MBA Knowledge Base

Business • Management • Technology

Home » Managerial Economics » Case Study: Inflation in India

Case Study: Inflation in India

Knowing Inflation

By inflation one generally means rise in prices. To be more correct inflation is persistent rise in the general price level rather than a once-for-all rise in it, while deflation is persistent falling price. A situation is described as inflationary when either the prices or the supply of money are rising, but in practice both will rise together. These days economies of all countries whether underdeveloped, developing as well developed suffers from inflation. Inflation or persistent rising prices are major problem today in world. Because of many reasons, first, the rate of inflation these years are much high than experienced earlier periods. Second, Inflation in these years coexists with high rate of unemployment, which is a new phenomenon and made it difficult to control inflation.

An inflationary situation is where there is ‘too much money chasing too few goods’. As products/services are scarce in relation to the money available in the hands of buyers, prices of the products/services rise to adjust for the larger quantum of money chasing them.

Read More: Definition of inflation and it’s types

Inflation is no stranger to the Indian economy. The Indian economy has been registering stupendous growth after the liberalization of Indian economy. In fact, till the early nineties Indians were used to ignore inflation. But, since the mid-nineties controlling inflation has become a priority. The natural fallout of this has been that we, as a nation, have become virtually intolerant to inflation. The opening up of the Indian economy in the early 1990s had increased India’s industrial output and consequently has raised the India Inflation Rate. While inflation was primarily caused by domestic factors (supply usually was unable to meet demand, resulting in the classical definition of inflation of too much money chasing too few goods), today the situation has changed significantly.

Inflation today is caused more by global rather than by domestic factors. Naturally, as the Indian economy undergoes structural changes, the causes of domestic inflation too have undergone tectonic changes. The main cause of rise in the rate of inflation rate in India is the pricing disparity of agricultural products between the producer and consumers in the Indian market. Moreover, the sky-rocketing of prices of food products, manufacturing products, and essential commodities have also catapulted the inflation rate in India. Furthermore, the unstable international crude oil prices have worsened the situation.

Defining causes of Inflation

What exactly is the nature of this inflation which has the nation in its grip? The different causes of inflation which are experienced in Indian economy in a large proportion would be:-

- Demand-pull inflation: This is basically when the aggregate demand in an economy exceeds the aggregate supply. It is also defined as `too much money chasing too few goods’. Bare-boned, it means that a country is capable of producing only 100 items but the demand is for 105 items. It’s a very simple demand-supply issue. The more demand there is, the costlier it becomes. Much the same as the way real estate in the country is rising.

- Cost-push inflation: This is caused when there is a supply shock. This represents the condition where, even though there is no increase in Aggregate Demand, prices may still rise. I.e. non availability of a commodity would lead to increase in prices. This may happen if the costs of especially wage cost rise.

- Imported Inflation: This is inflation due to increases in the prices of imports. Increases in the prices of imported final products directly affect any expenditure-based measure of inflation. They play an important role in driving the rise in domestic prices. The rise in the global prices of crude oil and agricultural commodities, including food grains, and industrial products, and setbacks to global economy resulting from sub-prime mortgage disaster and US recession have contributed to India’s inflation.

Other Causes:

- When the government of a country print money in excess, prices increase to keep up with the increase in currency, leading to inflation.

- Increase in production and labor costs, have a direct impact on the price of the final product, resulting in inflation.

- When countries borrow money, they have to cope with the interest burden. This interest burden results in inflation.

- High taxes on consumer products, can also lead to inflation. An increase in indirect taxes can also lead to increased production costs.

- Inflation can artificially be created through a circular increase in wage earners demands and then the subsequent increase in producer costs which will drive up the prices of their goods and services. This will then translate back into higher prices for the wage earners or consumers. As demands go higher from each side, inflation will continue to rise.

- Debt, war and other issues that cause a drastic financial blunder can also cause the inflation.

Measuring Inflation

Inflation in India is mainly estimated on the basis of fluctuations in the wholesale price index (WPI). The wholesale price index comprises of the following indices:

- Domestic Wholesale Price Index (DWPI)

- Export Price Index (EPI)

- Import Price Index (IPI)

- Overall Wholesale Price Index (OWPI)

The WPI consists of about 435 items and has three broad categories. They are:-

- Primary Articles (weight of 22.0253) — 22% Index

- Fuel, Power, Light, and Lubricants (weight of 14.2262) – 14% Index

- Manufactured Products (weight of 63.7485) — 64% Index

The base year of the WPI is 1993-94. The base year usually chosen is one where there has been fairly less volatility. The Indian WPI figure is released weekly on every Thursday. But recently the government has approved the proposal to release a wholesale price based inflation data on a monthly basis, instead of every week. The new series of WPI based inflation with 2004-05 as the base year would be launched soon. The move is aimed at improving the accuracy of the inflation data.

The monthly release of WPI is a widely-followed international practice. And, it is expected to improve the quality of data. Collection of price data of manufactured products will, accordingly, have a monthly frequency consistent with the practice of release of WPI. The new series of WPI based inflation with 2004-05 as the base year would be launched soon. However, the government will continue to release a weekly index for primary articles, and commodities in the fuel, power, light and lubricants groups. The weekly index will facilitate monitoring of prices of agricultural commodities and petroleum products, which are sensitive in nature.

Problems of Inflation

It has been reported that the manufacturing capacity in India is running around 95 per cent, which usually means it is running at full capacity. Therefore, when the price of manufactured products is increasing, it means that demand is usually higher than supply and that is a clear case of demand-pull inflation.

On the primary goods front, which consists of fruits, vegetables, food-grains etc, it is not that straight-forward. It has certainly been all over the news that the prices of fruits and vegetables are increasing and a trip to the supermarket or local grocery shop will testify to that. Although it is a clear case of demand-pull inflation, on the other, it is also a bit of a supply shock when one considers the fact that there is an abnormally high percentage of fruits and vegetables that goes to waste because of the lack of cold-storage facilities. Some estimates say 50 per cent of produce goes to waste and that is a conservative number.

The fuel price hike is a straight example of cost push inflation. When OPEC (The Organization of the Petroleum Exporting Countries) was formed, it squeezed the supply of oil and this caused oil prices to rise, contributing to higher inflation. Since oil is used in every industry, a sharp rise in the price of oil leads to an increase in the prices of all commodities.

The in depth problems due to inflation would be:

- When the balance between supply and demand goes out of control, consumers could change their buying habits, forcing manufacturers to cut down production.

- Inflation can create major problems in the economy. Price increase can worsen the poverty affecting low income household.

- Inflation creates economic uncertainty and is a dampener to the investment climate slowing growth and finally it reduce savings and thereby consumption.

- The producers would not be able to control the cost of raw material and labor and hence the price of the final product. This could result in less profit or in some extreme case no profit, forcing them out of business.

- Manufacturers would not have an incentive to invest in new equipment and new technology.

- Uncertainty would force people to withdraw money from the bank and convert it into product with long lasting value like gold, artifacts.

The imbalances inflation has created in the Indian economy:-

- It has created a new rich class in social and political lives who are corrupt themselves and also corrupt the overall society.

- The increased prices reduced the capacity to save and people preferred present consumption to future consumption.

- It has provided protection and subsides to industries which bred inefficiency.

- It has lead to misallocation of resources due to distortion of relative prices and finally a redistribution of wealth from the poor to the rich.

- It disturbs balance of payments.

Curbing Inflation

There are several reasons why we should worry about the spike in the inflation rate. Inflation is a tax on the poor and long-term lenders. Inflation is already too high, though it is definitely not at economy-wrecking levels. But it’s best to be serious about the threat it poses. Inflation has emerged as the biggest risk to the global outlook, having risen to very high levels across the world, levels that have not been generally seen for a couple of decades.

Currently, in India, we go through boom-and-bust cycles; sometimes GDP growth rates are very high and sometimes GDP growth rates drop sharply. This boom-and-bust cycle is unpleasant for every household. There is a powerful international consensus that stabilizing inflation reduces this boom-and-bust cycle of GDP growth.

