Press Centre

We blog about driver events, product updates, driving tips, driver stories and more.

- PRODUCT UPDATES

- DRIVER STORIES

Grab Reports First Quarter 2022 Results

Excerpt here. allow the user to have fully control on excerpt.

Grab Holdings Limited (NASDAQ: GRAB) today announced financial results for the quarter ended March 31, 2022.

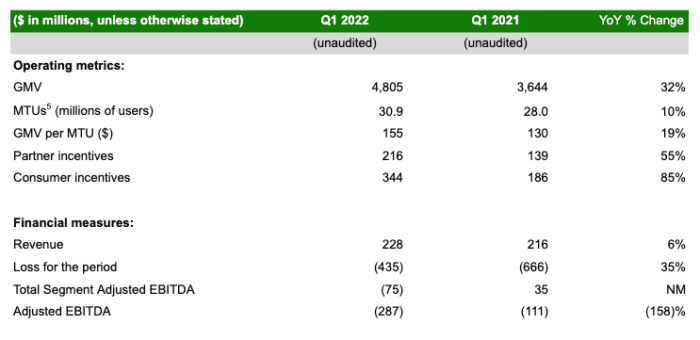

- Outperformed Q1 GMV and TPV guidance for deliveries, mobility and financial services

- GMV of $4.8 billion, grew 32% year-over-year (“YoY”)

- Revenue $228 million, up 6% YoY

- Loss for the period of $435 million, a 35% improvement YoY

SINGAPORE , May 19, 2022 – Grab Holdings Limited (NASDAQ: GRAB) today announced financial results for the quarter ended March 31, 2022.

“Our first quarter results are a testament to the resilience of Southeast Asia’s economy as we move past the worst of the pandemic restrictions. We are optimistic that our business will continue to strengthen as more countries pivot to living with Covid-19. In the quarter, we delivered strong top-line growth in deliveries as we expanded our merchant selection to give users more reasons to choose Grab. Our mobility business also rebounded and we expect it to gradually recover as Covid restrictions ease further and our active driver base increases,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab.

“ We are pleased to report strong first quarter results, with our core segments’ GMV and TPV outperforming the high-end of our guidance range. Reven ue rose year-on-year, driven by strong GMV growth and higher commission rates [1] , while our adjusted EBITDA margins improved from the fourth quarter. Looking ahead, we are focused on growing sustainably by being disciplined with our capital, optimizing our fixed cost base and tapering our incentive spend as the market rationalizes. We believe these actions will put us on a path to achieving segment adjusted EBITDA breakeven for deliveries by the end of 2023,” said Peter Oey, Chief Financial Officer of Grab.

Q1 Key Highlights

- Surpassed quarterly gross merchandise value [2] (GMV) and total payments volume [3] (TPV) Q1 guidance for deliveries, mobility and financial services, respectively.

- Improved Group and deliveries adjusted EBITDA margins, as a percentage of GMV, from the previous quarter.

- Demonstrated continued growth in financial services, and nearly doubled enterprise and new initiatives GMV year-on-year (YoY).

- Mobility segment continued to rebound as we increased the number of active drivers [4] on our platform

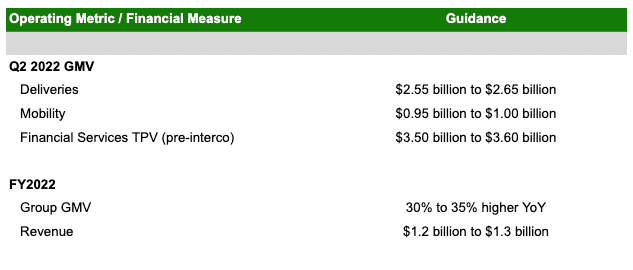

- Grab expects full-year 2022 YoY growth in Group GMV to be between 30% and 35% and full-year 2022 revenue to be between $1.2 billion and $1.3 billion.

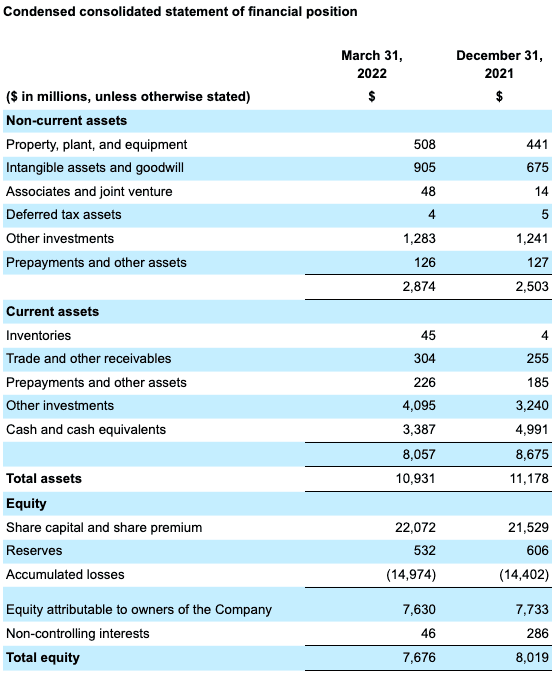

- As of March 31, 2022, Grab had cash liquidity of $8.2 billion, a decrease from $9.0 billion as of December 31, 2021 primarily due to net cash outflow from operating activities and the acquisition of Jaya Grocer.

First Quarter Group Financial and Operational Highlights

Q1 Business Review

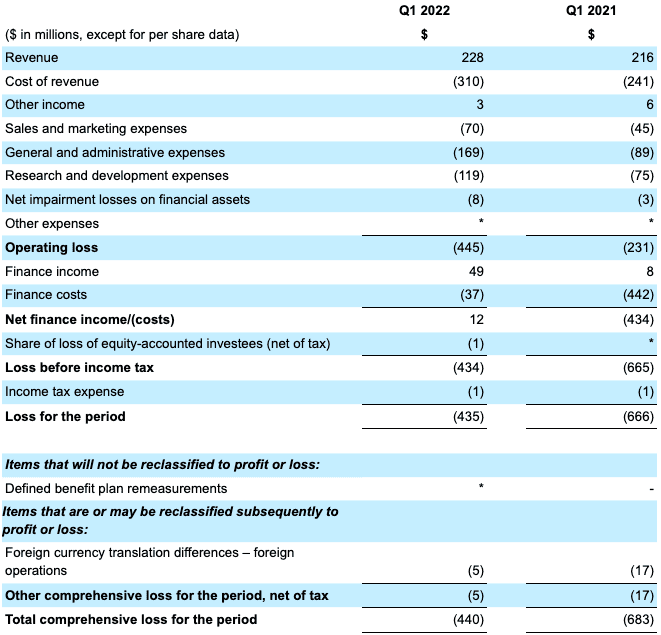

We delivered strong first quarter results that surpassed quarterly GMV and TPV guidance, driven by robust year-on-year GMV growth across all business segments. Overall, GMV and revenue grew 32% and 6% year-on-year respectively, driven by mobility segment acceleration, strong core food and groceries growth as we expanded our merchant selection and contributions from Jaya Grocer. Revenue rose 87% compared to the prior quarter, as total incentives in the deliveries segment moderated and this was the first quarter that included Jaya Grocer financial results since we closed the acquisition at the end of January 2022.

