Essay on Economics Importance In Daily Life

Students are often asked to write an essay on Economics Importance In Daily Life in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Economics Importance In Daily Life

Understanding economics.

Economics is a subject that studies how people, businesses, and governments make choices about how to use resources. It’s like a guidebook for making decisions. It’s not just about money, but also about time, effort, and what you give up when you make a choice.

Economics in Daily Life

Every day, we make choices based on economics. When you decide to buy a toy with your pocket money, you’re using economic thinking. You’re choosing what you value most. You’re also considering what you’re giving up – maybe another toy or a candy bar.

Importance of Economics

Understanding economics helps us make better choices. It helps us decide how to use our resources wisely. It also helps us understand the world around us. For example, why are some things more expensive than others? Economics can help answer that.

Economics and Future

Economics also helps us plan for the future. It helps us understand how to save and invest money. It helps us understand how the economy works. This knowledge can help us make smart choices about jobs, education, and more.

250 Words Essay on Economics Importance In Daily Life

What is economics.

Economics is a subject that helps us understand how people, businesses, and countries make choices about how to use their limited resources. The goal is to meet their needs and wants. This subject is part of our daily lives, and we all practice economics without even knowing it.

Personal Economics

Every day, we make decisions about what to buy, where to buy, and how much to spend. We also think about saving money for future needs. This is personal economics. We have to choose how to use our money wisely.

Economics in Business

Businesses also use economics. They decide what products to make, how many to produce, and at what price to sell them. They look at the demand for their products and the cost of making them. This helps them make profits and stay in business.

Economics in Society

Economics also plays a big role in society. It helps governments decide how to use their money. They have to choose what services to provide, like schools, hospitals, and roads. They also have to decide how to pay for these services, usually through taxes.

So, economics is very important in our daily lives. It helps us, businesses, and governments make important decisions. Understanding economics can help us make better choices and understand the world around us. So, even if you’re a student, it’s never too early to start learning about economics!

500 Words Essay on Economics Importance In Daily Life

Economics is a subject that helps us understand how the world works. It studies how people, businesses, and governments make choices about how to use resources. It’s like a guidebook that helps us make smart decisions about money and resources.

Economics in our Daily Lives

Every day, we make choices that involve economics. When we decide what to buy with our pocket money, that’s economics. When our parents choose how to spend their salary, that’s economics too. Even when our government decides how to use taxes, it’s using economics.

Importance of Economics in Spending

Economics helps us make good decisions about spending. It teaches us to think about the value of things. For example, if you have only $10 and you want to buy a book that costs $15, economics can help you decide if it’s worth saving up for the book or if you should spend your money on something else.

Economics and Saving

Economics doesn’t just help us with spending, but with saving too. It can help us understand why it’s important to save money for the future. For example, if you save a part of your pocket money every week, you could buy a more expensive toy or game later. This is called delayed gratification, a key concept in economics.

Economics in Resource Allocation

Economics also helps us understand how to use resources wisely. Resources can be anything from time to natural resources like water and trees. For example, if we understand that water is a limited resource, we will be more careful about not wasting it. This is an economic principle called scarcity.

Economics and Jobs

Economics is important in understanding jobs and careers too. It helps us understand why some jobs pay more than others and how supply and demand affect job opportunities. For example, if there are many people who can do a job, the pay might be lower. But if a job requires special skills that few people have, the pay might be higher.

In conclusion, economics is a part of our daily life. It helps us make smart choices about spending and saving. It teaches us to use resources wisely and understand the world of work. Just like a map helps us find our way, economics helps us navigate through life. So, even though it might seem like a tough subject, it’s worth learning because it’s so useful in our daily lives.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Economics And Society

- Essay on Economics And Economists

- Essay on Economic Theory

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Applying economics in everyday life

At the start of the academic year, I always feel a little pressure to justify the study of economics. Students come up asking things like, should they do economics or history? It’s hard to know what to say, but to get people excited about economics it’s good to try and think how economics can be applied in everyday life. Some of this is just common sense, but economics can help put a theory behind our everyday actions.

Buying goods which give the highest satisfaction for the price

This is common sense, but in economics, we give it the term of marginal utility theory. The idea is that a rational person will be evaluating how much utility (satisfaction) goods and services give him compared to the price. To maximise your overall welfare, you will consume a quantity of goods where total utility is maximised given your budget. For example, is it worth paying extra charges by airlines, such as paying for more leg-room? Or pay to get priority boarding? Economics suggests we need to evaluate the marginal benefit of these services compared to the marginal cost. See: Extra charges by airlines

Sunk cost fallacy

A sunk cost is an irretrievable cost, something we cannot get back. For example, suppose we sign up for a gym membership at $40 a month for a whole year. We are committed to paying $480, whether we go or not. If we are feeling unwell, should we go to the gym to get our money’s worth or should we write off the sunk cost and maximise our marginal utility for that particular day? See: sunk cost fallacy

Opportunity Cost

The first lesson of economics is the issue of scarcity and limited resources. If we use our limited budget for buying one type of good (food), there is an opportunity cost – we cannot spend that money on other goods such as entertainment. Opportunity cost is an intrinsic aspect of most economic choices. We may like the idea of lower income tax, but there will be an opportunity cost – in this case, less government revenue to spend on health care and education.