India is facing the problem of inflationary pressure because of the increase in Aggregate Demand while Aggregate Supply is respectively constant. The inflationary pressure faced by Indian Economy is due to Demand-Pull inflation i.e. Aggregate Demand > Aggregate Supply. Thus to curb inflation need to fill the gap between Aggregate Demand and Aggregate Supply. For this either we need to increase Aggregate Supply or decrease Aggregate Demand that can hamper economic development. To increase Aggregate Supply either there is a need to increase production capacity of all current production units or to build new production plants.

But as quoted in a survey done by RBI that all the production plants are running at their full production capacity thus all resources are full employed. The other way is to build new plant but to do this will take at least 18months to 2years. Thus meanwhile we need to decrease Money Supply, which is opted by RBI. Increasing production of useful goods and services is what India should focus on.

As in the short run it is not possible to meet the gap between Aggregate Demand and Aggregate Supply thus RBI is planning to decrease liquidity by reducing Money Supply from the market. RBI planned that Liquidity from the market can be drained by decreasing money supply and to do so it is increasing CRR, repo rate, reverse repo rate and taking other measure like that.

CRR i.e. Cash Reserve Ratio (Liquidity Ratio) is the percentage of deposit that a commercial bank needs to keep with RBI by which RBI control liquidity in the market and create Money Supply. Repo Rate is the rate at which RBI lends money to other commercial Banks.

The Reserve Bank said that such decisions had been taken to curb inflation in India. RBI is taking positive steps to reduce the inflation since inflations rates are going up week by week. By raising the reserve rate, a deflationary pressure can be put on the economy, since the money multiplier has been reduced. People will therefore save more. But in this hike, there is negative impact in terms of higher interest rates and personal loans, vehicle loans and other loans become costly. RBI may hike the rate to reduce the money circulation in the country but it also decreased the sales of all loan items and further it reduces the manufacturing activity of many industries. Now the public and private sector banks may raise the interest rate at which they lend money to borrowers.

Produce more exports than imports than another country, then your money deflates with respect to that currency. Exporting becomes a problem cause buyers from outside feel that the goods are expensive so they prefer buying some other country’s goods with cheaper rate. Thus money does not come in. in the same way, when public has more money they buy foreign goods, thus money goes out which is bad. There is a need to encourage people to purchase goods produced within the country.

It is important for policymakers to make credible announcements and degrade interest rates. Private agents must believe that these announcements will reflect actual future policy. If an announcement about low-level inflation targets is made but not believed by private agents, wage-setting will anticipate high-level inflation and so wages will be higher and inflation will rise. A high wage will increase a consumer’s demand (demand pull inflation) and a firm’s costs (cost push inflation), so inflation rises. Hence, if a policymaker’s announcements regarding monetary policy are not credible, policy will not have the desired effect.

Keynesians emphasize reducing demand in general, often through fiscal policy, using increased taxation or reduced government spending to reduce demand as well as by using monetary policy. Supply-side economists advocate fighting inflation by fixing the exchange rate between the currency and some reference currency such as gold. This would be a return to the gold standard. All of these policies are achieved in practice through a process of open market operations.

As individuals what can we do to stop Inflation?

Firstly save!!! As much of your money as possible should be saved. This will reduce the demand on the economy and hopefully reduce inflation. Do not overuse daily essentials like cooking gas, electricity etc. Cut down on inessentials when buying groceries. Look for cheaper alternatives to products that you normally buy.

Keep roads, highways, sidewalks, etc., beautified to help attract tourism and bring additional monetary into a growing economy. Stop illegal immigration. Illegal activities reap the benefits of the country but don’t pay taxes. Government-backed investment schemes such as Post Office Savings Schemes, Public Provident Funds (PPF) and National Savings Certificates (NSC) are best to invest in when inflation is slowly inching up and you are only looking at safety, not returns. Invest in short term deposits and funds, commodities and property. This will help you to slowly reach your financial goals while safeguarding your hard-earned money.

Read More: Treasury bills and inflation control

Related posts:

- Definition of Inflation – Types of Inflation

- Case Study: Advertising Strategies of The Times of India

- Case Study: McDonald’s Business Strategies in India

- Case Study: L’Oreal Marketing Strategies in India

- Case Study: Coffee Cafe Business in India

- Case Study on MNC’s Marketing Strategies: In India, it’s a Brand New Way

- Case Study of Kishore Biyani: India’s Retail King

- Case Study of Maggi: Brand Extension and Repositioning in India

- Case Study on Vodafone’s Re-Branding Strategies in India: Hutch to Vodafone

- The Stages of Inflation

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Open access

- Published: 21 June 2022

The impact of macroeconomic factors on food price inflation: an evidence from India

- Asharani Samal ORCID: orcid.org/0000-0001-8275-0267 1 ,

- Mallesh Ummalla 2 &

- Phanindra Goyari 1

Future Business Journal volume 8 , Article number: 15 ( 2022 ) Cite this article

5 Citations

Metrics details

The present study investigates the impact of macroeconomic factors on food price inflation in India utilizing the monthly time series during January 2006–March 2019. The long-run relationship is confirmed among the variables using the ARDL bounds testing approach to cointegration. The coefficients of long-run estimates show that per capita income, money supply, global food prices, and agricultural wages are positively and significantly impacted food price inflation in both the short and long-run. While food grain availability has a negative and significant impact on food price inflation in both the short-run and long run. Further, the short-run estimates revealed that real exchange rate positively impacts food price inflation. However, the coefficient is insignificant in the short-run. The Granger causality estimates show that a short-run bidirectional causality is confirmed among per capita income, the exchange rate, per capita net availability of food grain and food price inflation. Further, there is evidence of unidirectional causality running from global food prices to food price inflation. However, there is no causal relationship running from money supply and agricultural wages to food price inflation in the short-run.

Introduction

The main objective of monetary policy in any economy is to maintain price stability. However, high food price inflation affects not only macroeconomic stability but also small farmers and poor consumers of the developing country where poor people spend their massive portion of income on food consumption. Agricultural commodity price volatility negatively impacts all societies by causing macroeconomic instability; specifically, it affects the impoverished that spend a large portion of their resources on food and fuel [ 47 ]. Therefore, high food price inflation has become a significant concern among the researchers and policymakers in determining responsible factors to surge in food price inflation. The high food price inflation has been experienced in the recent period due to increasing demand for biofuels in many developed countries, increasing demand for various diets among newly prosperous populations as compared to the production of such foodstuff, rise in minimum support prices, rapid regional economic growth, increasing the cost of fertilizers and other inputs, rising oil prices, etc.

Agriculture is very competitive in producing homogenous goods, given its vulnerability and high dependence on monsoon. It also contributes 17% of gross domestic product and employs more than 50% of the population. However, the contribution of the agricultural sector to GDP has been declining substantially since 2014, and the growth of agriculture is likely to increase by 2.1% in 2018–19 [ 23 ]. Further, price of agricultural products is more volatile than the non-agricultural sector due to high dependence on climate change. Therefore, attention should be given to the agricultural sector and the behavior of agriculture prices, especially for developing countries like India, where the majority of the population depends on agriculture. The persistent and high food price inflation over the period has gained more extensive attention in India by the researchers and policymakers as food price inflation has been the major contributor behind the increase in overall Wholesale Price Index (WPI) inflation in India [ 2 ]. Further, agricultural price is susceptible to relative changes in input prices, supply factors, etc.

Theoretically, rising food prices are basically due to two factors in the literature, i.e., real and monetary shocks. These are explained by structuralist and monetarist approaches, respectively. According to structuralists, the money supply is passive, and the real shocks in a particular sector tend to upsurge in food price inflation. Hence, inflation occurs in the prices of other goods. However, monetarists argued that inflation could arise through an autonomous increase in money supply via generating aggregate demand, which increases the relative price of commodities. Therefore, an increase in money supply is a cause for inflation, not necessarily by real shocks.