As countries eased pandemic restrictions further during the quarter, monthly transacting users (MTUs) rose 10% year-on-year to reach 30.9 million, while average spend per user, defined as GMV per MTU, rose 19% to $155, indicating resilient demand for our services.

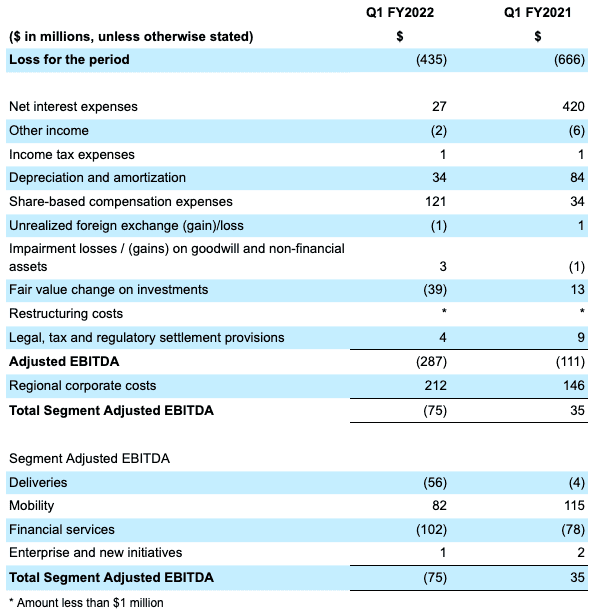

Adjusted EBITDA was negative $287 million, declining from negative $111 million a year ago on higher regional costs and incentive investments, while adjusted EBITDA improved by approximately $17 million compared to the fourth quarter 2021, as total incentives in our deliveries segment came down. Adjusted EBITDA margins as a percentage of GMV declined to (6.0)% in the quarter compared to (3.1)% in the same period a year ago, but improved from (6.8)% achieved in the previous quarter. Net loss for the quarter was $435 million, a 35% improvement year-on-year, primarily due to elimination of the non-cash interest expense of Grab’s convertible redeemable preference shares that converted to ordinary shares in December 2021 and will no longer be incurred going forward.

Q2 & FY2022 Business Outlook

Looking ahead, we believe the worst of the pandemic restrictions are behind us as more countries in the region pivot to living with Covid. We are optimistic that our mobility supply will stabilize in the second-half of 2022, and that mobility driver incentives as a percentage of GMV will taper in that period.

We exited the first quarter with mobility GMV on the rebound on a sequential basis. Our active driver base, the majority of which complete both deliveries and mobility jobs, increased in the quarter, but was still below pre-Covid levels. Over the month of March, our active driver base was 76% of December 2019 levels. We will continue to grow our driver base in order to capture the strong demand we are seeing coming back online. Furthermore, we are closely monitoring the impact of fuel inflation on our drivers’ earnings, and will continue to look for ways to support our drivers in mitigating the effects.

For our deliveries segment, we are focused on improving our unit economics by tapering incentives as a percentage of GMV, and driving organic growth in our core food and groceries deliveries segment. We will do this by improving the driver and user experience through tech and product enhancements, and strengthening our moat by offering users a wide selection of merchants to meet their needs. As we exited the first quarter, we saw stable demand for deliveries, despite an easing of Covid-restrictions in some countries, and a moderating of consumer incentives compared to the prior quarter. These early signs indicate that demand for deliveries may remain stable even as Southeast Asia moves to a post-pandemic footing. Longer term, we plan to expand our deliveries segment into underpenetrated outer cities and towns in most of our markets to tap growth opportunities there. During the quarter, we began to integrate Jaya Grocer stores onto our groceries marketplace in Malaysia and plan to complete the integration in the second-half of 2022.

Financial Services

For financial services, we will continue to embed different payment and lending options into our app to enhance our marketplace and better support our drivers, merchants and consumers. For example, we will expand the Buy Now Pay Later product into more markets in 2022 and 2023. Our Singapore digital bank is undergoing an internal pilot, and we plan to launch it publicly in the second half of the year. In April, Grab’s digital banking joint venture with Singtel, also known as GXS Bank, and a consortium of partners were selected to receive a full digital banking license in Malaysia, subject to meeting all of Bank Negara Malaysia’s regulatory conditions. This development is another milestone in our journey to bring financial services to a vast underserved market.

OVO continues to make meaningful progress as it deepens its open ecosystem in order to tap the long-term opportunities within Indonesia’s payments and financial services landscape.

Sustainable Growth

Going forward, we are focused on sustainable growth to meet our core food deliveries and overall deliveries segment adjusted EBITDA breakeven timelines of by the first half of 2023 and the end of 2023, respectively. We are also targeting long-term segment adjusted EBITDA margins for mobility and deliveries of 12% and 3% and above, respectively. To achieve this, we are focused on three key levers. First, we are focused on overall cost management where we will optimize our fixed cost base, streamline our core segments to drive internal efficiencies and continue to be disciplined with our capital by managing our incentive spend closely. Second, we plan to leverage technology, partnerships and our superapp ecosystem to grow our user base, improve efficiency and increase user stickiness. Last, we will continue to position our core segments for recovery and growth in order to capture the vast opportunities across our core segments.

In May, we announced three new sustainability goals in our annual Environment, Social and Governance report. They are i) to double the number of marginalized individuals earning an income on our platform by 2025, ii) to expand the proportion of women on our leadership bench to 40% by 2030, and iii) to achieve carbon neutrality within our ecosystem by 2040. These goals serve as a blueprint for us as we transition to a triple bottom line company; one where we deliver financial performance for our shareholders while ensuring we have a positive social impact on communities and on the environment.

