- Paragraph Generator

- Cover Letter

- Authorization Letter

- Application Letter

- Letter of Intent

- Letter of Recommendation

- Business Plan

Incident Report

- Reference Letter

- Minutes of Meeting

- Letter of Resignation

- Excuse Letter

- Research Proposal

- Job Application

- Acknowledgement

- Employment Letter

- Promissory Note

- Business Proposal

- Statement of Purpose

- Offer Letter

- Deed of Sale

- Letter of Interest

- Power of Attorney

- Solicitation Letter

17+ SAMPLE Market Research Report in PDF | MS Word | Google Docs | Apple Pages

Market research report | ms word | google docs | apple pages, 17+ sample market research report , what is a market research report, benefits of market research report, basic methods of market research, how to create a market research report, what is the format of a report, what exactly is primary research, and how do i begin, what is the difference between primary and secondary data.

Market Research Report Template

Market Research Report of Traditional Medicine Conference

Global Market Research Report

Market Research Final Report

Market Research Survey Report

Basic Market Research Report

Sample Innovation Market Research Report

Market Research Report and Analysis

Market Research Report in PDF

Application Services Market Research Report

Industry Market Research Report

Standard Market Research Report

Market Research Report Format

Marketplace Research Report

Market Research Progress Report

Market Research Report in DOC

Marketing Annual Research Activity Report

- One-on-one interviews- These are conducted in high-traffic areas such as shopping malls during in-person surveys. They allow you to hand out product samples, packaging, or advertising to consumers and get rapid feedback. In-person surveys can provide response rates of over 90%, but they are expensive. An in-person survey might cost up to $100 per interview due to the time and work needed.

- Telephone surveys- This is cheaper than in-person surveys, but they are more costly than surveys sent by mail. However, consumers’ aversion to constant telemarketing and persuading consumers to engage in phone polls has become more challenging. Response rates to telephone surveys are typically in the 50 %to 60 % range.

- Mail surveys- This is a low-cost technique to reach a large number of people. They’re a lot less expensive than in-person or phone surveys, but they only get 3 to 15% of people to respond. Mail surveys, despite their low return, are still a cost-effective option for small enterprises.

Share This Post on Your Network

You may also like these articles, conference report.

A conference report is a comprehensive summary of key points discussed during a conference, capturing insights, outcomes, and action items for future reference. These reports ensure participants and stakeholders…

An incident report is a formal document used to record and communicate details about unexpected events, accidents, or issues within an organization. It serves as a critical tool for…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

What is a Marketing Research Report and How to Write It?

Table of contents

To see what Databox can do for you, including how it helps you track and visualize your performance data in real-time, check out our home page. Click here .

There is nothing more embarrassing for a marketer than to hear a client say “…this doesn’t quite address the business questions that we need to answer.” And unfortunately, this is a rather common occurrence in market research reporting that most marketers would care to admit.

So, why do most market research reports fail to meet client expectations? Well, in most cases, because there is more emphasis on methodology and analytic techniques used to craft the report rather than relying on data visualization, creative story-telling, and outlining actionable direction/steps.

Now, our next big question is, how do you avoid your client’s dreaded deer-in-the-headlights reaction when presenting such a report? This blog post will answer this and much more, as we go through the following:

What Is a Market Research Report?

Why is market research important, differences between primary and secondary market research, types of market research, market research reports advantages and disadvantages, how to do market research, how to prepare a market research report: 5 steps, marketing research report templates, marketing research reports best practices, bring your market research reports a step further with databox.

The purpose of creating a market research report is to make calculated decisions about business ideas. Market research is done to evaluate the feasibility of a new product or service, through research conducted with potential consumers. The information obtained from conducting market research is then documented in a formal report that should contain the following details:

- The characteristics of your ideal customers

- You customers buying habits

- The value your product or service can bring to those customers

- A list of your top competitors

Every business aims to provide the best possible product or service at the lowest cost possible. Simply said, market research is important because it helps you understand your customers and determine whether the product or service that you are about to launch is worth the effort.

Here is an example of a customer complaint that may result in more detailed market research:

Suppose you sell widgets, and you want your widget business to succeed over the long term. Over the years, you have developed many different ways of making widgets. But a couple of years ago, a customer complained that your widgets were made of a cheap kind of foam that fell apart after six months. You didn’t think at the time that this was a major problem, but now you know it.

The customer is someone you really want to keep. So, you decide to research this complaint. You set up a focus group of people who use widgets and ask them what they think about the specific problem. After the conducted survey you’ll get a better picture of customer opinions, so you can either decide to make the changes regarding widget design or just let it go.

PRO TIP: How Well Are Your Marketing KPIs Performing?

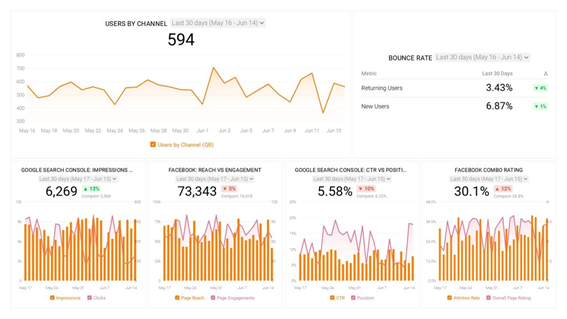

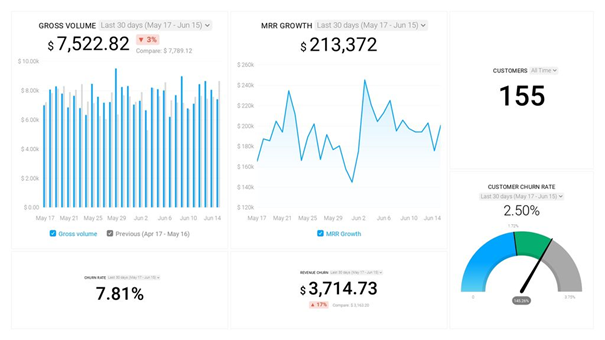

Like most marketers and marketing managers, you want to know how well your efforts are translating into results each month. How much traffic and new contact conversions do you get? How many new contacts do you get from organic sessions? How are your email campaigns performing? How well are your landing pages converting? You might have to scramble to put all of this together in a single report, but now you can have it all at your fingertips in a single Databox dashboard.

Our Marketing Overview Dashboard includes data from Google Analytics 4 and HubSpot Marketing with key performance metrics like:

- Sessions . The number of sessions can tell you how many times people are returning to your website. Obviously, the higher the better.

- New Contacts from Sessions . How well is your campaign driving new contacts and customers?

- Marketing Performance KPIs . Tracking the number of MQLs, SQLs, New Contacts and similar will help you identify how your marketing efforts contribute to sales.

- Email Performance . Measure the success of your email campaigns from HubSpot. Keep an eye on your most important email marketing metrics such as number of sent emails, number of opened emails, open rate, email click-through rate, and more.

- Blog Posts and Landing Pages . How many people have viewed your blog recently? How well are your landing pages performing?

Now you can benefit from the experience of our Google Analytics and HubSpot Marketing experts, who have put together a plug-and-play Databox template that contains all the essential metrics for monitoring your leads. It’s simple to implement and start using as a standalone dashboard or in marketing reports, and best of all, it’s free!

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your HubSpot and Google Analytics 4 accounts with Databox.

