Visit DesignFiles

Interior Design Business Plans: The Ultimate Guide

As an interior designer, you already understand the importance of creating plans. Design plans, project plans, floor plans—they’re the foundation upon which your creative vision takes shape. But did you know that creating a business plan is also a pivotal step in building a successful design firm?

An interior design business plan documents your vision, goals, strategy, and blueprint for growing your business. Think of your interior design business plan as a roadmap, guiding you forward, step by step.

In this post, I’ll dive into exactly why interior design business plans are critical for the growth of your firm, and how you can create one that sets you up for success.

Table of Contents

Why do you need a business plan as a designer?

You might be asking yourself this question, wondering if it’s really worth the effort. The answer is a resounding yes. It’s not enough to be an excellent designer. You also need to know how to run a business. And trying to run a business without a plan is sort of like driving to an unfamiliar destination without a map or GPS. You might have a general sense of where you’re headed, but without precise directions and landmarks to guide you, the journey becomes fraught with uncertainty and unnecessary detours.

By creating a business plan, you can hopefully avoid those detours and move forward with conviction and purpose.

A well-crafted business plan, which documents the goals of your business and strategies and timelines for attaining those goals, will provide you with the scaffolding necessary to build the design firm of your dreams. It will also help keep you accountable. By regularly referencing back to your business plan, you can quickly get a snapshot of your progress and what still needs to be done.

A business plan is also a great way to stay aligned with present and/or future team members, ensuring everyone is on the same page and headed in the same direction. And if you decide to seek investors at any point, having a business plan on-hand will be incredibly useful.

How to write an interior design business plan? (11 steps)

Crafting an interior design business plan requires thorough research, strategic thinking, and a clear understanding of your objectives. Here are the essential steps to help you create a comprehensive and actionable plan for your design firm:

1. Define your vision and goals

Start by digging deep and articulating your long-term vision for your interior design business. Establish specific, measurable goals that align with your vision, including financial objectives, timelines, and growth milestones. This process involves envisioning where you see your business in the next 5-10 years and setting tangible targets that reflect both your aspirations and the realities of the market.

Check out our workshop on getting paid what you’re worth with Gail Doby to help you unleash your business vision and goals.

2. Identify your target market

If you haven’t already done so, now is the time to conduct a detailed analysis of your target market—their needs, preferences, and demographics—and get it down on paper. This information will help you tailor your services and messaging to consistently meet the needs of your ideal client, and serve as a North Star, which you can keep referring back to in the future. Understanding your target market is crucial for effective marketing, service development, and client acquisition strategies.

Grab our detailed guide on getting crystal clear on your ideal target client .

3. Outline your services

When defining the range of services your interior design business will offer, you must consider the preferences and requirements of your target market, your own bandwidth, and your financial goals. Once you’ve landed on the services you plan to offer, provide detailed descriptions and breakdowns of each. You also want to ensure that you’ve created a pricing strategy for each service that reflects both the value you provide and the market demand.

Get our ultimate pricing guide to help set accurate prices for your services .

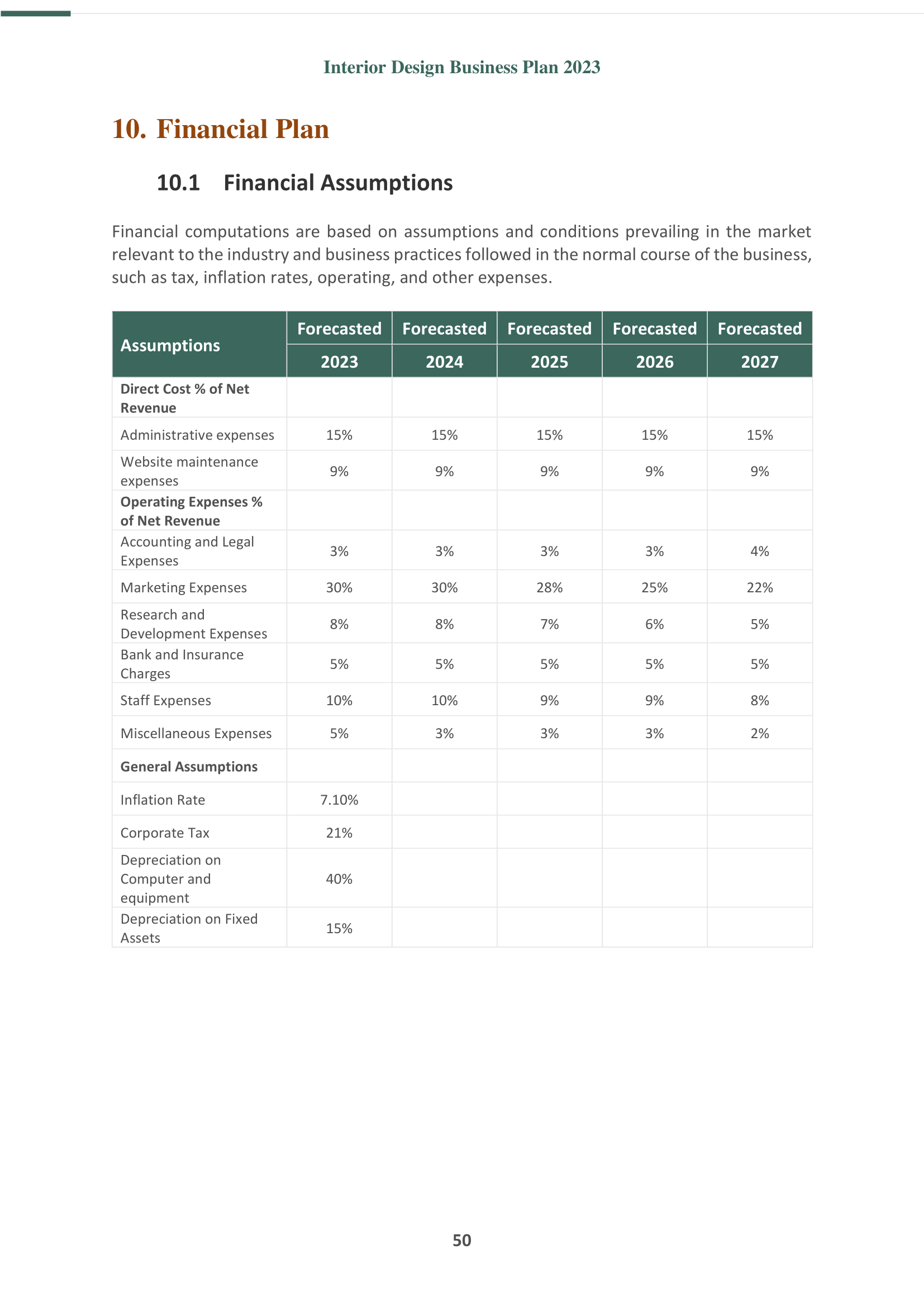

4. Plan your finances

Develop a comprehensive financial plan for your interior design business, including revenue projections, expenses, and profit targets. Determine your startup costs, ongoing expenses, and revenue streams. Set clear financial goals and establish strategies to achieve them, such as pricing strategies, budget allocation, and revenue diversification. You’ll also want to think about your tax strategy and explore potential sources of funding or investment to fuel your growth.

Watch our workshop with Megan Dahle on managing and understanding your finances like a pro .

5. Develop a marketing strategy

While you may want to consider creating a separate marketing plan, you should also factor marketing into your interior design business plan. Outline your strategy for attracting clients, identify the channels you’ll need to reach your target audience, and develop a plan for creating messaging and branding that will communicate your value proposition effectively. This involves leveraging various marketing channels, such as social media, your website, networking events, and partnerships and collaborations, to build brand awareness and generate qualified leads.

Check out our guide with 9 proven ways to get clients (+tutorials!) .

6. Build your team

Assess the team you will need to support your interior design business, considering factors such as expertise, skills, and workload. Determine the roles and responsibilities required to operate your business efficiently, including designers, project managers, assistants, and external contractors. Consider the hours per week required from each team member to meet your business objectives, and consider whether you need to invest in ongoing training and development to optimize your outcomes.