However, the developing countries like India are not exceptional from higher food prices and macro-economic instability. Since the 1991 economic reforms, the Indian economy has maintained a single-digit economic growth rate and moderate inflation. However, in recent years, one of the major problems that the Indian economy is facing is higher food price inflation. The WPI food price inflation was documented 10.20% during January 2008–July 2010 [ 33 ]. Further, CPI-IW for food was experienced at 8.05% during 2006–2019 while it was recorded at 13%, especially in 2013. However, the growth rate of gross food grain production was 2.66% during this period. The demand for food commodities increases at a higher rate due to the high economic growth rate (7–9%) per annum. In contrast, the annual growth of agriculture is relatively low (1.5%) compared to the service sector and GDP growth [ 40 ]. The total investment in agriculture has been reduced from 2.43 to 1.28% during 1979–80 to 2007–08 period [ 28 ]. The expenditure on subsidies, maintenance of existing projects, the relatively lower allocation for irrigation, rural infrastructure and research, lack of adequate credit support, and credit infrastructure in rural areas are the drivers of slow growth in public investment in agriculture [ 43 ]. Given this high food price inflation, researchers and policymakers have raised severe concern about reducing the food price inflation because most of the population spend half of the income on food expenditure, and food containing a larger share in the CPI basket. Therefore, it is necessary to find the causes and suitable majors to reduce food price inflation.

The present study contributes to food price inflation literature in several ways. First, a wide range of studies has investigated the drivers of food price inflation in India. The various demand and supply-side factors, namely, per capita income, growth of money supply, changing patterns of the consumer's dietary habits, high agricultural wages, speculations, and low growth of agricultural productions, are accountable for high food inflation. However, the results are ambiguous and vary considerably across countries due to different data periods and econometric methodologies applied in their studies. Second, the change in macroeconomic factors may have a substantial effect on food price inflation. For instance, if the food prices positively impact money supply, the consumer suffers from welfare loss. If it negatively effects on food prices, the producer suffers from welfare loss. However, this relationship of macroeconomic factors has not empirically analyzed significantly with respect to food price inflation in India. Third, various studies have explored the impact of macroeconomic factors on food price inflation across the world. For example, Kargbo [ 24 ] for Eastern and Southern Africa, Kargbo [ 25 ] for West Africa, Reziti [ 38 ] for Greek, Kargbo [ 26 ] for South Africa, Yu [ 46 ] for China and Sasmal [ 40 ]. Nevertheless, few studies have empirically examined the impact of selected macroeconomic factors on food price inflation by incorporating a control variable like per capita net availability of food grain into account. To the best of my knowledge, there is no study existing in the context of India. Fourth, most of the studies have taken WPI food indices, food items from only primary food articles or some of the index of selected food items, such as cereals and pulses, fruits and vegetables, milk and milk products, egg, meat, and fish as a measure of food price inflation. However, the present study has used the combined price index for industrial worker food (CPI-IW-F). Fifth, numerous studies have concluded that food price inflation is triggered by supply-side factors (see, [ 11 , 17 , 33 ]). However, to examine the rise in food price inflation, we have included both demand and supply-side factors in our study. Six, the present study also considered that food price inflation is not only influenced by domestic factors but also by global factors. More specifically, changes in global food prices and the exchange rate might positively and significantly impact food price inflation. However, the effect of these external factors on food price inflation does not explain the extent of food price inflation driven by domestic supply-side factors. For this purpose, we have included the per capita net availability of food grain as a control variable in the model. Suppose the demand for agricultural food items rises remarkably owing to a surge in macroeconomic factors. However, the supply of food items failed to meet the demand proportionately, then food items prices will go up. Therefore, the goal of the present study is to analyze the long-run and short-run impact of macroeconomic factors on food price inflation and verify the causal relationship aspect of these variables in the case of India over the period January 2006–March 2019.

The remaining of the paper is structured as follows. “ Literature review ” section follows the review of the literature on the relationship between macroeconomic factors and food price inflation. “ Methods ” section represents data and methodology. “ Results and discussion ” section discusses the results of the study. “ Conclusions ” section provides conclusive remarks and policy implications.

Literature review

This paper aims to examine the impact of macroeconomic factors on food price inflation. This section provides a review of the literature to establish the empirical basis of the link between macroeconomic factors and food price inflation.

Per capita income and food price inflation

Per capita income has a positive impact on food price inflation via increasing purchasing power of the money in the hands of the people, which leads to a surge in demand for food items resulting in a rise in food prices. Carrasco and Mukhopadhyay [ 10 ] argued that per capita income is positively affected food prices in three South Asian economies. However, the decline in agricultural production increases food prices up, and magnitudes are varying across countries. Agrawal and Kumarasamy [ 1 ] documented that food price inflation rose with the response to increases in India’s per capita income. They also suggested a 1% surge in per capita income upsurges the demand for fruits, vegetables, milk, and edible oil by 0.55–0.65%, and animal products by 0.38%. However, it reduces the demand for cereals and pulses by 0.05% and 0.20%, respectively. Joiya and Shahzad [ 22 ] and Sasmal [ 40 ] reported the same findings in Pakistan and India, respectively. In contrast, the study also found a negative association between food price inflation and per capita income. Kargbo [ 24 ] in Ethiopia and Malawi among Eastern and Southern African countries, Kargbo [ 25 ] for Cote d'Ivoire of West African countries.

Money supply and food price inflation

An increase in the money supply positively affects food price inflation through market credit facility by generating aggregate demand. However, it reduces food prices by creating investment via availing credit to the producer. Numerous studies have investigated the impact of money supply on food price inflation across the world. For example, Mellor and Dar [ 29 ] found that the expansion of money supply largely determines upward pressure on food grains prices. Barnett et al. [ 5 ] found that money supply positively affects food inflation and agricultural commodity prices in the U.S. Similar results were found by Kargbo [ 26 ] and Asfaha and Jooste [ 3 ] for South Africa. Further, Bhattacharya and Jain [ 8 ] concluded that an unexpected monetary tightening induces food price inflation in emerging and developed countries. However, a negative relationship is established between money supply and food prices for Kargbo [ 24 ], Kargbo [ 25 ], and Yu [ 46 ] for Eastern and Southern African countries and West African countries and China.

Exchange rate and food price inflation

The depreciation of the real exchange rate increases food price inflation by expanding the cost of importing petroleum products, fertilizer, and other finished products relating to agricultural commodities, leading to rising domestic market prices. In other words, depreciation of the exchange rate directly affects the agricultural sectors vi changing the prices of tradable and non-tradable goods resulting in a change in the prices of agricultural products in favor of the farmer. Taylor and Spriggs [ 45 ] showed that the exchange rate has a greater influence on volatility of agricultural prices in Canada. Similarly, Mitchell [ 30 ] and Mushtaq et al. [ 32 ] and Iddrisua and Alagidede [ 19 ] also concluded that the depreciation of the exchange rate is positively affected food prices in the U.S., Pakistan and South Africa, respectively. In contrast to this, Cho et al. [ 12 ] confirmed that change in the exchange rate has a negative impact on relative agricultural prices. However, Sasmal [ 40 ] found no significant relationship between the exchange rate and food price inflation in India during 1971–2012.

Global food price and food price inflation

The increase in the global food price of the commodity can influence the domestic price via international trade mechanism. The export increases as the global food price increases resulting in a decrease in domestic market supply followed by a hike in prices. On the contrary, the rise in import raises the domestic substitute food item’s price followed by a surge in domestic market price. Robles [ 39 ] indicated that the international prices transmission has a positive impact on the domestic agricultural market in Asian and Latin American countries. Gulati and Saini [ 16 ] revealed that the global food price index is positively impacted food price inflation in India. Similarly, Baltzer [ 4 ] states that an increase in international prices promotes domestic prices in the case of Brazil and South Africa. However, the price.

transmission is very limited in China and India. Lee and Park [ 27 ] confirmed that the lagged values of global food price inflation are positively impacted food price inflation in 72 countries. Selliah et al. [ 41 ] revealed that an increase in global food price increases domestic food prices in both the short and long run in Sri Lanka. Similarly, Holtemöller and Mallick [ 17 ], Bhattacharya and Sen Gupta [ 6 ], and Huria and Pathania [ 18 ] also documented that global food price shocks have a significant and positive inflationary trend on food inflation in India. However, Rajmal and Mishra [ 37 ] pointed out a limited transmission of prices from international food prices to domestic prices in India.