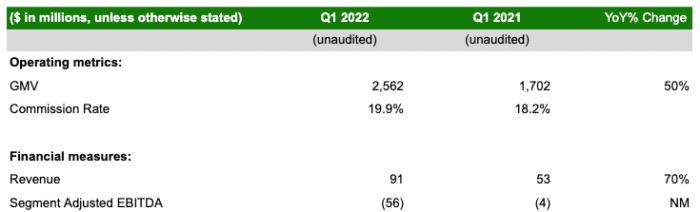

First Quarter Segment Financial and Operational Highlights

Our deliveries segment registered strong GMV and revenue growth driven by continued growth in food and groceries deliveries and contributions following our acquisition of Jaya Grocer. Deliveries’ MTUs and average spend per user grew by 26% and 19% year-on-year respectively, as we expanded our merchant selection and deepened local merchant relationships to give users more reasons to transact with Grab.

In Q1 2022, active merchant-partners [6] grew by 34% year-on-year and we continued to forge strong local partnerships to drive organic growth . For example, we launched a pilot in the first quarter to partner with and promote local food merchants to our users by creating bespoke marketing materials that we amplified in-app. We saw early positive results from this pilot and we plan to expand these partnerships this year.

Segment Adjusted EBITDA declined $52 million year-on-year to negative $56 million, but improved by 34% from the previous quarter as total incentives spent moderated on a sequential basis. We also made progress on our deliveries unit economics with segment adjusted EBITDA margins as a percentage of GMV, improved to (2.2)% in the quarter from (3.5)% in the fourth quarter 2021 as total incentives as a proportion of deliveries GMV declined to 16.3% from 18.2% quarter-on-quarter.

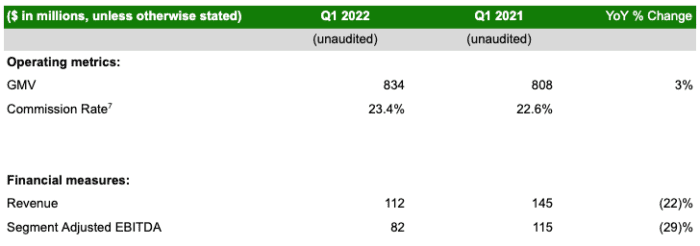

In the first quarter, our mobility segment showed signs of a rebound on both the demand and supply side of the marketplace. Furthermore, we see the continuation of a gradual recovery coming out of the quarter, as countries like Singapore, Indonesia and the Philippines loosened Covid and travel restrictions in March.

Segment MTUs continued to recover and mobility GMV rose 9% quarter-on-quarter, signaling demand recovery after the impact of Omicron in the first two months of the quarter. We increased our average monthly active drivers by 220,000 from the third quarter 2021 to the first quarter 2022. The number of active drivers on our platform over Q1 2022 reached the highest level since Q2 2020, indicating that our efforts to onboard more drivers for our platform are bearing fruit. Looking ahead, we will continue to acquire drivers in order to reestablish our pre-covid supply levels and to capture the strong demand we see coming back online. We expect our mobility supply to stabilize in H2 2022, and for mobility driver incentives as a percentage of GMV to taper in that period.

Revenue and segment adjusted EBITDA declined year-on-year as we spent to acquire drivers to capture demand coming back online. Segment Adjusted EBITDA margin for mobility declined to 9.8% of GMV in Q1 2022 compared to 14.3% of GMV in Q1 2021 and from 10.1% of GMV in the previous quarter.

Furthermore, we are closely monitoring the impact of fuel price inflation on our driver-partners’ earnings and taking steps to support them. In Q1 2022, we raised ride-hailing fares in Vietnam, while in Singapore we introduced a temporary driver fee of S$0.50 per ride in addition to fuel discount schemes to help our partners defray higher operating costs.

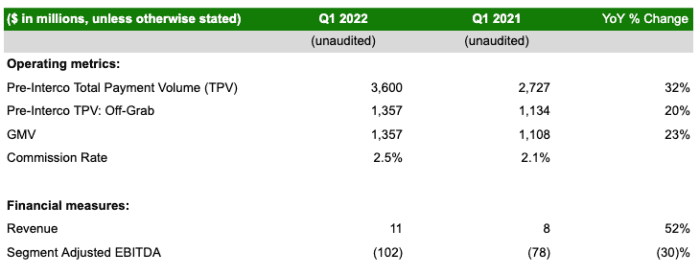

Financial Services

Financial Services (Pre-InterCo) TPV grew robustly in the first quarter, driven by on-platform growth as well as strong MTUs growth of 18% year-on-year. Continued on-platform transaction growth enhances our Superapp flywheel, as GrabPay users have higher levels of retention rates, spending and cross-segment usage compared to cash-users.

Revenue and GMV grew 52% and 23% year-on-year respectively, driven by off-platform GMV growth and strong ecosystem lending growth. TPV [8] of our Buy Now Pay Later product has grown 5 times from Q1 2021 to Q1 2022. Overall loans disbursed, that includes Buy Now Pay Later loans, grew 3 times in the same period.

In the quarter, OVO continued to execute on its open ecosystem strategy, signing up key partners and launching its first recurring payment partnership with a global subscription-based streaming service. OVO also expanded its partnerships with key merchants in the groceries, travel and marketplace segments to capture growth opportunities in those segments. One such partner is Indomaret, a convenience store chain in Indonesia. In the quarter, the number of Indomaret top-up transactions to the OVO wallet grew 57% month-on-month on average, indicating the partnership’s success in driving user stickiness for OVO.

In the quarter, we also launched our first Islamic financing product with a partner in Malaysia. The Shariah-compliant product lets eligible drivers tap convenient financing options to address their cash flow needs. This product is yet another example of how we deliver value to our users via our hyperlocal approach.

Financial services segment adjusted EBITDA for Q1 2022 declined in the quarter to $(102) million, versus $(78) million in Q1 2021 on continued investment into our digital bank strategy and higher consumer incentives, while segment adjusted EBITDA margin for Q1 2022 was at (2.8)% of TPV, an improvement from (2.9)% in Q1 2021.

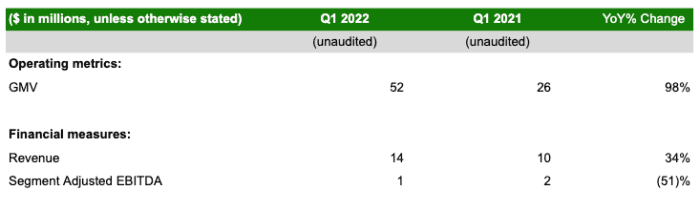

Enterprise and New Initiatives

In the quarter, enterprise and new initiatives GMV and revenue grew strongly on a year-over-year basis driven by gains in our advertising business. GrabAds also increased its advertiser base seven times compared to the same period a year ago, by onboarding more Grab merchants on its advertising platform that provides search and display advertising options to drive in-app sales.

