Essay on Internet Banking

In this essay we will discuss about Internet Banking. After reading this essay you will learn about: 1. Meaning of Internet Banking 2. Objectives and Drivers of Internet Banking 3. Trends in India 4. Facilities Available 5. Emerging Challenges 6. Main Concerns 7. Strategies to be Adopted by Indian Banks.

- Essay on the Strategies to be Adopted by Indian Banks for Introducing Internet Banking

Essay # 1. Meaning of Internet Banking :

With the growth of internet and wireless communication technologies, telecommunications etc. in recent years, the structure and nature of banking and financial services have gone for a sea change. Internet banking or e-banking is the latest in this series of technological wonders in the recent past which involves use of internet for delivery of banking products and services.

Even the Morgan Stanley Dean Witter Internet Research emphasised that web is more important for retail financial services than that for many other industries. Internet banking or e-banking is changing the banking and its structure and is having major effects on banking relationships.

ADVERTISEMENTS:

Banking activity is now no longer confined to the branches where a customer has to approach the branch in person, for withdrawing cash or deposit a cheque or request for a statement of Accounts.

In accessing a true internet banking, any inquiry or transaction is processed online without any reference to the branch (anywhere banking) at any time. Thus providing Internet banking is gradually becoming a “need to have” than a “nice to have” service.

The net banking is, therefore, more of a norm rather than an exception in many developed countries because it is the cheapest way of providing banking services. Under this system, online banking is possible where every bank customer is provided with a personal identification number (PIN) for making online transactions with the bank through internet connections.

Internet banking or e-banking falls into four main categories, from Level 1—minimum functionality sites that offer only access to deposit account data—to level 4 sites highly sophisticated offering, enabling integrated sales of additional products and access to other financial services—such as investment and insurance.

In other works, a successful internet banking solution offers:

1. Exceptional rates on savings, CDs and IRAs.

2. Checking Account with no monthly fee, free bill payment and rebates on ATM surcharges.

3. Credit card facilities with low rates.

4. Easy online applications for all accounts including personal loans and mortgages.

5. 24-hour account access.

6. Quality customary service with personal attention.

Essay # 2. Objectives and Drivers of Internet Banking :

The internet has developed level playing field and thereby afforded open access to customers in the global market-place. Internet banking is a cost-effective delivery channel for the modernized financial institutions.

In this system, consumers are embracing many benefits of e-banking. To have access to one’s accounts at any time and from any location through world wide web (www) is a convenient practice, which was unknown a short time ago.

Thus, a bank’s internet presence transforms from ‘brochure/ware’ status to ‘internet banking’ status once the bank goes through a technology integration effort so as to enable its customer to access information about his or her specific account details.

Following are the six primary objectives or drivers of internet banking:

1. To improve customer access.

2. To facilitate the offering of more services.

3. To increase customer loyalty.

4. To attract large number of customers.

5. To provide cost-effective services offered by competitors.

6. To reduce customer attrition.

Keeping objectives in mind, the internet banking facilities has been progressing at a rapid pace throughout the world.

Essay # 3. Trends of Internet Banking in India :

In India, initially a beginning was made in internet banking only in some big cities which was just in rudimentary stage. After getting initial success, the internet banking facility is gradually being expanded in all cities and towns to make the system popular.

The banking industry in India is also facing unprecedented competition from non-traditional banking institutions which are now a day’s offering banking and financial services over the Internet. The deregulation of the banking industry along with emergence of new technologies are enabling the new competitors in the banking sector to enter the financial services market quite efficiently and quickly.

Core or Anywhere Banking:

In order to support internet banking facilities another new concept of banking i.e., core or anywhere banking is introduced. Initially introduced by the foreign banks, the same concept in new increasingly adopted by public sector banks and also the private sector banks.

Under this concept of banking, bank customers who have an account with any select branch can easily operate his account from different designated branches on the bank spread throughout the country.

Under this system, a customer can avail cash withdrawal, cash deposit, transfer of funds, inter-city and intra-city transactions, collection of draft and cheques etc. facilities from any of such designated branches conveniently irrespective of its locations.

Core banking concept has improved the standard of the banking services with the help of modern technology. In present times, most of the public sector banks have already adopted this concept and started extending these facilities to its customers gradually by including more and more of its important branches under this category.

Progress of Internet Banking:

In India, internet banking is gradually being developed throughout the country.

As per the recent study it is observed that:

(a) A number of banks have already adopted internet banking and are offering varied kind of services through it,

(b) These internet sites generally offer only most of the basic services. Only 50 per cent are known as ‘entry level’ sites offering little more than company information’s and basic marketing materials and 10 per cent are offering ‘advanced transactions’ such as online funds transfer, transactions and cash management services etc.; and

(c) Most of the foreign and private banks in India are much advanced in terms of the number of sites and their level of development in terms of rendering advanced technology linked services to its customers. Recently, an authority of ICICI Bank observed, “Our Internet banking base has been growing at an exponential pace over the last few years. Currently around 78 per cent of the bank’s customer base is registered for Internet banking.”

Security Precautions :

In order to make their bank account safe, one should follow certain security precautions. Customer should never share personal information like PIN number, passwords etc. with anyone, including employees of the bank. It is important that documents that contain confidential information are safeguarded. PIN or password should be changed immediately and memorized before destroying the mailers.

Customers are also advised not to provide sensitive account-related information over unsecured e-mails or over the phone. He must take simple precautions like changing the ATM, PIN and online login and transaction passwords on a regular basis. It is also important to ensure that the logged in session is properly signed out.

Essay # 4. Facilities Available Under Internet Banking in India:

Following facilities are made available for customers under internet banking in India:

(i) Bill Payment Service:

Bill payment service is a utility service of internet banking. Accordingly, each bank has tie-ups with various utility companies, service providers, insurance companies across the country. Such tie-ups can facilitate online payment of bills of electricity, telephone, mobile phone, credit card, insurance premium bills etc.

In order to make online payment of bills, a simple one-time registration for each bills has to be made and a standing instruction has to be made to make online payment of recurring bills automatically. Most interestingly, the bank usually does not charge customers for such online bill payment.

(ii) Fund Transfer:

Internet banking has made provision for transfer of any amount of fund from one account to another of the same or any other bank. Accordingly, customers can send money anywhere in India. Once a customer logs in his account, he needs to mention the payee’s account number, his bank and the branch. The transfer will take place in a day or so, whereas in a traditional method it takes about three to four working days. ICICI Bank recently reported that its online bill payment and fund transfer facility have been most popular online services.

(iii) Credit Card Customers:

Internet banking provides the facility of credit card to its customers. With internet banking, customers can not only pay their credit card bills online but also gets a loan on their cards. Not just this, they can also apply for an additional card, request a credit line increase and in case the card is lost, one can report lost card online.

(iv) Railway Pass and Online Booking:

Through Internet banking facility to issue Railway pass is also available. Indian Railways has tied up with ICICI bank for this purpose and one can now make railway pass for local trains online. The pass can be delivered to the customer at his doorstep. Initially, the facility was limited to Mumbai, Thane, Nashik, Surat and Pune. The bank would just charge Rs 10 + 12.24 per cent of service tax. Moreover, online booking of e-tickets of Railways, Airlines etc. can also be made with some arrangement with banks through Internet banking.