7. Define operational processes

Establish operational processes and workflows to streamline your interior design business operations. Define protocols for client communication, project management, and quality assurance to ensure consistency and efficiency. Determine the hours per week needed to manage various aspects of your business effectively, and leverage technology and automation tools, like the ones you can access with DesignFiles, to optimize your workflow and enhance productivity.

Watch our workshop on advanced project management strategy with Kimberley Seldon .

8. Assess and mitigate risk

Identify potential risks and challenges that may affect your interior design business and develop strategies to mitigate them. Consider factors such as economic fluctuations, market competition, and project delays. Implement contingency plans and risk management strategies to minimize disruptions and ensure the continuity of your business.

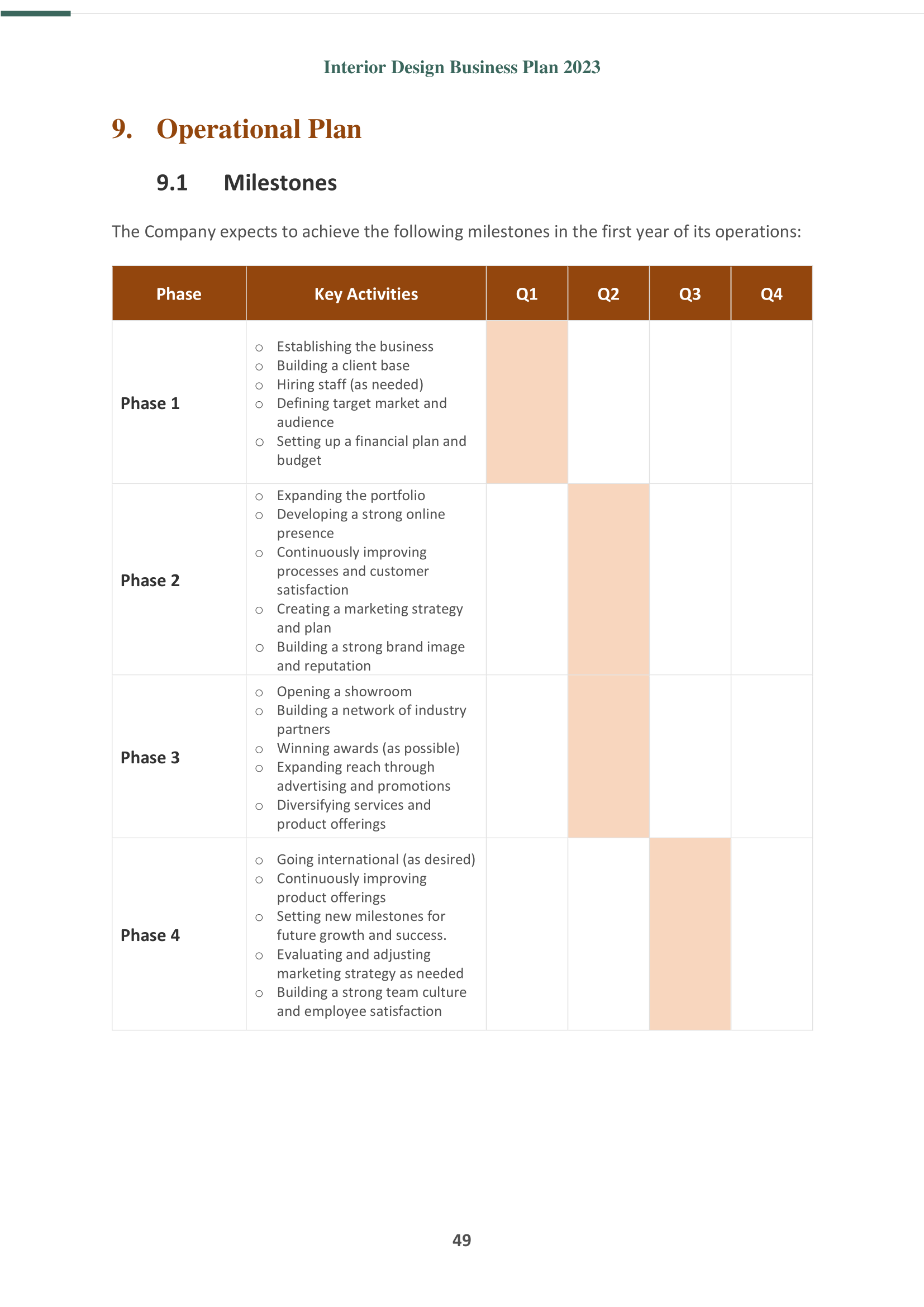

9. Set milestones and timelines

Break down your goals into actionable milestones with specific timelines for achieving them. Establish measurable criteria for success and track your progress regularly. Determine the hours per week required to meet your milestones and allocate resources accordingly to stay on track. Regularly review your timelines, and adjust if needed to reflect changes in market conditions, client feedback, and internal priorities.

Watch our live hotseat coaching sessions with Nancy Ganzekaufer to get inspired on your next goal .

10. Monitor and adapt

Continuously monitor your interior design business’s performance and adapt your strategies as needed to capitalize on opportunities and address challenges. Stay flexible and responsive to changes in the market, client preferences, and industry trends. Regularly review and update your business plan to reflect evolving circumstances and ensure alignment with your goals.

11. Seek feedback and collaboration

Seek feedback from mentors, peers, coaches, and other industry experts to refine your interior design business plan. Don’t shy away from leveraging external insights to enhance your business strategy and drive growth.

Looking for a pro community? Join the DesignFiles Facebook group with over 10,000 interior designers.

3 sample interior design business plans

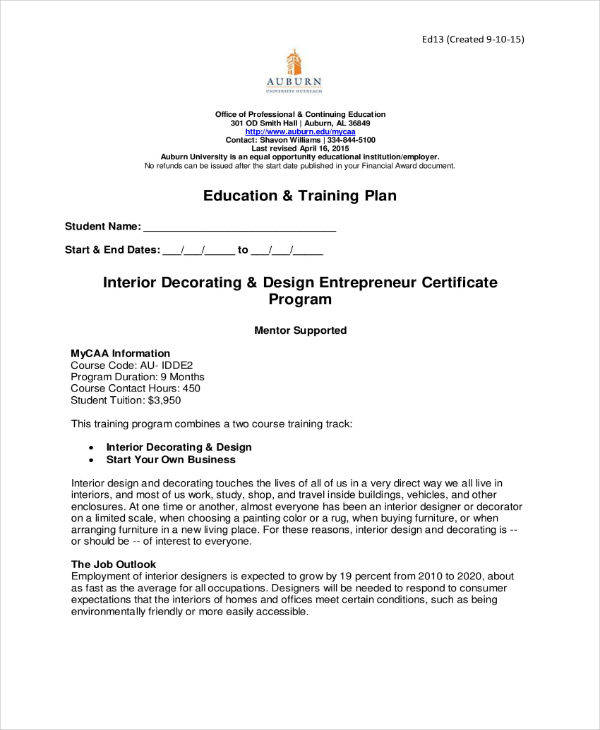

Check out these examples to inspire your own business plan.

1. Interior design business plan example by Wix

This sample business plan does a great job of outlining all the key areas of the business in a clear and succinct way. By keeping it concise, this business plan is easy to follow and digest.

We recommend diving a little deeper into topics such as target market. If you can get more specific in creating your personas—for example, getting clear on the age range and kinds of budgets of your ideal client—that will help you be more targeted in all your strategies. We also recommend going into more detail with your competitive analysis as really digging into what your competitors are doing will help you strengthen your own plan.

Finally, going into more detail about your marketing and financial plans will help give you a clearer direction for moving forward. While you can certainly create separate more detailed documents for each, where you get into the nitty gritty, it’s still helpful to include as much detail as possible in your overall business plan so everything is in one place.

2. Interior design business plan example by OGS Capital

This more substantive business plan example goes into much greater detail, including graphics and cost breakdowns. While you don’t necessarily need to go into this level of granular detail in your business plan, it’s always helpful to look at different examples and approaches so you can tailor yours. Ultimately your business plan needs to be unique to your own business, needs, and goals.