There’s no such thing as free parking

Another example of opportunity cost – no one likes to pay for parking, but would we be better off if parking was free? Most likely not. If parking was free, demand might be greater than supply causing people to waste time driving around looking for a parking spot. Free parking would also encourage people to drive into city centres rather than use more environmentally friendly forms of transport. The result would be that free parking would increase congestion; therefore although we would pay less for parking, we would face other indirect costs. (time wasted)

Behavioural economics and bias

Traditional economic theory assumes that man is rational. However, the work of behavioural economics suggests we can be prone to bias and irrational behaviour. For example, we may be prone to a present bias where we overvalue pleasure in the short-term and ignore long-term implications. For example, consuming demerit goods like alcohol or not saving sufficiently for retirement. The insight of present bias suggests we make decisions our future self would not make. If we become aware of these bias and irrational behaviour, then we can make better decisions which improve our long-term welfare.

See: Behavioural economics

Irrational exuberance

Another issue in behavioural economics is that of irrational exuberance or when we get carried away by an asset bubble. Can we be sure we will not get carried away by a boom and bubble? History suggests that many investors are over-optimistic about their ability to leave the market at the optimal time and can feel that this time is different.

See: Irrational exuberance

On the other hand

In economics, there’s always another way of looking at the world. Borrowing is bad, except when it isn’t. Nothing is black and white in economics; it depends. For example, government borrowing to finance pensions for an ageing population can lead to an unsustainable rise in government debt. However, government borrowing during a recession can help the economy recover.

Diminishing returns

If we like chocolate cake, why do we not eat three per day? The reason is diminishing returns. The first chocolate cake may give us 10/10. The second cake 3/10. The third cake may make us sick and give a negative utility. People may have different opinions about when diminishing returns set in. Some students may feel this is after the second pint, other students only after considerably more. There are also diminishing returns to money. That is why we don’t spend all our time working – extra money gives increasingly less satisfaction and reduces leisure time

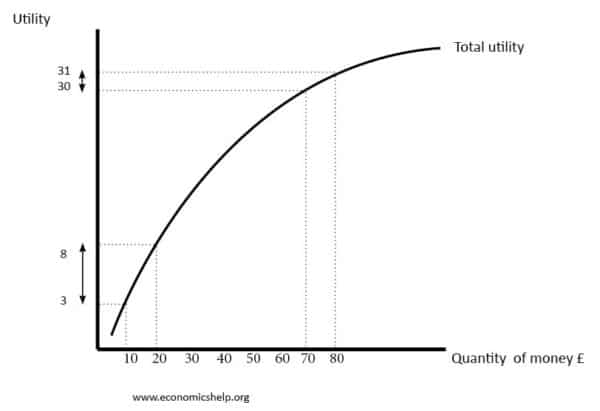

DIminishing returns to wealth/income

A similar concept is that of diminishing returns to wealth and income. Does an extra $100 give us more utility? Yes, but it depends on our current income. If we have a very low salary, the extra $100 will make a big difference. But, if we earn $100,000 a year, we may not notice that extra $100 a year. The importance of this is for choosing the right balance between work and leisure. What is the value in working a long working week, if the extra money earnt has a limited marginal utility?

Externalities

Economics may feel we are promoting selfish ends – firms maximise profits, consumers maximise their personal utility. Adam Smith claimed pursuing selfish goals ended up in improving the greater good. But, in economics, we also try to consider the impact of our actions on other people. If a firm produces chemicals, it may make a profit, but cause an external cost of pollution. To ignore this external cost would be to create an inefficient outcome. We should make the firm pay the cost of its pollution so that it has the incentive to minimise or halt external costs. Externalities are everywhere. Even your decision to study economics could have positive externalities in the future. For example, you could end up being an economics teacher helping others learn all about economics.

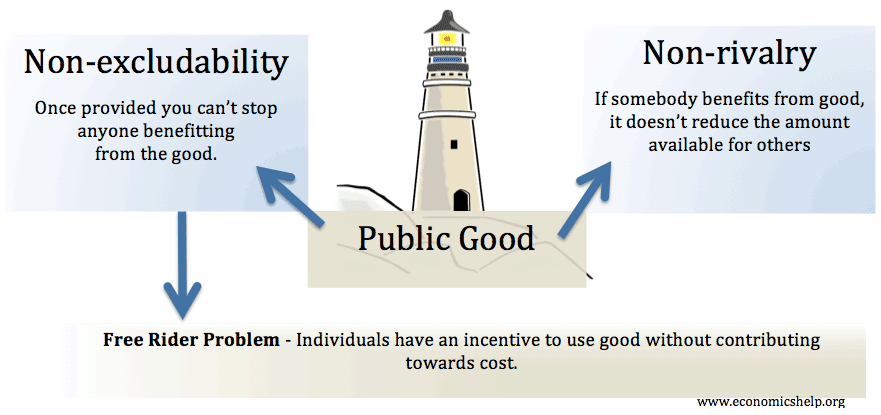

Public goods not provided by the free market .

The free market has many advantages. Private firms tend to be more efficient, innovative and respond to consumer preferences. However, many goods and services would either be not provided or under-provided in a free market. Public goods like street lighting and law and order. Also, public services like health care and education would be provided in insufficient quantities. Therefore, to optimise social welfare there is a need for government intervention through taxes and direct public provision. We may dislike taxes, but we would dislike not being able to see a doctor.