(v) Investing through Internet Banking:

Through Internet banking, opening a fixed deposit account has become easier. A customer can now open an FD account online through funds transfer. Online banking can also be a great friend for lazy investors. Moreover, investors with interlinked de-mat account and bank account can easily trade in the stock market and the amount will be automatically debited from their respective bank accounts and the shares will be credited in their de-mat account.

Besides, some banks provide its customers the facility to purchase mutual funds directly from the online banking system. Nowadays, most leading banks offer both online banking and de-mat account facilities. However, if a customer is having his de-mat account with independent share brokers, then he needs to sign a special form, which will link his two accounts.

(vi) Recharging Prepaid Phone:

Through Internet banking, recharging of prepaid phone has also become possible. It is no longer needed to rush to the vendor to recharge prepaid phones as and when talk time runs out. Here the customer just tops-up his prepaid mobile cards by logging in to Internet banking. By just selecting operator’s name, entering mobile number and the amount of recharge, the prepared phone of the customer is again back in action within few minutes.

(vii) Shopping at Fingertips:

Internet banking provides facility of shopping at fingertips. Leading banks have tied-up with various shopping websites. With a range of all kind of products. One can shop online and the payment is also made conveniently through his account. One can also buy railway and air tickets through Internet banking.

Essay # 5. Emerging Challenges of Internet Banking in India :

In India, a large sophisticated and highly competitive Internet Banking Market is gradually being developed with market pressure and is subjected to the following emerging challenges:

1. Demand side pressure due to increasing access to low cost electronic services.

2. Emergence of open standards for banking functionally.

3. Growing customer awareness and need for transparency.

4. Global players in the fray.

5. Close integration of bank services with web based E-commerce or even disintermediation of service through direct electronic payments (E-cash).

6. More convenient international transactions due to the fact that the Internet along the general deregulation trends, eliminate geographic boundaries.

7. Move from one stop shopping to ‘Banking Portfolio’, i.e., unbundled product purchases.

The Internet and its underlying technologies have been changing and transforming not just banking but all aspects of finance and commerce. It usually represents much more than a new distribution opportunity. Internet banking will also enable nimble players to leverage their traditional brick and mortar presence for improving customer satisfaction and gain share.

Essay # 6. Main Concerns in Internet Banking :

Internet banking in India has its areas of concern. In the mean time, a number of cases related to fraud and cheating of banks and customers by unscrupulous persons have already been lodged in India with this type of banking facilities. Irrespective of that attempts have been made by the RBI and the banking authorities for promoting safety and soundness of online and e-banking facilities in the country by issuing necessary guidelines.

In a recent survey conducted by the Online Banking Association, member institutions rated security as the most important issue of online banking. Thus there is a dual requirement to protect customers privacy and product against fraud.

Banking Securely:

Online Banking provides an overview of Internet Commerce and how one company can handle secure banking practices for its financial institution clients and their customers. Moreover, some basic information on the transmission of confidential data is presented in Security and Encryption on the web. In this respect, PC Magazine Online also offers a primer as to how encryption works.

Besides, a multi-layered security architecture comprising firewalls, filtering routers, encryption and digital certification ensures that customers account information is protected fully from un-authorised access in the following manner:

(i) Firewalls and filtering routers ensure that only the legitimate Internet users are usually allowed to access the system.

(ii) Encryption techniques used by the bank (including the sophisticated public key encryption) would ensure that privacy of data flowing between the browser and the Infinity system is protected.

(iii) Digital certification procedures provide the assurance that the data a customer receive is from the infinity system.

Essay # 7. Strategies to be Adopted by Indian Banks for Introducing Internet Banking :

In present times, Internet banking has no alternatives. Indian banking is gradually getting more and more access of Internet banking. Thus, Internet banking would drive us into an age of creative destruction due to non-physical exchange; complete transparency is also giving rise to perfectly electronic market place and customer supremacy.

At this moment, the question may be asked “what the Indian Banks should do under the present circumstances?” Whatever is the strategy chosen and options adopted, certain key parameters would largely determine the success of banks on web.

In order to attain long term success, in respect of Internet banking, a bank may follow:

(i) Adopting a webs mindset.

(ii) Catching on the first mover’s advantage.

(iii) Recognising the core competencies.

(iv) Enabling handling multiplicity with simplicity.

(v) Initiating senior management to transform the organisation from inward to outward looking.

(vi) Aligning roles and value propositions with customers segments.

(vii) Redesigning optimal channel port-folio.

(viii) Acquiring new capabilities through strategic alliances.

However, the above mentioned steps can be implemented by following four steps mentioned below:

(i) In the first phase, the customer be familiarized to new environment by demo version of software on banks, website. This will enable users to give suggestions for improvements, which can be incorporated in its later versions wherever possible.

(ii) The second phase provides various services such as account information and balances, statement of account, transaction tracking, mail box, check book issue, stop payment, financial and customized information.

(iii) The third phase may include additional multi-utility services like fund transfers, DD issue, standing instructions, opening fixed deposits and intimation of loss of ATM cards.

(iv) The final phase should include advanced corporate banking services like third party payments, utility bill payments, establishment of L/Cs, Cash Management Services etc. Enhanced plan for the customers in future may include requests for demand drafts and pay orders and many more to bring in the ultimate in banking convenience.

Thus by following the above mentioned strategies, it will help banks to translate their traditional business model into a Internet banking one, falling into the following three main categories:

(i) One-stop shop.

(ii) Virtual one stop shop.

(iii) Best of Breed Supplier.

Thus by following the above steps, the Indian bankers can pave the way for the successful introduction and popularizing the new concept of Internet banking on a large scale.

Related Articles:

- Essentials of a Sound Banking System

- Top 12 Functions of the Central Bank | Banking

- Financial Inclusion in Banking in India

- Essay on Indian Postal Services

Pros and Cons of Online Banking

Online-only banks offer advantages like competitive interest rates, but consumers may miss brick-and-mortar services.

Getty Images

Some online banks belong to ATM networks, but not all of them.

In its truest form, online banking means doing business with an online-only bank. This differs from conducting business with a traditional bank that offers online banking services. Find out more about how online banking works, the pros and cons of banking online and what you can do to keep your deposits safe.

The Ins and Outs of Overdraft Protection

Austin Cole July 6, 2023

What Is Online Banking?

Unlike a traditional bank, an online-only bank doesn’t operate brick-and-mortar branches where you can seek help from tellers and other bank personnel. Instead, a customer of an online-only bank takes care of banking tasks on a website or app accessed with a computer, smartphone or tablet. These tasks can include depositing checks , transferring money and paying bills. In addition, a customer can typically use a debit card to deposit or withdraw money at an ATM or to make purchases online or in stores.

Financial products that an online-online bank might offer include checking accounts, savings accounts, certificates of deposit and loans.

Market research company J.D. Power reports that more than one-fourth of Americans (27%) use an online-only bank. A 2023 study by J.D. Power found that customer satisfaction with online-only banks is "climbing steadily," thanks to high marks for competitive interest rates and the ease of managing accounts and transferring money .

Pros of Online Banking

There is a lot to like about conducting business with an online-only bank.

Potentially Higher Interest Rates

Online-only banks normally pay higher annual percentage yields on savings accounts , CDs and and other accounts that earn interest . Gary Zimmerman, founder and CEO of cash management platform MaxMyInterest.com, explains that online-only banks are able to do this because they don't bear the costs of maintaining physical branches.