Step 3: Watch your dashboard populate in seconds.

Marketing research requires both primary and secondary market research. But what does that mean and what are the main differences?

Primary market research takes in information directly from customers, usually as participants in surveys. Usually, it is consisted of:

- Exploratory Primary Research – This type of research helps to identify possible problem areas, and it’s not focused on discovering specific information about customers. As with any research, exploratory primary research should be conducted carefully. Researchers need to craft an interviewing or surveying plan, and gather enough respondents to ensure reasonable levels of statistical reliability.

- Specific Primary Research – This type of research is one of the best ways to approach a problem because it relies on existing customer data. Specific research provides a deeper, more thorough understanding of the problem and its potential solutions. The greatest advantage of specific research is that it lets you explore a very specific question, and focus on a specific problem or an opportunity.

Secondary market research collects information from other sources such as databases, trend reports, market or government statistics, industry content, etc. We can divide secondary market research into 3 categories:

- Public market data – Public sources range from academic journals and government reports to tax returns and court documents. These sources aren’t always easy to find. Many are available only in print in libraries and archives. You have to look beyond search engines like Google to find public source documents.

- Commercial data – Those are typically created by specialized agencies like Pew, Gartner or Forrester. the research agencies are quite expensive, but they provide a lot of useful information.

- Internal data – Your organization’s databases are gold mines for market research. In the best cases, your salespeople can tell you what they think about customers. Your salespeople are your direct sources of information about the market. Don’t underestimate your internal data.

In general, primary research is more reliable than secondary research, because researchers have to interview people directly. But primary research is expensive and time-consuming. Secondary research can be quicker and less expensive.

There are plenty of ways to conduct marketing research reports. Mostly, the type of research done will depend on your goals. Here are some types of market research often conducted by marketers.

Focus Groups

Product/service use research, observation-based research, buyer persona research, market segmentation research, pricing research, competitive analysis research, customer satisfaction and loyalty research, brand awareness research, campaign research.

An interview is an interactive process of asking and answering questions and observing your respondent’s responses. Interviews are one of the most commonly used tools in market research . An interview allows an organization to observe, in detail, how its consumers interact with its products and services. It also allows an organization to address specific questions.

A focus group is a group of people who get together to discuss a particular topic. A moderator leads the discussion and takes notes. The main benefit of focus groups is that they are quick and easy to conduct. You can gather a group of carefully-selected people, give them a product to try out, and get their feedback within a few hours/days.

Product or service use research helps you obtain useful information about your product or service such as:

- What your current customers do with the product/service

- Which features of the product/service are particularly important to your customers

- What they dislike about the product/service

- What they would change about the product/service

Observation-based research helps you to observe your target audience interacting with your product or service. You will see the interactions and which aspects work well and which could be improved. The main point is to directly experience the feedback from your target audience’s point of view.

Personas are an essential sales tool. By knowing your buyers’ pain points and the challenges they face, you can create better content, target messaging, and campaigns for them. Buyer persona research is based on market research, and it’s built around data that describes your customers’ demographics, behaviors, motivations, and concerns. Sales reporting software can significantly help you develop buyer personas when you gain insights after you collected all information.

Market segmentation research is carried out to better understand existing and potential market segments. The objective is to determine how to target different market segments and how they differ from each other. The three most important steps in writing a market segmentation research report are:

- Defining the problem

- Determining the solution [and]

- Defining the market

Related : 9 Customer Segmentation Tips to Personalize Ecommerce Marketing and Drive More Sales

A price that is too high, or too low, can kill a business. And without good market research, you don’t really know what is a good price for your product. Pricing research helps you define your pricing strategy.

In a competitive analysis, you define your “competition” as any other entity that competes with you in your market, whether you’re selling a widget or a piece of real estate. With competitive analysis research, you can find out things like:

- Who your competitors are

- What they’ve done in the past

- What’s working well for them

- Their weaknesses

- How they’re positioned in the market

- How they market themselves

- What they’re doing that you’re not

Related : How to Do an SEO Competitive Analysis: A Step-by-Step Guide

In today’s marketplace, companies are increasingly focused on customer loyalty. What your customers want is your product, but, more importantly, they want it delivered with a service that exceeds their expectations. Successful companies listen to their customers and respond accordingly. That’s why customer satisfaction and loyalty research is a critical component of that basic equation.

Related : 11 Tactics for Effectively Measuring Your Customer Service ROI

Who you are, what you stand for, what you offer, what you believe in, and what your audience thinks of you is all wrapped up in brand. Brand awareness research tells what your target audience knows about your brand and what’s their experience like.

A campaign research report is a detailed account of how your marketing campaign performed. It includes all the elements that went into creating the campaign: planning, implementation, and measurement.

Here are some of the top advantages and disadvantages of doing market research and crafting market research reports.

- Identify business opportunities – A market research report can be used to analyze potential markets and new products. It can give information about customer needs, preferences, and attitudes. Also, it compare products and services.

- A clear understanding of your customers – A market report gives company’s marketing department an in-depth picture about customers’ needs and wants. This knowledge can be used to improve products, prices, and advertising.

- Mitigates risks – 30% of small businesses fail within the first two years. Why is this so? The answer is that entrepreneurs are risk takers. However, there are risks that could be avoided. A good marketing research will help you identify those risks and allow you to mitigate them.

- Clear data-driven insights – Market research encompasses a wide range of activities, from determining market size and segment to forecasting demand, and from identifying competitors to monitoring pricing. All of these are quantified and measurable which means that gives you a clear path for building unique decisions based on numbers.

Disadvantages

- It’s not cheap – Although market research can be done for as little as $500, large markets like the United States can run into millions of dollars. If a research is done for a specific product, the budget may be even much higher. The budget also depends on the quality of the research. The more expensive it is, the more time the research will take.

- Some insights could be false – For example, if you are conducting a survey, data may be inadequate or inaccurate because respondents can, well, simply be dishonest and lie.

Here are the essential steps you need to take when doing market research:

Define your buyer persona

Identify a persona group to engage, prepare research questions for your market research participants, list your primary competitors, summarize your findings.

The job of a marketing persona is to describe your ideal customer and to tell you what they want, what motivates them, what frustrates them, and what limits them. Finding out these things means you have a better chance of designing your products, services, marketing messages, and brand around real customers. There is no one right way to create a buyer persona, though.

For example, if you’re in an industry focused on education, you could include things like:

- Educational level

- Education background

It’s recommended that you create 3-5 buyer personas for your products, based on your ideal customer.

This should be a representative sample of your target customers so you can better understand their behavior. You want to find people who fit both your target personas and who represent the broader demographic of your market. People who recently made a purchase or purposefully decided not to make one are a good sample to start with.

The questions you use determine the quality of your results. Of course, the quality of your results also depends on the quality of your participants.

Don’t ask questions that imply a yes or no answer. Instead, use open questions. For example, if you are researching customers about yogurt products, you could ask them: „ What have you heard about yogurt ?” or “ What do you think of yogurt ?“.

Avoid questions that use numbers, such as “ How many times a week do you eat yogurt ?”

Avoid questions that suggest a set of mutually exclusive answers, such as “ Do you like yogurt for breakfast, lunch, or dinner ?”

Avoid questions that imply a scale, such as “ Do you like chocolate-flavored yogurt ?”

