Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

TAX REFORMS IN INDIA : A CRITICAL ANALYSIS-

The present research paper examines the tax reforms undertaken in India in the areas of both direct

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

The Jurisprudence of Taxpayer Rights in India: An Evolutionary Tale in Direct Taxation

- Published: 21 November 2019

- Volume 40 , pages 271–297, ( 2019 )

Cite this article

- Kinshuk Jha 1

310 Accesses

Explore all metrics

This article traces the evolution of taxpayer rights in direct taxes in India. From the first income tax statute introduced in British India to the most recent one, a broad analysis has been done of the enactments to comprehend the jurisprudence of taxpayer rights in India. The role of different administrative committees and the courts of law in establishing taxpayer rights has also been analysed. The scope of taxpayer rights in post-independence India has been probed, the colonial and post-colonial travails of the taxpayer have been outlined, and the contemporary redressals to taxpayer concerns up to the period of September 2019 have been examined in this article.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

The Ideas of “Rights” in the “East” and “West” and Their Continued Evolution: A Case Study on Taxpayer’s Rights in Taiwan

Making International Tax Law: Analysing Tax Jurisprudence in India

Tax evasion and tax amnesties in regional taxation

‘V G Siddhartha was the founder of India’s largest coffee-shop chain, Coffee Day Enterprises, a $572 million-in-sales business (with more than 10,000 employees) that persuaded a country raised on tea to consume something else entirely. It made him a wealthy man, one of the richest in India and, for a brief moment after Coffee Day’s 2015 IPO, a billionaire.’ Brown ( 2019 : para 3).

Johnson ( 2019 ).

Choudhary ( 2019 : para 2).

The Central Board of Direct Taxes (CBDT) is a statutory authority functioning under the Central Board of Revenue Act, 1963. The officials of the Board in their ex-officio capacity also function as a Division of the Ministry dealing with matters relating to levy and collection of direct taxes.

“Tax terrorism” is the Indian term for harassment by revenue officials. Dhume ( 2019 ).

Bentley ( 2016 : 192).

Foucault ‘referred to his method of study as description, arguing that the role of philosophy is not to reveal what is hidden, but rather to make us see what is seen.’ Orford ( 2012 : 609).

Singh ( 2019 : 2).

Indra Sawhney case (1992: para 479).

Singh ( 2019 : 10).

Smith ( 1999 :145).

James Wilson was India’s first finance minister and founder of The Economist. By 1859, Wilson -a former hatter from Hawick, Scotland; financier; and magazine editor (The Economist) was a leading member of the Liberal Government; on the cusp of becoming Chancellor of the Exchequer. Bagehot ( 1968 : 352–353).

‘The East India Company was formed in London on the last day of 1600 by a group of merchants, mariners, explorers and politicians. Its mandate was to finance trading voyages to India, Southeast Asia and China with subscribed Capital.’ Roy ( 2015 : 6).

Hibbert ( 1978 ).

‘Thomas Babington Macaulay, the English historian, essayist and politician, called the East India Company ‘the greatest corporation in the world’. Today we would use those words. We might call it the world’s most powerful corporation, which it was during its 275 year life that extended from the mercantilist period of chartered monopolies to the industrial age of modern corporations.” Das quoted in Roy ( 2015 : xxiv–xxv).

Jenkins ( 2012 : 89).

Letter to a friend (July 4, 1860) The name of the recipient is not disclosed: letters copied to Bagehot are described in all published sources only as letters to friends. Quoted in Jenkins ( 2012 : 91).

Income was taxed in four broad schedules or heads. The schedules cast a wide net, and were based on what we now know as the residence and source principles. Ibid .

Pagar (YEAR: 21–22) citing Report on the Income Tax in the N W Provinces (1861–1862) ; Niyogi (Year: 36–37).

Rao ( 1931 : 11, fn.127).

While the Income tax was payable by all persons having income more than 20 lb, Licence Tax would be payable by all. This would cover all the classes whose income was difficult to be assessed or those subjects who paid little towards the revenue of India in other respects. Moore ( 1966 ).

Income Tax Act of 1886.

IT Report ( 2018 : para 1.4).

Alvaredo et al. (2017: para 1.3).

IT Report ( 2018 : para 1.6).

Income Tax Act ( 1961 ), Section 5.

IT Report ( 2018 : 1.7).

Jenkins ( 2012 : 14).

ITA ( 1860 s.64).

ITA ( 1860 s.55, s.56 cl.4).

ITA ( 1860 s.60, s.53).

ITA ( 1860 ss.177–178, 216).

The purdah system was in place in Hindu and Muslim communities both.

ITA ( 1860 ), sec. 197.

Punjab Laws Act 1872 .

Income Tax Act of ( 1886 ).

Income Tax Act of ( 1918 ).

Indian Income Tax (Amendment) of ( 1939 ).

Income Tax Act of ( 1922 ).

Indian Income Tax (Amendment) Act of ( 1926 ).

Sections 256 and 257 of the Income Tax Act of ( 1961 ).

Law Commission of India (1958: 1).

India gained independence on 15th August, 1947 and ceased to exist as a British colony.

While the work of most of the committees is significant, the focus here is on some noteworthy contributions towards the evolution and protection of taxpayer rights.

IT Report ( 2018 : 3).

Law Commission of India (1958: para 2).

Direct Taxes Administration Enquiry Committee Report (1960: para 8).

Chikermane ( 2018 : para 1).

Introduction, Final Report, 1971, Direct Taxes Enquiry Committee (1970).

Gulati ( 1972 : 1314–1317).

India signed its first bilateral tax treaty with Greece in 1965, followed by one with Egypt in 1969. 17 more bilateral agreements were concluded in the 1980 s with countries like Japan, Mauritius, USA and Brazil, among others. In the 1990 s, this process gained momentum and 39 treaties were signed, notably with France, the United Kingdom, Singapore, Switzerland, China and Russia. Jaiswal and Biyani ( 2016 : 10).

Rao ( 2016 : para 2).

Taxpayers are allowed to mitigate their tax liability so long as it is within the four corners of law. This principle was laid in Inland Revenue Commissioners v. Duke of Westminster (1936: 490). Though in a later judgment of Ramsay Ltd. v. Inland Revenue Commissioners ( 1982 : para) the use of colorable devices for tax planning was completely shunned.

“Treaty shopping” connotes a premeditated effort to take advantage of the international tax treaty network and a careful selection of the most favorable tax treaty for a specific purpose. Rosenbloom ( 1983 : 766).

Duhigg and Kocieniewski ( 2012 : 2).

Deloitte ( 2018 : para 1).

Zuchermann ( 2015 : 36).

Vodafone v. Union of India ( 2012 : 573).

Sections 2(14), 2(47), 9 and 195 of the Indian Income Tax Act 1961 were amended by the Finance Act of 2012. Govt. of India.

For detailed history of retrospectivity, see, Salve ( 2015 : 1–28).

Singh and Nagpal ( 2014 : 5).

Krishnamurthy ( 2013 : para 2).

GAAR was finally made effective from 1st of April, 2017 in India.

GAAR Report (2012: 36).

Krishnamurthy ( 2013 : para 1).

TARC recommendations (2014: 2–3).

OECD ( 2013 : para 1).

An earlier attempt was made by the UPA Government to bring a new legislation in 2010 when a taskforce had submitted a draft Direct Tax Code. However, this could not be taken further due to differences within and outside the Government. Business Line ( 2019 : para 2).

A good tax system is generally perceived as comprising of the four canons of taxation of Adam Smith, namely, canons of equality, certainty, convenience and economy. These canons were propounded in his much-acclaimed work ‘ An Inquiry into the Nature and Causes of the Wealth of Nations , published in 1776. Smith ( 1999 : 416).

Article 265 in The Constitution of India 1949 states ‘Taxes not to be imposed save by authority of law No tax shall be levied or collected except by authority of law’ ( 1950 : Art. 265).

