- Search Search Please fill out this field.

- Corporate Finance

- Financial Analysis

What Is Business Forecasting? Definition, Methods, and Model

:max_bytes(150000):strip_icc():format(webp)/andy__andrew_beattie-5bfc262946e0fb005143d642.jpg)

What Is Business Forecasting?

Business forecasting involves making informed guesses about certain business metrics, regardless of whether they reflect the specifics of a business, such as sales growth, or predictions for the economy as a whole. Financial and operational decisions are made based on economic conditions and how the future looks, albeit uncertain.

Key Takeaways:

- Forecasting is valuable to businesses so that they can make informed business decisions.

- Financial forecasts are fundamentally informed guesses, and there are risks involved in relying on past data and methods that cannot include certain variables.

- Forecasting approaches include qualitative models and quantitative models.

Understanding Business Forecasting

Companies use forecasting to help them develop business strategies. Past data is collected and analyzed so that patterns can be found. Today, big data and artificial intelligence has transformed business forecasting methods. There are several different methods by which a business forecast is made. All the methods fall into one of two overarching approaches: qualitative and quantitative .

While there might be large variations on a practical level when it comes to business forecasting, on a conceptual level, most forecasts follow the same process:

- A problem or data point is chosen. This can be something like "will people buy a high-end coffee maker?" or "what will our sales be in March next year?"

- Theoretical variables and an ideal data set are chosen. This is where the forecaster identifies the relevant variables that need to be considered and decides how to collect the data.

- Assumption time. To cut down the time and data needed to make a forecast, the forecaster makes some explicit assumptions to simplify the process.

- A model is chosen. The forecaster picks the model that fits the dataset, selected variables, and assumptions.

- Analysis. Using the model, the data is analyzed, and a forecast is made from the analysis.

- Verification. The forecast is compared to what actually happens to identify problems, tweak some variables, or, in the rare case of an accurate forecast, pat themselves on the back.

Once the analysis has been verified, it must be condensed into an appropriate format to easily convey the results to stakeholders or decision-makers. Data visualization and presentation skills are helpful here.

Types of Business Forecasting

There are two key types of models used in business forecasting—qualitative and quantitative models.

Qualitative Models

Qualitative models have typically been successful with short-term predictions, where the scope of the forecast was limited. Qualitative forecasts can be thought of as expert-driven, in that they depend on market mavens or the market as a whole to weigh in with an informed consensus.

Qualitative models can be useful in predicting the short-term success of companies, products, and services, but they have limitations due to their reliance on opinion over measurable data. Qualitative models include:

- Market research : Polling a large number of people on a specific product or service to predict how many people will buy or use it once launched.

- Delphi method : Asking field experts for general opinions and then compiling them into a forecast.

Quantitative Models

Quantitative models discount the expert factor and try to remove the human element from the analysis. These approaches are concerned solely with data and avoid the fickleness of the people underlying the numbers. These approaches also try to predict where variables such as sales, gross domestic product , housing prices, and so on, will be in the long term, measured in months or years. Quantitative models include:

- The indicator approach : The indicator approach depends on the relationship between certain indicators, for example, GDP and the unemployment rate remaining relatively unchanged over time. By following the relationships and then following leading indicators, you can estimate the performance of the lagging indicators by using the leading indicator data.

- Econometric modeling : This is a more mathematically rigorous version of the indicator approach. Instead of assuming that relationships stay the same, econometric modeling tests the internal consistency of datasets over time and the significance or strength of the relationship between datasets. Econometric modeling is applied to create custom indicators for a more targeted approach. However, econometric models are more often used in academic fields to evaluate economic policies.

- Time series methods : Time series use past data to predict future events. The difference between the time series methodologies lies in the fine details, for example, giving more recent data more weight or discounting certain outlier points. By tracking what happened in the past, the forecaster hopes to get at least a better than average view of the future. This is one of the most common types of business forecasting because it is inexpensive and no better or worse than other methods.

Criticism of Forecasting

Forecasting can be dangerous. Forecasts become a focus for companies and governments mentally limiting their range of actions by presenting the short to long-term future as pre-determined. Moreover, forecasts can easily break down due to random elements that cannot be incorporated into a model, or they can be just plain wrong from the start.

But business forecasting is vital for businesses because it allows them to plan production, financing, and other strategies. However, there are three problems with relying on forecasts:

- The data is always going to be old. Historical data is all we have to go on, and there is no guarantee that the conditions in the past will continue in the future.

- It is impossible to factor in unique or unexpected events, or externalities . Assumptions are dangerous, such as the assumption that banks were properly screening borrowers prior to the subprime meltdown . Black swan events have become more common as our reliance on forecasts has grown.

- Forecasts cannot integrate their own impact. By having forecasts, accurate or inaccurate, the actions of businesses are influenced by a factor that cannot be included as a variable. This is a conceptual knot. In a worst-case scenario, management becomes a slave to historical data and trends rather than worrying about what the business is doing now.

Negatives aside, business forecasting is here to stay. Appropriately used, forecasting allows businesses to plan ahead for their needs, raising their chances of staying competitive in the markets. That's one function of business forecasting that all investors can appreciate.

Kesh, Someswar and Raja, M.K. "Development of a Qualitative Reasoning Model for Financial Forecasting." Information Management & Computer Security, vol. 13, no. 2, 2005, pp. 167-179.

Infiniti Research. " Business Forecasting: The Challenges in Knowing the Unknown ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-699097865-5914251597ff43a1b2e59a0c3cecc660.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Contact sales

Start free trial

Business Forecasting: Why You Need It & How to Do It

Table of Contents

What is business forecasting, the importance of business forecasting, business forecasting process, business forecasting methods, elements of business forecasting, sources of data for forecasting, business forecasting only goes so far, how projectmanager helps business forecasting.

Well-run organizations don’t fly by the seat of their pants; they’re constantly working on business forecasting and business planning. Every decision and every process is based on data obtained from business forecasting, business intelligence tools, market research and scenario planning. Companies focus their energies on ways to predict market trends to help them set successful long-term strategies.

Some business forecasts are based on highly sophisticated statistical methods while others are based on experience and past data. Others simply follow a gut feeling. One thing remains constant: all industries rely on business forecasting.

Business forecasting refers to the process of predicting future market conditions by using business intelligence tools and forecasting methods to analyze historical data.

Business forecasting can be either qualitative or quantitative. Quantitative business forecasting relies on subject matter experts and market research while quantitative business forecasting focuses only on data analysis.

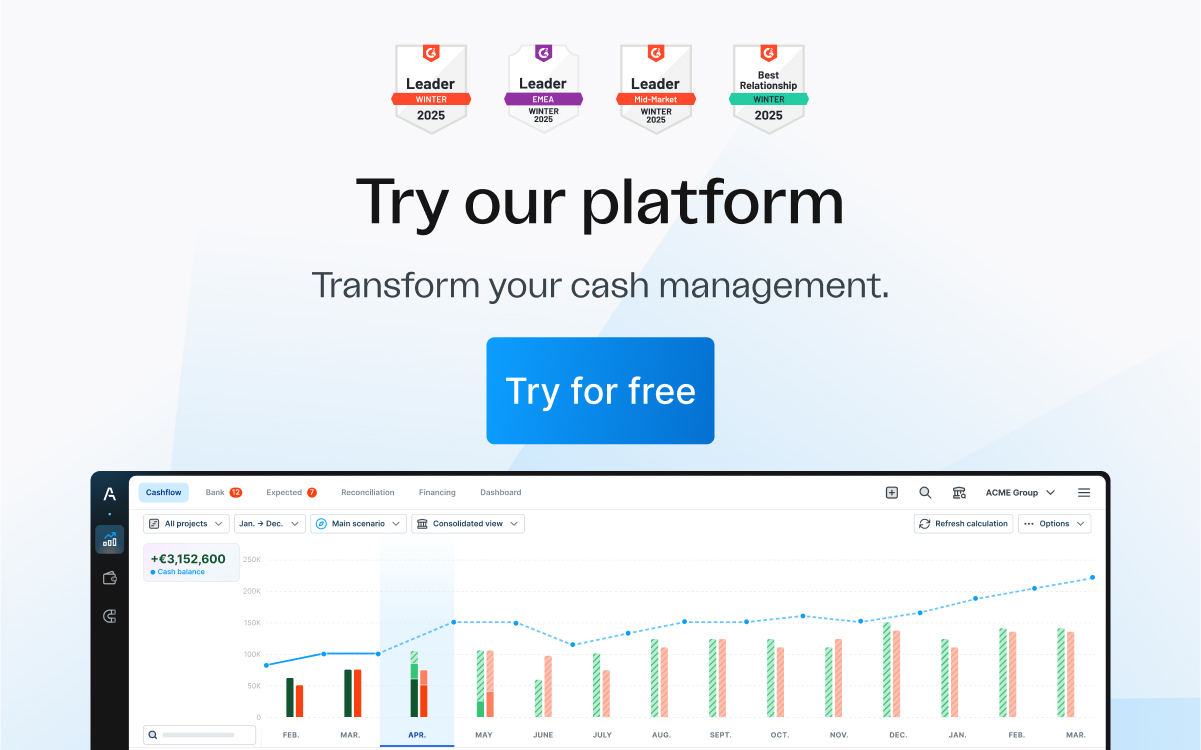

You can access historical data with project management tools such as ProjectManager , project management software that delivers real-time data for more insightful business forecasting. Our live dashboard requires no setup and automatically captures six project metrics which are displayed in easy-to-read graphs and charts. Get a high-level view of your project for better business planning. Get started with ProjectManager for free today.