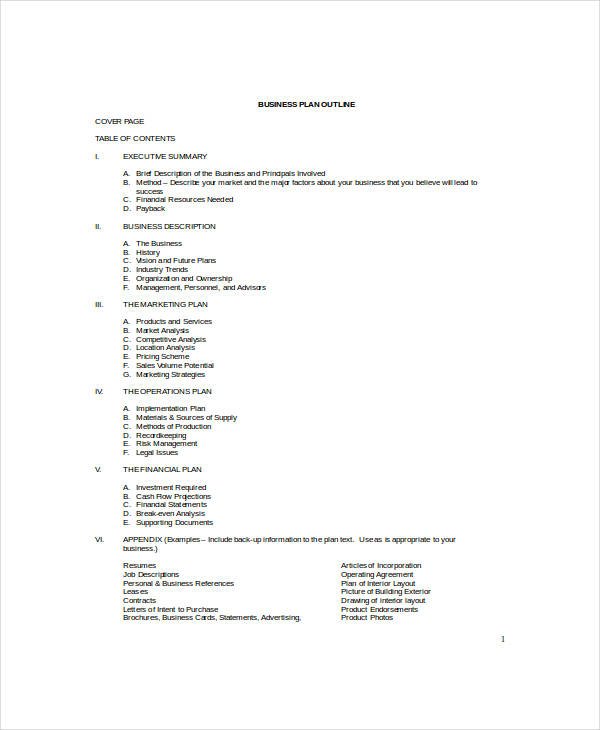

3. Business News Daily business plan template

Ready to create your own? This business plan template from Business News Daily is a great resource to help you get started in creating your own interior design business plan.

As you get started on crafting your interior design business plan, remember it’s more than just a document. By investing the necessary time and reflection now to create a solid plan, you’re laying the foundation from which the rest of your business will grow and evolve.

In addition to outlining the tangible elements of your business strategy, your business plan also embodies your vision and values, serving as your compass as you move forward.

Ready to grow your design business? Create a strong foundation with the most intuitive software and save dozens of hours each month. Learn more about DesignFiles.

Keep reading...

9 Templates for Interior Design Contracts (Free & Paid)

Before you dive into your next dreamy design project, it’s important to have a contract that lays out all the...

Bookkeeping for Interior Designers: Estimated Costs & Key Services

Keeping up with all the creative elements of your interior design projects is exciting, but when it comes to the...

10 Tips for Running an Interior Design Small Business

Whether you’re about to start or are already running an interior design small business, you know one thing: being at...

Tips for a Simple Interior Design Business Plan to get you Started

So you’ve decided you’re going to start your own interior design business. Congratulations! But have you thought about putting together a business plan for your new venture?

Writing down what you’re trying to achieve, the services you’ll offer, and other important factors will help you streamline your business strategy, keep you focused on your goals, and (perhaps most importantly) make sure your idea makes sense.

It’s a good idea to create a business plan before investing money in your new business; that way, you’ll have a better understanding of how it’ll make money and whether it’s likely to be profitable.

Throughout this guide, I’m going to explain the importance of having a business plan for your interior design business and take you through what information to include.

Here’s to a well-planned and successful interior design business!

Why do I Need an Interior Design Business Plan?

There are various benefits of putting together an interior design business plan before going ahead with your new venture, but it really boils down to two factors:

- Helping you understand your business

- Helping you explain your business to others

Helping you Understand your Business

Before you do anything, you need to get your thoughts in order to ensure you have a viable business idea. Writing things down usually helps them make sense, and it’s no different with a business plan.

Your interior design business plan will help you:

- Summarise your business idea: What you’re trying to achieve, what services you’ll offer, how you’ll operate etc.

- Identify goals and potential problems: Set out goals and how you’ll achieve them, and identify any risks and how to overcome them.

- Plan your business operations: From sales and marketing to onboarding staff.

- Get your finances in order: Estimate your revenue, business expenses, and any financing you’ll require to get your business off the ground.

- Pinpoint your priorities and identify any gaps in the business

Helping you Explain your Business to Other People

A business plan can also help you convince other people to back your business. This includes:

- Financial assistance: If you’re planning on getting financial backing from investors or securing a bank loan for your interior design business, you’ll need to present a well-formed business plan.

- Employees and suppliers: Potential employees and suppliers are unlikely to work with a business if they don’t know what it does. A business plan will help you explain this so you can onboard staff and suppliers before getting started.

- Explaining your business: Writing down a business summary will help you better explain your business to other people, so next time you’re asked what your business does (or will do), you won’t fumble over your words.

Interior Design Business Plan Top Tips

Before writing your business plan, keep the following points in mind:

Write it for an Outsider

Write your business plan as if the person who’s reading it knows nothing about you, your business or the interior design industry. This will likely be the case when it comes to getting investment.

Keep it Concise

Don’t go into too much unnecessary detail. Keep it to the point and focus on the sections listed below. After all, you want people to read it!

Be Realistic

Avoid skimming over potential risks and problems, and be honest and realistic about finances. Being over-optimistic might get you the loan you’re after, but it could lead to problems in the future.

Know your Market

Make sure to include market research, details on competitors, where your business fits into the interior design market and what makes it different to what’s already out there.

What to Include in your Interior Design Business Plan

When it comes to writing your business plan, try to use the following structure:

Executive summary

Elevator pitch

About the business owner

Products and services

Business structure

The market: Customers, competitors and market overview

Section 7:

Sales and marketing strategy

Business operations

- Business expenses

Section 10:

Financial forecasts

Let’s go into a bit more detail on each section:

1. Executive Summary

An executive summary is essentially a summary of your interior design business plan, so it’s best to write this section last. It should include key points, so if someone were to only read this section, they’d still have an understanding of your business and what you’re trying to achieve.

Your executive summary should include:

- Business name and type of business (e.g. sole trader or LTD company)

- A summary of the services you’ll offer and/or products you intend to sell

- Mission statement: What is the aim of your business? (e.g. become the number one interior design service in your area)

- Goals and objectives: It’s good to include short, mid, and long-term goals. (e.g. generate [amount] of profit in the first year)

- Financial summary: Financial goals and any secured or required funding

- Keys to success: How will you achieve your objectives? (e.g. provide high-quality services and first-class communication)

2. Elevator Pitch

An elevator pitch is a short summary of your business. It’s what you’ll tell people when they ask what your business does. Writing down an elevator pitch will help ensure you have a clear idea of your business direction and enable you to give a concise, well-formed description when you explain your business to others.

It should include:

- What your business does

- Who your target audience is

- Your unique selling point (USP): What sets you apart from competitors?

3. About the Business Owner

Add a bit about yourself, why you want to start an interior design business, and any experience you have in the industry. Things to cover include:

- Who are you?

- Why do you want to start this business?

- What experience do you have?

- Relevant qualifications and training

- Relevant hobbies and interests

4. Services you’ll Offer

How is your business going to make its money? Explain the different interior design services your business will offer and whether you’ll also sell any physical products.

- A list of services you’ll offer as an interior designer

- Any products you’ll sell

- Plans for future products and services

5. Business Structure

Will you work as a sole trader and hire contractors to help, or will you hire employees? Do you have a network of suppliers in place to help you carry out your projects? Include information on your employees, contractors, suppliers, and their roles in this section:

- Whether you’ll hire full-time employees or outsource to contractors

- Job roles and responsibilities

- List of suppliers needed to help fulfil projects

6. Market Summary

The market summary section of your business plan should include information about the current market and market trends, your target audience, and competitors. This section will not only help outsiders understand your target market, but it’ll also help you understand how best to advertise your products and services.

Your market summary can be split into a few sections:

Target customers

- Target customer profile: Who are your target customers?

- Who are you selling to? (e.g. businesses or individuals, residential or commercial)

- Why do they/will they buy from you?

- Any already confirmed orders

Competitors

- Who are your competitors?

- What’s your USP? What makes your business different?