American and French Revolutions primarily.

The legislative powers are divided within three lists, namely, Union, State and Concurrent, within the premise of this Article.

BMR Advisors ( 2013 : 34).

Lohia Machines v. UOI ( 1985 : 308).

KrishnaMurthi and Co v. State of Madras ( 1972 : 2455).

BMR Advisors ( 2013 : 50).

‘The State shall not deny to any person equality before the law or the equal protection of the laws within the territory of India.’ Constitution of India ( 1950 : Art. 14).

Article 301–304 provide the scope of taxation on movement of Goods and Services across the territory of India. Reasonable restrictions, through entry taxes, on public policy grounds were held as valid impositions. A Constitution Bench of 9 judges in Jindal Stainless Ltd. v. State of Haryana ruled this by a 7:2 opinion. The bench further stated that the factum as to whether an entry tax is discriminatory or not has to be examined by the respective benches hearing the same. Constitution of India ( 1950 : Art. 301–304).

Jindal Stainless v. State of Haryana ( 2016 : 461).

Cape Brandy Syndicate v. IRC ( 1921 :71).

Saran v. Commissioner of Sales Tax ( 1985 : 985).

Varghese V. ITO ( 1981 : 597).

Collector of Central Excise vs Parle Exports ( 1989 : 644).

Commissioner of Customs (Import), Mumbai v. Dilip (2009: 40).

Some jurisdictions have the Taxpayer Bill of Rights in place instead of a Charter, for example USA and Canada. Also, the Tax Code of Chile has a legislated list of taxpayer rights. Govt. of Australia ( 2017 : Chap. 2).

The concept was first articulated and implemented in the United Kingdom by the Conservative Government of John Major in 1991 as a national programme with a simple aim: to continuously improve the quality of public services for the people of the country so that these services respond to the needs and wishes of the users. The programme was re-launched in 1998 by the Labour Government of Tony Blair which rechristened it “Services First”. India followed suit by introducing Citizen Charter in most of the public departments in 1998. Govt. of India ( 2017 : para 4 ff).

de Zeeuw ( 2008 : 40).

Govt. of Australia ( 2017 : Chap. 2).

Jain and Sekar ( 2015 : 445).

Section 246-A, 253(2), 260-A(2), 263 and 264 of the Income Tax Act of ( 1961 ).

Deloitte ( 2019 : 9).

Final Report, 1971, Direct Taxes Enquiry Committee, 1970.

Section 245 B of Income-tax Act, 1961 (Chapter XIX-A).

A proviso to Section 245 H of the Income Tax Act 1961 was inserted in June 2007. This amendment limited the extent of immunity only to provisions of Income Tax Act 1971 and Wealth Tax Act 1957 , for all applications filed before the Settlement commission after 1st June 2007.

Only a writ petition can be filed if principles of natural justice have been violated and mandatory procedural requirements of law were not complied with.

Govt. of India ( 2016 : Para 1).

Savla and Sharma ( 2017 : para 3).

Section 245D(4A) of the Income Tax Act 1961 .

Govt. of India ( 2015 : chap 8).

Deloitte ( 2019 : para.1).

Columbia Sportswear Co. v. DIT ( 2012 : 224).

Section 245(R)(6) of Income Tax Act ( 1961 ).

Dhruva Advisors ( 2018 : 3).

Section 92CC and 92CD, Income Tax Act 1961 .

Black's Law ( 2009 ).

Dhruva Advisors (2018: para 4).

Section 144C of Income Tax Act 1961 , inserted by Finance Act of 2009.

MAP is an alternative available to taxpayers for resolving disputes giving rise to double taxation whether juridical or economic in nature. The agreement for avoidance of double taxation between the countries would give authorization for assistance of Competent Authorities in the respective jurisdiction under MAP. In the context of OECD Model Convention for the Avoidance of Double Taxation, Article 25 provide for assistance of Competent Authorities under MAP. Vaidya and Rao (2011: para).

Sections 2(14), 2(47), 9 and 195 of the Indian Income Tax Act ( 1961 ) were amended by the Finance Act of 2012. Govt. of India ( 2012a , b , c ).

Mohan ( 2012 : para 2).

Mohan ( 2013 : para 3).

Srivats ( 2017 : para 5).

Cairn Energy ready to reinvest in India if retro tax issue is resolved. PTI ( 2019b : para 1).

Cairn India tax case: Retrospective tax arbitration award delayed till 2019-end. PTI ( 2019a : para 2).

Recently, the Delhi High Court in the case of Union of India v. Khaitan Holdings (Mauritius) Limited & Ors. refused to grant anti-arbitration injunction (i.e. stay on arbitration proceedings) to Union of India in a dispute under India-Mauritius Bilateral Investment Treaty. It held that interference by domestic courts in arbitral proceedings under BIT is permissible only in “compelling circumstances” in “rare cases”. The Court reaffirmed that issues as to the jurisdiction of the arbitral tribunal should be decided by the arbitral tribunal itself. Modani et al. ( 2019 : para 1).

Ranjan and Anand ( 2018 : para 1).

‘CBDT initiates probe into Cafe Coffee Day founder V G Siddhartha's death.’ Choudhary ( 2019 : para.3).

‘Faceless e-assessment scheme for taxpayers launched’. ET Bureau ( 2019 : para.2).

Relief for markets as super-rich surcharge on FPIs is withdrawn. Sultana ( 2019 : para.).

Ernst and Young ( 2019 : 1–2).

OECD ( 2013 ).

Govt. of India ( 2019 : para 1).

Kanga and Palkhivala ( 2004 : ix).

Alvaredo, Facundo, Augustin Bergeron, and Guilhem Cassan, Income concentration in British India, 1885 – 1946 . Online Appendix. http://piketty.pse.ens.fr/files/AlvaredoBergeronCassan2017Appendix.pdf .

Bagehot, Walter. 1968. Collected Works. London: The Economist 3: 352–353.

Google Scholar

Bentley, Duncan. 2016. Taxpayer Rights: Coping With Globalization and Uncertainty. Tax Notes International . Special Reports: 192.

Brown, Abram. 2019. The Tragedy Behind The Death of Former Billionaire V.G. Siddhartha, India’s Coffee King. Forbes . https://www.forbes.com/sites/abrambrown/2019/07/31/vg-siddhartha-death-coffee-day/#1396593f4f7b .

Business Line. 2019. Task force on direct tax code submits report to FM Nirmala Sitharaman . https://www.thehindubusinessline.com/economy/task-force-on-direct-tax-code-submits-report-to-nirmala-sitharaman/article29146603.ece .

Choudhary, Shrimi. 2019. CBDT Initiates Probe into Cafe Coffee Day founder V G Siddhartha’s death. Business Standard . https://www.business-standard.com/article/current-affairs/vg-siddhartha-s-death-cbdt-starts-inquiry-in-cafe-coffee-day-case-119081401620_1.html .

de Zeeuw, Maarten. 2008. The Formulation of Taxpayer Rights and Obligations in a Developing Country. Asia-Pacific Tax Bulletin 14: 40.

Deloitte. 2019. Tax Policy Paper 5, Advance Rulings in India. https://www2.deloitte.com/content/dam/Deloitte/in/Documents/tax/in-tax-advance-rulings-india-tax-policy-paper-noexp.pdf .

Deloitte. 2018. Tax Insights, Corporate residency test — ATO’s new Approach Increases Risk for foreign Companies to be Treated as Australian Tax Residents . https://www2.deloitte.com/content/dam/Deloitte/au/Documents/tax/deloitte-au-tax-insight-corporate-residency-test-ato-new-approach-210618.pdf .

Dhruva Associates. 2018. Tax dispute resolution in India trends and insights. https://dhruvaadvisors.com/insights/files/TaxDisputesResolutionIndia_v2.pdf .

