy to navigate. (Strongly Agree to Strongly Disagree)”

- “I feel that the pricing is fair for the value I receive. (Strongly Agree to Strongly Disagree)”

- “I would recommend this product/service to others. (Strongly Agree to Strongly Disagree)”

- “I am likely to purchase from this company again. (Strongly Agree to Strongly Disagree)”

- “The company values customer feedback. (Strongly Agree to Strongly Disagree)”

- “I am confident in the security of my personal information. (Strongly Agree to Strongly Disagree)”

- “The product features meet my expectations. (Strongly Agree to Strongly Disagree)”

- “Customer service resolved my issue promptly. (Strongly Agree to Strongly Disagree)”

When to use Likert scale questions: You can use these survey question examples in different types of surveys, such as customer satisfaction (CSAT) surveys. Likert scale questions give you precise measurements of how satisfied respondents are with a specific aspect of your product or service.

8. Matrix Survey Questions

Matrix survey questions allow respondents to evaluate multiple items using the same set of response options. Many companies combine matrix survey questions with Likert scales to make the survey easier to do.

- “Please rate the following aspects of our service. (Customer support, Product quality, Delivery speed)”

- “Evaluate your level of satisfaction with these website features. (Search functionality, Content relevance, User interface)”

- “Rate the importance of the following factors in your purchasing decision. (Price, Brand, Reviews)”

- “Assess your agreement with these statements about our company. (Innovative, Ethical, Customer-focused)”

- “Rate your satisfaction with these aspects of our product. (Ease of use, Durability, Design)”

- “Evaluate these aspects of our mobile app. (Performance, Security, Features)”

- “Rate how well each of the following describes our brand. (Trustworthy, Innovative, Responsive)”

- “Assess your satisfaction with these elements of our service. (Responsiveness, Accuracy, Friendliness)”

- “Rate the effectiveness of these marketing channels for you. (Email, Social Media, Print Ads)”

- “Evaluate your agreement with these workplace policies. (Flexibility, Diversity, Wellness initiatives)”

When to use matrix survey questions: Ask matrix survey questions when you want to make your survey more convenient to answer, as they allow multiple questions on various topics without repeating options. This is particularly helpful when you want to cover many points of interest in one survey.

9. Demographic Questions

Lastly, demographic questions collect basic information about respondents, aiding in data segmentation and analysis.

- “What is your age?”

- “What is your gender? (Male, Female, Prefer not to say, Other)”

- “What is your highest level of education completed?”

- “What is your employment status? (Employed, Self-employed, Unemployed, Student)”

- “What is your household income range?”

- “What is your marital status? (Single, Married, Divorced, Widowed)”

- “How many people live in your household?”

- “What is your ethnicity?”

- “In which city and country do you currently reside?”

- “What is your occupation?”

When to use demographic questions: From the survey question examples, you can easily tell that these questions aim to collect information on your respondents’ backgrounds, which will be helpful in creating buyer personas and improving market segmentation.

Surveys can help you accomplish many things for your business, but only if you do it right. Creating the perfect survey isn’t just about crafting the best survey questions, you also have to:

1. Define Your Objectives

Before crafting your survey, be clear about what you want to achieve. Whether it’s understanding customer satisfaction, gauging interest in a new product, or collecting feedback on services, having specific objectives will guide your survey design and ensure you ask the right questions.

2. Know Your Audience

Understanding who your respondents are will help tailor the survey to their interests and needs, increasing the likelihood of participation. Consider demographics, behaviors, and preferences to make your survey relevant and engaging to your target audience.

3. Choose the Right Type of Survey Questions

Utilize a mix of the nine types of survey questions to gather a wide range of data. Balance open-ended questions for qualitative insights with closed-ended questions for easy-to-analyze quantitative data. Ensure each question aligns with your objectives and is clear and concise.

4. Keep It Short and Simple (KISS)

Respondents are more likely to complete shorter surveys. Aim for a survey that takes 5-10 minutes to complete, focusing on essential questions only. A straightforward and intuitive survey design encourages higher response rates.

5. Use Simple Language

Avoid technical jargon, complex words, or ambiguous terms. The language should be accessible to all respondents, ensuring that questions are understood as intended.

6. Ensure Anonymity and Confidentiality

Assure respondents that their answers are anonymous and their data will be kept confidential. This assurance can increase the honesty and accuracy of the responses you receive.

7. Test Your Survey

Pilot your survey with a small group before full deployment. This testing phase can help identify confusing questions, technical issues, or any other aspects of the survey that might hinder response quality or quantity.

8. Choose the Right Distribution Channels

Select the most effective channels to reach your target audience. This could be via email, social media, your website, or in-app notifications, depending on where your audience is most active and engaged.

9. Offer Incentives

Consider offering incentives to increase participation rates. Incentives can range from discounts, entry into a prize draw, or access to exclusive content. Ensure the incentive is relevant and appealing to your target audience.

10. Analyze and Act on the Data

After collecting the responses, analyze the data to extract meaningful insights. Use these insights to make informed decisions, implement changes, or develop strategies that align with your objectives. Sharing key findings and subsequent actions with respondents can also demonstrate the value of their feedback and encourage future participation.

11. Follow Up

Consider following up with respondents after the survey, especially if you promised to share results or if you’re conducting longitudinal studies. A follow-up can reinforce their importance to your research and maintain engagement over time.

12. Iterate and Improve

Surveys are not a one-time activity. Regularly conducting surveys and iterating based on previous feedback and results can help you stay aligned with your audience’s changing needs and preferences.

These survey question examples are a great place to start in creating efficient and effective surveys. Why not take it a step further by integrating a customer feedback tool on your website?

FullSession lets you collect instant visual feedback with an intuitive in-app survey. With this tool, you can:

- Build unique surveys

- Target feedback based on users’ devices or specific pages

- Measure survey responses

Aside from FullSession’s customer feedback tool, you also gain access to:

- Interactive heat maps: A website heat map shows you which items are gaining the most attention and which ones are not, helping you optimize UI and UX.

- Session recordings: Watch replays or live sessions to see how users are navigating your website and pinpoint areas for improvement.

- Funnels and conversions: Analyze funnel data to figure out what’s causing funnel drops and what contributes to successful conversions.

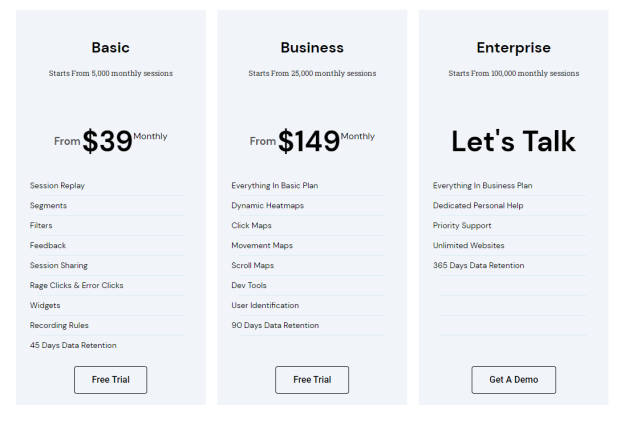

The FullSession platform offers a 14-day free trial. It provides two paid plans—Basic and Business. Here are more details on each plan.

