🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a Competitive Analysis for Your Business Plan

11 min. read

Updated January 3, 2024

Do you know who your competitors are? If you do, have you taken the time to conduct a thorough competitor analysis?

Knowing your competitors, how they operate, and the necessary benchmarks you need to hit are crucial to positioning your business for success. Investors will also want to see an analysis of the competition in your business plan.

In this guide, we’ll explore the significance of competitive analysis and guide you through the essential steps to conduct and write your own.

You’ll learn how to identify and evaluate competitors to better understand the opportunities and threats to your business. And you’ll be given a four-step process to describe and visualize how your business fits within the competitive landscape.

- What is a competitive analysis?

A competitive analysis is the process of gathering information about your competitors and using it to identify their strengths and weaknesses. This information can then be used to develop strategies to improve your own business and gain a competitive advantage.

- How to conduct a competitive analysis

Before you start writing about the competition, you need to conduct your analysis. Here are the steps you need to take:

1. Identify your competitors

The first step in conducting a comprehensive competitive analysis is to identify your competitors.

Start by creating a list of both direct and indirect competitors within your industry or market segment. Direct competitors offer similar products or services, while indirect competitors solve the same problems your company does, but with different products or services.

Keep in mind that this list may change over time. It’s crucial to revisit it regularly to keep track of any new entrants or changes to your current competitors. For instance, a new competitor may enter the market, or an existing competitor may change their product offerings.

2. Analyze the market

Once you’ve identified your competitors, you need to study the overall market.

This includes the market size , growth rate, trends, and customer preferences. Be sure that you understand the key drivers of demand, demographic and psychographic profiles of your target audience , and any potential market gaps or opportunities.

Conducting a market analysis can require a significant amount of research and data collection. Luckily, if you’re writing a business plan you’ll follow this process to complete the market analysis section . So, doing this research has value for multiple parts of your plan.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Create a competitive framework

You’ll need to establish criteria for comparing your business with competitors. You want the metrics and information you choose to provide answers to specific questions. (“Do we have the same customers?” “What features are offered?” “How many customers are being served?”)

Here are some common factors to consider including:

- Market share

- Product/service offerings or features

- Distribution channels

- Target markets

- Marketing strategies

- Customer service

4. Research your competitors

You can now begin gathering information about your competitors. Because you spent the time to explore the market and set up a comparison framework—your research will be far more focused and easier to complete.

There’s no perfect research process, so start by exploring sources such as competitor websites, social media, customer reviews, industry reports, press releases, and public financial statements. You may also want to conduct primary research by interviewing customers, suppliers, or industry experts.

You can check out our full guide on conducting market research for more specific steps.

5. Assess their strengths and weaknesses

Evaluate each competitor based on the criteria you’ve established in the competitive framework. Identify their key strengths (competitive advantages) and weaknesses (areas where they underperform).

6. Identify opportunities and threats

Based on the strengths and weaknesses of your competitors, identify opportunities (areas where you can outperform them) and threats (areas where they may outperform you) for your business.

You can check out our full guide to conducting a SWOT analysis for more specific questions that you should ask as part of each step.

- How to write your competitive analysis

Once you’ve done your research, it’s time to present your findings in your business plan. Here are the steps you need to take:

1. Determine who your audience is

Who you are writing a business plan for (investors, partners, employees, etc.) may require you to format your competitive analysis differently.

For an internal business plan you’ll use with your team, the competition section should help them better understand the competition. You and your team will use it to look at comparative strengths and weaknesses to help you develop strategies to gain a competitive advantage.

For fundraising, your plan will be shared with potential investors or as part of a bank loan. In this case, you’re describing the competition to reassure your target reader. You are showing awareness and a firm understanding of the competition, and are positioned to take advantage of opportunities while avoiding the pitfalls.

2. Describe your competitive position

You need to know how your business stacks up, based on the values it offers to your chosen target market. To run this comparison, you’ll be using the same criteria from the competitive framework you completed earlier. You need to identify your competitive advantages and weaknesses, and any areas where you can improve.

The goal is positioning (setting your business up against the background of other offerings), and making that position clear to the target market. Here are a few questions to ask yourself in order to define your competitive position:

- How are you going to take advantage of your distinctive differences, in your customers’ eyes?

- What are you doing better?

- How do you work toward strengths and away from weaknesses?

- What do you want the world to think and say about you and how you compare to others?