- SWOT analysis: Strengths, Weaknesses, Opportunities and Threats

Market research

- Size of market

- Market trends

- Field research (Ask prospective customers what they think about your business idea)

7. Sales and Marketing Strategy

How will you reach your target customers, and what channels will you sell your products through? What price point will you sell your services at? The sales and marketing strategy section should cover:

- Sources of income: How will you sell your products and services? (E.g. online services, products, commercial and residential projects)

- Marketing channels: How will you advertise your products and services?

(E.g. word of mouth, social media, direct mail, trade shows)

- Pricing strategy: What price point and why?

- Are you likely to get repeat customers or retainer clients?

8. Business Operations

This section covers the day-to-day running of your business, what’s involved in each interior design project or the production of any products you sell, where your business will operate, what equipment and insurance you’ll need, etc.

- Production/projects: How long will it take, how much will it cost you?

- Payment: How will customers pay? (e.g. upfront, deposit, payment plan)

- List of suppliers: Who are your suppliers?

- Business premises: Where will your business operate from?

- Equipment needed: What equipment do you need for your business to operate?

- Licenses and insurance: What licenses and insurance do you need for your business to operate?

There are various expenses involved in running a business, so you’ll need to list these. Your expenses will include things like:

- Business premises

- Employee/contractor wages

- Merchandise production

- Loan repayments

- Financial Forecasts

Financial forecasts can be tricky if you’re just starting out, but try to put together a realistic calculation for the next three to five years. Essentially, you need to prove that your business will survive and become profitable. If you’re a small business or startup, speaking to an adviser at your bank may help with forecasting.

Your financial forecasts should include:

- Historical sales figures from the last three to five years (if applicable)

- Sales forecast: How much money you expect the business to take

- Profit forecast: How much profit you expect the business to make

- Monthly cash flow and business bank balance

- Balance sheet: Your business’ assets, liabilities and stockholders’ equity (smaller businesses may not require this

As you can see, a lot goes into starting your own interior design business. And while creating a business plan might seem like a long process, it’ll definitely help you in the long run.

About The Author

Freddie Chatt

Related posts, transforming spaces: the integration of ai interior design, 7 of the best free interior designer courses online, 5 key seo tips for interior designers: rank your interior design website, 14 tips for your interior design blog: get more clients from your blog.

Item added to your cart

Here is a free business plan sample for an interior design services.

If you have a passion for transforming spaces and a flair for design, embarking on a career as an interior designer might be your calling.

In the following paragraphs, we will present to you a comprehensive business plan tailored for aspiring interior designers.

As you may already understand, a meticulously developed business plan is a cornerstone of success for any creative professional. It serves as a roadmap, guiding you through establishing your brand, identifying your target market, and outlining your business strategies.

To jumpstart your journey, you can utilize our interior designer business plan template. Our team is also on standby to provide a free review and offer suggestions for improvement.

How to draft a great business plan for your interior design services?

A good business plan for an interior designer must reflect the unique aspects of the design industry.

To start, it is crucial to provide a comprehensive overview of the interior design market. This includes current statistics and identifying emerging trends within the industry, as illustrated in our interior design business plan template .

Then, you should articulate your business concept effectively. This encompasses your design philosophy, pinpointing your target clientele (such as homeowners, real estate developers, commercial clients), and the distinctive services you offer (residential design, commercial projects, sustainable design, etc.).

The next section should delve into market analysis. This requires a thorough understanding of your competitors, industry trends, and client preferences.

For an interior designer, particular emphasis should be placed on the services portfolio. Detail the range of design services you plan to provide - space planning, color consultation, furniture selection, etc. - and explain how they cater to the needs and tastes of your intended market.

The operational plan is also vital. It should outline your business location, the structure of your design studio, supplier relationships for materials and furnishings, and your project management approach.

For an interior designer, it is important to highlight your design process, project timelines, and the quality of materials and workmanship.

Then, address your marketing and sales strategy. How will you build your brand and maintain client relationships? Consider promotional tactics, client engagement, and potential value-added services (such as virtual design consultations).

Utilizing digital strategies, like a professional website or an active social media presence, is equally important in the modern marketplace.

The financial plan is another critical component. This should include your startup costs, revenue projections, operating expenses, and the point at which you will break even.

In the interior design business, project-based billing can vary widely, so it is crucial to have a thorough understanding of your pricing structure and cash flow management. For assistance, you can refer to our financial forecast for interior designers .

Compared to other business plans, an interior design business plan must pay special attention to portfolio development, client relationship management, and the creative process, which are central to the industry.

A well-crafted business plan will not only help you clarify your vision and strategy but also attract clients or secure financing.

Lenders and investors are looking for a solid market analysis, realistic financial projections, and a clear understanding of how you will manage projects and client expectations.

By presenting a detailed and substantiated plan, you showcase your professionalism and dedication to the success of your interior design business.

To achieve these goals while saving time, feel free to complete our interior design business plan template .

A free example of business plan for an interior design services

Here, we will provide a concise and illustrative example of a business plan for a specific project.

This example aims to provide an overview of the essential components of a business plan. It is important to note that this version is only a summary. As it stands, this business plan is not sufficiently developed to support a profitability strategy or convince a bank to provide financing.

To be effective, the business plan should be significantly more detailed, including up-to-date market data, more persuasive arguments, a thorough market study, a three-year action plan, as well as detailed financial tables such as a projected income statement, projected balance sheet, cash flow budget, and break-even analysis.

All these elements have been thoroughly included by our experts in the business plan template they have designed for an interior designer .

Here, we will follow the same structure as in our business plan template.

Market Opportunity

Market data and figures.

The interior design industry is a dynamic and evolving sector with significant growth potential.

Recent studies have shown that the global interior design market is expected to reach a value of over 150 billion dollars by the next few years. This growth is driven by an increasing interest in home renovation and design, fueled by real estate market trends and the desire for personalized living spaces.

In the United States, there are over 100,000 interior design businesses, generating an estimated annual revenue of over 10 billion dollars. This underscores the vital role interior design plays in the American economy and the housing industry.

The interior design industry is witnessing several key trends that are shaping the future of living spaces.

Sustainability and eco-friendly designs are at the forefront, with clients seeking materials and products that have a lower environmental impact. There is a growing demand for energy-efficient designs, green living walls, and the use of recycled materials.

Technological advancements are also influencing the industry, with virtual reality (VR) and augmented reality (AR) tools allowing clients to visualize designs before implementation. Smart home technology integration is becoming increasingly popular, as clients look for convenience and automation in their living spaces.

Minimalism continues to be a popular aesthetic, with clean lines and uncluttered spaces. However, there is also a rise in bold and expressive designs, with personalized touches that reflect the individuality of the client.

Online design services and platforms are expanding, offering more accessible and flexible design solutions to a broader audience.

Lastly, the focus on wellness has led to designs that promote health and well-being, incorporating elements like natural light, air purification, and biophilic design principles.

Success Factors

Several factors contribute to the success of an interior design business.

First and foremost, the ability to understand and translate client visions into tangible designs is crucial. A designer who can create functional, aesthetically pleasing, and personalized spaces is more likely to build a strong reputation.

Innovation and staying abreast of design trends and new materials can help an interior designer stand out in a crowded market.

Networking and building relationships with suppliers, contractors, and clients are essential for business growth and the successful execution of design projects.

Excellent communication and project management skills are also vital, ensuring that projects are completed on time, within budget, and to the client's satisfaction.

Finally, a strong online presence, through a well-designed website and active social media engagement, can help an interior designer showcase their work and attract new clients.

The Project

Project presentation.

Our interior design project is dedicated to creating personalized, functional, and aesthetically pleasing living and working spaces for clients who value a harmonious and tailored environment. Situated in a vibrant urban area, our services will cater to a diverse clientele, ranging from homeowners seeking to revamp their living spaces to businesses looking to enhance their commercial interiors.

We will focus on delivering innovative design solutions that reflect the unique style and needs of each client, ensuring that every space we design is both beautiful and practical.

Our interior design firm aspires to be recognized for its creative excellence, attention to detail, and commitment to transforming spaces into inspiring and inviting places.