- The Basic plan costs $39/month and allows you to monitor up to 5,000 monthly sessions.

- The Business plan costs $149/month and helps you to track and analyze up to 25,000 monthly sessions.

- The Enterprise plan starts from 100,000 monthly sessions and has custom pricing.

If you need more information, you can get a demo.

It takes less than 5 minutes to set up your first website or app survey form, with FullSession , and it’s completely free!

How many questions should I include in my survey?

Aim for 10-15 questions to keep surveys short and engaging, ideally taking 5-10 minutes to complete. Focus on questions that directly support your objectives.

How can I ensure my survey questions are not biased?

Use neutral language, avoid assumptions, balance answer choices, and pre-test your survey with a diverse group to identify and correct biases.

How do I increase my survey response rate?

To boost response rates, ensure your survey is concise and relevant to the audience. Use engaging questions, offer incentives where appropriate, and communicate the value of respondents’ feedback. Choose the right distribution channels to reach your target audience effectively.

Enhance Your Insights With Richer User Behavior Data

Discover FullSession's Digital Experience Intelligence solution firsthand. Explore FullSession for free

Learn / Blog / Article

Back to blog

Survey questions 101: 70+ survey question examples, types of surveys, and FAQs

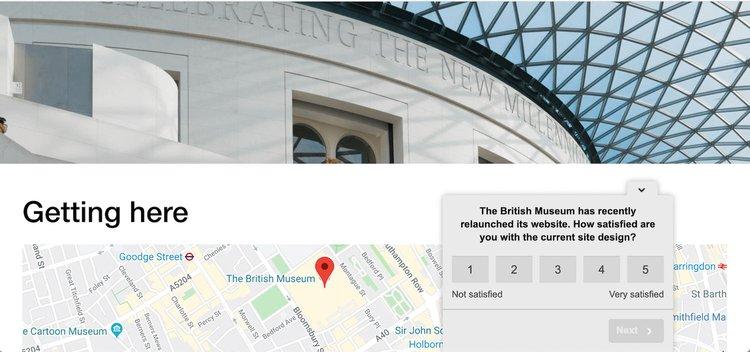

How well do you understand your prospects and customers—who they are, what keeps them awake at night, and what brought them to your business in search of a solution? Asking the right survey questions at the right point in their customer journey is the most effective way to put yourself in your customers’ shoes.

Last updated

Reading time.

This comprehensive intro to survey questions contains over 70 examples of effective questions, an overview of different types of survey questions, and advice on how to word them for maximum effect. Plus, we’ll toss in our pre-built survey templates, expert survey insights, and tips to make the most of AI for Surveys in Hotjar. ✨

Surveying your users is the simplest way to understand their pain points, needs, and motivations. But first, you need to know how to set up surveys that give you the answers you—and your business—truly need. Impactful surveys start here:

❓ The main types of survey questions : most survey questions are classified as open-ended, closed-ended, nominal, Likert scale, rating scale, and yes/no. The best surveys often use a combination of questions.

💡 70+ good survey question examples : our top 70+ survey questions, categorized across ecommerce, SaaS, and publishing, will help you find answers to your business’s most burning questions

✅ What makes a survey question ‘good’ : a good survey question is anything that helps you get clear insights and business-critical information about your customers

❌ The dos and don’ts of writing good survey questions : remember to be concise and polite, use the foot-in-door principle, alternate questions, and test your surveys. But don’t ask leading or loaded questions, overwhelm respondents with too many questions, or neglect other tools that can get you the answers you need.

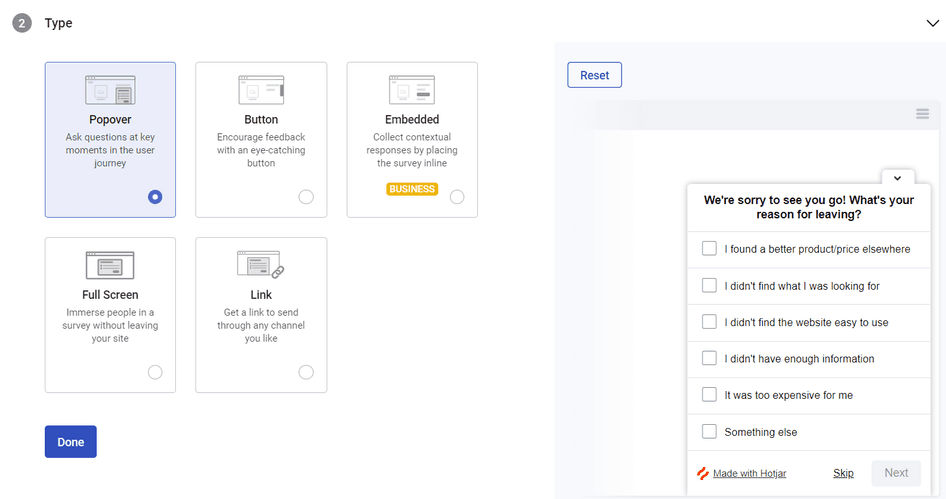

👍 How to run your surveys the right way : use a versatile survey tool like Hotjar Surveys that allows you to create on-site surveys at specific points in the customer journey or send surveys via a link

🛠️ 10 use cases for good survey questions : use your survey insights to create user personas, understand pain points, measure product-market fit, get valuable testimonials, measure customer satisfaction, and more

Use Hotjar to build your survey and get the customer insight you need to grow your business.

6 main types of survey questions

Let’s dive into our list of survey question examples, starting with a breakdown of the six main categories your questions will fall into:

Open-ended questions

Closed-ended questions

Nominal questions

Likert scale questions

Rating scale questions

'Yes' or 'no' questions

1. Open-ended survey questions

Open-ended questions give your respondents the freedom to answer in their own words , instead of limiting their response to a set of pre-selected choices (such as multiple-choice answers, yes/no answers, 0–10 ratings, etc.).

Examples of open-ended questions:

What other products would you like to see us offer?

If you could change just one thing about our product, what would it be?

When to use open-ended questions in a survey

The majority of example questions included in this post are open-ended, and there are some good reasons for that:

Open-ended questions help you learn about customer needs you didn’t know existed , and they shine a light on areas for improvement that you may not have considered before. If you limit your respondents’ answers, you risk cutting yourself off from key insights.

Open-ended questions are very useful when you first begin surveying your customers and collecting their feedback. If you don't yet have a good amount of insight, answers to open-ended questions will go a long way toward educating you about who your customers are and what they're looking for.