3. Visualize your competitive position

There are a few different ways to present your competitive framework in your business plan. The first is a “positioning map” and the second is a “competitive matrix”. Depending on your needs, you can use one or both of these to communicate the information that you gathered during your competitive analysis:

Positioning map

The positioning map plots two product or business benefits across a horizontal and vertical axis. The furthest points of each represent opposite extremes (Hot and cold for example) that intersect in the middle. With this simple chart, you can drop your own business and the competition into the zone that best represents the combination of both factors.

I often refer to marketing expert Philip Kohler’s simple strategic positioning map of breakfast, shown here. You can easily draw your own map with any two factors of competition to see how a market stacks up.

It’s quite common to see the price on one axis and some important qualitative factor on the other, with the assumption that there should be a rough relationship between price and quality.

Competitive matrix

It’s pretty common for most business plans to also include a competitive matrix. It shows how different competitors stack up according to the factors identified in your competitive framework.

How do you stack up against the others? Here’s what a typical competitive matrix looks like:

For the record, I’ve seen dozens of competitive matrices in plans and pitches. I’ve never seen a single one that didn’t show that this company does more of what the market wants than all others. So maybe that tells you something about credibility and how to increase it. Still, the ones I see are all in the context of seeking investment, so maybe that’s the nature of the game.

4. Explain your strategies for gaining a competitive edge

Your business plan should also explain the strategies your business will use to capitalize on the opportunities you’ve identified while mitigating any threats from competition. This may involve improving your product/service offerings, targeting underserved market segments, offering more attractive price points, focusing on better customer service, or developing innovative marketing strategies.

While you should cover these strategies in the competition section, this information should be expanded on further in other areas of your business plan.

For example, based on your competitive analysis you show that most competitors have the same feature set. As part of your strategy, you see a few obvious ways to better serve your target market with additional product features. This information should be referenced within your products and services section to back up your problem and solution statement.

- Why competition is a good thing

Business owners often wish that they had no competition. They think that with no competition, the entire market for their product or service will be theirs. That is simply not the case—especially for new startups that have truly innovative products and services. Here’s why:

Competition validates your idea

You know you have a good idea when other people are coming up with similar products or services. Competition validates the market and the fact that there are most likely customers for your new product. This also means that the costs of marketing and educating your market go down (see my next point).

Competition helps educate your target market

Being first-to-market can be a huge advantage. It also means that you will have to spend way more than the next player to educate customers about your new widget, your new solution to a problem, and your new approach to services.

This is especially true for businesses that are extremely innovative. These first-to-market businesses will be facing customers that didn’t know that there was a solution to their problem . These potential customers might not even know that they have a problem that can be solved in a better way.

If you’re a first-to-market company, you will have an uphill battle to educate consumers—an often expensive and time-consuming process. The 2nd-to-market will enjoy all the benefits of an educated marketplace without the large marketing expense.

Competition pushes you

Businesses that have little or no competition become stagnant. Customers have few alternatives to choose from, so there is no incentive to innovate. Constant competition ensures that your marketplace continues to evolve and that your product offering continues to evolve with it.

Competition forces focus & differentiation

Without competition, it’s easy to lose focus on your core business and your core customers and start expanding into areas that don’t serve your best customers. Competition forces you and your business to figure out how to be different than your competition while focusing on your customers. In the long term, competition will help you build a better business.

- What if there is no competition?

One mistake many new businesses make is thinking that just because nobody else is doing exactly what they’re doing, their business is a sure thing. If you’re struggling to find competitors, ask yourself these questions.

Is there a good reason why no one else is doing it?

The smart thing to do is ask yourself, “Why isn’t anyone else doing it?”

It’s possible that nobody’s selling cod-liver frozen yogurt in your area because there’s simply no market for it. Ask around, talk to people, and do your market research. If you determine that you’ve got customers out there, you’re in good shape.

But that still doesn’t mean there’s no competition.

How are customers getting their needs met?

There may not be another cod-liver frozen yogurt shop within 500 miles. But maybe an online distributor sells cod-liver oil to do-it-yourselfers who make their own fro-yo at home. Or maybe your potential customers are eating frozen salmon pops right now.

Are there any businesses that are indirect competitors?

Don’t think of competition as only other businesses that do exactly what you do. Think about what currently exists on the market that your product would displace.