Value Proposition

The value proposition of our interior design project lies in our ability to create bespoke environments that resonate with our clients' personal tastes and functional requirements.

Our dedication to understanding each client's vision and translating it into reality sets us apart, offering a seamless and enjoyable design experience. We are committed to sourcing high-quality materials, furnishings, and accessories that not only look stunning but also stand the test of time.

We aim to empower our clients by involving them in the design process, ensuring their space is a true reflection of their identity, and educating them on design principles and the latest trends.

Our firm is poised to become a cornerstone in the community, providing innovative design solutions that enhance the way people experience their surroundings.

Project Owner

The project owner is an experienced interior designer with a keen eye for detail and a passion for creating spaces that tell a story.

With a background in design and architecture, along with a strong portfolio of successful projects, the owner brings a wealth of knowledge and creativity to the table. They are dedicated to staying ahead of industry trends and continuously honing their craft to deliver exceptional design outcomes.

With a belief in the power of design to transform lives, the owner is committed to making interior design accessible and enjoyable, ensuring that each project reflects the client's personality and lifestyle.

Their commitment to design excellence and client satisfaction is the driving force behind the project, aiming to create spaces that not only look beautiful but also enhance the quality of life for those who inhabit them.

The Market Study

Target market.

The target market for this interior design business is segmented into various groups.

Firstly, there are homeowners looking to renovate or update their living spaces to reflect their personal style and enhance functionality.

Secondly, the market includes real estate developers and investors seeking professional design services to increase the marketability and value of their properties.

Additionally, commercial clients such as businesses, hotels, and restaurants require interior design services to create aesthetically pleasing and brand-aligned environments for their customers.

Lastly, collaborations with architects and contractors can be a significant market segment, as these professionals often require the expertise of interior designers to complete their projects.

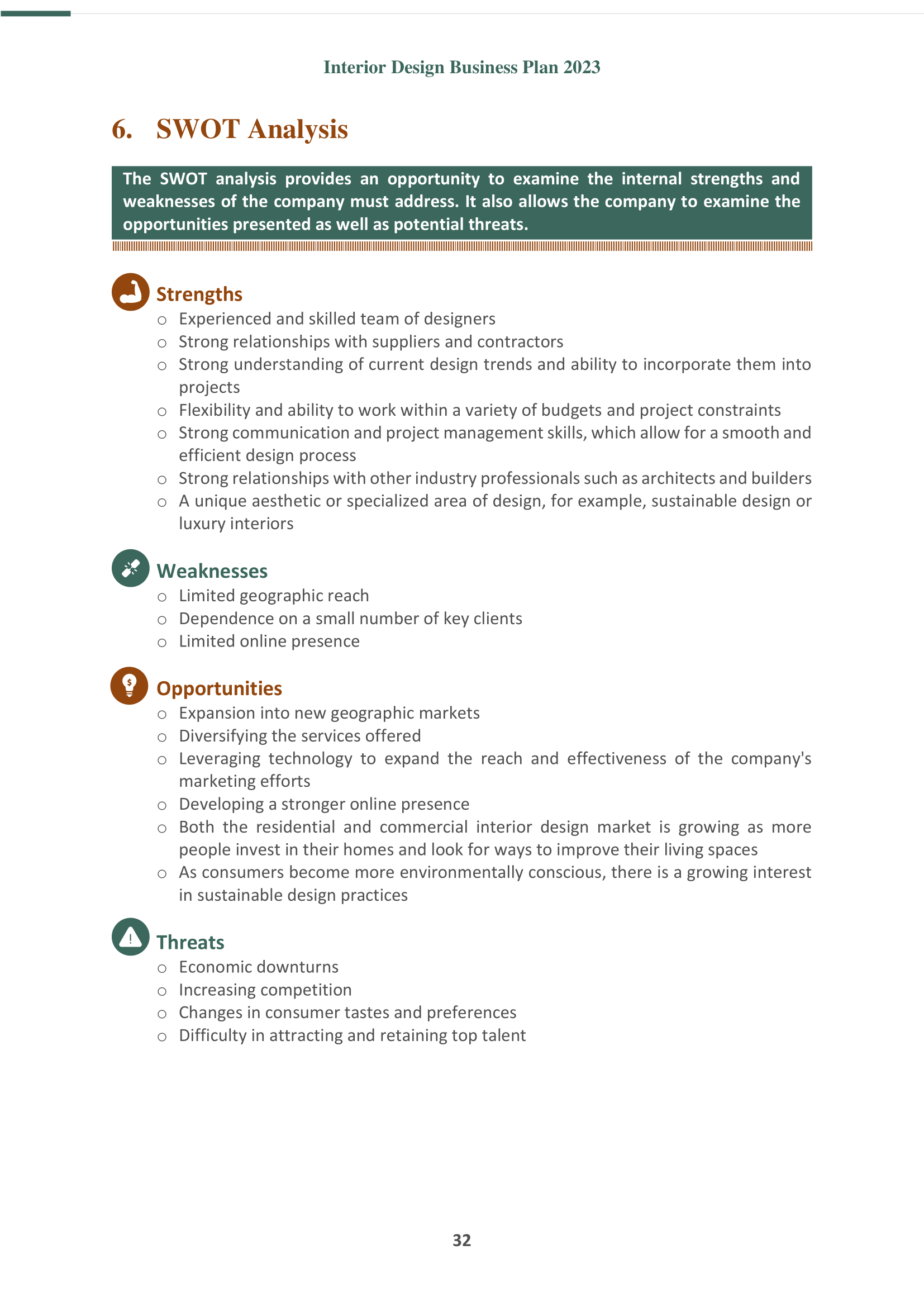

SWOT Analysis

A SWOT analysis of this interior design business project highlights several key points.

Strengths include a strong portfolio showcasing diverse design styles, personalized customer service, and a network of reliable suppliers and contractors.

Weaknesses may involve the cyclical nature of the real estate market and the challenge of staying abreast of design trends and client preferences.

Opportunities can be found in leveraging social media and digital marketing to reach a broader audience, as well as in the growing trend of sustainable and eco-friendly design.

Threats might include economic downturns affecting clients' willingness to invest in design services and the competitive nature of the interior design industry.

Competitor Analysis

Competitor analysis in the interior design industry indicates a competitive landscape.

Direct competitors include other local interior designers and design firms, as well as online design services that offer virtual consultations and digital solutions.

These competitors vie for clients who value professional expertise, creativity, and the ability to transform spaces.

Potential competitive advantages include a unique design approach, exceptional project management skills, strong client relationships, and a focus on sustainable practices.

Understanding the strengths and weaknesses of competitors is crucial for carving out a unique niche and ensuring client loyalty.

Competitive Advantages

Our competitive edge lies in our personalized approach to each project, ensuring that every design reflects the client's individual needs and lifestyle.

We maintain a curated network of craftsmen and suppliers, allowing us to source unique materials and finishes that set our designs apart.

Our commitment to sustainability and eco-friendly design not only appeals to environmentally conscious clients but also represents a growing trend in the industry.

Moreover, our expertise in space planning and functionality ensures that our designs are not only beautiful but also practical and livable.

You can also read our articles about: - how to offer interior design services: a complete guide - the customer segments of an interior design services - the competition study for an interior design services

The Strategy

Development plan.

Our three-year development plan for the interior design business is designed to establish a strong market presence.

In the first year, we will concentrate on building a robust portfolio and establishing strong relationships with key clients and suppliers. We aim to become a recognized name in the local market for high-quality interior design services.

The second year will focus on expanding our services to include virtual interior design consultations and leveraging technology to enhance our design process and customer experience.

In the third year, we plan to explore collaborations with architects and property developers, positioning ourselves as the go-to experts for interior design in new developments and renovations.

Throughout this period, we will prioritize customer satisfaction, creativity, and staying ahead of design trends to ensure we provide exceptional value to our clients.

Business Model Canvas

The Business Model Canvas for our interior design business targets individuals and businesses looking to create functional and aesthetically pleasing spaces.

Our value proposition is centered around personalized design solutions that reflect our clients' tastes and needs, combined with exceptional project management to ensure a seamless process from concept to completion.