Quantitative Forecasting

Quantitative forecasting is applicable when there is accurate past data available to predict the probability of future events. This method pulls patterns from the data that allow for more probable outcomes. The data used in quantitative forecasting can include in-house data such as sales numbers and professionally gathered data such as census statistics. Generally, quantitative forecasting seeks to connect different variables in order to establish cause and effect relationships that can be exploited to benefit the business.

Qualitative Forecasting

Qualitative forecasting is based on the opinion and judgment of consumers and experts. This business forecasting method is useful if you have insufficient historical data to make any statistically relevant conclusions. In such cases, an expert can help piece together the known bits of data you do have to try to make a qualitative prediction from that known information.

Qualitative business forecasting is also useful when little is known about the future in your industry. Relying on historical data is useless if that data is not relevant to the uncharted future you are approaching. This can be the case in innovative industries, or if there’s a new constraint entering the market that has never occurred before such as new tax law.

Business forecasting is critical for businesses whenever the future is uncertain or whenever an important strategic business decision is being made. The more the business can focus on the probable outcome, the more success the organization has as it moves forward.

Here are the steps that a business forecaster should typically follow:

- Define the question or problem you need to solve with your business forecasting efforts. For example, you might be interested in estimating whether your organization will be able to meet product demand for the next quarter.

- Identify the datasets and variables that need to be taken into consideration. In this case, datasets such as the sales records from the previous year and variables related to capacity, production and demand planning .

- Choose a business forecasting method that adjusts to your dataset and forecasting goals. That depends on whether your problem or question can be solved using a qualitative, quantitative or mixed approach.

- Based on the analysis of historical data, you can proceed to estimate future business performance. Keep in mind that the accuracy of your business forecasting depends on the quality of your data.

- Determine the discrepancy between your business forecast and actual business performance. Document your findings and improve your business forecasting process.

As stated above, there are two main types of business forecasting methods, qualitative and quantitative. We’ve compiled some of the more common forecasting models from both sides below.

Delphi Method

This qualitative business forecasting method consists in gathering a panel of subject matter experts and getting their opinions on the same topic in a manner in which they can’t know each other’s thoughts. This is done to prevent bias , which makes it possible for a manager to objectively compare their opinions and see if there are patterns, consensus or division.

Market Research

There are many market research techniques that evaluate the behavior of customers and their response to a certain product or service. Some of those market research methods collect and analyze quantitative data, such as digital marketing metrics and others qualitative data, such as product testing, or customer interviews.

Time Series Analysis

Also referred to as “trend analysis method,” this business forecasting technique simply requires the forecaster to analyze historical data to identify trends. This data analysis process requires statistical analysis as outliers need to be removed. More recent data should be given more weight to better reflect the current state of the business.

The Average Approach

The average approach says that the predictions of all future values are equal to the mean of the past data. Past data is required to use this method, so it can be considered a type of quantitative forecasting. This approach is often used when you need to predict unknown values as it allows you to make calculations based on past averages, where one assumes that the future will closely resemble the past.

The Naïve Approach

The naïve approach is the most cost-effective and is often used as a benchmark to compare against more sophisticated methods. It’s only used for time series data where forecasts are made equal to the last observed value. This approach is useful in industries and sectors where past patterns are unlikely to be reproduced in the future. In such cases, the most recent observed value may prove to be the most informative.

- Develop the Basis: Before you can start forecasting, you must develop a system to investigate the current economic situation around you. That includes your industry and its present position as well as its popular products to better estimate sales and general business operations.

- Estimating Future Business Operations: Now comes the estimation of future conditions, such as the course that future events are likely to take in your industry. Again, this is based on collected data to help with quantitative estimates for the scale of operations in the future.

- Regulating Forecasts: Whatever your forecast is, it must be compared to actual results. This is the only way to find deviations from the norm. Then the reasons for those deviations must be figured out, so action can be taken to correct those deviations in the future.

- Reviewing Forecasting Process: By reviewing the deviations between forecasts and actual performance data, improvements are made in the process, allowing you to refine and review the information for accuracy.

Your forecast will only be as good as the data you put into it. Before collecting data, ask yourself these questions:

- Why collect data?

- What kind of data?

- When to collect it?

- Where to collect it?

- Who will collect it?

- How will it be collected?

These are the questions that will shape your plan for the collection of data, a crucial facet of business forecasting. Once you have your plan, you can collect data from a variety of sources.

Primary Sources

Primary sources contain first-hand data, often collected with reporting tools . These are the ones that you or the person assigned this task to collect personally. If primary data is not available, you must go out and source it through interviews, questionnaires or observations.

Secondary Sources

Secondary sources contain published data or data that has been collected by others. This includes official reports from governments, publications, financial statements from banks or other financial institutions, annual reports of companies, journals, newspapers, magazines and other periodicals.

If business forecasting were a crystal ball, then everyone would be reaping the rewards of their foresight. While business forecasting is a tool to get a better view of what the future might have in store, there’s the argument that it’s wasting valuable time and resources on little return.

It’s true; you can follow the steps, use a variety of methodologies and still get it wrong. It is, after all, the future. There’s no way to ever manage all the variables that can impact future events. There are errors in calculations and the innate prejudices of the people managing the process, all of which add to the unpredictability of the results.

While you’re not going to have a clear, unobscured vision of the future by using business forecasting, it can provide you with insight into probable future trends to give your organization an advantage. Even a small step can be a great leap forward in the highly competitive world of business. By combining statistical and econometric models with experience, skill and objectivity, business forecasting is a formidable tool for any organization looking for a competitive advantage.

Clearly, business forecasting is a project unto itself. To manage a project and collect the data in a way that’s useful in the future, you need a project management tool that can help you plan your process and select the data that helps you decide on a way forward.