[1] Commission Rate is an operating metric, representing the total dollar value paid to Grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of GMV, over the period of measurement.

[2] GMV means gross merchandise value, an operating metric representing the sum of the total dollar value of transactions from Grab’s services, including any applicable taxes, tips, tolls and fees, over the period of measurement.

[3] Total Payments Volume (TPV) is defined as the value of payments, net of payment reversals, successfully completed through the Grab platform for the financial services segment. Pre-InterCo means this segment data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation.

[4] Active driver-partners are defined as Grab’s driver-partners that had bid at least one job on the Grab driver app during a month. Active driver-partners over a quarterly or annual period are calculated based on the average of the Active drivers for each month in the relevant period.

[5] MTUs means monthly transacting users, which is an operating metric defined as the monthly number of unique users who transact via our products, where transact means to have successfully paid for any of our products. MTUs over a quarterly or annual period are calculated based on the average of the MTUs for each month in the relevant period. Figure is inclusive of OVO MTUs. Excluding OVO MTUs, our MTUs for Q1 2022 and Q1 2021 would be 27.8 million and 23.8 million respectively, and GMV per MTU will be $173 and $153 respectively.

[6] Active merchant-partners are defined as Grab’s merchant-partners that had completed at least one order on the Grab merchant app during a month. Active merchant-partners over a quarterly or annual period are calculated based on the average of the Active merchants for each month in the relevant period.

[7] Commission Rate is an operating metric, representing the total dollar value paid to Grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of GMV, over the period of measurement.

[8] Calculated as the year-on-year change in TPV (pre-interCo) generated from Buy Now Pay Later.

Grab is Southeast Asia’s leading superapp based on GMV in 2021 in each of food deliveries, mobility and the e-wallets segment of financial services, according to Euromonitor. Grab operates across the deliveries, mobility and digital financial services sectors in 480 cities in eight countries in the Southeast Asia region – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Grab enables millions of people each day to access its driver- and merchant-partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance, wealth management and telemedicine, all through a single “everyday everything” app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone, and since then, the Grab app has been downloaded onto millions of mobile devices. Grab strives to serve a triple bottom line: to simultaneously deliver financial performance for its shareholders and have a positive social and environmental impact in Southeast Asia.

Forward-Looking Statements

This document and the announced investor webcast contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s beliefs and expectations, business strategy and plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab’s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described in the “Risk Factors” section of Grab’s registration statement on Form F-1 and the prospectus therein, and other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information and Non-IFRS Financial Measures

Grab’s unaudited selected financial data for the three months ended March 31, 2022 and 2021 included in this document and the investor webcast is based on financial data derived from the Grab’s management accounts that have not been reviewed or audited.

This document and the investor webcast also include references to non-IFRS financial measures, which include: Adjusted EBITDA, Total Segment Adjusted EBITDA and Segment Adjusted EBITDA. However, the presentation of these non-IFRS financial measures is not intended to be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies.

Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab’s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab’s management uses: Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab’s business segments, as it does not include regional corporate costs.

There are a number of limitations related to the use of non-IFRS financial measures. In light of these limitations, we provide specific information regarding the IFRS amounts excluded from these non-IFRS financial measures and evaluate these non-IFRS financial measures together with their relevant financial measures in accordance with IFRS.

This document and the investor webcast also includes “Pre-InterCo” data that does not reflect elimination of intragroup transactions, which means such data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions.

Explanation of non-IFRS financial measures:

- Adjusted EBITDA is a non-IFRS financial measure calculated as net loss adjusted to exclude: (i) interest income (expenses), (ii) other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses.

- Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

- Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value.

Operating Metrics

Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab’s services, including any applicable taxes, tips, tolls and fees, over the period of measurement. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of a consumer’s spend that is being directed through Grab’s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare, Grab’s aggregate operating results, which captures significant trends in its business over time.

Monthly Transacting User (MTUs) is defined as the monthly transacting users, which is an operating metric defined as the monthly number of unique users who transact via Grab’s products, where transact means to have successfully paid for any of Grab’s products. MTUs is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business.

Commission Rate represents the total dollar value paid to Grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of GMV, over the period of measurement.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by Grab from those driver- and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by Grab from those driver- and merchant-partners. Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Industry and Market Data

This document also contains information, estimates and other statistical data derived from third party sources, including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations, and you are cautioned not to give undue weight on such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

Unaudited Summary of Financial Results

Condensed consolidated statement of profit or loss and other comprehensive income

Condensed consolidated statement of financial position

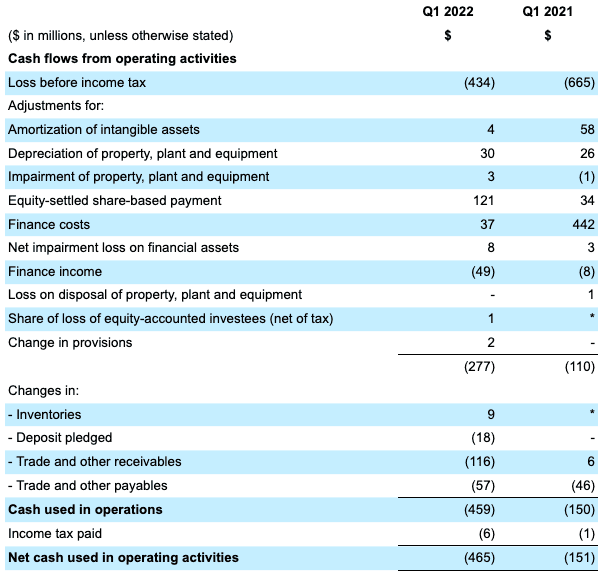

Condensed consolidated statement of cash flow

For inquiries regarding Grab, please contact:

Grab: [email protected]

Sard Verbinnen & Co: [email protected]

Grab: [email protected]

Source: Grab Holdings Limited

Visit our country press centres

- Philippines

Media Library

Media inquiries, follow us on grab social channels.

- Inside Grab

Engineering Stories

Contact the grab media team.

Please complete the fields below and a member of the Grab media team will respond to your inquiry regarding news stories. For customer support inquiries, do use the contact details found at the bottom of the webpage.