Dhume, Sadanand. 2019. India Should Quit Harassing the ‘Super-Rich’: Boosting Taxes on High Earners Won’t Bring in the Revenue Modi Needs. It will Drive Out the Wealthy. The Wall Street Journal (22 Aug 2019).

Ernst and Young. 2019. Global Tax Alert, India Reduces Tax Rates for Indian Companies. https://www.ey.com/Publication/vwLUAssets/India_reduces_tax_rates_for_Indian_companies/$FILE/2019G_004266-19Gbl_India%20reduces%20tax%20rates%20for%20Indian%20companies.pdf .

ET Bureau. 2019. Faceless e-Assessment Scheme for Taxpayers Launched. https://economictimes.indiatimes.com/news/economy/policy/faceless-e-assessment-scheme-for-taxpayers-launched/articleshow/71480584.cms?from=mdr .

Garner, Bryan, and Henry Campbell Black. 2009. Black’s Law , 9th ed. Minnesota: West Publishing.

Gulati, I.S. 1972. Wanchoo Report: A Critique. Economic and Political Weekly 28 (7): 1314–1317.

Hibbert, Christopher. 1978. The Great Mutiny . London: Viking.

Jain, Parul, and K. Sekar. 2015. Country Report: India , 445–467. Rotterdam: International Fiscal Association Publication, Rotterdam.

Jaiswal, Suraj, and Neeti Biyani. 2016. India’s Experience with Exchange of Information Agreements. http://www.cbgaindia.org/wp-content/uploads/2016/05/Indias-Experience-with-Exchange-of-Information-Agreements-Web-Publication.pdf .

Jenkins, C.L. 2012. Legislative Comment 1860: India’s First Income tax. British Tax Review 7: 87–116.

Krishnamurthy, Vijay. 2013. India’s GAAR: Nice Idea, Shame About the Execution. ITR. https://www.internationaltaxreview.com/article/b1fbsrj45h1rr6/indias-gaar-nice-idea-shame-about-the-execution .

Modani, Kshama Loya, Ashish Kabra, and Mohammad Kamran. 2019. In Line with Vodafone, Delhi High Court Refuses Another Anti-BIT Arbitration Injunction . New Delhi: Nisith Desai Associates.

Mohan, Ashwin. 2013. Government Faces Yet Another Blow to Retrospective Tax Laws. https://economictimes.indiatimes.com/news/economy/finance/government-faces-yet-another-blow-to-retrospective-tax-laws/articleshow/23315094.cms .

Mohan, Ashwin. 2012. McLeod Russel First to Challenge India’s Retrospective Tax Laws. https://economictimes.indiatimes.com/wealth/personal-finance-news/mcleod-russel-first-to-challenge-indias-retrospective-tax-laws/articleshow/14100295.cms?from=mdr .

Moore, R.J. 1966. Sir Charles Wood’s Indian Policy, 1853–66 . Manchester: Manchester University Press.

Orford, A. 2012. In Praise of Description. Leiden Journal of International Law 25: 609–625.

Article Google Scholar

PTI. 2019a. Retrospective Tax Arbitration Award Delayed Till 2019-End. Livemint. https://www.livemint.com/companies/news/cairn-india-tax-case-retrospective-tax-arbitration-award-delayed-till-2019-end-1552316630693.html .

PTI. 2019b. Cairn Energy Ready to Reinvest in India if Retro Tax Issue is Resolved. Livemint. https://www.livemint.com/companies/news/cairn-energy-ready-to-reinvest-in-india-if-retro-tax-issue-is-resolved-ceo-1564898649921.html .

Ranjan, Prabhash, and Pushkar Anand. 2018. Vodafone Versus India—BIT by BIT, International Arbitration Becomes Clearer. The Wire . https://thewire.in/business/vodafone-versus-india-bit-international-arbitration .

Rao, MG. 2016. Raja Chelliah: The Father of Tax Reform. Financial Express . https://www.financialexpress.com/opinion/raja-chelliah-the-father-of-tax-reform/335558/ .

Rao, V.K.R.V. 1931. Taxation of Income in India . London: Longmans, Green and Co.

Rosenbloom, H.D. 1983. Tax Treaty Abuse: Problems and Issues. Law and Policy in International Business 15: 763.

Roy, T. 2015. The East India Company: the World’s Most Powerful Corporation . Gurgan: Penguin.

Salve, Harish. 2015. Retrospective Taxation — the Indian Experience . British Institute of International and Comparative Law. https://www.biicl.org/files/6722_panel_two_harish_salve.pdf .

Savla, PS, and Keerthiga Sharma. 2017. Budget 2017: Is it Time to Mediate with the Revenue ? https://www.moneycontrol.com/news/business/personal-finance/budget-2017-is-it-time-to-mediatethe-revenue-944492.html .

Shrimi, Choudhary. 2019. CBDT Initiates probe into Cafe Coffee Day Founder V G Siddhartha’s Death. Business Standard. August 15, 2019. https://www.business-standard.com/article/current-affairs/vg-siddhartha-s-death-cbdt-starts-inquiry-in-cafe-coffee-day-case-119081401620_1.html .

Singh, P. 2019. Spinning Yarns From Moonbeams: A Jurisprudence of Statutory Interpretation in Common Law. Statute Law Review . https://doi.org/10.1093/slr/hmy035 .

Singh, RR, and Neetika Kaushal Nagpal. 2014. Navigating the Headwinds: Mitigating Contention in India-US Business Engagement. http://icrier.org/ICRIER_Wadhwani/Index_files/India’s_Investment_Climate.pdf .

Srivats, KR. 2017. Uncertainty Continues Over Retrospective Taxation. Business Line . https://www.thehindubusinessline.com/economy/policy/uncertainty-continues-over-retrospective-taxation/article9657224.ece .

Sultana, Nasrin. 2019. Relief for Markets as Super-Rich Surcharge on FPIs is Withdrawn. Livemint . https://www.livemint.com/politics/policy/surcharge-withdrawal-for-fpis-big-positive-for-markets-1566573215377.html .

Johndon, T.A. 2019. Coffee and froth: For VG Siddhartha, a lot could happen over coffee. The Indian Express .

The Bar Council of India.Year. Nani Palkhivala. http://www.barcouncilofindia.org/about/legends-of-the-bar/nani-palikhivala/ .

Zuchermann, Gabriel. 2015. The Hidden Wealth of Nations . Chicago: The University of Chicago Press.

Kanga, J.B., and N.A. Palkhivala. 2004. Law and Practice of Income Tax , 9th ed. New Delhi: LexisNexis.

Adam, Smith. 1999 [1776] Wealth of Nations . Skinner, Andrew (Intro). London: Penguin.

Cape Brandy Syndicate v. IRC . 1921. KB 64.

Heydon’s Case . (1584) 3 Co Rep 7a.

Collector Of Central Excise vs Parle Exports . 1989. AIR [SC] 644.

Columbia Sportswear Co. v. DIT . 2012. 11 SCC 224.

Commissioner of Customs (Import), Mumbai v. Dilip Kumar and Company . 2018. 9 SCC 40.

Eilbeck (Inspector of Taxes) v. Rawling . 1982. A.C. 300.

Govind Saran Ganga Saran vs Commissioner Of Sales Tax . 1985. AIR 1041, 1985 SCR (3) 985.

Lohia Machines Ltd and Anr v UOI. 1985. 152 ITR 308.

Jindal Stainless Ltd v. State of Haryana . 2016. Indlaw SC 979.

K. P. Varghese V. ITO . 1981. 131 ITR 597.

Krishna Murthi and Co v State of Madras . 1972. AIR 1972 SC 2455.

Vodafone International Holdings B.V. v. Union of India . 2012. 1 S.C.R. 573.

W. T. Ramsay Ltd. v. Inland Revenue Commissioners . [1982] A.C. 300.

Legislations

Code of Civil Procedure , 1908.

Constitution of India , 1950.

Income Tax (Amendment) Act , 1926.

Income Tax (Amendment) Act , 1939.

Income Tax Act , 1860.