Agricultural wage and food price inflation

One of the significant public work programs is the National Rural Employment Guarantee (NREG), which promotes the real daily agricultural wage rates. On the one hand, an increase in rural wages can induce food prices by increasing production costs. On the other hand, it raises food prices via higher purchasing power, resulting in higher wages, which boosts the demand for food items. Gulati and Saini [ 16 ] revealed that domestic farm wages are positively associated with food price inflation in India. Goyal and Baikar [ 15 ] showed that the rapid increase in MGNREGA wages when it merged with inflation boosts agricultural wages rather than the implementation of MGNREGA across India. Bhattacharya and Sen Gupta [ 6 , 7 ] examined the drivers of food price inflation in India over the period 2006–2013. The structural vector error correction model (SVECM) showed that agricultural wage inflation promotes food price inflation after the implementation of MNGREGS.

The above literature review shows that both demand and supply-side factors have contributed to food price inflation. Many studies have investigated the impact of macroeconomic factors on food price inflation across the globe. However, only a few studies have been directed, which empirically examined the effect of macroeconomic factors on food price inflation by incorporating per capita net availability of food grain and agricultural wages in a multivariate framework. So far as we know, there is no study available in the case of India in this regard employing monthly data over the period January 2006–March 2019. Hence, our study attempts to fill this gap.

The present study makes use of monthly time series data on per capita GDP (Y), real exchange rate (EX), money supply (M3), global food price index (GF), per capita net availability of food grain (NFG), agricultural wages (AW) and combined price index-industrial workers for food (CPI-IW-F) indices as a proxy for food price index (FP) during January 2006–March 2019. The data on per capita GDP, real exchange rate, money supply is collected from the Reserve Bank of India (RBI), whereas combined price index-industrial workers for food and agricultural wages are retrieved from the Ministry of Labor Bureau, Government of India. The data on per capita net availability of food grain and real global food price index are obtained from the Directorate of Economics and Statistics, Department of Agriculture & Farmers Welfare, Government of India, and the Food and Agriculture Organization of the United Nations, respectively. Monthly data on per capita net availability of food grain and per capita GDP is not available in the case of India. Therefore, we have used the linear interpolation method to get the monthly data for this variable. Footnote 1 The selection of the data period has been considered based on the availability of uniform and consistent monthly data over a period of time. We use high-frequency data while working on macroeconomic variables to capture the true impact of it [ 31 ]. Further, data on food price inflation is volatile, measuring the impact of macroeconomic factors on food inflation using high-frequency data, namely, weekly and monthly, provides accurate estimates rather than annual series. Since, data on a targeted variable i.e., food inflation is not available on a weekly basis for a longer period in the case of India. Therefore, we have used monthly data for this purpose.

The real exchange rate (EX) is measured as the real effective exchange rate which is trade based weighted average value of Indian currency against 36-currency bilateral weights, per capita income (Y) is measured as the percentage change in per capita gross domestic product, money supply (MS) is measured as broad money (MS), global food prices (GF) are measured as a real global food price index, and agricultural wages (AW) is measured as average daily wage rates from agricultural occupations; per capita net availability of food grain (NFG) is measured as gross production plus net imports plus stocks. Finally, food price inflation (FP) is measured as combined price index-industrial workers for food index (CPI-IW-F). The food inflation was experienced in India from 2006 onwards. However, the CPI-combined series is used and available from 2014 onwards to measure the official inflation rate. To get a more extended frequency of data on food inflation series, we have used consumer price index-industrial workers for food (CPI-IW-F) as a proxy for food inflation measures. We select to use CPI-IW-F because Bicchal and Durai [ 9 ] and Goyal [ 14 ] established that CPI-IW and CPI-combined have similar properties with CPI-IW is available for a more extended period. All the variables are seasonally adjusted using CENSUS X13 and converted into the natural logarithm form except per capita GDP.

Unit root tests

One should necessarily check the properties of all the variables before commencing any econometric techniques as it gives spurious and invalid results. The ARDL technique requires to check the integration properties of the selected variables to confirm that none of the variables should follow I (2) process, which seems to be invalid and unsuitable for applying the ARDL approach. Therefore, we use the ADF and PP tests to check the order of integration of the variables.

ARDL bounds testing approach to cointegration

We employ the ARDL bounds testing approach to cointegration propounded by Pesaran and Shin [ 35 ] and Pesaran et al. [ 36 ] in order to examine the long-run and short-run association between macroeconomic factors and food price inflation in India. This method is superior over other traditional approaches of Johansen and Juselius [ 21 ] and Johansen [ 20 ] cointegration on the following grounds. First, it is one of the most popular and flexible methods. It does not impose any restriction on any nature of data and can be applied irrespective of all the order of integration I (1) or I (0) or both mix. Second, as noted by Pesaran and Shin [ 35 ] that ARDL estimators give the true parameters, and coefficients are super consistent as compared to other long-run estimates, especially when the sample size is small. Third, it also helps to eradicate the problem of the endogeneity that appears in the model. Fourth, it is even able to capture both short-run and long-run estimates simultaneously. The unrestricted error correction models (UECM) of the ARDL model can be represented as follows:

where ∆ denotes first difference operator; \({\varepsilon}_{t}\) is the error term; \({\alpha }_{1}\) , \({\alpha }_{2}\) , \({\alpha }_{3}\) , \({\alpha }_{4}\) , \({\alpha }_{5}\) , \({\alpha }_{6}\) , and \({\alpha }_{7}\) are the constant; \({\alpha }_{F}\) , \({\alpha }_{Y}\) , \({\alpha }_{M}\) , \({\alpha }_{E}\) , \({\alpha }_{G}\) , \({\alpha }_{NF}\) , and \({\alpha }_{A}\) are the long-run coefficients; \({\beta }_{h}\) , \({\beta }_{i}\) , \({\beta }_{j}\) , \({\beta }_{k},{\beta }_{l}, {\beta }_{m}\) and \({\beta }_{n}\) are the short-run coefficients.

The optimal lag selection has been made based on the Akaike Information Criteria (AIC). The primary step in the ARDL model is to estimate the Eqs. ( 1 – 7 ) by ordinary least squares (OLS). The long-run relationship is determined based on the F test or Wald test for the coefficient of the lagged levels of the variables. The null hypothesis of no long-run relationship, \({H}_{0}:{\alpha }_{F}={\alpha }_{Y}={\alpha }_{M}={\alpha }_{E}={\alpha }_{G}={\alpha }_{NF}={\alpha }_{A}=0\) against the alternative hypothesis of the long-run, \({H}_{1}:{\alpha }_{F}\ne {\alpha }_{Y}\ne {\alpha }_{M}\ne {\alpha }_{E}\ne {\alpha }_{G}\ne {\alpha }_{NF}\ne {\alpha }_{A}=0\) referred to the equation follows as (FP/Y, MS, EX, GF, NFG, AW). According to Pesaran et al. [ 37 ], the null hypothesis of no long-run association can be rejected if F -statistics is greater than the upper critical bound (UCB). It suggests that there is a long-run association among the variables. While, test statistics falls below the lower critical bound (LCB), null hypothesis cannot be rejected. It suggests that there is no long-run association among the variables. If the calculated value falls between the lower and upper critical points, the result is inconclusive. Because the two asymptotic critical values bound lower value (assuming the regressors are I (0)) and upper (assuming purely I (1) regressors) provide a test for cointegration.