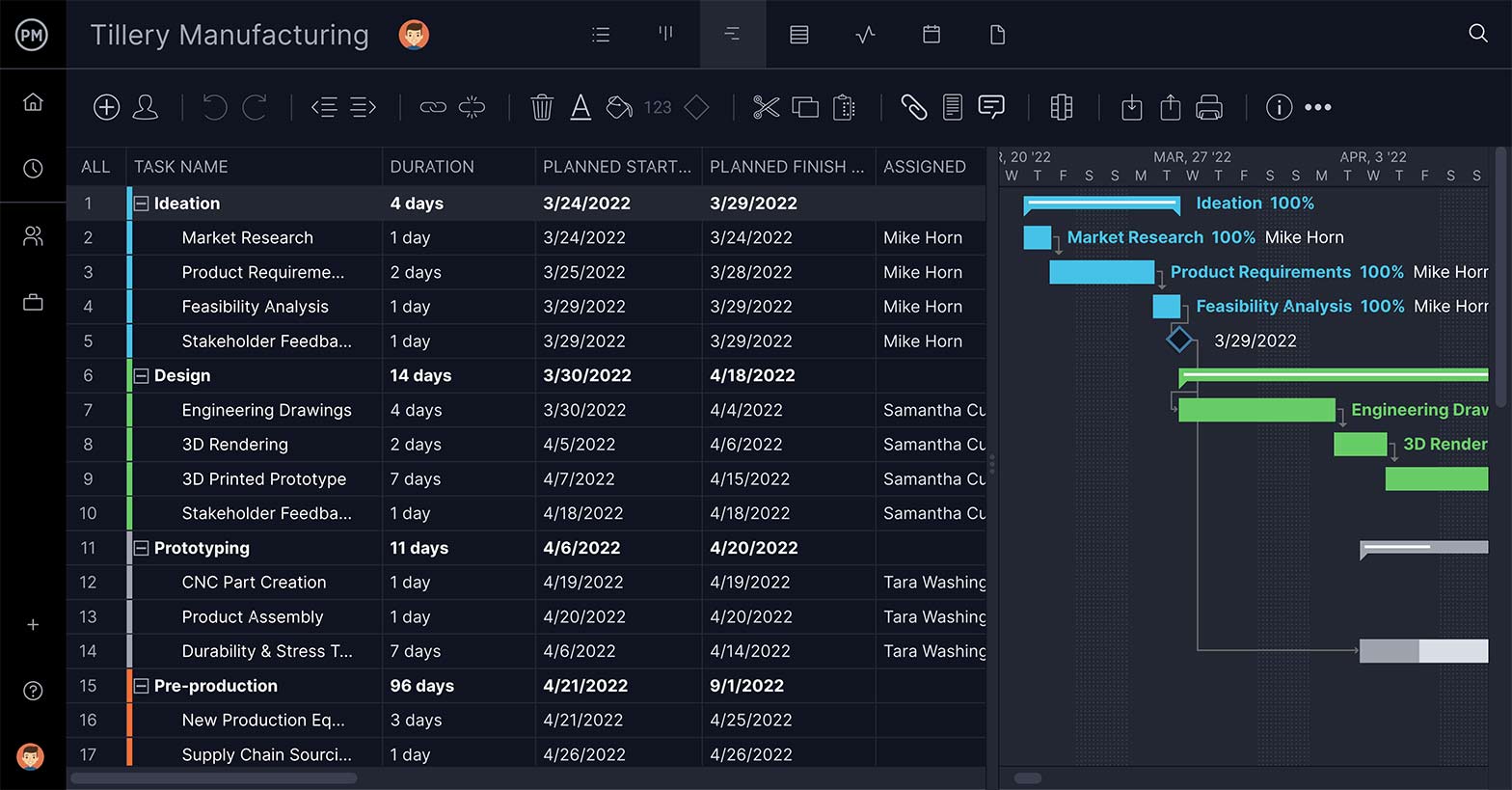

ProjectManager is award-winning software that organizes projects with features that address every phase. The first thing in forecasting is choosing how you’ll take action and make a plan. For example, if you’re going to interview customers to see where the market is likely headed, you’ll need to schedule those interviews. Our online Gantt chart places those interviews as tasks on a timeline so you can get everyone interviewed before your deadline.

Store All of Your Data in One Place

Those interviews will produce a lot of paperwork, and your data needs to be collected and stored somewhere easily accessible. You can attach notes to each task so the paperwork for each interviewee is saved with the notes that you took. You can also tag those tasks to make it easier to filter the project and locate the interview subjects for which you’re looking. If you’re worried that there’ll be too many documents and images attached to one task, don’t worry as we have unlimited file storage.

ProjectManager can’t predict the future, but it does provide you with the tools you need to take advantage of business forecasting. Our project management software collects data in real-time, and stores past data, allowing you to filter information and pull up the metrics you need to make the right decision. Try it today with this free 30-day trial.

Deliver your projects on time and under budget

Start planning your projects.

How to write a sales forecast for a business plan

Table of Contents

What is a sales forecast?

Why do you need a sales forecast, how do you write a sales forecast, top-down or bottom-up, writing your sales forecast, calculating a sales forecast, how can countingup help manage your forecasting.

Sales forecasts are an important part of your business plan . If done correctly, they can give accurate projections of your business’ cash flow, and let you better prepare for the year ahead. They can also make it easier to find the right investors . While it’s easier for existing businesses with plenty of data, you can still calculate a sales forecast for a new business .

In this guide, we’ll explore:

- How can you manage your forecasting?

A sales forecast is a prediction of your business’ future revenue. In order to be an accurate prediction, the forecast is based on previous sales, current economic trends, and industry performance. Having a sales forecast is a useful tool, because it gives you a better idea of how to manage your business.

Having a sales forecast is like using the past to have a peek into the future of your company. It might not be 100% accurate, but it can help you plan any future spending, or prevent any cash flow issues from occurring.

You can also use your sales forecast to monitor your business’ progress. For instance, if your business regularly performs better than your forecast, it could be a sign that your business is continuing to grow. On the other hand, if your actual sales are frequently less than expected, this could be a sign that your business is struggling and needs adjustment.

It’s important to remember that any projections you make aren’t guaranteed, there can be advantages and disadvantages of financial forecasting .

Now we’ve run through why having a sales forecast can help you run your business, let’s look at how to write one.

While there are two types of sales forecasting (top-down and bottom-up), one is a lot more accurate for small businesses than the other. A top-down forecast looks at the market as a whole and attributes a portion of the market to your business.

A top-down approach may work for large businesses that already own a significant chunk of the market. When forecasting for a small business, it’s easy to overestimate your market share. For example, a 1% market share may not seem like a lot, but a small restaurant owning 1% of the £89.5 billion UK market is extremely unrealistic.

The alternative to top-down is bottom-up. A bottom-up sales forecast starts with existing company data (like customer or product information) and works up to revenue. Since this starts with the company, it’s easier to

Your sales forecast is ultimately a prediction of your revenue over a set period. It considers the amount you think you’ll sell, and the cost of those sales. We’ve included how to calculate a sales forecast below.

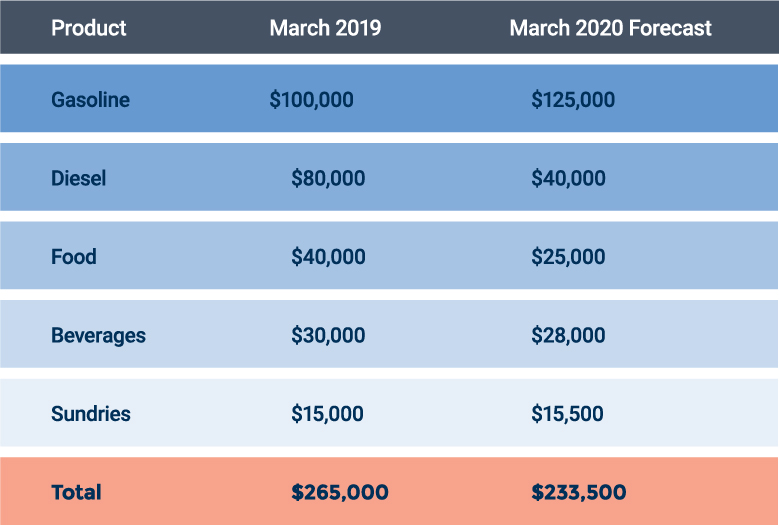

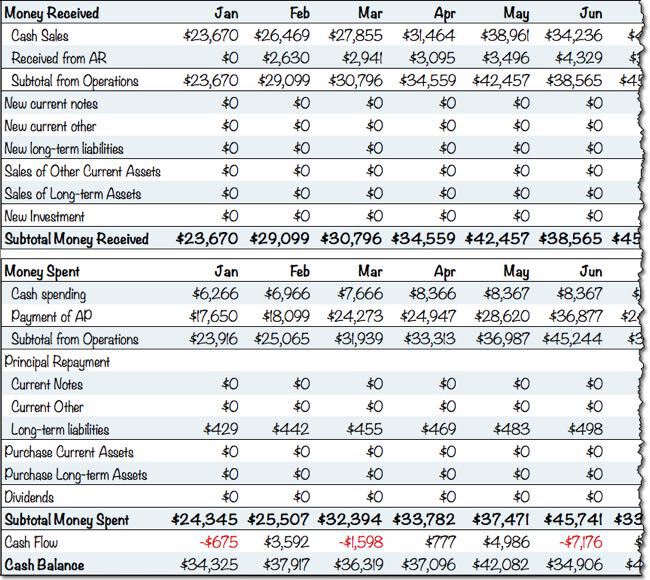

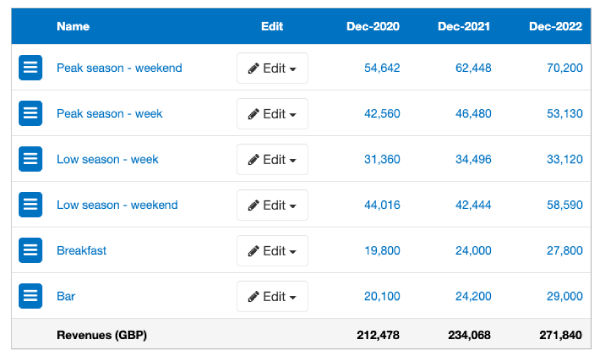

A sales forecast consists of three separate values: revenue, cost of goods sold, and gross profit. For estimating values in the calculations below, it’s best to use any existing business data to be as accurate as possible.

To calculate your predicted revenue:

- Make a list of your available goods and services

- Note the price of each of your goods and services

- Estimate the expected sales of each good or service

- Multiply the price by the estimated sales to get your estimated revenue

- Add them all together to get your total revenue

For example, if your food truck business sold pizzas at £10 and burgers at £5, you would multiply these values by how much you expected to sell. For calculating a weekly sales forecast, you might estimate selling 60 pizzas and 80 burgers. Your predicted revenue for that week would be £600 for pizzas and £400 for burgers — giving £1,000 total.

In order to figure out how much profit you’ll make, you also need to calculate your costs for those predicted sales. To calculate your predicted costs:

- Figure out how much each good or service will cost per unit

- Multiply each cost by the projected sales

Using the same example as above, assume a single pizza cost £3.50 to make and a burger cost £2. Using the estimated sales, the total cost for your pizzas (3.5 x 60) would be £210, and £160 for your burgers (2 x 80). Combining these two figures gives you a total cost of £370.

