Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

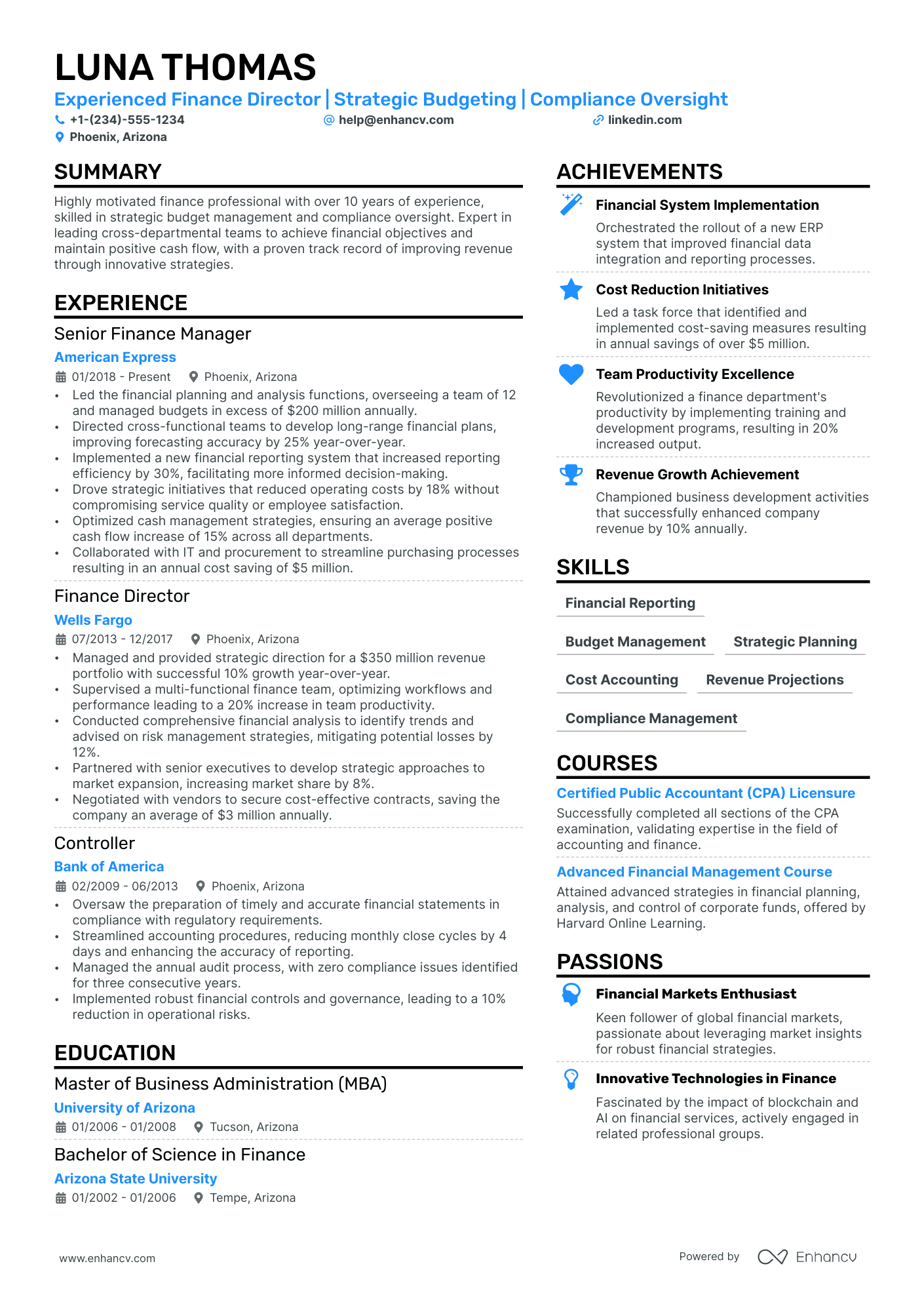

5 Finance Manager Resume Examples Made for 2024

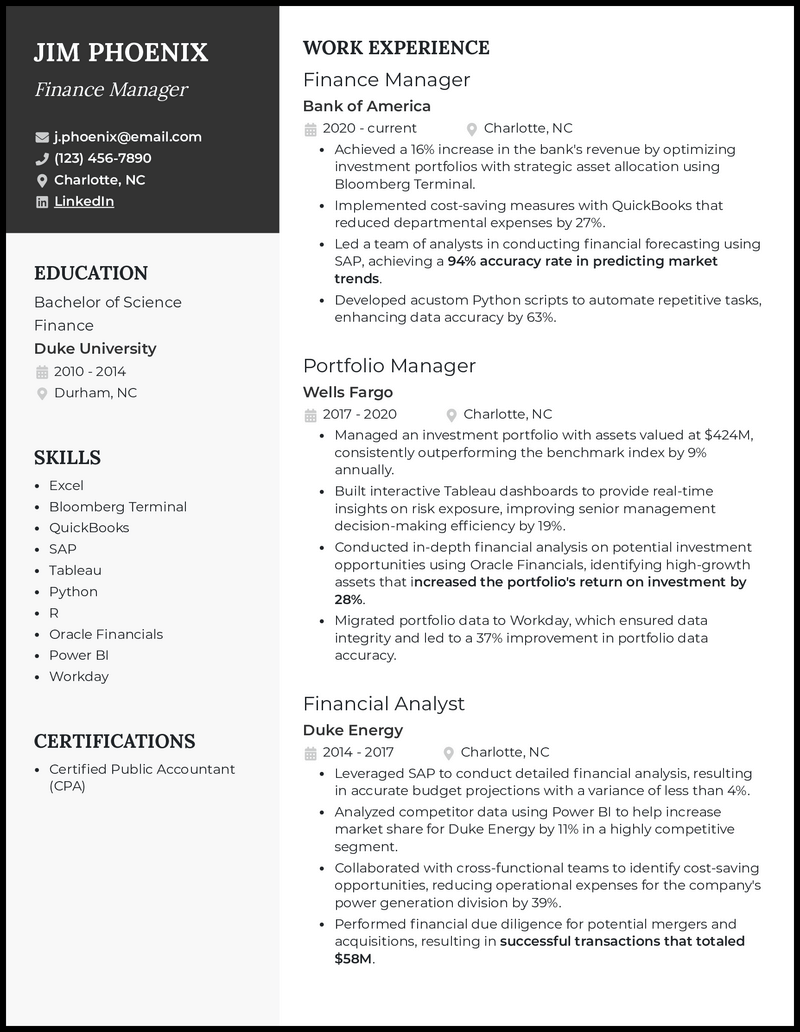

Finance Manager Resume

- Finance Manager Resumes by Experience

- Finance Manager Resumes by Role

- Write Your Finance Manager Resume

optimizing company spending is where you thrive. You get financial reports created, investments maximized, and plan effective strategies to meet long-term financial goals.

But does your resume template allow you to show why you’re the best fit to lead financial teams?

With the many qualifications and skills needed to succeed in the financial world, the hiring process can feel tricky, even when you know cash flow management and income statements like the back of your hand. That’s why we created our finance manager resume examples that will help you display your skills in the best way to impress hiring managers.

or download as PDF

Why this resume works

- Demonstrating your well-rounded expertise will give your finance manager resume an edge.

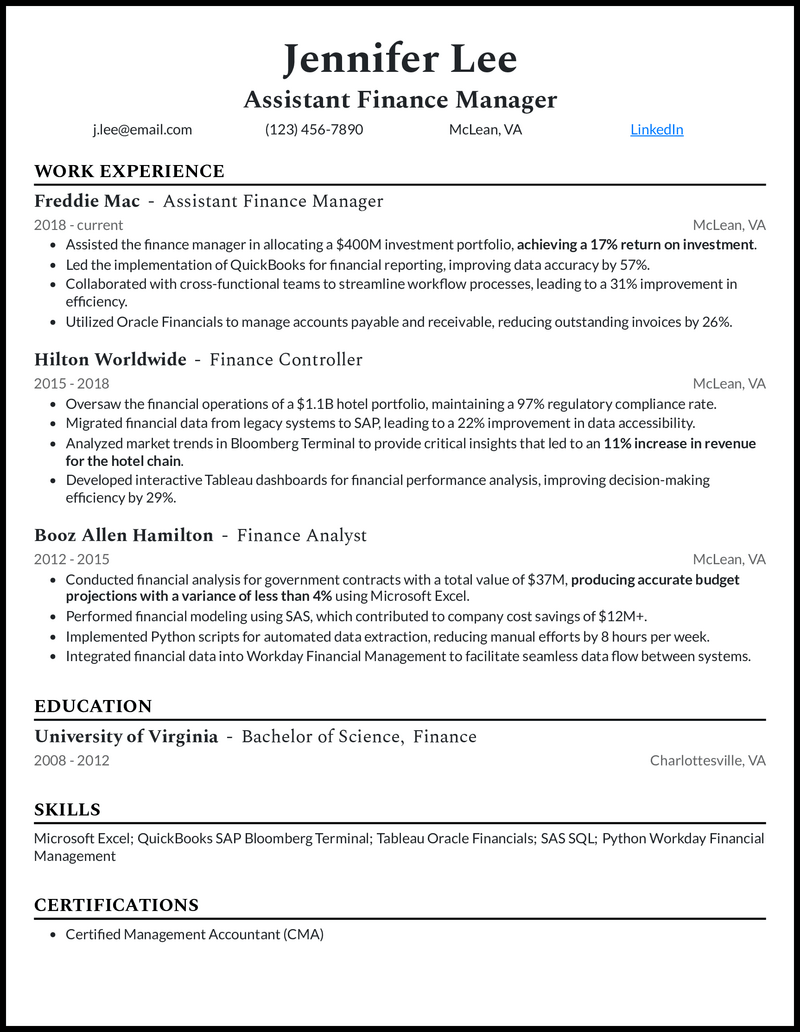

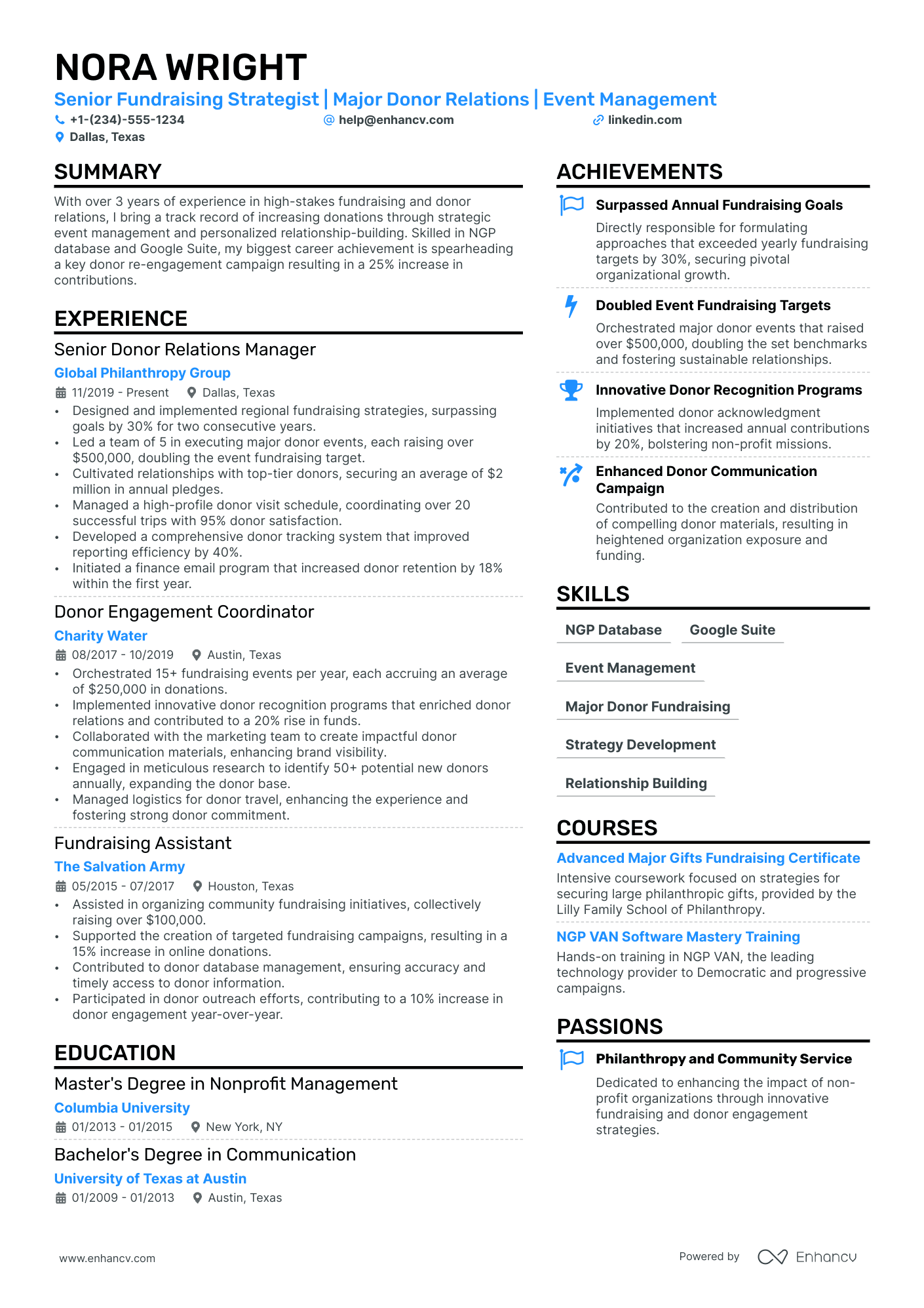

Assistant Finance Manager Resume

- This approach will put your assistant finance manager resume in a better place than simply listing former job titles.