After identifying the long-run relationship among the variables, our next step is to apply the vector error correction model to examine the directions of causality among the variables in both the short-run and long-run. The model of VECM can be written as follows.

where \(\Delta\) is the difference operator; \({ECM}_{t-1}\) is the lagged error correction term, which is derived from the long-run cointegration relationship; \({\varepsilon}_{1t}\) , \({\varepsilon}_{2t}\) , \({\varepsilon}_{3t}, {{\varepsilon}_{4t}, \varepsilon}_{5t}, {\varepsilon}_{6t}\) and \({\varepsilon}_{7t}\) are the random errors; \({\gamma }_{1}\) , \({\gamma }_{2}\) , \({\gamma }_{3, }{\gamma }_{4, }{\gamma }_{5, }{ \gamma }_{6}\) and \({\gamma }_{7}\) are the speed of adjustments. The long-run relationship among the variables indicates that there is a presence of Granger-causality at least one direction, which is determined by F -statistics and lagged error correction term. The short-run causal relationship is represented by F- statistics on the explanatory variables while long-run causal relationship is represented by t-statistics on the coefficient of the lagged error correction term. The error correction term ( \({ECT}_{t-1}\) ) is negative and statistically significant (t-statistic) at the 1% significance level.

Results and discussion

Preliminary analysis.

A preliminary analysis is conducted using commonly used descriptive statistics. We also reported the summary of descriptive statistics of all the considered variables during the study period in Table 1 . The results revealed that the average food price index and the real exchange rate is 5.375% and 4.687% during the study period. However, the average money supply and real global food price index is 11.185% and 4.619%. The per capita net availability of food grain and agricultural wages is 5.130% and 6.931% whereas, per capita income is 0.445%, which is lower than other variables across the sample period. The results of the correlation matrix are represented in Table 2 . The correlation analysis results revealed that per capita income, money supply, real exchange rate, real global food price index, per capita net availability of food grain and agricultural wages are positively associated with food price inflation. For instance, food price inflation is highly correlated with per capita income, money supply, real exchange rate, per capita net availability of food grain, and agricultural wages. It suggests that macroeconomic factors might be promoting food price inflation in India. Similarly, per capita income is positively correlated with money supply, exchange rate, and per capita net availability of food grain, and agricultural wages. Further, there is a high positive correlation between agricultural wages and per capita net availability of food grain.

Results of unit root tests

To avoid spurious and invalid results of all the non-stationary data, we have checked the integration properties of all the variables and confirm that none of the variables follows the I (2) process. Therefore, the ADF and PP unit root tests are used to check the order of integrations of the variables. The results of unit root tests are reported in Table 3 . It indicates that food price inflation (FP), per capita income (Y), money supply (MS), real exchange rate (EX), real global food price index (GF), per capita net availability of food grain (FG) and agricultural wages (AW) are integrated of order I (1).

Results of ARDL cointegration tests

The above unit root test results show that all variables follow a same order of integration, i.e., I (1). Therefore, we apply the ARDL technique to check the long-run relationship among the variables using Eqs. ( 1 )-( 7 ) during January 2006–March 2019. Here, the optimal lag length is 2, according to VAR lag order selection criteria. The results of the ARDL model are presented in Table 4 . The result shows that calculated F -statistics (4.155) is larger than UCB at the 5% level of significance when food price inflation is considered a dependent variable (FP/Y, MS, EX, GF, NFG, WA). It indicates that there is a long-run relationship among food price inflation (FP) and per capita income (Y), money supply (MS), real exchange rate (EX)), global food prices (GF), per capita net availability of food grain (NFG), and agricultural wages (WA). Likewise, calculated F- statistics (11.043) is also larger than UCB at the 5% level of significance when per capita income is considered a dependent variable and integrated order (1). Therefore, UCB is applied to establish a long-run relationship among the variables. Likewise, calculated F- statistics (10.239) is also larger than UCB at the 5% level of significance when money supply (MS) is considered a dependent variable. Similarly, calculated F- statistics (3.335) is also larger than UCB at the 10% level of significance when global food price (GF) is considered a dependent variable. However, calculated F -statistics is lower than UCB when the exchange rate (EX), per capita net availability of food grain (NFG), and agricultural wages (AW) serve as dependent variables. It suggests a there is no long-run relationship among the variables when the exchange rate, per capita net availability of food grain and agricultural wages are the dependent variables.

Results of long-run and short-run estimates

The cointegration test results based on the ARDL model revealed the long-run equilibrium relationship among the variables. However, these results do not explain the cause-and-effect association among the food price inflation and macroeconomic factors, namely, per capita income, money supply, exchange rate, global food prices, per capita net availability of food grains, and agricultural wages. Hence, we have investigated the impact of macroeconomic factors on food price inflation in this part. It is better to check the long-run effect of macroeconomic factors on food price inflation after confirming the cointegration relationship among the variables when food price inflation is considered the dependent variable. The results of the long-run analysis are reported in Table 5 in panel-I. The long-run results illustrate that per capita income is positively and significantly impacted food price inflation. It implies that a one unit increase in per capita income induces food price inflation by 0.14 unit. The rise in per capita income raises the purchasing power of the money, which leads to a surge in demand for food items resulting in a hike in food prices. The results of our study similar to Carrasco and Mukhopadhyay [ 10 ] in three South Asian economies, Agrawal and Kumarasamy [ 1 ] in India, Joiya and Shahzad [ 22 ] in Pakistan and Sasmal [ 40 ] in India. However, our result is inconsistent with Kargbo [ 24 ] and Kargbo [ 25 ], who revealed a negative relation between the variables in Ethiopia and Malawi, and in Cote d'Ivoire, respectively.

Similarly, a 1% increase in money supply increases food price inflation by 0.36%. It implies that the rise in money supply puts upward pressure on food price inflation and is significant at the 1% level of significance. Money supply is positively affecting food price inflation by generating aggregate demand in the market, which pushes the food prices up. This finding is consistent with Kargbo [ 24 ] for Kenya, Sudan, and Tanzania among the Eastern and Southern African countries and contradictory with Sasmal [ 40 ] who did not find any long-run relationship between money supply and food price inflation in India and Yu [ 46 ] for China who confirmed that monetary policy expansion has a negative impact on prices of seven major food products in the long-run. Similarly, a rise in the real exchange rate has a downward pressure on food price inflation. It indicates that a 1% increase in the real exchange rate will have a negative impact on food price inflation by 0.30%. The increase in the real exchange rate reduces food prices by lowering the import of petroleum products, fertilizer, and other products relating to agricultural commodities in the long run. Hence, organic fertilizers can be used to produce commercial food products to reduce the dependency on fertilizers, which may maintain price stability and reduce the negative welfare impact on food prices. This outcome is consistent with Cho et al. [ 12 ] and is inconsistent with Iddrisua and Alagidede [ 19 ] in South Africa, Durevall et al. [ 13 ] in Ethiopia. Further, per capita net availability of food grain has a negative impact on food price inflation. In other words, there is an inverse relationship between per capita net availability of food grains and food price inflation in India. It suggests that a 1% increase in per capita net availability of food grains reduces food price inflation by 0.69%. The increase in the supply of net food availability in the domestic market by increasing food production can reduce food price inflation. On the other hand, if the supply of food grain availability declines due to crop failure, it increases food price inflation. Therefore, the government should increase domestic food production and reduce the exports of commodities at the time of food inflation to maintain stability in prices. Further, agricultural production is seasonal, and it is highly correlated to the month of food harvest. The stock of food grain during harvest season can avoid the off seasonal food price inflation. Increasing the stock of food items by establishing a larger cold storage system and strengthen and widening the existing warehouses can also help to control food inflation in India. This result is similar to Kargbo [ 25 ] in Cote d’Ivoire and Nigeria and Carrasco and Mukhopadhyay [ 10 ] in three South Asian economies and inconsistent with Sasmal [ 40 ], who failed to establish a significant relationship between agricultural food production and food price inflation in India in the long-run. Furthermore, our results revealed that food price inflation rose with the response to increases in global food prices. It suggests that a 1% surge in global food price upsurges food price inflation by 0.13%. This result is consistent with Selliah et al. [ 41 ] for Sri Lanka, Holtemöller and Mallick [ 17 ] for India, and Huria and Pathania [ 18 ] for India. However, Rajmal and Mishra [ 37 ] and Baltzer [ 4 ] pointed out a limited transmission of prices from international food prices to domestic prices in India. The extent of transmission of global food prices on price hike in the domestic market depends on at which magnitudes commodity’s international trade takes place. Finally, our study results also found that agricultural wages have a positive and significant impact on food price inflation at the 1% level of significance. It implies that a 1% surge in agricultural wages increases the food price inflation by 0.31% in the long-run. The rise in wage rate via welfare-oriented-schemes like MNGREGS increases the bargaining and purchasing power of money, increasing in demand for food items followed by increased food inflation. The increase in the agricultural wage rate should be substituted with food price inflation by increasing productivity. Hence, the increase in demand for food originated by a hike in the agricultural wage rate can be substituted by raising the productivity of each worker. A similar result is found by Bhattacharya and Sen Gupta [ 7 ] for India.