Press Contact

- Your Name *

- Email Address *

- Your Country Your Country Singapore Malaysia Indonesia Thailand Philippines Vietnam Afghanistan Albania Algeria American Samoa Andorra Angola Antigua and Barbuda Argentina Armenia Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia and Herzegovina Botswana Brazil Brunei Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile China Colombia Comoros Congo, Democratic Republic of the Congo, Republic of the Costa Rica Côte d'Ivoire Croatia Cuba Curaçao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Faroe Islands Fiji Finland France French Polynesia Gabon Gambia Georgia Germany Ghana Greece Greenland Grenada Guam Guatemala Guinea Guinea-Bissau Guyana Haiti Honduras Hong Kong Hungary Iceland India Iran Iraq Ireland Israel Italy Jamaica Japan Jordan Kazakhstan Kenya Kiribati North Korea South Korea Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Maldives Mali Malta Marshall Islands Mauritania Mauritius Mexico Micronesia Moldova Monaco Mongolia Montenegro Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands New Zealand Nicaragua Niger Nigeria Northern Mariana Islands Norway Oman Pakistan Palau Palestine, State of Panama Papua New Guinea Paraguay Peru Poland Portugal Puerto Rico Qatar Romania Russia Rwanda Saint Kitts and Nevis Saint Lucia Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Sint Maarten Slovakia Slovenia Solomon Islands Somalia South Africa Spain Sri Lanka Sudan Sudan, South Suriname Swaziland Sweden Switzerland Syria Taiwan Tajikistan Tanzania Togo Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vanuatu Vatican City Venezuela Virgin Islands, British Virgin Islands, U.S. Yemen Zambia Zimbabwe

- Media Title *

For members of the media who have inquiries about Grab for your reporting, kindly fill in the form below and our Grab Communications team will reach out to assist you.

We will only be able to reply to media inquiries. For all other questions, please visit our Help Center.

Forward Together

3 Media Close, Singapore 138498

Follow us and keep updated!

- Investor Relations

- Sustainability

- Grab Financial Group

- GrabForGood Fund

- Airport Guides

- GrabExpress

- GrabRewards

- Financial services

- Family Account BETA

- Help Centre

- Drive with us

- Deliver with us

- Driver Centre

- GrabAcademy

- Partner with us

- Financial resources

- Grab for Business

- GrabFinance

- GrabDefence

- Business Delivery Service

Quick Links

- Developer Portal

Komsan Chiyadis

GrabFood delivery-partner, Thailand

COVID-19 has dealt an unprecedented blow to the tourism industry, affecting the livelihoods of millions of workers. One of them was Komsan, an assistant chef in a luxury hotel based in the Srinakarin area.

As the number of tourists at the hotel plunged, he decided to sign up as a GrabFood delivery-partner to earn an alternative income. Soon after, the hotel ceased operations.

Komsan has viewed this change through an optimistic lens, calling it the perfect opportunity for him to embark on a fresh journey after his previous job. Aside from GrabFood deliveries, he now also picks up GrabExpress jobs. It can get tiring, having to shuttle between different locations, but Komsan finds it exciting. And mostly, he’s glad to get his income back on track.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

Grab Reports Fourth Quarter and Full Year 2021 Results

- Strong end to 2021 with another record quarter and year in Gross Merchandise Value (“GMV”), exceeding the high end of full year 2021 guidance range

- 2021 GMV grew 29% year-over-year (“YoY”) to $16.1 billion , and Q4 GMV grew 26% YoY to $4.5 billion

- Deliveries continues to outperform with GMV growing 56% YoY in 2021, and 52% YoY in Q4

- Mobility on the road to recovery with 45% quarter-over-quarter (“QoQ”) GMV growth in Q4

- Grab retained regional category leadership in 2021 for online food delivery, ride-hailing and e-wallet payments; accounting for more than half of Southeast Asia’s total food delivery GMV

SINGAPORE --(BUSINESS WIRE)-- Grab Holdings Limited (NASDAQ:GRAB), Southeast Asia’s leading superapp, today announced financial results for the fourth quarter and full year ended December 31, 2021 .

“2021 was our strongest year yet, even as we faced tougher conditions with the Delta and Omicron variants. We achieved outsized growth in both GMV and Revenues while continuing to improve our Adjusted EBITDA margins year over year, demonstrating the resilience and growing relevance of the superapp,” said Anthony Tan , Group CEO and co-founder of Grab . “Southeast Asians are relying more and more on the Grab superapp for a multitude of daily needs. 56% of our users are now using two or more Grab services and the average user spend on our platform in 2021 grew 31% year over year. We expect 2022 to be another watershed year for Grab, as we get ready to launch our digibank in Singapore , and continue to pursue the massive opportunities in deliveries to outserve consumers with more options and better convenience.”

Peter Oey , Chief Financial Officer of Grab, added, “We maintained category leadership across all our core verticals with our food delivery business making up the majority of Southeast Asia’s online food delivery market. The superapp gives us significant advantages in capital efficiencies, while continuing to drive greater loyalty and retention among our users. We plan to be judicious and disciplined in allocating capital, as we double down on the long-term growth opportunities of our on-demand, advertising and financial services businesses. Our Segment Adjusted EBITDA margins for Fiscal Year 2021 have improved year over year across our three core segments, and we have best-in-class margins in mobility. We remain laser focused on our path to profitability and will continue to improve our unit economics.”

Full Year 2021 Financial and Operational Highlights

- GMV grew by 29% YoY to hit $16.1 billion , marking a record year for Grab. This exceeded the upper end of outlook provided in September 2021 .

- Average Monthly Transacting Users (“MTUs”) for 2021 were 24.1 million, 2% lower YoY primarily due to severe lockdowns in Q3. However, Grab ended the year with 27.7 million MTUs in December 2021 , higher than any other month in 2021 and reflecting strong bounce-back as movement restrictions eased.

- Average spend per user, defined as GMV per MTU, increased by 31% YoY to $666 , reflecting greater loyalty and an increasingly entrenched user base.

- Deliveries and financial services outperformed expectations with 56% YoY growth in GMV and 37% YoY growth in Pre-Interco TPV respectively. This more than offset the 14% YoY drop in mobility GMV as the emergence of new variants slowed recovery.

- Revenue increased by 44% YoY to $675 million off the back of strong growth in deliveries and financial services. Grab’s reported revenue is net of consumer, merchant and driver-partner incentives.

- Loss for 2021 was $3.6 billion , which includes $1.6 billion non-cash interest expense related to Grab’s convertible redeemable preference shares that ceased upon Grab’s public listing and $353 million in one-time public listing related expenses.

- Adjusted EBITDA of $(842) million met our guidance range. This was an 8% decline YoY. However, Adjusted EBITDA margins at (5.2)% of GMV improved compared to (6.2)% in 2020.