"Investors who want to safeguard their cash while earning more interest know that online banks are a smart choice," Zimmerman says.

Potentially No Fees

In some cases, only-online banks don't charge any fees . Before opening an account, investigate what fees, if any, an online-only bank imposes. In 2022 alone, U.S. banks charged a total $7.7 billion in fees just for overdraft and nonsufficient fund transactions, according to the Consumer Financial Protection Bureau.

Deposits Are Insured

The Federal Deposit Insurance Corp . insures deposits at member banks, and the National Credit Union Administration insures deposits at member credit unions. This applies to both traditional and online-only banks and credit unions, meaning an account-holder's money is protected up to a certain dollar amount.

Keep in mind that most, but not all, banks and credit unions are federally insured .

Robust Mobile Apps

Online-only banks might have mobile apps with more robust features than traditional banks' apps. For instance, an online-only bank app might include financial management tools that enable automatic savings or automatic investing.

How Do Money Orders Work?

Casey Bond May 17, 2023

Cons of Online Banking

There are some downsides to banking online you should consider before opening an account.

No Branches

Online-only banks don't operate branches where you can do business. For some banking customers, that's not a problem. But others might be put off by the inability to chat face-to-face with a teller or other banking professional, or to access services that may not be available online (such as getting a cashier's check or renting a safe deposit box ).

Kate Sullivan, vice president of marketing and communications at The Cooperative Bank, notes that some traditional banks offer the same online services as online-only banks but still operate branches that you can visit or call. Sullivan's bank maintains four branches in the Boston area.

ATM Access Varies

When you're a customer of an online-only bank, you'll need to be familiar with your bank's ATM fee reimbursement policy. Some, but not all, online-only banks belong to ATM networks that offer fee-free transactions.

Not All Online Banks Are the Same

Consumers might question the banking prowess of online-only banks. Why? Because some of these banks technically aren't banks. Rather, they're financial technology companies whose banking services are backed up by a traditional bank.

Savings Calculator

Use this free savings calculator to project how your money can grow over time.

Is Online Banking Safe?

Digital banking is on the rise. A May 2022 survey by polling company Morning Consult found 52% of U.S. consumers do most of their banking online or via mobile app, whether that's with a traditional bank or an online-only bank.

Some folks riding this digital wave may be wondering whether online banking – doing business with a bank that lacks physical branches – is safe. Good news: In general, online banking is considered safe.

In most cases, deposits at online-only banks are insured just like deposits at traditional banks. Furthermore, online-only banks are regulated the same way as traditional banks. On top of that, online-only banks adopt security measures aimed at shielding your information from harm.

Fraud Protection

Maryalene LaPonsie Jan. 22, 2021

Fighting Cybersecurity Threats

Even though all digital banking operations face cybersecurity threats, the ISACA professional organization for IT professionals points out that an online-only bank might be "a high-profile target for cybercriminals." That’s due in part to the banks' heavy dependence on technology.

Still, the Consumer Financial Protection Bureau emphasizes that online banking is safe as long as you follow the best practices for keeping your information secure. Here are four tips for improving the safety of online banking:

- Set up strong passwords for bank accounts and digital devices. Each hard-to-guess password should be at least eight characters, with a combination of uppercase letters, lowercase letters, numbers and symbols. Passwords should be changed regularly, perhaps every three months.

- Use multifactor authentication. Multifactor authentication requires at least two methods of verifying your identity before you can gain access to an online account or digital device. For instance, you might be prompted to type in a username and password, and then enter a temporary PIN that's sent to you via text message.

- Steer clear of public Wi-Fi. Public Wi-Fi is not as secure as the Wi-Fi at your home or workplace. Therefore, it's best to avoid online banking when you're on a public network.

Tags: money , banking , interest rates , cybersecurity , savings

Popular Stories

Banking Advice

Best of Banking

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is Online Banking? Definition, Pros and Cons

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Definition: What is online banking?

Online banking means managing your bank accounts using a computer or mobile device, and internet connection. Online banking allows you to make the same transactions as you would at a brick-and-mortar bank — including transferring funds, depositing checks and paying bills — but using your computer or mobile device instead of doing them in person. Online banking can sometimes be referred to as digital banking, electronic banking, internet banking or web banking, or even mobile banking (though mobile banking specifically refers to banking done on a mobile device, rather than a computer).

Traditional banks and credit unions with branches typically let customers access their accounts through the internet, too. But online banks and providers offer primarily mobile access. You won’t meet a banker face to face, but with a mobile device or computer, you can reach your account anytime. Here's a closer look at online banks.

Ready to start banking online?

Say goodbye to waiting in line at a branch and hello to convenience.

Member FDIC

SoFi Checking and Savings

4.60% SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

EverBank Performance℠ Savings

on Wealthfront's website

Wealthfront Cash Account

on Betterment's website

Betterment Cash Reserve – Paid non-client promotion

5.50% *Current promotional rate; annual percentage yield (variable) is 5.50% as of 4/2/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .75% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks conducted through clients’ brokerage accounts at Betterment Securities.

Marcus by Goldman Sachs High-Yield CD

5.10% 5.10% APY (annual percentage yield) as of 04/29/2024

EverBank CD

5.05% 5.05% Annual Percentage Yield

5.00% 5.00% APY (annual percentage yield) as of 04/29/2024

Discover® Cashback Debit

Chase Total Checking®

Deposits are FDIC Insured

Chime Checking Account

Discover® Money Market Account

Pros of online banks

To better understand how online banking works, consider the advantages of online banks.

Because online banks don’t have to spend money on branch maintenance, they tend to have low or no fees. Many online accounts don’t charge monthly service fees, for example, and some don’t charge overdraft fees, either.

To compare, accounts at large brick-and-mortar banks often charge a monthly service fee of around $10, though they may waive it if you meet certain requirements, such as having a $1,500 minimum daily balance. In addition, an overdraft fee at a large bank can cost $30-$35 .

» Tend to overdraw your account? See our picks for the best banks for overdrafts

Better interest rates

At online banks, deposit accounts tend to have higher annual percentage yields. The best online savings accounts, for example, have APYs around 5%. Compare that with the national average savings rate of 0.45% , and some of the largest brick-and-mortar banks, which have savings accounts that earn only 0.01% APY.

A few percentage points' difference might not sound like much, but the larger your balance, the more it matters. A balance of $10,000 deposited for a year at 0.01% will earn a dollar; at 5%, it earns just over $500.

» Use our tool: Calculate your earnings with NerdWallet’s savings calculator

Online cash management accounts are another option for earning interest. These financial products are offered by nonbank service providers, such as brokerages. They typically combine the features of checking, savings and investment accounts, and can also have good yields.

» Cash management accounts: See our top picks for these APY-earning online hybrids

Cons of online banks

Before you jump into online banking, learn more about the disadvantages of online banks.

No branches

With an online bank, prepare to have limited access to in-person help. Instead of face-to-face meetings, many banks offer phone-based customer service. Some banks offer assistance through social media and online chat, as well.

Cash can be hard to deposit

Online banks often have cumbersome cash deposit processes. You might have to find a deposit-accepting ATM. Or you may need to put money into a traditional bank account and transfer it to your online account. You could also use cash to buy a money order, and then deposit it electronically using your online bank’s mobile app.