The last step is to work out your gross profit , and it’s a relatively simple calculation.

- Subtract the total predicted cost from your total predicted revenue

Continuing with the example above, your revenue (£1,000) minus your costs (£370), leaves you with a projected gross profit of £630 for the week. Using this estimate, you can then plan how much working capital your business should have access to. It’s important to remember that these are only estimates, and your actual values can be higher or lower than your forecast.

If you want your forecasts to be as accurate as possible, you need to refer to all of your business’ financial data. Since collecting and collating this data can be challenging, you may want to use financial management software like the Countingup app.

When trying to calculate your sales forecasts, having an up-to-date log of your current sales can be hugely beneficial. By combining a business current account with accounting software, Countingup is the only software that provides real-time cash flow tracking.

The Countingup app also provides business owners with access to automatically generated profit and loss statements. These can prove invaluable when trying to stay aware of all your business’ costs.

Start your three-month free trial today. Find out more here .

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

How to throw a launch party for a new business.

So your business is all set up and you’re ready to launch in

How to set up a TikTok shop (2024)

TikTok can be an excellent platform for growing a business, big or small.

Best side hustle ideas to start in 2024 (UK Edition)

Looking to start a new career? Or maybe you’re looking to embrace your

10 key tips to starting a business in the UK

10 things you need to know before starting a business in the UK

How to Register A Company in the UK

There are over four million companies registered in the UK – could your

How to set up your business: Sole trader or limited company

If you’ve just started a business, you’ll likely be faced with the early

How to register as a sole trader

Running a small business and considering whether to register as a sole trader?

How to open a Barclays business account

When starting a new business, one of the first things you need to

6 examples of objectives for a small business plan

Your new company’s business plan is a crucial part of your success, as

How to start a successful business during a recession

Starting a business during a recession may sound like madness, but some big

What is a mission statement (and how to write one)

When starting a small business, you’ll need a plan to get things up

How does self-employment work?

The decision to become self-employed is not one to take lightly, and you

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how to create a financial forecast for a startup business plan.

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

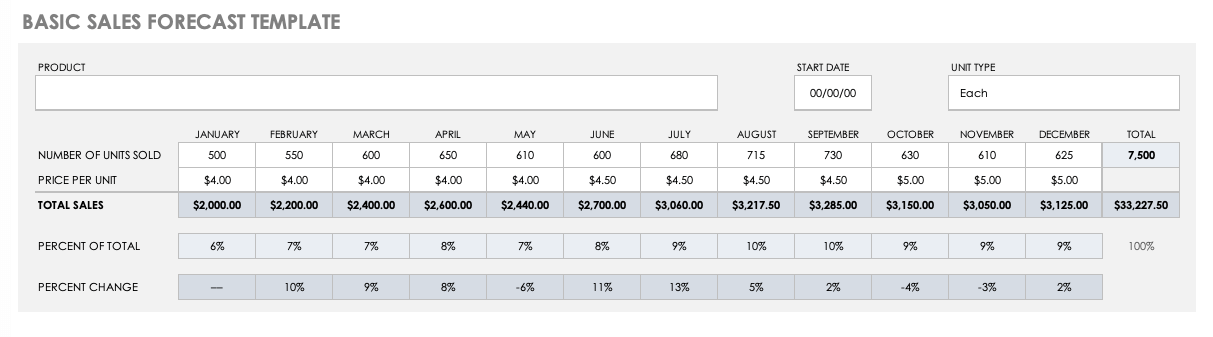

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

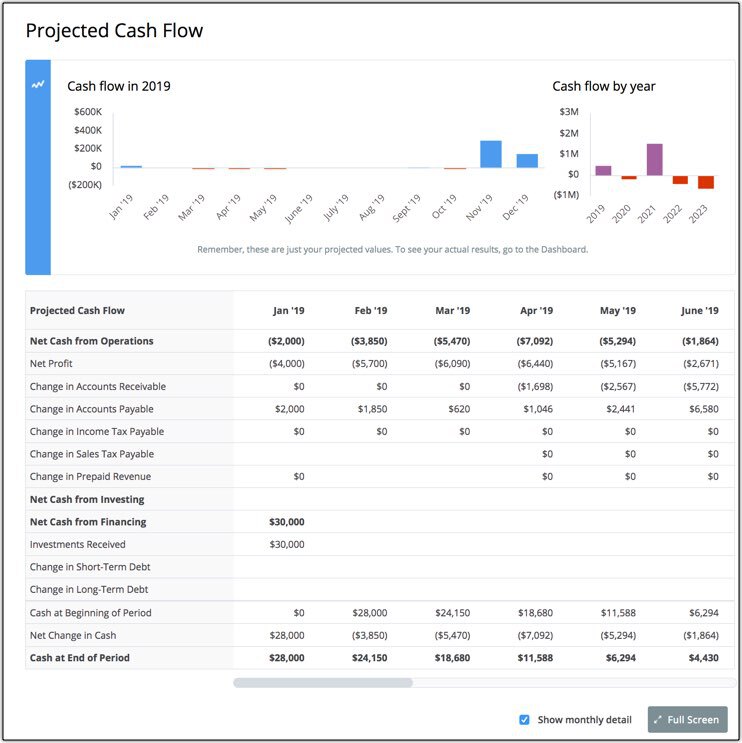

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

What is enterprise resource planning, choosing an enterprise resource planning tool for your small business, 10 benefits of erp systems for small businesses.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Professional Services

- Creative & Design

- See all teams

- Project Management

- Workflow Management

- Task Management

- Resource Management

- See all use cases

Apps & Integrations

- Microsoft Teams

- See all integrations

Explore Wrike

- Book a Demo

- Take a Product Tour

- Start With Templates

- Customer Stories

- ROI Calculator

- Find a Reseller

- Mobile & Desktop Apps

- Cross-Tagging

- Kanban Boards

- Project Resource Planning

- Gantt Charts

- Custom Item Types

- Dynamic Request Forms

- Integrations

- See all features

Learn and connect

- Resource Hub

- Educational Guides

Become Wrike Pro

- Submit A Ticket

- Help Center

- Premium Support

- Community Topics

- Training Courses

- Facilitated Services

What Is Business Forecasting? Why It Matters

April 25, 2021 - 10 min read

Companies conduct business forecasts to determine their goals, targets, and project plans for each new period, whether quarterly, annually, or even 2–5 year planning.

Forecasting helps managers guide strategy and make informed decisions about critical business operations such as sales, expenses, revenue, and resource allocation . When done right, forecasting adds a competitive advantage and can be the difference between successful and unsuccessful companies.

In this guide to business forecasting, we'll cover:

- What is business forecasting?

- What are the best forecasting techniques?

- Why forecasting in management is important

- How to conduct business forecasts

- A few forecasting examples for businesses

An introduction to business forecasting

What is business forecasting? Business forecasting is a projection of future developments of a business or industry based on trends and patterns of past and present data.

This business practice helps determine how to allocate resources and plan strategically for upcoming projects, activities, and costs. Forecasting enables organizations to manage resources , align their goals with present trends, and increase their chances of surviving and staying competitive.

The purpose of forecasts is to develop better strategies and project plans using available, relevant data from the past and present to secure your business's future . Good business forecasting allows organizations to gain unique, proprietary insights into likely future events, leverage their resources, set product team OKR , and become market leaders.

Managers conduct careful and detailed business forecasts to guarantee sound decision-making based on data and logic, not emotions or gut feelings.

What are important business forecasting methods?

There are several business forecasting methods. They fall into two main approaches:

- Quantitative forecasting

Qualitative forecasting

Quantitative and qualitative forecasting techniques use and provide different sets of data and are needed at different stages of a product's life cycle.

Note that significant changes in a company, such as new product focus, new competitors or competitive strategies, or changing compliance requirements diminish the connection between past and future trends. This makes choosing the right forecasting method even more important.

Quantitative business forecasting

Use quantitative forecasting when there is accurate past data available to analyze patterns and predict the probability of future events in your business or industry.

Quantitative forecasting extracts trends from existing data to determine the more probable results. It connects and analyzes different variables to establish cause and effect between events, elements, and outcomes. An example of data used in quantitative forecasting is past sales numbers.

Quantitative models work with data, numbers, and formulas. There is little human interference in quantitative analysis. Examples of quantitative models in business forecasting include:

- The indicator approach : This approach depends on the relationship between specific indicators being stable over time, e.g., GDP and the unemployment rate. By following the relationship between these two factors, forecasters can estimate a business's performance.

- The average approach : This approach infers that the predictions of future values are equal to the average of the past data. It is best to use this approach only when assuming that the future will resemble the past.