After having discussed long-run results, we shall move in to discuss with reference to the short-run. The results of the short-run analysis are reported in Table 5 in panel-II. The short-run analysis indicates an increase in per capita income and money supply is positively related to food price inflation in the short-run as the coefficients of these variables are statistically significant. Similarly, food price inflation rises with the increase in global food prices. Further, the real exchange rate has a positive impact on food price inflation in the short-run. However, the result is not significant. Moreover, agricultural wages have a positive impact on food price inflation. It implies that an increase in agricultural wages raises food price inflation in the short run. The outcome is consistent with Huria and Pathania [ 18 ] for India. However, per capita net availability of food grain is negatively and significantly impacted food price inflation. It suggests that a 1% increase in food grain availability decreases food price inflation by 0.11% in the short-run. In contrast, a decrease in the growth rate of food grain availability increases food price inflation. This finding is similar to Kargbo [ 25 ] in Cote d’Ivoire and Senegal among West African countries. Finally, the results also documented lagged food price inflation positively impacts present food price inflation. It suggests that a 1% increase in lagged food price upsurges food price inflation by 0.36% in the short run.

The sign of lagged ECT is negative and significant at the 1% level, which implies that short-run deviation from food prices can be restored toward the long-run equilibrium with a 16.8% speed. The model has satisfied all the diagnostic tests. This model is free from autoregressive conditional heteroscedasticity; the functional form of the model is well specified, which is represented by the Ramsey RESET coefficient.

Results of VECM Granger causality test

After identifying the long-run association between macroeconomic factors and food price inflation, we have employed the VECM Granger causality test to examine the directions of causality among the variables in both the short-run and long-run. The Granger causality results are represented in Table 6 . The outcomes of the short-run causality tests are obtained from the F -statistics of lagged independent variables, while the results of long-run causality are obtained from the negative and significant coefficients of t-statistics of lagged error correction term. The results are reported in Table 6 and show that a short-run bidirectional causality is confirmed between per capita income, exchange rate, and food price inflation at a 1% level. This finding is opposite of Sasmal [ 40 ], who reported a unidirectional causality running from per capita income to food price inflation in India. Similarly, a bidirectional causality is existed between percapita net availability of food grain and food price inflation in the short run. It implies that the increase in food grain availability reduces food price inflation by increasing domestic food grain production on the one hand. Whereas on the other hand, an increase in food price inflation also leads to a rise in food grain availability by rising demand for food products. Further, there is a unidirectional causality running from global food prices to food price inflation. It suggests that an increase in global price attracts exporters to increase their supply of food items to the global market to get high profit, which eventually decreases the domestic market supply, resulting an in a price increase. However, there is no causal relationship running from money supply and agricultural wages to food price inflation in the short run.

There is an existence of a bidirectional causal relationship between global food prices and per capita income. However, no causality runs from money supply, exchange rate, per capita net availability of food grain, and agricultural wages to per capita income. A short run unidirectional causality is established from food price inflation, exchange rate, global food prices, and per capita net availability of food grain to money supply. A bidirectional causality has existed between agricultural wages and money supply in the short run. Further, unidirectional causality is running from per capita income, the exchange rate to global food prices. A unidirectional causal relationship is found from per capita income, money supply, the exchange rate, and global food prices to per capita net availability of food grain in the short run. Moreover, short-run unidirectional causality is confirmed from food price inflation, per capita income, the exchange rate and global food prices to agricultural wages.

Moving to the long-run causality, the coefficients of \({ECM}_{t-1}\) are negative and statistically significant in Eq. ( 8 ), where money supply, global food prices, and per capita net availability of food grain are the dependent variables. Therefore, results revealed a bidirectional causality among the money supply, global food prices, and per capita net availability of food grain production in the long-run.

Conclusions

This study aimed to examine the impact of macroeconomic factors on food price inflation in India during January 2006–March 2019. To consider the short-run dynamics and the long-run analysis and directions of causality among the variables, we have applied the ARDL model and Granger causality test in our study. The ARDL results have shown evidence of the long-run association among the macroeconomic factors and food price inflation. The long-run result show that percapita income, money supply, global food price, and agricultural wages have a positive and significant impact on food price inflation of India in both the long-run and short run. However, the per capita net availability of food grain negatively impacts food price inflation. It implies that an increase in food grain availability reduces food price inflation in both the short and long run. Further, the real exchange rate is positively affecting food price inflation. However, it is insignificant in the short-run. The Granger causality estimates show that a short-run bidirectional causality is confirmed among per capita income, the exchange rate, per capita net availability of food grain, and food price inflation. Further, there is evidence of unidirectional causality running from global food prices to food price inflation. However, there is no causal relationship running from money supply and agricultural wages to food price inflation in the short run. The long-run results revealed a bidirectional causality among the money supply, global food prices and per capita net availability of food grain.

Given these results, the paper makes important contribution to the macroeconomic factors and food price inflation in India. The significant policy suggestions are that the growth in money supply promotes food price inflation in the long-run, which affects the welfare of the poor consumer as the majority of the people depend on agriculture. It also positively affects market credit facility by generating aggregate demand followed by changes in relative prices across commodities, which push the food prices up. Therefore, the government should adopt effective policy measures to protect consumers from higher food prices. These are the effectively implementation of public distribution systems, policies for food security, and reducing the money supply via adopting a contractionary monetary policy, which eventually reduces food price inflation by reducing demand for food items. Further, the increase in global food inflation triggers food price inflation by international trade channels. However, the influence of global food inflation on food price inflation can be moderated by introducing a flexible tariff structure. Hence, the government should introduce stable and liberal trade policies that reduce food price inflation without compromising farmers remuneration values.

Moreover, our result also revealed that an increase in the net availability of food grain reduces food price inflation in both the short and long run. Therefore, the government should take necessary steps in favor of an increase in domestic food production. The high yielding variety (HYV) seeds, easily accessible credit facilities should be available to the farmer, increasing the domestic agricultural food production, thereby reducing the import of agricultural goods through the exchange rate and their adverse impact on food inflation. The stock of food grain during harvest season can avoid off seasonal food inflation. The increasing the stock of food items by establishing an extensive cold storage system and strengthening large warehouses can control food inflation in India. Furthermore, the rise in agricultural wages boosts food price inflation. The increase in the agricultural wage rate should be substituted with food price inflation by increasing labor productivity. Hence, the increase in demand originated by a hike in the agricultural wage rate can be substituted by raising each workers productivity.

Our results also found that per capita income Granger causes food price inflation both in the short-run. In this respect, we can say that there is a huge sectoral imbalance among the sectors. The government should be more focused on the agricultural sector and its growth and productivity by allocating massive funds in the irrigation, agricultural research, and innovation of modern technology and its adaptation in agriculture instead of spending on the name of social security and welfare of the poor. Therefore, balanced and sustainable growth and stability can be achieved for a developing country like India. The real exchange rate and food price inflation Granger causes to each other. The depreciation of the real exchange rate increases the food price inflation via expanding the import of petroleum products, fertilizer, and other finished products relating to agricultural commodities, which are very expensive. The increasing import of these products promotes food price inflation by raising domestic prices. Hence, to reduce the food price inflation, the government should increase the domestic agricultural production to meet our demand for food items rather than importing from other countries.

Availability of data and materials

Data used in the study are available in the Reserve Bank of India, Ministry of Labor Bureau, Directorate of Economics and Statistics, Department of Agriculture & Farmers Welfare, Government of India, and the Food and Agriculture Organization of the United Nations.