There are, however, a few downsides to open-ended questions:

First, people tend to be less likely to respond to open-ended questions in general because they take comparatively more effort to answer than, say, a yes/no one

Second, but connected: if you ask consecutive open-ended questions during your survey, people will get tired of answering them, and their answers might become less helpful the more you ask

Finally, the data you receive from open-ended questions will take longer to analyze compared to easy 1-5 or yes/no answers—but don’t let that stop you. There are plenty of shortcuts that make it easier than it looks (we explain it all in our post about how to analyze open-ended questions , which includes a free analysis template.)

💡 Pro tip: if you’re using Hotjar Surveys, let our AI for Surveys feature analyze your open-ended survey responses for you. Hotjar AI reviews all your survey responses and provides an automated summary report of key findings, including supporting quotes and actionable recommendations for next steps.

2. Closed-ended survey questions

Closed-end questions limit a user’s response options to a set of pre-selected choices. This broad category of questions includes

‘Yes’ or ‘no’ questions

When to use closed-ended questions

Closed-ended questions work brilliantly in two scenarios:

To open a survey, because they require little time and effort and are therefore easy for people to answer. This is called the foot-in-the-door principle: once someone commits to answering the first question, they may be more likely to answer the open-ended questions that follow.

When you need to create graphs and trends based on people’s answers. Responses to closed-ended questions are easy to measure and use as benchmarks. Rating scale questions, in particular (e.g. where people rate customer service or on a scale of 1-10), allow you to gather customer sentiment and compare your progress over time.

3. Nominal questions

A nominal question is a type of survey question that presents people with multiple answer choices; the answers are non-numerical in nature and don't overlap (unless you include an ‘all of the above’ option).

Example of nominal question:

What are you using [product name] for?

Personal use

Both business and personal use

When to use nominal questions

Nominal questions work well when there is a limited number of categories for a given question (see the example above). They’re easy to create graphs and trends from, but the downside is that you may not be offering enough categories for people to reply.

For example, if you ask people what type of browser they’re using and only give them three options to choose from, you may inadvertently alienate everybody who uses a fourth type and now can’t tell you about it.

That said, you can add an open-ended component to a nominal question with an expandable ’other’ category, where respondents can write in an answer that isn’t on the list. This way, you essentially ask an open-ended question that doesn’t limit them to the options you’ve picked.

4. Likert scale questions

The Likert scale is typically a 5- or 7-point scale that evaluates a respondent’s level of agreement with a statement or the intensity of their reaction toward something.

The scale develops symmetrically: the median number (e.g. a 3 on a 5-point scale) indicates a point of neutrality, the lowest number (always 1) indicates an extreme view, and the highest number (e.g. a 5 on a 5-point scale) indicates the opposite extreme view.

Example of a Likert scale question:

When to use Likert scale questions

Likert-type questions are also known as ordinal questions because the answers are presented in a specific order. Like other multiple-choice questions, Likert scale questions come in handy when you already have some sense of what your customers are thinking. For example, if your open-ended questions uncover a complaint about a recent change to your ordering process, you could use a Likert scale question to determine how the average user felt about the change.

A series of Likert scale questions can also be turned into a matrix question. Since they have identical response options, they are easily combined into a single matrix and break down the pattern of single questions for users.

5. Rating scale questions

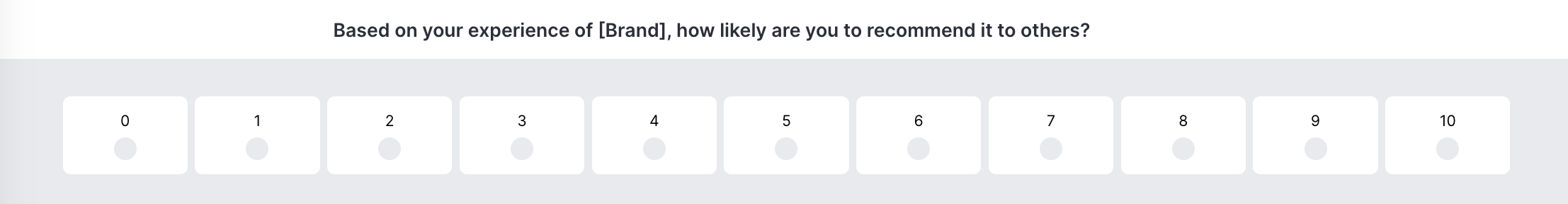

Rating scale questions are questions where the answers map onto a numeric scale (such as rating customer support on a scale of 1-5, or likelihood to recommend a product from 0-10).

Examples of rating questions:

How likely are you to recommend us to a friend or colleague on a scale of 0-10?

How would you rate our customer service on a scale of 1-5?

When to use rating questions

Whenever you want to assign a numerical value to your survey or visualize and compare trends , a rating question is the way to go.

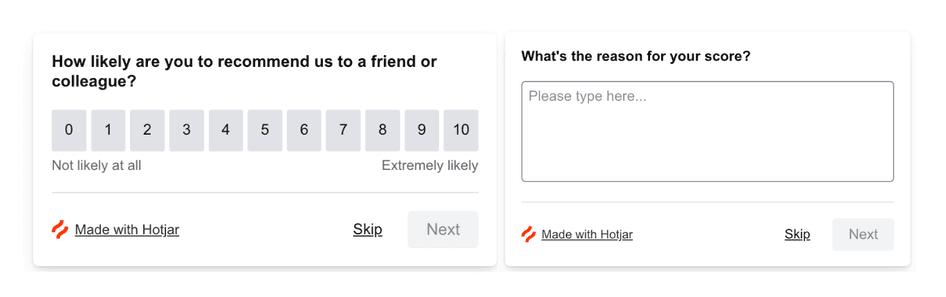

A typical rating question is used to determine Net Promoter Score® (NPS®) : the question asks customers to rate their likelihood of recommending products or services to their friends or colleagues, and allows you to look at the results historically and see if you're improving or getting worse. Rating questions are also used for customer satisfaction (CSAT) surveys and product reviews.

When you use a rating question in a survey, be sure to explain what the scale means (e.g. 1 for ‘Poor’, 5 for ‘Amazing’). And consider adding a follow-up open-ended question to understand why the user left that score.

Example of a rating question (NPS):

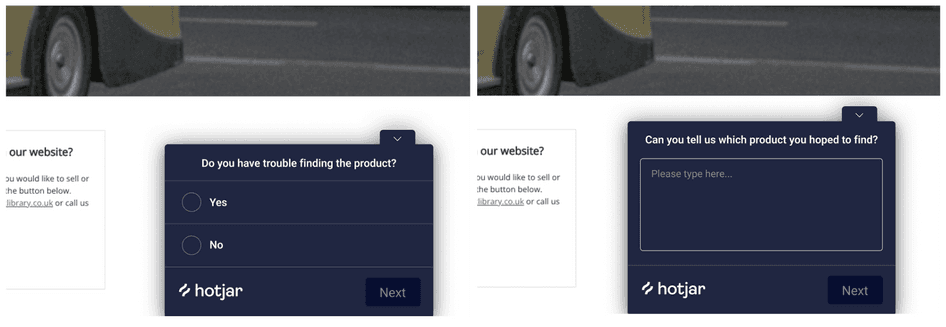

6. ‘Yes’ or ‘no’ questions

These dichotomous questions are super straightforward, requiring a simple ‘yes’ or ‘no’ reply.