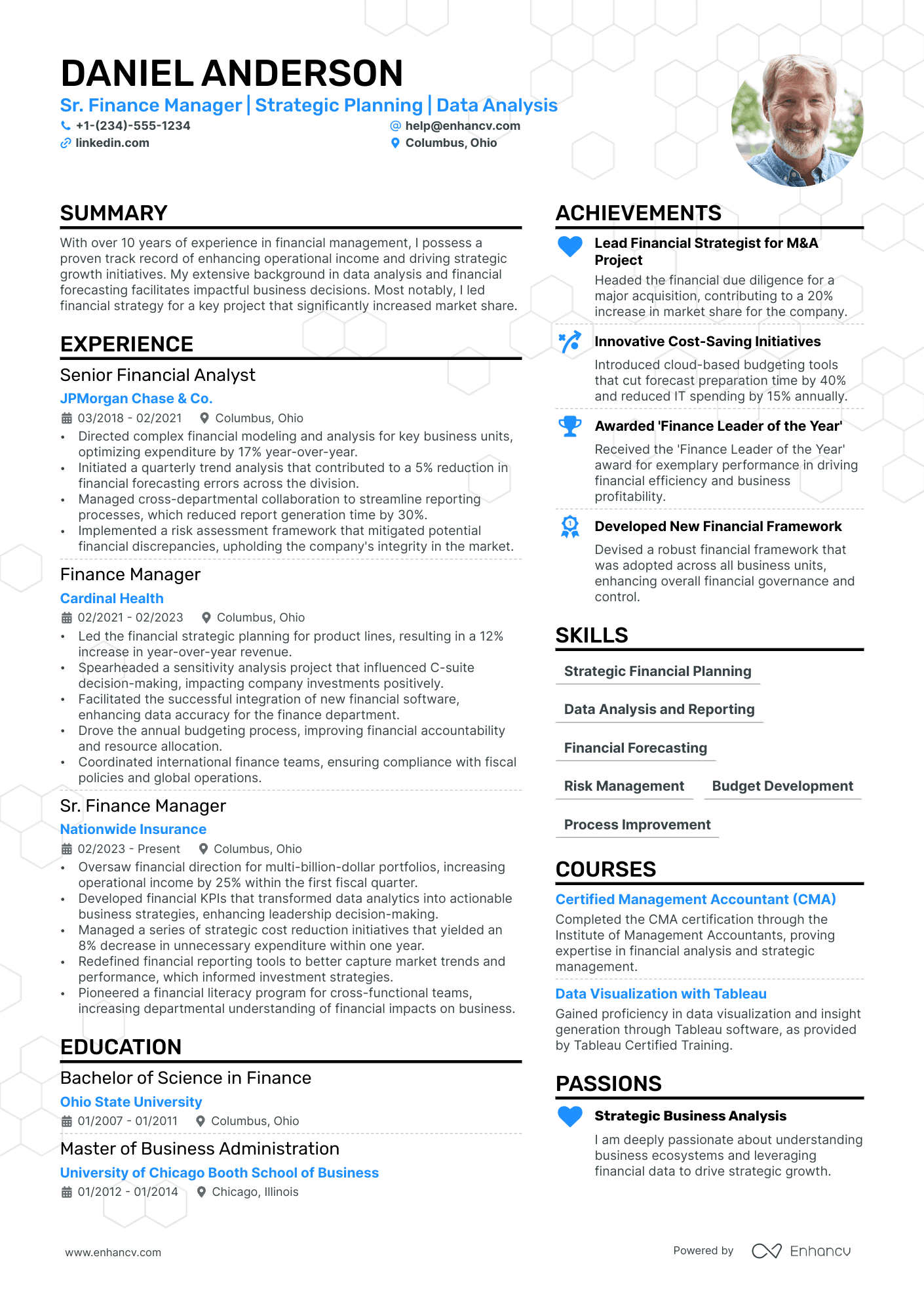

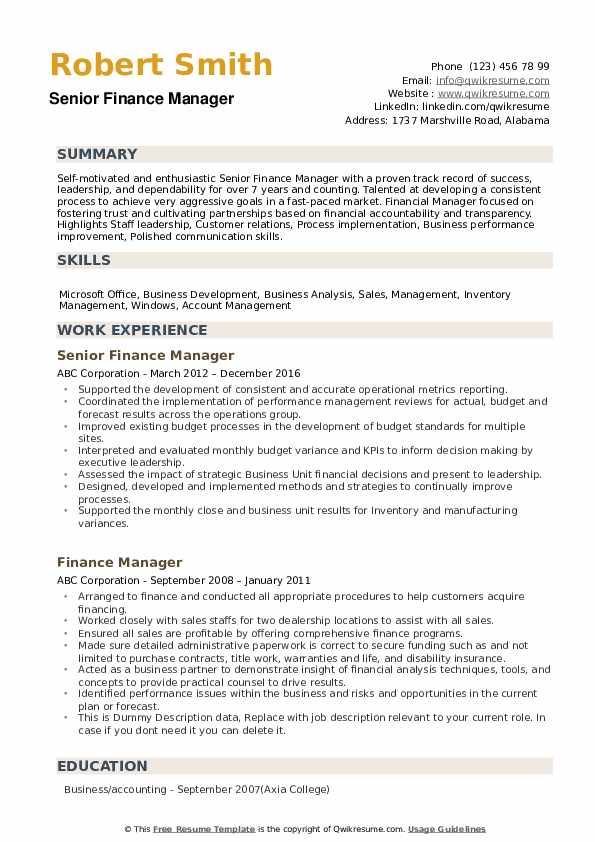

Senior Finance Manager Resume

- Have your education (cue Bachelor of Science Economics) sit at the top of this side column, followed by your skills (not just any, but those pertinent to the role) and certifications (Certified Public Accountant). Hobbies, while optional, can present you as a well-rounded candidate besides offering an interesting talking point during your job interview.

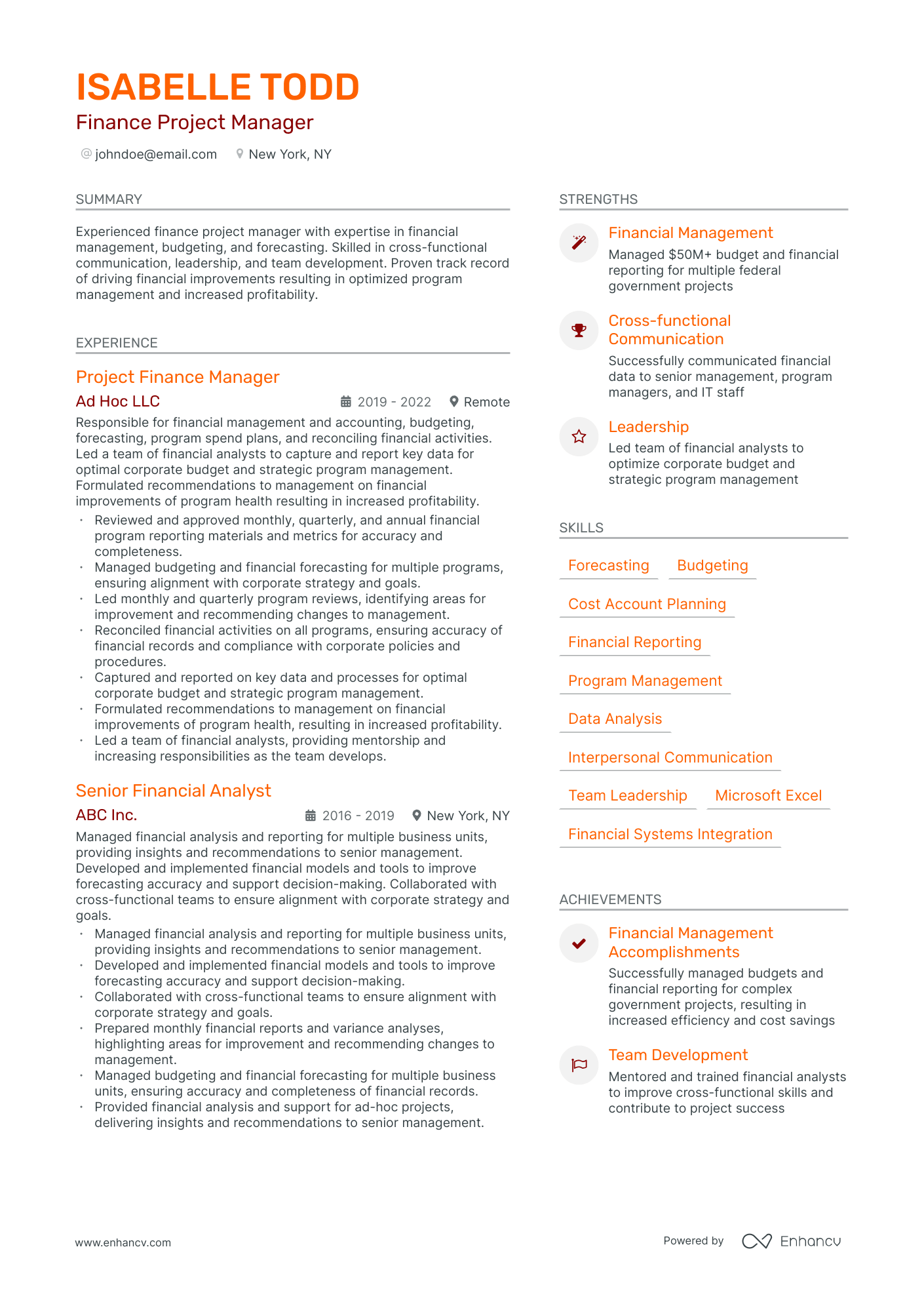

Finance Project Manager Resume

- Notice how Morgan talks about supervising the financial team and boosting project tracking efficiency at Blackrock. Increasing client retention and fostering cost management initiatives at Metlife further solidify his potential for success in the finance project manager role.