Market researchers sometimes call one company the top competitor, another middle competitor, and the third one small competitor. However you classify them, you want to identify at least three companies in each category. Now, for each business on your list, list its key characteristics. For example, if your business sells running shoes, a key characteristic might be the product’s quality.

Next, make a list of your small business’s competitive advantages. These include the unique qualities or features of your business that make it the best choice of customers for the products or services it offers. Make a list of these competitive advantages and list them next to the key characteristics you listed for your business.

You have just finished writing your marketing research report. Everything is out there quantified or qualified. You just have to sum it up and focus on the most important details that are going to make a big impact on your decisions. Clear summary leads to a winning strategy!

Related : How to Prepare a Complete Marketing Report: The KPIs, Analysis, & Action Plan You Need

Here’s how to prepare a market research report in 5 simple steps:

Step 1: Cluster the data

Step 2: prepare an outline, step 3: mention the research methods, step 4: include visuals with narrative explanations, step 5: conclude the report with recommendations.

Your first step is to cluster all the available information into a manageable set. Clustering is the process of grouping information together in a way that emphasizes commonalities and minimizes differences. So, in market research, this will help to organize all the information you have about a product, service, or target market and identify your focus areas.

A marketing research report should be written so that other people can understand it:

- Include background information at the beginning to explain who your audience is and what problem you are trying to solve for them.

- In the body of the report, include a description of the methodology – Explain to the reader how your research was done, what was involved, and why you selected the methodology you used.

- Also in the body of the report, include the results of your market research. These may be quantitative or qualitative, but either way they should answer the questions you posed at the beginning.

- Include the executive summary – A summary of the entire report.

The market research methodology section includes details on the type of research, sample size, any limitations of the studies, research design, sample selection, data collection procedures, and statistical analyses used.

Visuals are an essential part of the presentation. Even the best-written text can be difficult to understand. Charts and graphs are easier to understand than text alone, and they help the reader see how the numbers fit the bigger picture.

But visuals are not the whole story. They are only one part of the presentation. Visuals are a cue for the reader. The narrative gives the story, not just the numbers.

Recommendations tend to follow logically from conclusions and are a response to a certain problem. The recommendation should always be relevant to the research rationale, that is, the recommendation should be based on the results of the research reported in the body of the report.

Now, let’s take a look at some dashboard reporting templates you could use to enhance your market research:

- Semrush (Position Tracking) Report

Brand Awareness Report

Sales pipeline performance report, customer success overview report, stripe (mrr & churn) report, semrush (position tracking) report template.

This free SEMRush dashboard template will help you monitor how your website’s search visibility on search engines evolves on a monthly basis. This dashboard contains all of the information you need to make changes and improve the ranking results of your business in Google Search.

This Brand Awareness Report will help you to get a sense of your brand awareness performance in Google Analytics, Google Organic Search, and Facebook. Use this dashboard to track brand awareness the same way you track other marketing campaigns.

Are your sales and marketing funnel healthy and growing? How is your sales and marketing funnel performing? What are the key conversion rates between your lifecycle stages? With a pipeline performance dashboard , you’ll get all of the answers quickly.

This Customer Success Overview Dashboard allows you to analyze how your customer service team’s responsiveness impacts your business. Use this dashboard to assess the correlation between your customer service performance and churn rate.

This Stripe dashboard tracks your churn rate and MRR growth in real-time and shows you which customers (and how many of them) you have at any given point in time. All you have to do to get started is to connect your Stripe account.

As we said earlier, there are no strict rules when it comes to writing marketing research reports. On the other hand, you must find your focus if you want to write a report that will make a difference. Here are some best practices you should keep in mind when writing a research report.

- Objectives – The objective of a market research report is to define the problems, identify key issues, and suggest recommendations for further research. If you answer them successfully, you’re on the right way.

- Don’t worry about the format – Be creative. The report could be in a form of a PowerPoint presentation, Excel sheet, interactive dashboard or even a video. Use the format that best fits your audience, but make sure to make it easy to read.

- Include an executive summary, scorecard , or a dashboard – This is really important because time is money, and most people don’t have time to waste. So, how to put everything important in a short role? Address all of the objectives and put them in a graphic dashboard or scorecard. Also, you can write an executive summary template (heart of the report) that can be easily updated and read by managers or CEOs.

- Use storytelling – A good story always makes a great point because it’s so memorable. Your research report results can double the effect with a catchy story.

- Keep it short – It’s not a secret that we are reading so little in the digital era. Use a lot of white space and bullet points. Too much text on a page means less focus for the reader.

- Be organized – Maintain the order of information. It’s important for the reader to navigate through the report easily. If they want to find some details or specific information it would be great to divide all sections with appropriate references.

- Methodological information – Methodological details could be boring. Include only the most important details that the reader needs to know to understand the big picture.

- Use images (or other visualizations) whenever you can – A good picture speaks for 1.000 words! If you can communicate the point visually, don’t hesitate to do it. It would be a lot easier for those who don’t like a lot of text to understand your results. But don’t push them where you can’t.

- Create readable graphs – The crown of marketing research reports is a comprehensive graph. Make sure to design precise and attractive graphs that will power up and round your story.

- Use the Appendix – You can include all secondary information such as methodological details and other miscellaneous data in the Appendix at the end of the report.

Market research reports are all about presenting your data in an easy-to-understand way and making calculated decisions about business ideas. But this is something easier said than done.

When busy stakeholders and executives grab a report, they need something that will give them an idea of the results – the big picture that addresses company wide-business goals.

Can a PowerPoint presentation or a PDF report meet those expectations? Most likely not. But a dashboard can.

Keep in mind that even with the best market analysis in the world, your market research report won’t be actionable if you don’t present the data efficiently and in a way that everyone understands what the next steps are. Databox is your key ally in the matter.

Databox dashboards are designed to help you present your market research data with clarity – from identifying what is influencing your business, and understanding where your brand is situated in the market, to gauging the temperature of your niche or industry before a new product/service launch.

Present your research results with efficient, interactive dashboards now by signing up for a free trial .

- Databox Benchmarks

- Future Value Calculator

- ROI Calculator

- Return On Ads Calculator

- Percentage Growth Rate Calculator

- Report Automation

- Client Reporting

- What is a KPI?

- Google Sheets KPIs

- Sales Analysis Report

- Shopify Reports

- Data Analysis Report

- Google Sheets Dashboard

- Best Dashboard Examples

- Analysing Data

- Marketing Agency KPIs

- Automate Agency Google Ads Report

- Marketing Research Report

- Social Media Dashboard Examples

- Ecom Dashboard Examples

Does Your Performance Stack Up?

Are you maximizing your business potential? Stop guessing and start comparing with companies like yours.

A Message From Our CEO

At Databox, we’re obsessed with helping companies more easily monitor, analyze, and report their results. Whether it’s the resources we put into building and maintaining integrations with 100+ popular marketing tools, enabling customizability of charts, dashboards, and reports, or building functionality to make analysis, benchmarking, and forecasting easier, we’re constantly trying to find ways to help our customers save time and deliver better results.

Do you want an All-in-One Analytics Platform?

Hey, we’re Databox. Our mission is to help businesses save time and grow faster. Click here to see our platform in action.