Some providers also partner with a third-party service, such as Green Dot, to let retailers and convenience stores accept cash deposits. But these services typically charge fees of around $5 for deposits.

» MORE: How to deposit cash at an online bank

Fewer one-stop-shop options

Some online banks have outstanding savings accounts but don’t offer checking or certificates of deposit, so you might have to open one type of account at one institution and a separate type of account at another.

» CONSIDER: 4 advantages of traditional banks over online banks

Online banks' standard bank services

Though online banks typically offer higher rates and lower fees, many still have basic banking features you can expect to find at traditional banks, including:

ATM access. A good online bank will be part of an ATM network, like Allpoint or MoneyPass, with thousands of fee-free machines nationwide. If you need to withdraw cash from a non-network machine, some online banks will also reimburse any fees the ATM owner charges.

Security. Online banks with standard security measures are just as safe as traditional banks. Look for features such as encryption and fraud monitoring, and before you open a bank account, make sure the money is insured by the Federal Deposit Insurance Corp . There are also measures you can take to ensure secure online banking , including avoiding public Wi-Fi networks and keeping anti-virus software up to date.

Accessibility. You can access your bank accounts and bank services wherever there’s internet — on your computer or mobile device — around the clock. You can also reach customer service by phone — in some cases, 24 hours a day, seven days a week.

Frequently asked questions about online banking

Here are answers to common questions about online banking.

What is the meaning of online banking and how do you use online banking?

To bank online means to manage your bank accounts using your computer or mobile device. You can bank online — transfer money and pay bills electronically — through bank websites or by using a bank’s mobile app. Banks often also offer check deposits via their mobile apps.

Most standard or traditional banks offer online account management, so you can handle your banking tasks via the bank website or app. With an online-only bank, all banking tasks are handled online via the bank website or app. Some banks are app-based, so account management is handled primarily through their mobile apps.

What are the types of online banking?

You can use online banking through bank websites on your computer or mobile device, or by using mobile banking apps.

Can you open a bank account online?

You can open a bank account online for both online and brick-and-mortar banks. Online-only banks require you to open a bank account online; there’s no option to go to a branch to open an account.

» LEARN: How to open a bank account online in 4 steps

What about neobanks?

Financial technology companies that offer banking services are often called neobanks . With these providers, deposits are usually FDIC-insured through partner banks, and accounts often have the low monthly fees and strong rates that many online banks have. However, neobanks may lack traditional banking features, such as access to personal or cashier’s checks and wire transfers. They can be a solid option if you prefer online-only banking, but consider these factors and questions to ask before opening a neobank account .

Should you open an online bank account?

If you want higher rates and lower fees and don’t need frequent branch banking services, an online bank may be worth considering. Keep in mind, you can choose to open an online account without giving up an existing account at your local institution. In fact, having accounts at both a traditional bank and an online bank could give you the best of both worlds: the best savings rates and access to in-person help when you need it.

Or you could take a bigger action and move your accounts to an online-only institution (see our guide on how to switch banks ). Either way, you can open a new online account in minutes, and have access at your fingertips at any time.

On a similar note...

Find a better savings account

See NerdWallet's picks for the best high-yield online savings accounts.

- Search Search Please fill out this field.

What Is Online Banking?

How online banking works.

- Online Banks

Pros and Cons of Online Banking

What do you need for online banking, how can you safely use online banking, the bottom line.

- Personal Finance

What Is Online Banking? Definition and How It Works

:max_bytes(150000):strip_icc():format(webp)/John_Egan-9937-Editcopy-JohnEgan-e8c3407be32947ba95561ab855d13dc8.jpg)

Investopedia / Daniel Fishel

Online banking allows you to conduct financial transactions through the Internet. Online banking offers customers almost every service traditionally available through a local branch including deposits, transfers, and online bill payments.

Virtually every banking institution has some form of online banking you can access through a computer or app. Online banking is also known as internet banking or web banking.

Key Takeaways

- Online banking allows you to conduct financial transactions through a computer or smart phone using the internet.

- With online banking, you don’t need to visit a branch to complete many transactions.

- To take advantage of online banking, you’ll need an electronic device, an internet connection, and perhaps your debit card or account numbers.

Online banking is a popular way of doing business with a bank. With online banking, you aren't required to visit a bank branch to complete most of your basic banking transactions. You can do all of this at your own convenience, wherever you want—at home, at work, or on the go. Online banking can be done using a browser or app. Mobile banking is online banking that is done on a phone or tablet.

Here are some of common ways you can use online banking.

Bank anytime

With online banking, you don’t need to visit a physical bank branch but you can do it wherever you want—at home, work, or on the go. In addition, you can typically do online banking 24/7. However, customer support might not be available at all hours.

Access accounts with browsers and apps

You can do online banking through a financial institution’s web portal using a web browser (such as Chrome or Safari) through a mobile app. This allows you to access services from many locations.

Deposit Checks

You can usually deposit a check through a mobile app using a process known as remote deposit capture . Enter the check amount, then use the app to take a photo of the front and back of the check to complete the deposit.

Manage Finances

Many banks and credit unions offer tools to help you review and balance your budget built into apps or the website. You may also be able to track spending trends, or track savings toward a goal.

Perform Other Financial Services

Online banking transactions vary from one financial institution to another. Most banks generally provide essential services such as electronic transfers and bill payments. Some banks even let you set up new checking or CD accounts or apply for credit cards through web portals. Other online functions include ordering checks, stopping payments on checks, or reporting a change of address.

Online banking may provide fewer services than traditional banking does. For instance, you can’t exchange foreign currency.

You may be unable to complete a credit application online, such as a mortgage application. Instead, some banking business must be carried out at a bank or credit union branch.

Online Banks

Online banks operate exclusively online, meaning they don’t operate branches where you can conduct business in person. The best online banks offer low-cost or free banking, plus above-average interest rates on savings accounts , certificates of deposit (CDs) , and money market accounts .

These banks handle customer service by phone, email, or online chat rather than in person. Prominent online banks in the U.S. include Ally Bank , Discover Bank , and Synchrony Bank .

Online-only banks might not provide direct automatic teller machine (ATM) access but usually enable customers to use ATMs at other banks and retail stores. They might even reimburse some or all of the ATM fees other financial institutions charge. The savings gained by not maintaining physical branches typically allows online banks to deliver significant savings on banking fees.

While you can deposit or take out a certain amount of cash at an ATM or store, most online banks impose a dollar limit.

As of October 2023, just 6% of U.S. adults with bank accounts reported their primary bank was an online bank.

Fast and efficient

Easy to monitor accounts

Customer service challenges

Tech and connectivity required

Hacking risk

Pros explained:

- Convenience : Basic banking transactions can be done at any time of day or night, seven days a week. If your bank offers a payment network such as Zelle , you can use your online bank account to send money to a person or business. You can also open and close various accounts online, such as checking and savings accounts.

- Fast and efficient : Funds can be transferred between accounts almost instantly, especially if the two accounts are held at the same institution. Plus, mobile check deposits can be made in just a few minutes.

- Ease of monitoring accounts : You can closely monitor your accounts to spot suspicious activity. Around-the-clock access to banking information provides early fraud detection, serving as a guardrail against financial losses.