We offer our services through direct consultations, online platforms, and partnerships with home improvement stores, utilizing our key resources such as our design expertise and network of reliable contractors and suppliers.

Key activities include client consultations, design conceptualization, project management, and networking with industry professionals.

Our revenue streams are generated from design fees, project management services, and potentially from exclusive product lines in the future. Our costs are mainly associated with marketing, staffing, and operational expenses.

Find a complete and editable real Business Model Canvas in our business plan template .

Marketing Strategy

Our marketing strategy is focused on showcasing our design expertise and successful projects.

We aim to attract clients by highlighting our unique design approach and the transformative impact of our work on their spaces. Our strategy includes a strong online portfolio, engaging social media content, and before-and-after showcases of our projects.

We will also network with industry professionals and participate in local home shows and design expos to increase visibility.

Additionally, we plan to collaborate with influencers and lifestyle bloggers to reach a wider audience and establish our brand as a leader in the interior design industry.

Risk Policy

The risk policy for our interior design business focuses on mitigating risks associated with project timelines, budget management, and client satisfaction.

We will implement strict project management protocols to ensure deadlines are met and budgets are adhered to. We will also maintain open and transparent communication with our clients to manage expectations and ensure satisfaction.

Regular training and professional development will be provided to our team to keep them updated on the latest design trends and technologies.

We will also secure professional indemnity insurance to protect against any unforeseen professional liabilities. Our priority is to deliver exceptional design services while managing the risks inherent in the creative and project-based nature of our work.

Why Our Project is Viable

We are committed to establishing an interior design business that responds to the growing demand for personalized and professional design services.

With our focus on client satisfaction, innovative design solutions, and strategic market positioning, we are confident in our ability to thrive in the competitive interior design industry.

We are passionate about enhancing the spaces where people live and work and are excited to build a business that reflects our commitment to design excellence.

We are adaptable and ready to evolve with the industry, looking forward to the bright future of our interior design venture.

You can also read our articles about: - the Business Model Canvas of an interior design services - the marketing strategy for an interior design services

The Financial Plan

Of course, the text presented below is far from sufficient to serve as a solid and credible financial analysis for a bank or potential investor. They expect specific numbers, financial statements, and charts demonstrating the profitability of your project.

All these elements are available in our business plan template for an interior designer and our financial plan for an interior designer .

Initial expenses for our interior design business include costs for professional design software, a well-equipped office space, a portfolio website, sample materials for client presentations, liability insurance, and marketing efforts to establish a strong brand presence.

Our revenue assumptions are based on an in-depth analysis of the local market's demand for interior design services, factoring in trends in home renovation, real estate development, and the increasing appreciation for personalized living spaces.

We anticipate a steady growth in client engagements, starting with smaller projects and expanding to larger, more lucrative contracts as our reputation for quality and creativity grows.

The projected income statement outlines expected revenues from our design services, project costs (materials, subcontractors, travel), and operating expenses (office rent, marketing, salaries, etc.).

This results in a forecasted net profit that is essential for assessing the long-term viability of our interior design business.

The projected balance sheet reflects assets unique to our business, such as design software, office equipment, and furniture, as well as liabilities including business loans and accounts payable.

It provides a snapshot of the financial standing of our interior design firm at the conclusion of each fiscal period.

Our projected cash flow statement details the inflows and outflows of cash, enabling us to predict our financial needs at any point. This is crucial for maintaining a healthy cash balance and ensuring smooth business operations.

The projected financing plan identifies the specific sources of funding we intend to tap into to cover our initial costs.

The working capital requirement for our interior design business will be diligently tracked to guarantee we have sufficient funds to support our day-to-day activities, such as sourcing materials, managing inventory, and compensating our team.

The break-even analysis for our venture will pinpoint the volume of business we need to achieve to cover all our costs, including the initial investments, and to begin generating profits.

It will signal the point at which our business becomes financially sustainable.

Key performance indicators we will monitor include the profit margin on our design projects, the current ratio to evaluate our ability to meet short-term liabilities, and the return on investment to determine the efficiency of the capital we have invested in our business.

These metrics will assist us in gauging the financial health and overall success of our interior design enterprise.

If you want to know more about the financial analysis of this type of activity, please read our article about the financial plan for an interior design services .

- Choosing a selection results in a full page refresh.

- Opens in a new window.

How To Write a Winning Interior Design Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for interior design businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every interior design business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Interior Design Business Plan?

An interior design business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Interior Design Business Plan?

An interior design business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Interior Design Business Plan

The following are the key components of a successful interior design business plan:

Executive Summary

The executive summary of an interior design business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your interior design

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your interior design business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your interior design firm, mention this.

You will also include information about your chosen interior design business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an interior design business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the interior design industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, an interior design business’ customers may include:

- Businesses (office, retail, and hospitality firms)

- Other designers, architects, and homebuilders

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or interior design services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or you may promote your interior design business via public relations, speaking engagements, or networking.

Operations Plan

This part of your interior design business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an interior design business include reaching $X in sales. Other examples include hitting certain customer targets or partnering with specific retailers or distributors.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific interior design industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Interior Design Business

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Interior Design Business

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup interior design business.

Sample Cash Flow Statement for a Startup Interior Design Business

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your interior design company . It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

A well-written business plan is an essential tool for any interior design business. The tips we’ve provided in this article should help you write a winning business plan for your interior design firm.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Articles

How To Develop Your Interior Design Mission Statement + Examples

Detailing the Interior Design Scope of Work + Template & Sample

Interior Design Business Forms & Templates

Interior Design Client Questionnaire: What You Should Ask Your Clients + Template

Interior Design Contracts & Agreements: What To Include + Sample Template

BUSINESS STRATEGIES

How to create an interior design business plan

Starting a business , especially in the interior design space, can be an exciting and rewarding venture. Whether you have a passion for interior design or simply want to capitalize on the growing demand for aesthetically pleasing spaces, creating a comprehensive interior design business plan is a crucial first step. A business plan serves as a roadmap for starting your interior design business including outlining your goals, strategies and financial projections. Keep reading to learn how to construct your own plan.

Not sure how to begin? Learn more about how to start a service business .

How to write a business plan for an interior design business in 6 steps

Here are the six main parts of a interior design business plan:

Executive summary

Business and domain names

Market research and analysis

Operations plan

Marketing and advertising plan

Financial plan

01. Executive summary

The executive summary is the first section of your interior design business plan. It provides an overview of your business and highlights the key points from each section of the plan. The executive summary should be concise, clear and engaging to capture the reader's attention. It should include:

A brief description of your interior design business

Your mission statement and vision for the business

A summary of your target market and competition

An overview of your marketing and growth strategies

Your financial projections and funding requirements

02. Business and domain names

Choosing the right business name for your interior design business is crucial for building brand awareness and trust. Start by brainstorming ideas that reflect the essence of your business and resonate with your target market. You can use a business name generator tool to brainstorm design business names and to check the availability of relevant domain names .

When choosing a domain name, consider these best practices:

Keep it short, memorable and easy to spell

Include relevant keywords related to rental properties

Avoid numbers, hyphens or special characters

Choose a domain extension (.com, .net, .org) that aligns with your target audience

Once you’ve landed on a business name and the right legal structure, make sure to properly register your business .

03. Market research and analysis

Including a market analysis and research section in your interior design business plan is essential for understanding the competitive environment and developing effective business strategies. Conduct market research to identify trends, demand and competition in the interior design market.

Your market analysis should cover:

An overview of the interior design market in your target area

Demographic information about your target audience

Competitor analysis, including their strengths and weaknesses

Pricing strategies and rental rates in the market

Opportunities for differentiation and unique selling propositions

04. Operations plan

The operations plan outlines the logistical aspects of your interior design business. It covers important details such as location, premises, equipment and staffing needs.

You’ll need to detail the ideal location for your interior design business based on target market preferences. Consider and explain the size and layout of the premises, as well as equipment and staffing requirements.