Grew up as a Copywriter. Evolved into the Content creator. Somewhere in between, I fell in love with numbers that can portray the world as well as words or pictures. A naive thinker who believes that the creative economy is the most powerful force in the world!

Get practical strategies that drive consistent growth

8 Client Reporting Best Practices for Agencies and Consultants (with Examples)

Streamlining Sales Processes with HubSpot and Databox

Marketing Reporting: The KPIs, Reports, & Dashboard Templates You Need to Get Started

Build your first dashboard in 5 minutes or less

Latest from our blog

- How Companies Use HubSpot to Drive Growth and Value [Insights from 160+ Teams] November 8, 2024

- Top 15 Social Media Analytics Tools for 2025 October 31, 2024

- Metrics & KPIs

- vs. Tableau

- vs. Looker Studio

- vs. Klipfolio

- vs. Power BI

- vs. Whatagraph

- vs. AgencyAnalytics

- vs. DashThis

- Product & Engineering

- Inside Databox

- Terms of Service

- Privacy Policy

- Talent Resources

- We're Hiring!

- Help Center

- API Documentation

Market Research Report

Report generator.

Market research equips a company or businessperson the information from their past or current undertaking and analyzes these details to anticipate and plan for the future. This process may not be actually done by all, but it really is a game changer. To present these data, reports are used.

Since these gathered pieces of information are vital for the company’s growth and success, reports should be comprehensible and organized. Though a researcher already obtained a set of useful data, if he/she can’t relay this to the panel well, it all goes to waste. Hence, the presence of a market research report is really critical.

Market Research Report Examples & Templates

Feeling anxious about how to channel these pieces of information to the panel neatly and properly? Let us help you with that! This composition will give you ideas on how to present your market research report professionally with these templates and examples.

1. Editable Market Research Report

- Google Docs

- Apple Pages

Size: A4 & US Letter Size

As a market researcher , the data that you have gathered is very crucial. Thinking about the complexity of this information, it could be very difficult to present it in a simple and understandable manner. If it’s an arduous job that keeps you from being productive, give this template a try. This editable market research report is very light to edit so you can make one on your own.

2. Environmental Monitoring Market Research Report

Size: 503 KB

Being one of the forces that affect a business, the environment should be studied. In this market research report, the present critique of the media and the Roundtable on Sustainable Palm Oil (RSPO) who assert the requirements of membership reporting are inadequate. This well-designed report helps the company to know and assess the occurring challenges. If you’re into a similar task, take time reading this sample.

3. Sample Market Research Report

Size: 151 KB

If creating a market research report is new to you, refer to simple samples first. This comprehensible paper from Advanced Products Inc. provides you a report tackling the hardwood manufacturers in the U.S. Furthermore, this report wants to identify the potentials and the market segment, examine the company’s capability, etc.

4. MSI Data Market Research Report

Size: 688 KB

Market research can be done in-house, by the company itself, or by a third-party company that has expertise in this field. This sample falls on the latter which is conducted by MSI Market Research for Industry, an independent company emerged in 1980. This report talks about contaminated land assessment and remediation in the UK market. Is your topic related? Consider seeing this sample.

5. Agricultural Market Research Report

Size: 730 KB

Along with mining and forestry, agriculture is the source of the common raw materials in several types of business. Therefore, it should be studied well to know what are the different aspects or factors affecting agricultural sustainability. This market research report discusses the community attitudes toward Australian fisheries management and provided their findings well.

6. Sales and Marketing Research Report

Sales and marketing research is also vital to identify issues and generate solutions for each of the issues. This sample from RSM McClure Watters aims to investigate and assess the supply of skills for the current exportation as well as the marketing forecast, gaps, provisions, and recommendations to address any identified issues. If you are going to write one, this sample is recommendable to read.

7. DOI Market Research Report

Size: 160 KB

DOI or digital object identifier is a distinct alphanumeric string that is uniquely given by an agency to provide a continuous link and distinguish the content to its location on the Internet. Interestingly, this sample from mEDRA helps them to determine the application status of the DOI in which countries and in which sectors it is being used. If you see this sample as relatable, you may consider this as your guide.

8. Benchmarking Market Research Report

Size: 620 KB

Benchmarking is a process to measure the quality of the services, products, strategies, etc. of an organization in comparison to the measurement of fellow. A sample market research report is written to present the marketing mix model potential in deriving a consensus ranking for benchmarking on selected retail stores in Malaysia. Taking into consideration, before writing one, read a sample like this first.

9. Market Research Project Report

Size: 348 KB

The market research also helps to identify a certain approach or intervention’s feasibility . It also oversees if an advertisement is considered impactful or not. Likewise, this study from the School of Business-University of Nairobi aims to examine the effectiveness of Internet advertising on consumer behavior. Be guided in writing one with this simple market research project report .

10. Fashion Market Research Report

Trends in fashion changes rapidly; thus, it is very vital to learn whether a certain style would capture the consumer’s taste. This sample market research report from the Business of Fashion and McKinsey & Company provides them a forecast of the expected growth across regions and see the massive transformation in the fashion industry. Spare some time for this sample but learn more.

11. Content Marketing Research Report

Size: 975 KB

Content marketing is a merchandising tactic that focused on attractive contents to lure and keep the target market. This content marketing report shows various data from the North American B2B content marketers regarding the different issues they have encountered. Moreover, the way information is presented here is well done and highly readable. Learning this vibrant sample could really help you a lot.

Having a market research report is a good way to take into consideration the overall picture of the business. Creating one may be intimidating, especially if you are new to this field. Anyway, you can always seek for guides to help you achieve your goals. These samples and templates are just a few of them. Seeking for more? Our website will always be glad to support you.

Text prompt

- Instructive

- Professional

Generate a report on the impact of technology in the classroom on student learning outcomes

Prepare a report analyzing the trends in student participation in sports and arts programs over the last five years at your school.

- Free Resources

14 Market Research Examples

This article was originally published in the MarketingSherpa email newsletter .

Example #1: National bank’s A/B testing

You can learn what customers want by conducting experiments on real-life customer decisions using A/B testing. When you ensure your tests do not have any validity threats, the information you garner can offer very reliable insights into customer behavior.

Here’s an example from Flint McGlaughlin, CEO of MarketingSherpa and MECLABS Institute, and the creator of its online marketing course .

A national bank was working with MECLABS to discover how to increase the number of sign-ups for new checking accounts.

Customers who were interested in checking accounts could click on an “Open in Minutes” link on the bank’s homepage.

Creative Sample #1: Anonymized bank homepage

After clicking on the homepage link, visitors were taken to a four-question checking account selector tool.

Creative Sample #2: Original checking account landing page — account recommendation selector tool

After filling out the selector tool, visitors were taken to a results page that included a suggested package (“Best Choice”) along with a secondary option (“Second Choice”). The results page had several calls to action (CTAs). Website visitors were able to select an account and begin pre-registration (“Open Now”) or find out more information about the account (“Learn More”), go back and change their answers (“Go back and change answers”), or manually browse other checking options (“Other Checking Options”).

Creative Sample #3: Original checking account landing page — account recommendation selector tool results page

After going through the experience, the MECLABS team hypothesized that the selector tool wasn’t really delivering on the expectation the customer had after clicking on the “Open in Minutes” CTA. They created two treatments (new versions) and tested them against the control experience.

In the first treatment, the checking selector tool was removed, and instead, customers were directly presented with three account options in tabs from which customers could select.