- Cash liquidity1 totalled $9.0 billion at the end of the fourth quarter, while our net Cash liquidity2 was $6.8 billion .

Fourth Quarter 2021 Financial and Operational Highlights

- GMV grew 26% YoY to reach $4.5 billion , marking four straight record quarters for Grab. Deliveries and financial services demonstrated strong YoY GMV and TPV (Pre-interco) growth of 52% and 29% respectively. Mobility GMV declined 11% YoY but continues to recover with 45% QoQ growth.

- MTUs grew by 3% YoY and 18% QoQ to 26.0 million as lockdowns continued to ease, the highest since COVID-19 related movement restrictions came into force in Q2 2020.

- Average spend per user increased by 23% YoY to $173 .

- Revenue was $122 million , a 44% decline YoY as Grab preemptively invested to grow driver supply to support strong recovery in mobility demand. Consumer incentives for mobility and deliveries also increased as Grab invested in its category share and MTU growth.

- Loss for the period was $1.1 billion which included $311 million non-cash interest expense related to Grab’s convertible redeemable preference shares that ceased upon Grab’s public listing and $328 million related to one-time public listing related expenses, of which $290 million is non-cash.

- Adjusted EBITDA of $(305) million was down by $203 million YoY. Adjusted EBITDA margins were (6.8)% of GMV compared to (2.8)% in Q4 2020. The decline is a result of the increased investments in incentives stated above, and strategic investments in areas such as tech and financial services, including the digibank as we prepare for its launch in Singapore .

Fourth Quarter and FY2021 Financial and Operational Highlights

(i) See “Operating Metrics” section herein for an explanation of operating metrics used throughout this release.

(ii) For a reconciliation to the most directly comparable IFRS measure see the section titled "Unaudited Financial Information and Non-IFRS Financial Measures.”

Results by Segments

- GMV for 2021 was $8.5 billion , a 56% increase YoY. Q4 deliveries GMV grew 52% YoY to hit a record high of $2.4 billion .

- Deliveries commission rate4 for 2021 was 18.2%, an increase from 16.6% in 2020, and average order values for deliveries increased by 41% in 2021, compared to 2019, before COVID-19.

- Revenue for 2021 was $148 million , up from $5 million in 2020. Q4 Revenue for deliveries declined 98% YoY to $1 million as Grab invested in incentives to maintain its category leadership and to grow adoption of new services. Grab grew category share for food delivery in 2021 compared to 2020, while driving greater efficiencies from incentive investment. For example, on a per order basis, across competitive markets such as Indonesia , Malaysia , Thailand , and Vietnam , we estimate that our GMV to cost ratios5 are 25% to almost 100% more efficient than competitor averages.

- Deliveries Segment Adjusted EBITDA of $(130) million for 2021 represented a margin of (1.5%) as a percentage of GMV, an improvement from (3.9%) in 2020. Q4 deliveries Segment Adjusted EBITDA was $(84) million .

- Euromonitor expects online penetration for grocery delivery to more than double between 2020 and 2025. Grab is doubling down on this space, and in January 2022 , completed its acquisition of a majority stake in Jaya Grocer, a profitable and leading mass-premium supermarket chain in Malaysia with 44 stores. Both companies will partner to make on-demand groceries more accessible to Malaysian consumers. All Jaya Grocer stores will also adopt GrabPay and GrabRewards.

- Grab has also appointed Hardy Cao as its new Head of Supermarkets. Cao is a retail industry veteran with more than two decades of experience. His prior roles include the Chief Operating Officer of Hema in China and President of Carrefour China South Territory as well as Vice President of Carrefour China.

- Grab also continues to forge multi-vertical partnerships across payments, rewards, deliveries and ads with leading global brands. In Q4, Grab announced an expanded partnership with McDonald’s to transform the quick service restaurant experience in Singapore . Grab and Starbucks will also partner across multiple verticals to enhance the Starbucks Experience for customers in Southeast Asia .

- GMV for 2021 was $2.8 billion , down by 14% YoY. Q4 GMV for mobility increased by 45% QoQ (11% decline YoY) to $765 million , on the back of strong recovery in ride-hailing demand as countries continue to cautiously reopen.

- Mobility Commission Rate for 2021 was 23.4%, an increase from 21.3% in 2020.

- Revenue for 2021 grew 4% YoY to $456 million . Mobility Revenue for Q4 was $105 million , down 27% YoY as Grab invested in driver incentives to bolster driver supply to capture strong recovery. Mobility consumer incentive levels also increased in certain markets as investments made in category leadership. In Singapore for example, Grab retained a comfortable lead in category share for Mobility and estimates it spent 4x less on promotions per ride in Q4 than a competitor6.

- Segment Adjusted EBITDA for 2021 of $345 million was a margin of 12.4% on GMV for 2021, which improved from 9.5% in 2020. Mobility Segment Adjusted EBITDA for Q4 was $76 million , a 32% decrease compared to Q4 2020. The decline was likewise due to the investments made in higher driver incentives to meet demand bounceback from lockdowns reopening and maintaining category share.

Financial Services

- Total Payments Volume (Pre-InterCo) for 2021 was $12.1 billion , a 37% increase YoY. Pre-InterCo TPV for Q4 increased by 29% YoY to $3.4 billion , another record quarter for Grab’s financial services segment on a TPV basis.

- Commission Rate for 2021 was 2.3%, an increase from 1.9% in 2020.

- Revenue for 2021 grew by $37 million YoY to $27 million . Financial services Revenue for Q4 was $(1) million , a $3 million improvement YoY.

- Segment Adjusted EBITDA of $(349) million for 2021 represented a margin of (2.9%) of TPV, which was an improvement from (3.7%) in 2020. Financial services Segment Adjusted EBITDA for Q4 was $(110) million , compared to $(82) million in Q4 2020. The decline was due to investments in preparation for digibank launch in Singapore .

- TPV for Buy Now Pay Later has grown 5x between Q4 2020 and Q4 2021. Since its launch in late 2020, off-platform Buy Now Pay Later has seen strong uptake and results. Currently available in Singapore and Malaysia , Grab plans to launch the service in additional markets in 2022.

- Grab continues to invest in digibank opportunities in key markets. The Grab-Singtel digibank joint venture is ramping up operations and getting ready to launch in Singapore in 2022. Separately, Grab and a consortium of partners have applied for a digibank license in Malaysia . Grab also recently completed an acquisition of a 16.26% stake in Bank Fama in Indonesia .