It’s the difference between direct competition and indirect competition. When Henry Ford started successfully mass-producing automobiles in the U.S., he didn’t have other automakers to compete with. His competition was horse-and-buggy makers, bicycles, and railroads.

Do a competitive analysis, but don’t let it derail your planning

While it’s important that you know the competition, don’t get too caught up in the research.

If all you do is track your competition and do endless competitive analyses, you won’t be able to come up with original ideas. You will end up looking and acting just like your competition. Instead, make a habit of NOT visiting your competition’s website, NOT going into their store, and NOT calling their sales office.

Focus instead on how you can provide the best service possible and spend your time talking to your customers. Figure out how you can better serve the next person that walks in the door so that they become a lifetime customer, a reference, or a referral source.

If you focus too much on the competition, you will become a copycat. When that happens, it won’t matter to a customer if they walk into your store or the competition’s because you will both be the same.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Don't let competition derail planning

Related Articles

10 Min. Read

How to Write the Company Overview for a Business Plan

How to Set and Use Milestones in Your Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

6 Min. Read

How to Write Your Business Plan Cover Page + Template

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

Our biggest savings of the year

Black Friday Save 60%

for life on the #1 rated business plan software

on the #1 rated business plan software

on the #1 Business Planning Software

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

What is competitive analysis? Template, examples, and how-to

In this comprehensive guide, we’ll define what a competitive analysis is, describe the benefits product teams stand to gain from conducting one, and walk through the steps of how to do a competitive analysis.

Through the tutorial, we’ll refer to examples to demonstrate how each step of a competitive analysis works in practice. We’ll also provide a list of customizable, free competitive analysis templates for you to use when completing these steps on your own.

Complete guide to competitive analysis

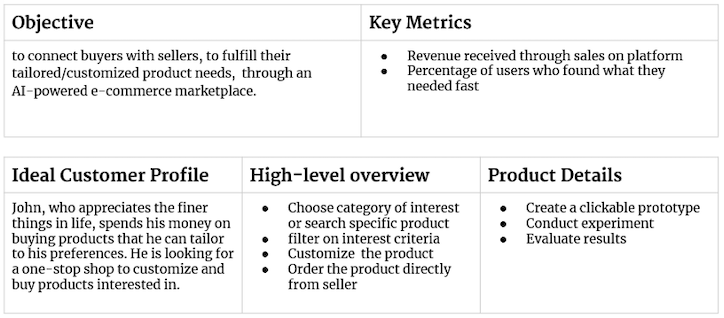

Picture this: you just came up with the next disruptive, game changing, AI-powered e-commerce marketplace. The objective is to connect buyers with sellers to fulfill their tailored and customized product needs.

You’re confident your product will take on Etsy and other big players in the market. You did some market and user research and have a good idea of your ideal customer and their (underserved) needs. Based on this data, you believe your marketplace can reach product-market fit quickly.

It’s now time for you to dust off your copy of Sun Tzu’s T he Art of War . Why is that, you ask?

The Art of War is an ancient Chinese military textbook that, although dated somewhere between ~500–400 B.C., is one of the most influential management books out there to this day. It provides great strategic and tactical advice. Moreover, it provides guidance to help you assess yourself and your competition to gain an advantage.

Maintaining a competitive advantage is the goal. Even if you have the best product in the world and you know there is a market for it, if you don’t understand your competition, you‘re bound to fail. That’s why you need to perform a competitive analysis.

As the band Rage Against the Machine would say, know your enemy .

What is competitive analysis?

Competitive analysis (sometimes called a competitor analysis or competition analysis) is exactly what it sounds like: a structured approach to identifying and analyzing your competitors. More concretely, it’s an assessment of your competition’s offerings, strategy, strengths, and weaknesses.

A competitive analysis helps you answer questions such as:

- Which other companies are providing a solution similar to ours?

- What are the ideal customer’s minimum expectations?

- What are they currently not getting from our product with regard to those expectations?

- What barriers do competitors in the market fce?

- What should we avoid introducing in our product?

- What price are customers willing to pay for our product?

- What value do we need to provide to make our product stand out in the market?

- What trends are happening and how might they change the playing field?

When conducted thoroughly and regularly, a competitive analysis provides you with tons of information that can be used to improve and optimize your product. The end result is a holistic overview of your competitor landscape.

Why do a competitive analysis?