Creative Sample #4: Checking account landing page Treatment #1

The second treatment’s landing page focused on a single product and had only one CTA. The call-to-action was similar to the CTA customers clicked on the homepage to get to this page — “Open Now.”

Creative Sample #5: Checking account landing page Treatment #2

Both treatments increased account applications compared to the control landing page experience, with Treatment #2 generating 65% more applicants at a 98% level of confidence.

Creative Sample #6: Results of bank experiment that used A/B testing

You’ll note the Level of Confidence in the results. With any research tactic or tool you use to learn about customers, you have to consider whether the information you’re getting really represents most customers, or if you’re just seeing outliers or random chance.

With a high Level of Confidence like this, it is more likely the results actually represent a true difference between the control and treatment landing pages and that the results aren’t just a random event.

The other factor to consider is — testing in and of itself will not produce results. You have to use testing as research to actually learn about the customer and then make changes to better serve the customer.

In the video How to Discover Exactly What the Customer Wants to See on the Next Click: 3 critical skills every marketer must master , McGlaughlin discussed this national bank experiment and explained how to use prioritization, identification and deduction to discover what your customers want.

This example was originally published in Marketing Research: 5 examples of discovering what customers want .

Example #2: Consumer Reports’ market intelligence research from third-party sources

The first example covers A/B testing. But keep in mind, ill-informed A/B testing isn’t market research, it’s just hoping for insights from random guesses.

In other words, A/B testing in a vacuum does not provide valuable information about customers. What you are testing is crucial, and then A/B testing is a means to help better understand whether insights you have about the customer are either validated or refuted by actual customer behavior. So it’s important to start with some research into potential customers and competitors to inform your A/B tests.

For example, when MECLABS and MarketingExperiments (sister publisher to MarketingSherpa) worked with Consumer Reports on a public, crowdsourced A/B test, we provided a market intelligence report to our audience to help inform their test suggestions.

Every successful marketing test should confirm or deny an assumption about the customer. You need enough knowledge about the customer to create marketing messages you think will be effective.

For this public experiment to help marketers improve their split testing abilities, we had a real customer to work with — donors to Consumer Reports.

To help our audience better understand the customer, the MECLABS Marketing Intelligence team created the 26-page ConsumerReports Market Intelligence Research document (which you can see for yourself at that link).

This example was originally published in Calling All Writers and Marketers: Write the most effective copy for this Consumer Reports email and win a MarketingSherpa Summit package and Consumer Reports Value Proposition Test: What you can learn from a 29% drop in clickthrough .

Example #3: Virtual event company’s conversation

What if you don’t have the budget for A/B testing? Or any of the other tactics in this article?

Well, if you’re like most people you likely have some relationships with other human beings. A significant other, friends, family, neighbors, co-workers, customers, a nemesis (“Newman!”). While conducting market research by talking to these people has several validity threats, it at least helps you get out of your own head and identify some of your blind spots.

WebBabyShower.com’s lead magnet is a PDF download of a baby shower thank you card ‘swipe file’ plus some extras. “Women want to print it out and have it where they are writing cards, not have a laptop open constantly,” said Kurt Perschke, owner, WebBabyShower.com.

That is not a throwaway quote from Perschke. That is a brilliant insight, so I want to make sure we don’t overlook it. By better understanding customer behavior, you can better serve customers and increase results.

However, you are not your customer. So you must bridge the gap between you and them.

Often you hear marketers or business leaders review an ad or discuss a marketing campaign and say, “Well, I would never read that entire ad” or “I would not be interested in that promotion.” To which I say … who cares? Who cares what you would do? If you are not in the ideal customer set, sorry to dent your ego, but you really don’t matter. Only the customer does.

Perschke is one step ahead of many marketers and business leaders because he readily understands this. “Owning a business whose customers are 95% women has been a great education for me,” he said.

So I had to ask him, how did he get this insight into his customers’ behavior? Frankly, it didn’t take complex market research. He was just aware of this disconnect he had with the customer, and he was alert for ways to bridge the gap. “To be honest, I first saw that with my wife. Then we asked a few customers, and they confirmed it’s what they did also. Writing notes by hand is viewed as a ‘non-digital’ activity and reading from a laptop kinda spoils the mood apparently,” he said.

Back to WebBabyShower. “We've seen a [more than] 100% increase in email signups using this method, which was both inexpensive and evergreen,” Perschke said.

This example was originally published in Digital Marketing: Six specific examples of incentives that worked .

Example #4: Spiceworks Ziff Davis’ research-informed content marketing

Marketing research isn’t just to inform products and advertising messages. Market research can also give your brand a leg up in another highly competitive space – content marketing.

Don’t just jump in and create content expecting it to be successful just because it’s “free.” Conducting research beforehand can help you understand what your potential audience already receives and where they might need help but are currently being served.

When Spiceworks Ziff Davis (SWZD) published its annual State of IT report, it invested months in conducting primary market research, analyzing year-over-year trends, and finally producing the actual report.

“Before getting into the nuts and bolts of writing an asset, look at market shifts and gaps that complement your business and marketing objectives. Then, you can begin to plan, research, write, review and finalize an asset,” said Priscilla Meisel, Content Marketing Director, SWZD.

This example was originally published in Marketing Writing: 3 simple tips that can help any marketer improve results (even if you’re not a copywriter) .

Example #5: Business travel company’s guerilla research

There are many established, expensive tactics you can use to better understand customers.

But if you don’t have the budget for those tactics, and don’t know any potential customers, you might want to brainstorm creative ways you can get valuable information from the right customer target set.

Here’s an example from a former client of Mitch McCasland, Founding Partner and Director, Brand Inquiry Partners. The company sold a product related to frequent business flyers and was interested in finding out information on people who travel for a living. They needed consumer feedback right away.

“I suggested that they go out to the airport with a bunch of 20-dollar bills and wait outside a gate for passengers to come off their flight,” McCasland said. When people came off the flight, they were politely asked if they would answer a few questions in exchange for the incentive (the $20). By targeting the first people off the flight they had a high likelihood of reaching the first-class passengers.

This example was originally published in Guerrilla Market Research Expert Mitch McCasland Tells How You Can Conduct Quick (and Cheap) Research .

Example #6: Intel’s market research database

When conducting market research, it is crucial to organize your data in a way that allows you to easily and quickly report on it. This is especially important for qualitative studies where you are trying to do more than just quantify the data, but need to manage it so it is easier to analyze.

Anne McClard, Senior Researcher, Doxus worked with Shauna Pettit-Brown of Intel on a research project to understand the needs of mobile application developers throughout the world.

Intel needed to be able to analyze the data from several different angles, including segment and geography, a daunting task complicated by the number of interviews, interviewers, and world languages.

“The interviews were about an hour long, and pretty substantial,” McClard says. So, she needed to build a database to organize the transcripts in a way that made sense.

Different types of data are useful for different departments within a company; once your database is organized you can sort it by various threads.

The Intel study had three different internal sponsors. "When it came to doing the analysis, we ended up creating multiple versions of the presentation targeted to individual audiences," Pettit-Brown says.

The organized database enabled her to go back into the data set to answer questions specific to the interests of the three different groups.

This example was originally published in 4 Steps to Building a Qualitative Market Research Database That Works Better .