Enterprise and New Initiatives

- Enterprise and new initiatives GMV in 2021 grew 248% YoY to $153 million . Q4 GMV for enterprise and new initiatives grew 127% YoY to $51 million . Grab’s advertising business saw its GMV grow by 189% YoY in Q4.

- Revenue for enterprise and new initiatives for 2021 increased by 22% YoY to $44 million . Revenue for the segment in Q4 declined by 39% YoY to $16 million .

- Segment Adjusted EBITDA for 2021 was $9.3 million or 6% of GMV, compared to 21% of GMV in 2020. Q4 enterprise and new initiatives Segment Adjusted EBITDA was $5 million , down $15 million YoY as continued investments were made in Grab’s Advertising business to expand its merchant base. Between Q4 2020 and Q4 2021, the number of merchants using Grab Marketing Services have more than tripled.

Grab remains category leader in Southeast Asia for online food delivery, ride-hailing and e-wallet payments

Euromonitor has updated its analysis for the full year of 2021 to determine category share across Grab’s three core business verticals: deliveries, mobility and financial services. Based on Euromonitor’s independent analysis, Grab continued to be the category leader in 2021 by GMV in online food delivery and ride-hailing, and by TPV in the e-wallet segment of financial services in Southeast Asia , despite increased competition. Notably, Euromonitor found that Grab continues to be the leading ride-hailing and food delivery platform in Indonesia .

Source: Euromonitor International estimates from desk research, consumer survey, and trade interviews with leading market players and relevant industry stakeholders in the online food delivery, ride hailing and e-wallet sectors

According to data.ai (formerly known as App Annie ), Grab led the mobility and delivery category in 2021 for Southeast Asia with the highest number of average monthly active users and downloads7, being 2.2x and 1.2x larger respectively compared to the next closest competitor.

Company Outlook

Coming off Q4 which is a seasonally strong quarter, for Q1 2022 Grab currently expects:

- Deliveries GMV to be between $2.4 billion to $2.5 billion

- Mobility GMV to be between $0.75 billion to $0.80 billion

- Financial Services Pre-InterCo TPV to be between $3.1 billion to $3.2 billion

Grab further expects GMV growth for each of the quarters from Q2 to Q4 2022 to accelerate to 30 - 35% YoY, subject to shifts in the COVID-19 environment.

Looking beyond 2022, Grab is progressing towards core food delivery Segment Adjusted EBITDA breakeven by the first half of 2023 and deliveries Segment Adjusted EBITDA breakeven by the end of 2023. In the long term, Grab is targeting steady state Adjusted EBITDA to GMV margins of 12% in mobility and 3% in deliveries.

Grab is Southeast Asia’s leading superapp based on GMV in 2021 in each of food deliveries, mobility and the e-wallets segment of financial services, according to Euromonitor. Grab operates across the deliveries, mobility and digital financial services sectors in 480 cities in eight countries in the Southeast Asia region – Cambodia , Indonesia , Malaysia , Myanmar , the Philippines , Singapore , Thailand and Vietnam . Grab enables millions of people each day to access its driver- and merchant-partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance, wealth management and telemedicine, all through a single “everyday everything” app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone, and since then, the Grab app has been downloaded onto millions of mobile devices. Grab strives to serve a double bottom line: to simultaneously deliver financial performance for its shareholders and a positive social impact in Southeast Asia .

Forward-Looking Statements

This document and the announced investor webcast contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s beliefs and expectations, business strategy and plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab’s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described in the “Risk Factors” section of Grab’s registration statement on Form F-1 and the prospectus therein, and other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information and Non-IFRS Financial Measures

Grab’s unaudited selected financial data for the three months and year ended December 31, 2021 and 2020 included in this document and the investor webcast is based on financial data derived from the Grab’s management accounts that have not been reviewed or audited.

This document and the investor webcast also include references to non-IFRS financial measures, which include: Adjusted EBITDA, Total Segment Adjusted EBITDA and Segment Adjusted EBITDA. However, the presentation of these non-IFRS financial measures is not intended to be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies.

Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab’s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab’s management uses: Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab’s business segments, as it does not include regional corporate costs.

There are a number of limitations related to the use of non-IFRS financial measures. In light of these limitations, we provide specific information regarding the IFRS amounts excluded from these non-IFRS financial measures and evaluate these non-IFRS financial measures together with their relevant financial measures in accordance with IFRS.

This document and the investor webcast also includes “Pre-InterCo” data that does not reflect elimination of intragroup transactions, which means such data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions.

Explanation of non-IFRS financial measures:

- Adjusted EBITDA is a non-IFRS financial measure calculated as net loss adjusted to exclude: (i) interest income (expenses), (ii) other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) stock-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses.

- Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

- Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value.

Operating Metrics

Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab’s services, including any applicable taxes, tips, tolls and fees, over the period of measurement. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of a consumer’s spend that is being directed through Grab’s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare, Grab’s aggregate operating results, which captures significant trends in its business over time.

Monthly Transacting User (MTU) is defined as the monthly transacting users, which is an operating metric defined as the monthly number of unique users who transact via Grab’s products, where transact means to have successfully paid for any of Grab’s products. MTU is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business.

Commission Rate represents the total dollar value paid to Grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of GMV, over the period of measurement.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by Grab from those driver- and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by Grab from those driver- and merchant-partners. Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Industry and Market Data

This document also contains information, estimates and other statistical data derived from third party sources, including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations, and you are cautioned not to give undue weight on such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

Unaudited Summary of Financial Results

View source version on businesswire.com : https://www.businesswire.com/news/home/20220303005457/en/

For inquiries regarding Grab, please contact:

Media Grab: [email protected] Sard Verbinnen & Co : [email protected]

Investors Grab: [email protected]

Source: Grab Holdings Limited

In This Story

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NIPPON ACTIVE VALUE FUND PLC

- AMD (ADVANCED MICRO DEVICES)

- TESLA, INC.

- NVIDIA CORPORATION

- DELIVERY HERO SE

- THE EDINBURGH INVESTMENT TRUST PLC

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Dividend Aristocrats

- Multibaggers

- Undervalued stocks

- Dividend Kings

- Cloud Computing

- 3D Printing

- In Vino Veritas

- Let's all cycle!

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Quantum computing

- Powerful brands

- Biotechnology

- E-Commerce & Logistics

- The genomic revolution

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- ProRealTime Trading

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Grab Holdings Limited

Kyg4124c1096.