Cons of Online Banking

- Customer service challenges : Sometimes, you might need to visit a branch to handle certain transactions, such as buying a cashier’s check. In other cases, you might not even have access to a branch. Furthermore, you may prefer depositing checks, withdrawing money or discussing your financial needs face-to-face.

- Tech and connectivity required : Some customers may need to be more comfortable with the tech-heavy aspects of online banking. For example, they may need help with some online tasks, such as setting up automatic payments . In addition, online banking depends on a reliable internet connection. Connectivity issues make it difficult to process transactions when you want to.

- Hacking risk : Although security continually improves, online accounts remain vulnerable. Customers should use their wireless plans rather than public WiFi networks when logging into an online bank account. This can help prevent unauthorized account access.

To take advantage of online banking you’ll need an internet connection and an electronic device like a computer or mobile phone. After setting up your account, you’ll keep handy a debit or other bank card, and access to your account numbers.

Setting up your online banking account can also be reasonably straightforward. But you’ll need a few things to set up an online checking account or savings account, just like a brick-and-mortar bank account. The bank will spell out exactly what you need on its website, but it typically requires:

- Your name, date of birth, address, and other information

- Social Security number

- Government-issued ID with a photo, such as a driver’s license or passport

- A way to fund your account

To shield your money and your personal information from cyber crooks, you should take these safety precautions:

- Set a strong, unique password, and change it regularly. The federal Cybersecurity & Infrastructure Security Agency recommends a password with at least 16 characters. The password should contain a random string of uppercase letters, lowercase letters, numbers, and symbols.

- Rely on a password manager to help discreetly set and remember passwords.

- Enable two-factor authentication or multi-factor authentication if it’s available. This involves using at least two forms of identification, such as a password and a fingerprint, to access an online account.

- Never provide your online banking details to other people.

- Avoid online banking when using public WiFi, such as at a coffee shop or restaurant.

- Check your accounts regularly for suspicious activity and report suspected fraud immediately.

Can You Use Online Banking to Pay Bills?

You can use online banking to pay bills by logging into your online banking account to arrange bill payments electronically or by check. Online bill pay is a simple way to take care of your bills and help ensure you're always on time with payment by setting up automatic payments. It works especially well for bills with regular, set amounts, such as a mortgage payment, insurance premium, or car payment.

What Is the Best Online Bank?

The best online bank for you will depend on your banking service needs and priorities. Investopedia's choice for best online bank overall is Ally bank. Our top choice for savings is Synchrony Bank and our top choice for checking is Discover.

Online banking is a fast, inexpensive, and convenient way to handle many of your everyday financial needs. You can probably access online banking if you already do business with a bank or credit union. All you need to do is sign up for online banking services. And while you can use online banking features from a traditional bank, picking an online-only bank for your banking needs might boost the interest you earn on savings and help reduce fees.

Consumer Financial Protection Bureau. " Online and Mobile Banking Tips for Beginners. "

Civic Science. " Online-Only Banks Are Gaining Ground With Gen Z ."

Cybersecurity & Infrastructure Security Agency. " Use Strong Passwords ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1469602094-b13b5453a78241329cfc05ad814504ab.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Internet Banking Effects and Results Essay

Introduction, development history, technical description/process of how it works, effects of internet banking.

Internet banking has certainly played a key role in the increase and ease of banking services the world over and the reasons for this are not difficult to discern. Online banking provides flexible opportunities for online services to customers. The highly integrated Customer Relationship Management (CRM) supported by advanced software integrates the basic financial services in demand the world over by individuals and organizations. The three central areas of organizational requirements that include operational, analytical, and collaborative are addressed. CRM and online banking systems and their benefits have generated few research studies but continue to grow and dominate the activities within the banking sector thus defining and shifting the culture in which we handle our finances. The reason I have settled on this topic is based on personal experience I had with my Dad when I was very young. To access banking services, one had to not only keep time but also make a long line behind other clients. This is the exact position we found ourselves in some fifteen years back in our attempt to access banking services. That is no more because internet banking has revolutionized the culture in the banking industry.

At the beginning of the 20 th century in the United States, demand exceeded supply and this precipitated a move by the company to change their business strategies in concentrating on selling as many products as they could afford to. In this case, companies did not pay attention to the customer and the customer’s needs and requirements. Heiko, Wayne, and Robert (1994) explain that “suppliers focused on product development, manufacturing capacity, and securing distribution outlets, without regard to their consumers”.

In the middle of the 20 th century, however, the economic situation changes, and by this time consumers had the power of choice due to excess supply which exceeded demand. Heiko, Wayne, and Robert (1994) point out that “The era of the passive consumer was coming to an end. Companies began to find out what their customers were, what they wanted, and how they could be satisfied; they analyzed data about their customers and segmented them based on their demographics, such as age, gender, and other personal information. Then they promoted their product or service to a specific subset of customers and prospects”.

This period was characterized by target marketing where each company invested much of its efforts on four P’s (price, promotion, product, and placement).In this regard, the concept of CRM and internet banking came in the late 1990s. Although there is no clear definition of CRM, Fareena and Roy (2000) define it as follows: Customer Relation Management “is about understanding the nature of the exchange between customer and supplier and managing it appropriately. With the advent of internet banking, companies changed their business emphasis in increasing the ‘share of wallet’ of their customer. They developed a close connection with their customers and took into consideration the customer needs, requirements and demands. All these were done to satisfy customer demands as well as retain them.

The emergence of CRM on the other hand made marketers carry out a comprehensive analysis of the customer. This was done with to categories customer based on long term period and retention. Moreover, this strategy contributed to cross-selling and up-selling (Greiner, 1972). In addition to the above, the dynamics of changing demographics and consumer purchasing patterns, coupled with ever stronger competition, have certainly put increased pressure on banks to adopt cutting-edge technologies to meet the growing demands of the consumer. These have impacted a lot on the banking sector globally and as such have devised new avenues for driving customer relations and developing distinct competencies that will ensure their survival. The adoption of CRM and internet banking has brought with it several benefits both to the customers and the banks. The scale of operations has improved and banking services the world over have not only been made easier but have also recorded a decline in general costs. These have impacted immensely on the culture of how we shop, procure goods, access our cash deposits, and relate with our banking services providers. One fundamental aspect of quality life is the ease by which we access both goods and services in fulfilling the constant demands in our lives. This has been made so by the rapid development of internet banking that has revolutionized our shopping culture.

Internet banking; also referred to as e-banking allows clients to carry out financial transactions on a secure site that belongs to their banking services provider. This can either be a virtual bank or a credit union. They offer safe banking solutions to their customers on the internet and have been embraced by a large number of clients the world over due to their ease and convenience in accessing banking services. Common transactions that are offered by internet banking include bill payments, wire transfers, account-to-account transfers, loan applications, and the opening of new accounts. In addition to the above, it offers non-transactional services to the clients such as online statements and lives chats with the customer relations services. Security is handled by the authentication of a single password in the form of PIN/TAN or signature-based online banking that involves the digital encryption of all transactions.

In the analysis of the world’s economy, the online banking service sector has precipitated the increase in the number of those using banking facilities and drastically changed the culture of our banking and shopping. This translates to a more vigorous banking sector that can play an important in an economy. The general population has befitted immensely from the availability of loans and capacity to provide safe custody for the deposits at the touch of a mouse. Shortly, the rate of internet banking will depend on the rate at with the customers embrace and appreciate the use of internet banking in carrying out their financial transactions and the ability to instill mote secure online banking operations that can deal with cybercrimes.