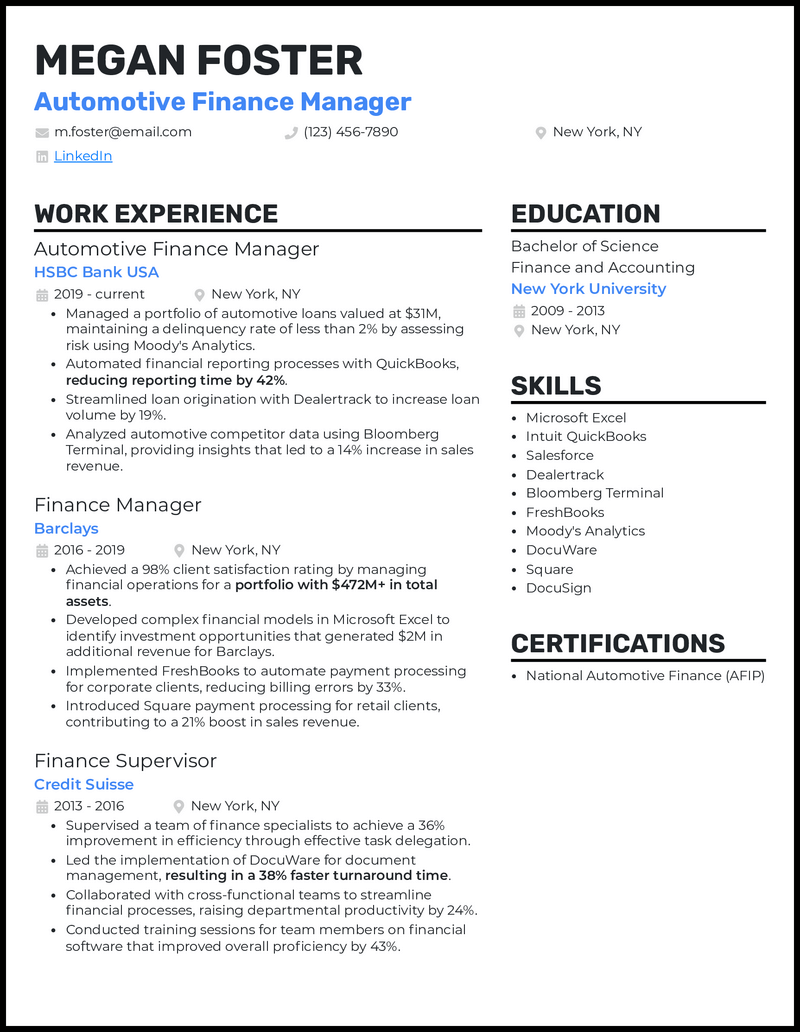

Automotive Finance Manager Resume

- Showcasing your National Automotive Finance (AFIP) certification is one effective way to get this point across.

Related resume examples

- Financial Analyst

- Investment Banking

- Account Manager

- Account Executive

Create a Finance Manager Resume That Aligns with the Job Description

The first step in an effective finance management resume is choosing the right skills. However, when you handle many tasks, from compliance to cost reduction efforts, you’re probably wondering which abilities are best to put in this small section of your resume.

Aim to align all the skills you list based on each company’s needs emphasized in the job description . For instance, a company needing help with future projections would appreciate your ability to analyze data trends in Salesforce and Moody’s Analytics to assist in those tasks.

Need some ideas?

15 top finance manager skills

- Internal Auditing

- Financial Planning

- Income Statements

- Balance Sheets

- Moody’s Analytics

- Microsoft Excel

- Employee Relations

- Forecasting

- Financial Reporting

- Oracle Suite

- Process Improvement

Your finance manager work experience bullet points

While your abilities to tackle financial planning and reporting with ease will catch a hiring manager’s eye, they’ll still want to see how you’ve succeeded on the job to know you’re the best fit.

Fortunately, listing some great work experience examples should be a breeze with your in-depth knowledge of how businesses use numbers to optimize for success. Each example you list should contain a metric illustrating what you achieved, such as improving process efficiency or generating a better ROI.

Here are some examples of great financial metrics to give you some ideas.

- Profit margin: Every business wants to maintain great margins to ensure profitability and continued growth, which is why you’re there to optimize the financial books accordingly.

- Accuracy: Compliance is a big deal in the financial field, so maintaining financial books and reporting standards with precision is vital.

- Cost reductions: Financial managers who are experts at strategically reducing material or production costs will always stand out in the hiring process.

- Reporting time: The business environment is fast-paced, so speeding up reporting time will significantly benefit decision-makers contemplating investments or promotional strategies.

See what we mean?

- Managed a portfolio of automotive loans valued at $31M, maintaining a delinquency rate of less than 2% by assessing risk using Moody’s Analytics.

- Automated financial reporting processes with QuickBooks, reducing reporting time by 42%.

- Migrated financial data from legacy systems to SAP, leading to a 22% improvement in data accessibility.

- Developed interactive Tableau dashboards for financial performance analysis, improving decision-making efficiency by 29%.

9 active verbs to start your finance manager work experience bullet points

- Streamlined

3 Ways to Optimize a Finance Manager Resume if You Lack Experience

- Even if you don’t have financial management experience, there are still many ways you can showcase leadership. For instance, you could list examples of training new team members in essential reporting tasks or leading a team in a companywide risk management assessment.

- When you perform tasks like forecasting or audits with high amounts of technical ability, it can still translate into why you’ll make a great team leader. For instance, you could explain how you developed a new reporting process in QuickBooks that boosted efficiency by 58%.

- As you’ve worked your way up in the financial field, your most recent experiences will showcase your most relevant skills to the needs of a management position. Listing your most recent jobs first will help you emphasize key skills like financial planning or process improvement to help you stand out.

3 Strategies to Improve Your Finance Manager Resume When You Have Experience

- Finance managers with ten or more years of experience will benefit from a summary. It’ll help to showcase a few primary skills and experiences right away that catch a hiring manager’s attention, such as how you’ve managed a $400 million investment portfolio, using market analytics to grow it by an average of 17% annually over your 12-year career.

- When you’ve worked many jobs in the financial industry, it’s important to narrow down the ones you include on your resume to three or four. Aim for positions that are the most recent and the most relevant to primary tasks like employee relations or financial audits.

- When you have a lot of financial management experience, it’s easy to get carried away with examples that are too in-depth and will overwhelm hiring managers. So keep your examples to short one-sentence descriptions, like how you used Xero’s bank connections feature to make the reconciliations process 34% more efficient.

One page will be the best length for a finance manager’s resume. Think of it like submitting a financial report to decision-makers. You want it to be concise and easy to understand so hiring managers can easily pick up on key skills like managing end-of-year income statements.

Action words like “processed” or “improved” make the work experience examples you list sound more engaging. It’ll help grab a hiring manager’s attention when explaining how you implemented Moody’s Analytics during risk management assessments to identify reporting errors 37% more accurately.

When writing a cover letter , use the opportunity to fill in any gaps on your resume or make a more personal connection with the company’s mission. For instance, you could explain how you want to use your cost reduction strategies to help a wellness brand continue bringing its products to consumers at an affordable price to achieve the brand’s goal of helping more people live a healthier lifestyle.

- • Managed credit control resulting in a decrease of aged debtor days from 90 to 60 days

- • Implemented a new system for customer remittance advices resulting in a 50% reduction in queries

- • Produced weekly reports of debtors and overview of status resulting in a more efficient debt collection process

- • Managed month-end processing resulting in timely and accurate financial reporting

- • Developed and maintained finance reports resulting in improved financial analysis

- • Implemented a new system for managing subcontractor HR & CIS submissions resulting in a 30% reduction in errors