- Grab : Investor Day 2022 Presentation

Q&A Session

Cautionary Statement

FORWARD-LOOKING STATEMENTS. This presentation and the related webcast (together, this "Presentation") contain "forward-looking statements" within the meaning of the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Presentation, including but not limited to, statements about Grab's goals, targets, projections, outlooks, roadmaps, estimations, steady-state information, beliefs and expectations, business strategy and plans, objectives of management for future operations of Grab, market sizes, and growth opportunities, are forward-looking statements. Similarly, ESG roadmaps are dependent on future factors, such as continued technological progress and policy support, and also represent forward-looking statements. Some of the forward-looking statements can be identified by the use of forward-looking words, including "anticipate," "expect," "suggest," "plan," "believe," "intend," "estimate," "target," "project," "should," "could," "would," "may," "will," "forecast," "annualized," "illustrative" or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab's ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19 and currency exchange fluctuations; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described in the "Risk Factors" section of Grab's registration statement on Form F-1 and the prospectus therein, and other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the "SEC"). Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law. "Grab" refers to, unless the context otherwise requires, Grab Holdings Limited and its subsidiaries and consolidated affiliated entities.

NON-IFRS FINANCIAL MEASURES. This Presentation includes references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin and financial information on a constant currency basis. However, the presentation of these non-IFRS financial measures is not intended to be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab's management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab's management uses: Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab's business segments, as it does not include regional corporate costs. There are a number of limitations related to the use of non-IFRS financial measures. In light of these limitations, Grab provides specific information regarding the IFRS amounts excluded from these non-IFRS financial measures and evaluate these non-IFRS financial measures together with their relevant financial measures in accordance with IFRS. With regard to forward-lookingnon-IFRS guidance and targets provided in this Presentation, Grab is unable to provide a reconciliation of these forward-lookingnon-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict. See the Supplemental Information from page 105 to 107 of this Presentation for additional important information regarding the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures.

SUPPLEMENTAL INFORMATION. See the Supplemental Information from page 105 to 107 of this Presentation for additional important information regarding unaudited financial information, industry and market data, definitions of operating metrics, trademarks and tradenames, and rounded numbers contained in this Presentation.

Anthony Tan

CEO & Co-founder

Southeast Asia's leading superapp

Country Countries

City Cities

This is an excerpt of the original content. To continue reading it, access the original document here .

Attachments

- Original Link

- Original Document

Grab Holdings Ltd. published this content on 28 September 2022 and is solely responsible for the information contained therein. Distributed by Public , unedited and unaltered, on 28 September 2022 00:15:04 UTC .

Latest news about Grab Holdings Limited

Chart grab holdings limited.

Company Profile

Income statement evolution, ratings for grab holdings limited, analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector application software.

- Stock Grab Holdings Limited - Nasdaq

- News Grab Holdings Limited

IMAGES

COMMENTS

Grab Investor Relations Overview Press Releases Events & Presentations. Stock Information ... Grab 2023 Q3 Results Presentation. Grab 2023 Q2 Results Presentation. Grab 2023 Q1 Results Presentation. Grab 2022 Q4 Results Presentation. Archived Presentations; Upcoming Events. Stay tuned for upcoming events

SINGAPORE, February 23, 2023 - Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the fourth quarter and full year ended December 31, 2022. "Our 2022 and fourth quarter results demonstrate our commitment to accelerating our path to profitability. In the fourth quarter, we achieved revenue growth of 310% ...

Grab Investor Relations Overview Press Releases Events & Presentations. Stock Information . Stock Quote & Chart; ESG . Governance Documents; Management; Board of Directors; ... 2022 Q4 Results. Read more about 2022 Q4 Results; 2022 Q3 Results. Read more about 2022 Q3 Results; Investor day.

Loss for the period of $435 million, a 35% improvement YoY. SINGAPORE, May 19, 2022 - Grab Holdings Limited (NASDAQ: GRAB) today announced financial results for the quarter ended March 31, 2022. "Our first quarter results are a testament to the resilience of Southeast Asia's economy as we move past the worst of the pandemic restrictions.

Grab Holdings Limited ( NASDAQ: GRAB) Q2 2022 Earnings Conference Call August 25, 2022 8:00 AM ET. Company Participants. Vivian Tong - Head of US Investor Relations. Anthony Tan - Chief Executive ...

Grab Holdings Limited (NASDAQ:GRAB) Q1 2022 Earnings Conference Call May 19, 2022 8:00 AM ETCompany Participants. Vivian Tong - Head of US Investor Relations. Anthony Tan - Chief Executive Officer ...

Mar 3, 2022 7:01AM EST. Strong end to 2021 with another record quarter and year in Gross Merchandise Value ("GMV"), exceeding the high end of full year 2021 guidance range. 2021 GMV grew 29% ...

NEW YORK, Jan. 30, 2023 (GLOBE NEWSWIRE) -- Grab Holdings Limited (NASDAQ: GRAB, the "Company" or "Grab"), plans to announce its unaudited fourth quarter and full year 2022 results before ...

NEW YORK, July 21, 2022 (GLOBE NEWSWIRE) -- Grab Holdings Limited (NASDAQ: GRAB, the "Company" or "Grab"), plans to announce its second quarter results before the U.S. market opens on ...

SA Transcripts. 145.6K Follower s. Grab Holdings Limited ( NASDAQ: GRAB) Q3 2022 Earnings Conference Call November 16, 2022 8:00 AM ET. Company Participants. Vivian Tong - Head of US Investor ...

NEW YORK, Oct. 20, 2022 (GLOBE NEWSWIRE) -- Grab Holdings Limited (NASDAQ: GRAB, the "Company" or "Grab"), plans to announce its unaudited third quarter results before the U.S. market ...

Grab Holdings Ltd. published this content on 28 September 2022 and is solely responsible for the information contained therein. Distributed by Public, unedited and unaltered, on 28 September 2022 00:15:04 UTC . Grab Holdings Limited announces an Equity Buyback for $500 million worth of its shares.

Grab Investor Presentation. Valuation. As we've mentioned in previous articles, valuing Grab is quite hard given that it is not yet profitable, and that there is a lot of uncertainty as to its ...

Grab 2022 Investor Day Presentation. At the same time, Grab's enormous network also makes cross-selling incredibly efficient. For example, following the launch of GXBank in Malaysia in November ...

GRAB 2022 Q2 Results Presentation In August 2022, Grab reported its latest second-quarter performance report. Top line figures show revenue soaring by 79% YoY, GMV by 30% YoY, and GMV/Transacting ...

Grab Investor Presentation Guidance The company sounded confident that revenue can outperform their initial guidance range of $1.25 billion to $1.3 billion for 2022, which they now raised to be $1 ...