Online banking has remained a business topic that has generated much impact because of its ability to only ease the banking process but also effectively deal with the increasing demands of fast, safe, and convenient banking services. This is because it has enabled us to acquire the basic goods and services with little effort in comparison to the traditional model of buying and selling. It is therefore worth appreciating that the little things that make human lives easy impact greatly on our culture.

- Fareena, G. & Roy B. H. 2000, Consumer Preferences of Internet Services Overtime: Initial Exploration. New York: Sage.

- Greiner, L. 1972, Evolution and revolution as organizations grow. Harvard Business Review , 50 (4), 37-46.

- Heiko, L.,Wayne, J and Robert, A. 1994, Retailing and Online Consumer Information Services. Washington: OLCISs.

- Psychological Profile of John Wayne Gacy

- Successful CRM Implementation in Banks

- The Works by Lu Huan and Wayne Thiebaud

- The Basics of Finance and Investment

- Soaring Wheat Prices Push Food Costs Up Worldwide

- Microfinance Institutions and African Economic Activities

- Financing Difficulty and Solution for SME’s in China

- Cost Benefit Analysis of the Company

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2021, December 27). Internet Banking Effects and Results. https://ivypanda.com/essays/internet-banking-effects-and-results/

"Internet Banking Effects and Results." IvyPanda , 27 Dec. 2021, ivypanda.com/essays/internet-banking-effects-and-results/.

IvyPanda . (2021) 'Internet Banking Effects and Results'. 27 December.

IvyPanda . 2021. "Internet Banking Effects and Results." December 27, 2021. https://ivypanda.com/essays/internet-banking-effects-and-results/.

1. IvyPanda . "Internet Banking Effects and Results." December 27, 2021. https://ivypanda.com/essays/internet-banking-effects-and-results/.

Bibliography

IvyPanda . "Internet Banking Effects and Results." December 27, 2021. https://ivypanda.com/essays/internet-banking-effects-and-results/.

- My Account My Account

- Cards Cards

- Travel Travel

- Insurance Insurance

- Rewards & Benefits Rewards & Benefits

- Business Business

Related Content

Advantages and disadvantages of online banking.

Published: December 04, 2020

Updated: June 10, 2022

With most of the world operating remotely, online banking may be a huge help to your business. Learn more about the advantages and disadvantages of online banking.

Thanks to its advanced web services and mobile apps, online banking had come into the spotlight way before the pandemic. But, more than ever, business owners now rely on this technology to meet their banking needs from the safety and convenience of their homes. If you’re thinking of using an online bank for your business, it’s important to weigh its pros and cons and learn how these innovative banking features are changing the way business owners interact with their money.

In today’s fast-moving world, businesses use online banking to replace in-person visits to a branch. It offers a variety of web-based features to make financial transactions online including:

- Bill payments

- Tax payments

- Cash transfers to vendors and suppliers

- Deposits to retirement accounts (either your personal account or your company’s pension plan)

- Open new accounts

- Loan applications for business loans, credit cards or lines of credit

- The ability to deposit cheques.

Online banking can be accessed via a computer or your bank’s mobile app. All you need is a bank account, a secure password and a good internet connection, and you can access your account from anywhere, which is especially important as we are urged to stay home.

Advantages of online banking

In addition to being able to bank at any time, from anywhere, there are other advantages to banking online. You may also be able to:

Pay bills online

This might be one of the top advantages of online banking because you don’t have to take time out of your day to go to the bank. You can simply log into your account and pay your bill online right away. For increased efficiency, you may also set up automated bill payments, which helps you manage your cash flow when you have monthly payments to and from vendors.

Transfer money

You may need to do a rapid money transfer to a client or vendor, or you may need to transfer money from one account to another. Instead of sending a registered cheque and waiting for it to clear, you may securely transfer the money online.

Deposit cheques online

Rather than driving to a bank branch and waiting in line, you may be able to deposit cheques online in minutes. And because most financial institutions have an app that replicates its services from your phone, you have the ability to always bank on the go. Plus, some banks offer 24/7 customer service, so you can speak to a customer service representative at any time.

Lower your overhead fees

If your business banks online, your banking fees may be lower, as online banks may not have to pay for the cost and upkeep of branches, and those savings may be transferred to you. Plus, they may have more no-fee options that add to your savings.

Disadvantages of online banking

While online banking is always improving, there are some disadvantages for business owners reliant on immediate and constant access to their banking services.

Technology disruptions

Online banking relies on a strong internet connection. If your internet is disrupted by a power outage, server issues at your bank, or if you’re in a remote location, your ability to access your accounts might be affected. Scheduled site maintenance also means you can’t access your accounts and may have to seek an alternative.

Lack of a personal relationship

A personal relationship with your bank may be able to offer an advantage over online banking. If you need a business loan, a new line of credit, a waived fee or to make changes to your current banking needs, having that relationship can help.

In-person banking relationships can also help you craft a business account tailored to your specific needs. They can also make notes in your files about cheques, cash deposits and international payments so you can avoid extended holds on your money.

An ideal relationship would be a blend of online banking for your day-to-day transactions and a personal relationship with your banker to assist with bigger needs. That way, you have multiple options to support your business.

Privacy and security concerns

Financial institutions have very good security, but no system is foolproof. Valuable information is always prone to hacks, but you might be able to prevent this if you:

- Always use the mobile app and the website directly. You should see a small lock to the left of the search bar, which indicates the site is secure.

- Make sure you have a strong password based on a combination of numbers, symbols and letters. It’s also important to change your password regularly.

- Do not click on any links in text messages if you haven’t agreed to that method of communication.

- Use two-step authentication, which adds an extra layer of security.

Limited services

Online banking features a lot of services, but some of them still require business owners to go into banks to “wet sign” documents. This includes loan and credit applications, a large cash withdrawal or large deposits. But as online banking technology continues to evolve, you may eventually be able to electronically sign for these in the future.

These days, banks know business owners want the ease and convenience of online banking, so they’re constantly upgrading and improving their digital assets. You may take advantage of this rapidly changing banking technology and tailor an online banking system that is unique to your business needs. If you think online banking could benefit your business, talk to your bank about the time- and cost-saving advantages of going digital.

This article is intended for general informational purposes only and does not constitute legal advice or an opinion on any issue. It should not be regarded as comprehensive or a substitute for professional advice.

Trending Content

E-banking Overview: Concepts, Challenges and Solutions

- Published: 28 November 2020

- Volume 117 , pages 1059–1078, ( 2021 )

Cite this article

- Belbergui Chaimaa 1 ,

- Elkamoun Najib 1 &

- Hilal Rachid 1

23 Citations

1 Altmetric

Explore all metrics

The expansion of information technology has led to a new form of banking. Traditional banking, based on the physical presence of the customer, is only a part of banking activities. In the last few years, electronic banking has emerged, adopting a new distribution channels like Internet and mobile services. The main goal was to allow businesses to improve the quality of service delivery and reduce transaction cost, and anytime and anywhere service demand for customers. However, it increased the vulnerability to fraudulent activities like spamming, phishing and credit card frauds. Then, the main challenge that opposes electronic banking is ensuring banking security. In this context, this paper aims to provide an overview of the electronic banking service highlighting various aspects, investigating various challenges and risks, and discussing some proposed solutions.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

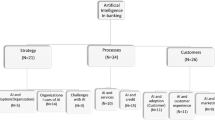

Utilization of artificial intelligence in the banking sector: a systematic literature review

Artificial Intelligence and Fraud Detection

A Comprehensive Study of Artificial Intelligence and Cybersecurity on Bitcoin, Crypto Currency and Banking System

Kurnia, S., Peng, F., & Liu, Y. R. (2010). Understanding the adoption of electronic banking in China. In 43rd Hawaii International Conference on System Sciences , Honolulu, Hawaii, USA, pp. 1–10.