By using the linear interpolation method, we have converted the annual data into the monthly time series data. Because the high-frequency data increases the power of a statistical test and provide robust results [ 48 ]. The interpolation method has been widely used in the empirical analysis [ 34 , 42 , 44 ].

Abbreviations

Autoregressive distributed lag

Combined price index

Wholesale price index

Reserve Bank of India

Agrawal P, Kumarasamy D (2014) Food price inflation in India: causes and cures. Indian Econ Rev 49(1):57–84

Google Scholar

Anand R, Ding D, Tulin V (2014) Food inflation in India: the role of monetary policy. IMF working paper-14/178

Asfaha TA, Jooste A (2007) The effect of monetary changes on relative agricultural prices. Agrekon 46(4):460–474

Article Google Scholar

Baltzer K (2013) International to domestic price transmission in fourteen developing countries during the 2007–08. [In] Food crisis food price policy in an era of market instability. Oxford University Press, Oxford

Barnett RC, Bessler DA, Thompson RL (1983) The money supply and nominal agricultural prices. Am J Agric Econ 65(2):303–307

Bhattacharya R, Sen Gupta A (2017) What role did rising demand play in driving food prices up? South Asian J Macroecon Public Finance 6(1):59–81

Bhattacharya R, Sen Gupta A (2018) Drivers and impact of food inflation in India. Macroecon Finance Emerg Mark Econ 11(2):146–168

Bhattacharya R, Jain R (2020) Can monetary policy stabilise food inflation? Evidence from advanced and emerging economies. Econ Model 89:122–141

Bicchal M, Durai SRS (2019) Rationality of inflation expectations: an interpretation of Google Trends data. Macroecon Finance Emerg Mark Econ 12(3):229–239

Carrasco B, Mukhopadhyay H (2012) Food price escalation in South Asia. Econ Polit Wkly 47(46):59–70

Chand R (2010) Understanding the nature and causes of food inflation. Econ Polit Wkly 9XLV(9):10–13

Cho G, Kim M, Koo WW (2005) Macro effects on agricultural prices in different time horizons. Meeting of the American Agricultural Economics Association, Providence, Rhode Island

Durevall D, Loening J, Birru Y (2013) Inflation dynamics and food prices in Ethiopia. J Dev Econ 104:89–106

Goyal A (2015) Understanding high inflation trend in India. South Asian J Macroecon Public Finance 4(1):1–42

Goyal A, Baikar AK (2015) Psychology, cyclicality or social programmes: Rural wage and inflation dynamics in India. Econ Pol Wkly 50:116–125

Gulati A, Saini S (2013) Taming food inflation in India. Commission for Agricultural Cost and Prices, Discussion paper 4. Ministry of Agriculture, Government of India

Holtemöller O, Mallick S (2016) Global food prices and monetary policy in an emerging market economy: the case of India. J Asian Econ 46:56–70

Huria S, Pathania K (2018) Dynamics of food inflation: assessing the role of intermediaries. Glob Bus Rev 19(5):1363–1378

Iddrisu AA, Alagidede IA (2020) Monetary policy and food inflation in South Africa: A quantile regression analysis. Food Policy 91: 101816.

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59(6):1551–1580

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf Bull Econ Stat 52(2):169–210

Joiya S, Shahzad A (2013) Determinants of high food prices: the case of Pakistan. Pak Econ Soc Rev 51(1):93–107

Kapoor A (2018) Competitiveness in agriculture will boost other sectors, Business standard, June 05, retrieved from https://www.business-standard.com/article/news-ians/competitiveness-in-agriculture-will-boost-other-sectors-column-active-voice-118060500301_1.html

Kargbo JM (2000) Impacts of monetary and macroeconomic factors on food prices in eastern and Southern Africa. Appl Econ 32(11):1373–1389

Kargbo JM (2005) Impacts of monetary and macroeconomic factors on food prices in West Africa. Agrekon 44(2):205–224

Kargbo JM (2007) The effects of macroeconomic factors on South African agriculture. Appl Econ 39(17):2211–2230

Lee HH, Park C Y (2013) International transmission of food prices and volatilities: a panel analysis. Asian Development Bank economics working paper series (373). https://doi.org/10.2139/ssrn.2323056

Mani H, Bhalachandran G, Pandit VN (2011) Public investment in agriculture and GDP growth: Another look at the intersectoral linkages and policy implications. Working paper no. 201, Centre for Development Economics, Delhi School of Economics

Mellor JW, Dar AK (1968) Determinants and development implications of food grains prices in India, 1949–1964. Am J Agric Econ 50(4):962–974

Mitchell D (2008) A note on rising food prices. World Bank policy research working paper series no. 4682

Modugno M (2013) Now-casting inflation using high frequency data. Int J Forecast 29(4):664–675

Mushtaq K, Awan DA, Abedullah A, Ahmad F (2011) Impact of monetary and macroeconomic factors on wheat prices in Pakistan: implications for food security. Lahore J Econ 16(1):95–110

Nair S, Eapen L (2012) Food price inflation in India (2008 to 2010). Econ Polit Wkly 47(20):46–54

Paramati SR, Bhattacharya M, Ozturk I, Zakari A (2018) Determinants of energy demand in African frontier market economies: an empirical investigation. Energy 148:123–133

Pesaran MH, Shin Y (1999) An autoregressive distributed lag modelling approach to cointegration analysis. In: Strom S (ed) Econometrics and economic theory in 20th century: the Ragnar Frisch centennial symposium, Chapter 11. Cambridge University Press, Cambridge

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Rajmal, Mishra S (2009) Transmission of international food prices to domestic food prices The Indian evidence. RBI staff studies, Department of Economic Analysis and Policy, S S (DEAP):6/2009

Reziti I (2005) The relationship between macroeconomic variables and relative price variability in Greek Agriculture. Int Adv Econ Res 11(1):111–119

Robles M (2011) Price transmission from international agricultural commodity markets to domestic food prices: case studies in Asia and Latin America. IFPRI, Washington, DC

Sasmal J (2015) Food price inflation in India: the growing economy with sluggish agriculture. J Econ Finance Admin Sci 20(38):30–40

Selliah S, Applanaidu SD, Hassan S (2015) Transmission of global food prices to domestic prices: evidence from Sri Lanka. Asian Soc Sci 11(12)

Shahbaz M, Arouri M, Teulon F (2014) Short- and long-run relationships between natural gas consumption and economic growth: evidence from Pakistan. Econ Model 41:219–226

Sivagnanam KJ, Murugan K (2016) Impact of public investment on agriculture sector in India. J Econ Soc Dev 12(2):45–51

Tang CF, Chua SY (2012) The savings-growth nexus for the Malaysian economy: a view through rolling sub-samples. Appl Econ 44(32):4173–4185

Taylor J, Spriggs J (1989) Effects of the monetary macro-economy on Canadian agricultural prices. Can J Econ 22(2):278–289

Yu X (2014) Monetary easing policy and long-run food prices: evidence from China. Econ Model 40:175–183

Zhang Z, Lohr L, Escalante C, Wetzstein M (2010) Food versus fuel: What do prices tell us? Energy Policy 38(1):445–451

Zhou S (2001) The power of cointegration tests versus data frequency and time spans. South Econ J 67(4):906–921

Download references

Acknowledgements

Not applicable.

The authors declare that no funding from any agencies was received for this study.

Author information

Authors and affiliations.

School of Economics, University of Hyderabad, Hyderabad, 500046, India

Asharani Samal & Phanindra Goyari

School of Business, Woxsen University, Hyderabad, 502345, India

Mallesh Ummalla

You can also search for this author in PubMed Google Scholar

Contributions

AS: Conceptualization, methodology, software, formal analysis, data curation, writing—original draft, reviewing and editing. MU: Resources, data curation, writing—reviewing and editing. PG: Resources, supervision and editing. All authors have read and approved the final manuscript.

Corresponding author

Correspondence to Asharani Samal .