- • Managed and processed wages resulting in timely and accurate payroll

- • Oversaw petty cash resulting in improved expense management

- • Reconciled bank statements resulting in accurate financial records

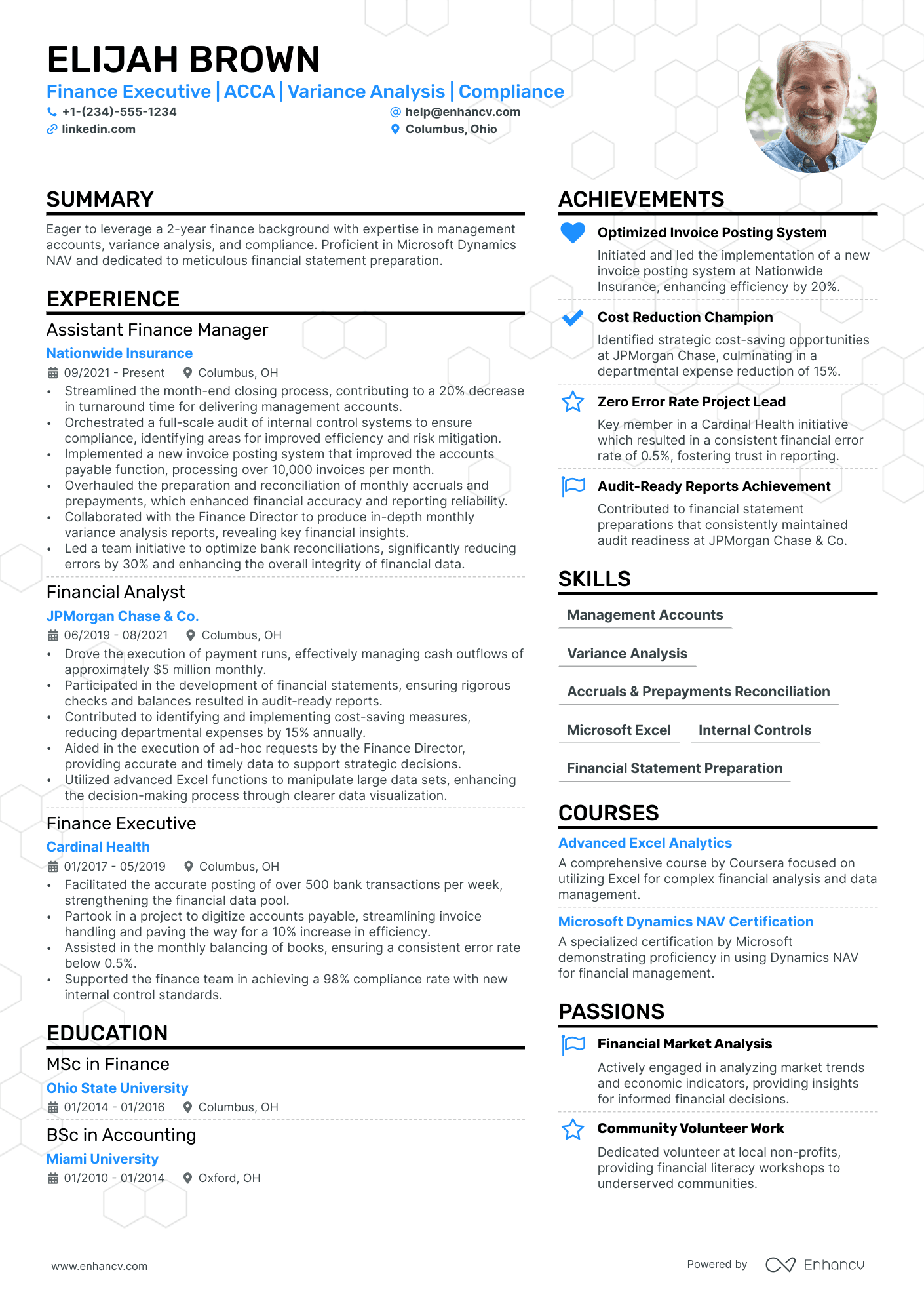

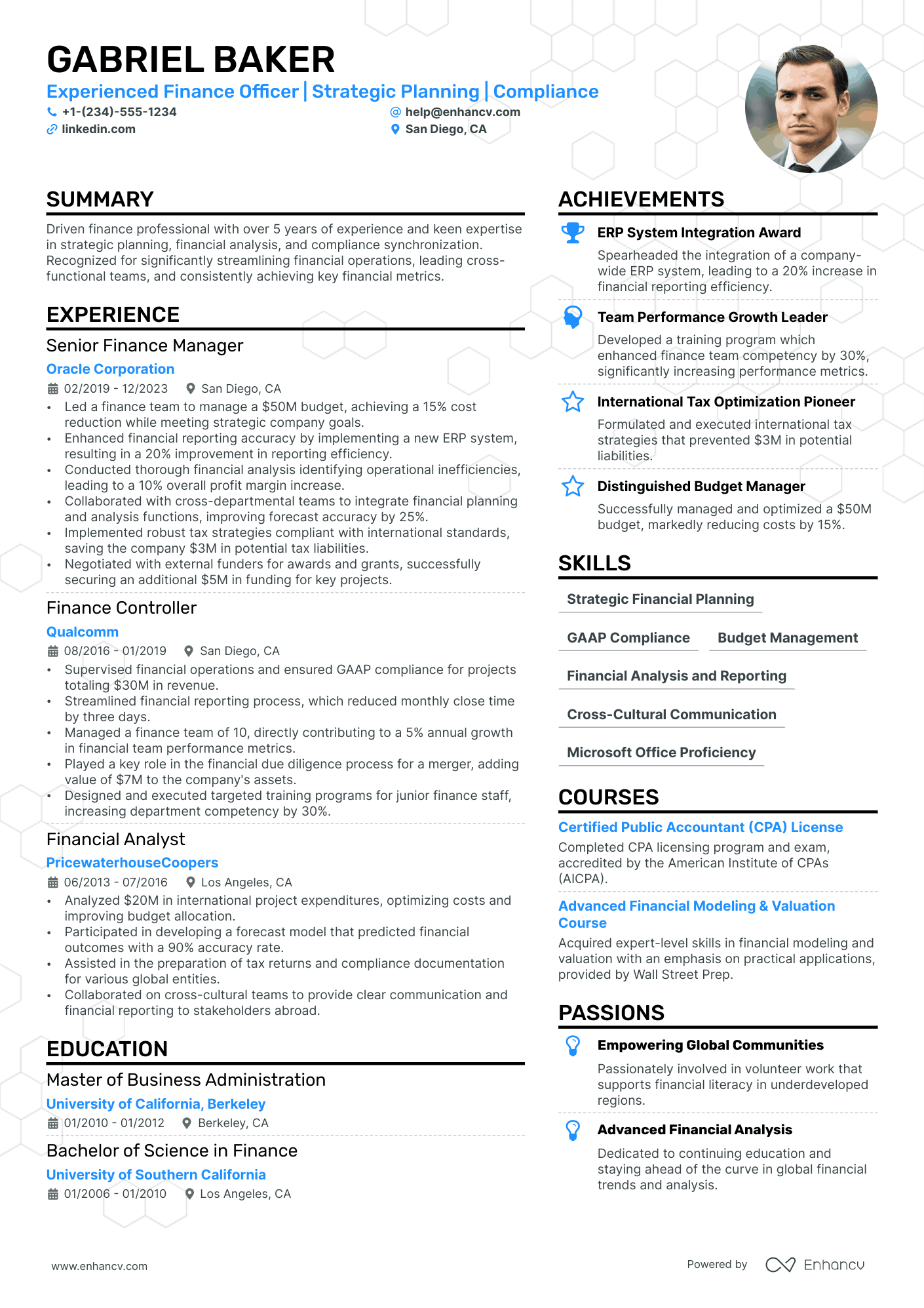

13 Finance Manager Resume Examples & Guide for 2024

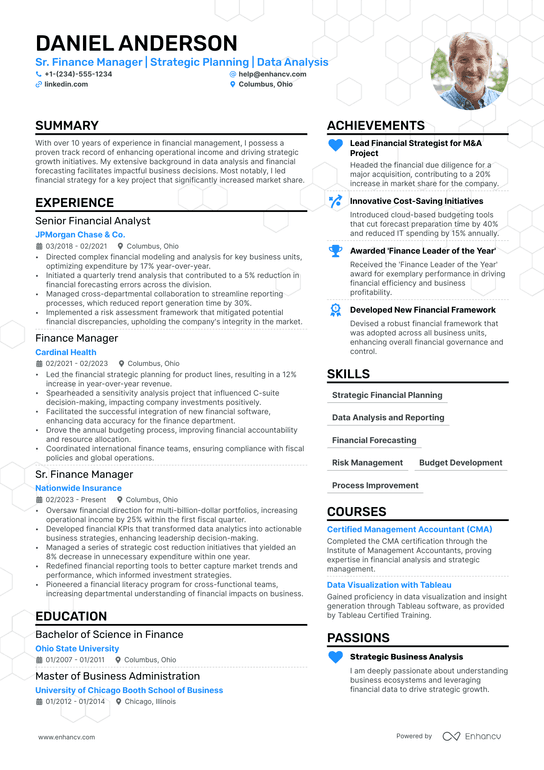

Your finance manager resume must highlight your expertise in financial planning and strategy. It should clearly showcase your proficiency in budgeting and forecasting. Strong analytical skills and experience in optimizing financial performance are essential for your profile. Demonstrated leadership in managing financial teams should be apparent in your work history.

All resume examples in this guide

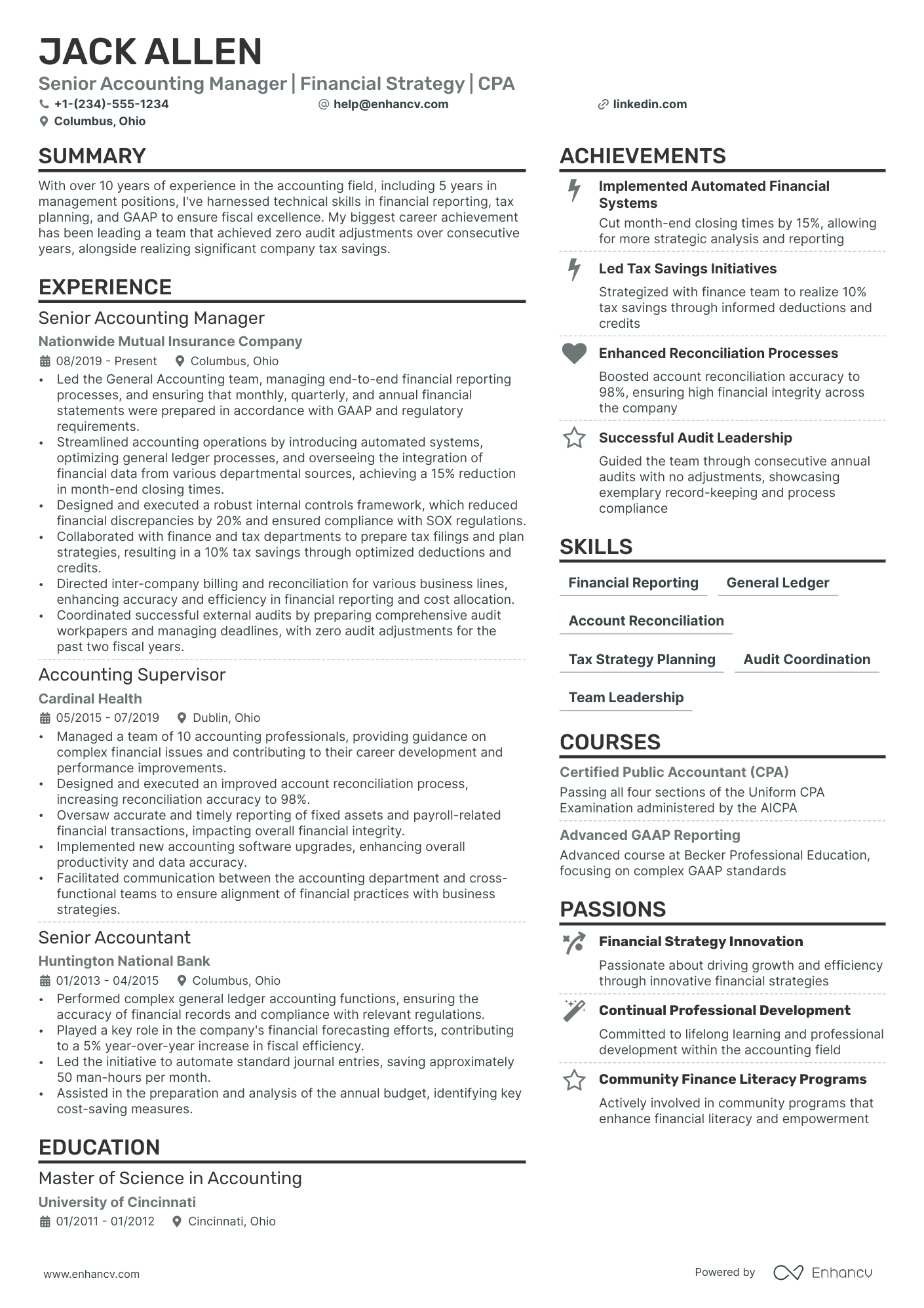

Senior Finance Manager

Credit Manager

Director of Finance

Finance Director

Finance Executive

Finance Officer

Finance Project Manager

Financial Controller

Financial Management Specialist

Financial Reporting Manager

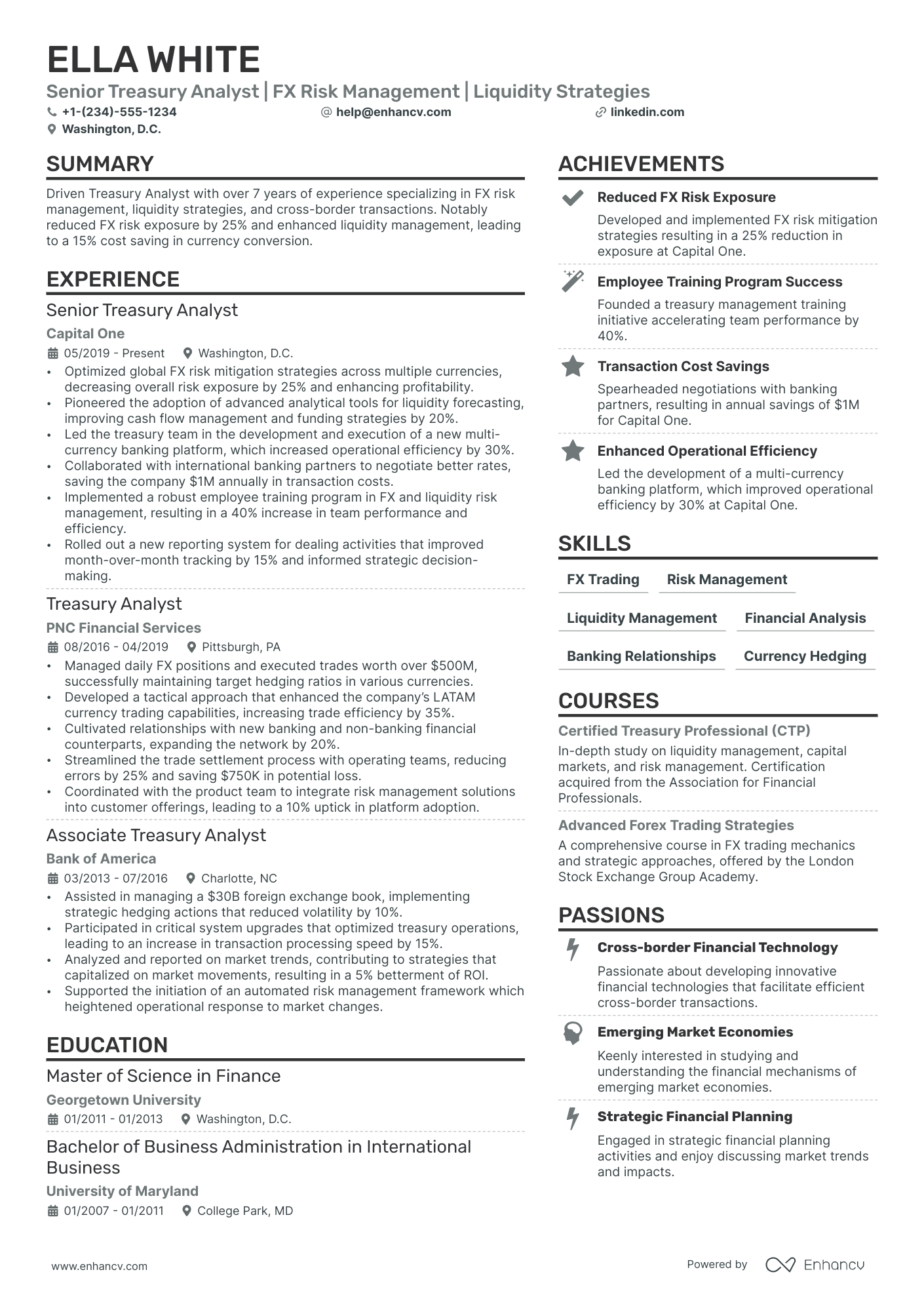

Treasury Manager

VP of Finance

Resume guide, choose the best format for your finance manager resume, add your contact information in the resume header, feature a standout finance manager experience section, list your education, list your relevant finance manager skills, include your finance manager certificates, use extra sections to make your resume stand out, create a matching cover letter for your finance manager resume, key takeaways.