Examples of yes/no questions:

Was this article useful? (Yes/No)

Did you find what you were looking for today? (Yes/No)

When to use ‘yes’ or ‘no’ questions

‘Yes’ and ‘no’ questions are a good way to quickly segment your respondents . For example, say you’re trying to understand what obstacles or objections prevent people from trying your product. You can place a survey on your pricing page asking people if something is stopping them, and follow up with the segment who replied ‘yes’ by asking them to elaborate further.

These questions are also effective for getting your foot in the door: a ‘yes’ or ‘no’ question requires very little effort to answer. Once a user commits to answering the first question, they tend to become more willing to answer the questions that follow, or even leave you their contact information.

70+ more survey question examples

Below is a list of good survey questions, categorized across ecommerce, software as a service (SaaS), and publishing. You don't have to use them word-for-word, but hopefully, this list will spark some extra-good ideas for the surveys you’ll run immediately after reading this article. (Plus, you can create all of them with Hotjar Surveys—stick with us a little longer to find out how. 😉)

📊 9 basic demographic survey questions

Ask these questions when you want context about your respondents and target audience, so you can segment them later. Consider including demographic information questions in your survey when conducting user or market research as well.

But don’t ask demographic questions just for the sake of it—if you're not going to use some of the data points from these sometimes sensitive questions (e.g. if gender is irrelevant to the result of your survey), move on to the ones that are truly useful for you, business-wise.

Take a look at the selection of examples below, and keep in mind that you can convert most of them to multiple choice questions:

What is your name?

What is your age?

What is your gender?

What company do you work for?

What vertical/industry best describes your company?

What best describes your role?

In which department do you work?

What is the total number of employees in your company (including all locations where your employer operates)?

What is your company's annual revenue?

🚀 Get started: gather more info about your users with our product-market fit survey template .

👥 20+ effective customer questions

These questions are particularly recommended for ecommerce companies:

Before purchase

What information is missing or would make your decision to buy easier?

What is your biggest fear or concern about purchasing this item?

Were you able to complete the purpose of your visit today?

If you did not make a purchase today, what stopped you?

After purchase

Was there anything about this checkout process we could improve?

What was your biggest fear or concern about purchasing from us?

What persuaded you to complete the purchase of the item(s) in your cart today?

If you could no longer use [product name], what’s the one thing you would miss the most?

What’s the one thing that nearly stopped you from buying from us?

👉 Check out our 7-step guide to setting up an ecommerce post-purchase survey .

Other useful customer questions

Do you have any questions before you complete your purchase?

What other information would you like to see on this page?

What were the three main things that persuaded you to create an account today?

What nearly stopped you from creating an account today?

Which other options did you consider before choosing [product name]?

What would persuade you to use us more often?

What was your biggest challenge, frustration, or problem in finding the right [product type] online?

Please list the top three things that persuaded you to use us rather than a competitor.

Were you able to find the information you were looking for?

How satisfied are you with our support?

How would you rate our service/support on a scale of 0-10? (0 = terrible, 10 = stellar)

How likely are you to recommend us to a friend or colleague? ( NPS question )

Is there anything preventing you from purchasing at this point?

🚀 Get started: learn how satisfied customers are with our expert-built customer satisfaction and NPS survey templates .

Set up a survey in seconds

Use Hotjar's free survey templates to build virtually any type of survey, and start gathering valuable insights in moments.

🛍 30+ product survey questions

These questions are particularly recommended for SaaS companies:

Questions for new or trial users

What nearly stopped you from signing up today?

How likely are you to recommend us to a friend or colleague on a scale of 0-10? (NPS question)

Is our pricing clear? If not, what would you change?

Questions for paying customers

What convinced you to pay for this service?

What’s the one thing we are missing in [product type]?

What's one feature we can add that would make our product indispensable for you?

If you could no longer use [name of product], what’s the one thing you would miss the most?

🚀 Get started: find out what your buyers really think with our pricing plan feedback survey template .

Questions for former/churned customers

What is the main reason you're canceling your account? Please be blunt and direct.

If you could have changed one thing in [product name], what would it have been?

If you had a magic wand and could change anything in [product name], what would it be?

🚀 Get started: find out why customers churn with our free-to-use churn analysis survey template .

Other useful product questions

What were the three main things that persuaded you to sign up today?

Do you have any questions before starting a free trial?

What persuaded you to start a trial?

Was this help section useful?

Was this article useful?

How would you rate our service/support on a scale of 1-10? (0 = terrible, 10 = stellar)

Is there anything preventing you from upgrading at this point?

Is there anything on this page that doesn't work the way you expected it to?

What could we change to make you want to continue using us?

If you did not upgrade today, what stopped you?

What's the next thing you think we should build?

How would you feel if we discontinued this feature?

What's the next feature or functionality we should build?

🚀 Get started: gather feedback on your product with our free-to-use product feedback survey template .

🖋 20+ effective questions for publishers and bloggers

Questions to help improve content.

If you could change just one thing in [publication name], what would it be?

What other content would you like to see us offer?

How would you rate this article on a scale of 1–10?

If you could change anything on this page, what would you have us do?

If you did not subscribe to [publication name] today, what was it that stopped you?

🚀 Get started: find ways to improve your website copy and messaging with our content feedback survey template .

New subscriptions

What convinced you to subscribe to [publication] today?

What almost stopped you from subscribing?

What were the three main things that persuaded you to join our list today?

Cancellations

What is the main reason you're unsubscribing? Please be specific.

Other useful content-related questions

What’s the one thing we are missing in [publication name]?

What would persuade you to visit us more often?

How likely are you to recommend us to someone with similar interests? (NPS question)

What’s missing on this page?

What topics would you like to see us write about next?

How useful was this article?

What could we do to make this page more useful?

Is there anything on this site that doesn't work the way you expected it to?

What's one thing we can add that would make [publication name] indispensable for you?

If you could no longer read [publication name], what’s the one thing you would miss the most?

💡 Pro tip: do you have a general survey goal in mind, but are struggling to pin down the right questions to ask? Give Hotjar’s AI for Surveys a go and watch as it generates a survey for you in seconds with questions tailored to the exact purpose of the survey you want to run.

What makes a good survey question?

We’ve run through more than 70 of our favorite survey questions—but what is it that makes a good survey question, well, good ? An effective question is anything that helps you get clear insights and business-critical information about your customers , including

Who your target market is

How you should price your products

What’s stopping people from buying from you

Why visitors leave your website

With this information, you can tailor your website, products, landing pages, and messaging to improve the user experience and, ultimately, maximize conversions .

How to write good survey questions: the DOs and DON’Ts

To help you understand the basics and avoid some rookie mistakes, we asked a few experts to give us their thoughts on what makes a good and effective survey question.

Survey question DOs

✅ do focus your questions on the customer.