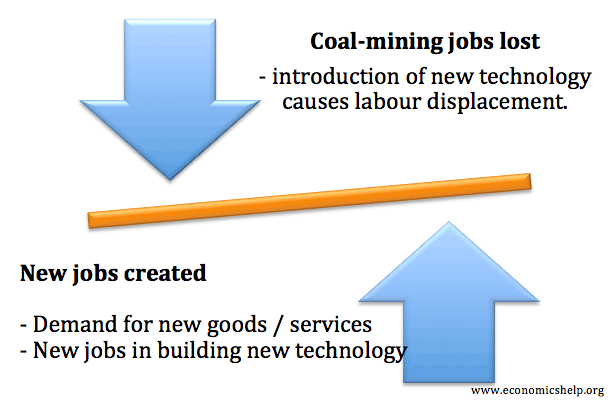

Should I worry about automation and new technology?

There are concerns that new technology and automation will lead to job losses and some people losing out. If our job is threatened by new technology is the fear justified? Economic analysis suggests there it is a fallacy that new technology leads to permanent job losses. This is known as the Luddite Fallacy – though some jobs are lost, new ones are created. Automation and new technology are not guaranteed to make everyone better off – especially in the short term. See: Pros and cons of automation

Macroeconomics affects everyone

Everyone is affected in some way by macroeconomic issues such as inflation and unemployment. Inflation can reduce the value of your savings. If you keep cash under your bed during high inflation, you’d be better off trying to buy gold or some physical assets. Mass unemployment can cause society to fragment, therefore there is a need to adopt policies to try and reduce unemployment.

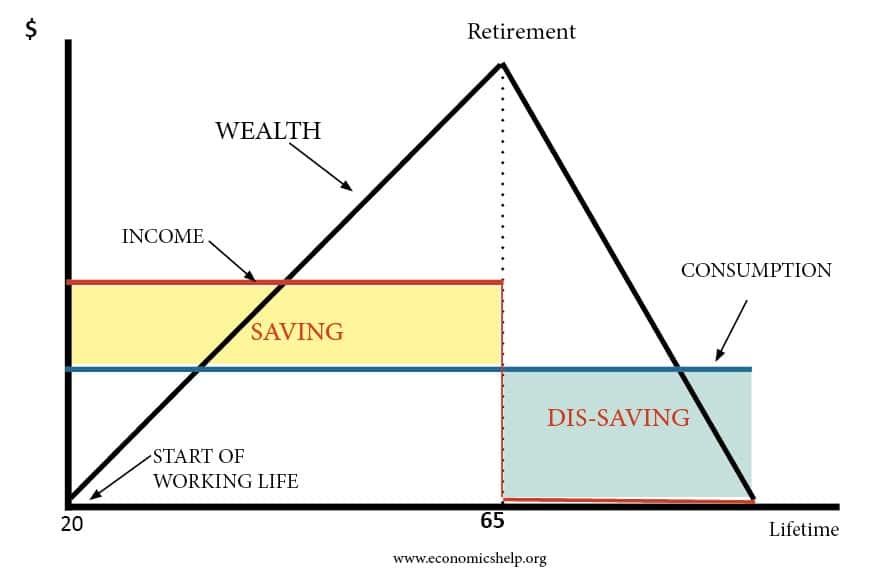

Life-cycle hypothesis

The Life Cycle Hypothesis states that to maximise lifetime utility, we should try to smooth our consumption patterns over the course of our life. It is not good to have substantial income when we are old and unable to move. Spending some money in our student years will give greater overall utility. This justifies taking out a student loan to pay back when we are working and then saving for a pension in our retirement.

Examples of economics in everyday life

- Is the price of Starbucks a rip-off?

- Is it rational to put money in an honesty box?

- How will you be affected by a devaluation of the Pound?

- How will you be affected by low-interest rates?

- How will you be affected by a recession?

- 10 reasons to study economics

Last updated: 10th November 2021, Tejvan Pettinger , www.economicshelp.org, Oxford, UK

11 thoughts on “Applying economics in everyday life”

Very nice article especially to beginners (students). It’s easily understandable.

interesting

Great, i like economics, its interesting and fascinating.

THEN BATTER THINKS TO DEVLOPMENT A APPLICATION ON PREFROM A APPLICATION TO ECONOMICALS THINKS IN HUMAN ON UNDER CONNECTION IN HUMAN THINKS

concepts are very clear and nite becouse initially importance of economics..

Very easily explained.Make more like these.

make a poem about economics using many different economic topics and email it back to me please its for an economics project !!!

Being an economics student ,it is Very informative for me ….

Very comprehensive thoughts. The application of both micro and macro economics in daily life is lot yet people don’t realize. For example , when you go to mall to purchase your daily needs or other products, you simply calculate opportunity cost between two products. And as a rationale consumer select one product over other who’s marginal value is more. Soon meet you with more such concepts

I like this. I really helps me as I have to constantly explain these concepts everyday. It’s just nice to know others feel the same.

Quote inspiring. Our everyday application of Economics concepts are enormously. We always use public roads ,streetlights, sewer lines and public security. We also complain about those not using them well without knowing that once these goods and services are provides, we can not stop others from using it, neither can the consumption by others reduce the quantity available for our consumption.