By Experience

You know a thing or two about how to handle the vast resources of major corporations. What makes you unique is your ability to drive healthy business development through the use of proper accounting processes.

But, although you may be top-notch with keeping finances in check, it’s not easy to represent your skills on a resume. If that’s you, we’ve got you covered, as you’ll learn how to structure your resume so that it has the most impact on employees. In this article, you’ll find a thorough description of all the major sections of a resume , including examples.

At Enhancv, we’re obsessed with refining how we write resumes, discovering new strategies to maximize the success of our client’s resumes. We recently did a study and found that our resumes did significantly better than Microsoft Word resume templates when scanned with Applicant Tracking Systems (ATS) software.

We’ve also learned a few key details about formatting which you’ll find below:

- Length/Columns: Although length and amount of columns aren’t too important, we found that a 1 page resume with two columns is the best format for your resume.

- Section headings: It’s important to only put information specific to the section heading in each section. For example, if you’re writing your ‘Education’ section, only include your education in there.

- Color and Design: Although color and design isn’t scanned by ATS software, adding eye-catching colors and designs to your resume can help it stand out from the pile.

- Font: Don’t worry, you don’t have to stick with boring Times New Roman when writing your resume. In fact, all Google fonts can be easily scanned through ATS software.

- File format: PDF is the go-to format for resumes because it doesn’t compress or move around important graphics and information, unlike a Word document.

Also, it’s a good idea to use a reverse chronological format when listing your experience, as you can showcase your most recent experience first. This gives a recruiter an opportunity to gain a better understanding of your career trajectory (where you started and where you’ve gotten to in your career).

If you’re switching careers or are in a more creative field, use a hybrid resume format. A hybrid resume format allows you to place your skills right next to your experience in equal columns.

Include both your technical and mathematical skills with your interpersonal skills to create a well-rounded resume.

Your contact information is almost as important as your experience on a resume. It tells a hiring manager how to best reach you, as well as crucial information about your location and social media handles. Always check that your resume header is correct, and that it matches your cover letter.

Here are some other key details to include in your resume header:

- Your first name and last name

- Your phone number

- Your email address

- Your location

- Relevant social media handles (optional)

Create an interesting finance manager resume summary

Your resume summary is your first opportunity to show that you’re the perfect person for the role. It’s a short pitch—between two to three sentences—which gives you an opportunity to list major achievements and skills from your career.

Below, you can find some details to include in your resume summary:

- Your title and years of experience

- Your most relevant skills in your field

- Your top 1-2 professional achievements

It’s also a great space to include keywords that can be scanned by ATS software. Peruse the job description and you’ll find skills and experience that are expected for the candidate filling the position. Include those keywords in your resume summary.

Your experience might tip the scales in being selected for a finance manager position. That’s why it’s important to include only the most important information which applies to the position you’re applying for.

Below, you’ll find a list of things to include in your resume experience section:

- Reverse chronological order

- Company name, location, and description

- Date of employment: It’s important to include both the month and year on your resume because ATS software tracks for it.

- Achievements and responsibilities: Here is where you can showcase your abilities to a potential hiring manager. Tailor your responsibilities in your previous roles to the expectations for the role in the job description. These can be major keywords used by ATS software.

- Action words: Use action words to showcase your experience. For example, ‘managed’ falls flat when compared to words like ‘spearheaded’ and ‘initiated’.

- Quantify your achievements: Always remember to add specific figures, percentages, or real-world monetary figures to boost the claims you make in your experience section.

3 examples of quantifiable achievements in the finance manager niche:

- Reducing departmental spending

- Improving cash management

- Leading a financial restructuring to increase profitability

- • Spearheaded a cost-saving initiative which reduced departmental expense by 20%. Discovered inefficient practices in the budgeting process, and implemented processes to create tighter controls.

- • Improved cash flow through a capital management strategy which resulted in a 15% increase in cash flow.

- • Led a financial restructuring process which increased profitability for one of our largest clients.

In the finance field, your education can play just as much a part in getting hired as your experience. If you come from a prestigious university or had top grades, you want to list those when you mention your education. Here are some other things to include when listing your education:

- Degree Name

- University, college, or other institution

- Location (optional)

- Years attended

As a finance manager, your role involves a lot of technical skills that involve using software and technology to manage finances. But you’re also going to need a lot of soft skills, or people skills, as you liaison with clients, providing them with all the information they need to make informed financial decisions.

Let’s look at the difference between hard skills and soft skills.

Hard skills

Hard skills, also referred to as technical skills, are skills which depend on a specific workplace. The financial field, with major technical skills, will involve computer software and in-depth knowledge of accounting practices.

The top three technical skills for finance manager roles:

- Risk Management

Soft skills

Soft skills can make all the difference in your job search, as hiring managers are desperate to find people who have great interpersonal skills. Whether it’s managing a team or the ability to build rapport with clients, soft skills are an invaluable skill set for finance managers to have. These skills are not limited to one specific job, and can apply to many roles.

If you want to give a boost to your resume, include specific quantifiable soft skills which showcase your leadership skills.

In order to thrive in the financial sector, finance managers need to sift through data, finding patterns and changes within the market, while also performing strategic planning.

The three most popular soft skills for finance manager

- Analytical thinking

Any certificate you have can give you a significant advantage over other job applicants. This is especially true in the financial sector, as specialized certificates can show a unique expertise which you can offer to potential clients.

Below, you will find a list of important information to include when putting certificates on your resume:

- Certification name

- Name of issuer

- Year of obtainment

- Location (if applicable)

- Date of expiration (if applicable)

- Expected date of obtainment (if applicable)

The top 3 job certificates for a finance manager resume:

- Certified Treasury Professional (CTP)

In a managerial role, showing what an average day looks like can help of hiring manager see a little more of what working with you will look like. Marissa Mayer used a “Day in my life” section on her resume with outstanding success. This might be something that you’re also interested in, including in your own resume.

Below, you can find a list of extra sections to include in your resume:

- Membership of professional associations: Including professional associations on your resume can help to show that you have unique expertise which is backed by a reliable institution.

- Publications: Listing the publications that you’ve written for can help to show that you are a subject matter expert, someone who has a deep understanding of financial management.

- Conferences: Listing conferences you’ve attended or those that you’ve spoken at can help for you to build rapport with a hiring manager. In all likelihood, a potential manager may have attended the same conferences.

- Volunteering: Nonprofits are always looking for help with finances. If you’ve dedicated your time to volunteering your expertise, be sure to include it on your resume.

Your cover letter is your first opportunity to share a bit more about yourself, going deeper than what your resume says. Always make sure that the contact information in your resume matches that of your cover letter. Also, include keywords from the job description scattered throughout your cover letter in order to make it successful in ATS software.

Below, you will find a finance manager cover letter example:

Dear Ms. Packer,

I am writing to apply for the Finance Manager position at Timbres International. With a strong background in finance, a proven track record of delivering results, and a passion for driving financial growth, I am confident that my skills and experience will make me an ideal candidate for this role.

As an accomplished finance professional with over [number] years of experience in diverse financial management roles, I have gained extensive expertise in strategic financial planning, budgeting, forecasting, and analysis. Throughout my career, I have consistently demonstrated my ability to optimize financial performance, enhance operational efficiency, and provide critical insights to support informed decision-making.

In my current role as Finance Manager at ZXY Publishing, I have successfully implemented robust financial controls and streamlined processes, resulting in cost savings of over $14 000 annually. I have also developed and executed comprehensive financial models to support investment decisions, resulting in a 10% increase in overall profitability. Through my strong analytical skills, I have identified key areas for improvement and implemented strategies to mitigate risks and enhance financial performance.

Moreover, I possess a deep understanding of international finance, having managed global financial operations, conducted foreign currency risk analysis, and implemented effective hedging strategies. This experience has equipped me with the ability to navigate complex financial environments and ensure compliance with international regulations.

Beyond my technical expertise, I am known for my collaborative leadership style and my ability to build and motivate high-performing finance teams. I foster a culture of accountability, innovation, and continuous improvement, empowering my team members to achieve their full potential and contribute to organizational success. By implementing robust performance measurement systems, I have effectively aligned finance goals with overall business objectives, driving cross-functional collaboration, and delivering exceptional results.

I am excited about the opportunity to join Timbres International, a renowned organization known for its commitment to excellence and innovation. I am confident that my skill set, combined with my passion for driving financial growth, would enable me to make a significant contribution to your team. I am eager to leverage my expertise to optimize financial strategies, improve operational efficiencies, and support Timbres International in its pursuit of global success.

Thank you for considering my application. I have attached my resume for your review. I would welcome the opportunity to discuss my qualifications further and learn more about Timbres International’s vision and goals. Please feel free to contact me at your convenience via email.

I look forward to the possibility of contributing to the continued success of Timbres International as the Finance Manager. Thank you for your time and consideration.

- It’s always a good idea to format your resume using a reverse chronological format.

- Do a quick check and make sure that your resume and cover letter headers match.

- Use your resume summary as an elevator pitch, a brief description of why you think you’re the best person for the position.

- Always quantify your experience, using real numbers, data, and tangible skills to showcase your expertise.

- Soft skills are just as important as technical skills in the financial field.

- Use extra sections to showcase your unique skill set.

- Leverage your cover letter by using keywords from the job description to make it more easily scannable by ATS software.

Finance Manager resume examples

Explore additional finance manager resume samples and guides and see what works for your level of experience or role.

Looking to build your own Finance Manager resume?

- Resume Examples

The Best Words to Describe Yourself on a Resume

Why is my resume getting rejected, background check for employment: what does it show and how to know if you passed, how to write an international resume for a job abroad, dates on resume: how to format, templates & tips, should i put a job i got fired from on my resume.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Finance Manager Resume Example

Resume Examples

- Common Tasks & Responsibilities

- Top Hard & Soft Skills

- Action Verbs & Keywords

- Resume FAQs

- Similar Resumes

Common Responsibilities Listed on Finance Manager Resumes:

- Develop and manage annual budgeting and forecasting processes

- Monitor financial performance and analyze variances to budget

- Prepare financial statements and reports

- Develop financial models and analyses to support strategic initiatives

- Manage cash flow and liquidity

- Oversee accounts payable and receivable

- Develop and maintain internal controls

- Manage financial audits and tax compliance

- Analyze and interpret financial data

- Identify and recommend cost savings opportunities

- Develop and implement financial policies and procedures

- Advise senior management on financial matters

Speed up your resume creation process with the AI-Powered Resume Builder . Generate tailored achievements in seconds for every role you apply to.

Finance Manager Resume Example:

- Developed and implemented a new budgeting process that resulted in a 10% reduction in expenses and a 5% increase in revenue.

- Analyzed financial data and identified cost savings opportunities, resulting in a 15% reduction in operating costs over a one-year period.

- Provided financial guidance to senior management, resulting in informed decision-making and a 20% increase in profitability.

- Managed cash flow and liquidity, ensuring timely payments to vendors and reducing outstanding accounts payable by 25%.

- Developed and maintained internal controls, resulting in a successful financial audit with no major findings.

- Implemented financial policies and procedures, resulting in improved compliance and a 10% reduction in financial risk.

- Developed financial models and analyses to support strategic initiatives, resulting in a successful merger with a competitor and a 30% increase in market share.

- Managed financial audits and tax compliance, resulting in a 100% compliance rate and no penalties or fines.