- Econometric modeling : Econometric modeling is a mathematically rigorous approach to forecasting. Forecasters assume the relationships between indicators stay the same and test the consistency and strength of the relationship between datasets.

- Time-series methods : Time-series methods use historical data to predict future outcomes. By tracking what happened in the past, forecasters expect to get a near-accurate view of the future.

Qualitative business forecasting is predictions and projections based on experts' and customers' opinions. This method is best when there is insufficient past data to analyze to reach a quantitative forecast. In these cases, industry experts and forecasters piece together available data to make qualitative predictions.

Qualitative models are most successful with short-term projections. They are expert-driven, bringing up contrasting opinions and reliance on judgment over calculable data. Examples of qualitative models in business forecasting include:

- Market research : This involves polling people – experts, customers, employees – to get their preferences, opinions, and feedback on a product or service.

- Delphi method : The Delphi method relies on asking a panel of experts for their opinions and recommendations and compiling them into a forecast.

How do you choose the right business forecasting technique?

- Choosing the right business forecasting technique depends on many factors. Some of these are:

- Context of the forecast

- Availability and relevance of past data

- Degree of accuracy required

- Allocated time to conduct the forecast

- Period to be forecast

- Costs and benefits of the forecast

- Stage of the product or business needing the forecast

Managers and forecasters must consider the stage of the product or business as this influences the availability of data and how you establish relationships between variables. A new startup with no previous revenue data would be unable to use quantitative methods in its forecast.

The more you understand the use, capabilities, and impact of different forecasting techniques, the more likely you will succeed in business forecasting.

Why is business forecasting important?

Any insight into the future puts your organization at an advantage. Forecasting helps you predict potential issues, make better decisions, and measure the impact of those decisions.

By combining quantitative and qualitative techniques, statistical and econometric models , and objectivity, forecasting becomes a formidable tool for your company.

Business forecasting helps managers develop the best strategies for current and future trends and events. Today, artificial intelligence, forecasting software, and big data make business forecasting easier, more accurate, and personalized to each organization.

Forecasting does not promise an accurate picture of the future or how your business will evolve, but it points in a direction informed by data, logic, and experiential reasoning.

What are the integral elements of business forecasting?

While there are different forecasting techniques and methods, all forecasts follow the same process on a conceptual level. Standard elements of business forecasting include:

- Prepare the stage : Before you begin, develop a system to investigate the current state of business.

- Choose a data point : An example for any business could be "What is our sales projection for next quarter?"

- Choose indicators and data sets : Identify the relevant indicators and data sets you need and decide how to collect the data.

- Make initial assumptions : To kickstart the forecasting process, forecasters may make some assumptions to measure against variables and indicators.

- Select forecasting technique : Pick the technique that fits your forecast best.

- Analyze data : Analyze available data using your selected forecasting technique.

- Estimate forecasts : Estimate future conditions based on data you've gathered to reach data-backed estimates.

- Verify forecasts : Compare your forecast to the eventual results. This helps you identify any problems, tweak errant variables, correct deviations, and continue to improve your forecasting technique.

- Review forecasting process : Review any deviations between your forecasts and actual performance data.

How do you do business forecasting?

Successful business forecasting begins with a collaboration between the manager and forecaster. They work together to answer the following questions:

- What is the purpose of the forecast? How will it be used?

- What are the components and dynamics of the system the forecast is focused on?

- How relevant is past data in estimating the future?

Once these answers are clear, choose the best forecasting methods based on the stage of the product or business life cycle, availability of past data, and skills of the forecasters and managers leading the project.

With the right forecasting method, you can develop your process using the integral elements of business forecasting mentioned above.

How do you get data for business forecasting?

A forecast is only as good as the data supplied. Before collecting data, ask:

- Why do you need it?

- What kind of data do you need?

- When will you collect it?

- Where will you gather it?

- Who is in charge of collecting it?

- How will you collect it?

- How will you analyze it?

When you have these answers, you can start collecting data from two main sources:

- Primary sources : These sources are gathered first-hand using reporting tools — you or members of your team source data through interviews, surveys, research, or observations.

- Secondary sources : Secondary sources are second-hand information or data that others have collected. Examples include government reports, publications, financial statements, competitors' annual reports, journals, and other periodicals.

Business forecasting examples

Some forecasting examples for business include:

- Calculating cash flow forecasts, i.e., predicting your financial needs within a timeframe

- Estimating the threat of new entrants into your market

- Measuring the opportunity of developing a new product or service

- Estimating the costs of recurring bills

- Predicting future sales growth based on past sales performance

- Analyzing relationships between variables, e.g., Facebook ads and potential revenue

- Budgeting contingencies and efficient allocation of resources

- Comparing customer acquisition costs and customer lifetime value over time

What are the limits of business forecasting?

You can follow the rules, use the right methods, and still get your business forecast wrong. It is, after all, an attempt to predict the future. Some limits to business forecasting include:

- Biases and errors by the forecasters or managers

- Incorrect information from employees, experts, or customers

- Inaccurate past numbers

- Sudden change in market conditions

- New industry regulations

How Wrike helps with business forecasting

The more accurate your business forecasting, the more effective your strategies and plans can be. While many things in business are out of your control, having an informed forecast of what lies ahead makes you prepared and confident about the future.

Wrike helps gather data in one central platform, extract insights, and communicate findings with forecasters and managers. Other benefits of Wrike include real-time data, integrations with other forecasting software, streamlined collaboration, and visibility into every business forecasting project.

Are you ready to make projections for your business, allocate your resources for the best results, and improve your business forecasting process? Get started with a two-week free trial of Wrike today.

Kelechi Udoagwu

Kelechi is a freelance writer and founder of Week of Saturdays, a platform for digital freelancers and remote workers living in Africa.

Related articles

Strengthen and Optimize Agency Resource Management

Improve your agency’s resource management processes and learn how Wrike boosts performance across the board with our robust project management software.

Release Management: Definition, Phases, and Benefits

What is release management and how can it improve software development strategy? In this guide, we talk about release management processes and their benefits.

The Definitive Guide to Data-Driven Marketing

Wondering what data-driven marketing is and how to reap its benefits for your business? Find out how to create your own data-driven strategy with our guide.

Get weekly updates in your inbox!

You are now subscribed to wrike news and updates.

Let us know what marketing emails you are interested in by updating your email preferences here .

Sorry, this content is unavailable due to your privacy settings. To view this content, click the “Cookie Preferences” button and accept Advertising Cookies there.

The Last Guide to Sales Forecasting You’ll Ever Need: How-To Guides and Examples

By Kate Eby | January 26, 2020 (updated August 26, 2021)

- Share on Facebook

- Share on LinkedIn

Link copied

Sales forecasts are a critical part of your business planning. In this comprehensive guide, you’ll learn how to do them correctly, including explanations of different forecasting methods, step-by-step tutorials, and advice from experienced finance and sales leaders.

Included on this page, you'll find details on more than 20 sales forecasting techniques , information regarding how to forecast sales for new businesses and products , a step-by-step guide on how to forecast sales , and a free sales forecast template .

What Is Sales Forecasting?

When you produce a sales forecast , you are predicting what your sales or revenue will be in the future. An accurate sales forecast helps your firm make better decisions and is arguably the most important piece of your business plan.

A sales forecast contrasts with a sales goal . The former is the realistic representation of what you believe will occur, while the latter is what you want to occur. Forecasts are never perfectly accurate, but you should be as objective as possible when creating a sales forecast. Goals, on the other hand, can be based on optimistic or motivational targets.

Because the sales forecast is critical to business planning, many different stakeholders in a company (beyond sales managers and representatives) rely on these estimates, including human resources planners, finance directors, and C-level executives.

In this article, you’ll learn about different sales forecasting methods with varying levels of sophistication. The most basic method is called naive forecasting , which uses the prior period’s actual sales for the new period’s forecast and does not apply any adjustments for growth or inflation. Naive forecasts are used as comparative figures for more robust methods.

What Is Sales Planning?

A sales plan describes the goals, strategies, target customers, and likely hurdles for your sales effort. The sales plan defines your sales strategy and the method of execution you will use to achieve the numbers in your sales forecast.

Overview of Sales Forecasting Steps

Your sales forecasting model can ultimately become very sophisticated, but to grasp the basics, you should first gain a high-level understanding of what is involved. There are three primary steps to getting started:

- Decide which forecasting method or technique you will use. Also, determine the time period for your forecast. Later in this guide, we will review different methods of forecasting sales, including how to know which is best for your business.

- Gather the data to plug into your forecast model. The data points will vary by method, but will almost always include your actual past sales and current growth rate.

- Pick a tool to support your forecasting effort. For learning purposes, you can start with pencil and paper, but soon after, you’ll want to take advantage of digital solutions. Common tools include spreadsheets, accounting software, and customer relationship management (CRM) or sales management solutions.