Example #7: National security survey’s priming

When conducting market research surveys, the way you word your questions can affect customers’ response. Even the way you word previous questions can put customers in a certain mindset that will skew their answers.

For example, when people were asked if they thought the U.S. government should spend money on an anti-missile shield, the results appeared fairly conclusive. Sixty-four percent of those surveyed thought the country should and only six percent were unsure, according to Opinion Makers: An Insider Exposes the Truth Behind the Polls .

But when pollsters added the option, "...or are you unsure?" the level of uncertainty leaped from six percent to 33 percent. When they asked whether respondents would be upset if the government took the opposite course of action from their selection, 59 percent either didn’t have an opinion or didn’t mind if the government did something differently.

This is an example of how the way you word questions can change a survey’s results. You want survey answers to reflect customer’s actual sentiments that are as free of your company’s previously held biases as possible.

This example was originally published in Are Surveys Misleading? 7 Questions for Better Market Research .

Example #8: Visa USA’s approach to getting an accurate answer

As mentioned in the previous example, the way you ask customers questions can skew their responses with your own biases.

However, the way you ask questions to potential customers can also illuminate your understanding of them. Which is why companies field surveys to begin with.

“One thing you learn over time is how to structure questions so you have a greater likelihood of getting an accurate answer. For example, when we want to find out if people are paying off their bills, we'll ask them to think about the card they use most often. We then ask what the balance was on their last bill after they paid it,” said Michael Marx, VP Research Services, Visa USA.

This example was originally published in Tips from Visa USA's Market Research Expert Michael Marx .

Example #9: Hallmark’s private members-only community

Online communities are a way to interact with and learn from customers. Hallmark created a private members-only community called Idea Exchange (an idea you could replicate with a Facebook or LinkedIn Group).

The community helped the greeting cards company learn the customer’s language.

“Communities…let consumers describe issues in their own terms,” explained Tom Brailsford, Manager of Advancing Capabilities, Hallmark Cards. “Lots of times companies use jargon internally.”

At Hallmark they used to talk internally about “channels” of distribution. But consumers talk about stores, not channels. It is much clearer to ask consumers about the stores they shop in than what channels they shop.

For example, Brailsford clarified, “We say we want to nurture, inspire, and lift one’s spirits. We use those terms, and the communities have defined those terms for us. So we have learned how those things play out in their lives. It gives us a much richer vocabulary to talk about these things.”

This example was originally published in Third Year Results from Hallmark's Online Market Research Experiment .

Example #10: L'Oréal’s social media listening

If you don’t want the long-term responsibility that comes with creating an online community, you can use social media listening to understand how customers talking about your products and industry in their own language.

In 2019, L'Oréal felt the need to upgrade one of its top makeup products – L'Oréal Paris Alliance Perfect foundation. Both the formula and the product communication were outdated – multiple ingredients had emerged on the market along with competitive products made from those ingredients.

These new ingredients and products were overwhelming consumers. After implementing new formulas, the competitor brands would advertise their ingredients as the best on the market, providing almost magical results.

So the team at L'Oréal decided to research their consumers’ expectations instead of simply crafting a new formula on their own. The idea was to understand not only which active ingredients are credible among the audience, but also which particular words they use while speaking about foundations in general.

The marketing team decided to combine two research methods: social media listening and traditional questionnaires.

“For the most part, we conduct social media listening research when we need to find out what our customers say about our brand/product/topic and which words they use to do it. We do conduct traditional research as well and ask questions directly. These surveys are different because we provide a variety of readymade answers that respondents choose from. Thus, we limit them in terms of statements and their wording,” says Marina Tarandiuk, marketing research specialist, L'Oréal Ukraine.

“The key value of social media listening (SML) for us is the opportunity to collect people’s opinions that are as ‘natural’ as possible. When someone leaves a review online, they are in a comfortable environment, they use their ‘own’ language to express themselves, there is no interviewer standing next to them and potentially causing shame for their answer. The analytics of ‘natural’ and honest opinions of our customers enables us to implement the results in our communication and use the same language as them,” Tarandiuk said.

The team worked with a social media listening tool vendor to identify the most popular, in-demand ingredients discussed online and detect the most commonly used words and phrases to create a “consumer glossary.”

Questionnaires had to confirm all the hypotheses and insights found while monitoring social media. This part was performed in-house with the dedicated team. They created custom questionnaires aiming to narrow down all the data to a maximum of three variants that could become the base for the whole product line.

“One of our recent studies had a goal to find out which words our clients used to describe positive and negative qualities of [the] foundation. Due to a change in [the] product’s formula, we also decided to change its communication. Based on the opinions of our customers, we can consolidate the existing positive ideas that our clients have about the product,” Tarandiuk said.

To find the related mentions, the team monitored not only the products made by L'Oréal but also the overall category. “The search query contained both brand names and general words like foundation, texture, smell, skin, pores, etc. The problem was that this approach ended up collecting thousands of mentions, not all of which were relevant to the topic,” said Elena Teselko, content marketing manager, YouScan (L'Oréal’s social media listening tool).

So the team used artificial intelligence-based tagging that divided mentions according to the category, features, or product type.

This approach helped the team discover that customers valued such foundation features as not clogging pores, a light texture, and not spreading. Meanwhile, the most discussed and appreciated cosmetics component was hyaluronic acid.

These exact phrases, found with the help of social media monitoring, were later used for marketing communication.

Creative Sample #7: Marketing communicating for personal care company with messaging based on discoveries from market research

“Doing research and detecting audience’s interests BEFORE starting a campaign is an approach that dramatically lowers any risks and increases chances that the campaign would be appreciated by customers,” Teselko said.

This example was originally published in B2C Branding: 3 quick case studies of enhancing the brand with a better customer experience .

Example #11: Levi’s ethnographic research

In a focus group or survey, you are asking customers to explain something they may not even truly understand. Could be why they bought a product. Or what they think of your competitor.

Ethnographic research is a type of anthropology in which you go into customers’ homes or places of business and observe their actual behavior, behavior they may not understand well enough to explain to you.

While cost prohibitive to many brands, and simply unfeasible for others, it can elicit new insights into your customers.

Michael Perman, Senior Director Cultural Insights, Levi Strauss & Co. uses both quantitative and qualitative research on a broad spectrum, but when it comes to gathering consumer insight, he focuses on in-depth ethnographic research provided by partners who specialize in getting deep into the “nooks and crannies of consumer life in America and around the world.” For example, his team spends time in consumers’ homes and in their closets. They shop with consumers, looking for the reality of a consumer’s life and identifying themes that will enable designers and merchandisers to better understand and anticipate consumer needs.

Perman then puts together multi-sensory presentations that illustrate the findings of research. For example, “we might recreate a teenager’s bedroom and show what a teenage girl might have on her dresser.”

This example was originally published in How to Get Your Company to Pay Attention to Market Research Results: Tips from Levi Strauss .

Example #12: eBags’ ethnographic research

Ethnographic research isn’t confined to a physical goods brand like Levi’s. Digital brands can engage in this form of anthropology as well.

While usability testing in a lab is useful, it does miss some of the real-world environmental factors that play a part in the success of a website. Usability testing alone didn’t create a clear enough picture for Gregory Casey, User Experience Designer and Architect, eBags.