05. Marketing and advertising plan

Your interior design business plan should include a detailed marketing and advertising plan to attract customers. Popular strategies include online advertising, social media marketing and traditional advertising like print ads.

You’ll additionally want to create a business website that puts your business on the map. Ensure that you use a reliable website builder that includes built-in marketing tools, and can scale with your business.

Learn more: How to make a website

Remember that no matter where you choose to promote your business, you’ll want to make sure that your branding remains consistent. Start by using a logo maker to create a logo and to help shape your visual identity.

06. Financial plan

The financial plan of an interior design business plays a crucial role in shaping its success and sustainability. It serves as a comprehensive roadmap that guides the business through various financial aspects, ensuring a solid foundation for growth and profitability. This plan encompasses several key components that collectively contribute to the business's financial health and long-term viability.

The financial plan delves into all aspects related to the financial well-being of the business. It covers a wide range of financial considerations, including startup costs, ongoing operational expenses, revenue projections and net profitability. By addressing these aspects, the plan ensures that the business owner has a clear understanding of the financial landscape and can make informed decisions.

One of the critical elements of the financial plan is identifying the sources of funding that will fuel the business's initial establishment and subsequent growth. Whether through personal savings, loans, investments from stakeholders or other means, understanding the available funding sources is vital for effectively managing cash flow, covering expenses and facilitating smooth operations.

Interior design business plan examples

Creating a business plan for your interior design business is essential for setting a solid foundation and ensuring long-term success. To help you get started, here are two draft business plans for a hypothetical interior design business.

Business plan template 1: Urban Rentals

Urban Rentals is a premier interior design business specializing in providing high-quality urban living spaces for young professionals and students in the city. Our mission is to offer modern, well-designed apartments in desirable locations at competitive rental rates. With a focus on customer satisfaction, we aim to create a hassle-free rental experience for our tenants.

Company and domain names

The company name, Urban Rentals, reflects our target market and the type of properties we offer. We have secured the domain name urbanrentals.com, which aligns perfectly with our brand identity and makes it easy for potential tenants to find us online.

Market analysis and research

We have conducted extensive market research to understand the demand for rental properties in urban areas. Our target audience consists of young professionals and students seeking convenient, stylish and affordable apartments. We have identified several competitors in the market but believe that our unique amenities and competitive pricing will set us apart.

Urban Rentals plans to acquire properties in desirable urban neighborhoods close to public transportation, restaurants and entertainment options. We will renovate these properties to meet modern standards and provide essential amenities like high-speed internet, laundry facilities and secure access. Our dedicated property management team will handle tenant inquiries, maintenance requests and ensure that all properties are well-maintained.

To attract tenants, we will utilize a multi-channel marketing approach. This includes online advertising through rental listing websites and social media platforms, as well as targeted online ads. We will also establish partnerships with local colleges and universities to reach student tenants. Additionally, we will implement referral programs and incentivize word-of-mouth marketing through satisfied tenants.

Urban Rentals will be initially funded through a combination of personal savings and a small business loan. We project steady growth over the next five years, with a focus on maintaining high occupancy rates and increasing rental income. Our financial plan includes detailed revenue projections, expense forecasts and cash flow analysis.

Business plan template 2: Coastal Properties

Coastal Properties is an interior design business specializing in providing beachfront vacation homes for tourists and travelers seeking a luxurious coastal experience. Our mission is to offer premium properties with stunning ocean views, top-notch amenities and exceptional customer service. We aim to create unforgettable vacation experiences for our guests.

The company name, Coastal Properties, reflects our focus on beachfront locations and coastal living. We have secured the domain name coastalproperties.com, which perfectly represents our brand and helps potential guests find us easily online.

We have conducted extensive market research to understand the demand for vacation rentals in popular coastal destinations. Our target audience consists of affluent travelers seeking high-end accommodations with breathtaking views. We have identified competitors in the market but believe that our exclusive properties and exceptional service will attract discerning guests.

Coastal Properties plans to acquire premium beachfront properties in sought-after coastal destinations. These properties will be fully furnished with upscale amenities like private pools, beach access and concierge services. We will work with reputable property management companies to handle guest inquiries, reservations and property maintenance.

To reach our target audience, we will implement a comprehensive marketing and advertising plan. This includes online advertising through vacation rental platforms and luxury travel websites. We will also collaborate with travel influencers and establish partnerships with local businesses to promote our properties. Additionally, we will leverage social media platforms to showcase stunning visuals of our properties and engage with potential guests.

Coastal Properties will be initially funded through a combination of personal investments and private investors. We project strong revenue growth based on high occupancy rates and premium rental rates. Our financial plan includes detailed income projections, expense forecasts and return on investment analysis.

Benefits of writing an interior design business plan

An interior design business plan is vital to a variety of functions, including:

Funding: A comprehensive business plan demonstrates that you have thoroughly researched and analyzed the market opportunity. It showcases your understanding of the industry and your ability to execute your ideas effectively. Investors are more likely to provide funding and help you raise money for your business when they see a clear plan with achievable goals and realistic financial projections.

Resource planning: A well-written business plan helps you identify the resources needed to start and operate your interior design business successfully. It outlines the equipment, supplies, technology and personnel required to deliver high-quality services to your clients. By understanding these resource requirements upfront, you can budget accordingly and avoid unexpected expenses.

Business success: A business plan forces you to think critically about every aspect of your interior design business. It prompts you to consider potential challenges and develop strategies to overcome them. By setting specific goals and outlining actionable steps, you can stay focused and increase the likelihood of success. A business plan also helps you track your progress and make adjustments as needed.

Decision-making: Having a clear business plan provides a framework for making informed decisions. It serves as a reference point to evaluate opportunities, assess risks and prioritize tasks. When faced with new opportunities or challenges, you can refer back to your business plan to ensure alignment with your overall vision and goals.

Vision-setting: A well-crafted business plan is an effective communication tool. It allows you to articulate your vision, mission and values to potential clients, partners and employees. By clearly defining your unique selling proposition and target market, you can differentiate yourself from competitors and attract the right audience.

Got your sights on other business ideas?

Check out these guides for gaining service business ideas , other service business examples , and starting other types of businesses .

How to start an online business

How to start a consulting business

How to start a fitness business

How to start a fitness clothing line

How to start a makeup line

How to start a candle business

How to start a clothing business

How to start an online boutique

How to start a T-shirt business

How to start a jewelry business

How to start a subscription box business

How to start a beauty business

How to start a frozen food business

How to start a DJ business

How to start a flower business

How to start a plumbing business

How to start a baking business

How to start a babysitting business

How to start a virtual assistant business

How to start a car wash business

How to start a food prep business

How to start a pool cleaning business

Looking to start a business in a specific state?

How to start a business in Arizona

How to start a business in South Carolina

How to start a business in Virginia

How to start a business in Michigan

How to start a business in California

How to start a business in Florida

How to start a business in Texas

How to start a business in Wisconsin

Related Posts

How to create flower business plan

How to create a medical supply business plan

How to create a car wash business plan

Was this article helpful?

Interior Design Business Plan Template [Updated 2024]

Interior Design Business Plan Template

If you want to start an Interior Design business or expand your current Interior Design business, you need a business plan.

The following Interior Design business plan template gives you the key elements to include in a winning Interior Design business plan.

You can download our Business Plan Template (including a full, customizable financial model) to your computer here.