Comments are closed.

Economics and Its Meaning in Everyday Life Research Paper

Introduction, modern economics, profit maximisation, social benefit.

Economics is the social science of making sufficient choices or decisions and studies how people interact in their society economically. This paper introduces the subject of economics and unfolds what it is all about. We live in a society where economics is a valuable need in order for us to understand and handle any problems that may occur in the future. The basic economic problem is scarcity, where people’s wants and needs are unlimited.

Every time a need is satisfied, a new need is then created thus, creates the unlimited wants and needs of the human characteristic. The problem of scarcity results in allocation, which is the process of choosing needs that will be gratified and how many resources we will use in order to satisfy them. Because there are so many wants waiting to be satisfied, there are only so many resources to fulfill those wants. Limited resources are the condition of there not being enough resources to fulfill all wants and needs.

Since economics is all about making choices, people must understand the cost and benefits of any choice in order to make competent choices. Opportunity cost and Opportunity benefits guide the decisions process of individuals and countries and determine the goods to which they are going to be produced. However, Opportunity cost is the option that you must give up when you make a choice, and opportunity benefit is what you gain by making a certain decision. An example of opportunity cost and opportunity benefit is assuming one night you have a stack of homework waiting for you to do, but when your parents get home, they demand that you go out with them to eat dinner and catch a flick afterward. Yet you really want to do your homework and study, but you give up your education time to spend the night with your parents. Your opportunity cost of this is what you give up, and that is your study time; however, you do gain a benefit from giving up your homework, and that is a movie and a casual dinner with your parents.

Every society has basic economic questions, and when responding to these questions, societies must balance the needs of individuals with the needs of society together. The subject Economics is divided into two separate branches: microeconomics which examines the choices of individuals regarding one product, one firm, or one industry, and macroeconomics examines the conduct of the whole economy at once. Everything in life has a theory; in economics, the importance of theory is a simplified description of reality.

The economic theory helps to understand the economic systems, which are the combination of social and individual decision-making it uses to answer the three economic questions. Economist uses an ideological tool called a budget constraint that is the mixture of goods that can be acquired although it is given a limited amount of income. A person goes through life they will make economic decisions as a consumer, as a worker, and as a citizen that will make an understanding of economic theory an important part of everyday life. (Cubitt, 2005).

Countries such as the United States use a variance of approaches in order to answer the basic economic questions. A market economy is buyers and sellers and is the state of trade as determined by prices, supply, and demand. The question of what to produce is decided by individual consumers and producers in the marketplace by using the price system. A command economy is all about government planners deciding what is produced and available for sale. A traditional economy is where prices are set because of holidays. A mixed economy is a combination of a market, command, and traditional economy. Although the U.S. has a great economy, the main economic problem still lies in our hands. Scarcity and choice exist in all economies. However, like our society, other societies use different combinations of individual and social choices to allocate resources.

Modern economics vs. political economy, as it used to be called-dates back to1776. It begins with the American Revolution. A man named Adam Smith, a Scottish philosopher, published a book called Smith’s work is considered the first example of modern economics. In some places, Smith is most famous for suggesting that businesses always try to monopolize markets and raise prices. Economists credit Adam Smith’s theory of the invisible hand – the idea that a market economy will operate so that no one can be made better off without making someone else worse off. It is as if an invisible hand is guiding the markets when in reality, the markets merely reflect the activities of those trading in them.

When prices for some widely consumed good or service surge or when some company s profits appear to reach stratospheric levels, the popular press seems to return to St. Augustine and ask what is the just price. Others maintain that economics began much, much earlier. Economics figures in most national elections. John Kennedy was elected during the recession that plagued the prior administration; the recession ended in the second month of Kennedy s term as he demonstrated a combination of timing and luck matched by few Presidents.

Franklin D. Roosevelt s landslide victory in 1936-based on his efforts to turn back the Great Depression- set the course for the next several decades of U.S. politics. The economy is telling us what s happening and what could happen next. To understand the economy, you have to look at how the economy is measured, scaled, and gauged. How big, rich fast-growing it is. The economy in the United States and increasingly throughout the world is organized into markets. Markets are where we trade things- someone s labor, time, and effort for his wage; or hard-earned dollars for a car.

Markets are rather old-maybe as old as civilization itself. Markets are crucial to understanding the economy. They include much more than the stock market, although that one is quite interesting. Markets exist for almost anything-time and labor, art, cars, things we make, and services we buy. Most markets have common elements, patterns that make buying a car and getting a second opinion before surgery almost the same thing. As the axiom goes, the only constant changes. In the economy, changes occur all the time. They are what shift prices ad gives rise to opportunities.

Economics is the rules of the game, how we organize society. Most of what we see as important in everyday life is organized by the economy. On a day-to-day basis, economics has to do with what kind of job we have or don’t have; with how much money we can earn; with what things cost; with whether we can save and invest enough for a comfortable future; with how much we need tomorrow and with how well off our children will be in coming years. Economics is why we have jobs. Why we work, why we earn incomes, why money matters, and why markets are important. Economic ideas contribute to the way our society is organized. That the kind of organization we have today has evolved gradually doesn’t t make the principles behind it any less important. It evolved through history to the current arrangement and is still changing and evolving. The social fabric is always likely to be changing. Many of the principles behind the current organization depend on economics and include many ideas.