As you get going, remember not to be overly focused on complex formulas. Do regular reality checks to make sure your sales forecasts accord with common sense. Bounce forecasts off sales reps to get realistic feedback, and revise.

You will likely achieve greater accuracy if you build your forecasts based on unit sales wherever possible, because pricing can move independently from unit sales. Use data if you have it.

Benefits and Importance of Sales Forecasting

Sales forecasting helps your business by giving you data to make decisions concerning allocating resources, assigning staff, and managing cash flow and overhead. Using this data reduces your risk and supports your growth.

Your sales forecast enables you to predict both short and long-term performance and customer demand for your product. In the short term, having a sales forecast makes it easy for you to spot when actual sales are not meeting estimates and gives you an opportunity to make corrections early in the period.

The forecast guides how much you spend on marketing and administration, and the projections generate your sales reps’ objectives. In this way, sales forecasts are an important benchmark for gauging the performance of your sales reps.

Sales forecasts also lead to better management of inventory levels. With a good idea of how much product you will sell, you can stock enough to meet customer demand without missing any sales and without carrying more than you need. Excess inventory ties up capital and reduces profit margins.

In the long term, sales forecasts can help you prepare for changes in your business. For example, you might see that within a few years, your company will require more manufacturing capacity to meet growing sales. To expand capacity, you may need to build a new factory, so now you can start planning how you will pay for it. Predictive sales forecasting is a critical part of your presentation if you are seeking equity capital from investors or commercial loans for expansion.

In short, sales forecasting helps your business avoid surprises, so you aren’t making decisions in a crisis environment. Companies with trustworthy sales forecasts see a 10 percentage point greater increase in annual revenues compared to counterparts without, according to research from the Aberdeen Group .

What Makes a Good Sales Forecast?

The most important quality for a sales forecast is accuracy. But, the benefits of accuracy must be weighed against the time, effort, and expense of the forecasting technique.

Useful sales forecasts are also easily understood and often include visual elements, such as charts, graphs, and tables, to make important trends visible.

Ideally, you can quickly build a highly reliable sales forecast with simple, economical methods. The ultimate forecast method would automatically (i.e., without manual intervention) fetch the relevant data and make predictions using an algorithm finely tuned to your business.

In reality, the forecasting process is more time consuming and subjective. Sales forecasts often depend on reps’ assessments of how likely their prospects are to close, and perceptions vary widely. (A conservative rep’s 60 percent probability may be understated, while another rep’s 60 percent may be overly optimistic.)

Sales managers, who are usually responsible for forecasting, spend a lot of time factoring in these nuances and other market factors when calculating forecasts.

Surprisingly, spending more time on forecasting does not always improve accuracy. According to research from CSO Insights, sales managers who spend 15 to 20 percent of their time producing their forecast had win rates for approximately 46.5 percent of deals. But, when they spend more than 20 percent of their time on forecasting, the win rate declined by more than two percentage points.

An axiom of forecasting is that accuracy is highest during time periods that are close at hand and lowest during those that are far into the future. Short-term forecasts draw upon the following: deals that are already in the sales pipeline, the current economic environment, and actual market trends. So, the data underlying short-term forecasts is more reliable.

Forecasting for distant time periods requires bigger guesses about opportunities, demand, competitor activity, and product trends, so it makes sense that the forecast becomes less accurate the further into the future you go. (This concept applies to many companies, especially those that are young and growing; the concept becomes more relevant for all businesses at three years and beyond.) Bear this thought in mind when you look at your sales forecast in order to make long-term decisions.

Sales Forecasting Methods: Qualitative and Quantitative

Sales forecasting methods break down broadly into qualitative and quantitative techniques. Qualitative forecasts depend on opinions and subjective judgment, while quantitative methods use historical data and statistical modeling.

Qualitative Methods for Sales Forecasting

Sales forecasting often uses five qualitative methods. These are based on different ways of generating informed opinions about sales prospects. Creating and conducting these kinds of surveys is often expensive and time intensive. These five qualitative methods include the following:

- Jury of Executive Opinion or Panel Method: In this method, an executive group meets, discusses sales predictions, and reaches a consensus. The advantage of this method is that the result represents the collective wisdom of your most informed people. The disadvantage is that the result may be skewed by dominant personalities or the group may spend less time reflecting.

- Delphi Method: Here, you question or survey each expert separately, then analyze and compile the results. The output is then returned to the experts, who can reconsider their responses in light of others’ views and answers. You may repeat this process multiple times to reach a consensus or a narrow range of forecasts. This process avoids the influence of groupthink and may generate a helpful diversity of viewpoints. Unfortunately, it can be time consuming.

- Sales Force Composite Method: With this technique, you ask sales representatives to forecast sales for their territory or accounts. Sales managers and the head of sales then review these forecasts, along with the product owners. This method progressively refines the views of those closest to the customers and market, but may be distorted by any overly optimistic forecasts by sales reps. The composite method also does not take into account larger trends, such as the political or regulatory climate and product innovation.

- Customer Surveys: With this approach, you survey your customers (or a representative sample of your customers) about their purchase plans. For mass-market consumer products, you may use market research techniques to get an idea about demand trends for your product.

- Scenario Planning: Sales forecasters use this technique most often when they face a lot of uncertainty, such as when they are estimating sales for more than three years in the future or when a market or industry is in great flux. Under scenario planning, you brainstorm different circumstances and how they impact sales. For example, these scenarios might include what would happen to your sales if there were a recession or if new duties on your subcomponents increased prices dramatically. The goal of scenario planning is not to arrive at a single accepted forecast, but to give you the opportunity to counter-plan for the worst-case scenarios.

Quantitative Methods for Sales Forecasting

Quantitative sales forecasting methods use data and statistical formulas or models to project future sales. Here are some of the most popular quantitative methods:

- Time Series: This method uses historical data and assumes history will repeat itself, including seasonality or sales cycles. To arrive at future sales, you multiply historical sales by the growth rate. This method requires chronologically ordered data. Popular time-series techniques include moving average, exponential smoothing, ARIMA, and X11.

- Causal: This method looks at the historical cause and effect between different variables and sales. Causal techniques allow you to factor in multiple influences, while time series models look only at past results. With causal methods, you usually try to take account of all the possible factors that could impact your sales, so the data may include internal sales results, consumer sentiment, macroeconomic trends, third-party surveys, and more. Some popular causal models are linear or multiple regression, econometric, and leading indicators.

Sales Forecasting Techniques with Examples

In reality, most businesses use a combination of qualitative and quantitative methods to produce sales forecasts. Let’s look at the common ways that companies put sales forecasting into action with examples.

Intuitive Method

This forecasting method draws on sales reps’ and sales managers’ opinions about how likely an opportunity is to close, so the technique is highly subjective. Estimates from reps with a lot of experience are likely to be more accurate, and the reliability of the forecast requires reps and managers to be realistic and honest.

This method can be especially helpful if you do not have historical data or if you are assessing new prospects early in your funnel. In these cases, a rep’s gut feeling after initial contact can be a good indicator. If you are a manager, you will review reps’ estimates with an eye for any outliers and work with those reps to make any necessary adjustments.

Here is an example of the intuitive method in action: You manage a team of four sales reps. You go to each one and inquire about the leads they are nurturing. You ask each rep which opportunities they believe they will win in the next quarter and how much those sales will be worth. John, your strongest rep, tells you $175,000. Alice, another strong performer, says $115,000. Bob, who is in his second year at your company, reports $85,000. Jennifer, a recent college graduate, projects $100,000. You calculate the total of those forecasts and arrive at an intuitive forecast of $450,000. However, you suspect Jennifer’s forecast is unrealistic, because she is inexperienced, so you ask her more questions. Based on what you learn, you decide that only half of Jennifer’s deals are likely to close, so you reduce her contribution to $50,000 and revise your total quarterly forecast to $400,000.

Scenarios Method

Scenario forecasts are qualitative and involve you projecting sales outcomes based on a variety of assumptions. This process can also be a helpful business planning exercise, because once you identify major risks or uncertainty for your company, you can develop action plans to deal with these circumstances if they arise.

Scenario forecasts require an in-depth knowledge of your business and industry, and the quality of the forecast will vary with the expertise of the person or group who prepares the estimate.

To create a scenario forecast, think about the key factors that affect sales, external forces that could influence the outcome, and major uncertainties. Then, write a narrative and numerical description of how the scenario would play out under various combinations of these key factors, external forces, and uncertainties.

Here is an example of the scenarios method in action: Your company sells components for military vehicles. You notice that the most impactful things your sales reps do are meeting with procurement officers in the defense departments of major nations and holding factory tours and product demonstrations for them. These are your key factors.

The external forces are the number of tenders or requests for proposals that military procurement departments announce, and the value of those items. The risk of conflict in various parts of the world, scarcity of your raw materials, and trends in budget authorizations for defense by major countries are your critical uncertainties.