It may be tempting to focus on your company or products, but it’s usually more effective to put the focus back on the customer. Get to know their needs, drivers, pain points, and barriers to purchase by asking about their experience. That’s what you’re after: you want to know what it’s like inside their heads and how they feel when they use your website and products.

Rather than asking, “Why did you buy our product?” ask, “What was happening in your life that led you to search for this solution?” Instead of asking, “What's the one feature you love about [product],” ask, “If our company were to close tomorrow, what would be the one thing you’d miss the most?” These types of surveys have helped me double and triple my clients.

✅ DO be polite and concise (without skimping on micro-copy)

Put time into your micro-copy—those tiny bits of written content that go into surveys. Explain why you’re asking the questions, and when people reach the end of the survey, remember to thank them for their time. After all, they’re giving you free labor!

✅ DO consider the foot-in-the-door principle

One way to increase your response rate is to ask an easy question upfront, such as a ‘yes’ or ‘no’ question, because once people commit to taking a survey—even just the first question—they’re more likely to finish it.

✅ DO consider asking your questions from the first-person perspective

Disclaimer: we don’t do this here at Hotjar. You’ll notice all our sample questions are listed in second-person (i.e. ‘you’ format), but it’s worth testing to determine which approach gives you better answers. Some experts prefer the first-person approach (i.e. ‘I’ format) because they believe it encourages users to talk about themselves—but only you can decide which approach works best for your business.

I strongly recommend that the questions be worded in the first person. This helps create a more visceral reaction from people and encourages them to tell stories from their actual experiences, rather than making up hypothetical scenarios. For example, here’s a similar question, asked two ways: “What do you think is the hardest thing about creating a UX portfolio?” versus “My biggest problem with creating my UX portfolio is…”

The second version helps get people thinking about their experiences. The best survey responses come from respondents who provide personal accounts of past events that give us specific and real insight into their lives.

✅ DO alternate your questions often

Shake up the questions you ask on a regular basis. Asking a wide variety of questions will help you and your team get a complete view of what your customers are thinking.

✅ DO test your surveys before sending them out

A few years ago, Hotjar created a survey we sent to 2,000 CX professionals via email. Before officially sending it out, we wanted to make sure the questions really worked.

We decided to test them out on internal staff and external people by sending out three rounds of test surveys to 100 respondents each time. Their feedback helped us perfect the questions and clear up any confusing language.

Survey question DON’Ts

❌ don’t ask closed-ended questions if you’ve never done research before.

If you’ve just begun asking questions, make them open-ended questions since you have no idea what your customers think about you at this stage. When you limit their answers, you just reinforce your own assumptions.

There are two exceptions to this rule:

Using a closed-ended question to get your foot in the door at the beginning of a survey

Using rating scale questions to gather customer sentiment (like an NPS survey)

❌ DON’T ask a lot of questions if you’re just getting started

Having to answer too many questions can overwhelm your users. Stick with the most important points and discard the rest.

Try starting off with a single question to see how your audience responds, then move on to two questions once you feel like you know what you’re doing.

How many questions should you ask? There’s really no perfect answer, but we recommend asking as few as you need to ask to get the information you want. In the beginning, focus on the big things:

Who are your users?

What do potential customers want?

How are they using your product?

What would win their loyalty?

❌ DON’T just ask a question when you can combine it with other tools

Don’t just use surveys to answer questions that other tools (such as analytics) can also answer. If you want to learn about whether people find a new website feature helpful, you can also observe how they’re using it through traditional analytics, session recordings , and other user testing tools for a more complete picture.

Don’t use surveys to ask people questions that other tools are better equipped to answer. I’m thinking of questions like “What do you think of the search feature?” with pre-set answer options like ‘Very easy to use,’ ‘Easy to use,’ etc. That’s not a good question to ask.

Why should you care about what people ‘think’ about the search feature? You should find out whether it helps people find what they need and whether it helps drive conversions for you. Analytics, user session recordings, and user testing can tell you whether it does that or not.

❌ DON’T ask leading questions

A leading question is one that prompts a specific answer. Avoid asking leading questions because they’ll give you bad data. For example, asking, “What makes our product better than our competitors’ products?” might boost your self-esteem, but it won’t get you good information. Why? You’re effectively planting the idea that your own product is the best on the market.

❌ DON’T ask loaded questions

A loaded question is similar to a leading question, but it does more than just push a bias—it phrases the question such that it’s impossible to answer without confirming an underlying assumption.

A common (and subtle) form of loaded survey question would be, “What do you find useful about this article?” If we haven’t first asked you whether you found the article useful at all, then we’re asking a loaded question.

❌ DON’T ask about more than one topic at once

For example, “Do you believe our product can help you increase sales and improve cross-collaboration?”

This complex question, also known as a ‘double-barreled question’, requires a very complex answer as it begs the respondent to address two separate questions at once:

Do you believe our product can help you increase sales?

Do you believe our product can help you improve cross-collaboration?

Respondents may very well answer 'yes', but actually mean it for the first part of the question, and not the other. The result? Your survey data is inaccurate, and you’ve missed out on actionable insights.

Instead, ask two specific questions to gather customer feedback on each concept.

How to run your surveys

The format you pick for your survey depends on what you want to achieve and also on how much budget or resources you have. You can

Use an on-site survey tool , like Hotjar Surveys , to set up a website survey that pops up whenever people visit a specific page: this is useful when you want to investigate website- and product-specific topics quickly. This format is relatively inexpensive—with Hotjar’s free forever plan, you can even run up to 3 surveys with unlimited questions for free.

Use Hotjar Surveys to embed a survey as an element directly on a page: this is useful when you want to grab your audience’s attention and connect with customers at relevant moments, without interrupting their browsing. (Scroll to the bottom of this page to see an embedded survey in action!) This format is included on Hotjar’s Business and Scale plans—try it out for 15 days with a free Ask Business trial .

Use a survey builder and create a survey people can access in their own time: this is useful when you want to reach out to your mailing list or a wider audience with an email survey (you just need to share the URL the survey lives at). Sending in-depth questionnaires this way allows for more space for people to elaborate on their answers. This format is also relatively inexpensive, depending on the tool you use.

Place survey kiosks in a physical location where people can give their feedback by pressing a button: this is useful for quick feedback on specific aspects of a customer's experience (there’s usually plenty of these in airports and waiting rooms). This format is relatively expensive to maintain due to the material upkeep.

Run in-person surveys with your existing or prospective customers: in-person questionnaires help you dig deep into your interviewees’ answers. This format is relatively cheap if you do it online with a user interview tool or over the phone, but it’s more expensive and time-consuming if done in a physical location.

💡 Pro tip: looking for an easy, cost-efficient way to connect with your users? Run effortless, automated user interviews with Engage , Hotjar’s user interview tool. Get instant access to a pool of 200,000+ participants (or invite your own), and take notes while Engage records and transcribes your interview.