- Identified and recommended improvements to the forecasting process, resulting in a 95% accuracy rate and improved decision-making for senior management.

- Financial analysis and modeling

- Budgeting and forecasting

- Cash flow management

- Cost reduction and savings

- Internal controls and audit management

- Financial reporting and compliance

- Strategic financial planning

- Risk management and mitigation

- Tax compliance and planning

- Financial policy development and implementation

- Vendor and accounts payable management

- Financial decision-making support

- Mergers and acquisitions

- Financial software proficiency (e.g., Excel, QuickBooks, SAP)

- Communication and presentation skills

- Leadership and team management

Top Skills & Keywords for Finance Manager Resumes:

Hard skills.

- Financial Analysis and Reporting

- Budgeting and Forecasting

Risk Management

- Financial Modeling

- Accounting Principles and Practices

- Cash Flow Management

- Investment Analysis and Portfolio Management

- Tax Planning and Compliance

- Cost Management and Reduction

- Financial Planning and Strategy

- Auditing and Compliance

- Business Performance Analysis

Soft Skills

- Leadership and Team Management

- Communication and Presentation Skills

- Collaboration and Cross-Functional Coordination

- Problem Solving and Critical Thinking

- Adaptability and Flexibility

- Time Management and Prioritization

- Attention to Detail and Accuracy

- Decision Making and Strategic Planning

- Risk Management and Compliance

- Conflict Resolution and Negotiation

- Emotional Intelligence and Relationship Building

Resume Action Verbs for Finance Managers:

- Strategized

- Implemented

- Consolidated

- Facilitated

- Streamlined

Generate Your Resume Summary

Resume FAQs for Finance Managers:

How long should i make my finance manager resume, what is the best way to format a finance manager resume, which keywords are important to highlight in a finance manager resume, how should i write my resume if i have no experience as a finance manager, compare your finance manager resume to a job description:.

- Identify opportunities to further tailor your resume to the Finance Manager job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Complete the steps below to generate your free resume analysis.

Related Resumes for Finance Managers:

Financial analyst, senior financial analyst, fp&a analyst, entry level financial analyst, junior financial analyst, financial business analyst.

- Career Blog

Finance Manager Resume: Best Examples and Tips for 2024

If you’re considering a career move into a finance manager position, having a well-crafted resume is essential. Your finance manager resume is the first point of contact with potential employers and it needs to stand out from the competition.

In this article, we will explore the importance of a good finance manager resume, key skills and qualifications that are essential for the role, and what you can expect to find in this article.

Importance of a good finance manager resume

A well-written finance manager resume is crucial in setting yourself apart from other candidates. The finance industry is highly competitive and employers receive an overwhelming number of resumes for each available position.

Therefore, your finance manager resume needs to be targeted, highlighting your specific skills and achievements. It should also showcase your ability to handle complex financial situations, your attention to detail, and your ability to work collaboratively with other departments within a company.

Key skills and qualifications for a finance manager

To succeed as a finance manager, you need more than just a degree in finance or accounting. You also need to have strong interpersonal skills, experience in managing teams, and the ability to communicate complex financial concepts to non-financial stakeholders.

Key qualifications for a finance manager position include a degree in finance, accounting or economics, CPA certification, experience in strategic planning, budgeting and financial analysis, as well as excellent computer skills.

What to expect in this article

In this article, we will provide you with some of the best examples of finance manager resumes that have proven successful in securing employment. We will also provide you with tips on how to tailor your finance manager resume to fit different job descriptions.

We will discuss the difference between a chronological and functional resume, and provide you with guidance on which format is best suited for you. We will also provide you with tips on how to write a strong professional summary that highlights your strengths and experience.

This article is your ultimate guide to creating a finance manager resume that sets you apart from the competition, highlights your abilities and increases your chances of securing your dream job in finance.

Finance Manager Job Description

Finance Manager role is crucial for the success of any organization. They play a significant role in managing the financial operations of the company and ensuring that the business’s finances are in order.

Overview of the finance manager role

The Finance Manager is responsible for the financial health of the organization. They create financial reports, manage budgets, and make strategic decisions that affect the company’s financial standing. A Finance Manager works with other departments like HR, Operations, and Sales to ensure the smooth operation of the business, making sure expenses are under control, and revenue is within expected targets.

Key responsibilities and duties

The following below are the primary responsibilities and duties of a Finance Manager:

- Managing the organization’s financial systems – developing and maintaining detailed financial policies and procedures that comply with regulatory requirements.

- Analyzing financial data and delivering accurate, timely financial reports and analysis to management that facilitates effective decision making.

- Overseeing the preparation of the budget, cash flow forecast, and financial forecasts; analyzing budget variance periodically, recommending budget adjustments where necessary.

- Ensuring that all tax returns, payroll, and other regulatory requirements are completed accurately and on time.

- Managing and training the finance team and ensuring they meet departmental targets and goals.

- Collaborating with other departments to identify cost-saving opportunities, reduce expenses, and increase revenue streams.

- Reviewing and managing the company’s investments and capital allocation strategies.

Skills and qualifications required

To become a successful Finance Manager, you must have the following skills and qualifications:

- Bachelor’s degree in Finance or Accounting – Having a degree in Finance or Accounting is often essential for this role.

- Advanced knowledge of financial management systems and software – Proficiency in tools such as Excel and other accounting software, like SAP and Quickbooks, is essential.

- Analytical skills – As a Finance Manager, you must have strong analytical skills with the ability to interpret and analyze complex financial data and provide insightful reports.

- Problem-solving skills – Finance Managers must identify problems and implement effective solutions to overcome them.

- Strong communication skills – The Finance Manager interacts with various departments in the company and needs to provide clear, concise, and professional reports to different stakeholders.

- Excellent leadership skills – A Finance Manager must be able to lead and motivate their team effectively, drive performance, and foster collaborative relationships.

It takes years of education and experience to become a successful Finance Manager. But, with a strong desire to learn the ropes and the right skills, you can build a fulfilling career in this field.

Understanding the Finance Manager Resume Format

As a finance manager, your resume is your first impression to potential employers. A well-structured resume can be the key to getting your foot in the door, while a poorly organized one can end up in the trash bin. Therefore, it is essential to understand the importance of having a clear and concise finance manager resume format.

Importance of a Well-Structured Resume

A well-structured finance manager resume increases the chances of getting noticed by hiring managers. A great format showcases your skills, education, and experience in a way that is easy to read and understand. This means that the best finance manager resumes are clear, concise, and professional, with all necessary information neatly organized.

Different Formats for a Finance Manager Resume

There are different formats for a finance manager resume, such as chronological, functional, and combination. Each format has its advantages and disadvantages, and the choice often depends on your experience and skills.

Chronological Resume: This format lists your work history in reverse chronological order, with the most recent experience first. This is the most popular resume format for finance managers, as it is straightforward and easy to follow. It is ideal for those with a consistent work history and no employment gaps.

Functional Resume: This format focuses on your skills and accomplishments rather than your work experience. It is ideal for those who have employment gaps, a limited work history, or are changing careers.

Combination Resume: This format is a combination of the chronological and functional resume. It highlights your skills and accomplishments while also providing a clear work history. It is ideal for those with a solid work history who want to emphasize specific skills or achievements.

How to Choose the Right Format for Your Experience and Skills

When deciding which finance manager resume format to use, consider your experience, skills, and the job you are applying for. Keep in mind the following tips:

- If you have a solid work history with no employment gaps, choose a chronological format.

- If you have limited work experience or are changing careers, choose a functional or combination format.

- When applying for a specific job or industry, tailor your resume to match the job requirements and use the format that highlights your relevant skills and experience.

A well-written, and structured finance manager resume can make all the difference when it comes to landing your dream job. Consider your experience and skills when choosing the right format, and tailor your resume to match the job requirements. With a clear and concise finance manager resume, you can stand out from the competition and impress potential employers.

Finance Manager Resume Examples

When it comes to creating a resume for a finance manager position, there are a few things you definitely want to get right. To help you out, we’ve gathered some sample resumes for finance manager positions to analyze and evaluate. Here are the key takeaways and lessons from each example.

Sample Resume 1: John Smith

Overview: John Smith is an experienced finance manager who has worked for multiple companies in the financial industry. He is skilled in financial reporting, budgeting, and analysis.

123 Main Street, Anytown, USA | (555) 123-4567 | [email protected]

Experienced finance manager with a proven track record in financial reporting, budgeting, and analysis. Skilled in developing financial strategies, optimizing financial processes, and driving profitability. Strong leadership abilities with a focus on team management and fostering cross-functional collaboration. Committed to delivering results and exceeding financial targets.

Finance Manager | XYZ Financial Services | Anytown, USA

- Oversaw financial reporting and analysis, ensuring accuracy and compliance with regulatory requirements.

- Developed and implemented budgeting and forecasting models, resulting in a 10% reduction in operating costs.

- Led a team of financial analysts, providing guidance and mentorship to drive their professional development.

- Collaborated with cross-functional teams to streamline financial processes and improve efficiency.

Financial Analyst | ABC Corporation | Anytown, USA

- Conducted financial analysis, identifying cost-saving opportunities and recommending strategic initiatives.

- Prepared monthly financial reports, highlighting key performance indicators and trends.

- Assisted in the development and monitoring of departmental budgets, ensuring alignment with corporate goals.

- Supported the CFO in the preparation of financial presentations for executive meetings.

Bachelor of Science in Finance | University of Anytown | Anytown, USA

Evaluation: John’s resume is well-organized and easy to read. He has provided a summary that highlights his relevant experience, skills, and achievements. John has also made sure to include specific examples of projects he has worked on and the results he has achieved.

Key Takeaways and Lessons:

- Use a summary section to highlight your relevant experience and skills.

- Provide specific examples of projects you have worked on and the results you have achieved.

- Make sure your resume is easy to read and well-organized.

Sample Resume 2: Jane Doe

Overview: Jane Doe is a finance manager with excellent analytical and communication skills. She has experience in financial planning, forecasting, and variance analysis.

Results-driven finance manager with excellent analytical and communication skills. Experienced in financial planning, forecasting, and variance analysis. Proven ability to optimize financial processes and drive organizational success. Strong interpersonal skills with a focus on building effective relationships across all levels of the organization.

- Led financial planning and analysis efforts, providing accurate and timely insights for strategic decision-making.

- Developed and implemented forecasting models, resulting in improved budget accuracy and resource allocation.

- Conducted variance analysis to identify trends and areas for improvement, implementing cost-saving initiatives.

- Collaborated with HR to develop and implement employee incentive programs, improving overall productivity.

Senior Financial Analyst | ABC Corporation | Anytown, USA

- Prepared financial reports and presentations for executive leadership, highlighting key performance metrics.

- Assisted in the development of annual budgets, ensuring alignment with corporate objectives.

- Conducted financial modeling and scenario analysis to support strategic planning initiatives.

Evaluation: Jane’s resume is well-written and concise. She has highlighted her most relevant experience and skills using bullet points. Jane has also included a section on her education, which is important for finance manager positions.

- Use bullet points to highlight your most relevant experience and skills.

- Include a section on your education, especially if you have a degree in finance or accounting.

- Ensure your resume is well-written and concise.

Sample Resume 3: David Lee

Overview: David Lee is a finance manager with a strong background in financial analysis and risk management. He has experience in developing financial models and implementing financial controls.

Finance manager with a strong background in financial analysis and risk management. Experienced in developing financial models and implementing financial controls to drive business performance. Proven ability to identify growth opportunities and optimize financial resources. Strong leadership skills with a focus on building high-performing teams.

- Conducted financial analysis, including financial modeling and scenario analysis, to support strategic decision-making.

- Developed and implemented risk management strategies to mitigate financial risks and improve stability.

- Led the implementation of financial controls and processes, ensuring compliance with regulatory requirements.

- Collaborated with cross-functional teams to develop and monitor financial performance metrics.

- Prepared financial reports and presentations for executive leadership, providing insights on key financial trends.

- Conducted financial forecasting and budgeting, identifying areas for cost reduction and efficiency improvement.