Principles of economics include Private property- we can own land, houses, tools, books, and all kinds of other goods and use them, or dispose of them, as we wish. Another is a job. We have jobs and earn income with our labor. Human rights-we do to own other people and don’t have pre-emptive rights to someone else s labor and property. Markets- the way we exchange private property or exchange labor for income is through a voluntary bargaining process called a market. We use money as a way to store wealth and to buy and sell things we own, including our own labor.

The thing that distinguishes markets and money from other elements of the economy is that they are a little more fundamental. In almost any society based on private property, both money and markets are present. Not much private property is needed to give rise to markets and money just enough so that people have some things to exchange and need a way to keep track of how much money they have. Trading has been practiced since before recorded history. Ancient tribes traded with one another to get essential tools that were hard to make locally. (Samuelson, 2005) Today economist speaks of gains form trade.

The most misunderstood part of economics is in public debates. Recently the political arena has echoed with arguments over the budget deficit and the national debt. We hear every possible opinion, from claims that we are about to drown in our own red ink, to suggestions that we ignore the debt, to claims that cutting our taxes will lead to larger tax revenues for the government and a drop in the deficit. Some of these arguments are involved; the difference between the national debt and the budget deficit is rather straightforward. Each year the government collects taxes and spends money. When expenditures exceed revenues, the government is left with a gap. This gap is the deficit.

Expenditures cover a wide range of items, including social security benefits, Medicare and Medicaid payments, salaries of government workers, foreign aid, and government purchases from paper clips to jet planes. The numbers and reports on the national debt have another important complication. The government saves some revenues by investing them in Treasury bonds. Measurement of economics has a venerable history. For a long time, people thought the only thing to economics was measuring or counting. Forecasts almost always require numbers- at times to provide a forecast that really gets specific, at other times to make a vague forecast look specific enough to be worth paying for. (Fontaine, 2005) Sometimes economics drives the way we measure. As we look at the unemployment rate, deciding what we measure often involves understanding the economy and its various sectors and markets larger.

Some longer-term issues related to the deficit are also legitimate concerns. Over the last few decades, the proportion of total income that America saves and invests in forth future has declined. If we invest less today, there will be less wealth tomorrow. One reflection of the decline in savings is the rise of the deficit. Simply worrying about the deficit, some politicians argue, is the wrong response. Increasing savings is the right response. Japan, in its peak years of economic growth, had far more savings and a far larger than in the United States.

One of the more recent developments in mathematics, physics, and related sciences is a collection of studies alternately referred to as complexity theory, self-organization, and chaos theory. While some commentators may argue that economics has a special claim on chaos, there are interesting parallels between many of these studies and economics. (Keen, 2004) One of the ideas behind these theories is that at times a collection of objects- animals, computer programs, people, or almost anything else seem to become very well organized without any systematic communication or planning.

The economy surrounds us, and it plays a large part in our lives. It has more impact than the weather on how we live and how well we live. Economics runs through other parts of our lives as well. If the economy is in a recession or a depression, it hits a lot of people. The economy helps us keep track of the nation’s standing. The economic system has grown since Adam Smith s book. Right now, since the economy is good, it is easy to get jobs. During a recession or a depression, the economy is the indication of what is going wrong and what to fix. Everyday life is circled around the economy. The different kinds of markets provide a different understanding. The stock market also is an indicator of the economy. The stock market shows the sales and wealth of the different markets around our country. If the economy is good, we know it. It shows everywhere, and politicians don’t hesitate to base an election on how well they did or how awful the economy was under another politician. It will make or break the politician.

All of the businesses have common factors. They all provide products in the form of goods or services. For example, books, food, fitness training, utilities, etc., some of the products provided by businesses are needed by customers. They are, in essence, providing necessities, for example, basic food and clothing. Some businesses, on the other hand, provided products that customers can be persuaded to want through advertising. For example, luxury food, fashion clothing, or a holiday, etc. A business may therefore be defined as; an organization that provides goods or services which satisfy customer needs and wants.

The objective of profit maximization brings with it an imperative question to be considered in great detail; should businesses maximize profits? Businesses have a social responsibility. They need to aim to reduce pollution, improve safety levels, and preserve jobs, etc. firms, in the effort to maximize profits, go against many social and ethical issues, for example, if materials needed by a firm can be found cheaper abroad, profit-maximizing firms will by from countries whose political regimes, the U.K. public may not approve of. It is argued, however, that in order to pay attention to aspects, such as pollution levels, and preservation of jobs, etc., the firm needs to be financially stable. In other words, they need to be making a profit. The importance of profit is just one aspect of the profit-maximizing position of a firm, which adopts the profit-maximizing objective. (Ernst, 2007).

In a short conclusion to the profit-maximizing objective of a firm, one might suggest that there is only one valid definition of a business’s purpose: to create a customer. Profits, then, are the results of being in business. They test how efficiently a business has created a customer in terms of the cost to the business in relation to the revenue gained through the customer.

The size of a firm displays a close correlation to sales revenue. As such, sales revenue is often considered a surrogate. It is said that although high levels of profit bring with it benefits to the owners or shareholders of a firm, high levels of sales revenue, on the other hand, bring with it benefits for managers, for example, higher levels of income.