You look at how your key factors, external factors, and major uncertainties might combine. One scenario might entail the outcome if your reps increased the number of meetings and product events by 20 percent, the value of U.S. tenders launched rose by six percent, and France decreased defense spending by two percent.

Under this scenario, you might forecast a six percent increase in unit sales resulting from the following:

- Having more in-person sales contacts should boost sales by five percent based on past performance.

- You can increase revenue by three percent due to greater U.S. tender opportunities and your current market share.

- Major customer France will not purchase anything, reducing sales by two percent.

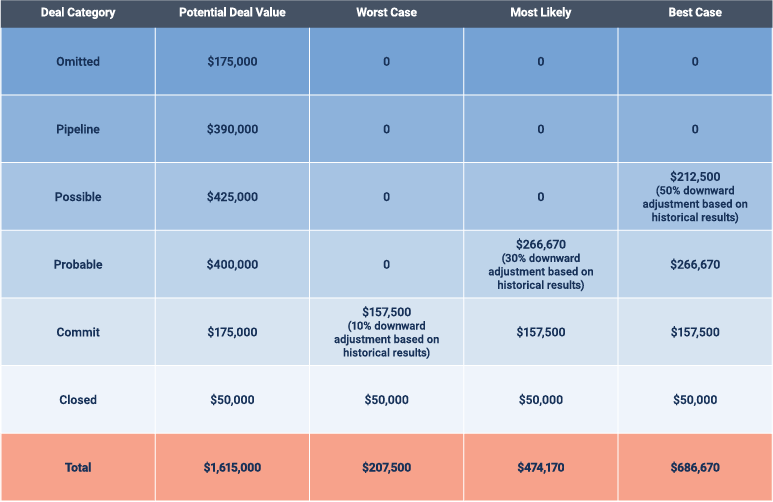

Sales Category Method

The category forecasting method looks at the probability that an opportunity will close and divides opportunities into groups based on this probability. The technique relies somewhat on intuition, as does the intuitive method, but the sales category method brings more structure and discipline to the process.

The categories that each company uses vary widely, but they correspond broadly to stages in the sales pipeline. These are some typical labels and definitions:

- Omitted: The deal has been lost or the prospect is no longer engaging.

- Pipeline: The opportunity will not realistically close during the quarter.

- Possible, Best Case, Upside, or Longshot: There is a realistic possibility that the deal could close at the projected value in the quarter if everything falls into place, but this is not certain. Overall, fewer than half of the opportunities in this group end up closing in the quarter at the planned value.

- Probable or Forecast: The sales rep is confident that the deal will close at the planned value in the quarter. Most of these opportunities will come to fruition as expected.

- Commit or Confident: The salesperson is highly confident that the deal will close as expected in this quarter, and only something extraordinary and unpredictable could derail it. The probability in this category is 80 to 90 percent. Any deal that does not close as forecast should generally experience only a short, unanticipated delay, rather than a total loss.

- Closed: The deal has been completed; payment and delivery have been processed; and the sale is already counted in the quarter’s revenue.

To compile your forecast, look at the combined value of the potential deals in the categories under three scenarios:

- Worst Case: This is the minimum value you can anticipate, based on the closed and committed deals. If you have very good historical data for your sales reps and categories and feel confident making adjustments, such as counting a portion of probable deals, you may do so, but it is important to be consistent and objective.

- Most Likely: This scenario is your most realistic forecast and looks at closed, committed, and probable deal values, again with possible adjustments based on historical results. For example, if you have tracked that only 60 percent of your probable deals tend to close in the quarter, adjust their contribution downward by 40 percent.

- Best Case: This is your most optimistic forecast and hinges on executing your sales process perfectly. You count deals in the closed, commit, probable, and possible categories, with adjustments based on past performance. The possible category, in particular, requires a downward adjustment.

As the quarter or period progresses, you revise the forecast based on updated information. This method can quickly get cumbersome and time consuming without an analytics solution.

Here is an example of the sales category method in action: You interview your sales team and get details from the reps on each deal they are working on. You assign the opportunities to a category, then make adjustments for each scenario based on past results. For example, you see that over the past three years, only half the deals in the possible category each quarter came to fruition. Here’s what the forecast looks like:

Top-Down Sales Forecasting

In top-down sales forecasting, you start by looking at the size of your entire market, called the total addressable market (TAM), and then estimate what percentage of the market you can capture.

This method requires access to industry and geographic market data, and sales experts say top-down forecasting is vulnerable to unrealistic objectives, because expectations of future market share are often largely conjecture.

Here is an example of top-down sales forecasting in action: You operate a new car dealership in San Diego County, California. From industry and government statistics, you learn that in 2018, 112 dealers sold approximately 36,000 new cars and light trucks in the county. You represent the top-selling brand in the market, you have a large sales force, and your dealership is located in the most populous part of the county. You estimate that you can capture eight percent of the market (2,880 vehicles). The average selling price per vehicle in the county last year was $36,000, so you forecast gross annual sales of $103.7 million. From there, you determine how many vehicles each rep must sell each month to meet that mark.

Bottom-Up Sales Forecasting

Bottom-up sales forecasting works the opposite way, by starting with your individual business and its attributes and then moving outward. This method takes account of your production capacity, the potential sales for specific products, and actual trends in your customer base. Staff throughout your business participates in this kind of forecasting, and it tends to be more realistic and accurate.

Begin by estimating how many potential customers you could have contact with in the period. This potential quantity of customers is called your share of market (SOM) or your target market . Then, think about how many of those potential customers will interact with you. Then, make an actual purchase.

Of those who do purchase, factor in how many units of your product they will buy on average and then how much revenue that represents. If you aren’t sure how much your customers will spend, you can interview a few.

Here is an example of bottom-up sales forecasting in action: Your firm sells IT implementation services to mid-sized manufacturers in the Midwest. You have a booth at a regional trade show, and 3,000 potential customers stop by and give you their contact information. You estimate that you can engage 10 percent of those people in a sales call after the trade show and convert 10 percent of those calls into deals. That represents 30 sales. Your service packages cost an average of $250,000. So, you forecast sales of $7.5 million.

Market Build-Up Method

In the market build-up method, based on data about the industry, you estimate how many buyers there are for your product in each market or territory and how much they could potentially purchase.

Here is an example of the market build-up method in action: Your company makes safety devices for subways and other rail transit systems. You divide the United States into markets and look at how many cities in each region have subways or rail. In the West Coast territory, you count nine. To implement your product, you need a device for each mile of rail track, so you tally how many miles of track each of those cities have. In the West Coast market, there are a total of 454 miles of track. Each device sells for $25,000, so the West Coast market would be worth a total $11.4 million. From there, you would estimate how much of that total you could realistically capture.

Historical Method

The historical sales forecasting technique is a classic example of the time-series forecasting that we discussed under quantitative methods.

With historical models, you use past sales to forecast the future. To account for growth, inflation, or a drop in demand, you multiply past sales by your average growth rate in order to compile your forecast.

This method has the advantage of being simple and quick, but it doesn’t account for common variables, such as an increase in the number of products you sell, growth in your sales force, or the hot, new product your competitor has introduced that is drawing away your customers.

Here is an example of the historical method in action: You are forecasting sales for March, and you see that last year your sales for the month were $48,000. Your growth rate runs about eight percent year over year. So, you arrive at a forecast of $51,840 for this March.

Opportunity Stage Method

The opportunity stage technique is popular, especially for high-value enterprise sales that require a lot of nurturing. This method entails looking at deals in your pipeline and multiplying the value of each potential sale by its probability of closing.

To estimate the probability of closing, you look at your sales funnel and historical conversion rates from top to bottom. The further a deal progresses through the stages in your funnel or pipeline, the higher likelihood it has of closing.

The strong points of this method are that it is straightforward to calculate and easy to do with most CRM systems.

But, opportunity-stage forecasting can be time consuming.

Moreover, this method doesn’t account for the unique characteristics of each deal (such as a longtime repeat customer vs. a new prospect). In addition, the deal value, stage, and projected close date have to be accurate and updated. And, the age of the potential deal is not reflected. This method treats a deal progressing quickly through the stages of your pipeline the same as one that has stalled for months.

If your sales process, products, or marketing have changed, the use of historical data may make this method unreliable.