- Assisted in the evaluation of investment opportunities and performed financial due diligence.

- Supported the CFO in developing financial strategies to drive business growth.

Bachelor of Business Administration in Finance | University of Anytown | Anytown, USA

Evaluation: David’s resume is well-structured and highlights his relevant experience and achievements. He has included specific examples of projects he has worked on and the results he has achieved. David has also made sure to emphasize his skills in financial analysis and risk management.

- Structure your resume to highlight your relevant experience and achievements.

- Use specific examples to demonstrate your skills and achievements.

- Emphasize your skills in financial analysis and risk management.

Sample Resume 4: Sarah Kim

Overview: Sarah Kim is a finance manager with experience in financial reporting, analysis, and forecasting. She has worked for a variety of companies in the financial industry.

Finance manager with experience in financial reporting, analysis, and forecasting. Proven ability to drive financial performance and optimize resources. Strong attention to detail and analytical skills. Excellent team player with a focus on collaboration and building strong business relationships.

- Managed financial reporting processes, ensuring accuracy and compliance with regulatory requirements.

- Conducted financial analysis and prepared reports on key performance metrics for management review.

- Assisted in the development of annual budgets, monitoring variances and recommending corrective actions.

- Collaborated with cross-functional teams to improve financial processes and efficiency.

- Prepared financial statements and reports, analyzing variances and identifying areas for improvement.

- Conducted financial forecasting and assisted in the development of annual budgets.

- Collaborated with the finance team to improve financial systems and streamline processes.

- Supported senior management in financial analysis and decision-making.

Bachelor of Science in Accounting | Anytown University | Anytown, USA

Evaluation: Sarah’s resume is well-written and easy to read. She has included a summary section that highlights her skills and experience. She has also provided specific examples of projects she has worked on and the results she has achieved.

- Use a summary section to highlight your skills and experience.

How to Customize Your Finance Manager Resume

To increase your chances of landing that dream job as a finance manager, it’s important to customize your resume according to the job description. This will show potential employers that you’re serious about the role and have taken the time to look into their specific needs.

Here are some tips to help you customize your finance manager resume:

Tailoring your resume to match the job description

The first step in tailoring your resume is to carefully read the job description and make note of the specific requirements and qualifications that the company is looking for. This will help you identify the key skills and experiences that you should highlight in your resume.

Make sure to also use the same language and terminology that the company uses in their job description. This shows that you understand the company’s needs and demonstrates that you’re a good fit for the role.

Highlighting your relevant experience and achievements

When customizing your resume, it’s important to focus on your relevant experience and accomplishments. Don’t simply list all of your past jobs and responsibilities. Instead, highlight the experiences that are specifically relevant to the finance manager role you’re applying for.

Include quantifiable results and achievements that demonstrate your success in previous roles. Use bullet points and strong action verbs to make your accomplishments stand out.

Incorporating keywords and industry-specific terminology

To get your resume past applicant tracking systems (ATS), it’s important to use the same keywords and phrases that the company uses in their job description. This will help your resume get noticed by hiring managers.

In addition to keywords, make sure to include industry-specific terminology that demonstrates your knowledge and expertise in finance. This will show potential employers that you’re not just a generalist, but a specialist in your field.

Customizing your finance manager resume with the job description in mind, highlighting your relevant experience and achievements, and incorporating keywords and industry-specific terminology are key to making your resume stand out and landing that dream job.

Writing an Effective Finance Manager Resume Summary or Objective

When it comes to crafting a finance manager resume, the summary or objective statement is the first thing you need to consider. It serves as your introduction to potential employers and gives them an idea of who you are and what your skills and qualifications are. But do you know the difference between a summary and an objective statement?

Difference between a Summary and Objective Statement

A summary statement is a brief overview of your qualifications and experience. It highlights your top skills and achievements relevant to the position you are applying for. A summary statement is ideal for someone who has years of experience in the finance industry or in a related field.

On the other hand, an objective statement is a short statement that outlines your personal goals for your next career move. It is suitable for entry-level candidates or someone who pivots their career into finance. The objective statement should be tailored to the position you want to apply for, focusing on your relevant skills and accomplishments that make you suitable for the role.

Tips for Creating a Compelling Summary or Objective

To create a powerful summary or objective statement, consider the following tips:

Keep it concise: The summary or objective statement should be brief, preferably no longer than 3-4 sentences.

Highlight your top skills: Focus on the skills that set you apart from other candidates. These skills should be relevant to the job description.

Use quantifiable data: Quantifying your achievements can make your statement more impressive. Use numbers to show your impact.

Tailor your statement: Customize your summary or objective statement to reflect the job you are applying for.

Avoid using passive language: Use action verbs to describe your achievements and skills.

Examples of Effective Statements

Here are some examples of effective summary statements:

“Results-driven finance manager with over 10 years of experience delivering financial analysis and strategic recommendations to senior executives. Proficient in budget forecasting, financial modeling, and risk management.”

“Detail-oriented finance manager with experience overseeing budgets, forecasting, and financial reporting. Skilled in developing strategies to streamline financial processes and improve overall efficiency.”

Here are some examples of effective objective statements:

“Recent finance graduate seeking an entry-level finance manager position where I can utilize my analysis and modeling skills to drive business growth.”

“As a seasoned accountant seeking a career change into finance management, I am looking for a position that challenges me to apply my analytical and problem-solving skills to help businesses drive revenue and success.”

By following these tips and using examples like these, you can create a compelling summary or objective statement that highlights your skills, experience, and goals, setting you apart from other candidates in the process.

Showcasing Your Finance Manager Skills on Your Resume

One of the best ways to stand out in the highly competitive job market for finance managers is to showcase your skills and accomplishments in your resume. Here are some key skills for a finance manager that you should highlight:

Key Skills for a Finance Manager

- Financial Analysis: the ability to analyze financial data and create reports that provide insights into the financial health of the organization.

- Budget Planning and Management: the ability to create, implement, and manage budgets that align with the organization’s goals and financial resources.

- Risk Management: the ability to identify and mitigate financial risks to the organization and its stakeholders.

- Strategic Planning: the ability to develop long-term financial plans and strategies that support the organization’s vision and mission.

- Leadership: the ability to lead and manage a team of financial professionals and work collaboratively with cross-functional teams.

How to Highlight Your Skills Using Bullet Points or in the Work Experience Section

To effectively demonstrate your skills as a finance manager, you can use bullet points to highlight your accomplishments and key responsibilities in your work experience section. For example:

- Led a team of financial analysts in conducting a comprehensive financial analysis of the organization’s revenue streams, resulting in the identification of new revenue opportunities and cost-saving measures.

- Developed and managed a $10 million budget for a new product line, resulting in a 20% increase in revenue and a 15% decrease in production costs.

- Implemented a risk management strategy that identified and addressed potential financial risks, resulting in a 50% decrease in insurance premiums and a more secure financial position for the organization.

You can also use your skills and accomplishments in your summary or objective statement at the top of your resume to immediately grab the attention of potential employers.

Including Industry-Specific Certifications, Licenses, and Trainings

Finance managers are expected to have a strong knowledge of finance principles and practices, as well as industry-specific regulations and standards. Therefore, including industry-specific certifications, licenses, and trainings in your resume can demonstrate your expertise and commitment to professional development. Some examples of relevant certifications and licenses include:

- Certified Public Accountant (CPA)

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Risk Management Certification (RMC)

- Financial Industry Regulatory Authority (FINRA) Licenses

Be sure to list any relevant training programs or workshops you have attended, such as financial analysis, budgeting, or leadership development programs.

A well-crafted resume that showcases your finance manager skills, accomplishments, and industry-specific certifications can significantly increase your chances of landing your dream job.

Detailing Your Work Experience as a Finance Manager

As a finance manager, your work experience is perhaps the most important section of your resume. Recruiters and hiring managers want to know exactly what you’ve achieved in your previous roles and what you can bring to their organization.

Organizing Your Work Experience Section

To effectively organize your work experience section, consider reverse chronological order. This means that your most recent experience should be listed first, and your oldest experience should be listed last. This allows recruiters and hiring managers to see your most recent and relevant experience first.

When describing your work experience, it’s important to include the company name, your job title, and the dates you worked in that role. It’s also important to use bullet points when describing your responsibilities and achievements, as this makes it easier to read and understand your experience.

Discussing Responsibilities, Achievements, and Outcomes of Previous Roles

When describing your responsibilities, be specific and use action verbs that explain what you did. For example, rather than saying “I managed budgets,” say “I developed and managed budgets for a team of 20+, resulting in a 15% increase in profits.” The second statement is much more specific and gives a clear idea of what you achieved.

In addition to responsibilities, include achievements and outcomes of your previous roles. This gives recruiters and hiring managers a clear picture of what you’re capable of, and how you can contribute to their organization. For example, if you successfully implemented a new software system that saved your previous company thousands of dollars, include that in your experience section.

Formatting for Maximum Impact

To make your work experience section stand out, use formatting techniques such as bolding, italics, and bullet points. Bolding your job title and company name makes them easier to find, while bullet points make it easier to read and understand your responsibilities and achievements.

It’s also important to consider the length of your work experience section. While it’s important to include all relevant information, try to keep it concise and to the point. Recruiters and hiring managers often have a lot of resumes to read, so making it easy for them to find the most important information is key.

Your work experience section as a finance manager is crucial to your resume. Use reverse chronological order, be specific when describing your responsibilities and achievements, and format for maximum impact. If you can effectively showcase your previous experience, you’ll be sure to stand out to recruiters and hiring managers.

Education and Certifications for a Finance Manager Resume

As a finance manager, having the right education and certifications is crucial to getting a job in the field. Employers usually require candidates to have at least a bachelor’s degree in finance, accounting, economics, or a related field. Many employers also prefer candidates with a master’s degree or an MBA in finance or business administration.

To excel in a finance manager position, you should have a strong understanding of financial principles, such as budgeting, forecasting, financial analysis, and financial reporting. It is essential to have experience with financial software and tools, such as Excel, QuickBooks, and financial modeling software.

In addition to formal education, finance managers often hold relevant certifications, which demonstrate their expertise and competence in the field. Some of the most common certifications for finance managers include the Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), Certified Management Accountant (CMA), and Certified Financial Planner (CFP).

Including relevant certifications and degrees on your resume can add credibility to your qualifications and set you apart from other candidates. Be sure to include the name of the degree or certification, the institution where it was obtained, and the date of completion.

When presenting education and certifications on a resume, it is crucial to highlight the most impactful elements of your education rather than just providing a list. Consider tailoring your resume to the specific job requirements and emphasizing your education that specifically applies to those requirements.

For example, if the job requires budgeting and financial analysis skills, highlight your relevant coursework or certifications that show proficiency and expertise in those areas. Consider including specific accomplishments in your education such as academic honors or exceptional performance in a particular course.

Securing a finance manager position requires having the right education and certifications. Candidates should have, at minimum, a bachelor’s degree or higher in finance, accounting, or a related field, as well as relevant certifications such as CPA, CFA, CMA, or CFP. Presenting your education and certifications with specific information and accomplishments that apply to the job requirements can significantly increase your chances of landing the job.

Tips for Writing a Cover Letter for a Finance Manager Position

When applying for a finance manager position, your cover letter can be just as important as your resume or CV. This document is your opportunity to showcase your writing skills and demonstrate why you are the best candidate for the job. Here are some tips for writing a successful cover letter for a finance manager position:

Importance of a Cover Letter

A cover letter is an essential part of any job application, especially for finance manager roles. This is your chance to showcase your personality and highlight your skills and experience in a way that your resume may not. A well-written cover letter can help you stand out from other candidates and make a great first impression on a potential employer.

Key Elements of a Successful Cover Letter

To write an effective cover letter, you should include the following key elements:

- A strong opening: Start your cover letter with a sentence that grabs the reader’s attention and makes them want to keep reading.

- An introduction: Introduce yourself and explain why you are interested in the finance manager position.

- Relevant experience: Highlight your relevant experience in finance and management, including any specific achievements or successes you have had in these areas.