One major difference to note between profit maximization and revenue maximization is the term to which the objectives are set. A firm whose overall objective is profit maximization is said to have such an objective set long term. In other words, the objective is hoped to be met over a five-year period. A firm whose overall objective, on the other hand, is revenue maximization, is said to have such an objective set short term, the objective is hoped to be met over a two-year period. (Fullbrook, 2004) Perhaps another significant difference to note is that of by whom such objectives have been set. Managers had both the ability and motivation to pursue objectives other than Profit Maximisation, and as we will see soon, this ability and motivation of firm’s managers extend to them being able to pursue Non-Maximising objectives, for example, Social Benefit. Similarly to Revenue Maximisation, controllers of a firm are more interested in objectives that satisfy them, such as Salary, prestige, and status, and job security. (MacKenzie, 2003).

As with those who commit to Revenue Maximising objectives, those who set Growth Maximisation as their objective do so with consideration of what growth the owners in the firm want to see, such as profit, sales, and market share. These different sets of objectives are reconciled by concentrating on the growth of the size of the firm, which in turn will bring with it high salaries and status for managers and larger profits and market shares to keep the shareholders happy. As with the Profit Maximising objective, growth maximization has to limit factors or constraints, both managerial and financial. Finding a product or a market to expand can prove problematic to the management team of a firm. Having found an area of expansion, the management team also faces the limitation of remaining in control of such expansions.

In order to become a growth-driven company, investments need to be made. The funds required for such investments are ever-increasing and can be obtained by either internal investments by the use of retained profit, or external investments funded by borrowing, the latter creating further liabilities for the firm. (Amos, 1994) If either of the aforementioned means of investments is not closely controlled, the risk of either takeovers or shareholder revolt is increased, which intern would have a knock-on effect on the job security of management. Ensuring that the growth of demand is matched equally by the growth in capital supplied can satisfy the above constraints. Control of the leverage revenue will help to keep the level of borrowing in check. Control of the liquidity ratio can prevent a firm from becoming insolvent. Finally, via the retention ratio, profits can be distributed sufficiently in order to keep shareholders happy.

Businesses have a significant contribution to social welfare; we visited this idea earlier when discussing the profit maximization objective of a firm, where one stated the importance of pollution reduction and job security etc. By paying attention to the social welfare of consumers and employees, those within firms will benefit. Namely, suppliers of capital, labor, and other resources that have in the past received substantial returns for their contribution to the improvement of social welfare. Consumers can also benefit where social benefit is the key objective of a firm, through increasing the quality and quantity of the goods and services available to them for consumption.

The public can, in many ways, be the backbone of a firm. They state that the very existence of certain firms is a result of public consent and that as such, those firms that are amongst the most successful tend to be those that exercise socially responsible behavior. It is said that Social Benefit is not a maximizing objective because, in order to be an objective, it would be required to be measurable. Rather, the social benefit is considered in terms of what combinations of goods and services should be produced? How many goods and services should be provided? And finally, how they should be distributed.

There are five main maximization objectives of a firm. You will have noticed throughout the descriptions a mention of the differentiation between managers and owners of a firm. Most large firms tend to be run by professional management teams rather than the owner of the firm. As such, conflicts in the interests or direction of the firm can and do happen. Such conflicts occur as a result of differences between the objectives of the owners and of the managers, also referred to as controllers. The main aim of the owner of a firm is that of maximization of the overall value of the firm, whether that is maintained through profit maximization, revenue maximization, management utility theory, company growth, or indeed social benefit.

The above conflicting interests of a firm’s progression can be better defined as the principal-agent problem, whereby objectives, different to those of the principle, also referred to as the owner, are pursued by the agent, also referred to as the controller or manager. The problem or conflict occurs when the principle has difficulty enforcing their contracts upon the agent or when the monitoring of the agent to verify that they are furthering the principle’s objectives becomes unjustifiably costly.

In economics, profits are not merely an objective; they are, in fact, the very reason for the existence of the business enterprise. The statement alone opens discussions regarding the existence of a firm. For Example, A charity shop, by its very nature, does not thrive on profit as a means of existence, rather, it relies on the generosity of the general public, and therefore it would be fair to suggest that the objective of most charity shops is a social benefit. The nature of a business, its size, location, and management model will all together determine the route to which the company wishes to follow. Thus the objectives it will set. When looking into any business, large or small, one will see that no single decision is clear, there are many clouds surrounding the smallest of decisions, and so the analysis of firms, and in particular, the objectivity of a firm, cannot be made in black and white, there is simply too much about the organization, macro and microeconomics, politics and social factors to consider, all of which are ever-changing.

Amos, Orley. Economic Literacy . Hawthornel, New Jersey: Career Press, (1994).

Cubitt, Robin (2005) “Experiments and the Domain of Economic Theory,” Journal of Economic Methodology 12: 297-210.

Ernst, Z. (2007) “Philosophical Issues Arising from Experimental Economics”, Philosophy Compass, Blackwell.

Fontaine, P. and R. Leonard (2005) The Experiment in the History of Economics London: Routledge.

Fullbrook, Edward, What’s Wrong With Economics, Anthem, (2004).