Competitive analysis is a fundamental product management instrument. It helps PMs learn what works and what doesn’t when trying to acquire market share, identify market trends, and locate gaps in their product offering.

Competitive analysis exists to help you avoid making mistakes and empower you to beat competitors to the punch in the pursuit of product growth and success.

Knowing your competition will bring you great rewards. Conducting a competitive analysis will help you more effectively:

- Create benchmarks

- Identify opportunities to better serve customers

- Make strategic decisions

- Determine your pricing strategy

- Identify market gaps

- Determine distribution and marketing strategies

Typically, the first time you create a competitor analysis is when doing your market research. This helps you get an idea of the product-market fit , which will evolve along your journey.

As a product manager, your role is not to analyze how well your competitors are able to showcase themselves. It is your job to make the product what the customer needs it to be. Understanding your competitor’s capabilities, pricing, and product positioning helps you in this.

Keep in mind that your competitors will likely showcase themselves to appear better than they probably are. You’ll be able to acquire tons of information about them, but you should take that information with a pinch of salt.

How to do a competitive analysis

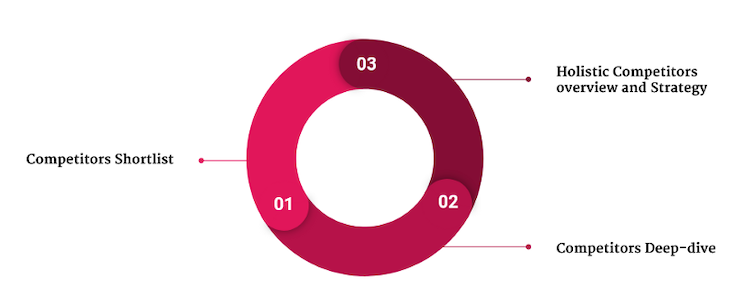

There is no a single way to do a competitive analysis. In general, a competitive analysis is made up of three fundamental components:

- A shortlist of competitors

- A competitor deep dive

- A holistic overview and strategy

To demonstrate how to do a competitor analysis, we’ll refer back to the example outlined in the introduction.

Over 200k developers and product managers use LogRocket to create better digital experiences

Remember, in our example, we’re looking to disrupt the market with an AI-powered e-commerce marketplace app that helps buyers and sellers connect to fulfill highly customized orders. Let’s call our innovative new product AGORA.

1. Create a shortlist of your competitors

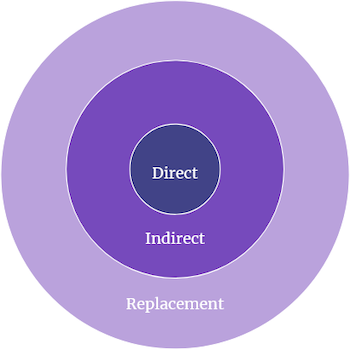

There are three types of competitors:

- Direct — Competitors that offer the same product and target the same ideal customer; you are battling direct competitors heads-on

- Indirect — Competitors that either offer a somewhat similar product or target the same ideal customer

- Replacement — Competitors that offer a different product but target the same ideal customer

For a competitive analysis, you need to identify at least your direct and indirect competitors. So how do you do that? By looking inward and researching obsessively .

Look inward

To figure out who your direct and indirect competitors are, you need to look inward first to understand your product positioning: who are you servicing and what is the offering you are providing?

You can answer these questions by doing a self-assessment using the product canvas . Originally introduced by Roman Pichler, the product canvas has since tbeen tweaked and refined.

In its core, the product canvas covers:

- The name of the product

- Objectives and key metrics for success

- The ideal customer

- A high-level overview of what’s required to meet the customer’s needs

- Just enough product details about short-term goals

For our example product, the competitive analysis might look something like this:

Research obsessively

A simple Google search using keywords from your self-assessment can get you pretty far. Other resources that can help you identify your competitors include tools such as Crunchbase, Similarweb, Statista, etc.

As the old saying goes, the customer knows best. If you don’t have many customers yet, review sites such G2, Capterra, Trustpilot, and Google Reviews can help you.

If you do have customers, go ask them. Most customers try and evaluate several products before deciding on the right product to buy. Nothing is stopping you from asking them which other brands they considered and why they ultimately chose yours.

Once you have established who your competitors are, you might find yourself in a market with many direct and indirect competitors. If that is the case, select about seven of the most relevant competitors to include in your competitor deep dive.