10 survey use cases: what you can do with good survey questions

Effective survey questions can help improve your business in many different ways. We’ve written in detail about most of these ideas in other blog posts, so we’ve rounded them up for you below.

1. Create user personas

A user persona is a character based on the people who currently use your website or product. A persona combines psychographics and demographics and reflects who they are, what they need, and what may stop them from getting it.

Examples of questions to ask:

Describe yourself in one sentence, e.g. “I am a 30-year-old marketer based in Dublin who enjoys writing articles about user personas.”

What is your main goal for using this website/product?

What, if anything, is preventing you from doing it?

👉 Our post about creating simple and effective user personas in four steps highlights some great survey questions to ask when creating a user persona.

🚀 Get started: use our user persona survey template or AI for Surveys to inform your user persona.

2. Understand why your product is not selling

Few things are more frightening than stagnant sales. When the pressure is mounting, you’ve got to get to the bottom of it, and good survey questions can help you do just that.

What made you buy the product? What challenges are you trying to solve?

What did you like most about the product? What did you dislike the most?

What nearly stopped you from buying?

👉 Here’s a detailed piece about the best survey questions to ask your customers when your product isn’t selling , and why they work so well.

🚀 Get started: our product feedback survey template helps you find out whether your product satisfies your users. Or build your surveys in the blink of an eye with Hotjar AI.

3. Understand why people leave your website

If you want to figure out why people are leaving your website , you’ll have to ask questions.

A good format for that is an exit-intent pop-up survey, which appears when a user clicks to leave the page, giving them the chance to leave website feedback before they go.

Another way is to focus on the people who did convert, but just barely—something Hotjar founder David Darmanin considers essential for taking conversions to the next level. By focusing on customers who bought your product (but almost didn’t), you can learn how to win over another set of users who are similar to them: those who almost bought your products, but backed out in the end.

Example of questions to ask:

Not for you? Tell us why. ( Exit-intent pop-up —ask this when a user leaves without buying.)

What almost stopped you from buying? (Ask this post-conversion .)

👉 Find out how HubSpot Academy increased its conversion rate by adding an exit-intent survey that asked one simple question when users left their website: “Not for you? Tell us why.”

🚀 Get started: place an exit-intent survey on your site. Let Hotjar AI draft the survey questions by telling it what you want to learn.

I spent the better half of my career focusing on the 95% who don’t convert, but it’s better to focus on the 5% who do. Get to know them really well, deliver value to them, and really wow them. That’s how you’re going to take that 5% to 10%.

4. Understand your customers’ fears and concerns

Buying a new product can be scary: nobody wants to make a bad purchase. Your job is to address your prospective customers’ concerns, counter their objections, and calm their fears, which should lead to more conversions.

👉 Take a look at our no-nonsense guide to increasing conversions for a comprehensive write-up about discovering the drivers, barriers, and hooks that lead people to converting on your website.

🚀 Get started: understand why your users are tempted to leave and discover potential barriers with a customer retention survey .

5. Drive your pricing strategy

Are your products overpriced and scaring away potential buyers? Or are you underpricing and leaving money on the table?

Asking the right questions will help you develop a pricing structure that maximizes profit, but you have to be delicate about how you ask. Don’t ask directly about price, or you’ll seem unsure of the value you offer. Instead, ask questions that uncover how your products serve your customers and what would inspire them to buy more.

How do you use our product/service?

What would persuade you to use our product more often?

What’s the one thing our product is missing?

👉 We wrote a series of blog posts about managing the early stage of a SaaS startup, which included a post about developing the right pricing strategy —something businesses in all sectors could benefit from.

🚀 Get started: find the sweet spot in how to price your product or service with a Van Westendorp price sensitivity survey or get feedback on your pricing plan .

6. Measure and understand product-market fit

Product-market fit (PMF) is about understanding demand and creating a product that your customers want, need, and will actually pay money for. A combination of online survey questions and one-on-one interviews can help you figure this out.

What's one thing we can add that would make [product name] indispensable for you?

If you could change just one thing in [product name], what would it be?

👉 In our series of blog posts about managing the early stage of a SaaS startup, we covered a section on product-market fit , which has relevant information for all industries.

🚀 Get started: discover if you’re delivering the best products to your market with our product-market fit survey .

7. Choose effective testimonials

Human beings are social creatures—we’re influenced by people who are similar to us. Testimonials that explain how your product solved a problem for someone are the ultimate form of social proof. The following survey questions can help you get some great testimonials.

What changed for you after you got our product?

How does our product help you get your job done?

How would you feel if you couldn’t use our product anymore?

👉 In our post about positioning and branding your products , we cover the type of questions that help you get effective testimonials.

🚀 Get started: add a question asking respondents whether you can use their answers as testimonials in your surveys, or conduct user interviews to gather quotes from your users.

8. Measure customer satisfaction

It’s important to continually track your overall customer satisfaction so you can address any issues before they start to impact your brand’s reputation. You can do this with rating scale questions.

For example, at Hotjar, we ask for feedback after each customer support interaction (which is one important measure of customer satisfaction). We begin with a simple, foot-in-the-door question to encourage a response, and use the information to improve our customer support, which is strongly tied to overall customer satisfaction.

How would you rate the support you received? (1-5 scale)

If 1-3: How could we improve?

If 4-5: What did you love about the experience?

👉 Our beginner’s guide to website feedback goes into great detail about how to measure customer service, NPS , and other important success metrics.

🚀 Get started: gauge short-term satisfaction level with a CSAT survey .

9. Measure word-of-mouth recommendations

Net Promoter Score is a measure of how likely your customers are to recommend your products or services to their friends or colleagues. NPS is a higher bar than customer satisfaction because customers have to be really impressed with your product to recommend you.

Example of NPS questions (to be asked in the same survey):

How likely are you to recommend this company to a friend or colleague? (0-10 scale)

What’s the main reason for your score?

What should we do to WOW you?

👉 We created an NPS guide with ecommerce companies in mind, but it has plenty of information that will help companies in other industries as well.

🚀 Get started: measure whether your users would refer you to a friend or colleague with an NPS survey . Then, use our free NPS calculator to crunch the numbers.

10. Redefine your messaging

How effective is your messaging? Does it speak to your clients' needs, drives, and fears? Does it speak to your strongest selling points?

Asking the right survey questions can help you figure out what marketing messages work best, so you can double down on them.

What attracted you to [brand or product name]?

Did you have any concerns before buying [product name]?

Since you purchased [product name], what has been the biggest benefit to you?

If you could describe [brand or product name] in one sentence, what would you say?

What is your favorite thing about [brand or product name]?

How likely are you to recommend this product to a friend or colleague? (NPS question)

👉 We talk about positioning and branding your products in a post that’s part of a series written for SaaS startups, but even if you’re not in SaaS (or you’re not a startup), you’ll still find it helpful.

Have a question for your customers? Ask!

Feedback is at the heart of deeper empathy for your customers and a more holistic understanding of their behaviors and motivations. And luckily, people are more than ready to share their thoughts about your business— they're just waiting for you to ask them. Deeper customer insights start right here, with a simple tool like Hotjar Surveys.