“After we had designed our mobile and tablet experience, I wanted to run some contextual user research, which basically meant seeing how people used it in the wild, seeing how people are using it in their homes. So that’s exactly what I did,” Gregory said.

He found consumers willing to open their home to him and be tested in their normal environment. This meant factors like the television, phone calls and other family members played a part in how they experienced the eBags mobile site.

“During these interview sessions, a lot of times we were interrupted by, say, a child coming over and the mother having to do something for the kid … The experience isn’t sovereign. It’s not something where they just sit down, work through a particular user flow and complete their interaction,” Gregory said.

By watching users work through the site as they would in their everyday life, Gregory got to see what parts of the site they actually use.

This example was originally published in Mobile Marketing: 4 takeaways on how to improve your mobile shopping experience beyond just responsive design .

Example #13: John Deere’s shift from product-centric market research to consumer-centric research

One of the major benefits of market research is to overcome company blind spots. However, if you start with your blind spots – i.e., a product focus – you will blunt the effectiveness of your market research.

In the past, “they’d say, Here’s the product, find out how people feel about it,” explained David van Nostrand, Manager, John Deere's Global Market Research. “A lot of companies do that.” Instead, they should be saying, “Let's start with the customers: what do they want, what do they need?”

The solution? A new in-house program called “Category Experts” brings the product-group employees over as full team members working on specific research projects with van Nostrand’s team.

These staffers handle items that don’t require a research background: scheduling, meetings, logistics, communication and vendor management. The actual task they handle is less important than the fact that they serve as human cross-pollinators, bringing consumer-centric sensibility back to their product- focused groups.

For example, if van Nostrand’s team is doing research about a vehicle, they bring in staffers from the Vehicles product groups. “The information about vehicle consumers needs to be out there in the vehicle marketing groups, not locked in here in the heads of the researchers.”

This example was originally published in How John Deere Increased Mass Consumer Market Share by Revamping its Market Research Tactics .

Example #14: LeapFrog’s market research involvement throughout product development (not just at the beginning and the end)

Market research is sometimes thought of as a practice that can either inform the development of a product, or research consumer attitudes about developed products. But what about the middle?

Once the creative people begin working on product designs, the LeapFrog research department stays involved.

They have a lab onsite where they bring moms and kids from the San Francisco Bay area to test preliminary versions of the products. “We do a lot of hands-on, informal qualitative work with kids,” said Craig Spitzer, VP Marketing Research, LeapFrog. “Can they do what they need to do to work the product? Do they go from step A to B to C, or do they go from A to C to B?”

When designing the LeapPad Learning System, for example, the prototype went through the lab “a dozen times or so,” he says.

A key challenge for the research department is keeping and building the list of thousands of families who have agreed to be on call for testing. “We've done everything from recruiting on the Internet to putting out fliers in local schools, working through employees whose kids are in schools, and milking every connection we have,” Spitzer says.

Kids who test products at the lab are compensated with a free, existing product rather than a promise of the getting the product they're testing when it is released in the future.

This example was originally published in How LeapFrog Uses Marketing Research to Launch New Products .

Related resources

The Marketer’s Blind Spot: 3 ways to overcome the marketer’s greatest obstacle to effective messaging

Get Your Free Test Discovery Tool to Help Log all the Results and Discoveries from Your Company’s Marketing Tests

Marketing Research: 5 examples of discovering what customers want

Online Marketing Tests: How do you know you’re really learning anything?

Improve Your Marketing

Join our thousands of weekly case study readers.

Enter your email below to receive MarketingSherpa news, updates, and promotions:

Note: Already a subscriber? Want to add a subscription? Click Here to Manage Subscriptions

Get Better Business Results With a Skillfully Applied Customer-first Marketing Strategy

The customer-first approach of MarketingSherpa’s agency services can help you build the most effective strategy to serve customers and improve results, and then implement it across every customer touchpoint.

Get headlines, value prop, competitive analysis, and more.

Marketer Vs Machine

Marketer Vs Machine: We need to train the marketer to train the machine.

Free Marketing Course

Become a Marketer-Philosopher: Create and optimize high-converting webpages (with this free online marketing course)

Project and Ideas Pitch Template

A free template to help you win approval for your proposed projects and campaigns

Six Quick CTA checklists

These CTA checklists are specifically designed for your team — something practical to hold up against your CTAs to help the time-pressed marketer quickly consider the customer psychology of your “asks” and how you can improve them.

Infographic: How to Create a Model of Your Customer’s Mind

You need a repeatable methodology focused on building your organization’s customer wisdom throughout your campaigns and websites. This infographic can get you started.

Infographic: 21 Psychological Elements that Power Effective Web Design

To build an effective page from scratch, you need to begin with the psychology of your customer. This infographic can get you started.

Receive the latest case studies and data on email, lead gen, and social media along with MarketingSherpa updates and promotions.

- Your Email Account

- Customer Service Q&A

- Search Library

- Content Directory:

Questions? Contact Customer Service at [email protected]

© 2000-2024 MarketingSherpa LLC, ISSN 1559-5137 Editorial HQ: MarketingSherpa LLC, PO Box 50032, Jacksonville Beach, FL 32240

The views and opinions expressed in the articles of this website are strictly those of the author and do not necessarily reflect in any way the views of MarketingSherpa, its affiliates, or its employees.

6 Real Market Research Report Examples To Inspire You

- ViB Editorial Team

- September 30, 2024

Table of Contents

If you’re looking for market research report examples, you’re in the right place. Even in B2B tech, it’s no secret market research is a key component to businesses seeking long-term viability and brand success. From better understanding consumer segments to creating powerful research-backed content, and even developing future-proof product roadmaps, market research is the cornerstone of strategic decision-making.

In fact, 89% of marketers surveyed by Hubspot reported that leveraging the market research they performed had a positive quantitative impact on their business.

But, creating a piece of valuable research for your tech company can feel… a little hard to imagine.

What are the best market research topics for my B2B tech industry? What is the larger story to tell to subtly reinforce my company’s positioning?

What questions should I ask? Who should I ask? What about… how long should a research report be? How do I present my findings? You probably have a million questions. And I’d love to answer them all by showing you some of the best market research report examples that we’ve gathered along the way.

B2B organizations must have a solid awareness of their industry space and the current market trends to stay relevant in an ever-competitive digital landscape.

Market research report examples to get inspo from

As a leading market research vendor in the B2B tech space, we’ve helped a ton of B2B tech marketers like you with:

- Full-service third-party market research projects

- Respondent recruiting, data collection, and data analysis

- Creation of market research reports in each client’s brand

- Generating demand using research-backed content

Sounds similar to your goals?

Whether you’re here for some inspo, or want to evaluate our work, let’s dig into some market research report examples we could all learn a thing or two from.👇

1 - Snyk: Infrastructure as code security

Snyk is a developer security platform that enables application and cloud developers to secure their whole application.

They recently conducted the Infrastructure as Code Security Insights report to provide insights on the state of Infrastructure as Code (IaC) deployment and the challenges faced by developers in securing their code, infrastructure configuration, and containers.

The goal of the report? To help organizations understand the benefits of automated security testing for IaC definitions, the roadblocks to the widespread use of IaC, and how organizations differ in their approaches to using IaC.

With that, we helped Snyk form a story around IaC and recruited hundreds of IT professionals across industries and company sizes.