Vrîncianu, M., & Popa, L. A. (2010). Considerations regarding the security and protection of e-banking services consumers’ interests. The Amfiteatru Economic Journal , 12 (28), 388–403.

Google Scholar

Peotta, L., Holtz, M. D., David, B. M., Deus, F. G., & Timoteo de Sousa, R. (2011). A formal classification of internet banking attacks and vulnerabilities. International Journal of Computer Science and Information Technology, 3 (1), 186–197.

Article Google Scholar

Drig, I., & Isac, C. (2014). E-banking services – Features, challenges and benefits. 10.

Chavan, J. (2013). Internet banking – Benefits and challenges in an emerging economy. International Journal of Research in Business Management, 1 (1), 19–26.

MathSciNet Google Scholar

Singhal, D., & Padhmanabhan, V. (2009). A study on customer perception towards internet banking: Identifying major contributing factors. Journal of Nepalese Business Studies, 5 (1), 101–111.

Liao, S., Shao, Y. P., Wang, H., & Chen, A. (1999). The adoption of virtual banking: An empirical study. International Journal of Information Management, 19 (1), 63–74.

Bahl, D. S. (2012). E-banking: Challenges and policy implications. International Journal of Computing & Business Research , 229–6166.

Zarei, S. (2011). Risk management of internet banking. In 10th WSEAS International conference on Artificial Intelligence, Knowledge Engineering and Data Bases , Cambridge, UK, pp. 134–139.

Hanaek, P., Malinka, K., & Schafer, J. (2008). E-banking security - comparative study. In 42nd Annual IEEE International Carnahan Conference on Security Technology , Prague, Czech Republic, pp. 326–330.

Omariba, Z. B., & Masese, N. B. (2012). Security and privacy of electronic banking. International Journal of Computer Science Issues (IJCSI), 9 (4), 432–446.

Park, K. C., Shin, J. W., & Lee, B. G. (2014). Analysis of authentication methods for smartphone banking service using ANP. KSII Transactions on Internet & Information Systems, 8 (6).

Brar, T. P. S., Sharma, D., & Khurmi, S. S. (2012). Vulnerabilities in e-banking: A study of various security aspects in e-banking. International Journal of Computing & Business Research .

Yang, Y. J. (1997). The security of electronic. In International Systems Security Conference , pp. 41–52.

Yang, J., Cheng, L., & Luo, X. (2009). A comparative study on e-banking services between China and USA. International Journal of Electronic Finance, 3 (3), 235–252.

Zahid, N., Mujtaba, A., & Riaz, A. (2010). Consumer acceptance of online banking. European Journal of Economics, Finance and Administrative Sciences, 27 (1).

Geetha, K. T., & Malarvizhi, V. (2011). Acceptance of E-banking among customers: An empirical investigation in India. The Journal of Internet Banking and Commerce, 15 (2), 1–17.

Deb, M., & Lomo-David, E. (2014). An empirical examination of customers’ adoption of m-banking in India. Marketing Intelligence & Planning, 32 (4), 475–494.

Lee, J. H., Lim, W. G., & Lim, J. I. (2013). A study of the security of Internet banking and financial private information in South Korea. Mathematical and Computer Modelling, 58 (1–2), 117–131.

Moga, L., Nor, K., Neculita, M., & Khani, N. (2012). Trust and security in e-banking adoption in Romania. Communications of the IBIMA , 1–10.

Komb, F., Korau, M., Belás, J., & Korauš, A. (2016). Electronic banking security and customer satisfaction in commercial banks. Journal of Security and Sustainability Issues, 5 (3), 411–422.

Ranaweera, H. (2019). Risk of electronic payments of the banking sector in Sri Lanka: Case of Colombo district. 4 (1).

Rajaratnam, A. (2019). The factors influencing on internet banking adoption in Trincomalee District, Sri Lanka, Sri Lanka. International Research Journal of Advanced Engineering and Science, 4 (1), 160–164.

Hasan, A. S., Baten, M. A., Kamil, A. A., & Parveen, S. (2010). Adoption of e-banking in Bangladesh: An exploratory study. African Journal of Business Management, 4 (13), 2718–2727.

Jalal, A., Marzooq, J., & Nabi, H. A. (2011). Evaluating the impacts of online banking factors on motivating the process of e-banking. Journal of Management and Sustainability, 1 (1).

Abukhzam, M., & Lee, A. (2010). Factors affecting bank staff attitude towards E-banking adoption in Libya. The Electronic Journal of Information Systems in Developing Countries, 42 (1), 1–15.

Abdellatif, T., Jinene, C., & Khazmi, N. (2014). Une cartographie de la résistance à l’adoption du M-Banking en Tunisie [Mapping of resistance to the adoption of M-Banking in Tunisia]. 8 (1).

Halime, Z. F., & Kirmi, B. Etude de la résistance à l’adoption et l’utilisation de la banque mobile. Management Research .

Floh, A., & Treiblmaier, H. (2006). What keeps the e-banking customer loyal? A multigroup analysis of the moderating role of consumer characteristics on e-loyalty in the financial service industry. SSRN Electronic Journal .

Gunson, N., Marshall, D., Morton, H., & Jack, M. (2011). User perceptions of security and usability of single-factor and two-factor authentication in automated telephone banking. Computers & Security, 30 (4), 208–220.

Weir, C. S., Douglas, G., Richardson, T., & Jack, M. (2010). Usable security: User preferences for authentication methods in eBanking and the effects of experience. Interacting with Computers, 22 (3), 153–164.

Ahmad, D. T., & Hariri, M. (2012). User acceptance of biometrics in e-banking to improve security.

Tassabehji, R., & Kamala, M. A. (2009). Improving e-banking security with biometrics: Modelling user attitudes and acceptance. In 3rd International Conference on New Technologies, Mobility and Security , Cairo, Egypt, pp. 1–6.

Moeckel, C. Human-computer interaction for security research: The case of EU e-banking systems.

Rifà-Pous, H. (2009). A secure mobile-based authentication system for e-banking. In On the Move to Meaningful Internet Systems: OTM, 5871 , 848–860.

Hamidi, N. A., Mahdi Rahimi, G. K., Nafarieh, A., Hamidi, A., & Robertson, B. (2013). Personalized security approaches in e-banking employing flask architecture over cloud environment. Procedia Computer Science, 21 , 18–24.

Alsaiari, H., Papadaki, M., Dowland, P. S., & Furnell, S. M. (2014). Alternative graphical authentication for online banking environments.

Elkhodr, M., Shahrestani, S., & Kourouche, K. (2012). A proposal to improve the security of mobile banking applications. 2012 Tenth International Conference on ICT and Knowledge Engineering (pp. 260–265). IEEE: Bangkok, Thailand.