Build surveys faster with AI🔥

Use AI in Hotjar Surveys to build your survey, place it on your website or send it via email, and get the customer insight you need to grow your business.

FAQs about survey questions

How many people should i survey/what should my sample size be.

A good rule of thumb is to aim for at least 100 replies that you can work with.

You can use our sample size calculator to get a more precise answer, but understand that collecting feedback is research, not experimentation. Unlike experimentation (such as A/B testing ), all is not lost if you can’t get a statistically significant sample size. In fact, as little as ten replies can give you actionable information about what your users want.

How many questions should my survey have?

There’s no perfect answer to this question, but we recommend asking as few as you need to ask in order to get the information you want. Remember, you’re essentially asking someone to work for free, so be respectful of their time.

Why is it important to ask good survey questions?

A good survey question is asked in a precise way at the right stage in the customer journey to give you insight into your customers’ needs and drives. The qualitative data you get from survey responses can supplement the insight you can capture through other traditional analytics tools (think Google Analytics) and behavior analytics tools (think heatmaps and session recordings , which visualize user behavior on specific pages or across an entire website).

The format you choose for your survey—in-person, email, on-page, etc.—is important, but if the questions themselves are poorly worded you could waste hours trying to fix minimal problems while ignoring major ones a different question could have uncovered.

How do I analyze open-ended survey questions?

A big pile of qualitative data can seem intimidating, but there are some shortcuts that make it much easier to analyze. We put together a guide for analyzing open-ended questions in 5 simple steps , which should answer all your questions.

But the fastest way to analyze open questions is to use the automated summary report with Hotjar AI in Surveys . AI turns the complex survey data into:

Key findings

Actionable insights

Will sending a survey annoy my customers?

Honestly, the real danger is not collecting feedback. Without knowing what users think about your page and why they do what they do, you’ll never create a user experience that maximizes conversions. The truth is, you’re probably already doing something that bugs them more than any survey or feedback button would.

If you’re worried that adding an on-page survey might hurt your conversion rate, start small and survey just 10% of your visitors. You can stop surveying once you have enough replies.

Related articles

User research

5 tips to recruit user research participants that represent the real world

Whether you’re running focus groups for your pricing strategy or conducting usability testing for a new product, user interviews are one of the most effective research methods to get the needle-moving insights you need. But to discover meaningful data that helps you reach your goals, you need to connect with high-quality participants. This article shares five tips to help you optimize your recruiting efforts and find the right people for any type of research study.

Hotjar team

How to instantly transcribe user interviews—and swiftly unlock actionable insights

After the thrill of a successful user interview, the chore of transcribing dialogue can feel like the ultimate anticlimax. Putting spoken words in writing takes several precious hours—time better invested in sharing your findings with your team or boss.

But the fact remains: you need a clear and accurate user interview transcript to analyze and report data effectively. Enter automatic transcription. This process instantly transcribes recorded dialogue in real time without human help. It ensures data integrity (and preserves your sanity), enabling you to unlock valuable insights in your research.

Shadz Loresco

An 8-step guide to conducting empathetic (and insightful) customer interviews

Customer interviews uncover your ideal users’ challenges and needs in their own words, providing in-depth customer experience insights that inform product development, new features, and decision-making. But to get the most out of your interviews, you need to approach them with empathy. This article explains how to conduct accessible, inclusive, and—above all—insightful interviews to create a smooth (and enjoyable!) process for you and your participants.

- Make a Survey

Opinion Stage » survey » Survey Questions

16 Types of Survey Questions, with 100 Examples

Good survey questions will help your business acquire the right information to drive growth. Surveys can be made up of different types of questions. Each type has a unique approach to gathering data. The questions you choose and the way you use them in your survey will affect its results.

These are the types of survey questions we will cover:

- Open-Ended Questions

- Closed-Ended Questions

- Multiple Choice Questions

- Dichotomous Questions

- Rating Scale Questions

- Likert Scale Questions

- Nominal Questions

- Demographic Questions

- Matrix Table Questions

- Side-by-Side Matrix Questions

- Data Reference Questions

- Choice Model Questions

- Net Promoter Score Questions

- Picture Choice Questions

- Image Rating Questions

- Visual Analog Scale Questions

But before we go into the actual question types, let’s talk a little about how you should use them.

Try this survey

Ready to create your own? Make a survey .

How to Use Survey Questions in Market Research

First, you need to make sure it’s a survey you’re after. In some cases, you may find that it’s actually a questionnaire that you need (read more here to learn the difference: Survey Vs. Questionnaire ), or a research quiz. In any case, though, you will need to use the right type of questions.

To determine the right type of questions for your survey, consider these factors:

- The kind of data you want to gather

- The depth of the information you require

- How long it takes to answer the survey

Regardless of the size of your business, you can use surveys to learn about potential customers, research your product market fit, collect customer feedback or employee feedback, get new registrations, and improve retention.

Surveys can help you gather valuable insights into critical aspects of your business. From brand awareness to customer satisfaction, effective surveys give you the data you need to stay ahead of the competition.

So, how should you use surveys for your market research?

Try this market research survey

Ready to create your own? Make a research survey .

Identify Customer Needs and Expectations

Perhaps the idea of using customer surveys in this advanced era of data analytics seems quaint. But one of the best ways to find out what consumers need and expect is to go directly to the source and ask. That’s why surveys still matter. All companies and online businesses can benefit from using market research surveys to determine the needs of their clients.

Determine Brand Attributes

A market research survey can also help your company identify the attributes that consumers associate with your brand. These could be tangible or intangible features that they think of when they see your brand. By determining your brand attributes, you can identify other brands in the same niche. Additionally, you can gain a clear understanding of what your audience values.

Understand Your Market’s Supply and Demand Chain

Surveying existing and potential customers enables you to understand the language of supply and demand. You can understand the measure of customer satisfaction and identify opportunities for the market to absorb new products. At the same time, you can use the data you collect to build customer-centric products or services. By understanding your target market, you can minimize the risks involved in important business ventures and develop an amazing customer experience.

Acquire Customer Demographic Information

Before any campaign or product launch, every company needs to determine its key demographic. Online surveys make it so much easier for marketers to get to know their audience and build effective user personas. With a market research survey, you can ask demographic survey questions to collect details such as family income, education, professional background, and ethnicity. It’s important to be careful and considerate in this area since questions that seem matter-of-fact to you may be experienced as loaded questions or sensitive questions by your audience.

Strategize for New Product Launches

Businesses of all sizes can use customer surveys to fine-tune products and improve services. Let’s say there’s a product you want to launch. But you’re hesitant to do so without ensuring that it will be well-received by your target audience. Why not send out a survey? With the data you gather from the survey responses, you can identify issues that may have been overlooked in the development process and make the necessary changes to improve your product’s success.