Income Tax Act , 1886.

Income Tax Act , 1918.

Income Tax Act , 1922.

Income Tax Act , 1961.

Indian Evidence Act , 1872.

Punjab Laws Act , 1872.

Right to Information Act , 2005.

Wealth Tax Act , 1957.

Advisors, B.M.R. 2013. Managing Tax Disputes in India: Key concepts and Practical Insights . New Delhi: Lexis Nexis.

Chikermane, Gautam. 2018. India Matters . https://www.orfonline.org/expert-speak/43040-70-policies-the-93-5-percent-marginal-rate-of-taxation-1971/ .

Duhigg, Charles & David Kocieniewsky. 2012. How Apple Sidesteps Billions in Taxes. New York Times , 12 April.

Govt of Australia. 2017. Historical consideration of taxpayer rights and protections in Australia . http://igt.gov.au/publications/reports-of-reviews/taxpayers-charter-and-taxpayer-protections-review/chapter-2-taxpayer-rights-in-australia-and-international-comparisons/ .

Govt. of India, Press Information Bureau. 2019. Ratification by India of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting. https://pib.gov.in/newsite/PrintRelease.aspx?relid=191125 .

Govt. of India. 2014. Status of TARC recommendations. https://dor.gov.in/sites/default/files/Status%20Of%20TARC%20Recommendations_0.pdf .

Govt. of India. 1971. Direct Taxes Enquiry Committee: Final Report . http://www.thehinducentre.com/multimedia/archive/03091/direct-taxes-enqui_3091080a.pdf .

Govt. of India. 2012. Central Board of Direct Taxes, 29th May, 2012, F. No. 500/1 1 1 12009-FTD-l). https://www.incometaxindia.gov.in/Lists/Departmental%20News/Attachments/214/Departmental_News.pdf .

Govt. of India. 2012. Expert Committee, Final Report on General Anti Avoidance Rules (GAAR) in Income-tax Act, 1961. https://www.finmin.nic.in/sites/default/files/report_gaar_itact1961.pdf .

Govt. of India. 2015. Report No. 3 of 2015 (Direct Taxes). https://cag.gov.in/sites/default/files/audit_report_files/Union_Compliance_Direct_Tax_Revenue_Dept_3_2015_chapter_8.pdf .

Govt. of India. 2012. Central Board of Direct Taxes, F. No. 500/1 1 1 12009-FTD-l (Pt.).. https://www.incometaxindia.gov.in/Lists/Departmental%20News/Attachments/214/Departmental_News.pdf .

Govt. of India. 2016. Department of Revenue, Settlement Commission (IT-WT). https://dor.gov.in/rti/settlement-commisssion-itwt .

Govt. of India. 2017. The Citizens’ Charter: Indian Experience. https://darpg.gov.in/citizens-charters-historical-background .

Income Tax Report. 2018. Task Force for drafting the new Income Tax Law, Report on Income Tax Reforms for building a new India . https://www.thehindu.com/news/resources/article29215092.ece/Binary/IncomeTaxReformsReport.pdf .

Jha, Kinshuk. 2017. Taxpayer rights and obligations. The Hindu . https://www.thehindu.com/opinion/op-ed/taxpayer-rights-and-obligations/article19723024.ece .

OECD. 2013. Action Plan on base Erosion and Profit shifting. https://www.oecd.org/ctp/BEPSActionPlan.pdf .

PWC. 2011. Answering Queries: Mutual Agreement Procedure.. https://www.pwc.in/assets/pdfs/publications-2011/pwc_india_-_mutual_agreement_procedure_answering_queries-130112.pdf .

Vaishnava, Saumya. 2014. First Report of the Tax Administration Reforms Commission . PRS. https://www.prsindia.org/sites/default/files/parliament_or_policy_pdfs/1404204462_TARC%20First%20Report%20Summary.pdf .

Download references

Acknowledgements

I am thankful to International Bureau of Fiscal Documentation, Amsterdam for the research stay during the summer of 2017. It provided me with valuable insights which have been helpful in the development of this paper. I thank Luca Cerioni for his generous guidance. I also thank Prabhakar Singh and Arpita Gupta for the sustained conversations and thoughtful comments.

Author information

Authors and affiliations.

Jindal Global Law School, Sonipat, India

Kinshuk Jha

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Kinshuk Jha .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Jha, K. The Jurisprudence of Taxpayer Rights in India: An Evolutionary Tale in Direct Taxation. Liverpool Law Rev 40 , 271–297 (2019). https://doi.org/10.1007/s10991-019-09239-7

Download citation

Published : 21 November 2019

Issue Date : October 2019

DOI : https://doi.org/10.1007/s10991-019-09239-7

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- History of taxation

- Direct taxes

- Income tax law

- Taxpayer rights

- Tax administration

- Tax reforms

- Tax certainity

- Find a journal

- Publish with us

- Track your research

The Official Journal of the Pan-Pacific Association of Input-Output Studies (PAPAIOS)

- Open access

- Published: 09 May 2020

Tax structure and economic growth: a study of selected Indian states

- Yadawananda Neog ORCID: orcid.org/0000-0002-3578-0460 1 &

- Achal Kumar Gaur 1

Journal of Economic Structures volume 9 , Article number: 38 ( 2020 ) Cite this article

49k Accesses

27 Citations

3 Altmetric

Metrics details

The present study examines the long-run and short-run relationship between tax structure and state-level growth performance in India for the period 1991–2016. The analysis in this paper is based on the model of Acosta-Ormaechea and Yoo ( 2012 ), and for the verification of the relationship between taxation and economic growth the panel regression method is used. With the use of 14 Indian states data, Panel Pool mean group estimation indicates that income tax and commodity–service tax have negative effects whilst property and capital transaction tax have a significant positive effect on state economic growth. This study finds ‘U’ shape relationship between tax structure and growth performance. Based on the analysis, we conclude that for faster growth of Indian states, policymakers should give more focus on property taxes along with the reduction in income taxes.

1 Introduction

The study on the potential association between tax structure and growth performance has gathered a great deal of attention from policymakers, academicians and regulatory circles for several reasons. First, the developing and emerging economies require a large volume of tax revenues for the smooth and efficient functioning of the state at both the national and sub-national levels. Globalization has laid down the foundation for Goods and Service Tax (GST) in many developing countries (Mcnabb 2018 ). Due to competition, developing countries are also facing the difficulties to maintain existing tax revenues (Bird and Zolt 2011 ). Second, tax collection and structure of it create distortionary impacts in the economy through tax burden. Thus, the positive and negative impact of tax made the ‘tax–growth’ relationship more complex and the structure of taxation has a definite role in the development process of an economy.

In a budget constraint economy like India, investigation of tax–growth relationship enables us to formulate the suitable policy measure for the more inclusive and equitable growth process. The budget crisis is usually resolved through the cut-down of public spending or/and an increase in tax revenues (Macek 2014 ). Rapid reduction in spending or increase in taxes is harmful to long-run growth performance. Thus, the concern of the government lies with the problem of fiscal consolidation with sustainable growth performance where tax policies are vital.

Empirical evidence on the impact of tax structure on growth performance is not conclusive. India has adopted the Goods and Service Tax (GST) policy in 2017 intending to raise indirect tax collections and transform the indirect tax structure into a single market to avoid tax evasions and double taxation. GST is regarded as one of the major tax policy changes in independent India and economists are an optimist about its impact on revenue generations and growth performance. But this policy is not the only policy that shaped in independent India; other major policy changes also take place after independence. Footnote 1 Tax Reform Committee (TRC) report of 1991 regarded one of the productive and structured policy recommendations in the recent decade. At the state level, sales tax reform in the form of Value Added Tax (VAT) in 2005 becomes a fruitful policy initiative. However, the tax collections in both national and sub-national level are still low as compared to the international standards. Changes in tax policy also change in the tax structure in the economy and India witnessed these changes at both levels of governments. Recent studies proved that the changes in tax structure have decisive implication in the growth performance through work–leisure behaviour, investment decisions and overall productivity (Arnold et al. 2011 ; Gemmell et al. 2011 ; Macek 2014 ; Mdanat et al. 2018 ; Durusu-Ciftci 2018 ). In India, very few empirical studies are available which analyse the impact of these changes in tax structure on growth performance and this study will be first to investigate tax–growth nexus in India with the use of state-level data.