Keen, Steve, Debunking Economics, Zed Books, (2004).

MacKenzie, D. F. Muniesa and L. Siu (eds.) (2003): Do Economists Make Markets? On the Performativity of Economics. Princeton: Princeton University Press.

Samuelson, L. (2005) “Economic Theory and Experimental Economics”, Journal of Economic Literature 43: 65-107.

- The Synergy Between Capitalism and Democracy

- Basics of Microeconomics and Macroeconomics

- The Walmart Firm’s Funding Strategies for Growth Maximization

- Determinants of Wages: Earning Potential Maximization

- The Goal of the Firm: Maximization of the Wealth

- Pitt County: Urban Economics and Export-Based Theories

- Marx and Weber in Relation to History: Materialism and Existential Idealism

- Reductionist Effect in Macroeconomics

- Government: The Cause or the Solution

- Financial Accounting Theory: Capture Theory and Economic Interest Theory

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2021, October 25). Economics and Its Meaning in Everyday Life. https://ivypanda.com/essays/economics-and-its-meaning-in-everyday-life/

"Economics and Its Meaning in Everyday Life." IvyPanda , 25 Oct. 2021, ivypanda.com/essays/economics-and-its-meaning-in-everyday-life/.

IvyPanda . (2021) 'Economics and Its Meaning in Everyday Life'. 25 October.

IvyPanda . 2021. "Economics and Its Meaning in Everyday Life." October 25, 2021. https://ivypanda.com/essays/economics-and-its-meaning-in-everyday-life/.

1. IvyPanda . "Economics and Its Meaning in Everyday Life." October 25, 2021. https://ivypanda.com/essays/economics-and-its-meaning-in-everyday-life/.

Bibliography

IvyPanda . "Economics and Its Meaning in Everyday Life." October 25, 2021. https://ivypanda.com/essays/economics-and-its-meaning-in-everyday-life/.

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

IvyPanda uses cookies and similar technologies to enhance your experience, enabling functionalities such as:

- Basic site functions

- Ensuring secure, safe transactions

- Secure account login

- Remembering account, browser, and regional preferences

- Remembering privacy and security settings

- Analyzing site traffic and usage

- Personalized search, content, and recommendations

- Displaying relevant, targeted ads on and off IvyPanda

Please refer to IvyPanda's Cookies Policy and Privacy Policy for detailed information.

Certain technologies we use are essential for critical functions such as security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and ensuring the site operates correctly for browsing and transactions.

Cookies and similar technologies are used to enhance your experience by:

- Remembering general and regional preferences

- Personalizing content, search, recommendations, and offers

Some functions, such as personalized recommendations, account preferences, or localization, may not work correctly without these technologies. For more details, please refer to IvyPanda's Cookies Policy .

To enable personalized advertising (such as interest-based ads), we may share your data with our marketing and advertising partners using cookies and other technologies. These partners may have their own information collected about you. Turning off the personalized advertising setting won't stop you from seeing IvyPanda ads, but it may make the ads you see less relevant or more repetitive.

Personalized advertising may be considered a "sale" or "sharing" of the information under California and other state privacy laws, and you may have the right to opt out. Turning off personalized advertising allows you to exercise your right to opt out. Learn more in IvyPanda's Cookies Policy and Privacy Policy .

The World’s Fastest Growing Economy Is not What You Think

Top 10 Countries With Highest GDP Growth Rate in 2024

Budgeting Guide: How To Make an Effective Budget for Beginners

Global Debt Reaches Record High of the $315 Trillion

The importance of economics in our everyday lives.

Economics plays an important role in managing individual as well as collective affairs of life, encompassing business, finance, and the economy. In today’s world, individuals face a fundamental problem in the form of unlimited wants amidst limited resources. The importance of economics can be seen from the fact that it helps individuals and societies achieve maximum wants or profits by optimally using limited resources.

- Importance of economics

- Mental development

- Sense of responsibility

- Manage personal economic affairs

- Solution to economic problems

- Optimal use of resources

- Reduce income inequality

- Economics planning

- Political stability

- Development and growth of a country

- Globalization & economics

- Economics is useful for the various sections of society

Importance of Economics

The approach of economics towards problem-solving is practical. It enlightens the minds of people to understand how to make personal economic plans; manage business affairs; and use limited resources to fulfil their unlimited wants . Moreover, knowledge of economics helps policymakers solve economic problems like inflation and unemployment, use limited resources optimally, and make policies for the development and growth of the country.

The following points show the importance of economic science in our daily lives.

1. Mental Development

The knowledge of economics develops the mental capabilities of individuals. It helps individuals understand how to organise their daily economic affairs, how to invest, how to do business, and how to adapt to a changing economic environment.

- Positive vs. Normative Economics: Differences & Examples

- Is Economics a Science?

2. Sense of Responsibility

It is a fact that our earth’s resources are limited and they are replenishing day by day. Knowledge of economics creates a sense of responsibility towards the limited resources of our planet and encourages the optimal use of resources.

3. Manage Personal Economic Affairs

The life of man revolves around fulfilling the basic needs, necessities and luxuries of life. Knowledge of economics helps individuals manage their personal affairs related to budget, investments, allocations of resources, saving and consumption, etc.