Develop a Strategic Marketing Plan

Surveys can be used in the initial phases of a campaign to help shape your marketing plan. Thanks to in-depth analytics, a quick and easy survey that respondents can finish within minutes can give you a clear idea of what potential consumers need and expect.

Create beautiful online surveys in minutes

Types of Survey Questions

No matter the purpose of your survey, the questions you ask will be crucial to its success. For this reason, it’s best to set the goal of your survey and define the information you want to gather before writing the questions.

Ask yourself: What do I want to know? Why do I want to know this? Can direct questions help me get the information I need? How am I going to use the data I gather?

Once you have a clear goal in mind, you can choose the best questions to elicit the right kind of information. We’ve made a list of the most common types of survey questions to help you get started.

1. Open-Ended Questions

If you prefer to gather qualitative insights from your respondents, the best way to do so is through an open-ended question. That’s because this survey question type gives respondents more opportunity to say what’s on their minds. After all, an open question doesn’t come with pre-set answer choices that respondents can select. Instead, it uses a text box where respondents can leave more detailed responses.

Ideally, you should ask such questions when you’re doing expert interviews or preliminary research. You may also opt to end surveys with this type of question. This is to give respondents a chance to share additional concerns with you. By letting respondents give answers in their own words, even to a single question, you can identify opportunities you might have overlooked. At the same time, it shows that you appreciate their effort to answer all your questions.

Since quantifying written answers isn’t easy to do, opt to use these questions sparingly, especially if you’re dealing with a large population.

Examples of open-ended questions:

- What can you tell us about yourself? (Your age, gender, hobbies, interests, and anything else you’re willing to share)

- How satisfied or dissatisfied are you with our service?

- What has kept you from signing up for our newsletter?

2. Closed-Ended Questions

Consumers want surveys they can answer in a jiffy. Closed-ended questions are ideal for market research for that reason. They come with a limited number of options, often one-word responses such as yes or no, multiple-choice, or a rating scale. Compared to open-ended questions, these drive limited insights because respondents only have to choose from pre-selected choices.

Ask closed-ended questions if you need to gather quantifiable data or to categorize your respondents. Furthermore, you can use such questions to drive higher response rates. Let’s say your audience isn’t particularly interested in the topic you intend to ask them about. You can use closed-ended questions to make it easier for them to complete the survey in minutes.

Close-ended question examples:

- Which of the following are you most likely to read? (a) a series of blog posts (b) a novel (c) the daily news (d) I don’t read on a regular basis

- How would you rate our service on a 5-point scale, with 1 representing bad service, and 5 representing great service?

- How likely are you to recommend us on a scale of 0 to 10?

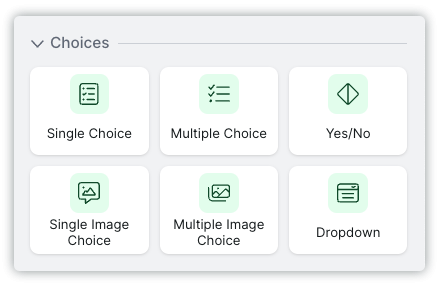

3. Multiple Choice Questions

Multiple-choice questions are a basic type of closed-ended survey question that give respondents multiple answers to choose from. These questions can be broken down into two main categories:

- Single-answer questions – respondents are directed to choose one, and only one answer from a list of answer options.

- Multiple answer questions – where respondents can select a number of answers in a single question.

When designed correctly they can be very effective survey questions since they’re relatively simple questions to answer, and the data is easy to analyze.

Multiple-choice sample questions:

- It’s exceptional

- Could be better

- It’s terrible

- Whole-grain rice

- Gluten-free noodles

- Suger-free soft drinks

- Lactose-free ice cream

Try this product survey

Ready to create your own? Make a product survey .

4. Dichotomous Questions

Dichotomous questions are a type of close-ended questions with only two answer options that represent the opposite of each other. In other words, yes/no questions, or true/false questions. They’re often used as screening questions to identify potential customers since they’re so quick and easy to answer and require no extra effort.

They’re also good for splitting your audience into two groups, enabling you to direct each group to a different series of questions. This can be done quite easily using skip logic which sends people on different survey paths based on their answers to previous questions.

Examples of questions:

Do you have experience working with Google Analytics? Yes/no Google Analytics is used for tracking user behavior. True/false Google Analytics has a steep learning curve for the average user. Agree/disagree

5. Rating Scale Questions

Also called ordinal questions, these questions help researchers measure customer sentiment in a quantitative way. This type of question comes with a range of response options. It could be from 1 to 5 or 1 to 10.

In a survey, a respondent selects the number that accurately represents their response. Of course, you have to establish the value of the numbers on your scale for it to be effective.

Rating scales can be very effective survey questions, however, the lack of proper survey scaling could lead to bad survey questions that respondents Don’t know how to answer. And even if they think you do, the results won’t be reliable because every respondent could interpret the scale differently. So, it’s important to be clear.

If you want to know how respondents experienced your customer service, you can establish a scale from 1 to 10 to measure customer sentiment. Then, assign the value of 1 and 10. The lowest number on the scale could, for instance, mean “very disappointed” while the highest value could represent “very satisfied”.

Examples of rating scale questions:

- On a scale of 0 to 10, how would you rate your last customer support interaction with us? (0=terrible, 10=amazing)

- How likely are you to recommend our company to a friend or colleague on a scale of 1 to 5? 1=very unlikely, 5=very likely

- How would you rate your shopping experience at our online business on a scale of 1 to 7? 1=bad, 4=ok, 7=amazing

6. Likert Scale Questions

These questions can either be unipolar or bipolar. Unipolar scales center on the presence or absence of quality. Moreover, they don’t have a natural midpoint. For example, a unipolar satisfaction scale may have the following options: extremely satisfied, very satisfied, moderately satisfied, slightly satisfied, and not satisfied.

Bipolar scales, on the other hand, are based on either side of neutrality. That means they have a midpoint. A common bipolar scale, for instance, may have the following options: extremely unsatisfied, very unsatisfied, somewhat unsatisfied, neither satisfied nor dissatisfied, somewhat satisfied, very satisfied, or extremely satisfied.

Likert scale questions can be used for a wide variety of objectives. They are great for collecting initial feedback. They can also help you gauge customer sentiment, among other things.

Likert scale sample questions:

- How important is it that you can access customer support 24/7? (Choices: Very Important, Important, Neutral, Low Importance, and Not Important At All)

- How satisfied are you after using our products? (Choices: Very Satisfied, Moderately Satisfied, Neutral, Slightly Unsatisfied, and Very Unsatisfied)

- How would you rate our customer care representative’s knowledge of our products? (Choices: Not at All Satisfactory, Low Satisfactory, Somewhat Satisfactory, Satisfactory, and Very Satisfactory)

Try this Likert scale survey

Ready to create your own? Make a Likert scale survey .

7. Nominal Questions

Also a type of measurement scale, nominal questions come with tags or labels for identifying or classifying items. For these questions, you can use non-numeric variables. You can also assign numbers to each response option, but they won’t actually have value.