- Skills and qualities: Discuss the specific skills and qualities that make you a great fit for the role. These might include strong analytical and problem-solving skills, leadership abilities, and attention to detail.

- A strong closing: End your cover letter with a brief summary of why you are the ideal candidate for the job, and express your enthusiasm about the opportunity.

Examples and Tips for Writing a Finance Manager-Specific Cover Letter

When writing a finance manager-specific cover letter, it’s essential to tailor your letter to the job you are applying for. Here are some tips for writing a great finance manager-specific cover letter:

- Research the company: Take the time to research the company you are applying to and include specific details about the organization in your cover letter.

- Highlight your skills: Finance manager roles require a unique set of skills, so be sure to highlight these in your cover letter. These might include financial analysis, risk management, and budgeting.

- Be specific: Show that you have done your research and understand the requirements of the position by including specific examples of how you have demonstrated the skills and experience needed for the job.

- Be concise and professional: Keep your cover letter concise and professional, focusing on the most relevant qualifications and experience. Make sure to proofread your letter carefully before submitting it.

A well-written cover letter is an essential part of any finance manager job application. By including the key elements of a successful cover letter and tailoring your letter to the specific job, you can make a great first impression on potential employers and increase your chances of landing an interview.

Common Mistakes to Avoid in Your Finance Manager Resume

As a finance manager, you need to be careful about the content you include in your resume. Many candidates make common mistakes that can hurt their chances of landing their dream job. In this section, we will discuss some of the most common mistakes candidates make in their finance manager resumes and how to avoid them.

Resume Mistakes That Can Hurt Your Chances of Landing an Interview

Before we proceed to the common mistakes, let’s first highlight some of the ways these mistakes can have a negative impact on your job search. First, recruiters and hiring managers receive hundreds of resumes for each opening. They often have limited time to review each resume, meaning that it’s important to make an instant positive impression. If your resume has any of these common mistakes, it may quickly be discarded. Second, finance roles require attention to detail, accuracy, and clarity. Resumes that contain mistakes might suggest that the candidate isn’t detail-oriented or may lack the required skills.

Examples of Common Mistakes

Lacking Focus: A common mistake that applicants make is being too general in the summary section of their resumes. This may lead to an ambiguous impression and don’t convey their strengths or expertise as a finance manager.

Incorrect Contact Information: There’s nothing more frustrating than trying to contact an applicant and having their information incorrect. Remember, a slight mistake in your email or phone number can lead to missed interviews and job opportunities.

Using an Unprofessional Email Address: If you are still using your high school or college email address, it’s time for an upgrade. Avoid using unprofessional email addresses like “WildChild.

Related Articles

- The Ultimate Teacher Resume Template: Example for 2023

- Job Search Stress: 3 Proven Tips for Managing It in 2023

- Customer Account Specialist Resume: Examples and Tips

- CV vs Resume: Key Differences and Details in 2023

- Radio Frequency Engineer: Job Description & Responsibilities

Rate this article

0 / 5. Reviews: 0

More from ResumeHead

Samples › Finance Manager

Finance Manager Sample

Download and customize our resume template to land more interviews. Review our writing tips to learn everything you need to know for putting together the perfect resume.

Not sure how to format your resume? Download our free guide and template .

Finance Managers promote a company’s fiscal security. They monitor daily transactions, oversee investments, and draft financial reports and forecasts. In recent years Finance Managers have played an increasingly strategic role, advising senior leaders on long-term business plans and opportunities. Finance Managers combine strong analytical and communication skills to translate complex financial issues into clear terms for their colleagues. Get a leg up on the competition with a resume crafted by our professional writers. Below, our resources, including expert writing tips, are at your fingertips!

You should never use a creative resume

Many job seekers think that an eye-catching resume template will help them stand out to hiring managers and increase their chances of landing an interview. This is a myth put out by resume builders that value design over content.

The truth is that most hiring managers prefer a traditional resume format.

Creative resume templates, like the one pictured here, can actually hurt your chances of landing an interview. Instead, you should use a basic resume format that quickly communicates your basic information and qualifications–like the one included below.

Finance Manager resume (text format)

How confident are you feeling about your resume? If you need more help, you can always refer to the following resume sample for a position.

City, State or Country if international

Phone | Email

LinkedIn URL

FINANCE MANAGER PROFESSIONAL

Detail-oriented, driven, Finance Manager highly regarded for leadership and specialized excellence in all areas of Finance. Exceptional analytical skills, with the ability to examine and understand business needs and deliver comprehensive reports for external groups while exceeding stringent expectations. Accustomed to managing multiple projects simultaneously in fast-paced, deadline-driven environments. Strong collaborative skills with experience working in a team environment, able to work effectively alongside individuals from diverse backgrounds.

CORE COMPETENCIES

Financial Accounting

AP & AR

P&L Analysis

Balance Sheet

Accounts Reconciliation

Cash Flow Projections

Business Acumen

Leadership/ Coaching

Strategic Partnerships

Financial Statements

Market Analysis

Process Improvement

PROFESSIONAL EXPERIENCE

FINANCE MANAGER

COMPANY INC | CHICAGO, IL | 2015 to 2020

Responsibilities

Responsible for the management and reporting of ops supervisor, purchasing manager, purchasing coordinator, receiving technician.

Worked with the director of pharmacy business and finance services, and other senior managers of the department to coordinate information requests, problem identification, and problem resolution, to help the Pharmacy optimize its financial performance as a department. Ensured that departmental billing operation complied with all established BWH policies and procedures.

Translated information from budget, accounting, and analytic processes into effective communication tools for multiple audiences including senior leadership and physicians.

Worked with director of pharmacy business and finance, and other senior managers of the pharmacy department to coordinate information requests, problem identification, and problem resolution, to help the pharmacy department optimize its effectiveness and financial performance.

Oversaw all fiscal operations in the departments. Managed department’s operations supervisor, purchasing staff and receiving staff. Responsible for establishing and monitoring individual goals, conducting performance evaluations, and professional development plans for assigned staff.

Developed department cost center budgets based on overall plans of the department and hospital. Developed the expense allocation methodology.

Performed accounting activities in conjunction with BWH finance department to ensure accurate monthly application of revenue and expense.

DIRECTOR OF FINANCE

COMPANY INC | CHICAGO, IL | 2012 to 2015

Offered proactive thinking around resourcing allocation, product launch opportunities and business performance management.

Reviewed financial performance at product group, region, segment and customer levels and interacted with Commercial leaders and Management Team.

Business Cases - worked with product marketing, Go To Market, and Sales to develop detailed analysis to support decision making.

Managed and executed weekly, monthly & quarterly reports and ad-hoc analysis for Go To Market and Sales.

Continued to optimize offshore workload and to move additional work offshore.

Assisted in the establishment of clear and transparent business costs.

COMPANY INC | AMHERST, MA | 2008 to 2012

Completed company’s first financial statement audit. Reduced monthly closing and reporting cycle from three months to ten days. Reviewed all monthly, quarterly, and annual financial statements.

Coordinated and reviewed all corporate federal and state income and franchise tax returns. Oversaw the filing and payment of over 550 quarterly and annual payroll tax reports.

Created sophisticated spreadsheet models to analyze operating metrics across all departments and designed a 12-month cash forecasting tool.

Facilitated 100% revenue growth annually from 2009 - 2011.

Converted financial systems to Sage MAS500 and interfaced with HRP Payroll processing system.

Integrated two acquisitions during 2009 that doubled gross revenue. Analyzed owner payouts based on client retention and ROI. Centralized accounting at headquarters office.

Complete School Name, City, St/Country: List Graduation Years If Within the Last Ten Years Complete Degree Name (Candidate) – Major (GPA: List if over 3.3)

Relevant Coursework: List coursework taken (even include those you are planning on taking)

Awards/Honors: List any awards, honors or big achievements

Clubs/Activities: List clubs and activities in which you participated

Relevant Projects: List 2-3 projects you have worked on

Everything you need to write your finance manager resume

Now that you’ve seen an example of a job winning Finance Manager resume, here are some tips to help you write your own. You should always begin with a summary section. Remember to use basic formatting with clear section headings and a traditional layout. Finally, be sure to include top skills throughout your resume. We’ve included several examples common for Finance Manager below.

Let’s start with your resume summary section.

The resume summary replaces the out-of-date resume objective. A summary outlines the most impressive parts of your resume for easy recall by your potential employer, while also serving to fill in personal qualities that may not appear elsewhere on the page. Remember that summaries are short and consist of pithy sentence fragments! You can check out the Finance Manager resume example for more information!

Always start with your most recent positions at the top of your resume. This is called reverse-chronological format , and keeps your most relevant information easy for hiring managers to review.

2. Formatting

Our experts recommend you start your resume with a resume summary, like the one above. Other common sections are Work Experience, Education, and either Skills or Core Competencies. Here are some guides from our blog to help you write these sections:

How To Write Your Resume’s Work Experience Section

How To Write Your Resume’s Education Section

Good Skills To Put On Your Resume

Some resumes will include other sections, such as Volunteer Experience or Technical Skills . When it comes to what sections you need to include on your resume, you will know best!

Other sections for you to consider including are foreign language skills, awards and honors, certifications, and speaking engagements. These could all be relevant sections for your resume.

Join more than 1 million people who have already received our complimentary resume review.

In 48 hours, you will know how your resume compares. We’ll show you what’s working--and what you should fix.

3. Appropriate skills

Accounts Payable & Receivable

Investment Allocation

Mergers & Acquisitions

Profit & Loss (P&L) Analysis

Staff Leadership

Strategic Planning

Talent Coaching

4. Experience section

Your Work Experience section should make up the bulk of your resume. This section should include your relevant job titles, companies that employed you, and the dates you were employed.

The bulk of your Finance Manager resume should be the Experience section. This section is where you outline your relevant job titles, companies, and the dates you were employed, and describe each position you held. The Experience section is also a great place to engage readers with your work highlights and achievements. There are various ways to frame and expand on your job details so they help impress readers with your overall candidacy. For example, let’s look closer at two bullet points from the sample resume above. ▪ Created sophisticated spreadsheet models to analyze operating metrics across all departments and designed a 12-month cash forecasting tool. This is a strong bullet point because it kicks off with the action verb “Created.” A rule of thumb for recognizing a good resume verb is that it expresses your having started or improved something for the company. Lively verbs like “Introduced,” “Boosted,” “Eliminated,” or “Strengthened” sustain the reader’s interest and help capture the positive impact you’ve made at your employers. More passive verbs like “Handled” or “Carried out” may be appropriate in some cases, but are less likely to engage readers since they express your having simply completed tasks and assignments. ▪ Translated information from budget, accounting, and analytic processes into effective communication tools for multiple audiences including senior leadership and physicians. This is an effective statement because it demonstrates the practical use of soft skills such as communication and collaboration in the context of the job. Soft skills are hard to measure, so providing context is a great way to impress on readers your competency in those areas.

Let’s wrap it up!

Standout resumes will include a resume summary, a traditional reverse-chronological layout, and the skills and experience relevant to your job target. This resume example shows how to include those elements on a page. It’s up to you to insert your personal compelling qualifications.

Keep your resume format easy to scan by both humans and computers; our resume template is designed by our experts to satisfy both audiences. And be sure to include your own skills, achievements, and experiences. Job-winning resumes are resumes that successfully market you, leading recruiters and hiring managers to want to learn more!

Finally, emphasize your interest with a customized cover letter. When writing, remember that the resume and cover letter should support each other. Check out our cover letter tips and examples for more advice.

Didn’t get the specific answers you were looking for on this page? Hire a professional resume writer to get the advice you need to land your next job.

Related posts:

ATS Resume Test: Free ATS Checker & Formatting Examples

What Does Relevant Experience on a Resume Mean?

How to Tailor Your Resume to Different Positions

Is your resume working?

Find out with a free review from ZipJob.

PROTECT YOUR DATA

This site uses cookies and related technologies for site operation, and analytics as described in our Privacy Policy. You may choose to consent to our use of these technologies, reject non-essential technologies, or further manage your preferences.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Financial Services

Finance Manager Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the finance manager job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.