This analysis primarily concerned with tax structure rather than to tax levels (usually measured as a tax–GDP ratio). The main advantage of tax structure analysis is that it provides revenue-neutral tax policy changes which remove the difficulties related with the question of how aggregate tax revenue changes relates with expenditure changes (Arnold et al. 2011 ). The empirical results from linear panel regression suggest us that property and capital transection tax are positively affecting the state’s growth performance, where commodity and service tax effect negatively. However, the non-linear panel regression indicates that the positive effect is only visible for property taxes at a higher level where the negative effect of commodity and service taxes becomes positive after a threshold point. The effect of income tax is not significant in long run irrespective of panel regression models.

The structure of the paper is as follows: Sect. 2 deals with the theoretical framework and empirical literature, followed by a brief description of data and methodology in Sect. 3 . Empirical results and discussion are presented in Sect. 4 and our last Sect. 5 is for conclusions and recommendations.

2 Theoretical framework and empirical literature

Growth literature very recently acknowledges the role of taxation in the growth process of an economy. Until recently, growth models are more concerned with the steady-state process and exogenous changes. On the theoretical ground, taxation does not have any impact on growth (Myles 2000 ). Development of endogenous growth models creates the space for fiscal policy especially tax policy in determining the growth performance. Barro ( 1990 ), King and Rebello ( 1990 ) and Jones et al. ( 1993 ) were the pioneer in this regard. Tax level and tax structure have an impact on the saving behaviour of the household and investment in human capital. On the other hand, the firm also changes its investment decisions and innovations following tax policies (Johansson et al. 2008 ). These decisions and incentives in the accumulation of physical and human capital create the ‘Growth’ disparities amongst the countries and state economies.

A large body of literature available on “Tax-Growth” relationship is mostly dedicated to cross-country settings (Martin and Fardmanesh 1990 ; Karras 1999 ; Myles 2000 ; Tosun and Abizadeh 2005 ; Johansson et al. 2008 ; Vartia et al. 2008 ; Arnold 2011 ; Szarowska 2013; Macek 2014 ; Stoilova 2017 ; Safi et al. 2017 ; Durusu-Ciftci 2018 ) that investigates the effect of tax policy on economic performance. Income and corporation taxes are the major tax instruments for the governments irrespective of the level of developments of a country. The formation of tax structure with these two taxes has many implications in the growth performance. The study made by Arnold et al. ( 2011 ), Macek ( 2014 ) and Dackehag and Hansson ( 2012 ) has explored the negative relation of income and corporation tax with growth performance. Vartia et al. ( 2008 ) find the negative impact of corporation tax for OECD countries. If we consider the average and marginal tax rate, marginal tax is very influential than to average tax rate in investment decisions and labour supply. Empirical studies prove that marginal tax has a negative relation with growth, which indicate raising of marginal tax rate is associated with compromises with growth performance (Padovano and Galli 2001 ; Lee and Gordon 2005 ; Poulson and Kaplani 2008 ). Studies also established that other type of taxes also has a significant impact on growth performance, like consumption tax (Johansson et al. 2008 ; Durusu-Ciftci 2018 ), GST and Payroll (Tosun and Abizadeh 2005 ), property tax (Xing 2011 ), labour tax (Szarowska 2014 ), sales tax (Ojede and Yamarik 2012 ), excise (Reynolds 2006 ), etc.

However, looking at the single country’s perspective, we find very little evidence on the same. Stockey and Rebelo ( 1995 ) with the use of the endogenous growth model study the role of tax reforms on U.S. growth performance. They have found that tax reforms have very minor implication with economic outcomes. There are several studies exist for US economy where they empirically try to establish the link between tax and growth. Atems ( 2015 ) finds the spatial spillover effect of income taxes on the growth of 48 contiguous states. On the other hand, Ojede and Yamarik ( 2012 ) have not found any kind of impact of income taxes on growth in these states. Their panel pool mean group estimation indicates that property and sales tax has detrimental consequences in development. With the use of data for the U.S. covering the period of 1912–2006, Barro and Redlick ( 2009 ) find that average marginal income taxes were halting the economic growth. However, they have provided an interesting argument that in wartime, the tax does not have any kind of relation with growth. In search of an answer to the question that whether corporate tax rise destroys jobs in the U.S., Ljungqvist and Smolyansky ( 2016 ) use firm-level data for the period 1970–2010. The main conclusion of the paper is that a rise in corporate tax is not good for employment and income and has very little impact on economic activity. Using the error correction model, Mdanat et al. ( 2018 ) find for Jordan that income tax, corporation tax and personal tax negatively impact the growth. They suggest that irrespective of tax collection, the prime focus of the government should be social justice of the people. Dladla and Khobai ( 2018 ) also find similar results for South Africa where income taxes are coming out to be negative. For the case of Italy, Federici and Parisi ( 2015 ) used the 880 firms’ data and results show that corporation tax is bad for investments with the consideration of both effective average and marginal taxes rates.

Looking at the literature, the empirical relationship of tax structure with growth performance is still unclear for India. This study attempts to fill the gap by examining the effect of tax policy on economic performance in an emerging economy such as India at the state level. Second, with the use of panel Pool Mean Group (PMG) estimator which assumes slope homogeneity in the long run and heterogeneity in the short run, we can incorporate the dynamic behaviour of the variables which will be new to tax structure–growth study in India. Third, the tax–growth nexus may show a non-linear relationship due to the threshold effect. We consider this non-linearity in our panel regression model which will be a contribution to the existing literature.

3 Data and methodology

To study the effect of tax policy on economic performance in India, we employed three models and included each tax instruments in the models separately to avoid the problem of Multicollinearity. Following the works of Arnold et al. ( 2011 ) and Acosta-Ormaechea and Yoo ( 2012 ), the tax structure is measured by the share of individual tax to the total state tax revenues. We investigate the tax–growth relationship with the following equation.

Here, Y it is the growth rate of Per capita net state domestic product (NSDP), SGI is the state gross investment as a percentage of state domestic product, TAX is one of the tax shares (Property, Commodity & Services and Income), Tax Burden Footnote 2 is the ratio of total tax revenues to state domestic product and ϵ is the error term. Per the work of Acosta-Ormaechea and Yoo ( 2012 ), this study is more concerned with the impact of tax structure on growth rate rather than level effect. In model 1, we include property tax share, and in model 2 and model 3, we incorporate commodity & service tax and income tax, respectively. By following the approach of Arnold et al. ( 2011 ), we include total tax burden as a control variable which will reduce the biases that may occur from correlation in between tax mix and tax burden. We also included Secondary Enrollment Rate as a proxy variable for human capital in our model, but the inconsistent and insignificant results make us drop the variable from the final estimation model.

In search of a possible non-linear relationship, we introduce a separate panel regression by introducing the square of each tax share into the models.

If the coefficient of α 3 significant and carries an opposite sign to α 2 , then we can conclude that there is a non-linear relationship exist.

In this study, we included 14 Indian states for the period 1991 to 2016 and excluded North-Eastern states due to their relatively small tax revenue collections. Data have been taken from the Centre for Monitoring Indian Economy (CMIE) and Handbook of Statistics on the Indian States, published by Reserve Bank of India. The states that are included in this study are Andhra Pradesh (undivided), Footnote 3 Assam, Gujarat, Haryana, Himachal Pradesh, Jammu & Kashmir, Karnataka, Kerala, Maharashtra, Punjab, Tamil Nadu, Orissa, Rajasthan and West Bengal. All the states are included in model 1 and model 2. For model 3, due to the data availability, we include only seven states Footnote 4 namely Andhra Pradesh, Assam, Gujarat, Karnataka, Kerala, Maharashtra, and West Bengal.