4. Solution to economic problems

Every country faces various economic challenges, including inflation , unemployment, poverty, incoming equality, deficit balance of payments, etc. Knowledge of economics offers a way out of these problems by enabling economists and policymakers to make effective and informed policy measures.

5. Optimal use of resources

The planet’s resources are scarce. The main purpose of economics is to optimally use limited resources to fulfil maximum wants. It helps countries optimally use their limited resources with better allocation among different alternatives to boost economic development and growth. Moreover, microeconomics deals with how consumers can fulfil their wants and how firms can maximise their profits with the minimum cost.

6. Reduce income inequality

Incoming equality is a major problem in the modern world. After the capitalist revelation, the problem of income inequality intensified. According to the Oxfam inequality report, one per cent of people hold two-thirds of the world’s wealth produced in the last two years. The subject of economics advocates the fair distribution of wealth among the citizens of a country. It advocates social justice and equality so that the gains of economic development and growth can reach every person In a country.

7. Economics planning

Economic planning is the key requirement for the development and growth of a country. Advanced countries leverage economic planning as a tool to optimally use their limited resources, thereby maximizing efficiency and productivity. The knowledge of economics enables countries to make short-term, medium-term, and long-term plans to boost social and economic growth.

8. Political Stability

Political and economic stability are related to each other, as economic stability paves the way for political stability. The governments that make feasible economic policies for the social and economic development of people are always promoted, leading to political stability. On the other hand, governments that fail to deliver pragmatic policies for the development and betterment of their citizens often face opposition and are even overthrown.

9. Development of a country

Economics promotes the economic development and growth of a country. Many economic problems, such as inflation, unemployment, poverty, market failures, income inequality, etc., can be fixed with better policies for the economic development of the country.

Economics provides comprehensive data regarding various economic indicators such as GDP, savings, investment, and policy rate to know the present state of the economy. Based on these indicators, policymakers can make better and more feasible policies for the economic and social development of a country.

10. Globalisation & Economics

The world has changed into a global village where economic activities transcend national borders. People working from their homes provide services across the globe as freelancers. In addition, individuals engaged in e-commerce businesses, buying and selling goods and services in multiple countries. So, knowledge of economics is an essential requirement for understanding global market trends and their dynamics.

Economics is useful for various sections of society

Businessman Economics helps businessmen make informed investment decisions by analyzing various economic indicators, models, and theories. It helps businessmen optimize resource allocation to earn maximum profit.

Politicians The knowledge of economics is helpful for politicians because they are directly linked with people to solve their economic and social problems.

Ministers Government ministers related to finance and economic affairs are supposed to be economists. They have to make policies for the people and they must know the economic and social issues faced By people.

In short, economics is a social science which deals with human behaviour related to economic matters. The importance of economics cannot be overlooked in the modern world because it enlightens the minds of people to optimally use limited resources. Moreover, economics promotes or advocates social justice and fair distribution of wealth. It helps people make informed choices and allocate their scarce resources to fulfill their maximum wants.

You may also like

Comparing Economic Laws with State and Moral Laws

Is Economics a Science? A Critical Analysis

Positive vs. Normative Economics: What is the Difference?

Add comment, cancel reply.

Save my name, email, and website in this browser for the next time I comment.

7 Financial Mistakes To Avoid in Your 20s and 30s

Learn economics.

10 Different Types of Costs: Explained with Examples

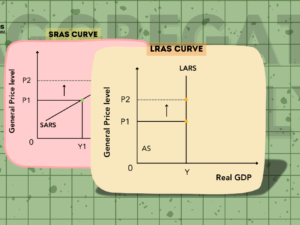

Aggregate Supply Curve: Definition, Graph and Key Determinants

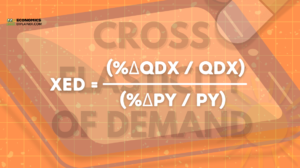

Cross Elasticity of Demand: Formula and How to Calculate

Recent posts.

Energy Transition Index: Country Rankings and Scores in 2024

IMAGES

VIDEO

COMMENTS

Another important element of life is work. Which job will give the most satisfaction? It is not just about finding a well-paid job, we tend to gain most job satisfaction when we feel part of the process and …

250 Words Essay on Economics Importance In Daily Life. What is Economics? Economics is a subject that helps us understand how people, businesses, and countries make choices about how to use their limited …

I am a single mom and the science of economics is a daily occurrence, at the grocery store, while doing homework, and in my choice of …

Writing an economics essay is all about analyzing how money, markets, and policies shape our everyday lives. Whether you're breaking down the effects of a recession or …

Applying economics in everyday life illustrates how deeply it is woven into our daily decision-making. It provides a framework for understanding how we allocate limited resources like time and money, weighing the costs and …

How do we apply economics in everyday life? From understanding different ticket prices to the diminishing returns of drinking extra beer - you mostly can't escape economics.

We live in a society where economics is a valuable need in order for us to understand and handle any problems that may occur in the future. The basic economic problem is scarcity, where people’s wants and needs are …

Every country faces various economic challenges, including inflation, unemployment, poverty, incoming equality, deficit balance of payments, etc. Knowledge of economics offers a way out of these problems by enabling …

As I started to look at different research to work on this paper I discover how much of my life and family live is controlled by Economics. Everything from where we live to how much money I …