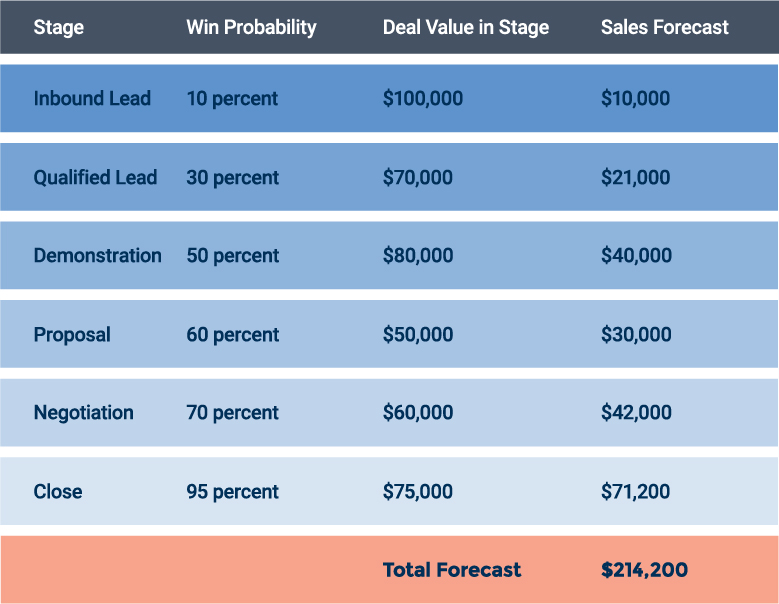

Here is an example of the opportunity stage method in action: Say your sales pipeline comprises six stages. Based on historical data, you calculate the close probability at each stage. Then, to arrive at a forecast, you look at the potential value of the deals at each stage and multiply them by the probability.

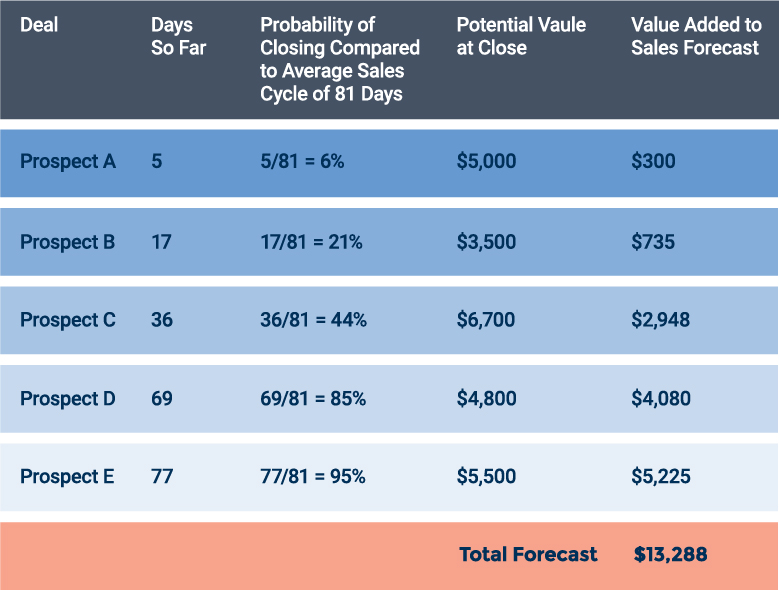

Length-of-Sales-Cycle Method

This is another quantitative method that shares some similarities with the deal stage method. However, this model looks at the length of your average sales cycle.

First, determine the average length in days of your sales process. This figure is also known as time to purchase or sales velocity . Add the total number of days it took to close all of the past year’s deals and divide by the number of deals. Then, calculate the probability of new deals closing in a certain period of time as a percentage of the average sales cycle length.

With this method, the biases of individual reps are less of a factor than with the deal stage model. Also, with this technique, you can fine-tune the probabilities for different lead types. (For example, prospects referred by current customers may close in an average of 27 days, while prospects who make contact after an online search need an average of 62 days.) But, this technique requires you to know and record how and when prospects enter your pipeline, which can be time intensive.

Here is an example of the length-of-sales-cycle method in action: You review the 37 deals your company won last year and see that they took a total of 2,997 days to close. To calculate the average length of the sales cycle, you divide 2,997 by 37 and see that the average sales cycle lasted 81 days. You then look at the five deals currently in your pipeline.

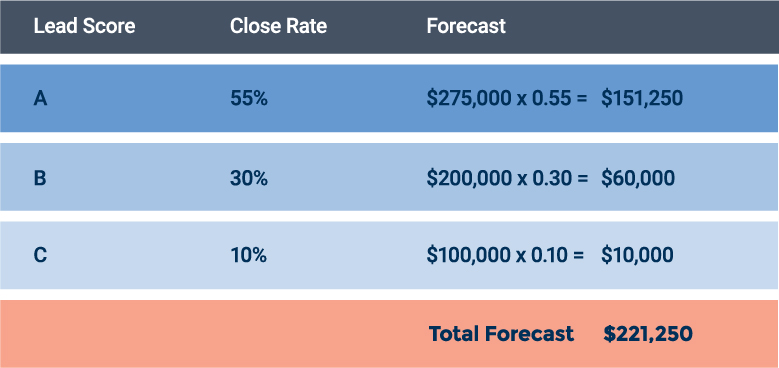

Lead Scoring Method

This technique requires you to have lead scoring in place. With lead scoring, you profile your ideal customers based on attributes (like industry, size, and location) as well as behavior (such as whether they have recently raised capital or whether the contact person has requested a demonstration of your product).

You then classify future leads based on how closely they match your ideal customer. You can label the categories with distinctions such as A, B, or C or hot, warm, or cold, or you can assign numbers up to one hundred using formulas that add and subtract points for different attributes and behaviors. (For example, “They requested a demo, which adds 15 points, but they are not in your ideal industry, which subtracts 10 points.”)

To create your forecast, you then look at the historical close rate for leads in each category and multiply that by the value of the opportunities currently in the group.

Here is an example of the lead scoring method in action: Your company sells textbooks for advanced math and science. Your ideal customer is a university with at least 25,0000 students that has an engineering school and is located on the east coast. These are your A prospects. B prospects have at least 10,000 students. C prospects have at least 10,000 students, but are located elsewhere in the country.

You then look at the close rates and potential deal values for each lead score. Finally, you multiply the close rate by the potential value of the deals in the category or by your average sales value.

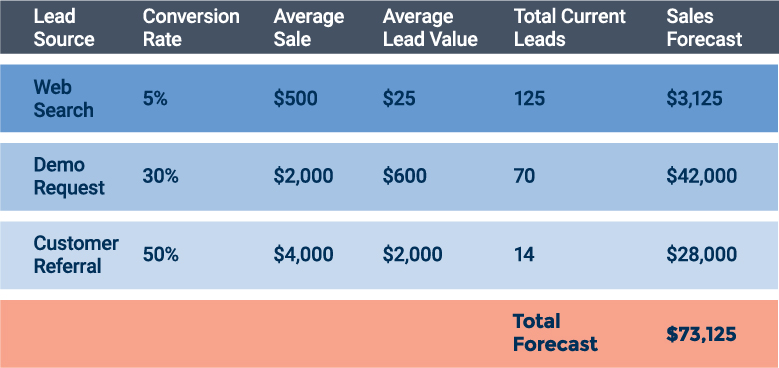

Lead Source Method

This model forecasts future sales based on how you acquired the lead, using the behavior of previous leads as a benchmark.

For example, say your company sells a software application. Some leads come from search traffic to your website; some originate with demonstration requests at conferences, and some are referrals from existing customers.

Look at your historical data to track the percentage of leads who converted to sales for each lead source. In addition, calculate the average value of a sale for each source. Then, by using the conversion probability and sales values, you can forecast the sales that the leads at the top of your funnel are likely to generate.

Here is an example of the lead source method in action: Based on source, you compile your historical data and discover the following conversion rates and sales value for leads.

One advantage of this sales forecasting method is that you can project how many leads of each type you would need to generate in order to hit a target. Suppose you have a conference coming up where participants will be able to request demonstrations of your product, and you would like to win an additional $30,000 in sales from the demo leads. Based on the average lead value of $600, you know you will want to generate 50 leads who request demos at the conference.

One drawback to lead source forecasting is that the method does not account for potential differences in the length of the sales cycle for the lead types. That makes it difficult to pinpoint the period in which the revenue will occur. Therefore, you should do a separate analysis of time to purchase in order to allocate sales to the right period.

Another challenge is that sometimes you may not be sure of the lead source. For example, suppose that another customer has recommended your product to a contact and that that contact decides to first check you out on your website. You might very well assign a lower lead value to this prospect, assuming they will behave like our web-originated leads, when, in reality, they will probably behave more like the customer referral leads.

Lastly, remember that this method won’t account for changes in your marketing or pricing that influence conversion rates and customer behavior.

Sales by Row Method

This method is a good fit for small businesses that sell different products or services. Rather than forecasting sales for each individual product type, you project sales for categories.

Each row in your forecast will cover different physical products (such as pick-up trucks, heavy trucks, and delivery vans) and service units (such as hours of labor or service types like replacing a faucet, unclogging a drain, or installing a toilet).

You can employ this method to forecast units and then factor them by average prices to arrive at revenue. Or, you can look exclusively at revenue. If you sell a subscription service, you can calculate recurring revenue for each product type.

For each row, you would look at how much you sold in the same period a year earlier and then adjust for factors such as inflation, organic growth, new products, increased workforce, or special circumstances.