The selection of the study period is primarily driven by the argument provided by Rao and Rao ( 2006 ) that after the market-oriented economic reform of 1991, more systematic and long-term goal-oriented tax reforms were initiated in state level for India. The economic reform also brings rapid growth in India and it becomes very interesting to look at the tax–growth nexus after the economic reform. The second restriction related to the use of long data span is the availability of data for each tax head for each of the states under this study.

3.1 Unit root

Pool Mean Group (PMG) specification is very fruitful and widely used model to capture the dynamic behaviour of policy variables. This model is very powerful as it can investigate both I (0) and I (1) variables in a single autoregressive distributive lag (ARDL) model setup. A necessary condition in the ARDL model is that the model cannot deal with the I(2) variables. Thus, the investigation of stationarity becomes a compulsion. We used popular panel unit root tests like LLC (Levin et al. 2002 ), the IPS (Im et al. 2003 ), the ADF-Fisher Chi square (Maddala and Wu 1999 ) and PP-Fisher Chi square (Choi 2001 ) in this study.

3.2 Panel PMG model

The Mean Group (MG) estimator was developed by Pesaran and Smith ( 1995 ) to solve the issue of bias related to heterogeneous slopes in dynamic panels. Traditional panel models like instrumental variables’ estimator of Anderson and Hsiao ( 1981 , 1982 ) and Arellano and Bond ( 1991 ) may produce inconsistent results in a dynamic panel framework (Pesaran et al. 1999 ). MG estimator takes the average value of every cross-section and provides the long-run estimate for ARDL or PMG. On the other hand, Pooled Mean Group (PMG) estimator developed by Pesaran et al. ( 1999 ) assumes slope homogeneity in the long run but heterogeneous slopes in the short run for cross-section units. Dynamic Fixed Effect (DFE) also works like PMG and restricts cointegrating vector to be equal across all panels and restricts the speed of adjustment to be equal.

Under these assumptions, PMG is more efficient estimator than to MG and DFE estimator. The prime requirement for PMG estimator is that T should be sufficiently large to N. Panel ARDL or PMG works through maximum likelihood. Our basic PMG begins with the following equation.

Here, x it is the vector explanatory variables and y i is the lag dependent variable. X it allows the inclusion of both I (0) and I (1) variables. State fixed effect is captured through μ i . Above equation can be re-parameterized to ARDL format.

ɸ i measures the state-specific speed of adjustment and known as Error Correction Term. Β i is the vector of long-run relationships and α ij and θ ij are the vectors of short-run dynamic relationships. Pesaran et al. ( 1999 ) did not provide any statistical test for checking long-run relationship but it can be concluded form sign and magnitude of Error Correction Term (ECT). If it is negative and less than − 2, a long-run relationship can be established.

4 Results and discussion

Panel unit root test results from Table 1 suggest that in the case of Model 1 & 2, the Growth rate of Per Capita Net State Domestic Product (PC-NSDP), Property tax and commodity taxes are stationary at level. Gross investment and total tax revenue share to GDP are stationary at the 1st difference in all models and income tax share is also stationary at the same order.

5 PMG model results

We have reported MG, PMG and DFE estimation in the Tables 2 and 3 . The Hausman test indicates that the PMG model is the best model for our data than to MG model. Negative and significant error correction terms in all the models show the long-run relationship in between variable. One major issue related to the tax–growth equation is the problem of endogeneity of the variables. As growth in per capita GDP is our dependent variables, there is a possibility that tax collections behave along with business cycles. Therefore, we tested the weak/strong exogeneity of the tax variables through the correlation analysis between business cycles and tax shares. Business cycles have been calculated using the Hodrick-Prescott (HP) Filter. We have found that all the tax instruments are very weakly related to the business cycles movement and thus, we conclude that variables are not truly endogenous.

The speed of adjustment in PMG model 1, 2 and 3 are 78.9%, 78.4% and 79.6%, respectively. For the sake of completeness, we have reported MG and DFE Footnote 5 model results also. But we are more concerned with the results of PMG estimator as Hausman test suggested that PMG is a better model than to MG. The sign of the property tax is positive and significant in the long run as well as in the short run. Results are in line with the findings of Acosta-Ormaechea and Yoo ( 2012 ). Property tax generally considered a good revenue source for state and municipal governments for providing economic and social services in the city. This tax is also able to establish cost–benefit linkages and feasible decisions for the citizens. The positive impact of property taxes indicates that the revenue generation and productive utilization of these revenues exceed the distortionary effect in these states. As we expected, the tax burden is negatively associated with growth performance in both long run and short run. The relationship is showing the distortionary effect of the tax collection in the state economy. In all models, gross investment enhancing the growth in per capita SDP in the long run. Signs are readily justified as enlargement of capital formation has a positive impact on output and employment which channelized to the development outcomes (Swan 1956 , Solow 1956 ).

Commodity and service taxes are negatively related to the growth in per-capita SDP in the long run as well as in short run and findings are similar to the work of Ojede and Yamarik ( 2012 ). Footnote 6 This tax now comes under the Goods & Services taxes, but in the pre-GST period, commodity and service taxes are reducing growth in per capita NSDP. Commodity taxes are indirect taxes and state own tax revenues mostly come from indirect taxes. As indirect taxes, it has certain disadvantages like inflationary pressure in the economy and regressive to the poor section of the society. Our results also support the same hypothesis that increased commodity tax share is harmful. In India, commodity and service tax includes central sale tax, state excise duty, vehicle tax, goods & passenger tax, electricity duty and entertainment tax. Central sale tax was imposed on interstate trade of commodities which is now transformed to Inter-State GST (IGST). According to Das ( 2017 ), if the IGST rate is high to the Revenue Neutral Rate, it will harm the aggregate demand in the economy through the reduction of disposable income. Heavy vehicle and passenger tax collections are creating an abysmal environment for industrial activities. The tax burden variable is also carrying a negative sign in both long run and short run and magnitude is very similar to model 1. Income tax share has become insignificant and positive in the long run and negative insignificant in the short run.

After examining the linear relationships, we extended our analysis to the examination of a non-linear relationship with the use of PMG estimation model. The result from Tables 4 and 5 indicates the existence of a non-linear relationship between tax structure and growth performance for Indian states. The linear coefficient for property taxes has now become negative and the square of it turns out to be positive. Thus, the property taxes show a ‘U’-shaped relationship with states’ growth performance which implies that a rise in property taxes is bad for growth initially and after a threshold point, it becomes growth enhancing. The threshold point for property taxes is 1.88 which indicates that more than 80.77% observation is more than to threshold point.

In the case of commodity and service taxes, both the linear and non-linear coefficients are significant with different signs. However, the coefficient magnitudes are abnormally large and this is due to the inclusion of both linear and quadratic terms into the single equation. The small commodity and service taxes are very bad for the state economy, whereas the large amount of it shows a positive relation. The threshold point for this tax is 4.45 which implies that 79.95% observation lies above the threshold. This is a very interesting result as high commodity and service taxes could lead to high inflation in the economy and high inflation regarded as atrocious for growth. Further investigation of these findings is highly recommendable. As like linear panel regression, the income tax shows no relation in our non-linear regression model also. However, the short-run coefficient for income tax is significant and shows a negative relationship. Income tax is considered to be distortionary tax to the economy in the presence of income and substitution effect (Kotlan 2011 ). Income tax mostly impacts the savings of the households and labour supply which is regarded as an engine of growth.

6 Conclusions and recommendations

In this study, we try to find out the long-run and short-run relationship between different tax structure and economic growth in states of India. Empirical evidence from linear regression suggests that the property tax enhancing growth and commodity & service taxes reduce it. The non-linear regression validates these findings for property taxes where high property taxes are good for growth. In the case of commodity & service taxes, the results become opposite after the threshold point and affecting the growth negatively. Interestingly, we do not find any significant impact of income taxes on growth in both linear and non-linear regressions in the long run.