2. Do a deep dive on each competitor

From your a shortlist of competitors, choose about seven of your most important and dig up all the relevant information on each one.

The research conducted during the previous step will help you capture the most relevant information about your competitors for the following categories:

Company profile

Ideal customer profile, product information, market approach, swot analysis.

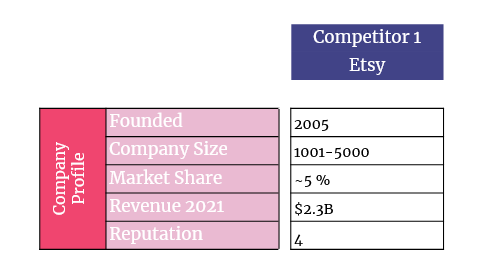

Start by creating a company profile for each of your competitors to gain a better understanding of who they are. Include the following information:

- Name — What is the name of your competitor?

- Founding date — When was the company founded? How long has it been in the market?

- Company size — How many employees does the company have? Are they equipped to service the market and innovate?

- Market share — The portion of the market controlled by the competitor’s product

- Revenue — The income the competitor generates from its product

- Reputation — What do customers think of your competitor’s product on a scale from one to five?

Let’s apply this framework to our AGORA competitive analysis example:

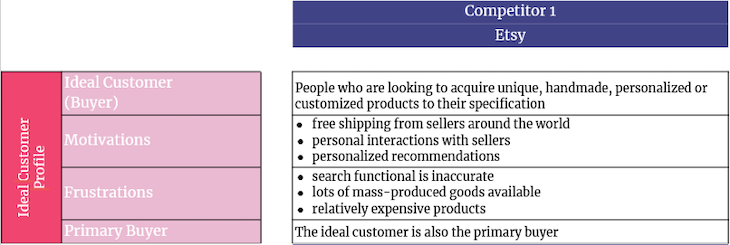

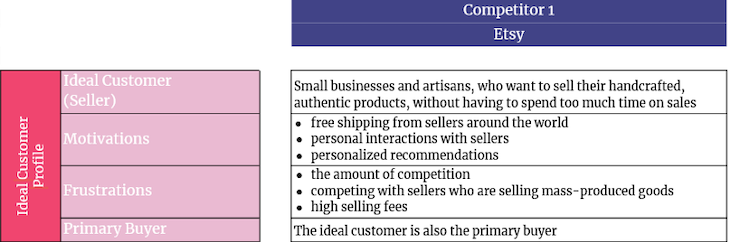

It’s important to understand who your competitors are serving and who is buying the product. This not only to reconfirm that the competitor is indeed a direct (or indirect) competitor, but also to understand what customers like and dislike about the competitor’s product.

The information you’re looking for includes:

- Ideal customer — Who is the competitor’s target customer and what defines them?

- Motivations — What does the customer enjoy about your competitor’s product?

- Frustrations — What does the customer hate about the product?

- Primary buyer — Who is the primary buyer of the product? Is it the as the ideal customer, or is it a different persona?

Let’s see what this would look like following our AGORA example. Below is an example ideal customer profile for Etsy. First, for the buyer:

And the ideal customer profile for Etsy sellers:

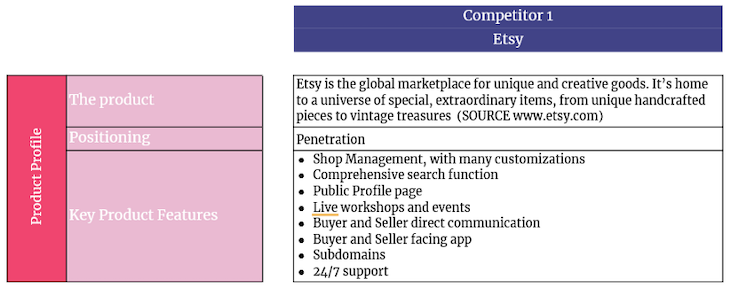

Not to be captain obvious, but you want to capture more details about the product your competitor is offering and its positioning.

The information we’re looking for at this step includes:

- The product — What is the tagline your competitor is using to market its product?

- Positioning — Based on the quality and price of the product, place the product into a one of several buckets. For example, Economy (low quality, low price), Skimming (low quality, high price), Penetration (high quality, low price), and Premium (high quality, high price)

- Product features — What are the key features being marketed and promoted?