Interior Design Business Plan Example

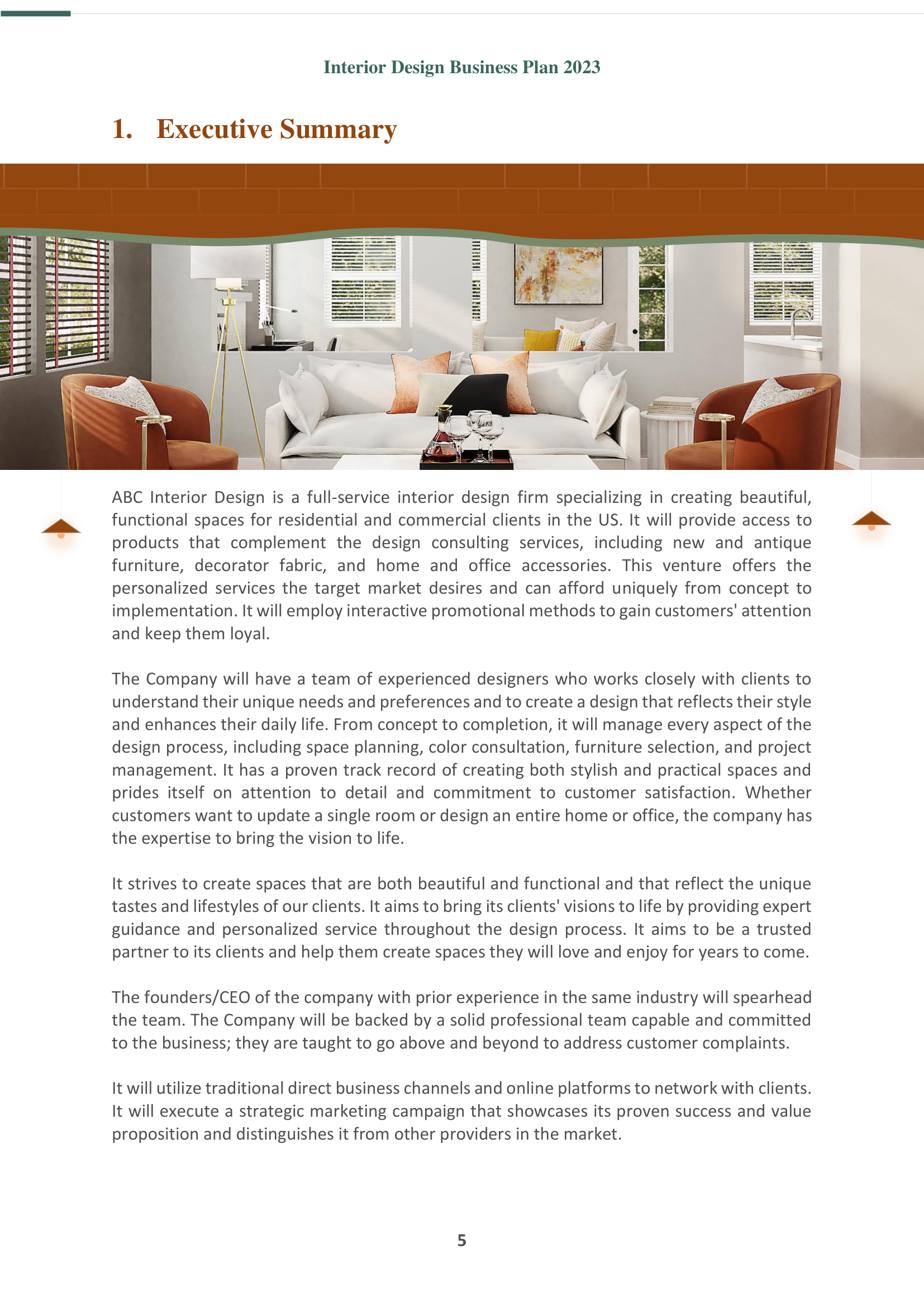

I. executive summary, business overview.

[Company Name] is an interior design firm in [location] that handles residential and commercial spaces within the city, but also works on projects nationwide. It specializes in modern and contemporary styles, but also provides customized design services for any type of project.

The company aims for beauty, functionality and excellence in every project. Thus, its team of designers are the best in their field, experienced and equipped with a high quality educational background in Interior Design and related fields. Most of all, client satisfaction is [Company Name]’s priority. It prides itself in achieving clients’ goals for their space without compromising design, quality and comfort.

Products Served

[Company Name] will be able to provide the following services to its clients:

- Interior design: Planning and designing of indoor spaces

- Design and build: Designing and supervision of a new space from start to finish

- Renovation: Space improvement and remodeling

- e-Design: Online interior design consultation that includes space design/plan, coordinating with client’s local suppliers for furniture and raw materials, and access to [Company Name]’s online space designing platform.

[Company Name] designs projects for residential and commercial properties, as well hospitality clients.

Customer Focus

[Company Name] will primarily serve the residents who live within the city. The demographics of these customers are as follows:

- 226,520 residents

- 20,541 businesses

- Average income of $58,100

- 44.6% married

- 39% in Mgt./Professional occupations

- Median age: 37.2 years

Management Team

[Company Name] management team is led by its owner, the entrepreneur-turned-interior-designer, [Founder’s Name]. [Founder] worked as a business consultant for [x] years at [Company Name] and later pursued a career in Interior Design. He passed the exam for the National Council for Interior Design with high remarks.

[Founder’s Name] will lead the company with his colleague, [Manager B], who is also an interior designer from [Location]. He will assist [Founder] with the entire operation of [Company Name].

Success Factors

[Company Name] is uniquely qualified to succeed for the following reasons:

- [Company Name] is the first in [city] to have an online design planning platform for interior designers and clients to interact.

- The management team has a track record of success in the interior design business and hies designers with outstanding educational background and portfolio..

- Our location is in an economically progressing area where businesses are flourishing and expanding and residents are earning more income that they can use for home renovations.

Financial Highlights

[Company Name] is seeking a total funding of $220,000 of debt capital to open its interior design business. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses and working capital.

Specifically, these funds will be used as follows:

- Headquarters design/build: $100,000

- Working capital: $120,000 to pay for marketing, salaries, and lease costs until [Company Name] reaches break-even

Top line projections over the next five years are as follows:

| Financial Summary | FY 1 | FY 2 | FY 3 | FY 4 | FY 5 |

|---|---|---|---|---|---|

| Revenue | $560,401 | $782,152 | $1,069,331 | $1,379,434 | $1,699,644 |

| Total Expenses | $328,233 | $391,429 | $552,149 | $696,577 | $776,687 |

| EBITDA | $232,168 | $390,722 | $517,182 | $682,858 | $922,956 |

| Depreciation | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 |

| EBIT | $225,168 | $383,722 | $510,182 | $675,858 | $915,956 |

| Interest | $6,016 | $5,264 | $4,512 | $3,760 | $3,008 |

| Pre Tax Income | $219,152 | $378,458 | $505,670 | $672,098 | $912,948 |

| Income Tax Expense | $76,703 | $132,460 | $176,985 | $235,234 | $319,532 |

| Net Income | $142,449 | $245,998 | $328,686 | $436,864 | $593,416 |

| Net Profit Margin | 25% | 31% | 31% | 32% | 35% |

II. Company Overview

Who is [company name].

With the integration of advanced technology, [Company Name] allows its clients to make design amendments through the eDesign service. With this technology, the clients have access to an online space designing platform that they can view to see how their actual space would look like. This also has an edit feature where they can make changes to the designer’s layout to show what they need for their space.

[Company Name]’s History

[Company Name] was established by the entrepreneur-turned-interior-designer, [Founder’s Name].

In [year], [Founder’s Name] earned a degree in Interior Design and started accepting pro bono projects for his friends to test if he can pursue a career in the design field. His first two projects earned him high praise and future recommendations. He then went on to take the exam for the National Council for Interior Design and when he passed it with high marks, he decided to start his own Interior Design company, [Company Name].

Since incorporation, [Company Name] was able to achieve the following milestones:

- Found a business location and signed Letter of Intent to lease it

- Developed the company’s name, logo and website located at [website]

- Determined equipment and fixture requirements

- Began recruiting key employees

[Company Name]’s Products/Services

Below is [Company Name]’s initial services list:

III. Industry Analysis

The Interior Design industry has been supported by periods of growth in residential construction and nonresidential construction. The largest market for the Interior Design industry consists of individuals seeking residential design services. Therefore, growth in housing starts, existing home sales and other residential construction projects generally helps drive revenue growth. As a result, years in which residential construction has grown have been beneficial to the industry.

Per capita disposable income and the number of households earning more than $100K have also played a determining role, since industry services are highly discretionary. Periods of higher consumer confidence, per capita disposable income and corporate profit further drive demand since industry services are generally considered a discretionary spending item.