As far as the total tax burden is concerned, negative relation with the growth performance is verified and results are in line with Arnold et al. ( 2011 ). The negative effect of commodity and service taxes in the short run is expected to be neutralized through the implementation of GST in India. Promotion of growth performance at the state level concerning income taxes is also very crucial. Income tax has a direct effect on individuals and their saving and investment behaviour. On the other side, tax revenues should be placed in productive investments. With the spending, the government can promote inclusive growth, equality and efficiency in the economy.

The most promising path emerged through this study for long-run growth performance in Indian states is to lower the total tax burden and shifting from income and commodity taxes to property tax for revenue generations. The conclusion may be debatable on various grounds as the studied variables do not take into account institutional quality, administrative efficiency in tax collection, fiscal balance and condition of the states and existence of informal sectors. Future research can be done to incorporate these issues.

Availability of data and materials

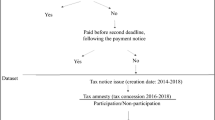

Dataset analysed in this study is available from the corresponding author on reasonable request.

One can see the writings of Rao and Rao ( 2006 ) for brief discussion.

This is the proxy for total tax burden in the economy with certain limitations. It does not include informal economy and expenditure policies.

Telangana state was established in 2014. We merged the data of Andhra Pradesh and Telangana to achieve aggregate data for undivided Andhra Pradesh.

Data for Income tax are available for ten states, but inclusion of these states made the model inconsistent due to huge fluctuations in tax revenue collections.

Most of the coefficients of PMG and DFE are in similar range and smaller than to MG estimator. This is due to MG estimator only takes the information of each state time series to estimate long-run and short-run coefficients.

They use sale tax, where our study takes aggregate revenue for commodity and services. However, inference can be drawn as sale tax and is one of the dominant contributors in total commodity and service tax revenue in India.

Abbreviations

Net state domestic product

Goods and service tax

Foreign direct investments

- Pool mean group

Dynamic fixed effect

Auto-regressive distributed lag

The organization for economic co-operation and development

Anderson TW, Hsiao C (1981) Estimation of dynamic models with error components. J Am Stat Assoc 76(375):598–606

Article Google Scholar

Anderson TW, Hsiao C (1982) Formulation and estimation of dynamic models using panel data. J Econom 18(1):47–82

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arnold JM et al (2011) Tax policy for economic recovery and growth. Econ J 121:59–80. https://doi.org/10.1111/j.1468-0297.2010.02415.x

Atems B (2015) Another look at tax policy and state economic growth: the long and short run of it. Econ Lett 127(1):64–67

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Politic Econ Univ Chicago Press 98(5):103–126

Barro RJ, Redlick CJ (2009) Macroeconomic effects from government purchases and taxes, ADB economics working paper series, No. 232

Bird RM, Zolt EM (2011) Dual income taxation: a promising path to tax reform for developing countries. World Dev 39(10):1691–1703

Choi I (2001) Unit root tests for panel data. J Int Money Fin. 20:249–272

Dackehag M, Hansson A (2012) Taxation of income and economic growth : an empirical analysis of 25 rich OECD countries

Das S (2017) Some concerns regarding the goods and services tax. Econ Polit Wkly 52(9)

Dladla K, Khobai H (2018) The impact of taxation on economic growth in South Africa, MPRA Paper No. 86219, 1–15

Durusu-çiftçi D, Gökmenoğlu KK, Yetkiner H (2018). The heterogeneous impact of taxation on economic development: new insights from a panel cointegration approach. Economic systems. Elsevier BV. https://doi.org/10.1016/j.ecosys.2018.01.001

Federici D, Parisi V (2015) Do corporate taxes reduce investments? Evidence from Italian firm level panel data. Cogent Econ Finance 3:1–14. https://doi.org/10.1080/23322039.2015.1012435

Gemmell N, Kneller R, Sanz I (2011) The timing and persistence of fiscal policy impacts ongrowth: evidence from OECD countries. Econ J 121(550):33–58

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econometrics. 115:53–74

Johansson Å et al (2008) Taxation and economic. Growth. https://doi.org/10.1787/241216205486OECD

Jones L, Manuelli R, Rossi P (1993) Optimal taxation in models of endogenous growth. J Polit Econ 101(3):485–517

Karras G (1999) Taxes and growth: testing the neoclassical and endogenous growth models. Contemporary Econ Policy. 17(2):177–188

King R, Rebelo S (1990) Public policy and economic growth: developing neoclassical implications. J Polit Econ 98(5):S126-50

Kotlán I, Machová Z, Janíčková L (2011) Vliv zdanění na dlouhodobý ekonomický růst. Politická ekonomie. 5:638–658

Lee Y, Gordon RH (2005) Tax structure and economic growth. J Public Econ 89(5–6):1027–1043. https://doi.org/10.1016/j.jpubeco.2004.07.002

Levin A, Lin CF, Chu CS (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econometrics. 108(1):1–24

Ljungqvist A, Smolyansky M (2016). To cut or not to cut? On the impact of corporate taxes on employment and income, Finance and economics discussion series 2016–006. Washington: Board of Governors of the Federal Reserve System, http://dx.doi.org/10.17016/FEDS.2016.006

Macek R (2014) The impact of taxation on economic growth: case study of OECD countries. Rev Econ Perspect. 14(4):309–328. https://doi.org/10.1515/revecp-2015-0002

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxford Bull Econ Stat 61:631–652

Martin R, Fardmanesh M (1990) Fiscal variables and growth: a cross-sectional analysis. Public Choice 64:239–251

Mcnabb K (2018) Tax structures and economic growth: new evidence from the government revenue dataset. J Int Dev 30:173–205. https://doi.org/10.1002/jid.3345

Mdanat MF et al (2018) Tax structure and economic growth in Jordan, 1980–2015. EuroMed J Bus 13(1):102–127. https://doi.org/10.1108/EMJB-11-2016-0030

Myles GD (2000) Taxation and economic growth. Fiscal Studies. 21(1):141–168. https://doi.org/10.1016/0264-9993(93)90021-7

Ojede A, Yamarik S (2012) Tax policy and state economic growth : the long-run and short-run of it, Economics Letters. Elsevier BV, 116, No.2, pp. 161–165. https://doi.org/10.1016/j.econlet.2012.02.023

Ormaechea AS, Yoo J (2012) Tax composition and growth: a broad cross-country perspective. IMF Working Papers. https://doi.org/10.5089/9781616355678.001

Padovano F, Galli E (2001) Tax rates and economic growth in the OECD countries (1950–1990). Econ Inq 39(1):44–57

Pesaran MH, Smith RP (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econometrics. 68:79–113

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc. 94:621–634

Poulson BW, Kaplani JG (2008) State income taxes and economic growth. Cato J 28(1):53–71

Google Scholar

Rao MGR, Rao RK (2006) Trends and issues in tax policy and reform in India. INDIA POLICY FORUM

Reynolds S (2006) The impact of increasing excise duties on the economy. Working Paper Series 58069. PROVIDE Project

Saafi S, Mohamed MBH, Farhat A (2017) Untangling the causal relationship between tax burden distribution and economic growth in 23 OECD countries: fresh evidence from linear and non-linear Granger causality. Eur J Comp Econ. 14(2):265–301

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Stoilova D (2017) Tax structure and economic growth: evidence from the European Union. Contaduría y Administración. 62:1041–1057. https://doi.org/10.1016/j.cya.2017.04.006

Stokey NL, Rebelo S (1995) Growth effects of flat-rate taxes. J Polit Econ 103(3):519–550

Swan TW (1956) Economic growth and capital accumulation. Econ Record 32:334–361. https://doi.org/10.1111/j.1475-4932.1956.tb00F434

Szarowska I (2014) Effects of taxation by economic functions on economic growth in the European Union. MPRA Paper No. 59781

Tosun MS, Abizadeh S (2005) Economic growth and tax components: an analysis of tax changes in OECD. Appl Econ 37:2251–2263. https://doi.org/10.1080/00036840500293813

Vartia L (2008) How do taxes affect investment and productivity ? An industry-level analysis of OECD countries. OECD Economics Department Working Papers 656

Xing J (2011) Does tax structure affect economic growth? Empirical evidence from OECD countries, Centre for Business Taxation, WP 11/20

Download references

Acknowledgements

Authors like to acknowledge the anonymous referee for his/her valuable comments.