Referring to our example AGORA app, the product information associated with Etsy on a competitor analysis might look as follows:

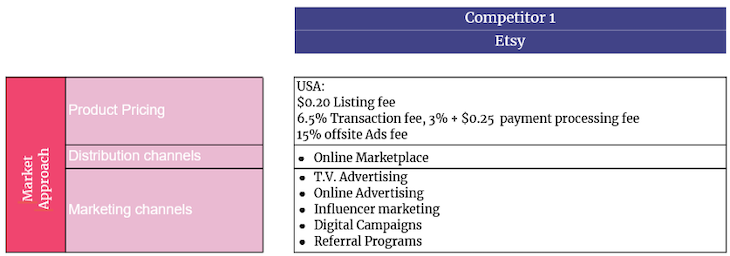

Next, seek to understand how your competitors are bringing the product to market .

List the following information:

- Pricing — What does the product costs? If there is a tiered pricing model, what does it look like?

- Distribution channels — Through which channels is your competitor selling the product?

- Marketing channels — Through which channels is the product being promoted?

In our AGORA competitor analysis example, this section would look something like:

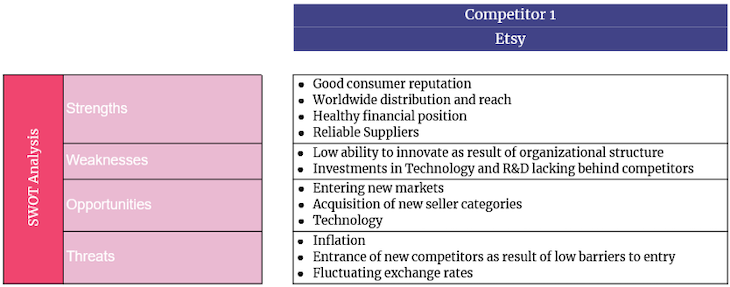

With all the information you’ve collected, you’ll find yourself in a good place to do a SWOT analysis . This is one of the most common and popular competitive analysis frameworks.

SWOT stands for strengths, weaknesses, opportunities, and threats:

- Strengths — What is going well for the competitor?

- Weaknesses — What is not going well? What obvious flaws are there?

- Opportunities — What could give your competitor an advantage?

- Threats — What might harm your competitor’s product?

For AGORA, our example competitive analysis might include a SWOT analysis that looks like this:

3. Develop a holistic overview and strategy

Now that you have a better view of your competitors, it’s time to determine how you want to approach them in the market: do you want to avoid your competitors or attack them?

Two extremely useful tools that can help you make this assessment are the competitive matrix and battle cards .

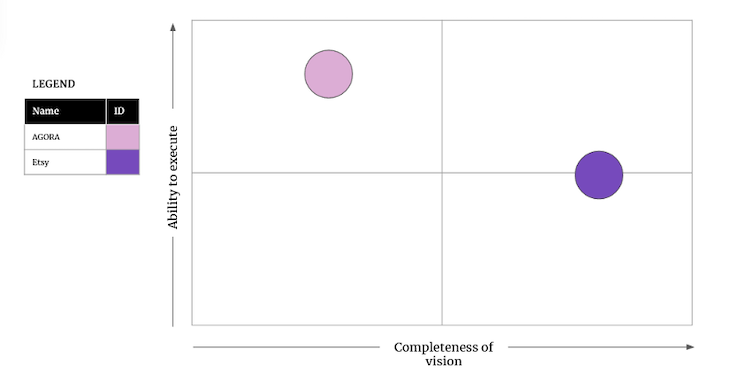

Competitive matrix

One way to operationalize the data you gathered during your competitive analysis is to plot out a four-quadrant competitive matrix.

Define key factors for the and x and y axes and plot yourself and your competition accordingly to see how you stack up. This approach is also known as perceptual mapping.