That gave us a clear, comprehensive understanding of the need for organizations to prioritize IaC security and implement best practices to ensure the reliability and security of their infrastructure.

Some findings that helped position them as a valuable player in their industry include👇

- 63% of companies are just beginning to explore IaC technology, while only 7% have implemented IaC to the best of current industry capabilities.

- 71% of companies would prefer to standardize on a common toolset/workflow across all IaC configuration types and formats.

- A lack of standardized workflow and practices was the leading reason respondents chose to remediate a security issue manually.

- 61% of respondents pointed to speed-related issues as a reason for remediating a security issue manually.

💡 Tip: Incorporate your branding

What I also love about Snyk’s report is its strong branding, alongside objective results obtained through an independent survey through our team at ViB.

That’s major because typically, most marketing teams have one or the other.

- Strong branding through a survey conducted in-house that’s potentially perceived as biased

- Or an independent survey conducted by an external research vendor, but without any individual branding because of limitations in ownership and usage.

If you ask me, having the best of both worlds helps Snyk reinforce its brand leadership and credibility at the same time. Win-win!

🚀 See how Snyk designed their branded report here.

Moving on, let’s take a look at some other great market research report examples.

2 - Illumio: Security segmentation report

Illumio is a cybersecurity company that specializes in providing solutions for micro-segmentation and security.

The first platform for breach containment, Illumio recently published a report, The State of Security Segmentation, which dives into the ways organizations can protect against the lateral movement that leads to breaches.

The goal of the report? To get a better understanding of how companies segment today and what difficulties they face.

Likewise, with the help of ViB Research , Illumio surveyed over 300+ IT professionals in their specialized cybersecurity industry. They were then able to highlight the critical role of segmentation in enhancing network security, and the shift away from traditional firewalls in favor of more agile and cost-effective solutions.

Some of the biggest takeaways for tech professionals from Illumio’s report are:

- More than half of the respondents do not have and are not planning segmentation in the next six months.

- Two-thirds of respondents think the firewall is an over-the-hill gold digger when it comes to segmentation.

- Today’s IT norm is hybrid: on-prem data centers and multiple clouds.

- Security incidents are inevitable.

💡Tip: Repurpose your report into derivative content

In this market research report example , what Illumio did brilliantly was repurposing.

Illumio repurposed a single market report into a range of thought leadership content and used it across demand generation channels.

“Once the survey was launched, it took about 4-6 weeks when we had the results in our hands, where we were able to just run with it and build Illumio's first State of Security Segmentation report, and enough snackable content to repurpose in social, email, content syndication , and other demand generation channels. I definitely highly recommend this service.” Jaye Liang, Senior Marketing Manager at Illumio

For example, using insights from the report they created with ViB, Illumio developed the whitepaper — Decoupling Security from the Network: The Evolution of Segmentation .

The lesson here: while a single research report feels like a big investment, it can function as a launch pad for repurposing value-added content that’s easily shareable across all segments of your target audience.

Get an exclusive look into the State of Segmentation Report and a copy of Illumio’s topical whitepaper, Decoupling Security from the Network: The Evolution of Segmentation, which builds on their market research report.

🚀 Download their sample report and whitepaper today.

Best Pay Per Lead Generation Companies For B2B Tech

What is B2B Demand Generation? + 5 Strategies for SaaS and Tech

From Top to Bottom: B2B Lead Generation Services for Each Stage of the Marketing Funnel

3 - split: feature management and experimentation.

Split is “a feature delivery platform that pairs speed and reliability of feature flags with data to measure the impact of every feature.”

This year, Split conducted its Feature Management & Experimentation Impact Report which examined the challenges and areas for improvement in these practices, as well as the adoption and impact of feature releases on business and user experience.

This report was based on a survey of over 300 software professionals who came from a variety of backgrounds (engineering, development, product management, etc.).

Some highlights from the survey are below 👇

- 92% of respondents either agree or completely agree that software feature management is critical to developing and releasing successful digital experiences.

- 50% feel that easily pinpointing unexpected issues during a feature rollout is an important priority.

- 60% felt that their top area for improvement involved software feature release quality and reliability.

- 14% have implemented a feature experiment platform; 39% are investigating, 29% plan to implement.

Organizations that roll out software features on demand often show lower levels of involvement in feature management and experimentation compared to their more deliberate counterparts.

The data does show strong moves toward adopting feature management and experimentation . It’s clear that the industry is moving in this direction, and now is the right time to take action if you want to stay competitive with digital industry leaders.

💡 Tip: Actively promote your research report

Similar to how Illumio created a range of repurposed content, Split is taking an active step toward promoting its market research report.

Spot this feature of the research report live on Split’s home page for example.

By commissioning ViB to do their research, Split was able to use and promote the content on any channel without any need for further licensing fees or permissions .

Often, research vendors have a pretty strict list of recirculation restrictions, or an additional price tag of a few grand just to reuse and reshare the published materials.

🚀 Check out Split’s report here.

4 - Siemplify: Remote security operations

Siemplify recently acquired by Google, is an intuitive workbench that enables security teams to both manage risk and reduce the cost of addressing threats.

Launched in early 2021, Siemplify conducted a Remote Security Operations study that looked at how COVID-19 and the need to work from home affected the ability of SecOps professionals to do their security work.

The report delves into key findings on the threat impact, people impact, and the path forward.

It was based on a survey of hundreds of IT professionals in leadership positions. Respondents also worked at organizations with over 1,000 employees on average.

Let’s take a look at some of their most notable findings👇

- 51% of respondents said investigating suspicious activities became more difficult due to balancing security and corporate demand.

- 47% of respondents said collaboration and communication suffered naturally, making everyday tasks more challenging.

- Roughly one-third of respondents reported seeing an increase in network intrusions, malware, ransomware, and vulnerabilities.

Incidents of phishing have increased for 57% of respondents, topping the list.

💡 Tip: Be the first to capture an emerging trend

With Siemplify, the key takeaway was their smart choice of topic.

This report was conducted immediately after the lockdown and released shortly after.

Within a year of the onset of the pandemic, they leveraged an ongoing and developing issue, tailored it to their industry. They were able to launch original data about a hot topic , standing out against the content their competitors were pushing.

And then by working with ViB, they were able to push for a specific story (some vendors will only commission research for a predetermined list of topics that they’ve set).

Within weeks , we collaboratively produced a completed report, allowing the company to quickly respond to an emerging trend.

👉 See how Siemplify angled their report here

Now, let’s move on to the rest of our B2B market research report examples .

5 - Softchoice: Cloud Enabled AI

Softchoice is a software-focused IT solutions provider that equips organizations to be efficient, agile, and innovative.

The Cloud Enabled AI report explores the potential of AI and ML (machine learning) in the cloud, revealing opportunities and barriers to their implementation.

Some of the most impactful takeaways are 👇

- Despite understanding that analytics, AI, and ML will have a transformative impact on industries in the coming five years, many organizations are falling behind in integrating them.

- 46% of respondents believe that a multi-cloud approach is very important, with 14% considering it extremely important.

- The most common barriers to leveraging the full benefits of analytics, AI, and ML are a lack of in-house expertise (38%) and difficulty implementing AI and ML solutions (22%).

💡 Tip: How to recruit targeted respondent from niche industries

This report was based on a survey of over 200 IT professionals across 18 different industries.

What was great about Softchoice’s report example is their specificity in targeting.