Not applicable.

Author information

Authors and affiliations.

Department of Economics, Banaras Hindu University, Varanasi, India

Yadawananda Neog & Achal Kumar Gaur

You can also search for this author in PubMed Google Scholar

Contributions

Both the authors’ handled the data, analysed and contribute their part to write the manuscript. Both authors read and approved the final manuscript.

Corresponding author

Correspondence to Yadawananda Neog .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

See Tables 1 , 2 , 3 , 4 and 5 .

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Neog, Y., Gaur, A.K. Tax structure and economic growth: a study of selected Indian states. Economic Structures 9 , 38 (2020). https://doi.org/10.1186/s40008-020-00215-3

Download citation

Received : 26 November 2019

Revised : 16 March 2020

Accepted : 29 April 2020

Published : 09 May 2020

DOI : https://doi.org/10.1186/s40008-020-00215-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Tax structure

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50+ Focused Taxation Research Topics For Your Dissertation

Published by Ellie Cross at December 29th, 2022 , Revised On May 2, 2024

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance on and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper explaining the importance of accounting in the tax department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time.

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK tax studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK.

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, conduct a thorough investigation of enhancing tax benefits among British nationals.

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy.

- The effect and limitations of bilateral and multilateral tax treaties in addressing double taxation and preventing tax evasion.

- Assess solutions: OECD/G20 Base Erosion and Profit Shifting (BEPS) project and explore the implications for multinational corporations.

- The Impact of Tax cuts in Obtaining Social, monetary, and Aesthetic Ends That Benefit the Community.

- Exploring the Effect of Section 1031 of the Tax Code During Transactions on Investors and Business People.

- Investigating the role of environmental taxes and incentives in addressing global environmental challenges.

- Evaluating the impact of increased transparency on multinational enterprises and global efforts to combat tax evasion and illicit financial flows.

- Exploring the health and financial effects of a proposed policy to increase the excise tax on cigarettes.

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyse cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

Find the most unique and interesting dissertation topic ideas for translation studies to help you in your translation dissertation/ thesis.

As a part of the change management sphere of organizational setups, innovation management dissertation topics have increased in popularity in the last decade. A wide range of topics are covered in in-depth research in innovation management.

Are you looking for an interesting veterinary dissertation topic idea? We have gathered a list of the best 45 veterinary dissertation topics for you.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

Journal Press India ®

Vision: journal of indian taxation.

Double-blind Peer-reviewed (Refereed) Journal: No publication charges

Published by: journal press india.

Print ISSN: 2347-4475; e-ISSN: 2395-2571

Editor/s: dr. prasant kumar panda and dr. m. m. sury, frequency: bi-annual, indexation: index copernicus international, google scholar, ebsco, summon (proquest), indian citation index, cross-ref, cnki scholar, research gate, j-gate and scilit..

Recommend this Journal!

Complete the form below to recommend this journal to your institutional Head of the Department/ Principal/ Librarian/ others.

Your Details

Details of the head of the department/ principal/ librarian/ others to whom the journal is recommended.

Important Information for authors It has been brought to our notice that some third parties are fraudulently charging Fees from authors for submission of manuscripts to JPI journals through their website. JPI categorically reiterates that authors don't have to pay any fee for submission/publication of manuscripts to JPI journals and the submission is valid only if made through JPI website following the given submission guidelines . Authors are requested not to use any other portal for submission and neither pay any amount whatsoever to anyone for submission. JPI will not be liable for the same.

To foster and promote a thorough understanding of Indian tax system, tax policy and laws and their implications for domestic and international business practices.

Aims and Scope

Vision is a bi-annual d ouble blind peer-reviewed journal that examines and analyses policy and laws relating to business and taxation in India. The journal invites manuscripts which explores issues related to taxation laws, business laws, tax policy, public finance, national and sub-national fiscal management, federal fiscal transfers and other such issues that have implications for both the theory and practice of taxation. The scope of papers, however, is not limited to the above themes and those papers that contribute to an overall understanding of the functioning of the business and taxation laws and their implications for business are also welcome. The journal intends to serve the interests of academicians, tax professionals, business executives, government functionaries and others interested in taxation in India.

Current Issue: Volume 10, Issue 2 (July - December 2023)

Table of Contents

Research Papers

Resolving the hamletian dilemma: can non-consideration of an argument in appeal trigger rectificatory jurisdiction in indian tax law.

Doi: 10.17492/jpi.vision.v10i2.1022301

Pages: 1-13

Published Online: December 10, 2023

An Overview of State Finance of Kerala from 2001-02 to 2023-24

Doi: 10.17492/jpi.vision.v10i2.1022302

Pages: 14-39

GST Revenue Landscape in India: Assessing the Effects on Government Exchequer

Doi: 10.17492/jpi.vision.v10i2.1022303

Pages: 40-54

The Implication of Corporate Income Taxation on Foreign Direct Investment in Tanzania

Doi: 10.17492/jpi.vision.v10i2.1022304

Pages: 55-70

Exploring the Landscape of Corporate Tax Reforms: A Comprehensive Bibliometric Analysis

Doi: 10.17492/jpi.vision.v10i2.1022305

Pages: 71-86

Role of AI Chatbot in Income Tax Prediction in India

Doi: 10.17492/jpi.vision.v10i2.1022306

Pages: 87-117

Perspectives

The two-pillar solution : not a choice, but a compulsion.

Doi: 10.17492/jpi.vision.v10i2.1022307

Pages: 118-132

Time-travel in the Era of Taxation: The Story of How the Indian Tax Courts Retroactively Opted to Treat Two Independent Parties as Associated Entities

Doi: 10.17492/jpi.vision.v10i2.1022308

Pages: 133-139

- Login / Register

News/Events

Indira Institute of ...

Indira Institute of Management, Pune Organizing International Confe...

D. Y. Patil Internat...

D. Y. Patil International University, Akurdi-Pune Organizing Nation...

ISBM College of Engi...

ISBM College of Engineering, Pune Organizing International Conferen...

Periyar Maniammai In...

Department of Commerce Periyar Maniammai Institute of Science &...

Institute of Managem...

Vivekanand Education Society's Institute of Management Studies ...

Deccan Education Society Institute of Management Development and Re...

S.B. Patil Institute...

Pimpri Chinchwad Education Trust's S.B. Patil Institute of Mana...

D. Y. Patil IMCAM, A...

D. Y. Patil Institute of Master of Computer Applications & Managem...

Vignana Jyothi Insti...

Vignana Jyothi Institute of Management International Conference on ...

Department of Commer...

Department of Commerce, Faculty of Commerce & Business, University...

By continuing to use this website, you consent to the use of cookies in accordance with our Cookie Policy.

Transforming last mile – connectivity in India through aviation

Strengthening India’s maritime sector: The role of GIFT IFSC

How India shops online

Deals at a glance

Net-zero banking: Creating a long-term and sustainable financial services economy

Partnering with a private equity fund: Benefits and considerations for business owners

Unlocking opportunities in tax using GenAI

Mastering the art of long-term value creation

Transforming India’s mining landscape with autonomous technology

Chairperson’s Awards: Our Changemakers

Building a better future of work

Loading Results

No Match Found

Addressing the ‘tax gap’ in India