Ethics declarations

Ethics approval and consent to participate, consent for publication, competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Samal, A., Ummalla, M. & Goyari, P. The impact of macroeconomic factors on food price inflation: an evidence from India. Futur Bus J 8 , 15 (2022). https://doi.org/10.1186/s43093-022-00127-7

Download citation

Received : 02 July 2021

Accepted : 15 May 2022

Published : 21 June 2022

DOI : https://doi.org/10.1186/s43093-022-00127-7

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Food price inflation

- Macroeconomic factors

- ARDL bounds testing approach

- Causality test

JEL Classification

- Business News

- India Business News

- Explained in charts: India's inflation situation and its impact on households

Explained in charts: India's inflation situation and its impact on households

Visual Stories

PPF Calculator

This financial tool allows one to resolve their queries related to Public Provident Fund account.

FD Calculator

When investing in a fixed deposit, the amount you deposit earns interest as per the prevailing...

NPS Calculator

The National Pension System or NPS is a measure to introduce a degree of financial stability...

Mutual Fund Calculator

Mutual Funds are one of the most incredible investment strategies that offer better returns...

Other Times Group News Sites

Popular categories, hot on the web, trending topics, living and entertainment, latest news.

The dynamics of survey-based household inflation expectations in India

IIM Ranchi Journal of Management Studies

ISSN : 2754-0138

Article publication date: 13 December 2021

Issue publication date: 1 March 2022

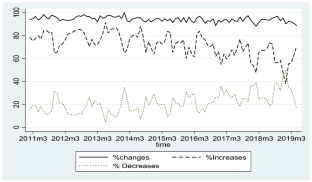

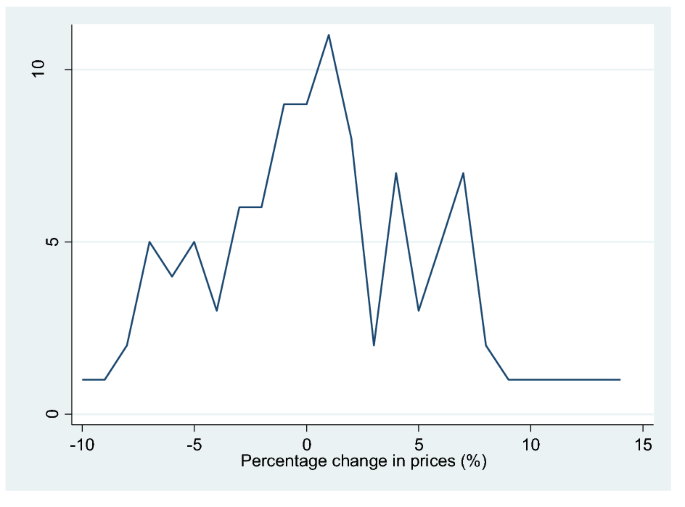

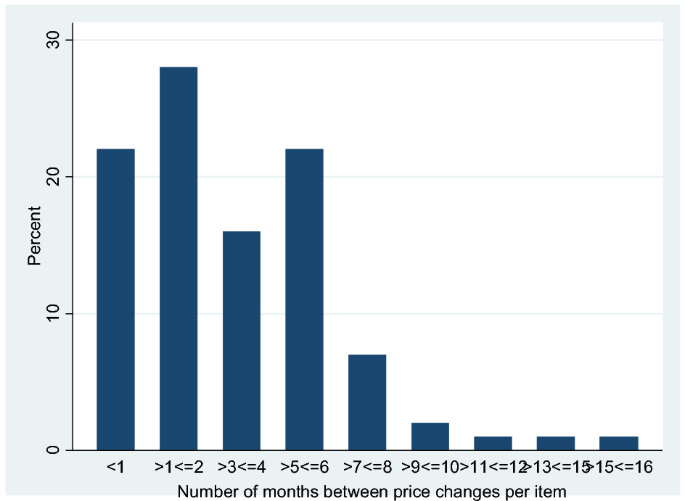

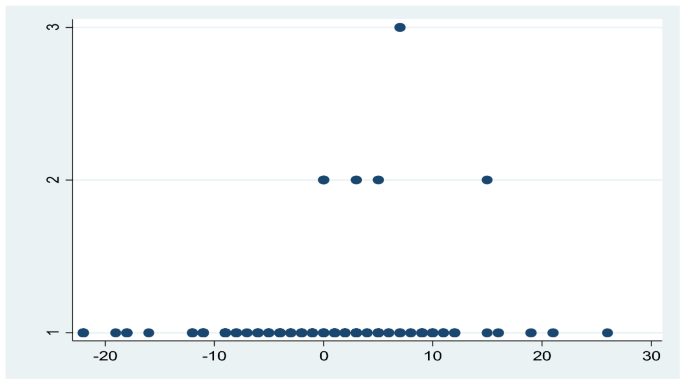

The author analyzes households' inflation expectations data for India, collected quarterly by the RBI for more than a decade. The contribution of this paper lies in two folds. First, this study examines the relationship between relatively recent inflation expectations survey of households (IESH) and the actual inflation for India. Secondly, the author employs a structural VAR with the time period 2006 Q2 to 2020 Q2 on inflation expectation survey data of India. A short-term non-recursive restriction is imposed in the model in order to capture the simultaneous co-dependence causal effect of inflation expectation and realized inflation.

Design/methodology/approach

This paper studies the dynamic behavior of inflation expectations survey data in two folds. First, the author analyzes the time series property of the survey data. The author begins with testing the stationarity property of the series, followed by the casual relationship between the expected and actual inflation. The author further examines the short-run and long-run behavior of the IESH with actual inflation. Employing autoregressive distributed lag and Johansen co-integration, the author tested if a long-run relationship exists between the variables. In the second approach, the author investigates the determinants of inflation expectations by employing a non-recursive SVAR model.

The preliminary explanatory test reveals that inflation expectation is a policy variable and should be used in monetary policy as an instrument variable. The model identifies the price puzzle for India. The author finds that the response of inflation to a monetary policy shock is neutral. The results also indicate that the expectations of the general public are self-fulfilling.

Originality/value

IESH has only commenced from September 2005, hence is relatively new as compared to other survey in developed countries. Being a new data set so far, the author could not locate any study devoted in analyzing the behavior of the data with other macroeconomic variables.

- Inflation expectations

- Monetary policy

Impulse response function

Jha, S. (2022), "The dynamics of survey-based household inflation expectations in India", IIM Ranchi Journal of Management Studies , Vol. 1 No. 1, pp. 38-54. https://doi.org/10.1108/IRJMS-08-2021-0109

Emerald Publishing Limited

Copyright © 2021, Saakshi Jha

Published in IIM Ranchi Journal of Management Studies . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

1. Introduction

Every central bank faces the challenge of keeping the inflation rate within reasonable limits. One of the main factors that determine the rate of inflation is the inflation expectations of various macroeconomic agents in an economy. Thus, central banks try to keep the inflation expectations “well-anchored” primarily by making their policy for targeting inflation public and by sharing the data on the inflation expectations of professional forecasters and the general public. While these policies have been an inherent part of the central banks in developed countries, it is only recently that India has begun following a similar path.

Inflation expectations can influence the behavior of economic agents. The inter-temporal decisions like savings, investments, wage negotiations, etc., made by economic agents are highly dependent on their expectations about future inflation. These inter-temporal decisions, in turn, affect economic activity, which further influences actual inflation. If the current inflation rate creates expectations for future inflation, which itself is induced by the expectations of the economic agents, it leads to the creation of an “inflation expectations spiral” in the economy. The effect of the “inflation expectations spiral” can cause high and persistent inflation, thereby reducing the effectiveness of monetary policy for controlling inflation.

In order to control inflation and to avoid the trap of “inflation expectations spiral,” the monetary policymakers must know the pattern and behavior of expected inflation. Berk (2002) indicates that any effect of monetary policy on inflation expectations depends upon the direction and intensity of the causality between the inflation expectations and actual inflation. Ball et al. (2005) point out that the dynamic correlation between inflation expectations and realized inflation will help anchor inflation expectations and strengthen the credibility of central banks. In other words, a strong co-relationship between the realized and expected inflation will allow monetary policy to achieve price stability for the economy.