Chapter Google Scholar

Islam Khan, B. U., Olanrewaju, R. F., Anwar, F., & Yaacob, M. (2018). Offline OTP based solution for secure internet banking access. In 2018 IEEE Conference on e-Learning, e-Management and e-Services (IC3e) , Langkawi Island, Malaysia, pp. 167–172.

Brodi, D., & Jankovi, R. (2016). Usability analysis of the specific captcha types. In International Scientific Conference , pp. 272–277.

Hoonakker, P., Bornoe, N., & Carayon, P. (2009). Password authentication from a human factors perspective: Results of a survey among end-users. Human Factors and Ergonomics Society Annual Meeting Proceedings, 53 (6), 459–463.

Mridha, F., Nur, K., Kumar, A., & Akhtaruzzaman, M. (2017). A new approach to enhance internet banking security. International Journal of Computer Applications, 160 (8), 35–39.

Chandanshive, A., Sureka, A., Gongiwala, V., & Nalawade, A. (2018). Access control using 3 level authentications for e-banking. International Journal on Recent and Innovation Trends in Computing and Communication, 6 (4).

Shen, L., Zheng, N., Zheng, S., & Li, W. (2010). Secure mobile services by face and speech based personal authentication. In 2010 IEEE International Conference on Intelligent Computing and Intelligent Systems , Xiamen, China, pp. 97–100.

Onyesolu, M. O., Odoh, M., Akanwa, A. O., & Nwasor, V. C. (2010). Robust authentication model for ATM: A biometric strategy measure for enhancing e-banking security in Nigeria. International Journal of Advanced Research in Computer Science .

Bhosale, S. T. (2012). Security in e-banking via card less biometric. International Journal of Advanced Technology & Engineering Research, 2 (4), 457–462 2(2250).

Plateaux, A., Lacharme, P., Jøsang, A., & Rosenberger, C. (2014). One-time biometrics for online banking and electronic payment authentication. Availability, Reliability, and Security in Information Systems, 8708 , 179–193.

Darwish, S. M., & Hassan, A. M. (2012). A model to authenticate requests for online banking transactions. Alexandria Engineering Journal, 51 (3), 185–191.

Kumbhar, S., & Sahu, S. (2007). A new framework for online transaction using visual cryptography and steganography. International Journal of Innovative Research in Computer and Communication Engineering, 3 (11), 11418–11422.

Yaseen Khudhur, D., Saad Hameed, S., & Al-Barzinji, S. M. (2018). Enhancing e-banking security: Using whirlpool hash function for card number encryption. International Journal of Engineering & Technology, 7 (2.13).

Thompson, L. (2003). Smart card authentication: Added security for systems and network access.

Karia, A., Patankar, D. A. B., & Tawde, P. (2014). SMS-based one time password vulnerabilities and safeguarding OTP over network. International Journal of Engineering Research, 3 (5).

Al-Fairuz, M., & Renaud, K. (2010). Multi-channel, multi-level authentication for more secure eBanking.

Alarifi, A., Alsaleh, M., & Alomar, N. (2017). A model for evaluating the security and usability of e-banking platforms. Computing, 99 (5), 519–535.

Article MathSciNet Google Scholar

Download references

Author information

Authors and affiliations.

STIC Laboratory, Chouaib Doukkali University, El Jadida, Morocco

Belbergui Chaimaa, Elkamoun Najib & Hilal Rachid

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Belbergui Chaimaa .

Additional information

Publisher’s Note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Chaimaa, B., Najib, E. & Rachid, H. E-banking Overview: Concepts, Challenges and Solutions. Wireless Pers Commun 117 , 1059–1078 (2021). https://doi.org/10.1007/s11277-020-07911-0

Download citation

Accepted : 29 October 2020

Published : 28 November 2020

Issue Date : March 2021

DOI : https://doi.org/10.1007/s11277-020-07911-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Authentication

- Find a journal

- Publish with us

- Track your research

- Checking Account

- Online Savings Account

- Money Market Account

- Certificate of Deposit

- IRA Certificate of Deposit

- IRA Savings Account

- Discover Bank Blog Home

- Banking 101

- Career & Education

- Family Finance

- Life Planning

- Compare Retirement Accounts

- Find an Account

The 5 benefits of online banking

It’s convenient. It’s easy. See what else online banking has to offer.

February 14, 2024

Ask anyone what comes to mind when they think of things that make their lives easier, and they’re likely to say cell phones, household appliances, or cars. Yet one of the biggest boosts to easy living in recent years has been the arrival of online banking. Just think of it. No more lines. No dealing with the post office and stamps. And no more chasing down branch managers just to find out the balance of your account.

Because your financial security, convenience, and peace of mind are top priorities for Discover ® , we strive to provide you with the highest level of online banking services.

Online banking customers enjoy instant access from their computer or mobile device to a full range of services, allowing you to:

- Check balances on accounts and view records of your transactions

- Pay bills automatically each month with easy-to-set-up auto payment

- Transfer funds between accounts

- Download or print statements for your tax or personal records

- Access your account 24/7

Online banks such as Discover offer many different types of accounts, including Certificates of Deposit (CDs) , Individual Retirement Accounts (IRAs) , Money Market Account and an Online Savings Account . These accounts often offer higher rates than brick-and-mortar banks. That’s because they have low overhead expenses and can pass their savings along to customers in the form of better rates. But while other banks may offer these accounts, Discover has just the right mix for you, with the returns and liquidity you demand for each unique financial goal.

Online banking with Discover is also secure enough to keep your money safe and your mind at ease. Access is password protected and secured by other identity confirmations, while sophisticated encryption technology is used to prevent unauthorized access to any of your personal data. Additionally, Discover Bank, an FDIC member, offers accounts that are protected up to $250,000 per depositor, per account ownership category.

Given the growing list of conveniences and services offered through online banking, it’s no surprise that it’s grown in popularity among all age groups over the last few years. According to a Bankrate report , 88% of people polled who use online-only banks are satisfied with the bank’s service.

So, if you’re not already among the growing ranks of satisfied consumers taking advantage of the many benefits of Discover’s online banking services, sign up today. Discover offers the unique combination of account access and competitive rates that will make your financial life easier to manage and help you achieve your financial goals.

Articles may contain information from third parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third party or information.

- Share article on facebook.

- Share article on twitter.

- Share article on linked in.

Related Content

What do you need to open a bank account.

Going mobile with your online savings account

Money market account vs. savings account: Which is best for you?

Banking on Your Terms

Checking account: enjoy everyday checking and earn cash back while doing it.

Online Savings Account: Imagine an Online Savings Account Without the Monthly Fees

Money Market Account: Get the Best of Both Worlds: Flexibility and High Yields

Certificate of Deposit: Lock in Your APY and Reap the Returns

Individual Retirement Accounts: Make Saving for Retirement a Lot Easier

Quick Quiz: Find the Account That's Right For You

You are leaving Discover.com

You are leaving Discover.com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party. Discover Bank does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. For personal advice regarding your financial situation, please consult with a financial advisor.

Top 10 Advantages and Disadvantages of Online Payments

4th January 2024 14 Comments

Table of Contents

- 1 What Are Online Payments?

- 2.1 Tips to follow while making online payments

- 3.1 1. Speed of transactions

- 3.2 2. Convenience