A competitive matrix for our example would look like this:

Battle cards

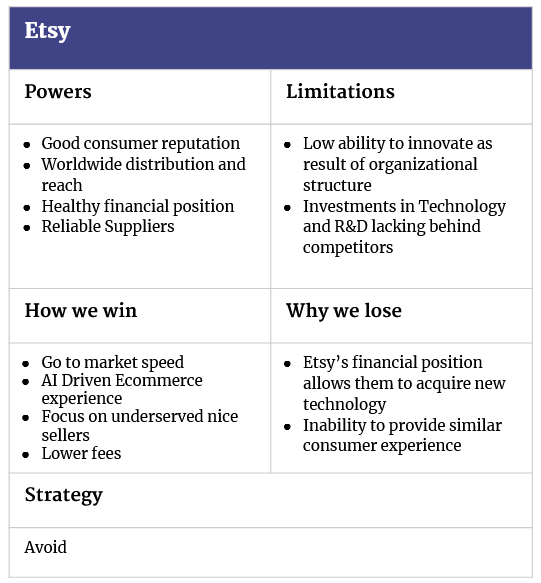

You can use the four-quadrant competitive matrix and competitor insights to create battle cards for each of your competitors.

Battle cards are a visual aid that help you compare your product against those of your competitors at a glance. It’s a quick and easy way to see how you stack up in key areas of performance and value. It’s also a neat way to help sales in their conversations with customers.

Here’s what you should include on each battle card:

- Company name — Name of your competitor

- Powers — What makes this competitor stand out from the rest?

- How we win — What should we do to gain a competitive advantage over this competitor?

- Why we lose — What is this competitor better at? What should we avoid so we don’t lose market share?

- Pricing — How much of a threat is the competitor’s product to our market share (low, medium, or high)?

- Strategy — Should we attack or avoid this competitor?

A battle card for our example competitive analysis might look as follows:

Alternative competitive analysis frameworks

If you‘ve followed the framework described above, you should have solid insight into your competitors, your product opportunities, and the best strategy to attack or avoid your competitors in the market.

If you want to dig deeper, you can follow up your competitive analysis by producing a Five Forces analysis and/or customer journey map .

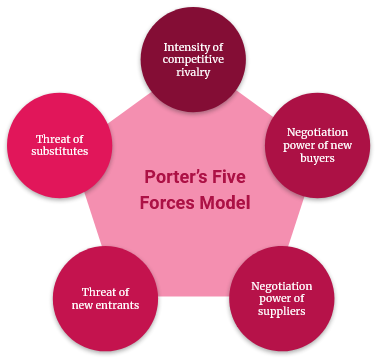

The Five Forces model

You still might want to consider gaining more insights into the competitive structure of the market you are in — in other words, gain a better understanding of how easy it is to either enter or be replaced by a competitor in the market.

A great framework to use for this type of competitor analysis is the Five Forces model , originally conceived by Michael Porter.

According to the Five Forces model, you can assess the market you are in by looking at:

- Intensity of competitive rivalry

- Negotiation power of new buyers

- Negotiation power of suppliers

- Threat of new entrants

- Threat of substitutes

Customer journey map

Instead of zooming out, you can also zoom in on the journey ideal customers make when interacting with the product itself, the distribution, or marketing channels.

On a journey map, your touchpoints are the customer, the activity performed, how the customer experiences the activities, and their expectations.

Free competitive analysis templates

A competitive analysis is a continuously updated document packed with information about your most important competitors to help you determine how to approach them in your target market.

The competitive analysis model described in this article consists of three steps that are designed to produce the insights you need to rule the market once and for all.

Below are free, customizable competitive analysis templates for each step of the process described in this article:

- Competitive analysis template

- Product canvas template

- Competitive matrix template

- Battle card template

- Customer journey map template

NOTE : To use and customize the competitive analysis templates above, after opening, select File > Make a copy from the main menu.

Featured image source: IconScout

LogRocket generates product insights that lead to meaningful action

Get your teams on the same page — try LogRocket today.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- #market analysis

Stop guessing about your digital experience with LogRocket

Recent posts:.

How failure to recall products can lead to liability claims

To proactively address liability concerns, you can create an internal product recall team for dealing with risks and ensuring quality.

Introducing Galileo AI Fall ‘24: Galileo Highlights is GA; announcing Ask Galileo

Our Galileo AI Fall ’24 release makes Highlights available to all Pro and Enterprise customers. We’re also debuting Ask Galileo, which enables you to directly ask questions about what you see in session replays.

Leader Spotlight: Adapting product strategies for B2B2C, with Mark Kamyszek

Mark Kamyszek, Vice President of Product Management at TeamSnap, talks about the product launch process for B2B2C companies.

A guide to context switching

Continuously switching between various tasks and activities strains cognitive resources and leads to feelings of fatigue and overwhelm.

Leave a Reply Cancel reply

IMAGES

VIDEO